Page 1

Clearing

Release 4.6B

™

HELP.FIBP

Page 2

Clearing SAP AG

Copyright

©

Copyright 2000 SAP AG. All rights reserved.

No part of this brochure may be reproduced or transmitted in any form or for any purpose without

the express permission of SAP AG. The information contained herein may be changed without

prior notice.

Some software products marketed by SAP AG and its distributors contain proprietary software

components of other software vendors.

®

Microsoft

Microsoft Corporation.

IBM

AS/400

ORACLE

INFORMIX

Informix Software Incorporated.

, WINDOWS®, NT®, EXCEL®, Word® and SQL Server® are registered trademarks of

®

, DB2®, OS/2®, DB2/6000®, Parallel Sysplex®, MVS/ESA®, RS/6000®, AIX®, S/390®,

®

, OS/390®, and OS/400® are registered trademarks of IBM Corporation.

®

is a registered trademark of ORACLE Corporation, California, USA.

®

-OnLine for SAP and Informix® Dynamic ServerTM are registered trademarks of

®

, X/Open®, OSF/1®, and Motif® are registered trademarks of The Open Group.

UNIX

®

HTML, DHTML, XML, XHTML are trademarks or registered trademarks of W3C

, World Wide

Web Consortium, Laboratory for Computer Science NE43-358, Massachusetts Institute of

Technology, 545 Technology Square, Cambridge, MA 02139.

®

is a registered trademark of Sun Microsystems, Inc. , 901 San Antonio Road, Palo Alto,

JAVA

CA 94303 USA.

®

JAVASCRIPT

is a registered trademark of Sun Microsystems, Inc., used under license for

technology invented and implemented by Netscape.

SAP, SAP Logo, mySAP.com, mySAP.com Marketplace, mySAP.com Workplace, mySAP.com

Business Scenarios, mySAP.com Application Hosting, WebFlow, R/2, R/3, RIVA, ABAP, SAP

Business Workflow, SAP EarlyWatch, SAP ArchiveLink, BAPI, SAPPHIRE, Management

Cockpit, SEM, are trademarks or registered trademarks of SAP AG in Germany and in several

other countries all over the world. All other products mentioned are trademarks or registered

trademarks of their respective companies.

2 December 1999

Page 3

SAP AG Clearing

Icons

Icon Meaning

Caution

Example

Note

Recommendation

Syntax

Tip

December 1999 3

Page 4

Clearing SAP AG

Contents

Clearing ...............................................................................................................6

The Clearing Program ................................................................................................................... 7

Introduction to the Clearing Program.......................................................................................... 8

Prerequisites for Clearing............................................................................................................. 9

Open Item Management........................................................................................................... 10

Criteria for Grouping Open Items ............................................................................................. 11

Items That Are Not Cleared......................................................................................................12

Parameters for Running the Program ....................................................................................... 13

Running the Clearing Program .................................................................................................. 14

Generating a Line Item List and Additional Log....................................................................... 15

Clearing Transactions ................................................................................................................. 16

The Basic Principles for Clearing Transactions....................................................................... 17

Account Clearing ...................................................................................................................... 19

Posting with Clearing................................................................................................................ 21

Clearing Transactions ................................................................................................................. 24

Self-Defined Clearing Transactions.......................................................................................... 25

Transactions for Posting with Clearing..................................................................................... 26

Transaction for Account Clearing ............................................................................................. 30

Defining and Maintaining Clearing Transactions...................................................................... 32

Payment Differences ................................................................................................................... 33

Differences Within Tolerance Limits......................................................................................... 35

Differences Outside Tolerance Limits ...................................................................................... 37

Reason Codes.......................................................................................................................... 38

Automatic Postings for Clearing Transactions ........................................................................ 39

Gains or Losses from Payment Differences............................................................................. 40

Bank Charges and Bank Posting ............................................................................................. 41

Cross-Company Code Clearing ................................................................................................. 42

Prerequisites for Cross-Company Code Clearing .................................................................... 44

Bank Subaccounts ...................................................................................................................... 45

Example: Posting a Check Received ....................................................................................... 46

Prerequisites for Using Bank Subaccounts .............................................................................. 47

Specifications for Processing Open Items ............................................................................... 48

Fields for the Selection, Search and Sort Functions ................................................................ 50

Standard Sort Sequence ..........................................................................................................51

Line Layout of Open Item Processing ...................................................................................... 52

Clearing Open Items.................................................................................................................... 55

Introduction to Clearing Open Items ......................................................................................... 56

Clearing Functions in Accounts Payable.................................................................................. 57

Clearing Functions in Accounts Receivable............................................................................. 58

Clearing Functions in the General Ledger................................................................................ 59

Posting and Clearing................................................................................................................... 60

The Clearing Process .................................................................................................................. 61

Entering the Document Header for Clearing Transactions ...................................................... 62

Entering the Line Items ............................................................................................................ 63

Selecting Open Items ............................................................................................................... 64

4 December 1999

Page 5

SAP AG Clearing

Choosing Specific Items for Clearing ....................................................................................... 66

Clearing Between a Customer and Vendor.............................................................................. 67

Processing Open Items ............................................................................................................ 68

Processing Open Items with Commands ............................................................................ 69

Processing Open Items with Menus or Function Keys ....................................................... 70

Processing Open Items with the Mouse.............................................................................. 71

Setting Editing Options for Open Item Processing.............................................................. 72

Functions for Open Item Processing ........................................................................................ 73

Changing the Line Layout in Open Item Processing........................................................... 74

Searching for Open Items ................................................................................................... 75

Searching for a Specific Amount......................................................................................... 76

Processing Open Items as per Payment Advice Note ........................................................ 77

Distributing the Clearing Amount by Age ............................................................................ 79

Sorting Open Items ............................................................................................................. 80

Switching Between Gross and Net Amount ........................................................................ 81

Switching Between Foreign and Local Currency ................................................................ 82

Posting Partial Payments: Customers and Vendors ........................................................... 83

Posting Residual Items ....................................................................................................... 84

Displaying Open Items ............................................................................................................. 85

Explaining Differences.............................................................................................................. 86

Noting Open Items as Payment Advice Notes: Customers and Vendors ................................ 87

Correcting Errors ...................................................................................................................... 88

Clearing Between Company Codes ........................................................................................... 89

Clearing Open Items in Foreign Currency ................................................................................ 90

Clearing Mixed Currency Open Items in the Local Currency ................................................... 92

System Translates All Amounts to Local Currency During Clearing................................... 93

System Uses Historical Values in Local Currency During Clearing.................................... 94

Clearing Open Items with a Future Posting Date ..................................................................... 95

Outgoing Payments with Printed Forms: Customers and Vendors ....................................... 96

Clearing Open Items and Printing the Forms: Customers and Vendors.................................. 97

Printing Forms for Items Already Cleared: Customers and Vendors ....................................... 98

Clearing an Account.................................................................................................................... 99

Resetting Clearing ..................................................................................................................... 100

Clearing Open Items in Release 4.0 ......................................................................................... 101

December 1999 5

Page 6

Clearing SAP AG

Clearing

Clearing

The Clearing Program [Page 7]

This section introduces you to the clearing process in the R/3 System and explains how to

automatically clear open items using the clearing program.

Clearing Procedure [Page 16]

This section explains the requirements that need to be fulfilled in order to clear open items in the

R/3 System.

Clearing Open Items [Page 55]

This section describes the process of clearing open items using the Post with Clearing function.

Clearing 4.0 [Page 101]

This section describes the new functions for clearing open items in Release 4.0.

6 December 1999

Page 7

SAP AG Clearing

The Clearing Program

The Clearing Program

Open items on an account can be cleared manually using the Account clearing function, or they

can be cleared automatically by the system. Automatic clearing is especially useful for clearing

accounts in the general ledger.

This section describes:

• The prerequisites for automatic clearing

• How to clear accounts automatically.

