Page 1

TEC Electronic Cash Register

MA-55 (US Version)

TEC

tokvo

euecTP'C

Page 2

----------------------------------------------------------NOTICE-------------------------------------------------------------

This equipment has been tested and found to comply with the limits for a Class A digital

device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide

reasonable protection against harmful interference when the equipment is operated in a

commercial environment. This equipment generates, uses, and can radiate radio frequency

energy and, if not installed and used in accordance with the instruction manual, may cause

harmful interference to radio communications. Operation of this equipment in a residential

area is likely to cause harmful interference in which case the user will be required to correct

the interference at his own expense.

WARNING

"THIS DIGITAL APPARATUS DOES NOT EXCEED THE CLASS A LIMITS FOR RADIO

NOISE EMISSIONS FROM DIGITAL APPARATUS SET OUT IN THE RADIO INTERFER

ENCE REGULATIONS OF THE CANADIAN DEPARTMENT OF COMMUNICATIONS."

"LE PRÉSENT APPAREIL NUMÉRIQUE N’EMET PAS DE BRUITS RADIOÉLECTRIQUES

DÉPASSANT LES LIMITES APPLICABLES AUX APPAREILS NUMÉRIQUES DE LA

CLASSE A PRESCRITES DANS LE RÉGLEMENT SUR LE BROUILLAGE RADIOÉLEC

TRIQUE ÉDICTÉ PAR LE MINISTÈRE DES COMMUNICATIONS DU CANADA."

Copyright © 1993

by Tokyo EiBCtrIc Co,, Lid.

Ati Righli Reserved

1-ie-tO Uchikenda, Chlyoda-ku. Tokyo, JAPAN

Page 3

1. Introduction

Thank you for choosing the TEC electronic cash register MA'55 series. This

instruction manual provides a description of the functions and handling of this

register and should be read carefully to ensure optimum performance. Since every

consideration has been given to safety and reliability, there is no danger of damaging

the machine by incorrect operation.

Please refer to this manual whenever you have any questions concerning the

machine. This machine has been manufactured under strict quality control and

should give you full satisfaction. However, if the machine is damaged during transit,

or there are any unclear points in this manual:

For supplies, service or assistance call;

LOM1074

Please have the following information available when

you call:

Product Name: TEC Electronic Cash Register

Model: MA-55

Serial Number: ___

Place Purchased;_________

_________________

______________

_

Date of Purchase:

If tor any reason this product is to be returned to the store

where purchased, it must be packed in the original carton.

The specifications described in this manual may be modified by TEC, if neces

sary.

Be sure to keep this manual for future reference.

-1 -

Page 4

2. Unpacking

E01-11074

©

^Control Keys (M Key; 2 pcs.)

(^Journal Take-up Reel (1 pc.)

@Paper Roll 57mm x 030mm (1 pcs.

(3) Dry Batteries (SUM-3 1.5V; 3 pcs.

(^Owner's Manual (1 pc.)

2 -

Page 5

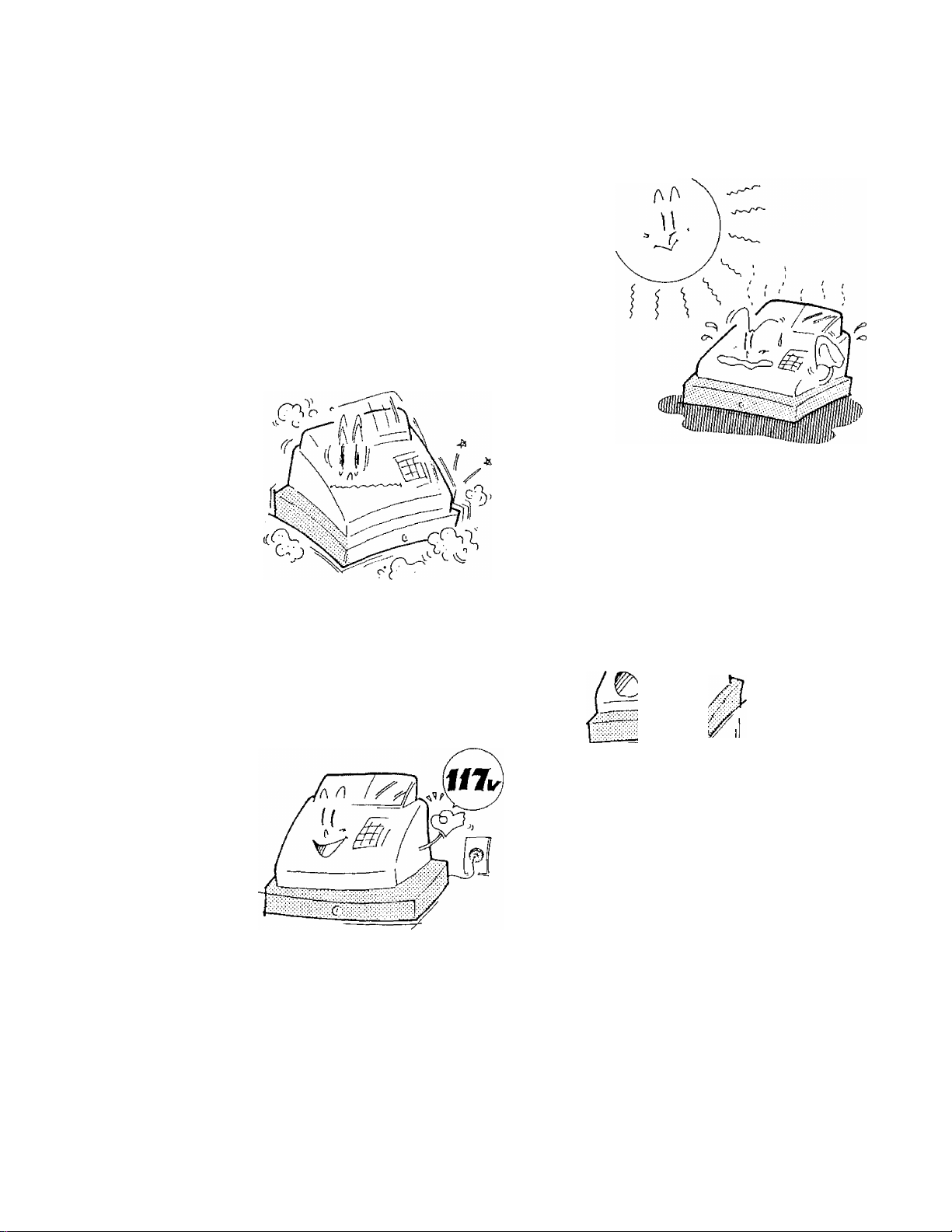

3. Precautions

The ECR is a precision machine. Please handle it carefully considering the following

guidelines.

Remarks on the Location

Do not place it where unusual temperature

changes are expected or where it will be

subject to direct sunlight.

Place it on a flat and level surface with little

dust, humidity, vibration, etc.

EOM1074

Keep it away from water sources.

Be certain that the power voltage in your area

matches that required for the machine. {The

rated voltage is 117V ±10% AC.)

The socket-outlet shall be installed near

the equipment and shall be easily ac

cessible.

- 3 -

Page 6

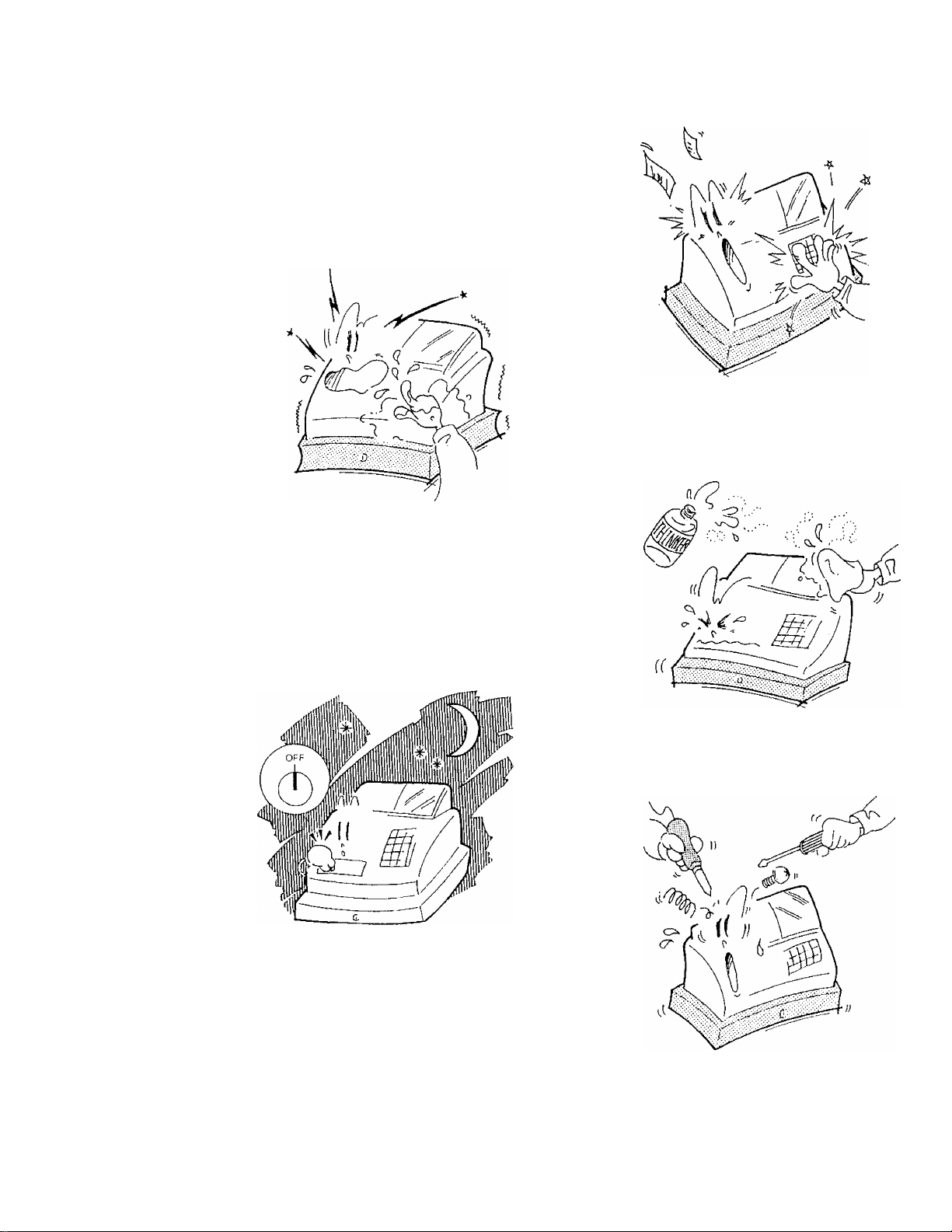

Remarks on Operating the ECR

The keys on the keyboard function with a light

touch. Avoid pressing the keys too hard.

