Page 1

TEC Electronic Cash Register

Table of Contents

MA-516-100 SERIES

Owner’s Manual

Page 2

The socket-outlet shall be installed near the equipment and shall be easily accessible.

Le socle de prise de courant doit être installé à proximité du matériel et doit être

aisément accessible.

Copyright © 1999

by TOSHIBA TEC CORPORATION

All Rights Reserved

570 Ohito, Ohito-cho, Tagata-gun, Shizuoka-ken, JAPAN

Page 3

Safety Summary

Safety Summary

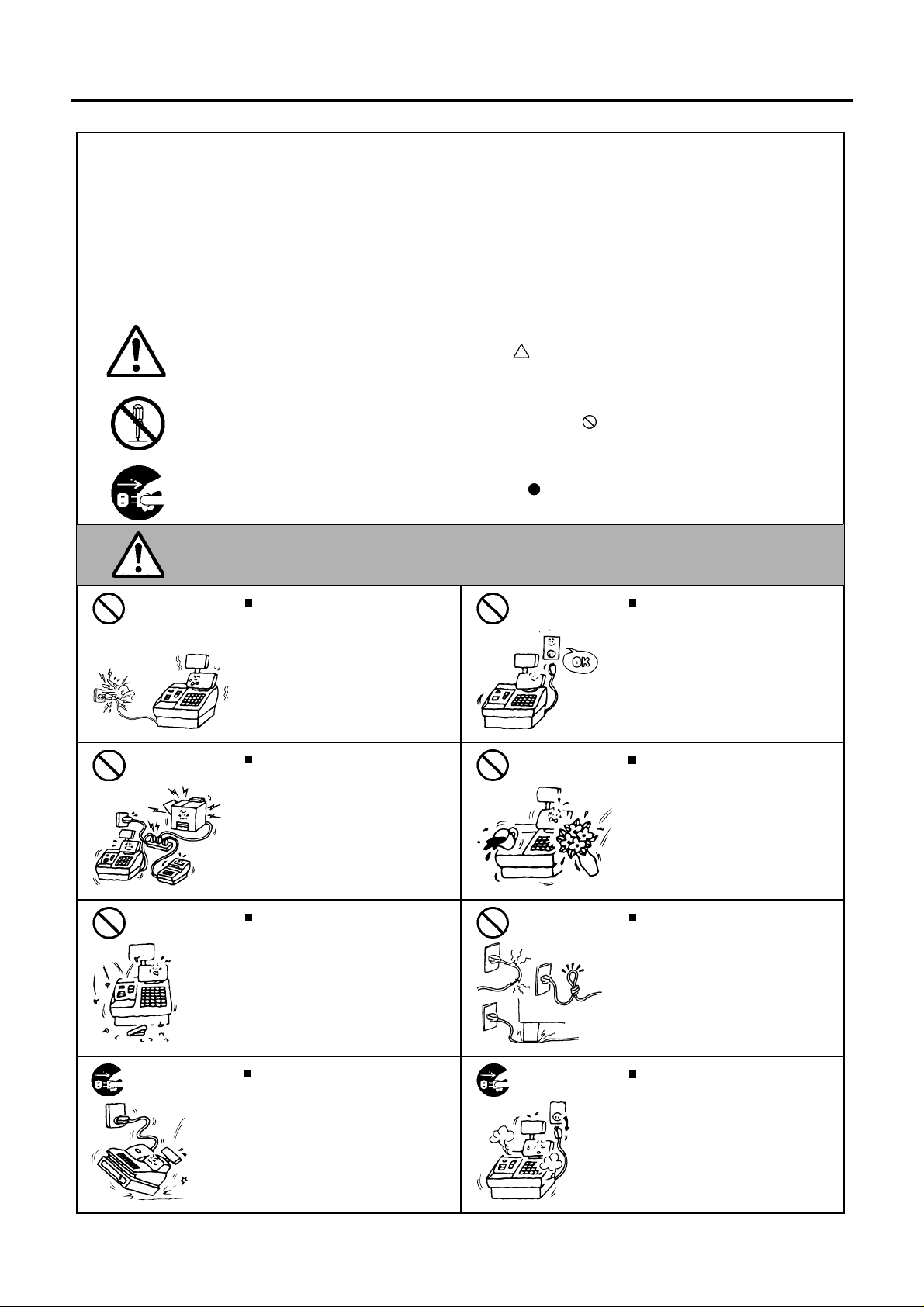

Personal safety in handling or maintaining the equipment is extremely important. Warnings and Cautions

necessary for safe handling are included in this manual. All warnings and cautions contained in this

manual should be read and understood before handling or maintaining the equipment.

Do not attempt to effect repairs or modifications to this equipment. If a fault occurs that cannot be rectified

using the procedures described in this manual, turn off the power, unplug the machine, then contact your

authorized TOSHIBA TEC representative for assistance.

Meanings of Each Symbol

This symbol indicates warning items (including cautions).

Specific warning contents are drawn inside the symbol.

(The symbol on the left indicates a general caution.)

This symbol indicates prohibited actions (prohibited items).

Specific prohibited contents are drawn inside or near the symbol.

(The symbol on the left indicates “no disassembling”.)

This symbol indicates actions which must be performed.

Specific instructions are drawn inside or near the symbol.

(The symbol on the left indicates “disconnect the power cord plug from the outlet”.)

EO1-11099

This indicates that there is the risk of death or serious injury if the

WARNING

Prohibited

Prohibited

Prohibited Prohibited

Do not plug in or unplug the power

cord plug with wet hands as this may

cause electric shock.

If the machines share the same

outlet with any other electrical

appliances which consume large

amounts of power, the voltage will

fluctuate widely each time these

appliances operate. Be sure to

provide an exclusive outlet for the

machine as this may cause the

machines to malfunction.

Do not insert or drop metal,

flammable or other foreign objects into

the machines through the ventilation

slits, as this may cause fire or electric

shock.

machines are improperly handled contrary to this indication.

Any other than the

specified AC voltage

is prohibited.

Prohibited

Do not use voltages other than the

voltage (AC) specified on the rating

plate, as this may cause fire or

electric shock.

Do not place metal objects or

water-filled containers such as flower

vases, flower pots or mugs, etc. on

top of the machines. If metal objects

or spilled liquid enter the machines,

this may cause fire or electric

shock.

Do not scratch, damage or modify

the power cords. Also, do not place

heavy objects on, pull on, or excessively bend the cords, as this may

cause fire or electric shock.

Disconnect

the plug.

If the machines are dropped or their

cabinets damaged, first turn off the

power switches and disconnect the

power cord plugs from the outlet, and

then contact your authorized

TOSHIBA TEC representative for

assistance. Continued use of the

machine in that condition may cause

fire or electric shock.

(i)

Disconnect

the plug.

Continued use of the machines in an

abnormal condition such as when the

machines are producing smoke or

strange smells may cause fire or elec-

tric shock. In these cases, immediately turn off the power switches and

disconnect the power cord plugs from

the outlet. Then, contact your authorized TOSHIBA TEC representative for

assistance.

Page 4

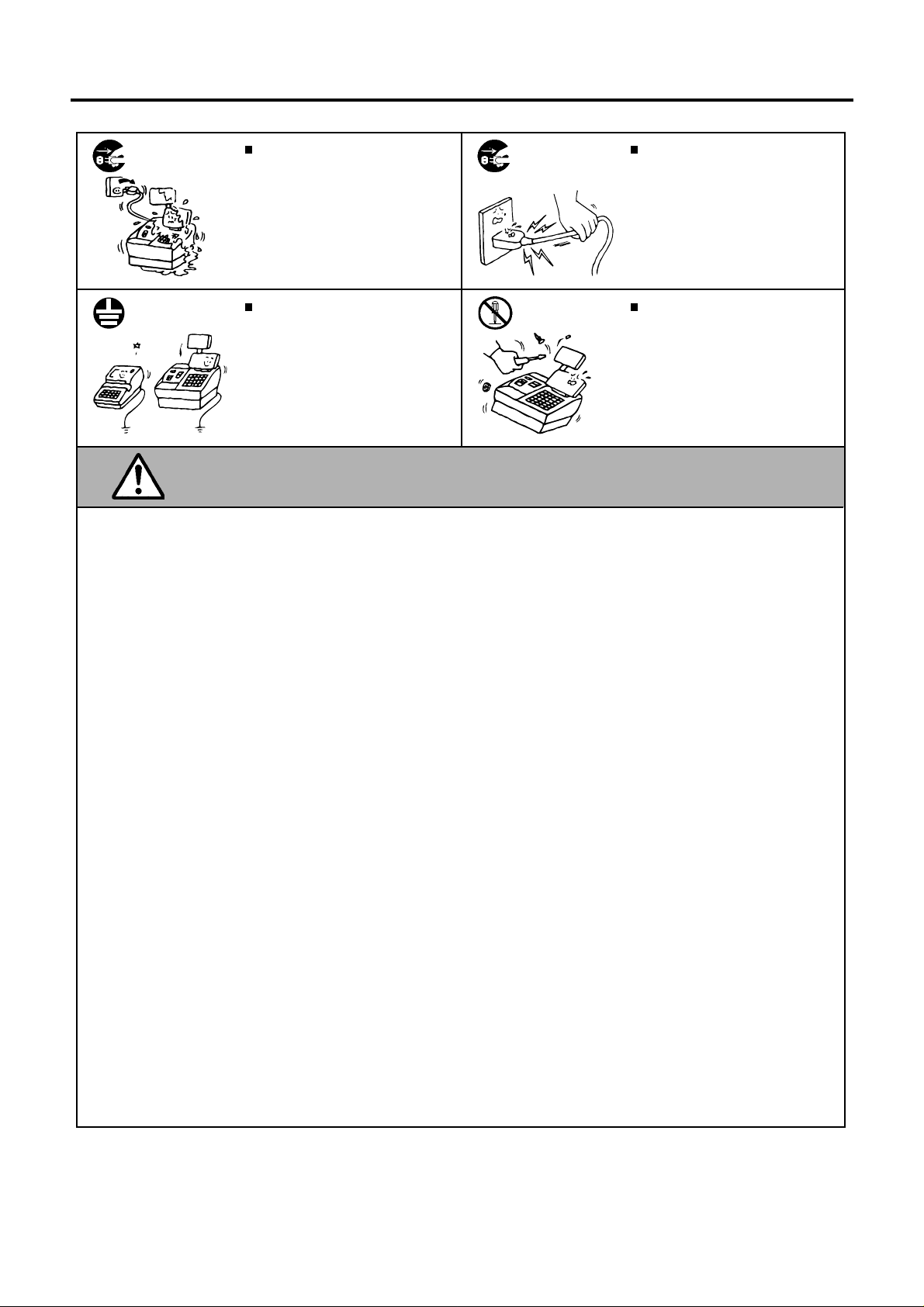

Safety Summary

EO1-11099

Disconnect

the plug.

Connect a

grounding

wire.

If foreign objects (metal fragments,

water, liquids) enter the machines,

first turn off the power switches and

disconnect the power cord plugs from

the outlet, and then contact your

authorized TOSHIBA TEC representative for assistance. Continued

use of the machine in that condition

may cause fire or electric shock.

Ensure that the equipment is

properly grounded. Extension cables

should also be grounded. Fire or

electric shock can occur on improperly grounded equipment.

Disconnect

the plug.

No

disassembling.

When unplugging the power

cords, be sure to hold and pull on

the plug portion. Pulling on the cord

portion may cut or expose the internal wires and cause fire or electric

shock.

Do not remove covers, repair or

modify the machine by yourself. You

may be injured by high voltage, very

hot parts or sharp edges inside the

machine.

Unauthorized modification is prohibited.

This indicates that there is the risk of personal Injury or damage to

CAUTION

objects if the machines are improperly handled contrary to this indication.

Precaution

The following precautions will help to ensure that this machine will continue to function correctly.

• Try to avoid locations that have the following adverse conditions:

* Temperatures out of the specification * Direct sunlight * High humidity

* Shared power socket * Excessive vibration * Dust/Gas

• Do not subject the machine to sudden shocks.

• Do not press the keys too hard. Keys will operate correctly if they are touched lightly.

• Clean the cover and keyboard, etc. by wiping with a dry cloth or a cloth soaked with detergent and wrung out

thoroughly. Never use thinner or other volatile solvent for cleaning.

• At the end of the day, turn the power OFF, then clean and inspect the exterior of the machine.

• Try to avoid using this equipment on the same power supply as high voltage equipment or equipment likely to

cause mains interference.

• USE ONLY TOSHIBA TEC SPECIFIED consumables.

• DO NOT STORE the consumables where they might be exposed to direct sunlight, high temperatures, high

humidity, dust, or gas.

• When moving the machine, take hold of the drawer and lift the machine.

• Do not place heavy objects on top of the machines, as these items may become unbalanced and fall causing

injury.

• Do not block the ventilation slits of the machines, as this will cause heat to build up inside the machines and

may cause fire.

• Do not lean against the machine. It may fall on you and could cause injury.

Request Regarding Maintenance

• Utilize our maintenance services.

After purchasing the machines, contact your authorized TOSHIBA TEC representative for assistance once per year or

so to have the inside of the machines cleaned. Otherwise, dust will build up inside the machines and may cause fire or

malfunction. Cleaning is particularly effective before humid rainy seasons.

• Our maintenance service performs the periodic checks and other work required to maintain the quality and

performance of the machines, preventing accidents beforehand.

For details, please consult your authorized TOSHIBA TEC representative for assistance.

• Using insecticides and other chemicals

Do not expose the machines to insecticides or other volatile solvents, as this will deteriorate the cabinet or other parts

or cause the paint to peel.

(ii)

Page 5

MA-516-100 SERIES

EO1-11116

1. Introduction

Thank you for choosing the TEC electronic cash register MA-516-100 series. This instruction manual provides a

description of the functions and handling of this register and should be read carefully to ensure optimum performance.

Since every consideration has been given to safety and reliability, there is no danger of damaging the machine by incorrect

operation.

Please refer to this manual whenever you have any questions concerning the machine. This machine has been

manufactured under strict quality control and should give you full satisfaction.

For supplies, service or assistance call:

Please have the following information available when

you call:

Product Name: TEC Electronic Cash Register

Model: MA-516-100

Serial Number:

Place Purchased:

Date of Purchase:

If for any reason this product is to be returned to the store where purchased, it must be packed in the original carton.

• The specifications described in this manual may be modified by TOSHIBA TEC, if necessary.

• Be sure to keep this manual for future reference.

