Page 1

Instant Payment

Notification Guide

Last updated: July 10, 2012

Page 2

IPN Guide

Document Number: 10087.en_US-20120710

© 2012 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting f rom the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Chapter 1 Introducing IPN . . . . . . . . . . . . . . . . . . . . . . . 7

IPN Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

IPN Protocol and Architecture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

IPN Messages Generated by PayPal Payments Standard . . . . . . . . . . . . . . . 11

IPN Messages Generated by APIs . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

IPN Messages Generated by a Back-Office Procedure . . . . . . . . . . . . . . . . . 13

PayPal-Initiated IPN Messages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

A Sample IPN Message and Response . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Non-IPN Notification Mechanisms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Chapter 2 Implementing an IPN Listener . . . . . . . . . . . . . . . .19

Chapter 3 Identifying Your IPN Listener to PayPal . . . . . . . . . . .21

Setting Up IPN Notifications on PayPal . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Dynamically Setting the Notification URL . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Chapter 4 IPN Testing . . . . . . . . . . . . . . . . . . . . . . . . . 25

Testing Your Listener. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

IPN Troubleshooting Tips . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Chapter 5 IPN Operations on PayPal . . . . . . . . . . . . . . . . . . 29

Using the IPN History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Resending IPN Messages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

July 10, 2012 3

Page 4

Contents

Chapter 6 Using Fraud Management Filters With IPN . . . . . . . . . 37

Chapter 7 IPN Variable Reference . . . . . . . . . . . . . . . . . . . 41

IPN Transaction Types. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Transaction and Notification-Related Variables . . . . . . . . . . . . . . . . . . . . . . . 42

Buyer Information Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Payment Information Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Auction Variables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Mass Pay Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Recurring Payments Variables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Subscription Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Dispute Resolution Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

Pay Message Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Preapproval Message Variables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Adaptive Accounts IPN Messages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

Payment Review Using Notifications. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68

Revision History. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

4 July 10, 2012

Page 5

Preface

This document describes the Instant Payment Notification (IPN) message service.

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

IPN Guide July 10, 2012 5

Page 6

Documentation Feedback

6 July 10, 2012 IPN Guide

Page 7

1

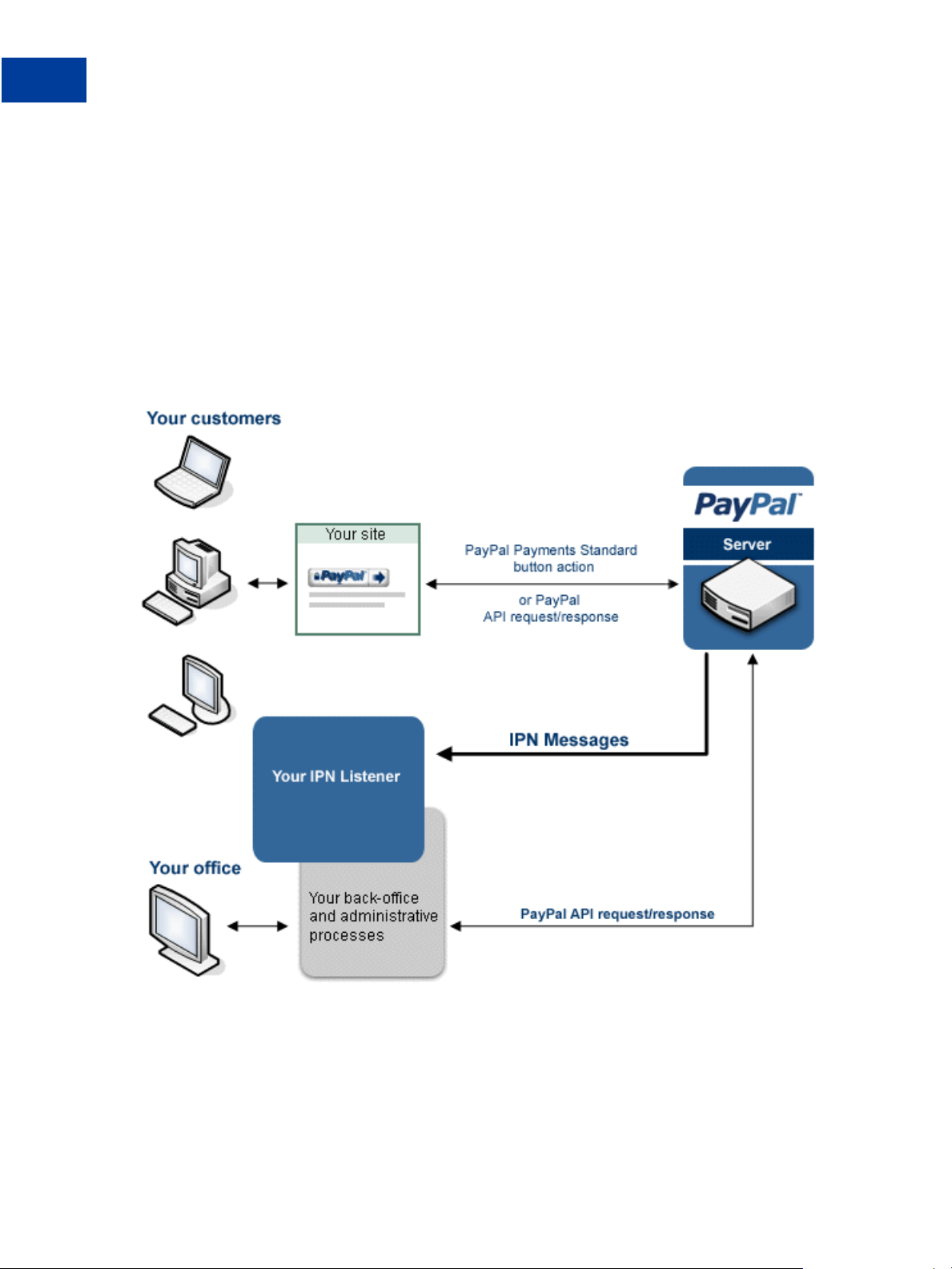

Instant Payment Notification (IPN) is a message service that notifies you of events related to

PayPal transactions. You can use it to automate back-office and administrative functions, such

as fulfilling orders, tracking customers, and providing status and other information related to a

transaction.

IPN Overview

IPN Protocol and Architecture

A Sample IPN Message and Response

Non-IPN Notification Mechanisms

IPN Overview

IPN notifies you when an event occurs that affects a transaction. Typically, these events

represent various kinds of payments; however, the events may also represent authorizations,

Fraud Management Filter actions and other actions, such as refunds, disputes, and

chargebacks.

Introducing IPN

IPN is a message service that PayPal uses to notify you about events, such as:

Instant payments, including Express Checkout, Adaptive Payments, and direct credit card

payments, and authorizations, which indicate a sale whose payment has not yet been

collected

eCheck payments and associated status, such as pending, completed, or denied, and

payments pending for other reasons, such as those being reviewed for potential fraud

Recurring payment and subscription actions

Chargebacks, disputes, reversals, and refunds associated with a transaction

In many cases, the action that causes the event, such as a payment, occurs on your website;

however, your website is not the only source of events. In many cases, events can be generated

by Website Payment Standard buttons, the PayPal API, or by PayPal itself.

You detect and process IPN messages with a listener, sometimes called a handler, which is a

script or program that you write. It waits for messages and passes them to various back-end or

administrative processes that respond the messages. PayPal provides sample code that you can

modify to implement a listener that detects IPN messages.

The actions to take when your listener is notified of an event are specific to your needs.

Examples of the kinds of actions you might take when your listener receives an IPN message

include the following:

IPN Guide July 10, 2012 7

Page 8

Introducing IPN

IPN Overview

Trigger order fulfillment or enable media downloads when a check clears or a payment is

made

Update your list of customers

Update accounting records

Create specialized “to do” lists based on the kind of event

You are typically notified of events by email as well, but the IPN message service enables you

to automate your response to events. The following diagram shows how events can occur and

how PayPal responds with IPN messages that it sends to your listener:

8 July 10, 2012 IPN Guide

Page 9

Introducing IPN

IPN Protocol and Architecture

The diagram shows requests and responses, which are the result of processing button clicks or

API operations on PayPal. PayPal sends an IPN message when it sends a response to a request.

The IPN message is not actually part of the response sent to your website. Rather, the IPN

message is sent to the your listener, which allows you to take actions that are not directly tied

to the operation of your website.

NOTE: The diagram does not show the IPN authen tication protocol messages that validate the

IPN message.

IPN is an asynchronous message service, meaning that messages are not synchronized with

actions on your website. Thus, listening for an IPN message does not increase the time it takes

to complete a transaction on your website.

The IPN message service does not assume that all messages will be received by your listener

in a timely manner. Because the internet is not 100% reliable, messages can become lost or

delayed. To handle the possibility of transmission and receipt delays or failures, the IPN

message service implements a retry mechanism that resends messages at various intervals

until you acknowledge that the message has successfully been received. Messages may be

resent for up to four days after the original message.

