Page 1

TEC Electronic Cash Register

Table of Contents

MA-186-100 SERIES

Owner’s Manual

Page 2

NOTICE

This equipment has been tested and found to comply with the limits for a Class A digital

device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful interference when the equipment is operated in a commercial

environment. This equipment generates, uses, and can radiate radio frequency energy and,

if not installed and used in accordance with the instruction manual, may cause harmful

interference to radio communications. Operation of this equipment in a residential area is

likely to cause harmful interference in which case the user will be required to correct the

interference at his own expense. Changes or modifications not expressly approved by

manufacturer for compliance could void the user’s authority to operate the equipment.

WARNING

“This Class A digital apparatus meets all requirements of the Canadian Interference-Causing

Equipment Regulations.”

“Cet appareil numénque de la classe A respecte toutes les exigences du Règlement sur le

matériel brouilleur du Canada.”

Copyright © 1999

by TOSHIBA TEC CORPORATION

All Rights Reserved

570 Ohito, Ohito-cho, Tagata-gun, Shizuoka-ken, JAPAN

Page 3

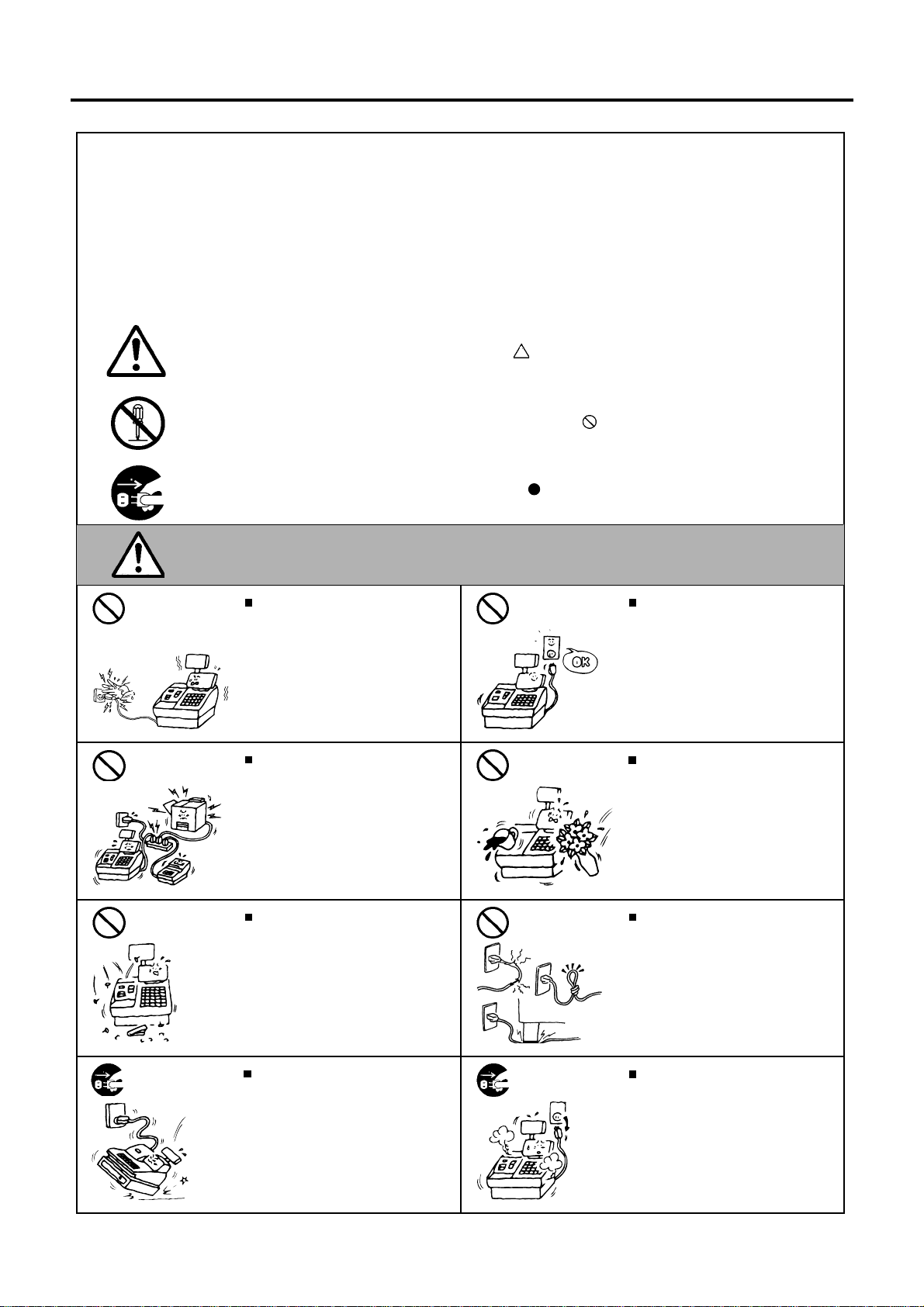

Safety Summary

Safety Summary

Personal safety in handling or maintaining the equipment is extremely important. Warnings and Cautions

necessary for safe handling are included in this manual. All warnings and cautions contained in this

manual should be read and understood before handling or maintaining the equipment.

Do not attempt to effect repairs or modifications to this equipment. If a fault occurs that cannot be rectified

using the procedures described in this manual, turn off the power, unplug the machine, then contact your

authorized TOSHIBA TEC representative for assistance.

Meanings of Each Symbol

This symbol indicates warning items (including cautions).

Specific warning contents are drawn inside the symbol.

(The symbol on the left indicates a general caution.)

This symbol indicates prohibited actions (prohibited items).

Specific prohibited contents are drawn inside or near the symbol.

(The symbol on the left indicates “no disassembling”.)

This symbol indicates actions which must be performed.

Specific instructions are drawn inside or near the symbol.

(The symbol on the left indicates “disconnect the power cord plug from the outlet”.)

EO1-11115

This indicates that there is the risk of death or serious injury if the

WARNING

Prohibited

Prohibited

Prohibited Prohibited

Do not plug in or unplug the power

cord plug with wet hands as this may

cause electric shock.

If the machines share the same

outlet with any other electrical

appliances which consume large

amounts of power, the voltage will

fluctuate widely each time these

appliances operate. Be sure to

provide an exclusive outlet for the

machine as this may cause the

machines to malfunction.

Do not insert or drop metal,

flammable or other foreign objects into

the machines through the ventilation

slits, as this may cause fire or electric

shock.

machines are improperly handled contrary to this indication.

Any other than the

specified AC voltage

is prohibited.

Prohibited

Do not use voltages other than the

voltage (AC) specified on the rating

plate, as this may cause fire or

electric shock.

Do not place metal objects or

water-filled containers such as flower

vases, flower pots or mugs, etc. on

top of the machines. If metal objects

or spilled liquid enter the machines,

this may cause fire or electric

shock.

Do not scratch, damage or modify

the power cords. Also, do not place

heavy objects on, pull on, or excessively bend the cords, as this may

cause fire or electric shock.

Disconnect

the plug.

If the machines are dropped or their

cabinets damaged, first turn off the

power switches and disconnect the

power cord plugs from the outlet, and

then contact your authorized

TOSHIBA TEC representative for

assistance. Continued use of the

machine in that condition may cause

fire or electric shock.

(i)

Disconnect

the plug.

Continued use of the machines in an

abnormal condition such as when the

machines are producing smoke or

strange smells may cause fire or elec-

tric shock. In these cases, immediately turn off the power switches and

disconnect the power cord plugs from

the outlet. Then, contact your authorized TOSHIBA TEC representative for

assistance.

Page 4

Safety Summary

EO1-11115

Disconnect

the plug.

Connect a

grounding

wire.

If foreign objects (metal fragments,

water, liquids) enter the machines,

first turn off the power switches and

disconnect the power cord plugs from

the outlet, and then contact your

authorized TOSHIBA TEC representative for assistance. Continued

use of the machine in that condition

may cause fire or electric shock.

Ensure that the equipment is

properly grounded. Extension cables

should also be grounded. Fire or

electric shock can occur on improperly grounded equipment.

Disconnect

the plug.

No

disassembling.

When unplugging the power

cords, be sure to hold and pull on

the plug portion. Pulling on the cord

portion may cut or expose the internal wires and cause fire or electric

shock.

Do not remove covers, repair or

modify the machine by yourself. You

may be injured by high voltage, very

hot parts or sharp edges inside the

machine.

Unauthorized modification is prohibited.

This indicates that there is the risk of personal Injury or damage to

CAUTION

objects if the machines are improperly handled contrary to this indication.

Precaution

The following precautions will help to ensure that this machine will continue to function correctly.

• Try to avoid locations that have the following adverse conditions:

* Temperatures out of the specification * Direct sunlight * High humidity

* Shared power socket * Excessive vibration * Dust/Gas

• Do not subject the machine to sudden shocks.

• Do not press the keys too hard. Keys will operate correctly if they are touched lightly.

• Clean the cover and keyboard, etc. by wiping with a dry cloth or a cloth soaked with detergent and wrung out

thoroughly. Never use thinner or other volatile solvent for cleaning.

• At the end of the day, turn the power OFF, then clean and inspect the exterior of the machine.

• Try to avoid using this equipment on the same power supply as high voltage equipment or equipment likely to

cause mains interference.

• USE ONLY TOSHIBA TEC SPECIFIED consumables.

• DO NOT STORE the consumables where they might be exposed to direct sunlight, high temperatures, high

humidity, dust, or gas.

• When moving the machine, take hold of the drawer and lift the machine.

• Do not place heavy objects on top of the machines, as these items may become unbalanced and fall causing

injury.

• Do not block the ventilation slits of the machines, as this will cause heat to build up inside the machines and

may cause fire.

• Do not lean against the machine. It may fall on you and could cause injury.

Request Regarding Maintenance

• Utilize our maintenance services.

After purchasing the machines, contact your authorized TOSHIBA TEC representative for assistance once per year or

so to have the inside of the machines cleaned. Otherwise, dust will build up inside the machines and may cause fire or

malfunction. Cleaning is particularly effective before humid rainy seasons.

• Our maintenance service performs the periodic checks and other work required to maintain the quality and

performance of the machines, preventing accidents beforehand.

For details, please consult your authorized TOSHIBA TEC representative for assistance.

• Using insecticides and other chemicals

Do not expose the machines to insecticides or other volatile solvents, as this will deteriorate the cabinet or other parts

or cause the paint to peel.

(ii)

Page 5

MA-186-100 SERIES

EO1-11115

TABLE OF CONTENTS

Page

1. Introduction .................................................................................................................................... 1

2. Unpacking ....................................................................................................................................... 2

3. Outline of Preparation Procedure Before Operating the ECR ................................................... 3

4. Appearance and Nomenclature .................................................................................................... 5

5. Control Lock and Control Keys .................................................................................................... 6

Control Keys ........................................................................................................................ 6

Control Lock ........................................................................................................................ 6

6. Display............................................................................................................................................. 7

Operator’s Display ...............................................................................................................7

Customer’s Display..............................................................................................................7

Numeric Display .................................................................................................................. 8

Message Descriptors (Triangular Lamps)............................................................................ 8

7. Keyboard.........................................................................................................................................9

Standard Keyboard Layout.................................................................................................. 9

Other Optional Keys: ........................................................................................................... 9

8. Installing the Paper Roll .............................................................................................................. 10

9. Time and Date Setting.................................................................................................................. 13

Time Setting or Adjustment................................................................................................ 13

Date Setting or Adjustment................................................................................................ 14

Displaying the Time ...........................................................................................................15

Printing the Time and Date................................................................................................ 15

10. Tax Table Setting .......................................................................................................................... 15

U.S. Tax Tables Setting (also applicable to PST in Canada) ............................................ 15

GST Rate Setting (applicable to Canada only).................................................................19

Non-taxable Limit Amount Setting (applicable to only certain areas in Canada)............... 20

Tax Calculation Test...........................................................................................................21

11. Optional Key Setting....................................................................................................................21

List of Keys ........................................................................................................................ 21

Key Installation Setting ...................................................................................................... 23

Blank Keyboard Sketch (for your planning aid) ................................................................ 23

12. Daily Operation Flow.................................................................................................................... 25

13. Training ......................................................................................................................................... 26

14. Setting Preparation of Each Key and Transaction Entries....................................................... 27

Receipt-issue/Non-issue Selection.................................................................................... 27

Clearing Errors, or Clearing Wrong Declaration Key or Wrong Numeric Entries............... 28

No-sale (Exchange) ........................................................................................................... 29

Received-on-Account Payment ......................................................................................... 30

Paid Out............................................................................................................................. 31

Department Keys............................................................................................................... 31

PLU (Price-Look-Up) (PLU Key)........................................................................................40