- 1 -

Page 6

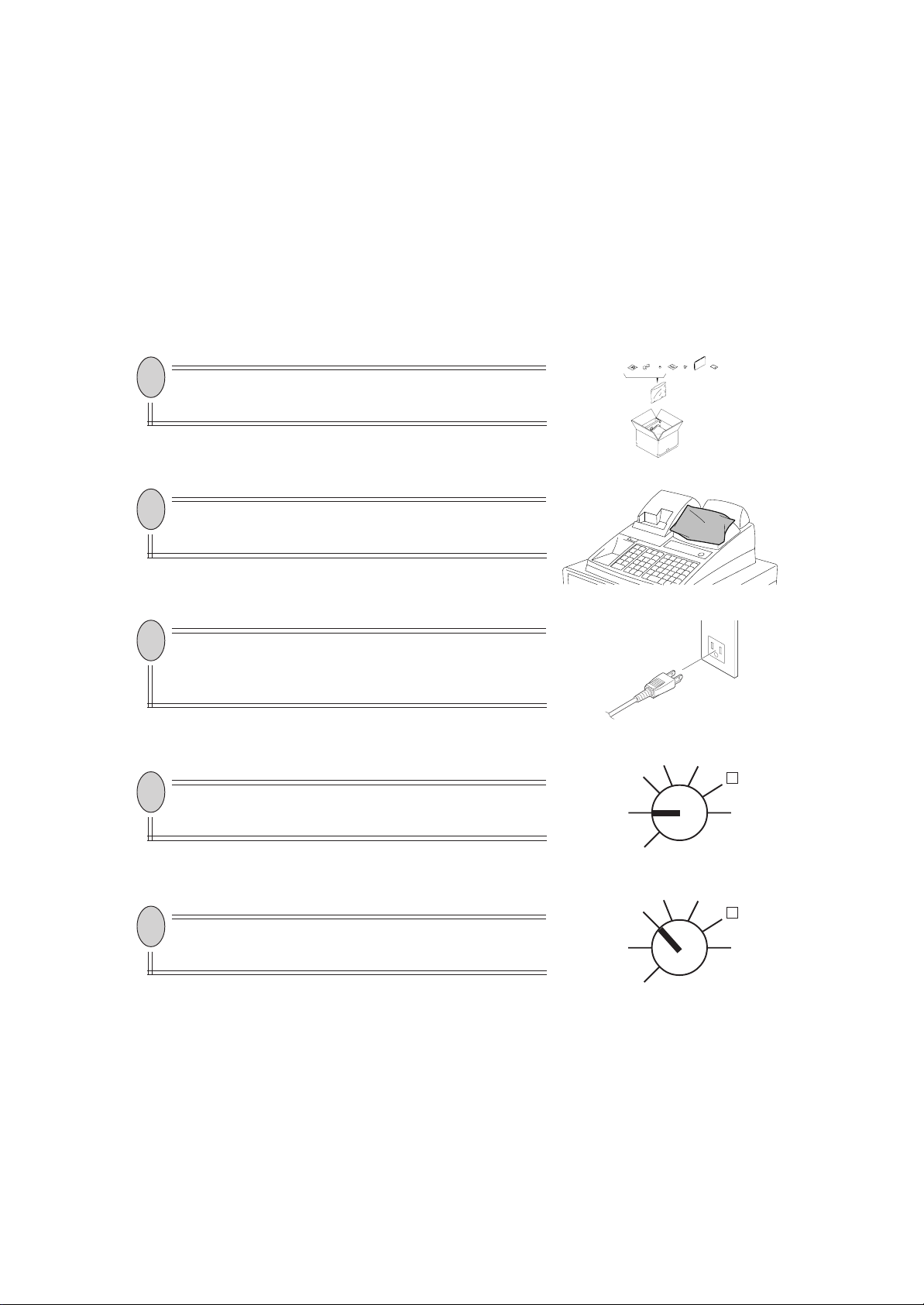

2. Unpacking

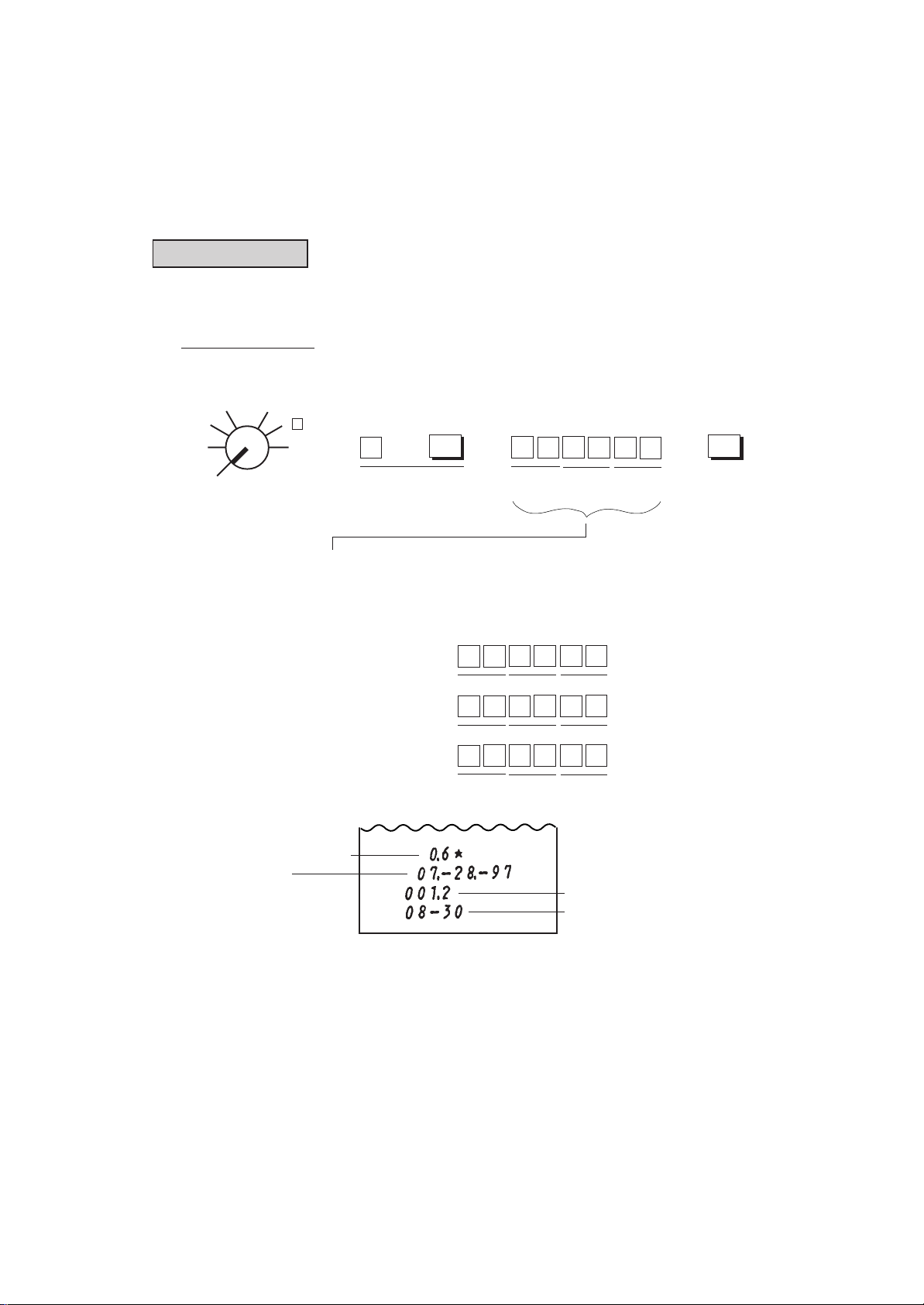

(1) (2) (3) (5) (6) (7) (8) (9)(4)

MA-516-100 SERIES

EO1-11116

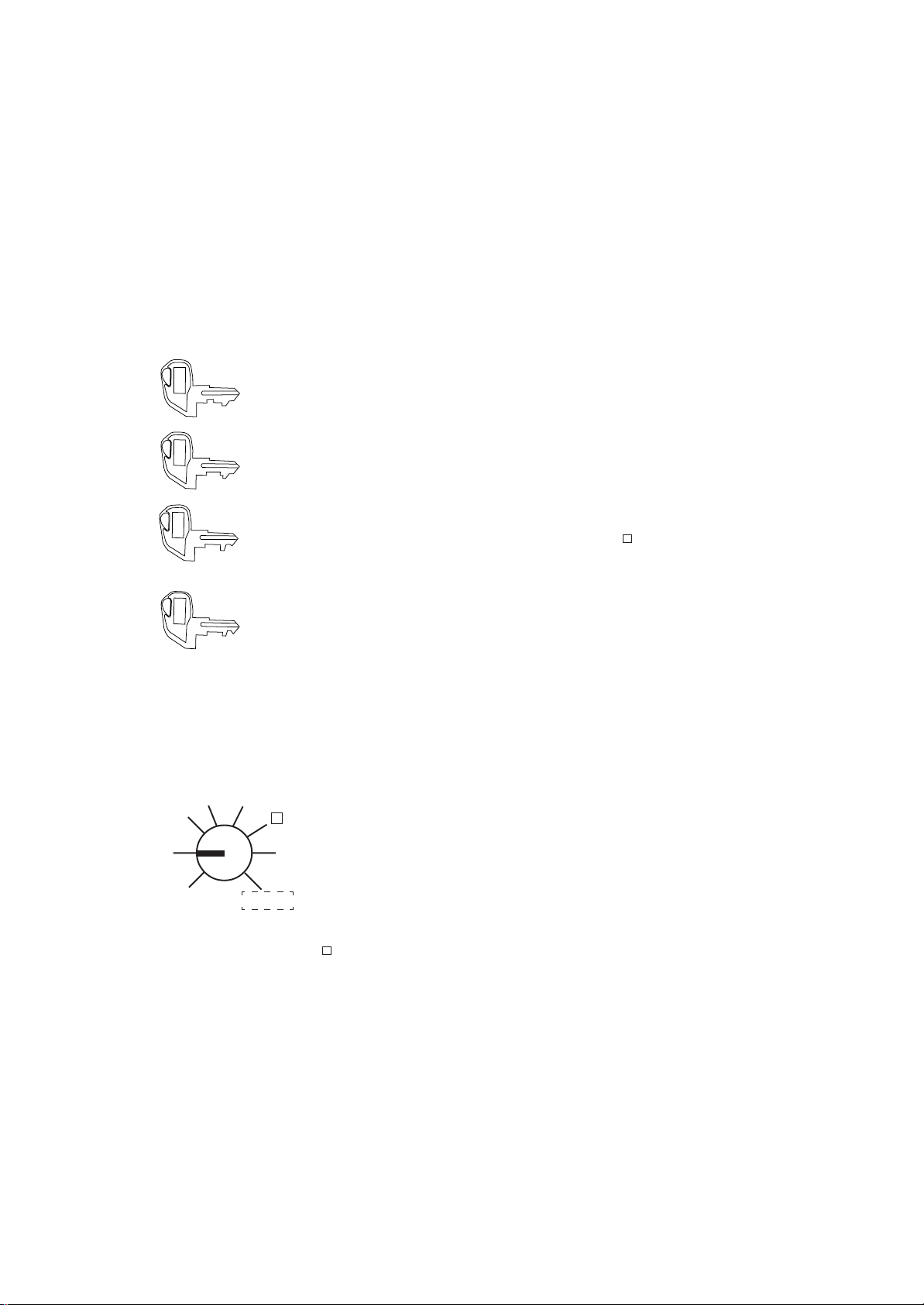

[1] Control Key (REG Key, MGR Key, MA Key, S Key;

2 pcs. respectively)

[2] Drawer Key (2 pcs.)

[3] Printer Cover Key (2 pcs.)

[4] Paper Roll 45mm x Ø50mm (2 pcs.)

[5] Stamp Ink (1 pc.)

[6] Ribbon Cassette (1 pc.)

[7] Journal Take-up Reel (1 pc.)

[8] Owner’s Manual (1 pc.)

[9] Warranty Registration (1 pc.)

- 2 -

Page 7

3. Precautions

The ECR is a precision machine. Please handle it carefully considering the following guidelines.

Remarks on the Location

Do not place it where unusual temperature changes are

expected or where it will be subjected to direct sunlight.

MA-516-100 SERIES

EO1-11116

Place it on a flat and level surface with little dust, humidity,

vibration, etc.

Keep it away from water sources.

Be certain that the power voltage in your area matches that

required for the machine. (The rated voltage is 117V AC.)

The socket-outlet shall be installed near the equipment

and shall be easily accessible.

Le socle de prise de courant doit être installé à proximité

du matériel et doit être aisément accessible.

- 3 -

Page 8

Remarks on Operating the ECR

The keys on the keyboard function with a light touch. Avoid

pressing the keys too hard.

Do not handle the machine with wet hands, since this may

cause electrical malfunctions and corrosion of parts.

MA-516-100 SERIES

EO1-11116

Do not apply thinner, benzine, or other volatile materials to

the cabinet or other plastic parts. Such liquids will cause

discoloration or deterioration. If dirty, wipe off with a piece of

cloth soaked in a neutral detergent and wrung out thoroughly.

Turn the Control Lock to OFF position when all operations are

completed after business hours.

Never try to repair the ECR. Call dealer for information of your

local TEC representative.

- 4 -

Page 9

EO1-11116

MA-516 OWNER’S MANUAL

TABLE OF CONTENTS

Page

1. Introduction..........................................................................................................1

2. Unpacking ............................................................................................................1

3. Precautions ..........................................................................................................3

Remarks on the Location...................................................................................................3

Remarks on Operating the ECR........................................................................................4

5. Outline of Preparation Procedure Before Operating the ECR........................9

6. Appear a nc e and Nome ncl at ure ......................................................................... 11

7. Control Lock and Control Keys .........................................................................12

Control Keys.......................................................................................................................12

Control Lock .......................................................................................................................12

8. Display..................................................................................................................13

Numeric Display .................................................................................................................14

Message Descriptors (Status Lamps)...............................................................................14

9. Keyboard ..............................................................................................................15

10. Installing the Receipt/Journal Roll ....................................................................16

Installing the Receipt Roll..................................................................................................16

Installing the Journal Roll..................................................................................................18

11. Installing the Ribbon Cassette...........................................................................19

12. Setting the Time and Date .................................................................................. 20

Setting the Time.................................................................................................................. 20

Setting the Date.................................................................................................................. 21

Displaying the Time............................................................................................................ 22

Printing the Time and Date................................................................................................ 22

13. Tax Table Setting................................................................................................. 22

- 5 -

Page 10

EO1-11116

MA-516 OWNER’S MANUAL

Setting the U.S. Tax Table (Also applicable to PST in Canada)...................................... 22

Setting the GST Rate (applicable to Canada only).......................................................... 27

Setting the Non-taxable Limit Amount

(applicable to only certain areas in Canada).................................................................... 28

Tax Calculation Test........................................................................................................... 29

14.Register No. Setting............................................................................................ 29

15.Optional Key Setting........................................................................................... 30

List of Keys......................................................................................................................... 30

Key Installation Setting...................................................................................................... 32

Blank Keyboard Sketch (for your planning aid)............................................................... 32

16.Daily Operation Flow........................................................................................... 35

Before Opening the Store.................................................................................................. 35

During Business Hours...................................................................................................... 35

After Closing the Store...................................................................................................... 35

17.Cashier Identifying Operation............................................................................ 36

(1) Signing Method............................................................................................................. 36

(2) Cashier Push Key Method............................................................................................ 37

18. Setting Preparation of Each Key,

And Transaction Entries..................................................................................... 38

Receipt-issue/Non-issue Selection................................................................................... 38

Clearing Errors, or Clearing Wrong Declaration Key or Wrong

Numeric Entries.................................................................................................................. 39

Department Keys................................................................................................................ 40

PLU (Price-Look-UP).......................................................................................................... 51

Preset Price Open............................................................................................................... 59

Listing Capacity Open........................................................................................................ 60

Percent Charge, Percent Discount.................................................................................... 61

Dollar Discount................................................................................................................... 63

Vendor Coupon................................................................................................................... 64

Store Coupon...................................................................................................................... 65

Tax Modification................................................................................................................. 66

Food Stamp Modification................................................................................................... 67

- 6 -

Page 11

EO1-11116

MA-516 OWNER’S MANUAL

Item Correction (Last Line Voiding).................................................................................. 68