NOTE: Unless you are certain that a failure occurred on the the Internet, the most likely cause

of lost, delayed, or duplicate IPN messages is faulty logic in the listener itself.

Because messages can be delivered at any time, your listener must always be available to

receive and process messages; however, the retry mechanism also handles the possibility that

your listener could become swamped or stop responding.

The IPN message service should not be considered a real-time service. Your checkout flow

should not wait on an IPN message before it is allowed to complete. If your website waits for

an IPN message, checkout processing may be delayed due to system load and become more

complicated because of the possibility of retries.

IPN Protocol and Architecture

IPN is designed to be secure, reliable, and asynchronous. To meet these requirements, the

protocol requires you to acknowledge receipt of IPN messages. The IPN service provides a

retry mechanism to handle cases in which a message is not acknowledged; for example, when

a transmission or receipt failure occurs.

When you enable IPN, PayPal sends messages to the IPN listener at the URL you specify in

your account’s profile. You can override the URL to associate other IPN listeners with specific

transactions. In this case, you specify the listener’s URL when you set up a Website Payment

Standard button or a PayPal API operation.

The IPN protocol consists of three steps:

1. PayPal sends your IPN listener a message that notifies you of the event

IPN Guide July 10, 2012 9

Page 10

Introducing IPN

IPN Protocol and Architecture

2. Your listener sends the complete unaltered message back to PayPal; the message must

contain the same fields in the same order and be encoded in the same way as the original

message

3. PayPal sends a single word back, which is either VERIFIED if the message originated with

PayPal or INVALID if there is any discrepancy with what was originally sent

Your listener must respond to each message, whether or not you intend to do anything with it.

If you do not respond, PayPal assumes that the message was not received and res ends the

message. PayPal continues to resend the message periodically until your listener sends the

correct message back, although the interval between resent messages increases each time. The

message can be resent for up to four days.

This resend algorithm can lead to situations in which PayPal resends the IPN message while

you are sending back the original message. In this case, you should send your response again,

to cover the possibility that PayPal did not actually receive your response the first time. You

should also ensure that you do not process the transaction associated with the message twice.

IMPORTANT: PayPal expects to receive a response to an IPN message within 30 seconds.

Your listener should not perform time-consuming operations, such as creating

a process, before responding to the IPN message.

After PayPal verifies the message, there are additional checks that your listener or back-end or

administrative software must take:

Verify that you are the intended recipient of the IPN message by checking the email address

in the message; this handles a situation where another merchant could accidentally or

intentionally attempt to use your listener.

Avoid duplicate IPN messages. Check that you have not already processed the transaction

identified by the transaction ID returned in the IPN message. You may need to store

transaction IDs and the last payment status returned by IPN messages in a file or database

so that you can check for duplicates. If the transaction ID sent by PayPal is a duplicate, you

should not process it again.

NOTE: You must track the last payment status returned by IPN messages because PayPal

could send an IPN for a pending payment and a second one for the completed

payment, both of which would have the same transaction ID. Relying on just the

transaction ID could lead to the completed payment being treated as a duplicate.

Because IPN messages can be sent at various stages in a transaction’s progress, make sure

that the transaction’s payment status is “completed” before enabling shipment of

merchandise or allowing the download of digital media.

Verify that the payment amount actually matches what you intend to charge. Although not

technically an IPN issue, if you do not encrypt buttons, it is possible for someone to capture

the original transmission and change the price. Without this check, you could accept a

lesser payment than what you expected.

10 July 10, 2012 IPN Guide

Page 11

IPN Protocol and Architecture

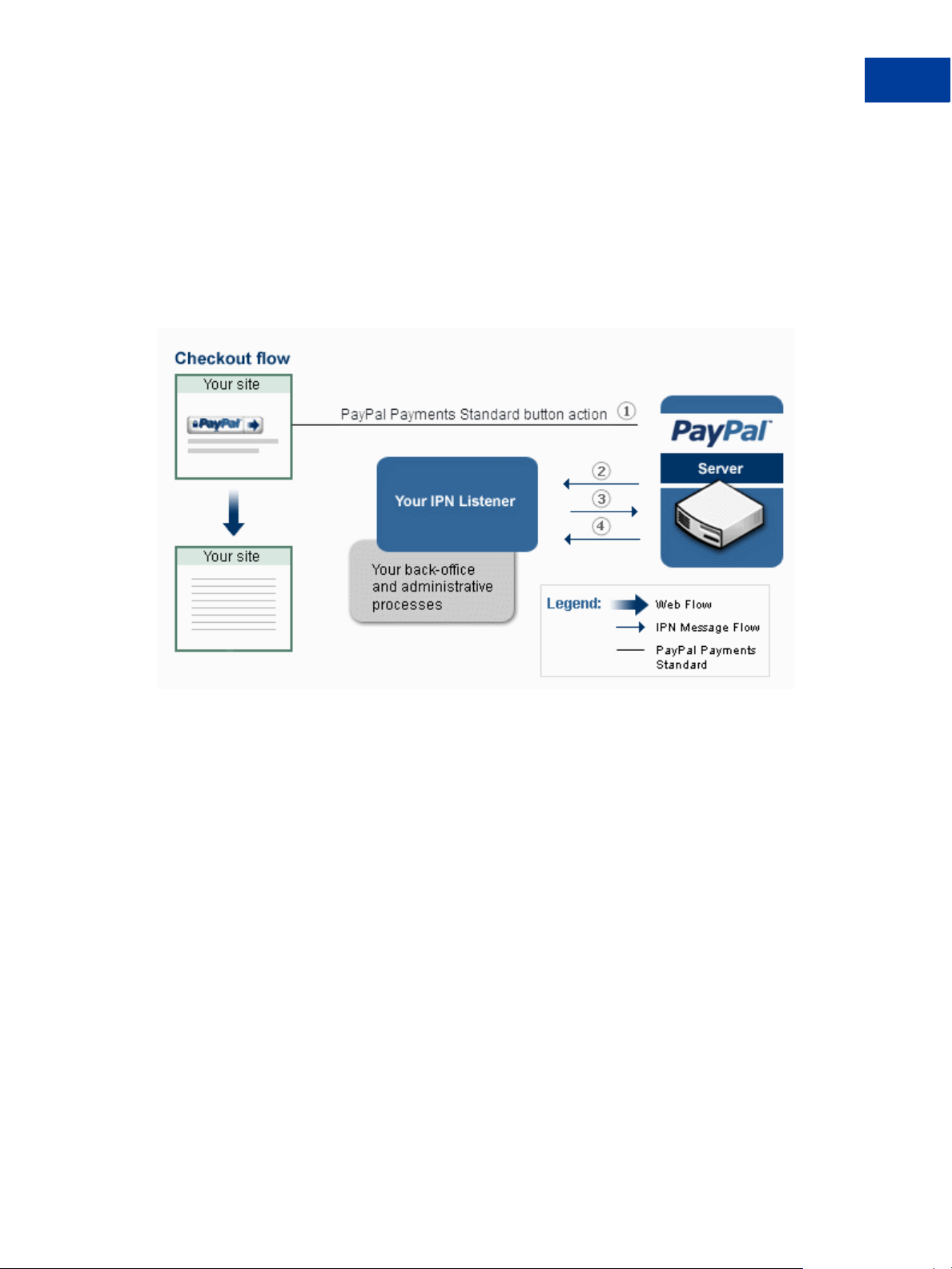

IPN Messages Generated by PayPal Payments Standard

PayPal generates an IPN message when your customer clicks a PayPal Payments Standard

(previously known as Website Payments Standard) payment button, such as a Buy Now

button, and completes the transaction on PayPal. You can use this notification to kick-off order

fulfillment, enable digital media downloads, store information in a customer relationship

management (CRM) or accounting system, and so on.

The following diagram shows both the web flow and the IPN message authentication protocol:

Introducing IPN

The numbers in diagram correspond to the following steps:

1. The button action initiates a payment that completes on PayPal

2. PayPal sends your IPN listener a message that notifies you of the event

3. Your listener sends the complete unaltered message back to PayPal; the message must

contain the same fields in the same order and be encoded in the same way as the original

message

4. PayPal sends a single word back, which is either VERIFIED if the message originated with

PayPal or INVALID if there is any discrepancy with what was originally sent

Your IPN listener must implement the IPN authentication protocol (steps 2, 3, and 4 in this

diagram). After successfully completing the protocol, your back-office or administrative

process vets the contents of the message and responds appropriately. For example, if the

payment status for the transaction is “Completed,” your system can print a packing list or

email a password to your customer for downloading digital media.

