Page 1

Merchant Setup and

Administration Guide

Last updated: January 2010

Page 2

PayPal Merchant Setup and Administration Guide

Document Number: 10064.en_US-201001

© 2010 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resultin g from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

C

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

About This Guide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Where to Go for More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Chapter 1 Setting Up and Administering Your Account . . . . . . . . 9

Adding Your Credit Card Statement Name. . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Blocking Certain Kinds of Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Blocking Payments From U.S. Payers Without a Confirmed Address. . . . . . . . . . 12

Blocking Payments in Currencies That You Do Not Hold . . . . . . . . . . . . . . . . 12

Blocking Accidental Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Blocking Payments from Payers With Non-U.S. PayPal Accounts . . . . . . . . . . . 14

Blocking Payments Initiated Through the Pay Anyone Subtab . . . . . . . . . . . . . 15

Blocking Payments Funded With eChecks . . . . . . . . . . . . . . . . . . . . . . . 16

Adding Users to Your PayPal Account. . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Managing Users of Your Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Determining Access Privileges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Adding a User to Your Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Editing Access Privileges for a User. . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Resetting the Password for a User . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Removing a User . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Handling Multiple Currencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Managing Currency Balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Accepting or Denying Cross-Currency Payments . . . . . . . . . . . . . . . . . . . . 28

Chapter 2 Setting Controls for PayPal Checkout Pages . . . . . . . .29

Co-Branding the PayPal Checkout Pages . . . . . . . . . . . . . . . . . . . . . . . . . . 29

About Custom Payment Pages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Accessing Your Custom Payment Pages . . . . . . . . . . . . . . . . . . . . . . . . 31

Adding or Editing a Page Style . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Making a Page Style Primary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Merchant Setup and Administration Guide January 2010 3

Page 4

C

Contents

Removing a Page Style . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Getting Contact Telephone Numbers . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Providing Your Customer Service Number . . . . . . . . . . . . . . . . . . . . . . . . . 37

Handling Gift Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Prompting Buyers for Gift Messages . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Prompting Buyers for Gift Wrapping . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Prompting Buyers for Gift Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Prompting Buyers for Marketing Messages . . . . . . . . . . . . . . . . . . . . . . . . . 40

Asking Buyers a Survey Question . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Language Encoding Your Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Character Sets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Character Encoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Your Default Language Encoding . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Changing Your Default Website Language . . . . . . . . . . . . . . . . . . . . . . . 42

Changing the Encoding Used by Your Website . . . . . . . . . . . . . . . . . . . . . 43

Chapter 3 Viewing Your Account History. . . . . . . . . . . . . . . .45

Using Monthly Account Statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Activating Monthly Account Statements . . . . . . . . . . . . . . . . . . . . . . . . . 46

Viewing Monthly Account Statements . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Printing Monthly Account Statements . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Downloading Monthly Account Statements . . . . . . . . . . . . . . . . . . . . . . . 49

Deactivating Monthly Account Statements. . . . . . . . . . . . . . . . . . . . . . . . 50

Accessing Your Account History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Searching History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Basic Searching by Activity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Advanced Searching by Field Value. . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Selecting Predefined Time Frames for Basic History Search . . . . . . . . . . . . . . 56

Specifying Date Ranges for Basic and Advanced History Search. . . . . . . . . . . . 56

Downloading History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Selecting Which Fields to Include in the Download . . . . . . . . . . . . . . . . . . . 59

Understanding the Status and Life Cycle of Transactions . . . . . . . . . . . . . . . . 62

Reconciling Transactions using the Balance Impact Column . . . . . . . . . . . . . . 62

Reconciling Transactions Using the Net Amount Column . . . . . . . . . . . . . . . 63

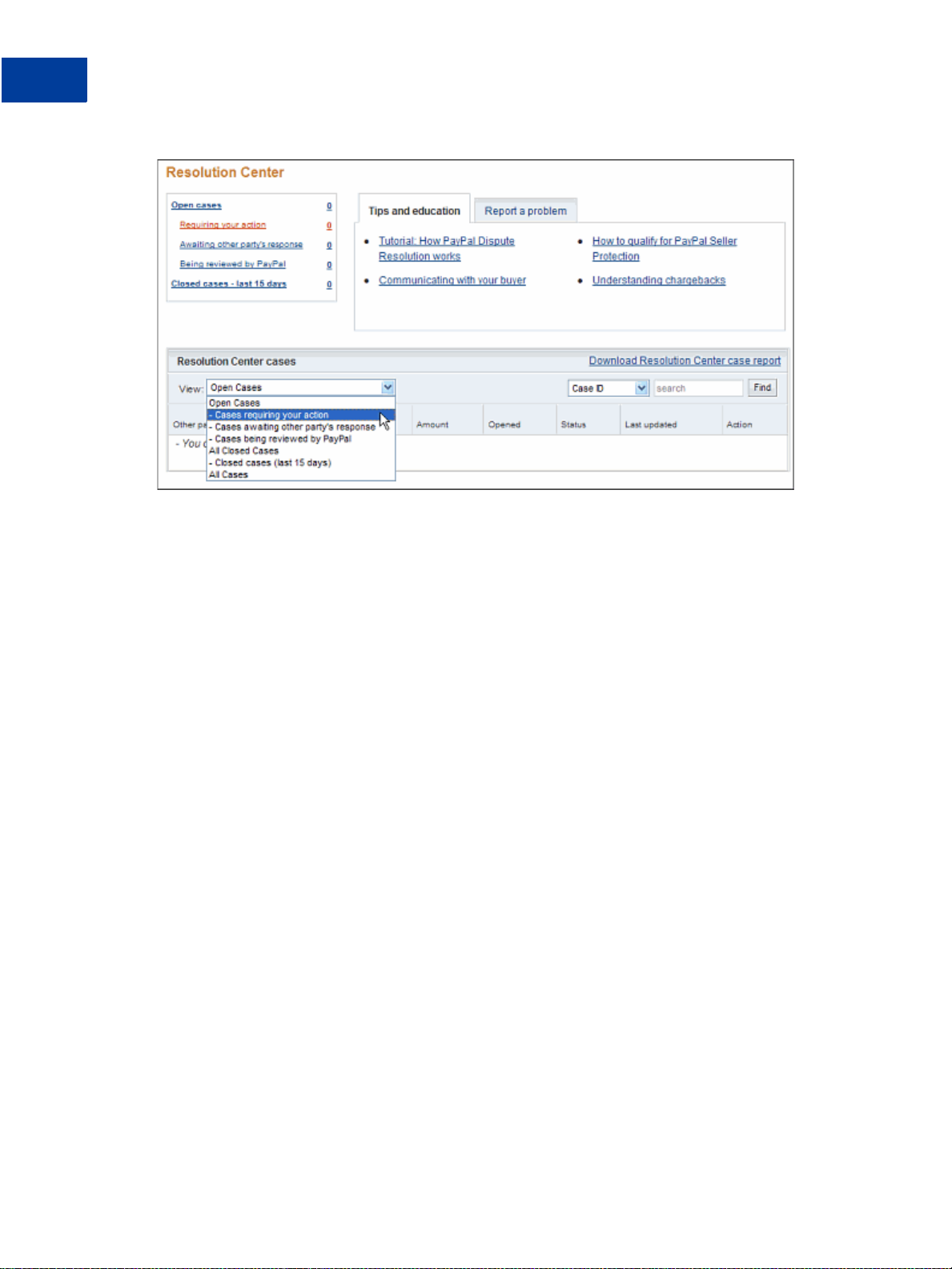

Monitoring Disputed Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Programmatic Access to Resolution Center Case Reports . . . . . . . . . . . . . . . 64

Appendix A Downloadable History Log Fields . . . . . . . . . . . . . . 67

4 January 2010 Merchant Setup and Administration Guide

Page 5

Contents

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .75

C

Merchant Setup and Administration Guide January 2010 5

Page 6

C

Contents

6 January 2010 Merchant Setup and Administration Guide

Page 7

Preface

P

About This Guide

The Merchant Setup and Administra tion Guide describes how to perform set-up,

administrative, and other back-office tasks that let you manage your PayPal account.

The following table summarizes the contents of this guide.

TABLE P.1 Summary of the Contents of This Guide

Feature Description See

Credit Card Statement

Name

Block Payments Choose options to block payments from certain

Manage Users Create separate user names for your account with

Manage Multiple

Currencies

Custom Payment Pages Brand the PayPal checkout pages with your own

Payer Contact

Telephone

Default Language and

Character Encoding

Account History Search and review account activity, activate

Create a name that appears on the payer’s credit

card statements.

payers, currencies, or funding sources.

different permission levels.

Choose the currencies that your account will hold a

balance and accept or deny cross-currency

payments.

logo and colors.

Prompt people for their contact telephone numbers

when they pay you on Paypal.

Set the default language and character encoding to

use for data exchange between your website and

PayPal.

monthly account statements, and download account

history.

“Adding Your Credit Card

Statement Name” on page 9

“Blocking Certain Kinds of

Payments” on page 10

“Adding Users to Y our PayPal

Account” on page 17

“Handling Multiple

Currencies” on page 23

“Co-Branding the PayPal

Checkout Pages” on page 29

“Getting Contact Telephone

Numbers” on page 35

“Language Encoding Y our

Data” on page 41

Chapter 3, “Viewing Your

Account History

Intended Audience

This guide is for merchants and secondary users who log in to PayPal accounts for a variety of

set-up and on-going administrative tasks.

Merchant Setup and Administration Guide January 2010 7

Page 8

Preface

P

Revision History

Revision History

The following table lists the revisions made to the Merchant Setup and Administration Guide.

TABLE P.2 Revision History for This Guide

Date Published Description

January 2010 Added topics for

“Providing Your Customer Service Number” on page 37,

“Handling Gift Purchases” on page 37, “Prompting Buyers for Marketing

Messages” on page 40

page 40

October 2009 Updated

, which let you control the way your PayPal checkout pages operate.

“Handling Multiple Currencies” on page 23, “Co-Branding the

PayPal Checkout Pages” on page 29

Account History

. Added a field to “Fields and Values in Downloadable

History Logs” on page 67

September 2009 Updated

“Co-Branding the PayPal Checkout Pages” on page 29 and

Chapter 3, “Viewing Your Account History.

June 2009 New guide.

Where to Go for More Information

z www.paypal.com/developer > How To > Administration/Back Office > Recurring

Payments Administration

z Fraud Management Filters

z Virtual Terminal User’s Guide

, and “Asking Buyers a Survey Question” on

, and Chapter 3, “Viewing Your

.

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

8 January 2010 Merchant Setup and Administration Guide

Page 9

1

Setting Up and Administering Your Account

Before you take your first payment on your PayPal account, consider the following:

z How do you want your name to appear on credit card statements?

z Will you accept payments from other countries?

z Do you want to grant account access to other users in your organization?

z What currencies will you accept?

Use your PayPal account profile to set and edit these options.

Read the following topics to learn about the profile settings:

z “Adding Your Credit Card Statement Name” on page 9

z “Blocking Certain Kinds of Payments” on page 10

z “Adding Users to Yo ur PayPal Account” on page 17

z “Handling Multiple Currencies” on page 23

Adding Your Credit Card Statement Name

When PayPal members pay with credit cards on file with their PayPal accounts, the transaction

descriptions appear on their credit card statements in the following format:

PAYPAL*MERCHANT

By default, MERCHANT is:

z For premiere accounts, the mailbox name of the email address that you specified when you

signed up your account.

z For business accounts, the business name that you specified when you signed up for your

account.

The value you specified is converted to all upper-case letters, spaces are removed, and the

result is truncated to eleven characters. The result is stored in your account profile as your

Credit Card Statement Name.

The default value for your Credit Card Statement Name may be difficult for payers to

understand. To reduce chargebacks and payer confusion, replace the default Credit Card

Statement Name with one that accurately reflects your business or legal name. Use the

Payment Receiving Preferences page to make this change.

1. Log in to your PayPal website at

The My Account Overview page opens.

https://www.paypal.com.

Merchant Setup and Administration Guide January 2010 9

Page 10

Setting Up and Administering Your Account

1

Blocking Certain Kinds of Payments

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

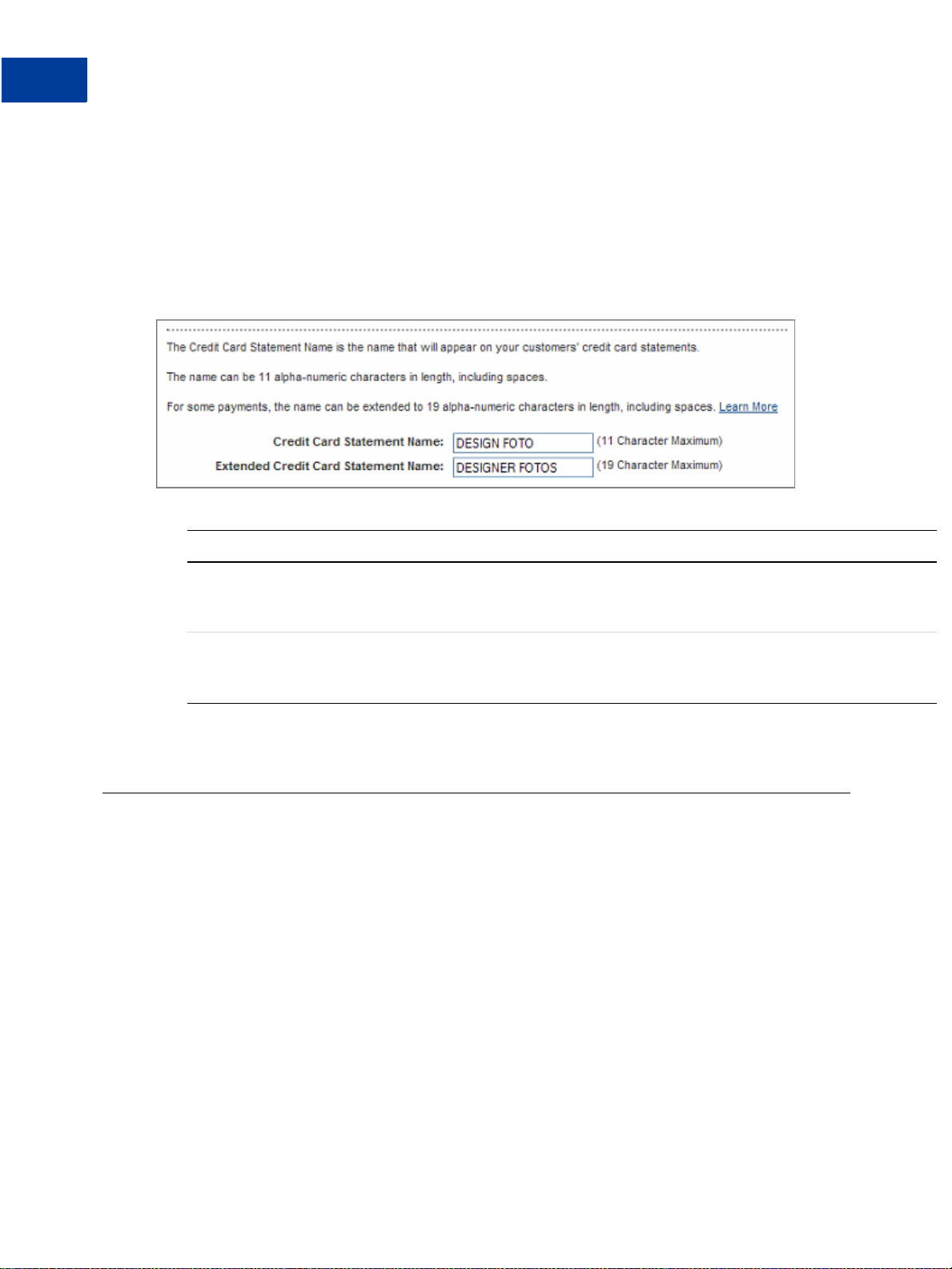

4. Scroll down the page to the Credit Card Statement Name section, as shown below.

5. Change your credit card statement settings:

Setting Action

Credit Card St atement Name Enter up to 11 characters and spaces. Do not include special characters, such as

“&,” “#”, or “_”. The value is converted to all capital letters and might be

truncated by some credit card processors.