Returned Merchandise....................................................................................................... 68

Void (Designated Line Voiding)......................................................................................... 70

All Void (Transaction Cancel)............................................................................................ 71

Non-add Number Print....................................................................................................... 72

Subtotal Read & Print......................................................................................................... 73

Taxable Total Read............................................................................................................. 74

Manual Tax Entry................................................................................................................ 74

Food Stamp Tender............................................................................................................ 75

Cash Total, Cash Tender................................................................................................... 77

Non-cash Media Total, Non-cash Media Tend er.............................................................. 80

Multi-tender, Split Tender.................................................................................................. 82

Tax Exemption.................................................................................................................... 84

Check Cashing.................................................................................................................... 85

No-sale................................................................................................................................ 86

Received-on Account Payment......................................................................................... 87

Paid Out............................................................................................................................... 88

Sale Paid in Foreign Currencies........................................................................................ 88

Post-issue Receipt............................................................................................................. 92

Validation Print................................................................................................................... 93

Print/Non-print Options on Sale Receipts........................................................................ 95

19.Operations in “MGR” Mode................................................................................ 96

Items programmed to require Manager Intervention....................................................... 96

Listing Capacity Release................................................................................................... 97

20.Operations in “ - “ Mode................................................................................... 98

21.Read and Reset Reports..................................................................................... 99

Programming Operations Relating to Repo rts................................................................ 99

Taking Read and Reset-Reports....................................................................................... 101

Report Sample Format....................................................................................................... 107

22.System Option Setting........................................................................................ 117

Programming Procedure.................................................................................................... 117

Address: 1......................................................................................................................... 119

Address: 2......................................................................................................................... 120

- 7 -

Page 12

EO1-11116

MA-516 OWNER’S MANUAL

Address: 3......................................................................................................................... 122

Address: 4......................................................................................................................... 123

Address: 5......................................................................................................................... 124

Address: 6......................................................................................................................... 124

Address: 7......................................................................................................................... 125

Address: 8......................................................................................................................... 126

Address: 9......................................................................................................................... 127

Address: 10....................................................................................................................... 128

Address: 11....................................................................................................................... 129

Address: 12....................................................................................................................... 130

Address: 13....................................................................................................................... 131

Address: 14....................................................................................................................... 132

Address: 15....................................................................................................................... 133

Address: 16....................................................................................................................... 134

23.Program Data Verification................................................................................. 136

Operating Procedure........................................................................................................ 136

24.Paper Roll Replacement and Other Maintenance........................................... 141

Replacing the Receipt Roll.............................................................................................. 141

Replacing the Journal Roll.............................................................................................. 142

Replacing the Ribbon Cassette....................................................................................... 143

Replenishing Ink to the Store Name Stamp................................................................... 145

Manual Drawer Release and Lock................................................................................... 147

Removing the Drawer....................................................................................................... 147

Changing the Layout of the Mone y Case....................................................................... 148

Media Slot......................................................................................................................... 149

25.In Case of the Power Failure............................................................................. 149

26.Troubleshooting................................................................................................. 150

27.Status Clear and Memory Clear Operations.................................................... 155

Status Clear....................................................................................................................... 155

Sales Memory Clear.......................................................................................................... 156

All Memory Clear.............................................................................................................. 157

28.Specifications..................................................................................................... 158

STAMP ORDER................................................................................................................. 159

- 8 -

Page 13

MA-516-100 SERIES

(1) (2) (3) (5) (6) (7) (8) (9)(4)

5. Outline of Preparation Procedure Before

Operating the ECR

This chapter shows the outline of set-up procedure of the ECR before actually starting the ECR operation.

1

Remove the cash register from the carton, referring to Chapter “2.

Unpacking” on page 2. And take out all the parts and accessories.

2

Remove the tapes and seals for holding parts or protecting the

register surfaces.

EO1-11116

3

Plug the power cord of the register into a wall outlet. Make sure that

the outlet voltage matches that of the power required for the

register.

4

Insert the MA key into the Control Lock.

5

Turn the Control Lock to the REG position.

MGR

X

REG

-

OFF Z

SET

MGR

X

REG

-

OFF

SET

Z

- 9 -

Page 14

6

Install the Receipt and Journal rolls

Installing the Receipt/Journal Roll”)

Cassette

sette”)

7

If any optional keys are installed or relocated on the keyboard, the

optional key setting programming must be performed first before

any other programming. Refer to Chapter

Setting.”

8

Set the time and date correctly,

the Time and Date”

(referring to Chapter “11. Installing the Ribbon Cas-

.

.

(referring to Chapter “10.

. Also, install the Ribbon

“15. Optional Key

referring to Chapter “12. Setting

MA-516-100 SERIES

EO1-11116

9

Set the tax tables,

Setting”

10

When multiple registers are used in one store, or to distinguish this

register from others used by other stores in the same chain, set the

Register Number,

ting”

11

Perform programming of the register, such as Departments and

PLUs, according to the requirement of the market and your store

(refer to Chapter 18 and thereafter)

.

.

referring to the Chapter “13. Tax Table

referring to Chapter “14. Register No. Set-

.

- 10 -

Page 15

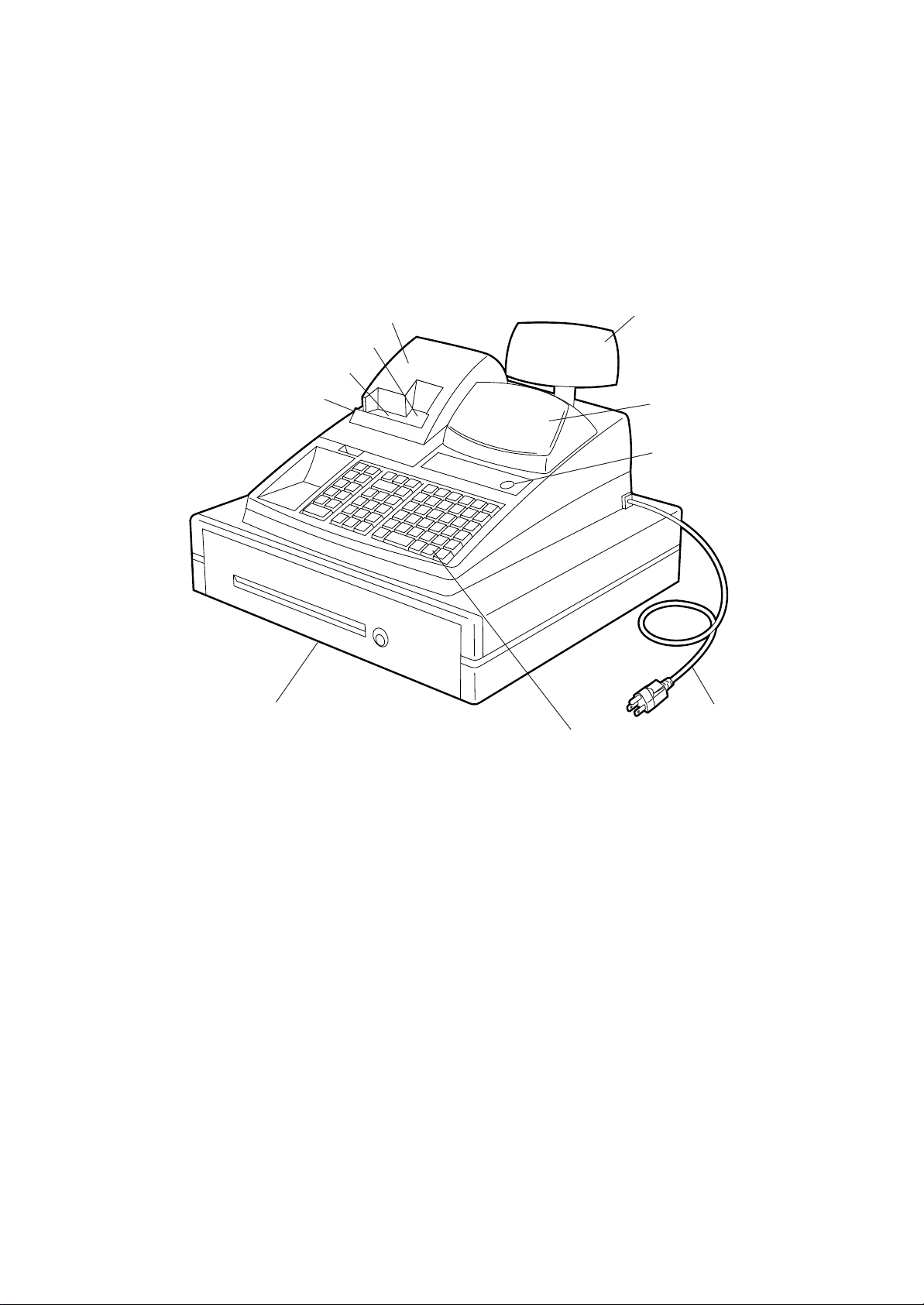

6. Appearance and Nomenclature

MA-516-100 SERIES

EO1-11116

Validation Slot

Drawer

Printer Cover

Journal Window

Receipt Outlet

Customer’s Display

Operator’s Display

Control Lock

Power Cord

Keyboard

Operator’s Display

Used by the operator to confirm the entry contents and

the status of the register. (page 13)

Customer’s Display

Provided for the customer to see the amount entered

for each item and sale total. (page 13)

Receipt Outlet

The receipt for the finalized sale is issued.

Printer Cover

The cover for the Receipt/Journal printer.

Journal Window

The operator can see which items have already been

entered through this window.

Validation Slot

Used to print the required item on the validation slip.

(page 93)

Control Lock

It selects the type of register operations. (page 12)

Keyboard

Used to enter sale items. (page 15)

Drawer

Cash and other media are kept here. It automatically

opens on finalizing a sale.

- 11 -

Page 16

7. Control Lock and Control Keys

REG

MA

Control Keys

There are four types of Control Keys: the REG key, the MGR key, the MA key, and the S key.

MA-516-100 SERIES

EO1-11116

REG key: The REG key is used by the cashier or clerk who operates ordinary transaction entries. This

MGR key: The MGR key is used by the store manager. This key can access the positions of OFF,

MGR

MA key: The MA key is used by the owner who will daily supervise the collection of money and

S key: The S key is used by the owner. This key can access any position including BLIND of the

S

key can access the positions of OFF and REG of the Control Lock.

REG, X, and MGR.

printout of transactions recorded by the register. This key is also used by programmer. This

key can access the positions of SET, OFF, REG, X, MGR, - , and Z.

Control Lock. However, to prevent programmed data and sales data from being changed

by mistake, use the REG, MGR, or MA keys for transaction entries or report taking

purposes.

Control Lock

The Control Lock has eight effective positions for different modes of operation, which are accessed by the appropriate

Control Keys.

(position) (function)

MGR

X

REG

-

OFF Z

SET

BLIND

* not actually

printed.

SET ....... The register allows programming operations.

OFF ....... Nothing appears on the display in this position. However, the power is being

supplied to the register.

REG....... Ordinary transaction entries are carried out in this mode. Displays the

current time while no entries are under way.

X ............ The sale totals in memory can be read (X reports) and the programmed data

can be verified in this position.

MGR ...... This position allows to enter operations requiring Manager Intervention as

well as all ordinary transaction entries to be carried out in the “REG” mode.

- ............ This is the “Negative Mode” position, which makes entered data processed

reversely to the REG or MGR mode. It is used to cancel or adjust sales data

already finalized.

Z ............ All the resettable totals and their respective counters in memory will be read

and reset in this position (Z reports)

BLIND ... The register allows special programming operations and memory clear

operations.

- 12 -

Page 17

MA-516-100 SERIES

EO1-11116

8. Display

The Operator’s Display (front display) is located at the top of the register just above the keyboard. The Customer’s Display

may be used only as a rear display if left in the retracted position or it can be positioned for viewing at other angles by

pulling it upward and turning it to the desired position. The display has two types of display portions — numeric display

and message descriptors (status lamps).

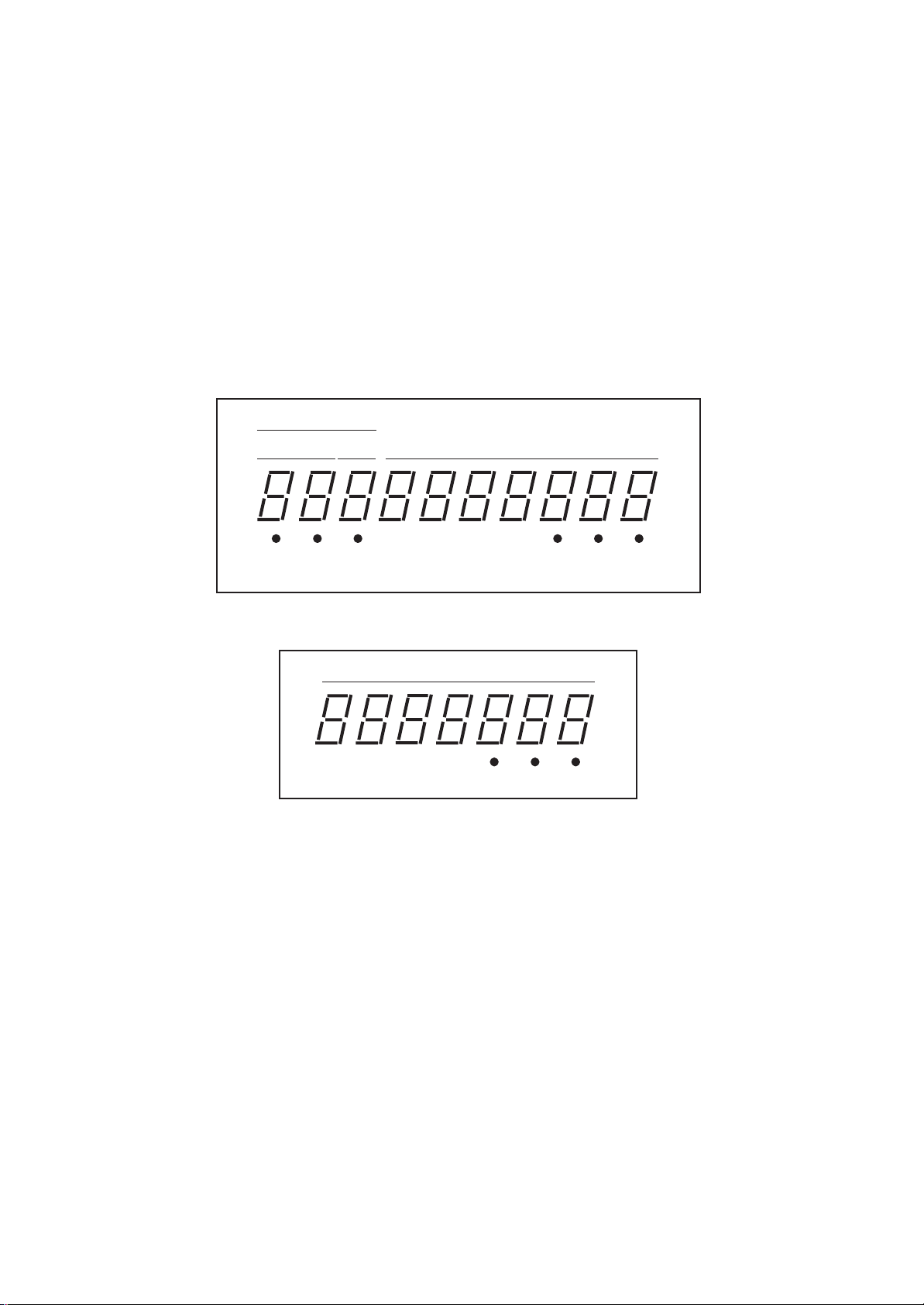

Operator’s Display

PLU

DPT

SIGN ALM R TL ST CG

ON OFF

RPT

Customer’s Display

AMOUNT

AMOUNT

AMOUNT

TL ST CG

- 13 -

Page 18

Numeric Display

AMOUNT (8 digits for total display, 7 digits for entries):

Displays the numeric data, such as amount, quantity, etc. When the obtained total or subtotal amount

is 8-digit, the RPT digit is also used for the amount display. When no entries are under way and the

Control Lock is in the REG position, the current time is displayed.