Introduction to the Clearing Program [Page 8]

Prerequisites for Clearing [Page 9]

Executing the Clearing Program

Parameters for Running the Program [Page 13]

Running the Clearing Program [Page 14]

Reviewing the Clearing Results

Generating a Line Item List and Additional Log [Page 15]

December 1999 7

Page 8

Clearing SAP AG

Introduction to the Clearing Program

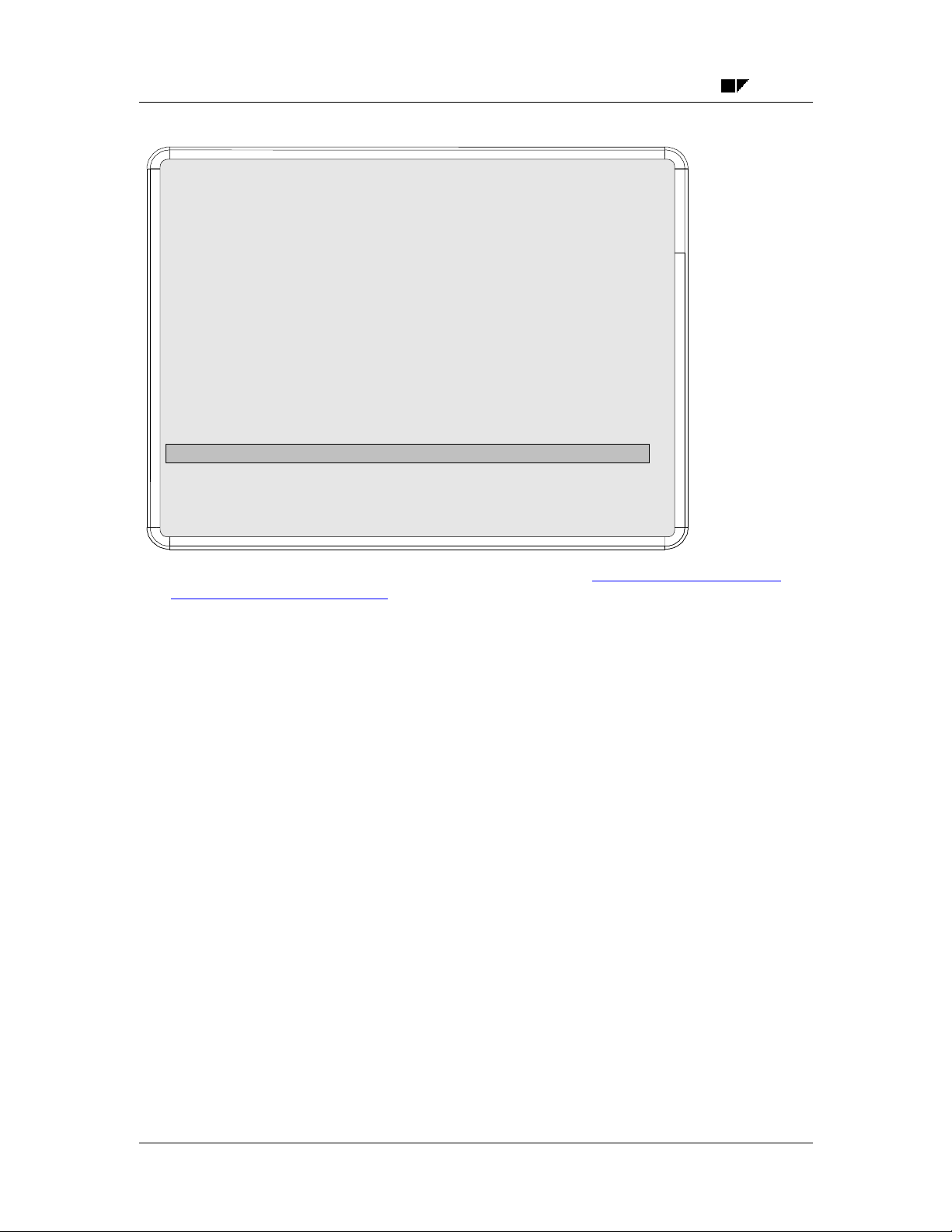

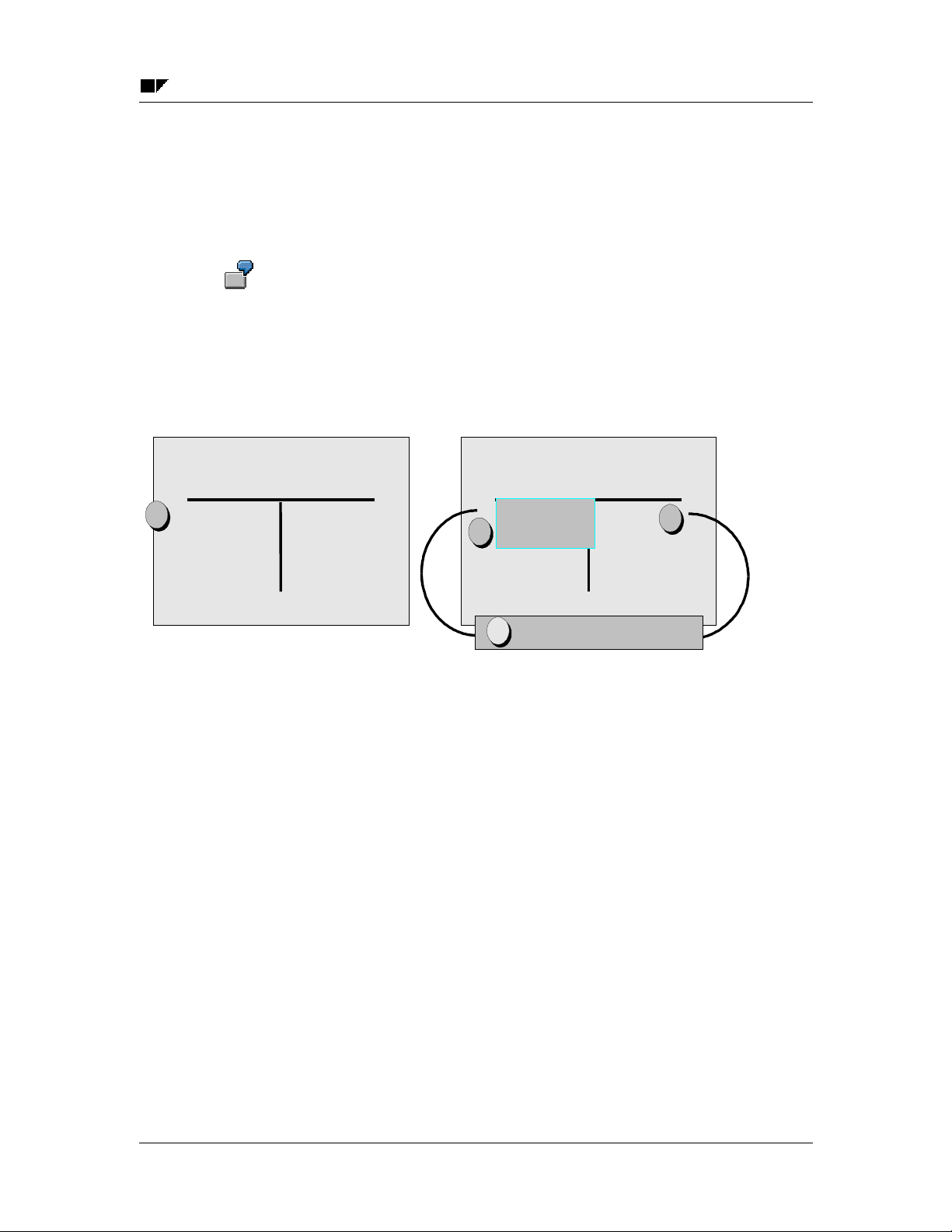

Introduction to the Clearing Program

You can use the clearing program to clear open items from customer, vendor, and G/L accounts.

This program uses predefined criteria to group together open items per account. If the balance of

the group of open items equals zero in local, foreign, and where applicable, the parallel currency,

the items are marked as cleared.

Customer

2,000

3,000

can be cleared

During clearing, the program enters a clearing document number and a clearing date in the line

items. It uses the document number and posting date from the most recent document with the

highest document number that is part of the clearing process.

5,000

The program groups together those items from an account that have the same:

• Business area

• Trading partner ID

• Reconciliation account number

• Currency in which the general ledger is updated

• Up to four criteria that you define

You can specify criteria for each account type based on a single account or an interval of

accounts. You use these criteria to restrict the number of items that are considered together. This

ensures that only those items that are based on a specific business transaction are cleared

together.

You want to clear the open items in the GR/IR clearing account automatically. In

addition to the criteria predefined by the system, you set a criteria for the purchase

order number. This criteria ensures that only goods receipt items and invoice items

that belong to each other are cleared together.

8 December 1999

Page 9

SAP AG Clearing

Prerequisites for Clearing

Prerequisites for Clearing

The following prerequisites must be met in order for open items to be cleared:

• The accounts must be managed on an open item basis.

• The accounts that can be cleared automatically must be defined in Customizing for Financial

Accounting.

