Page 1

TEC Electronic Cash Register

Table of Contents

MA-156-1 SERIES

Owner’s Manual

Page 2

NOTICE

This equipment has been tested and found to comply with the limits for a Class A digital

device, pursuant to Part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful interference when the equipment is operated in a commercial

environment. This equipment generates, uses, and can radiate radio frequency energy and,

if not installed and used in accordance with the instruction manual, may cause harmful

interference to radio communications. Operation of this equipment in a residential area is

likely to cause harmful interference in which case the user will be required to correct the

interference at his own expense. Changes or modifications not expressly approved by

manufacturer for compliance could void the user’s authority to operate the equipment.

WARNING

“This Class A digital apparatus meets all requirements of the Canadian Interference-Causing

Equipment Regulations.”

“Cet appareil numénque de la classe A respecte toutes les exigences du Règlement sur le

matériel brouilleur du Canada.”

Copyright © 1999

by TOSHIBA TEC CORPORATION

All Rights Reserved

570 Ohito, Ohito-cho, Tagata-gun, Shizuoka-ken, JAPAN

Page 3

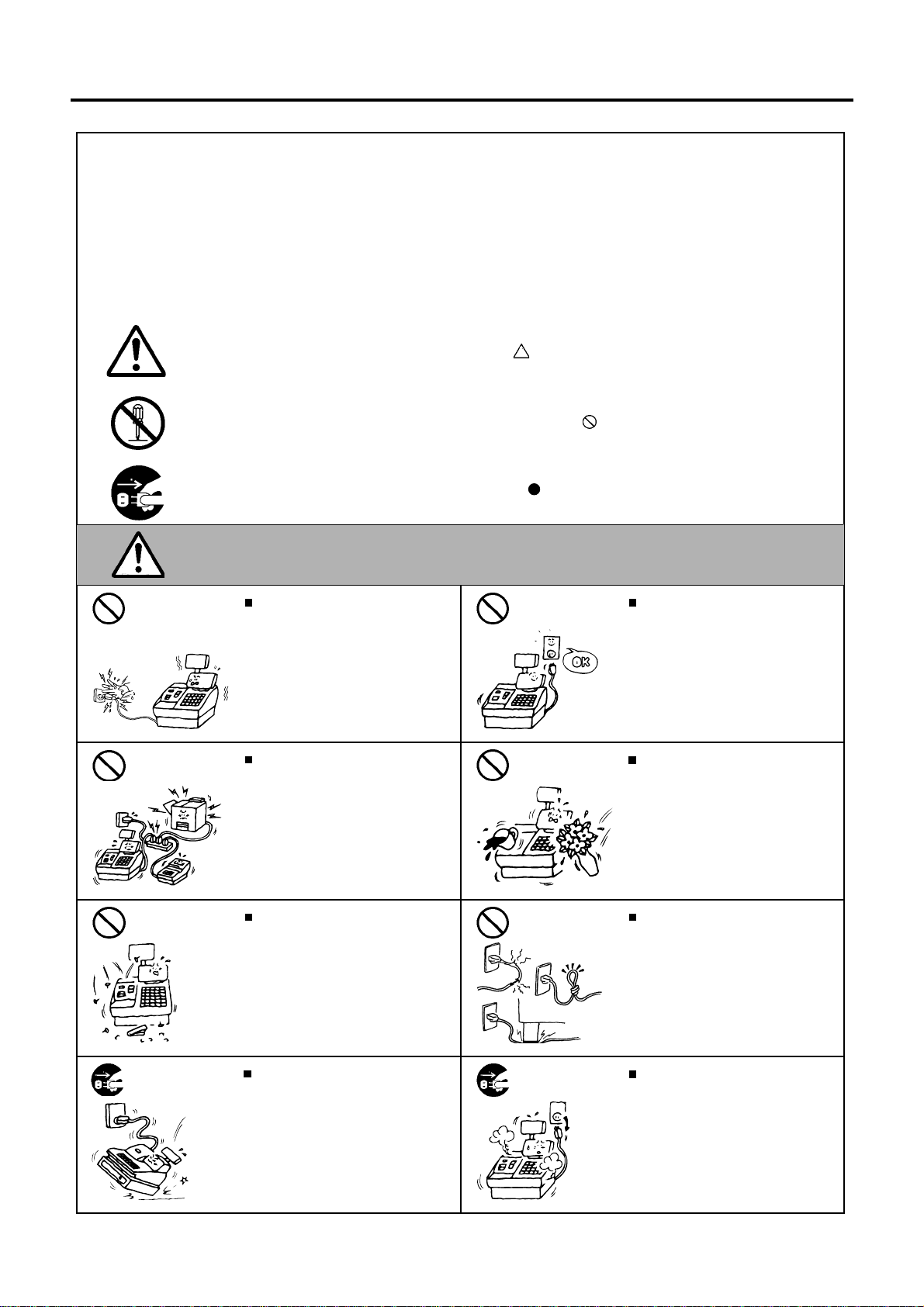

Safety Summary

Safety Summary

Personal safety in handling or maintaining the equipment is extremely important. Warnings and Cautions

necessary for safe handling are included in this manual. All warnings and cautions contained in this

manual should be read and understood before handling or maintaining the equipment.

Do not attempt to effect repairs or modifications to this equipment. If a fault occurs that cannot be rectified

using the procedures described in this manual, turn off the power, unplug the machine, then contact your

authorized TOSHIBA TEC representative for assistance.

Meanings of Each Symbol

This symbol indicates warning items (including cautions).

Specific warning contents are drawn inside the symbol.

(The symbol on the left indicates a general caution.)

This symbol indicates prohibited actions (prohibited items).

Specific prohibited contents are drawn inside or near the symbol.

(The symbol on the left indicates “no disassembling”.)

This symbol indicates actions which must be performed.

Specific instructions are drawn inside or near the symbol.

(The symbol on the left indicates “disconnect the power cord plug from the outlet”.)

EO1-11099

This indicates that there is the risk of death or serious injury if the

WARNING

Prohibited

Prohibited

Prohibited Prohibited

Do not plug in or unplug the power

cord plug with wet hands as this may

cause electric shock.

If the machines share the same

outlet with any other electrical

appliances which consume large

amounts of power, the voltage will

fluctuate widely each time these

appliances operate. Be sure to

provide an exclusive outlet for the

machine as this may cause the

machines to malfunction.

Do not insert or drop metal,

flammable or other foreign objects into

the machines through the ventilation

slits, as this may cause fire or electric

shock.

machines are improperly handled contrary to this indication.

Any other than the

specified AC voltage

is prohibited.

Prohibited

Do not use voltages other than the

voltage (AC) specified on the rating

plate, as this may cause fire or

electric shock.

Do not place metal objects or

water-filled containers such as flower

vases, flower pots or mugs, etc. on

top of the machines. If metal objects

or spilled liquid enter the machines,

this may cause fire or electric

shock.

Do not scratch, damage or modify

the power cords. Also, do not place

heavy objects on, pull on, or excessively bend the cords, as this may

cause fire or electric shock.

Disconnect

the plug.

If the machines are dropped or their

cabinets damaged, first turn off the

power switches and disconnect the

power cord plugs from the outlet, and

then contact your authorized

TOSHIBA TEC representative for

assistance. Continued use of the

machine in that condition may cause

fire or electric shock.

(i)

Disconnect

the plug.

Continued use of the machines in an

abnormal condition such as when the

machines are producing smoke or

strange smells may cause fire or elec-

tric shock. In these cases, immediately turn off the power switches and

disconnect the power cord plugs from

the outlet. Then, contact your authorized TOSHIBA TEC representative for

assistance.