MA-516-100 SERIES

EO1-11116

DPT (2 digits): Displays the code which represents each Department key.

RPT (1 digit): Displays the repeat count of the same item. The count is indicated from the second entry on, and only

PLU (3 digits of the DPT and RPT are used for this purpose):

It stays lit when repeating the same department entry.

the last digit will be displayed even if the count exceeds nine.

Displays the PLU code when any PLU is entered. It goes out when repeating the same PLU entry,

then only the RPT digit will be displayed for the repeat entry count.

Message Descriptors (Status Lamps)

SIGN ON: Illuminates when a cashier has signed ON when the Cashier Signing Method is selected. (It never

ALM: Illuminates with the alarm buzzer to indicate that the last operation or numeric entry was an error.

R OFF: Illuminates when the Receipt-OFF mode is declared by the [LOG/RECEIPT] key. In this condition,

TL: Illuminates with the total amount displayed when a sale is finalized without any amount tendered.

ST: Illuminates with the subtotal amount displayed when the [ST] or [TXBL TL] key is depressed.

CG: When an amount tendering operation has been performed, this lamp illuminates with the amount of

illuminates for the Cashier Push Key Method.)

To clear the error condition, depress the [C] key.

no receipts will be issued for a sale to be entered. To extinguish this lamp (i.e., to change into ReceiptON mode for issuing receipts), simply depress the [LOG/RECEIPT] key again.

change due displayed.

- 14 -

Page 19

MA-516-100 SERIES

EO1-11116

9. Keyboard

The following is the standard keyboard layout, which was initially set at the factory. This register is designed to be capable

of programming most of the keys at desired locations or adding some optional keys in place of the current keys. If you

are in need of changing the locations or adding keys, see Chapter “15. Optional Key Setting”.

Standard Keyboard Layout

LOG

RECEIPT

#/NS

FS/M

PR

OPEN

LC

OPEN

PLU

RTN

MDSE

VOID

ITEM

CORR

@/FOR

AMT

VALI

DATE

RF

C

JF

TX/M

789

456

123

0

00

•

ST

21

22

23

24

25

26

1

27

2

28

3

29

4

30

10

5

AT/TL

31

6

11

32

7

12

33

8

13

34

9

14

35

15

36

16

37

17

38

18

39

19

40

20

CHK

TEND

DPT

SHIFT

R/A

V.CPN

S.CPN

FSTL

TEND

Chg

RECEIPT

ISSUE

PO

DOLL

DISC

%–

EX

MISC

- 15 -

Page 20

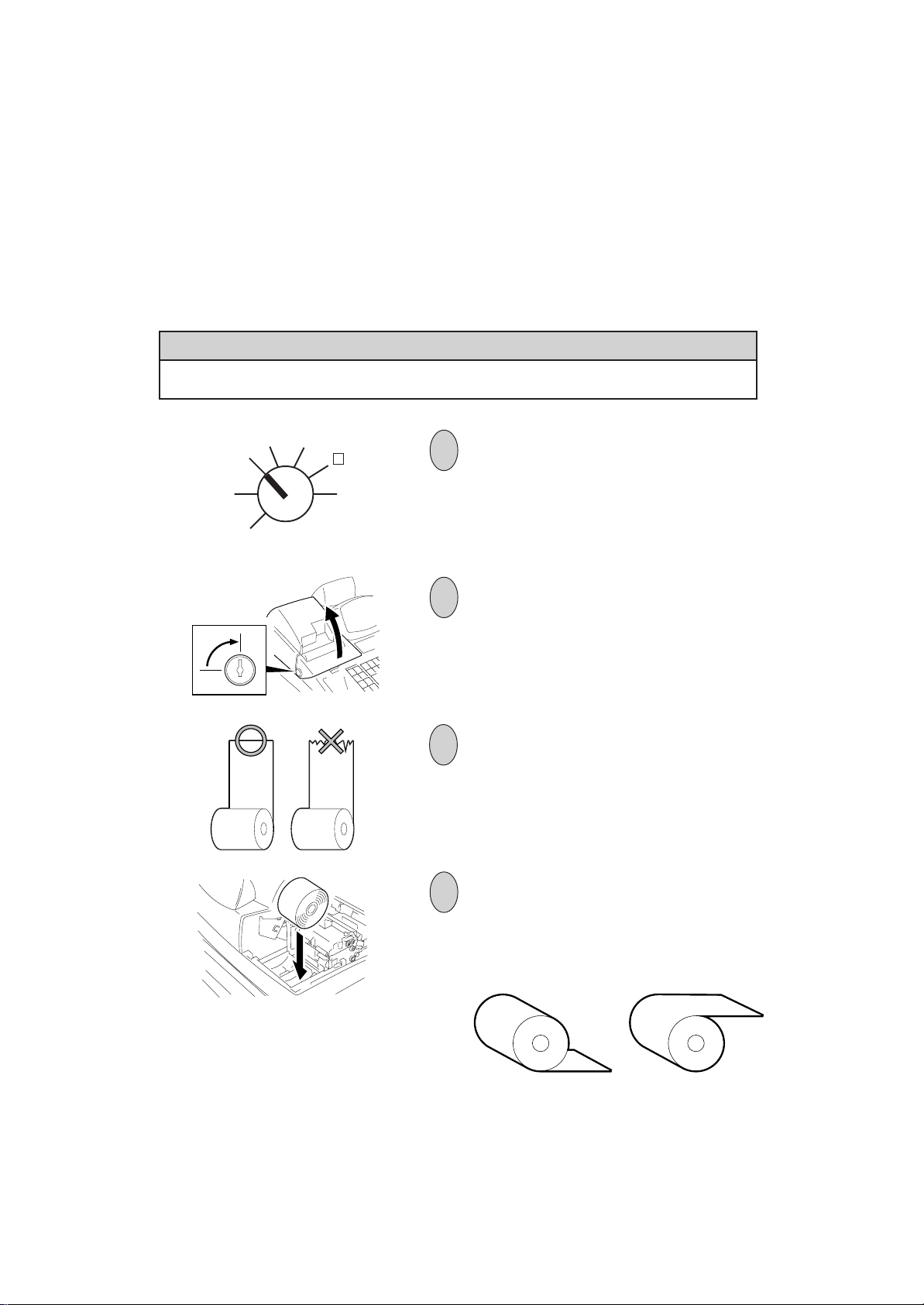

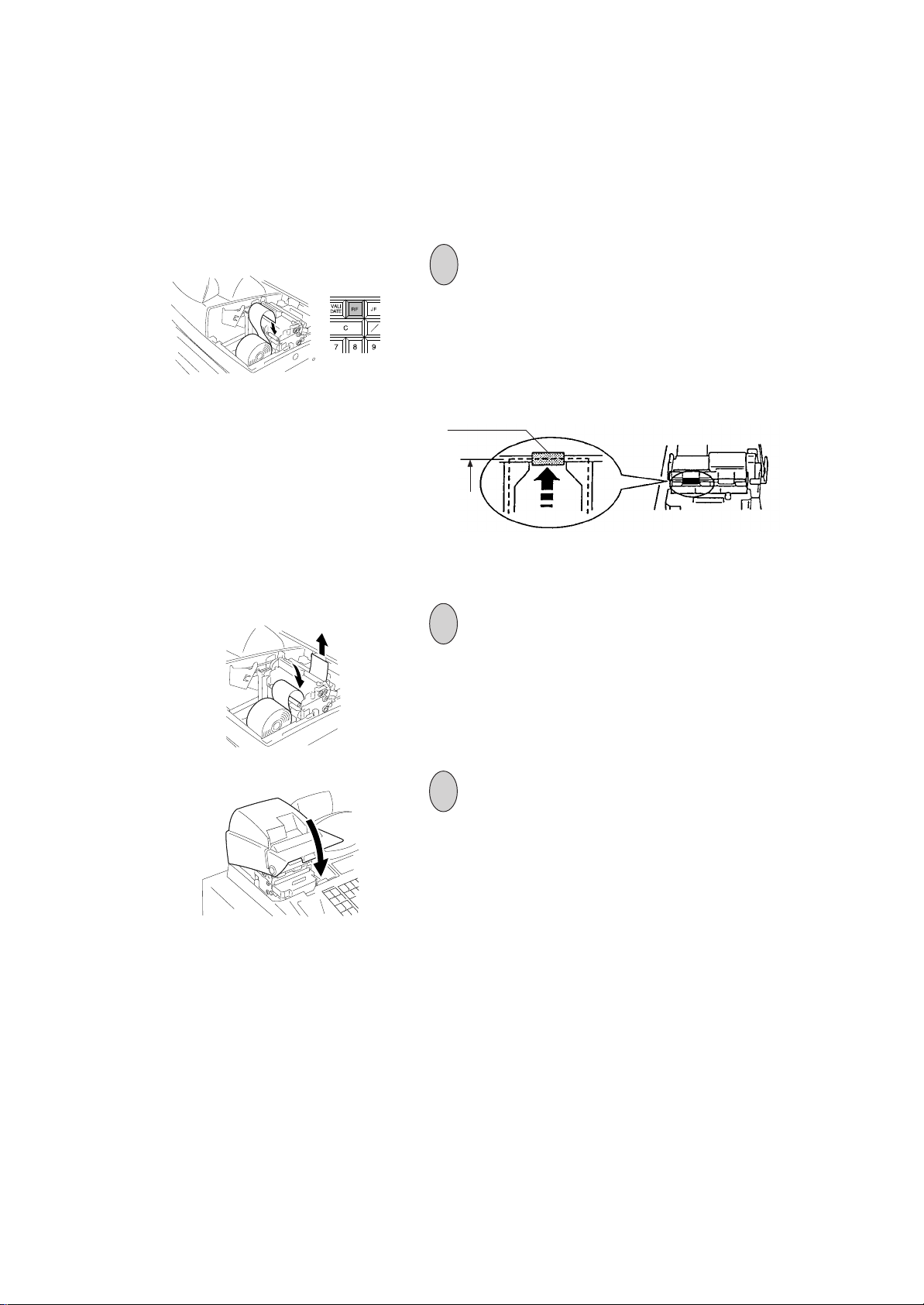

10. Installing the Receipt/Journal Roll

Installing the Receipt Roll

WARNING!

Care must be taken not to injure yourself with the paper cutter.

MGR

REG

OFF

SET

X

Z

1

Turn the Control Lock to the REG position using a

Control Key.

2

MA-516-100 SERIES

EO1-11116

To remove the Printer Cover, insert the Printer Cover

Key to the Printer Cover Lock, and then turn it 90°

clockwise.

3

Cut the paper end to make it sharp.

4

Place the paper roll in the outer side holder of the two roll

holders.

Correct Incorrect

- 16 -

Page 21

TX

M

Roller (Black)

Paper End

MA-516-100 SERIES

EO1-11116

5

Insert the paper end into the receipt inlet behind the

printer. Then, feed the paper by hand into the inside of

the printer while pressing the [RF] key provided at the

central upper side of the keyboard until the paper end

comes in contact with the roller (black) as shown below.

If the paper is not fed smoothly, cut the paper end again

to make it sharp, then re-set the paper roll.

<Front View>

6

Press the [RF] key until about 4 inches (about 10 cm) of

paper comes out of the printer.

7

Attach the Printer Cover, and cut the excess paper with

the attached cutter.

After closing the Printer Cover, depress the [#/NS] key

to check print condition.

- 17 -

Page 22

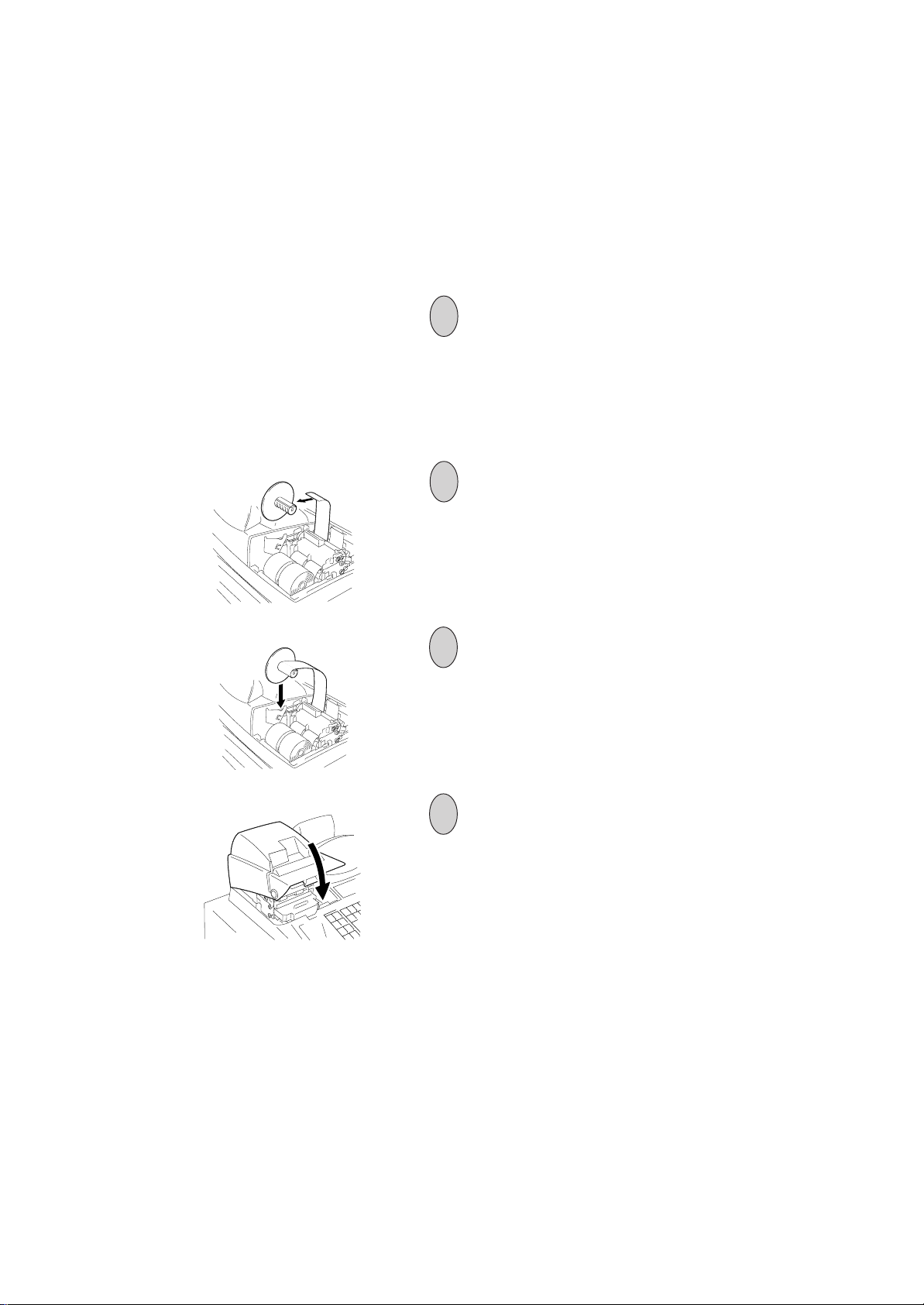

Installing the Journal Roll

MA-516-100 SERIES

EO1-11116

1

Follow Steps 1 to 7 for “Installing the Receipt Roll” on the

preceding page, except that the paper roll should be

placed inner side of the two holders and the [JF] key

should be used for the journal roll.