• The items to be cleared cannot trigger a posting, for example, cash discounts or exchange

rate differences.

• The items cannot be special G/L transactions. These items are cleared with special

functions. For more information about special G/L transactions, see Special G/L

Transactions: Down Payments and Guarantees [Ext.]

See also:

Open Item Management [Page 10]

Criteria for Grouping Open Items [Page 11]

Items That Are Not Cleared [Page 12]

December 1999 9

Page 10

Clearing SAP AG

Open Item Management

Open Item Management

The basic prerequisite for automatic clearing is that the accounts must be kept on an open item

basis. Customer and vendor accounts are always managed in this way. This allows you to

monitor your outstanding receivables and payables at any time. The open item management

option, however, must be defined for general ledger accounts. You would set this option, for

example, for clearing accounts and bank subaccounts in order to be able to track whether the

business transactions posted to these accounts are closed yet.

Open item management ensures that all items that have not yet been cleared are available in the

system. A document can only be archived after all open items in a document have been cleared.

10 December 1999

Page 11

SAP AG Clearing

Criteria for Grouping Open Items

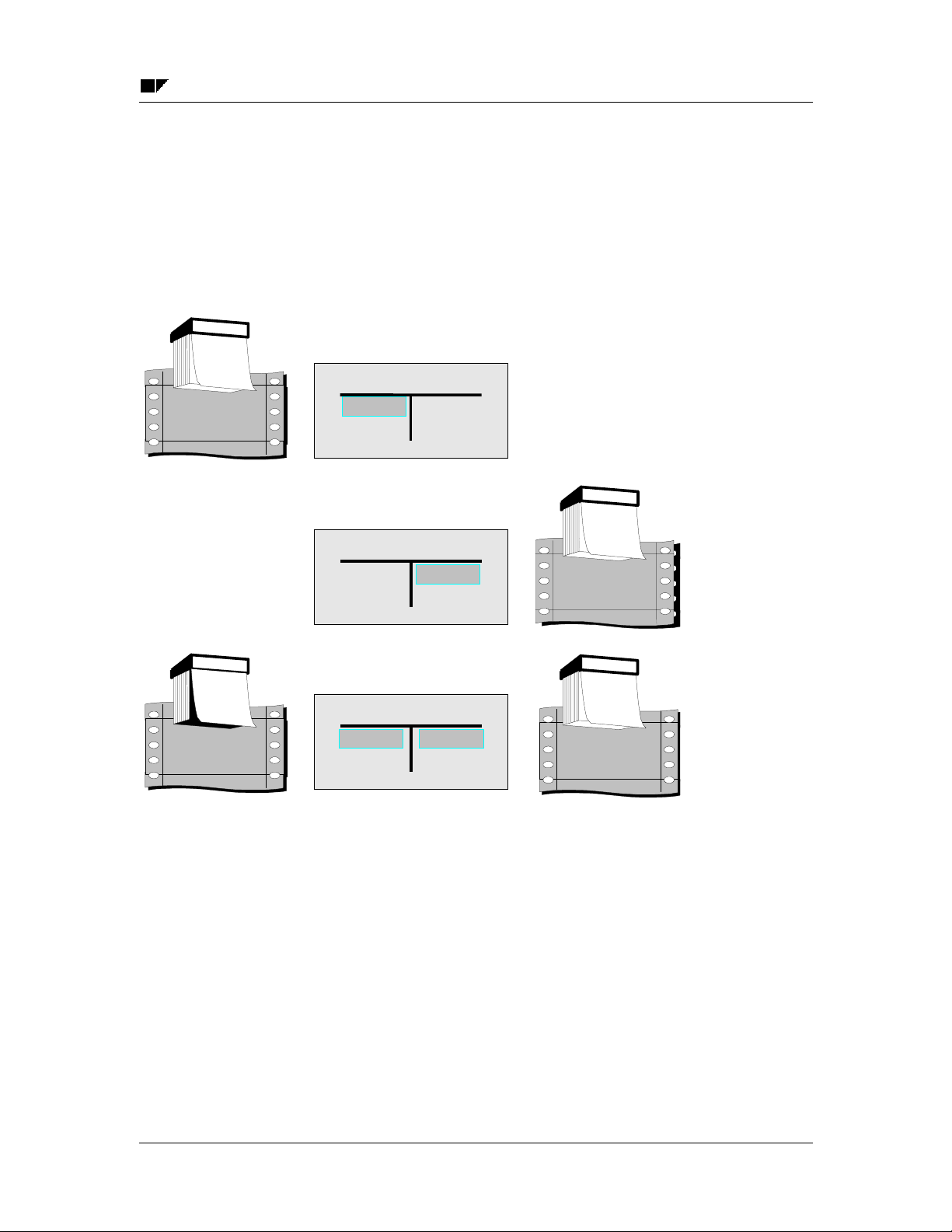

Criteria for Grouping Open Items

In addition to the criteria predefined by the system, you can define up to four other criteria to

group together open items for clearing. To do this, enter the following when configuring the

clearing program:

• Account type

• An account number or a number interval

• Two additional criteria

Acct. type

S

. . .

Acct. no.1 Acct. no.2

191000 191100 EBELN

Crit 1

. . .. . .. . .

Crit 2 Crit 3 Crit 4

Fields from tables BSEG or BKPF can be entered as criteria. If possible, you should select fields

so that they will also be contained in tables BSIS (G/L accounts), BSID (customer accounts), or

BSIK (vendor accounts).

December 1999 11

Page 12

Clearing SAP AG

Items That Are Not Cleared

Items That Are Not Cleared

The program does not clear special G/L transactions or post any new documents. It therefore

does not clear items if additional postings would be required.

You posted a vendor invoice. This item could be cleared with a credit memo. At the

time of clearing, cash discount would have to be posted. Therefore, the clearing

program cannot clear the item.

Items that require an additional posting are:

• Items that contain cash discount. Cash discount would have to be posted for these items.

• Items that were posted using the net procedure. Cash discount clearing would have to be

posted for these items.

• Items that would require a withholding tax posting.

A posting would also be required if the items balance to zero in document currency, but not in the

local currency or parallel currency (group or global company currency, and so on). Clearing could

not be carried out in this case either.

