Page 1

BA-35 Solar Quick Reference Guide

Table of Contents

General Information

The Display

...................................

Arithmetic Operations

Correcting Errors

Display Formats

Memory Operations

Math Operations

Percentage Calculations

..........................

........................

.............................

..............................

..........................

..............................

.....................

Percentage Change Calculations

Margin and Markup Calculations

Compound Interest Calculations

Annuity Calculations

Converting to EFF or APR

Balance, Interest, and Principal

Statistics

......................................

..........................

...................

..............

............

............

.............

2

4

6

7

8

9

10

12

13

14

16

18

23

24

27

Common Keystroke Sequences

Error Conditions

In Case of Difficulty

..............................

...........................

.............

TI Product Service and Warranty

Information

.................................

© 1996 by Texas Instruments Incorporated

30

35

37

38

1

Page 2

General Information

Turning the Calculator On and Off

(All Clear/On)

u

This key also clears the display, all pending

operations, and values in memory or the mode

registers.

The calculator turns off automatically when the

solar cell panel is no longer exposed to light.

Modes

The calculator can operate in three different

modes. Setting the calculator to a particular

mode prepares it to perform special functions.

—Turns on the calculator.

The available modes are statistics, financial,

and profit margin.

Indicators in the display tell you the calculator's

current mode. STAT displays for statistics, FIN

for financial. No indicator is displayed for profit

margin mode.

2

—Changes the calculator to the next

mode in sequence. To set the calculator to a

particular mode, press

2

repeatedly until

the appropriate indicator is displayed.

Changing to a new mode clears the contents of

the mode registers.

You can do arithmetic, mathematical, and

percentage operations in any mode.

2

Page 3

Second Functions

0

—Enables you to

(Second Function)

perform the “second” functions that are marked

over some of the keys. To perform a second

function, press

and then the appropriate

0

function key.

When you press

0

2nd

,

appears in the

display until you press another key.

If you press

and then a key that does not

0

have a second function, the key performs its

normal function. If you accidentally press

0

press it again to cancel its effect.

Clearing the Calculator

u

—Clears the calculator

(All Clear/On)

completely, including the display, all pending

operations, and the memory and mode

registers. Pressing

u

also sets the

calculator to floating-decimal format and

,

financial mode

(Clear Entry/Clear)

-

.

—Clears incorrect

entries, error conditions, the display, or pending

operations. It does not affect the memory, the

mode registers, or the display format.

0 b

—Clears any

(Clear Mode Registers)

values that have been stored in the mode

registers.

Note:

Changing to a new mode also clears the

contents of the mode registers.