Extended Credit Card

Statement Name

Enter up to 19 characters and spaces. Do not include special characters, such as

“&,” “#”, or “_”.The value is converted to all capital letters and might be

truncated by some credit card processors.

6. Scroll to the bottom of the page and click the Save button.

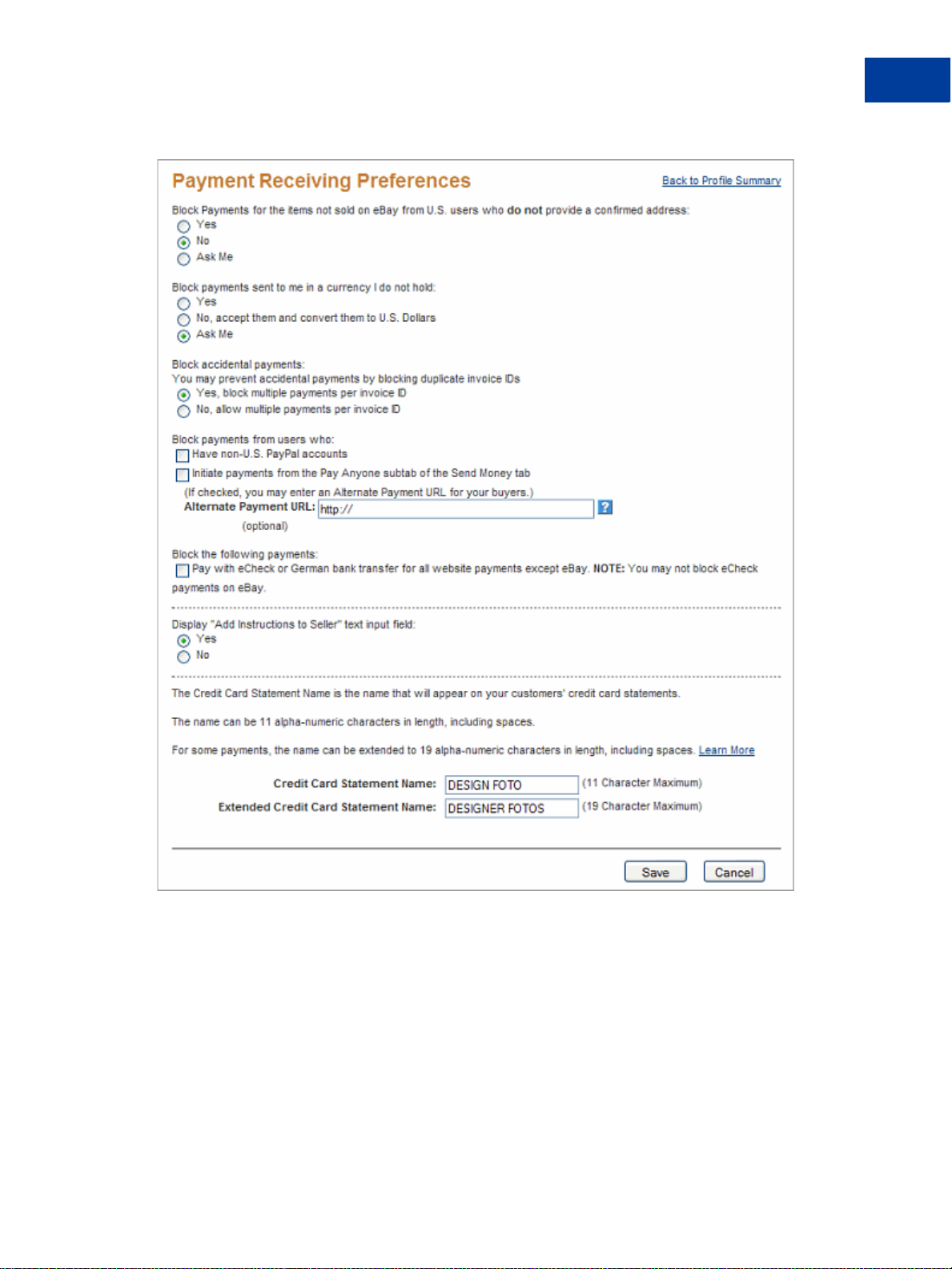

Blocking Certain Kinds of Payments

Use the Payment Receiving Preferences page to block payments from certain payers,

currencies, or funding sources. For example, if your account maintains currency balances for

U.S. dollars and Euros, you can block payments that are in other currencies.

The Payment Receiving Preferences page contains several options that you can set to block

payments in certain situations.

10 January 2010 Merchant Setup and Administration Guide

Page 11

Payment Receiving Preferences page

Setting Up and Administering Your Account

Blocking Certain Kinds of Payments

1

Read the following topics to learn more about blocking payments:

z Blocking Payments From U.S. Payers Without a Confirmed Address

z Blocking Payments in Currencies That You Do Not Hold

z Blocking Accidental Payments

z Blocking Payments from Payers With Non-U.S. PayPal Accounts

z Blocking Payments Initiated Through the Pay Anyone Subtab

z Blocking Payments Funded With eChecks

Merchant Setup and Administration Guide January 2010 11

Page 12

Setting Up and Administering Your Account

1

Blocking Certain Kinds of Payments

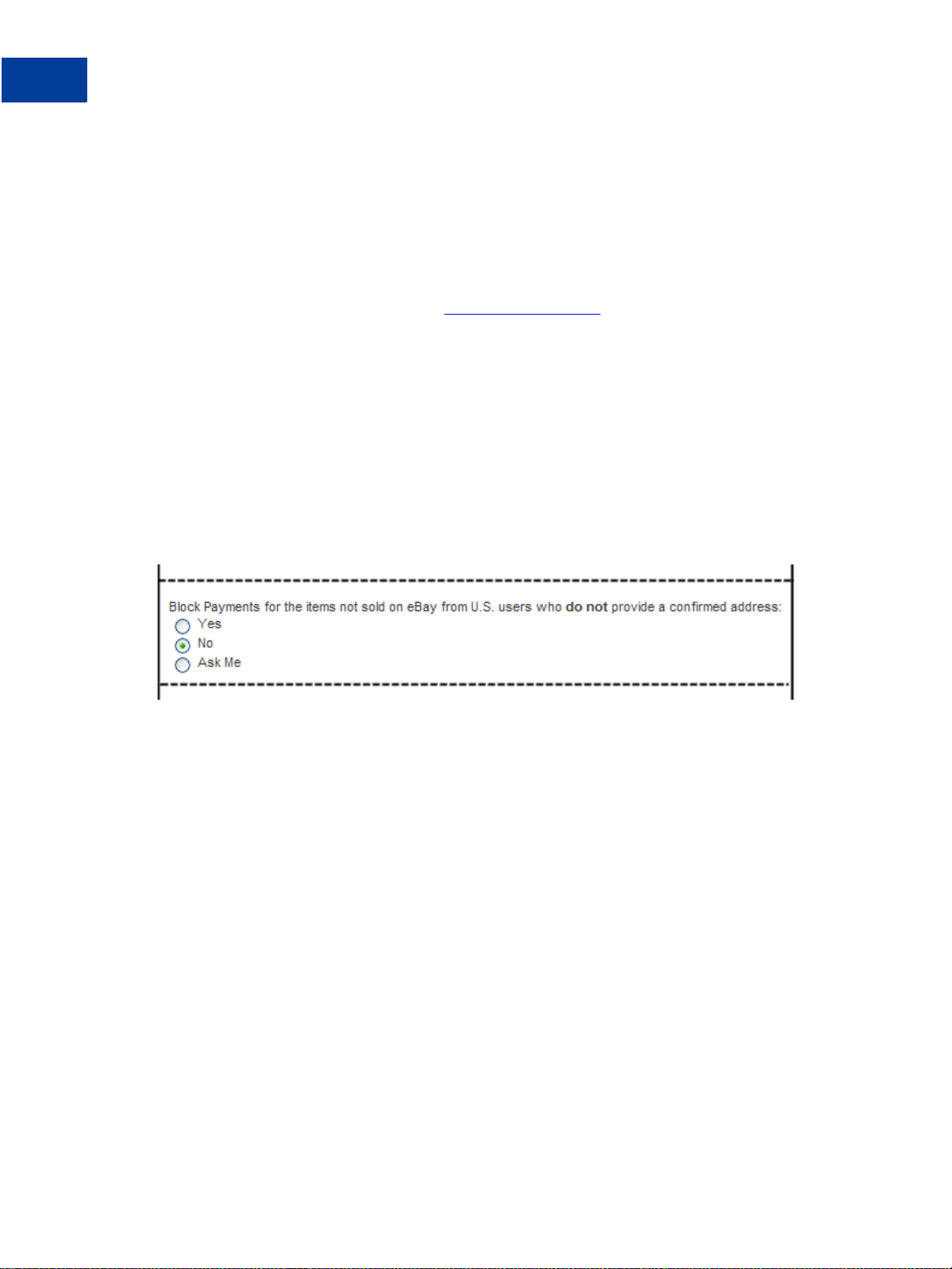

Blocking Payments From U.S. Payers Without a Confirmed Address

You can better manage your risk by blocking payments where the payer chooses not to share

his Confirmed Address with you. PayPal provides Confirmed Addresses to help you make

informed decisions when shipping goods. To be eligible for PayPal's Seller Protection Policy

(SPP), and to help reduce your risk of dealing with fraudulent buyers, ship to a buyer’s

Confirmed Address.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

4. Select an option from the Block payments for items not sold on eBay from U.S. users

who do not provide a confirmed address section, as shown below:

5. Select one of the following options:

– Yes – Block all payments from U.S. payers without a Confirmed Address. This option

requires that all U.S. payers provide a Confirmed Address in order to pay you.

– No – Accept all payments. To maximize your sales, select this option.

– Ask Me – Choose whether to accept or deny payment without a Con firmed Ad dress on

a transaction-by-transaction basis. This option lets you decide whether to take on the risk

of not having the payer’s Confirmed Address for each transaction. If you accept the

payment, it becomes a completed transaction. If you deny a particular payment, PayPal

notifies the payment sender that their payment was denied and credits the sender with the

payment amount. PayPal does not charge fees for denied payments.

https://www.paypal.com.

6. Scroll to the bottom of the page and click Save.

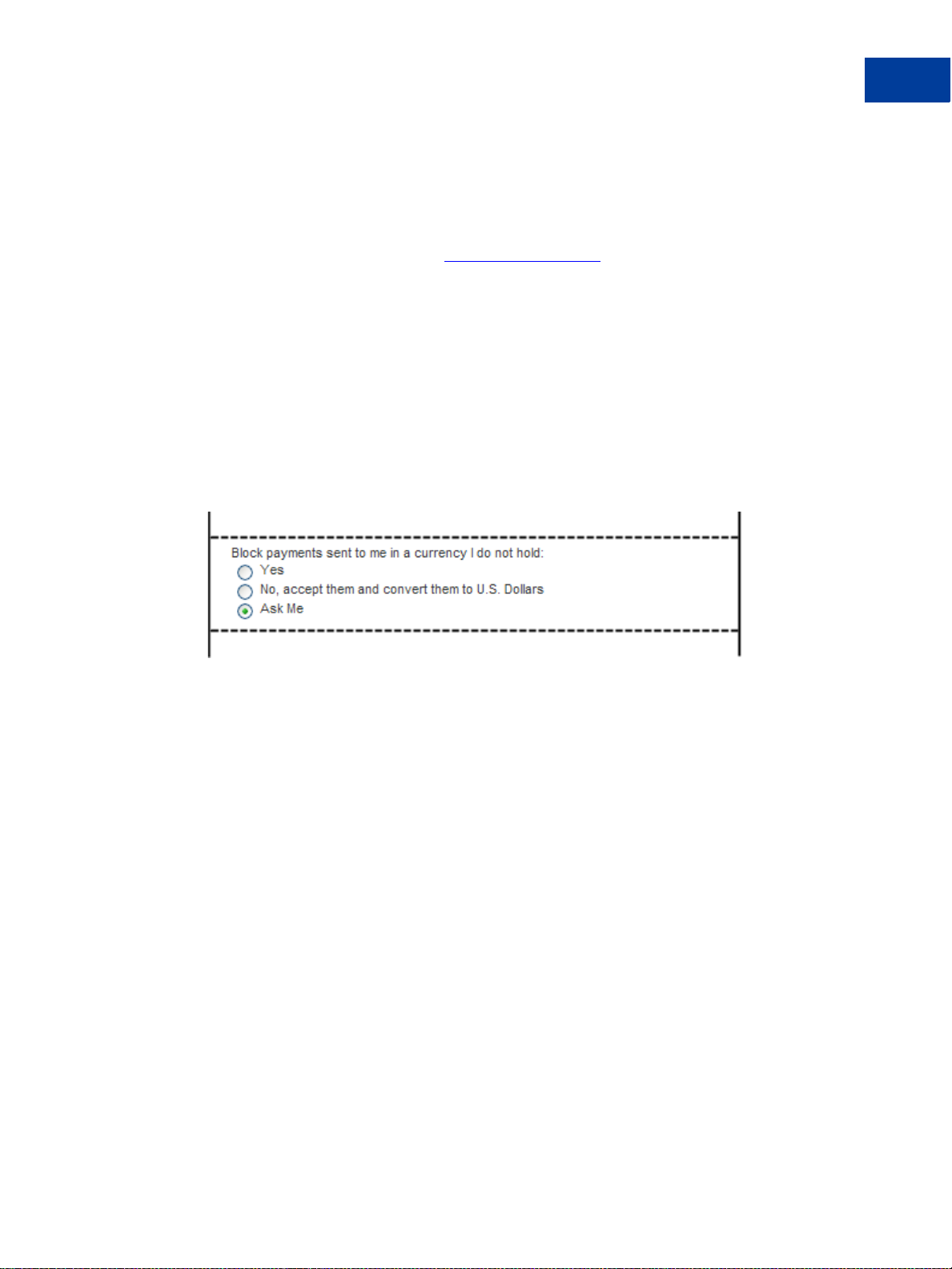

Blocking Payments in Currencies That You Do Not Hold

When you receive a payment in a currency you do not hold, PayPal prompts you to open a

balance for that currency, convert it to your primary balance, or deny the payment. Payments

12 January 2010 Merchant Setup and Administration Guide

Page 13

Setting Up and Administering Your Account

Blocking Certain Kinds of Payments

in currencies for which you hold a balance are applied to the appropriate balance. You see a

summary of each currency balance in your Account Overview page.

For more information about currencies associated with your account, see “Managing Currency

Balances” on page 24.

1

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

4. Scroll down the page to the Block payments sent to me in a currency I do not hold

section as shown below.

5. Select one of the following options:

– Yes – Accept the payment regardless of the currency in which the payment is made.

– No, accept them and convert them to U.S. Dollars – Accept the payment, but

automatically converts to U.S. Dollars.

– Ask Me – Choose whether to accept or deny payment in a currency you do not currently

hold on a transaction-by-transaction basis. If you accept the payment, it becomes a

completed transaction. If you deny a particular payment, the sender of the payment is

notified that the payment has been denied and is credited with the payment amount.

PayPal does not charge fees for denied payments.

https://www.paypal.com.