12 December 1999

Page 13

SAP AG Clearing

Parameters for Running the Program

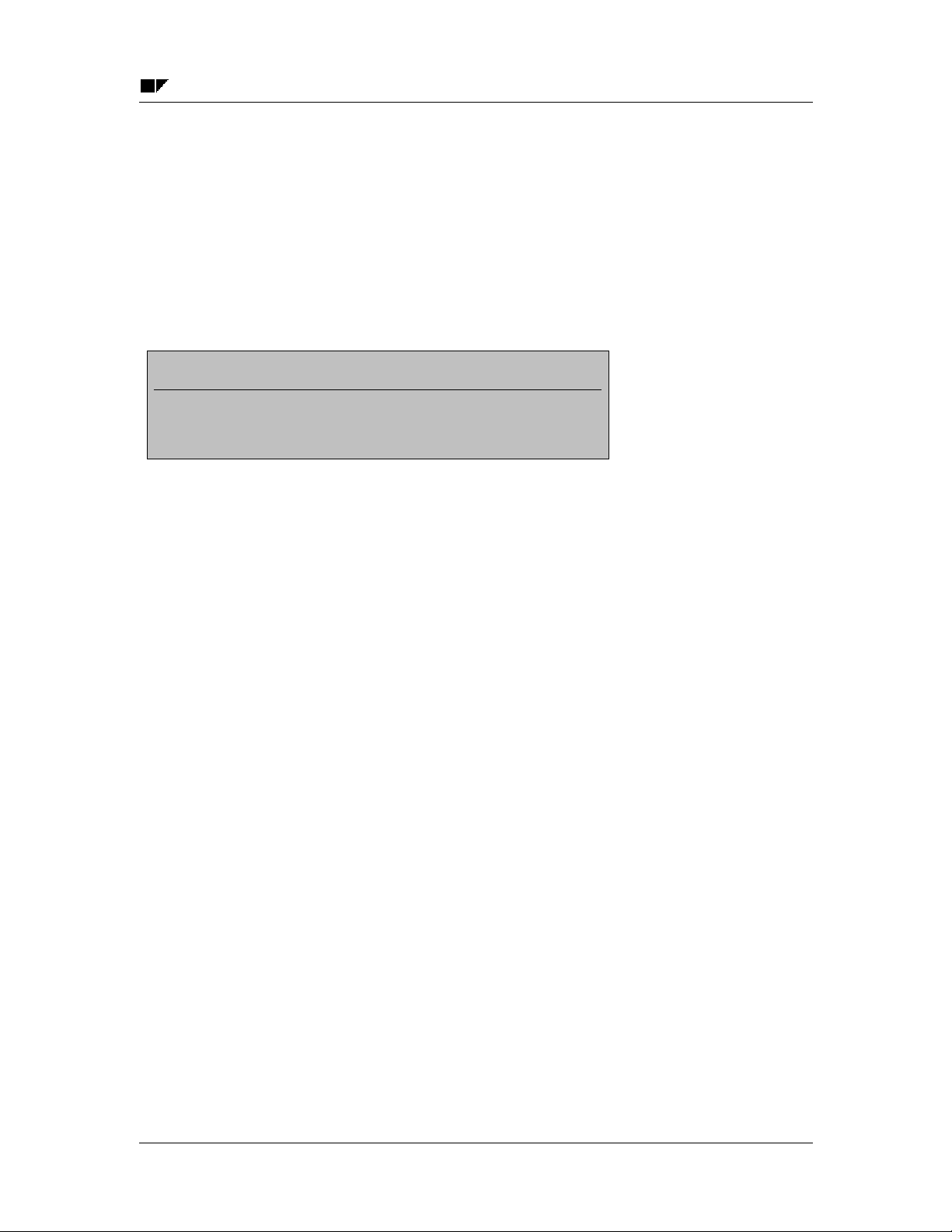

Parameters for Running the Program

For the program run, you specify in which company codes which accounts should be cleared.

You can specify individual accounts or intervals of account numbers. You can restrict the

selection of open items even more by specifying a fiscal year.

If you do not enter any parameters, the entire dataset is selected. You should

therefore always specify company codes and accounts.

To avoid having to enter the parameters repeatedly for every program run, you can store your

specifications in variants. A variant consists of a complete group of clearing parameters which

you save and call up together .

December 1999 13

Page 14

Clearing SAP AG

Running the Clearing Program

Running the Clearing Program

To execute the clearing program from the General Ledger, Accounts Payable, or Accounts

Receivable menu:

1. Choose Periodic processing → Automatic clearing.

The screen to enter the parameters for clearing open items is displayed.

2. Specify the accounts you want to clear, select the lists you want the program to

generate, and specify whether the program should clear the items.

If you select the parameter Test run (default), a list of the items to be cleared is output.

Clearing is only carried out however, if you have not selected the field Test run.

3. Choose Program → Execute or Execute in background.

The system outputs the results of the clearing transaction.

14 December 1999

Page 15

SAP AG Clearing

Generating a Line Item List and Additional Log

Generating a Line Item List and Additional Log

The program outputs:

• A line item list, which can be output in either short form or detailed form.

• Additional log. This contains information about the line items that were not selected and any

system messages about the account types for which no items were selected.

You can print the lists by choosing List → Print.

December 1999 15

Page 16

Clearing SAP AG

Clearing Transactions

Clearing Transactions

The following topics explain the different requirements and features for clearing open items in the

SAP R/3 System.

The Basic Principles for Clearing Transactions [Page 17]

Clearing Transactions [Page 24]

Payment Differences [Page 33]

Automatic Postings for Clearing Transactions [Page 39]

Cross-Company Code Clearing [Page 42]

Bank Subaccounts [Page 45]

Specifications for Processing Open Items [Page 48]

16 December 1999

Page 17

SAP AG Clearing

The Basic Principles for Clearing Transactions

The Basic Principles for Clearing Transactions

Open items are in fact unfinished transactions. For example, a vendor invoice that has not been

settled remains in the vendor account as an open item until it is paid.

The open items of an account can only be cleared once you post an identical offsetting amount to

the account. In other words, the balance of the items assigned to each other must equal zero, as

shown in the illustration below.

Customer

2,000

3,000

can be cleared

During clearing, the system enters a clearing document number and the clearing date in these

items. Invoices on a customer account, for example, would then be marked as paid, while items

on a bank clearing account would be marked as cleared.

5,000

In order for you to clear items from an account, the account must be managed on an open item

basis. Customer and vendor accounts are always managed in this way. This allows you to

monitor your outstanding receivables and payables at any time. The open item management

option, however, must be defined for general ledger accounts. You would set this option, for

example, for bank subaccounts and clearing accounts in order to be able to track whether the

business transactions posted to these accounts are closed yet.

Open item management ensures that all items that have not yet been cleared are available in the

system. A document can only be archived after all open items in a document have been cleared.

You can see whether an item has been cleared in the line item display or document display. In

line item display, the last three digits of the clearing document number are displayed if you

choose the standard line layout variant. You will want to view clearing documents to find out how

the open items were cleared.

December 1999 17

Page 18

Clearing SAP AG

The Basic Principles for Clearing Transactions

Customer ............ EVANS

Company code ... 0001

Incoming payment /15---------------------------------------- 01000000843 - 002

Amount .......5,000.00

Tax code .....

-------------------------------------------------------------------------------------------

Business area ......

Baseline date ...05/10/91

Pmnt block ...

Pmnt method

Clearing ... 05/10/91 / 0100000843 Pmnt amount ... 5,000.00 USD

Assignment..19910510 Cash flow ........ 0

---------------------------------------------------------------------------------------------

Clrg BusArea ...

Disc. amount ... 0.00 USD

/ /

There are two functions you can choose from to clear open items Account Clearing [Page 19]

and Posting with Clearing [Page 21]. These procedures are explained in the following section.

18 December 1999

Page 19

SAP AG Clearing

Account Clearing

Account Clearing

In this clearing procedure, you select open items that balance to zero from an account. These

items are marked as cleared by the system. The system enters a clearing document number and

the clearing date in the document items. The clearing date can be the current date or a date that

you enter manually. The clearing document number is the number of the most recent document

involved in the clearing transaction.

Posted on

1

9

9

1

F

2

E

B

Check clearing

5,200.00

Check clearing

5,200.00

Posted on

1

9

9

2

2

5

J

A

N

Document no.

0000008

Ü 3

Document no.

0000049

Clearing

1

9

9

2

2

2

F

EB

0000049

Since postings do not have to be made during account clearing, documents are usually not

created. However, the system might have to make clearing entries if line items from different

business areas are part of the clearing transaction. In this case, a document is created. The

number of this clearing document is entered in all cleared items.

Check clearing

5,200.00 5,200.00Document no.

Clearing

1

9

9

2

2

2

F

E

B

Document no.

0000049

December 1999 19

Page 20

Clearing SAP AG

Account Clearing

Business area 1 Business area 2

Check clearingCheck clearing

5,200.00

Conditions for Clearing

Generally, you use this procedure for bank subaccounts and clearing accounts. For example, you

would use the check number to select an item in the checks receivable account to clear it against

the cashed check.

Automatic Clearing

Instead of clearing items manually, you can also use a program to clear them automatically

(provided no new items have to be created to clear the open items). For more information, see

The Clearing Program [Page 7]

Selected for

clearing

Automatic

clearing posting

5,200.00

5,200.005,200.00

20 December 1999

Page 21

SAP AG Clearing

Posting with Clearing

Posting with Clearing

Using the posting with clearing function, you enter document line items and then select the open

items that are to be cleared. Once the total amount of selected open items equals the amount of

entered line items, the system clears the open items by creating one or more offsetting entries.

A customer pays several receivables amounting to 5,000 USD by check. You enter

the amount of the check payment in the checks receivable account (see 1 in the

illustration below). To clear the receivables on the customer account, you choose the

open items (see 2 below). The amount you enter and the items you select must

balance to zero. The system posts an incoming payment (automatic offsetting entry)

to the customer account (see 3 below) and marks the open items as cleared (see 4

below). All four steps are performed in one procedure.

Customer

5,000.00

3

1

1

1

Incoming

5,000.00

2,000.00

2

1

3,000.00

4,000.00

4

cleared

1

In this clearing procedure, the system generates a clearing document comprised of the items you

entered and the offsetting entries it created to balance the document to zero.

The system marks the items as cleared and sets the clearing date and clearing document

number in the open items you selected and in the offsetting entries it created. The clearing date

is usually the posting date. If however, the items you select for clearing have a posting date that

comes after the posting date of the clearing document, the system uses the most recent posting

date as the clearing date. The following illustration shows the item that the system posted

automatically in the above example. The open items are cleared, and the document line item

they are matched to contains the clearing information.

December 1999 21

Page 22

Clearing SAP AG

Posting with Clearing

Customer ............ EVANS

Company code ... 0001

Incoming payment /15---------------------------------------- 01000000843 - 002

Amount .......5,000.00

Tax code .....