3

Page 4

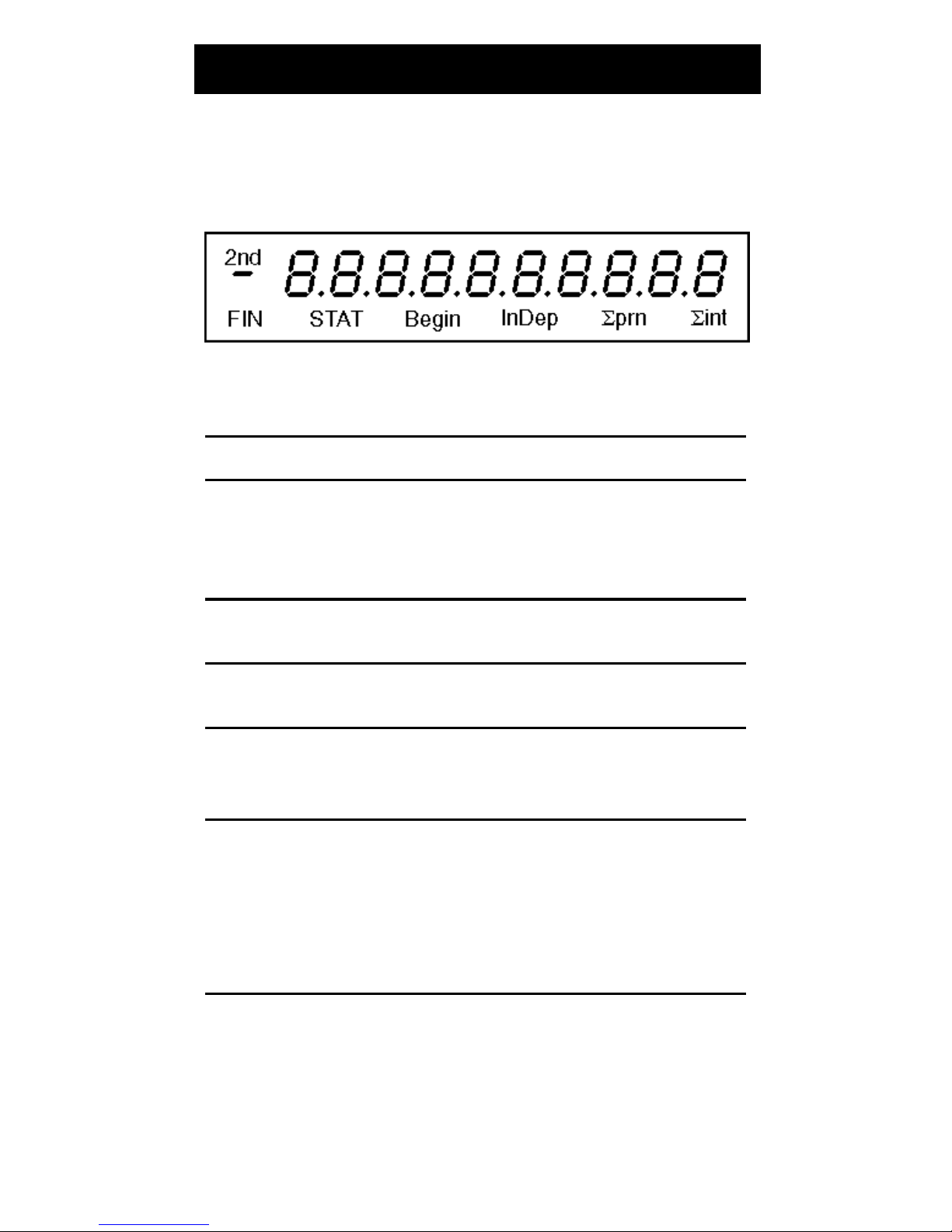

The Display

g

The display shows a maximum of 10 digits,

although the calculator internally retains a

maximum

Display Indicators

Indicator Meaning

nd The calculator will access the

of 13 digits.

second function of the next

key pressed (appears when

you press

0

).

FIN The calculator is in the

financial mode.

STAT The calculator is in the

statistics mode.

Note:

No indicator displays

when the calculator is in

profit margin mode.

Begin The calculator computes

annuities as be

inning-ofperiod payments rather than

end-of-period payments.

(Displayed only in the

financial mode.)

(continued)

4

Page 5

Indicator Meaning

g

g

g

g

InDep The displayed result is for

the independent variables

(x values). (Displayed only in

the statistics mode.)

Dep The displayed result is for

the dependent variables

(y values). (Displayed only in

the statistics mode.)

prn The value in the display is

the summed principal over a

ran

e of payments.

(Displayed only in the

financial mode.)

prn The value in the display is

the principal for a sin

le

payment. (Displayed only in

the financial mode.)

int The value in the display is

the summed interest over a

ran

e of payments.

(Displayed only in the

financial mode.)

int The value in the display is

the interest for a sin

le

payment. (Displayed only in

the financial mode.)

5

Page 6

Arithmetic Operations

Entering Numbers

6

- ?

(Digits)

—Enter digits into the display.

You can enter a maximum of 10 digits and a

decimal point.

(Decimal Point)

A

@

(Change Sign)

—Enters a decimal point.

—Changes the sign of the

number in the display. To enter a negative

number, first enter the number as a positive

value and then press

@

.

Arithmetic Keys

p, o, n, m

—Perform the arithmetic

operations of addition, subtraction,

multiplication, and division.

(Equals)

l

—Completes all pending operations

and displays the result of a calculation.