6. Scroll to the bottom of the page and click Save.

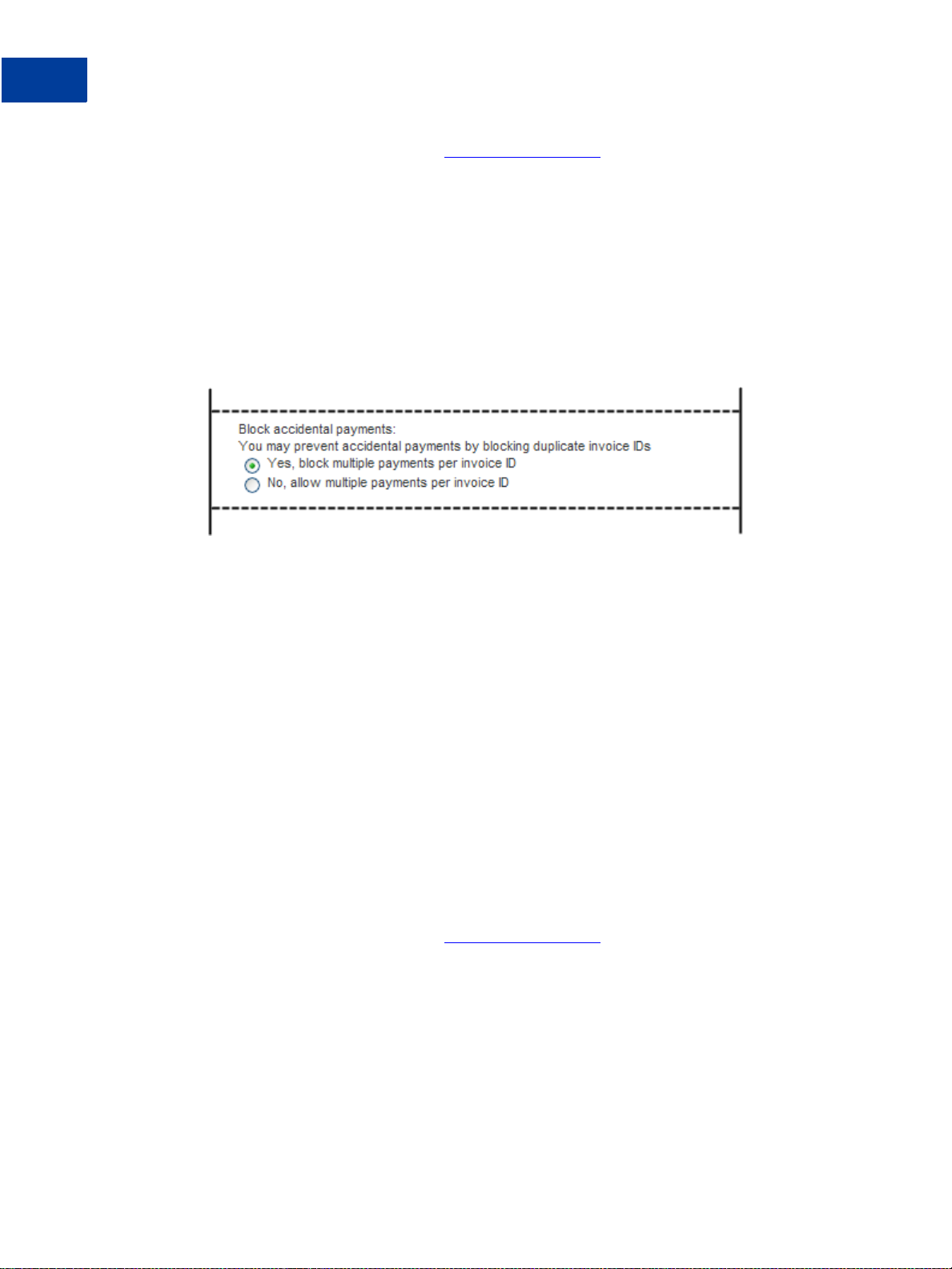

Blocking Accidental Payments

You can choose whether to accept payments with the same Invoice ID or to block payments

when the Invoice ID was already used.

When you receive payments from buyers, you can include an optional Invoice ID field to

track payments; buyers will not see this ID. A buyer's Invoice ID must be unique for each

transaction. If PayPal receives a payment with an Invoice ID that was used for another

payment, PayPal will not accept the transaction.

Merchant Setup and Administration Guide January 2010 13

Page 14

Setting Up and Administering Your Account

1

Blocking Certain Kinds of Payments

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

4. Scroll down the page to the Block accidental payments section as shown below.

5. Select one of the following options:

– Yes, block multiple payments per invoice ID – Do not accept more than one payment

per invoice. This option prevents duplicate payments that you must refund.

– No, allow multiple payments per invoice ID – Do not limit the number of payments

received for an invoice. Choosing this option might result in duplicate payments that

require a refund.

6. Scroll to the bottom of the page and click Save.

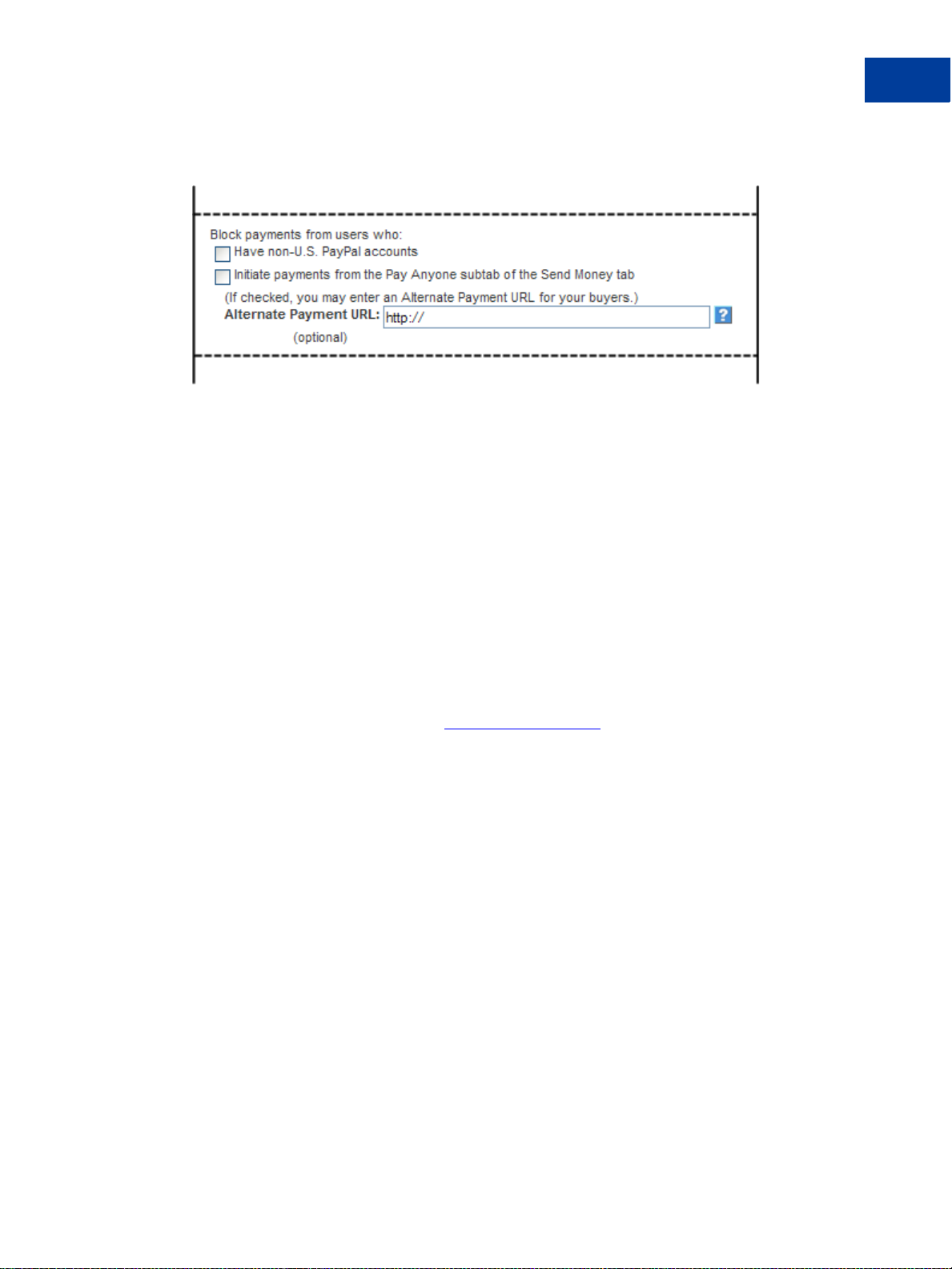

Blocking Payments from Payers With Non-U.S. PayPal Accounts

Because many international addresses cannot be confirmed, you may choose to block

payments from users with non-U.S. PayPal accounts in order to qua l ify for the Seller

Protection Policy.

NOTE: By choosing this preference, you will deny non-U.S. users the ability to send you

payments. This may significantly reduce your sales volume.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

https://www.paypal.com.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

14 January 2010 Merchant Setup and Administration Guide

Page 15

Setting Up and Administering Your Account

Blocking Certain Kinds of Payments

4. Scroll down to the Block payments from users who section, as shown below.

5. Select Have non-U.S. PayPal accounts.

6. Scroll to the bottom of the page and click Save.

Blocking Payments Initiated Through the Pay Anyone Subtab

1

You can choose whether or not to receive payments initiated via the Pay Anyone subtab of the

Send Money tab on the PayPal website. Selecting this option might help you manage your

account, because the payments you receive will be associated with a specific item or

transaction that you defined.

If you block these payments, you accept only payments initiated from Buy Now, PayPal

Shopping Cart, Gift Certificate, Subscription, and Donate buttons, as well as Winning

Buyer Notification, Mass Payments, Money Requests, Smart Logos, or eBay Checkout

Payments.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

4. Scroll down to the Block payments from users who section, as shown below

https://www.paypal.com.

Merchant Setup and Administration Guide January 2010 15

Page 16

Setting Up and Administering Your Account

1

Blocking Certain Kinds of Payments

5. Select Initiate payments from the Pay Anyone subtab of the Send Money tab.

6. Scroll to the bottom of the page and click Save.

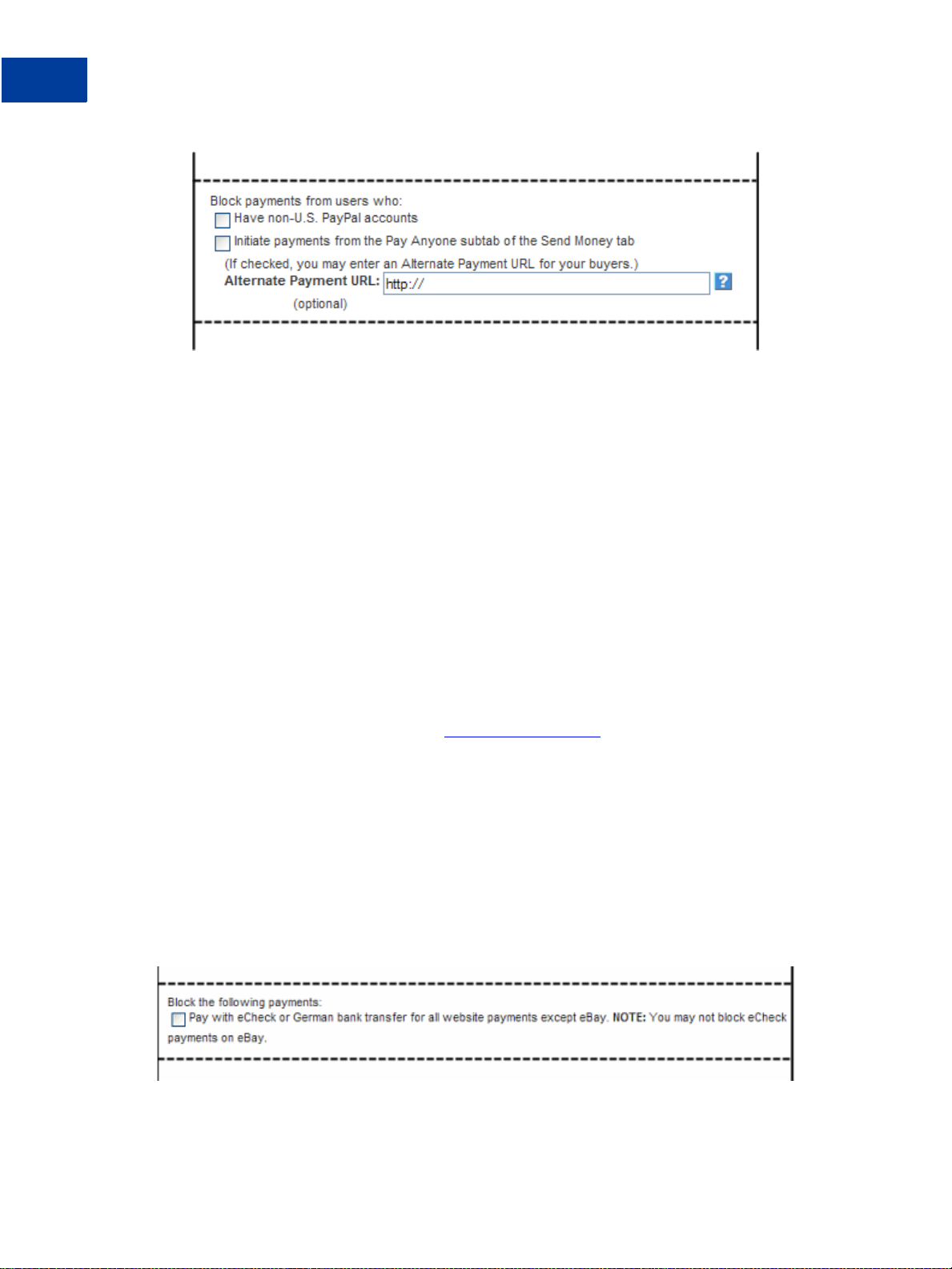

Blocking Payments Funded With eChecks

You can block payments from PayPal members who pay with eChecks. Because eCheck

payments take three to four business days to clear, you might want to block them for your

Instant Purchase and Buy Now buttons.

If you choose to block these payments, users who attempt to pay via eCheck are prompted to

add a credit card to their account before completing the transaction.

If you choose not to block these payments, you can receive eCheck payments through PayPal

Website Payments or Auction Logos. eCheck payments are listed as Pending and are not

credited to your PayPal account for three to four business days.

NOTE: You may not block eCheck payments on eBay.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Payment Receiving Preferences link.

The Payment Receiving Preferences page opens.

4. Scroll down to the Block the following payments section, as shown below.

16 January 2010 Merchant Setup and Administration Guide

Page 17

Setting Up and Administering Your Account

5. Select the option in the Block following payments section.

6. Scroll to the bottom of the page and click Save.

Adding Users to Your PayPal Account

If you have a PayPal Business account, you can let people in your organization access your

account by adding them as users and granting them specific access privileges. This chapter

describes how to determine which privileges to set for users and how to add, edit, and remove

users of your account.

Read the following topics to learn more about managing users:

z Managing Users of Your Account

z Determining Access Privileges

z Granting Administrative Access to Another User

z About PayPal Account Access Privileges

Adding Users to Your PayPal Account

1

z Adding a User to Your Account

z Resetting the Password for a User

z Removing a User

Managing Users of Your Account

As the holder of a PayPal Business account, you are the primary user of the account. You

automatically receive all access privileges for your account. One of those privileges is to add

users to your account.

To have people in your organization complete tasks for you, add them as secondary users to

your account by using the Manage users function page. For example, you can grant privileges

to your accountant to manage funds in your account.

Manage Users lets you add and remove users, add and edit access privileges granted to users,

and change user’s passwords. Access the Manage users page using a link in your account

profile.

NOTE: You can add up to 200 users to your PayPal account.

Determining Access Privileges

When you add users to your account, grant them access to different account areas based on

their business roles. For example, grant your developers the API Activation & Authorization

privilege so they can help complete your account’s implementation.

Merchant Setup and Administration Guide January 2010 17

Page 18

Setting Up and Administering Your Account

1

Adding Users to Your PayPal Acco unt

Before adding users to your account, determine which account areas and functions they should

access. By granting access only to the information or features they need, you can maintain

better control of your account.

When you add a user or modify a user’s access, you must select which privileges to grant;

PayPal does not set them. You can change the privileges that you grant later, if necessary.

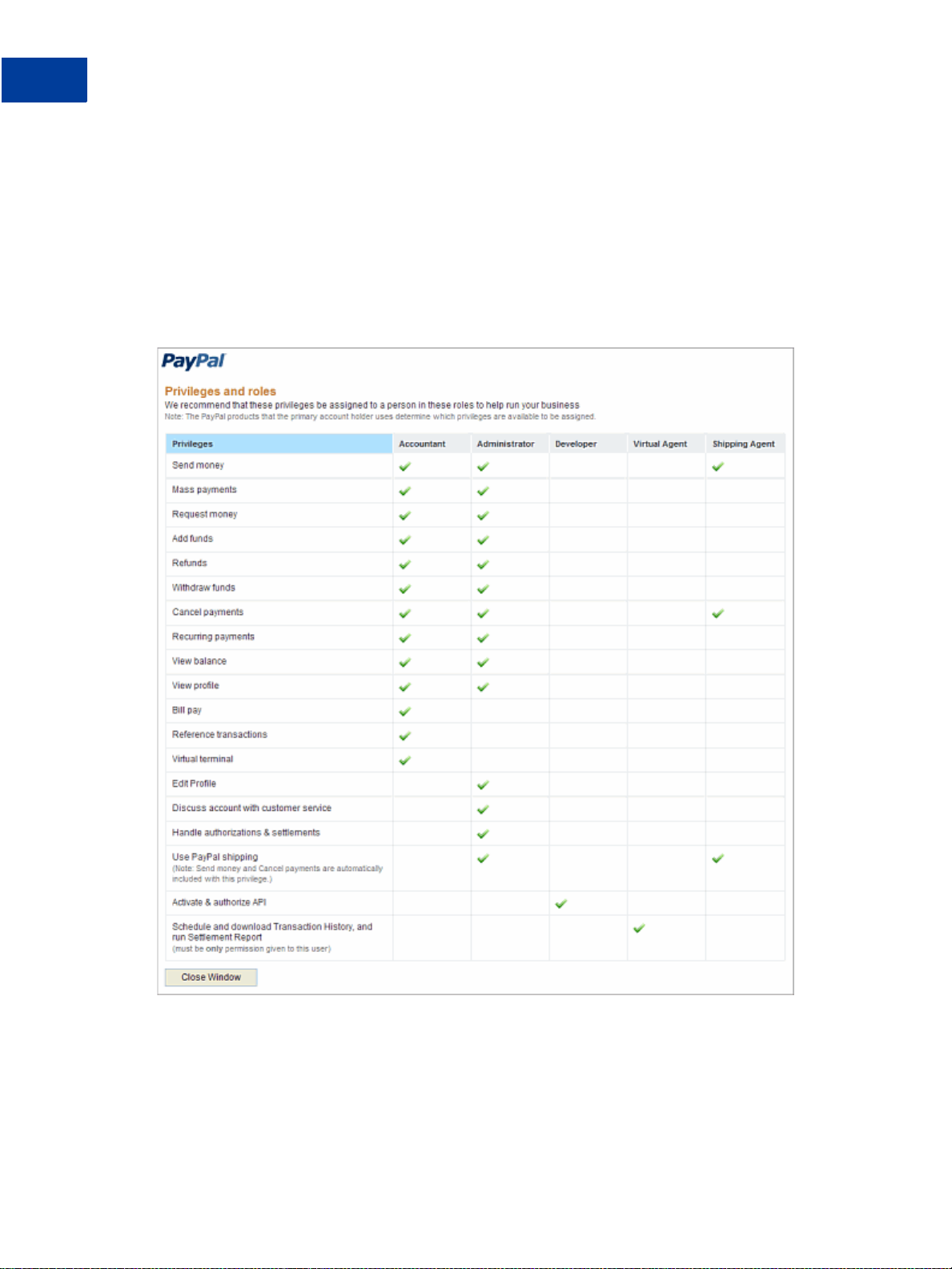

The following chart recommends privileges for different roles in your organization.

NOTE: If your account doe s not have one of the PayPal features listed, you cannot assign

access privileges for it.

NOTE: If you assign the Schedule and download T ransactio n History, and run Settlement

Report privilege to a user, it must be the only privilege assigned to that user.

When you are adding or editing a user, you can display a popup that contains this chart by

clicking the What privileges do we recommend? link on the Add Users or Edit user access

pages.

18 January 2010 Merchant Setup and Administration Guide

Page 19

Setting Up and Administering Your Account

Adding Users to Your PayPal Account

For more details about access privileges, see “About PayPal Account Access Privileges” on

page 19.

Granting Administrative Access to Another User

When you select the Discuss account with customer service privilege, the Account

administrator agreement page displays. This page outlines the terms that you must accept to

grant administrative access to a secondary user.

Read the terms and click Accept to grant administrative access to the user. If you click

Decline, the privilege will not be granted to the user.

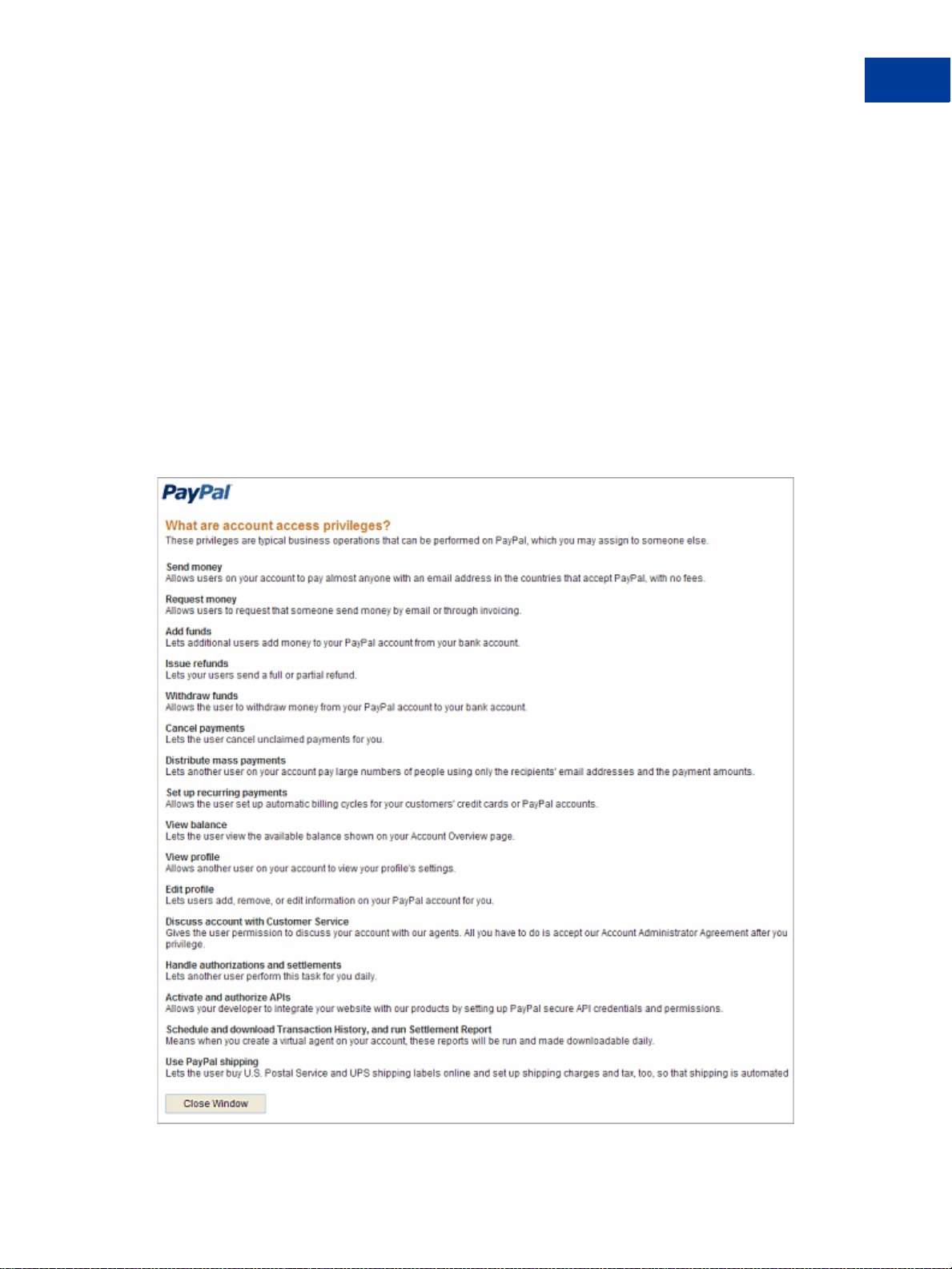

About PayPal Account Access Privileges

T o help you determine which privileges to grant a user , you can disp lay a popup that describes

the access privileges. Each description tell you which tasks are included for the access

privilege. For example, if you grant the Request money privilege, the user can request money

from someone by email or through invoicing.

1

Merchant Setup and Administration Guide January 2010 19

Page 20

Setting Up and Administering Your Account

1

Adding Users to Your PayPal Acco unt

To display the popup, click the What are PayPal account privileges? link on the Add Users

or Edit user access pages.

Adding a User to Your Account

When you add a user to your account, you must provide the following information:

z User ID – A unique ID that is 8 to 16 characters long and contains only letters and

numbers. Choose the user ID carefully; once assigned, you cannot change it.

NOTE: Do not use an email address as the user ID. User IDs for seconda ry users do not

permit special characters.

z Password – A combination of 8-20 characters that contains letters, numbers, and special

characters. You can change the password, as needed.

z User Access – Select one or more privileges from the list on the page. To help you choose,

the recommended privileges are grouped by common roles in an organization.

For more information, see “Determining Access Privileges” on page 17.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Account Information column, click the Manage Users link.

The Manage users page opens.

4. Click the Add User button.

The Add Users page opens.

20 January 2010 Merchant Setup and Administration Guide

Page 21

Setting Up and Administering Your Account

Adding Users to Your PayPal Account

1

5. Change the user settings:

Setting Action

User’s first and last name Enter the first and last name of the person to whom you want to give access to

your account.

User ID Enter a combination of 8-16 characters. Special characters are not allowed.

Password Enter a combination of 8-20 letters, numbers, and special characters. Letters in

the password are case-sensitive.

Re-enter User ID Enter the same combination of characters that you entered for User ID.

User Access Select any of the checkboxes to grant the user specific privileges within your

account. Privileges are grouped by user role; each role lists its recommended

privileges.

Accounting

– Send money

– Request money

– Add funds

– Refunds

– Withdraw funds

– Cancel payments

– Recurring payments

– Mass payments

– Bill pay

– Reference transactions

– Virtual terminal

Administration

– View balance

– View prof ile

– Edit profile

– Discuss account with Customer Service

– Handle authorizations & settlements

Integration

– Activate & authorize APIs

Virtual Agent

– Schedule and download Transaction History and run Settlement Report

Shipping Agent

– Use PayPal shipping

6. Click the Save button.

Merchant Setup and Administration Guide January 2010 21

Page 22

Setting Up and Administering Your Account

1

Adding Users to Your PayPal Acco unt

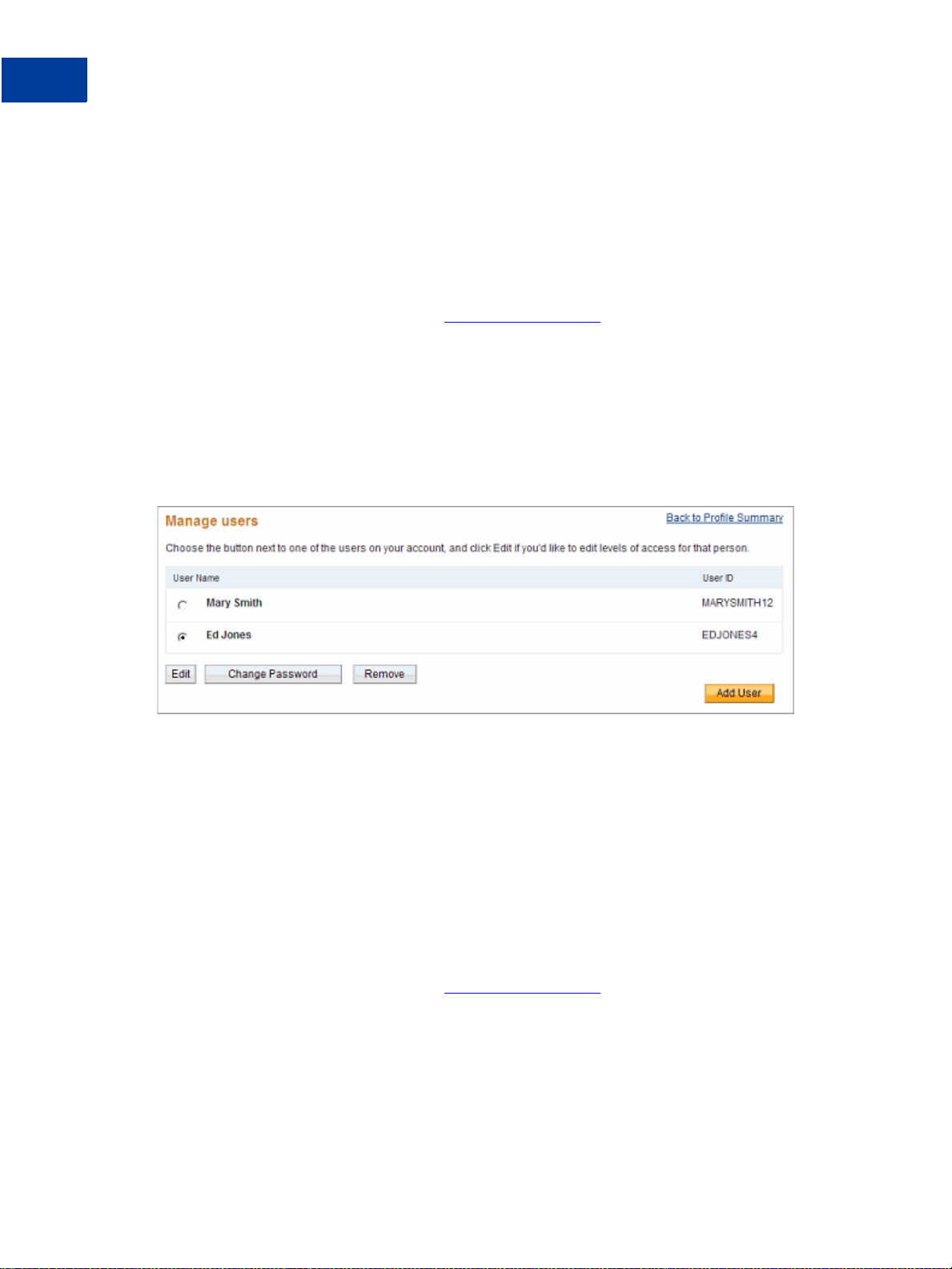

Editing Access Privileges for a User

After you add a user, you can change the user’s access privileges. You ca nnot change the

user’s name or user ID.

For example, when a user’s responsibilities in your organization change, you can add or

remove access privileges to reflect the user’s adjusted role. Use the Edit user access page to

make these adjustments.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Account Information column, click the Manage Users link.

The Manage Users page opens:

4. Select the radio button next to the User Name, and click the Edit button.

The Edit user access page opens, with the User Name and User ID displayed as read-only

text.

https://www.paypal.com.

5. Select and deselect checkboxes for the access privileges that you want to grant or revoke.

6. Click the Save button.

Resetting the Password for a User

If users forget their passwords, you can reset them by using the Change user password page.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

22 January 2010 Merchant Setup and Administration Guide

https://www.paypal.com.

Page 23

Setting Up and Administering Your Account

Handling Multiple Currencies

1

3. In the Account Information column, click the Manage Users link.

The Manage users page opens.

4. Select the radio button next to the User Name for the user, and click the

Change Password button.

The Change user password page opens, with the User Name and User ID displayed as

read-only text.

5. Change the password settings:

Setting Action

Password Enter a combination of 8-20 letters, numbers, and special characters. Letters in

the password are case-sensitive.

Re-enter Password Enter the same combination of characters and special characters that you entered

for Password.

6. Click the Save button.

Removing a User

When people leave your organization or change to roles that do not need account access, you

should remove them from your account. Use the Remove user page to remove a user from

your account. This page asks for confirmation before removing the user.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Account Information column, click the Manage Users link.

The Manage users page opens.

4. Select the radio button next to the User Name for the user, and click the Remove button.

The Remove user page opens, with the User Name and User ID displayed as read-only

text.

5. Click the Yes button to permanently remove the user from your account.

https://www.paypal.com.

Handling Multiple Currencies

PayPal helps you handle multiple currencies in the following ways:

Merchant Setup and Administration Guide January 2010 23

Page 24

Setting Up and Administering Your Account

1

Handling Multiple Currencies

z Managing Currency Balances

z Accepting or Denying Cross-Currency Payments

Managing Currency Balances

Use the Currency Balances section of your account profile to manage your currency

balances, including:

z Opening or closing currency balances

z Selecting your primary currency balance

z Converting funds from one currency balance to funds in another currency balance.

People can pay you in the following currencies; you maintain PayPal balances only in those

currencies that you specify.

24 January 2010 Merchant Setup and Administration Guide

Page 25

Setting Up and Administering Your Account

1

Handling Multiple Currencies

Currencies and Currency Codes Supported by PayPal

Currency Currency Code

Australian Dollar AUD

Brazilian Real

NOTE: This currency is supported as a payment

BRL

currency and a currency balance for in-country

PayPal accounts only.

Canadian Dollar CAD

Czech Koruna CZK

Danish Krone DKK

Euro EUR

Hong Kong Dollar HKD

Hungarian Forint HUF

Israeli New Sheqel ILS

Japanese Yen JPY

Malaysian Ringgit

NOTE: This currency is supported as a payment

MYR

currency and a currency balance for in-country

PayPal accounts only.

Mexican Peso MXN

Norwegian Krone NOK

New Zealand Dollar NZD

Philippine Peso PHP

Polish Zloty PLN

Pound Sterling GBP

Singapore Dollar SGD

Swedish Krona SEK

Swiss Franc CHF

Taiwan New Dollar TWD

Thai Baht THB

U.S. Dollar USD

NOTE: Use the IS0-4217 code for the currency_code HTML variable of HTML buttons

with monetary amounts in currencies in other than USD.

Merchant Setup and Administration Guide January 2010 25

Page 26

Setting Up and Administering Your Account

1

Handling Multiple Currencies

Selecting Your Primary Currency

Your primary currency is the default currency for sending and requesting payments. If your

account has multiple currency balances, you can change which currency is the primary.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Currency Balances link.

The Manage Currencies page opens.

4. Click the radio button next to the currency you want to use as the default and click the

Make Primary button

The Manage Currencies page confirms that you changed your primary currency displays

(Primary) after the currency name.

Adding Currency Balances

If you want to accept payments in a particular currency, you must add that currency to your

account. When you add the new currency, all future payments that you receive in this currency

are automatically credited to this balance.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Currency Balances link.

The Manage Currencies page opens.

4. Select a currency name from the Select new currency dropdown menu and click the Add

Currency button.

The Manage Currencies page confirms that you added a currency balance and displays it

in the Currency list.

Transferring Amounts Between Currency Balances

Use the Manage Currencies page to move amounts from one currency balance to another.

Before confirming the transfer, you can see the currency exchange rate that PayPal will use.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

26 January 2010 Merchant Setup and Administration Guide

Page 27

Setting Up and Administering Your Account

Handling Multiple Currencies

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Currency Balances link.

The Manage Currencies page opens.

4. Type the amount that you want to transfer in the From field and select the currency name

from the dropdown menu.

5. Select the currency name that you want to receive the amount from the To dropdown menu.

6. Click the Calculate button to see the amount in the new currency that will be transferred

and the exchange rate used to calculate that amount.

7. Click the Review Exchange button to see the details of your transfer.

8. Click the Exchange Currency button to complete the transfer.

The Manage Currencies page displays the updated balances for the two currencies you

used.

1

Closing Currency Balances

You can close a currency only if there are no funds in that balance. If you still have available

funds in that currency, you must transfer those funds to a different currency before you

continue. If you receive any future payments in a closed currency, you will be given an option

to accept or deny each payment.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Currency Balances link.

The Manage Currencies page opens.

4. Click the radio button next to the currency that you want to close.

Note: If the currency does not have a zero balance, you must transfer all funds to another

currency before you can remove it.

5. Click the Close Currency button.

The Manage Currencies page confirms the removal and displays an updated currency list.

https://www.paypal.com.

Merchant Setup and Administration Guide January 2010 27

Page 28

Setting Up and Administering Your Account

1

Handling Multiple Currencies

Accepting or Denying Cross-Currency Payments

You choose which currencies you accept and how you want to accept them. You can set your

Payment Receiving Preferences to handle cross-currency payments in different ways.

For more information, see “Blocking Certain Kinds of Payments” on page 10.

When people make payments in currencies that you hold, the funds appear in your account in

the balance of that currency . When peop le make payments in currencies that you do not hold,

you choose whether to accept or deny the payments. These transaction display an Accept

dropdown menu in the Order status/Actions column.

If you accept a payment, receiving fees are assessed in the currency in which the funds were

sent. Payments converted to your primary currency are converted at a competitive exchange

rate.

1. In the Order status/Actions column for the transaction, select Accept or Deny.

The Accept or Deny this Payment page opens.

2. Select what to do with the payment:

– Accept the payment and convert it…

– Accept the payment and create a balance…

– Deny this payment and return the money to the sender.

3. Click the Submit button.

28 January 2010 Merchant Setup and Administration Guide

Page 29

2

Setting Controls for PayPal Checkout Pages

Your PayPal account profile lets you set options to control the way your PayPal checkout

pages look and operate. These options control the PayPal checkout pages regardless of which

PayPal payment solutions you use as a PayPal merchant.

Read the following topics to learn about controlling the PayPal checkout pages:

z “Co-Branding the PayPal Checkout Pages” on page 29

z “Getting Contact Telephone Numbers” on page 35

z “Providing Your Customer Service Number” on page 37

z “Handling Gift Purchases” on page 37

z “Prompting Buyers for Marketing Messages” on page 40

z “Asking Buyers a Survey Question” on page 40

z “Language Encoding Your Data” on page 41

Co-Branding the PayPal Checkout Pages

Custom payment pages let you co-brand the PayPal checkout pages with your own logo and

colors. You can add up to three custom payment page styles.

Read the following topics to learn about co-branding the PayPal checkout pages:

z “About Custom Payment Pages” on page 29

z “Accessing Your Custom Payment Pages” on pa ge 31

z “Adding or Editing a Page Style” on page 32

z “Making a Page Style Primary” on page 33

z “Removing a Page Style” on page 34

About Custom Payment Pages

When your account is created, PayPal sets up the default PayPal payment page style in your

account profile. Add your own custom payment page styles to co-brand the PayPal checkout

pages with your logo and colors.

The PayPal payment page style has PayPal branding only. Depending on your account type,

your business name or email address appears in the upper left of the pages.

Merchant Setup and Administration Guide January 2010 29

Page 30

Setting Controls for PayPal Checkout Pages

2

Co-Branding the PayPal Checkout Pages

Example of the Default PayPal Payment Page Style

You can add custom payment pages to your account to add the below co-branding features:

z Header image – you own logo image, in place of your business name or email address

z Header background – a fill color of your choice, above the main page area

z Header border – a line color of your choice, above the main page area

z Background – a fill color of your choice, surrounding the main page area

30 January 2010 Merchant Setup and Administration Guide

Page 31

Setting Controls for PayPal Checkout Pages

Co-Branding the PayPal Checkout Pages

Example of a Custom Payment Page Style with Co-Branding Options

2

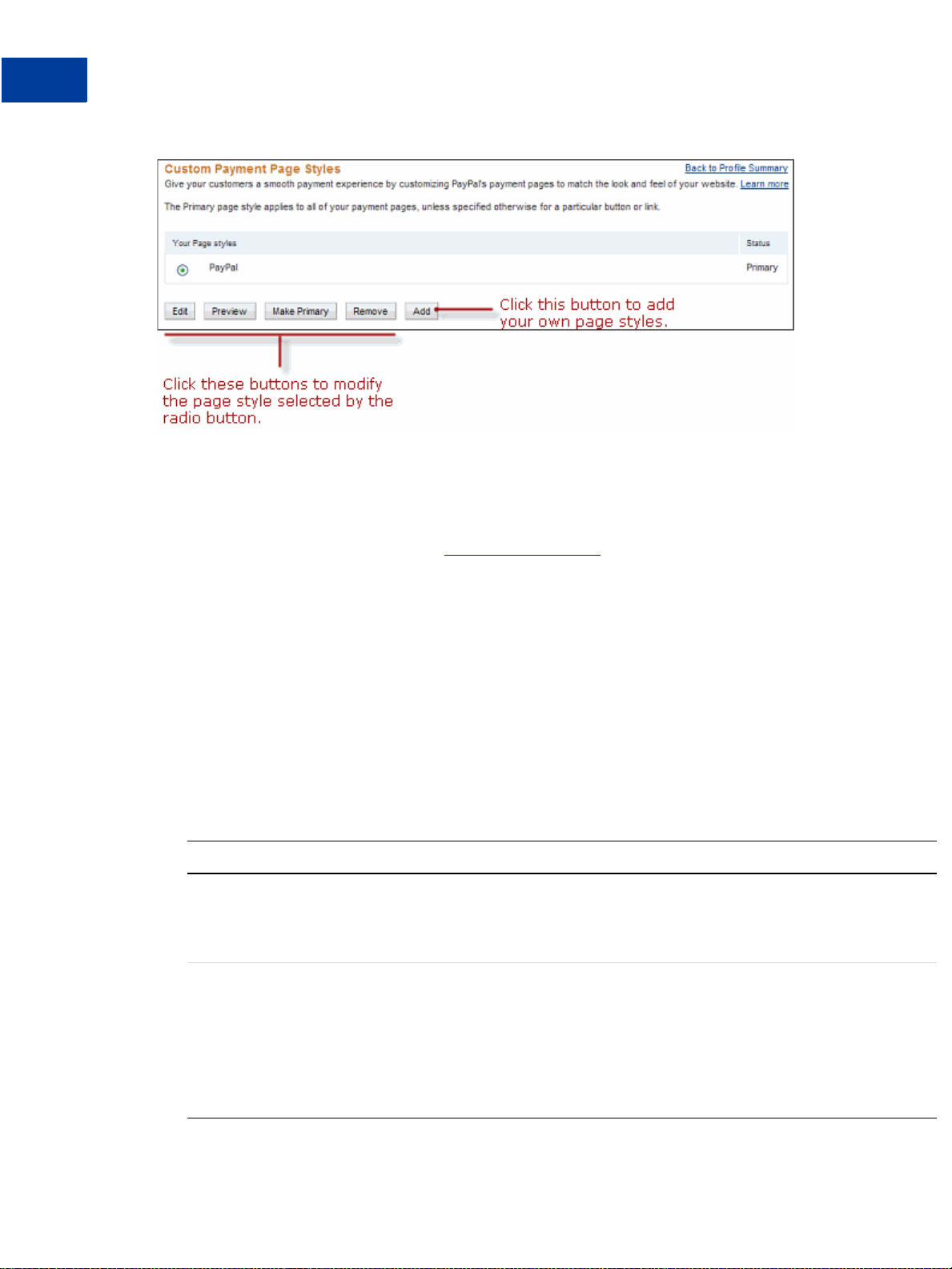

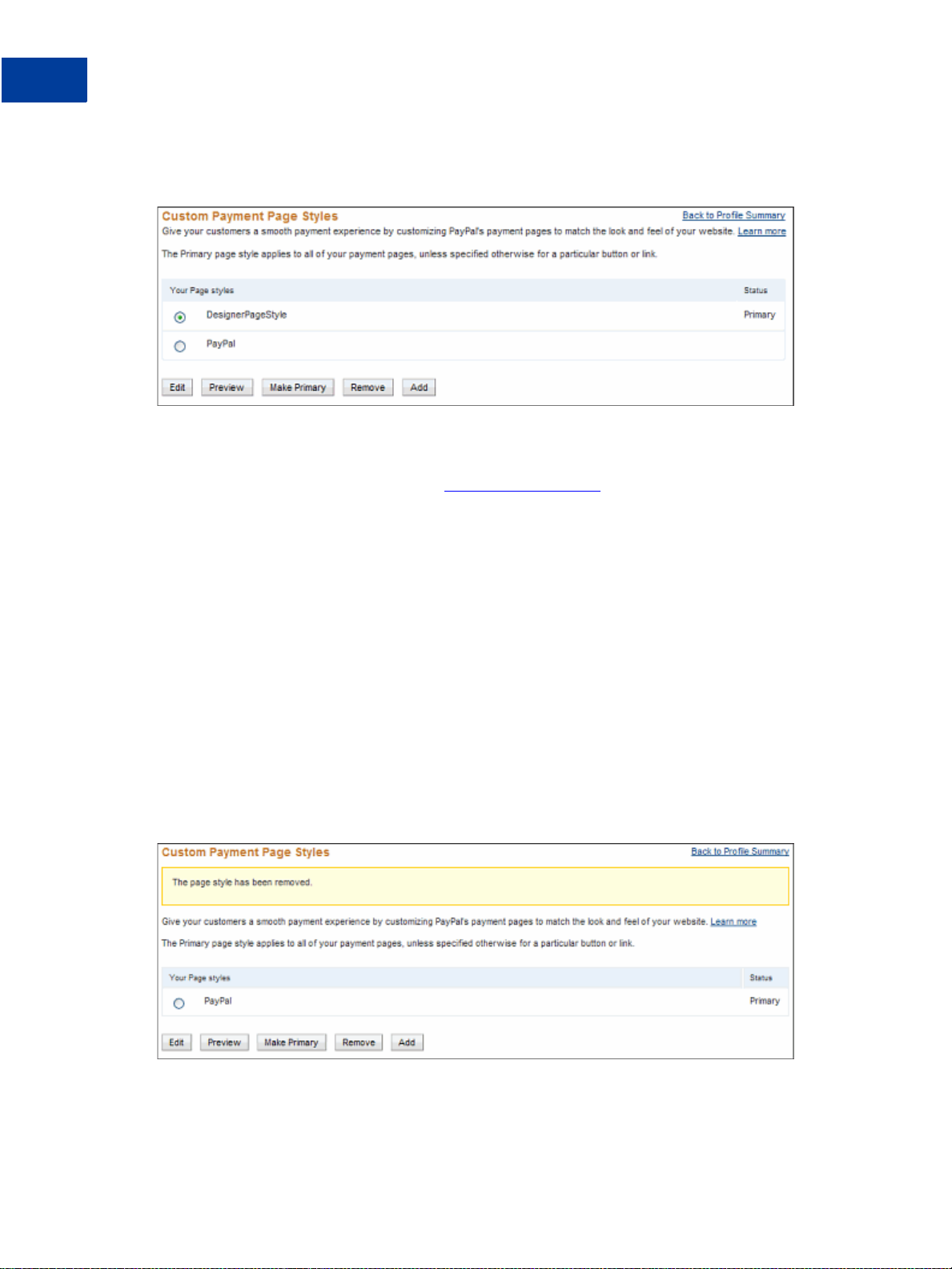

Accessing Your Custom Payment Pages

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Custom Payment Page Styles page opens.

Result:

From Custom Payment Page S tyles page, you can add, edit, preview, and remove page styles,

as well as making one of the page styles the primary page style.

Merchant Setup and Administration Guide January 2010 31

Page 32

Setting Controls for PayPal Checkout Pages

2

Co-Branding the PayPal Checkout Pages

Custom Payment Page Styles

NOTE: The PayPal page style is a permanent page style. You cannot edit or remove it.

Adding or Editing a Page Style

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Custom Payment Page Styles page opens.

4. Click the Add button or the Edit button.

The Edit Custom Page Style page opens.

5. Enter your custom page style preferences.

Setting Action

Page Style Name (requir ed) Enter a name up to 30 characters long. The name can contain letters, numbers, and

underscores, but no other symbols or spaces. The Page S tyle Name is used to refer

Header Image URL

(optional)

to the page style in your PayPal account and in the

for your Website Payment buttons.

Enter the URL for an image that should appear at the top left of the payment page.

Maximum size of the image is 750 pixels wide by 90 pixels high; larger images are

reduced to this size. The image must be in a valid graphics format such as gif, jpg,

or png.

NOTE: PayPal recommends that you enter an image URL only if the image is

stored on a secure (https) server. Otherwise, your payer’s web browser

displays a message that the payment page contains insecure items.

page_style HTML variable

32 January 2010 Merchant Setup and Administration Guide

Page 33

Setting Controls for PayPal Checkout Pages

Co-Branding the PayPal Checkout Pages

Setting Action

2

Header Background Color

(optional)

Header Border Color

(optional)

Payment Flow Background

Color (optional)

6. Click the Preview button to view a mock-up of your page style.

7. Click the Save button to save it.

Making a Page Style Primary

When you make a page style primary, it is applied to all checkout pages unless you specify

otherwise in the programming code of individual payment transactions. If you do not

designate a page style as primary, the PayPal page style is used.

1. Log in to your PayPal website at

The My Account Overview page opens.

Enter the border color for the header using HTML hex code. The color code must

be six digits long and should not contain the # symbol. The header border is a twopixel perimeter around the header space.

Enter the border color for the header using HTML hex code. The color code must

be six digits long and should not contain the # symbol. The header border is a twopixel perimeter around the header space.

Enter the background color for the payment page using HTML hex code. The color

code must be six digits long and should not contain the # symbol.

https://www.paypal.com.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Custom Payment Page Styles page opens.

4. Click the radio button next to the page style you that want to make your primary sty l e.

5. Click the Make Primary button.

The Make Custom Page Style Primary page opens.

Merchant Setup and Administration Guide January 2010 33

Page 34

Setting Controls for PayPal Checkout Pages

2

Co-Branding the PayPal Checkout Pages

6. Click the Make Primary button to confirm your choice. The designated primary page

moves to the top of the Custom Payment Page Styles list.

Removing a Page Style

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Custom Payment Page Styles page opens.

4. Click the radio button next to the page style you that want to remove.

5. Click the Remove button.

6. The Remove Custom Page Style page opens.

7. Click the Remove button to confirm your choice.

The designated page no longer appears in the Custom Payment Page Styles list.

34 January 2010 Merchant Setup and Administration Guide

Page 35

Setting Controls for PayPal Checkout Pages

Getting Contact Telephone Numbers

Contact T elephone Number is a feature that lets you obtain the contact telephone numbers that

PayPal collects from people who pay you. Contact Telephone Number is off by default.

PayPal always collects contact telephone numbers from people when they sign up for PayPal

accounts. PayPal collects telephone numbers to help confirm the identities of account holders

and to contact them if necessary to help them with problems on their accounts.

You can turn on Contact Telephone Number in one of two ways:

z On (Optional Field) – During checkout PayPal gives people the option of sharing their

contact telephone numbers with you.

Merchants Allow People to Share Their Telephone Numbers During Checkout

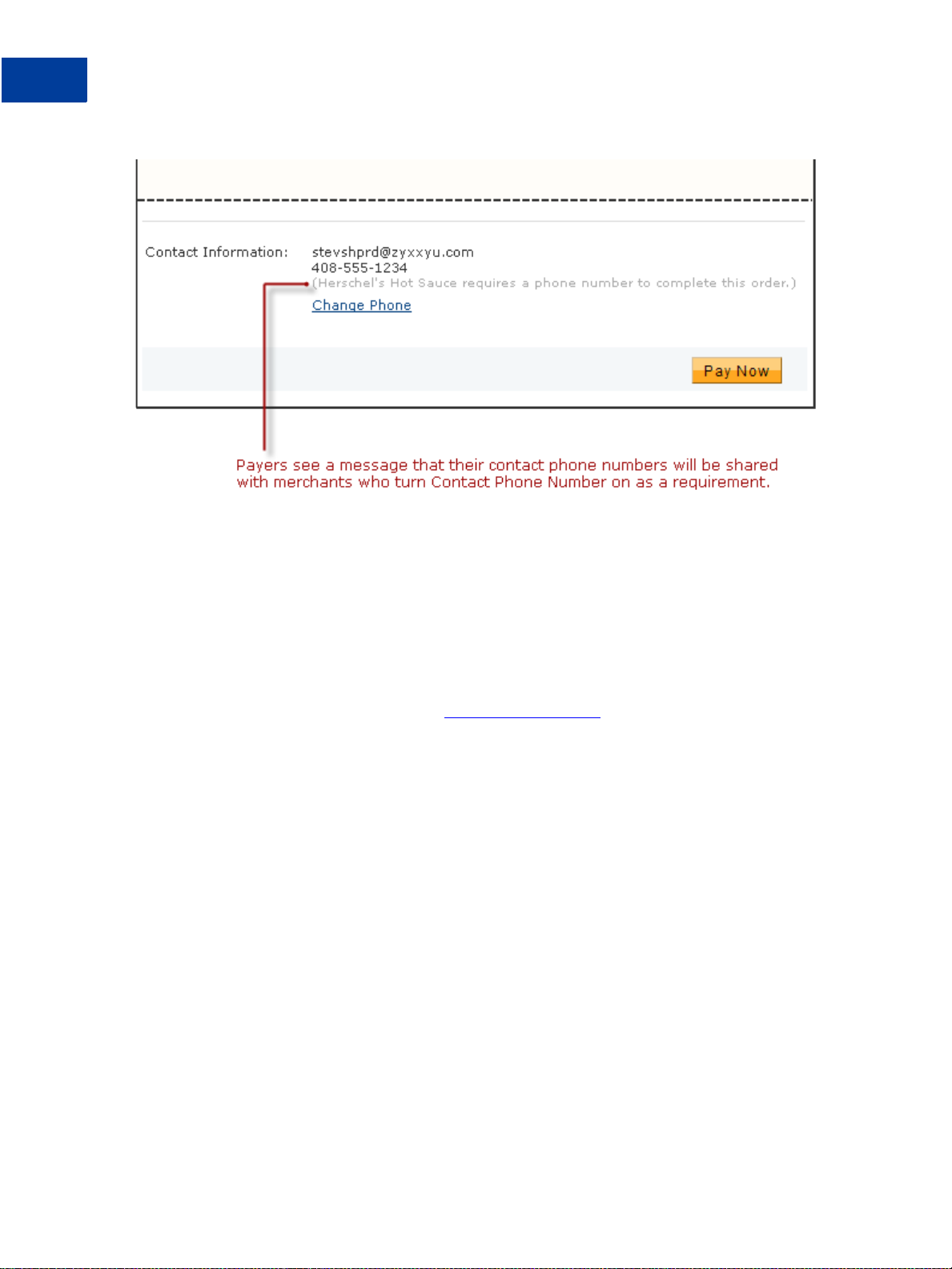

Getting Contact Telephone Numbers

2

z On (Required Field) – During checkout PayPal informs people that their contact

telephone numbers will be shared with you because you require it.

Merchant Setup and Administration Guide January 2010 35

Page 36

Setting Controls for PayPal Checkout Pages

2

Getting Contact Telephone Numbers

Merchants Require People To Share Their Telephone Numbers During Checkout

When people share their contact telephone numbers with you, PayPal includes their shared

numbers in the transaction details section of payment authorization notices sent by email.

Also, PayPal displays the shared numbers in the Transaction Details page for transactions in

which contact telephone numbers were shared. These actions let you and your payers know

that contact telephone numbers were shared as part of the transaction.

IMPORTANT: In accordance with the PayPal user agreement, you may use contact telephone

numbers only to communicate with the payer about the related transaction.

You may not use them for unsolicited communication.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Website Payment Preferences link.

4. Scroll down the page to the Contact Telephone Number section.

5. Select one of the following options:

– On (Optional Field) – PayPal lets payers share their telep hone numbers with you, as an

option.

– On (Required Field) – PayPal informs payers that their telephone numbers will be

shared with you because you require it.

– Off (PayPal recommends this option) – PayPal does not share payers’ telephone

numbers with you.

6. Scroll to the bottom of the page and click Save.

36 January 2010 Merchant Setup and Administration Guide

Page 37

Setting Controls for PayPal Checkout Pages

Providing Your Customer Service Number

Providing Your Customer Service Number

If you offer buyers customer service by phone, you can provide your customer service phone

number on the PayPal checkout pages. Buyers who have questions during checkout can tal k to

customer service agents before completing their purchases.

For merchants who use Website Payments Standard, this option affects only Buy Now, Add to

Cart, and Cart Upload checkout pages.

2

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Customize Your Payment Page page opens.

4. Click the Options tab.

5. Under the Merchant service options heading, select the Display your phone number to

customers checkbox.

The page expands to show your current phone number.

6. Click the Save button.

Handling Gift Purchases

If your buyers purchase items to give as gifts, you can enable support for gift purchases in the

PayPal checkout pages. Often, buyers want to add gift messages, gift wrap, and gift receipts to

their online gift purchases.

https://www.paypal.com.

Read the following topics to learn more about handling gift purchases:

z “Prompting Buyers for Gift Messages” on page 38

z “Prompting Buyers for Gift Wrapping” on page 38

z “Prompting Buyers for Gift Receipts” on page 39

NOTE: If you are an Express Checkout or a Website Payments Pro merchant, your developers

can control these settings through API programming.

Merchant Setup and Administration Guide January 2010 37

Page 38

Setting Controls for PayPal Checkout Pages

2

Handling Gift Purchases

Prompting Buyers for Gift Messages

Buyers of gift purchases may want to include a message to their gift recipients. Enable the

PayPal checkout pages to prompt buyers for gift messages, because buyers often ship their gift

purchases directly to recipients.

When you prompt buyers for gift messages during checkout, they can enter messages up to

150 characters in length.

For merchants who use Website Payments Standard, this option affects only Buy Now, Add to

Cart, and Cart Upload checkout pages.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Customize Your Payment Page page opens.

4. Click the Options tab.

5. Under the Gift options heading, select the Allow gift messages checkbox.

6. Click the Save button.

Prompting Buyers for Gift Wrapping

Buyers may want their gift purchases gift wrapped. Enable the PayPal checkout pages to

prompt buyers for gift wrapping if you offer that service.

When you prompt buyers for gift wrapping during checkout, you specify the description of

your gift wrapping option. Also, you can specify an amount to charge buyers for the extra

service.

NOTE: PayPal displays the prompt to buyers only when the payment is in the same currency

as your primary balance.

For merchants who use Website Payments Standard, this option affects only Buy Now, Add to

Cart, and Cart Upload checkout pages.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

38 January 2010 Merchant Setup and Administration Guide

Page 39

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Customize Your Payment Page page opens.

4. Click the Options tab.

5. Under the Gift options heading, select the Offer gift wrap checkbox.

6. Enter your gift wrap settings:

Setting Action

Enter gift wrap description here Type a description of no more than 25 characters.

Amount Enter the amount you charge for give wrap, priced in

7. Click the Save button.

Prompting Buyers for Gift Receipts

Setting Controls for PayPal Checkout Pages

Handling Gift Purchases

the currency of your primary balance.

2

Buyers of gift purchases may want to include a gift receipt so that recipients can return gift

items to you. Enable the PayPal checkout pages to prompt buyers for gift receipts if you allow

gift returns.

Gift receipts allow recipients to return or exchange gifts directly , without showing the prices of

items.

For merchants who use Website Payments Standard, this option affects only Buy Now, Add to

Cart, and Cart Upload checkout pages.

1. Log in to your PayPal website at

https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Customize Your Payment Page page opens.

4. Click the Options tab.

5. Under the Gift options heading, select the Send gift receipts checkbox.

6. Click the Save button.

Merchant Setup and Administration Guide January 2010 39

Page 40

Setting Controls for PayPal Checkout Pages

2

Prompting Buyers for Marketing Messages

Prompting Buyers for Marketing Messages

You can increase sales by sending marketing messages to buyers. Enable the PayPal checkout

pages to prompt buyers for accepting marketing messages if you run a marketing program.

When you prompt buyers for marketing messages and they accept, you can send them

promotional information like sale announcements or newsletters by email. If you choose this

option, you also need to offer an unsubscribe service.

For merchants who use Website Payments Standard, this option affects only Buy Now, Add to

Cart, and Cart Upload checkout pages.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Customize Your Payment Page page opens.

4. Click the Options tab.

5. Under the Merchant service options heading, select the Offer promotional emails

checkbox.

6. Click the Save button.

https://www.paypal.com.

Asking Buyers a Survey Question

You can better understanding your buyers by asking them a survey question during checkout.

Enable the PayPal checkout pages to ask buyers a survey question so you can find out how to

improve your products and services.

When you ask buyers a survey question during checkout, your question can be up to 50

characters long. Buyers answer by selecting choices from a dropdown menu. You can specify

up to 5 answers. Each answer can be up to 15 characters long.

For merchants who use Website Payments Standard, this option affects only Buy Now, Add to

Cart, and Cart Upload checkout pages.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

40 January 2010 Merchant Setup and Administration Guide

https://www.paypal.com.

Page 41

Setting Controls for PayPal Checkout Pages

Language Encoding Your Data

2

3. In the Selling Preferences column, click the Custom Payment Pages link.

The Customize Your Payment Page page opens.

4. Click the Options tab.

5. Under the Merchant service options heading, select the Add a customer service survey

checkbox.

6. Enter your survey settings:

Setting Action

Question Enter the question that you want to ask buyers, up to 50 characters in length.

For example, you might ask, “How did you hear about us?”

Answers Enter up to 5 answers. Each answer can be up to 15 characters in length.

For example, your answers might be:

“the web”

“email”

“radio or TV add”

“someone I know”

“other”

7. Click the Save button.

Language Encoding Your Data

Websites that use PayPal in different parts of the world work with different languages and

different character encoding schemes. Use your account profile settings to match the character

encoding of the PayPal checkout pages with the character encoding of yo ur website.

PayPal refers collectively to differences between languages and character encoding as

language encoding.You can specify default settings in your account profile for the language

encoding that your website uses to exchange data with PayPal. These settings are used for all

transactions sent from your website to PayPal and all automated notifications sent from PayPal

to your website. However, you can override the default settings on individual transactions.

Character Sets

A character set is a defined set of individual letters and symbols used in a particular language.

For instance, the ASCII character is commonly used to define the characters in written

American English. The Big 5 character set is commonly used to define the characters in

written Chinese.

In your account profile, the character set for your default language encoding preferences is

known as your website‘s language.

Merchant Setup and Administration Guide January 2010 41

Page 42

Setting Controls for PayPal Checkout Pages

2

Language Encoding Your Data

Character Encoding

Character encoding is the way a computer system represents internally the letters and symbols

of a particular character set. Computers use the internal representation to store, transmit, and

process data.

Different character encoding schemes define the number of bytes each character requires and

the pattern of on/off bits that identify a particular charac ter. For example, single-byte encoding

schemes, such as ANSI and extended ASCII, allocate one byte for each character or symbol in

character set for Western European languages. Other encoding schemes, such as Unicode and

UTF-8, allocate several bytes for each character in their multiple-language character sets.

In your account profile, the character encoding for your default language encoding preferences

is known simply as encoding.

Your Default Language Encoding

When you sign up for a PayPal account, the system determines your default language

encoding based on your country of origin. For example, if you sign up with a French postal

address, your language encoding preferences are set as:

z Your website’s language – Western European

z Encoding – ANSI

Generally, the default language encoding preferences selected by PayPal is appropriate. In

some cases, particularly in Asian countries or with certain operating systems, your website

language and/or encoding preferences may not match those used by your website. If not, you

must set your language encoding preferences to match the language and encoding that your

website uses. Otherwise, data cannot be exchanged with PayPal.

Changing Your Default Website Language

Changing your website language changes the character set used on your website, such as

Western European, Japanese, or Russian.

1. Log in to your PayPal account at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Language Encoding link.

The Language Encoding page opens, as shown below.

https://www.paypal.com.

42 January 2010 Merchant Setup and Administration Guide

Page 43

Setting Controls for PayPal Checkout Pages

4. From the Your website’s language dropdown menu, select an appropriate setting.

5. Click the Save button.

Changing the Encoding Used by Your Website

Changing your encoding changes the character encoding scheme used on your website, such

as UTF-8, EUC-JP, or KOI8-R.

You might need to select the encoding for data that your website sends to PayPal with Website

Payments Standard buttons separately from the data sent by PayPal through Instant Payment

Notification, downloadable history logs, and email notifications.

Language Encoding Your Data

2

1. Log in to your PayPal account at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Selling Preferences column, click the Language Encoding link.

The Language Encoding page opens.

4. Ensure that setting for Your website’s language is correct.

5. Click the More Options button.

The More Encoding Options page opens.

https://www.paypal.com.

6. From the Encoding dropdown menu, select the appropriate character encoding scheme for

data that your website sends to PayPal.

Merchant Setup and Administration Guide January 2010 43

Page 44

Setting Controls for PayPal Checkout Pages

2

Language Encoding Your Data

– If you want to use the same encoding scheme for receiving data that PayPal sends to your

website, ensure that the Yes radio button is selected.

– If you want to use a different encoding scheme, click the No radio button and select the

encoding scheme you want to use to receive data from PayPal from the No, use

dropdown menu.

7. Click the Save button to preserve both the encoding options that you selected on this page

and the website language you selected on the previous page.

NOTE: You can click the Cancel button to return to the previous page and review your

choice for website language. However, selections that you made on the More

Encoding Options page are lost.

44 January 2010 Merchant Setup and Administration Guide

Page 45

Viewing Your Account History

3

With account history and reporting tools, you can access monthly account statements, search

your account history for different kinds payments and transactions, download history to your

local computer, and access reports about disputed transactions.

Read the following topics to learn about using your account history:

z “Using Monthly Account Statements” on page 45

z “Accessing Your Account History” on page 50

z “Searching History” on page 51

z “Monitoring Disputed Transactions” on page 63

Using Monthly Account Statements

Monthly account statements list the totals of the payments received, payments sent, fees

charged, and other credits and debits that occurred in your account. You must activate monthly

account statements to see this information. You activate and view monthly account statements

from the Profile Summary page. New statements become available on the 15th of each

month. Up to three past monthly statements are available at one time. You can print the

monthly statement or download it to a spreadsheet.

The monthly account statement displays one line for each date included in the statement.

When you first open the statement, account activity amounts display in your default currency;

you can view other currencies that your account uses by selecting a currency type.

Merchant Setup and Administration Guide January 2010 45

Page 46

Viewing Your Account History

3

Using Monthly Account Statements

Monthly Account Statement

Activating Monthly Account Statements

46 January 2010 Merchant Setup and Administration Guide

Page 47

Viewing Your Account History

Using Monthly Account Statements

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Monthly Account Statements link.

The Monthly Account Statements page opens.

4. On the Monthly Account Statements page, click the Yes radio button.

3

5. Click the Save button.

Viewing Monthly Account Statements

You can view and print each statement for three months before it is removed from PayPal’s

servers. You select a statement from a dropdown menu by its month and year.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Monthly Account Statements link.

The Monthly Account Statements page opens.

https://www.paypal.com.

Merchant Setup and Administration Guide January 2010 47

Page 48

Viewing Your Account History

3

Using Monthly Account Statements

4. On the Monthly Account Statements page, select a report from the dropdown menu.

5. Click the View button.

The Monthly Account Statement page opens for the month and year you selected.

6. To view monthly account information for another currency, select a currency from the

Currency Type dropdown menu.

7. Click the Done button to close the statement.

Printing Monthly Account Statements

The monthly account statement displays a button at the bottom of the page that lets you open a

printable version of the statement.

48 January 2010 Merchant Setup and Administration Guide

Page 49

Viewing Your Account History

Using Monthly Account Statements

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Monthly Account Statements link.

The Monthly Account Statements page opens.

4. On the Monthly Account Statements page, select a report from the dropdown menu.

5. Click the View button.

The Monthly Account Statement page opens for the month and year you selected.

6. Click the Get Printable Version button at the bottom of the page.

A printable version of the statement opens in a separate window.

7. Click the Print button to print the statement.

3

8. Click the Close Window button to close the printable version.

9. Click the Done button to close the statement.

Downloading Monthly Account Statements

The monthly account statement displays a button at the bottom of the page that lets you

download the statement information to a comma-delimited value (CSV) file.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Monthly Account Statements link.

The Monthly Account Statements page opens.

4. On the Monthly Account Statements page, select a report from the dropdown menu.

5. Click the View button.

The Monthly Account Statement page opens for the month and year you selected.

https://www.paypal.com.

6. Click the Download button at the bottom of the page.

The Opening Download.csv dialog box opens.

7. When prompted, select whether to open the file or to save it on your local computer.

Merchant Setup and Administration Guide January 2010 49

Page 50

Viewing Your Account History

3

Accessing Your Account History

8. Click the Done button to close the statement.

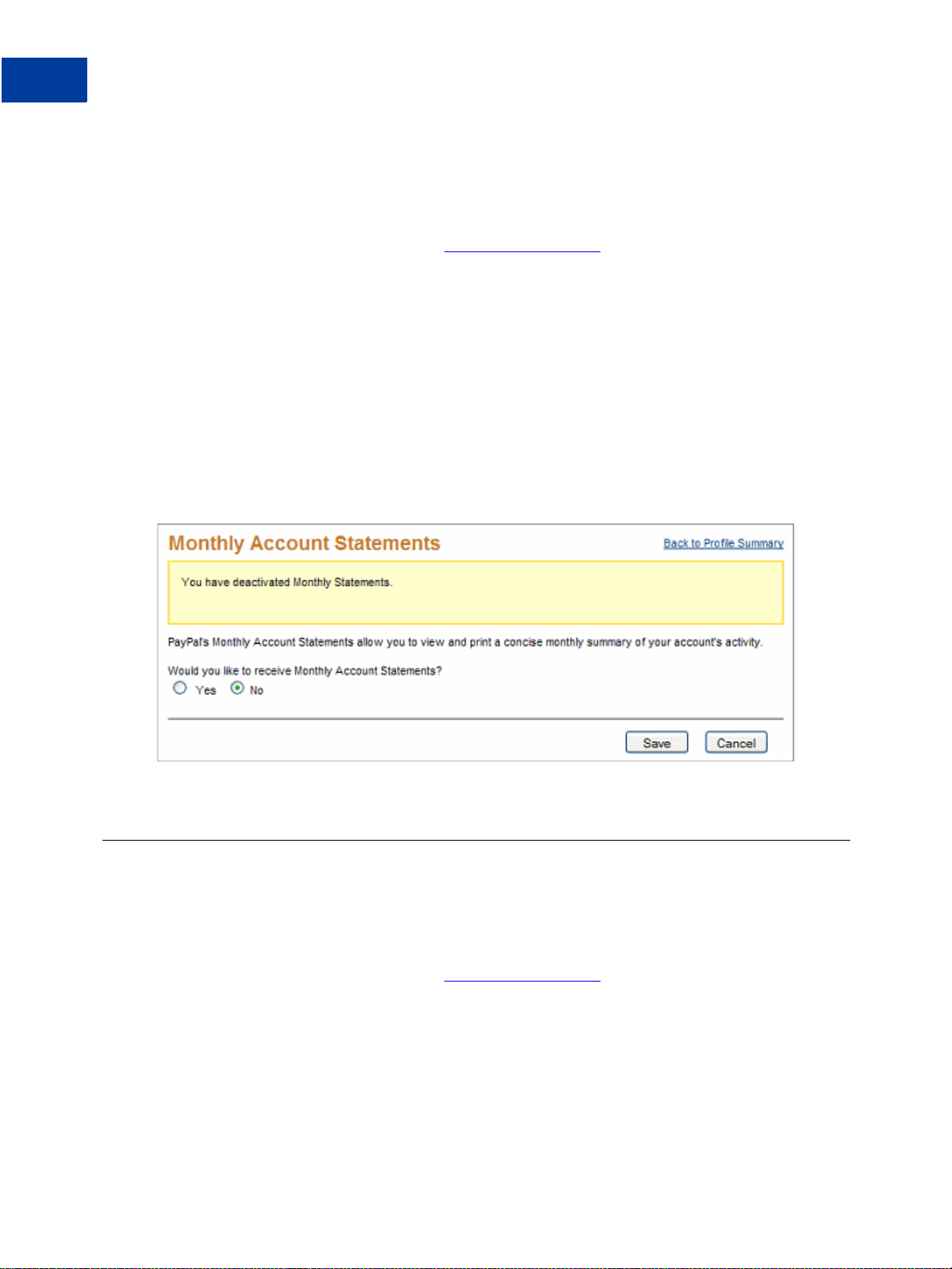

Deactivating Monthly Account Statements

1. Log in to your PayPal website at https://www.paypal.com.

The My Account Overview page opens.

2. Click the Profile subtab.

The Profile Summary page opens.

3. In the Financial Information column, click the Monthly Account Statements link.

The Monthly Account Statements page opens.

4. On the Monthly Account Statements page, click the No radio button.

The Monthly Account Statements page displays a message indicating that you have

deactivated monthly reports. You can reactivate the reports at a later time, if desired.

5. Click the Back to Profile Summary link.

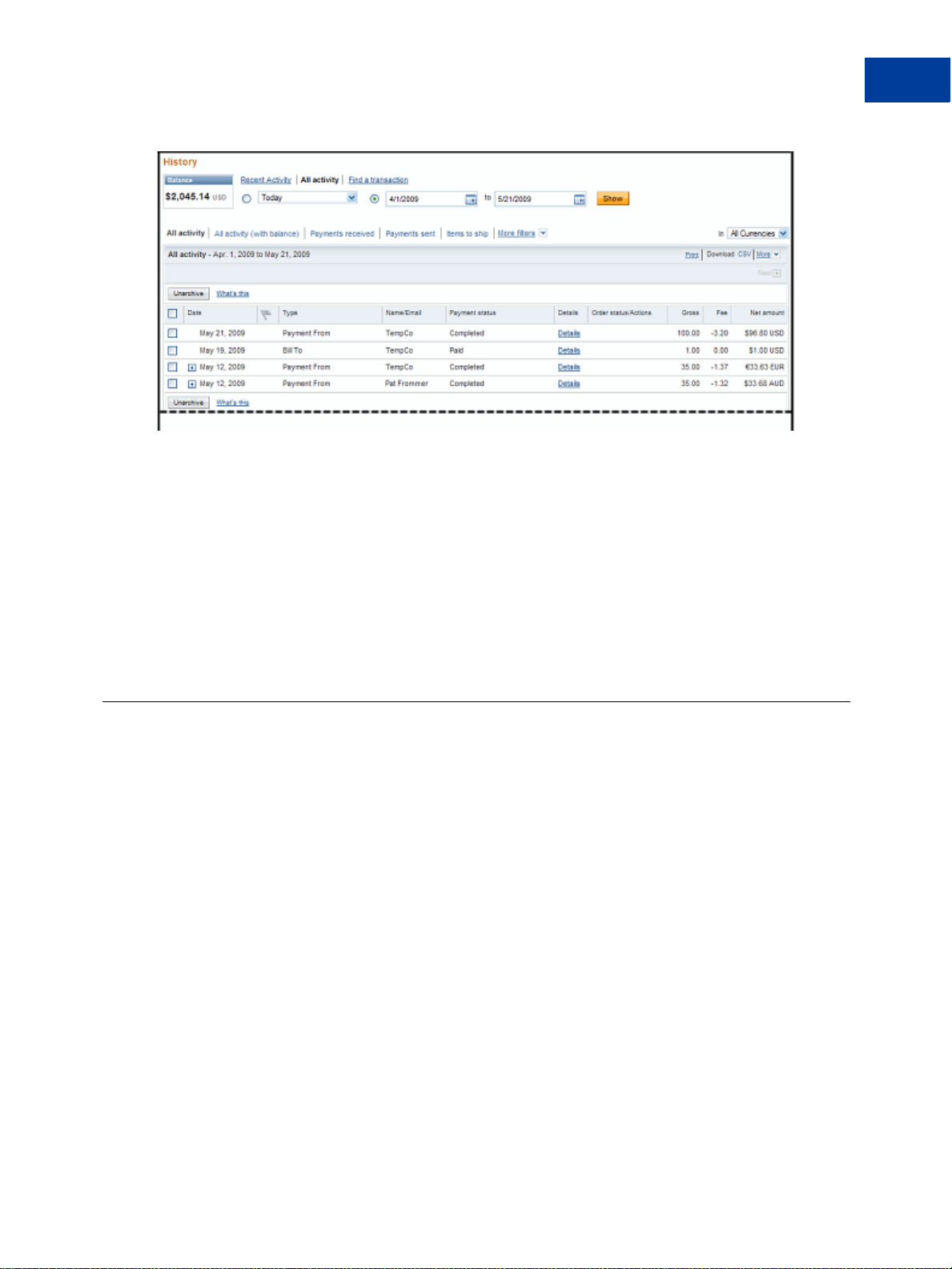

Accessing Your Account History

Use the History page to see the transactions for your account. When you first open the page,

the History page displays your current account balance and a list of the transactions that

occurred in the last 30 days.

1. Log in to your PayPal website at

The My Account Overview page opens.

2. Click the History subtab.

The History page opens.

50 January 2010 Merchant Setup and Administration Guide

https://www.paypal.com.

Page 51

Viewing Your Account History

Searching History

– or –

To go to a specific area of your account history, place the cursor over the History subtab

and select an one of the following options from the displayed list:

– Basic Search

– Advanced Search

– Download History

–Reports

–IPN History

3

For more information about searching history, see “Searching History” on page 51.

Searching History

Search your account history for payments and other activity using date ranges, activity types,

or field values. There are two ways to search your account history:

z Basic Searching by Activity

z Advanced Searching by Field Value

Use Basic Search to search your transaction history by specifying the kind of account activity

you want to view. In Basic Search, the History page displays date fields, and links for

frequently-used activity types to let you quickly filter your account information, It also

contains a More filters dropdown menu with additional activity options that you can use.

Merchant Setup and Administration Guide January 2010 51

Page 52

Viewing Your Account History

3

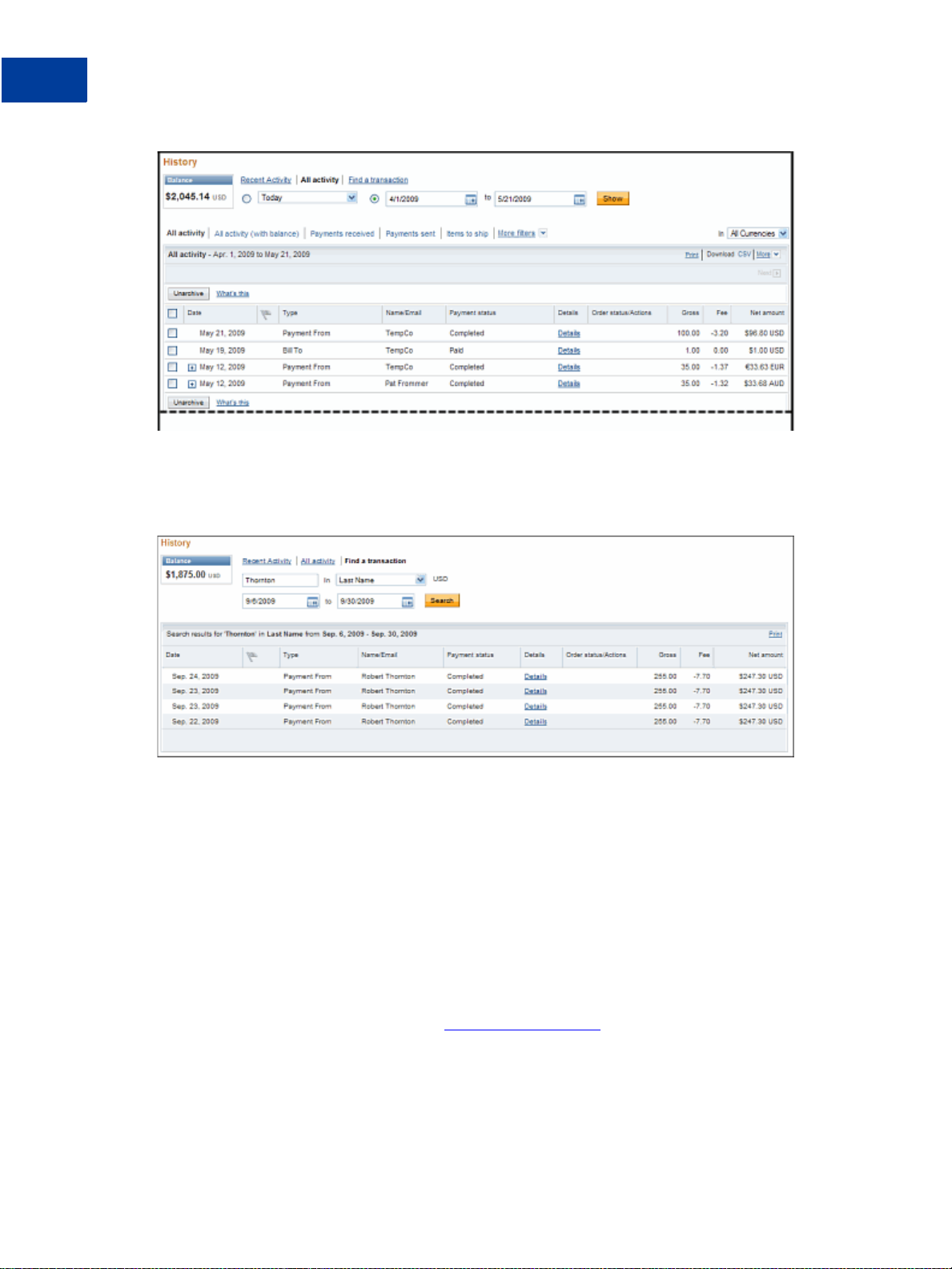

Searching History

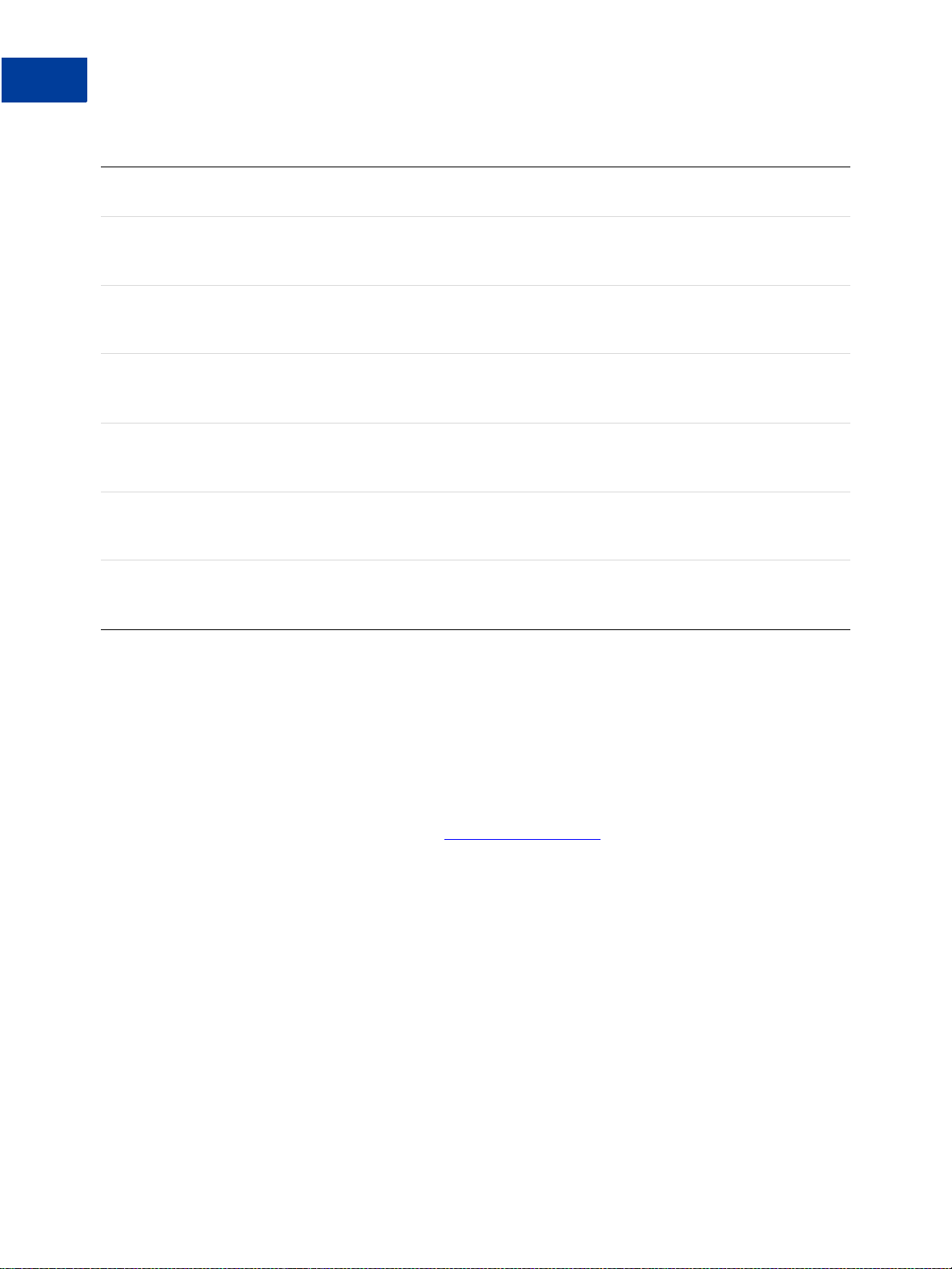

Use Advanced Search to search your transaction history by entering a value or a pattern of

values in a specific transaction field and specifying a date range. In Advanced Search, the

History page displays a search value field, a transaction field dropdown menu, and date range

fields.

Basic Searching by Activity

Use Basic Search to find transactions by account activity within a specific date range. When

you first open the History page, it uses the default choice of All Activity and displays your

account activity for the last 30 days. All Activity displays all transactions for any currency you

accept in your account. Select another activity type, time frame, or currency type to filter the

information you see.

For example, click All Activity (with balance) to display a Balance column to show how each

transaction affected your balance. Transactions that do not affect your account balance show

an ellipsis (...) in the column.

1. Log in to your PayPal website at

The My Account Overview page opens.

52 January 2010 Merchant Setup and Administration Guide

https://www.paypal.com.

Page 53

Viewing Your Account History

2. Select Basic Search from the History subtab.

The History page opens.

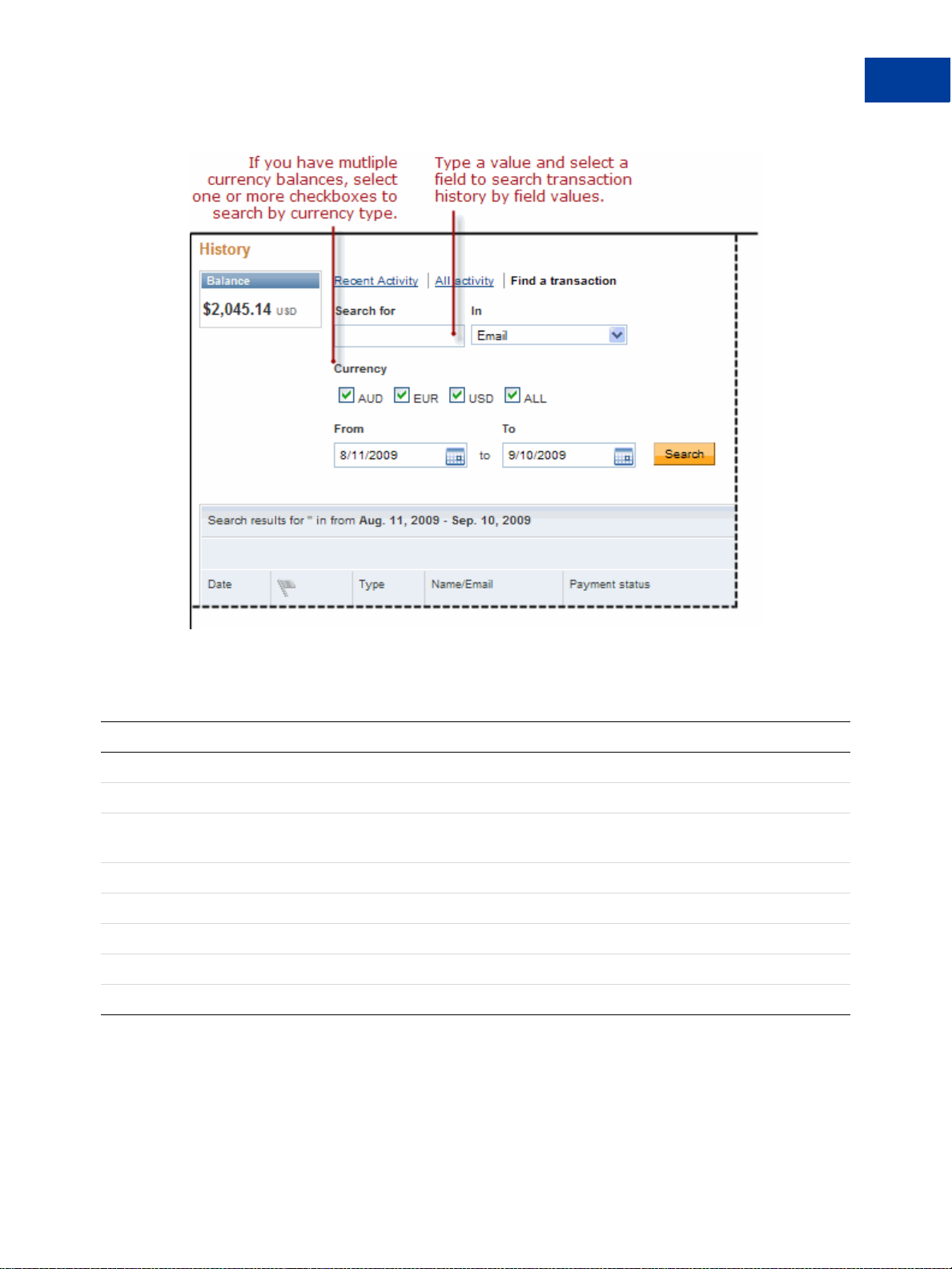

3. Select the time frame for the activity you want to display.

Searching History

3

– To search through recent transactions, click Recent Activity and select one of the

predefined date ranges from the dropdown menu:

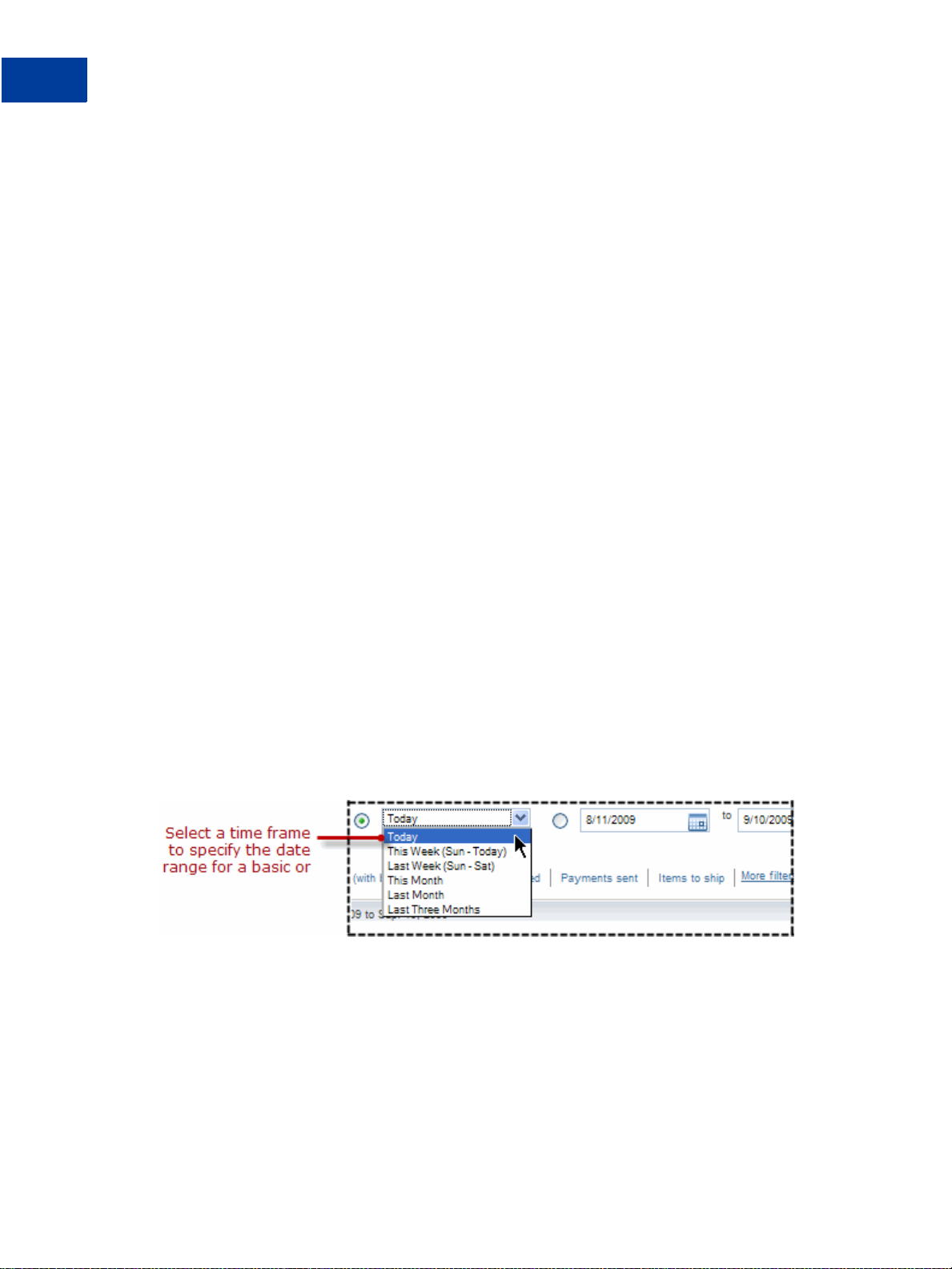

– To search through all transactions, click All Activity. T ype the dates to use or select one

of the predefined date ranges from the dropdown menu. Click the Show button.

The History page displays the transactions that meet your selection criteria.

For detailed information on how to specify a time frame, see “Specifying Date Ranges for

Basic and Advanced History Search” on page 56.

4. To filter the information you see, click one of the activity links:

– Recent Activity

– All Activity

– All Activity (with balance)

– Payments Received

– Payments Sent

– Items to ship

- Or -

Select a filter from the More filters dropdown list. The table below shows a list of the

options you might see in the dropdown menu.