Page 1

Q2 – Robust performance in complicated times

Roland Busch, Deputy CEO

Ralf P. Thomas, CFO

Analyst Call, May 8, 2020

siemens.comUnrestricted © Siemens 2020

Page 2

Unrestricted © Siemens 2020

May 8, 2020Page 2 Q2 FY 2020 Analyst Call

Notes and forward-looking statements

This document contains statements related to our future business and financial performance and future events or developments involving

Siemens that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. We may also make forward-looking

statements in other reports, prospectuses, in presentations, in material delivered to shareholders and in press releases. In addition, our

representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and

certain assumptions of Siemens’ management, of which many are beyond Siemens’ control. These are subject to a number of risks,

uncertainties and factors, including, but not limited to, those described in disclosures, in particular in the chapter Report on expected

developments and associated material opportunities and risks of the Annual Report, and in the Half-year Financial Report, which should be

read in conjunction with the Annual Report. Should one or more of these risks or uncertainties materialize, events of force majeure, such as

pandemics, occur or should underlying expectations including future events occur at a later date or not at all or assumptions prove incorrect,

actual results, performance or achievements of Siemens may (negatively or positively) vary materially from those described explicitly or

implicitly in the relevant forward-looking statement. Siemens neither intends, nor assumes any obligation, to update or revise these forwardlooking statements in light of developments which differ from those anticipated.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or

may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation

or as alternatives to measures of Siemens’ net assets and financial positions or results of operations as presented in accordance with the

applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled

alternative performance measures may calculate them differently.

Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages

may not precisely reflect the absolute figures.