Page 4

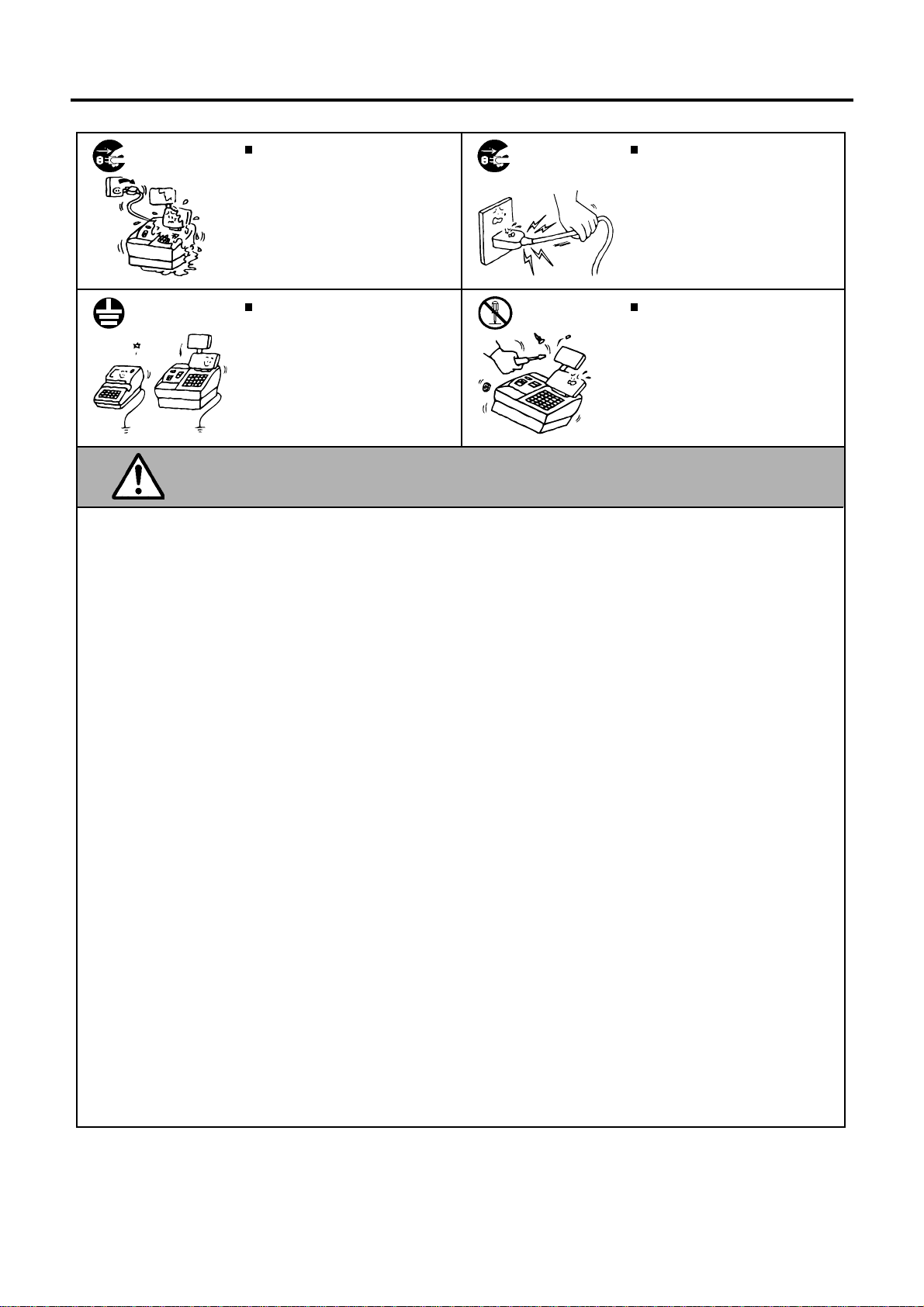

Safety Summary

EO1-11099

Disconnect

the plug.

Connect a

grounding

wire.

If foreign objects (metal fragments,

water, liquids) enter the machines,

first turn off the power switches and

disconnect the power cord plugs from

the outlet, and then contact your

authorized TOSHIBA TEC representative for assistance. Continued

use of the machine in that condition

may cause fire or electric shock.

Ensure that the equipment is

properly grounded. Extension cables

should also be grounded. Fire or

electric shock can occur on improperly grounded equipment.

Disconnect

the plug.

No

disassembling.

When unplugging the power

cords, be sure to hold and pull on

the plug portion. Pulling on the cord

portion may cut or expose the internal wires and cause fire or electric

shock.

Do not remove covers, repair or

modify the machine by yourself. You

may be injured by high voltage, very

hot parts or sharp edges inside the

machine.

Unauthorized modification is prohibited.

This indicates that there is the risk of personal Injury or damage to

CAUTION

objects if the machines are improperly handled contrary to this indication.

Precaution

The following precautions will help to ensure that this machine will continue to function correctly.

• Try to avoid locations that have the following adverse conditions:

* Temperatures out of the specification * Direct sunlight * High humidity

* Shared power socket * Excessive vibration * Dust/Gas

• Do not subject the machine to sudden shocks.

• Do not press the keys too hard. Keys will operate correctly if they are touched lightly.

• Clean the cover and keyboard, etc. by wiping with a dry cloth or a cloth soaked with detergent and wrung out

thoroughly. Never use thinner or other volatile solvent for cleaning.

• At the end of the day, turn the power OFF, then clean and inspect the exterior of the machine.

• Try to avoid using this equipment on the same power supply as high voltage equipment or equipment likely to

cause mains interference.

• USE ONLY TOSHIBA TEC SPECIFIED consumables.

• DO NOT STORE the consumables where they might be exposed to direct sunlight, high temperatures, high

humidity, dust, or gas.

• When moving the machine, take hold of the drawer and lift the machine.

• Do not place heavy objects on top of the machines, as these items may become unbalanced and fall causing

injury.

• Do not block the ventilation slits of the machines, as this will cause heat to build up inside the machines and

may cause fire.

• Do not lean against the machine. It may fall on you and could cause injury.

Request Regarding Maintenance

• Utilize our maintenance services.

After purchasing the machines, contact your authorized TOSHIBA TEC representative for assistance once per year or

so to have the inside of the machines cleaned. Otherwise, dust will build up inside the machines and may cause fire or

malfunction. Cleaning is particularly effective before humid rainy seasons.

• Our maintenance service performs the periodic checks and other work required to maintain the quality and

performance of the machines, preventing accidents beforehand.

For details, please consult your authorized TOSHIBA TEC representative for assistance.

• Using insecticides and other chemicals

Do not expose the machines to insecticides or other volatile solvents, as this will deteriorate the cabinet or other parts

or cause the paint to peel.

(ii)

Page 5

EO1-11099

TABLE OF CONTENTS

Page

1.Introduction....................................................................................................................................1

2.Unpacking.......................................................................................................................................2

3.Outline of Preparation Procedure Before Operating the ECR...................................................3

4.Appearance and Nomenclature....................................................................................................5

5.Mode Select Switch........................................................................................................................5

6.Display.............................................................................................................................................6

7.Keyboard.........................................................................................................................................7

Functions of Each Key.............................................................................................................................................7

8.Installing the Paper Roll................................................................................................................9

9.Programming................................................................................................................................11

System Option Setting...........................................................................................................................................12

Department Status Setting.....................................................................................................................................14

Time Setting...........................................................................................................................................................15

Date Setting...........................................................................................................................................................15

Department HALC Setting.....................................................................................................................................16

Secret Code Setting...............................................................................................................................................17

% Rate Setting.......................................................................................................................................................17

PLU Setting............................................................................................................................................................18

PLU Deletion..........................................................................................................................................................19

Amount Format Setting..........................................................................................................................................19

Tax Table Setting....................................................................................................................................................20

10.Verification of Programmed Data................................................................................................24

11.Daily Operation Flow....................................................................................................................25

12.Transaction Entries......................................................................................................................26

When an error has occurred .................................................................................................................................26

Displaying the Time................................................................................................................................................26

No-sale...................................................................................................................................................................27

Sale Item Entries (Department Entries).................................................................................................................27

Sale Item Entries (PLU Entries).............................................................................................................................28

Dollar Discount.......................................................................................................................................................30

Percent Discount or Percent Charge.....................................................................................................................30

Void........................................................................................................................................................................31

Returned Merchandise...........................................................................................................................................31

Non-add Number Print...........................................................................................................................................32

Subtotal Read and Print.........................................................................................................................................32

Finalizing a Sale.....................................................................................................................................................32

Tax Exemption.......................................................................................................................................................35

Received-on-Account Payment.............................................................................................................................35

Paid Out.................................................................................................................................................................35

13.Read (X) and Reset (Z) Reports..................................................................................................39

14.Maintenance..................................................................................................................................39

Replacing the Paper Roll.......................................................................................................................................39

Replacing the Ink Roller.........................................................................................................................................40

Manual Drawer Release........................................................................................................................................40

Removing the Drawer............................................................................................................................................41

Battery Exchange...................................................................................................................................................41

15.Specifications...............................................................................................................................42

CAUTION:

1. This manual may not be copied in whole or in part without prior written permission of

TOSHIBA TEC.