Do no handle the machine with wet hands,

since this may cause electrical malfunctions

and corrosion of parts.

EO1-11074

Do not apply thinner, benzine, or other vola

tile materials to the cabinet or other plastic

parts. Such liquids will cause discoloration or

deterioration, if dirty, wipe off with a piece of

cloth soaked in a neutral detergent and

wrung out thoroughly.

Turn the Control Lock to OFF position when

all operations are completed after business

hours.

Never try to repair the ECR. In the event of

a problem, please call your authorized TEC

dealer, reseller or local TEC representative.

Page 7

4. Table of Contents

Chapter Page

eol-11074

1. Introduction

2. Unpacking

3. Precautions

............................................

...............................................

.............................................

4. Table of Contents........................................ 5

5. Outline of Preparation Procedure Before Operating the ECR

6. Appearance and Nomenclature

7. Control Lock and Control Key

..............................

.............................

...

8. Display................................................ 10

9. Keyboard............................................... 11

Functions of Each Key

10. Installing the Paper Roll

11. Programming

.........................................

.................................

............................

11

13

16

Time Setting.......................................... 16

Date Setting.......................................... 16

Setting Department Preset Prices

Setting Department HALC and System HALC

Department Tax Status & Negative Status

Department Itemized/Single-item Status

% Preset Rate Setting

.................................

.......................

.................

.................

..................

19

19

20

20

21

% Calculation Fraction Rounding Process Selection........21

Tax Feature Selection..................................22

% Key Type & Tax Status, Amount Form Setting

............

22

System Option 1 Setting................................23

System Option 2 Setting................................23

System Option 3 Setting................................24

Tax Table Setting

12. Verification of Programmed Data

13. Daily Operation Flow

.....................................

.......................

.................................

25

29

30

14. Transaction Entries..................................31

When an error has occurred............................. 31

Displaying the Time and Date........................... 31

No-sale

Sale Item Entries {Department Entries)

Percent Discount or Percent Charge

Void

..............................................

..................

.....................

................................................

32

32

34

34

Manual Tax............................................35

Non-add Number Print

..................................

35

Subtotal Read......................................... 35

Taxable Total Read

Finalizing a Sale

Received-on-Account Payment

Paid Out

.............................................

....................................

.....................................

............................

35

36

38

38

15. Read (X) and Reset (Z) Reports........................39

16. Maintenance

.........................................

40

Replacing the Paper Roll...............................40

Replacing the Ink Roller

Manual Drawer Release

Removing the Drawer

Battery Exchange

17. Specifications

......................................

......................................

..............................

.................................

...................................

41

41

42

42

43

1

2

3

6

8

9

-5-

Page 8

5. Outline of Preparation Procedure Before Operatino

the ECR

This chapter shows the outline of set-up procedure of the ECR before actually starting

the ECR operation.

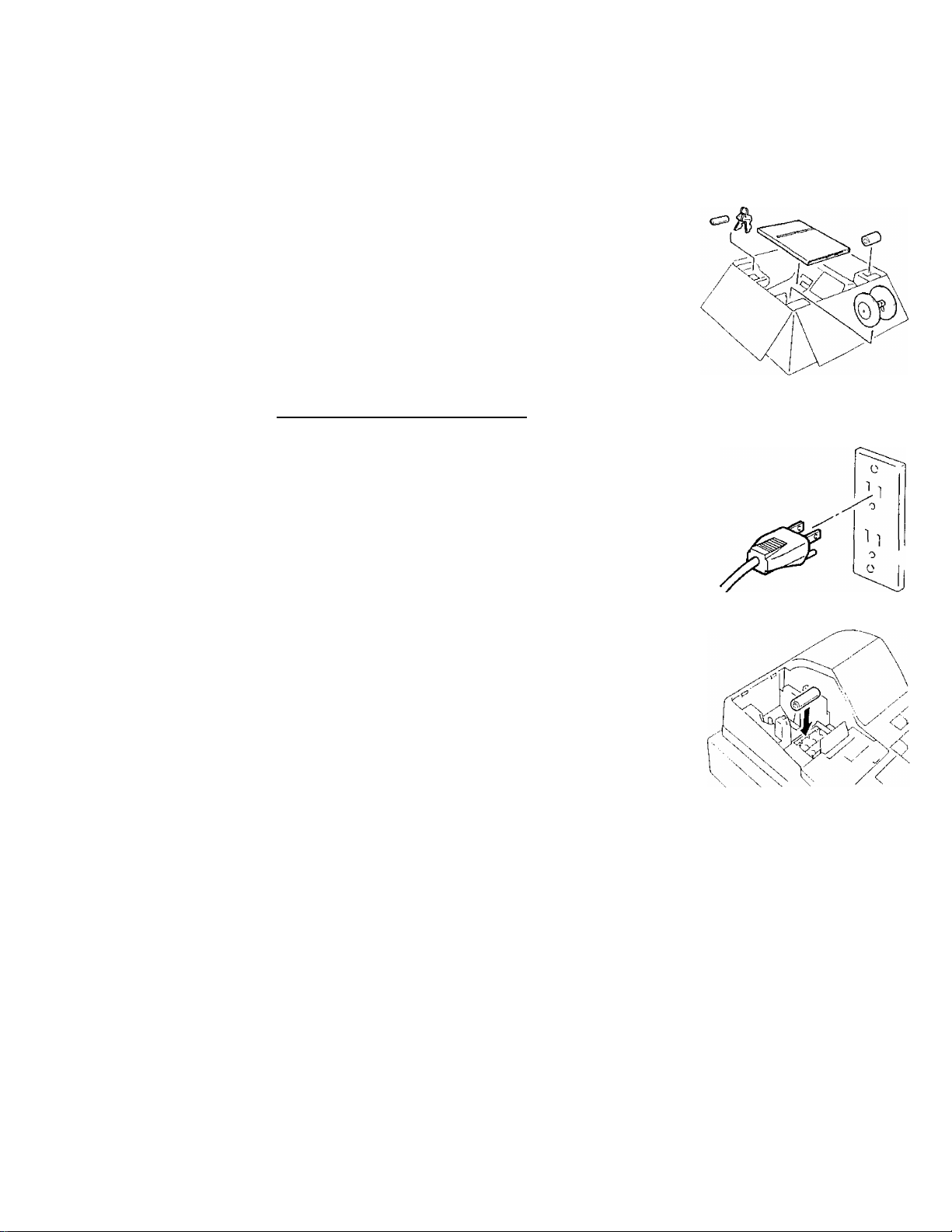

Remove the cash register from the carton, referring to

Chapter "2. Unpacking" on page 2. And take out all the

parts and accessories.

Remove the tapes and seals that are holding parts or

~j| protecting the register surfaces.

________________

EO1-11074

Plug the power cord of the register into a wall outlet.

Make sure that the outlet voltage matches that of the

power required for the register.

NOTE: Before the batteries are inserted, be sure to insert

the power plug.

Detach the Paper Cover and the Battery Cover, then

insert the batteries (3 pieces).

WARNING: Be certain to insert the batteries enclosed in the

package. If they are not insert and the power is

turned OFF (including a power failure occurrence),

the sales data and the programmed data will be

cleared.

Insert the Control Key (M Key) into the Control Lock.

Turn the Control Lock to the REG1 position.

OFF

REG2 1 REG1

OFF

REG2 i^EGt

-6-

Page 9

Install the Receipt or Journal roll (referring to Chapter

"10. Installing the Paper Roll'}

Set the time and date correctly, referring to "Setting

the Time and Date" in Chapter 11.

Set the tax tables, referring to "Tax Table Setting" in

Chapter 11.

E01-11074

Perform other programming operations, such as pro

gramming of Departments, according to the require

ment of the market and your store (refer to Chapter 11

and thereafter).