Page 3

Unrestricted © Siemens 2020

May 8, 2020Page 3 Q2 FY 2020 Analyst Call

Our agenda for today

Q2 FY 2020 Financials

Covid-19 impact & Executing Vision 2020+

Page 4

Unrestricted © Siemens 2020

May 8, 2020Page 4 Q2 FY 2020 Analyst Call

Covid-19 update: Operations up and running near normal levels

Successful crisis management – Siemens with proven track record

Covid-19 - Where we are

▪ Priority #1: Employee health & safety

▪ Crisis proven leadership team and highly engaged

employees

▪ Reliable partner with strong balance sheet,

liquidity & rating

Operations up and running near normal levels

▪ Demand highly uncertain

▪ Global supply chains stressed

▪ 24 factory sites closed, mainly in India

▪ ~7.4k employees in short time work

▪ Further cost out initiated

We take social responsibility to fight Covid-19

Covid-19 aid fund

Ramp up ventilator

production in UK

Covid-19 tests

released by

Siemens smart clinic

for Colombia

Page 5

Unrestricted © Siemens 2020

May 8, 2020Page 5 Q2 FY 2020 Analyst Call

Orders

Covid-19 impact not yet fully visible in FY Q2

Revenue IB Adj. EBITA

margin

Indust. ND/EBITDAFree Cash Flow (IB) EPS

-9% -1% 12.1%

€0.80 1.8x

Orders and Revenue growth comparable

€1.1bn

Page 6

Unrestricted © Siemens 2020

May 8, 2020Page 6 Q2 FY 2020 Analyst Call

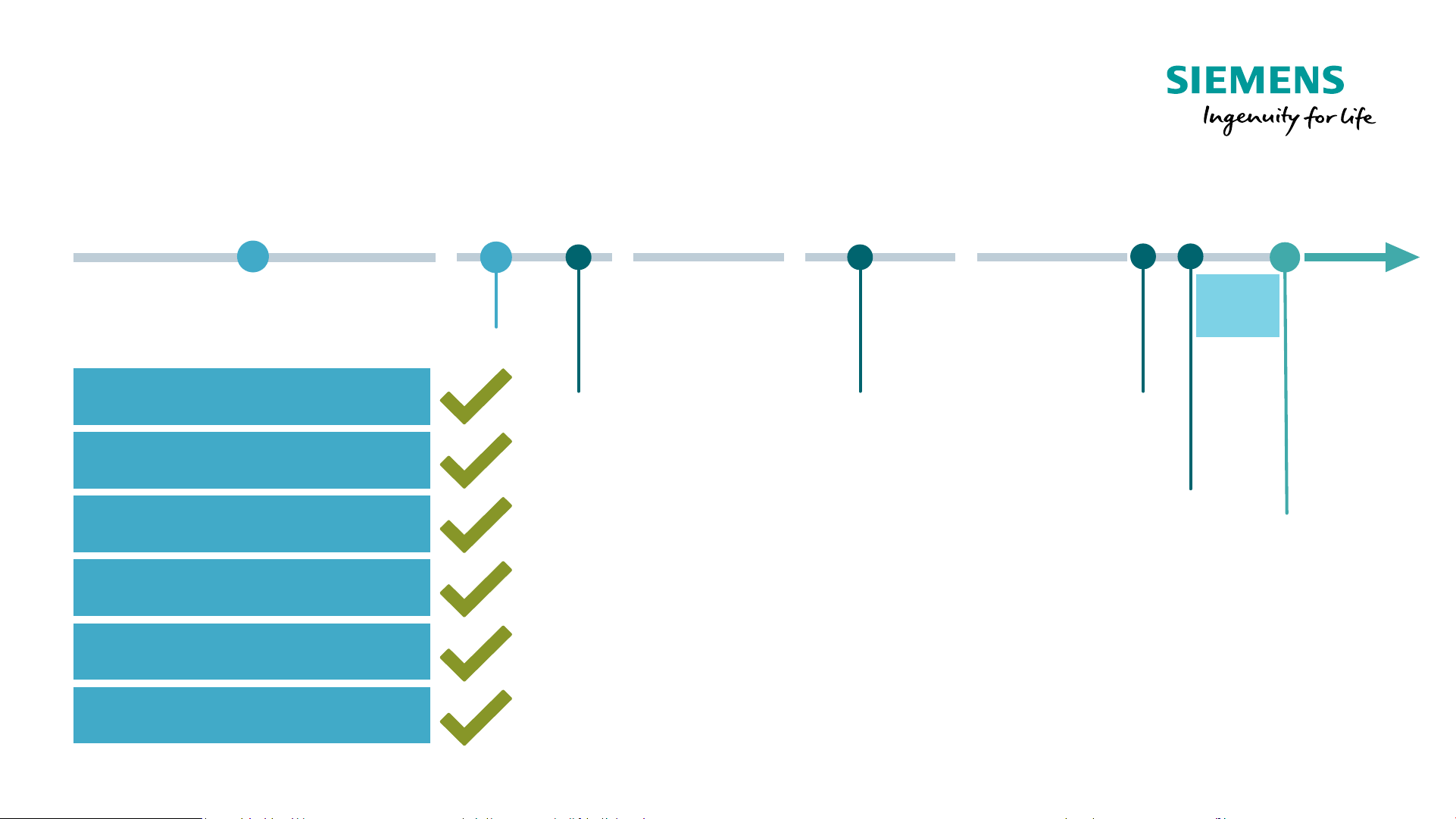

Siemens Energy on track for listing end of September

April

2020

May

2020

June

2020

July

2020

September

2020

Today

Spin-off-

Report

Extraordinary

General Meeting

(Jul 9)

Listing

Brand name announced

Carve-out effective March 31

Road-

show

Portfolio set-up defined

Leadership team in place

Acquisition +8% SGRE stake

Siemens Energy in D/O

March

2020

Carve-out

finalized

August

2020

Prospectus

Capital

Market Day

(Sep 1)