IPN Guide July 10, 2012 11

Page 12

Introducing IPN

IPN Protocol and Architecture

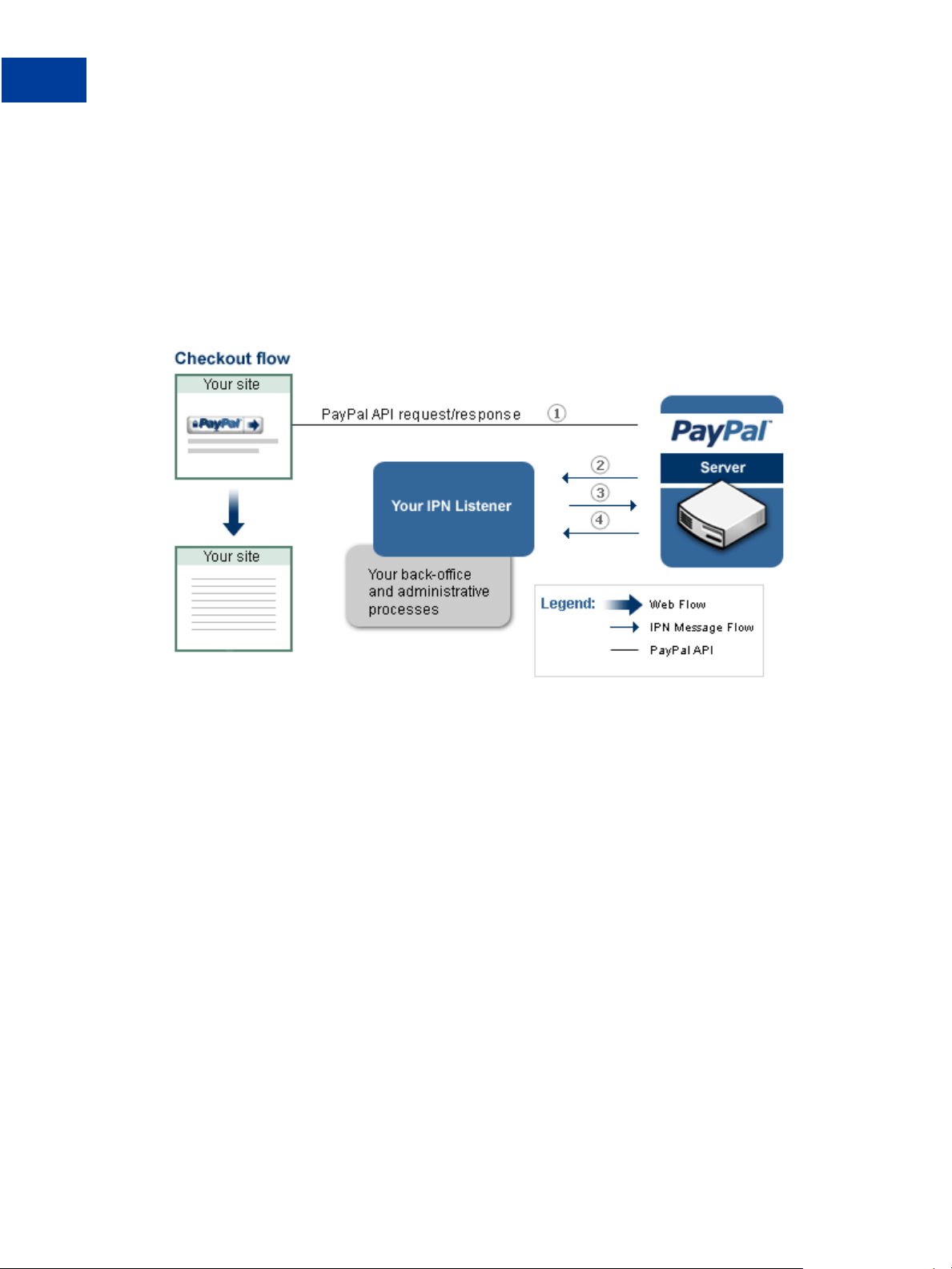

IPN Messages Generated by APIs

PayPal generates an IPN message when you invoke an API operation, such as

DoExpressCheckoutPayment of DoDirectPayment during checkout or an Adaptive

Payments Pay, Preapproval, or ExecutePayment API operation. You can use this

notification to kick-off order fulfillment, enable digital media downloads, store information in

a customer relationship management (CRM) or accounting system, and so on.

The following diagram shows both the web flow and the IPN message authentication protocol:

The numbers in the diagram correspond to the following steps:

1. The API operation initiates a payment on PayPal.

2. PayPal sends your IPN listener a message that notifies you of the event

3. Your listener sends the complete unaltered message back to PayPal; the message must

contain the same fields in the same order and be encoded in the same way as the original

message

4. PayPal sends a single word back, which is either VERIFIED if the message originated with

PayPal or INVALID if there is any discrepancy with what was originally sent

Your IPN listener must implement the IPN authentication protocol (steps 2, 3, and 4 in this

diagram). After successfully completing the protocol, your back-office or administrative

process vets the contents of the message and responds appropriately. For example, if the

payment status for the transaction is “Completed,” your system can print a packing list or

email a password to your customer for downloading digital media.

12 July 10, 2012 IPN Guide

Page 13

IPN Messages Generated by a Back-Office Procedure

PayPal generates an IPN message when you perform actions that invoke the PayPal API,

regardless of whether it is from your website or from a back-office or administrative

procedure. You can use this notification to trigger an email to your customer, store information

in a CRM or accounting system, and so on.

The following diagram shows both an administrative web flow and the IPN message

authentication protocol:

Introducing IPN

IPN Protocol and Architecture

The numbers in diagram correspond to the following steps:

1. Your back-office or administrative process invokes a PayPal API operation; for example, it

could invoke the RefundTransaction API operation when your employee issues a

refund.

2. PayPal sends your IPN listener a message that notifies you of the event

3. Your listener sends the complete unaltered message back to PayPal; the message must

contain the same fields in the same order and be encoded in the same way as the original

message

4. PayPal sends a single word back, which is either VERIFIED if the message originated with

PayPal or INVALID if there is any discrepancy with what was originally sent

Your IPN listener implements the IPN authentication protocol (steps 2, 3, and 4 in this

diagram). After successfully completing the protocol, your listener or back-office or

administrative process vets the contents of the message and responds appropriately. For

example, your system can notify the customer of the refund by email.

IPN Guide July 10, 2012 13

Page 14

Introducing IPN

A Sample IPN Message and Response

PayPal-Initiated IPN Messages

Some IPN messages generated by PayPal are not directly associated with a web flow. PayPal

generates an IPN message when external events arise that might affect a transaction, such as

disputes, chargebacks, echeck clearing, and various recurring payment and subscription

events.

In this case, events that trigger IPN messages are not directly related to actions on your

website. The following diagram shows the steps your listener must take:

The numbers in diagram correspond to the following steps, which implement the IPN message

authentication protocol:

1. PayPal sends your IPN listener a message that notifies you of the event

2. Your listener sends the complete unaltered message back to PayPal; the message must

contain the same fields in the same order and be encoded in the same way as the original

message

3. PayPal sends a single word back, which is either VERIFIED if the message originated with

PayPal or INVALID if there is any discrepancy with what was originally sent

After successfully completing the protocol, your back-office or administrative process vets the

contents of the message and responds appropriately. For example, the IPN messages may

trigger you to print shipping labels for items whose payments have cleared, investigate

disputes and chargebacks, store information in an accounting system, and so on.

A Sample IPN Message and Response

An IPN message consists of variables that describe the transaction. These variables contain

information about you, your customer, and the details of the transaction itself.

PayPal sends a message, similar to the following one, for a $19.95 purchase made by Express

Checkout:

14 July 10, 2012 IPN Guide

Page 15

Introducing IPN

A Sample IPN Message and Response

mc_gross=19.95&protection_eligibility=Eligible&address_status=confirmed&pay

er_id=LPLWNMTBWMFAY&tax=0.00&address_street=1+Main+St&payment_date=20%3A12%

3A59+Jan+13%2C+2009+PST&payment_status=Completed&charset=windows1252&address_zip=95131&first_name=Test&mc_fee=0.88&address_country_code=US&

address_name=Test+User¬ify_version=2.6&custom=&payer_status=verified&add

ress_country=United+States&address_city=San+Jose&quantity=1&verify_sign=Atk

OfCXbDm2hu0ZELryHFjY-Vb7PAUvS6nMXgysbElEn9v1XcmSoGtf&payer_email=gpmac_1231902590_per%40paypal.com&txn_id=61E67681CH32