- 7-

Page 10

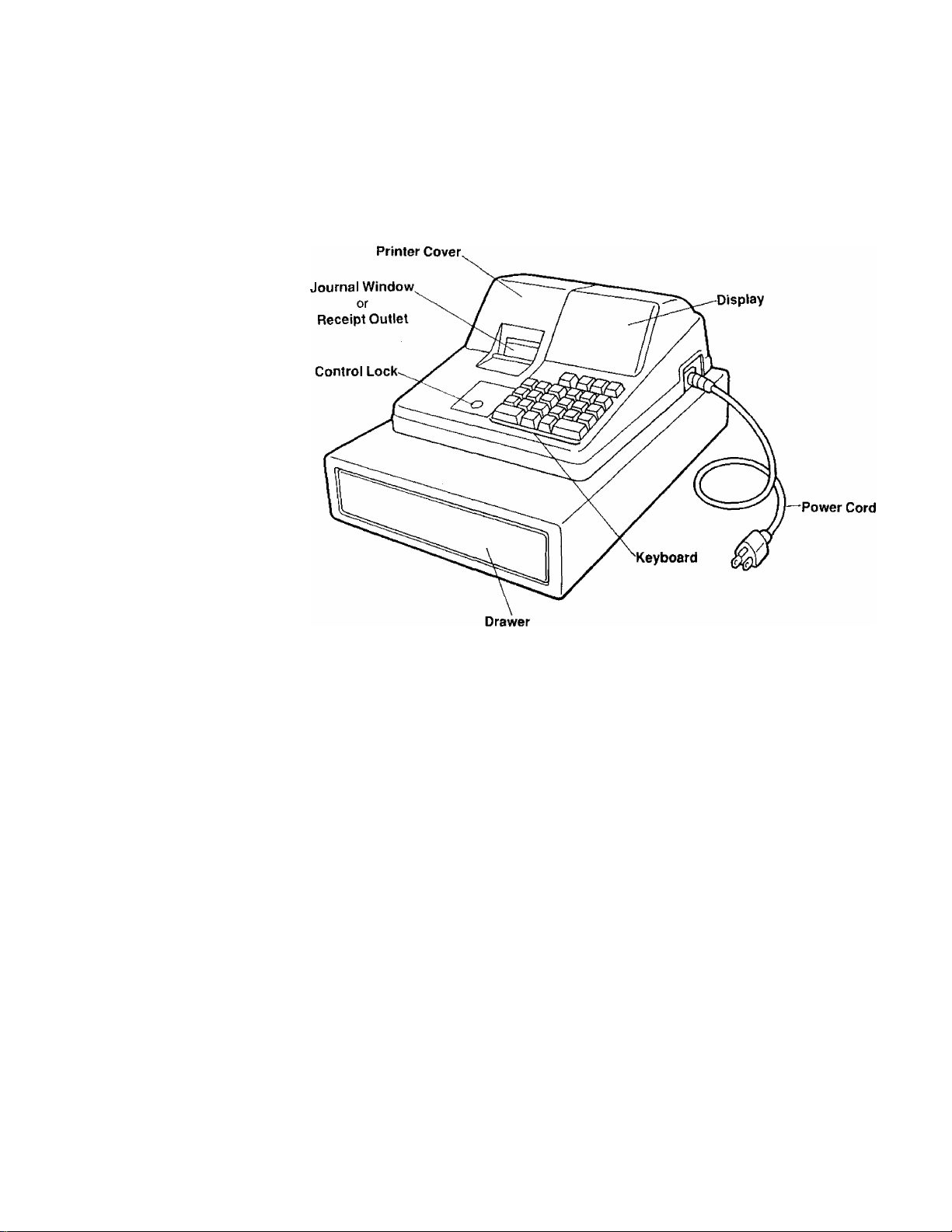

6. Appearance and Nomenclature

EO1-11074

Printer Cover

The cover for the Receipt or Journal paper

holder and the printer.

Receipt Outlet or Journal Window

The receipt for the finalized sale is issued

with the Receipt-format option.

Or, the operator can see which items have

already been entered through this window

with the Journal-format option.

Display

Used by the operator to confirm the entry

contents and the status of the register,

(page 10)

Control Lock

It selects the type of register operations,

(page 9)

Keyboard

Used to enter sale items, {page 11)

Drawer

Cash and other media are kept here. It

automatically opens on finalizing a sale.

8 -

Page 11

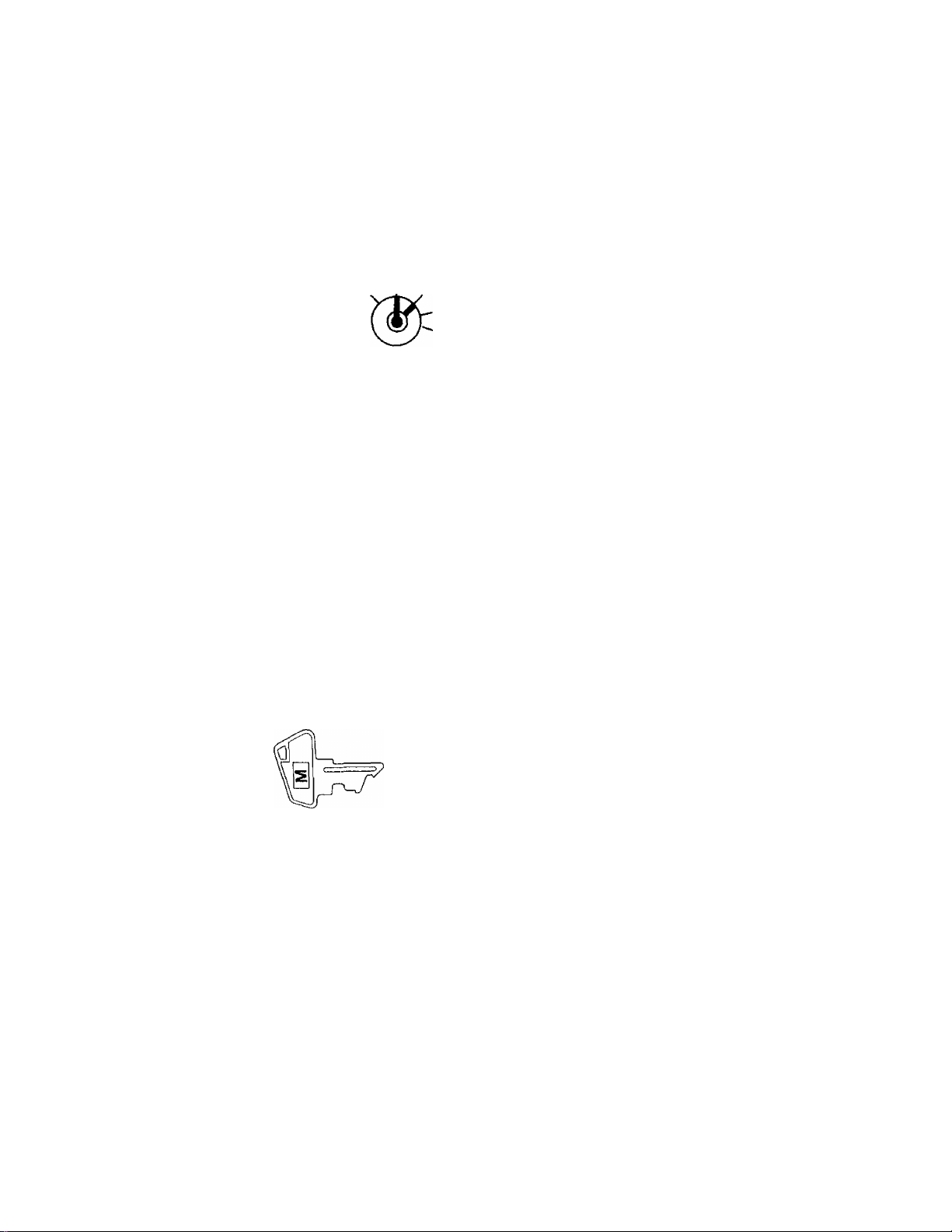

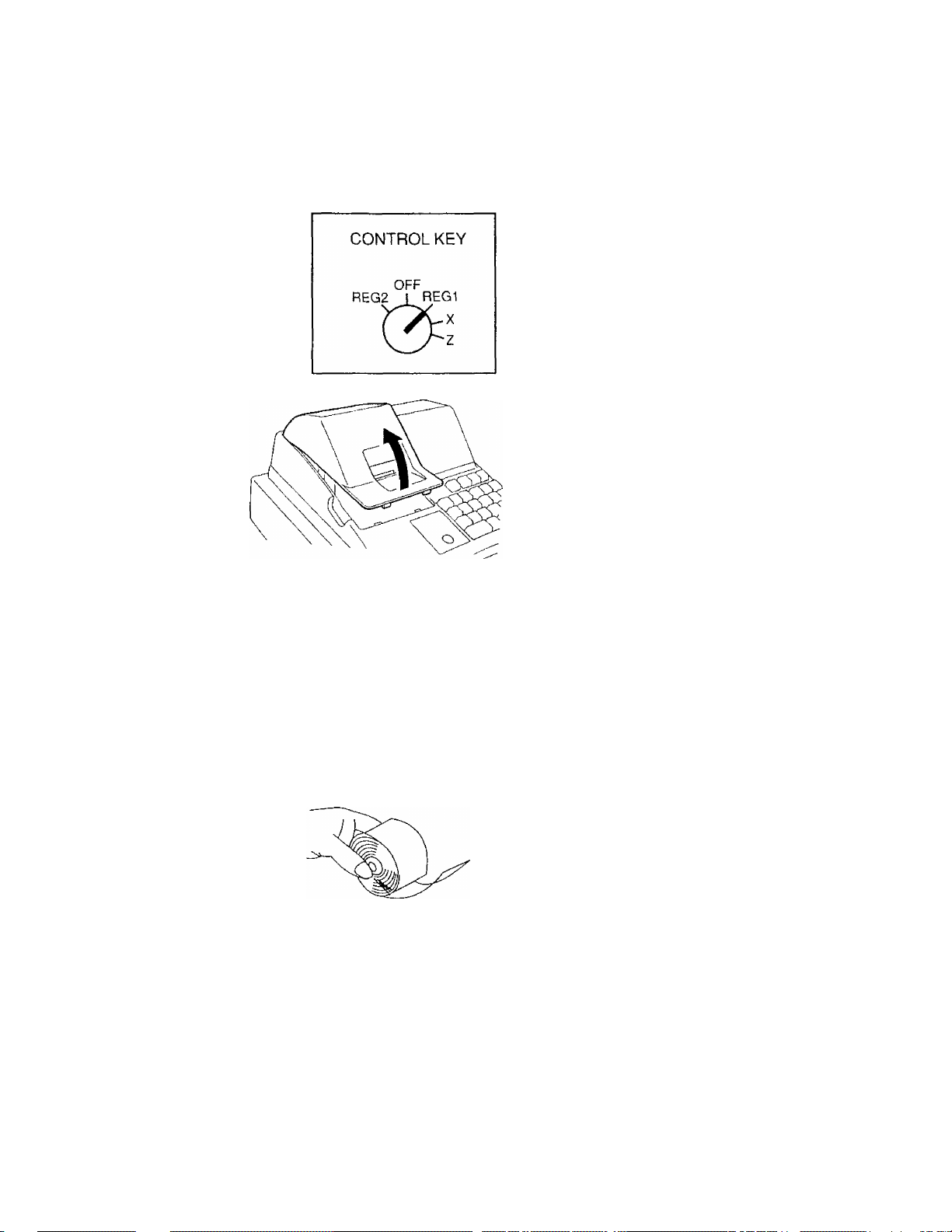

7. Control Lock and Control Key

Control Lock

EOM1074

OFF

REG2 I REGI

OFF...

