Page 1

TEC Electronic Cash Register

M A-85-100

Owner’s Manual

TEC

)

TX3KYO EUECTRIC CO., LTD.

Page 2

---------------------------------------------------------NOTICE

-----------------------------------------------------------

This equipment has been tested and found to comply with the limits for a Ciass A digitai

device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide

reasonable protection against harmful interference when the equipment is operated in a

commercial environment. This equipment generates, uses, and can radiate radio frequency

energy and, if not installed and used in accordance with the instruction manual, may cause

harmful interference to radio communications. Operation of this equipment in a residential

area is likely to cause harmful interference in which case the user will be required to correct

the interference at his own expense.

WARNING

“THIS DIGITAL APPARATUS DOES NOT EXCEED THE CLASS A LIMITS FOR RADIO

NOISE EMISSIONS FROM DIGITAL APPARATUS SET OUT IN THE RADIO INTERFER

ENCE REGULATIONS OF THE CANADIAN DEPARTMENT OF COMMUNICATIONS."

“LE PRÉSENT APPAREIL NUMÉRIQUE N’EMET PAS DE BRUITS RADIOÉLECTRIQUES

DÉPASSANT LES LIMITES APPLICABLES AUX APPAREILS NUMÉRIQUES DE LA

CLASSE A PRESCRITES DANS LE RÉGLEMENT SUR LE BROUILLAGE RADIOÉLEC

TRIQUE ÉDICTÉ PAR LE MINISTÈRE DES COMMUNICATIONS DU CANADA."

Copyright © 1993

by Tokyo Electric Co., Ltd.

All Rights Reserved

Uchlkanda, Chlyoda-ku, Tokyo. JAPAN

Page 3

1. Introduction

Thank you for choosing the TEC electronic cash register MA-85-100 series.

This instruction manual provides a description of the functions and handling of

this register and should be read carefully to ensure optimum performance.

Since every consideration has been given to safety and reliability, there is no

danger of damaging the machine by incorrect operation.

Please refer to this manual whenever you have any questions concerning the

machine. This machine has been manufactured under strict quality control and

should give you full satisfaction. However, if the machine is damaged during

transit, or there are any unclear points in this manual:

For supplies, service or assistance call:

EOl-11072

Please have the following information available when

you call:

)

Product Name: TEC Electronic Cash Register

Model: MA-85-100

Serial Number:

Place Purchased;

Date of Purchase:

If for any reason this product is to be returned to the

store where purchased, it must be packed in the original

carton.

• The specifications described in this manual may be modified by TEC, if

necessary.

• Be sure to keep this manual for future reference.

_________________________

________________________

__

-1 -

Page 4

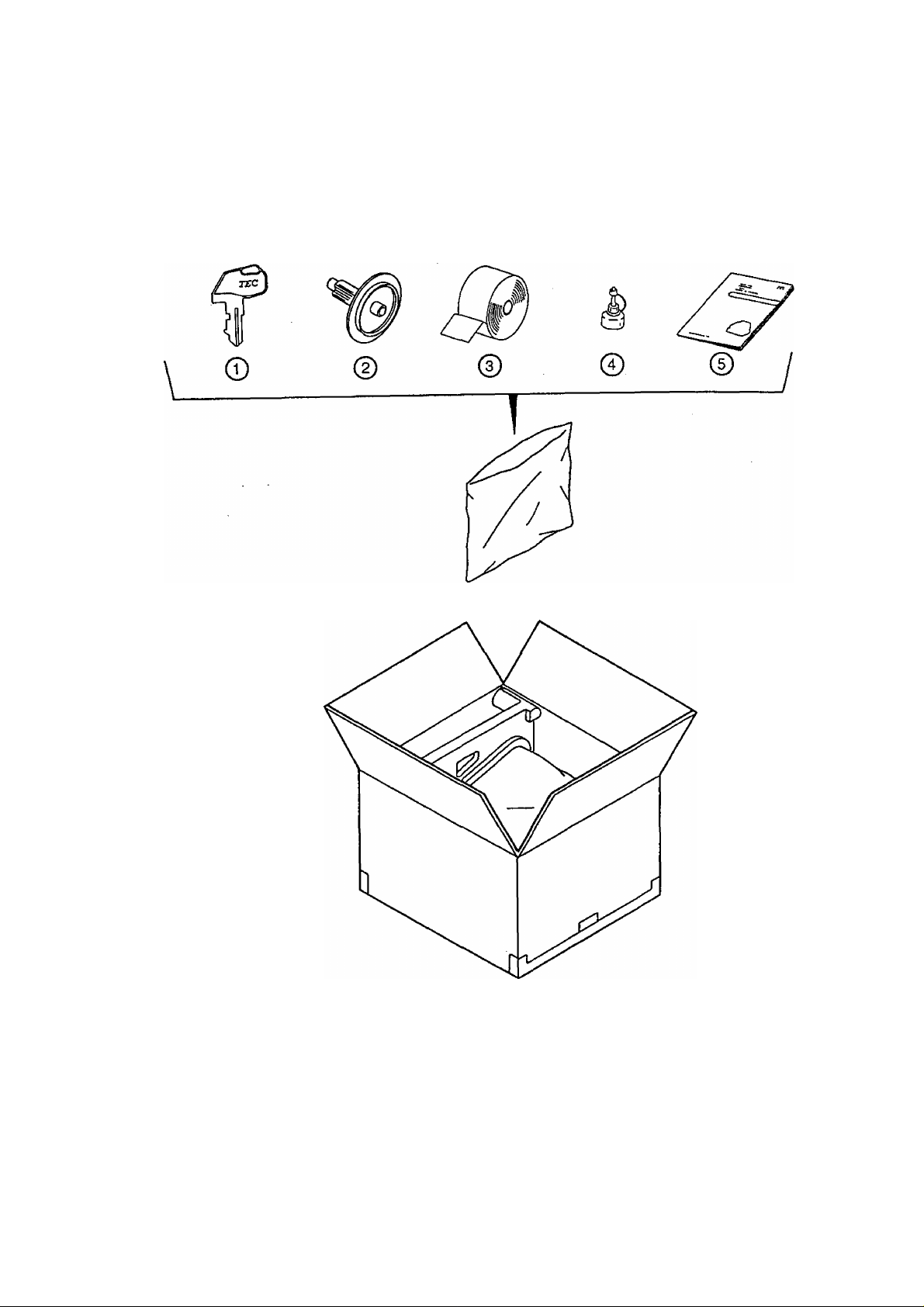

2. Unpacking

EOl -11072

d) Control Key

(REG Key, MA Key, S Key; 2 pcs. respectively)

© Journal Take-up Reel (1 pc.)

® Paper Roll 58mm x 050mm (1 pc.)

® Stamp Ink (1 pc.)

© Owner’s Manual (1 pc.)

-2 -

Page 5

3. Precautions

The ECR is a precision machine. Please handle it carefully considering the

following guidelines.

Remarks on the Location

Do not place it where unusual temperature

changes are expected or where it will be

subjected to direct sunlight.

EOI-11072

Place it on a flat and level surface with little

dust, humidity, vibration, etc.

)

Keep it away from water sources.

Be certain that the power voltage in your

area matches that required for the

machine. (The rated voltage is 117V AC.)

The socket-outlet shall be Installed near

the equipment and shall be easily

accessible.

-3-

Page 6

Remarks on Operating the ECR

The keys on the keyboard function with a

light touch. Avoid pressing the keys too

hard.

Do not handie the machine with wet

\ hands, since this may cause eiectricai

maifunctions and corrosion of parts.

EOl-11072

Do not apply thinner, benzine, or other

volatile materials to the cabinet or other

plastic parts. Such liquids wili cause

discoloration or deterioration, if dirty, wipe

off with a piece of cioth soaked in a neutrai

detergent and wrung out thoroughly.

Turn the Control Lock to OFF position

when ali operations are compieted after

business hours.

Never try to repair the ECR. If a problem

occurs, please call your authorized TEC

dealer, reseller or local TEC representative.

-4-

Page 7

E01-11072

4. Table of Contents

)

1. Introduction .................................................................................... 1

2. Unpacking....................................................................................... 2

3. Precautions..................................................................................... 3

Remarks on the Location ........................................................................................................ 3

Remarks on Operating the ECR............................................................................................... 4

5. Outline of Preparation Procedure Before Operating the ECR 8

page

6. Appearance and Nomenciature

....................................................

10

7. Controi Lock and Controi Keys .................................................... 11

Control Keys ......................................................................................................................... 11

Control Lock ......................................................................................................................... 11