6

Page 7

Correcting Errors

Correcting Entry Errors

(Clear Entry/Clear)

-

—To clear a numerical

entry, press

-

once; then enter the correct

number. To clear all pending operations and

begin the calculation again, press

(x Exchange y)

w

—Exchanges the values

-

twice.

of x and y. If you enter x and y in the incorrect

order, press

to reverse them. Then

w

complete the calculation.

(Backspace)

v

—Removes the last digit or

decimal point from the displayed number if you

have not yet pressed an operation key (p, o,

n, m

, etc.). This key is useful for correcting

entry errors without having to clear the display

and start again.

Correcting Immediate Functions

You can often correct an immediate function by

performing the “reverse” operation. For

example, if you press

0 ]

can correct the operation by pressing

by mistake, you

0 k

.

7

Page 8

Display Formats

Floating-Decimal Format

The calculator normally displays numbers in

“standard” floating-decimal format, in which

numbers are displayed in the range

-

9,999,999,999 to -0.000000001, 0, or

0.000000001 to 9,999,999,999. If the result of a

calculation is too large or too small to be

displayed in the normal format, it is displayed in

scientific notation. This means the result is

expressed as a base value (mantissa) times 10

raised to a power (exponent). For example, 5.9

12

12 means 5.9 x 10

The calculator is always in floating-decimal

.

format when you turn it on. By changing the

display format, you can convert a number from

one format to another.

0 c

(Fixed Decimal)

—Enables you to set

the number of decimal places displayed in a

result.

§

To set the number of decimal places, press

0 c

and then press the appropriate digit

key (6-?).

§

To remove the fixed-decimal setting and

restore floating-decimal format, press

c A

.

0

If a result has more than the selected number

of decimal places, the displayed number is

rounded. If a result has fewer than the selected

number of decimal places, trailing 0s are

added.

8

Page 9

Memory Operations

The memory can store any numeric value

within the range of the calculator. You can use

the calculator’s memory to store, sum, and

recall a numeric value. You can use the

memory in any mode.

(Store)

r

value in the memory, replacing any value

previously stored there. When 0 is displayed,

—Stores the displayed numeric

you can clear the memory by pressing

r

,

thereby storing a zero in memory.

t

—Adds the displayed numeric value

(Sum)

to the contents of the memory.

To add a series of numbers to the memory, use

to store the first number (thereby replacing

r

any previous value). Then use

remaining numbers. Use

s 0 P

t

with the

to

display the total.

To subtract the displayed value from the value

in memory, press

displayed value) and then press

0 P

s 0 P

to display the total.

(Recall Memory)

(to change the sign of the

@

. Use

t

—Displays

s

(recalls) the number stored in memory, without

affecting the contents of the memory.

9

Page 10

Math Operations

0 \

(Reciprocal)

—Calculates the

reciprocal of the displayed number, which is the

same as one divided by the number.

0 ]

(Square)

—Raises the displayed

number to the second power, which is the same

as multiplying the number by itself. The number

can be any value whose square is in the range

of the calculator.

0 k

(Square Root)

—Calculates the square

root of the displayed number. The displayed

number must be positive or zero; otherwise, an

error condition occurs. The result is always

positive.

0 H

(Universal Power)

—Raises any

positive number to any power within the range

of the calculator or calculates any root of any

positive number within the range of the

calculator.

To calculate a power:

1. Enter the number (y) that you want to raise

to a power.

2. Press

0 H

.

3. Enter the power (x).

4. Press l or any key that completes the

operation.

10

Page 11

To calculate a root:

1. Enter the number (y) whose root you want to

find.

2. Press

0 H

.

3. Enter the root (x).

4. Press

0 \

.

5. Press l or any key that completes the

operation.

0 G

(Natural Logarithm)

—Calculates the

natural logarithm (base e = 2.718281828459) of

the displayed number. The number must be

positive; otherwise, an error condition occurs.

0 ^

(Natural Antilogarithm)

— Calculates

the natural antilogarithm of the displayed

number. This is equivalent to the value of e

raised to the power of the number in the

display.

11

Page 12

Percentage Calculations

(Percent)

E

add-ons, discounts, and percentage ratios.