REGI

REG2

.Stops register operations and

extinguishes the display.

.Used to register normal sales

with receipts (or jounals)

printed.

.Used to register normal sales

without any receipt (or journal)

printed.

.Used to read sales totals proc

essed in the register report

memory (X report). Receivedon-Account and Paid Out op

erations are also performed in

this position.

.Used to read and reset sales

totals in the register report

memory (Z report). Also used to

program preset data and read

those data.

Control Key

Two keys of the same type are packed in the carton. It is used

to turn the Control Lock to a required position. The key may

be inserted or pulled out in the OFF or REG1 position.

- 9

Page 12

8. Display

Description

EOM1074

n n n

U'UU

Amount

- Negative Mark or Repeat Count

n n^n

u f^D LI - a oj

Department Code, Message Descriptor

Amount

Negative Mark

Repeat Count

Department Code

Message Descriptor:

Displays the numeric data, such as amount, quantity, etc.

Displays the current time or date when the [X] key is de

pressed in the REG1 or REG2 mode.

When a Void, Percent Discount, or Negative Department item

has been entered, the Negative Mark is displayed.

The mark is also displayed when the subtotal or sale total is

obtained and the amount is negative.

'Displays the repeat count of the same item being entered.

The count display shows up from the second entry on, and

only the last digit will be displayed even if the count exceeds

nine.

. Displays the Department Code (1 to 4) when the correspond

ing Department Key is depressed for any sale Item entry.

(Subtotal)

O

Indicates that the displayed amount is the current

subtotal of the sale.

(Total)

o

Indicates that the sale is finalized and the displayed

amount is the sale total.

(Change)

n

Indicates that the sale is finalized with an amount

tendered and the displayed amount is the change

due.

n

(Error)

Indicates that the last operation has caused an error.

10-

Page 13

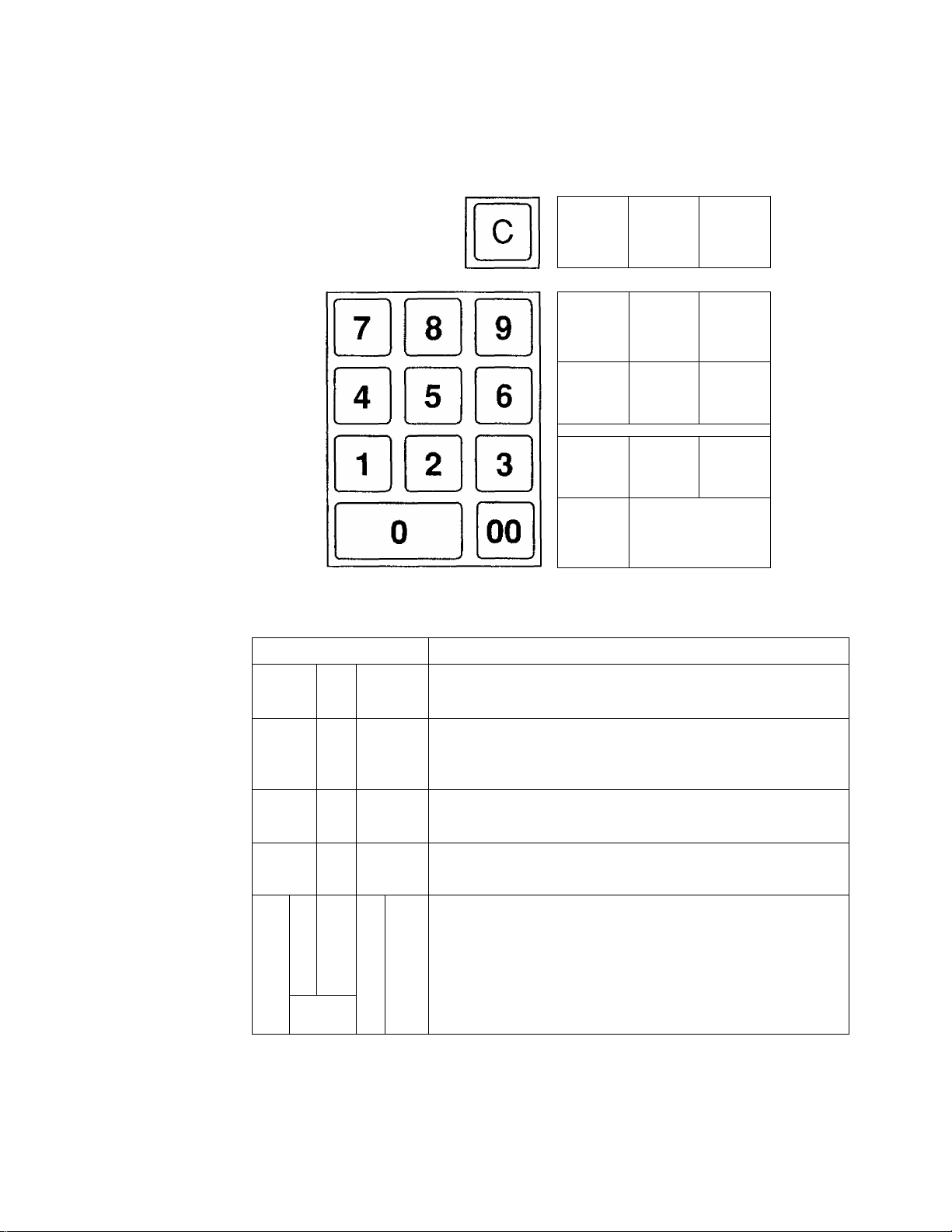

9. Keyboard

The following shows the key layout on the MA-55 keyboard;

------

EO1-11074

'

Functions of Each Key

KEY

'

c

Clear Key: Used to clear a wrong entry or operation error.

X

.

-

^

...... ^

-

VD

TX1/M

4

PO

_

______

' '

TX2/M

3

R/A

ST

2

-

1

FUNCTION

FEED

-

-

--------

-

.

______ j

Chg

AT/TL

-

/o

#/

/NS

7

4

[H

X

VD

FEED

E

B

B

0

9

6

3

00

Multiplication / Date & Time Display Key: Used to enter

sale items by multiplication inside a sale. Also used to

display the time or date outside a sale.

Void Key: Used to delete items already entered in the

current sale.

Feed Key; Used to feed the receipt or journal paper.

Numeric Keys: Used to enter numeric data, such as

amounts, quantities, and code numbers.

The [00] key functions the same as depressing the [0] key

twice consecutively.

11

Page 14

EOM1074

' ^

1

KEY

to

TX1/M

PO

TX2/M

R/A

%

y

/NS

_

____

FUNCTION

Department Keys 1 to 4; Used to enter sale items and

4

^

process the amount into appropriate departments.

Tax 1 Modifier / Paid Out Key (X Mode): Used inside a

sale to reverse the Tax 1 status of departments from

taxable to non-taxable, or vice versa. When outside a sale,

it is used to record amounts paid out of the drawer without

relating to a sale.

Tax 2 Modifier / Received-on-Account Key (X Mode):

Used inside a sale to reverse the Tax 2 status of depart

ments from taxable to non-taxable, or vice versa. When

outside a sale, it is used to record received-on-account

payment amounts.

Percent Charge or Discount Key: Used toadd orsubtract

a percent rate, preset or manually entered, to or from the

sale or an individual sale item. Whether the key is used as

Percent Charge or Percent Discount can be programmed.

Non-add Number Print / No-sale Key: When depressed

with a prior number entry, it functions as Non-add Number

Print Key. When simply depressed without a numeric entry

outside a sale, it functions as No-sale Key.

ST

Chg

AT/TL

Subtotal Key: Used to obtain a subtotal (sale total amount

up to the moment).

Charge Key: Used to finalize a sale as charge (non-cash

media sales, such as check, house charge, credit cards,

etc. defined by the store) by a simple depression without

any numeric entry (Total Function only).

Cash Amount Tender/Total Key; Used to finalize a sale

as cash by depressing with a prior tendered amount entry

(Tender Function) or by a simple depression without any

numeric entry (Total Function).

12-

Page 15

10. Installing the Paper Roll

E01-11074

Turn the Control Lock to the REG1 posi

tion using a Control Key.

Remove the Paper Cover.

rXi

y

j

Cut the paper end to make it sharp.

Hold the paper roll so that the paper end

will be fed from the bottom.

- 13

Page 16

EOM1074

Piace the paper roll in the paper pocket.

Insert the paper end into the Paper Inlet

located on the rear side of the printer, and

hold down the [FEED] key on the keyboard

until the paper end comes out of the outlet.