-------------------------------------------------------------------------------------------

Business area ......

Baseline date ...05/10/91

Pmnt block ...

Pmnt method

Clearing ... 05/10/91 / 0100000843 Pmnt amount ... 5,000.00

Assignment ..19910510 Cash flow

---------------------------------------------------------------------------------------------

Clrg BusArea ...

Disc. amount ... 0.00 USD

/ /

There are three functions you can choose from for posting with clearing. The one basic function

can be used for any type of business transaction in which items need to be posted and cleared

simultaneously. The two other functions are specially designed for incoming and outgoing

payments.

Clearing Options

You can:

• Clear several accounts and account types

• Clear items in any currency

• Clear items and post any differences

• Enter any number of line items (for example, bank charges)

Automatic Clearing

You can also execute posting with clearing automatically by running the payment program.

Normally, you run the payment program to pay vendor invoices. You can also use the payment

program if you and your customers have agreed on a debit memo procedure (collection or direct

debiting procedure).

Some special G/L transactions, such as bills of exchange, are cleared using special

functions. For more information about special G/L transactions, see Special G/L

Transactions: Down Payments and Payment Guarantees [Ext.] and Special G/L

Transactions: Bills of Exchange [Ext.].

22 December 1999

Page 23

SAP AG Clearing

Posting with Clearing

December 1999 23

Page 24

Clearing SAP AG

Clearing Transactions

Clearing Transactions

The standard system contains a clearing transaction for each clearing function that creates

documents. The clearing transactions are:

• Incoming payment

• Outgoing payment

• Transfer posting with clearing

A clearing transaction represents a business transaction that requires that an item be cleared. To

clear items against an incoming payment, you would use the Incoming payment clearing

transaction. If you are making a payment to a vendor, you would use the Outgoing payment

clearing transaction.

There are two separate functions specially designed for each of these clearing transactions:

Incoming payment and outgoing payment. They both use special screens that make it easier to

process open items. The fast entry function enables you to quickly enter payment lots. It uses the

posting keys that are defined for the incoming payment clearing transaction.

Self-Defined Clearing Transactions [Page 25]

Transactions for Posting with Clearing [Page 26]

Transaction for Account Clearing [Page 30]

Defining and Maintaining Clearing Transactions [Page 32]

24 December 1999

Page 25

SAP AG Clearing

_

_

_

Self-Defined Clearing Transactions

Self-Defined Clearing Transactions

In addition to the incoming and outgoing payment functions, the system offers a general clearing

function that you can use for posting with clearing. You can use it to post any clearing

transaction. After you have called up the function, select the required transaction.

Document

Posting

Document

Reference

Doc. header

Transaction to be processed ------------------------------------------------------

Outgoing

Incoming

Transfer posting with

PostKey..._

You can define your own clearing transactions for this general function. This provides your

accounting clerks with clearing transactions specifically designed for the business transactions to

be posted. This simplifies the transaction.

Doc. type... ?

Period....... 5

Sp. G/L... _

Company

Currency/rate.....D

Translation

Interco trs.

December 1999 25

Page 26

Clearing SAP AG

Transactions for Posting with Clearing

Transactions for Posting with Clearing

The following overview lists the clearing transactions in the standard system and the functions

used to post them.

Clearing functions

Incoming

payment

Outgoing

payment

Clearing

an account

Clearing transactions

Incoming payment

Outgoing payment

Transfer posting

User-defined

General

clearing

function

The system has to make clearing entries for each transaction except account clearing (see

Account Clearing [Page 19] and Posting with Clearing [Page

21] ). To do this, it requires posting

keys for the corresponding clearing procedure.

The required posting keys are already defined for these transactions in the standard system. You

will have to change the standard settings or make new settings if:

• You change the posting keys delivered with the standard system, or you do not want to use

the predefined posting keys. You then have to enter the new posting keys for the clearing

transactions.

• You want to change the name of the transaction. In this case, simply enter a new name for

the clearing transaction.

• You require more transactions. You must define these transactions.

The following illustration shows the clearing transactions that are defined in the standard system

(see 1) and the options for choosing one of the transactions in the general clearing function (see

2).

26 December 1999

Page 27

SAP AG Clearing

r

_

_

_

___

_____

_________

Transactions for Posting with Clearing

Document

Posting

Document

Reference

Doc. heade

Transaction to be

2

1

Outgoing

Incoming

Transfer posting

PostKey..._

Doc. type... ?

Period....... 5

Clearing

AUSGZAHL

EINGZAHL

UMBUCHUNG

Company

Currency/rate.....D

Translation

Übergreifd.

Name

Outgoing

Incoming

Transfer posting with

UmsKz... _

1

1

Posting Keys for Clearing Transactions

For each transaction, the following posting keys are specified for debit and credit postings

depending on the account type:

• Customer and vendor accounts are assigned posting keys for the clearing entry, the residual

item balance, and special G/L transactions.

• G/L accounts are assigned only a debit and credit posting key. No further distinction is made

for the posting keys for G/L accounts.

If you define your own transactions, you should maintain all posting keys for each account type.

Using the incoming payment transaction, the following illustration shows why this is necessary:

December 1999 27

Page 28

Clearing SAP AG

Transactions for Posting with Clearing

Posting keys for EINGZAHL Incoming payment

Customers ----------------Clearing entry

Residual item bal.

Special G/L trans.

Vendors ----------------Clearing entry

Residual item bal.

Special G/L trans.

G/L accounts ---------------

When you post an incoming payment, the system requires a posting key to generate the

offsetting entry for open items selected. To generate this offsetting entry, it uses the customer

credit posting key that is specified for the clearing entry. All the other posting keys are used for

special situations that may occur when posting an incoming payment:

• The customer debit posting key specified for the clearing entry is required if an incoming

payment is posted across different business areas. If you select, for example, an invoice and

a credit memo from different business areas for the clearing transaction, the system has to

make a debit posting to clear the credit memo as well as a credit posting to clear the invoice.

Debit ----------------------------08 Payment clearing

06 Payment difference

09 Special G/L debit

Debit ----------------------------28 Payment clearing

26 Payment difference

29 Special G/L debit

Debit ----------------------------40 Debit posting

Credit ------------------15 Incoming payment

16 Payment difference

39 Special G/L credit

Credit ------------------35 Incoming payment

36 Payment difference

39 Special G/L credit

Credit ------------------50 Credit posting

• Vendor posting keys are required so that offsetting entries can be made to the vendor

account when open items are cleared between a customer and vendor.

• Posting keys are required for special G/L transactions (for example, down payments) if you

want to clear, for example, an invoice and a down payment in a single clearing transaction.

The system can also deal with payment differences when you post and clear items, but requires

a posting key to do this. You can treat payment differences as follows:

• You can post the payment as a partial payment. The system does not mark the open items

you selected as cleared. The partial payment is posted to the customer account with an

invoice reference that allows you to track which invoice the partial payment was matched to.

For partial payments, the system uses the posting keys you define for clearing open items.

The posting key defined in the standard system for customer partial payments is posting key

“15”.

• If you post any outstanding receivable as a residual item, the original receivable is

automatically cleared from the account. To post the residual item, the system uses the

posting keys specified for the residual item balance.

28 December 1999

Page 29

SAP AG Clearing

Transactions for Posting with Clearing

The posting keys you specify for the Transfer posting with clearing transaction are used for the

general clearing function and, if the system has to make internal transfer postings, for the

account clearing function as well.

The payment program and the special functions for outgoing and incoming payments use the

posting keys defined for the incoming payment and outgoing payment transactions.

You cannot delete these transactions.

Posting keys for the invoice and credit memo fast entry function are defined separately in the

system.

December 1999 29

Page 30

Clearing SAP AG

Transaction for Account Clearing

Transaction for Account Clearing

Normally you use the account clearing function without creating a posting. However, the system

may have to automatically make transfer postings in some cases. This is necessary for example,

if you are clearing in several business areas, since you have to carry out clearing between the

individual business areas.

You want to clear items in a clearing account that were posted to different business

areas. When clearing the items, the system has to generate a document since it has

to generate a clearing posting for each business area.

Business area 1 Business area 2

Check clearingCheck clearing

5,200.00

For account clearing, you enter an account, account type, clearing currency, clearing date and, if

necessary, a special G/L indicator. All the information that is required if clearing postings are

generated is defined in the system. This includes the document type and the posting key. You

specify both for the transfer posting with clearing transaction.