—Calculate percentages,

Key

Operation

Percentage

dd-On

Discount

Percentage

Sequence Function

n E

n

l

Calculates n%

of the principal

amount.

n E

p

l

Calculates n%

of the principal

amount and

adds the result

to the principal.

o

n E

l

Calculates n%

of the principal

amount and

subtracts the

result from the

principal.

m

n E

l

Divides the

Ratio

principal

amount by n%.

12

Page 13

Percentage Change Calculations

0 4

(Percent Change)

—Calculates the

percentage change between two values. To

calculate the percentage change:

1. Enter the new value.

2. Press

0 4

.

3. Enter the old value.

4. Press l.

The percentage change is calculated by the

formula:

New value - Old value

x 100

Old value

If the result is positive, there is a percentage

increase. If the result is negative, there is a

percentage decrease.

13

Page 14

Margin and Markup Calculations

To calculate cost, selling price, gross profit

margin, or markup, use

2

to set the

calculator to the profit-margin mode (no display

indicator).

R

S

U

(Selling Price)

(Margin)

—Enters the cost.

—Enters the selling price.

—Enters the gross profit margin,

(Cost)

which is the difference between selling price

and cost expressed as a percentage of the

selling price

(Markup)

0 Z

.

—Enters the markup, which is

the difference between selling price and cost

expressed as a percentage of the

cost

.

If the percentage is positive, the selling price is

greater than the cost. If the percentage is

negative, the selling price is less than the cost.

1

—Computes the

(Computation Key)

unknown value for gross profit margin problems

and markup problems.

Recalling Values

To recall a value that you have entered or

computed, press

and the appropriate key

s

for the value you want to recall. For example, to

recall the value for margin, press

s U

.

14

Page 15

Performing Gross Profit Margin

Calculations

To calculate cost, selling price, or gross profit

margin:

1. Press

use

2

0 b

to enter the profit margin mode

to clear the registers and

(no display indicator).

2. Enter the two known values (CST, SEL, or

MAR).

3. Press

and the key for the unknown

1

value.

Performing Markup Calculations

To calculate cost, selling price, or markup:

1. Press

use

2

0 b

to enter the profit margin mode

to clear the registers and

(no display indicator).

2. Enter the two known values (CST, SEL, or

MU).

3. Press

and the key (or key sequence)

1

for the unknown value.

15

Page 16

Compound Interest Calculations

To calculate compound interest, use

2

to

set the calculator to the to the financial mode

FIN

(

appears in the display).

In compound interest calculations in which no

payment is involved, the payment (PMT) is

assumed to be zero. When the payment has a

value other than zero, the calculator treats the

problem as an annuity (a series of regular,

equal payments).

Compound Interest Keys

In compound interest calculations, the following

keys are used to enter or calculate the values

listed below.

—Total number of compounding periods.

C

—Percent interest per compounding period.

I

—Present value of a future amount. With a

K

savings account, for example, PV represents

what your money is worth today.

—Future value of a present amount. With a

L

savings account, for example, FV represents

what your money will be worth in the future.

1

—Computes the

(Computation Key)

unknown value for compound interest

problems

.

16

Page 17

Recalling Values

To recall a value that you have entered or

computed, press

and the appropriate key

s

for the value you want to recall. For example, to

recall the present value, press

s K

.

Performing Compound Interest Calculations

To perform a compound interest calculation,

you must know any three of the four values

(N, %i, PV, or FV). Follow these steps to find

the unknown value:

1. Press

use

2

0 b

to enter the financial mode (

to clear the registers and

FIN

appears in the display).

2. Enter the three known values (N, %i, PV, or

FV).

3. Press

and the key for the unknown

1

value.

For compound interest calculations, the

payment (PMT) must be zero. This value is set

automatically when you press

2

to enter the

financial mode or when you clear the financial

registers.

17

Page 18

Annuity Calculations

For annuity calculations, use

calculator to financial mode (

2

FIN

to set the

appears in the

display).

An annuity is a series of equal payments made

at regular time periods with interest calculated

at the end of each period. Ordinary annuities

have end-of-period payments; annuities due

have beginning-of-period payments.

0 a

(Beginning-of-Period)

—Sets the

calculator to compute for annuity-due problems

(beginning-of-period payments).

Pressing

0 a

causes

Begin

to appear in

the display. The beginning-of-period function is

in effect until you cancel it (by pressing

0 a

again) or leave the financial mode.

