Page 1

Express Checkout for

Payflow Pro

Last updated: October 2009

Page 2

Express Checkout for Payflow Pro

Document Number: 200042.en_US-200910

© 2009 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal (Europe) S.à r.l. et Cie., S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard

Royal, L-2449, Luxembourg, R.C.S. Luxembourg B 118 349.

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resultin g from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Related Documentation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

How to Contact Customer Support. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Document History . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Chapter 1 Express Checkout Processing Flow. . . . . . . . . . . . . 9

What Is Express Checkout? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

How Express Checkout Works. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Express Checkout Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Express Checkout ACTION Values . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Express Checkout Token . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Express Checkout Sale Transaction Example . . . . . . . . . . . . . . . . . . . . . . . . 12

Set Express Checkout (ACTION=S). . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Redirecting the Buyer to PayPal . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Get Express Checkout Details (ACTION=G) . . . . . . . . . . . . . . . . . . . . . . 14

Redirecting the Buyer to Your Website . . . . . . . . . . . . . . . . . . . . . . . . . 15

Do Express Checkout Payment (ACTION=D). . . . . . . . . . . . . . . . . . . . . . 15

Other Express Checkout Concepts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Obtaining the Buyer’s Telephone Numbe r During Checkout . . . . . . . . . . . . . . 16

Eliminating Your Order Review Page . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Pending Responses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Chapter 2 Billing Agreements and Reference Transactions . . . . . .19

About Reference Transactions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

About Billing Agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

About Billing Types. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Ways To Obtain a BAID . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Obtaining the BAID With Express Checkout Purchase . . . . . . . . . . . . . . . . . . . 21

Example of Obtaining the BAID With Express Checkout Purchase . . . . . . . . . . . 24

Obtaining the BAID Without Express Checkout Purchase. . . . . . . . . . . . . . . . . . 25

Example of Obtaining the BAID Without Express Checkout Purchase . . . . . . . . . 28

Express Checkout for Payflow Pro 3

Page 4

Contents

Updating a Billing Agreement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Example of Updating a Billing Agreement . . . . . . . . . . . . . . . . . . . . . . . . 29

Using Reference Transactions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Reference Transaction Request Passing the BAID . . . . . . . . . . . . . . . . . . . 30

Reference Transaction Request Passing the PNREF Value as ORIGID . . . . . . . . 31

Chapter 3 Express Checkout Transaction Types . . . . . . . . . . . .33

Honor Period and Authorization Period . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Payment Transaction Types . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Order. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Do Reauthorization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Do Authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Delayed Capture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Complete Capture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Partial Capture. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Void . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

Chapter 4 Transaction Responses . . . . . . . . . . . . . . . . . . .41

Response Parameters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

Address Verification Service Responses From PayPal . . . . . . . . . . . . . . . . . . . 42

Card Security Code Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

Normalized Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

PayPal Card Security Code Results. . . . . . . . . . . . . . . . . . . . . . . . . . . 44

PNREF Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

PNREF Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

RESULT Values and RESPMSG Text . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

RESULT Values for Transaction Declines or Errors . . . . . . . . . . . . . . . . . . . 45

Chapter 5 Express Checkout Testing . . . . . . . . . . . . . . . . .51

Testing Your Integration Using the Sandbox. . . . . . . . . . . . . . . . . . . . . . . . . 51

Create A Business Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Create a Payflow Test Account . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Link Your Payflow Pro Account to the Sandbox . . . . . . . . . . . . . . . . . . . . . 52

4 Express Checkout for Payflow Pro

Page 5

Contents

Testing Your Integration Using the PayPal Simulator . . . . . . . . . . . . . . . . . . . . 53

Appendix A Express Checkout Parameter Reference . . . . . . . . . .55

Connection Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

User Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

Express Checkout Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . 57

Set Express Checkout Request Parameter Descriptions . . . . . . . . . . . . . . . . 57

Set Express Checkout Response Parameter Descriptions . . . . . . . . . . . . . . . 63

Get Express Checkout Details Request Parameter Descriptions . . . . . . . . . . . . 64

Get Express Checkout Details Response Parameter Descriptions . . . . . . . . . . . 64

Do Express Checkout Payment Request Parameter Descriptions . . . . . . . . . . . 68

Do Express Checkout Payment Response Parameter Descriptions . . . . . . . . . . 72