Listing Capacity Open ....................................................................................................... 46

Percent Charge, Percent Discount .................................................................................... 46

Dollar Discount .................................................................................................................. 49

Item Correct (Last Line Voiding) ........................................................................................ 49

Void (Designated Line Voiding) .........................................................................................50

All Void (Transaction Cancel) ............................................................................................51

Returned Merchandise ...................................................................................................... 51

Non-add Number Print....................................................................................................... 52

Subtotal Read.................................................................................................................... 53

Taxable Total Read ............................................................................................................ 53

Manual Tax Entry............................................................................................................... 54

Finalizing a Sale ................................................................................................................ 54

Check Cashing (Cashing Non-cash Media) ...................................................................... 55

Post-issue Receipt.............................................................................................................55

Page 6

MA-186-100 SERIES

EO1-11115

Tax Status Modification ...................................................................................................... 56

Tax Exemption ...................................................................................................................57

Print/Non-print Options on Sale Receipts.......................................................................... 58

15. Read and Reset Reports..............................................................................................................59

Programming Operations Relating to Reports................................................................... 59

Taking Read and Reset Reports ........................................................................................ 61

16. System Option Setting.................................................................................................................69

Address: 1 ......................................................................................................................... 71

Address: 2 ......................................................................................................................... 72

Address: 3 ......................................................................................................................... 73

Address: 6 ......................................................................................................................... 74

Address: 7 ......................................................................................................................... 75

Address: 8 ......................................................................................................................... 76

Address: 11........................................................................................................................77

Address: 13 ....................................................................................................................... 78

Address: 14 ....................................................................................................................... 79

Address: 15 ....................................................................................................................... 80

Address: 16 ....................................................................................................................... 81

17. Cashier Signing Operation (optional function) ......................................................................... 82

Programming Requirements..............................................................................................82

Cashier Sign ON & Sign OFF............................................................................................ 82

Cashier Reports.................................................................................................................83

18. Electronic Journal (E.J.) Print (optional function) .................................................................... 83

Programming Requirement ............................................................................................... 83

E.J.-Near-Full Warning in REG Mode................................................................................ 83

Reading of the Remaining Lines of E.J. Memory .............................................................. 84

Electronic Journal Report .................................................................................................. 84

19. Program Data Verification ........................................................................................................... 86

Operating Procedure ......................................................................................................... 86

20. Paper Roll Replacement and Other Maintenance ..................................................................... 90

Replacing the Paper Roll................................................................................................... 90

Replacing the Ink Ribbon .................................................................................................. 93

Replenishing Ink to the Store Name Stamp ...................................................................... 95

Manual Drawer Release and Lock .................................................................................... 96

Removing the Drawer........................................................................................................ 97

Battery Exchange .............................................................................................................. 97

Changing the Layout of the Money Case .......................................................................... 98

Media Slot..........................................................................................................................99

21. In Case of the Power Failure ..................................................................................................... 100

22. Troubleshooting ......................................................................................................................... 100

23. Status Clear and Memory Clear Operations ............................................................................ 104

Status Clear .....................................................................................................................104

Sales Memory Clear ........................................................................................................ 105

All Memory Clear ............................................................................................................. 106

24. Specifications ............................................................................................................................. 107

Stamp Order .................................................................................................................... 109

CAUTION:

1. This manual may not be copied in whole or in part without prior written permission of

TOSHIBA TEC.

2. The contents of this manual may be changed without notification.

3. Please refer to your local Authorized Service representative with regard to any queries

you may have in this manual.

Copyright © 1999

by TOSHIBA TEC CORPORATION

All Rights Reserved

570 Ohito, Ohito-cho, Tagata-gun, Shizuoka-ken, JAPAN

Page 7

MA-186-100 SERIES

1. Introduction

Thank you for choosing the TEC electronic cash register MA-186-100 series. This owner’s manual provides

a description of the functions and handling of this register and should be read carefully to ensure optimum

performance. Since every consideration has been given to safety and reliability, there is no danger of

damaging the machine by incorrect operation.

Please refer to this manual whenever you have any questions concerning the machine. This machine has

been manufactured under strict quality control and should give you full satisfaction. However, if the

machine is damaged during transit, or there are any unclear points in this manual:

For supplies, service or assistance call:

Please have the following information available when

you call:

EO1-11115

Product Name: TEC Electronic Cash Register

Model: MA-186-100

Serial Number:

Place Purchased:

Date of Purchase:

If for any reason this product is to be returned to the store where purchased, it must be packed in the original

carton.

• The specifications described in this manual may be modified by TOSHIBA TEC, if necessary.

• Be sure to keep this manual for future reference.

- 1 -

Page 8

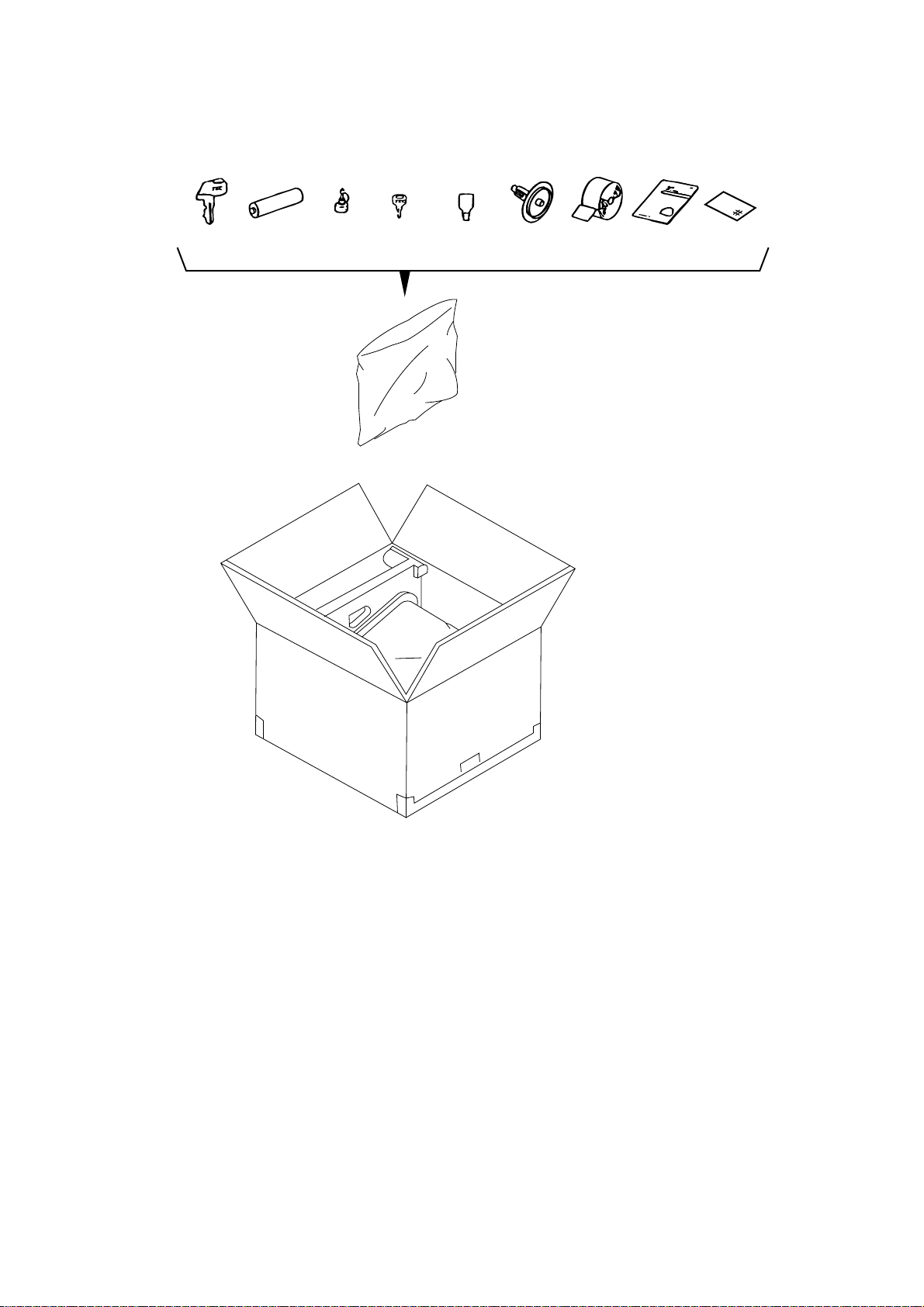

2. Unpacking

(1) (2) (3) (4) (5) (6) (7) (8) (9)

MA-186-100 SERIES

EO1-11115

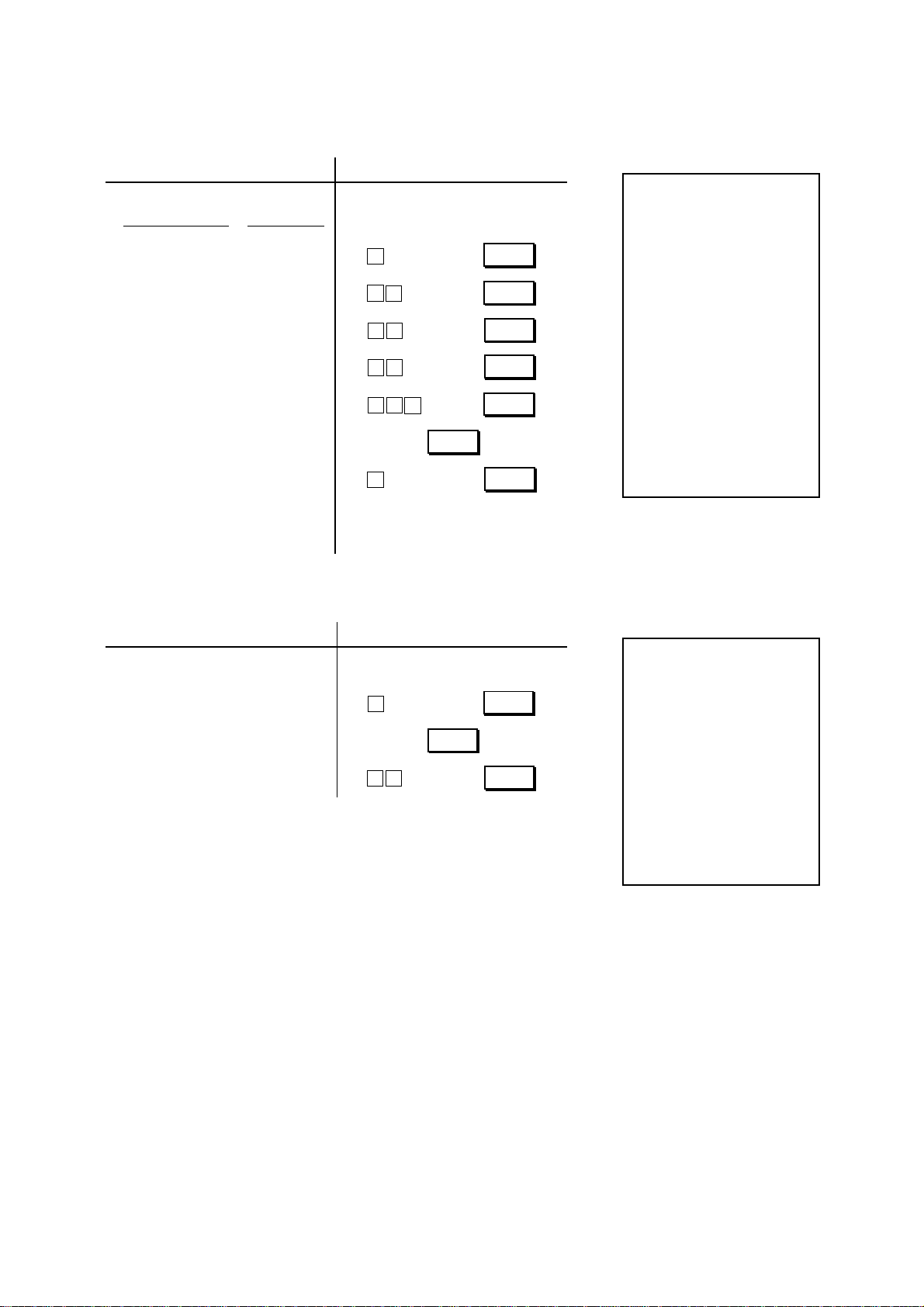

(1) Control Key

(REG Key, MA Key, S Key: 2 pcs. respectively)

(2) Dry Battery (SUM-3 1.5V) (3 pcs.)

(3) Stamp Ink (1 pc.)

(4) Drawer Key (2 pcs.)

(5) Printer Cover Key (2 pcs.)

(6) Paper Roll 58 mm x ø50 mm (1 pc.)

(7) Journal Take-up Reel (1 pc.)