§

When

Begin

is in the display, the calculator

solves using beginning-of-period payments.

§

When

Begin

is not in the display, the

calculator solves using end-of-period

payments.

Note:

If an annuity problem does

not

use

beginning-of-period payments, be sure that

Begin

the answer. Having

is not in the display before you compute

Begin

in the display has no

effect on compound interest calculations in

which no payment is involved.

18

Page 19

Annuity Keys

In annuity calculations, the following keys are

used to enter or calculate the values listed

below.

—Total number of payment periods.

C

—Percent interest per payment period.

I

—Present value of a series of payments plus

K

the present value of FV. With a savings

account, PV represents an initial deposit (not

including the first payment). With a loan, PV

represents the loan amount.

M

—Amount of the regular payment. This

value may be positive or negative, depending

on the type of problem you are solving (as

explained on page 20).

—Future value of a series of payments plus

L

the future value of PV. With a savings account,

FV represents the final amount withdrawn. With

a loan, FV represents any balloon payment that

must be made in addition to the last regular

payment.

1

(

—Computes the

Computation Key)

unknown value for annuity problems.

§

When

Begin

is not displayed, the

1

key

computes the unknown value for ordinary

annuities (annuities with end-of-period

payments).

§

When

Begin

computes the unknown value for annuities

due (annuities with beginning-of-period

payments).

is displayed, the

19

1

key

Page 20

Annuity Calculations

(Continued)

Recalling Values

To recall a value that you have entered or

computed, press

and the appropriate key

s

for the value you want to recall. For example, to

recall the present value, press

s K

.

Positive or Negative Payments

In annuity problems, the present value and

future value are usually positive numbers. The

payment amount may be positive or negative,

depending on the type of problem you are

solving.

§

If payments are discounted backward, the

payment amount is positive. This is the case

in mortgage, loan, bond, and lease

problems.

These problems have a present value, but

they may or may not have a future value. (If

there is no future value, FV=0.)

§

If payments are compounded forward, the

payment amount is negative. This is the

case in savings problems.

These problems have a future value, but

they may or may not have a present value.

(If there is no present value, PV=0.)

20

Page 21

Performing Annuity Calculations

To perform an annuity calculation, you must

know any four of the five values (N, % i, PV,

PMT, or FV). Follow these steps to find the

unknown value:

1. Press

use

2

0 b

to enter the financial mode (

to clear the registers, and

FIN

appears in the display).

2. Ensure that the calculator is set correctly for

the type of annuity calculation desired.

§

For ordinary annuities,

Begin

should not

be displayed.

§

For annuities due,

Begin

should be

displayed.

Press

0 a

to turn

Begin

on or off.

3. Enter the four known values (N, % i, PV,

PMT, or FV).

4. Press

and the key for the unknown

1

value.

Note:

Generally, solving for the interest rate

requires more time than other calculations. If

you use unrealistic values, the calculator may

take several minutes before indicating an error

condition. If this occurs, press

u

to clear

the calculation.

21

Page 22

Annuity Calculations

(Continued)

Special Functions for Monthly

Compounding or Payment Periods

0 h

(Monthly Interest)

—Divides the

number in the display by 12 and displays the

result. This number can then be stored as the

monthly interest rate (%i). To use the

0 h

key sequence:

1. Enter the annual interest rate for a

compound interest or annuity problem.

2. Press

0 h

Then press

I

.

to store the result.

The two steps above have the same effect as

entering the number of years and then pressing

12 l.

m

0 i

(Number of Monthly Payments)

—

Multiplies the number in the display by 12 and

displays the result. This number can then be

stored as the number of compounding periods

or payment periods (N). To use the

0 i

key

sequence:

1. Enter the number of years for a compound

interest or annuity problem with monthly

compounding or payment periods.

2. Press

0 i

.

Then press C to store the result.

The two steps above have the same effect as

entering the number of years and then pressing

12 l.

n

22

Page 23

Converting to EFF or APR

To convert to EFF or APR, use

calculator to the financial mode (

2

FIN

to set the

appears in

the display.)