2. The contents of this manual may be changed without notification.

3. Please refer to your local Authorized Service representative with regard to any queries

you may have in this manual.

Page 6

Page 7

1. Introduction

Thank you for choosing the MA-156 series. This instruction manual provides a

description of the functions and handling of this register and should be read carefully

to ensure optimum performance. Since every consideration has been given to safety

and reliability, there is no danger of damaging the machine by incorrect operation.

Please refer to this manual whenever you have any questions concerning the

machine. This machine has been manufactured under strict quality control and

should give you full satisfaction. However, if the machine is damaged during transit,

or there are any unclear points in this manual:

For supplies, service or assistance call:

EO1-11099

Please have the following information available when you

call:

Product: Electronic Cash Register

Model: MA-156-1

Serial Number:

Place Purchased:

Date of Purchase:

If for any reason this product is to be returned to the store where

purchased, it must be packed in the original carton.

• The specifications described in this manual may be modified by the manufacturer,

if necessary.

• Be sure to keep this manual for future reference.

- 1 -

Page 8

2. Unpacking

5

EO1-11099

6

4

3

2

1

1 Journal Take-up Reel (1 pc.) 4 Printer Cover/Drawer Key (2 pcs.)

2 Paper Roll 57 mm x ø50 mm (1 pc.) 5 Owner's Manual (1 pc.)

3 Dry Batteries (SUM-3 1.5V; 3 pcs.) 6 Warranty Registration Card (1 pc.)

- 2 -

Page 9

EO1-11099

3. Outline of Preparation Procedure Before Operating

the ECR

This chapter shows the outline of set-up procedure of the ECR before actually starting

the ECR operation.

1

Remove the cash register from the carton, referring to

Chapter “2. Unpacking” on page 2. And take out all

the parts and accessories.

2

Remove the tapes and seals that are holding parts or

protecting the register surfaces.

3

Plug the power cord of the register into a wall outlet.

Make sure that the outlet voltage matches that of the

power required for the register.

WARNING: Be sure to plug in the power cord first, then insert the

batteries.

4

Detach the Printer Cover and the Battery Cover, then

insert the batteries (3 pieces). After inserting the

batteries, attach the Battery Cover.

WARNING: Be certain to insert the batteries enclosed in the

package. If they are not insert and the power is

turned OFF (including a power failure occurrence),

the sales data and the programmed data will be

cleared.

5

Set the Mode Select Switch to the REG position.

SET

OFF

- 3 -

REG

X

Z

Page 10

6

Install the Receipt or Journal roll (referring to Chapter

"8. Installing the Paper Roll").

7

Set the time and date correctly, referring to "Setting

the Time and Date" in Chapter 9.

8

Set the tax tables, referring to "Tax Table Setting" in

Chapter 9.

EO1-11099

9

Perform other programming operations, such as programming of Departments, according to the requirement of the market and your store (refer to Chapter 9

and thereafter).

- 4 -

Page 11

4. Appearance and Nomenclature

EO1-11099

Journal Window

or

Receipt Outlet

Mode Select Switch

Drawer Keyboard

Printer Cover

The cover for the Receipt or Journal paper holder

and the printer.

Printer Cover Display

Power Cord

External Battery

Kit Connector

Display (Operator and Customer)

Used to confirm the entry contents and the status

of the register. (page 6)

Receipt Outlet or Journal Window

The receipt for the finalized sale is issued.

Or, the operator can see which items have already

been entered through this window.

External Battery Kit Connector

The External Battery Kit (K-BAP-QM) is available as an option. By connecting this kit into the

connector, the register is operable without AC

power.

5. Mode Select Switch

SET

OFF

REG

X

Z

SET ............Used to program preset data.

OFF ............Stops register operations and extinguishes the display. How-

REG ...........Used to register normal sales .

X................. Used to read sales totals processed in the register report

Mode Select Switch

The Mode Select Switch is provided inside the

Printer Cover.

It selects the type of register operations. (page 5)

Keyboard

Used to enter sale items. (page 7)

Drawer

Cash and other media are kept here. It automatically opens on finalizing a sale.

ever, the power is being supplied to the register.

memory (X report). Received-on-Account and Paid Out

operations are also performed in this position. Also used to

read preset data.

Z .................Used to read and reset sales totals in the register report

memory (Z report).

- 5 -

Page 12

6. Display

▲

Department Code

Message Descriptor

Amount

Repeat Count

▲

...

EO1-11099

Message Descriptor in case

of the mode change error

▲

Description

Amount

Repeat Count

Department Code

Message Descriptor:

Displays the numeric data, such as amount, quantity, etc.

Displays the current time or date when the [X/TIME] key is

depressed in the REG mode.

Displays the repeat count of the same item being entered.

The count display shows up from the second entry on, and

only the last digit will be displayed even if the count exceeds

nine.

Displays the Department Code (1 to 8) when the corresponding Department Key is depressed for any sale item entry.

(Subtotal)

Indicates that the displayed amount is the current

subtotal of the sale.

(Total)

Indicates that the sale is finalized and the displayed

amount is the sale total.

(Change)

Indicates that the sale is finalized with an amount

tendered and the displayed amount is the change

due.

(Negative Mark)

When a Void, Dollar Discount, Percent Discount, or

Returned Merchandise item has been entered, the

Negative Mark is displayed.

The mark is also displayed when the subtotal or sale

total is obtained and the amount is negative.

(Error)

Indicates that the last operation has caused an error.

In case of the mode change error, "M" is displayed

together with "E".

- 6 -

Page 13

7. Keyboard

The following shows the key layout on the MA-156 keyboard:

EO1-11099

FEED

#

RA

NS

VD

PLU

X

78

4

1

TIME

PO

C

Functions of Each Key

KEY

C

Clear Key: Used to clear a wrong entry or operation error.

9

5

6

23

000

1

2

3

4

FUNCTION

5

6

7

8

-

TAX

ST

AT/TL

%

%

CHK

CH

X

TIME

FEED

789

4

516

23

000

1

to

8

Multiplication / Time Display Key: Used to enter sale

items by multiplication inside a sale. Also used to display

the time outside a sale.

Feed Key: Used to feed the receipt or journal paper.

Numeric Keys: Used to enter numeric data, such as

amounts, quantities, and code numbers.

The [00] key functions the same as depressing the [0] key

twice consecutively.

Department Keys 1 to 8: Used to enter sale items and

process the amount into appropriate departments.

- 7 -

Page 14

EO1-11099

KEY

TAX

%

ST

CH

AT/TL

FUNCTION

Tax Modifier: Used inside a sale to reverse the Tax status

of departments, PLUs, Dollar Discount, and Percent

Charge/Discount from taxable to non-taxable, or vice

versa.

Percent Charge or Discount Key: Used to add or subtract

a percent rate, preset or manually entered, to or from the

sale or an individual sale item. Whether the key is used as

Percent Charge or Percent Discount can be programmed.

Subtotal Key: Used to obtain a subtotal (sale total amount

up to the moment).

Charge Key: Used to finalize a sale as charge (non-cash

media sales, such as house charge, credit cards, etc.

defined by the store) by a simple depression without any

numeric entry (Total Function only).

Cash Amount Tender / Total Key: Used to finalize a sale

as cash by depressing with a prior tendered amount entry

(Tender Function) or by a simple depression without any

numeric entry (Total Function).

CHK

VD

#

RA

NS

PO

PLU

Check Amount Tender/Total Key: Used to finalize a sale

as check by depressing with a prior tendered amount entry

(Tender Function) or by a simple depression without any

numeric entry (Total Function).

Returned Merchandise/Void Key: Used inside a sale to

delete items already entered in the current sale. When

outside a sale, it is used to refund money to a customer who

has returned items already purchased.

Non-add Number Print/Received-on-Account Key (X

Mode): When depressed with a prior number entry, it

function as Non-add Number Print Key. When used in X

mode, it functions to record received-on-account payment

amounts.