(8) Owner’s Manual (1 pc.)

(9) Warranty Registration (1 pc.)

- 2 -

Page 9

MA-186-100 SERIES

(1) (2) (3) (4) (5) (6) (7) (8) (9)

EO1-11115

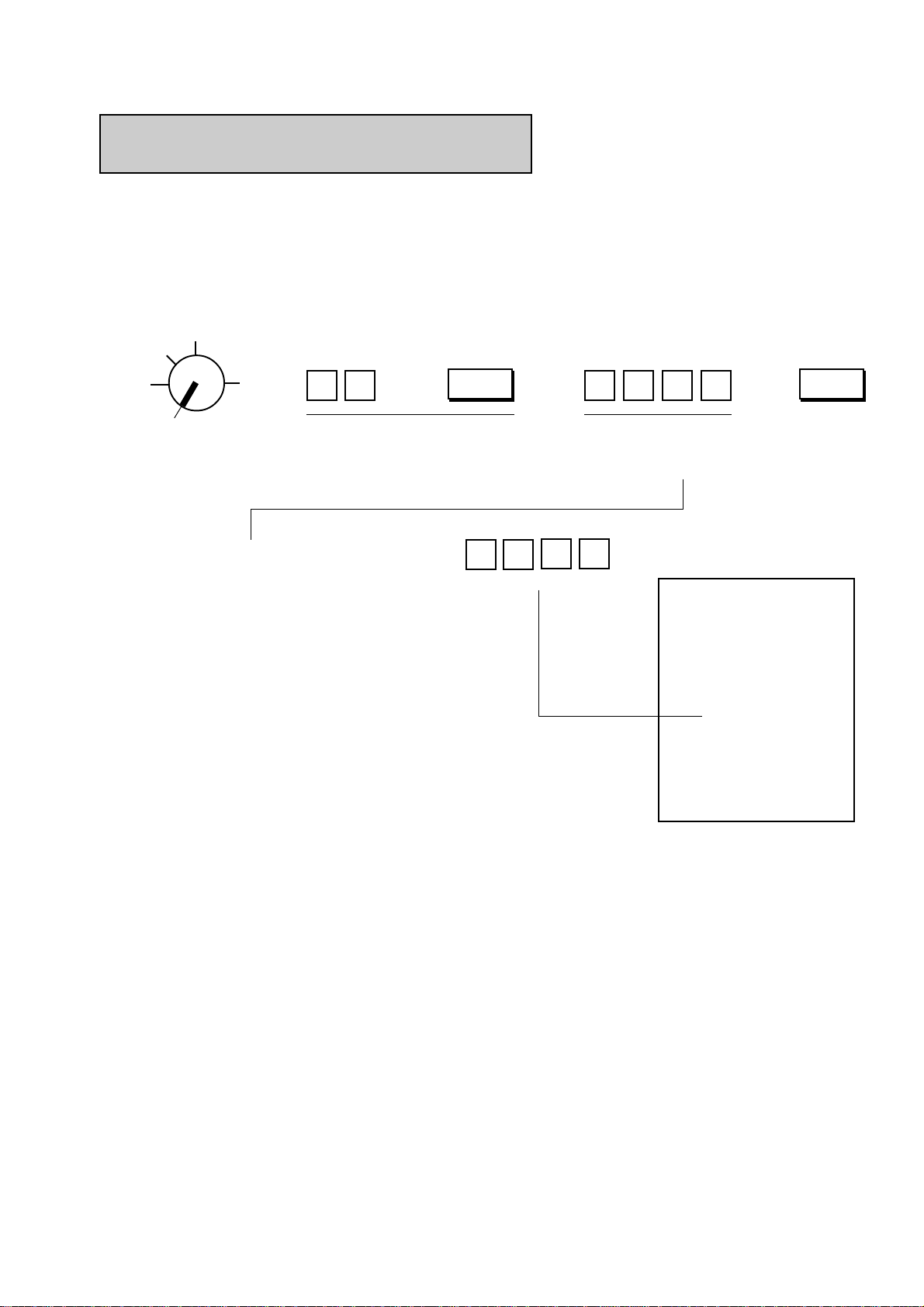

3. Outline of Preparation Procedure Before Operating the

ECR

This chapter shows the outline of set-up procedure of the ECR before actually starting the ECR operation.

1

Remove the cash register from the carton, referring

to Chapter 2. Unpacking on page 2. And take out all

the parts and accessories.

2

Remove the tapes and seals for holding parts or

protecting the register surfaces.

3

Plug the power cord of the register into a wall outlet.

Make sure that the outlet voltage matches that of the

power required for the register.

WARNING: Be sure to plug in the power cord first, then

insert the batteries.

4

Detach the Printer Cover and the Battery Cover, then

insert the batteries (3 pieces).

WARNING: Be certain to insert the batteries enclosed

in the package. If they are not inserted and

the power is turned OFF (including a

power failure occurrence), the sales data

and the programmed data will be cleared.

5

Insert the REG key into the Control Lock.

- 3 -

REG

OFF

SET

X

Z

Page 10

6

Turn the Control Lock to the REG position.

7

Install the paper roll

ing the Paper Roll” on page 10)

8

If any optional keys are installed or relocated on

(referring to Chapter “8. Install-

.

the keyboard, the optional key setting programming must be performed first before any other programming. Refer to Chapter “11. Optional Key

Setting” on page 21.

MA-186-100 SERIES

EO1-11115

X

REG

OFF Z

SET

9

Set the time and date correctly, referring to Chapter

“9. Time and Date Setting” on page 13.

10

Set the tax tables, referring to the Chapter “10. Tax

Table Setting” on page 15.

11

Perform programming of the register, such as Departments and PLUs, according to the requirement of the market and your store

(refer to Chap-

ter 14 and thereafter).

- 4 -

Page 11

4. Appearance and Nomenclature

MA-186-100 SERIES

EO1-11115

Journal Window or Receipt Outlet

Control Lock

Drawer

Printer Cover

Customer’s Display

Operator’s Display

Power Cord

Keyboard

Operator’s Display

Used by the operator to confirm the entry

contents and the status of the register. (page

7)

Customer’s Display

Provided for the customer to see the amount

entered for each item and sale total. (page 7)

Journal Window/Receipt Outlet

The operator can see which items have

already been entered through this window

with the Journal-format Option.

The receipt for the finalized sale is issued

with the Receipt-format Option.

Printer Cover

The cover for the Receipt/Journal printer.

Control Lock

It selects the type of register operations.

(page 6)

Keyboard

Used to enter sale items. (page 9)

Drawer

Cash and other media are kept here. It automatically opens on finalizing a sale.

- 5 -

Page 12

MA-186-100 SERIES

5. Control Lock and Control Keys

Control Keys

There are three types of Control keys: the REG (registration) key, the MA (manager) key, and the S

(service) key.

REG Key: The REG key is used by the cashier or clerk who operates ordinary transac-

tion entries. This key can access the positions of OFF and REG of the Control

REG

MA Key: The MA key is used by the store manager or owner who will daily supervise

MA

S Key: The S key is used by the owner. This key can access any position including

S

Lock.

the collection of money and printout of transactions recorded by the register.

This key is also used when programming the register. This key can access the

positions of SET, OFF, REG, X, and Z.

BLIND of the Control Lock. To prevent programmed data and sales data from

being changed or cleared by mistake, use the REG or MA keys for transaction

entries or report taking purposes.

EO1-11115

Control Lock

The Control Lock has six effective positions for different modes of operation, which are accessed by the

appropriate Control Keys.

(position) (function)

MA

➤

S

REG

REG

X

➤

ZOFF

SET

➤

BLIND

* not actually

printed.

SET ....................... The register allows programming and

training operations.

OFF ....................... Nothing appears on the display in this

position. However, the power is being sup-

➤

plied to the register.

REG....................... Transaction entries are carried out in this

mode. Displays the current time while no

entries are under way.

X ......................... The sale totals in memory can be read (X

reports) and the programmed data can be

verified in this position.

Z ......................... All the resettable totals and their respec-

tive counters in memory will be read and

reset in this position (Z reports).

BLIND ..................... The register allows special programming

operations and memory clear operations.

The keys may be inserted or pulled out at the “OFF” or “REG”

position.

- 6 -

Page 13

MA-186-100 SERIES

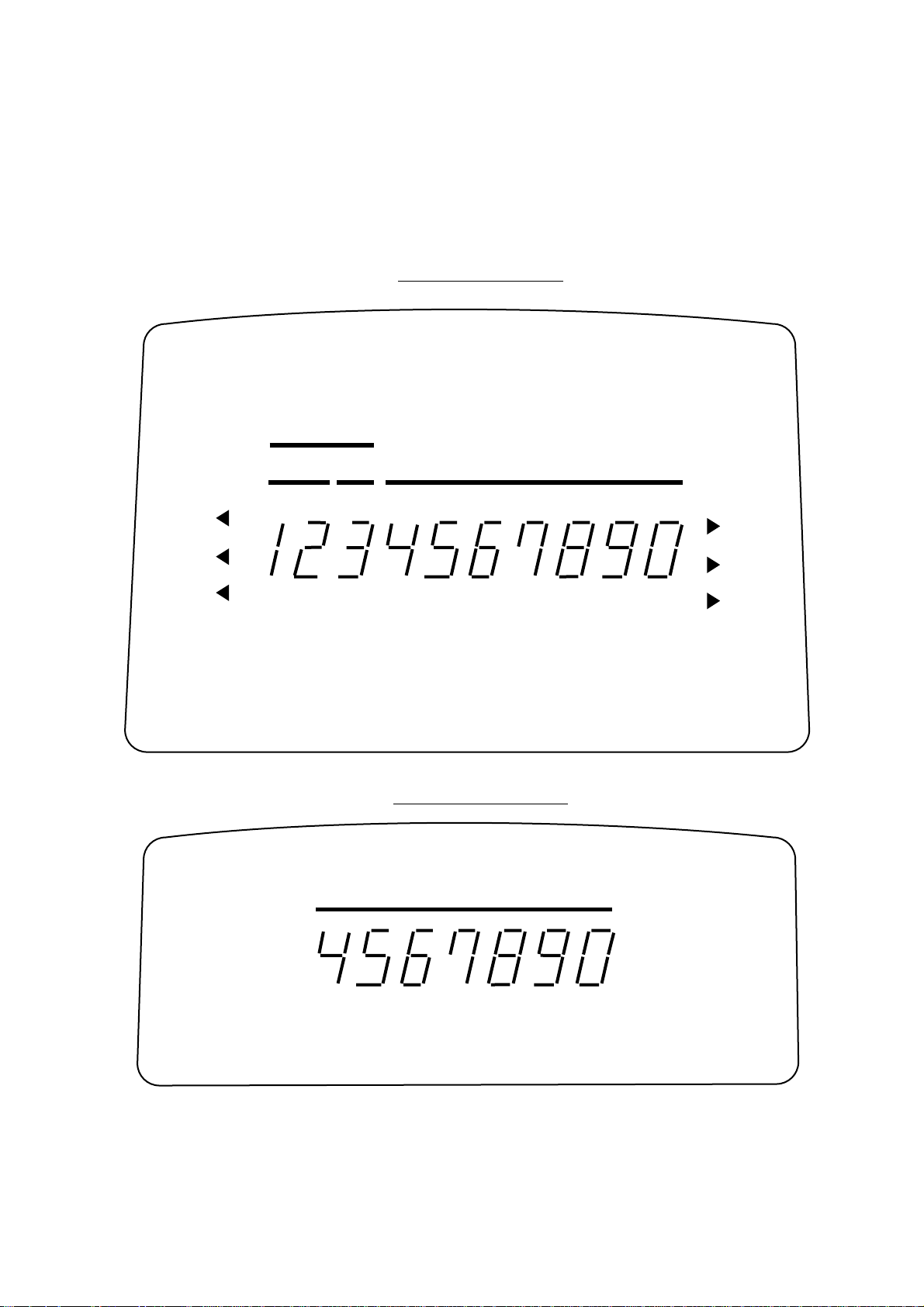

6. Display

The Operator’s Display (front display) is located at the top of the register just above the keyboard. The

Customer’s Display may be used only as a rear display if left in the retracted position or it can be positioned

for viewing at other angles by pulling it upward and turning it to the desired position. The display has two

types of display portions—numeric display and message descriptors (triangular lamps).