If the printer is used for journal, fold the top

end of the paper and insert the folded end

into the slit of the Take-up Reel Shaft.

Then wind the paper two or three times, set

the reel to the holder, and hold down the

[FEED] key for a while to tense the paper.

If the printer is used for receipts, do not

wind the paper end around the Journal

Take-up Reel.

- 14-

Page 17

EOM1074

If the printer is used for journal, simply

attach the Paper Cover. The Receipt

Outlet is used as Journal Window.

If the printer is used for receipts, attach the

Paper Cover with the paper end coming

out of the Receipt Outlet located on the

Paper Cover.

15-

Page 18

11. Programming

The time and date should be adjusted and such data as status of each department,

percent rate, etc. should be programmed before starting sale entries. Printing occurs

as programming is proceeded.

• The programmed data will be retained by dry batteries even if the power of

the machine is turned OFF or a power failure occurs.

EOM1074

• Turn the Control Lock to the Z position before starting reg

any programming operation (Time Setting and Date

Setting can be operated in either X or Z position). f

• Key indications in the operation patterns in this manual:

Time Setting

I I

. ..

Entry through a Numeric Key □ . Function Key depression

(Control Lock; X or Z)

2

The 24-hour system (military time} is used for time setting.

□□□□ — Q (No printing occurs. Indicates the set result in the

Hour Minute

display.)

(00 to 23) (00 to 59)

Date Setting

]□ □□ DC

Month Day Year

(Control Lock: X or Z)

X

I

(No printing occurs. Indicates the set

’ result in the display.)

(01 to 12) (01 to 31) (93,94, etc.)

NOTE: The dale entry order above shows the initial set order. The entry order of Day-

Month- Year or Year-Month-Day can be selected instead of Month-Day- Year by the

Date Entry Order option to be described iater.

Sample Programming Operations

To set the time to 1:05 pm and the date to August 5.1993:

Display

(Time Setting)

n 1 nr

LI 1

LIO

(□ to clear the time display

0[1]0[I][9][I][3 (Date Setting)

- 16-

nn nr

UO ~ UO

Value of

seconds

nn

LI LI

nr\n

LMO LI

ri -f

~ oo

Page 19

E01-11074

The following programming operations are performed in the common operation

pattern as shown below. You may go through a specific programming operation or go

through all the operations at one time.

Common Operation Pattern

Control Lock; Z

, nnna

A Subnnode No,

(3 digits)

. □

...................

Entry of data to be set

(Number of digits varies ac

Only displays the set data (no

print occurs).

□[s^

cording to each submode)

To continue to another Submode No.

Prints the set data as well as

preset data of all other

Submode Nos.

Submode

No.

001

002

003

004

005

006

007

008

009

010

oil

012

013

014

Submode No. and Programming Operation

Programming Operation

Department 1 Preset Price

Department 2 Preset Price

Department 3 Preset Price

Department 4 Preset Price

Department HALC & System HALC

Department Tax & Negative Status

Department Single-item Status 4 digits

% Key Preset Rate 4 digits

% Calculation Fraction Rounding 2 digits

Tax Feature Selection

% Key Type & Status, Amount Form &

Amount Division Symbol

System Option 1

System Option 2

System Option 3

Entry data to

be set

Max. 5

digits for

each

5 digits

4 digits

2 digits

2 digits

2 digits

for each

- 17

Page 20

EOI-11074

The following table shows the initial settings of the machine before changing the

programming data. Select the programming operation whose data must be changed

referring to the table.

Initial Settings

Submode No.

001 to 004

Department 1 to 4 Preset Price (one for each)

Programming Operation

Department 1 to 4 HALC (one for each)

005

System HALC

006

Department Tax Status

Department Negative Status

007

008

Department Single-item Status

% Preset Rate

009 % Calculation Fraction Process

010

Oil

Tax Feature

% Key Type, Its Tax Status

Amount Form, Amount Division Symbol

Initial Setting

None {= open price)

None (= 7 digits)

None (= 8 digits)

Dept, 1 : Tax 1 Taxable

Dept. 2: Tax 1 Taxable

Dept. 3: Non-taxable

Dept. 4: Non-taxable

Dept. 4; Negative

Others: Positive

All Depts.: Itemized

10.00%

Round Off

Tax 1: Add-on Tax

Tax 2: Add-on Tax

%- Key, Non-taxable

0.00 (Point)

012

013

014

System Option 1 (Print/Non-print Option in sales)

Consecutive No.

Subtotal (automatic subtotal)

Current Time

Subtotal (manual [ST] key depression)

Taxable Total 1

Taxable Total 2

Print

Print

Print

Non-print

Non-print

Non-print

System Option 2

Printer used for:

Consecutive No. resetting after Z Report

Time System for Display & Print

Receipt

Non-resettable

12-hour system

Date Entry Order Month-Day-Year

System Option 3

Tender to finalize a sale as cash

[ST] Key before finalizing any sale

Not compulsory

Not compulsory

GST Feature (for CANADA) Not applicable

18-

Page 21

Setting Department Preset Prices

A unit price of up to 5 digits can be preset on each Department Key.

E01-11074

Lil —► □

Submode No.:

001 for Dept. 1

002 for Dept. 2

003 for Dept. 3

004 for Dept. 4

................................................

□ \E]

Preset Price

(1 to 99999; max, 5 digits)

When 0 (zero) is entered

here, the Department is set

as an open-price depart

ment.

Display Example) $1.00 is set to Dept. 3:

riri “/

U UJ

Submode No.

Preset Price

(= Dept. No.)

n n I n n

U Li I Li Li

now set

Setting Department HALC and System HALC

The HALC {High Amount Listing Capacity) is used to check excessively high

amounts entered by mistake. By setting HALCs, such mistakes will be prevented

at the earliest stage.

Dept.2 Dept.4

Dept.1 Dept.3 : System

Lll

Submode No.

□□nnnm

HALC for each dept.

0 to 7 {indicating the

number of digits for

max. amount entry

allowed); 0 is the

same as 7.

\

For example, if "3" is entered, it means 3 digits and

the high amount limit is 999 {$9.99},

HALC for Sale Finalization,

Manual Tax, Received-onAccount, Paid Out.

0 to 8 (indicating the

number of digits for max.

amount allowed); 0 is the

same as 8.

______

'/

Display Example)

4 digits for Dept. 1

5 digits for Dept, 2

6 digits for Dept. 3

7 digits for Dept. 4

8 digits for System

-19-

nn r

LI Li 3

/ ir r rin

3 0 to

Page 22

Department Tax Status & Negative Status

Each Department can be set to be taxable to Tax 1 and/or Tax 2, and to be a

negative department. A negative department is used to enter returned merchan-

Dept.2 Dept.4

Dept.1 i Dept.3

EOM1074

Submode No.

Status Code 0 to 7

for each department:

0; Non-taxable, Positive

1: Tax 1 (or VAT1) Taxable, Positive

2; Tax 2 (or VAT2) Taxable, Positive

3: Tax 1 (or VAT1) & Tax 2 (or VAT2) Taxable.

Positive

4; Non-taxable, Negative

5: Tax 1 (or VAT1) Taxable, Negative

6: Tax 2 (or VAT2) Taxable, Negative

7: Tax 1 (or VAT1) & Tax 2 (or VAT2) Taxable.

Negative

NOTE When the GST Feature is selected by program option (Submode No. 014), "Tax 1" will

be GST and “Tax 2" will be PST.

Display Example)

Dept. 1

Dept. 2

Dept. 3

Tax 1 & Tax 2, Positive

Tax 1, Positive

Tax 2, Positive

nn r

u uo

Dept. 4: Non-taxable, Negative

icon

Department Itemized/Single-item Status

This operation selects the receipt-issue type status for each department.

When a department is set to be an "Itemized" department, a sale item entry

through that Department Key will not immediately finalize the sale and will allow

other item entries until a media key {[AT/TL] or [Chg]) is operated.

When a department is set to be a "Single-item" department, a sale item entry

through that Department Key will immediately finalize the sale as cash and issue

a receipt if it is operated outside a sale. However, when a Single-item department

is operated during a sale, it functions the same as an Itemized department.

-20-

Page 23

Dept.2 Dept.4

Dept.1

Dept.3

EOM1074

\J}

Submode No.

□□□□ E

Status Code for

each department:

0; Itemized

1: Single-item

Display Example)

Dept. 1

Dept. 2

Dept. 3

Dept. 4

Itemized

Itemized

Single-item'

itemized ■

n n n

LIU 1

% Preset Rate Setting

HBB nn

Submode No.

NOTE: Whether the [%] key is used as Percent Discount Key or Percent Charge Key is

determined in Submode 011.

Display Example)

□□□□ m

Preset Percent Rate

0001 (0.01%) to 9999 (99.99%);

aiways enter 4 digits.

n n n

LI LI O

LI O LI LI

in

n n

LI LI ILI

n r n n

% Calculation Fraction Rounding Process Selection

nn\E

Submode No.

Display Example)

Rounding Process

Code:

00

Round Down

50

Round Off

99

Round Up

nnn

LI LI O

- 21 -

5% is set

nn

LI LI

Round Down

Page 24

Tax Feature Selection

This operation selects the basic tax feature.

ттмт-»- ппи

Submode No.

Tax 1 Type I

0,1, or 2 Tax 2 Type

_

___________________i

0: Non-taxable

1; Add-onTax

2; VAT

EOM1074

0, 1, or 2

Display Example)

n

in

и

lU

Tax 1 :

Add-on Tax

t 1

1 1

Tax 2:

Add-on Tax

% Key Type & Tax Status, Amount Form Setting

This operation provides selection of whether the % key is used as %- or %-»- key,

sets the Tax Status of the % key, and determines the Amount Form for display and

print.