Note: In Q2-20 Siemens booked 3 LGT and 28 small turbines

Page 7

Unrestricted © Siemens 2020

May 8, 2020Page 7 Q2 FY 2020 Analyst Call

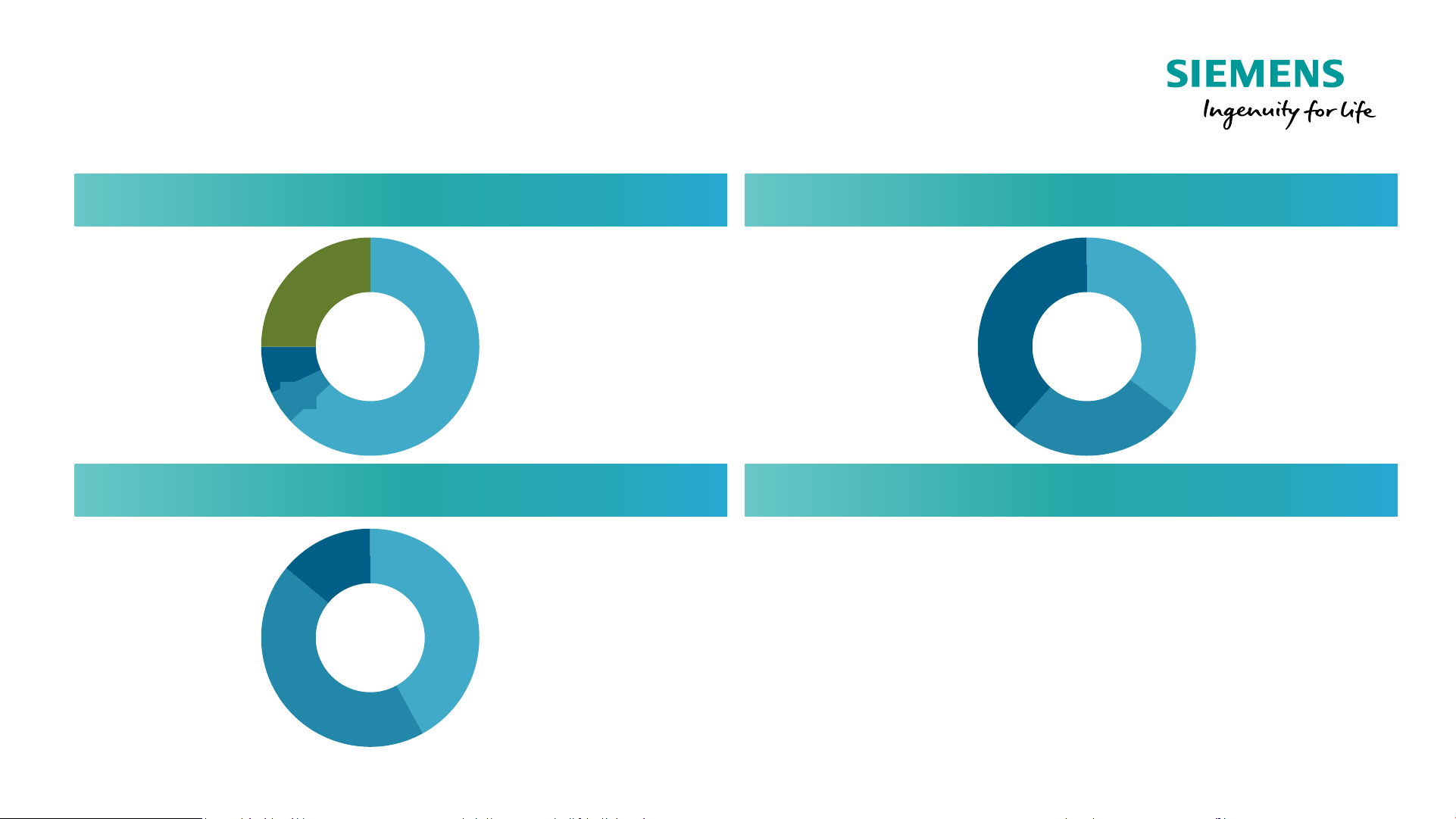

Resilient business portfolio – Ability to weather the storm

Digital Industries – €16.1bn Smart Infrastructure – €14.6bn

Resilient business portfolioMobility – €8.9bn

63%

7%

25%

Solutions

Automation Products

5%

Service

Software

Revenue

FY 2019

35%

26%

38%

Products

Systems & Software

Solutions &

Services

42%

44%

14%

Rolling Stock

Road & Rail

Infrastructure

Service

Revenue

FY 2019

Revenue

FY 2019

▪ Healthy short- and long-cycle business mix

▪ Balanced exposure to customer verticals

▪ Leading digital offerings

▪ Growing service and software share

▪ Strong order backlog

Page 8

Unrestricted © Siemens 2020

May 8, 2020Page 8 Q2 FY 2020 Analyst Call

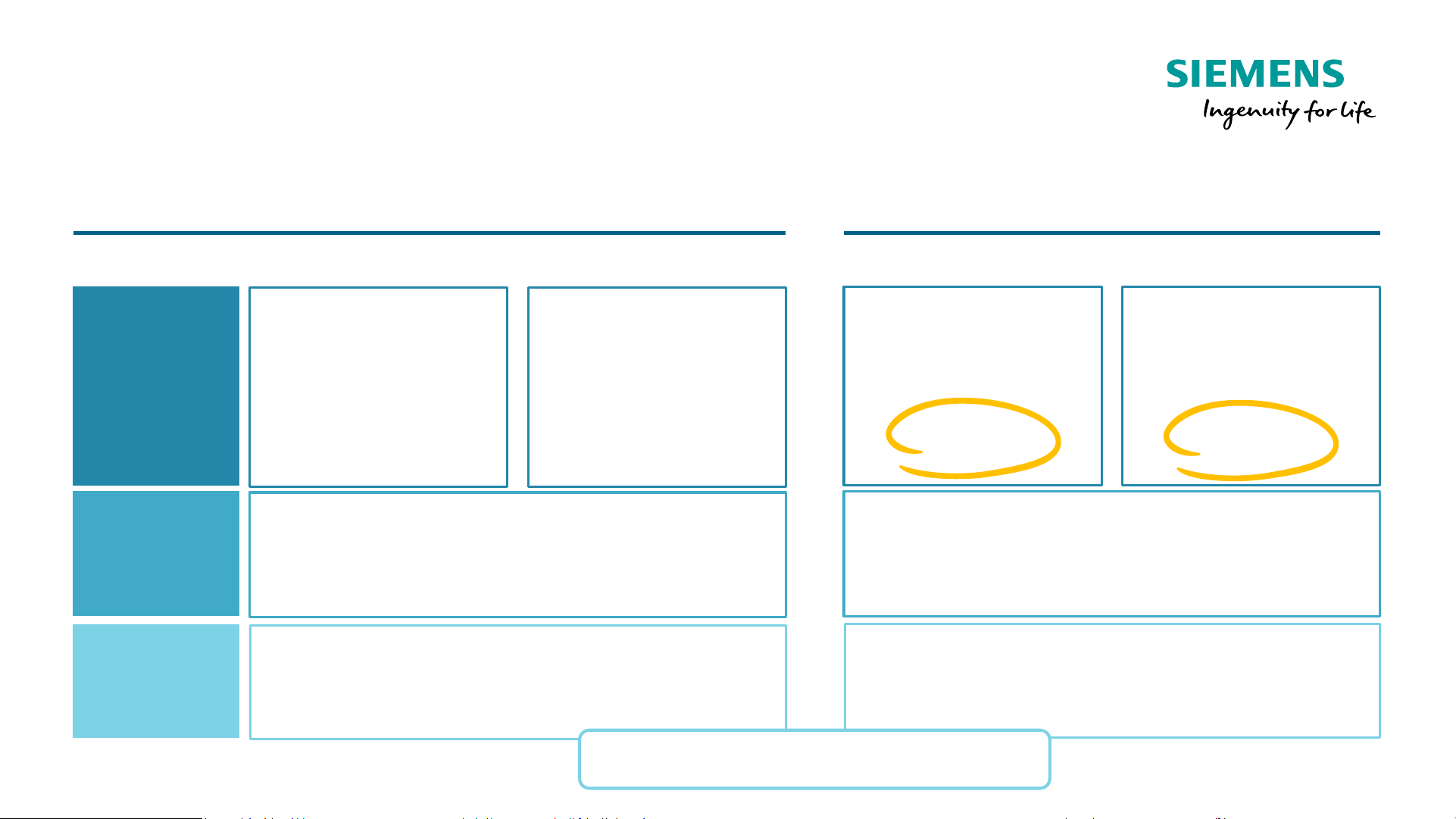

Competitiveness programs accelerated

Contingency cost measures expanded

~ €320m

by FY 2023

~ €160m

by FY 2021

~ €300m

by FY 2023

~ €150m

by FY 2021

Cost

optimization

Operating

Companies

~ €500m by FY 2023

~ €300m by FY 2021

€90m by FY 2021

Digital Industries Smart Infrastructure

Global

Business

Services

Lean and

effective

governance

~ €320m

by FY 2023

~ €295m

by FY 2021

~ €300 m

by FY 2023

~ €180m

by FY 2021

€90m by FY 2021

Digital Industries Smart Infrastructure

CMD 2019 View

Updated View Q2 FY 20

€50m to be delivered by Siemens Energy

~ €500m by FY 2023

~ €300m by FY 2021

Page 9

Unrestricted © Siemens 2020

May 8, 2020Page 9 Q2 FY 2020 Analyst Call

A leading vertically-integrated mobility player and

integral part of Siemens AG

Siemens Mobility

Key figures FY 2019: €12.9bn Orders | €8.9bn Revenue | 11% Adj. EBITA margin | 37k employees | €32bn Backlog (March 31, 2020)