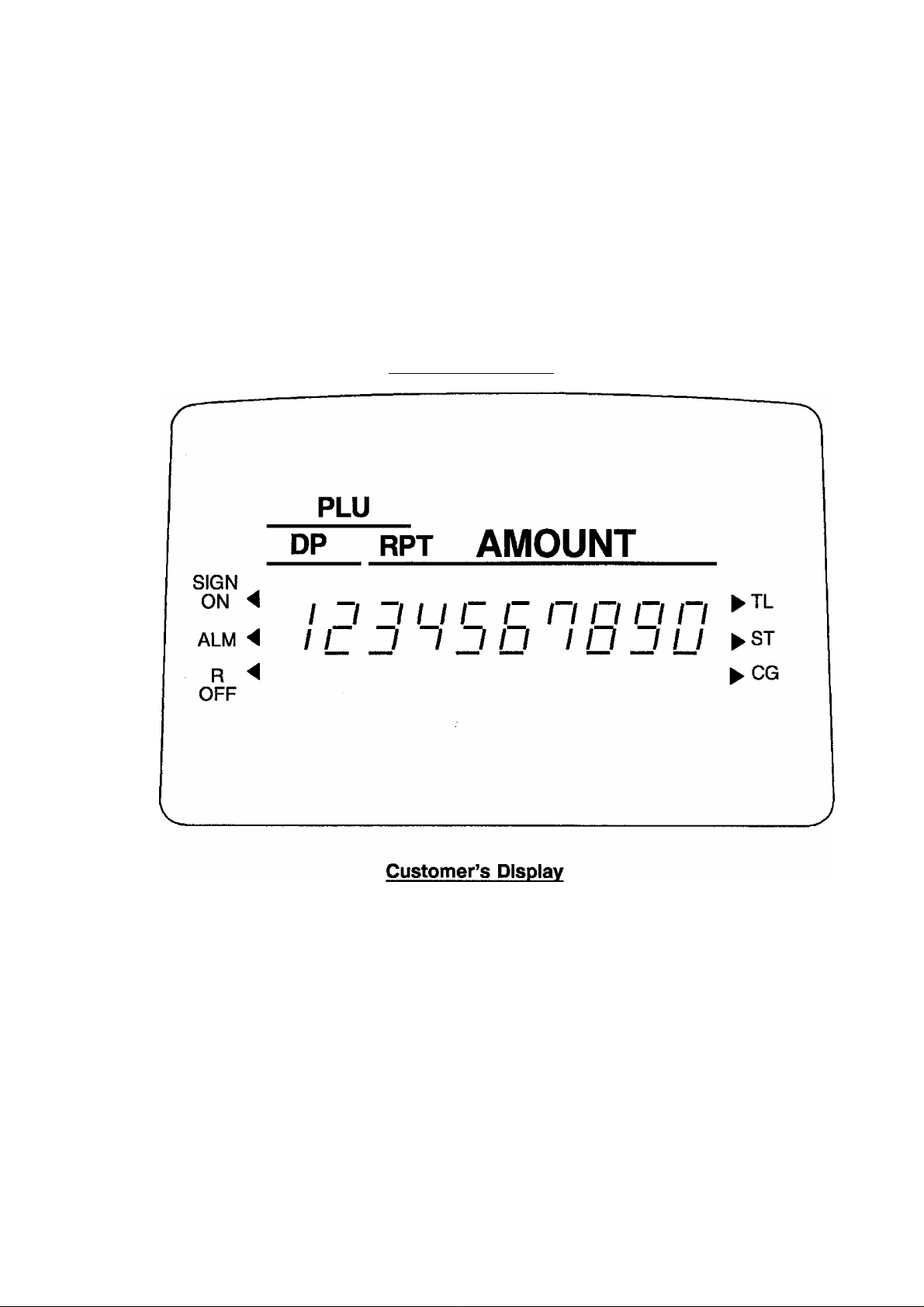

8. Dispiay .......................................................................................... 12

Operator’s Display ................................................................................................................. 12

Customer’s Display ................................................................................................................ 12

Numeric Display..................................................................................................................... 13

Message Descriptors ............................................................................................................. 13

)

9. Keyboard ..................................................................................... 14

Standard Keyboard Layout ..................................................................................................... 14

10. Instaiiing the Receipt/Journai Roii

11. Setting the Time and Date

Setting the Time .................................................................................................................... 17

Setting the Date .................................................................................................................... 18

Displaying the Time ............................................................................................................... 19

Printing Time and Date .......................................................................................................... 19

............................................

..................................................

15

17

12. Tax Table Setting .......................................................................... 20

Setting the U.S. (or PST) Tax Tables ..................................................................................... 20

Setting the GST Rate ............................................................................................................ 24

Setting the Non-taxable Limit Amount....................................................................................... 25

Tax Calculation Test............................................................................................................... 26

13. Optional Key Setting...................................................................... 27

List of Keys .......................................................................................................................... 27

Key Installation Setting .......................................................................................................... 28

Blank Keyboard Sketch (for your planning aid) .................................................................... 28

14. Daily Operation Fiow .................................................................... 30

15. Setting Preparation of Each Key and Transaction Entries . 31

Receipt-issue/Non-issue Selection ......................................................................................... 31

-5 -

Page 8

Clearing Errors, or Clearing Wrong Declaration Key or Wrong Numeric Entries............................ 32

Department Keys ................................................................................................................... 33

Programming Department Keys ...................................................................................... 33

Sale Item Entries Using Department Keys ........................................................................ 37

PLU (Price-Look-Up) .............................................................................................................. 42

Programming PLUs ......................................................................................................... 42

Sale Item Entries of PLUs ................................................................................................. 45

Listing Capacity Open............................................................................................................. 48

Percent Charge, Percent Discount .......................................................................................... 49

Setting Preset Rate for % Keys

% Key Operations in Sale Entries..................................................................................... 50

Dollar Discount .....................................................................

Tax Modification .......................................................................................................

Item Correction (Last Line Voiding) .......................................................................................... 52

Returned Merchandise ......................................................................................................... 53

Void (Designated Line Voiding)

All Void (Transaction Cancel) .................................................................................................. 55

Non-add Number Print ........................................................................................................... 56

Subtotal Read & Print ............................................................................................................. 57

Taxable Total Read ............................................................................................................... 58

Manual Tax Entry .................................................................................................................. 58

Cash Total, Cash Tender ....................................................................................................... 59

Non-cash Media Total, Non-cash Media Tender ...................................................................... 61

Multi-tender, Split Tender ....................................................................................................... 62

Tax Exemption ...................................................................................................................... 63

Check Cashing ...................................................................................................................... 64

No-sale ............................................................................................................................ . 65

Received-on-Account Payment .............................................................................................. 66

Paid Out ............................................................................................................................. 67

Post-issue Receipt ................................................................................................................. 68

Print/Non-print Options on Sale Receipts

.......................................................................................

...............................................

...........

...............................................................................................

.................................................................................

49

51

51

54

69

EOl-11072

16. Read and Reset Reports ............................................................... 70

Programming Operations Relating to Reports

Programming Hourly Range Table .................................................................................... 70

Selecting Print/Non-print Items on Reports ....................................................................... 71

Taking Read and Reset Reports ............................................................................................ 72

Fundamental Concepts of Various Types of Reports ......................................................... 72

Report Taking Operation .................................................................................................. 72

Daily Read Reports ................................................................................................... 73

Daily Reset Reports................................................................................................... 75

Periodical Read Reports............................................................................................. 76

Periodical Reset Reports ........................................................................................... 77

Report Sample Format ......................................................................................................... 77

Daily Individual Department Read Report .......................................................................... 78

Daily Media Sales & In-drawer Read Report

Financial Read or Reset Report (Daily or Periodical)

“ Memory Balance -- ..................................................................................................... 81

Daily Hourly Sates Read or Reset Report ........................................................................ 82

Daily PLU Read or Reset Report (All or Zone) .................................................................. 83

Cashier Read or Reset Report (Daily or Periodical) ............................................................ 84

..........................................................................

....................................................................

..........................................................

70

78

79

17. System Option Setting .................................................................. 85

Programming Procedure ....................................................................................................... 85

Address 1 ............................................................................................................................. 87

-6-

Page 9

Address 2 ............................................................................................................................. 87

Address 3 ............................................................................................................................. 88

Address 6 ............................................................................................................................. 89

Address 7 ............................................................................................................................ 89

Address 8 ............................................................................................................................. 90

Address 11 91

Address 13 ........................................................................................................................... 92

Address 14 ........................................................................................................................... 92

Address 15 ........................................................................................................................... 93

Address 16 .......................................................................................................................... 94

EOl-11072

18. Cashier Signing Operation (optionai function)

Programming Requirements ................................................................................................... 95

Cashier Sign ON & Sign OFF ............................................................................................... 95

Cashier Reports .................................................................................................................... 96

..............................

95

19. Eiectronic Journai Print (optionai function) .................................. 97

Programming Requirements ................................................................................................. 97

Electronic Journal Report ....................................................................................................... 97

Reading of the Remaining Lines of EJ Memory ....................................................................... 97

Print Sample Format of Electronic Journal ................................................................................ 98

20. Program Data Verification

Operating Procedure ............................................................................................................. 99

Department Preset Price Read ............................................................................................. 100

Department LC and Status Read .......................................................................................... 100

PLU Table Read ................................................................................................................. 101

Other Programmed Data Read

System Option Read ............................................................................................................ 102

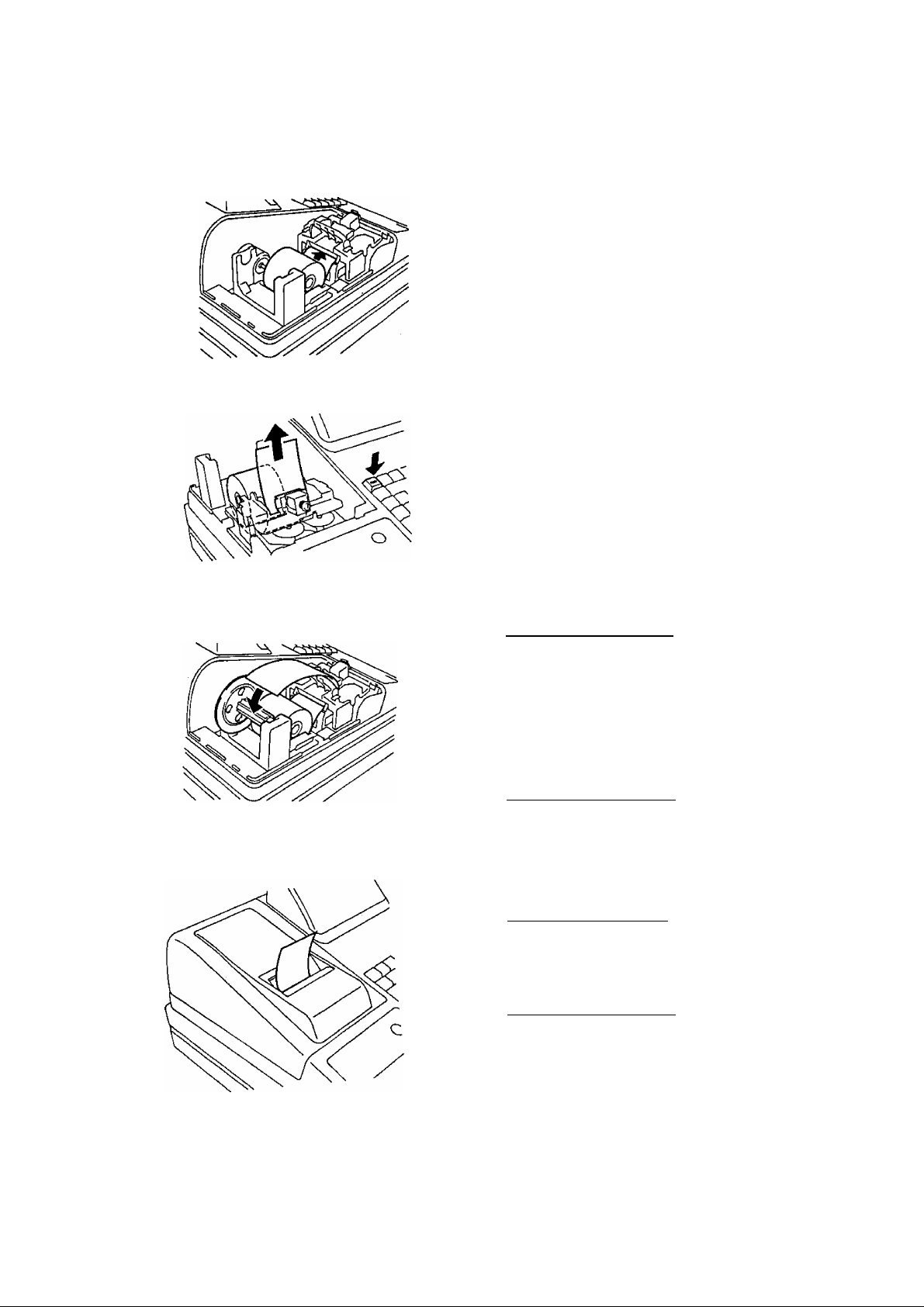

21. Paper Roll Repiacement and Other Maintenance

Replacing the Paper Roll .................................................................................................... 103

Replacing the Ink Ribbon .................................................................................................... 104

Replenishing Ink to the Store Name Stamp............................................................................. 105

Manual Drawer Release ...................................................................................................... 106

Removing the Drawer ......................................................................................................... 106

............................................................