Operator’s Display

PLU

PLU

EO1-11115

SIGN

SIGN

ON

ON

ALM

ALM

R

R

OFF

OFF

DP RPT

DPT

RPT

AMOUNT

AMOUNT

AMOUNT

Customer’s Display

AMOUNT

TL

TL

ST

ST

CG

CG

- 7 -

TL

ST

CG

Page 14

Numeric Display

AMOUNT (8 digits for total display, 7 digits for entries):

DPT (2 digits): Displays the code which represents each Department key. It

RPT (1 digit): Displays the repeat count of the same item. The count is indicated

PLU (3 digits of the DPT and RPT are used for this purpose):

MA-186-100 SERIES

EO1-11115

Displays the numeric data, such as amount, quantity, etc. When

the obtained total or subtotal amount is 8-digit, the RPT digit is

also used for the amount display. When no entries are under way

and the Control Lock is in the REG position, the current time is

displayed.

stays lit when repeating the same department entry.

from the second entry on, and only the last digit will be displayed

even if the count exceeds nine.

Displays the PLU code when any PLU is entered. It goes out when

repeating the same PLU entry, then only the RPT digit will be

displayed for the repeat entry count.

Message Descriptors (Triangular Lamps)

SIGN Illuminates when a cashier has signed ON if the cashier signing

:

ON method is selected (optional function).

ALM : Illuminates with the alarm buzzer to indicate that the last operation

or numeric entry was an error. To clear the error condition,

depress the [C] key.

R Illuminates when the Receipt-OFF mode is declared by the [LOG/

:

OFF RECEIPT] key. In this condition, no receipts will be issued for a

sale to be entered. To extinguish this lamp (i. e., to change into

Receipt-ON mode for issuing receipts), simply depress the [LOG/

RECEIPT] key again.

TL : Illuminates with the total amount displayed when a sale is final-

ized without any amount tendered.

ST : Illuminates with the subtotal amount displayed when the [ST] or

[TXBL TL] key is depressed.

CG : When an amount tendering operation has been performed, this

lamp illuminates with the amount of change due displayed.

- 8 -

Page 15

MA-186-100 SERIES

7. Keyboard

The following is the standard keyboard layout, which was initially set at the factory. This register is designed

to be capable of programming most of the keys at desired locations or adding some optional keys in place

of the current keys. If you are in need of changing the locations or adding keys, see Chapter “11. Optional

Key Setting” on page 21.

Standard Keyboard Layout

Department Keys 1 to 40

EO1-11115

#

R / A

TX/M

% –

ITEM

CORR

CID

FEED

PO

LC

OPEN

PLU

AMT

Other Optional Keys:

VOID NS

VOID

@

ALL

C

FOR

789

456

123

0

00

.

Chg

21

22

23

24

25

26

1

27

2

28

3

29

4

30

5

10

CHK

TND

31

11

6

32

12

7

33

8

13

34

9

14

35

15

TXBL

TL

AT

36

16

37

17

38

18

39

19

40

20

DPT

SHIFT

REPEAT

DOLL

DISC

RTN

MDSE

ST

TL

#/NS

•

• (Percent Charge Key)

%+

LOG

•

RECEIPT

RECEIPT

•

ISSUE

(Non-add Number Print /

No-sale Key)

(Log/Receipt Key)

(Post-receipt Key)

- 9 -

•

•

•

•

TX2/M

TAX

EX

GST/M

(Tax 2 Modifier Key)

(Manual Tax Key)

(Tax Exempt Key)

(GST Modifier Key; for Canada)

Page 16

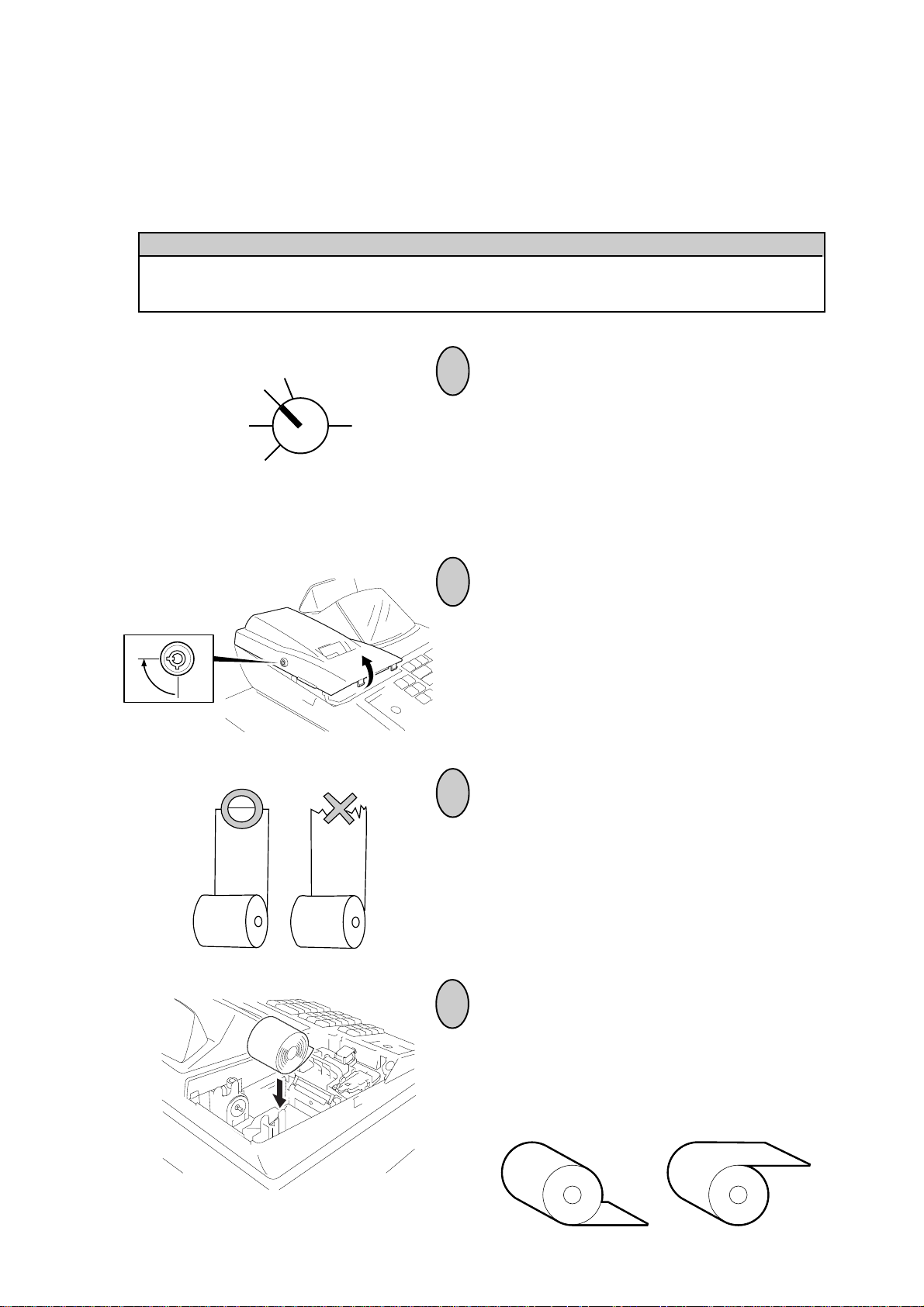

MA-186-100 SERIES

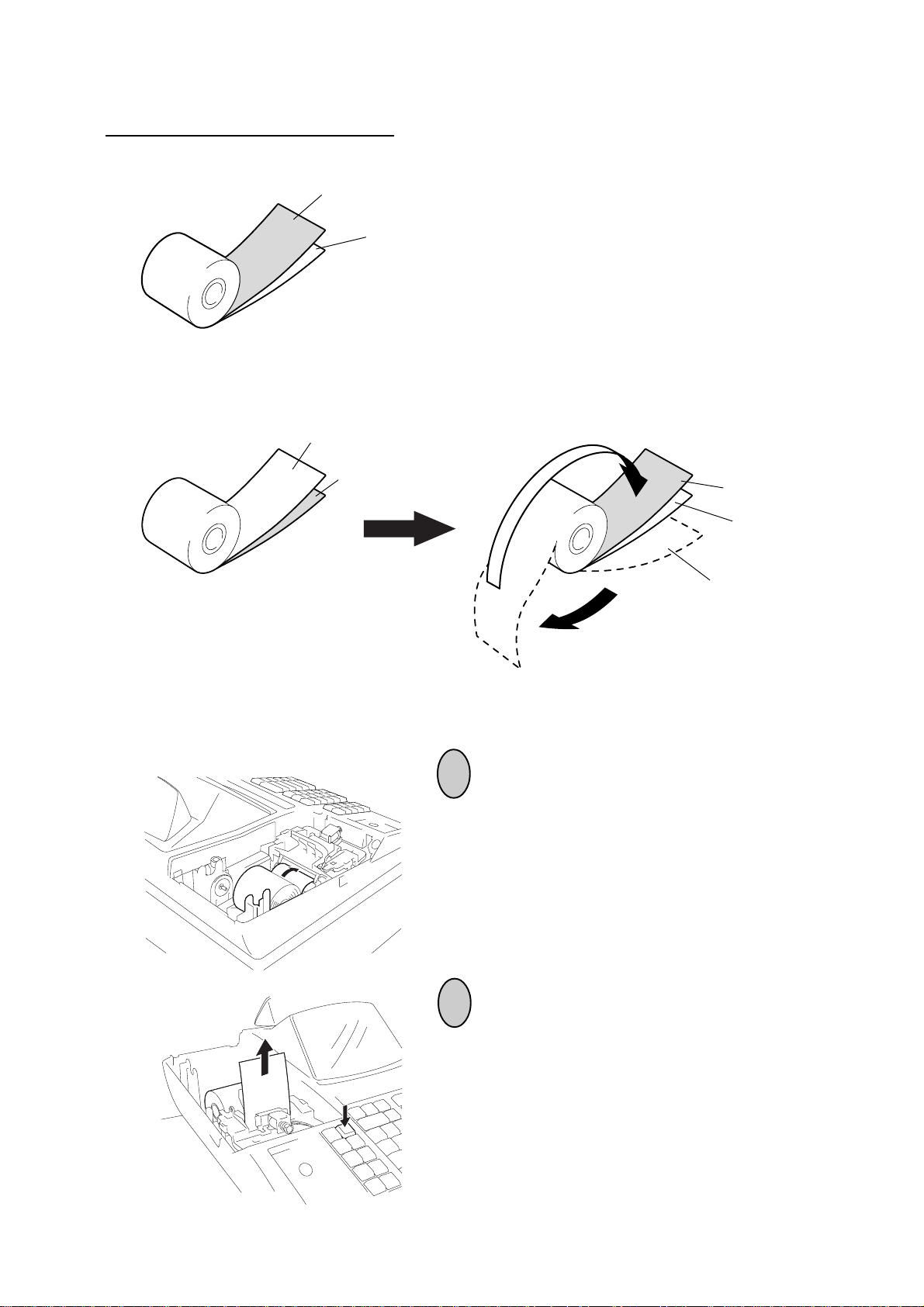

8. Installing the Paper Roll

The printer may be used for journal-format print (standard status) or receipt-format print (optional status).

For reversing the status, refer to Chapter “16. System Option Setting”, Address 2-Bit 7” on page 72.

WARNING!

Care must be taken not to injure yourself with the paper cutter.

EO1-11115

REG

OFF

SET

X

1

Turn the Control Lock to the REG position

Z

using a Control Key.

2

To remove the Printer Cover, insert the

Printer Cover Key to the Printer Cover

Lock, and then turn it 90° clockwise.

3

Cut the paper end to make it sharp.

4

Place the paper roll into the paper pocket.

Place the paper roll as shown below.

Correct Incorrect

- 10 -

Page 17

MA-186-100 SERIES

Note on placing the 2-ply paper:

Correct

When using the 2-ply paper, place it into the paper pocket as shown below.

Duplicate Sheet

Original Sheet

Incorrect

If the 2-ply paper has been placed as shown below, the printing contents are not

copied. In this case, re-place the 2-ply paper as shown above.

Original Sheet

EO1-11115

Duplicate Sheet

Duplicate Sheet

Original Sheet

Duplicate Sheet

* Place the duplicate sheet inside the original

sheet.

5

Insert the paper end into the paper inlet located

on the rear side of the printer.

6

Press the [FEED] key on the keyboard until the

paper end comes out of the outlet.

- 11 -

Page 18

MA-186-100 SERIES

EO1-11115

7

If used for journal, insert the paper end into the

slit on the Take-up Reel and wind it around the

reel two or three times, set the reel to the holder,

and press the [FEED] key for a while to tense

the paper.

If used for receipt, do not wind the paper end

around the Journal Take-up Reel.

* When the 2-ply paper is used, wind the dupli-

cate sheet around the Journal Take-up Reel

in the same manner as described in “If used

for journal,”. At this time, do not wind the

original sheet around the Journal Take-up

Reel.

8

If used for journal, simply attach the Printer

Cover. The Receipt Outlet is used as a Journal

Window.