38416&payment_type=instant&last_name=User&address_state=CA&receiver_email=g

pmac_1231902686_biz%40paypal.com&payment_fee=0.88&receiver_id=S8XGHLYDW9T3S

&txn_type=express_checkout&item_name=&mc_currency=USD&item_number=&residenc

e_country=US&test_ipn=1&handling_amount=0.00&transaction_subject=&payment_g

ross=19.95&shipping=0.00

Variable Notes

Information about you:

receiver_email = gm_1231902686_biz@paypal.com Check email address to make sure that this is not a spoof

receiver_id = S8XGHLYDW9T3S

residence_country = US

Information about the transaction:

test_ipn = 1 Testing with the Sandbox

transaction_subject =

txn_id = 61E67681CH3238416 Keep this ID to avoid processing the transaction twice

txn_type = express_checkout Type of transaction

Information about your buyer:

payer_email = gm_1231902590_per@paypal.com

payer_id = LPLWNMTBWMFAY

payer_status = verified

first_name = T est

last_name = User

address_city = San Jose

address_country = United States

address_country_code = US

address_name = Test User

address_state = CA

address_status = confirmed

IPN Guide July 10, 2012 15

Page 16

Introducing IPN

A Sample IPN Message and Response

Variable Notes

address_street = 1 Main St

address_zip = 95131

Information about the payment:

custom = Your custom field

handling_amount = 0.00

item_name =

item_number =

mc_currency = USD

mc_fee = 0.88

mc_gross = 19.95

payment_date = 20:12:59 Jan 13, 2009 PST

payment_fee = 0.88

payment_gross = 19.95

payment_status = Completed Status, which determines whether the transaction is

complete

payment_type = instant Kind of payment

protection_eligibility = Eligible

quantity = 1

shipping = 0.00

tax = 0.00

Other information about the transaction:

notify_version = 2.6 IPN version; can be ignored

charset = windows-1252

verify_sign = AtkOfCXbDm2hu0ZELryHFjY-

Vb7PAUvS6nMXgysbElEn9v-1XcmSoGtf

Before you can trust the contents of the message, you must first verify that the message came

from PayPal. To verify the message, you must send back the contents in the exact order they

were received and precede it with the command _notify-validate, as follows:

https://www.sandbox.paypal.com/cgi-bin/webscr?cmd=_notifyvalidate&mc_gross=19.95&protection_eligibility=Eligible&address_status=conf

irmed&payer_id=LPLWNMTBWMFAY&tax=0.00&...&payment_gross=19.95&shipping=0.00

16 July 10, 2012 IPN Guide

Page 17

PayPal will then send one single-word message, VERIFIED, if the message is valid; otherwise,

it will send another single-word message, INVALID.

IMPORTANT: After you receive the VERIFIED message, there are several important checks

you must perform before you can assume that the message is legitimate and

not already processed:

Non-IPN Notification Mechanisms

You can use IPN with other notification mechanisms. For example, you can use PDT or the

API to determine real-time information about a transaction and let IPN notify you of any

changes after the transaction occurs.

Introducing IPN

Non-IPN Notification Mechanisms

If you are using PayPal Payments Standard, you can use PDT to obtain information about the

transaction. If you are using Express Checkout or Direct Payment, the PayPal API notifies you

of the status and details of the transaction immediately and automatically. In either case, you

can immediately display to your customer the information being returned from PayPal. You

should not use IPN for this purpose.

IPN Guide July 10, 2012 17

Page 18

Introducing IPN

Non-IPN Notification Mechanisms

18 July 10, 2012 IPN Guide

Page 19

2

Implementing an IPN Listener

You write your IPN listener in the scripting or programming language of your choice and host

it on your web server. You can use sample code provided by PayPal as a starting point.

The PayPal SDKs for PayPal Payments Standard contain sample code in various programming

languages that you can modify to create your own listener. As a good programming practice,

as well as to keep things simple, your IPN listener should listen for a post from PayPal and

dispatch it immediately to another routine or process that handles the business logic associated

with the message. If your listener is structured in this way, it will be a simple and tight loop

that listens for a message and dispatches it for processing by your application logic.

For a list of code samples for IPN, refer to the following link:

Code Samples - Instant Payment Notification

IPN Guide July 10, 2012 19

Page 20

Implementing an IPN Listener

20 July 10, 2012 IPN Guide

Page 21

Identifying Your IPN Listener to

3

PayPal

After you implement and test your IPN listener, you make your listener known to PayPal by

specifying the listener’s URL in your account’s pro file. Optio nally, you can override the URL

to specify another listener for specific payments.

Setting Up IPN Notifications on PayPal

Dynamically Setting the Notification URL

Setting Up IPN Notifications on PayPal

After you implement and test your IPN listener, you identify the listener to PayPal by selecting

Instant Payment Notification Preferences from your account’s profile. You then specify

your listener’s URL and click the box to activate it.

Your listener must be located at the URL that you specify in the profile. Before you activate

your listener on PayPal, you should test the listener using the IPN simulator in the Sandbox.

IMPORTANT:

The steps to set up your listener for Sandbox testing and to set up your listener for live

operation on PayPal are the same. The only difference is that you log into the Sandbox to set

up your listener for Sandbox testing and you log into PayPal to set up your listener for live

operation.

NOTE: Sandbox testing goes beyond simply using the IPN simulator. The IPN simulator only

sends IPN messages to a listener; it does not perform the complete operation; for

example, it does not complete a transaction. Sandbox testing involves performing the

same actions in the Sandbox as you expect to be performed when the listener goes

live.

After you log in, follow these instructions to set up your listener:

1. Click Profile on the My Account tab.

2. Click Instant Payment Notification Preferences in the Selling Preferences column.

3. Click Choose IPN Settings to specify your listener’s URL and activate the listener.

The following screen appears:

IPN Guide July 10, 2012 21

Page 22

Identifying Your IPN Listener to PayPal

Setting Up IPN Notifications on PayPal

4. Specify the URL for your listener in the Notification URL field.

5. Click Receive IPN messages (Enabled) to enable your listener.

6. Click Save.

The following screen appears:

7. Click Back to Profile Summary to return to the Profile after activating your listener.

You also can click Edit settings to modify your notification URL or disable your listener.

You can click T u rn Off IPN to reset your IPN preferences.

22 July 10, 2012 IPN Guide

Page 23

Identifying Your IPN Listener to PayPal

Dynamically Setting the Notification URL

Dynamically Setting the Notification URL

You can specify an IPN listener for a specific payment; this is the only way to receive IPNs

associated with Adaptive Payments. In this case, PayPal sends the IPN message to the listener

specified in the notification URL for a specific button or API operation instead of the listener

specified in your Profile.

To specify a notification URL

For a/an ... specify your IPN Listener’s URL in the ...

PayPal Payments Standard button notify_url HTML form variable

NVP API operation NOTIFYURL field of the DoDirectPayment,

DoExpressCheckoutPayment, or DoReferenceTransaction request

SOAP API operation NotifyURL field of the DoDirectPayment,

DoExpressCheckoutPayment, or DoReferenceTransaction request

Adaptive Payments API operation ipnNotificationUrl field of the Pay or Preapproval request

NOTE: The IPN message will always be sent to your notification URL unless receiving IPNs

have been disabled. Even though you have not enabled receiving IPN messages in

your Profile or you have reset your preference by turning off IPN messages, PayPal

still sends IPN messages to the notification URL you specify for a specific payment.

IPN messages not sent because you disabled the preference in your Profile will appear

in the IPN history when you enable receiving IPNs. After they appear in the history,

you can choose whether or not to resend them.

IPN Guide July 10, 2012 23

Page 24

Identifying Your IPN Listener to PayPal

Dynamically Setting the Notification URL

24 July 10, 2012 IPN Guide

Page 25

IPN Testing

4

After you implement your listener and start it running on your web server , you can use the IPN

simulator in the Sandbox to send IPN messages to the URL at which your listener is running.

This tool allows you to verify that you are receiving IPN messages correctly.

Testing Your Listener

IPN Troubleshooting Tips

Testing Your Listener

The first level of testing is to ensure that your IPN listener receives messages and handles

them appropriately . This level of testing requires you to have your IPN listener running at your

notification URL; however, it does not require you to set up the listener in the Profile.

You must be logged into the Sandbox to use the IPN simulator. Not all API operations are

available using the IPN simulator.

To set up and send an IPN message using the simulator:

1. Select Instant Payment Notification (IPN) simulator from Test Tools.

2. Enter the URL to receive the notification and the kind of notification you want to test on

the following screen:

When you select the kind of transaction that you want to test, a form containing test data

appears:

IPN Guide July 10, 2012 25

Page 26

IPN Testing

Testing Your Listener

3. Keep or modify the values of fields that you want to include in the IPN.

By default, only populated fields are displayed. You can check the Show all fields box to

view all fields. The simulator does not check the validity of fields that you change.

26 July 10, 2012 IPN Guide

Page 27

4. Click Send IPN.

The IPN message is sent to the specified URL and the results of the operation are displayed

at the top of the page.

After Completing This Task:

If your IPN listener receives a message, you know that it is properly installed on your web

server. The default messages sent by the IPN simul ator are valid, thus, if your listener responds

correctly to the message, it should receive a VERIFIED message. If you do not receive any

message or if you receive an INVALID message after responding to the original message from

PayPal, you will need to troubleshoot your listener.