The standard system is delivered with a standard document type for all account types (see table

below). If the system has to generate documents for account clearing, it assigns them a number

from the number range for this document type.

Standard Document Types for Account Clearing Function

Account type

D AB General document

K AB General document

S AB General document

If you do not use the standard document type in your system, or you have deleted it, you have to

specify one of your own document types. If a valid document type is not specified for clearing

between business areas, the system cannot clear the items between the different business areas

specified on the debit and credit sides.

Document type Description

Selected for

clearing

Automatic

clearing posting

5,200.00

5,200.005,200.00

This means that you can also prevent entries from being offset automatically if, for example, your

organization does not want its users to clear items between different business areas.

Transfer posting with clearing is the transaction for account clearing in the standard system. It is

not possible to use any other transaction for account clearing. You can, however, make changes

to the transfer posting with clearing transaction.

30 December 1999

Page 31

SAP AG Clearing

Transaction for Account Clearing

For more information, see Defining and Maintaining Clearing Transactions [Page 32]

December 1999 31

Page 32

Clearing SAP AG

Defining and Maintaining Clearing Transactions

Defining and Maintaining Clearing Transactions

You can change the clearing transactions that are delivered with the standard system. The

functions for incoming and outgoing payments and the function for account clearing were each

assigned to a separate clearing transaction. If your company requires additional transactions, you

can define them for the general clearing function. To do this, you have to maintain the posting

keys and the texts that are displayed for choosing the transactions on the initial screen of the

general clearing function.

You cannot delete the transactions that are delivered with the standard system. You can only

delete the transactions that you define.

For more information on how to create or change clearing transactions, see the Define Posting

Keys for Clearing activity in the Financial Accounting Implementation Guide [Ext.].

32 December 1999

Page 33

SAP AG Clearing

Payment Differences

Payment Differences

Payment differences can occur when clearing open items if, for example, a customer does not

pay enough or takes an unauthorized cash discount. If the difference is immaterial, you usually

clear the receivable and post the difference. You can define how payment differences should be

posted. You have the following options:

• If the payment difference is immaterial, you can have the system automatically adjust the

cash discount or post the difference to a separate gain or loss account. You have to specify

the maximum amount of any differences that can be posted in this way by setting amount

tolerances and percentage limits.

• If the payment difference exceeds the tolerances you set, you can process the payment as a

partial payment or enter a residual item for the difference. When entering a partial payment,

the system does not clear the receivable, but posts the payment with an invoice reference.

When creating a residual item, the system clears the original receivable and posts the

outstanding difference as residual item to the customer account.

Payment difference

Yes No

Difference within

tolerance limits

for automatic cash

discount correction ?

Yes

Automatic

cash

discount

correction

posting of

deductions

Difference

within

limits for employee and

customer/vendor in

question ?

No

Automatic

unauthor.

tolerance

Carry forward

residual item?

NoYes

Res.item/

manual

cash disc.

corr. poss.

--Old

Old

receivables

are cleared

-

New

receivables/

residual items

posted without

invoice reference

Partial

payment

receivables

not cleared

Payment

posted with

invoice

Automatic posting

December 1999 33

Manual processing

Page 34

Clearing SAP AG

Payment Differences

Differences Within Tolerance Limits [Page 35]

Differences Outside Tolerance Limits [Page 37]

Reason Codes [Page 38]

34 December 1999

Page 35

SAP AG Clearing

Differences Within Tolerance Limits

Differences Within Tolerance Limits

Differences within tolerance limits are posted automatically. The system can either adjust the

cash discount amount or post the difference to a separate gain or loss account. When defining

your tolerance limits, you also specify how the system should post the differences.

You can define:

• The maximum difference amount for which the system should adjust the cash discount. The

difference is added to or subtracted from the cash discount.

• The maximum amounts or percentages for which the system should automatically post any

difference to a separate gain or loss account if the cash discount cannot be adjusted.

Tolerance limits are defined separately for users and business partners. The system checks both

limits when clearing open items. The lowest limit always has priority for the clearing transaction.

For one of your customers you set a maximum amount of two USD for adjusting the

cash discount amount when a payment difference occurs. For the accounting clerk

that processes this customer account, however, you set a maximum amount of one

USD. If differences occur when this clerk clears items from this customer account,

the system can adjust the cash discount amount only up to a maximum of one USD.

Settings you make for tolerance limits are valid in the currency of your company code (local

currency). The currency is always displayed when defining limits.

Defining Tolerance Limits

You set tolerance limits separately for your users and your business partners:

For adjusting cash discount, you can set separate tolerance limits depending on whether the

difference is a gain or a loss (see 1 in figure below).

Only if a cash discount posting exists and the cash discount amount allows the system to make

an adjustment can immaterial differences be cleared by adjusting the cash discount.

If the payment difference cannot be cleared by adjusting the cash discount, the system posts it to

a separate gain or loss account. You can also set a maximum amount for such postings for your

users and your business partners. The lowest limit has priority in clearing transactions. You can

set an absolute amount (see 2) or a percentage (see 3). The lowest limit has priority here as well.

To use only absolute amounts or percentages, simply enter maximum values for the other limits.

Limits can be separately for gains and losses.

December 1999 35

Page 36

Clearing SAP AG

A

Differences Within Tolerance Limits

Company code US01 SAP AG Redwood City

Tolerance group

Currency USD

Specifications for clearing transactions --------------------------------------------Grace days for due date determintn

Cash discount terms to display

Permitted payment differences -------------------------------------------------------

Percent Discount adjustment up to

0.5 %

0.5 %

3

1

2.00

2.00

1

1

Revenue

Expense

mount

2.00

2.00

2

1

Specifications for posting residual items from payment differences --------

Payment terms from invoice Fixed payment terms ZB04

Only grant partial cash discount Dunning key

Grouping Business Partners

Customers or vendors for which you want to use the same tolerances can be grouped together

using the tolerance group code. You assign this code to the required business partner in the

master record. The tolerances defined for this group code then apply to a group of business

partners.

You can also define tolerances without specifying a tolerance group. In this case, leave this field

blank. These tolerances will then apply to all customers or vendors that are not assigned any

tolerance group in their master records.

You can therefore define standard tolerances that apply to most of your business partners. If you

want to define special tolerances for some business partners, you can define these under a

separate code.

Tolerance groups are company code-specific. This ensures that all tolerance settings you make

are effective in the company code’s currency. It also gives you the option of defining different

company code-specific tolerances for the same business partner.

When defining tolerances, you can also make other useful settings for open item

processing, (see Specifications for Processing Open Items [Page 48]). For more

information about setting tolerances, see the Define Tolerances (Vendors) or Define

Tolerance Groups for Employees activities in the Financial Accounting

Implementation Guide [Ext.].

36 December 1999

Page 37

SAP AG Clearing

Differences Outside Tolerance Limits

Differences Outside Tolerance Limits

Differences exceeding the tolerance limits set for clearing them automatically may still occur

during a payment transaction due to several reasons. Your customer could, for example, send

you a payment advice note informing you of the items he wants to pay, but the amount paid may

not be enough to clear the amount of outstanding receivables.

When you process open items, you can choose from one of the following options:

• You can treat the payment as a partial payment. In this case, the system does not clear the

receivables, but posts the payment with an invoice reference by copying the invoice number

to the Invoice reference field in the payment item. To determine the date that payment is due

on, the system calculates the date on which the net amount of the invoice is due, and enters

this date in the Baseline date field for the payment. The payment is then included in the

dunning program and in cash management at this date.

• You can use the payment to clear the original receivables and post the remaining amount to

the customer account as a residual item. The payment amount is noted in the line items of

the original receivables.

• You can clear the original receivables and post the difference to an expense account.

The system requires the posting keys defined in the system for each of these transactions. For

more information, see Posting with Clearing [Page 21]

To post residual items, you have to specify what terms of payment you want to apply to these

items. You can define the following for each business partner:

• The terms of payment are taken from the invoice.

• The difference posting is always assigned predefined terms of payment. You can use a terms

of payment key to do this. During clearing, the terms of payment defined under the key are

used for the residual items.

• Cash discount should be granted only for the portion that was paid. The remaining cash

discount is only granted after the outstanding receivable is paid in full and only if the payment

deadline for cash discount is not exceeded. You should always choose this option if the

terms of payment in the invoice are used for the residual items.

• The possible dunning levels should be restricted. To do this, you can enter a dunning key

that represents the highest dunning level. In this way, you can ensure, for example, that legal

dunning proceedings are not initiated for residual items.