If used for receipt, attach the Printer Cover with

the paper end coming out of the Receipt Outlet

located on the Printer Cover.

* When the 2-ply paper is used, load the origi-

nal sheet as a receipt, and duplicate sheet as

a journal.

- 12 -

Page 19

MA-186-100 SERIES

9. Time and Date Setting

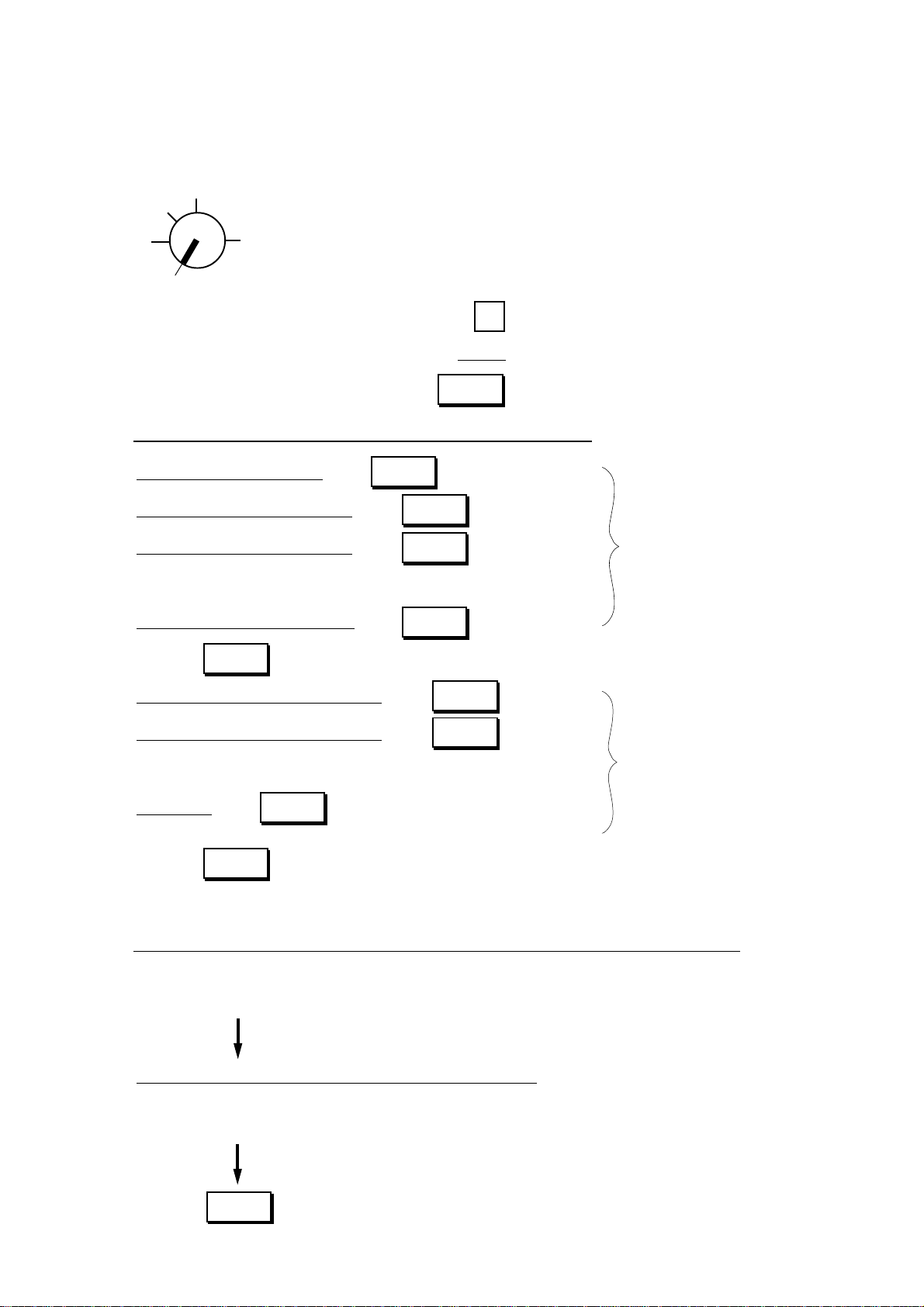

Time Setting or Adjustment

The register has a clock function. Once the time is set, the time is kept even when the power is turned off.

The 24-hour system (the military time) is used for time setting, display, and printing. Time setting is allowed

any time outside a sale.

Condition: Any time outside a sale; refer to “NOTE on Condition” on page 15.

Setting Procedure: .......Numeric Key

Use the MA Key to turn the Control Lock to “SET”. .......Function Key

REG

X

EO1-11115

OFF

Z

SET

Receipt Print Format:

Program No. for Time Setting

Time now set

(8:30 a.m. in this example)

→ → → →

5

Declaration of Program No. 5

for Time Setting

@/FOR

Hour

(00 to 23)

Minute

(00 to 59)

Issues a

receipt.

Examples) 1:05 a.m.: 1:32 p.m.:

0

501

1

Thank you

Call again

04.- 15.- 9 7

0.5

★

Date

08-3 0

000.8

08-3 0

Receipt Consecutive No.

Current Time

AT/TL

○○○

233

- 13 -

Page 20

MA-186-100 SERIES

Date Setting or Adjustment

The register has a calendar function. Once the date and time are correctly set, the day automatically

advances at midnight even when the power is turned off. The extra day of a leap year is also computed

automatically.

Condition: Any time outside a sale; refer to “NOTE on Condition” on page 15.

Setting Procedure:

Use the MA Key to turn the Control Lock to “SET”.

REG

X

EO1-11115

OFF

SET

Z

→ → → →

6

Declaration of Program No. 6

for Date Setting

@/FOR

Month

(01 to 12)

Day

(01 to 31)

Year

(97, 98, etc.)

AT/TL

○○○

Issues a

receipt.

NOTE: The date set/print order is Month-Day-Year. If you want to change the order into

Day-Month-Year or Year-Month-Day, see Chapter “16. System Option Setting”,

Address 16 - Bits 7 and 8 on page 81.

Examples) To set 28 May, 1997:

0

825

79

Month-Day-Year order

Month Day Year

2

508

79

Day-Month-Year order

Day Month Year

Receipt Print Format:

Program No. for Date Setting

Date now set

(28 May, 1997 in this example)

9

507

Year Month Day

Thank you

Call again

04.- 15.- 9 7

0.6

★

05.- 28.- 9 7

000.9

08-5 0

- 14 -

82

Year-Month-Day order

Date

(before this date setting)

Receipt Consecutive No.

Current Time

Page 21

MA-186-100 SERIES

Displaying the Time

The current time is displayed in the “AMOUNT” area when the Control Lock is turned to REG from any other

position. When the Control Lock position is changed or any entry operation starts, the displayed time

disappears.

Time Display Format:

(Example: 1:45 p.m.)

Printing the Time and Date

EO1-11115

The current time is printed on every receipt, as the bottom line

preceding page)

(refer to Chapter “16. System Option Setting”, Address 1 - Bit 1 on page 71)

The date is printed on every receipt, as the top line below the Store Name Stamp print

Print Format on the preceding page)

position is to issue a receipt of any transaction (for example, a No-sale receipt).

. The time can be programmed to non-print, if necessary, by a System Option selection

. The quickest way to verify the date print with the Control Lock in REG

(refer to the Receipt Print Format on the

.

(refer to the Receipt

10.Tax Table Setting

For details about the actual tax table, contact to the location where the register was purchased.

U.S. Tax Tables Setting (also applicable to PST in Canada)

There are three ways to set state and local tax tables. Select one that suits the tax table required to be set.

Condition: After Daily Financial Reset

NOTE on “Condition”:

Unless the register satisfies this condition, the programming operations will not be allowed.

“After ... Reset” means that the designated reset report must be taken before entering the

programming (setting) operation. An error will result if the operation is attempted without taking the

report.

However, it does not necessarily mean “immediately after ...” When the designated reset report

has already been taken and then some operations are performed in the “X”, “Z”, or “SET” mode,

the condition “After ... Reset” is still satisfied and the programming operation is still allowed.

On the contrary, when the designated reset report has been taken but then some sales data

relating to that report’s output data are entered in the “REG” mode, the programming operation will

no longer be allowed and the same reset report must be taken again.

Thus the condition “After ... Reset” indicates that all the sales data relating to the report data must

be zero (except non-resettable memory data). Because of this “Condition” requirement, the report

data will be protected from any inconsistencies of sales data entered in the period from a resetting

of the report to another resetting of the same report next time. When no condition is specified to

a programming (setting) operation, it means that the operation is allowed any time outside a sale

but the cashier must be signed off if the Cashier Signing Method is selected.

- 15 -

Page 22

Setting Procedure:

Use the MA Key to turn the Control Lock to “SET”.

REG

OFF

X

Z

→ Go to 1), 2), or 3) shown below.

MA-186-100 SERIES

EO1-11115

SET

Indications of types of keys shown below:

..... Individual Numeric Key

| | ..... Data to be entered through Numeric Keys

..... Function Key

1) Tax 1; Full Breaks (Non-cyclic Breaks + Cyclic Breaks)

|max. amount non-taxable| →

|max. amount for 1¢ tax levied| →

|max. amount for 2¢ tax levied| → Non-cyclic Tax Breaks

...........

Repeat up to the “A” Break.

|max. amount for N¢ tax levied| → .....

ST

|max. amount for N + 1¢ tax levied| →

(to indicate the “A” Break entry)

TX1/M

TX1/M

TX1/M

TX1/M

“A” Break

TX1/M

|max. amount for N + 2¢ tax levied| →

...........

TX1/M

Cyclic Tax Breaks

Repeat up to the “B” Break.

|“B” Break| → (“B” Break - “A” Break

AT/TL

TX1/M

= a multiple of $1.00)

(to complete this tax table setting)

NOTE: Each amount (break) entry may be a maximum of 4-digit value (9999¢).

2) Tax 1; “A” Break and % Rate Combination (Non-cyclic Breaks + % Rate)

First, set all the non-cyclic breaks up to the “A” Break entry and the [ST] key depression shown in the above

case of “1) Tax 1 Full Breaks”.

|Tax Rate applied when exceeding the “A” Break amount|

(Max. 6 digits up to 99.9999%. Use the [.] key for a decimal value. Examples: To set 5%, enter 5. To set

5.26%, enter 5 → [.] → 2 → 6. The fraction of the amount resulting from this % rate calculation will be

rounded off.)

AT/TL

(to complete this tax table setting)

- 16 -

Page 23

3) Tax 1; % Rate Only

MA-186-100 SERIES

EO1-11115

0

→

TX1/M

(to indicate that no breaks are entered)

ST

|Tax Rate applied to any amount| →

AT/TL

(The description for the Tax Rate in the above case 2) is also applied to this case.)

NOTES: 1. In a single-tax area, the [TX1/M] key may be labeled as [TX/M] key.

2. For Tax 2 table setting in a multi-tax area, follow the same procedure in 1), 2), or 3) above,

using the [TX2/M] key instead of [TX1/M]. To install the [TX2/M] key on the keyboard, refer

to Chapter “11. Optional Key Setting” on page 21.

3. If two tax tables are to be set, the Tax 1 table must be set first. The Tax 1 table setting will

automatically reset the old Tax 1 and Tax 2 tables.

4. A maximum of 64 breaks may be entered for Tax 1 and Tax 2 tables altogether.

Setting Examples:

ex. 1) Tax 1; Full Breaks

Tax Table Key Operation

Control Lock: SET

Amount Range Tax Levied

Thank you

Call again

$0.00 to $0.10 0¢

$0.11 to $0.22 1¢

$0.23 to $0.39 2¢

$0.40 to $0.56 3¢

$0.57 to $0.73 4¢

$0.74 to $0.90 5¢

$0.91 to $1.08 6¢

... “A” Break

$1.09 to $1.24 7¢

$1.25 to $1.41 8¢

$1.42 to $1.58 9¢

$1.59 to $1.74 10¢

$1.75 to $1.91 11¢

$1.92 to $2.08 12¢

05.- 28.- 9 7

0.0

★

00

01

02

03

04

05

06

07

08

09

10

11

12

★

0.1 0

★

0.2 2

★

0.3 9

★

0.5 6

★

0.7 3

★

0.9 0

★

1.0 8

★

1.0 8

★

1.2 4

★

1.4 1

★

1.5 8

★

1.7 4

★

1.9 1

★

2.0 8

★

2.0 8

001.6

08-5 4

ST

1

TX

TL

ST

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

1

0

2

2

9

3

5

6

7

3

09

01

8

421

141

851

471

191

02

8

... “B” Break

AT/TL

- 17 -

Page 24

ex. 2) Tax 1; “A” Break and % Rate Combination

Tax Table Key Operation

MA-186-100 SERIES

EO1-11115

Amount Range Tax Levied

$0.00 to $0.10 0¢

$0.00 to $0.09 0¢

$0.10 to $0.29 1¢

$0.30 to $0.59 2¢

$0.60 to $0.84 3¢

$0.85 to $1.12 4¢

... “A” Break

5% is applied to any amount

exceeding the “A” Break.

ex. 3) Tax 1; % Rate only

Tax Table Key Operation

Control Lock: SET

9

2

9

5

9

48

1

21

ST

5

TX1/M

TX1/M

TX1/M

TX1/M

TX1/M

AT/TL

Thank you

Call again

05.- 28.- 9 7

0.0

★

00

01

02

03

04

★

0.0 9

★

0.2 9

★

0.5 9

★

0.8 4

★

1.1 2

★

1.1 2

5. %

001.7

08-5 4

ST

1

TX

10% is applied to any amount.

