Page 1

Invoicing User’s Guide

Last updated: September 2010

Page 2

PayPal Invoicing User’s Guide

Document Number: 10115.en_US-201009

© 2010 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting f rom the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

About This Guide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Where to Go for More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Chapter 1 About Invoicing . . . . . . . . . . . . . . . . . . . . . . . 9

What is Invoicing? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

What’s the Difference Between Request Money and Invoicing?. . . . . . . . . . . . . . . . 9

Invoicing End-to-End. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

What Does Y our Customer See? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Accessing PayPal Invoicing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Chapter 2 Creating Invoices . . . . . . . . . . . . . . . . . . . . . . 15

The Invoicing Process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

What’s in an Invoice? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Creating Invoices and Entering Details . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

1. Accessing the Create a New Invoice Page . . . . . . . . . . . . . . . . . . . . . . 19

2. Entering Your Contact Information . . . . . . . . . . . . . . . . . . . . . . . . . . 19

3. Entering Recipient Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

4. Entering Invoice Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

5. Entering Item Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

6. Entering a Discount, Shipping Fee, and Invoice Notes . . . . . . . . . . . . . . . . 26

7. Finalizing an Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Previewing Invoices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

Previewing an Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Saving Invoices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Saving an Invoice as a Draft. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Sending Invoices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Sending an Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Printing Invoices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Invoicing User’s Guide September 2010 3

Page 4

Contents

Printing an Invoice from the Preview Page . . . . . . . . . . . . . . . . . . . . . . . 33

Printing an Invoice from the Invoice Details Page . . . . . . . . . . . . . . . . . . . . 34

Chapter 3 Managing Your Invoices . . . . . . . . . . . . . . . . . . .35

About the Manage Invoices Page . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

About Invoice Statuses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Searching Invoices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

About the Basic Filters. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

About the Advanced Filters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Searching Invoices with a Basic Filter . . . . . . . . . . . . . . . . . . . . . . . . . . 40

Searching Invoices with an Advanced Filter. . . . . . . . . . . . . . . . . . . . . . . 41

Reviewing Invoice Details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Opening Invoice Details From the Manage Invoice Page . . . . . . . . . . . . . . . . 45

Editing Invoices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Editing an Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Exporting Invoice Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Invoice Summary Activity Information . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Invoice Details Activity Information . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Downloading and Saving Invoice Activity . . . . . . . . . . . . . . . . . . . . . . . . 51

Downloading and Opening Invoice Activity . . . . . . . . . . . . . . . . . . . . . . . 53

Copying Invoices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Copying an Invoice from the Manage Invoices Page . . . . . . . . . . . . . . . . . . 54

Copying an Invoice from the Invoice Details Page . . . . . . . . . . . . . . . . . . . 54

Sending Invoice Reminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Sending a Reminder. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Canceling Invoices. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

Canceling an Invoice from the Manage Invoices Page . . . . . . . . . . . . . . . . . 56

Canceling an Invoice from the Invoice Details Page. . . . . . . . . . . . . . . . . . . 57

Archiving and Unarchiving Invoices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

Archiving an Invoice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

Unarchiving an Invoice. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

About Invoices and Shipping. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61

Chapter 4 Managing Invoice Payments . . . . . . . . . . . . . . . . .63

About Invoice Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Viewing PayPal Invoice Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Viewing a PayPal Invoice Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Recording Invoice Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

4 September 2010 Invoicing User’s Guide

Page 5

Contents

Marking an Invoice as Paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

Viewing and Editing Manually Recorded Payments. . . . . . . . . . . . . . . . . . . 66

Chapter 5 Customizing Your Invoice Information . . . . . . . . . . . 69

About Invoice Customization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

Customizing Your Contact Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

Editing Your Contact Information in an Invoice . . . . . . . . . . . . . . . . . . . . . 70

Editing Your Contact Information in Invoice Settings . . . . . . . . . . . . . . . . . . 72

Including a Logo in Your Invoices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

Adding a Logo When You Create an Invoice . . . . . . . . . . . . . . . . . . . . . . 75

Adding a Logo in Invoice Settings . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Changing Your Invoice Logo. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Deleting Your Invoice Logo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

Including a Logo on Your Payment Page . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Adding Your Payment Logo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Changing Your Payment Logo in Invoice Settings. . . . . . . . . . . . . . . . . . . . 80

Deleting Your Payment Logo in Invoice Settings . . . . . . . . . . . . . . . . . . . . 81

Chapter 6 Working with Invoice Templates. . . . . . . . . . . . . . .83

About Invoice Templates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83

How Invoice Settings Relate to Invoice Template Contents . . . . . . . . . . . . . . . 84

Working with Templates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Creating Templates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Saving an Invoice as a Template . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Creating a Template in the Create a New Invoice Page. . . . . . . . . . . . . . . . . 89

Adding a Template in Invoice Settings. . . . . . . . . . . . . . . . . . . . . . . . . . 91

Managing Templates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

About the Manage Your Templates Page . . . . . . . . . . . . . . . . . . . . . . . . 94

Editing a Template . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Setting the Default Template. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Previewing Templates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

Deleting Templates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .101

Chapter 7 Working with the Address Book. . . . . . . . . . . . . . 103

About the Address Book . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .103

Accessing the Address Book. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .104

Adding Contacts to the Address Book . . . . . . . . . . . . . . . . . . . . . . . . . . . .104

Saving Recipient Information to the Address Book . . . . . . . . . . . . . . . . . . .104

Invoicing User’s Guide September 2010 5

Page 6

Contents

Adding a Contact in the Address Book Page . . . . . . . . . . . . . . . . . . . . . .107

Editing Address Book Entries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .110

Editing a Contact. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .110

Searching for Contacts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .114

Searching for a Contact . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .115

Deleting Address Book Entries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .115

Deleting Contacts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .116

Chapter 8 Working with Saved Items. . . . . . . . . . . . . . . . . 119

About Saved Items. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .119

What’s in a Saved Item?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .120

Adding a Saved Item. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .120

Adding an Item in an Invoice. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .120

Adding an Item in Invoice Settings. . . . . . . . . . . . . . . . . . . . . . . . . . . .121

Editing Saved Items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .123

Editing a Saved Item. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .123

Deleting Saved Items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .125

Deleting a Saved Item . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .125

Chapter 9 Managing Your Tax Information . . . . . . . . . . . . . . 127

About Tax Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .127

Adding Tax Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .128

Adding Tax Information in an Invoice or Template. . . . . . . . . . . . . . . . . . . .128

Adding Tax Information in Invoice Settings . . . . . . . . . . . . . . . . . . . . . . .130

Adding Tax Information in a Saved Item. . . . . . . . . . . . . . . . . . . . . . . . .131

Editing Tax Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .132

Editing a Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .133

Deleting Tax Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .134

Deleting a Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .134

Chapter 10 Invoice Administration . . . . . . . . . . . . . . . . . . 135

Managing Your Invoices and Payments . . . . . . . . . . . . . . . . . . . . . . . . . . .135

Maintaining Your Invoice Settings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .136

Adding Users to Perform Invoicing Tasks . . . . . . . . . . . . . . . . . . . . . . . . . .136

Invoicing and Reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .137

6 September 2010 Invoicing User’s Guide

Page 7

Preface

About This Guide

The Invoicing User’s Guide describes how to create and send invoices in your PayPal account.

Intended Audience

This guide is for merchants and secondary users who log in to PayPal accounts to create and

send invoices.

Revision History

The following table lists the revisions made to the Invoicing User’s Guide.

TABLE 1.1 Revision History for This Guide

Date Published Description

September 2010 New guide.

Where to Go for More Information

For information on the administrative tasks you can perform from your PayPal account, see

the Merchant Setup and Administra tion Guide

page linked to the Library tab in Developer Central.

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

. The guide is located on the Documentation

Invoicing User’s Guide September 2010 7

Page 8

Documentation Feedback

8 September 2010 Invoicing User’s Guide

Page 9

About Invoicing

1

PayPal Invoicing lets you create and send professional invoices through email. You can save

invoice information for re-use, reducing the amount of time it takes to create invoices.

Read the following topics to learn more about PayPal Invoicing:

“What is Invoicing?” on page 9

“What’s the Difference Between Request Money and Invoicing?” on page 9

“Invoicing End-to-End” on page 10

“What Does Your Customer See?” on page 11

“Accessing PayPal Invoicing” on page 13

What is Invoicing?

PayPal Invoicing provides a way to create and send invoices to your customers. Invoicing lets

you save item details, tax rates, and recipients so you can use them for future invoices. You

can customize how your business information appears on the invoices, making them more

professional.

PayPal provides a default invoice template for you to use or you can create your own

customized templates. Using customized templates saves time by storing details about your

items, prices, and standard tax rates.

Using Invoicing, you send invoices by email and get paid through PayPal. Your invoice

recipients can view and pay through their PayPal accounts. Recipients without PayPal

accounts can pay you in several other ways.

Invoicing does not replace the Request Money feature. You can still use Request Money for

those items that don’t need an invoice. You access both the Invoicing and Request Money

features from the Request Money tab in your PayPal account.

What’s the Difference Between Request Money and Invoicing?

Use Request Money to request payment for goods or services where tracking item detail is

not required, or when sending payment requests to multiple recipients. You must enter the total

amount to be paid because Request Money does not calculate tax or add shipping amounts for

you. When your recipients look at details of the money request, they see your name and email

address, the amount and date requested, a subject line, and any notes you entered. When you

view a payment request in History, you see the request information an d paymen t information

when the request is paid.

Invoicing User’s Guide September 2010 9

Page 10

About Invoicing

1

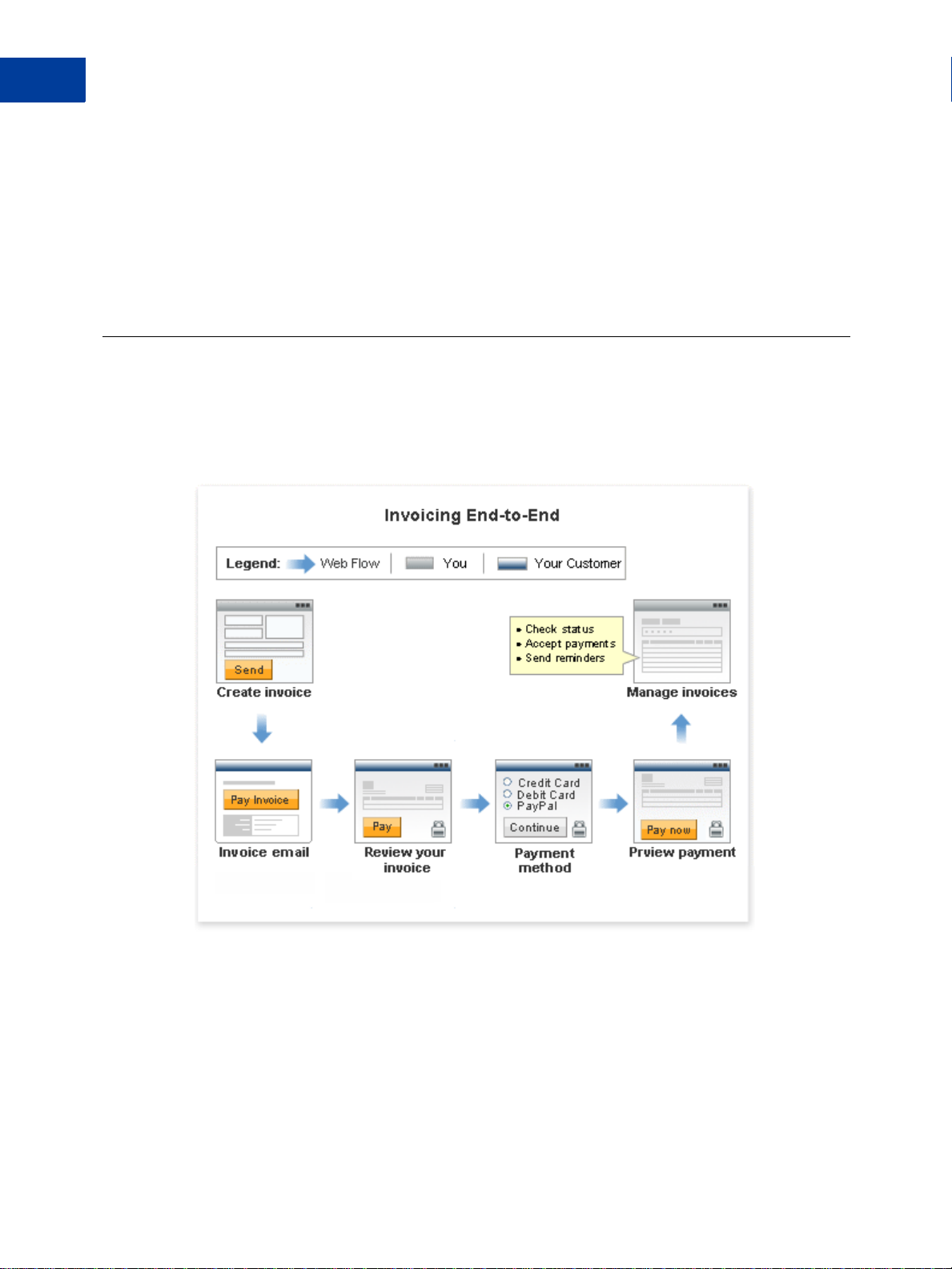

Invoicing End-to-End

Use Invoicing to request payments for goods or service when you want to provide item

details, have the tax and discount amounts automatically calculated, and you want to track and

manage your invoices and payments. When your recipients review an invoice, they see your

customized contact information, payment terms, line item details including unit prices and

taxes, shipping and discount information, and invoice totals. When you view the invoice in

Manage Invoices, you see the same details your recipient sees, invoice status information, and

payment information when the invoice is paid.

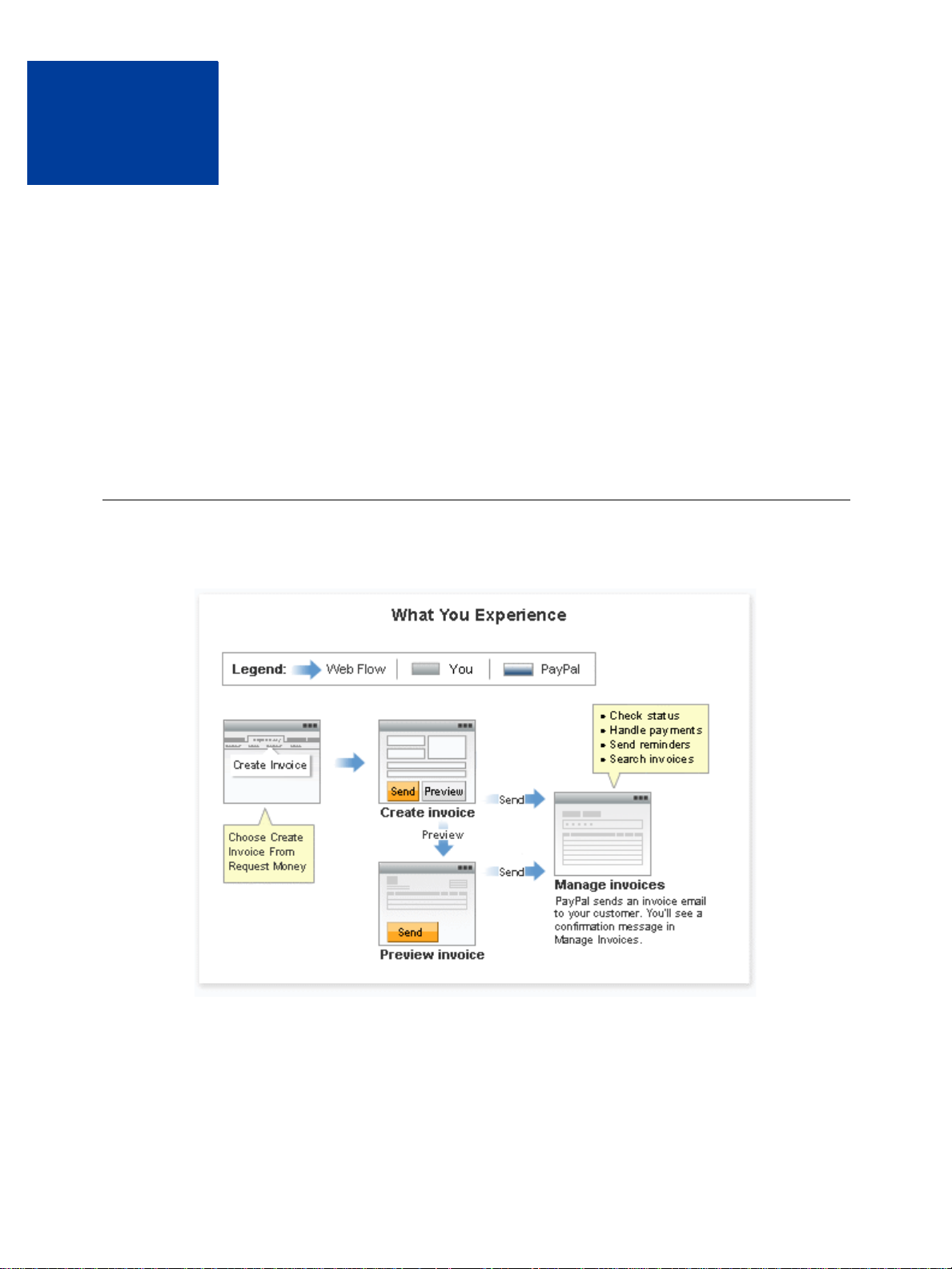

Invoicing End-to-End

Invoicing has two participants: you and your customer. You create, send, and manage invoices.

Your customer, the invoice recipient, receives the invoice and makes a payment.

The following illustrates the invoice flow for both you and your customer.

1. You create the invoice.

When you create an invoice, you identify the invoice recipient, set the payment terms, enter

item details, enter shipping or discount amounts, and enter notes to the recipient, if

necessary. When you send the invoice, an email is sent to the invoice recipient.

See “Creating Invoices” on page 15 for instructions.

10 September 2010 Invoicing User’s Guide

Page 11

About Invoicing

What Does Your Customer See?

2. Your customer receives an email that contains a link to the invoice.

Customers can use the email link to view invoices. PayPal account holders can view

invoices through their PayPal accounts.

3. Your customer opens the invoice and reviews it.

You customer can start the payment process by clicking Pay.

4. Your customer determines the payment method.

Your customer can pay in one of two ways:

– Using a PayPal account.

– By credit or debit card, check, or bank transfer.

5. Your customer reviews the payment.

After reviewing the payment information, your customer approves the payment.

6. You manage invoices and payments.

You can check an invoice’s status and determine whether to send a reminder about

payment, cancel the invoice, or print the invoice to mail to the recipient.

When you receive a PayPal payment, PayPal updates the invoice status and provides a link

to the Transaction Details for the payment. The money is added to your account.

If your customer pays by another method, you can manually record the payment for the

invoice.

See “Managing Invoice Payments” on page 63 and “Managing Your Invoices” on page 35

for more information.

1

See “What Does Your Customer See?” on page 11 for more information about your customer’s

payment experience.

What Does Your Customer See?

When you send invoices, email notifications are sent to your customers (invoice recipients).

Invoice emails contain a summary of the invoice information and requests payment. Email

messages also contain a link and a URL that open in the invoice.

The following illustration shows the steps your customers take to pay invoices.

Invoicing User’s Guide September 2010 11

Page 12

About Invoicing

1

What Does Your Customer See?

1. Your customer opens an invoice

Invoice recipients can open their invoices in the following ways:

– Click the Pay Invoice button in the email.

– Copy the invoice URL in the email message and paste it in a web browser.

– Open their PayPal accounts and open the invoice from their Account Overview or

History page.

2. Your customer reviews the invoice and clicks Pay.

The Review your invoice page displays the invoice details including payment terms, item

details, and the invoice totals. Before starting the payment process, your customer can print

a copy of the invoice.

3. Your customer selects the payment method.

Customers who want to use their PayPal accounts to pay the invoice must first log in (if

they are not already) and select the payment method from their account.

Customers who do not use a PayPal account to pay the invoice can enter debit or credit

card information for online payment.

Recipients who pay by offline methods should contact you for payment instructions.

12 September 2010 Invoicing User’s Guide

Page 13

4. Your customer reviews and approves the payment.

The Review your payment page displays a summary of the payment inform ation. Your

customers click Pay Now to finalize payments.

5. Your customer receives verification of the completed payment.

A final page displays the transaction ID for the payment and an order summary email is

sent to your customer.

PayPal account holders can see invoice and payment details through their Account

Overview or History pages.

Accessing PayPal Invoicing

You access PayPal Invoicing by clicking the Request Money tab in your PayPal account.

Request Money displays the Request Money subtab and three invoicing subtabs.

NOTE: The Request Money feature is not an invoicing component and is not included in this

guide.

About Invoicing

Accessing PayPal Invoicing

1

Use the following subtabs to access invoicing components:

Manage Invoices: Opens the Manage Invoices page.

Use this page to review your invoices, search for invoices, and perform invoice actions.

See “Managing Your Invoices” on page 35 for information about this page and how to use

it.

Create Invoice: Opens the Create a new invoice page.

Use this page to create an invoice or save an invoice as a template. Also, you can save

information to your Invoice Settings, such as customer contact information, to use again

later.

See “Creating Invoices” on page 15 to learn how to create invoices.

Invoice Settings: Opens the Enter your contact information page with an Invoice

Settings navigation box on the left.

Invoice Settings lets you save your invoice contact information and logo, your payment

logo, tax information, items to invoice, invoice templates, and customer contact

information. Use the Invoice Settings navigation box to open one of these pages. For

example, click Address book to open the Address book page.

See the following sections to learn about Invoice Settings.

– “Customizing Your Invoice Information” on page 69

– “Working with Invoice Templates” on page 83

– “Working with the Address Book” on page 103

– “Working with Saved Items” on page 119

– “Managing Your Tax Information” on page 127

Invoicing User’s Guide September 2010 13

Page 14

About Invoicing

1

Accessing PayPal Invoicing

14 September 2010 Invoicing User’s Guide

Page 15

Creating Invoices

2

Create invoices for goods and services through the Request Money tab.

“The Invoicing Process” on page 15

“Creating Invoices and Entering Details” on page 17

“Previewing Invoices” on page 28

“Saving Invoices” on page 30

“Sending Invoices” on page 31

“Printing Invoices” on page 32

The Invoicing Process

The invoicing process begins with creating an invoice and ends with managing the invoices.

Invoicing User’s Guide September 2010 15

Page 16

Creating Invoices

2

The Invoicing Process

1. Create an invoice.

You create an invoice for goods and services by clicking Create Invoice from Request

Money.

When you first open the Create a new invoice page, it automatically selects the default

invoice template for your account. In the beginning, it is a PayPal-defined template. You

can create your own templates and customize some of the invoice entries, such as the

payment terms shipping cost. The template also identifies the currency to use for your

invoices. See

“Working with Invoice Templates” on page 83 for instructions.

The Create a new invoice page displays the primary contact information from your

Account Profile. You can change the information displayed by selecting an alternate

address or email stored in your profile. You can customize your contact information by

specifying what information to display, adding a web site URL or fax nu mber, and

including a logo. See

NOTE: Customizing contact information in invoicing does not affect the information in

“Customizing Your Invoice Information” on page 69 for instructions.

your Account Profile. To edit your address, phone number, or email, go to your

Profile Summary page.

2. Enter invoice details.

You identify the invoice recipient (your customer) by email address. You can also enter

optional billing and shipping addresses for the invoice recipient. You can store this

information in your address book to use in future invoices. See

“W orking with the Address

Book” on page 103 for instructions.

You add one or more items to invoice by entering item names or your product IDs. For each

item, you enter a date, a quantity , and a unit price. If an item is subject to tax, you can select

the rate. You can store item information for reuse by clicking a link on the invoice or by

adding items through the Invoice Settings page. You can also store tax information in the

Invoice Settings page. See

“W orkin g with Saved Items” on page 119 and “Managing Your

Tax Information” on page 127 for instructions.

As you complete each item, the invoice amounts are automatically calculated. You can

apply a discount to the invoice, add a shipping/handling fee, and add a tax rate for the

shipping fee. Other things you can include in the invoice are a terms and conditions

description and a note to the recipient. You can include a memo that does not appear on the

invoice and can be used as an advanced search criteria in Manage Invoices.

When you have entered invoice information, you can preview how it will appear to the

recipient, save it for a later time, save it as a template, or close it.

See “Creating Invoices and Entering Details” on page 17 for instructions.

3. Preview the invoice (optional).

You can use the Preview invoice page to see how the invoice will appear to your customer .

From Preview invoice, you can send the invoice, print it, or edit it.

See “Previewing Invoices” on page 28 and “Printing Invoices” on page 32 for instructions.

16 September 2010 Invoicing User’s Guide

Page 17

4. Send the invoice to your customer.

After you enter and review the invoice, click Send. PayPal sends an email notification to

your customer about the invoice.

See “Sending Invoices” on page 31 for instructions.

5. Manage your invoices.

After sending an invoice, you can check the status of your invoices, send reminders to your

customers, manage invoice payments, and research invoices in the Manage Invoices page.

You can also review invoices in your History page.

See “Managing Your Invoices” on page 35 for instructions.

What’s in an Invoice?

Invoices contain the following information:

Your contact information: Your name, email address, street address, phone number,

company name, and a logo.

Creating Invoices

Creating Invoices and Entering Details

2

Invoice recipient (your customer) information: Email address (required), billing

address, shipping address, and business name.

Invoice information: Invoice number, invoice date, payment terms, and due date.

Item and invoice details: Name, date, quantity, unit price and tax for each item, discount,

shipping amounts, terms and conditions, and notes to the recipient.

Memo: Text to track with the invoice.

When you create an invoice, the Create a new invoice page accesses information from your

Account Profile and Invoice Settings to pre-fill some of the fields. As you enter invoice

information, additional Invoice Settings are available to help speed up invoice entry. For

example, if you save tax rate information in Invoice Settings, you can select a saved rate to

use in the invoice.

Creating Invoices and Entering Details

You can create an invoice right away using the PayPal Default Template. You can add your

own templates later or save your current invoice to use as a template.

As you create an invoice, you can choose to save some of the information in your Invoice

Settings to reuse at a later time. This information includes some of your contact information,

your logo, recipient contact information, invoice line items, and tax amounts.

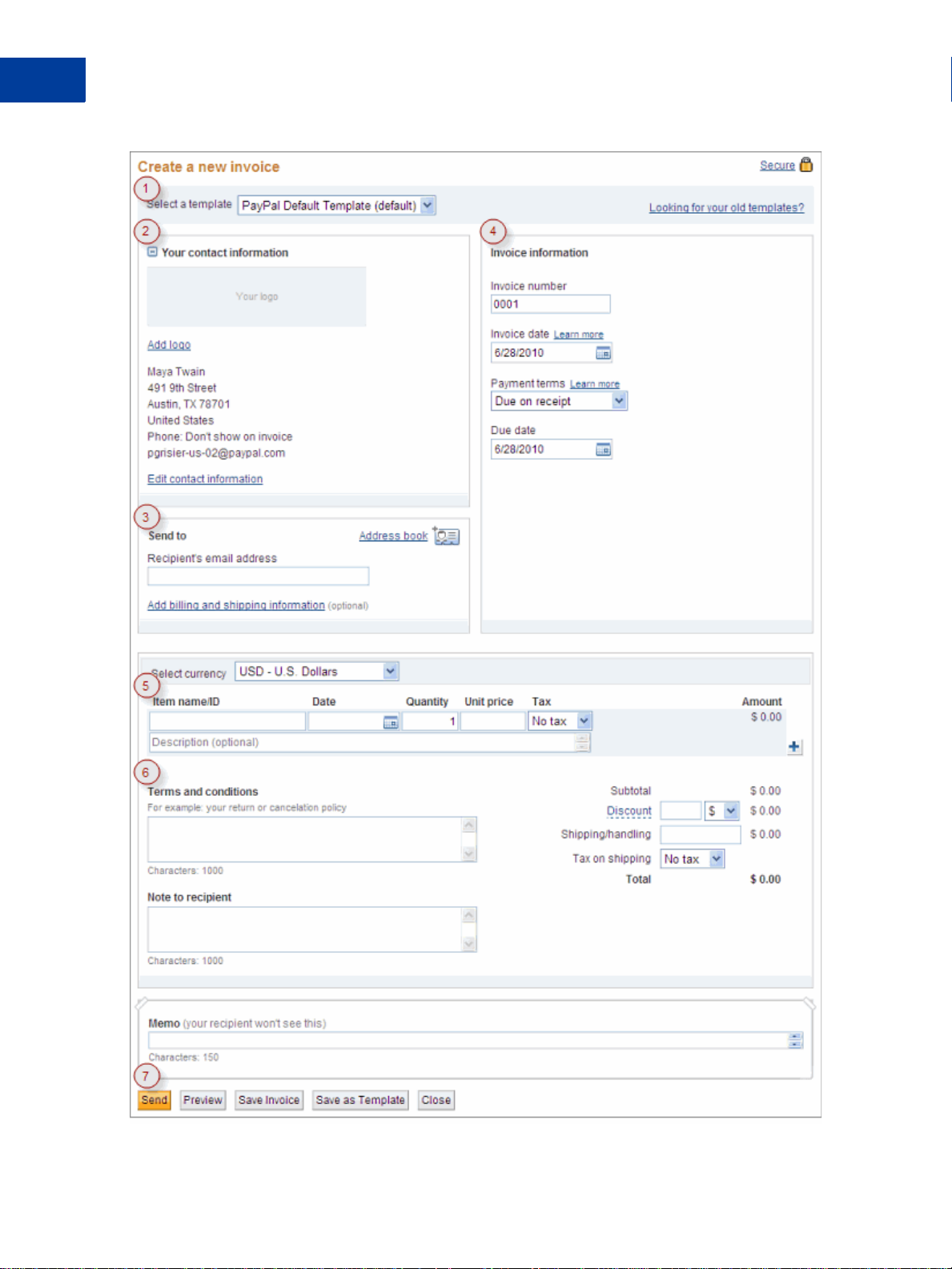

You use the Create a new invoice page to enter invoice information. The following

illustration shows the Create a new invoice page as it appears the first time you open it.

Invoicing User’s Guide September 2010 17

Page 18

Creating Invoices

2

Creating Invoices and Entering Details

18 September 2010 Invoicing User’s Guide

Page 19

The numbers in this illustration correspond with the instruction steps in this chapter:

“1. Accessing the Create a New Invoice Page” on page 19

“2. Entering Your Contact Information” on page 19

“3. Entering Recipient Information” on page 20

“4. Entering Invoice Information” on page 23

“5. Entering Item Information” on page 24

“6. Entering a Discount, Shipping Fee, and Invoice Notes” on page 26

“7. Finalizing an Invoice” on page 27

1. Accessing the Create a New Invoice Page

1. Log in to your PayPal account.

2. Click the Request Money tab.

3. Click Create an Invoice.

Creating Invoices

Creating Invoices and Entering Details

2

The Create a new invoice page opens. The default template is selected automatically. If

you have not added your own templates yet, the PayPal Default Template is selected.

4. To use a different template, select one from Select a template.

See “Working with Invoice Templates” on page 83 for more information.

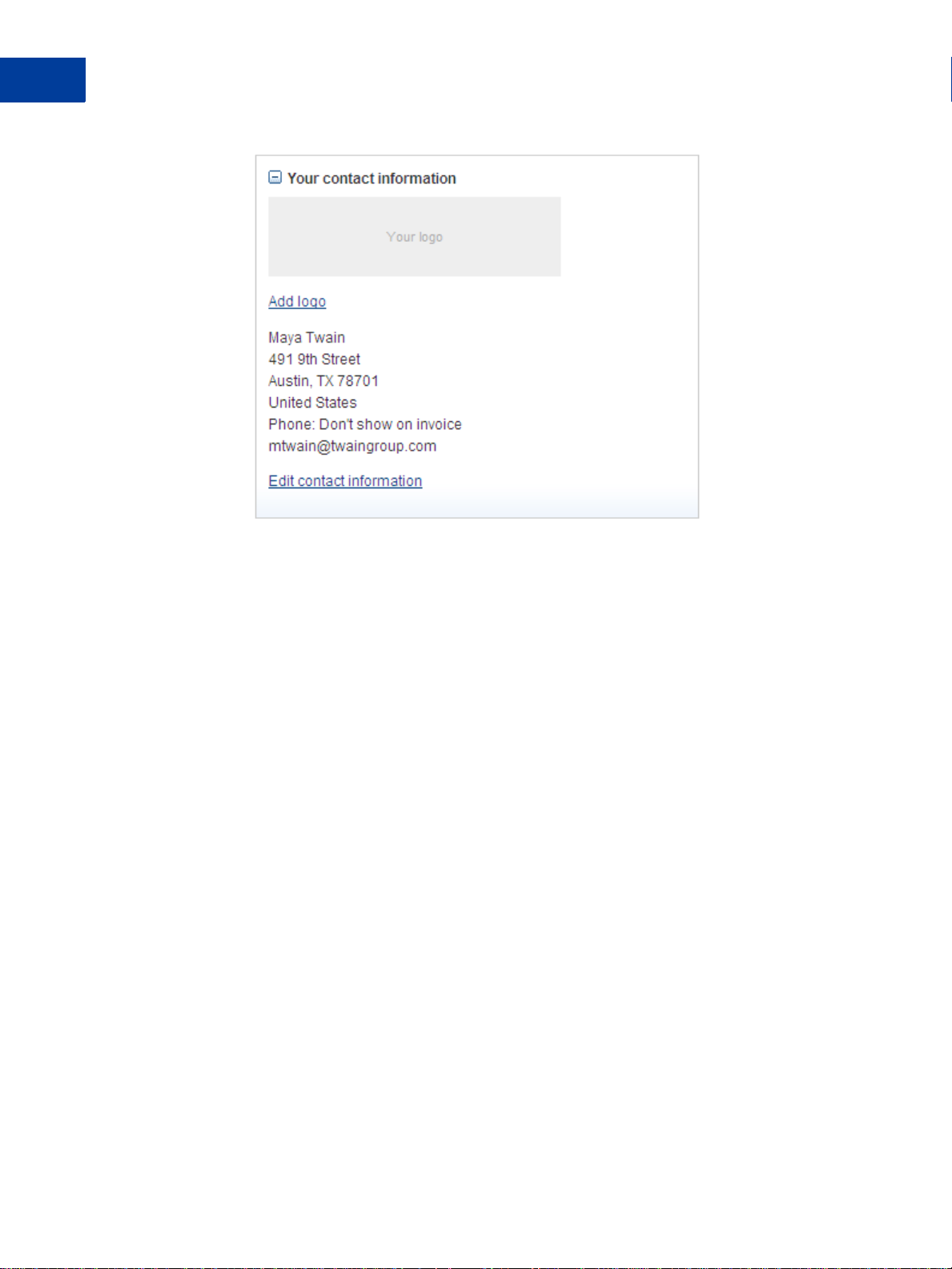

2. Entering Your Contact Information

1. Edit Your contact information.

The displayed contact information is stored in your Account Profile information. If your

address, phone number, or email are incorrect, you must correct them in your Profile page.

You can add more contact information or control whether your phone numbers or email

address appear in the invoice by customizing your contact information. See

Your Invoice Information” on page 69 for instructions.

2. Add or change the logo for the invoice.

Setting Action

Add logo Click to add a logo to the template.

This setting appears when the template does not have a logo.

Change logo Click to use a different logo.

This setting appears when the template already contains a logo.

“Customizing

Remove logo Click to delete the logo.

This setting appears when the template already contains a logo.

Invoicing User’s Guide September 2010 19

Page 20

Creating Invoices

2

Creating Invoices and Entering Details

See “Including a Logo in Your Invoices” on page 74 for detailed instructions.

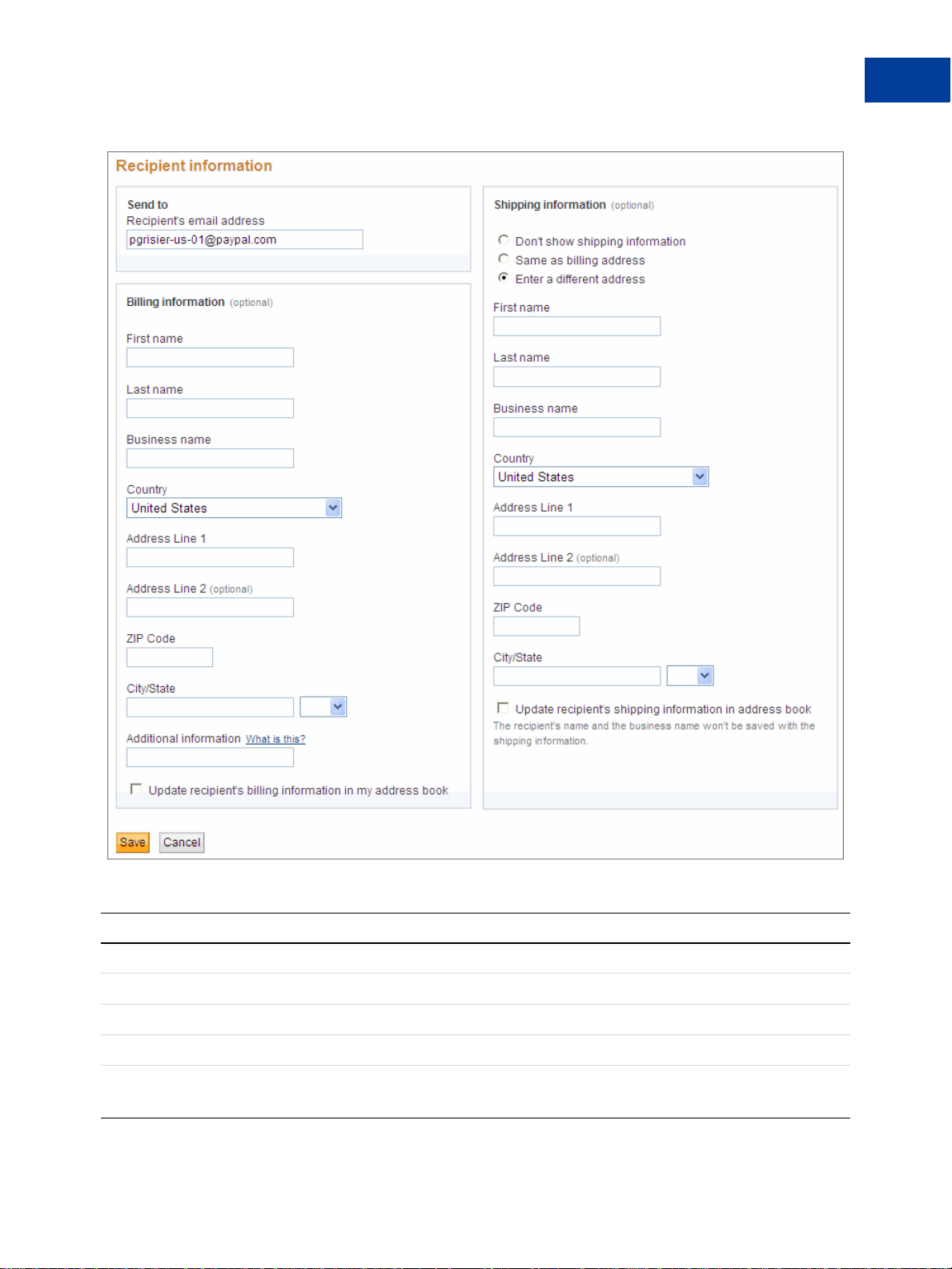

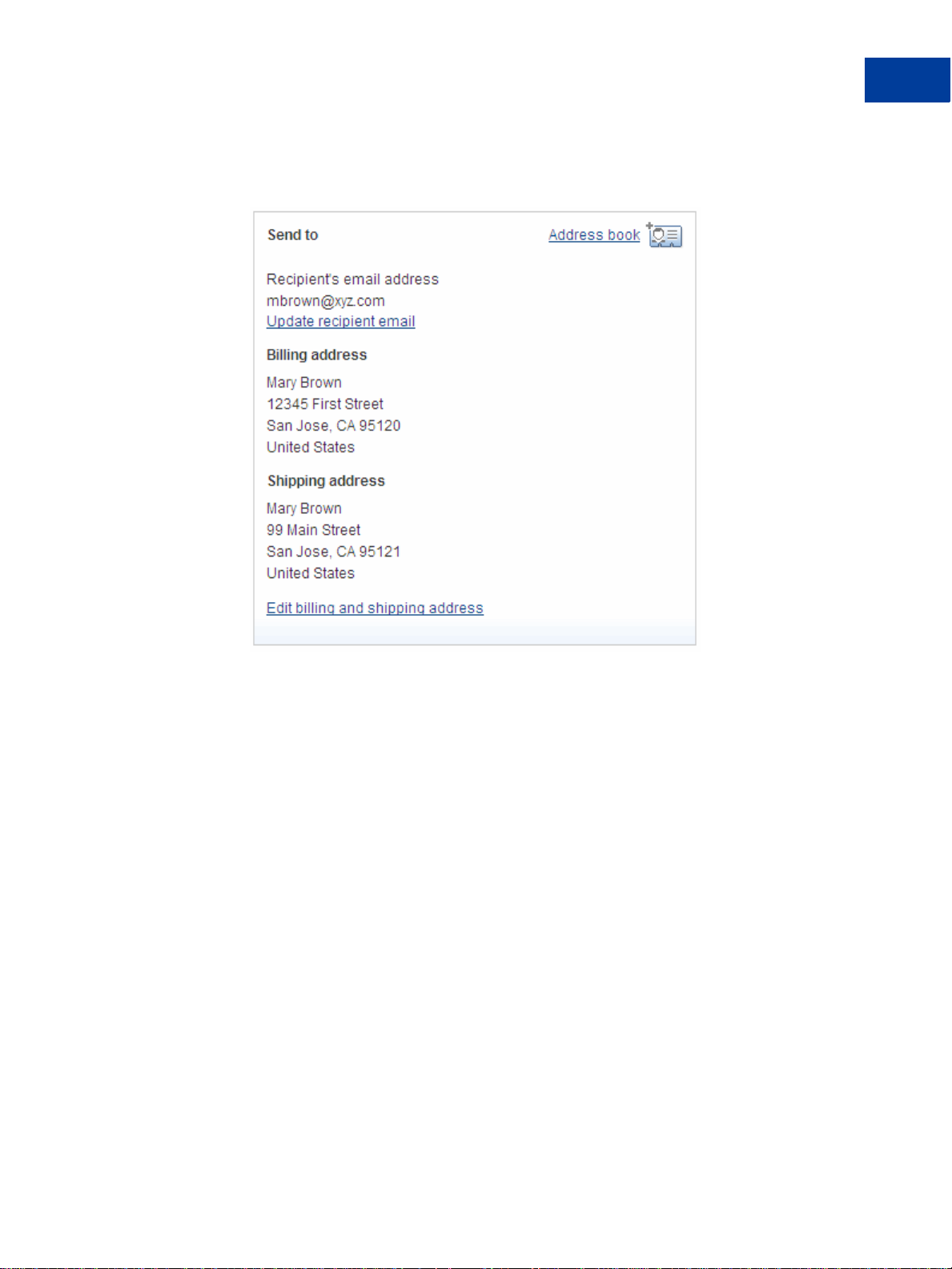

3. Entering Recipient Information

1. Enter the Recipient’s email address. (Required)

As you type the email address, you will see a list of your address book contacts that match

the characters you enter, starting with the third character . The search process looks through

the address book for matches in email addresses, names, and business names and shows all

matches in the list.

If your recipient is in the list, select it. If not, continue entering the address until you have

entered the correct recipient email address.

- Or Click Address book to search for a recipient in your address book and return it to the

invoice. See

2. Click Add billing and shipping information. (Optional)

The Recipient information page opens. If you selected a recipient from the address book,

the billing and shipping information fields display the recipient’s saved information.

“Searching for a Contact” on page 115 for instructions.

20 September 2010 Invoicing User’s Guide

Page 21

Creating Invoices

Creating Invoices and Entering Details

2

3. Enter Billing information.

Setting Action

First name Enter the recipient’s first or given name.

Last name Enter the recipient’s last or family name.

Business name Enter the name of recipient’s business.

Country Select the country for the billing address.

Address line 1

Address line 2

Invoicing User’s Guide September 2010 21

Enter up to 2 lines of the contact’s billing address.

Page 22

Creating Invoices

2

Creating Invoices and Entering Details

Setting Action

Zip code Enter the zip or postal code.

City/State Enter the city name for the billing address in the first field.

Select a state code from the drop down list in the second field.

Additional information Enter any information you want to appear on the invoice. For example, use

this field to track the contact’s account number.

Update recipient’s billing

information in my address book

Select this option to save the billing information to your address book.

4. Click Enter a different address to add Shipping information.

Setting Action

First name Enter the recipient’s first or given name.

Last name Enter the recipient’s last or family name.

Business name Enter the name of recipient’s business.

Country Select the country for the shipping address.

Address line 1

Address line 2

Zip code Enter the zip or postal code.

City/State Enter the city name for the shipping address in the first field.

Update recipient’s shipping

information in address book

Enter up to 2 lines of the contact’s shipping address.

Select a state code from the drop down list in the second field.

Select this option to save the shipping information to your address book.

22 September 2010 Invoicing User’s Guide

Page 23

Creating Invoices

Creating Invoices and Entering Details

5. Click Save.

The Create a new invoice page displays the recipient’s billing and shipping information.

2

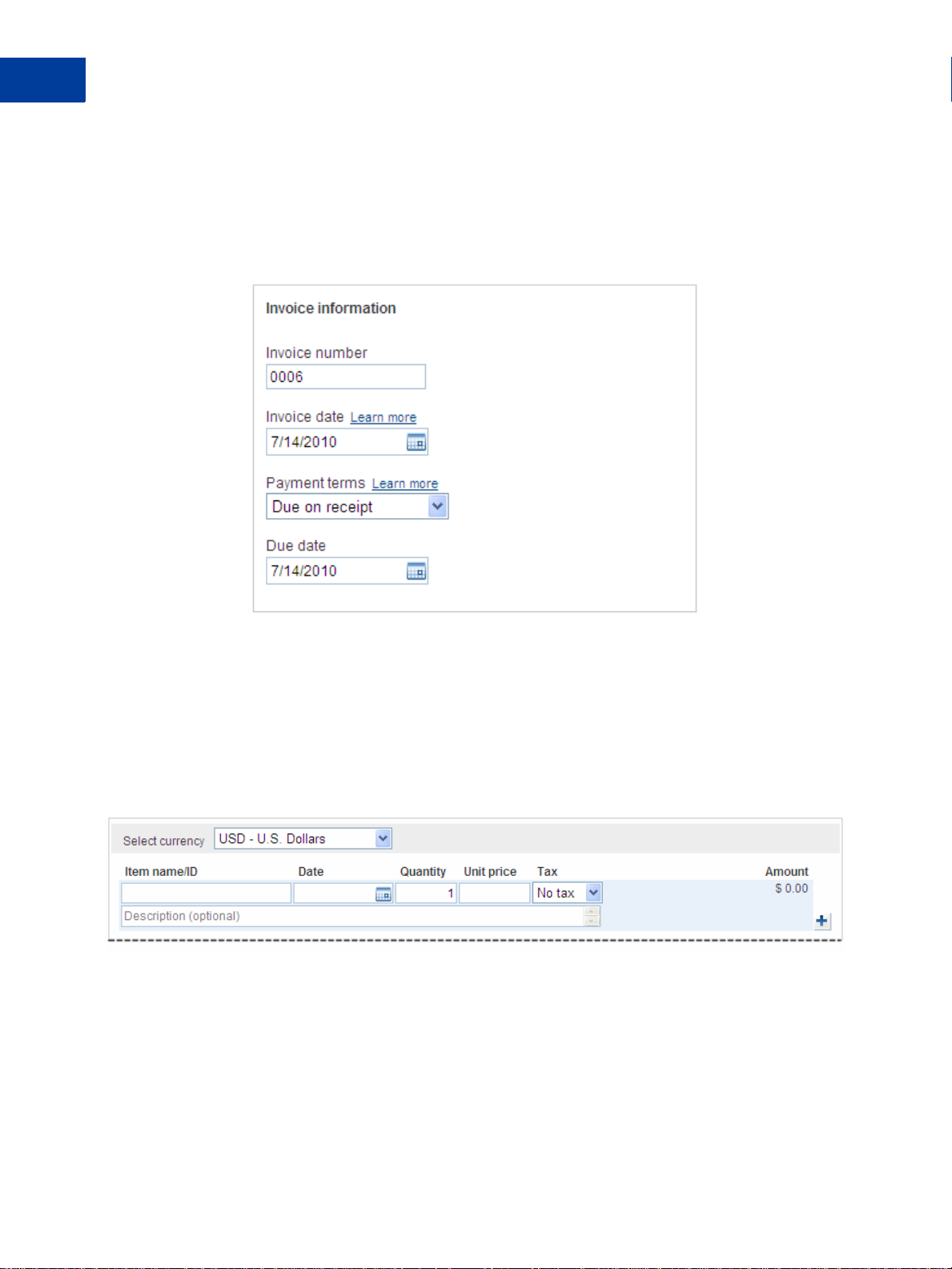

4. Entering Invoice Information

Review the Invoice Information section and make any necessary changes.

1. Change the Invoice number to use a different numbering system than the default.

Invoice numbering automatically starts with 0001 and increments by 1 for each subsequent

invoice. You can use the default numbering sy stem or use one of your own.

2. Change the Invoice date to use a different date.

The Invoice date is automatically set to today’ s date. Enter the date of the invoice or select

one from the calendar control.

You can use an invoice date that is after the current date. However, when you click Send,

the invoice is sent right away regardless of the date you entered.

3. Change the Payment terms.

Select the number of days before payment is due. This field is automatically set to Due on

receipt. For example, to specify that full payment is due in 30 days, select Net 30.

NOTE: When you select a different term, the invoice Due date might change to match the

option you selected.

Invoicing User’s Guide September 2010 23

Page 24

Creating Invoices

2

Creating Invoices and Entering Details

4. Change the Due date only if you selected Due on date specified in Payment terms.

The Due date is automatically set to match the Payment terms. For example, if you select

Net 30, the due date changes to a date that is 30 days after the Invoice date.

NOTE: If you enter a date in Due date, Payment terms will automatically change to Due

on date specified.

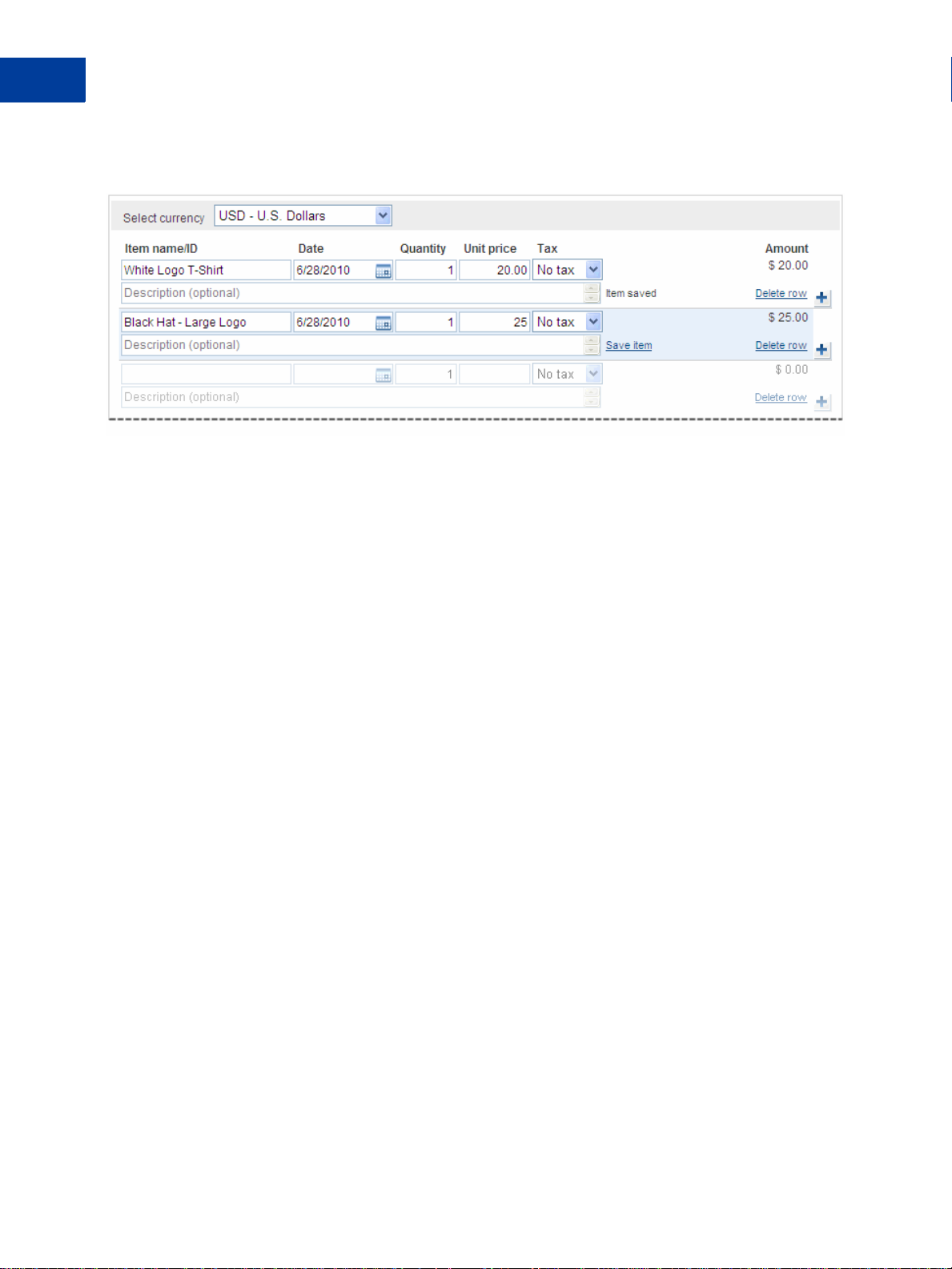

5. Entering Item Information

Your invoice must contain at least on e item before you can send it.

If you started with the PayPal Default Template, you must add item information.

If you started with a template that contains item information, review the included items and

make any necessary changes. You can add more items, if necessary.

Complete the following information for each item.

1. Enter the Item name/ID.

If you have saved items, you can select one from the list that appears when you click in the

field.

24 September 2010 Invoicing User’s Guide

Page 25

Creating Invoices

Creating Invoices and Entering Details

2. Enter the Date for the item.

When you tab or click in the date field, a Calendar opens. Select the date from the

Calendar or type the date in the field.

3. Enter the number of items in Quantity.

4. Enter a Unit price.

If you selected a saved item, the stored unit price displays.

5. Select the Tax for this item.

– If you selected a saved item with an assigned tax rate, the Tax displays. To change it,

select a tax from the list.

– If the item does not have a tax, select No tax.

– If the correct tax rate is not listed, select Add tax. See “Adding Tax Information in an

Invoice or Template” on page 128 for instructions.

Taxes are not displayed at the item level. The taxes applied to the invoice displays above

the invoice total.

2

6. Enter an item Description. (Optional)

7. Click Save item to add it to your Invoice Settings.

When you save an item, Save item changes to Item saved. The item will appear in the

Saved items page of your Invoice Settings. See

for more information.

8. Review the item Amount.

The Amount is calculated by multiplying Quantity times Unit price. Amount does not

include any specified tax for the item at this level. Taxes are totalled for the invoice and

display above the invoice total.

9. To remove an item from the invoice, click Delete row.

10.Click the Plus button to add more blank rows to the item section.

“Working with Saved Items” on page 119

Invoicing User’s Guide September 2010 25

Page 26

Creating Invoices

2

Creating Invoices and Entering Details

NOTE: Each time you add an item to the invoice, an empty item row is added to the end of

the list. The Plus button is another way to add rows to the invoice.

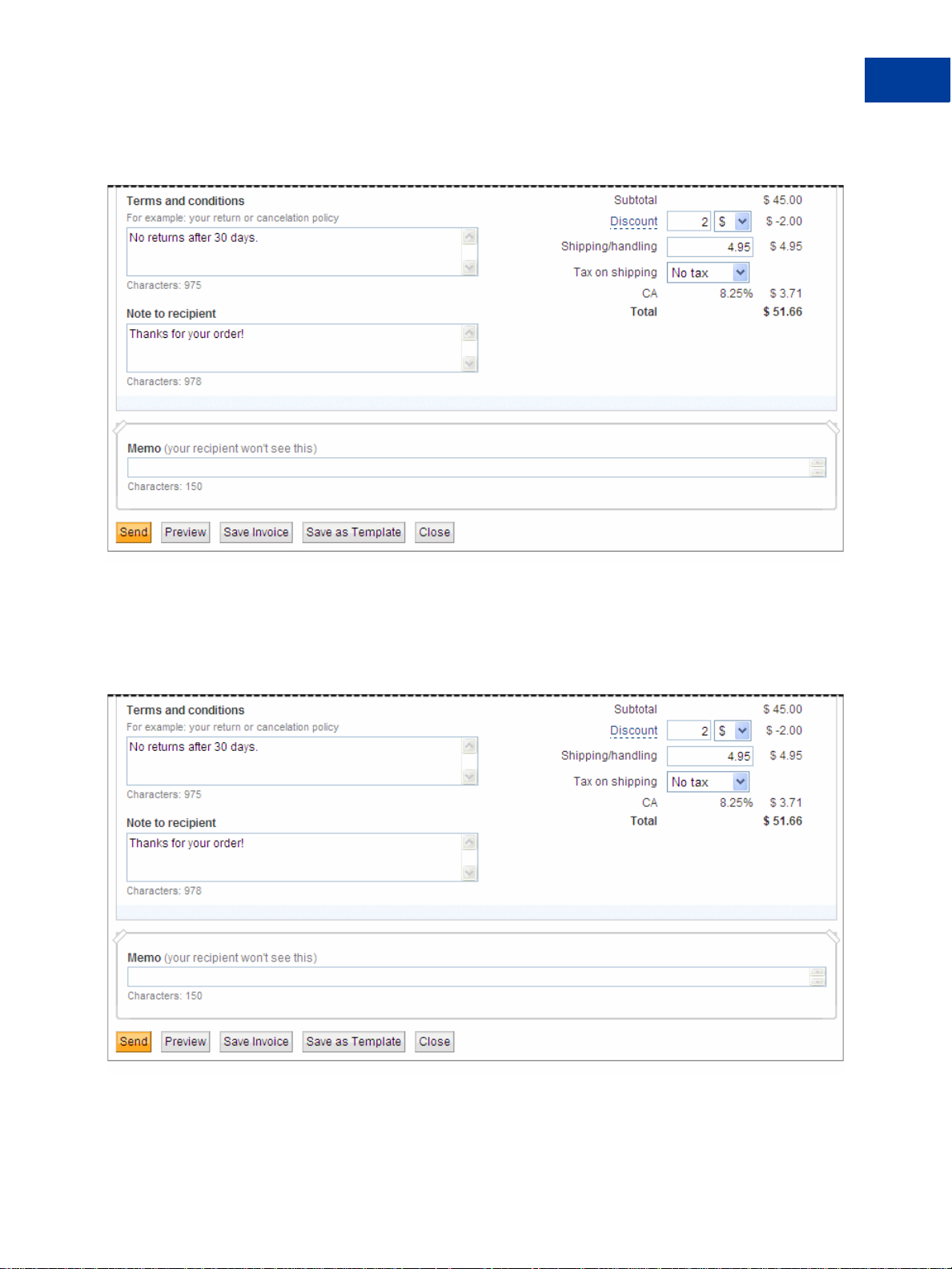

6. Entering a Discount, Shipping Fee, and Invoice Notes

You can specify additional information that applies to the entire invoice. This information

includes discounts, shipping and handling costs, and invoice notes.

1. Enter a Discount amount and select the type of discount.

Discount applies to the entire invoice and appears in the invoice totals section.

NOTE: If you want the discount to appear in the invoice items list, enter it as an invoice

item with a negative amount.

2. Enter a Shipping/handling amount.

3. If your shipping or handling fee is subject to tax, select a tax rate from Tax on shipping.

If the correct tax rate is not listed, add a new tax. See “Adding Tax Information in an

Invoice or Template” on page 128 for instructions.

4. Enter Terms and conditions text, up to 1,000 characters. This text appears in the invoice.

5. Enter Note to recipient text, up to 1,000 characters. This text appears in the invoice.

26 September 2010 Invoicing User’s Guide

Page 27

Creating Invoices

Creating Invoices and Entering Details

6. Enter Memo text, up to 150 characters. This text does not appear in the invoice.

2

7. Finalizing an Invoice

When you have entered invoice information, you can perform several tasks using the buttons

at the bottom of the page.

Send the invoice. See “Sending Invoices” on page 31.

Invoicing User’s Guide September 2010 27

Page 28

Creating Invoices

2

Previewing Invoices

Preview the invoice to see it from your recipient’s point of view. See “Previewing

Invoices” on page 28.

Save invoice as a draft to complete or use as a template at a later time. See “Saving

Invoices” on page 30.

Save as Template to use the current invoice again. See “Saving an Invoice as a Template”

on page 87.

Close the invoice.

When you close an invoice, a dialog box opens and gives you the option of saving your

changes. Click Don’t Save to discard your changes.

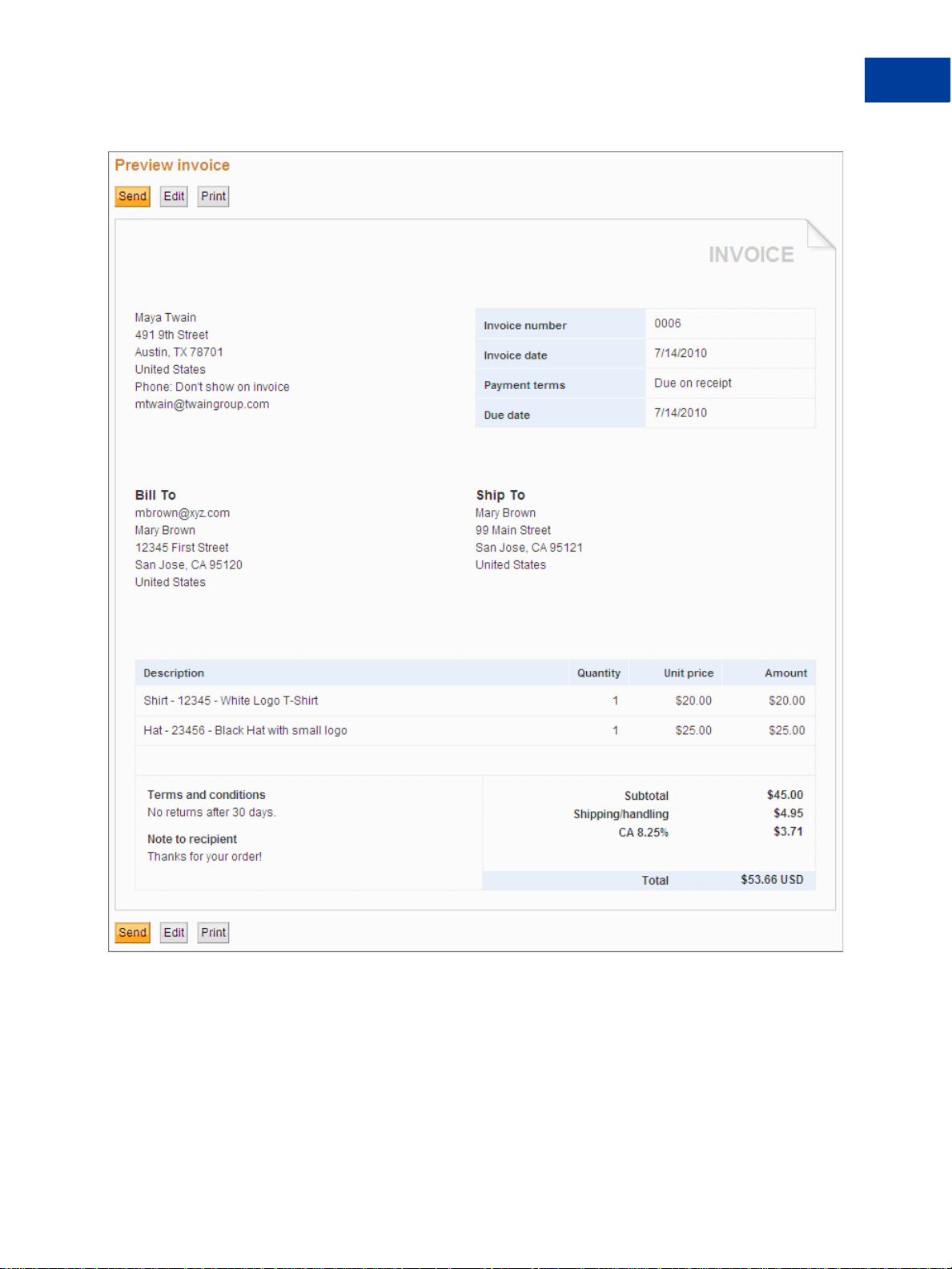

Previewing Invoices

You can preview how an invoice will look to your customer before sending it. The Preview

invoice page displays the invoice information you have entered. You can preview the invoice

just before sending it or any time you want to see how the invoice looks.

28 September 2010 Invoicing User’s Guide

Page 29

Creating Invoices

Previewing Invoices

2

After reviewing the invoice, you can send, edit, or print it from the Preview invoice page.

Invoicing User’s Guide September 2010 29

Page 30

Creating Invoices

2

Saving Invoices

Previewing an Invoice

1. Open the Create a new invoice page and enter invoice information.

See “Creating Invoices and Entering Details” on page 17 for detailed instructions.

2. Click Preview at the bottom of the Create a New Invoice page.

The Preview page opens. The Preview box displays your contact information, invoice

dates, payment terms, and the invoice information you entered.

3. Review the invoice and determine whether it is ready to send.

4. Perform one of the following actions:

– Click Send to send the invoice to the customer.

– Click Edit to go back to the Create a new invoice page.

– Click Print to make a hard-copy of the invoice.

See “Sending Invoices” on page 31 for more information.

See “Creating Invoices and Entering Details” on page 17 for more information.

See “Printing Invoices” on page 32 for instructions.

Saving Invoices

There might be occasions when you want to save an invoice without sending it. For example,

if you need to clarify an order, you can enter the invoice information you have and save it as a

draft. When you know how to handle the order, you can open the saved invoice and complete

it.

When you save an invoice as a draft, a time stamp appears below the button indicating the date

and time your invoice was saved. You can access saved invoices in the Manage Invoices

page. See

You can also save an invoice as a template. See “Saving an Invoice as a Template” on page 87

for instructions.

Saving an Invoice as a Draft

1. Log in to your PayPal account.

2. Click the Request Money tab and then click Create Invoice.

The Create a new invoice page opens.

3. Enter information for the invoice.

See “Creating Invoices and Entering Details” on page 17 for instructions.

“Managing Your Invoices” on page 35 for information about this page.

30 September 2010 Invoicing User’s Guide

Page 31

4. Click Save Invoice at the bottom of the page.

The date and time you saved the invoice appears at the bottom of the page.

Sending Invoices

Creating Invoices

Sending Invoices

2

After you enter invoice information, you can send the invoice from the Create a new invoice

page or preview it before sending.

When you send invoices, an email notifications are sent to your recipients. PayPal account

holders see invoices in their account History. You can see the invoices in your Manage

Invoices page.

See “Managing Your Invoices” on page 35 for more information.

Sending an Invoice

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click the Request Money tab and then click Create Invoice.

The Create a new invoice page opens.

4. Enter information for the invoice.

See “Creating Invoices and Entering Details” on page 17 for instructions.

5. Click Send to send the invoice.

The Manage Invoices page opens. A message at the top of the page confirms that your

invoice was sent. Your invoice appears at the top of the invoice list.

Invoicing User’s Guide September 2010 31

Page 32

Creating Invoices

2

Printing Invoices

See “Managing Your Invoices” on page 35 for more information.

Printing Invoices

If you need a copy of the invoice to send to your customer or for your records, you can print it

from the Preview page or from the Invoice Details page. A print version of the invoice

displays in a separate window.

32 September 2010 Invoicing User’s Guide

Page 33

Creating Invoices

Printing Invoices

2

After printing, the window closes.

Printing an Invoice from the Preview Page

1. Enter invoice information in the Create a new invoice page.

See “Creating Invoices and Entering Details” on page 17 for detailed instructions.

2. Click Preview at the bottom of the Create a new invoice page.

The Preview page opens. The Preview box displays your invoice information.

3. Click Print.

A Print Invoice window and the Print dial og box open. Your invoice information display s

in a printer-ready format in the Print Invoice window.

Invoicing User’s Guide September 2010 33

Page 34

Creating Invoices

2

Printing Invoices

4. Select a printer in the Print dialog box.

5. Click Print.

After printing, close the Print Invoice. You can now perform other actions on the Preview

page.

Printing an Invoice from the Invoice Details Page

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click an invoice number in the Invoice # column of the Manage Invoices page.

The Invoice details page opens. The page displays invoice status information and the

invoice details.

4. Click Print.

A Print Invoice window and the Print dial og box open. Your invoice information display s

in a printer-ready format in the Print Invoice window.

5. Select a printer in the Print dialog box.

6. Click Print.

After printing, close the Print Invoice window. You can now perform other actions on the

Invoice details page or return to the Manage Invoices page.

34 September 2010 Invoicing User’s Guide

Page 35

3

Managing Your Invoices

After sending invoices, you’ll want to manage and track your invoices and payments. The

Manage Invoices page contains a set of tools for you to quickly find the invoices you need

and perform invoicing tasks.

Read the following topics to learn about managing your invoices.

“About the Manage Invoices Page” on page 35

“Searching Invoices” on page 38

“Reviewing Invoice Details” on page 42

“Editing Invoices” on page 47

“Exporting Invoice Information” on page 49

“Copying Invoices” on page 54

“Sending Invoice Reminders” on page 55

“Canceling Invoices” on page 56

“Archiving and Unarchiving Invoices” on page 58

“About Invoices and Shipping” on page 61

See “Managing Invoice Payments” on page 63 for instructions on handling invoice payments.

About the Manage Invoices Page

The Manage Invoices page opens when you click Manage invoices on the Request Money

tab. This page automatically opens after you send or save an invoice. Manage Invoices is the

main page to use when managing your invoices and payments.

When you click the Request Money tab, it displays either the Request Money page or the

Manage Invoices page depending on the last request you performed. For example, if you sent

an invoice the last time you visited this tab, the Manage Invoices page opens.

Invoicing User’s Guide September 2010 35

Page 36

Managing Your Invoices

3

About the Manage Invoices Page

Manage Invoices displays the list of invoices that you have sent or saved. It displays the

following information for each invoice:

Column Description

Invoice date Date sent or saved.

Due date Date payment is due according to the payment terms in the invoice.

Recipient Name of the recipient or the recipient’s company name if one was used in the invoice.

If you saved the recipient in the add res ss book, click the recipient to open its address

book entry.

Status Current status of the invoice. See “About Invoice Statuses” on page 37 for a list of

statuses.

Invoice # ID number assigned to the invoice. Click this number to open Invoice details.

36 September 2010 Invoicing User’s Guide

Page 37

Managing Your Invoices

About the Manage Invoices Page

Column Description

Action Available actions for the invoice depending on the invoice’s status. If there are

multiple actions, an arrow displays in the box.

Amount Invoice total amount.

Memo Displays an icon when the invoice contains a note to yourself. Hover over the icon to

display the contents of the memo.

Manage Invoices displays 20 invoices per page. If there are multiple pages of invoices, Page

displays the number of the current page and the total number of pages. You change pages by

clicking Previous and Next, which display at the top and bottom of the invoice list.

3

Use other Manage Invoice options to create invoices, filter and search invoices, archive and

unarchive invoices, and download invoice activity. From this page, you can open Invoice

Settings, Create an invoice, or the Request Money page.

About Invoice Statuses

Each invoice is assigned a status based on where it is in the invoicing process. A status appears

for each invoice listed in your History and Manage Invoices pages. At a quick glance, you

can determine whether an invoice is paid. You can review the details for all invoices regardless

of invoice status.

The available invoice statuses are listed below in alphabetical order.

Invoicing User’s Guide September 2010 37

Page 38

Managing Your Invoices

3

Searching Invoices

Status Description

Canceled Invoice was canceled.

Draft Invoice was created and saved. It was not sent to the recipient.

Marked as paid Invoice was manually marked as paid.

Paid Invoice was paid by a PayPal account holder.

Sent Invoice was sent.

Depending on an invoice’s status, you can perform certain actions on an invoice. For example,

you can print all invoices, but you can only edit invoices that have not been paid, marked as

paid, or canceled. Some actions can be performed either on the Manage Invoices or Invoice

details pages. Other actions can only be performed on the Invoice details page.

You can perform the following actions on the Manage Invoices page:

Send a Reminder: Only available when invoice status is Sent.

Mark as Paid: Only available when invoice status is Sent.

Cancel the invoice: Only available when invoice status is Sent.

Copy the invoice: Available for all invoice statuses.

You can perform all of these actions and the following actions on the Invoice details page:

Edit the invoice: Only available when the invoice status is Draft or Sent.

Print the invoice: Available for all invoice statuses.

See “Reviewing Invoice Details” on page 42 for instructions on using the Invoice details

page.

Searching Invoices

The Manage Invoices page contains two search filters: Basic and Advanced. Use these

search filters to find invoices that match certain criteria. For example, if you want to see all

invoices that are past due, you can use the Past due filter in Basic filter to quickly find them.

If you want to see all invoices sent to a particular recipient, you can search by email address in

Advance filter.

When you open the Manage Invoices page, the Basic filter selections and All Active invoices

display in the page. As you apply search filters, the invoice list changes to display invoices

that match your filter.

38 September 2010 Invoicing User’s Guide

Page 39

About the Basic Filters

Basic filter contains predefined filters for some of the most common searches you might need.

Filter Results

All active All invoices that have not been archived.

Unsent Saved invoices.

The invoice status is Draft.

Unpaid Sent invoices that have not been paid.

The invoice status is Sent.

Paid Paid invoices.

The invoice status is either Paid or Marked as paid.

Past due Sent invoices that are past their due dates.

With one click, Basic filter displays the invoices that match the search criteria.

If you need to narrow down the list of invoices more than Basic filter allows, use Advanced

filter instead.

Managing Your Invoices

Searching Invoices

3

About the Advanced Filters

Use Advanced filter to filter your searches by almost every top-level invoice value. Advanced

filters are useful when you need to search for specific invoice data.

You can apply the following filters.

Filter Search Criteria

Email Enter all or part of the recipient’s email address.

Recipient name Enter all or part of the recipient’s first and last name.

Company name Enter all or part of the recipient's company name.

Invoice number Enter all or part of the invoice number.

Status Select an invoice status.

Archived items No additional criteria.

See “Archiving and Unarchiving Invoices” on page 58 for information about

archived invoices.

Amount Enter an amount range in the two box es that display.

Currency Select a currency.

Memo Enter memo text or keywords that might appear in invoice memos.

For example, if you typically include a memo about special discounts, search for

discount.

Invoicing User’s Guide September 2010 39

Page 40

Managing Your Invoices

3

Searching Invoices

Filter Search Criteria

Payment date Specify the payment date range. Enter the From and To dates of the date range in

the text boxes or use the Calendar controls to select them.

Due date Specify the due date range. Enter the From and To dates of the date range in the

text boxes or use the Calendar controls to select them.

Invoice date Specify the invoice date range. Enter the From and To dates of the date range in the

text boxes or use the Calendar controls to select them.

For most of the text filters, partial text can match. For example, the text mit matches Smith

and Mitty.

Searching Invoices with a Basic Filter

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click a filter in the Basic filter box.

– All Active

– Unsent

– Unpaid

– Paid

– Past due

See “About the Basic Filters” on page 39 for a description of these filters.

The Manage Invoices page refreshes and displays the invoices matching the search filter .

You can apply another filter or look an the invoice details for one or more of the invoices

listed.

40 September 2010 Invoicing User’s Guide

Page 41

Searching Invoices with an Advanced Filter

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click Advanced filter.

The Advanced filter search box displays on the page. The Basic filter search box moves

to the back.

4. Select a filter in Filter by.

– Email

– Recipient name

– Company name

– Invoice number

– Status

– Archived items

– Amount

– Currency

– Memo

Managing Your Invoices

Searching Invoices

3

If the filter lets you enter search criteria, one or more fields display next to your Filter by

selection.

See “About the Advanced Filters” on page 39 for a description of these filters.

5. Enter search criteria for your filter, if available.

–For Status and Currency filters, select an item from the drop down list.

– For other filters, enter the criteria to find.

6. To use a date range to filter the search, select a date type from And (below the Filter by

field) and enter a date range.

– Select a date from the Calendar control.

- Or Enter the starting date in the first date field.

– Select a date from the Calendar control.

- Or Enter a date in the to field (second date field).

Invoicing User’s Guide September 2010 41

Page 42

Managing Your Invoices

3

Reviewing Invoice Details

7. Click Show.

The Manage Invoices page displays a list of invoices that match your criteria. If there are

no matches, the page displays a message indicating that there are no matches.

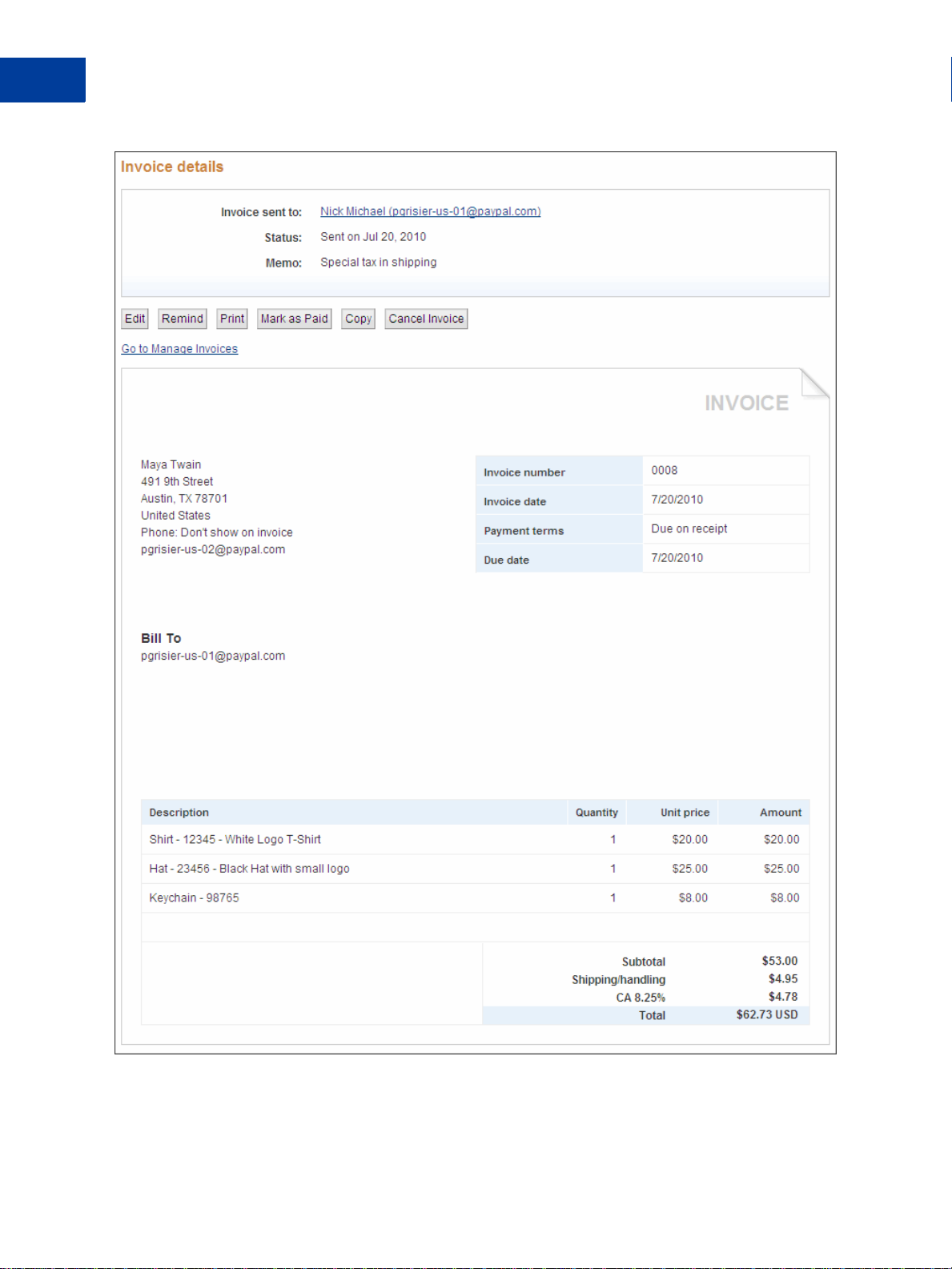

Reviewing Invoice Details

The Manage Invoices page lists the invoices that you sent or saved. Invoices also appear in

your History page. You can view detailed information for an invoice in the Invoice details

page.

You can access the Invoice details page from the following pages:

Manage Invoices

Account Overview for recent invoices

History

Any page that contains an invoice number link

The Invoice details page is divided into three sections:

1. Invoice status: Contains the recipient’s email address, current status, and invoice memo

text display at the top of the page.

2. Invoice actions: A set of buttons for the actions you can perform for the current invoice

and a link you can use to return to the previous page.

3. Invoice: Displays the invoice as it appears to the recipient. This section shows your contact

information, the invoice date and payment terms, the recipient’s information, the items

invoiced, and the invoice totals. If you included Terms and Conditions or Notes text, it

appears below the item list.

42 September 2010 Invoicing User’s Guide

Page 43

Managing Your Invoices

Reviewing Invoice Details

Use the Invoice details page to review the contents of the invoice, recipient information, and

the invoice terms. From this page, you can perform the following actions for open invoices.

Edit: Update or change the invoice contents. For example, if the recipient moved, you can

edit the address information.

See “Editing Invoices” on page 47 for instructions.

Remind: Send an email reminder to the recipient.

See “Sending Invoice Reminders” on page 55 for instructions.

Print: Print the invoice for your records or to send a copy to your customer.

See “Printing Invoices” on page 32 for instructions.

Mark as Paid: Manually set the invoice to Paid.

See “Recording Invoice Payments” on page 65 for instructions.

Copy: Use a copy of the invoice as the starting point for a new invoice.

See “Copying Invoices” on page 54 for instructions.

Cancel Invoice: Mark the invoice as canceled and send an email notification to the

recipient.

3

See “Canceling Invoices” on page 56 for instructions.

After an invoice is paid or canceled, you can only print or copy it.

Invoicing User’s Guide September 2010 43

Page 44

Managing Your Invoices

3

Reviewing Invoice Details

44 September 2010 Invoicing User’s Guide

Page 45

Managing Your Invoices

Opening Invoice Details From the Manage Invoice Page

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click the invoice number in the Invoice # column to open that invoice.

The Invoice details page opens.

Reviewing Invoice Details

3

Invoicing User’s Guide September 2010 45

Page 46

Managing Your Invoices

3

Reviewing Invoice Details

46 September 2010 Invoicing User’s Guide

Page 47

4. Click a button to perform an action on this invoice.

For example, click Print to make a copy of the invoice for your records.

- Or Click Go to Manage Invoices to return to the Manage Invoices page.

Editing Invoices

You can update or change invoices that have not been paid, marked as paid, or canceled. For

example, if your customer ordered another item, you can add it to an existing invoice. Use the

Invoice details page to edit the contents of the invoice, recipient information, and the invoice

terms.

When you select an invoice to edit, the Edit invoice page opens and displays the information

that was sent to your customer. You can edit any of the fields in the invoice, bu t you cannot use

a different template for the invoice. Because you are editing an existing invoice, you can only

Send, Print, or Close the invoice.

Managing Your Invoices

Editing Invoices

3

When you send an edited invoice, the Manage Invoices page displays information about the

edited invoice, replacing the original entry for the invoice.

When your customer views the invoice details, the invoice Status displays a message

indicating that the invoice was edited and the date it was edited. Your customer sees only the

edited version of the invoice.

Editing an Invoice

NOTE: If you need more detailed information about completing invoice fields, see “Creating

Invoices and Entering Details” on page 17.

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click an Invoice #.

The Edit invoice page opens.

Invoicing User’s Guide September 2010 47

Page 48

Managing Your Invoices

3

Editing Invoices

4. Add or change the logo for the invoice.

Setting Action

Add logo Click to add a logo.

This setting appears when the invoice does not have a logo.

Change logo Click to use a different logo.

This setting appears when the invoice contains a logo.

Remove logo Click to delete the logo.

This setting appears when the invoice contains a logo.

See “Including a Logo in Your Invoices” on page 74 for detailed instructions.

5. Click Edit contact information to change your information.

See “Editing Your Contact Information in an Invoice” on page 70 for instructions.

6. Update the recipient information in Send to.

7. Update the following Invoice information:

– Invoice number

– Invoice date

– Payment terms

– Due date

8. To change the currency, select one in Select currency.

9. Edit or add items.

Setting Action

Item name/ID Enter the item name.

If you have saved items, select one from the list that appears when you click

in the field.

Date Enter the Date for the item.

When you tab or click in the date field, a Calendar opens. Select the date

from the Calendar or type the date in the field.

Quantity Enter the number of items.

Unit price Enter the unit price.

If you selected a saved item, the stored amount displays. You can change it ,

if necessary .

Tax Select the tax for this item.

If you selected a saved item with an assigned tax rate, the tax displays. You

can change it, if necessary.

If the correct tax rate is not listed, add a new tax. See “Adding Tax

Information in an Invoice or Template” on page 128 for instructions.

48 September 2010 Invoicing User’s Guide

Page 49

Managing Your Invoices

Exporting Invoice Information

10.Edit or add shipping and discount information:

Setting Action

Discount Enter a number and select a discount type.

Shipping/handling Enter an amount.

Tax on shipping Select the tax to apply to the shipping or handling fee.

If the correct tax rate is not listed, add a new tax. See “Adding Tax

Information in an Invoice or Template” on page 128 for instructions.

11. Edit or add invoice notes and text:

–Enter T erms and conditions text, up to 1,000 characters. This text appears on an invoice.

–Enter Note to recipient text, up to 1,000 characters. This text appears on an invoice.

–Enter Memo text, up to 150 characters. This text does not appear on an invoice.

12.Click Send.

The Manage invoices page opens and displays a message verifying that your editing

invoice was sent. The edited invoice’s information appears in the invoice list.

Before sending the edited invoice, you can click Print to make a copy for your records or

mail to your customer.

3

Exporting Invoice Information

You can export invoice information to use in a spreadsheet or other application by

downloading invoice activity from the Manage Invoices page. You can open the activity file

immediately or save file to use later.

Each invoice in the activity file generates one row of information. Each column in the activity

file represents a piece of the invoice’s information,. If an invoice does not contain certain data,

such as tax or shipping amounts, the columns are empty.

Before downloading the activity, use a basic or ad vanced filter to display only the invoices you

want in the file. For example, use a filter to limit the downloaded activity to paid invoices. See

“Searching Invoices” on page 38 for filtering instructions.

You can download two levels of invoice activity information:

Invoice Summary: The downloaded activity information contains one row of information

for each invoice. This is the default download.

See “Invoice Summary Activity Information” on page 50 for a list of the columns

contained in each row.

Invoice Details: The downloaded activity information contains one invoice summary row

and additional rows for each item, tax, shipping, and discount within an invoice. The

summary row contains the same information as the Invoice Summary download.

Invoicing User’s Guide September 2010 49

Page 50

Managing Your Invoices

3

Exporting Invoice Information

Additional columns appear for item details, tax amounts, shipping amounts and discount

amounts.

See “Invoice Details Activity Information” on page 50 for more information about the

columns contained in this download.

Invoice Summary Activity Information

The default download contains invoice summary information. Each row can contain the

information in the following table.

Date created Time created Invoice date Invoice date Due date

Payment date Status From email T o email Name

Company Invoice number Currency Item total Discount amount

Shipping amount Tax total Total invoice

amount

Customer note Invoice memo Invoice billing

address

Invoice Details Activity Information

You can download item details for each invoice to see a breakdown of the invoice’s contents.

In addition to the invoice summary information, you’ll see one item detail row for each

invoice item. If the invoice contains shipping charges or discounts, there is one row for each.

A Type column identifies the kind of data included in the row:

Invoice summary row: Contains all of the information listed in the previous table.

Invoice item row: Contains the invoice identification fields and the following item-

specific columns:

– Item date

–Item name

– Item description

– Item quantity

– Item unit price

– Item total

–Tax name

–Tax rate

Transaction ID Terms note

Other recipient

details

Invoice shipping

address

Shipping amount row: Displays invoice identification information and contains

information in the following columns:

– Shipping amount

–Tax name

–Tax rate

50 September 2010 Invoicing User’s Guide

Page 51

Managing Your Invoices

Exporting Invoice Information

–Tax total

Discount amount row: Displays invoice identification information and an amount in the

Discount amount column.

The following table contains a complete list of the columns in the invoice details activity.

Date created Time created Invoice date Due date

Payment date Type Status From email

T o email Name Company Invoice number

Currency Item date Item name Item description

Item quantity Item unit price Item total Discount amount

Shipping amount Tax name Tax rate Tax total

Total invoice amount Transaction ID Terms note Customer note

Invoice memo Invoice billing address Other recipient details Invoice shipping address

3

Downloading and Saving Invoice Activity

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Search for the invoices to export by applying a Basic or Advanced filter.

See “Searching Invoices” on page 38 for instructions.

Invoicing User’s Guide September 2010 51

Page 52

Managing Your Invoices

3

Exporting Invoice Information

4. Click CSV above the invoice list.

The Download your activity dialog box opens.

5. Select a type in Choose the file type.

The file type specifies how you want the activity data separated in each row. For example,

select Comma delimited to use a comma to separate the columns.

6. Click Include Item Details to export detailed information about each item in the invoice.

7. Click Download.

The File Download dialog box opens.

8. Click Save.

The Save File dialog box opens.

9. Enter a name in File name.

10.Click Save.

NOTE: To save the file in a dif ferent folder , browse to find the folder to use bef ore clicking

Save.

The Manage Invoices page opens.

52 September 2010 Invoicing User’s Guide

Page 53

Downloading and Opening Invoice Activity

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Search for the invoices to export by applying a Basic or Advanced filter.

See “Searching Invoices” on page 38 for instructions.

Managing Your Invoices

Exporting Invoice Information

3

4. Click CSV above the invoice list.

The Download your activity dialog box opens.

5. Select a type in Choose the file type.

The file type specifies how you want the activity data separated in each row. For example,

select Comma delimited to use a comma to separate the columns.

6. Click Include Item Details to export detailed information about each item in the invoice.

7. Click Download.

The File Download dialog box opens.

8. Click Open to display the information in an application.

Your selected application opens. Follow the directions to convert the information to your

application’s format, if necessary.

Invoicing User’s Guide September 2010 53

Page 54

Managing Your Invoices

3

Copying Invoices

Copying Invoices

You can copy an existing invoice as a quick way to create a new invoice. When you copy an

invoice, the Create a new invoice page opens and displays an exact replica of the original

invoice except for the invoice number , invoice date, and due date. These three fields are reset.

You can make any necessary edits before sending the invoice.

You can copy an invoice from the Manage Invoices page or from the Invoice details page.

Copying an Invoice from the Manage Invoices Page

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click Copy in the Action column for the invoice you want to copy.

The Create a new invoice page opens.

4. Edit or add information to an invoice copy as you would with any other new invoice.

When you are finished, you can send, preview, or save the invoice. You can also save the

invoice as a template.

See “Creating Invoices” on page 15 for instructions.

Copying an Invoice from the Invoice Details Page

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Click the Invoice #.

The Invoice details page opens.

4. Click Copy.

The Create a new invoice page opens.

5. Edit or add information to the invoice copy as you would with any other new invoice.

When you are finished, you can send, preview, or save the invoice. You can also save the

invoice as a template.

See “Creating Invoices” on page 15 for instructions.

54 September 2010 Invoicing User’s Guide

Page 55

Sending Invoice Reminders

If you have not received payment for your invoice, you can send a reminder that payment is

due. You can send invoice reminders for open invoices through the Manage Invoices page.

The reminder is an email message that you send to the invoice recipient. The email subject

contains the invoice number to help identify the invoice. You can include a personal message

of up to 1,000 characters. You can send a copy of the email to yourself for your records.

Sending a Reminder

1. Log in to your PayPal account.

2. Click the Request Money tab and then click the Manage Invoices subtab.

The Manage invoices page opens.

3. Select Remind in the Action column for the invoice that needs a reminder.

The Reminder page opens. The invoice recipient’s email displays in To: and the subject

line contains the invoice number.

Managing Your Invoices

Sending Invoice Reminders

3

4. Select Send me a copy of the email. (Optional)

5. Edit the Subject text, if necessary.

This is the email subject.

6. Enter a Note to the invoice recipient. (Optional)

Note text cannot exceed 1,000 characters. It appears in the body of the email message.

Invoicing User’s Guide September 2010 55

Page 56

Managing Your Invoices

3

Canceling Invoices

7. Click Send Reminder.

The Manage Invoices page displays a message confirming that your reminder was sent. If

you chose to receive a copy of the email, it will arrive in your email shortly.

Canceling Invoices

When a recipient cancels an order or you decide not to pursue an invoice for some reason, you

can cancel it through the Invoice details page. You can also cancel an invoice using an option

in the Manage Invoices page.

When you cancel an invoice, the invoice recipient receives an email notification. The default

email subject line contains the invoice number to help identify the invoice. You can include a

personal message of up to 1,000 characters. You can send a copy of the email to yourself for

your records.

The invoice status changes to Canceled. This invoice status displays in the History list in the

Payment Status column and in the Manage Invoices page in the Status column. The Invoice

details page displays the status, the date the status occurred, and the user who set the status.