No-sale/Paid Out Key (X Mode): Used outside a sale to

open the drawer without relating to a sale. When used in X

mode, it functions to record amounts paid out of the drawer

without relating to a sale.

PLU (Price-Look-Up) Key: Used to enter a PLU which is

linked to a department.

-

Dollar Discount Key: Used to subtract an amount from the

sale such as a discount.

- 8 -

Page 15

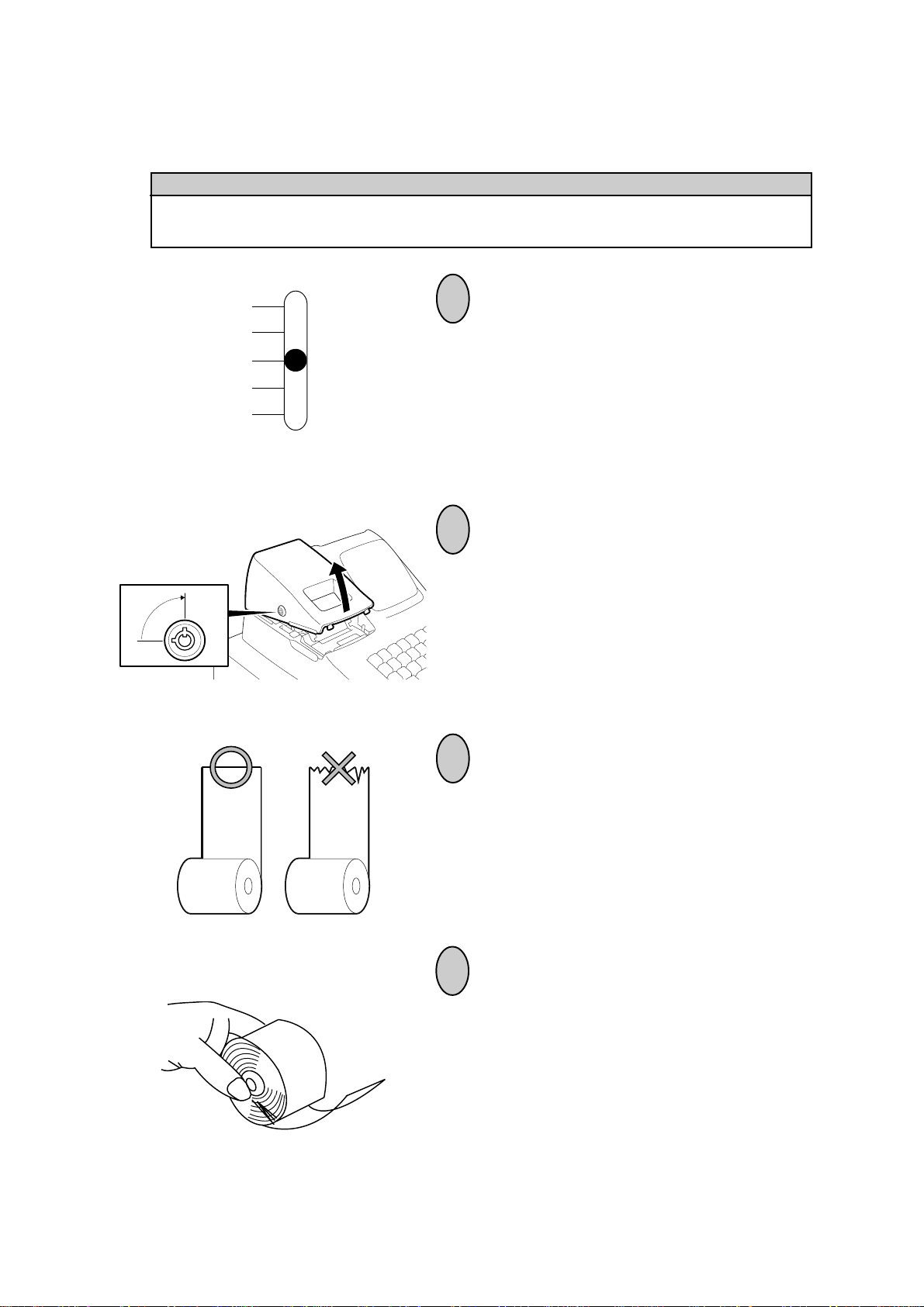

8. Installing the Paper Roll

WARNING!

Care must be taken not to injure yourself with the paper cutter.

EO1-11099

SET

OFF

REG

X

Z

1

Set the Mode Select Switch to REG

positon.

2

To remove the Printer Cover, insert the

Printer Cover/Drawer Key to the Printer

Cover Lock, and then Turn it 90° clockwise.

3

Cut the paper end to make it sharp.

4

Hold the paper roll so that the paper end

will be fed from the bottom.

- 9 -

Page 16

5

Place the paper roll in the paper pocket.

6

Insert the paper end into the Paper Inlet

located on the rear side of the printer, and

hold down the [FEED] key on the keyboard

until the paper end comes out of the outlet.

EO1-11099

7

If the printer is used for journal,fold the top

end of the paper and insert the folded end

into the slit of the Take-up Reel. Then wind

the paper two or three times, set the reel to

the holder, and hold down the [FEED] key

for a while to tense the paper.

If the printer is used for receipts, do not

wind the paper end around the Journal

Take-up Reel.

- 10 -

Page 17

8

If the printer is used for journal, simply

attach the Printer Cover. The Receipt

Outlet is used as Journal Window.

If the printer is used for receipts, attach the

Printer Cover with the paper end coming

out of the Receipt Outlet located on the

Printer Cover.

EO1-11099

9. Programming

The time and date should be adjusted and such data as status of each department, percent

rate, etc. should be programmed before starting sale entries. Printing occurs as programming

is proceeded.

• The programmed data will be retained by dry batteries even if the power

of the machine is turned OFF or a power failure occurs.

• Set the Mode Select Switch to the SET position before starting any

programming operation.

• Key indications in the operation patterns in this manual:

...................Entry through a Numeric Key ............................. Function Key depression

SET

OFF

REG

X

Z

- 11 -

Page 18

EO1-11099

System Option Setting

(Available after the Financial Reset (Z) Report is

taken.)

ST

HALC for tender amount of the [CHK] key

1 to 7 (NOTE 1 on the next page)

Date Entry Order

0 : Day-Month-Year

1 : Year-Month-Day

2 : Month-Day-Year

Time Print

0 : Print

1 : Non-print

GT Print

Even Number: Non-print

Odd Number: Print

The First Decimal Place Rounding

Process

0 or 1 : Round Off

2 or 3 : Round Up

4 or more : Round Down

Credit Balance (NOTE 2 on the next page)

0 : Prohibited

1 : Allowed

Use of the [CHK] key

0 : Total & Tender Functions

1 : Total Function only

2 : Tender Function only

Use of the [%] key

0 :% 1 : %+

Use of the Printer

0 : Journal

1 : Receipt

- 12 -

Page 19

EO1-11099

NOTES: 1. HALC (High Amount Listing Capacity) is used to check excessively high

amounts entered by mistake. For example, if "3" is entered, it means 3

digits and the high amount limit is 999 ($9.99).

2. Credit Balance means that amount entries through the [ - ] key will result

in over-subtraction of the subtotal amount at the time of the entry through

this key. If the status "Allowed" is selected, over-subtraction using the

[ - ] key will be allowed. The [VD] key is not subject to this "Credit

Balance" status selection.

3. Numeric values in bold face are those of the initial setting.

Sample Programming Operation

To set the following system options:

The printer is used for receipts: 1

The [%] key is used as the [% -] key: 0

The [CHK] key is used for "Tender" function only: 2

Credit Balance is allowed: 1

GT Print (Print) & The First Decimal Place Rounding Process (Round Up): 3

Time is printed: 0

Date Entry Order (Month-Day-Year): 2

Tender amount through the [CHK] key is allowed up to 5 digits ($999.99): 5

Key Operation)

1 0 2 1 3 0 2 5 ST

-- Print Sample --

10213025

0002

00-00

00-00-00

- 13 -

Values which were

programmed

#

Consecutive No.

Time

Date

Page 20

Department Status Setting

TAX

Repeatable for other department

EO1-11099

AL/TLX/TIME3 TX/M Dept.