Rail & Road Infrastructure

Customer Services

Turnkey

Rolling Stock

▪ Vertical market with attractive secular growth trends and

profit pool, allowing superior capital efficiency

▪ Covering entire customer value chain with mutually-

reinforcing businesses

▪ Lead digital transformation, benefitting from Siemens IoT

ecosystem and platform

Leading integrated set-up + excellent strategic fit in Siemens

▪ Resilient performance supported by high order backlog

▪ Stringent execution despite customer access restrictions

▪ Delays & shifts of project awards weigh on order growth

▪ Revenue CAGR > 5% | Adj. EBITA-margin mid-term > 11%

▪ ROCE accretive to Siemens target

Strong execution continues despite Covid-19 impact

Page 10

Unrestricted © Siemens 2020

May 8, 2020Page 10 Q2 FY 2020 Analyst Call

Portfolio Companies (POC)

Portfolio Companies:

Stringent execution of strategy – Flender spin-off planned

Siemens Valeo (50%)

Equity

invest.

Large Drives Applications

Siemens Logistics

Mechanical Systems &

Components (Sykatec)

Commercial Vehicles

Wind Energy Generation

Fully

owned

Mechanical Drives (Flender)

1) Siemens Energy Assets (SEA) transferred into POC during Q2 FY20, containing certain remaining regional business activities of Gas and Power,

which were not carved out to Siemens Energy due to country-specific regulatory restrictions or economic considerations

Exit

▪ Integration of Wind

Energy Generation into

Flender planned

▪ Spin-off and listing of

Flender: Decision by SAG

AGM on Feb 3, 2021 –

preparation started

Turnaround

▪ Execute full potential

plans FY19-FY22

▪ Master Covid-19

challenges

▪ Target FY22: >5% Adj.

EBITA

PE / Value creation approach

Turnaround

Exit

Not carved out

Siemens Energy Assets

1)

Primetals (49%)

Ongoing transformation program

H1 FY 20: Revenue: €2.7bn

Adj. EBITA margin: 0.4%

Page 11

Unrestricted © Siemens 2020

May 8, 2020Page 11 Q2 FY 2020 Analyst Call

Digital Industries (DI)

Holding up in Q2, further decline expected in Q3 FY 20

1.0

Q2 FY 19

3.0

Q2 FY 20

1.0

4.1

3.7

2.7

-10%¹

)

Q2 FY 19 Q2 FY 20

4.1

4.2

+2%¹

)

€m

therein Software

Q2 FY 19 Q2 FY 20

-230bps

15.9%

18.7% 16.9%

17-23%

18.2%

633

652

Q2 FY 19 Q2 FY 20

+3%

0.86 1.11

¹) Comparable

Adj. EBITA margin excl. severance

x.x%

Cash Conversion Rate

x.x

Orders:

Up on safety stocking & larger

contract wins

Revenue:

Short cycle significantly down

Software moderately lower

Free cash flow:

Effective working capital

management

Margin:

Holding up, stringent execution

of cost measures

Orders Revenue

Adj. EBITA Margin Free Cash Flow

€bn

Page 12

Unrestricted © Siemens 2020

May 8, 2020Page 12 Q2 FY 2020 Analyst Call

Covid-19 putting additional headwinds on challenging economic

environment

DI revenue share in vertical end markets

Q2 FY 2020 - Key regions Automation (excl. Software)

1) Y-o-Y industry revenue development

As of Q1/20

Trend next 3-4 quarters

1)

As of Q2/20

2)

Automotive

20%

Machine Tools

15%

Food & Beverage

10%

Pharma & Chemicals

10%

Aerospace & Defense

5%

Electronics &

Semiconductors

10%

Q2 FY 2020 - Software

Revenue -3% on tough comps

FY 2020e modest growth vs PY

Orders +1% | Revenue -13%

Covid-19 intensifying headwinds for

Machinery & Automotive

Orders -2% | Revenue -9%

Q2 heavily impacted from Covid-19 shutdown

Orders +10% | Revenue -18%

Q2 impacted by lockdown measures to fight Covid-19

March with growth momentum due to restart of production

Orders +1% | Revenue -13%

Discrete & Process Automation down

Limited Covid-19 impact in Q2

Note: Orders and revenue growth comparable; Regional data based on volume 3rdparty by customer location

2) Q3 FY 20 weak development in nearly all industries

Page 13

Unrestricted © Siemens 2020

May 8, 2020Page 13 Q2 FY 2020 Analyst Call

Smart Infrastructure (SI)