Annual Percentage Rate (APR)

—The interest

rate per compounding period multiplied by the

number of compounding periods per year.

Annual Effective Rate (EFF)

—The interest

rate compounded yearly that achieves the

same future value as the APR. The EFF is the

rate at which you actually earn for the period of

time stated.

0 N

(APR to EFF)

—Converts annual

percentage rates to annual effective rates.

1. Enter the APR.

2. Press

0 N

.

3. Enter the number of compounding periods

per year (c/yr) for the APR.

4. Press

0 O

to calculate the EFF.

l

(EFF to APR)

—Converts annual

effective rates to annual percentage rates.

1. Enter the EFF.

2. Press

0 O

.

3. Enter the number of compounding periods

per year (c/yr) for the APR.

4. Press l to calculate the APR.

23

Page 24

Balance, Interest, and Principal

To calculate balance, interest and principal, use

2

FIN

(

W

to set the calculator to the financial mode

appears in the display.)

(Balance)

—Calculates the remaining loan

balance (principal) after a selected payment.

To find the balance:

1. If necessary, press

0 a

to change the

calculator to solve for end-of-period

payments or beginning-of-period payments.

2. Enter the appropriate values with the C,

K, L

, and

M

keys.

3. Enter the payment number.

4. Press

W

.

I

,

(Interest and Principal

V

interest and principal portions of a

payment; when used with the

)—Calculates the

single

X

key, it

calculates the accumulated interest and

principal over a

(Payment Range Entry Key)

X

range

of payments.

—Enters a

selected range of payments (payment 1

through payment x) so that you can calculate

the accumulated interest and principal over that

range.

Note:

number as an integer.

When using

X

, enter the payment

Do not enter a decimal

point.

24

Page 25

Calculating a Single Payment

To find the interest and principal of a single

payment

1. If necessary, press

:

0 a

to change the

calculator to solve for end-of-period

payments or beginning-of-period payments.

2. Enter the appropriate values with the C,

K, L

, and

M

keys.

I

3. Enter the payment number.

4. Press

to calculate the interest. (The

V

int

indicator is displayed with the result.)

5. Press

to display the principal. (The

w

prn

indicator is displayed with the result.)

If you want to display the interest portion again,

,

press

. Pressing

w

interest and principal.

alternately displays the

w

25

Page 26

Balance, Interest, and Principal

(Cont.)

Calculating a Range of Payments

To find the summed interest and principal over

a range of payments:

1. If necessary, press

0 a

to change the

calculator to solve for end-of-period

payments or beginning-of-period payments.

2. Enter the appropriate values with the C,

K, L

, and

M

keys.

3. Enter the first payment number (P1) and

press

X

.

4. Enter the second payment number.

5. Press

(The

to calculate the interest.

V

G

indicator is displayed with the

int

result.)

6. Press

to display the principal.

w

I

,

(The

G

prn

indicator is displayed with the

result.)

If you want to display the interest portion again,

press

. Pressing

w

alternately displays the

w

interest and principal.

26

Page 27

Statistics

To enter a statistics problem, use

2

the calculator to the statistics mode (

to set

STAT

appears in the display).

0 b

(Clear Mode Registers

)—Clears any

previously entered data points.

(Statistics Data Entry)

g

—Enters the

displayed number as a data value in the

statistical registers. Each time you press

g

the display shows the number of data values

currently stored in the statistical registers.

0 f

(Statistics Data Removal

)—

Removes a data value from the statistical

registers. Each time you press

0 f

, the

display shows the number of data values

currently stored in the statistical registers.

,

Entering Two-Variable Data Values

Use

in conjunction with

w

to enter data

g

points with both x and y values as follows:

1. Enter an x value and press

2. Enter a y value and press

g

w

.

.

Repeat the procedure to enter additional data

points. You can also follow this procedure with

0 f

to remove data points.

27

Page 28

Statistics

Mean

(Continued)

0 z

(Data Mean)

—Calculates the mean

(average) of all the data values currently stored

in the statistical registers.

If you have entered data points with x and y

values, press

0 z

the y values; then press

to display the mean of

to display the

w

mean of the x values.

Standard Deviation

The

0 y

and

0 x

key sequences

calculate the standard deviation of the data

values in the statistical registers.