2

Insert the paper end into the slit on the Take-up Reel and

wind it around the reel two or three times.

3

Set the Journal Take-up Reel into the Reel Holder.

4

Attach the Printer Cover.

- 18 -

Page 23

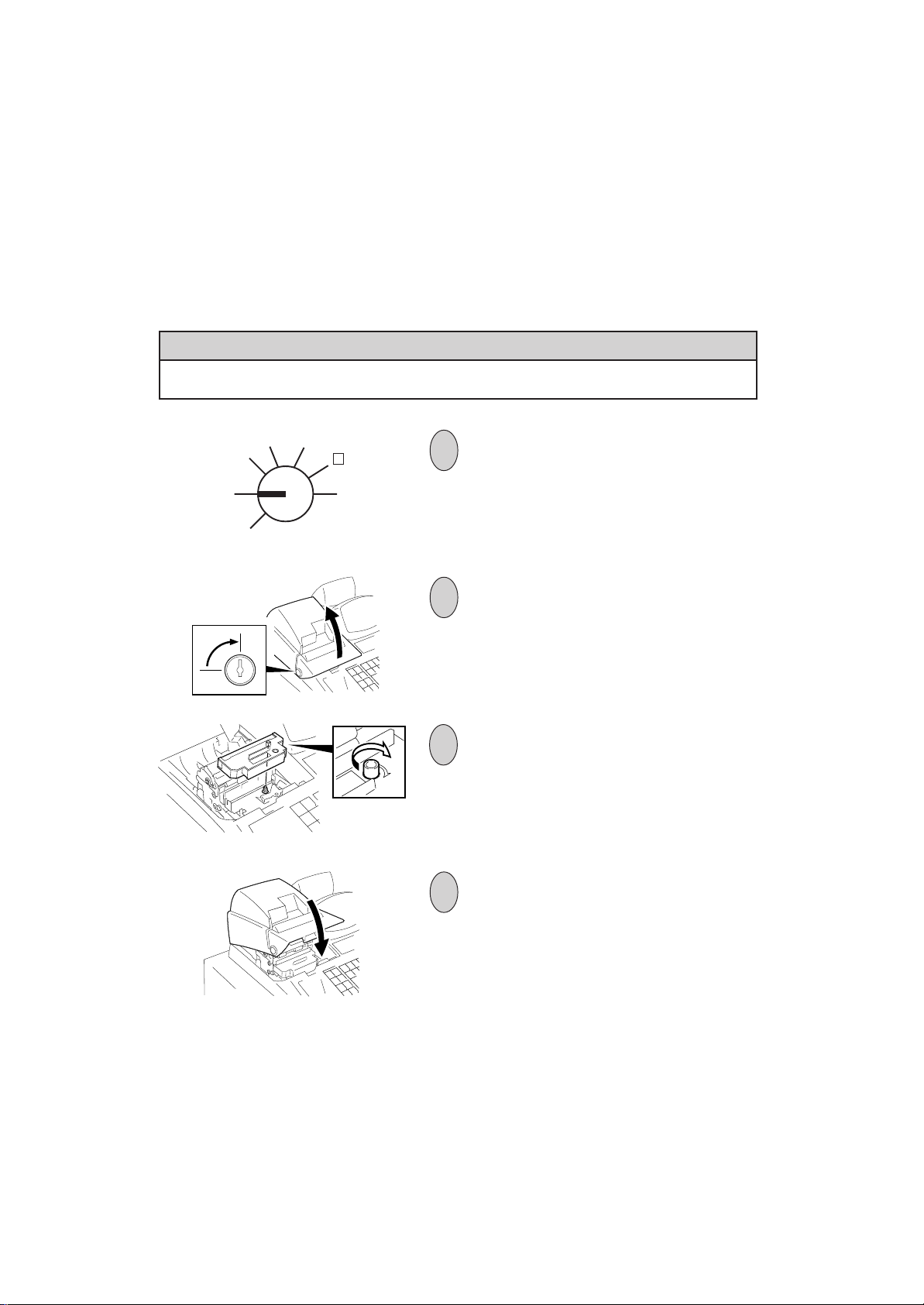

11. Installing the Ribbon Cassette

WARNING!

Care must be taken not to injure yourself with the paper cutter.

MGR

REG

OFF

SET

X

Z

1

Turn the Control Lock to the OFF position.

2

MA-516-100 SERIES

EO1-11116

To remove the Printer Cover, insert the Printer Cover

Key to the Printer Cover Lock, and turn it 90° clockwise.

3

Install the Ribbon Cassette as shown in the figure. After

installing the Ribbon Cassette, turn the knob of the

Ribbon Cassette in the direction of the arrow mark

several times to remove the slack on the ribbon.

4

Attach the Printer Cover.

- 19 -

Page 24

MA-516-100 SERIES

EO1-11116

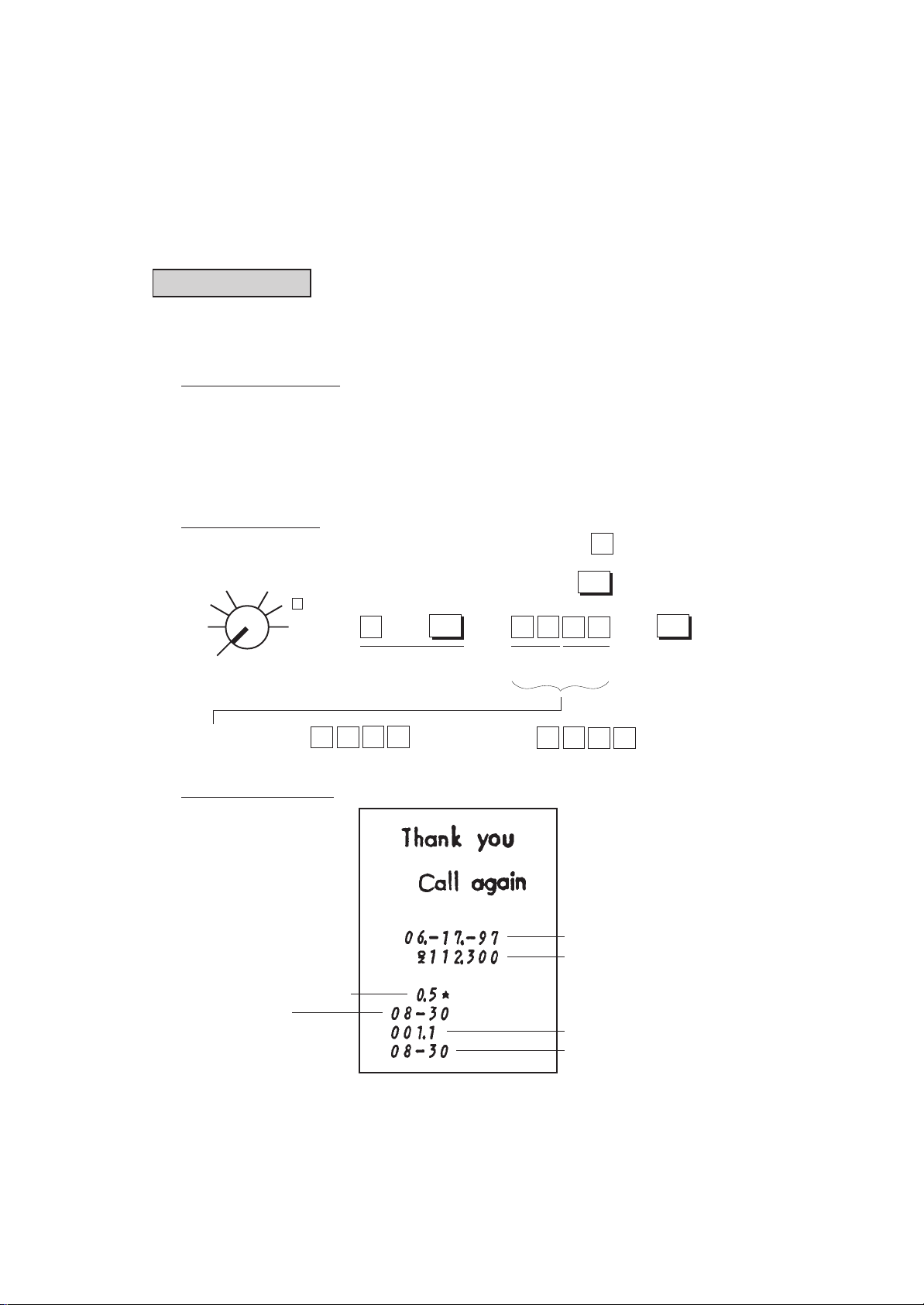

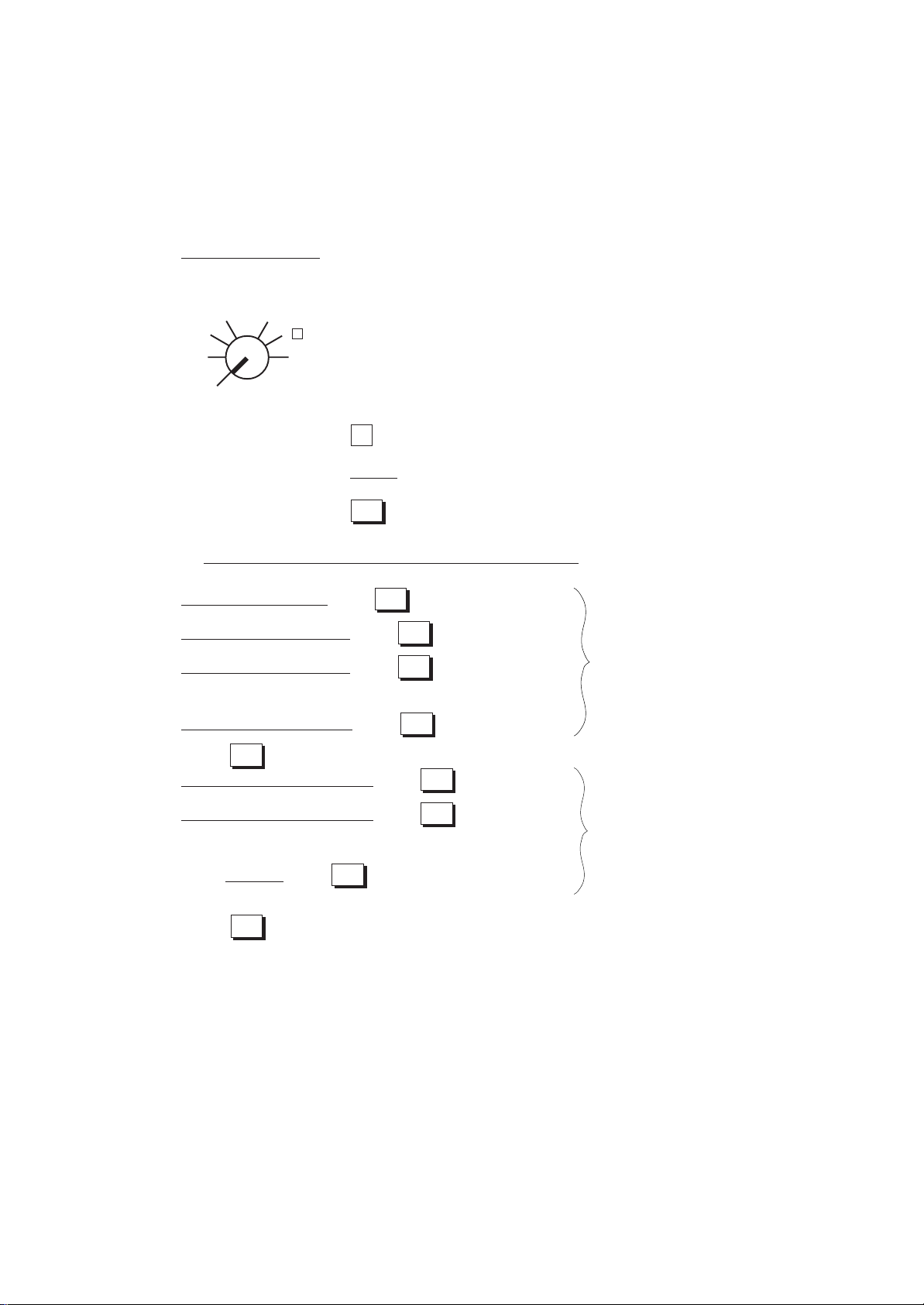

12. Setting the Time and Date

Setting the Time

The register has a clock function. Once the time is set, the time is kept even when the power is turned off. The 24hour system (the military time) is used for time setting, display, and printing. Time setting is allowed any time outside

a sale.

Condition for Setting: Must be signed off in the Cashier Signing Method. (In another method, a

Cashier Key may or may not be set to ON.)

page 36.

NOTE on “Condition”:

This is necessary for all program changes.

Setting Procedure:

Use the MA Key to turn the ..... Numeric Key

Control Lock to “SET”.

X

MGR

REG

OFF

SET

-

Z

5

→

Declaration of Program

No. 5 for Time Setting

→

@/FOR

→

Hour Minute

(00 to 23) (00 to 59)

Refer to Chapter 17 on

..... Function Key

AT/TL

→

.....

Issues a

receipt.

Examples) 1:05 a.m.: 1:32 p.m.:

100

5

Receipt Print Format

Program No. for Time Setting

Time now set

(8:30 a.m. in this example)

- 20 -

31

Date

Register No.

Receipt Consecutive No.

Current Time

2

3

Page 25

MA-516-100 SERIES

EO1-11116

Setting the Date

The register has a calendar function. Once the date and time are correctly set, the day automatically advances at

midnight even when the power is turned off. The extra day of a leap year is also computed automatically.

Setting Procedure

Use the MA Key to turn the

Control Lock to “SET”.

X

MGR

REG

OFF

SET

-

Z

6

→

Declaration of Program

No. 6 for Date Setting

→

@/FOR

→ →

Month Day Year

(01 to 12) (01 to 31) (97, 98, etc.)

AT/TL

.....

Issues a

receipt.

NOTE: The date set/print order is Month-Day-Year. If you want to change the order

Program No. for Date Setting

Date now set

(Jul. 28, 1997, in this example)

into Day-Month-Year or Year-Month-Day, select appropriate status of Bits 7

and 8 in Address 16 in Chapter “22. System Option Setting” on page 134.

Examples) To set July 28, 1997:

8

Month-Day-Year

order

Day-Month-Year

order

Year-Month-Day

order

8

2

7

0

Month Day Year

0

8

2

Day Month Year

0

79

Year Month Day

9 7

7

9 7

7

2

Receipt Consecutive No.

Current Time

- 21 -

Page 26

MA-516-100 SERIES

EO1-11116

Displaying the Time

The current time is displayed in the “AMOUNT” area when the Control Lock is turned to REG from any other position.