ИШШШ-» □□на

Submode No.

% Key Type and Status;

0 to 7

0: %-, Non-taxable

1: %-, Tax 1 (or VAT1) Taxable

2: %-, Tax 2 (or VAT2) Taxable

3: %-, Tax 1 (or VAT1) & Tax 2 (or

VAT2) Taxable

4: %+, Non-taxable

5; %+,Tax1 (or VAT1} Taxable

6: %-h, Tax 2 (or VAT2) Taxable

7: %+, Tax 1 (or VAT1) & Tax 2 (or

VAT2) Taxable

Display Example)

n 1 1

и 1 1

Amount Format, Division Symbol Selection;

0to7

0: 0,

1; 0.0

2: 0.00

3: 0.000

4: 0 ,

5: 0,0

6: 0,00

7; 0,000

n n

JC

%-, Tax 1 & Tax 2 Taxable

- 22-

0.00

Page 25

System Option 1 Setting

This setting is for print/non-print selections of some items on the sale receipts.

EOM1074

Consecutive No. Print, Auto Subtotal

Print, Current Time Print

Subtotal by [ST] Non-print, Taxable

Total 1 Print, Taxable Total 2 Print

System Option 2 Setting

This setting is for selections of printer use, Consecutive No. resetting method,

display & print time system, and date entry (setting, display, and print) order.

- 23 -

Month-Day-Year

Page 26

System Option 3 Setting

This setting is for selections of Tender for finalizing a cash sale, [ST] Key

depression before finalizing any sale, and GST Feature selection, and PST

EOM1074

Tender Not compulsory, [ST] Not compulsory

NonGST Feature

Program Receipt Sample Format fSubmodes 001 to 014^

Set Data

Submode No.

001-00000

002-00000

003- 00100

004- 00000

005- 45678

006.-1234

007--0010

006- -0500

009- ---00

010- -.-11

Mode Symbol

oil ■ ■ ■ ■ 22

012--..00

013- --20

014- ---00

02-20

0006#08-05-93

• Current Time

Consecutive No., Date

indicates "pm" when

the 12-hour system.

-24-

Page 27

Tax Table Setting

□00 El

Submode No.

^ ^ I ST I (Tax 1 Table Start Declaration)

I

2) I I.........................I I ST I (Minimum Amount for Tax Rate Calculation)

Max. 4 digits; 0 to 9999(C)

E01-11074

I

__

□□□□□□ El

6 digits; 000000 (0.0000%) to 999999 (99.9999%) See NOTE 1.

4) I |j j

2 digits; 00 for Round Down, 50 for Round Off, 99 for Round Up

I

□

........

Max. 6 digits; 0 to 999999(?;); enter 0 if there are no Cyclic Breaks.

I

6)

□

........

Max. 4 digits; 0 to 9999(C)

: Repeat this break entry for 2nd, 3rd, etc. up to the break that ends one cycle

: of this cyclic breaks. See NOTE 4.

^ If Tax 2 Table setting is not necessary, go to Step 9) after Step 6).

7)

TX2/MI (Tax 2 Table Start Declaration, which automatically declares Tax 1 Ta-

R/A I bleEnd)

(Rate Calculation Fraction Rounding Method)

□ (Start Amount for Cyclic Breaks) See NOTE 2.

□ (Minimum Amount for 1st Break) See NOTE 3.

4

8) Follow the Steps 2) to 6) above and set Tax 2 Rate and Breaks.

I

ST I (to complete the entire Tax Table setting operation)

- 25 -

Page 28

NOTES 1. When no Tax fíate is to be applied and the tax table is made of tax breaks only, enter

"0" in Step 2), enter 000000 in Step 3), and enter 00 in Step 4). Then go on to Steps

4), 5), and 6).

2. When there is no Cyclic Breaks in the tax table, enter "0" for the "Start Amount for

Cyclic Breaks"in Step 5).

3. The "Minimum Amount for 1st Break" indicates the amount to start taxing, and any

amount less than this value will be non-taxable.

4. The difference between the Minimum Amounts of two neighboring breaks, in Step

6), must not exceed 990.

5. When only a Tax fíate is to be applied and no tax break settings are necessary, skip

Steps 5) and 6).

6. The folio wing are calculation methods when both Tax fíate and Tax Breaks are set:

If Objective Amount^Minimum Amount for Tax Rate Calculation (in Step 2):

... The tax is calculated by the Tax Rate (%}.

If Objective Amount < Minimum Amount for Tax Rate Calculation (in Step 2):

When Objective Amount < Minimum Amount for 1 st Break (Step 6):

... Non-taxable

When Objective Amount ^Minimum Amount for 1 st Break (Step 6}:

... the tax is calculated by the Tax Breaks.

7. Even when only part of the tax table is to be changed, set the entire tax table again.

8. VAT Calculation:

VAT =

Objective Sale Amount x Rate

100 -I- Rale

Ë01-11074

Example) When Objective Sale Amount =$1.00, Rate=3.0000%, Round

ing Method = Round Up:

9. Tax Calculation With GST Feature:

To realize the CANADA Tax Feature, it is necessary to select in Submode

014:

Code 3 (GST Applied: RST Taxable Total Amount includes GST)

(If any other code is selected, the ordinary tax calculation will be

applied.)

When the CANADA Tax Feature is selected. Tax 1 and Tax 2 in the Tax Table

Setting operation correspond as in the following:

Tax 1 = GST

Tax 2 = PST

Calculation:

Tax 1 (GST):

Tax 2 (PST);

calculated from Taxable Total 1

calculated from "Taxable Total 2 -i- Tax calculated from

Taxable Total 1 & 2 by Tax 1"

100 x 3.0000

VAT =

100-^3.0000

= 2.912621

Round up

I

= 3

-26-

Page 29

Tax Table Setting Examples

Tax 1 Table Setting Example 1: % Rate only

Tax Rate: 15% applicable to any amount,

Fraction Round Off

{Submode)

jsij (Tax 1 Table Setting Start Deciaratior

01st] (Min. Amount for Tax Rate)

□[ U0000HII I'''®*

00 na (Rounding Method)

StI (to complete setting)

Tax 1 Table Setting Example 2: Tax Breaks only

To set the following Tax Break Table:

Breaks

Tax

$0.01 to $0.10

$0.11 to $0.21

$0.22 to $0.35

$0.36 to $0.50

Amount Difference

from Previous Break

Oi

1C

2c

3C $0.14

$0.51 to $0.644c

$0.65 to $0.78

$0.79 to $0.92

$0.93 to $1.07

$1.08 to$1.21

$1.22 to$1.35

$1.36 to $1.50

5C

6c

7C

8C

9C

10c

:

----

$0.10

$0.11

$0.15

$0.14

$0.14

$0.14

$0.15

$0.14

$0.14

I

----

0008#08-05-93

Non-cyclic Breaks

/

One cycle

of Cyclic Breaks

/

E01-11074

z

T'^ 1

02-20 *

Cyclic Breaks

000 Q (Submode)

[stJ (Tax 1 Table Setting Start Declaration)

[o] |S^ (Min. Amount for Tax Rate)

000000

00^3

00gf&m,—

00[ST| (Break)

----—

0013 (Break)

rilfsIfsTI (Break)

riiri~|[s^ (Break)

00

00 (Break)

0001 (Break)

00001 (Break)

00001(Break)

000

STI (to complete setting)

1

^

-------------------

------------0-11

-------------------

00091/08-05- 93

- 27 -

— 0-00

00-0000

-------

00

0-36

0-22

0-36

0*51

0-65

0- 79

0*93

1- 08

1*22

1-36

02-31

TX 1

Page 30

Tax 1 Table Setting Example 3: Tax Breaks & % Rate

To set the followingTax Break Table;

Breaks

Tax

$0.01 to $0.10

$0.11 to $0.22H

$0.23 to $0.39

$0.40 to $0.56

$0,57 to $0.73

$0,74 to $0.90

$0.91 to $1.08

Amount Difference

from Previous Break

00

$0.10

20

30

A0

50

60

$0.12

$0.17

$0.17

$0.17

$0.17

Non-cyclic Breaks

/

% Rate of 6%, Fraction is Round Off,

UI00C1I (Submode)

|ST| (Tax 1 Table Setting Start Declaration)

rr[) b ||9||s^(Min. Amount for Tax Rate) -

|5]|o||st| (RoundingMethod)

(Cyclic Break Start Amount;

, 0 for no Cyclic Break portion)

(Break)

-----------

00[^ (Break)

(Break)

[sirni^ (Break)

|THT||st1 (Break)

Mm [stI (Break)

mmmf^ (Break)

---------------------------------

1-09

06*0000 %

■50

-------------

------------

--------------

OOtOffOB- 05- 93

0*00

0*11

0*23

0*40

0*57

0*74

0*91

1*09

02-39

EO1-11074

TX 1

I

ST I (to complete setting)

NOTE: Basically, the tax amount levied should increment by 10 every time a break

is set. However, if 20 are to increment for one break, enter the same Break

value (Minimum Amount for the Break) twice.

Example)

00 [13 (Break)

00 H3

miMi^ (Break)

00 m

- 28

Page 31

12. Verification of Programmed Data

The set data of Submodes 001 to 014 and the Tax 1 and Tax 2 table contents can be

verified by the following operations. A receipt is issued for each operation.

OFF

REG2 i^EG1

Control Lock: Z ' - ^

EOM1074

To read set data of Submodes

001 to 014:

□ [¡Li

Submode No.