............................................................................................

.......................

99

101

103

22. Troubleshooting .......................................................................... 107

23. Status Clear and Memory Clear Operations ............................... 111

Status Clear ....................................................................................................................... 111

Sales Memory Clear ............................................................................................................ 112

All Memory Clear ................................................................................................................. 113

24. Specifications ............................................................................. 114

-7-

Page 10

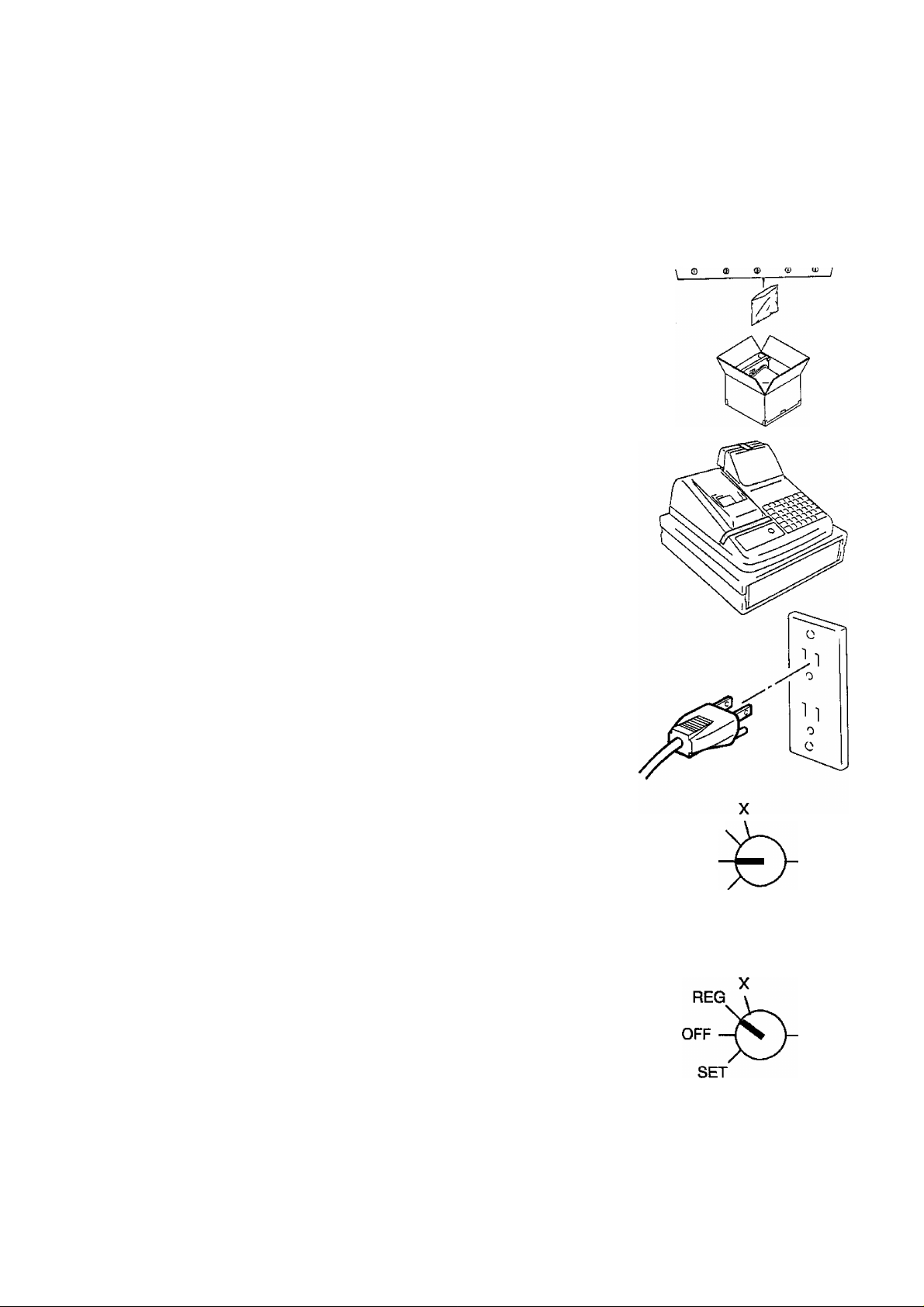

5. Outline of Preparation Procedure Before Operating

the ECR

This chapter shows the outline of set-up procedure of the ECR before actually

starting the ECR operation. ^

Remove the cash register from the carton,

referring to Chapter “2. Unpacking” on page 2.

And take out all the parts and accessories.

Remove the tapes and seals for holding parts or

protecting the register surfaces.

EOl-11072

Plug the power cord of the register into a wall

outlet. Make sure that the outlet voltage matches

that of the power required for the register.

Insert the MA key into the Control Lock.

Turn the Control Lock to the REG position.

REG

OFF

SET

-8-

Page 11

Install the paper roll (referring to Chapter ''10.

Installing the Paper Roll”).

If any optional keys are installed or relocated on

the keyboard, the optional key setting

programming must be performed first before any

other programming. Refer to Chapter “13.

Optional Key Setting.”

EOl-11072

Set the time and date correctly, referring to

Chapter “11. Setting the Time and Date”.

Set the tax tables, referring to the Chapter “12.

Tax Table Setting”.

Perform programming of the register, such as

Departments and PLUs, according to the

requirement of the market and your store (refer

to Chapter 14 and thereafter).

-9-

Page 12

6. Appearance and Nomenclature

EO1-11072

Receipt Outlet / Journal Window

Control Lock

j=

—

Drawer

.....

^

Keyboard

•Customer Display

Operator Display

Operator Display

Used by the operator to confirm the entry

contents and the status of the register,

(page 12)

Customer Display

Provided for the customer to see the amount

entered for each item and sale total, (page

12)

Receipt Outlet / Journal Window

The operator can see which items have

already been entered through this window

with the Journal-format Option.

The receipt for the finalized sale is issued

with the Receipt-format Option.

Control Lock

It selects the type of register operations,

(page 11)

Keyboard

Used to enter sale items, (page 14)

Drawer

Cash and other media are kept here. It

automatically opens on finalizing a sale.

-10 -

Page 13

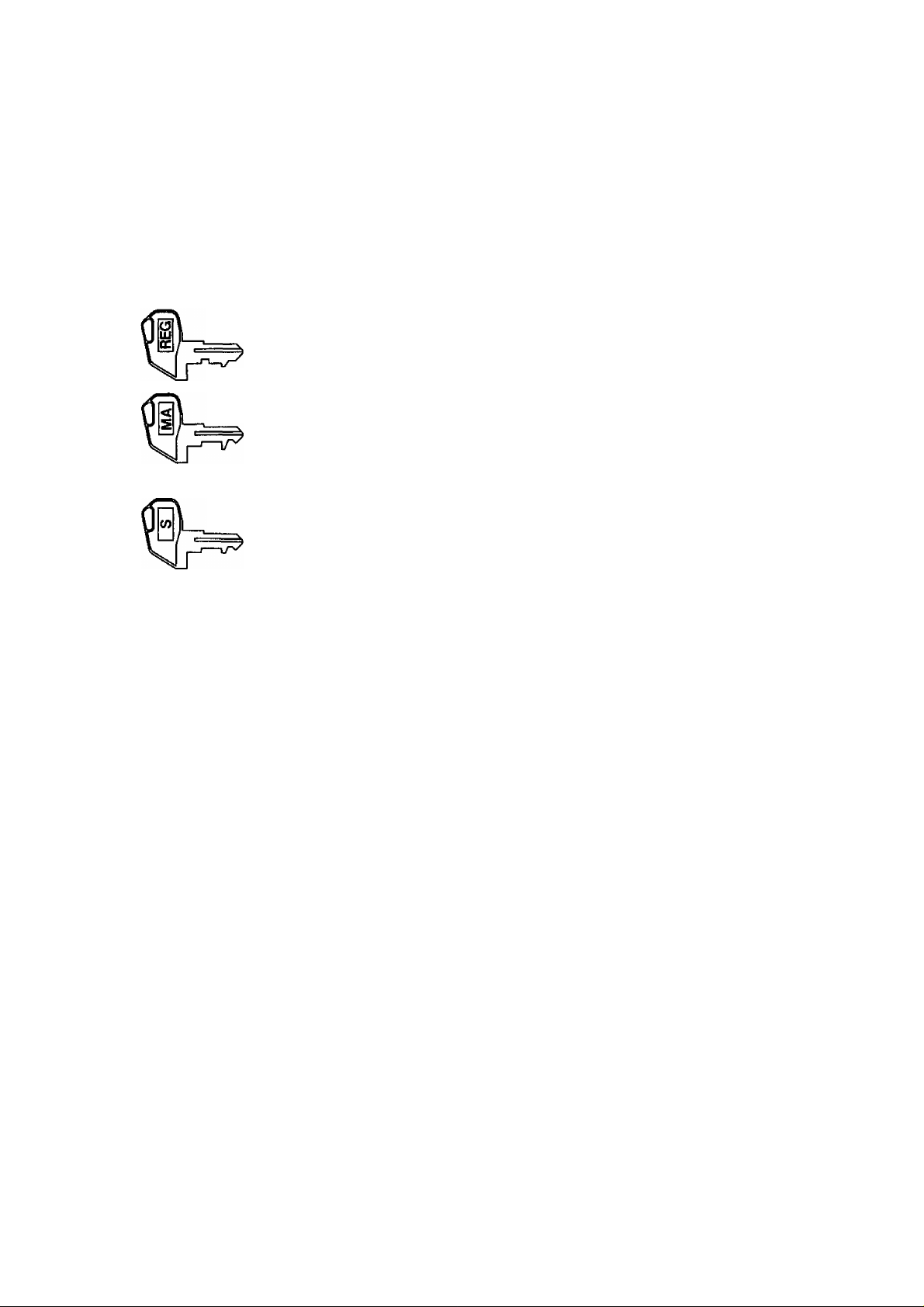

7. Control Lock and Control Keys

Control Keys

There are three types of Control keys: the REG (registration) key, the MA

(manager) key, and the S (service) key.

REG Key: The REG key is used by the cashier or clerk who operates

ordinary transaction entries. This key can access the

positions of OFF and REG of the Control Lock.