IPN Troubleshooting Tips

IPN failures fall into three categories: not receiving any IPN messages from PayPal, receiving

some but not all IPN messages, and receiving INVALID messages from PayPal after

responding to a message.

IPN Testing

IPN Troubleshooting Tips

If you do not receive any IPN messages from PayPal

Check the IPN History page on PayPal. It tells you whether PayPal sent the IPN message

and whether your listener responded to it. It may also provide information about the status

of the server on which your listener is running. If necessary, from this page you can also

request that PayPal resend the IPN message.

Check that the path to your IPN listener is correct and you are using that path correctly in

your IPN notification URL; for example, the file path is often similar to, but not the same

as, the URL.

Verify that your firewall settings are not blocking HTTP POST messages from PayPal.

If the logs for your web server are available, check the logs to confirm that messages are

being sent to your web server and check for any errors that may have occurred.

If you receive some messages but not others

Verify that your IPN listener is responding to all messages, even those you do not intend to

process.

Check that the account is valid and confirmed; for example, if you send money to an

unconfirmed account, PayPal does not send an IPN message.

If you receive an INVALID message

Check that your are posting your response to the correct URL, which is

https://www.sandbox.paypal.com/cgi-bin/webscr or

https://www.paypal.com/cgi-bin/webscr, depending on whether you are testing

in the Sandbox or you are live, respectively.

Verify that your response contains exactly the same IPN variables and values in the same

order, preceded with cmd=_notify-validate.

IPN Guide July 10, 2012 27

Page 28

IPN Testing

IPN Troubleshooting Tips

Ensure that you are encoding your response string and are using the same character

encoding as the original message.

NOTE: If you receive multiple IPN messages for the same transaction or if messages appear

to be out of order, this is not necessarily an indication that your listener is

malfunctioning. For example, if you do not respond in time, PayPal resends the

message. You should investigate these situations; however, because they could be

caused by a logic errors or performance problems as well.

28 July 10, 2012 IPN Guide

Page 29

IPN Operations on PayPal

5

The IPN History page on PayPal provides additional information to help you troubleshoot IPN

messages. You can use the IPN History page to determine the status of IPN messages and to

resend them, if necessary.

Using the IPN History

Resending IPN Messages

Using the IPN History

Use the IPN History page on PayPal to view IPN messages sent to you from PayPal and

request that messages be resent. You can select the IPN messages to review by date range, by

delivery status, and by PayPal transaction

IPN Guide July 10, 2012 29

Page 30

IPN Operations on PayPal

Using the IPN History

The search results contain the following information:

The date and time that PayPal created the IPN message

Whether this IPN message was the original message or whether it was resent, which is

indicated in the Date/time created column

The IPN message ID assigned by PayPal

The current status, which is one of the following values:

– Sent indicates that PayPal sent the message to your IPN listener

– Failed indicates that PayPal did not receive an acknowledgement to the message

30 July 10, 2012 IPN Guide

Page 31

IPN Operations on PayPal

Using the IPN History

– Queued indicates that PayPal is ready to send the message

– Retrying indicates that message was resent between 1 and 15 times and PayPal

continues to be resend the message

– Disabled indicates that the message will not be resent because the merchant’s account

has been disabled

NOTE: If you have requested that PayPal resend the IPN message and the status has not

been updated for the attempt, resending is appended to the status, e.g. Failed

- resending.

Your server’s response to the HTTP POST that delivered the IPN message to your listener.

For more information about these codes, see

HTTP/1.1.

If the message is related to a PayPal transaction, the ID of the PayPal transaction associated

with the message; you can

T o see more information about an IPN message, click on the message ID. The IPN details page

appears:

RFC 2616: Hypertext Transfer Protocol --

IPN Guide July 10, 2012 31

Page 32

IPN Operations on PayPal

Using the IPN History

In addition to the information on the IPN History page, the details contain the following

information:

Whether this IPN message was the original message or whether it was resent

The last time the message was resent

The URL on which your listener was running when the message was sent

The number of retries before the message was successfully acknowledged

The type of IPN message

32 July 10, 2012 IPN Guide

Page 33

Resending IPN Messages

You can use the IPN History page to request that PayPal resend one or more IPN messages.

You can search the IPN message history for the messages that may need to be resent and then

select them.

T o make a request that PayPal resend IPN messages, mark one or more messages for PayPal to

resend and click the Resend selected button to make the request:

IPN Operations on PayPal

Resending IPN Messages

If you check the box for To send an IPN again to a profile URL..., the message will be resent

to the current profile URL instead of the URL associated with the original message. If you do

IPN Guide July 10, 2012 33

Page 34

IPN Operations on PayPal

Resending IPN Messages

not check this option, PayPal sends the message to the same URL to which the original

message was sent, which is not necessarily the current profile URL.

You may receive a confirmation notice alerting you to the possibility that you will receive

duplicate messages. Click Confirm to resend; otherwise click Cancel:

After you make the request, PayPal notifies you that the messages have been resent and

updates the status. The status indicates that PayPal is resending the message until it actually

has been resent:

34 July 10, 2012 IPN Guide

Page 35

IPN Operations on PayPal

Resending IPN Messages

When the message has been sent, your server’s response to the HTTP POST is used to update

the HTTP response code field. A value of 200 indicates that your server successfully received

the IPN message. Other values typically indicate a server configuration error for the server that

hosts your IPN listener. For more information about these codes, see

Transfer Protocol -- HTTP/1.1. If you do not see a response code, you should check that your

RFC 2616: Hypertext

sever is running.

IPN Guide July 10, 2012 35

Page 36

IPN Operations on PayPal

Resending IPN Messages

36 July 10, 2012 IPN Guide

Page 37

6

Using Fraud Management Filters With IP N

Fraud Management Filter actions are reported in IPN payment messages only when a filter

causes the payment to be pended awaiting your review or a when you accept or deny a filterpended payment. Filter actions are not reported when filters flag payments for review, allow

payments to be accepted, or cause them to be denied.

When a payment occurs, an IPN message shows the transaction’s payment status as

Completed, regardless of whether a Fraud Management Filter was activated or not. There is

no special notification for transactions that are flagged by a Fraud Management Filter. If a

Fraud Management Filter is set to Deny, PayPal does not send an IPN message when the filter

actually causes the payment to be denied.

When a transaction is pended, however, PayPal sends an IPN message containing one or more

fraud_management_pending_filters_

the payment to be pended, where n=1 specifies the first filter, and so on. In addition, the

payment_status variable is set to Pending. The following example shows an IPN message

in which two filters cause the transaction to be pended:

n variables, which identify the filters that caused

IPN Guide July 10, 2012 37

Page 38

Using Fraud Management Filters With IPN

txn_type = virtual_terminal

payment_date = 17:11:42 Jul 15, 2008 PDT

last_name =

receipt_id = 3075-7371-4622-1677

residence_country = US

pending_reason = address

item_name =

payment_gross = 3.33

mc_currency = USD

business = acqrte_1215804264_biz@gmail.com

payment_type = instant

verify_sign = APYUGJhXGkUmvFnZf4I5co6CedKKAowZjfT4T7GXWJMDnZ0uFLkcq.oH

payer_status = unverified

test_ipn = 1

fraud_management_pending_filters_1 = Maximum Transaction Amount

tax = 0.00

txn_id = 5XN64179EB804362B

fraud_management_pending_filters_2 = Unconfirmed Address

quantity = 1

first_name =

receiver_email = acqrte_1215804264_biz@gmail.com

payer_id = PUWAJRBB8NM74

receiver_id = 2RXLTRMGT3M2G

item_number =

payment_status = Pending

shipping = 0.00

mc_gross = 3.33

custom =

charset = windows-1252

notify_version = 2.4

NOTE: If the transaction is for an authorization or an order, the auth_status variable may

also be set to Pending.