When the Control Lock position is changed or any entry operation starts, the displayed time disappears.

Time Display Format:

(Example: 1:45 p.m.)

Printing the Time and Date

The current time is printed on every receipt, as the bottom line

page)

. The time can be programmed to non-print, if necessary, by a System Option selection

System Option Setting”, Address 1 - Bit 1 on page 119)

The date is printed on every receipt, as the top line below the Store Name Stamp print (refer to the Receipt Print

Format on the page before the preceding). The quickest way to verify the date print with the Control Lock in REG

position is to issue a receipt of any transaction (for example a No-sale receipt).

(refer to the Receipt Print Format on the preceding

(refer to Chapter “22.

.

13. Tax Table Setting

For details about the actual tax table, contact to the location where the register was purchased.

Setting the U.S. Tax Tables (also applicable to PST in Canada)

There are three ways to set state and local tax tables. Select one that suits the tax table required to be set.

Condition for Setting: After Daily Financial Reset

NOTE on “Condition”:

Unless the register satisfies this condition, the programming operations will not be allowed.

“After ... Reset” means that the designated reset report must be taken before entering the programming

(setting) operation. An error will result if the operation is attempted without taking the report.

However, it does not necessarily mean “immediately after ...” When the designated reset report has already

been taken and then some operations are performed in the “X”, “Z”, or “SET” mode, the condition “After ...

Reset” is still satisfied and the programming operation is still allowed.

On the contrary , when the designated reset report has been taken but then some sales data relating to that

report’s output data are entered in the “REG” “MGR” or “ - ” mode, the programming operation will no longer

be allowed and the same reset report must be taken again.

Thus the condition “After ... Reset” indicates that all the sales data relating to the report data must be zero

(except non-resettable memory data). Because of this “Condition” requirement, the report data will be

protected from any inconsistencies of sales data entered in the period from a resetting of the report to another

resetting of the same report next time. When no condition is specified to a programming (setting) operation,

it means that the operation is allowed any time outside a sale but the cashier must be signed off if the Cashier

Signing Method is selected (See Chapter 17 on page 36)

.

- 22 -

Page 27

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

X

MGR

REG

OFF

-

Z

Go to 1), 2), or 3) below.

→

MA-516-100 SERIES

EO1-11116

SET

Indications of types of keys below:

..... Individual Numeric Key

| | ..... Data to be entered through Numeric Keys

..... Function Key

1) Tax 1; Full Breaks (Non-cyclic Breaks + Cyclic Breaks)

|max. amount non-taxable| →

|max. amount for 1¢ tax levied| →

|max. amount for 2¢ tax levied| → Tax Breaks

.....

Repeat up to the “A” Break.

|max. amount for N¢ tax levied| → .....

ST

(to indicate the “A” Break entry)

|max. amount for N + 1¢ tax levied| →

|max. amount for N + 2¢ tax levied| → Cyclic

.....

Repeat up to the “B” Break.

|“B” Break| →

TX1/M

TX1/M

(“B” Break - “A” Break

= a multiple of $1.00)

TX1/M

TX1/M

TX1/M

Non-cyclic

“A” Break

TX1/M

TX1/M

Tax Breaks

AT/TL

(to complete this tax table setting)

NOTE: Each amount (break) entry may be a maximum of 4-digit value (9999¢).

- 23 -

Page 28

MA-516-100 SERIES

EO1-11116

2) Tax 1; “A” Break and % Rate Combination (Non-cyclic Breaks + % Rate)

First, set all the non-cyclic breaks up to the “A” Break entry and the [ST] key depression shown in the above case

of “1) Tax 1 Full Breaks”.

↓

|Tax Rate applied when exceeding the “A” Break amount|

(Max. 6 digits up to 99.9999%. Use the [ . ] key for a decimal value. Examples: To set 5%, enter 5. To set 5.26%,

enter 5 → [ . ] → 2 → 6. The fraction of the amount resulting from this % rate calculation will be rounded off.)

↓

AT/TL

(to complete this tax table setting)

3) Tax 1; % Rate Only

→

ST

TX1/M

(to indicate that no breaks are entered)

AT/TL

using the [TX2/M] key instead of [TX1/M].

To install the [TX2/M] key on the keyboard, refer to Chapter “15. Optional Key Setting” on

page 30.

2. If two tax tables are to be set, the Tax 1 table must be set first. The Tax 1 table setting will

automatically reset the old Tax 1 and Tax 2 tables. The Tax 2 table can be set only when the

Tax 1 table has been set (i.e., the Tax 2 table alone cannot be set without setting the Tax

1 table).

3. No second depression of the [ST] key is allowed within one tax table setting. A maximum

of 64 breaks may be entered for Tax 1 and Tax 2 tables altogether.

0

|Tax Rate applied to any amount| →

(The description for the Tax Rate in the above case 2) is also applied to this case.)

NOTES 1. For Tax 2 table setting in a multi-tax area, follow the same procedure in 1) , 2), or 3) above,

- 24 -

Page 29

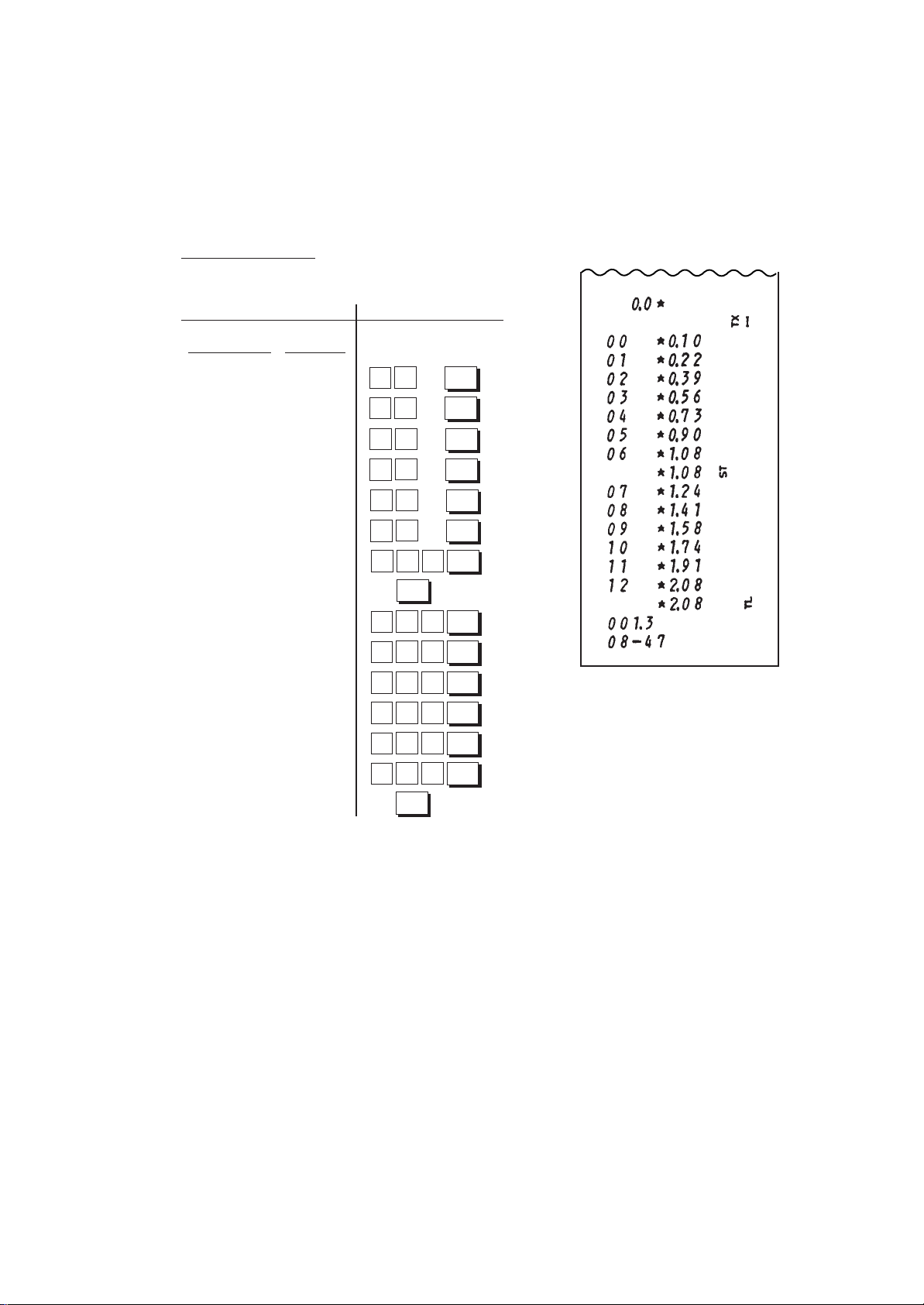

Setting Examples:

Example 1) Tax 1; Full Breaks

Tax Table Key Operation

Amount Range Tax Levied

MA-516-100 SERIES

EO1-11116

Control Lock: SET

$0.00 to $0.10 0¢

$0.11 to $0.22 1¢

$0.23 to $0.39 2¢

$0.40 to $0.56 3¢

$0.57 to $0.73 4¢

$0.74 to $0.90 5¢

$0.91 to $1.08 6¢

... “A” Break

$1.09 to $1.24 7¢

$1.25 to $1.41 8¢

$1.42 to $1.58 9¢

$1.59 to $1.74 10¢

$1.75 to $1.91 11¢

$1.92 to $2.08 12¢

... “B” Break

1

2

3

5

7 3

9

1

1

1

1

1

1 9

2

0

2

9

6

0

0

ST

2

4

5

7

0

AT/TL

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

8

TX1/M

4

TX1/M

1

TX1/M

8

TX1/M

4

TX1/M

1

TX1/M

8

- 25 -

Page 30

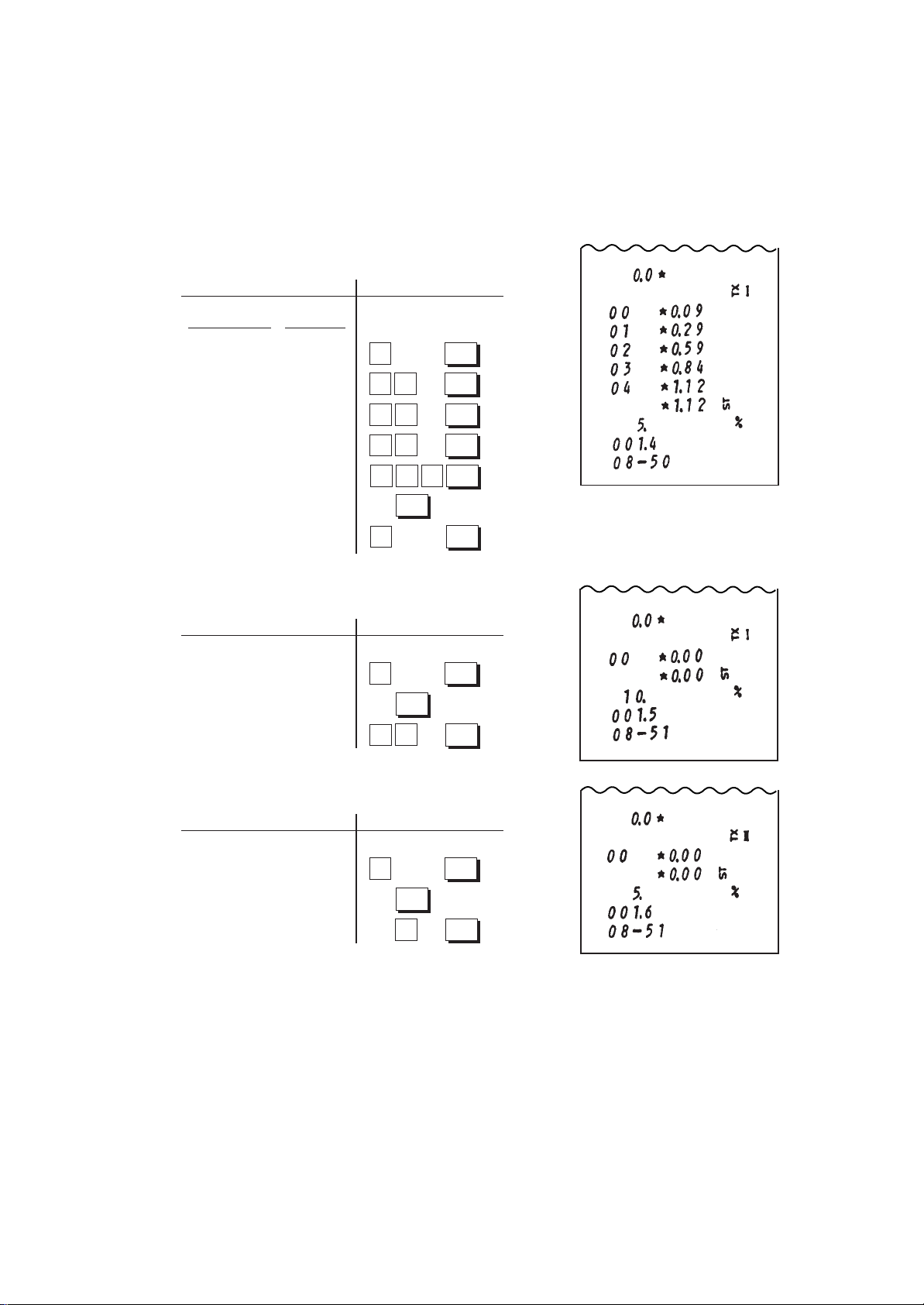

Example 2) Tax 1; “A” Break and % Rate Combination

Tax Table Key Operation

Control Lock: SET

Amount Range Tax Levied

MA-516-100 SERIES

EO1-11116

$0.00 to $0.09 0¢

$0.10 to $0.29 1¢

$0.30 to $0.59 2¢

$0.60 to $0.84 3¢

$0.85 to $1.12 4¢

... “A” Break

5% is applied to any amount

exceeding the “A” Break.

Example 3) Tax 1; % Rate Only

Tax Table Key Operation

10% is applied to any amount.

Example 4) Tax 2; % Rate Only

9

2

5

8

1

5

Control Lock: SET

0

1

TX1/M

TX1/M

9

TX1/M

9

TX1/M

4

TX1/M

TX1/M

2

1

ST

AT/TL

TX1/M

ST

0

AT/TL

Tax Table Key Operation

5% is applied to any amount.

Control Lock: SET

0

TX2/M

ST

5

AT/TL

- 26 -

Page 31

MA-516-100 SERIES

EO1-11116

Setting the GST Rate (applicable to Canada only)

Please note the following before operating the GST rate setting. The following preparations are required:

1) Select the “GST Active” status in Chapter “22. System Option Setting”, Address 14 -Bit 1 on page 132

(some other options can also be selected relating to GST in the same Address).

2) If the [GST/M] (GST Modifier) key must be changed to any other location on the keyboard, refer to Chapter

“15. Optional Key Setting” on page 30. On the Standard Keyboard (see page 15) at shipping from the

factory, the [FS/M] (Food Stamp Modifier) Key is installed. This key will be changed automatically into the

[GST/M] key by the operation described in 1) above.

Condition for Setting: After Daily Financial Reset

(refer to “NOTE on Condition” on page 22.)

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”. This portion is required only

X

MGR

REG

OFF

-

Z

→

when any decimal portion is

contained in the rate.

.

→

GST/M

SET

Examples)

7%

12%

8.55%

To reset the

rate once set:

GST Rate 0 to 99.99(%)

7

2

1

.