MA Key: The MA Key is used by the store manager or owner who will

daily supervise the collection of money and printout of

transactions recorded by the register. This key is also used

when programming the register. This key can access the

positions of SET, OFF, REG, X, and Z.

EOl-11072

S Key:

)

Control Lock

The Control Lock has five effective positions for different modes of

operation, which are accessed by the appropriate Control Keys.

*«N.

OFF —V- 2 register.

SET fBUNtDl Transaction entries are carried out in this

■ 2

rBl'lNDl

U____J

not actually

printed.

The S key is used by the owner. This key can access any

position including BLIND of the Control Lock. However, to

prevent programmed data and sales data from being

changed by mistake, use the REG or MA keys for

transaction entries or report taking purposes.

(position)

SET

OFF

The register allows programming operations.

Nothing appears on the display in this position.

However, the power is being supplied to the

(function)

REG

mode. Displays the current time while no

entries are under way.

X

The sale totals in memory can be read (X

reports) and the programmed data can be

verified in this position.

Z

BLIND

All the resettable totals and their respective

counters in memory will be read and reset in

this position (Z reports)

The register allows special programming

operations and memory clear operations.

-11 -

Page 14

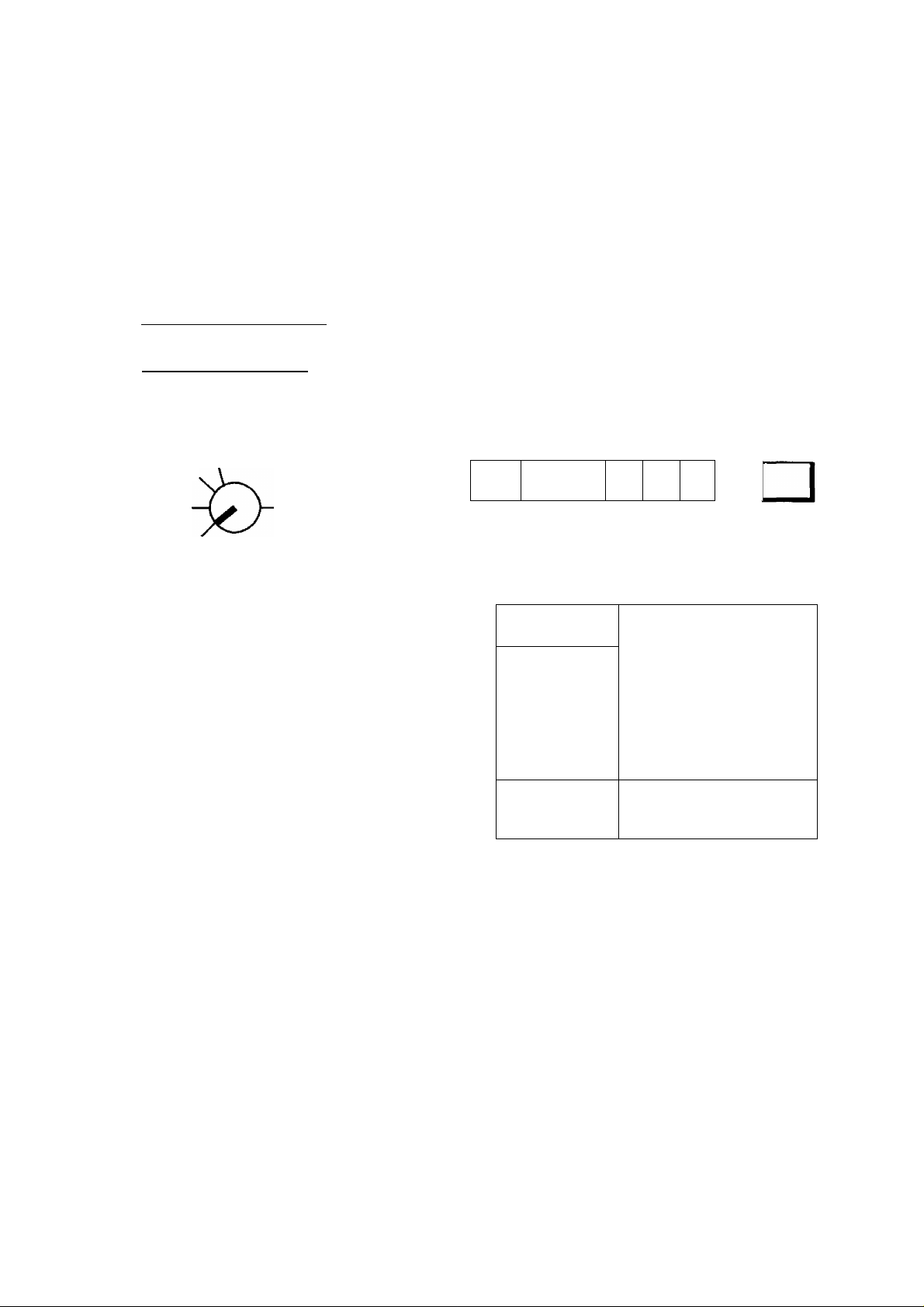

8. Display

The Operator’s Display (front display) is located at the top of the register just

above the keyboard. The Customer’s Display may be used only as a rear

display if left in the retracted position or it can be positioned for viewing at

other angles by pulling it upward and turning it to the desired position. The

display has two types of display portions - numeric display and message

descriptors (triangular lamps).

Operator’s Display

EOl-11072

r

AMOUNT

II r r n o O ri

- 12 -

inn III III

► TL

► ST

► CG

Page 15

Numeric Display

AMOUNT (8 digits for total display, 7 digits for entries):

Displays the numeric data, such as amount, quantity, etc.

When the obtained total or subtotal amount is 8-digit, the

RPT digit is also used for the amount display. When no

entries are under way and the Control Lock is in the REG

position, the current time is displayed.

DP (2 digits): Displays the code which represents each Department key.

It stays lit when repeating the same department entry.

EOl-11072

RPT (1 digit):

Displays the repeat count of the same item. The count is

indicated from the second entry on, and only the last digit

will be displayed even if the count exceeds nine.

PLU (3 digits of the DP and RPT are used for this purpose):

Displays the PLU code when any PLU is entered. It goes

out when repeating the same PLU entry, then only the

RPT digit will be displayed for the repeat entry count.

)

Message Descriptors (Triangular Lamps)

SIGN

ON

ALM

R

OFF

Illuminates when a cashier has signed ON if the cashier signing

method is selected (optional function).

illuminates with the alarm buzzer to indicate that the last

operation or numeric entry was an error. To clear the error

condition, depress the [C] key.

Illuminates when the Receipt-OFF mode is declared by the

[LOG/RECEIPT] key. In this condition, no receipts will be

issued for a sale to be entered. To extinguish this lamp (i.e., to

change into Receipt-ON mode for issuing receipts), simply

depress the [LOG/RECEIPT] key again.

TL

ST

CG

Illuminates with the total amount displayed when a sale

finalized without any amount tendered.

Illuminates with the subtotal amount displayed when the [ST] or

IS

[TXBL TL] key is depressed.

When an amount tendering operation has been performed, this

lamp illuminates with the amount of change due displayed.

-13-

Page 16

9. Keyboard

The following is the standard keyboard layout, which was initially set at the

factory. This register is designed to be capable of programming most of the

keys at desired locations or adding some optional keys in place of the current

keys. If you are in need of changing the locations or adding keys, see Chapter

“13. Optional Key Setting”.

Standard Keyboard Layout

EOl-11072

FEED

RTN

MDSE

TX/M

PLU

AMT

ITEM

CORR

NS VOID

C

ALL

VOID

@/FOR

7 8 9

4

1

5

2 3

0 00

6

1

2

3

4

5

LC

OPEN

10

6

7

8

9

% +

R/A

DOLL

DISC

Chg

ST

ATn'L

%-

PO

EX

CHK

TND

TXBL

TL

#/ClD

•

- 14 -

Page 17

10. Installing the Paper Roil

The printer may be used for journal-format print (standard status) or receiptformat print (optional status). (Refer to Chapter 17. System Option Setting,

Address 2 - Bit 7.)

Turn the Control Lock to the REG

position using a Control Key.

EOI-11072

Remove the Printer Cover.

)

rM'i

Cut the paper end to make it sharp.

0

Place the paper roll into the paper

pocket.

-15-

Page 18

EOl-11072

Insert the paper ends into the paper

inlet located on the rear side of the

printer.

Press the [FEED] key on the

keyboard until the paper end comes

out of the outlet.

If used for journal, insert the paper

end Into the slit on the Take-up Reel

and wind it around the reel two or

three times, set the reel to the holder,

and press the [FEED] key for a while

to tense the paper.

If used for receipts, do not wind the

paper end around the Journal Take-

up Reel.

If used for journal, simply attach the

Paper Cover. The Receipt Outlet is

used as a Journal Window.

If used for receipts, attach the Paper

Cover with the paper end coming out

of the Receipt Outlet located on the

Paper Cover.

* When the 2-ply paper is used, load the

upper sheet as a receipt, and bottom sheet

as a journal.

-16 -

Page 19

11. Setting the Time and Date

Setting the Time

The register has a dock function. Once the time is set, the time is kept even

when the power is turned off. The 24-hour system (the military time) is used

for time setting, display, and printing. Time setting is allowed any time outside

a sale.

Condition for Setting: Any time outside a sale.

Refer to the NOTE on "Condition** on page 20.

EOl-11072

Setting Procedure

Use the MA Key to turn the

Control Lock to “SET”.

REG

)

OFF

SET

Receipt Print Format

Declaration of Program

No. 5 for Time Setting

Examples)

©/FOR

1:05 a.m.:

0

1

Hour Minute

(00 to 23)

V

__

0 5

-----

□

(00 to 59)

—

^

1 3

Numeric Key

Function Key

1:32 p.m.:

3

AT/TL

Issues a

receipt.

2

- 17-

Page 20

Setting the Date

The register has a calendar function. Once the date and time are correctly

set, the day automatically advances at midnight even when the power is

turned off. The extra day of a leap year is also computed automatically.

Condition for Setting: Any time outside a sale.

Refer to the NOTE on “Condition” on page 20.

Setting Procedure

Use the MA Key to turn the

Control Lock to “SET”.

EOl-11072

NOTE: The date set/print order is Month-Day-Year. If you want to change the order

into Day-Month-Year or Year-Month-Day, select appropriate status of Bits 7

and 8 in Address 16 in Chapter “17. System Option Setting”.

Examples) To set May 28, 1993:

Receipt Print Format

©/FOR

Declaration of Program

No. 6 for Date Setting

0

2 I

9

1 1

Month

(01 to 12)

2

5

Month Day Year

8 I 0 II 5 I 9 I

Day Month Year

3 0 I 5 II 2

Year

Month

I I

Day

(01 to 31)

'"■'V-

...