If a transaction has been pended, PayPal sends an IPN message when the payment has been

accepted or denied. The following example shows an IPN message indicating that a pended

transaction has been accepted:

38 July 10, 2012 IPN Guide

Page 39

Using Fraud Management Filters With IPN

txn_type = virtual_terminal

payment_date = 17:11:42 Jul 15, 2008 PDT

last_name =

receipt_id = 3075-7371-4622-1677

residence_country = US

item_name =

payment_gross = 3.33

mc_currency = USD

business = acqrte_1215804264_biz@gmail.com

payment_type = instant

verify_sign = AFcWxV21C7fd0v3bYYYRCpSSRl31AjcbYkD.VCCBmpD4lZq.yYTxBKkr

payer_status = unverified

test_ipn = 1

fraud_management_pending_filters_1 = Maximum Transaction Amount

tax = 0.00

txn_id = 5XN64179EB804362B

fraud_management_pending_filters_2 = Unconfirmed Address

quantity = 1

receiver_email = acqrte_1215804264_biz@gmail.com

first_name =

payer_id = PUWAJRBB8NM74

receiver_id = 2RXLTRMGT3M2G

item_number =

payment_status = Completed

payment_fee = 0.45

mc_fee = 0.45

shipping = 0.00

mc_gross = 3.33

custom =

charset = windows-1252

notify_version = 2.4

The following example shows an IPN message indicating that a pended transaction has been

denied:

IPN Guide July 10, 2012 39

Page 40

Using Fraud Management Filters With IPN

txn_type = virtual_terminal

payment_date = 17:09:40 Jul 15, 2008 PDT

last_name =

receipt_id = 0739-3836-3393-2098

residence_country = US

item_name =

payment_gross = 2.11

mc_currency = USD

business = acqrte_1215804264_biz@gmail.com

payment_type = instant

verify_sign = AFcWxV21C7fd0v3bYYYRCpSSRl31ASrKFBPwac7aQm47p8CMLrdParSt

payer_status = unverified

test_ipn = 1

fraud_management_pending_filters_1 = Maximum Transaction Amount

tax = 0.00

txn_id = 53R82724RM1848354

fraud_management_pending_filters_2 = Unconfirmed Address

quantity = 1

first_name =

receiver_email = acqrte_1215804264_biz@gmail.com

payer_id = PUWAJRBB8NM74

receiver_id = 2RXLTRMGT3M2G

item_number =

payment_status = Denied

shipping = 0.00

mc_gross = 2.11

custom =

charset = windows-1252

notify_version = 2.4

40 July 10, 2012 IPN Guide

Page 41

7

IPN Variable Reference

PayPal returns related variables for each kind of IPN message. Not all variables are returned

for each type of transaction.

IPN Transaction Types

Transaction and Notification-Related Variables

Buyer Information Variables

Payment Information Variables

Auction Variables

Mass Pay Variables

Recurring Payments Variables

Subscription Variables

Pay Message Variables

Preapproval Message Variables

Adaptive Accounts IPN Messages

Dispute Resolution Variables

IPN Transaction Types

Typically, your back-end or administrative processes will perform specific actions based on

the kind of IPN message received. You can use the txn_type variable in the message to

trigger the kind of processing you want to perform.

Transaction Type

(txn_type) Description

— Credit card chargeback if the case_type variable contains chargeback

adjustment A dispute has been resolved and closed

cart Payment received for multiple items; source is Express Checkout or the PayPal

Shopping Cart.

express_checkout Payment received for a single item; source is Express Checkout

masspay Payment sent using MassPay

mp_signup Created a billing agreement

merch_pmt Monthly subscription paid for PayPal Payments Pro

IPN Guide July 10, 2012 41

Page 42

IPN Variable Reference

Transaction and Notification-Related Variables

Transaction Type

(txn_type) Description

new_case A new dispute was filed

recurring_payment Recurring payment received

recurring_payment

_expired

recurring_payment

_profile_created

recurring_payment

_skipped

send_money Payment received; source is the Send Money tab on the PayPal website

subscr_cancel Subscription canceled

subscr_eot Subscription expired

subscr_failed Subscription payment failed

subscr_modify Subscription modified

subscr_payment Subscription payment received

subscr_signup Subscription started

virtual_terminal Payment received; source is Virtual Terminal

web_accept Payment received; source is a Buy Now, Donation, or Auction Smart Logos button

Recurring payment expired

Recurring payment profile created

Recurring payment skipped; it will be retried up to a total of 3 times, 5 days apart

Transaction and Notification-Related Variables

Transaction and notification-related variables identify the merchant that is receiving a

payment or other notification and transaction-spe cific information.

Variable Name Description

business Email address or account ID of the payment recipient (that is, the

merchant). Equivalent to the values of receiver_email (if payment is

sent to primary account) and business set in the Website Payment

HTML.

NOTE: The value of this variable is normalized to lowercase characters.

Length: 127 characters

charset Character set

custom Custom value as passed by you, the merchant. These are pass-through

variables that are never presented to your customer

Length: 255 characters

42 July 10, 2012 IPN Guide

Page 43

IPN Variable Reference

Buyer Information Variables

Variable Name Description

ipn_track_id Internal; only for use by MTS and DTS

notify_version Message’s version number

parent_txn_id In the case of a refund, reversal, or canceled reversal, this variable

contains the txn_id of the original transaction, while txn_id contains a

new ID for the new transaction.

Length: 19 characters

receipt_id Unique ID generated during guest checkout (payment by credit card

without logging in).

receiver_email Primary email address of the payment recipient (that is, the merchant). If

the payment is sent to a non-primary email address on your PayPal

account, the receiver_email is still your primary email.

NOTE: The value of this variable is normalized to lowercase characters.

Length: 127 characters

receiver_id Unique account ID of the payment recipient (i.e., the merchant). This is

the same as the recipient's referral ID.

Length: 13 characters

resend Whether this IPN message was resent (equals true); otherwise, this is the

original message.

residence_country ISO 3166 country code associated with the country of residence

Length: 2 characters

test_ipn Whether the message is a test message. It is one of the following values:

1 – the message is directed to the Sandbox

txn_id The merchant’s original transaction identification number for the payment

from the buyer, against which the case was registered.

txn_type The kind of transaction for which the IPN message was sent.

verify_sign Encrypted st ring used to validate the authenticity of the transaction

Buyer Information Variables

Buyer information identifies the buyer or initiator of a transaction by payer ID or email

address. Additional contact or shipping information may be provided.

Variable Name Description

address_country Country of customer’s address

Length: 64 characters

IPN Guide July 10, 2012 43

Page 44

IPN Variable Reference

Payment Information Var iables

Variable Name Description

address_city City of customer’s address

Length: 40 characters

address_country_code ISO 3166 country code associated with customer’s address

Length: 2 characters

address_name Name used with address (included when the customer provides a Gift

Address)

Length: 128 characters

address_state State of customer’s address

Length: 40 characters

address_status Whether the customer provided a confirmed address. It is one of the

following values:

confirmed – Customer provided a confirmed address.

unconfirmed – Customer provided an unconfirmed address.

address_street Customer’s street address.

Length: 200 characters

address_zip Zip code of customer’s address.

Length: 20 characters

contact_phone Customer’s telephone number.

Length: 20 characters

first_name Customer’s first name

Length: 64 characters

last_name Customer’s last name

Length: 64 characters

payer_business_name Customer’s company name, if customer is a business

Length: 127 characters

payer_email Customer’s primary email address. Use this email to provide any credits.

Length: 127 characters

payer_id Unique customer ID.

Length: 13 characters

Payment Information Variables

Payment information identifies the amount and status of a payment transaction, including fees.

Variable Name Description

auth_amount Authorization amount

44 July 10, 2012 IPN Guide

Page 45

IPN Variable Reference

Payment Information Variables

Variable Name Description

auth_exp Authorization expiration date and time, in the following format:

HH:MM:SS DD Mmm YY, YYYY PST

Length: 28 characters

auth_id Authorization identification number

Length: 19 characters

auth_status Status of authorization

echeck_time_processed The time an eCheck was processed; for example, when the status changes

to Success or Completed. The format is as follows: hh:mm:ss MM DD,

YYYY ZONE, e.g. 04:55:30 May 26, 2011 PDT.

exchange_rate Exchange rate used if a currency conversion occurred.

fraud_managment_pending_fil

ters_

x

One or more filters that identify a triggering action associated with one of

the following payment_status values: Pending, Completed, Denied,

where

x is a number starting with 1 that makes the IPN variable name

unique;

x is not the filter’s ID number. The filters and their ID numbers

are as follows:

invoice Passthrough variable you can use to identify your Invoice Number for this

purchase. If omitted, no variable is passed back.

Length: 127 characters

item_name

x Item name as passed by you, the merchant. Or, if not passed by you, as

entered by your customer. If this is a shopping cart transaction, PayPal

will append the number of the item (e.g., item_name1, item_name2,

and so forth).

Length: 127 characters

item_number

x Pass-through variable for you to track purchases. It will get passed back to

you at the completion of the payment. If omitted, no variable will be

passed back to you. If this is a shopping cart transaction, PayPal will

append the number of the item (e.g., item_number1, item_number2,

and so forth)

Length: 127 characters

mc_currency

For payment IPN notifications, this is the currency of the payment.

For non-payment subscription IPN notifications (i.e., txn_type=

signup, cancel, failed, eot, or modify), this is the currency of the

subscription.

For payment subscription IPN notifications, it is the currency of the

payment (i.e., txn_type = subscr_payment)

mc_fee Transaction fee associated with the payment. mc_gross minus mc_fee

equals the amount deposited into the receiver_email account.

Equivalent to payment_fee for USD payments. If this amount is

negative, it signifies a refund or reversal, and eit h er of those payment

statuses can be for the full or partial amount of the original transaction fee.