Stringent implementation of competitiveness program

Q2 FY 20Q2 FY 19

1.3

2.2

1.3

2.2

3.5

3.5

-1%

1)

Q2 FY 19 Q2 FY 20

3.8

3.9

-3%¹

)

therein Products

Q2 FY 19 Q2 FY 20

-510bps

5.2%

10.6%

8.2%

10-15%

10.3%

366

280

Q2 FY 20Q2 FY 19

-23%

1.01

1.52

Orders:

Negative impact, mainly in

solutions & services

Revenue:

Product business down in

short-cycle industries

Margin:

Severance (300bps) & grid edge

investments continuing

¹) Comparable

Adj. EBITA margin excl. severance

x.x%

Cash Conversion Rate

x.x

Orders Revenue

Adj. EBITA Margin Free Cash Flow

Free cash flow:

Stringent working capital

management in difficult

environment

€m

€bn

Page 14

Unrestricted © Siemens 2020

May 8, 2020Page 14 Q2 FY 2020 Analyst Call

Siemens Mobility (MO)

Resilient performance despite Covid-19 headwinds

Q2 FY 19 Q2 FY 20

2.3

2.1

+6%¹

)

3.5

2.4

Q2 FY 19 Q2 FY 20

-32%¹

)

€bn

Q2 FY 20Q2 FY 19

-150bps

9.3%

11.1% 9.5%

9-12%

10.8%

147

-80

Q2 FY 19 Q2 FY 20

n/m

0.64

-0.38

Orders:

Down on tough comps due to

large orders in prior year

Revenue:

Growth on ramp up of large

projects

Free cash flow:

As expected, less payments on

unfavorable milestone timing

and lower orders

¹) Comparable

Adj. EBITA margin excl. severance

x.x%

Cash Conversion Rate

x.x

Orders Revenue

Adj. EBITA Margin Free Cash Flow

Margin:

Strong profitability continuing

€m

Page 15

Unrestricted © Siemens 2020

May 8, 2020Page 15 Q2 FY 2020 Analyst Call

Q2 FY 2020 - Below Industrial Businesses

Performance Q2 FY 2020

€m

therein:

-€67m Pensions

-€78m Corp. Items

Minorities

€44m

Tax Rate

@ 23.0%

652

93

34

SRE

-65

Elim., Corp.

Treasury,

Others

-302

-317

Tax

-8

IB Inc. Cont.

Ops

Net IncomeSFS POC Corp. Items,

Pensions

-146

-185

PPA

1,592

1,014

697

Disc. Ops.

Page 16

Unrestricted © Siemens 2020

May 8, 2020Page 16 Q2 FY 2020 Analyst Call

SFS with strong track record and highly diversified portfolio

▪ Focus on Siemens domains - combine financial and industrial

expertise

▪ Well diversified portfolio with a strong regional footprint in North

America and Europe

▪ Risk management culture at strict arms-length

▪ “Hold to maturity” investor – no credit trading

▪ Matched funding approach limiting risks

31%

62%

7%

Commercial

Finance

Project &

Structured Debt

Equity Business & Other

IBIT

1)

(in €m)

Total

assets

(in €bn)

286

304

1) IBIT = Income before income taxes; 2) Exposure according to split of total assets by Q2 FY20; 3) Allocation of the business to the Siemens business areas

based on the categorization by industry according to ISIC codes

Key figures

Industry diversification

3)

Consistent execution of strategy

Product diversification

2)

653

632

305

11.3

FY08

11.7

FY09 FY18

28.3

29.9

30.1

FY19 FY20 H1

41%

15%

17%

16%

11%

Siemens Core

(SI, DI, MO)

Healthineers

Siemens

Gamesa

Gas and Power

Other (IoT, PoC)

Page 17

Unrestricted © Siemens 2020

May 8, 2020Page 17 Q2 FY 2020 Analyst Call

Strong balance sheet, access to liquidity secured

▪ Strong credit rating: A1 (Moodys), A+ (S&P)

▪ €5bn equivalent bond issuance executed in

February at highly attractive terms

▪ New €3bn undrawn credit facility, adding to

existing €7.5bn undrawn credit lines

▪ US Commercial Paper market substantially

improved, further source for liquidity under

existing US$9bn program

▪ US$1.4bn maturities in remainder of FY 2020

7.8

10.5

Available funds

3.3

Cash &

cash

equivalents

Available Net

Liquidity

1)