AT/TL

Submode No.

Depress this key only

when setting a

department with

taxable status

Status Code:

0: Itemized

1: Single-item

(NOTE below)

NOTES: 1. When a department is set to be an "Itemized" department, a sale item entry

through that Department Key will not immediately finalize the sale and will

allow other item entries until a media key ([AT/TL], [CHK] or [CH]) is

operated.

When a department is set to be a "Single-item" department, a sale item entry

through that Department Key will immediately finalize the sale as cash and

issue a receipt if it is operated outside a sale. However, when a Single-item

department is operated during a sale, it functions the same as an Itemized

department.

2. Initial setting is as follows.

All departments .......Non-taxable & Itemized status

Sample Programming Operation

To set the following department status:

Department 1 ...... Taxable & Single-item

Department 2 ...... Non-taxable & Itemized

Department 3 ...... Taxable & Itemized

Department 4 ...... Non-taxable & Single-item

Key Operation)

1

-- Print Sample --

3

1

0

0

1

0003

00-01

00-00-00

0

2

TAXTAX

TX/M

#

1∗

2

3∗

4

Submode No.

Taxable Status Symbol

Department Code

Status Code

0: Itemized

1: Single-item

0

1

3

4

AL/TLX/TIME3 TX/M 1

AT/TL

- 14 -

Page 21

Time Setting

AT/TL

AL/TLX/TIME5

EO1-11099

Submode No.

Hour

(00 to 23)

Sample Programming Operation

To set the time to 13:35 (1:35 p.m):

Key Operation)

Date Setting

Submode No.

Month

(01 to 12)

AL/TLX/TIME5 1 3 3 5

AT/TL

Day

Minute

(00 to 59)

(01 to 31)

-- Print Sample --

13-35

0004

13-35

00-00-00

Year

(95, 96, etc.)

5

#

Time which was

programmed

AL/TLX/TIME6

AT/TL

NOTE: The date entry order above shows the initial set order. The entry order of Day-

Month-Year or Year-Month-Day can be selected instead of Month-Day-Year by

the System Option Setting described in page 12.

Sample Programming Operation

To set the date to October 3, 1995:

Key Operation)

6

AL/TLX/TIME5 1 0 9 50 3

AT/TL

-- Print Sample --

6

#

10-03-95

0005

13-46

10-03-95

Date which was

programmed

- 15 -

Page 22

Department HALC Setting

The HALC (High Amount Listing Capacity) is used to check excessively high amounts

entered by mistake. By setting HALCs, such mistakes will be prevented at the earliest

stage.

Repeatable for other department

AT/TL

8

0 to 7; For example, if "3" is entered, it means 3 digits and the

high amount limit is 999 ($9.99).

NOTE: Initial setting is as follows.

All departments..........Price entry up to 7 digits ($99999.99) is allowed.

Dept.

AL/TLX/TIME

EO1-11099

Sample Programming Operation

To set the following department HALCs:

Department 1 ...... 3 digits

Department 2 ...... 4 digits

Department 3 ...... 5 digits

Department 4 ...... 6 digits

Key Operation)

1

4

-- Print Sample --

2

0006

14-15

10-03-95

#

8

1

3

2

4

3

5

4

6

AT/TL

5

6

3

Department Code

HALC which was programmed

AL/TLX/TIME8 3

4

- 16 -

Page 23

Secret Code Setting

When this code is set, operations in the "Z" mode will be prohibited without this code

entry.

AT/TL

AL/TLX/TIME99

Secret Code: 1 to 9999

(0 to clear the secret code)

Sample Programming Operation

To set a secret code of 2428:

Key Operation)

EO1-11099

AT/TL

AL/TLX/TIME9 2 4 2 89

-- Print Sample --

99

#

2428

0007

14-45

10-03-95

Secret Code which was

programmed

% Rate Setting

%

Rate: 1 to 99

(0 to clear the % rate)

NOTE: Whether the % key is used as the function of %+ or %- is determined by the

System Option Setting described in page 12.

Sample Programming Operation

To set 5% on the [%] key:

Key Operation)

5

%

-- Print Sample --

5

0008

15-01

10-03-95

- 17 -

#

%-

"%+" is printed if the

[%] key is used as the

[%+] key

% Rate which was

programmed

Page 24

PLU Setting

Repeatable for other PLU

AT/TL

AL/TLPLU Dept.

EO1-11099

PLU Code:

1 to 100

Preset Price:

max. 6 digits

($9999.99)

NOTE below

Linked department

NOTE: When 0 is entered as a preset price in above key sequence, the preset price of $0.00

will be programmed.

Sample Programming Operation

To set the following PLUs:

PLU 6 (Preset Price: $1.50, Linked Department: Department 1)

PLU 24 (Preset Price: $2.50, Linked Department: Department 2)

PLU 28 (Preset Price: $1.75, Linked Department: Department 3)

PLU 30 (Preset Price: $2.00, Linked Department: Department 4)

Key Operation)

PLU6 1

1 7 5

5 0 2 PLU

3

1

03 PLU 2 0 0

4

-- Print Sample --

10-03-95

2 5 0

1.50

24

2.50

28

1.75

30

2.00

0011

15-47

6

4

1 @

2 @

3 @

4 @

2

AT/TL

AL/TL

PLU Code

Linked Department Code

Preset Price

82 PLU

- 18 -

Page 25

PLU Deletion

Repeatable for other PLU to be deleted

EO1-11099

V D

PLURTN/I.C

PLU Code:

1 to 100

AT/TL

AL/TL

Sample Programming Operation

To delete the PLU Code 30 which was programmed in the preceding page:

Key Operation)

AT/TL

V D

3

0

AL/TLPLURTN/I.C

-- Print Sample --

30

------0012

16-07

10-03-95

----

PLU Code which was

deleted

Deletion Symbol

Amount Format Setting

This operation determines the Amount Format for display and print.

AT/TL

AL/TL

1: Amount Format ( 0)

or

3: Amount Format (0.00) Initial Setting

Sample Programming Operation

To set the Amount Format of " 0":

Key Operation)

AT/TL

AL/TL

1

-- Print Sample --

0013

16-13

10-03-95

0

Amount Format which

was programmed

- 19 -

Page 26

EO1-11099

Tax Table Setting

TYPE 1: TAX FULL BREAKS (COMBINATION OF NON-CYCLIC AND CYCLIC BREAKS)

TAX

TX/M

Max. 4 digits; 0 to 9999 (¢)

TX/M

TAX

TAX

TX/M

(Max. amount non-taxable)

(Max. amount for 1¢ tax levied)

(Max. amount for 2¢ tax levied)

Repeat up to the "A" Break (Non-cyclic Break Limit)

TAX

TX/M

(Max. amount for N¢ tax levied)

ST

(to indicate the completion of Non-cyclic Breaks)

TAX

TX/M

(Max. amount for N+1¢ tax levied; Beginning of Cyclic

Breaks)

TX/M

TAX

(Max. amount for N+2¢ tax levied)

Repeat up to the "B" Break ("B" Break - "A" Break = Multiple of $1.00; max.

$99.00)

AL/TL

AT/TL

(to complete the Tax Table Setting)

NOTE: A maximum of 32 breaks can be programmed for the tax table.

- 20 -

Page 27

TYPE 2: TAX % ONLY

EO1-11099

TAX

TX/M

ST0

max. 5 digits; 0.001% to 99.999%

NOTE below

AT/TL

AL/TL

NOTES: 1. As for a numeric value to be entered, be certain to include down to three

decimal places. For example, to set 4%, enter "4000".

2. % Calculation Fraction Rounding Process for Tax is fixed to "Round Off".

TYPE 3: COMBINATION OF NON-CYCLIC BREAKS AND % RATE

First, complete the setting of Non-cyclic Breaks as shown in TYPE 1.

(Tax rate applied when exceeding the Non-cyclic

Break amount)

The description for

the Tax Rate in

TYPE 2 is also

applied to this case.

AT/TL

AL/TL

- 21 -

Page 28

Sample Programming Operation

TYPE 1: TAX FULL BREAKS

To set the following Tax Break Table:

Breaks Tax

EO1-11099

Amount Difference

from Previous Break

$0.01 to $0.10

$0.11 to $0.21

$0.22 to $0.35

$0.36 to $0.50

$0.51 to $0.64

$0.65 to $0.78

$0.79 to $0.92

$0.93 to $1.07

$1.08 to $1.21

$1.22 to $1.35

$1.36 to $1.50

Key Operation)

0¢

1¢

2¢

3¢

4¢

5¢

6¢

7¢

8¢

9¢

10¢

.