Control Lock: SET

0

ST

1

0

TX1/M

AT/TL

Thank you

Call again

05.- 28.- 9 7

0.0

★

00

★

0.0 0

★

0.0 0

10. %

001.8

08-5 4

ST

1

TX

- 18 -

Page 25

MA-186-100 SERIES

EO1-11115

GST Rate Setting (applicable to Canada only)

Please note the following before operating the GST rate setting. The following preparations are required:

1) Select the “GST Active” status in Chapter “16. System Option Setting”, Address 14-Bit 1 on page

79 (some other options can also be selected relating to GST in the same Address).

2) Install the [GST/M] (GST Modifier) key on the keyboard (in place of unnecessary key) referring to

Chapter “11. Optional Key Setting” on page 21.

Condition: After Daily Financial Reset; refer to “NOTE on Condition” on page 20.

Setting Procedure:

Use the MA Key to turn the Control Lock to “SET”.

This portion is required only

when any decimal portion is

contained in the rate.

REG

X

OFF

SET

Examples)

8.55%

To reset the rate once set:

→ →

Z

GST Rate 0 to 99.99 (%)

7%

12%

7

2

1

8

.

0

.

5

5

GST Rate 7% is set.

GST/M

Thank you

Call again

05.- 28.- 9 7

0.0

★

7.

←

001.5

08-5 4

TM

- 19 -

Page 26

Non-taxable Limit Amount Setting

(applicable to only certain areas in Canada)

This non-taxable amount limit must be set only in certain areas in Canada.

Condition: After Daily Financial Reset; refer to “NOTE on Condition” on page 15.

Setting Procedure:

Use the MA Key to turn the Control Lock to “SET”.

REG

X

MA-186-100 SERIES

EO1-11115

OFF

SET

Z

→ → → →

1

Declaration of Program No. 12 for

Non-taxable Limit Amount Setting

Example) $20.00

2

@/FOR

Non-taxable Limit Amount

(max. 4 digits; 1 to 9999¢,

or enter 0¢ to reset the

limit)

02

00

AT/TL

Thank you

Call again

05.- 28.- 9 7

1.2

★

★

20.0 0

002.4

09-0 0

NOTES: 1. When the sum of the sale portion subject to Tax (PST) 1 and the sale portion subject to Tax

(PST) 2 exceeds the Non-taxable Limit Amount programmed here, all the amount subject to

either of the two taxes are all taxed. When the sum is less than the programmed limit, Tax 1

is tax-exempted and only Tax 2 is calculated on the sale portion subject to Tax 2.

2. When the sum of the sale portion subject to Tax (PST) 1 and the sale portion subject to Tax

(PST) 2 is negative, the portion subject to Tax 1 will not be taxed.

3. When the sale portion subject to Tax 1 is tax-exempted, the taxable amount is not stored in

Tax 1 memory.

4. An error results when the [GST/M] key is depressed in sale entries on the ECR with Non-

taxable Limit Amount programmed.

- 20 -

Page 27

MA-186-100 SERIES

Tax Calculation Test

Tax calculation can be tested by the following procedure. This operation will not affect any sales data.

Operating Procedure:

Use the MA Key to turn the Control Lock to “X”.

X

REG

OFF

SET

Z

→ |Amount| →

Enter any amount

through Numeric

Keys. The entered

amount is displayed.

..........

TX/M

The tax amount (total of all the taxes due) is displayed in the AMOUNT portion.

(The Non-taxable Limit Amount setting is disregarded from this display.)

()

TX1/M

or or

..........

TXBL

TL

EO1-11115

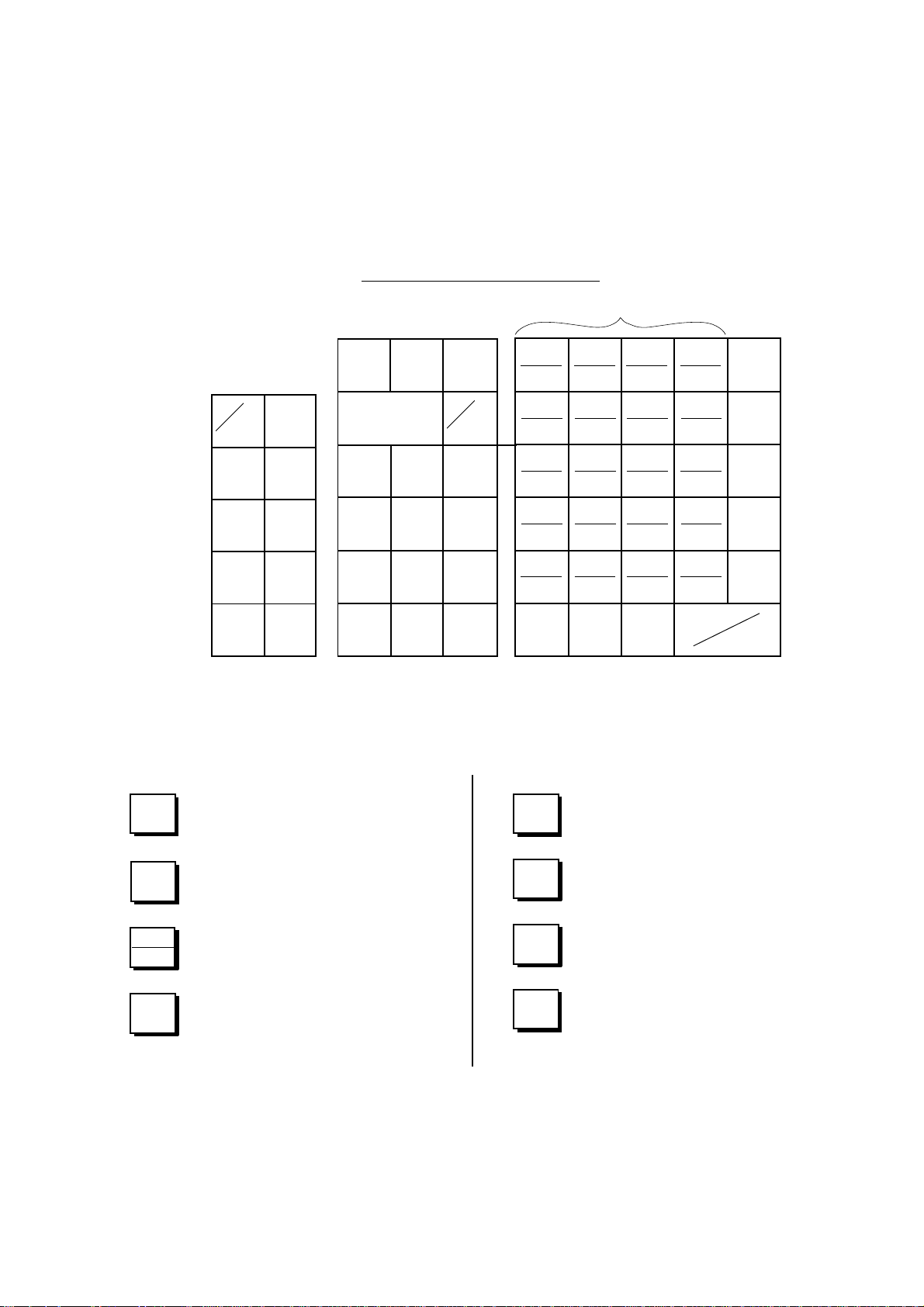

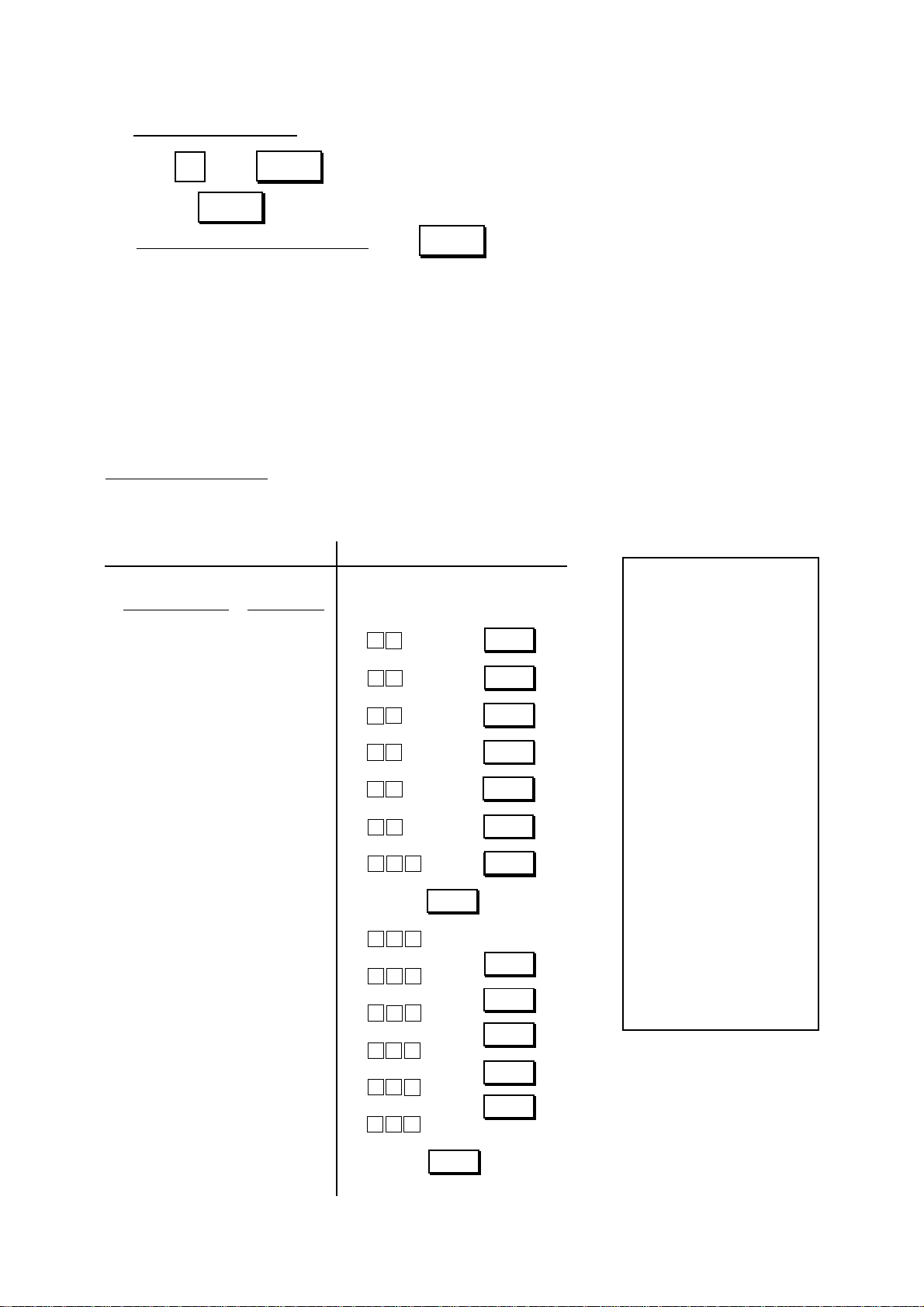

11. Optional Key Setting

This chapter introduces optional keys (keys not installed on the current Standard Keyboard) that can be

programmed. Please note, however, that adding an optional key means to sacrifice another key already

installed. If you plan to install any of the Optional Keys or change locations of any of the current keys, this

operation must be performed first before any other programming or setting operation

the end of this chapter).