.

8 9 3

Day

Year

(93, 94, etc

Month-Day-Year

Day-Month-Year

3

Year-Month-Day

I ^

AT/TL

issues a

receipt.

order

order

order

Program No. for

Date Setting

Date now set

(Nov. 12, 1993, in this example

Current Time

Thank you

Call again

1 0.- 1 9 3

18-

Date

(before this date setting)

Receipt Consecutive No.

Page 21

Displaying the Time

The current time is displayed in the “AMOUNT” area when the Control Lock is

turned to REG from any other position. When the Control Lock position is

changed or any entry operation starts, the displayed time disappears.

EOl-11072

Time Display Format:

(Example: 1:45 p.m.)

/ “/

I ~l

I I r

Printing the Time and Date

The current time is printed on every receipt or on journal (for every

transaction, read or reset report, or programming sequence), as the bottom

line (refer to the Receipt Print Format on the preceding page). The time can

be programmed to non-print, if necessary, by a System Option selection (refer

to Chapter *'17. System Option Setting**, Address 1 ~ Bit 1).

The date is printed on every receipt, as the top line below the Store Name

)

Stamp print (refer to the Receipt Print Format on the preceding page).

However, when the Journal-format Option is selected, the date is printed as

the last line only when a Read or Reset Report has been taken.

- 19-

Page 22

12. Tax Table Setting

For details about the actual tax table, contact to the location where the register was purchased.

Setting the U.S. Tax Tables (also applicable to PST in Canada)

There are three ways to set state and local tax tables. Select one that suits the tax table required to be set.

Condition for Setting: After Daily Financial Reset

NOTE on “Condition*':

Unless the register satisfies this condition, the programming operations will not be

allowed.

“After ... Reset” means that the designated reset report must be taken before

entering the programming (setting) operation. An error will result if the operation is

attempted without taking the report.

However, it does not necessarily mean “immediately after ...” When the designated

reset report has already been taken and then some operations are performed in the

“X”, “Z”, or “SET” mode, the condition “After ... Reset” is still satiated and the

programming operation is still allowed.

EO1-11072

On the contrary, when the designated reset report has been taken but then some

sales data relating to that report's output data are entered in the “REG” mode, the

programming operation will no longer be allowed and the same reset report must be

taken again.

Thus the condition “After ... Reset” indicates that all the sales data relating to the

report data must be zero (except non-resettable memory data). Because of this

“Condition” requirement, the report data will be protected from any inconsistencies

of sales data entered in the period from a resetting of the report to another resetting

of the same report next time. When no condition is specified to a programming

(setting) operation, it means that the operation is allowed any time outside a sale but

the cashier must be signed off.

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

REG

OFF

SET

—^ Go to 1), 2), or 3) on the following pages.

Indications of types of keys on the following pages:

□

I

___ __

□

......

Individual Numeric Key

I ....... Data to be entered through Numeric Keys

.......

• Function Key

-20-

Page 23

EOl-11072

1) Tax 1: Full Breaks (Non-cvciic Breaks + Cyclic Breaks)

)

[max, amount non-taxable[ —► I txi/m

[max, amount for 1C tax levied|

[max, amount for gg tax levied]

Repeat up to the “A** Break.

[max, amount for Nc tax levied] -

(to indicate the **A*' Break entry)

[max, amount for N -M c tax levied] [max, amount for N + 2c tax levied] -

Repeat up to the "S” Break.

TXI/M

I

|“B” Break]

(to complete this tax table setting)

NOTB: Bach amount (break) entry may be a maximum of 4-digit value (99990).

rB" Break - “A” Break

TXl/M

TXI/M

► I TXI/M I

= a multiple of $1.00)

...........

TXI/M

TXI/M

Break

Non-cyclic

Tax Breaks

Cyclic

Tax Breaks

2) Tax 1: “A” Break and % Rate Combination (Non-cvcIic Breaks + % Rate)

)

First, set all the non-cyclic breaks up to the “A” Break entry and the [ST] key

depression shown in the above case of “1) Tax 1 Full Breaks”.

[Tax Rate applied when exceeding the “A” Break amount]

(Max. 6 digits up to 99.9999%. Use the [. ] key for a decimal value. Examples: To

set 5%, enter 5. To set 5.26%, enter 5->[ . ]-»2->6. The fraction of the amount

resulting from this % rate calculation will be rounded off.)

3) Tax 1: % Rate Only

TX1/MI (to indicate that no breaks are entered)

[Tax Rate applied to any amount] —►

(The description for the Tax Rate in the above case 2) is also applied to this case.)

i

(to complete this tax table setting)

-21 -

Page 24

NOTES 1, In a single-tax area, the [TX1/M] key may be labeled as [TX/M] key.

2. For Tax 2 table setting in a multi-tax area, follow the same procedure in 1), 2), or

3) above, using the [TX2/M] key instead of [TX1/M].

To install the [TX2/M] key on the keyboard, refer to Chapter “13. Optional Key

Setting“.

3. If two tax tables are to be set, the Tax 1 table must be set first. The Tax 1 table

setting will automatically reset the old Tax 1 and Tax 2 tables.

4. A maximum of 64 breaks may be entered for Tax 1 and Tax 2 tables altogether.

Setting Examples:

ex. 1) Tax 1; Full Breaks

EOl-11072

Thank you

Call again

11. - 1E-9 3

0.0*

00 *aio

0 1 *a2 2

02

★ a39

03 *as 8

04

*a?3

0 5 ★ a9 0

0 6

0 7 * 12 4

0 8 * 14 1

1 0 *174

1 1 *19 1

1 2

* 10 8

*108 ST

09

* 158

*Z08

* 2.0 8 T 1

0 0 t6

0 8- 5 4

TX 1

-22-

Page 25

ex. 2) Tax 1; “A” Break and % Rate Combination

EOl-11072

Tax Table

Amount Range Tax LeviecI

Key Operation

Control Lock: SET

Thank you

Call again

$0.00 to $0.09 OC

$0.10 to $0.29 10

$0.30 to $0.59 20

$0.60 to $0.84 30

$0.85 to $1.12 40

... “A” Break

5% is applied to any

amount exceeding the

0

00

00

00

□00

ST

0 *

“A” Break.

,)

TXl/M

TX1/M

TXl/M

TX1/M

TXl/M

11.-12.-93

0.0*

TX 1

00 ★ aoe

01 *tt29

0 2 * 05 9

03 *084

04 ★ 112

★ 112 ST

5. %

0 0 1.7

0 8-54

ex. 3) Tax 1; % Rate Only

Tax Table

10% is applied to any

amount.

Key Operation

Control Lock; SET

0

□0

Thank you

Call again

1 1.- 1 2.- 9 3

0.0*

TX 1

0 0 *0.0 0

*0.0 0 ST

10. %

0 0 1.8

0 8-54

-23-

Page 26

Setting the GST Rate (applicable to Canada only)

Please note the following before operating the GST rate setting. The following

preparations are required:

1} Select the “GST Active” status in Chapter “17. System Option Setting”. Address 14 -

Bit 1 (some other options can also be selected relating to GST in the same Address).

2) Install the [GST/M] (GST Modifier) key on the keyboard (in place of unnecessary key)

referring to Chapter “13. Optional Key Setting”.

Condition for Setting: After Daily Financial Reset

(refer to “NOTE on Condition” on page 20.)

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

REG

This portion is required

only when any decimal

portion is contained in the

rate.

_

___________

A____________

EOl-11072

OFF

SET

Examples) '

~ 0

12%

To reset the rate

once set:

1 2

0

□□ □ □□

------------------V-------------------

GST Rate 0 to 99.99(%)

GST Rate 7%

is set.

Thank you

Call again

11.- 19 3

0.0

------

^ * 7. T

0 0 1.5

0 8-54

- 24 -

Page 27

Setting the Non-taxable Limit Amount

(applicable to only certain areas in Canada)

This nori’taxable amount limit must be set only in certain areas in Canada.

EO1-11072

Condition for Setting:

After Daily Financial Reset

(refer to “NOTE on Condition” on page 20.)

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

REG

OFF

SET

Example)

1 2

Declaration of Program

No. 12 for Non-taxable

Limit Amount Setting

$20.00

)

2 0

©/FOR

Non-taxable Limit Amount

(max. 4 digits: 1 to 99990,

or enter 00 to reset the limit)

0 1 0

-►

Thank you

Cail again

1 1.- 1 2, - 9 3

1.2 *

^ .i. 9 n n n

0 0 2.4

0 9-00

AT/TL

NOTES 1. When the sum of the sale portion subject to Tax (PST) 1 and the sale portion

subject to Tax (PST) 2 exceeds the Non-taxable Limit Amount programmed here, all

the amount subject to either of the two taxes are all taxed. When the sum is less

than the programmed limit. Tax 1 is tax-exempted and only Tax 2 is calculated on

the sale portion subject to Tax 2.

2. When the sum of the sale portion subject to Tax (PST) 1 and the sale portion

subject to Tax (PST) 2 is negative, the portion subject to Tax 1 will not be taxed.

3. When the sale portion subject to Tax 1 is tax-exempted, the taxable amount is not

stored in Tax 1 memory.

4. An error results when the [GST/MJ key is depressed in sale entries on the ECR with

Non-taxable Limit Amount programmed.

-25-

Page 28

Tax Calculation Test

Tax calculation can be tested by the following procedure. This operation will

not affect any sales data.

Operating Procedure:

Use the MA Key to turn the

Control Lock to “X”.

EOl-11072

REG

OFF

SET

|Amount|

Enter any amount

through Numeric Keys.

The entered amount is

displayed.

TX/M

or

TX1/M I or

TXBL

TL

The tax amount (total of all the

taxes due) is displayed in the

AMOUNT portion.

(The Non-taxable Limit Amount

setting is disregarded from this

display.)

-26-

Page 29

13. Optional Key Setting

This chapter introduces optional keys (keys not installed on the current

Standard Keyboard) that can be programmed. Please note, however, that

adding an optional key means to sacrifice another key already installed. If you

plan to install any of the Optional Keys or change locations of any of the

current keys, this operation must be performed first before any other

programming or setting operation (refer to NOTE 9 at the end of this chapter).

List of Keys

The following is the list of the all the keys that can be programmed on the keyboard. Numeric

Keys 0 to 9 are fixed as to their locations, therefore, not Included in the list. The “Key Code”

assigned to each key in the list is used in the setting procedure next page. For detail functions

and operations of each key, refer to Chapter “15. Setting Preparation of Each Key and

Transaction Entries”. For a brief information of the Optional Keys, refer to NOTE 8 at the end

of this chapter.

IZZI

□ -

(All those keys, not only the Optional Keys, can be eliminated or changed as to their locations

on the keyboard. However, please do not eliminate the keys of minimum requirements.)