IPN Guide July 10, 2012 45

Page 46

IPN Variable Reference

Payment Information Var iables

Variable Name Description

mc_gross Full amount of the customer's payment, before transaction fee is

subtracted. Equivalent to payment_gross for USD payments. If this

amount is negative, it signifies a refund or reversal, and either of those

payment statuses can be for the full or partial amount of the original

transaction.

mc_gross_

x The amount is in the currency of mc_currency, where x is the shopping

cart detail item number. The sum of mc_gross_

x should total

mc_gross.

mc_handling Total handling amount associated with the transaction.

mc_shipping Total shipping amount associated with the transaction.

mc_shipping

x This is the combined total of shipping1 and shipping2 Website

Payments Standard variables, where

number. The shipping

x variable is only shown when the merchant

x is the shopping cart detail item

applies a shipping amount for a specific item. Because profile shipping

might apply, the sum of shipping

x might not be equal to shipping.

memo Memo as entered by your customer in PayPal Website Payments note

field.

Length: 255 characters

num_cart_items If this is a PayPal Shopping Cart transaction, number of items in cart.

option_name1 Option 1 name as requested by you. PayPal appends the number of the

item where

x represents the number of the shopping cart detail item (e.g.,

option_name1, option_name2).

Length: 64 characters

option_name2 Option 2 name as requested by you. PayPal appends the number of the

item where

x represents the number of the shopping cart detail item (e.g.,

option_name2, option_name2).

Length: 64 characters

option_selection1 Option 1 choice as entered by your customer.

PayPal appends the number of the item where

x represents the number of

the shopping cart detail item (e.g., option_selection1,

option_selection2).

Length: 200 characters

option_selection2 Option 2 choice as entered by your customer.

PayPal appends the number of the item where

x represents the number of

the shopping cart detail item (e.g., option_selection1,

option_selection2).

Length: 200 characters

payer_status Whether the customer has a verified PayPal account.

verified – Customer has a verified PayPal account.

unverified – Customer has an unverified PayPal account.

46 July 10, 2012 IPN Guide

Page 47

IPN Variable Reference

Payment Information Variables

Variable Name Description

payment_date Time/Date stamp generated by PayPal, in the following format:

HH:MM:SS Mmm DD, YYYY PDT

Length: 28 characters

payment_fee USD transaction fee associated with the payment. payment_gross

minus payment_fee equals the amount deposited into the receiver

email account. Is empty for non-USD payments. If this amount is

negative, it signifies a refund or reversal, and eit h er of those payment

statuses can be for the full or partial amount of the original transaction fee.

NOTE: This is a deprecated field. Use mc_fee instead.

payment_fee_

x If the payment is USD, then the value is the same as that for mc_fee_x,

where

x is the record number; if the currency is not USD, then this is an

empty string.

NOTE: This is a deprecated field. Use mc_fee_x instead.

payment_gross Full USD amount of the customer’s payment, before transaction fee is

subtracted. Will be empty for non-USD payments. This is a legacy field

replaced by mc_gross. If this amount is negative, it signifies a refund or

reversal, and either of those payment statuses can be for the full or partial

amount of the original transaction.

payment_gross_

x If the payment is USD, then the value for thi s is the same as that for the

mc_gross_

x, where x is the record number the mass pay item. If the

currency is not USD, this is an empty string.

NOTE: This is a deprecated field. Use mc_gross_x instead.

IPN Guide July 10, 2012 47

Page 48

IPN Variable Reference

Payment Information Var iables

Variable Name Description

payment_status The status of the payment:

Canceled_Reversal: A reversal has been canceled. For example, you

won a dispute with the customer, and the funds for the transaction that was

reversed have been returned to you.

Completed: The payment has been completed, and the funds have been

added successfully to your account balance.

Created: A German ELV paym ent is made using Express Checkout.

Denied: You denied the payment. This happens on ly if the paym ent was

previously pending because of possible reasons described for the

pending_reason variable or the Fraud_Management_Filters_

variable.

Expired: This authorization has expired and cannot be captured.

Failed: The payment has failed. This happens only if the payment was

made from your customer’s bank account.

Pending: The payment is pending. See pending_reason for more

information.

Refunded: You refunded the payment.

Reversed: A payment was reversed due to a chargeback or other type of

reversal. The funds have been removed from your account balance and

returned to the buyer. The reason for the reversal is specified in the

ReasonCode element.

Processed: A payment has been accepted.

Voided: This authorization has been voided.

x

payment_type echeck: This payment was funded with an eCheck.

instant: This payment was funded with PayPal balance, credit card, or

Instant Transfer.

48 July 10, 2012 IPN Guide

Page 49

IPN Variable Reference

Payment Information Variables

Variable Name Description

pending_reason This variable is set only if payment_status = Pending.

address: The payment is pending because your customer did not include

a confirmed shipping address and your Payment Receiving Preferences is

set yo allow you to manually accept or deny each of these payments. To

change your preference, go to the Preferences section of your Profile.

authorization: You set the payment action to Authorization and have

not yet captured funds.

echeck: The payment is pending because it was made by an eCheck that

has not yet cleared.

intl: The payment is pending because you hold a non-U.S. account and

do not have a withdrawal mechanism. You must manually accept or deny

this payment from your Account Overview.

multi-currency: You do not have a balance in the currency sent, and

you do not have your Payment Receiving Preferences set to

automatically convert and accept this payment. You must manually accept

or deny this payment.

order: You set the payment action to Order and have not yet captured

funds.

paymentreview: The payment is pending while it is being reviewed by

PayPal for risk.

unilateral: The payment is pending because it was made to an email

address that is not yet registered or confirmed.

upgrade: The payment is pending because it was made via credit card

and you must upgrade your account to Business or Premier status in order

to receive the funds. upgrade can also mean that you have reached the

monthly limit for transactions on your account.

verify: The payment is pending because you are not yet verified. You

must verify your account before you can accept this payment.

other: The payment is pending for a reason other than those listed above.

For more information, contact PayPal Customer Service.

protection_eligibility ExpandedSellerProtection: Seller is protected by Expanded seller

protection

SellerProtection: Seller is protected by PayPal’s Seller Protection

Policy

None: Seller is not protected under Expanded seller protection nor the

Seller Protection Policy

quantity Quantity as entered by your customer or as passed by you, the merchant .

If this is a shopping cart transaction, PayPal appends the number of the

item (e.g. quantity1, quantity2).

IPN Guide July 10, 2012 49

Page 50

IPN Variable Reference

Auction Variables

Variable Name Description

reason_code This variable is set if payment_status =Reversed, Refunded, or

Canceled_Reversal.

adjustment_reversal: Reversal of an adjustment

buyer-complaint: A reversal has occurred on this transaction due to a

complaint about the transaction from your customer.

chargeback: A reversal has occurred on this transaction due to a

chargeback by your customer.

chargeback_reimbursement: Reimbursement for a chargeback

chargeback_settlement: Settlement of a chargeback

guarantee: A reversal has occurred on this transaction due to your

customer triggering a money-back guarantee.

other: Non-specified reason.

refund: A reversal has occurred on this transaction because you have

given the customer a refund.

NOTE: Additional codes may be returned.

remaining_settle Remaining amount that can be captured with Authorization and Capture

settle_amount Amount that is deposited into the account’s primary balance after a

currency conversion from automatic conversion (through your Payment

Receiving Preferences) or manual conversion (through manually

accepting a payment).

settle_currency Currency of settle_amount.

shipping Shipping charges associated with this transaction.

Format: unsigned, no currency symbol, two decimal places.

shipping_method The name of a shipping method from the Shipping Calculations section of

the merchant's account profile. The buyer selected the named shipping

method for this transaction.

tax Amount of tax charged on payment. PayPal appends the number of the

item (e.g., item_name1, item_name2). The tax

only if there was a specific tax amount applied to a particular shopping

cart item. Because total tax may apply to other items in the cart, the sum

of tax

x might not total to tax.

transaction_entity Authorization and Capture transaction entity

x variable is included

Auction Variables

Auction information identifies the auction for which a payment is made and additional

information about the auction.

50 July 10, 2012 IPN Guide

Page 51

IPN Variable Reference

Mass Pay Variables

Variable Name Description

auction_buyer_id The customer’s auction ID.

Length: 64 characters

auction_closing_date The auction’s close date, in the following format: HH:MM:SS DD Mmm

YY, YYYY PST

Length: 28 characters

auction_multi_item The number of items purchased in multi-item auction payments. It allows

you to count the mc_gross or payment_gross for the first IPN you

receive from a multi-item auction (auction_multi_item), since each

item from the auction will generate an Instant Payment Notification

showing the amount for the entire auction.

for_auction This is an auction payment—payments made using Pay for eBay Items or

Smart Logos—as well as Send Money/Money Request payments with the

type eBay items or Auction Goods (non-eBay).

Mass Pay Variables

Mass pay information identifies the amounts and status of transactions related to mass

payments, including fees.