8

0

5

5

GST Rate 7% is set.

- 27 -

Page 32

Setting the Non-taxable Limit Amount

(applicable to only certain areas in Canada)

This non-taxable amount limit must be set only in certain areas in Canada.

Condition for Setting: After Daily Financial Reset

(refer to “NOTE on Condition” on page 22.)

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

X

MGR

REG

OFF

SET

-

Z

→

2

1

Declaration of Program No. 12

for Non-taxable Limit Amount

Setting

→

@/FOR

→

Non-taxable Limit

Amount (max. 4 digits;

1 to 9999¢, or enter 0¢

to reset the limit)

MA-516-100 SERIES

→

EO1-11116

AT/TL

Example) $20.00

NOTES 1 . When the sum of the sale portion subject to Tax (PST) 1 and the sale portion subject to Tax

(PST) 2 exceeds the Non-taxable Limit Amount programmed here, all the amount subject

to either of the two taxes are all taxed. When the sum is less than the programmed limit, Tax

1 is tax-exempted and only Tax 2 is calculated on the sale portion subject to Tax 2.

2. When the sum of the sale portion subject to Tax (PST) 1 and the sale portion subject to Tax

(PST) 2 is negative, the portion subject to Tax 1 will not be taxed.

3. When the sale portion subject to Tax 1 is tax-exempted, the taxable amount is not stored in

Tax 1 memory.

4. An error results when the [GST/M] key is depressed in sale entries on the ECR with Nontaxable Limit Amount programmed.

5. This setting must not be operated when Food Stamps are handled in transactions.

0

2

0

0

- 28 -

Page 33

MA-516-100 SERIES

Tax Calculation Test

Tax calculation can be tested by the following procedure. This operation will not affect any sales data.

Operating Procedure:

Use the MA Key to turn the

Control Lock to “X”.

X

MGR

REG

OFF

SET

-

Z

→

→ |Amount| →

Enter any amount

through Numeric

Keys. The entered

amount is displayed.

.....

TX1/M

( or )

.....

The tax amount (total of all

the taxes due) is displayed

in the AMOUNT portion.

(The Non-taxable Limit

Amount setting is disregarded from this display.)

TXBL

TL

EO1-11116

14. Register No. Setting

When multiple registers are used in one store, or to distinguish this register from others used by other stores in the same

chain, set the Register Number in the following procedure.

Condition for Setting: Any time outside a sale. Must be signed off in the Cashier

Signing Method. (In other methods, a Cashier Key may or

Setting Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

X

MGR

REG

OFF

SET

Example)

No. 112300:

-

Z

112 0

may not be set to ON.)

→ →

Register Number

max. 6 digits; 0 to 999999

3

Register No. before this setting

Register No. now set

0

Refer to Chapter 17 on page 36.

#/NS

( or )

#

- 29 -

Page 34

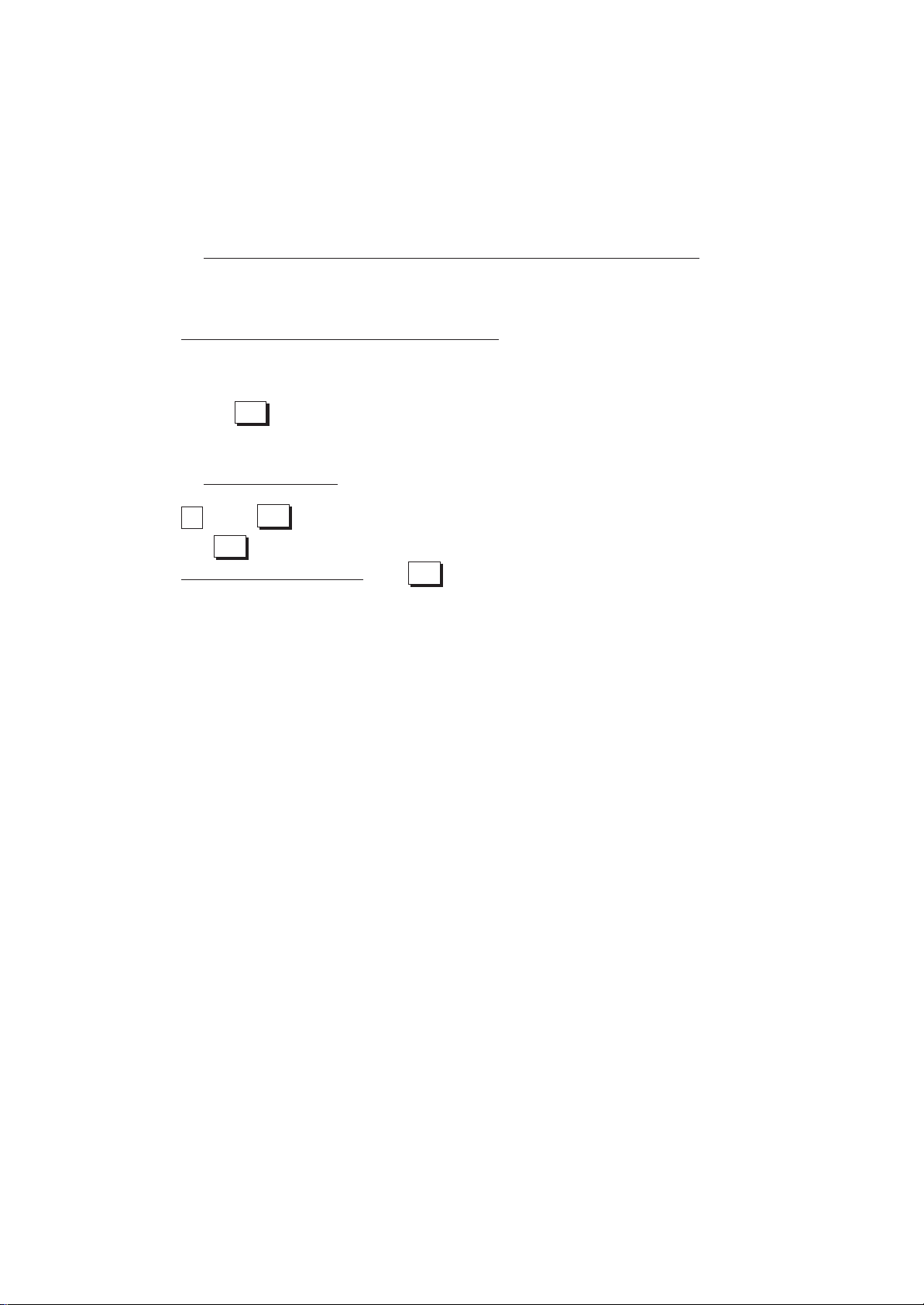

MA-516-100 SERIES

NOTES 1. The Decimal Point cannot be entered in the Register Number.

2. Preceding zeros, if any, will not be printed. For example, if “001234” is entered, “No. 1234”

will be printed.

3. The Register Number set here will be printed on the second line below the Store Name

Stamp print (just below the Date print line) on every receipt to be issued.

Store Name Stamp print space

Date

Register No.

EO1-11116

15. Optional Key Setting

This chapter introduces optional keys (keys not installed on the current Standard Keyboard) that can be programmed.

Please note, however, that adding an optional key means to sacrifice another key already installed. If you plan to install

any of the Optional Keys or change locations of any of the current keys, this operation must be performed first before any

other programming or setting operation

(refer to NOTE 9 at the end of this chapter).

List of Keys

The following is the list of the all the keys that can be programmed on the keyboard. Numeric Keys 0 to 9 are fixed

as to their locations, therefore, not included in the list. The “Key Code” assigned to each key in the list is used in the

setting procedure on the page after the next. For detail functions and operations of each key, refer to Chapters 17

to 19. For a brief information of the Optional Keys, refer to NOTE 8 at the end of this chapter.

.............Keys that must be installed as minimum requirement

.............Keys that are already installed on the Standard Keyboard

.............Optional Keys

Key Code Key Name

0

*1

1 to 20 Department Keys 1 to 20

61 RF (Receipt Feed)

62 JF (Journal Feed)

63 00 (Double-zero)

65 • (Decimal Point)

66 VND CPN (Vendor Coupon)

67 STR CPN (Store Coupon)

Code to deactivate the key.

Key Code Key Name

69 DOLL DISC (Dollar Discount)

70 %+ (Percent Charge)

71 %- (Percent Discount)

72 RTN MDSE

73 ITEM CORR (Item Correct)

74 VOID (Void)

75 ALL VOID (All Void)

76 AT/TL (Cash Tender/Total)

- 30 -

(Returned Merchandise)

Page 35

MA-516-100 SERIES

EO1-11116

Key Code Key Name

77 CHK TEND (Check Tender)

78 Chg (Charge Total)

79 MISC TEND

80 CPN (Media Coupon Tender)

82 ST (Subtotal)

83 R/A (Received-on-Account)

84 PO (Paid Out)

*2

*2

*2

85 NS (No-sale)

86 PR OPEN (Preset Price Open)

87 LC OPEN (Listing Capacity Open)

88 OPEN (PR & LC Open)

89 VALI DATE (Validation)

90 # (Non-add Number Print)

91 #/NS (Non-add Number/No-sale)

92 PLU (Price-Look-Up)

93 @/FOR (At/For; Multiplication)

94 RECEIPT ISSUE (Post-receipt)

95 C (Clear)

*1. At least one Department Key is required to be installed. On the standard keyboard layout

initially set at the factory, each of the department keys is designed to control two departments

as printed on a key sticker, using the [DPT SHIFT] key.

*2. The [#/NS] key has both [#] and [NS] functions. Therefore, when [#/NS] is installed, neither

[#] nor [NS] are necessary.

*3. Whether the key assigned with Key Code 115 will be [FS/M] or [GST/M] is decided by

Chapter 22. System Option Setting, Address 14 - Bit 1 selection on page 132.

*4. When the Signing Method is selected for cashier identification ( refer to Chapter 17 on page

36), this key must be installed. In other cashier identifying methods, this key merely functions

as receipt issue/non-issue key.

(Miscellaneous Tender)

Key Code Key Name

97 TX/M or TX1/M (Tax 1 Modifier)

98 TX2/M (Tax 2 Modifier)

99 TXBL TL (Taxable Total)

100 TAX (Manual Tax)

101 EX (Tax Exempt)

107 DPT SHIFT (Department Shift)

108 AMT (Amount)

115 FS/M (Food Stamp Modifier)

GST/M (GST Modifier)

117 CASH1 (Cash Payment 1)

118 CASH2 (Cash Payment 2)

119 CASH3 (Cash Payment 3)

120 FSTL TEND (Food Stamp Tender)

121 CUR1 (Foreign Currency 1)

122 CUR2 (Foreign Currency 2)

123 CUR3 (Foreign Currency 3)

124 CUR4 (Foreign Currency 4)

127 LOG/RECEIPT (Log/Receipt)

for CANADA

for US

*1

*3

*4

- 31 -

Page 36

Key Installation Setting

Condition for Setting: After all Daily and Periodical Resets

(refer to “NOTE on Condition” on page 22.)

Setting Procedure:

Use the S Key to turn the Control

Lock to the “BLIND” position.

X

MGR

REG

OFF

SET

(The BLIND position is the

unmarked step next to “Z”.)

-

Z

→

(BLIND)

Only to read the Key Code currently set on the key.

6

7

To declare Key Installation

Setting.

→

AT/TL

←

→

MA-516-100 SERIES

Repeat for all the keys to be

newly installed, for location

changes, or for reading Key

Codes already set.

EO1-11116

→

Key Code (max. 3

digits; see the List

of Keys on the

preceding pages.)

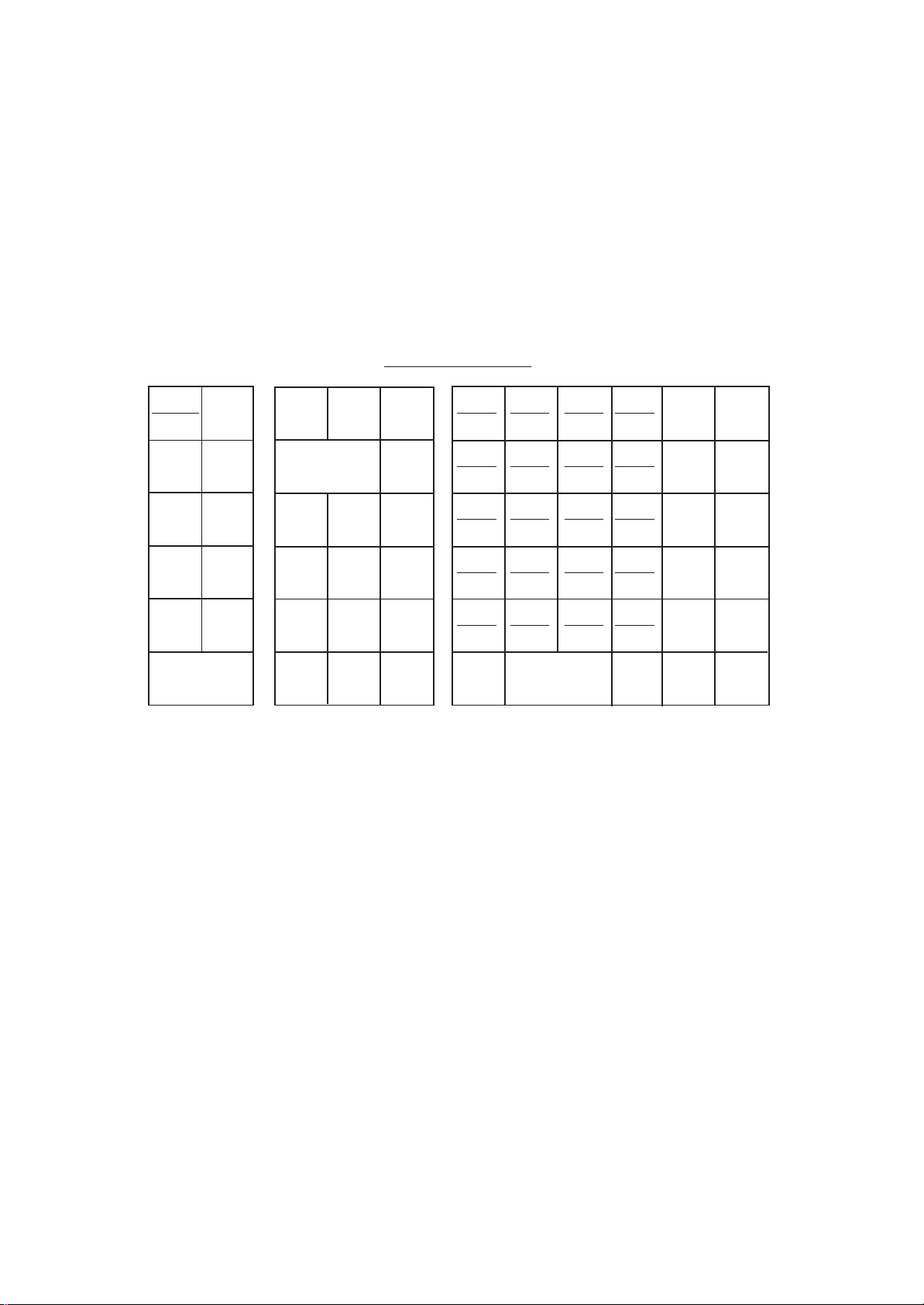

Blank Keyboard Sketch (for your planning aid)

Fill in:

Key Name→

Key Code →

(Refer to the

“List of Keys”

on the preceding pages)

For the Standard Keyboard

Layout, refer to

Chapter “9.