- Keys that must be installed as minimum requirement

* Keys that are already installed on the Standard Keyboard

• Optional Keys

EOl-11072

Code

[' ■,

Key

PO (Paid Out)

NS (No-sale)

LC OPEN (Listing Capacity Open)

#/CID (Non-add Number Print/Cash-

Key Name

in-drawer)

1 91 #^S (Non-add Number/No-sale)

PLU (Price-Look-Up)

@/FOR (At/For; Multiplication)

94 RECEIPT ISSUE (Post-receipt)

fiiiimi mi

1.^......1

1 127

C (Clear)

TK/M or TX1/M (Tax 1 Modifier)

TX2/M (Tax 2 Modifier)

98

TXBL TL (Taxable Total)

TAX (Manual Tax)

100

EX (Tax Exempt)

AMT (Amount)

GST/M (GST Modifier)

115

LOG/RECEIPT (Logffieceipt) i

*2

*3

Key

Code

)

*1

0 Code to deactivate the key.

Department Keys 1 to 10 |

11 to 15 Department Keys 11 to 15

US—^

FEED (PaperFeed)

00 (Double-zero)

• (Decimal Point)

DOLL DISC (Dollar Discount)

% + (Percent Charge)

% “ (Percent Discount)

RTN MDSE (Returned Merchandise)

ITEM CORR (Item Correct)

VOID (Void)

ALL VOID (All Void)

AT/TL (Cash Tender/Total)

CHK TND (Check Tender)

Chg (Charge Total)

ST (Subtotal) 1

R/A (Recetved-on-Account)

Key Name

*1. At ¡east one Department Key is required to be instaifed.

*2. The /#/WSJ key has both [#/CID] and [NS] hinctions. Therefore, when /#/WSJ is

instalied, neither [#/CID] nor [NS] are necessary. (At least, either [lif/CID] or [iSf/NS]

must be installed.)

-27-

Page 30

*3. W/je/7 the Signing Method is selected for cashier identification (refer to Chapter 18),

this key must be installed. If this optional function is not selected, this key merely

functions as receipt issue/non-issue key.

Key Installation Setting

Condition for Setting: After all Daily and Periodical Resets

(refer to “NÓTE on Condition” on page 20.)

Setting Procedure:

Use the S Key to turn the

Control Lock to the “BLIND”

position.

X

REG

OFF

SET

(The BUND positíon is the unmarked

step next to "Z".)

Only to read the Key Code currently set on the key.

Z

(BLIND)

7 6

To declare Key Installation

Setting.

Amt

EO1-11072

Repeat for all the

keys to be newly

installed, for location

changes, or for

reading Key Codes

already set.

Key Cocte Displays the

3diQte; see ^nterndKey

№e List of Keys on code in the

the preceding mOUm

portion, as it is

entered.

Blank Keyboard Sketch (for your planning aid)

Rll in:

Key Name

Key Code

(Refer to the "List

of Keys" on the

preceding page)

For the Standard

Keyboard Layout,

refer to Chapter “9.

Keyboard”.

) ( ) ( ) ( )

(

( )

( )

( )

( )

7

4 5

8 9

□

Depress the key

to be set with the

Key Code.

Displays the Key

Code set or read,

in the AMOUNT

portion.

(

( ) (

6

(

(

Depress the [AT/TLl key

to complete the Key

Installation Setting

operation.

) ( )

) ( )

) ( )

( )

)

) (

(

( ) (

( ) (

) (

(

AT7TL

)

)

)

)

( )

( )

1 2 3

0

( ) ( )

-28-

(

(

) ( )

)

( )

( )

AT/TL

(

)

Page 31

EOl-11072

NOTES

1. If Key Installation Setting is operated for the first time, all the keys are already set as in

the Standard keyboard Layout. Therefore, set only the keys that are to be changed as

to their locations or newly installed.

2. Ha wrong code has been entered and the key has also been depressed (i.e., a wrong

code has been set on a key), enter the correcf code and depress the key. The code

entered last will be effective.

3. H is entered as Key Code, the key will be dead and its memory will also be

closed.

4. Each of the keys programmed in this operation will have its memory (if any) opened

automatically.

5. The

[C]

key, H once set with Key Code 95, may be used to clear an error, but it

cannoi be used immediately after a Key Code entry (for the purpose of clearing the

wrong Key Code error). If any Key Code is entered and then the [C] key is

depressed, that Key Code will be set on the key that was once the [C] key.

6. On depressing the final [AT/TL] key, “0.00" is displayed in the AMOUNT portion,

indicating that the setting operation is completed. No printing occurs.

7. Use the Blank Keyboard Layout on the preceding page, if necessary, for your own

keyboard plan before starting the setting procedure.

8. Brief Information on Optional Keys:

Department Keys 11 to 15

Install additional Department Keys if the current Department Keys (1 to 10) are not

enough to classify the merchandise in your store.

[#/NS] (Non-add Number / No-sale Key)

This is a dual-function key, having both [#/ClD] and [NS] functions.

[RECEIPT ISSUE] (Post-issue Receipt Key)

When a sale is finalized with the “R OFF” lamp illuminated but receipt is required,

)

this key works. This function is effective only when the Receipt-format Option has

been selected.

[TX2M] (Tax 2 Modifier Key)

It is necessary in the dual-tax (PST) area, in addition to [TX1/M], for reversing the

Tax 2 taxable/non-taxable status of items.

[TAX] (Manual Tax Key)... Key Code 100

It is used to enter an irregular tax amount that cannot be calculated on the basis of

the programmed tax tables, and to add it to the sale total. For installing this key,

please note the following in entering Key Code 100:

Right: The last key is coirectly set with Key Code 100 ([TAX])

Wrong: 11 || 00 I I Key I The key is newly set with Key Code i, which is Departm

---------

LhJ 1 Key. The last key is not set with any Key Code.

[GST/M]

It is necessary in the GST-applicable area in Canada. It reverses the GST

taxable/non-taxable status of items.

[LOG/RECEIPT]

It functions as the Cashier Signing key (refer to Chapter 18), and also functions as

Receipt OFF key (refer to “Receipt-issue/Non-issue Selection" in Chapter 15).

9. H any of the following keys are newly installed or its location is changed, its relevant

programming operations are further required (even if once programmed, re

programming is necessary because the program data has been cleared):

Each Department Key

[PLU]

[TX(1)/MJ, [TX2/M], [GSTfM]

... PLU Table

... Department Status, LC (if required), Preset Prices (if

required) of the Department

... Respective Tax Tables or Rates (Tax 1, Tax 2, GST)

/% +}, /% —J ... Respective Preset % Rates (if required)

-29-

Page 32

14. Daily Operation Flow

The following shows a typical daily operation flow on the register.

• Ensure that the register is firmly

plugged in the wall outlet.

• Check if enough portion of paper roil is

left.

• Check the time, date, and print

condition.

Check the time, date, and print by

issuing a No-sale Receipt.

EOl-11072

Reference

Chapter

10

15

• Taking Daily Reset (Z) Reports

• Tear off the print portion of Journal

Paper (optional).

• Leave the drawer open, and turn the

Mode Lock to “OFF”.

11

15

16

16

21

21

• Take ail the cash and other contents

from the drawer to the office with the

torn Journal and printed Reset Reports.

- 30 -

Page 33

15. Setting Preparation of Each Key and Transaction

)

Entries

This chapter describes individuai key operations on transaction entries, and

setting requirements for the key if necessary. {The samples for the operation

and setting are described in the receipt formats.)

Receipt-issue/Non-issue Selection r^pj\ (log/receipt Key)

Receipts are issued or not issued according to the “R OFF” triangular lamp illuminated/

extinguished status on the Operator Display panel.

“R OFF” (Receipt OFF) Lamp Status Change Operations

LOG

Control Lock may be in

any position except

OFF.

Extinguished

RECEIPT

LOG

RECEIPT

EOI-11072

if-

Illuminated

)

NOTES 1. The Control Lock may be in any position (except OFF position) for changing the

Receipt ON/OFF status in the signed-ON or signed~OFF condition.

2. The “R OFF” lamp status at the starting of a transaction entry decides whether a

receipt will be issued for the transaction or not Switching the Receipt ON/OFF

status during a transaction will not be effective.

3. If a transaction entered with the "R OFF” lamp extinguished and finalized but a

receipt is required, the [RECEIPT ISSUE] {Posf-/sst;e Receipt) key can be operated

to issue a receipt (see “Post-Issue Receipt” on page 68).

4. Simply depress the [LOG/RECEIPT] key without a numeric entry. If the key is

depressed with a prior numeric entry in REG mode, it may turn out to be a Sign ON

or Sign OFF operation (refer to Chapter 18).

5. This operation is effective only when the Receipt-format Option has been selected.

When the Journal-format Option has been selected, journal printing will occur

regardless of any “R OFF" lamp status.

Receipt ON

Status

Receipt OFF

Status

-31 -

Page 34

EOl-11072

Clearing Errors, or Clearing Wrong Declaration

(Clear Key)

Key or Wrong Numeric Entries

When in sale entries an error has occurred with an alarm buzzer (beeps for about 2 seconds

only), a wrong Declaration Key (such as [RTN MDSE], [TX/M], etc.) has been depressed, or a

wrong numeric data has been entered; depress the [C] key.

Error has occurred (the

1)

alarm buzzer is

generated and the

“ALM” lamp illuminates),

and the keyboard is

locked.

2) Declaration Key has

been depressed.

ex.)

3) Numeric Keys are

entered.

ex.) 5

Declaration Key(s)

4)

+ Numeric Keys

The error condition is cleared (the

buzzer tone stops and the “ALM”

lamp is extinguished). Find the cause

of the error, and do the operation

again. Refer to “Possible Cause of

Error” attached where an error may

occur in each operation sequence on

the following procedure.

The entered data are all cleared at

once.

ex.)

Numeric Keys + Non-

5)

motorized Key (key that

does not trigger printing)

ex.)

6) Combination of 2) to 5) J

7) Combination of 6) + 1) _

NOTE When data is already entered and printed (through a Department Key, etc.), it cannof be

cleared by the [C] key any longer. In need of deleting such data, see the following:

©/FOR

The entered data are all cleared at

once, and the error condition is

cleared also. Refer to 1) for finding

the cause of error.

Item Correction (Last Line Voiding)

Void (Designated Line Voiding)

ITEM

CORR

page 52

page 54

All Void (Transaction Cancel)

-32

page 55

Page 35

EOl-11072

Department Keys

Dept 1 .

1 1 to

Dept

15

Programming Department Keys

These are department keys through which sales items are registered. A maximum of 15 keys

may be installed (Depts 11 to 15 are optional keys).