Variable Name Description

masspay_txn_id_

mc_currency_

mc_fee_

mc_gross_

x For Mass Payments, the transaction fee associated with the payment,

x The gross amount for the amount, where x is the record number the mass

mc_handling

payment_date For Mass Payments, the first IPN is the date/time when the record set is

x For Mass Payments, a unique transaction ID generat ed by the PayPal

system, where

x is the record number of the mass pay item

Length: 19 characters

x For Mass Payments, the currency of the amount and fee, where x is the

record number the mass pay item

where

x is the record number the mass pay item

pay item

x The x is the shopping cart detail item number. The handling_cart cart-

wide Website Payments variable is also included in the mc_handling

variable; for this reason, the sum of mc_handling

x might not be equal to

mc_handling

processed. Format: HH:MM:SS DD Mmm YYYY PST

Length: 28 characters

IPN Guide July 10, 2012 51

Page 52

IPN Variable Reference

Recurring Payments Variables

Variable Name Description

payment_status Completed: For Mass Payments, this means that all of your payments

have been claimed, or after a period of 30 days, unclaimed payments have

been returned to you.

Denied: For Mass Payments, this means that your funds were not sent

and the Mass Payment was not initiated. This may have been caused by

lack of funds.

Processed: Your Mass Payment has been processed and all payments

have been sent.

reason_code This variable is only set if status = Failed.

1001: Invalid UserID.

1003: Country of Residence check failure

1004: Country of Funding Source check failure

receiver_email_

status_

unique_id_

x For Mass Payments, the status of the payment, where x is the record

x For Mass Payments, the primary email address of the payment recipient,

where

x is the record number of the mass pay item.

Length: 127 characters

number

Completed: The payment has been processed, regardless of whether this

was originally a unilateral payment

Failed: The payment failed because of insufficient PayPal balance.

Returned: Payment has been returned after 30 days.

Reversed: This is for unilateral payments that were not claimed after 30

days and have been returned to the sender. Or the funds have been

returned because the Receiver’s account was locked.

Unclaimed: This is for unilateral payments that are unclaimed.

x For Mass Payments, the unique ID from input, where x is the record

number. This allows the merchant to cross-reference the payment

Length: 13 characters

Recurring Payments Variables

Recurring payments information identifies the amounts and status associated with recurring

payments transactions.

Variable Name Description

amount Amount of recurring payment

amount_per_cycle Amount of recurring payment per cycle

initial_payment_amount Initial payment amount for recurring payments

next_payment_date Next payment date for a recurring payment

52 July 10, 2012 IPN Guide

Page 53

IPN Variable Reference

Recurring Payments Variables

Variable Name Description

outstanding_balance Outstanding balance for recurring payments

payment_cycle Payment cycle for recurring payments

period_type Kind of period for a recurring payment

product_name Product name associated with a recurring payment

product_type Product name associated with a recurring payment

profile_status Profile status for a recurring payment

recurring_payment_id Recurring payment ID

rp_invoice_id The merchant’s own unique reference or invoice number, which can be

used to uniquely identify a profile.

Length: 127 single-byte alphanumeric characters

time_created When a recurrng payment was created

IPN Guide July 10, 2012 53

Page 54

IPN Variable Reference

Recurring Payments Variables

Summary of recurring payment variables

Variables Profile created message Recurring payment mes sage

Basic Information

business X

receiver_email XX

receiver_id X

Transaction Information

payment_status X

payment_type X

payment_date X

txn_id X

initial_payment_status X

initail_payment_txn_id X

txn_type recurring_payment_profile_

created

Currency and Exchange

mc_gross X

mc_fee X

mc_currency X

payment_gross X

currency_code XX

payment_fee X

Buyer Information

first_name XX

last_name XX

address_name X

address_street X

address_city X

address_state X

recurring_payment

address_zip X

address_country X

payer_email XX

54 July 10, 2012 IPN Guide

Page 55

IPN Variable Reference

Subscription Variables

Variables Profile created message Recurring payment mes sage

payer_id XX

payer_status XX

residence_country XX

address_country_code X

address_status X

Recurring Payment

recurring_payment_id XX

rp_invoice_id XX

product_name XX

product_type XX

period_type XX

payment_cycle XX

outstanding_balance XX

amount_per_cycle XX

initial_payment_amount XX

profile_status XX

amount XX

time_created XX

next_payment_date XX

Other Information

notify_version XX

charset XX

Subscription Variables

Subscription information identifies the amounts and parameters associated with subscription

transactions.

Variable Name Description

amount1 Amount of payment for trial period 1 for USD payments; otherwise blank

(optional).

IPN Guide July 10, 2012 55

Page 56

IPN Variable Reference

Subscription Variables

Variable Name Description

amount2 Amount of payment for trial period 2 for USD payments; otherwise blank

(optional).

amount3 Amount of payment for regular subscription period for USD payments;

otherwise blank.

mc_amount1 Amount of payment for trial period 1, regardless of currency (optional).

mc_amount2 Amount of payment for trial period 2, regardless of currency (optional).

mc_amount3 Amount of payment for regular subscription period, regardless of

currency.

password (optional) Password generated by PayPal and given to subscriber to access

the subscription (password will be encrypted).

Length: 24 characters

period1 (optional) Trial subscription interval in days, weeks, months, years

(example: a 4 day interval is “period1: 4 D”).

period2 (optional) Trial subscription interval in days, weeks, months, or years.

period3 Regular subscription interval in days, weeks, mo nths, or years.

reattempt Indicates whether reattempts should occur upon payment failures (1 is

yes, blank is no).

recur_times The number of payment installments that will occur at the regular rate.

recurring Indicates whether regular rate recurs (1 is yes, blank is no).

retry_at Date PayPal will retry a failed subscription payment.

subscr_date Start date or cancellation date depending on whether transactio n is

subscr_signup or subscr_cancel.

Time/Date stamp generated by PayPal, in the following format:

HH:MM:SS DD Mmm YY, YYYY PST

subscr_effective Date when the subscription modification will be effective (only for

txn_type = subscr_modify).

Time/Date stamp generated by PayPal, in the following format:

HH:MM:SS DD Mmm YY, YYYY PST

subscr_id ID generated by PayPal for the subscriber.

Length: 19 characters

username (optional) Username generated by PayPal and given to subscriber to

access the subscription.

Length: 64 characters

56 July 10, 2012 IPN Guide

Page 57

IPN Variable Reference

Subscription Variables

Summary of subscription variables

Multi-

USD

Variable Signup Cancel Modify

Basic Information

business XXXX X XX

receiver_email XXXX X XX

receiver_id XX

item_name XXXX X XX

item_number XXXX X XX

Advanced and Custom Information

invoice XXXX X XX

custom XXXX X XX

option_name1 XXXX X XX

Payment

Currency

Payment

Refund Failed EOT

option_selecti

on1

option_name2 XXXX X XX

option_selecti

on2

Transaction Information

payment_status XX X

pending_reason XX

reason_code XX

payment_date XX

txn_id XX

parent_txn_id XX

txn_type subscr_

Currency and Exchange information

mc_gross XX

mc_fee XX

XXXX X XX

XXXX X XX

signup

subscr_

cancel

subscr_

modify

subscr_payment subscr_

failed

subsc

r_eot

mc_currency XXXX X XX

settle_amount XX

exchange_rate XX

IPN Guide July 10, 2012 57

Page 58

IPN Variable Reference

Subscription Variables

Multi-

USD

Variable Signup Cancel Modify

payment_gross XXX

payment_fee X

Buyer Information

first_name XXXX X XX

last_name XXXX X XX

Payment

Currency

Payment

Refund Failed EOT

payer_business

_name

address_name XXXX X X

address_street XXXX X X

address_city XXXX X X

address_state XXXX X X

address_zip XXXX X X

address_

country

payer_email XXXX X XX

payer_id XXXX X XX

payer_status XXXX X XX

payment_type XX

Subscription Information

subscr_date XXX

subscr_

effective

XXXX X X

XXXX X X

X

period1 XXX

period2 XXX

period3 XXX

amount1 XXX

amount2 XXX

amount3 XXX

mc_amount1 XXX

mc_amount2 XXX

mc_amount3 XXX

58 July 10, 2012 IPN Guide

Page 59

IPN Variable Reference

Dispute Resolution Variables

Multi-

Variable Signup Cancel Modify

USD

Payment

Currency

Payment

Refund Failed EOT

recurring XXX

reattempt XXX

retry_at X

recur_times XXX

username XXXX X XX

password XXXX X XX

subscr_id XXXX X XX

Dispute Resolution Variables

Dispute resolution information identifies the case ID and status associated with a dispute.

Variable Name Description

case_creation_date Date and time case was registered, in the following format: HH:MM:SS

DD Mmm YY, YYYY PST

case_id Case identification number.

Format: PP-nnn-nnn-nnn-nnn where n is any numeric character.

case_type