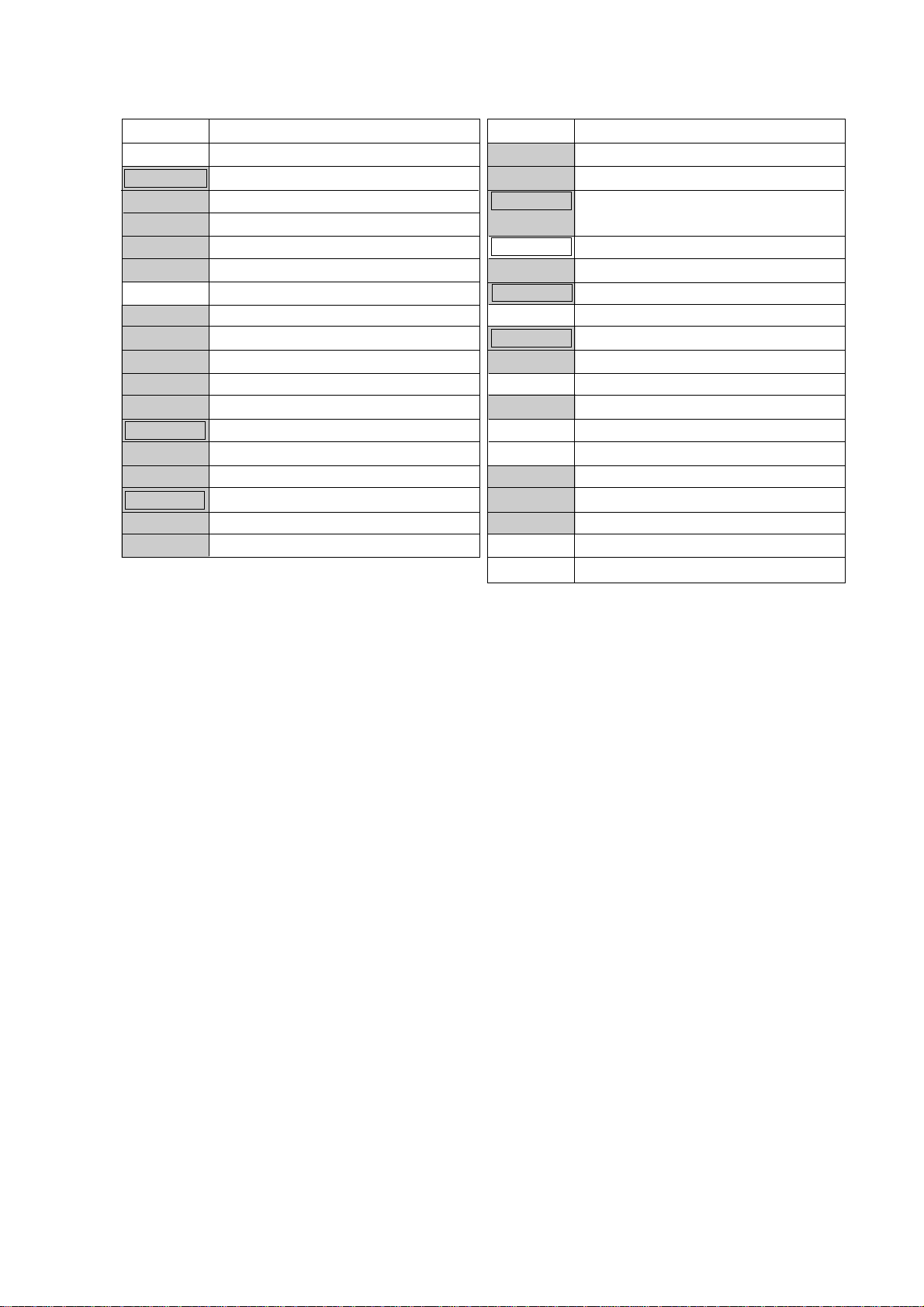

List of Keys

The following is the list of the all the keys that can be programmed on the keyboard. Numeric Keys 0 to 9

are fixed as to their locations, therefore, not included in the list. The “Key Code” assigned to each key in

the lists used in the setting procedure next page. For detail functions and operations of each key, refer to

Chapter “14. Setting Preparation of Each Key and Transaction Entries” on page 27. For a brief

information of the Optional Keys, refer to NOTE 8 at the end of this chapter.

............ Keys that must be installed as minimum requirement

............ Keys that are already installed on the Standard Keyboard

............ Optional Keys

(All those keys, not only the Optional Keys, can be eliminated or changed as to their locations on the

keyboard. However, please do not eliminate the keys of minimum requirements.)

(refer to NOTE 9 at

- 21 -

Page 28

MA-186-100 SERIES

EO1-11115

Key Code Key Name

0 Code to deactivate the key

*1

1 to 20 Department Keys 1 to 20

61 FEED (Paper Feed)

63 00 (Double-zero)

65 • (Decimal Point)

69 DOLL DISC (Dollar Discount)

70 %+ (Percent Charge)

71 %- (Percent Discount)

72 RTN MDSE (Returned Merchandise)

73 ITEM CORR (Item Correct)

74 VOID (Void)

75 ALL VOID (All Void)

76 AT/TL (Cash Tender/Total)

77 CHK TND (Check Tender)

78 Chg (Charge Total)

82 ST (Subtotal)

83 R/A (Received-on -Account)

84 PO (Paid Out)

Key Code Key Name

85 NS (No-sale)

87 LC OPEN (Listing Capacity Open)

90 #/CID (Non-add Number/Cash-in-

drawer)

91 #/NS (Non-add Number/No-sale)

92 PLU (Price-Look-Up)

93 @/FOR (At/For; Multiplication)

94 RECEIPT ISSUE (Post-receipt)

95 C (Clear)

97 TX/M or TX1/M (Tax 1 Modifier)

98 TX2/M (Tax 2 Modifier)

99 TXBL TL (Taxable Total)

100 TAX (Manual Tax)

101 EX (Tax Exempt)

107 DPT SHIFT (Department Shift)

108 AMT (Amount)

109 REPEAT (Repeat)

115 GST/M (GST Modifier)

127 LOG/RECEIPT (Log/Receipt)

*2

*2

*2

*3

*4

*5

*1. At least one Department Key is required to be installed.

*2. The [#/NS] key has both [#/CID] and [NS] functions. Therefore, when [#/NS] is installed,

neither [#/CID] nor [NS] are necessary. (At least, either [#/NS] or [#/CID] must be installed.)

*3. To designate the SFKC 100 for the [TAX] key (Manual Tax), operate the keys [1] → [0]

→

[0]. In this case, the [00] key is unavailable.

*4. The [DPT SHIFT] key designates the Department Nos. 21 to 40, using the Department keys

1 to 20.

*5. When the Cashier Signing Method is selected, this key must be installed. If this optional

function is not selected, this key merely functions as Receipt ON/OFF key.

- 22 -

Page 29

Key Installation Setting

Condition: After all Daily and Periodical Resets; refer to “NOTE on Condition” on page 15.

Setting Procedure:

Use the S Key to turn the Control Lock to the “BLIND” position.

MA-186-100 SERIES

EO1-11115

REG

X

OFF

SET

(The BLIND position is the

unmarked step next to “Z”.)

(BLIND)

Only to read the Key Code currently set on the key.

→ → →

Key Code (max. 3 digits;

see the List of Keys on the

preceding page.)

→ →

Z

7

To declare Key Installation Setting.

6

←

.

.

.

.

Displays the entered Key Code

in the AMOUNT

portion , as it is

entered.

AT/TL

Depress the key to be set

with the Key Code.

Displays the Key Code

set or read , in the

AMOUNT portion.

←

Repeat for all the

keys to be newly

installed, for location changes,

or for reading

Key Codes

already set.

AT/TL

Depress the [AT/

TL] key to complete the Key Installation Setting

operation.

Blank Keyboard Sketch (for your planning aid)

Fill in:

Key Name

→

Key Code

→

(Refer to the “List

of Keys” on the pre-

ceding page.)

For the Standard

Keyboard Layout,

refer to Chapter “7.

Keyboard” on page

9.

( )

( )

( ) ( )

( )

( )

( )

( )

( )

( )

( )

( )

( ) ( )

78

4

1

0

5

2

( )

( )

9

6

3

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( )

( ) ( )

( ) ( )

( )

( )

( )

( )

( )

( ) ( )

( )

( )

( )

( )

( )

AT/TL

- 23 -

Page 30

MA-186-100 SERIES

EO1-11115

NOTES: 1. If Key Installation Setting is operated for the first time, all the keys are already set as in the

Standard Keyboard Layout. Therefore, set only the keys that are to be changed as to their

locations or newly installed.

2. If a wrong code has been entered and the key has also been depressed (i.e.,a wrong code

has been set on a key), enter the correct code and depress the key. The code entered last

will be effective.

3. If “0” is entered as Key Code, the key will be dead and its memory will also be closed.

4. Each of the keys programmed in this operation will have its memory (if any) opened

automatically.

5. The [C] key, if once set with Key Code 95, may be used to clear an error , but it cannot be used

immediately after a Key Code entry (for the purpose of clearing the wrong Key Code error).

If any Key Code is entered and then the [C] key is depressed, that Key Code will be set on

the key that was once the [C] key.

6. On depressing the final [AT/TL] key, “0.00” is displayed in the AMOUNT portion , indicating

that the setting operation is completed. No printing occurs.

7. Use the Blank Keyboard Layout on the preceding page, if necessary, for your own keyboard

plan before starting the setting procedure.

8. Brief Information on Optional Keys:

[#/NS] (Non-add Number Print/No-sale Key)

It is unnecessary if the [#/CID] key and the [NS] key have already been installed. This

[#/NS] key has a double function performed by the above two keys.

[%+] (Percent Charge Key)

It is used to add a percent rate, preset or manually entered, to a sale or each sale item.

[LOG/RECEIPT] (Log/Receipt Key)

It is used for the cashier sign on/off operation when the cashier signing method

(optional function) has been selected. Also, used to select the receipt issue or nonissue without entering numbers.

[RECEIPT ISSUE] (Post-receipt Key)

It is used to print the receipt of the last sale completed in registration.

[TX2/M] (Tax 2 Modifier Key)

It is necessary in the dual-tax (PST) area, in addition to [TX1/M], for reversing the Tax

2 taxable/non-taxable status of items.

[TAX] (Manual Tax Key)

It is used to enter an irregular tax amount.

[EX] (Tax Exempt Key)

It is used to exempt designated tax(es) from a sale.

[GST/M] (GST Modifier Key)

It is necessary in the GST-applicable area in Canada. It reverses the GST taxable/nontaxable status of items.

9. If any of the following keys are newly installed or location is changed, its relevant programming

operations are further required (even if once programmed, re-programming is necessary

because the program data has been cleared):

Each Department Key .................Department Status, LC (if required), Preset Price (if

required) of the Department

[PLU] ............................................. PLU Table

[%+], [%-] ...................................... Respective Preset % Rates (if required)

[TX(1)/M], [TX2/M], [GST/M] ........Respective Tax Tables or Rates (Tax 1, Tax 2, GST)

- 24 -

Page 31

12.Daily Operation Flow

The following shows a typical daily operation flow on the register.

Before Opening the Store ...

• Ensure that the register is firmly

plugged in the wall outlet.

• Check if enough portion of paper

roll is left.

• Check the time, date, and print

condition.

Check the time, date, and

print by issuing a No-sale

Receipt. ...

Setting the time or date ...

MA-186-100 SERIES

EO1-11115

Reference

Chapter

3

8

14

9

During Business Hours ...

After Closing the Store ...

Opening the store

• Transaction entries on the register

• Taking Read (X) Reports periodically.

Closing the store

• Taking Daily Reset (Z) Reports

• Tear off the print portion of Journal

Paper (optional).

14

15

15

20

• Leave the drawer open, and turn

the Control Lock to “OFF”.

• Take all the cash and other contents from the drawer to the office

with the torn Journal and printed

Reset Reports.

- 25 -

20

20

Page 32

MA-186-100 SERIES

13.Training

This chapter describes a training provided for new employed cashiers. After entering the training mode,

a cashier may operate the same transaction entries as those in the REG mode. The data in the training

mode is processed to the Electronic Journal buffer when selecting the Electronic Journal function, however

not affect any actual sales data in business. As for the details of the Electronic Journal, refer to Chapter

“18. Electronic Journal (E. J.) Print (optional function)” on page 83.

• Turn the Control Lock to the SET position using the MA key.

• In the operation patterns, indicates an input through a numeric key, and indicates a depression

of a transaction key.

• The receipts shown as sample receipts will be printed when Receipt-format option is selected.

OPERATION FOR TRAINING MODE START

EO1-11115

AT/TL99

................................A training start receipt is issued.

ENTRIES IN TRAINING MODE

When the cashier signing option is selected, a sign ON is required before starting operations. Refer to

Chapter “17. Cashier Signing Operation (optional function)” on page 82 on how to sign ON.

A trainee can operate all transaction entries described in the next chapter.

except: 1) The drawer will not open.

2) The consecutive No. will not be incremented.