.

.

.

.

.

$0.10

$0.11

$0.14

$0.15

$0.14

$0.14

$0.14

$0.15

$0.14

$0.14

.

.

.

Non-cyclic Breaks

One cycle of

Cyclic Breaks

Cyclic Breaks

The same cycle

repeats.

1 0

2 2

3 5

ST

5 0

6 4

7 8

9 2

0 71

2 11

3 51

AT/TL

AL/TL

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TAX

TX/M

-- Print Sample --

0.10

0.21

0.35

0.35

0.50

0.64

0.78

0.92

1.07

1.21

1.35

1.35

0014

16-29

10-03-95

#

TX

TX

TX

ST

TX

TX

TX

TX

TX

TX

TX

TA

- 22 -

Page 29

TYPE 2: TAX % ONLY

To apply 15% to any amount:

EO1-11099

Key Operation)

TAX

AL/TLTX/M ST0 1 5 0 0 0

AT/TL

-- Print Sample --

TYPE 3: COMBINATION OF NON-CYCLIC BREAKS AND % RATE

To set the following Tax Break Table:

Breaks Tax

$0.01 to $0.10

$0.11 to $0.22

$0.23 to $0.39

$0.40 to $0.56

$0.57 to $0.73

$0.74 to $0.90

$0.91 to $1.08

0¢

1¢

2¢

3¢

4¢

5¢

6¢

Amount Difference

from Previous Break

$0.10

$0.12

$0.17

$0.17

$0.17

$0.17

Non-cyclic Breaks

. . .

0.00

0.00

15.00

0016

16-36

10-03-95

#

TX

ST

0 %

Key Operation)

1 0

2 2

3 9

5 6

7 3

9 0

0 81

ST

0 006

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TX/M

TAX

TAX

TX/M

TX/M

TAX

AT/TL

% Rate of 6%

- 23 -

-- Print Sample --

0.10

0.22

0.39

0.56

0.73

0.90

1.08

1.08

6.00

0017

16-38

10-03-95

#

TX

TX

TX

TX

TX

TX

TX

ST

0 %

Page 30

EO1-11099

10. Verification of Programmed Data

The set data of the programming operations can be verified by the following operations. A

receipt is issued for each operation.

SET

OFF

REG

Mode Select

Switch: X

X

Z

To read Department Status

ST

2

X

1∗

1

2

0

3∗

0

4

1

5

0

6

0

7

0

8

0

0021

16-25

10-03-95

Taxable Status

Symbol

Department Code

Status Code

0: Itemized

1: Single-item

To read PLU Tables

ST

3

X

6

1 @

1.50

24

2 @

2.50

28

3 @

1.75

0022

16-26

10-03-95

PLU Code

Linked

Department Code

Preset Price

To read % Rate and the contents of

the System Option

ST

4

10213025

0023

16-27

10-03-95

X

%-

5

#

% Rate

System Option

Setting

To calculate Tax Amount

Displays the tax

amount.

Any amount

TX/M

TAX

NOTE: Result of the Tax Calculation

Test is not printed.

- 24 -

Page 31

11. Daily Operation Flow

The following shows a typical daily operation flow on the register.

Before Opening the Store...

Ensure that the register is firmly plugged

in the wall outlet.

Check to see if sufficient portion of paper

roll remains.

EO1-11099

Reference

Page

3

9

During Business Hours...

After Closing the Store...

Check the time, and print condition.

Opening the store

Ordinary transaction entries

Received-on-Account and Paid Out trans-

actions

Taking Read (X) Report.

Closing the store

Taking Reset (Z) Report

26, 27

27

35

36

36

Tear off the print portion of Journal Paper

(if the printer is used for journal recording).

Leave the drawer open, and Set the

Mode Select Switch to OFF.

Take all the cash from the drawer to the

office with the journal and Reset (Z) Report.

- 25 -

39

40

40

Page 32

12. Transaction Entries

EO1-11099

If the register is programmed with all requirements, it is ready

to accept transaction entries. Before starting to enter transactions, set the Mode Select Switch to the REG position.

WARNING!

When opening the cash drawer, be careful not to let the drawer hit any person.

SET

OFF

REG

X

Z

When an error has occurred...

When the buzzer sounds continuously and "E" is indicated in the leftmost digit of the display,

the last operation has caused an error and the keyboard is locked. In that case:

Press the key to cancel the error condition and the keyboard is now operable.

C

This function of the [C] key is also applied to operations in other Mode Select Switch

positions.

If errors occur repeatedly on operating the same key sequence, check the cause of the

error. The following are possible causes of error:

■ The Mode Select Switch position is wrong.

■ The numeric value entered exceeds the high amount limit.

■ A numeric value has not been entered where required.

■ A numeric value has been entered where prohibited.

■ The key sequence is wrong, or a wrong key has been pressed.

■ The operation is not allowed at the current timing.

Displaying the Time

The time can be displayed on the register any time when the register is outside a sale.

X/TIME

........... Displays the current time.

minutehour

The time display will disappear when any key excluding the [FEED] key is pressed on the

keyboard or the Mode Select Switch position is changed.

- 26 -

Page 33

No-sale

The No-sale transaction is used to open the drawer without relating to a sale, for

such purposes of money exchanges, checking the print condition on the paper roll,

etc.

EO1-11099

NS/PO

The drawer opens.

NS

No-sale Symbol

Sale Item Entries (Department Entries)

1) Entry of One Item

Price

Dept.

Price

2.50 2

NOTE: The Price entry is possible up to 7 digits. However, it is limited by the

Department HALC (High Amount Listing Capacity).

Department

Code

2) Repeat Entry

Price

Dept. Dept.

Same Department Key

2.50

2.50 2 2

NOTE: Depress again the Department key that has been depressed for one

item entry. The item entry will be repeated as many times as the key is

depressed.

3) Quantity Extension (Multiplication)

X/TIME

Quantity (max. 3 digits)

Unit Price

Dept.

2.50

7.50

3

X

@

2

Quantity

Unit Price

Product

NOTE: The product (obtained by multiplication) must not exceed 7 digits.

- 27 -

Page 34

4) Single-item Department

If a Department Key is programmed with

Single-item status, any entry through the

key will immediately finalize the sale as

cash without operating any media key.

The operation is the same as ordinary

itemized Department keys already

described (Entry of One Item, Quantity

Extension), except that Repeat Entry is

not possible using a Single-item

Department key.

1.50

0.09

1.59

0052

15-10

10-03-95

1∗

TX

CA

Dept. Item, Taxable

Symbol

Tax

Cash Total

5) Tax Modification (applicable to Add-on Tax Feature)

Each department is programmed with its own Tax status (Non-taxable, or

Taxable ). To reverse the Tax status (from taxable to non-taxable, or vice

versa), depress the following key before or during the required department item

entry (before the Department Key, at the latest). (Refer to Entry of One Item,

Repeat Entry, Quantity Extension.)

EO1-11099

TX/M

TAX

... to reverse Tax status

NOTES: 1. The tax-modified status declared by the Tax Modifier key will be

held until another item is entered. The modified status is held

even when the item is repeated.

2. When a Department item is tax-modified and repeated and the

same item (with the same price and department) must still be

entered consecutively within a sale with the original tax status

regained, depress the [C] key before entering original tax-status

item.

Sale Item Entries (PLU Entries)

1) Entry of One Item

PLU

PLU Code; 1 to 100

Linked Department

Code

Preset Price

1.75 3*

2) Repeat Entry

PLU PLU

1.75

PLU Code; 1 to 100

Same PLU Key

1.75

3*

3*

NOTE: Depress again the PLU key that has been depressed for one item entry.

The item entry wil be repeated as many times as the key is depressed.

- 28 -

Page 35

3) Quantity Extension (Multiplication)

EO1-11099

X/TIME

Quantity (max. 3 digits)

PLU Code; 1 to 100

PLU

1.75

7.00

X

4

@

3∗

Quantity

Preset Price

Product

NOTE: The product (obtained by multiplication) must not exceed 7 digits.