Do Authorization Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . 74

Do Reauthorization Parameter Descriptions. . . . . . . . . . . . . . . . . . . . . . . . . 75

Void Parameter Descriptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Credit Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Delayed Capture Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Billing Agreement Parameter Descriptions. . . . . . . . . . . . . . . . . . . . . . . . . . 78

Create Customer Billing Agreement Request Parameters . . . . . . . . . . . . . . . 78

Create Customer Billing Agreement Response Parameters. . . . . . . . . . . . . . . 79

Update Customer Billing Agreement Request Parameters . . . . . . . . . . . . . . . 79

Update Customer Billing Agreement Response Parameters . . . . . . . . . . . . . . 80

Reference Transaction Parameter Descriptions . . . . . . . . . . . . . . . . . . . . . . . 81

Reference Transaction Request Parameters . . . . . . . . . . . . . . . . . . . . . . 81

Reference Transaction Response Parameters . . . . . . . . . . . . . . . . . . . . . 85

Appendix B Currency Codes . . . . . . . . . . . . . . . . . . . . . . .87

Appendix C Country Codes . . . . . . . . . . . . . . . . . . . . . . . 89

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .95

Express Checkout for Payflow Pro 5

Page 6

Contents

6 Express Checkout for Payflow Pro

Page 7

Preface

Intended Audience

This guide assumes that its readers:

z Are experienced web or application developers

z Have a background in payments services

z Are developing payment services applications that are integrating Express Checkout to

process transactions to be sent over the Payflow gateway

Related Documentation

For additional information on Payflow documentation and the Payflow SDK, go to

http://www.paypal.com/developer, select Documentation from the Library tab, and click the

Payflow Pro link.

How to Contact Customer Support

For problems with transaction processing or your connection to the server, contact Customer

Support by opening a ticket on the under Contact Support tab at

Document History

TABLE 3.1 Document history

Date Description

October 2009 Updated currency codes.

http://www.paypal.com/mts.

Express Checkout for Payflow Pro 7

Page 8

Document History

T

ABLE 3.1 Document history

Date Description

August 2009 Revised and updated.

Added reference transactions and

type.

Revised billing agreements.

Removed PayPal Button Placement.

Added “Eliminating Y our Order Review Page” to Chapter 1, “Express

Checkout Processing Flow.”

RecurringPayments billing

June 2009 Added

May 2009 Updated to correct for technical inaccuracies.

April 2009 Added creating billing agreements for setting up Recurring Payments

SHIPTONAME parameter .

through Express Checkout.

Added order line-item details parameters.

Updated with

PHONENUM parameter in Set Express Checkout request.

8 Express Checkout for Payflow Pro

Page 9

Express Checkout Processing

1

Flow

This chapter describes Express Checkout processing:

z “What Is Express Checkout?” on page 9

z “How Express Checkout Works” on page 9

z “Express Checkout Flow” on page 11

z “Express Checkout Sale Transaction Example” on page 12

z “Other Express Checkout Concepts” on page 16

What Is Express Checkout?

Express Checkout is PayPal’s method of payment. It offers your buyers an easy, convenient

checkout experience by letting them use shipping and billing information stored securely at

PayPal to check out, so they don’t have to re-enter it on your website.

Like other Payflow transactions, Express Checkout transaction requests send data as namevalue pair parameters, and include this basic set of required parameters:

z Connection parameters

z User parameters

z Transaction type (TRXTYPE) such as Sale (TRX TYPE=S), Authorization (TRXTYPE=A), or

Order (TRXTYPE=0)

z Tender type, which is always PayPal (TENDER =P)