001-00000

002-00000

003- 00000

004- 00000

005- 00000

006- -1104

007- -0000

008- -1000

009- ---50

010- --- 11

oil ---02

012-..-06

013- -.-00

014- ---00

01-14

0003#08-05-93

Set Data

To read Tax 1 and Tax 2 Tables

[¡][ST

TX 1 %Jax 1 Table:

1*09

06-0000

15-0000

0004#08-05-93

0-11

0-23

0-40

0-57

0-74

0-91

1*09

0-00

01-14

%

50

; /

TX 2

%

50

Tax 2 Table:

)

Receipt Consecutive No.

Date

-29-

Current

Time

When 12-hour

time system is

selected, the

asterisks indi

cates the time

"pm".

Page 32

13. Daily Operation Flow

The following shows a typical daily operation flow on the register.

EOM1074

Before Opening the Store ...

• Ensure that the register is firmly

• Check to see if sufficient portion of

• Checkthetime, date, and print con

plugged in the wall outlet.

paper roll remains.

dition.

Opening the store

Ordinary transaction entries

Received-on-Account and Paid

Out transactions

Taking Read (X) Report.

Reference

Page

13

31,32

31

38

39

After Closing the Store ...

Closing the store

• Taking Reset Report

• Tear off the print portion of Journal

Paper (if the printer is used for

journal recording).

• Leave the drawer open, and turn

the Control Lock to OFF.

• Take all the cash from the drawer

to the office with the journal and

Reset (Z) Report.

30-

39

40

42

42

Page 33

14. Transaction Entries

If the register is programmed with all requirements, it is ready to accept transaction

entries. Before starting to enter transactions, turn the Control Lock to either of the two

positions below;

When an error has occurred ...

When the buzzer sounds continuously and "E" is indicated in the leftmost digit of the display, the

last operation has caused an error and the keyboard is locked, in that case:

Press the El key to cancel the error condition and the keyboard is now operative,

This function of the fC] key is applied to operations in other Control Lock positions.

If errors occur repeatedly on operating the same key sequence, check the cause of

the error. The following are possible causes of error:

■ The Control Lock position is wrong.

■ The numeric value entered exceeds the high amount limit.

■ A numeric value has not been entered where required.

■ A numeric value has been entered where prohibited.

■ The key sequence is wrong, or a wrong key has been pressed.

■ The operation is not allowed at the current timing.

OFF

This position prints the transaction entry data on the

paper roll.

. ..

This position does not print the transaction entry

data on the paper roll.

EOt-11074

Displaying the Time and Date

.. Displays the current time.

hour

n “/

Li C

minute second

r r ir

~ DO

ID

(As for the time display and print, either 12-hour

system or 24-hour system can be selected.)

1 r

Displays the current date.

El

n n

UO

month day

nr

U D

n ~i

~ DD

year

The time or date display will disappear when any key is pressed on the keyboard or the Control

Lock position is changed.

(As for the date display and print order, Day-Month-

Year or Year-Month-Day order can be selected in

stead of Month-Day-Year.)

-31 -

Page 34

EOl-11074

No-sale

The NO'Sale transaction is used to open the drawer without relating to a sale, for such purposes

of money exchanges, checking the print condition on the paper roll, etc.

The drawer opens.

No-sale Symbol

Current Time

{The asterisks

means "pm" when

Receipt Consecutive No.

Date

the 12-hour sys

tem is selected.)

Sale Item Entries (Department Entries)

Department

1) Entry of One Item

Open-price Department

Price

Code

□

...

□ E

Price

Preset-price Department

□

.................

NOTE: The Price entry is possible up to 7 digits. However, it is limited by the Department

2) Repeat Entry

Open-price Department

□

Price Same Department Key

Preset-price Department

(□

NOTE 1.

LJ

Price

HALC (High Amount Listing Capacity) .

...

□ Ml a

...

n)^! El

Price Same Department Key

Depress again the Department key that has been depressed for one item entry.

The item entry will be repeated as many times as the key is depressed.

When a price is manually entered through a Preset-price Department key, the

2.

manual price will be entered by the Repeat Entry operation. If the preset price

must be entered instead of repeating the manually entered price, first depress the

[C] key then depress the Department Key.

3.

An item entered through a Negative Department cannot be repeated.

1*00

)

When a Preset-price Department key is simply depressed,

the preset price is entered. When a price is entered prior to

the Department Key, the manually entered price prevails.

.....

1*00

1*00

......

- 32 -

Page 35

3) Quantity Extension (Multiplication)

Open-price Department

□

.................

□[!]-»-□;

....................................

na

Quantity (max. 3 digits) Unit Price

Preset-price Department

Q)[^

Quantity (max, 3 digits) Unit Price

NOTE The product (obtained by multiplication) must not exceed 7 digits

4) Single-item Department

If a Department Key is programmed with

Single-item status, any entry through the

key wilt immediately finalizes the sale as

cash without operating any media key.

The operation is the same as ordinary

Itemized Department keys already de

scribed (Entry of One Item, Quantity

Extension), except that Repeat Entry is

not possible using a Single-item Depart

ment key.

OO2O#O0- 05- 93

Unit Price Quantity

1*00 3 —

1‘00 ST —

1*00 * 1 —

0*06 TX 1 —

1*00 * 2 —

0*15 TX 2 —

1*21 CA —

03- 06 *

— Dept. Item

— Subtotal

— Taxable 1

— Tax 1

— Taxable 2

— Tax 2

— Cash Total

E01-11074

Product

5) Tax Modification (applicable to Add-on Tax Feature)

Each department is programmed with its own Tax status (Non-taxable, Tax 1 Taxable, Tax 2

Taxable, orTax 1 & 2 Taxable). To reverse the Tax status (from taxable to non-taxable, or vice

versa), depress the following keys before ordering the required department item entry (before

the Department Key, at the latest). (Refer to Entry of One Item, Repeat Entry, Quantity

Extension.)

TX1/M

PO

to reverse Tax 1 status

TX2/M

R/A

111111

,to reverse Tax 2 status

When both Tax 1 status and Tax 2 status must be reversed, depress the two keys

consecutively.

NOTES 1. The tax-modi tied status declared by those Tax Modifier keys will be held until

another item is entered. The modified status is held even when the item is

repeated.

2. When a Department item is tax-modified and repeated and the same item (with

the same price and department) must still be entered consecuf/Ve within a sate

with the original tax status regained, depress the [CJ key before entering original

tax-status item.

6) Negative Department (Returned Merchandise)

When one of the Department keys are programmed with Negative status, an entry through that

department will automatically process the entered amount into negative. Returned merchan

dise may be entered. The operation is the same as positive Department keys (refer to Entry

of One Hem, Quantity Extension) except that Repeat Entry is not possible.

-2*50

- 33 -

Page 36

E01-11074

Percent Discount or Percent Charge

The [%] key can be programmed to function Percent Discounter Percent Charge.

1) Percent Discount/Charge on a Department Item

Department Entry i""" ► H {to activate the preset rate)

-------

► I I I 11 % I (to activate a

1-1

.....I-

Manual Rate; max. 4 digits

1 (0.01%) to 9999 (99.99%)

2) Percent Discount/Charge on Subtotal

Sale Item Entries (to activate the preset rate)

11 III manual rate)

NOTES 1. The Manual Rate can be en

tered in 4 digits at maximum;

to 9999 (result: 0.01% to

99.99%).

2. When a Manual Rate is entered,

the preset rate is disregarded.

3. The Percent Discount/Charge

cannot be operated after a Void

(Last Line Voiding or Desig

nated Line Voiding) entry.

I- I ► I I

^ ^ \ J

....

___ _ _

I I fin {to activate a

L. I LnIJ manual rate)

Manual Rate; max, 4 digits

1 (0.01%) to 9999 (99.99%:

6-00 ST

10-00 %

-0*60

■ Subtotal

10.00%

I]

Discount

Void

Sale items once entered within the current sale can be voided.

1) Last Line Voiding

When the last tine item (that has just been entered within the current transaction) is a

Department item or Percent Discount/Charge item, it can be voided by simply pressing the [VD]

key.

Department Entry i

Percent Discount/Charge —J ""' ' "

2) Designated Line Voiding

When a Department item entered before the last item is cancelled before the sale is finalized,

it can be voided. To operate it, follow the ordinary Department entry procedure (Entry of One

Item, Quantity Extension) except that the [VD] key is depressed iust before the Department

key depression.

2-00

-2-00 VD

voided

Jj[£j[0j Dept. 1|

2l|0 0| Dept.2|

1 0 0

NOTE To void a Preset-price Department entry using the Designated Line Voiding function,

the price must be entered. If the price entry is omitted, the key may function as Last

Line Voiding described in 1) above.

VDI Dept. 1|

- 34 ■

1-00 1

2-00 2

1-00 VD 1

voided

Page 37

EOM1074

Manual Tax

(applicable to Add-on Tax Feature only)

This operation is used to add an irregular tax amount that cannot automatically be calculated on

the basis of the programmed tax tables.

Sale Item Entries

NOTES 1. The Manual Tax entry is not possible

when the taxable total of the desig

nated tax is zero.

2. The Manual Tax entry is allowed only

once for each tax in a sate.

3. After entering manual tax(es), the sale must immediately be finalized.

4. The Manual Tax amount entered replaces the ordinary tax amount that was to be

calculated automatically on the basis of the programmed tax table.

TX1/M

PO

(for Tax 1 Addition)

TX2/M

R/A

(for Tax 2 Addition)

Displays the Taxable max. 8 digits or !im-

Total of the desig- ¡ted by System

natedtax. HALC

□

..

n\E\

: Tax Amount;

1-00 1

0-13 TX 1

Manual

Tax

Non-add Number Print

This function is to print any code number for future reference, such as Customer No., Credit Card

No., House Charge Account No., etc. Non-add numbers can be entered at the starting of a sate

or during a sale if the sale is not finalized. Multiple non-add numbers can be entered in a sale.

□

....