When the cashier signing option is selected, a sign OFF is required after completing operations. Refer to

Chapter “17. Cashier Signing Operation (optional function)” on page 82 on how to sign OFF.

OPERATION FOR TRAINING MODE END

9

AT/TL9

................................A training end receipt is issued.

- 26 -

Page 33

MA-186-100 SERIES

EO1-11115

Training Start Receipt Training End Receipt

Thank you

Call again

05.- 28.- 9 7

★★

041.3

18-5 0

Training Mode Symbol

★★

9

TT

Receipt issued in Training Mode

Thank you

Call again

05.- 28.- 9 7

→

★

10.0 0

★

★

12.5 0

041.3 1

18-5 1

★★

2.5 0

TT

CA

CL TT

RA RA

→

041.4

18-5 3

Entry Contents

Thank you

Call again

05.- 28.- 9 7

★★

★★

0

14.Setting Preparation of Each Key and Transaction

Entries

TT

This chapter describes individual key operations on transaction entries, and setting requirements for the

key if necessary.

WARNING!

When opening the cash drawer, be careful not to let the drawer hit any person.

Receipt-issue/Non-issue Selection (Log/Receipt Key)

Receipts are issued or not issued according to the “R OFF” triangular lamp illuminated/extinguished status

on the Operator Display panel.

LOG

RECEIPT

Illuminated (Receipt OFF status)

LOG

RECEIPT

Extinguished (Receipt ON status)

LOG

RECEIPT

NOTES: 1. The Control Lock may be in any position (except OFF position) for changing the Receipt ON/OFF

status in the signed-ON or signed-OFF condition.

2. The “R OFF” lamp status at the starting of a transaction entry decides whether a receipt will be

issued for the transaction or not. Switching the Receipt ON/OFF status during a transaction will not

be effective.

3. This operation is effective only when the Receipt-format Option has been selected. When the

Journal-format Option has been selected, journal printing will occur regardless of any “R OFF”

lamp status.

- 27 -

Page 34

MA-186-100 SERIES

EO1-11115

4. If a transaction entered with the “R OFF” lamp illuminated and finalized but a receipt is required,

the [RECEIPT ISSUE] (Post-issue Receipt) key can be operated to issue a receipt (see “Post-

issue Receipt” on page 55).

5. Simply depress the [LOG/RECEIPT] key without a numeric entry. If the key is depressed with a

prior numeric entry in REG mode, it may turn out to be a Sign ON or Sign OFF operation (refer to

Chapter 17 on page 82).

Clearing Errors, or Clearing Wrong Declaration

C (Clear Key)

Key or Wrong Numeric Entries

When in sale entries an error has occurred with an alarm buzzer (beeps for about 2 seconds only), a wrong

Declaration Key (such as [RTN MDSE], [TX/M], [GST/M], etc.) has been depressed, or a wrong numeric

data has been entered; depress the [C] key.

1) Error has occurred (the alarm

buzzer is generated and the

“ALM” lamp illuminates), and

the keyboard is locked.

2) Declaration Key has been depressed.

ex.)

3) Numeric Keys are entered.

ex.)

4) Declaration Key(s) + Numeric

Keys

RTN

MDSE

0

05

→ →

→ →

C

C

The error condition is cleared (the

buzzer tone stops and the “ALM” lamp is

extinguished). Find the cause of the error, and do the operation again. Refer to

“Possible Cause of Error” attached

where an error may occur in each operation sequence on the following procedure.

The entered data are all cleared at once.

ex.)

5) Numeric Keys + Non-motorized

Key (key that does not trigger

printing)

ex.)

6) Combination of 2) to 5)

7) Combination of 6) + 1)

RTN

MDSE

1

07

2

X

→ →

C

The entered data are all cleared at once,

and the error condition is cleared also.

Refer to 1) for finding the cause of error.

- 28 -

Page 35

MA-186-100 SERIES

NOTE: When data is already entered and printed (through a Department Key, etc.), it cannot be cleared by

the [C] key any longer. In need of deleting such data, see the following:

EO1-11115

Item Correction (Last Line Voiding) page 49

Void (Designated Line Voiding) page 50

All Void (Transaction Line Voiding) page 51

Furthermore, for details to clear various troubles and errors, refer to Chapter “22. Troubleshooting” on

page 100.

No-sale (Exchange)

<operable outside a sale only>

The No-sale transaction is used to open the drawer without relating to a sale, for such purposes of giving

changes (to break a large-amount bill), checking the receipt/journal print condition, date or time accuracy,

etc. This operation must be performed outside a sale only.

REG

OFF

SET

NS

(or )

X

Z

............................. The drawer opens.

#/NS

NS (No-sale Key) #/NS (Non-add Number Print/No-sale Key)

ITEM

CORR

VOID

ALL

VOID

05.- 28.- 9 7

010.2

09-1 0

Thank you

Call again

★

NS

←

←

←

←

←

Store Name Stamp

Date

No-sale Symbol

Receipt Consecutive No.

Time

NOTES: 1. Usually, Non-add Number entries are prohibited at the starting of a No-sale transaction (i.e. Non-

add Numbers cannot be printed on a No-sale receipt). However, a No-sale entry can be

programmed to be allowable after a Non-add Number entry. (Refer to Chapter “16. System

Option Setting”, Address 15-Bit 1 on page 80.)

2. The [#/NS] key operates and functions the same. When this key is depressed with a prior number

entry, it functions as the Non-add Number Print key. (Refer to the section of Non-add Number

Print on page 52.)

- 29 -

Page 36

MA-186-100 SERIES

EO1-11115

Received-on-Account Payment

<operable outside a sale only>

A received-on-account transaction is used to identify money which is in the drawer but not due to business.

For example, a customer pays for a sale finalized as a charge on a past day, or the cashier records the

change reserve in the drawer loaned from the store office. This operation must be performed outside a sale

only.

. . .

X

Z

R/A

REG

OFF

SET

Repeat if multiple amounts are received.

→ →

Payment Amount Received

(max. 7 digits)

R/A (Received-on-Account Key)

→

→

AT/TL

. . .

Total Amount tendered in cash

()

. . .

Total Amount tendered in check

AT/TL()

CHK

TND

NOTE: For finalizing the transaction, the [Chg] key

cannot be used. For further operation using

the media key, refer to the section “Finaliz-

ing a Sale” on page 54.

Thank you

Call again

05.- 28.- 9 7

★

10.0 0

★

2.5 0

★

12.5 0

010.3

09-1 0

CA

←

RA RA

←

←

Individual Amounts

Total Amount

received in cash

- 30 -

Page 37

MA-186-100 SERIES

EO1-11115

Paid Out

<operable outside a sale only>

A paid-out transaction is used when an amount of money is removed from the drawer without relating to

a sale, for the purpose of paying to wholesalers, etc. This operation must be performed outside a sale only.

REG

OFF

SET

NOTE: For finalizing the transaction, only the [AT/

TL] key can be used. (i. e. only cash can be

paid out) without entering a prior amount.

X

Z

PO (Paid Out Key)

Repeat if multiple amounts are paid out.

→ →

. . .

Paid Out Amount

(max. 7 digits)

PO AT/TL

Thank you

Call again

05.- 28.- 9 7

★

3.0 0

★

2.0 0

★

1.5 0

★

6.5 0

010.4

09-1 1

←

←

←

TL PO PO PO

←

Individual Paid-out

Amounts

Total Amount

Paid-out

Department Keys

21

Dept. 1

40

to , to control Dept. Nos. 21 to 40

Dept. 20

DPT

SHIFT

Programming Department Keys

These are department keys through which sales items are registered. 40 departments can be used. To

designate the Department Nos. 21 to 40, pressing the [DPT SHIFT] key before the Department Keys 1 to

20 is necessary.

- 31 -

Page 38

MA-186-100 SERIES

EO1-11115

Department Status Programming:

To use Department Keys, program how each Department Key is to be used, in accordance with

merchandise categories, operativity of the key, etc.

Condition: After Daily Financial Reset and Periodical Financial Reset (and All PLU Reset if the positive/

negative status is to be set), or Any time outside a sale for other status changes.

“NOTE on Condition” on page 15)

Programming Procedure:

Use the MA Key to turn the Control Lock to “SET”.

REG

X

(refer to

OFF

SET

Z

→ →

3

Declaration of Program No. 3

for Department Status

programming

@/FOR

Depress the required key(s) to obtain the appropriate

status for the department:

→

→

→

→

→

→

→

RTN

MDSE

TX1/M

TX2/M

GST/M

1

2

4

To set Negative status

NOTES 4, 5

To set Tax 1 taxable status

NOTES 1, 3

To set Tax 2 taxable status

NOTES 1, 3

To set GST taxable status

NOTES 1, 4

To set Single-item Key status

To set Itemized Key status

To set Other Income Dept. with

Itemized Key status

The status is reversed by pressing the same key

again.

NOTE 2

Key Type status

NOTE 6

Repeat for programming

other Department Keys.

←

Depress the [DPT

SHIFT] key to set

the Department

Nos. 21 to 40.

←

DPT

()

SHIFT

Depress the Department Key to

obtain the selected

statuses.

←

NOTE 7

NOTE 3

Dept.

→

→

5

0

To set Other Income Dept. with

Single-item Key status

To regain the initial statuses, i.e., Positive, Nontaxable, Non-GST and Itemized statuses); it may be

useful when you are confused with various status

selections for a department.

←

AT/TL

To complete this

operation and

issue a program

receipt

- 32 -

Page 39

MA-186-100 SERIES

EO1-11115

NOTES: 1. The tax tables of “Tax 1”, “Tax 2”, and “GST” should be programmed in Chapter “12. Tax Table

Setting” on page 20. Those tax tables will become effective in REG mode for adding the taxes to

sale items entered through a Department Keys only when the Department Key is programmed with

taxable status for the required tax in this operation.

2. Every time each of the [RTN MDSE], [TX1/M], [TX2/M], and [GST/M] keys in this operation is

pressed, the preset status is reversed. For example, if a Department Key is already set with “Tax

1 Taxable” status and the [TX1/M] key is pressed during the setting sequence of that Department

Key, it is now set with “Tax 1 Non-taxable” status. If [TX1/M] is again pressed, “Tax 1 Taxable”

status is again obtained.

3. The tax (PST) status obtained (as the result of [TX1/M] and/or [TX2/M] depressions) can

be verified by reading the numeric value displayed in the rightmost digit of the AMOUNT

portion when the individual Department Key is pressed. Similarly, the Key Type status is

displayed in the 2nd digit (next to the rightmost digit).

Display:

Displays the

Department

No.: 01 to 40

DP AMOUNT

0.

“0” fixed

Displays the following

numerics to indicate the Key

Type status.

0: Itemized

1: Single-item

4: Other Income (Itemized)

5: Other Income (Single-item)

Displays 0, 1, 2, or 3 to

indicate the obtained Tax

(PST) status.

0: Non-taxable

1: Tax 1 Taxable

2: Tax 2 Taxable

3: Both Tax 1 & Tax 2 Taxable

(These status codes are also printed on the program receipt issued when the final [AT/TL]

key is pressed; refer to the Receipt Format on next page.)

4. The Negative/Positive status and GST status can only be verified on the program receipt (refer

to next page) but not in the display. If a wrong status has been set, correct it by performing the

programming operation again.

5. If a Department Key is set with Negative status, an amount entered through that key will be

subtracted from the sale total. It may be used for item entries of coupons, returned bottles, etc.

6. Key Type Description.

Itemized Key: When a sale item amount is entered through this key, the sale is not

finalized until a media key (such as [AT/TL]) is operated. Other items can

be entered within one sale receipt sequence.

Single-item Key: A sale item entry through this key will automatically finalize the sale as

cash outside a sale (i.e. when no other items have been entered within

one receipt sequence). However, it will function just as an Itemized Key

if operated inside a sale.

Other Income Key: It is used to enter items which do not directly become sales for the store,

such as lottery, postage, gift wrapping fee, size adjustment fee, utility

(payment of electricity and gas), and donation.

7. To set the Department Nos. 21 to 40 (No. printed on the upper side of a Department Key Sticker),

depress the [DPT SHIFT] key before depressing a [DEPT] key.

ex.) To set the Department No. 21, operate [DPT SHIFT], then [DEPT 1].

- 33 -

Page 40

Department Status Program Receipt Format:

Key Operation

Control Lock: SET

@/FOR

3

TX1/M

TX2/M

1

Dept. 8

Thank you

Call again

MA-186-100 SERIES

EO1-11115

Key Type Status

0: Itemized

1: Single-item

4: Other Income

(Itemized)

5: Other Income

(Single-item)

TX2/M

TX1/M

AT/TL

RTN

MDSE

1

1

2

Dept. 5

Dept. 4

RTN

MDSE

Dept. 5

Dept. 10

05.- 28.- 9 7

0.3

★

08 13