If you entered data points with x and y values,

press

0 y

or

0 x

to display the

standard deviation of the y values; then press

to display the standard deviation of the x

w

values.

0 y

(“Population” Deviation)

—

Calculates the “n weighted” (or “population”)

standard deviation.

0 x

(“Sample” Deviation)

—Calculates

the “n - 1 weighted” (or “sample”) standard

deviation.

28

Page 29

Linear Regression

0 {

(Intercept/Slope)

—Enables you to

display the y-intercept and slope of the

representative line. To display the y-intercept

(b), press

press

0 d

w

(Correlation)

0 {

after you display the y-intercept.

; to display the slope (a),

—Calculates the

correlation between the x and y values in a set

of data points.

0 T, 0 Q

(Predicted Value

enter an x value, you can press

)—After you

0 Q

to

display the y value that corresponds with that x

on the best straight line through the data points

entered. Similarly, after you enter a y value, you

can press

0 T

to display the corresponding x

value.

29

Page 30

Common Keystroke Sequences

g

Monthly Payment for a Home Mortgage

Purpose: To find the amount of the monthly

payment on a mortgage with end-of-month

payments (ordinary annuity).

Values You Supply:

mortgage

§

amount

§

annual interest

§

number of

years

rate

in mortgage

Procedure Key

Sequence

Clear calculator and mode

isters; select two decimal

re

places.

Press

2

until

FIN

is

displayed.

Press

not

0 a

displayed.*

until

Begin

Enter mortgage amount.

Calculate interest rate.

Enter interest rate.

is

- 0 b

0 c

2

0 a

mortgage

rate

I

2

0 h

K

Calculate number of payment

periods.

Enter number of payment

periods.

Compute monthly payment.

* If payments occur at the beginning of each

month (annuity due), press

Begin

is displayed.

30

years

C

1 M

0 a

0 i

until

Page 31

Remaining Balance for a Home Mortgage

g

Purpose: To find the remaining balance—after

a selected payment number—of a mortgage

with end-of-month payments (ordinary annuity).

Values You Supply:

§

mortgage

amount

§

annual interest

§

number of

§

amount of

§

payment

years

payment

number

rate

in mortgage

Procedure Key

Sequence

Clear calculator and mode

isters; select two decimal

re

places.

Press

2

until

FIN

is

displayed.

Press

not

0 a

displayed.*

until

Begin

Enter mortgage amount.

is

- 0 b

0 c

2

0 a

mortgage

2

K

Calculate interest rate.

Enter interest rate.

rate

I

0 h

Calculate number of payment

periods.

years

0 i

Enter number of payment

periods.

Enter payment amount.

C

payment

M

Enter payment number and

calculate balance.*

number

W

* If payments occur at the beginning of each

month (annuity due), press

Begin

is displayed.

0 a

until

31

Page 32

Common Keystroke Sequences

g

(Cont.)

Loan Amount a Buyer Can Afford

Purpose: To find the maximum loan amount

and selling price a prospective home buyer can

afford, assuming that:

§

The buyer will pay a given percentage of the

selling price as a down payment.

§

An estimated percentage is added to the

monthly payment for taxes and insurance.

§

The total monthly payment (principal,

interest, taxes, and insurance) is not to

exceed a predetermined percentage limit of

the buyer's gross monthly income.

Values You Supply:

§

annual interest

§

number of

§

buyer's gross monthly

§

percent limit

§

percent taxes and Insurance

years

rate

in mortgage

income

(of gross monthly income)

(of total

monthly payment)

§

percent down

(of selling price)

Procedure Key Sequence

Clear calculator and

mode re

isters; select

wo decimal places.

Press

2

until

FIN

isplayed.

is

- 0 b

0 c

2

2

(continued)

32

Page 33

Procedure Key Sequence

g

Press

Begin

0 a

not

is

until

displayed.*

Enter monthly interest

rate.

Calculate and enter

number of monthly

payments.

Calculate and store

maximum monthly

payment.

Calculate and enter

maximum allowable loan

payment (without taxes

r insurance).