4) Single-item PLU

If a PLU is linked to a Department

with Single-item status, the entry

of this PLU will immediately finalize the sale as cash without operating any media key.

The operation is the same as

ordinary itemized PLU already

1.50

0.09

1.59

0056

15-26

10-03-95

1∗

TX

CA

Preset Price, Linked

Dept. Code, Taxable

Symbol

Tax

Cash Total

described (Entry of One Item,

Quantity Extension), except that

Repeat Entry is not possible using

a Single-item PLU.

5) Tax Modification (applicable to Add-on Tax Feature)

Tax status (Non-taxable, or Taxable) for each PLU is determined by that of the

linked Department. To reverse the Tax status (from taxable to non-taxable, or

vice versa), depress the following key before or during the required PLU item

entry (before the PLU Entry, at the latest). (Refer to Entry of One Item, Repeat

Entry, Quantity Extension.)

TX/M

TAX

... to reverse Tax status

NOTES: 1. The tax-modified status declared by the Tax Modifier key will be

held until another item is entered. The modified status is held

even when the item is repeated.

2. When a PLU item is tax-modified and repeated and the same item

must still be entered consecutively within a sale with the original

tax status regained, depress the [C] key before entering original

tax-status item.

- 29 -

Page 36

Dollar Discount

%

%

1) Dollar Discount on a Department Item or a PLU Item

EO1-11099

Department or PLU Entry

2) Dollar Discount on Subtotal

Sale Item Entries

NOTE: The discount amount must not exceed the item amount or the subtotal

unless the "Credit Balance" option is selected.

Percent Discount or Percent Charge

Discount Amount

Discount Amount

-

DISC

8.00

-1.50

DISCST

-

ST

Subtotal

Dollar Discount of

$1.50

The [%] key can be programmed to function Percent Discount or Percent Charge.

1) Percent Discount/Charge on a Department Item or a PLU Item

Department or PLU Entry

(to activate the preset rate)

(to activate a manual rate)

Manual Rate; max. 2 digits

1 (1%) to 99 (99%)

2) Percent Discount/Charge on Subtotal

(to activate the preset rate)

Sale Item Entries

ST

NOTE: When a Manual Rate is

entered, the preset rate is

disregarded.

%

(to activate a manual rate)

%

Manual Rate; max. 2 digits

1 (1%) to 99 (99%)

2.00

2

5

%-

-0.10

5%

Discount

- 30 -

Page 37

RTN/I.C

Void

Sale items once entered within the current sale can be voided.

1) Last Line Voiding

When the last line item (that has just been entered within the current transaction) is a Department item, a PLU item, Dollar Discount item, or Percent

Discount/Charge item, it can be voided by simply pressing the [VD] key.

Department or PLU Entry

Dollar Discount

Percent Discount/Charge

VD

2.00

2.00

2

2VD

EO1-11099

Voided

2) Designated Line Voiding

When a Department or a PLU item entered before the last item is canceled

before the sale is finalized, it can be voided. To operate it, follow the ordinary

Department or PLU entry procedure (Entry of One Item, Quantity Extension)

except that the [VD] key is depressed just before the Department or PLU key

depression.

Example)

1 0 0

2 0 0

1 0 0

Dept.1

Dept.2

VD

RTN/I.C

Dept.1

2.00

1.00

2.00

2

1∗

2RF

Returned Merchandise

The Returned Merchandise transaction is used to refund money to a customer who

has returned items already purchased. This operation must be performed outside

a sale only.

Voided

RTN/I.C

VD

Entry of sale item (Department or PLU) to be returned

(Entry of One Item, Quantity Extension)

- 31 -

3.00

-0.18

-3.18

1RF

TX

CA

Returned item

Cash to be returned

Page 38

Non-add Number Print

This function is to print any code number for future reference, such as Customer

No., Credit Card No., House Charge Account No., etc. Non-add numbers can be

entered at the starting of a sale or during a sale if the sale is not finalized. Multiple

non-add numbers can be entered in a sale.

EO1-11099

#/RA

Non-add Number; max. 7 digits

1234567 Non-add Number

#

Subtotal Read and Print

To read the total of the current sale by the customer's request or the operator's

requirement, simply depress the [ST] key.

Sale Item Entries

ST

Displays the subtotal (sale total including taxes up to the

moment).

NOTE: The subtotal amount to be printed is

the pre-taxed sale total.

11.50

Finalizing a Sale

1) Cash Total

5.00

0.18

5.18

0060

16-00

AT/TLST

ST

TX

CA

Subtotal

Tax

Cash Sale Total

Sale Item Entries

(

)

10-03-95

ST

2) Cash Tender

Sale Item Entries

(

)

Cash Tendered Amount

5.00

0.18

5.18

6.00

0.82

0063

16-10

10-03-95

ST

TX

NT

AT

CG

AT/TLST

Subtotal

Tax

Sale Total including Tax

Cash tendered

Change due

NOTE: The sale is finalized as in the sample receipt above when the tendered

amount is equal to or larger than the sale total (including taxes). When the

tendered amount is smaller than the sale total (short-tendered), the

balance due is displayed and the sale is not finalized. In such cases, refer

to "6) Multi-tender" and "7) Split Tender" on the page 34.

- 32 -

Page 39

3) Charge or Credit Total

Sale Item Entries

EO1-11099

(

)

ChgST

CH

4) Check Total

Sale Item Entries

5) Check Tender

Sale Item Entries

5.00

ST

0.18

TX

5.18

CH

0064

16-11

10-03-95

5.00

0.18

5.18

0067

16-15

CHKST

ST

TX

CK

(

(

)

10-03-95

)

Subtotal

Tax

Charge or Credit

Sale Total

Subtotal

Tax

Check Sale Total

CHKST

Check Tendered Amount

5.00

0.18

5.18

10.00

4.82

0068

16-20

10-03-95

ST

TX

NT

CK

CG

Subtotal

Tax

Sale Total including tax

Check tendered

Change due

NOTE: The System Option Setting allows you to select the following functions of

the [CHK] key.

Total & Tender functions

Total function only

Tender function only

- 33 -

Page 40

6) Multi-tender

Sale Item Entries

EO1-11099

(

)

Cash (or Check) Tendered

Amount less than the sale total

Cash (or Check) Tendered Amount

equal to or larger than the sale total

CHKAT/TLST

(

or

CHKAT/TL

or

(

)

)

7) Split Tender

Sale Item Entries

10-03-95

(

5.00

0.18

5.18

3.00

5.00

2.82

0069

16-23

)

ST

TX

TA

AT

AT

CG

Cash Tendered Amount

less than the sale total

Subtotal

Tax

Sale Total including tax

Cash tendered (short-tendered)

Cash tendered (over-tendered)

Change due

CHKAT/TLST

(

or

CHK Chg

Check Tendered Amount less than

the sale total-cash tendered amount

)

CH

15.00

0.90

15.90

3.00

5.00

7.90

0070

16-25

10-03-95

ST

TX

TA

AT

CK

CH

Subtotal

Tax

Sale Total including tax

Cash tendered (short-tendered)

Check tendered (short-tendered)

Charge or Credit Total

NOTES: 1. A maximum of 7 digits can be entered as Tendered Amount (up to

$99999.99).

2. When the sale total is zero or negative, the sale can only be finalized

by Cash Total function.

- 34 -

Page 41

Tax Exemption

The Tax Exemption transaction is used to exempt all taxes from the sale total.

EO1-11099

Sale Item Entries

(

)

TX/MST

TAX

5.00

1.75

6.75

6.75

Finalizing a sale

3∗

3∗

ST

CA

Sale item Entries with

Taxable Status

Cash Sale Total

without Tax

The following operations require the X position of the Mode Select Switch.

SET

OFF

REG

X

Z

Received-on-Account Payment

(Mode Select Switch: X)

The Received-on-Account transaction is used to identify money which is in the

drawer but not due to business. For example, a customer pays for a sale finalized

as house charge on a past day, or the operator records the change reserve in the

drawer loaded from the store office. This operation must be performed outside a

sale only.

The drawer opens to enable money entry into the drawer.