□ E

Non-add Number; max. 8 digits

12345670

■Non-add Number

Subtotal Read

To read the total of the current sale by the customer's request or the operator's requirement, simply

depress the [ST] key.

Sale Item Entries

NOTES 1. Printing of the subtotal amount fpre-taxed

sale total) by the operation above can be

selected by a program option.

2. When the Subtotal Compulsory option is selected, the [ST] key is always

required before finalizing a sale.

Displays the subtotal (sale total including taxes up

to the moment).

5*60 ST

Taxable Total Read (applicable to Add-on Tax Feature only)

tn need of reading the Taxable Total (pre-taxed amount) for a required tax (Tax 1 or Tax 2) during

a sale, operate the following.

Sale Item Entries

TX1/M

PO

(for Tax 1)

TX2/M

R/A

(for Tax 2)

Displays the Taxable Total (pre-taxed

sale portion amount subject to the

required tax).

■ 35 -

Page 38

Finalizing a Sate

1) Cash Total

2) Cash Tender

Sale Hem Entries

(ST

E01-11074

□

...............

□

Cash Tendered Amount

Subtotal (pre-taxed sale total)

■Taxable Total 1 {optional print)

•Tax 1

-Taxable Total 2 (optional print)

■Tax 2

Sale Total including Taxes

-Cash Tendered

■Change due

NOTB:

The sale is finalized as in the sample receipt above when the tendered amount

is equal to or larger than the sale total (including taxes). When the tendered

amount is smaller than the sate total (short-tendered), the balance due is

displayed and the sale is not finalized. In such cases, refer to "A) Multi-tender"

and "5) Split Tender " on the next page.

3) Charge or Credit Total

Sale Item Entries '► ( I ST

6-00 ST

4*00 * 1

0*24 TX 1

5-00 * 2

0*75 TX 2

6*99 CH

03-28 *

0037#08- 05- 93

-36-

Subtotal (manual print or auto-print)

■Taxable Total 1 (optional print)

-Tax 1

-Taxable Total 2 (optional print)

•Tax 2

• Charge or Credit Sale Total

Page 39

4) Multi-tender

EOI-11074

Sale Item Entries

5) Split Tender

Sale item Entries

stJ) -► □

.........................

□ |at/tl| —,

Cash Tendered Amount

less than the sale total

<□

................

D)B

Cash Tendered Amount

equal to or larger than the sale total

Subtotal (pre*taxed sale total)

Taxable Total 1 {optional print)

-Tax 1

■Taxable Total 2 {optional print)

■Tax 2

■ Sale Total including Taxes

■Cash Tendered {short-tendered)

•Balance due

-Cash Tendered {over-tendered)

-Change due

Cash Tendered Amount

less than the sale total

Subtotal {pre-taxed sale total)

•Taxable Total 1 (optional print)

-Tax 1

-Taxable Total 2 {optional print)

■Tax 2

■Sale Total including Taxes

-Cash Tendered (short-tendered)

-Charge or Credit Total

NOTES 1. A maximum of 8 digits can be entered as Tendered Amount (up 79999999).

However, it is limited by the System HALC if a limit of less than 8 digits is

programmed.

The [AT/TLJ key wilt always require a tendered amount entry if "Amount Tender

2.

Compulsory" option is selected.

When the sale total is zero or negative, the sale can only be finalized by Cash Total

3.

function regardless of option selections.

4. Neither Multidender nor Split Tender are possible for a negative sale total.

Chg

-37-

Page 40

EOI-11074

The loilowing operations require the Control Lock position to the X position.

OFF

REG2 I REG1

0=

Received-on-Account Payment (Control Lock: X)

The Received-on-Account transaction is used to identify money which is in the drawer but not due

to business. For example, a customer pays for a sale finalized as house charge on a past day,

or the operator records the change reserve in the drawer loaded from the store office. This

operation must be performed outside a sale only.

TX2/M

EH

...

EH

Payment Amount Received;

max. 8 digits (up to 79999999),

or limited by HALC

Paid Out

The Paid Out transaction is used when an amount of money is removed from the drawer without

relating to a safe, for the purpose of paying to a wholesaler, etc. This operation must be performed

outside a sale only.

□

Amount to be paid out;

max. 8 digits (up to 79999999),

or limited by System HALC

(Control Lock: X)

.................

□

R/A

TX1/M

PO

The drawer opens to enable money entry into the drawer.

10*00 RA

03-38 *

0041#08- 05- 93

The drawer opens to enable paying out.

12*00 PO

03-38 *

0040#08- 05- 93

-38

Page 41

15. Read (X) and Reset (Z) Reports

This chapter describes the operation to take Read and Reset reports and their print

format.

Report Sample Format

Before Taking Reports...

• The Read (X) Report allows to read

the totals but not clear the memory,

while the Reset (Z) Report allows to

read the totals and, at the same

time, clear all the resettable totals

when the report has been issued.

• The symbol "X" is printed at the top

right of a Read Report, while "Z" is

printed on a Reset Report to indi

cate the type of report. The con

tents of the two types of reports are

the same if both are taken at the

same time.

Operation

Read fX) Report

OFF

REG2 I^EG1

0001

87*67

22

26*90

11

24*75

11

29*00

-3*50

77*15

3*00

* TA

#

1

n

2

it

3

2

#

4

TA

#

2

VD

Reset Counter

Reset Report Symbol

("X" for Read Report)

Net Grand Total

(non-resettabte)

Dept. 1 Sales; Item Count

Amount

Dept.2 Sates; Item Count

Amount

Dept.3 Sales: Item Count

Amount

Dept-4 Sales: Item Count

Amount

Sum of Ail Depts.

Void Count

Amount

EOI-11074

0=5

{The drawer

opens.)

Reset iZ) Report

OFF

REG2 1 REG1

■ X

►

(The drawer

opens.)

Memory Balance

Sum of All Depts,

= {Positive Depts, Total)

- (Negative Depts. Total)

Net Sales

= (Cash Sates ) + (Charge Sales)

Cash-in-drawer Amount

= (Cash Sales) + (Received-on-

Account) - (Paid Out)

Net Grand Total

= (Sum of Daily Net Sates)

-0*05 %

53*50

3*13

53*25

7*99 TX 2

24

87*67

74*69

12*98

1

10*00

12*00

72*69

03- 40

0043#08- 05- 93

3

#

Percent {+ or -) Count

Amount

ST

TX 1

ST

Taxable Total 1 Amount

Tax 1 Amount

Taxable Total 2 Amount

Tax 2 Amount

* #

NT

CA

3

CH

RA

1

PO

2

CG

Total Customer Count

Net Sales (with Tax)

Cash Sales Amount

#

Charge Sates Count

Amount

#

Received-on-Account Count

Amount

#

Paid Out Count

Amount

NS

No-sale Count

Cash-in-drawer Amount

♦

Current Time

Consecutive No., Date

- 39 -

Page 42

16. Maintenance

Replacing the Paper Roll

EOM1074

Remove the Paper Cover,

If the printer is used for Journal, hold down

the [FEED] key to wind up the printed

portion of paper, then cut the paper as

shown in the figure. Hold down the

[FEED] key again to advance the remain

ing paper end.

If the printer is used for Receipt, cut the

paper roll as shown in the figure. Then

hold down the [FEED] key to advance the

remaining paper end.

The wound-up portion of the paper (when

used for Journal) can easily be removed

from the Reel by pulling it sideways.

Set the paper roil ready for print. Refer to

Chapter "10. Installing the Paper Roll".

- 40 -

Page 43

EOt-11074

Remove the Paper Cover.

Pinch the Ink Roller Knob with your fin

gers, and pull it up ward.

Manual Drawer Release

Insert the new Ink Roller in the slot of the

carriage by pushing it all the way in until it

is firmly settled with a "click" sound.

The drawer will automatically open on appropri

ate operations. However, in the even of a power

failure, etc., the drawer can be released manu

ally.

The Drawer Release Lever is located on the

bottom side of the register. Push the lever in the

direction of the arrow, and the drawer opens.

-41 -

Page 44

Removing the Drawer

E01 *11074

Pull out the drawer all the way until It hits the

stopper. Then lift up the drawer and pull it again.

To exchange batteries, please keep the

power cord of the register connected to the

wall outlet. If the batteries are removed

with the power cord disconnected, the

programmed data and sales data wilt all be

cleared.

Remove the Paper Cover.

Remove the paper roll, the Take-up Reel

(if used for Journal), and the Battery

Cover.

Replace the old batteries with new ones.

(Batteries: SUM'3 1.5V x 3 pieces)

Return the items removed in Step 3, and

attach the Paper Cover.

- 42

Page 45

17. Specifications

Size...........................................325mm (width) x 425mm (depth) x 224.5mm (height)

EO1-11074

Weight

......................................

Power Required

Power Consumed...................0.16A

Operating Temperature

Operating Humidity

Size of Paper Roll....................57.5±0.5mm (width) x max. 80mm (diameter),

Memory Protection

Handling the Batteries

..When inserting batteries, place them so that the positive (-r) and negative

(-) ends face the proper directions as shown in the battery compartment.

..Do not mix used and new batteries in the battery compartment. Replace

all batteries at the same time.

..Do not leave discharged batteries in the battery compartment. Leakage

from such batteries may damage the register.

..Do not dispose the batteries in a fire, if put in a fire, they may explode.

......................

................

.................

4.8Kg (product only), 6.3Kg (including package)

117V±10%, 60Hz

..........

0°C to 40°C

10% to 90% RH

0.06 to 0.085mm (thickness)

Dry Battery SUM-3 1.5 x 3 pieces;

Life of about 1 year

Specifications are subject to change without notice.

-43-

Page 46

Page 47

Page 48

TOKYO ELECTRIC CO,, LTD.

PRINTED IN JAPAN

EOM1074A 9309850 GS

Loading...

Loading...