December 1999 37

Page 38

Clearing SAP AG

Reason Codes

Reason Codes

To use the clearing document to find out why a difference existed, you can assign reason codes

to the line items. Reason codes are indicated by keys that you define in Customizing.

You can assign reason codes for the following:

• Partial payments made for open items.

• Residual items created for an open item. You can assign one or more reason codes if you

split the outstanding difference into several partial amounts.

• Differences posted on account without reference to an open item.

• For each line item you enter in the clearing procedure, if the reason code field for the account

is ready for input.

When you process residual items, the reason code also controls how the remaining amount is

posted. The remaining amount can be posted as follows:

• To a G/L account that is assigned to the reason code you enter.

• As a new customer or vendor open item if you do not enter a reason code, or if the reason

code you enter requires this.

Other features of reason codes:

• You can have the system send a payment notice to a customer if differences occur in

clearing open items with incoming payments. You can define what type of notice to create for

partial payments, residual items, and payments on account in the tolerance group set up for

the customer.

• The system can use the specified reason code to determine the type of notice to create as

long as only one reason code is specified in the entire clearing transaction.

• When you check a customer's credit limit, the total of open items is considered. You can

exclude disputed items from credit limit checks by assigning them a reason code.

Reason codes control:

• How the difference is posted (as a new open item or to a predefined G/L account)

• What type of payment notice is created

• Whether an item is include in credit limit checks

• For information on defining reason codes, see the following activities in the Financial

Accounting Implementation Guide [Ext.]:

− Define Reason Codes

−

− Define Standard Reason Codes for Clearing with Payment Advice Note

38 December 1999

Page 39

SAP AG Clearing

Automatic Postings for Clearing Transactions

Automatic Postings for Clearing Transactions

During clearing, the system can automatically post:

• Cash discounts paid or received

• Gains or losses from under/overpayments

• Input and output tax and withholding tax

• Bank charges

• Gains or losses from exchange rate differences

• Entries to clear the account for cash discount clearing in the net method of posting

To have the system post these items automatically, you have to define the accounts that should

be posted to. The next sections explain the preparations for automatically posting gains or losses

from overpayments and underpayments, and for posting the bank account items and bank

charges. For more information on setting up the other transactions, see:

Gains or Losses from Payment Differences [Page 40]

Bank Charges and Bank Posting [Page 41]

Where are automatic postings explained?

Functions Section

Cash discount postings

Tax adjustments and

Withholding tax

Exchange rate differences Foreign currency

Cash discount clearing for the

net procedure

Terms of payment and cash discounts

Taxes

Terms of payment and cash discounts

December 1999 39

Page 40

Clearing SAP AG

Gains or Losses from Payment Differences

Gains or Losses from Payment Differences

If a payment difference during clearing is within the predefined tolerances, the system can post it

automatically.

The system does not require any additional specifications to clear the difference by adjusting the

cash discount. However, for posting to a separate gain or loss account, you have to define

special rules to determine the appropriate account to post to.

The accounts can be determined based on the following criteria:

Debit or credit

Whether the difference is an under or overpayment determines which accounts are posted to.

Tax code

The tax code in the line item determines which accounts are posted to.

Reason code

The reason code in the line item determines which accounts are posted to.

If you choose to differentiate accounts by tax code and/or reason code, you have to

specify accounts for each tax code and reason code.

The system also requires the posting keys for debit and credit postings to G/L accounts for

automatic postings.

All of these settings are already made for the charts of accounts delivered with the standard

system. If you do not use these charts of accounts, you have to make the necessary settings

yourself.

40 December 1999

Page 41

SAP AG Clearing

Bank Charges and Bank Posting

Bank Charges and Bank Posting

The functions for incoming and outgoing payments include a field, Bank charges, in which you

can enter any bank charges that are part of the payment being made or received. For incoming

payments the system adds the bank charges to the clearing amount, while for outgoing payments

it deducts the charges from the clearing amount.

The system posts the charges to an expense account. To do this, it requires a posting key and

details of which account is to be posted to. Both of these details are already defined in the

standard system. If you are not using the charts of accounts delivered with the standard system,

you have to enter your own account specification for posting bank charges. The Relevant to cash

flow indicator must be set in the master records of accounts that record bank charges.

For the system to make the bank posting, you have to specify the bank account and amount in

the clearing function. The posting keys are already defined in the standard system. You only

have to change them if you are not using the standard posting keys for debit and credit postings

to G/L accounts.

If taxes have to be posted for bank charges, you have to set up the bank charges account so

that it is relevant for taxes. When posting the bank charges, the system then determines from the

account master record that tax entries have to be made for the charges, and displays a screen

for users to make the necessary entries.

December 1999 41

Page 42

Clearing SAP AG

Cross-Company Code Clearing

Cross-Company Code Clearing

You can enter cross-company code transactions in one step in the General Ledger, Accounts

Receivable, and Accounts Payable application components. This function would be used, for

example, for centralized procurement or payment.

For centralized payments, each individual company code enters its own invoices separately,

while a central company code pays them. During clearing of open items, the system makes

clearing entries between the company codes participating in the clearing procedure. These

clearing entries represent the receivables and payables that exist between the company codes in

centralized payment.

A separate document is created for each company code. These documents are marked as

belonging together by a common transaction number.

The following section describes the prerequisites that must be fulfilled for manual centralized

payment transactions. See also: Payments [Ext.]

Company code 0001 processes its own incoming payments as well as those for

company code 0002. The invoices are entered in the individual company codes.

42 December 1999

Page 43

SAP AG Clearing

Cross-Company Code Clearing

Clearing

CoCd

BUKKR

Ü1

0001

0001

company code

Customer

Clearing 0002

3

Clearing doc.

0100000011

CoCd 0001

Customer 100

Clearing 2,000

Bank 2,100

Transaction number

0100000011000191

CoCd

BUKKR

0002

0002

3

Clearing doc.

0100000010

CoCd 0002

Customer 2,000

Clearing ...2,000

1 2

100.00

Sales Revenue

Customer

2,000.00

Sales Revenue

100.00

100.00

2,000.00

2,000.00

1

2,000.00

Bank

1

2

2,100.00

Clearing 0001

321

2,000.00

3

The following invoices were posted in the illustration above:

1. An invoice for 100 USD was entered for company code 0001, and an invoice for 2,000

USD was entered for company code 0002.

After payment is received, you clear the open items. Since company code 0001 is also

responsible for company code 0002, select the open items on the customer account in company

code 0001. The open items from company code 0002 are automatically chosen for processing as

well.

2. You clear the receivables from the customer account for company codes 0001 and 0002.

The payment for 2,100 USD is posted in company code 0001.

3. The system automatically generates clearing postings for the individual company codes.

The payables between the company codes are therefore cleared and the company codespecific documents balance to zero.

See also:

Prerequisites for Cross-Company Code Clearing [Page 44]

December 1999 43

Page 44

Clearing SAP AG

Prerequisites for Cross-Company Code Clearing

Prerequisites for Cross-Company Code Clearing

To clear open items across company codes, you have to fulfil the following prerequisites:

• You have to specify which company codes are to be processed via a single company code.

In this specification you can distinguish between clearing transactions. You can therefore

have different combinations of company codes for incoming and outgoing payments.

• You have to specify the clearing accounts that record the receivables and payables between

the individual company codes. The system posts to these accounts automatically when

clearing the open items.

For the required settings, see the activity Prepare Cross-Company Code Manual Payments [Ext.]

in Customizing for Financial Accounting (Accounts Receivable and Accounts Payable →

Business Transactions → Outgoing Payments → Manual Outgoing Payments).

44 December 1999

Page 45

SAP AG Clearing

Bank Subaccounts

Bank Subaccounts

The charts of accounts delivered with the standard system contain a number of different bank

subaccounts. There are bank subaccounts for checks payable, checks receivable, outgoing wire

transfers, and bank direct debits.

Ü 3

Bank account

Bank collection

Using subaccounts has the following advantage: You have the possibility of reconciling at any

time the balance of the account at your bank with the balance of your corresponding G/L

account. The subaccounts ensure that all incoming and outgoing payments are only posted to

the G/L bank account when the money is actually debited from/credited to your bank account.

Incoming and outgoing payments are posted to the main G/L bank account once you receive and

enter the bank statement.

Outgoing check Outgoing transfer

Check receipt

See also:

Prerequisites for Using Bank Subaccounts [Page 47]

Example: Posting a Check Received [Page 46]

December 1999 45

Page 46

Clearing SAP AG

Example: Posting a Check Received

Example: Posting a Check Received

A customer sends a check payment for 5,000 USD. The payment was posted to the subaccount

for incoming checks and to the customer account (see figure 1 below), while at the same time

clearing the receivables on the customer account (see figure 2 below).