10.00

RA

Payment Amount Received;

max. 7 digits (up to $99999.99)

Paid Out

#/RA

(Mode Select Switch: X)

The Paid Out transaction is used when an amount of money is removed from the

drawer without relating to a sale, for the purpose of paying to a wholesaler, etc. This

operation must be performed outside a sale only.

NS/PO

Amount to be paid out;

max. 7 digits (up to $99999.99)

The drawer opens to enable paying out.

12.00

PO

- 35 -

Page 42

13. Read (X) and Reset (Z) Reports

PLU

AT/TL

(

)

(

)

This Chapter describes the operation to take Read and Reset reports and their print

formats.

Before Taking Reports...

The Read (X) Report allows to read the totals but not clear the memory, while the

Reset (Z) Report allows to read the totals and, at the same time, clear all the

resettable totals when the report has been issued.

The symbol "X" is printed at the top right of a Read Report, while "Z" is printed on

a Reset Report to indicate the type of report. The contents of the two types of

reports are the same if both are taken at the same time.

WARNING!

When opening the cash drawer, be careful not to let the drawer hit any person.

EO1-11099

OPERATION

Read (X) Report

SET

OFF

REG

X

Z

Reset (Z) Report

SET

OFF

REG

Financial Read (X) Report:

AT/TL

(The drawer opens.)

Cash-in-drawer Read (X) Report:

#/RA

(The drawer opens.)

PLU Read (X) Report:

PLU

(The drawer opens.)

Financial Reset (Z) Report:

(The drawer opens.)

X

Z

Secret code if

programmed

PLU Reset (Z) Report:

(The drawer opens.)

Secret code if

programmed

- 36 -

Page 43

Memory Balance

Grand Total = (Sum of Gross Sale)

Gross Sale = (Depts. Total) + (Tax Amount) + (Returned Merchandise & Desig-

nated Line Voiding) + (Last Line Voiding) + (%+)

NOTE 1

NOTE 2

Net Sale with Tax = (Depts. Total) + (Tax Amount) + (%+)

NOTE 2

Media Total = (Cash Sales) + (Check Sales) + (Charge Sales)

= (Net Sale with Tax) - (%-) - (Dollar Discount)

NOTE 3

Customer Total = (Cash Sales Customer) + (Check Sales Customer) + (Charge

Sales Customer)

Returned Merchandise & Designated Line Voiding

= (Returned Merchandise & Designated Line Voiding) +

(Negative Tax Amount)

NOTE 4

EO1-11099

NOTES: 1. The void transaction of %- and Dollar Discount is not processed to the

Void Memory. However, the void transaction of %+ is processed to

its memory.

2. In case that the [%] key is used as the [%+] key.

3. In case that the [%] key is used as the [%-] key.

4. "Negative Tax Amount" means a tax amount to be returned to a

customer with an amount of a returned item.

- 37 -

Page 44

Report Sample Format

EO1-11099

Financial Report

257.06

28

83.06

8.20

29.00

3.50

3.20

5.50

16.30

4.80

1.00

1.96

25

73.46

0.90

6.50

16

66.06

12

34.75

5.41

25.90

32.60

10.00

52.76

10.00

3.60

6.00

0003

0096

19-20

10-03-95

Z

#

∗

4

1

7

2

2

3

2

4

2

5

5

6

2

7

1

8

TX

NS

1

%-

4

-

NT

CA

1

CK

3

CH

3

RA

1

PO

∗TA

∗CK

1

VD

2

RF

Z

Cash-in-drawer Report

Reset Report Symbol

("X" for Read Report)

Grand Total (non-resettable)

Gross Sale: Item Count

Amount

Dept. 1 Sale:Item Count

Amount

Dept. 8 Sales:Item Count

Amount

Tax Total

Net Sale with Tax: Item Count

Amount

%- Count

Amount

Dollar Discount

Amount

Total Customer Count

Media Total

Cash Sales:Customer Count

Amount

Check Sales: Customer Count

Amount

Charge or Credit Sales: Customer Count

Amount

Received-on-account Count

Amount

Paid Out Count

Amount

Cash-in-drawer Amount

Check-in-drawer Amount

Last Line Voiding Count

Amount

Returned Merchandise & Designated

Line Voiding: Item Count, Amount

Reset Counter

Consecutive No.

Time

Date

52.76

0090

19-05

10-03-95

PLU Report

4.50

10.00

12.25

2.00

0002

0092

19-10

10-03-95

24

28

30

X

∗TA

Z

6

3

4

7

1

Z

Cash-in-drawer

Amount

PLU Code 6

Sales:Count

Amount

PLU Code 30

Sales:Count

Amount

Reset Counter

- 38 -

Page 45

14. Maintenance

Care must be taken not to injure yourself with the paper cutter.

Replacing the Paper Roll

EO1-11099

WARNING!

1

To remove the Printer Cover, insert the

Printer Cover/Drawer key to the Printer

Cover Lock, and then turn it 90° clockwise.

2

If the printer is used for Journal, hold down

the [FEED] key to wind up the printed

portion of paper, then cut the paper as

shown in the figure. Hold down the

[FEED] key again to advance the remaining paper end.

If the printer is used for Receipt, cut the

paper roll as shown in the figure. Then

hold down the [FEED] key to advance the

remaining paper end.

The wound-up portion of the paper (when

used for Journal) can easily be removed

from the Reel by pulling it sideways.

3

Set the paper roll ready for print.

Chapter "8. Installing the Paper Roll".

- 39 -

Refer to

Page 46

Replacing the Ink Roller

EO1-11099

1

To remove the Printer Cover, insert the

Printer Cover/Drawer key to the Printer

Cover Lock, and then turn it 90° clockwise.

2

Pinch the Ink Roller Knob with your fingers, and pull it upward.

Manual Drawer Release

3

Insert the new Ink Roller in the slot of the

carriage by pushing it all the way in until it

is firmly settled with a "click" sound.

The drawer will automatically open on appropriate operations. However, in the event of a

power failure, etc., the drawer can be released

manually.

First, insert the Printer Cover/Drawer Key to the

Drawer Key Lock, then turn it 90° counterclockwise.

Next, push the Drawer Release Lever located

on the bottom side of the register in the direction

of the arrow, and the drawer opens.

- 40 -

Page 47

Removing the Drawer

When opening the cash drawer, be careful not to let the drawer hit any person.

EO1-11099

Pull out the drawer all the way until it hits the

stopper. Then lift up the drawer and pull it again.

WARNING!

Battery Exchange

WARNING: Be certain to replace batteries with new ones

every year. If they run down, the programmed

data and sales data will all be cleared.

1

To exchange batteries, please keep the power

cord of the register connected to the wall outlet.

If the batteries are removed with the power

cord disconnected, the programmed data and

sales data will all be cleared.

2

To remove the Printer Cover, insert the

Printer Cover/Drawer key to the Printer Cover

Lock, and then turn it 90° clockwise.

3

Remove the Battery Cover.

- 41 -

Page 48

15. Specifications

EO1-11099

4

Replace the old batteries with new ones,

while confirming that the positive (+) and

negative (-) ends face the proper directions.

(Batteries: SUM-3 1.5V x 3 pieces)

NOTE: Do not mix used and new batteries in

the battery compartment.

5

Return the item removed in Step 3, and attach

the Printer Cover.

Size ................................... 350 mm (width) x 400 mm (depth) x 250.8 mm

(height including rubber feet)

Weight ............................... 4.76 kg

Power Required ................ 117V±10%, 60Hz

Power Consumed.............. 0.08A

Operating Temperature..... 0°C to 40°C

Operating Humidity ........... 10% to 90% RH

Size of Paper Roll ............. 57.5±0.5mm (width) x max. 80mm (diameter),

0.06 to 0.085mm (thickness)

Memory Protection ............ Dry Battery SUM-3 1.5 V x 3 pieces;

Life of about 1 year

(Be certain to replace batteries with new ones every

year.)

Handling the Batteries

When inserting batteries, place them so that the positive (+) and negative

(-) ends face the proper directions as shown in the battery compartment.

Do not mix used and new batteries in the battery compartment. Replace all

batteries at the same time.

Do not leave discharged batteries in the battery compartment. Leakage

from such batteries may damage the register.

Do not dispose the batteries in a fire. If put in a fire, they may explode.

Specifications are subject to change without notice.

- 42 -

Page 49

Page 50

Toshiba TEC Corporation

Loading...

Loading...