Keyboard” on

page 15.

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

789

456

123

( )

( )

........

→

Displays the

entered Key

Code in the

AMOUNT

portion, as it

is entered.

( )

( )

( )

( )

( )

Depress the key to

be set with the Key

Code.

Displays the Key

Code set or read, in

the AMOUNT portion.

( )

( )

( )

( )

( )

→

( )( )

( )( )

( )( )

( )( )

AT/TL

Depress the [AT/TL]

key to complete the

Key Installation Setting operation.

( )( )( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

0

( )( )

AT/TL( )

( )

( )

( )

- 32 -

Page 37

MA-516-100 SERIES

EO1-11116

NOTES 1. If Key Installation Setting is operated for the first time, all the keys are already set as in the

Standard keyboard Layout. Therefore, set only the keys that are to be changed as to their

locations or newly installed.

2. If a wrong code has been entered and the key has also been depressed (i.e., a wrong code has

been set on a key), enter the correct code and depress the key. The code entered last will be

effective.

3. If “0” is entered as Key Code, the key will be dead and its memory will also be closed. If “0” is

entered to the [DPT SHIFT] key (Key Code 107), each memory of the Department Nos. 21 to

40 will be closed.

4. Each of the keys programmed in this operation will have its memory (if any) opened automatically. Installing the [DPT SHIFT] key makes each memory of the Department Nos. 21 to 40 open

automatically.

5. The [C] key, if once set with Key Code 95, may be used to clear an error, but it cannot be used

immediately after a Key Code entry (for the purpose of clearing the wrong Key Code error). If any

Key Code is entered and then the [C] key is depressed, that Key Code will be set on the key that

was once the [C] key.

6. On depressing the final [AT/TL] key, “0.00” is displayed in the AMOUNT portion, indicating that

the setting operation is completed. No printing occurs.

7. Use the Blank Keyboard Layout on the preceding page, if necessary, for your own keyboard plan

before starting the setting procedure.

8. Brief Information on Optional Keys:

[%+] (%+ Key) --- Key Code 70

It is used to add a percent rate to an individual sale entry item or the entire sale.

[ALL VOID] (All Void Key) ... Key Code 75

It is used to cancel the contents in the current sale all at once.

[CPN] (Media Coupon Tender Key) ... Key Code 80

It is another non-cash media key to finalize a sale.

[NS] (No-sale Key) ... Key Code 85, [#] (Non-add Number Print Key) ... Key Code 90

These keys are not necessary if the [#/NS] key is installed. If the [#/NS] is not installed, those

keys should be separately installed for Non-add Number printing and No-sale entries

respectively.

[OPEN] (Preset & Listing Capacity Open Key) ... Key Code 88

This is a dual-function key that has both [LC OPEN] and [PR OPEN] functions. By

depressing this key once, both of those functions will be effective.

[TX2/M] (Tax 2 Modifier Key) ... Key Code 98

It is used to reverse the tax 2 status.

[TXBL TL] (Taxable Total Key) ... Key Code 99

It simply reads the Taxable Total (sale total amount + taxes due) during a sale. Since the [ST]

can have the same function, it is usually not necessary. However, when the [ST] is

programmed to be used to obtain the sale total amount without taxes, [TXBL TL] is

necessary.

- 33 -

Page 38

MA-516-100 SERIES

[TAX] (Manual Tax Key) ... Key Code 100

It is used to enter an irregular tax amount that cannot be calculated on the basis of the

programmed tax tables, and to add it to the sale total. For installing this key, please note the

following in entering Key Code 100:

EO1-11116

Right: The last key is correctly set with Key Code 100 ([TAX])

Wrong: The 00 key is newly set with Key Code 1, which is

[GST/M] (GST Modifier Key)... Key Code 115 (common Key Code with [FS/M])

[CASH1] to [CASH3] (Cash Tender Keys 1 to 3) ... Key Codes 117 to 119

[CUR1] to [CUR4] (Foreign Currency Keys 1 to 4) ... Key Codes 121 to 124

9. If any of the following keys are newly installed or its location is changed, its relevant programming

operations are further required (even if once programmed, re-programming is necessary

because the program data has been cleared):

1

It is necessary in the GST-applicable area in Canada. It reverses the GST taxable/nontaxable status of items. Whether the key with Key Code 115 is used as [FS/M] or [GST/M]

is determined by System Option, Address 14 - Bit 1 status (refer to page 132).

They are used for cash-tendering operations.

They are used to finalize a sale with foreign currencies.

Each Department Key ............ Department Status, LC (if required), Preset Price (if re-

[PLU] ........................................ PLU Table

[TX1/M], [TX2/M], [GST/M]...... Respective Tax Tables or Rates (Tax 1, Tax 2, GST)

[%+], [%–] ................................Respective Foreign Currency Exchange Rates

[CASH1] to [CASH3] ............... Respective Cash Tendering Amounts

[CUR1] to [CUR4] ....................Respective Foreign Currency Exchange Rates

0

1 00

0

→

→

Key

Key

Department 1 Key. The last key is not set with any Key

Code.

quired) of the Department

- 34 -

Page 39

16. Daily Operation Flow

The following shows a typical daily operation flow on the register.

Before Opening the Store ...

MA-516-100 SERIES

EO1-11116

Reference

Chapter

During Business Hours ...

After Closing the Store ...

• Ensure that the register is firmly plugged in

the wall outlet.

• Check if enough portions of Receipt and Journal

rolls are left.

• Check the time, date, and print condition.

Check the time, date, and print by issu-

ing a No-sale Receipt. ...

Setting the time or date ...

Opening the store

• Transaction entries on the register

• Taking Read (X) Reports periodically.

Closing the store

5

10

18

12

18 to 20

21

• Taking Daily Reset (Z) Reports

• Tear off the print portion of Journal Paper (optional).

• Leave the drawer open, and turn the Mode Lock

to “OFF”.

• Take all the cash and other contents from the

drawer to the office with the torn Journal and

printed Reset Reports.

- 35 -

21

24

24

Page 40

MA-516-100 SERIES

EO1-11116

17. Cashier Identifying Operation

The MA-516 adopts one of the following cashier-identifying methods.

(1) Signing Method, using the [LOG/RECEIPT] key.

(2) Cashier Push Key Method, using Cashier Keys (stay-down keys)

Method (1) is the standard feature. To change the cashier-identifying method from (1) to (2), appropriate System Option

selections are necessary as well as hardware option.

Chapter 22.)

(Refer to System Option, Address 15 - Bit 5 on page 133 in

(1) Signing Method (LOG/RECEIPT Key)

A cashier needs to “sign ON” for starting transaction entries on the register and identifying the operator. The signedON condition is held until a “sign OFF” is operated. A cashier can sign ON only when the register is in the signedOFF condition. A maximum of 8 cashiers can be identified in this signing method.

LOG

RECEIPT

Sign ON (operable in signed-OFF condition)

Use the REG Key to

turn the Control Lock to

the REG (or MGR or - )

position.

REG

OFF

SET

X

MGR

-

Z

The code being entered

is not displayed.

→

→

Cashier Code assigned to each cashier by the store

(1 digit; 1 to 8)

Secret Code generated by the cashier

(2 digits; any number from 01 to 99)

See NOTE 1 below.

The “SIGN ON” lamp illuminates, and a Sign

ON receipt is issued

LOG

RECEIPT

......... Transaction entries are now

(see the next page)

.....

possible (see the following

pages).

.

Sign OFF (operable in signed-ON condition)

Same Control Lock position as

the Sign ON

position in a signed-ON condition will cause an error.)

(changing the

→

0

→

The “SIGN ON” lamp is extinguished, and a Sign

OFF receipt is issued

LOG

RECEIPT

(see the next page)

......... No operations in REG, MGR or

.....

- mode will be allowed until a

Sign ON is again operated by

a cashier.

.

NOTES 1. The two-digit Secret Code portion, once entered for a cashier’s Sign ON, is set in the memory

of the register. The Secret Code of the same cashier is checked every time his/her Sign ON

is operated until the Daily Cashier Reset Report is taken at the end of the day. Then the

Secret Code is reset and a new Secret Code entry will be allowed . When the Secret Code

is within the range of 01 to 09, it is omissible to enter the preceding zero.

- 36 -

Page 41

2. If the [LOG/RECEIPT] key is simply depressed without a prior numeric entry or with only any

Declaration Key (such as [RTN MDSE]), the Receipt ON/OFF function is activated (refer to

“Receipt-issue/Non-issue Selection” in the next Chapter) but not Sign ON/OFF.

3. If the Cashier Identitying Function “NOTHING” (SET status) is selected (refer to Chapter “22.

System Option Setting,” Address 2 - Bit 8 on page 120), an error will result on a Sign On

or Sign OFF attempt.

Sign ON Receipt Format Sign OFF Receipt Format

Cashier Code (1 to 8)

The signed-ON Cash-

ier Code is printed on

every sale receipt.

(The Secret Code

portion is never

printed.)

(2) Cashier Push Key Method

This method is applied when four push stay-down keys are installed as cashier keys.

MA-516-100 SERIES

EO1-11116

Sign OFF Code

(always 0)

1 2 3 4 Each key (1 to 4) is assigned to each cashier. The register will not

operate in the REG, MGR, or - mode unless of these keys is pushed

held down.

NOTES 1. When this method is adopted, the signing function (“LOG” function) of the [LOG/RECEIPT] key

is deactivated. Accordingly, the key is only used as Receipt ON/OFF switch.

2. No receipts are issued on turning ON or OFF a Cashier Key. However, the Cashier Code (1 to

4) is printed near the bottom of every receipt to be issued.

- 37 -

Page 42

MA-516-100 SERIES

EO1-11116

18. Setting Preparation of Each Key, and Transaction

Entries

This chapter describes individual key operations on transaction entries, and setting requirements for the key if necessary.

WARNING!

When opening the cash drawer, be careful not to let the drawer hit any person.

Receipt-issue/Non-issue Selection (LOG/RECEIPT Key)

Receipts are issued or not issued according to the “R OFF” lamp illuminated/extinguished status on the Operator’s

Display panel.

LOG

RECEIPT

“R OFF” (Receipts OFF) Lamp Status Change Operations

Control Lock may be in any position except OFF.

LOG

RECEIPT

→

←

LOG

Extinguished Illuminated

.....

Receipt ON Status Receipt OFF Status

NOTES 1. The Control Lock may be in any position (except OFF position) for changing the Receipt ON/

OFF status in the signed-ON or signed-OFF condition.

2. The “R OFF” lamp status at the starting of a transaction entry decides whether a receipt will

be issued for the transaction or not. Switching the Receipt ON/OFF status during a

transaction will not be effective.

3. If a transaction entered with the “R OFF” lamp illuminated and finalized but a receipt is

required, the [RECEIPT ISSUE] (Post-issue Receipt) key can be operated to issue a receipt

(see “Post-issue Receipt” on page 92).

4. Simply depress the [LOG/RECEIPT] key without a numeric entry. If the key is depressed

with a prior numeric entry in “REG”, “MGR”, or “ - ” mode, it may turn out to be a Sign ON

or Sign OFF operation when the Singing Method is selected for cashier identification (refer

to the preceding chapter). However, if any Declaration Key (such as [RTN MDSE]) is already

pressed and then the [LOG/RECEIPT] key is pressed, the Declaration Key entry is not

canceled by the Receipt ON/OFF status change.

RECEIPT

.....

- 38 -

Page 43

MA-516-100 SERIES

EO1-11116

Clearing Errors, or Clearing Wrong Declaration

Key or Wrong Numeric Entries

When in sale entries an error has occurred with an alarm buzzer (beeps for about 2 seconds only), a wrong Declaration

Key (such as [RTN MDSE], [TX/M], [GST/M], etc.) has been depressed, or a wrong numeric data has been entered;

depress the [C] key.

1) Error has occurred (the alarm

buzzer is generated and the

“ALM” lamp illuminates), and

the keyboard is locked.

2) Declaration Key has been depressed.

Example)

3) Numeric Keys are entered.

Example)

4) Declaration Key (s) + Numeric

Keys

Example)

5) Numeric Keys + Non-motorized

Key (key that does not trigger

printing)

RTN

MDSE

5

RTN

MDSE

0

0

07

→

→→

C

→

C

C

(Clear Key)

The error condition is cleared (the

buzzer tone stops and the “ALM” lamp

is extinguished). Find the cause of the

error, and do the operation again. Refer to “Possible Cause of Error” attached where an error may occur in

each operation sequence on the following procedure.

The entered data are all cleared at once.

Example)

6) Combination of 2) to 5)

7) Combination of 6) + 1)

NOTE: When data is already entered and printed (through a Department Key, etc.), it cannot be cleared by the [C]

key any longer. In need of deleting such data, see the following:

Item Correction (Last Line Voiding) page 68

Void (Designated Line Voiding) page 70

All Void (Transaction Cancel) page 71

Operations in “ - ” Mode Chapter 20 (page 98)

X

21

→→

ITEM

CORR

ALL

VOID

VOID

C

The entered data are all cleared at once,

and the error condition is cleared also.

Refer to 1) for finding the cause of error.

- 39 -

Page 44

MA-516-100 SERIES

EO1-11116

Department Keys to , to control Dept. Nos. 21 to 40

Dept. 21

Dept. 21

Dept. 40

Dept. 20

DPT

SHIFT

Programming Department Keys

These are department keys through which sales items are registered. To designate the Department Nos. 21 to 40,

pressing the [DPT SHIFT] key before the Department Keys 1 to 20 is necessary.

Programming Department Status:

To use Department Keys, first program how each Department Key is to be used, in accordance with merchandise

categories, taxation, operativity of the key, etc.

Condition: After Daily Financial Reset and Periodical Financial Reset (and All PLU Reset

if the positive/negative status is to be set)

(refer to “NOTE on Condition” on page 22)

- 40 -

Page 45

Programming Procedure:

Use the MA Key to turn the

Control Lock to “SET”.

X

MGR

REG

OFF

SET

Depress the required key(s) to obtain the appropriate status for the department:

-

Z

3

→

Declaration of Program No.

3 for Department Status

programming

→

As for items marked with “NOTE”, refer to the corresponding

NOTE No. below and on the next page for further description.

@/FOR

MA-516-100 SERIES

Repeat for programming

other Department Keys

EO1-11116

←

→

→

→

→

→

→

→

→

→

→

RTN

MDSE

TX1/M

TX2/M

GST/M

FS/M

1

2

4

5

0

To set Negative status

NOTES 4, 5

To set Tax 1 taxable status

NOTES 1, 3

To set Tax 2 taxable status

NOTES 1, 3

To set GST taxable status

NOTE 1, 4

To set Food-stampable status

NOTE 4

To set Single-item Key status

To set Itemized Key status

To set Other Income Key status

To set Single-item

+ Other Income Key status

To regain the initial statuses, i.e., Positive, Nontaxable, Non-GST, Non-food-stampable and Itemized statuses); It may be useful when you are

confused with various status selections for department.

The status is

reversed by

pressing the

same key

again.

NOTE 2

Key Type

status

NOTE 6

Depress the

→

[DPT SHIFT]

key to set the

Department Nos.

21 to 40.

NOTE 7

DPT

()

SHIFT

→

Depress the

Department Key

to obtain the

selected statuses.

Dept.

NOTE 3

→

To complete this

AT/TL

operation and issue

a program receipt