Programming Department Status:

To use Department Keys, first program how each Department Key is to be used, in

accordance with merchandise categories, taxation, operativity of the key, etc.

Condition: After Daily Financial Reset and Periodical Financial Reset {and ALL PLU Reset

if the positive/negative status is to be set)

(refer to “NOTE on Condition“ on page 20)

Programming Procedure:

Use the MA Key to turn the

Control Lock to “SET^

REG

OFF

SET

As for iteivs marked with "NOTE", refer to the corresponding

NOTE No. on the next page for further description.

@/FOR

Declaration of Program

No. 3 for Department Status

programming

Repeat for programming

other Department Keys

Depress the required key(s) to obtain the appropriate status

for the department:

RTN

MDSE

TXl/M

TX2/M

GST/M

To set Negative status

NOTES 4, 5

To set Tax 1 taxable status

NOTES 1. 3

To set Tax 2 taxable status

NOTES 1, 3

To set GST taxable status

NOTES 1, 4

To set Single-item Key status

1

To set Itemized Key status ^

2

To regain the initial statuses, i.e., Positive, Nontaxable, Non-GST, and itemized statuses);

it may be useful when you are confused with

various status selections for a department

The status is

. re^ersecf by

^ pressing the

same key

again.

^ Key Type

status

NOTE 2

NOTE 6

Repeat for

setting other

status or

correcting the

statuses once

set

-------^

Dept.

Depress the

Department Key

to obtain the

selected

statuses.

NOTE3

To complete

this operation

and issue

a program

receipt

I

-33-

Page 36

EOM1072

NOTES 1. The tax tables of “Tax 1”, “Tax 2," and “GSV* should be programmed in

Chapter “12. Tax Table Setting”. Those tax tables will become effective in

REG mode for adding the taxes to sale items entered through a Department

Keys only when the Department Key is programmed with taxable status for

the required tax in this operation.

2. Every time each of the [RTN MDSE], [U1/M], [TX2/M], and [GST/M] keys

in this operation is pressed, the preset status is reversed. For example, if a

Department Key is aiready set with 'Tax 1 Taxable” status and the [TX1/M]

key is pressed during the setting sequence of that Department Key, it is

now set with ‘Tax 1 Non-taxable” status. lf[TX1/M] is again pressed, “Tax

1 Taxable” status is again obtained.

3. The tax (PST) status obtained (as the result of [TX1/M] and/or [TX2/M]

depressions) can be verified by reading the numeric value displayed in the

rightmost digit of the AMOUNT portion when the individual Department Key

is pressed. Similarly, the Key Type status is displayed in the 2nd digit (next

to the rightmost digit).

Displays the

Department

No.:

01 to 15

Display:

DP

I

Displays 0, or 1 to indicate the

Key Type status.

0: Itemized

1: Single-item

AMOUNT

m

“0” fixed

Displays 0, 1, 2, or 3

to indicate the

obtained Tax (PST)

status.

0: Non-taxable

1: Tax 1 Taxable

2: Tax 2 Taxable

3: Both Tax 1 &

Tax 2 Taxable

(These status codes are also printed on the program receipt issued when

the final [AT/TL] key is pressed; refer to the Receipt Format on next page.)

4. The Negative/Positive status and GST status can only be verified on the

program receipt (refer to next page) but not in the display. If a wrong status

has been set, correct it by performing the programming operation again.

5. If a Department Key is set with Negative status, an amount entered through

that key will be subtracted from the sale total. It may be used for item

entries of coupons, returned bottles, etc.

6. Key Type Description

Itemized Key: When a sale item amount is entered through this

key, the sale is not finalized until a media key (such

as [AT/TL]) is operated. Other items can be

entered within one sale receipt sequence.

Single-item Key: A sale Hern entry through this key will automatically

^nalize the sale as cash outside a sale (i.e. when

no other items have been entered within one receipt

sequence). However, it will function just as an

Itemized Key if operated inside a sale.

-34 -

Page 37

Department Status Program Receipt Format:

EOl -11072

Key Operation

Control Lock: SET

\3\

Programming Department LCs (Listing Capacities):

iKev Type Status'*

0: Itemized

1: Single-itemj

¡Tax StaFus fPST)

Non-taxable

Tax 1 Taxable

Tax 2 Taxable

Both Tax 1 &

Tax 2 Taxable

I Blank: GST Non-taxable

L.

)

The LC setting is used to check an amount limit error. By setting the LC, an amount entry

(due perhaps to a mistake by the operator) will be preyented at the earliest stage (i.e. an

error will result on entering an excessive amount through the department key).

Condition: After Daily Financial Reset

(refer to “NOTE on Condition” on page 20)

Programming Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

REG

OFF

X

SET

Repeat for setting LCs of other cfeparfmenfs.

□□

2-digtt LC code

for each department NOTES i, 2

ex.)

SE-

I

Value of the top digit

L

As for items marked with "NOTE", refer to the corresponding

NOTE No. on (be next page for further description.

8

Declaration of Program

No. 8 for Department LC

programming

Dept

@/FOR

1-L^DD

Common 2-digit LC code

-----------

for all departments NOTES i, 2

indicates $ 39.99

4 digits

-----------

----------

J

Allows to enter equal to

or smaller than $39.99 in

f

1

sale entries.

AT/TL

-35 -

Page 38

NOTES 1. If the individual LC of a department is set, it prevails over the common LC for

all departments.

2. To reset a LC once set, enter “0” in place of the 2-digit LC code. Then a

maximum of 7-digit amount can be entered in sale entries.

Department LC Program Receipt Format:

EO1-11072

Setting Department Preset Prices:

If a fixed price is always entered through a Department Key in sale entries, a preset price

can be set on the Department Key. Please note that once set with a preset price, the

Department Key will not accept any other price (open price) until the Department Key is

again programmed to be an open department.

Condition: Any time outside a sale

Programming Procedure:

Use the MA Key to turn the

Control Lock to ‘‘SET^

To set Open Department

(to allow manual amount entries)

X

REG

OFF

SET

NOTES 1. All the Department Keys are open departments (no preset price set) as initial

status.

2. If a Department Key is pressed with no Preset Price entry, the Key is set as

an open-price Department Key.

3. If “0” is entered as Preset Price, the Department Key is set with Preset

Price of $0.00.

Preset Price

(max. 6 digits; 0 to 999999; resulting

in $0.00 to $9999.99) NOTES 1, 2

Repeat for other Department Keys, If necessary.

NOTES 1, 2

Dept.

NOTES 1, 2, 3

AT/TL

-36 -

Page 39

Department Preset Price Setting Receipt Format:

EOl-11072

Sale Item Entries Using Department Keys

)

Various types of department entries are shown below.

Use the REG Key to turn the

Control Lock to “REG",

X

REG

OFF

SET

Entry of One Item;

Open-price Department

Receipt Print Format

□

................

Price of the item

(max. 7 digits; or

limited fay ft\e

Depar№ient LC)

□

If an error occurs here:

Possible cause of error:

The price entered exceeds the LC.

-*■ See the Listing Capacity Open Entry.

The Department Key is a preset-price key.

-► Use an open-price Department Key, or see the “Presetprice Department" entiy procedure on next page.

Dept

Depress the

appropriate

Deparfarient Key

for open price

Department —

No.

Entered Price —

* : Positive

-: Negative

Status Symbol

T: Tax 1 or Tax 2 (PST) Taxable

•: GST Taxable

T*: Tax (PST) Taxable and GST

Blank Not applicable to any o1 the

Taxable

0 1

^ove status.

*12 3

-37-

Page 40

E01-11072

Preset-price Department

Dept

Depress ttie

appropriate

Department Key

for preset price

— If an error occurs here:

Possible cause of error:

• The Department Key is an open-price key.

-♦ Use a preset-price Department Key.

or see ttie “Open-price Department"

entry on the preceding page.

Receipt Print Format

Department

No.

Status Symboi

See the description for the Receipt

Print Format on the preceding page.

Department Repeat Entry:

Depress again the Department Key used for the department item entry just entered. The

item entry is repeated as many times as the Department Key is depressed. (A negative

Department entry cannot be repeated.)

Open-price Department Repeat

□

................

Price

Dept

Dept

□

Depress the

same Department

Key

0 1

0 1

*12 3

*12 3

Preset-price Department Repeat

Dept Dept

Depress the

same Department

Key

04

04

*2.3 0

*2.30

-38-

Page 41

Department Quantity Extension (Multiplication):

When more than three or four items are to be entered with the same Department and

price, the Quantity Extension (multiplication) Is quicker than the Repeat Entry.

Open-price

Department

/ Product must not N

\ exceed 7 digits. /

If an error occurs here:

• Exceeding the LC of the

Department

Check the Unit Price.

-* See Listing

Capacity Open.

• Product exceeding 7 digits.

Check the Quantity

and Unit Price.

If an error occurs here:

j Possible cause of error:

I • Breeding the digit limit

I I

...........

®/F0R I

Quantiv;

max. 6 digits

0.001 to 999.999

NOTE1

^ □...................□

Dept

Unit Price;

max. 6 digits

Poss/We cause of error:

1

Preset-price

Department

□□□□□□□

3 digits for

integer (max.)

ex.)

123:

Required only for any

decimal portion entry.

3 digits for

decimal (max.)

rn[2l[3l

)

23.4:

0.234:

NOTES 1, When the QuanUty is a 1-digit integer (1 to 9) and a Preset-price Department

key is to foilowt the [X] key is omissible.

2. The product obtained by Quantity Extension cannot be repeated.

HJHIIIIII

(0)[m][i]i]

Dept

Product must not

exceed 7 digits.

,(

If an error occurs here:

Possible cause of error:

• Product exceeding 7 digits.

-*• Check ttie Quantity.

3. The decimal portion of the Quantity entry is processed down to the 2 digits

below the decimal point The fraction rounding at this time is fixed to ROUND

OFF.

4. You can select the rounding process of the fractions of the product (result of

multiplication) - ROUND OFF (inHiai setting), ROUND UP, or ROUND DOWN.

(Refer to Chapter **17. System Option Setting** Address 2 - Bits 1 and 2.

Receipt Print Format for Department Quantity Extension

Department

No. ^ 1 2.

01 *aoo

-39-

as 0

X

9

T ^

■Quantity

■ Unit Price

■Product

Page 42

Department SPP (Split-Package-Pricing):

This operation is used when a customer purchases only part but not all of the items in a

package {example: only two tomatoes in a priced package of three tomatoes).

Open-price Department

]□[

Purchased Q’ty

max. 3 digits

(integer only)

(Q’ty " Quantity)

@/FOR

If an error occurs here;

Possible cause of error:

• Q’ty Error

]□:

Whole Package Q’ty

max. 3 digits

(integer only)

-*■ Decimal Point is not

allowed in either Q’ty.

-+ Check the Q’ty digits.

©/FOR

► □

................