0 a

rate

years

0 h I

0 i

C

income

percent limit

n

E

l r

1

percent

p

taxes and

insurance

E

l

0 \ n s

0 P l M

Compute maximum

llowable loan amount.

Calculate house price

(includin

down

payment).

Calculate down payment.

PV

1

1

o

percent

down

E l 0 \

n s K l

o s K l

33

Page 34

Common Keystroke Sequences

g

(Cont.)

Selling Price of a House if Seller Pays

Points and Commission

Purpose: To find the selling price of a house,

assuming that the seller wants to make a

certain profit and that the selling price must

include points and commission.

Values You Supply:

§

original price

§

profit

§

points

§

commission

(dollar amount)

(percentage points)

(dollar amount)

(percentage points)

Procedure Key Sequence

Clear calculator and

mode re

isters; select

wo decimal places.

Press

2

until no

- 0 b

0 c

2

mode indicator is

isplayed.

2

dd original price and

profit to calculate cost

before points are added

n, and enter.

original price

l

profit

R

p

Enter points as a margin.

Compute selling price.

34

points

p

commission

U

1 S

l

Page 35

Error Conditions

When an error condition occurs, the word

“Error” appears in the display. The calculator

will not accept a keyboard entry until you press

-

(Press

or

u

-

pending operations; press

to clear the error condition.

twice to clear the condition and all

u

to clear the

calculator completely.)

General Error Conditions

The error conditions listed below can occur in

any mode. Errors occur when you:

§

Calculate a result that is outside the range

99

-9.999999 x 10

-99

10

§

Divide a number by zero.

§

Calculate

§

Calculate

to 9.999999 x 1099.

0 G

0 4

to -1 x 10

or

0 \

for an old value equal to

99

-

, zero, or 1 x

of zero.

zero.

§

Calculate

0 k, 0 G

, or

0 H

of a

negative number.

§

Use

0 H

to raise zero to the power of

zero.

§

Press a key or key sequence that cannot be

performed in the current mode.

Financial Error Conditions

In the financial mode, errors occur when you:

§

Calculate a financial unknown before you

have entered enough known variables or

when no solution exists.

35

Page 36

Error Conditions

(Continued)

Financial Error Conditions (Continued)

§

Use

0 O

or

0 N

when the number

of compounding periods per year is zero or

very large, or when %i is small.

§

Compute the balance or interest for a

payment number less than zero.

Statistics Error Conditions

In the statistics mode, errors occur when you:

§

Use

that |x| > 1 x 10

to enter a data point (x or y) such

g

50

.

§

Press

0 f

when there are less than two

data points in the statistical registers.

§

Calculate

§

Perform a statistical calculation when there

0 x

with only one data point.

are no data points.

§

Perform a linear regression calculation with

less than two data points.

§

Perform a linear regression calculation on a

vertical line.

§

Enter a series of data values such that the

sum of their squares exceeds the upper or

lower limit of the calculator.

36

Page 37

In Case of Difficulty

g

g

g

If you have difficulty operating the calculator,

you may be able to correct the problem with the

solutions suggested in the table below.

Observation Action

Display is blank;

igits do not

ppear.

The display

durin

a long calculation.

oes blank

Wait for it to finish.

Be sure the solar power

cells are exposed to an

adequate light source.

function does

not seem to

ork.

Be sure the calculator is

set for the correct mode—

profit margin, FIN, or

STAT.

he number of

ecimal digits

hat you expect

is not displayed.

Be sure the display is set

to the correct format—

floating decimal or fixed

decimal.

n error occurs. Check the error conditions

listed on pa

es 35-36.

If you experience difficulties other than those

listed above, press

calculator, and then repeat your calculation.

Review the operating instructions to be sure

that you are performing the calculation

correctly.

u

37

to clear the

Page 38

TI Product Service and Warranty

Information

TI Product and Services Information

For more information about TI products and

services, contact TI by e-mail or visit the TI

calculator home page on the world-wide web.

e-mail address:

internet address:

ti-cares@ti.com

http://www.ti.com/calc

Service and Warranty Information

For information about the length and terms of

the warranty or about product service, refer to

the warranty statement enclosed with this

product or contact your local Texas Instruments

retailer/distributor.

38

Loading...

Loading...