Ü 3

Incoming checks

1 1

5,000.00

2,000.00

3,000.00

4,000.00

Customer

5,000.00

cleared

Incoming checks

3

5,000.00

cleared

5,000.00

4

34

Bank account

5,000.00

2

Once the check is cashed at your bank, you can post it to the G/L bank account and choose the

same item from the Incoming Checks account for clearing (see figure 3 above). The system

credits the Incoming Checks account and clears the items against each other (see figure 4

above). The check is now marked as cashed. The bank account set up in the general ledger only

reflects the amounts that your bank actually debits or credits.

46 December 1999

Page 47

SAP AG Clearing

Prerequisites for Using Bank Subaccounts

Prerequisites for Using Bank Subaccounts

To use the bank subaccount methodology, you have to create the necessary subaccounts for

each bank account that is used in payment transactions. You can see which individual

subaccounts you need in the standard charts of accounts. Create these accounts in accordance

with the existing accounts in the system.

Subaccounts are generally managed on an open item basis and with line item display, since you

want to be able to see via these accounts at any time whether a business transaction has been

completed. For example, in the subaccount for checks payable, you can see whether a check

you issued has been cashed at your bank.

You can use the field status definition in the G/L account master record to design the screens for

posting items to bank subaccounts. For example, you will only need the fields Assignment

number, Text, Value dates, and Bank charges for subaccounts. You can hide any fields you do

not require. This makes it easier to enter business transactions and prevents you from making

incorrect entries. For more information on field status definition, see Field Status Definition:

Vendor Master Data [Ext.].

The field Assignment is particularly important. This field is used to assign items in a subaccount

to each other. In a check clearing account, for example, you can enter the check number in this

field. For more information about the field Assignment, see Assignment for the Line Item Display

(Accounts Receivable) [Ext.]

The payment program and extended banking processing also use the subaccount

methodology. Cash management evaluates the subaccounts. For more information,

see the documentation for Cash Management and Bank Subaccounts for the

Payment Program [Ext.].

December 1999 47

Page 48

Clearing SAP AG

Specifications for Processing Open Items

Specifications for Processing Open Items

To help you process open items efficiently, the following options are available:

Selection and search functions

Prior to calling up open items for processing, you can enter specific values to find the items that

you want to process. In the line item display you can search for individual items. The system

offers you fields for you to enter search values. You can specify which fields are displayed for

selection and search. See also: Fields for the Selection, Search and Sort Functions [Page 50]

Payment advice notes

A payment advice note created in the system contains all the information about incoming

payments that is required for clearing open items. This information includes:

• Gross, net, and difference amounts for the paid items

• Reason codes and customer reference information for payment differences

Payment advice notes are stored in the system under a key consisting of the company code,

account type, account number, and a payment advice number. Payment advice notes are either

entered manually or created automatically (payment advice notes via EDI or electronic bank

statement).

When you use the posting with clearing function, you can refer to a payment advice note. The

system automatically selects and activates the items that match the entries in that payment

advice note. The system also takes account of any payment differences using the reason codes

specified in the payment advice note.

Sort function

In line item display, you can sort the items according to various criteria. You specify the fields

according to which you want to sort in the system. When you access the sort function, you can

then choose from a list of fields that can be sorted. See also Standard Sort Sequence [Page 51]

Line layout of document information

The first screen that appears in all functions of open item processing is an overview screen that

displays the most important information about a document. This information comes from the

document header and the document line items. For each item of information there is one display

line. You decide which data to display in this line by defining the line layout. You can set up

several line layout variants. Accounting clerks can store a variant for a work session or in their

user master record using the editing options function. When the clerk then accesses the function,

the document information corresponding to this variant is displayed. When processing the open

items, the clerk can then select other variants and switch backwards and forwards between the

different variants. See also Line Layout of Document Information [Page 52]

Default values for cash discount terms and grace days

To process open items, you can also define a default value for the cash discount terms displayed

and grace days for the due date calculation of receivables. To define the grace days and the

default values for cash discount terms, you make entries in the following fields:

• Grace days for due date determination

• Cash discount terms to be displayed

Worklists

To process open items, you can specify a worklist instead of individual account numbers. You

use worklists to group together several accounts that you want to include in line item display and

48 December 1999

Page 49

SAP AG Clearing

Specifications for Processing Open Items

open item processing. In their editing options, accounting clerks can choose whether they want to

use worklists. For more information, see the Implementation Guide [Ext.] for Financial

Accounting.

Block for manual payment

You can use payment block reasons to prevent open items from being processed with the

functions for incoming and outgoing payments. To do this, you define your own keys for payment

block reasons and set them accordingly. It is still possible to make transfer postings or reverse

the items manually.

Internal payment advice notes

If you have to interrupt open item processing, you can save the current status of processing in

the form of an internal payment advice note. Later, you can continue processing by referencing

the payment advice number. See also: Payment Advice Notes [Ext.]

For more information on the settings you need to make in Customizing, see the Open Item

Processing [Ext.] activity in Customizing for Financial Accounting (Accounts Receivable and

Accounts Payable → Line Items).

December 1999 49

Page 50

Clearing SAP AG

Fields for the Selection, Search and Sort Functions

Fields for the Selection, Search and Sort Functions

For selecting, searching and sorting, you can determine which fields should be displayed for

every function separately. You can also determine the sequence in which the fields appear in the

selection screen and you can enter the required field name.

All the specifications needed for these functions are already contained in the standard system.

You can change or add to these predefined entries.

The figure below shows the selection screen for the open items and the possible

selection fields (see figure 1 below). The second figure shows the specification as to

which fields should be displayed for selection (see figure 2 below). An accounting

clerk will often want to specify the gross amount or a document number for selection.

That is why these fields were placed at the beginning of the field list.

Open items from ... -----------------------------------------------------------------

Account .................... EVANS

Account type ............. D

Other accounts ......... _

Automatic search . _

Company code .........0001

Normal OIs............

Special G/L ind..

X

Additional selection by ....

. Gross amount

. Document number

. Posting date

. Dunning area

. Business area

1

1

. Reference document

. Invoice list

. Document type

. Branch account

Define field selection for clearing transactions

Field name

-------------WRBTR

BELNR

BUDAT

MABER

GSBER

XBLNR

SAMNR

BLART

FILKD

WAERS

BSCHL Posting key

BLDAT

Name

-------------------------------Gross amount

Document number

Posting date

Dunning area

Business area

Reference document

Invoice list

Document type

Branch account

Currency

Document date

2

1

50 December 1999

Page 51

SAP AG Clearing

Standard Sort Sequence

Standard Sort Sequence

The open items of an account are always displayed in a standard sort sequence. For this

standard sequence, the system uses the fields Assignment, Document number, and Fiscal year.

If you select line items by specifying individual document numbers, the system displays the items

in the same order in which you specified the document numbers. You can set up your own

additional sort sequences as required. See also: Fields for the Selection, Search and Sort

Functions [Page 50]

December 1999 51

Page 52

Clearing SAP AG

Line Layout of Open Item Processing

Line Layout of Open Item Processing

In processing open items from one or more accounts, you can choose from several variants for

the line layout.

If you choose the variant Document number, the most important data from the

document header, such as document number and document date, is displayed, as

well as the days in arrears, the amount, and the cash discount. If you choose the

variant Reference number, the external document number is displayed instead of

the document type and the document date.

The above-mentioned variants are predefined in the standard system. You can change them or

create your own.

The line layout determines what information is displayed in open item processing. You can

assign a line layout variant to every user via their master record. As a result, the information

necessary for this person's task is displayed directly when the open items are being processed.

The line layout variant does not have to be changed.

Information on dunning eligibility can be important for an accounts receivable

accountant. You should therefore, via the master record, assign him a variant that

contains this information.

You can therefore use the variants to prepare information about the open items in accordance

with the tasks of your accounting clerks.

Defining a Line Layout

To define your own line layout variants, you have to:

• Specify the fields, the sequence in which they appear, and their display format (see 1 in the

figure below). You can use the display format to determine the output length of a field

(offset). This can be useful if, for example, you do not use ten-digit document numbers and

want to suppress the initial zeros in the display. Furthermore, you determine the distance

between a field and the previous field (see 2 in the figure below).

• Define the name of your variant (see 3 in the figure below).

The following figure shows the Document number line layout definition. The fields

were specified in the sequence required for the line layout (see 1). The display length