Whole Package

Price

max. 6 digits

□

Dept

If an error occurs here:

Possible cause of error:

Exceeding the LC of the

Department

-*■ Check the Whole

Package Price.

See Listing

Capacity Open.

Product exceeding 7 digits.

Check the Q’ties and

Whole Package

Price.

Preset-price Department

Dept

The preset price is regarded

as the Whole Package Price

If an error occurs here:

Possible cause of error:

Product exceeding 7 digits.

Check the Q’ties.

NOTES 1. The product (final result amount) obtained by SPP (Split-Package-Pricing)

cannot be repeated.

2. The product must not exceed 7 digits.

3. The rounding process of the fractions of the product resulted from the

calculation is fixed to ROUND UP (the final result amount is rounded up).

4. SPP is not possible using PLUs.

Receipt Print Format for Department SPP

Example)

Purchased Quantity = 2

Whole Package Price

Whole Package Quantity = 3

Whole Package Price = $1.00

Entered through Dept. 1 (openprice, Taxable department)

[^|@/FOR I |@/FOR I [T|[0][0]| Dept ^ [

-40-

Purchased

Quantity

Page 43

Single-Item Department Entry:

If a Department Key is programmed with Single-item status, an entry through the key

immediately finalizes the sale as cash and issues a receipt without operating a media key.

Such keys are operated in the same way as ordinary (itemized) Department Keys already

described, except that Repeat Entry is not possible using Single-item Department Keys.

NOTES 1. A sale item entry through this key will auiomaticaiiy finalize the sale as cash

outside a sale (Le. when no other items have been entered within one receipt

sequence). However, it will function just as an Itemized Key if operated inside

a sate.

2. Quantity Extension and SPP are also possible using Single-item Department

Keys.

Receipt Print Format for Sinole-item Department Entries

EOI-11072

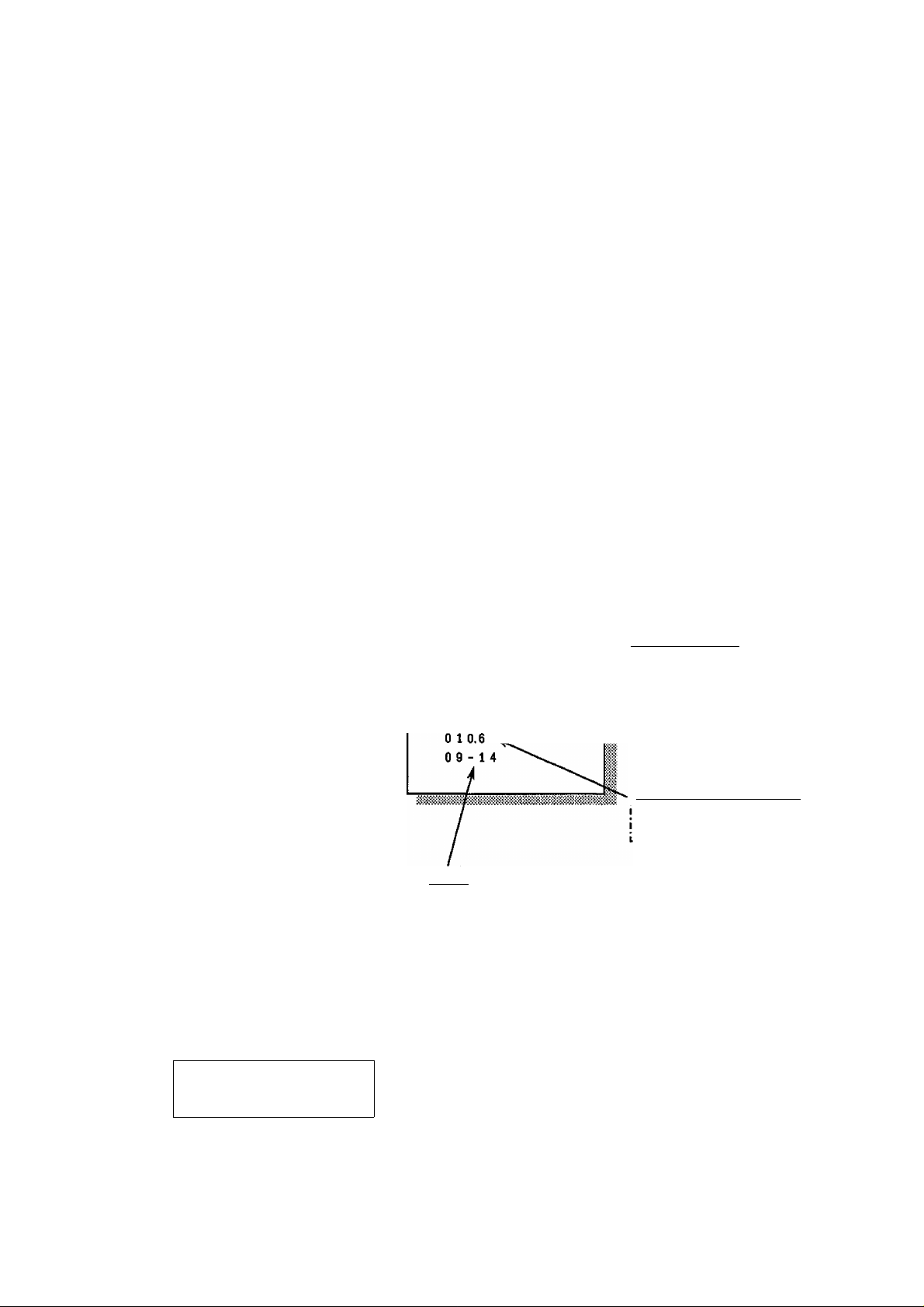

Example 1) ~ Bitry outside a sale --

When no sale is under way, an

item of $10.00 is entered through

Dept. 7 which is a Single-item &

Non-taxable department.

The sale is automatically finalized

as cash and a receipt is issued.

)

Example 2) - Entry inside a sale --

An item of $5.00 is first entered

through Dept. 1 which is an

Itemized & Taxable department.

Then an item of $10.00 is entered

through Dept. 7 which is a Single

item & Non-taxable department.

The sale is not finalized until a

media key is operated.

rniô][ïïl[ïï]F^

Receipt Consecutive No.

Thank you

Call again

1 1.- 1 2. - 9 3

0 7 * 1 0.0 0

0 1 0.&

09-12

f

Current Time

Thank you

Call again

1 1.- 1 2. - 9 3

*1 ao 0

C A’

Store Name

Stamp space

Date

Automaticaliy

finalized as

cash sale

(Cash Total)

000

Dept 1

Dept 7

-41 -

01 *aoo T

07 *iaoo

The sate is not finalized until a

media key is operated.

Page 44

PLU

I

PLU (Price-Look-Up)

A “PLU” is an individual merchandise item programmed with its own item code (PLU Code), its

link department (and mostly with a Preset Price). By programming PLUs, you can enter an

individual item by entering its PLU Code (which should be written on the price tag of the item),

instead of entering the price through a Department Key. By taking PLUs Reports, you can

analyze the sales data of each individual item. A maximum of 200 PLUs can be programmed.

(PLU Key)

Programming PLUs

Programming PLU Table:

Condition: To change settings of a PLU: When the required PLU sales total memory is

zero (i.e. when no sales are made or after a PLU Reset Report is taken to

reset the sales data of the PLU into zero)

To add new PLUs: Any time outside a sale.

(refer to **NOTE on Condition” on page 20)

Programming Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

EO1-11072

NOTES 1. When sequentially programming the PLUs, the code specification can be

omitted. When it is omitted at the very first PLU, PLU Code “1” is

automatically assigned.

2. An Open-price PLU always requires a price entry through Numeric Keys in

sale entries, and may be used for an item that frequently changes its price.

3. The statuses (PositivefNegative Status, Tax (PST) 1 & 2 Status, GST Status,

and Key Type Status) of each PLU is decided by the statuses of the

Department to which the PLU is linked.

-42-

Page 45

PLU Table Program Receipt Format:

Key Operation

Control Lock; SET

EOl-11072

PLU Code

10 PLU

IHULPLU I)|l

|2|0|Lplu I

5

0

1

0

0

9 9

[sjfPLu

PLU 1

PLU 1

Preset Price

2 3 0 0 Dept 1 1

AMT

0 Dept 3 1

I Dep^^

1 0 0

Dept^^

Dept^

Dep^^

Dept^Jj

)

Deleting Individual PLUs;

When any of the PLUs once programmed are not handled any more in the store, they can

be deleted.

Condition: When the required PLU sales total memory is zero (i.e. when no sales are

made or after a PLU Reset Report is taken to reset the sales data of the PLU

into zero)

(refer to 'WOT£ on Condition” on page 20)

Deleting Procedure:

X

REG

OFF

0

Declaration same as

PLU Programming on

the preceding page.

SET

flepeai for other PLUs to be deleted, if any.

ITEM

CORR

NOTES 1. Deletions are possible PLU by PLU.

2. If all the PLUs must be deleted (i.e., the PLU system itself is not necessary),

close the [PLU] Key. (Refer to Chapter 13.)

-43 -

©/FOR

PLU Code of the PLU

to be deleted

PLU

AT7TL

Page 46

PLU Deletion Receipt Format:

EOl-11072

Key Operation

Control Lock: SET

|@/FOR I

Thank you

Call again

PLU Code deleted

PLU Code

of PLU td'

be deleted

Deletion Symbol

Line

ITEM CORR

Total number of

PLUS remaining

13-16

set in memory

Changing PLU Preset Prices:

When only changing preset prices of PLUS as part of daily requirements, this operation is

quicker than operating “Programming PLU Table”.

Condition: Any time outside a sale.

Programming Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

flepeaf for oOier PLUs, if necessary.

NOTES

#/CID

or

NOTE 2 '

PLU Code

max. 3 digits;

1 to 200

NOTE 1

PLU

New Preset Price

max. 6 digits:

0 to 999999$ f

NOTES 1. The PLU Codes must exist in the PLU table file already programmed.

2. If “0” is entered as the New Preset Price, price of $0.00 is set. Neither price

setting nor changing is possible for Open-price PLUs in this operation.

3. For sequentially accessing PLU Codes, the code specification can be omitted.

PLU Price Change Setting

Receipt Format:

Key Operation

PLU Code

Control Lock: SET

Link

PLU 1

New Preset Price

1

2 3 4

5

#/CID

Department No.

New Preset Price

PLU Code

1

1

AT/TL

-44-

Page 47

Sale Item Entries of PLUs

Various types of PLU entries are shown below.

EOl-11072

Use the REG Key to turn the

Control Lock to “REG”.

X

REG

OFF

Price Entered

(When the price is within

3 digits, it is printed on

the PLU Code line.)

★ : Positive

Entry of One PLU Item: