Page 1

PayPal Intégral

Evolution Integration

Guide

Last updated: July 2012

Page 2

PayPal Intégral Evolution Integration Guide

Document Number: 10113.en_US-201207

© 2012 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal (Europe) S.à r.l. et Cie., S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard

Royal, L-2449, Luxembourg, R.C.S. Luxembourg B 118 349.

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information in this document to you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information contained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

About This Guide. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Revision History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Chapter 1 Getting Started with PayPal Intégral Evolution . . . . . . . 9

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Features and Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

How Intégral Evolution Works . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Seller Protection . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Instant Payment Review . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

PayPal Express Transaction Processing. . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Introduction to Integrating with Intégral Evolution . . . . . . . . . . . . . . . . . . . . . . 13

Chapter 2 Integrating Your Website Using HTML. . . . . . . . . . . .15

Simple Intégral Evolution Integration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Sample Integration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

HTML Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Chapter 3 Customising Your PayPal Payment Page . . . . . . . . . .21

Modifying Your PayPal Account Settings . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Settings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Appearance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Adding HTML Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

Chapter 4 Integrating iFrame in Your Website . . . . . . . . . . . . .33

Integrating iFrame . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Manual Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

API Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Page 4

Contents

Chapter 5 Integrating Your Website Using API . . . . . . . . . . . . . 39

Button Hosting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Using the Button Manager API with Intégral Evolution Checkout . . . . . . . . . . . . . . 40

Using URL Returned in the Response (Recommended) . . . . . . . . . . . . . . . . 40

Using Form POST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Encrypting Buttons Using Public and Private Key . . . . . . . . . . . . . . . . . . . . 43

Example of Initiating Checkout . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

BMCreateButton API Operation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

BMCreateButton Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

BMCreateButton Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

BMCreateButton Errors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Chapter 6 Testing Your Integration in Sandbox . . . . . . . . . . . .49

Creating a Preconfigured Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Testing Your Integration and Settings . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Testing Your Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Testing Your Settings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Chapter 7 Order Processing . . . . . . . . . . . . . . . . . . . . . .55

Verifying Transaction Status and Authenticity . . . . . . . . . . . . . . . . . . . . . . . . 55

Validate Instant Payment Notification (IPN) . . . . . . . . . . . . . . . . . . . . . . . 55

Execute a GetTransactionDetails API Call. . . . . . . . . . . . . . . . . . . . . . . . 56

Fulfilling Order . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

Chapter 8 Protecting Buttons by Using Encrypted Website Payments 57

Public Key Encryption Used by Encrypted Website Payments . . . . . . . . . . . . . . . 58

Setting Up Certificates Before Using Encrypted Website Payments. . . . . . . . . . . . . 58

Generating Your Private Key Using OpenSSL. . . . . . . . . . . . . . . . . . . . . . 59

Generating Your Public Certificate Using OpenSSL . . . . . . . . . . . . . . . . . . . 59

Uploading Your Public Certificate to Your PayPal Account . . . . . . . . . . . . . . . 59

Downloading the PayPal Public Certificate from the PayPal Website . . . . . . . . . . 60

Removing Your Public Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Using Encrypted Website Payments to Protect Your Payment Buttons . . . . . . . . . 61

Blocking Unprotected and Non-encrypted Website Payments . . . . . . . . . . . . . 62

Appendix A Optional API Operations. . . . . . . . . . . . . . . . . . .63

4

Page 5

Contents

GetTransactionDetails API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

GetTransactionDetails Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

GetTransactionDetails Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

RefundTransaction API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

RefundTransaction Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

RefundTransaction Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

DoCapture API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

DoCapture Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

DoCapture Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Chapter B Moving from PayPal Intégral to PayPal Intégral Evolution .81

Sample Code Comparison. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

Appendix C Error Messages . . . . . . . . . . . . . . . . . . . . . . .85

Appendix D Currency Codes . . . . . . . . . . . . . . . . . . . . . . .95

5

Page 6

Contents

6

Page 7

Preface

P

About This Guide

The PayPal Intégral Evolution Integration Guide describes how to integrate with Intégral

Evolution. It includes information about:

Features and benefits of Intégral Evolution.

Seller Protection.

Moving from Website Payments Standard to Intégral Evolution.

Integrating your website with Intégral Evolution.

Customising your hosted payment page.

Testing your integration in the Sandbox environment.

Verifying the status and authenticity of the transactions before fulfilling the orders.

Intended Audience

This guide is for merchants and developers that want to integrate with Intégral Evolution to

add transaction processing to their website.

Revision History

Revision history for Website Payments Pro Hosted Solution Integration Guide.

TABLE P.1 Revision History

Date Description

July 2012 Removed references to the deprecated HTML variable: shopping_url

June 2012

May 2012 Added IE9 to list of browsers that support iFrame.

Updated the requirements for the billing address fields in the

HTML Variables section.

Added a character limitations note to the following sections:

HTML Variables, Adding HTML Variables and

BMCreateButton API Operation.

Corrected the HTML samples in Chapter 2 and Chapter 5.

Page 8

Preface

P

Documentation Feedback

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

8

Page 9

1

Overview

PayPal Intégral Evolution is a payment platform allowing merchants to receive payments

funded by card or PayPal account.This solution is hosted by PayPal. You do not have to

capture or store credit card information on your website, thereby helping towards achieving

PCI compliance.

Intégral Evolution is the choice for merchants who prefer a solution where all financial details

are handled by PayPal.

In addition to Intégral Evolution, PayPal recommends that you implement the PayPal Express

button on your website. The button appears much earlier in the payment flow and gives

existing PayPal account holders the opportunity to use PayPal, thereby increasing the

transaction completion rate.

Getting Started with PayPal Intégral Evolution

Features and Benefits

Here are the features and benefits of Intégral Evolution:

PCI compliance - Payment Card Industry (PCI) Data Security Standards (DSS) is a global

security standard which applies to all businesses that collect, store, process, or transmit

card holder information. You can use PayPal’s hosted payment page as part of the PCI

compliance solution for your business.

N OTE: Intégral Evolution implementation helps achieving PCI compliance, and does not

necessarily guarantee it.

Supports iFrame - PayPal offers a compact payment form that can be integrated in an

iFrame on your website. The buyer completes the payment on your website and you can

maintain the checkout look and feel in the master frame that surrounds the compact

form.The credit card fields are part of the compact form so you do not have to collect this

information separately. For more information, refer to Chapter 4, “Integrating iFrame in

Your Website.

PayPal e-Terminal - PayPal-hosted online payment form, which enables you to accept

phone fax, mail orders for all major credit cards.

Seller Protection - This program protects you against chargebacks on transactions funded

by credit card or a PayPal account. For more information, refer to “Seller Protection” on

page 11

PayPal Express - Two-click payment option for PayPal account holders. For more

information, refer to “PayPal Express Transaction Processing” on page 12.

9

Page 10

Getting Started with PayPal Intégral Evolution

How Intégral Evolution Works

Supports Major Credit and Debit Cards - Supports Visa, MasterCard, Carte Bancaire,

Carte Aurore, Cofinoga, and 4 étoiles.

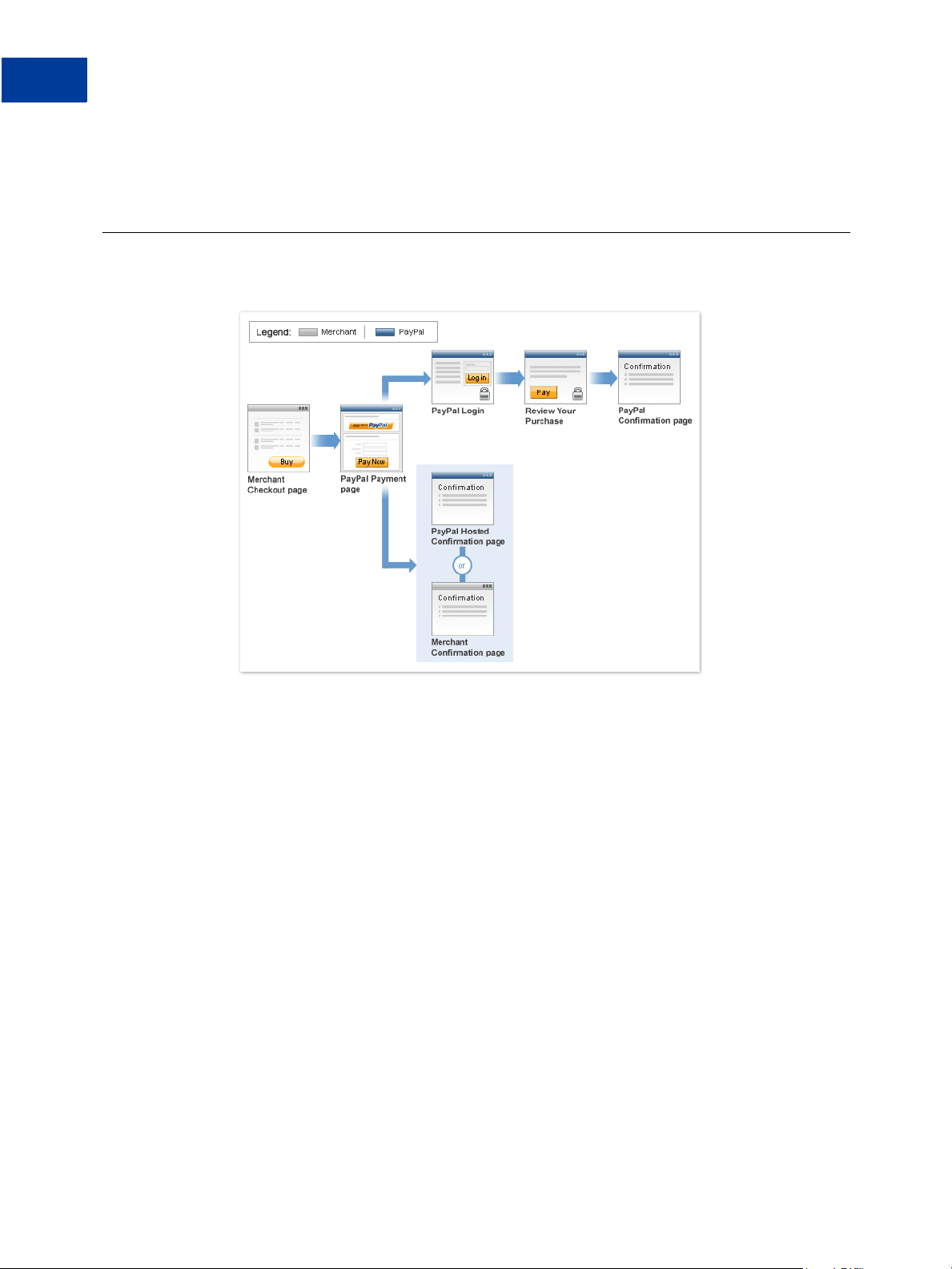

How Intégral Evolution Works

10

In the figure above, the top flow is for paying using your PayPal account and the bottom flow

is for paying with a card.

To integrate your website with Intégral Evolution:

1. Generate a button in your website checkout flow using HTML or API solution. The button

could be labeled Pay or Buy or similar. When the buyer clicks this button, they are

redirected to the payment page hosted by PayPal.

2. On the payment page, the buyer enters their debit or credit card information and clicks the

Pay Now button.They do not have to have a PayPal account, although they have the option

to use it if they have one.

3. If the transaction is successful, the buyer either sees PayPal’s confirmation page or is

redirected to a URL you specify. If the transaction is unsuccessful, an error message is

displayed, and the buyer can rectify the error and retry the transaction.

You can specify the content of the payment page and configure its appearance to reflect the

look and feel of your website (including your logo).

Page 11

Seller Protection

If PayPal is the only payment method on your website, transactions processed through Intégral

Evolution are eligible for PayPal’s Seller Protection. It covers payments done through the

payment flow of your website for items sold domestically and internationally. These items can

be purchased using a credit card or through the PayPal account.

To benefit from Seller Protection, the purchased item must be shipped to the address you

communicated to PayPal.

For this, you must perform the following tasks:

Send all the details of the billing and shipping address provided by the buyer in the Form

POST.

Set the address_override variable to true and showShippingAddress variable to

false (or unselect it in the Settings page on your Profile page).

IMPORTANT: Conditions apply. To see all conditions, please refer to PayPal e-Terminal and

Getting Started with PayPal Intégral Evolution

Seller Protection

PayPal Intégral Evolution User Agreement.

Instant Payment Review

To take advantage of Seller Protection, you must integrate with Instant Payment Review.

Payment Review is a feature that identifies high-risk transactions and notifies you so that you

can hold shipments until the risk has been evaluated by PayPal. It is made available to all

merchants and it reduces seller loss and makes the transactions eligible for Seller Protection.

When a transaction is initiated, PayPal runs additional buyer-risk assessment. PayPal scores all

transactions (Authorization and Sale) instantly and flags high-risk transactions as “Under

Review” and you are immediately notified. You should not ship merchandise or, in the case of

electronic media, you should not allow download access while the payment is under review.

PayPal fraud agents review the transaction within 24 hours and update the order as Completed

(released as safe by Payment Review) or Reversed (rejected by Payment Review). For risky

transactions, PayPal advises you to not ship the items until the transaction has been determined

as Completed. Payments that are completed are eligible for PayPal’s Seller Protection.

You can determine the status of a payment in the following ways:

Logging into https://www.paypal.com and viewing the status information in the

Transaction History.

Checking email sent by PayPal

Reviewing the Instant Payment Notification (IPN) message

Page 12

Getting Started with PayPal Intégral Evolution

PayPal Express Transaction Processing

Verifying the status of a transaction programatically. To check the initial status of a

transaction, use any of the following API operations:

– DoExpressCheckoutPayment

– DoReferenceTransaction

– DoAuthorization

– DoReauthorization

You can check the subsequent status of a transaction programatically by calling the

GetTransactionDetails API operation. For more information, refer to “GetTransactionDetails

API” on page 63.

N OTE: You must use version 58.0 (or +) of the API to obtain the initial status information

provided by DoExpressCheckoutPayment, DoReferenceTransaction, DoAuthorization,

or DoReauthorization.

To use payment review with DoExpressCheckoutPayment, DoReferenceTransaction,

DoAuthorization, and DoReauthorization Payment API operations, you must

1. Check the payment status in the response to the API operation; specifically, check whether

PaymentStatus is set to Pending.

2. If the

PaymentStatus is set to Pending and the PendingReason is set to PaymentReview,

If

PaymentStatus is set to Pending, check whether the PendingReason is set to

PaymentReview, because there are other reasons that a transaction may become pending.

For example, an unsettled authorization’s

PendingReason is set to authorization, which is not related to payment review.

PaymentStatus is set to Pending; however, its

you should not ship merchandise or, in the case of electronic media, you should not allow

download access.

Because the payment status will change after review, you must periodically check the payment

status using the GetTransactionDetails API operation, checking email from PayPal, reviewing

IPN messages, or checking the Transaction History on

PayPal Express Transaction Processing

PayPal Express is a 2-click payment solution allowing to boost your conversion rate. It enables

the buyers to use shipping information stored securely at PayPal to check out, so they do not

https://www.paypal.com.

12

Page 13

Getting Started with PayPal Intégral Evolution

Introduction to Integrating with Intégral Evolution

have to re-enter it on your site. This solution can be placed on both the product page as well as

the shopping cart page.

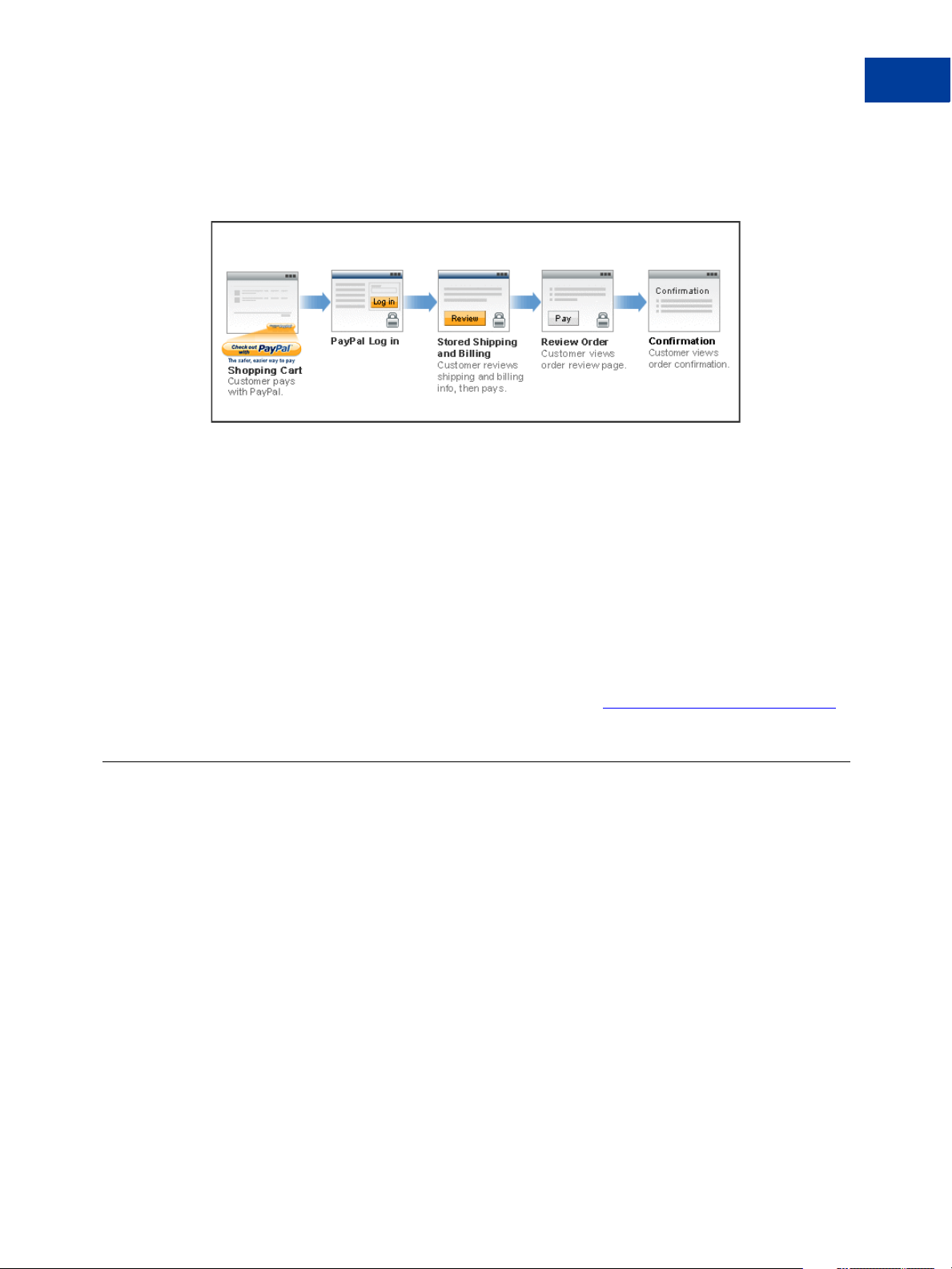

The following steps describe how PayPal Express works.

1. After selecting products to purchase on your website, buyers click Pay with PayPal

button.

2. They are redirected to the PayPal site where they log in using their PayPal login and

password.

3. After logging in, they review the order summary, and click Continue Checkout to

authorise the transaction.

4. The buyers are then returned to the confirmation page on your website where they can

verify the order details and submit the transaction.

For complete details on PayPal Express Checkout, refer to

Express Checkout Integration Guide.

Introduction to Integrating with Intégral Evolution

After signing up for Intégral Evolution, follow these steps to integrate your website

withIntégral Evolution:

1. Connect your website to Intégral Evolution: Identify a point in your website checkout flow

where you want to place a Pay or similar button that the buyer clicks on to initiate the

payment. You can do this using HTML or API. Clicking on this button redirects the buyer’s

browser to PayPal’s payment page for transaction processing. Depending on how you want

to integrate, follow the steps described in Chapter 2, “Integrating Your Website Using

HTML or Chapter 5, “Integrating Your Website Using API.

2. Optionally, customise the appearance and content of your PayPal-hosted payment page by

either sending the appropriate HTTP variables or by editing your PayPal account settings.

Refer to Chapter 3, “Customising Your PayPal Payment Page.

3. Optionally, test your integration in the PayPal Sandbox environment. This step is described

in Chapter 6, “Testing Your Integration in Sandbox.

Page 14

Getting Started with PayPal Intégral Evolution

Introduction to Integrating with Intégral Evolution

14

Page 15

2

Integrating Your Website Using HTML

This chapter provides instructions for a simple integration that enables you to begin processing

transactions using Intégral Evolution.

N OTE: PayPal recommends that you implement the simple integration to familiarise yourself

with Intégral Evolution before implementing a more customised integration.

As part of a simple integration, you get the default settings on your payment page. To

customise the look and feel of the page so it matches your website, you can do one of the

following:

Change your settings in your Profile section on PayPal.com, as described in “Modifying

Your PayPal Account Settings” on page 21.

Add the appropriate HTML variables to the payment page, as described in Table 2.1,

“HTML Variables for Settings of Payment Page and Table 3.1, “HTML Variables for Look

and Feel of Payment Page.

IMPORTANT: HTML variables will override the settings you save on your profile page.

Simple Intégral Evolution Integration

To integrate your website with Intégral Evolution, identify a point in your website checkout

flow where you want to place a button that the buyer clicks to initiate the payment. The button

should be labeled Continue to Payment, Pay or similar, and when clicked, should execute a

Form POST to PayPal. Clicking on this button redirects the buyer’s browser to the PayPal

payment page where they can pay with credit card, or their PayPal account.

The Form POST contains a set of HTML variables that describe the transaction. In the Form

POST, you must specify the following:

subtotal - amount of the transaction

business - Secure Merchant ID (found on the profile page) or the email address

associated with your PayPal account.

paymentaction - Indicates whether the transaction is for payment on a final sale or an

authorisation for a final sale (to be captured later).

The default currency is USD. Additionally, you can specify the appropriate HTML variables

listed in Table 2.1, “HTML Variables for Settings of Payment Page to customise the

information collected on the payment page or Table 3.1, “HTML Variables for Look and Feel

of Payment Page to customise the look and feel of the page. If the payment is successful, then

the buyer either sees the PayPal confirmation page or is redirected to the URL you specify in

your configuration.

Page 16

Integrating Your Website Using HTML

Simple Intégral Evolution Integration

The return URL is appended with a Transaction ID on the query string during the redirect back

from the payment page to your website. This Transaction ID can be used to retrieve the status

and verify the authenticity of the transaction. For detailed information on verifying the

authenticity of the transaction before fulfilling the order, refer to Chapter 7, “Order

Processing.

Sample Integration

Below is an example of a simple Intégral Evolution integration:

1. Sample Intégral Evolution Form POST:

<form action="https://securepayments.paypal.com/cgi-bin/acquiringweb"

method="post">

<input type="hidden" name="cmd" value="_hosted-payment">

<input type="hidden" name="subtotal" value="50">

<input type="hidden" name="business" value="HNZ3QZMCPBAAA">

<input type="hidden" name="paymentaction" value="sale">

<input type="hidden" name="return"

value="https://yourwebsite.com/receipt_page.html">

<input type="submit" name="METHOD" value="Pay">

</form>

The bold text is the value for the corresponding variable. It is recommended that you

enclose the values in quotes. For detailed information on these values, refer to Tab le 2.1,

“HTML Variables for Settings of Payment Page.

2. Output the HTML text into your website at the point where buyers will proceed with their

checkout.

3. Open your checkout page and test the button to ensure that it opens the PayPal payment

page.

You can also use the PayPal sandbox environment to test your integration. For complete

information on testing your integration in the PayPal Sandbox environment, refer to

Chapter 6, “Testing Your Integration in Sandbox.

16

Page 17

Integrating Your Website Using HTML

HTML Variables

The table below lists the Intégral Evolution HTML variables you can use to send in additional

transaction information along with your web request. For a list of HTML variables that you

can use to customise the look and feel of your payment page, refer to Table 3.1, “HTML

Variables for Look and Feel of Payment Page.

N OTE: The values you pass must not contain any of these special characters (){}<>\";

N OTE: Some merchants are required to pass billing information with every transaction. It is

recommended that you test your integration first, particularly if you plan to use iFrame,

to determine if the billing information fields are required.

TABLE 2.1 HTML Variables for Settings of Payment Page

V a r i a b l e D e s c r i p t i o n R e q u i r e d

HTML Variables

address1

address2

address_override

billing_address1

billing_address2

billing_city

billing_country

billing_first_name

billing_last_name

billing_state

billing_zip

bn

Street name of shipping address. (1 of 2 fields). No

Street name of shipping address. (2 of 2 fields). No

The payer is shown the passed-in address but cannot edit

No

it. This variable is overridden if there are errors in the

address. The allowable values are true/false. Default is

false.

Street name of the billing address. (1 of 2 fields). Conditional

Street name of the billing address. (2 of 2 fields). No

City name of the billing address. Conditional

Country code of the billing address. Conditional

First name of person the item is being billed to. Conditional

Last name of person the item is being billed to. Conditional

State name of the billing address. Conditional

Zip code of the billing address. Conditional

Identifies the source that built the code for the button.

Format -

<Company>_<Service>_<Product>_<Country>

No

business

buyer_email

Your PayPal account email address or your PayPal ID

Ye s

(Secure Merchant ID) associated with your PayPal

account. It is recommended that you use your PayPal ID,

which can be found on the top section of the Profile page

on PayPal.com

Email address of the buyer. No

17

Page 18

Integrating Your Website Using HTML

HTML Variables

ABLE 2.1 HTML Variables for Settings of Payment Page (Continued)

T

V a r i a b l e D e s c r i p t i o n R e q u i r e d

cancel_return

cbt

city

country

currency_code

custom

first_name

handling

invoice

last_name

lc

night_phone_a

The browser will be redirected to this URL if the buyer

No

clicks “Return to Merchant” link. Be sure to enter the

complete URL, including http:// or https://.

Sets the text for the “Return to Merchant” link on the

No

PayPal confirmation page. For business accounts, the

return button displays your business name in the place of

the word “Merchant” by default.

City name of shipping address. No

Country name of shipping address. No

The currency of the payment. The default is USD. No

Pass through variable never presented to the payer. No

First name of person the item is being shipped to. No

Handling charged. This amount is added to subtotal for

No

the total amount.

Order number in the merchant’s ordering/invoice system. No

Last name of person the item is being shipped to. No

The language of the login or sign-up page. No

The area code of the U.S. phone number, or the country

No

code of the phone number outside the U.S. This prepopulates the buyer’s home phone number.

18

night_phone_b

night_phone_c

notify_url

paymentaction

The three-digit prefix for U.S. phone numbers, or the

entire non-U.S. phone number for numbers outside the

U.S., excluding the country code. This pre-populates the

buyer’s home phone number.

NOTE: Use this variable for non-US numbers.

The four-digit phone number for U.S. phone numbers.

This pre-populates the buyer’s home phone number.

The URL to which PayPal posts information about the

transaction in the form of Instant Payment Notification. Be

sure to enter the complete URL, including http:// or

https://.

Indicates whether the transaction is for payment on a final

sale or an authorisation for a final sale (to be captured

later).

Allowable Values: - authorization or sale

Default Value - sale

No

No

No

Ye s

Page 19

Integrating Your Website Using HTML

HTML Variables

ABLE 2.1 HTML Variables for Settings of Payment Page (Continued)

T

V a r i a b l e D e s c r i p t i o n R e q u i r e d

return

shipping

state

subtotal

tax

zip

The URL to which the buyer’s browser is redirected to

No

after completing the payment. Be sure to enter the

complete URL, including http:// or https://.

Shipping charged. This amount is added to subtotal for

No

the total amount.

State of the shipping address. No

Amount charged for the transaction. If shipping, handling,

Ye s

and taxes are not specified, this is the total amount

charged.

Taxes charged. This amount is added to subtotal for the

No

total amount.

Postal code of the shipping address. No

19

Page 20

Integrating Your Website Using HTML

HTML Variables

20

Page 21

Customising Your PayPal

3

Payment Page

You can customise the look and feel of the PayPal payment page in the following two ways:

Modifying Your PayPal Account Settings

Adding HTML Variables

N OTE: HTML variables will override the settings you save on your profile page.

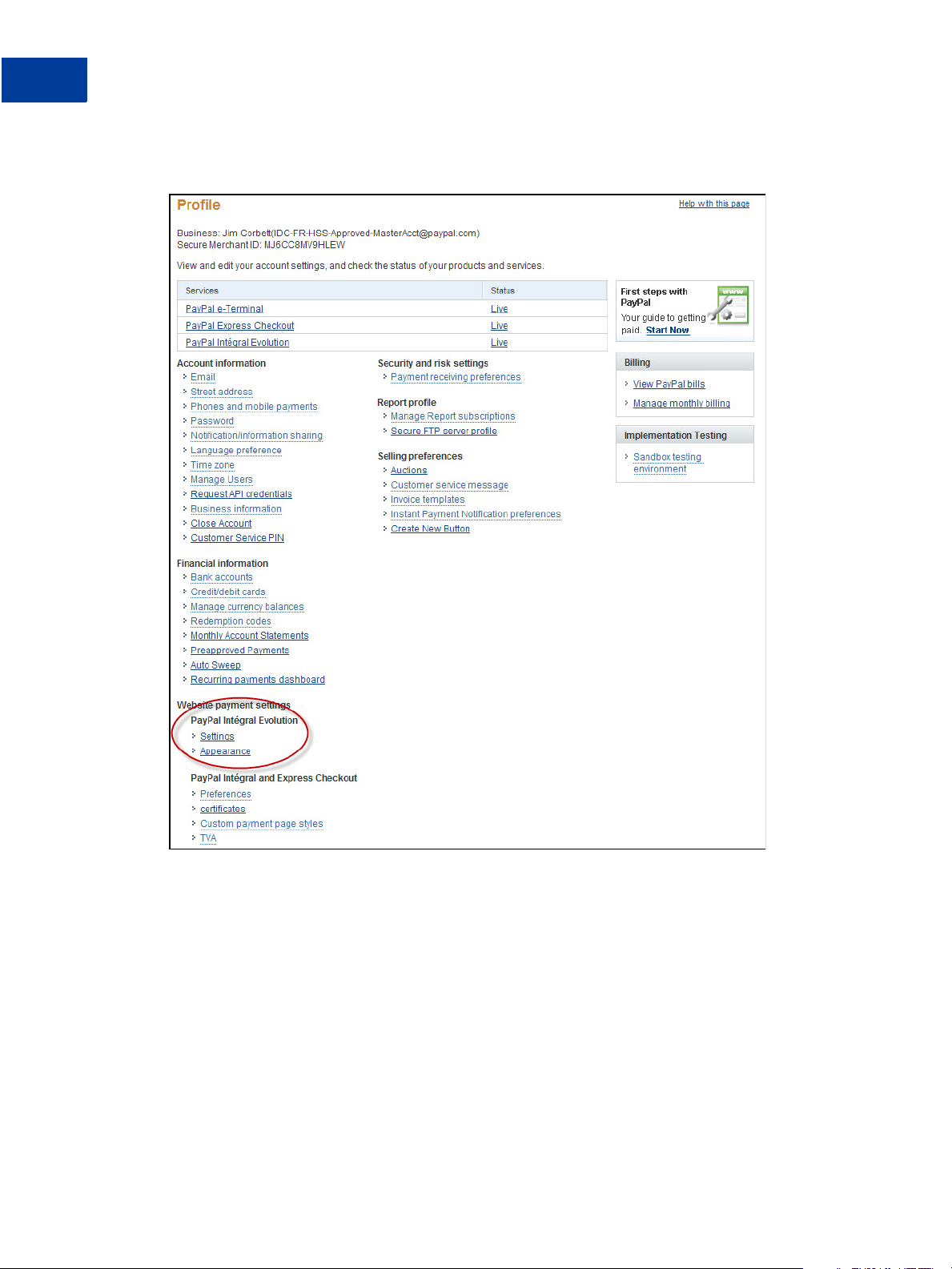

Modifying Your PayPal Account Settings

In your Profile section on PayPal.com, you can change the look and feel of the payment page

by modifying the settings on the following pages under the Website Payment Settings section.

Settings

Appearance

21

Page 22

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

22

Page 23

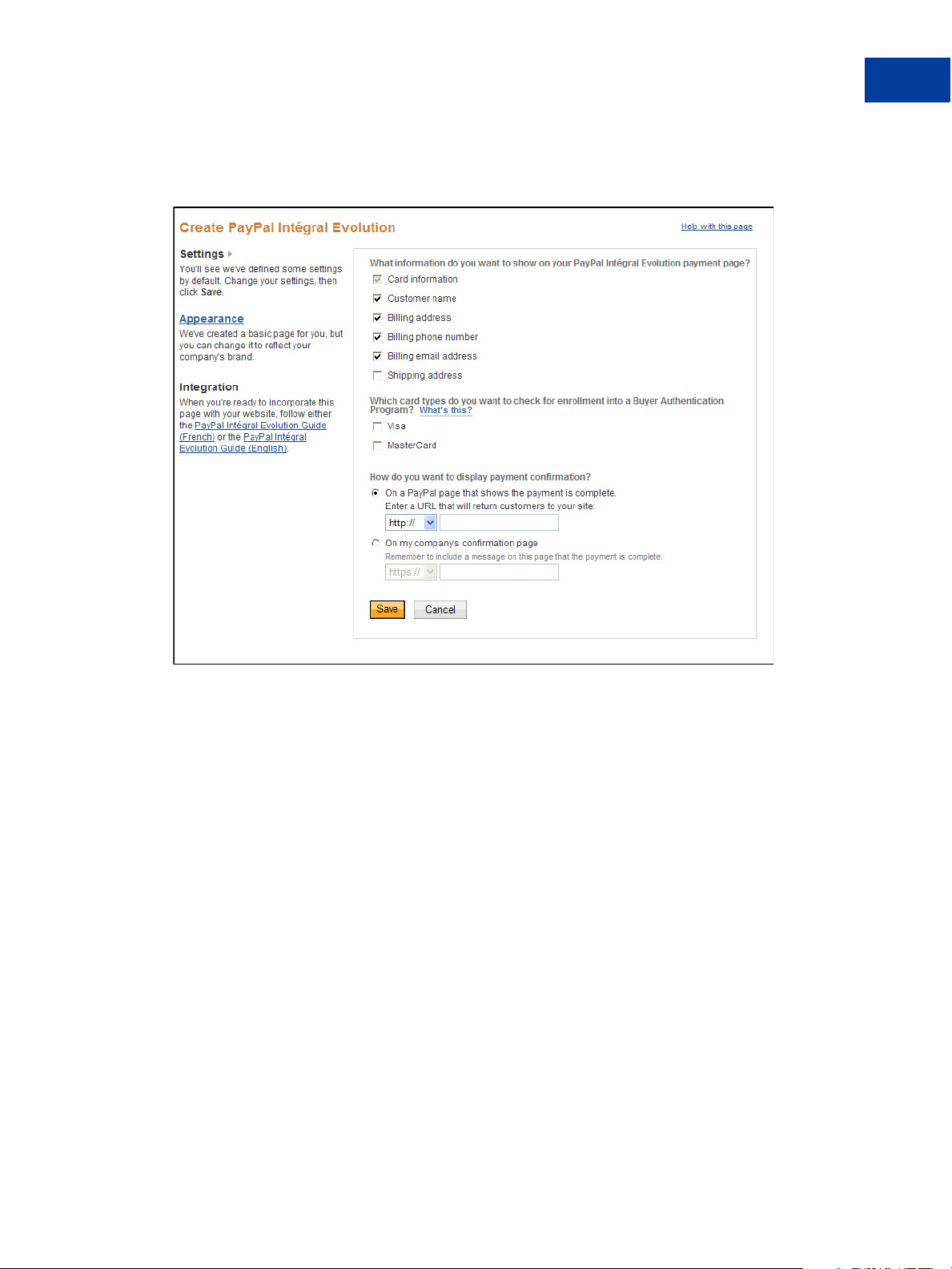

Settings

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

This page allows you to select the information you want to collect and display on your

payment page and where you want to display the payment confirmation.

Although we offer many options on this page, we recommend that you display as few options

as possible on the payment page. For example, you may have already collected shipping

address on your own website in order to calculate the shipping cost and passed it on to

PayPal's payment page. Therefore, it is not necessary to show this option on the payment page

again.

You could have information that has already been collected on your website, but you may

want to pass it to PayPal and display it on the hosted payment page again. This information

will be pre-filled and editable on this page.

Page 24

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

What information do you want to show on your PayPal Intégral Evolution payment page?

You can select the fields that are displayed on your hosted payment page. You have the

following options:

Card Information - Buyer's credit card information. This field is always displayed and

selected by default.

Customer Name - Buyer's first and last name

Billing Address - Buyer's billing address

Billing Phone Number - Buyer's phone number

Billing Email Address - Buyer's email address

Shipping Address - Buyer's shipping address. This is required for seller protection. Ensure

that you set the buyer's shipping address HTML variable if you do not select this box.

How do you want to display payment confirmation?

Once the transaction is successful, you can choose to display your payment confirmation on

either a PayPal's confirmation page or on your own payment confirmation page.

On a PayPal page that shows the payment is complete - The payment confirmation

appears on the PayPal confirmation page. Optionally, you can also provide a URL on the

confirmation page to take your buyer back to your website. To do so, enter the appropriate

URL in the field provided.

On the Company's confirmation page - The payment confirmation will appear on your

own payment confirmation page. For this, enter the URL of the page that will display the

payment confirmation. You will have to message the outcome of the transaction to the

buyer when PayPal redirects back to this URL. Be sure to display specifics of the order so

the buyer sees a meaningful confirmation. You can get the specifics of the order using the

Transaction ID we pass back to you with the return URL.

24

Page 25

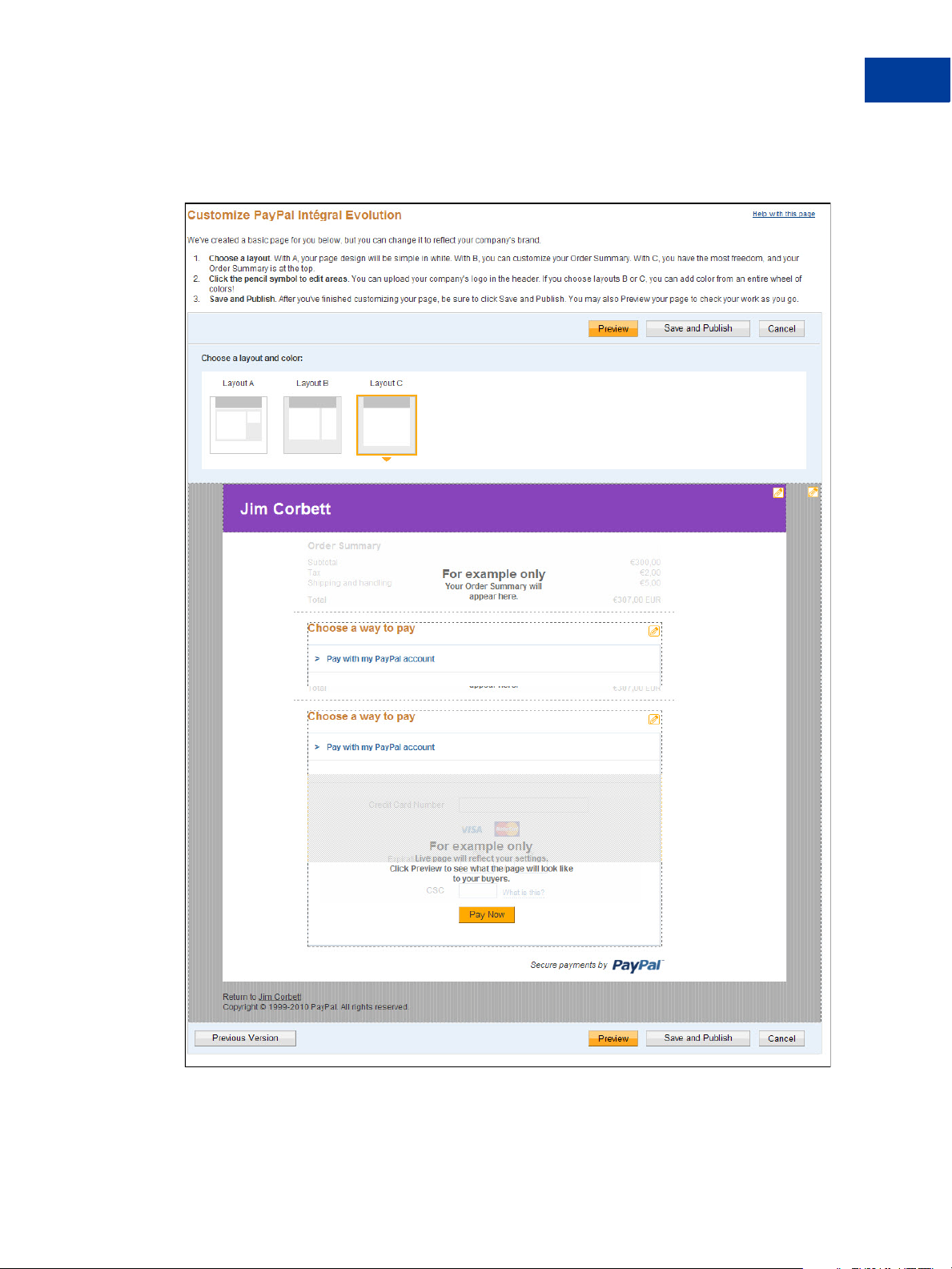

Appearance

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Page 26

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

This page allows you to customise your payment page. You can customise the header,

background, title, button, and the order summary column of your payment page.

PayPal offers three design templates for you to choose. Template A is the default template,

however, you can choose from any of the templates offered.

N OTE: Your buyers will not see the payment page until you have completed the HTML

integration with your website.

Preview the design of your payment page. You can either change the design of your template,

or select and customise a different template on this page. To make changes, left-click on the

section you are trying to modify or the corresponding Click to Edit button for that section. On

the pop-up that appears, click the color selector to change the color, or enter the appropriate

URL, as needed.

If the buyer pays by logging into PayPal, the look and feel of that flow can be customised

through the Intégral Evolution customisation options on the Profile page.

After making the changes, click one of the following buttons:

Preview - Preview the changes you have made to your template before saving and

publishing it.

Save and Publish - Save all the changes you have made and publish the updated template.

Your buyers will see the updated payment page.

Cancel - Discard all the changes you have made in this session.

Previous Version - Discard all changes you have made since the last time you saved the

template. Your buyers will see the last saved template.

N OTE: You must make all modifications (including changing templates) within the same

session, otherwise all changes will be lost and you will have to redo your changes. If

the session times out, the design of the template will remain at the version that was last

published.

26

Page 27

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Choosing a Template

Choose from the following three design templates:

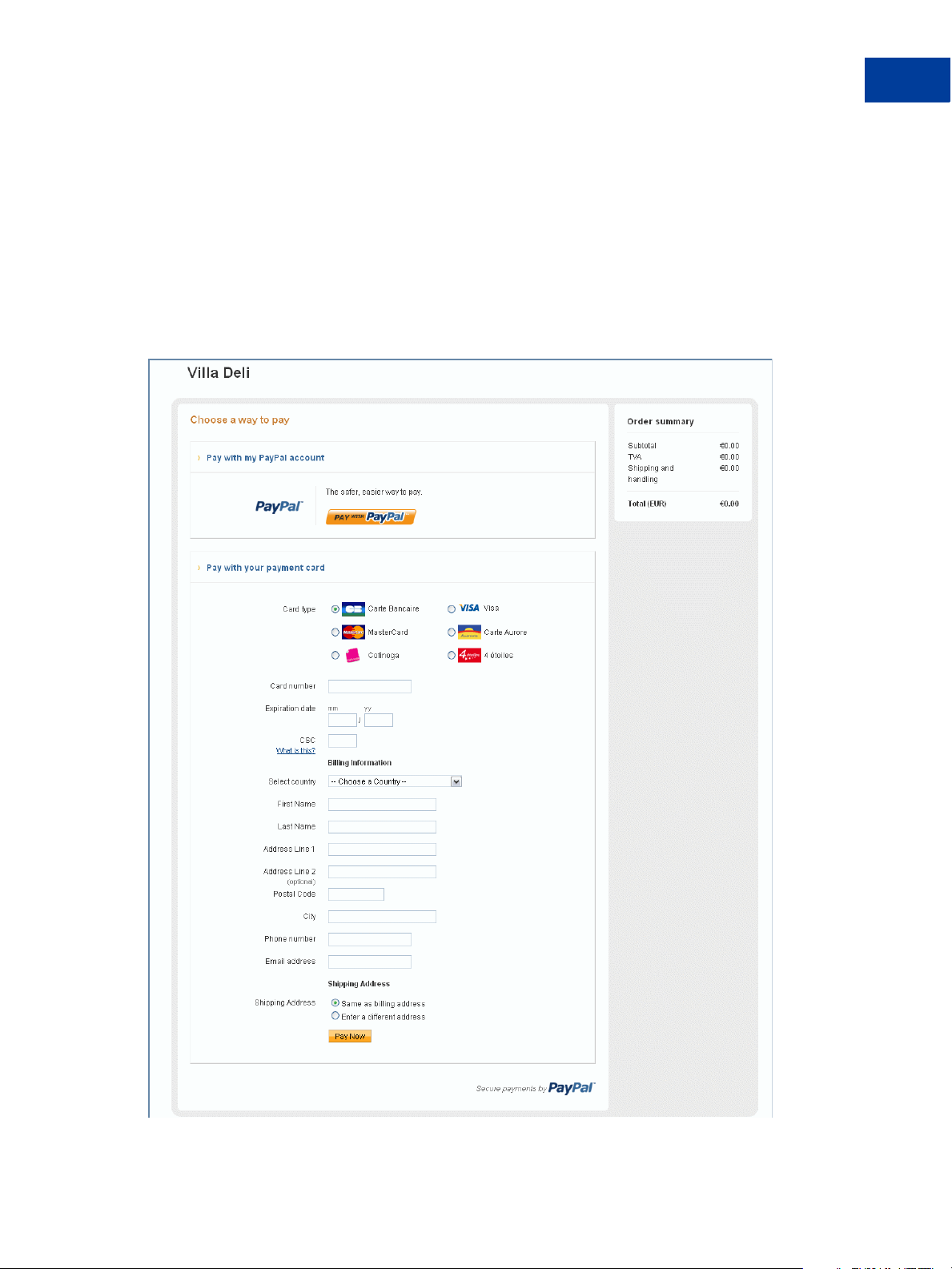

Template A

Template B

Template C

Template A. Selected by default - you can customise the header.

FIGURE 3.1 Template A

Page 28

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

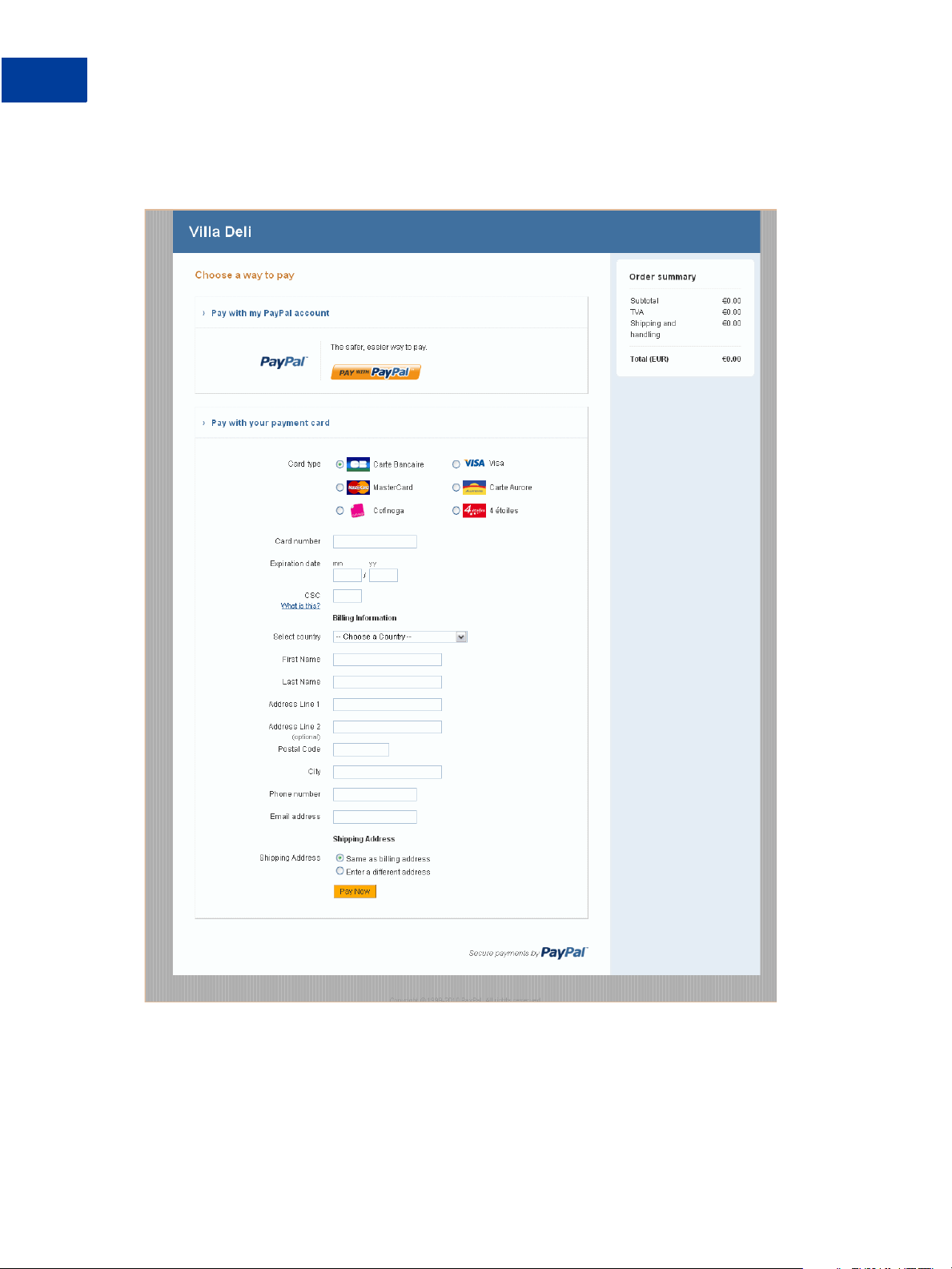

Template B. Customise the header, background, title, button, and the order summary column.

FIGURE 3.2 Template B

28

Page 29

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

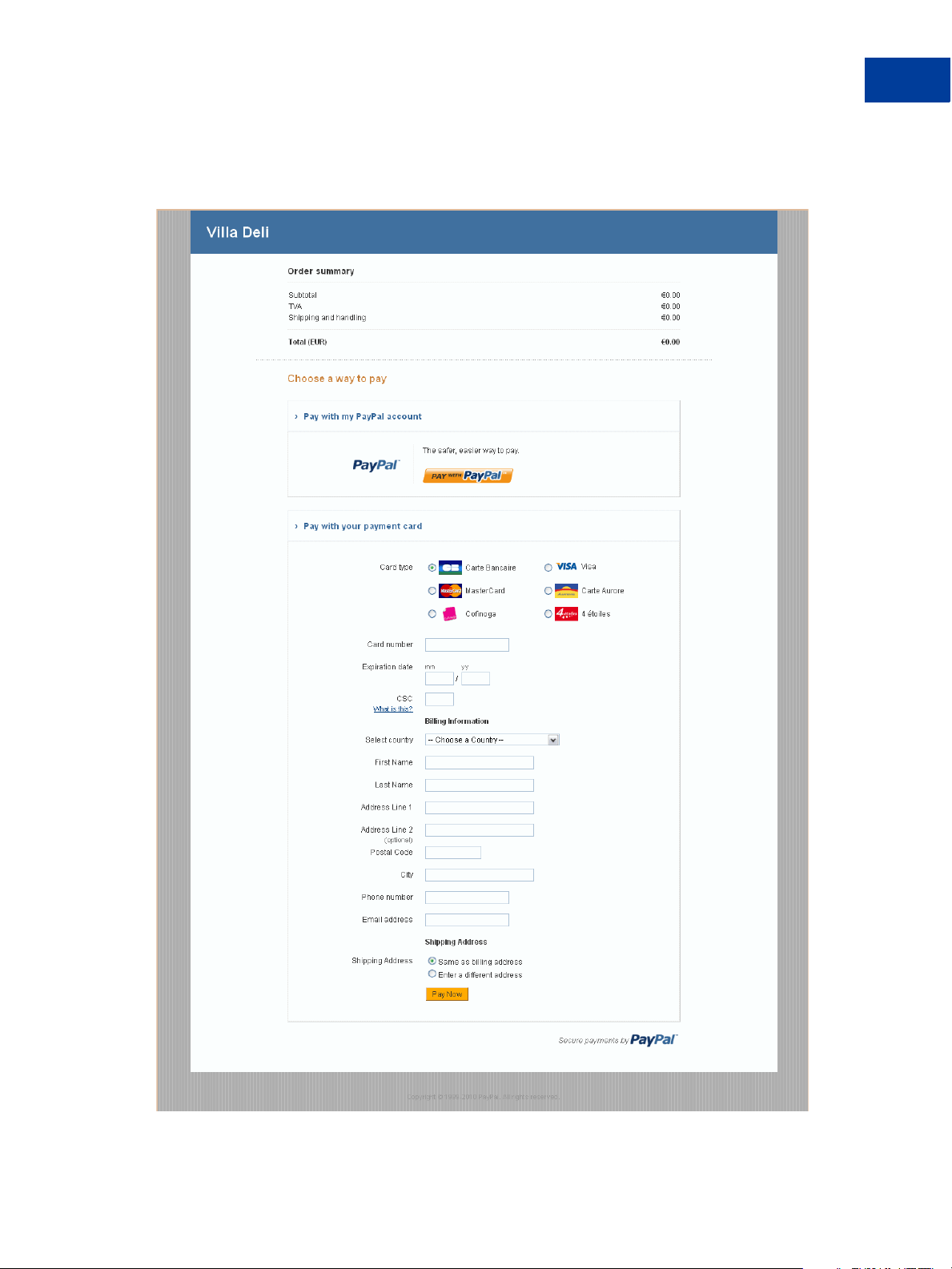

Template C. Customise the header, background, title, and the button.

FIGURE 3.3 Template C

Page 30

Customising Your PayPal Payment Page

Modifying Your PayPal Account Settings

Customising Your Template

Consider the following when you customise your template:

Header (applicable to Template A, B, and C) - By default, the business name from your

profile is shown in the header. You can change the following:

– Header height and color

– Font type, size, and color

– Swap between displaying the business name or the business logo image

– Position of the business name or the logo

N OTE: We recommend that you host your images on a secure server (https://) to avoid the

security dialog window that may hurt conversion.

Background (applicable to Template B and C) - You can change the following:

– Background color

– Background image URL

Title and Button (applicable to Template B and C) - You can change the following:

–Header color

– Title bar color and title text color

– Button color and button text color

Order Summary Column (applicable to Template C) - You can change the following:

– Column color

–Image URL

30

Page 31

Adding HTML Variables

The table below lists the Intégral Evolution HTML variables you can use to customise the look

and feel of your payment page.

N OTE: The values you pass must not contain any of these special characters (){}<>\";

TABLE 3.1 HTML Variables for Look and Feel of Payment Page

Variable Description

Customising Your PayPal Payment Page

Adding HTML Variables

bodyBgColor

bodyBgImg

footerTextColor

headerBgColor

headerHeight

logoFont

logoFontColor

logoFontSize

logoImage

logoImagePosition

logoText

Color of the surrounding background of the payment page.

Image of the surrounding background of the payment page. The file

extension can be .gif, .jpg, .jpeg, or .png format.

Color of the footer text.

Color of the header background.

Height of the header banner. It can be from 50 to 140 pixels. The

width cannot be changed. It is always 940 pixels.

Font type of the logo text.

Color of the logo text.

Font size of the logo text.

Image displayed in the logo. The acceptable file extension formats

are .gif, .jpg, .jpeg, or .png. The width of the image cannot be more

than 940 pixels.

Position of the image in the logo.

Business name displayed on your profile page. This field is editable

and text specified here is displayed on the header if logoImage is not

specified.

orderSummaryBgColor

orderSummaryBgImage

pageButtonBgColor

pageButtonTextColor

pageTitleTextColor

sectionBorder

Color of the Order Summary column on the right side of the payment

page. You cannot change the color of the Order Summary box.

Background image you can put in the Order Summary Column. The

acceptable file extension formats are .gif, .jpg, .jpeg, or .png.

Background color of the Pay Now button.

Color of the Pay Now button. You cannot change the text of the

button.

Color of the text used in the title of the page. (Text that says “Choose

a way to pay.”)

Background of the section that displays “Pay with my PayPal

account” or “Pay with a Card”.

Page 32

Customising Your PayPal Payment Page

Adding HTML Variables

T

ABLE 3.1 HTML Variables for Look and Feel of Payment Page

Variable Description

showCustomerName

showBillingAddress

showBillingPhone

showBillingEmail

showHostedThankyouPage

showShippingAddress

Display customer name (first name and last name).

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display billing address information.

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display billing phone number.

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display email address for billing purposes.

Default Value: false

Allowable Value: true or false, where true = show and false =

hide.

Display PayPal’s confirmation page.

Default Value: true

Allowable Value: true or false, where true = show and false =

hide.

Display shipping address.

Default Value: false

Allowable Value: true or false, where true = show and false =

hide.

32

subheaderText

template

Color of the “Pay with my PayPal account” or “Pay with a Card”

text.

Template used for your payment page. Options are TemplateA,

TemplateB, and TemplateC. TemplateD is used for iFrame

integration only and is not an option on the Customization page on

PayPal.com.

Page 33

4

Integrating iFrame in Your Website

PayPal offers a compact payment form that can be integrated in an iFrame on your website.

Since this form is integrated on your website, the buyer never leaves your website, thereby

reducing potential drop-offs. You can also maintain your checkout look and feel in the master

frame that surrounds the compact payment form. The credit card fields are part of the compact

payment form so you do not have to collect this information separately.

IMPORTANT: Due to security concerns involving iFrame, the following browsers are

supported and secure to use - Internet Explorer 7.0, 8.0 and 9.0, Firefox 8,

Chrome 4 and 4.1, Safari 4.x and 5.x. Transactions involving users of other

browsers should not use the iFrame flow or abandon the transaction.

Additionally, there is another risk beyond the iFrame flow - should the

PayPal iFrame become the source of an attack, it would appear that the attack

is originating from the merchant site; do not use the iFrame flow if you wish

to avoid this additional risk.

N OTE: Due to spoof concerns, the form does not contain any PayPal branding.

The compact payment form contains the following fields:

Credit card number

Expiry date

CVV2 number (if applicable, based on the card type)

Any additional fields required for other card types, such as start date and issue number for

Maestro or Switch.

The form also offers the following options:

Remove the Pay with PayPal button. Although the form offers the option to pay using

PayPal account by default, you can contact your account manager or customer support to

turn this option off.

Manually customize the color of the Pay Now button.

IMPORTANT: The compact payment form does not display the buyer's billing address, even

if showBillingAddress=true is passed. However, for some merchants,

it may be necessary to pass the billing address to successfully process the

transactions.

Page 34

Integrating iFrame in Your Website

Integrating iFrame

Integrating iFrame

Choose one of the following methods to integrate the compact payment form in your website:

Manual Integration

API Integration

IMPORTANT: For optimal performance, PayPal recommends that you load the iFrame asset

before other assets such as images and JavaScripts. If there are too many

assets running on your payment page when you load iFrame, the request for

the iFrame may not be placed or might get delayed. This may result in the

buyers seeing a blank iFrame.

Manual Integration

To manually integrate the compact payment form in your website, perform the following

steps:

1. Enter the iFrame tag at the location where you want the compact payment form to appear

on your website. For example:

<iframe name="hss_iframe" width="570px" height="540px"></iframe>

The allowable size for the compact payment form is 570 pixels in width to 540 pixels in

height.

2. Below is the iFrame code, add the hidden form that is populated with the appropriate

Intégral Evolution variables (including the total amount to be paid) and specify the variable

TemplateD. For example,

<form style="display:none" target="hss_iframe" name="form_iframe"

method="post"

action="https://securepayments.paypal.com/cgi-bin/acquiringweb">

<input type="hidden" name="cmd" value="_hosted-payment">

<input type="hidden" name="subtotal" value="50">

<input type="hidden" name="business" value="HNZ3QZMCPBAAA">

<input type="hidden" name="paymentaction" value="sale">

<input type="hidden" name="template" value="templateD">

<input type="hidden" name="return"

value="https://yourwebsite.com/receipt_page.html">

</form>

34

N OTE: If the iFrame transactions fail, pass the billing address

Page 35

Integrating iFrame in Your Website

Integrating iFrame

3. Ensure that the target name matches the iFrame name, as highlighted in the example below:

<iframe name="hss_iframe" width="570px" height="540px"></iframe>

<form style="display:none" target="hss_iframe" name="form_iframe"

method="post"

action="https://securepayments.paypal.com/cgi-bin/acquiringweb">

4. Submit the form using JavaScript. For example:

<script type="text/javascript">

document.form_iframe.submit();

</script>

Example of Manual Integration

The complete example as per the above steps is as follows:

<iframe name="hss_iframe" width="570px" height="540px"></iframe>

<form style="display:none" target="hss_iframe" name="form_iframe"

method="post"

action="https://securepayments.paypal.com/cgi-bin/acquiringweb">

<input type="hidden" name="cmd" value="_hosted-payment">

<input type="hidden" name="subtotal" value="50">

<input type="hidden" name="business" value="HNZ3QZMCPBAAA">

<input type="hidden" name="paymentaction" value="sale">

<input type="hidden" name="template" value="templateD">

<input type="hidden" name="return"

value="https://yourwebsite.com/receipt_page.html">

</form>

<script type="text/javascript">

document.form_iframe.submit();

</script>

API Integration

To integrate the compact payment form in your website using the API, refer to “Using the

Button Manager API with Intégral Evolution Checkout” on page 40.

N OTE: Use template=templateD for this type of integration.

There are two options in the response to initiate the Intégral Evolution payment flow:

Using URL Returned in the Response

Using Form POST

35

Page 36

Integrating iFrame in Your Website

Integrating iFrame

Using URL Returned in the Response

In the URL identified in the response as EMAILLINK, add “src” for iFrame as per the

example below to redirect the buyer and initiate the payment flow.

<iframe src="https://www.paypal.com/...?hosted_button_id=HSS-.."

width="570px" height="540px"></iframe>

The allowable size of the compact payment form is 570 pixels in width to 540 pixels in height.

IMPORTANT: This option is not supported by Safari browsers. Use the Form POST option

described below.

Using Form POST

Identify the WEBSITECODE in the response and use the code to create a Pay Now button on

your review page. When your buyer clicks the button, they are redirected to the PayPal hosted

payment page. Like the URL, the button is usable for approximately two hour or until the

payment is successful.

1. Enter the iFrame tag at the location where you want the compact payment form to appear

on your website. For example:

<iframe name="hss_iframe" width="570px" height="540px"></iframe>

The allowable size for the compact payment form is 570 pixels in width to 540 pixels in

height.

2. Insert the following in the iFrame tag:

WEBSITECODE=<form action="https://www.paypal.com/cgi-bin/webscr"

method="post">

<input type="hidden" name="cmd" value="_s-xclick">

<input type="hidden" name="hosted_button_id" value="HSSbXkpgPTNgZi7CyfIwWTAkWPSDbKziokU">

<input type="image" src="https://www.paypal.com/i/btn/btn_paynow_LG.gif"

border="0" name="submit" alt="PayPal - The safer, easier way to pay

online.">

<img alt="" border="0" src="https://www.paypal.com/i/scr/pixel.gif"

width="1" height="1">

</form>

3. Submit the form using JavaScript. For example:

<script type="text/javascript">

document.form_iframe.submit();

</script>

36

Page 37

Integrating iFrame in Your Website

Integrating iFrame

Example of API (Form POST) Integration

The complete example as per the above steps is as follows:

<iframe name="hss_iframe" width="570px" height="540px"></iframe>

WEBSITECODE=<form action="https://www.paypal.com/cgi-bin/webscr"

method="post">

<input type="hidden" name="cmd" value="_s-xclick">

<input type="hidden" name="hosted_button_id" value="HSSbXkpgPTNgZi7CyfIwWTAkWPSDbKziokU">

<input type="image" src="https://www.paypal.com/i/btn/btn_paynow_LG.gif"

border="0" name="submit" alt="PayPal - The safer, easier way to pay

online.">

<img alt="" border="0" src="https://www.paypal.com/i/scr/pixel.gif"

width="1" height="1">

</form>

<script type="text/javascript">

document.form_iframe.submit();

</script>

37

Page 38

Integrating iFrame in Your Website

Integrating iFrame

38

Page 39

5

Integrating Your Website Using API

Using the Button Manager API, you can programmatically create the checkout button that

initiates the Intégral Evolution checkout flow on your website. You create the checkout button

dynamically when the buyer attempts to checkout on your website. When the buyer clicks on

your checkout button, you call the BMCreateButton API operation to create a checkout

button and display it on your web page. When the buyer clicks on this checkout button, he or

she is redirected to the PayPal payment page where he or she can complete the payment.

HTML variables control the presentation of the PayPal payment pages, the information

contained on the pages, and pages to which your buyer can be returned to when leaving the

payment pages. For a list of HTML variables, refer to “HTML Variables” on page 17.

For complete information on the Button Manager API, refer to the

or

Button Manager API (SOAP).

N OTE: Using the Button Manager API, you can programmatically create the checkout button,

but not manage, edit, or delete it.

Button Hosting

For Intégral Evolution, using BUTTONTYPE=PAYMENT, you can create the following kinds

of checkout buttons:

Token buttons (BUTTONCODE=TOKEN) are not stored on PayPal. They are dynamic and

initiate the Intégral Evolution checkout flow. The parameters associated with this kind of

button are secure. They have a lifetime of approximately two hours, if not used.

Encrypted buttons (BUTTONCODE=ENCRYPTED) are not stored on PayPal. The

parameters associated with this kind of button are encrypted. You must update the web

pages that use an encrypted button each time the button or the associated information

changes.

Clear text buttons (BUTTONCODE=CLEARTEXT) are not stored on PayPal. The

parameters associated with this kind of button are not encrypted. They can be used

dynamically because you can change the value of a parameter anytime. However, if you

use them, recognize the risk that sensitive information can be altered or stolen.

Button Manager API (NVP)

N OTE: Hosted buttons (BUTTONCODE=HOSTED) are not supported for Intégral Evolution

and will return an error if used.

For more information about Button Manager API usage, refer to “BMCreateButton API

Operation” on page 45.

Page 40

Integrating Your Website Using API

Using the Button Manager API with Intégral Evolution Checkout

Using the Button Manager API with Intégral Evolution Checkout

To create a checkout button on your website, you call the BMCreateButton API operation.

When the buyer clicks on the checkout button, PayPal initiates the Intégral Evolution checkout

flow.

You must decode the response from the BMCreateButton API. For information about URL

encoding, refer to the

There are two options in the response to initiate the Intégral Evolution payment flow:

Using URL Returned in the Response (Recommended)

Using Form POST

Using URL Returned in the Response (Recommended)

Name-Value Pair API Developer Guide.

40

Using the URL identified in the response as EMAILLINK, you can redirect the buyer and

initiate the payment flow.

Example of TOKEN

EMAILLINK=https://www.paypal.com/cgi-bin/webscr?cmd=_sxclick&hosted_button_id=HSS2MTCOLOp9LoPGdFYsYclhbGyjJVNrMHO&HOSTEDBUTTONID=HSS2MTCOLOp9LoPGdFYsYclhbGyjJVNrMHO&TIMESTAMP=2010-0915T00:30:35Z&CORRELATIONID=2fc9a340a2356&ACK=Success&VERSION=65.0&BUILD=150

0269

Page 41

Integrating Your Website Using API

Using the Button Manager API with Intégral Evolution Checkout

Example of ENCRYPTED

EMAILLINK=https://www.paypal.com/acquiringweb?cmd=_hostedpayment&business=idc%2dautomation%2duk%2dpro%2dt1%40paypal%2ecom&tax=2&ship

ping=3&business=K5HHZSMWMCN58&subtotal=11&handling=4&TIMESTAMP=2010-0915T00:39:06Z&CORRELATIONID=23d12ce1161f2&ACK=Success&VERSION=65.0&BUILD=150

0269

Example of CLEARTEXT

EMAILLINK=https://www.paypal.com/acquiringweb?cmd=_hostedpayment&business=idc%2dautomation%2duk%2dpro%2dt1%40paypal%2ecom&tax=2&ship

ping=3&business=K5HHZSMWMCN58&subtotal=11&handling=4&TIMESTAMP=2010-0915T00:40:32Z&CORRELATIONID=64553e7c7c84&ACK=Success&VERSION=65.0&BUILD=1500

269

The button variables control the presentation in the flow and the information that is provided

to the buyer initially. Because the URL is associated with a Intégral Evolution token, the URL

is usable for approximately two hours after it is created or until the payment is successful.

Using Form POST

Identify the WEBSITECODE in the response and use the code to create a Pay Now button on

your review page. When your buyer clicks the button, they are redirected to the PayPal hosted

payment page. Like the URL, the button is usable for approximately two hours or until the

payment is successful.

41

Page 42

Integrating Your Website Using API

Using the Button Manager API with Intégral Evolution Checkout

Example for TOKEN

WEBSITECODE=<form action="https://www.paypal.com/cgi-bin/webscr"

method="post">

<input type="hidden" name="cmd" value="_s-xclick">

<input type="hidden" name="hosted_button_id" value="HSS2MTCOLOp9LoPGdFYsYclhbGyjJVNrMHO">

<input type="image"

src="https://www.paypal.com/en_US/i/btn/btn_auto_billing_LG.gif" border="0"

name="submit" alt="PayPal - The safer, easier way to pay online.">

<img alt="" border="0" src="https://www.paypal.com/en_GB/i/scr/pixel.gif"

width="1" height="1">

</form>

Example for ENCRYPTED

WEBSITECODE=<form action="https://www.paypal.com/cgi-bin/webscr"

method="post">

<input type="hidden" name="cmd" value="_s-xclick">

<input type="hidden" name="encrypted" value="BEGIN PKCS7......END PKCS7">

<input type="image"

src="https://www.paypal.com/en_US/i/btn/btn_auto_billing_LG.gif" border="0"

name="submit" alt="PayPal - The safer, easier way to pay online.">

<img alt="" border="0" src="https://www.paypal.com/en_GB/i/scr/pixel.gif"

width="1" height="1">

</form>

Example of CLEARTEXT

WEBSITECODE=<form action="https://www.paypal.com/acquiringweb"

method="post">

<input type="hidden" name="cmd" value="_hosted-payment">

<input type="hidden" name="business" value="test1@paypal.com">

<input type="hidden" name="tax" value="2">

<input type="hidden" name="shipping" value="3">

<input type="hidden" name="business" value="K5HHZSMWMCN58">

<input type="hidden" name="subtotal" value="11">

<input type="hidden" name="paymentaction" value="sale">

<input type="hidden" name="handling" value="4">

<input type="image"

src="https://www.paypal.com/en_US/i/btn/btn_auto_billing_LG.gif" border="0"

name="submit" alt="PayPal - The safer, easier way to pay online.">

<img alt="" border="0" src="https://www.paypal.com/en_GB/i/scr/pixel.gif"

width="1" height="1">

</form>

42

Page 43

Integrating Your Website Using API

Using the Button Manager API with Intégral Evolution Checkout

N OTE: The PayPal payment page displays a button identified as Pay Now to complete the

checkout flow. The Pay Now button on the PayPal page is different than the Pay Now

button created by the BMCreateButton API operation on the review page. You may

need to change the URL for the latter in BUTTONIMAGEURL to avoid confusion.If a

URL is not specified in BUTTONIMAGEURL, then the default Pay Now is used for the

button.

Encrypting Buttons Using Public and Private Key

Using Encrypted Website Payments helps secure payment buttons that you generate or write

manually. Encrypted Website Payments protects the HTML button code that contains pricing

information by encrypting it. HTML button code that you protect by using Encrypted Website

Payments cannot be altered by malicious third parties to create fraudulent payments. For

detailed information, refer to Chapter 8, “Protecting Buttons by Using Encrypted Website

Payments

Example of Initiating Checkout

The example shows the NVP parameters using BUTTONCODE=TOKEN for creating a URL to

initiate the Intégral Evolution checkout flow.

...

BUTTONCODE=TOKEN

BUTTONTYPE=PAYMENT

BUTTONIMAGEURL=https://www.paypal.com/en_US/i/btn/btn_billing.gif

L_BUTTONVAR0=subtotal=11

L_BUTTONVAR1=tax=2

L_BUTTONVAR2=shipping=3

L_BUTTONVAR3=handling=4

L_BUTTONVAR4=first_name=Bob

L_BUTTONVAR5=last_name=Jones

L_BUTTONVAR6=address1=Gardens

L_BUTTONVAR7=address2=99343

L_BUTTONVAR8=city=Paris

L_BUTTONVAR9=state=Alsace

L_BUTTONVAR10=zip=75002

L_BUTTONVAR11=country=FR

L_BUTTONVAR12=billing_first_name=BobBilling

L_BUTTONVAR13=billing_last_name=JonesBilling

L_BUTTONVAR14=billing_address1=5088 - 061 Craven Hill Gardens

L_BUTTONVAR15=billing_address2=Apt# 199343

L_BUTTONVAR16=billing_city=Wolverhampton

L_BUTTONVAR17=billing_state=West Midlands

L_BUTTONVAR18=billing_zip=W12 4LQ

L_BUTTONVAR19=billing_country=GB

L_BUTTONVAR20=night_phone_a=408

L_BUTTONVAR21=night_phone_b=398

L_BUTTONVAR22=night_phone_c=3065

43

Page 44

Integrating Your Website Using API

Using the Button Manager API with Intégral Evolution Checkout

L_BUTTONVAR23=notify_url=www.yourcompany.com

L_BUTTONVAR24=custom=custom1

L_BUTTONVAR25=cancel_return=http://www.cancel_return.com

L_BUTTONVAR26=paymentaction=sale

L_BUTTONVAR27=currency_code=GBP

L_BUTTONVAR28=invoice=123456789

L_BUTTONVAR29=lc=GB

L_BUTTONVAR30=showBillingAddress=false

L_BUTTONVAR31=showShippingAddress=false

L_BUTTONVAR32=showBillingEmail=true

L_BUTTONVAR33=showBillingPhone=true

L_BUTTONVAR34=showCustomerName=true

L_BUTTONVAR35=showCardInfo=true

L_BUTTONVAR36=showHostedThankyouPage=true

L_BUTTONVAR37=bn=GBD

L_BUTTONVAR38=cbt=Merchant ABCD

L_BUTTONVAR39=address_override=false

L_BUTTONVAR40=cpp_header_image=Red

L_BUTTONVAR41=logoText=YourCompanyLogo

L_BUTTONVAR42=logoImage=http://yourcompanyimages.com/logo.gif

L_BUTTONVAR43=logoImagePosition=center

L_BUTTONVAR44=logoFont=Arial Bold

L_BUTTONVAR45=logoFontSize=24px

L_BUTTONVAR46=logoFontColor=#f0ff0f

L_BUTTONVAR47=bodyBgImg=sdf

L_BUTTONVAR48=bodyBgColor=#AEAEAE

L_BUTTONVAR49=headerHeight=70px

L_BUTTONVAR50=headerBgColor=#4B6BA1

L_BUTTONVAR51=PageTitleTextColor=Blue

L_BUTTONVAR52=PageCollapseBgColor=Blue

L_BUTTONVAR53=PageCollapseTextColor=Yellow

L_BUTTONVAR54=PageButtonBgColor=Blue

L_BUTTONVAR55=PageButtonBgColor=Blue

L_BUTTONVAR56=orderSummaryBgColor=#EDF2F7

L_BUTTONVAR57=orderSummaryBgImage=http://teamworks/scr_bg_ordersummary.jpg

L_BUTTONVAR58=footerTextColor=#333333

L_BUTTONVAR59=footerTextlinkColor=#00f00f

L_BUTTONVAR60=template=templateC

L_BUTTONVAR61=return=http://www.yourcompany.com

44

Page 45

BMCreateButton API Operation

Use the BMCreateButton API operation to create Intégral Evolution checkout button.

BMCreateButton Request

BMCreateButton Response

BMCreateButton Errors

BMCreateButton Request

The request fields specify the characteristics of your button, which include associated menu

items related to the button. You can specify up to 5 menu items, each of which can include up

to 10 possible selections.

BMCreateButton Request Fields

N OTE: The values you pass must not contain any of these special characters (){}<>\";

Field Description

Integrating Your Website Using API

BMCreateButton API Operation

METHOD (Required)

BMCreateButton

BUTTONCODE (Optional) The kind of button code to create. It is one of the following values:

TOKEN - A secure button, not stored on PayPal, used only to initiate the

Intégral Evolution checkout flow; default for Pay Now button. Since

version 65.2

ENCRYPTED - An encrypted button, not stored on PayPal

CLEARTEXT - An unencrypted button, not stored on PayPal

BUTTONTYPE (Required) The kind of button you want to create.

PAYMENT - Pay Now button; since version 65.2

L_BUTTONVAR

n (Optional) HTML standard button variables

45

Page 46

Integrating Your Website Using API

BMCreateButton API Operation

BMCreateButton Response

The response contains an ID if the button is hosted on PayPal, and code for HTML in a

website and for a link in email.

BMCreateButton Response Fields

Field Description

WEBSITECODE HTML code for web pages

EMAILLINK Code for URL for the Intégral Evolution checkout flow

HOSTEDBUTTONID ID of a Intégral Evolution token

BMCreateButton Errors

Error

Code Short Message Long Message Correcting This Error...

10001 Internal Error Internal Error

11923 Invalid Argument The button image value specified is

invalid.

11924 Invalid Argument The button image URL specified is

invalid.

11925 Invalid Argument The button type specified is invalid.

11926 Invalid Data One of the parameters specified using

ButtonVar is invalid.

11927 Invalid Argument The buy now button text specified is

invalid.

11928 Invalid Argument The email or merchant ID specified is

invalid.

11929 Invalid Data A cart button must have an item name and

amount specified.

11931 Invalid Argument The subscription button text specified is

invalid.

11932 Invalid Data You must specify a corresponding number

of entries for option names and selections.

11933 Invalid Data You cannot skip index numbers for option

selections. Option selections must be

specified sequentially.

46

Page 47

Integrating Your Website Using API

BMCreateButton API Operation

Error

Code Short Message Long Message Correcting This Error...

11934 Invalid Data You must specify the same number of

entries for option prices and selections.

11936 Invalid Data You cannot specify both an item price and

prices for individual selections within an

option.

11937 Invalid Argument A text box name specified is invalid. Text

box names must not exceed 64 characters.

11938 Invalid Argument The button code value specified is invalid.

11940 Invalid Argument An option name specified is invalid.

Option names must not exceed 64

characters.

11941 Invalid Argument An option selection value specified is

invalid. Option selection values must not

exceed 64 characters.

11942 Invalid Argument An option price value specified is invalid.

Make sure any punctuation marks are in

the correct places.

11943 Invalid Argument The button country value specified is

invalid.

11945 Invalid Data The button country and language code

combination specified is invalid.

11947 Invalid Argument The tax rate specified is invalid. Make

sure any punctuation marks are in the

correct places and value specified is in the

range 0.0 to 100.

11948 Invalid Argument The amount specified is invalid. Make

sure any punctuation marks are in the

correct places.

12210 Invalid Argument The currency code value specified is

invalid.

13117 Invalid Argument Subtotal amount is not valid.

13118 Invalid Argument Tax amount is not valid.

13119 Invalid Argument Handling amount is not valid.

13120 Invalid Argument Shipping amount is not valid.

47

Page 48

Integrating Your Website Using API

BMCreateButton API Operation

48

Page 49

6

Testing Your Integration in Sandbox

The PayPal Sandbox is a self-contained environment within which you can prototype and test

PayPal features. The PayPal Sandbox is an almost identical copy of the live PayPal website.

Its purpose is to give developers a shielded environment for testing and integration purposes,

and to help avoid problems that might occur while testing PayPal integration solutions on the

live site. Before moving any PayPal-based application into production, you should test the

application in the Sandbox to ensure that it functions as you intend and within the guidelines

and standards set forth by the PayPal Developer Network (PDN).

For complete details on using Sandbox, refer to

Creating a Preconfigured Account

When you log in to the Sandbox, the Sandbox Test Environment home page appears, as shown

below:

Sandbox User Guide.

49

Page 50

Testing Your Integration in Sandbox

Creating a Preconfigured Account

To test your Intégral Evolution integration, create a preconfigured account using the following

steps:

1. On the Sandbox Home page, under the Test Accounts section, and click Create a

preconfigured buyer or seller account.

2. The Create a Sandbox Test Account page appears, as shown below:

50

Page 51

Testing Your Integration in Sandbox

Creating a Preconfigured Account

3. Choose France from the Country drop-down menu.

4. Select Website Payments Pro as the Account Type.

5. The Login Email and Password fields are pre-filled. The rest of the fields are optional so

make the appropriate selections or accept the defaults.

N OTE: Make a note of the password as you will need it to log into the Sandbox Test Site.

6. Click Create Account. The following page confirms the creation of the test account:

N OTE: The login email is a pseudo-randomized address, which is based on the address you

specified. Credit card and bank account numbers are also generated randomly,

which are displayed when you click View Details.

7. Ensure that Payment Review is set to Enabled. In doing so, all transactions on this account

are put into pending review state. You can then click accept or decline on the Transaction

Details page to simulate the fraud agent’s action.

Page 52

Testing Your Integration in Sandbox

Creating a Preconfigured Account

8. Click Enter Sandbox Test Site. The Sandbox Test Site appears in a different browser

window, as shown below. If you are not automatically logged in to the Sandbox Test Site,

log in using the email address created for the test account as part of step 6 and the password

you noted in step 5.

52

You are ready to test your Intégral Evolution integration on the Sandbox Test Site.

Page 53

Testing Your Integration and Settings

The following sections contain information for testing your integration and modifying the look

and feel of your payment page in the Sandbox environment.

Testing Your Integration

Testing Your Settings

Testing Your Integration

To test your integration in the Sandbox environment, follow the steps specified in “Simple

Intégral Evolution Integration” on page 15. For testing purposes, you must make the following

changes in the Form POST:

1. Change the URL to point to the Sandbox environment.

From:

Testing Your Integration in Sandbox

Testing Your Integration and Settings

<form action="https://securepayments.paypal.com/acquiringweb"

method="post">

<input type="hidden" name="cmd" value="_hosted-payment">

to:

<form action="https://securepayments.sandbox.paypal.com/acquiringweb"

method="post">

<input type="hidden" name="cmd" value="_hosted-payment">

2. Change the business value to the Secure Merchant ID value that is specified at the top

of the Profile page of the Sandbox Test Site.

Accordingly, the Form POST for testing purposes will be:

<form action="https://securepayments.sandbox.paypal.com/acquiringweb"

method="post">

<input type="hidden" name="cmd" value="_hosted-payment">

<input type="hidden" name="subtotal" value="50">

<input type="hidden" name="business" value="HNZ3QZMCPBAAA">

<input type="hidden" name="paymentaction" value="sale">

<input type="hidden" name="return"

value="https://yourwebsite.com/receipt_page.html">

<input type="submit" name="METHOD" value="Pay Now">

</form>

Page 54

Testing Your Integration in Sandbox

Testing Your Integration and Settings

Testing Your Settings

To change the look and feel of your payment page, modify the settings of the Appearance and

Settings pages in the Profile section of the Sandbox Test Site. For complete details, refer to

“Modifying Your PayPal Account Settings” on page 21.

54

Page 55

Order Processing

7

This chapter walks you through the end of end order processing experience. It includes

information about verifying the status and authenticity of the order before fulfilling it.

Verifying Transaction Status and Authenticity

When the buyer successfully completes a transaction, they are redirected either to the PayPal

confirmation page or a website you specified in the return variable or on the Settings page

in the Profile section (as outlined in “Simple Intégral Evolution Integration” on page 15).

When the browser is redirected to the website you specified, a Transaction ID is appended to

it.

When you receive the redirect (URL with Transaction ID), you must verify that the order was

completed successfully on PayPal before sending the items to the buyer. You can do so by

checking the confirmation email sent to you by PayPal or by verifying the transaction history.

You can also using one of the following methods:

Validate Instant Payment Notification (IPN)

IPN enables you to receive messages about transaction payments and activity from PayPal

through asynchronous, server-to-server communication. This allows you to integrate your

online payments with your order fulfillment process.

Through IPN, you receive messages for the following:

Payments and their status (pending, complete, or denied)

Fraud Management Filter actions

Recurring Payment activity

Authorisations, chargebacks, disputes, reversals, and refunds.

After a transaction has been processed, PayPal sends an IPN to the notification URL specified

in your transaction using the parameter notify_url, or in your PayPal Profile. You must

verify that the Transaction ID, transaction amount, and other order specific parameters such as

Invoice ID that are sent in the IPN match with the information you have in your order

processing system. For more details, refer to

Instant Payment Notification Guide.

55

Page 56

Order Processing

Fulfilling Order

Execute a GetTransactionDetails API Call

Using GetTransactionDetails API, you can obtain information about a specific

transaction.

If you are integrated with PayPal APIs, you can call GetTransactionDetails with the

Transaction ID that was returned in the web redirect to validate the authenticity of the order.

For complete details, refer to “GetTransactionDetails API” on page 63.

Fulfilling Order

After you have verified the authenticity of the payment amount and status, you can fulfil the

order by shipping the item to the buyer.

N OTE: To benefit from PayPal’s Seller Protection, the item must be shipped to the address

specified on the PayPal payment page or communicated to PayPal. Otherwise, the item

is not eligible for Seller Protection. For more information, refer to “Seller Protection”

on page 11.

56

Page 57

Protecting Buttons by Using

8

Encrypted Website Payments

Using Encrypted Website Payments helps secure payment buttons that you generate or write

manually. Encrypted Website Payments protects the HTML button code that contains pricing

information by encrypting it. HTML button code that you protect by using Encrypted Website

Payments cannot be altered by malicious third parties to create fraudulent payments.

Encrypted Website Payments relies on standard public key encryption for protection. With

public and private keys, you can dynamically generate HTML code for payment buttons and

encrypt the payment details before displaying the buttons on your website. The below table

illustrates the sequence of actions that occur with payment buttons protected by using

Encrypted Website Payments.

TABLE 8.1 How Encrypted Website Payments Works

Website Actions Buyer Action PayPal Action

Generate a public key for the

website, upload it to PayPal, and

download the PayPal public

certificate to the website.

N OTE: Do this action only once,

when you first integrate

Intégral Evolution with your

website.

Generate HTML code for a payment

button.

Encrypt the generated code by using

the PayPal public key and then

signing the encrypted code with the

website’s private key.

Publish the signed, encrypted

HTML code for the payment button

to the website

Click the published PayPal payment

button.

Check the authenticity of the data by

using the website’s public key,

which was previously uploaded to

PayPal.

Decrypt the protected button code

by using the PayPal private key.

Redirect the payer’s browser to the

appropriate PayPal checkout

experience, as specified in the

HTML variables of the decrypted

button code.

Page 58

Protecting Buttons by Using Encrypted Website Payments

Public Key Encryption Used by Encrypted Website Payments

Public Key Encryption Used by Encrypted Website Payments

Encrypted Website Payments uses public key encryption, or asymmetric cryptography, which

provides security and convenience by allowing senders and receivers of encrypted

communication to exchange public keys to unlock each others messages. The fundamental

aspects of public key encryption are:

Public keys – Public keys are created by receivers and are given to senders before they

encrypt and send information. Public certificates comprise a public key and identity

information, such as the originator of the key and an expiry date. Public certificates can be

signed by certificate authorities, who guarantee that public certificates and their public

keys belong to the named entities.

You and PayPal exchange each others’ public certificates.

Private keys – Private keys are created by receivers are kept to themselves.

You create a private key and keep it in your system. PayPal keeps its private key on its

system.

The encryption process – Senders use their private keys and receivers’ public keys to

encrypt information before sending it. Receivers use their private keys and senders’ public

keys to decrypt information after receiving it. This encryption process also uses digital

signatures in public certificates to verify the sender of the information.

You use your private key and PayPal’s public key to encrypt your HTML button code.