3.6

Short-term debt

Committed

credit lines

18.3

11.4

Commercial

Paper

Other

in €bn

Strong liquidity position (March 31, 2020) Liquidity actively managed

Note: excluding Discontinued Operations Energy 1) excludes current interest bearing debt securities of €1.3bn

Page 18

Unrestricted © Siemens 2020

May 8, 2020Page 18 Q2 FY 2020 Analyst Call

FY 2020: Top line guidance revised, EPS guidance suspended

▪ Book-to-bill > 1

AssumptionsFY 2020 Siemens Group

Revenue

FY 2019

58.5

▪ COVID-19 pandemic began to impact financial results in FY Q2

▪ Expect even stronger impacts from pandemic in FY Q3

▪ Beyond FY Q3, macroeconomic developments and influence on

Siemens cannot be reliably assessed – original guidance for FY 2020

no longer confirmed

▪ Expect FY 2020 moderate comparable revenue decline, with b-t-b >1.

Decline in demand most strongly affects DI and SI.

▪ Completion of spin-off and public listing of Siemens Energy before

end of FY 2020

▪ Expect spin-off gain within D/O, amount cannot yet be reliably forecast

▪ Expect material impacts on Net income from spin-off costs and tax

expenses related to carve-out of Siemens Energy

▪ Guidance Basic EPS from Net income for FY 2020 suspended

▪ Moderate

comparable

revenue decline

1) Comparable revenue reflecting reclassification of Gas & Power &

Siemens Gamesa Renewable Energy to Discontinued Operations

in €bn

1)

Page 19

Unrestricted © Siemens 2020

May 8, 2020Page 19 Q2 FY 2020 Analyst Call

Appendix

Page 20

Unrestricted © Siemens 2020

May 8, 2020Page 20 Q2 FY 2020 Analyst Call

DI: Covid-19 putting heavy headwinds on end markets

Cost-out accelerated, contingency measures intensified

Current situation Key mitigating actions

▪ Decline in key customer industries intensified in

March, full impact in FY Q3 expected

▪ China in recovery, US & Europe still to see worse

▪ Key factories run close to normal capacity levels

▪ Daily review of SCM activities to ensure

availability of components & transportation

▪ SW-Development centers impacted by local

shutdowns in U.S. and India

▪ Best practice sharing with China to bring back

white collar employees

160

160

280

CMD May 2019

25

Q2 2020 view

320

15

320

Until FY 23

FY 19

Until FY 21

▪ Accelerate digitalization (commissioning, service)

▪ Short-time-work implemented across all businesses

▪ Flexible time frames to reduce overtime & capacity

▪ Cutbacks in discretionary spending

▪ Capex – Re-prioritization of projects

▪ Close management of receivables & payment terms

in €m

Acceleration of cost optimization program

Contingency measures intensified

1

2

Page 21

Unrestricted © Siemens 2020

May 8, 2020Page 21 Q2 FY 2020 Analyst Call

SI: Competitiveness program accelerated

Execution of Vision 2020+ on track

Current situation Key mitigating actions

▪ Short-time work & mandatory paid time off

▪ Cost cutting measures, e.g. delay of events and of

non-critical IT-projects

▪ Securing customer & ensuring supplier payments

▪ Prioritize planned Capex spending

▪ Heterogeneous development in vertical markets

Healthcare, critical infrastructure

Hospitality, education

▪ Countries with different dynamics

China recovering, U.S. and Europe challenging

▪ Out of 70 factories, 8 closed, mainly in India

▪ Solutions: Many customer sites closed, expect strong

negative Q3 impact

▪ Service: Promotion of new, remote & digital services

▪ Products/Systems: Order decline becomes visible

Competitiveness program enhanced & accelerated

200

280

200

160

440

CMD May 2019 Q2 2020 view

400

Until FY 23

Until FY 21

1

2

Additional contingency measures

–

+

Therein

business mix

€100m

€140m

Page 22

Unrestricted © Siemens 2020

May 8, 2020Page 22 Q2 FY 2020 Analyst Call

Siemens Mobility – a valid contributor to Siemens’ aspirations

Revenue

Growth

▪ Resilient market with >3% growth

supported by megatrends

▪ Enhancing growth momentum:

metro, digitalization, service, growth regions

Adj. EBITA

Margin

ROCE

4% CAGR

over last 5 years

> 5%

> 11%

11-15%

Accretive to Siemens target 15-20%

▪ Portfolio shift to higher margin &

recurring revenue business:

components, products, platforms, digital

services, signalling in the cloud

▪ Selective margin accretive portfolio

moves

▪ Digitalization in own operations

4 - 5%

~15%

10-15%

5-10%

<5%

FY 2019

FY 2009

~6%

11%

Mobility achievements

Mobility mid-term ambition

Siemens mid-term

Profitability of portfolio

Accretive to Siemens target

Page 23

Unrestricted © Siemens 2020

May 8, 2020Page 23 Q2 FY 2020 Analyst Call

Net Debt

Q1 2020

∆ Working Capital

15.5

1.2

-7.2

Net Debt

adjustments

Net Debt

Q2 2020

-0.2

-1.1

Cash flows from

investing activities

Financing and

other topics

19.1

Ind. Net Debt

Q2 2020

27.4 34.6

Q2 ΔQ1

• SFS Debt +26.3 +0.4

• Post emp. Benefits -7.5 +1.1

• Credit guarantees -0.5 +0.0

• Fair value adj. +0.8 +0.2

(hedge accounting)

Ind. Net Debt/

EBITDA (c/o)

1.8x

(Q1 FY20: 1.1x)

Cash &

cash equiv.

€12.7

1)

Cash &

cash equiv.

€9.1bn

2)

Operating Activities

Q2 FY 2020

Net debt bridge

in €bn

therein a.o.:

• Dividend paid -3.2

• Cash flows from d/o -1.6

‒ SGRE stake (Iberdrola) -1.1

‒ Free Cash Flow -0.6

• Interest paid -0.3

• Share buyback -0.9

• FX reval. Net Debt -0.4

Cash flows from

operating activities

(w/o ∆ working capital)

therein a.o.:

• Capex -0.3

• SFS -0.6

1) Sum Cash & cash equivalents of €11.4bn and current interest bearing debt securities of €1.4bn

2) Sum Cash & cash equivalents of €7.8bn and current interest bearing debt securities of €1.3bn

Page 24

Unrestricted © Siemens 2020

May 8, 2020Page 24 Q2 FY 2020 Analyst Call

Provisions decreased in Q2 mainly due to increased discount rate and

D/O of Siemens Energy, partially offset by actual return on plan assets

Q2 FY 2020 – Pensions and similar obligations

1) All figures are reported on a continuing basis

2) Difference between DBO and fair value of plan assets additionally resulted in net defined benefit assets (Q2 2020: +€0.8bn); defined benefit obligation

(DBO), including other post-employment benefit plans (OPEB) of -€0.4bn

in €bn¹

FY 2018 FY 2019

Q1 FY

2020

Q2 FY 2020

D/O

S’ Energy

Defined benefit obligation (DBO)²

-35.9 -40.3 -39.2 -33.4 -3.1

Fair value of plan assets²

28.7 31.3 31.2 26.7 2.2

Provisions for pensions and similar obligations

-7.7 -9.9 -8.6 -7.5 -1.0

Discount rate

2.4% 1.3% 1.5% 1.8%

Interest income

0.5 0.6 0.1 0.1

Actual return on plan assets

0.4 3.2 -0.5 -1.6

Page 25

Unrestricted © Siemens 2020

May 8, 2020Page 25 Q2 FY 2020 Analyst Call

Q2 FY20 Profit Bridge from SHS disclosure to SAG disclosure

Different profit definitions at SHS and SAG to be considered in models

659

612

42

EBIT

(adjusted)

-1

PPA effects

600

Transaction

Cost (M&A)

-17

Severance EBIT

(as reported)

-42

PPA effects

0

Financial

Income

Severance

-30

17

629

in €m

Margin

x.x%

17.9%

16.3%

16.6%

17.1%

disclosure (as of May 8, 2020) disclosure (as of May 5, 2020)

Adj. EBITA

(excl. severance)

Consolidation

and accounting

differences

Adj. EBITA

(as reported)

Page 26

Unrestricted © Siemens 2020

May 8, 2020Page 26 Q2 FY 2020 Analyst Call

Financial calendar

Jul 9, 2020

Extraordinary

AGM

investorrelations@siemens.com

www.siemens.com/investor

+49 89 636-32474

May 8, 2020

Q2 Release

Aug 6, 2020

Q3 Release

Nov 12, 2020

Q4 Release

Jun 12, 2020

JPM Conference

virtual

Sep 10, 2020

MS Conference

London

Sep 1, 2020

CMD Siemens

Energy

Loading...

Loading...