How Express Checkout Works

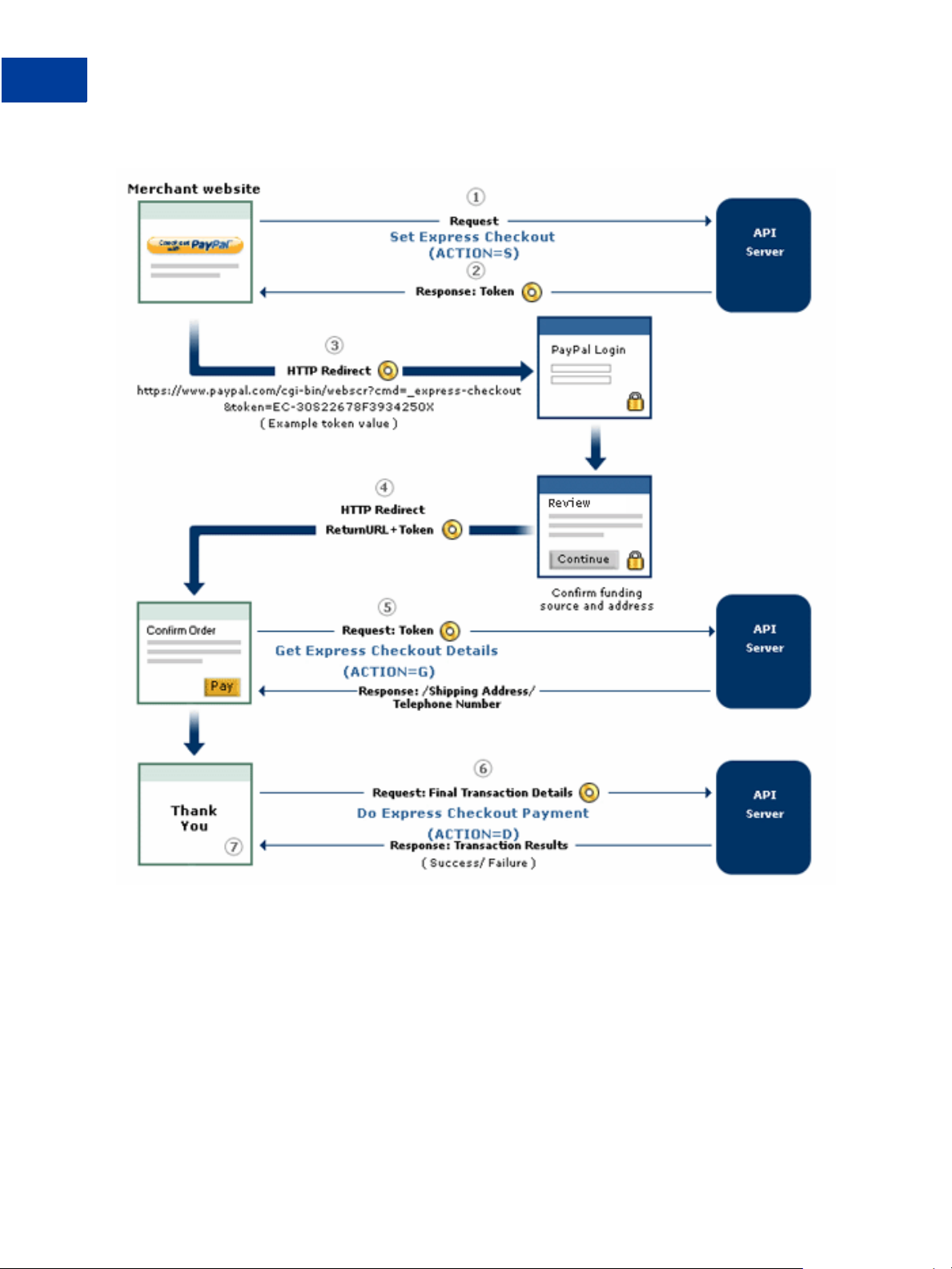

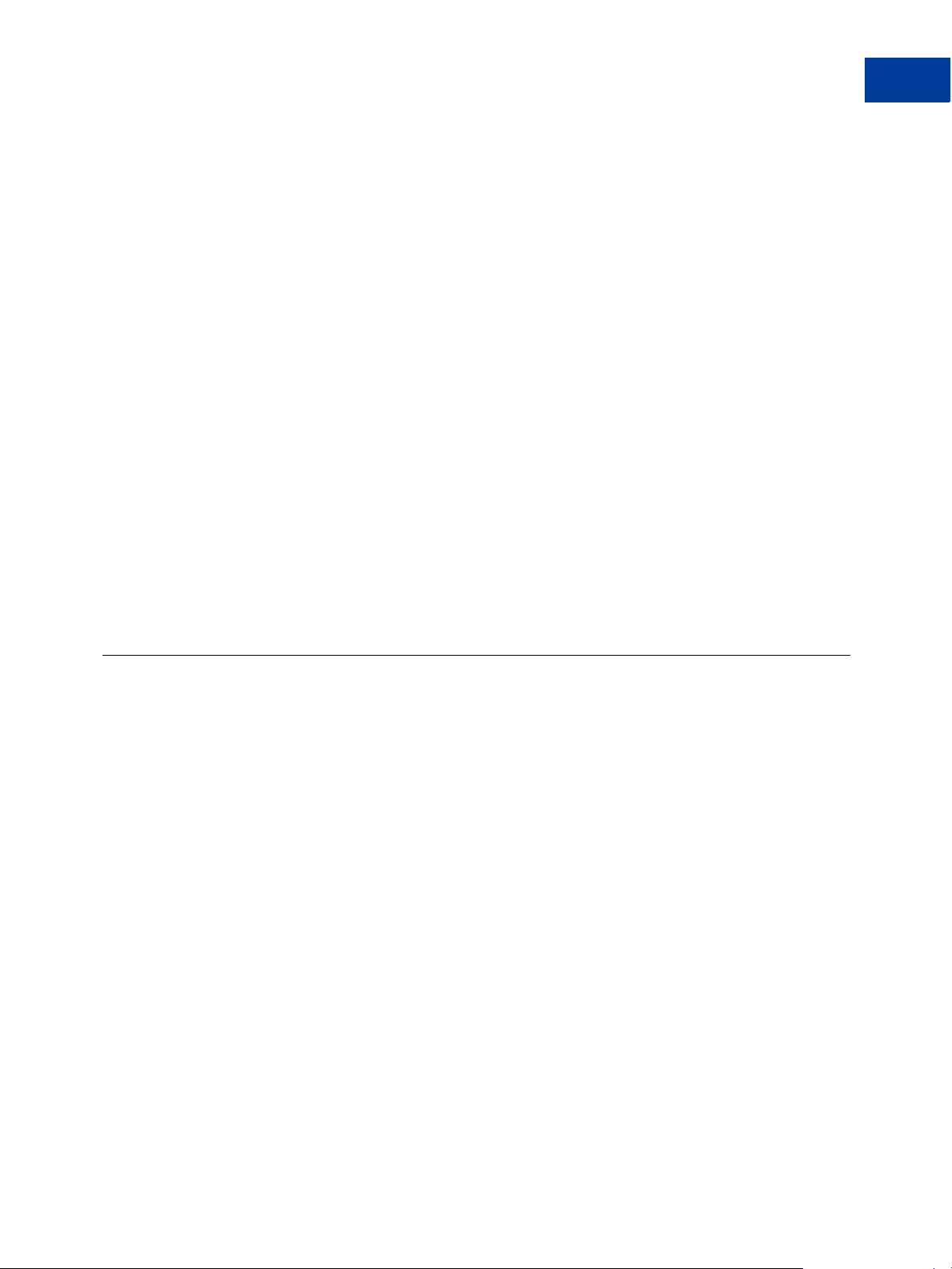

The figure below summarizes the Express Checkout flow.

Express Checkout for Payflow Pro 9

Page 10

Express Checkout Processing Flow

1

How Express Checkout Works

FIGURE 1.1 Exp ress Checko ut flow

The figure shows a typical set of web pages representing a merchant’s website. (The web page

layout may differ somewhat from your own web design.) The buyer uses the PayPal logo to

choose PayPal as their method of payment. Express Checkout gives you the flexibility to place

the PayPal logo at two points in the checkout flow:

z On your Shopping Cart page at the start of checkout, as shown

z On your Payment Methods page with other billing options

The numbered callouts in the figure correspond to the numbered events described below.

10 Express Checkout for Payflow Pro

Page 11

Express Checkout Processing Flow

Express Checkout Flow

1. On your website, your buyer checks out either by clicking the Check out with PayPal

button from your Shopping Cart page (as shown in the figure layout) or by selecting PayPal

from your Payment Methods page. This buyer action triggers the call to the Set Express

Checkout request.

2. The server responds to the request by returning a token or string value to your website. In

the figure above, the token is represented by an orange “donut.” The token keeps track of

your buyer throughout the checkout process.

3. You direct your buyer to the PayPal site, where they log in, select a funding source, and

confirm contact and shipping information. Express Checkout includes parameters that you

can use to customize the PayPal pages so they match characteristics of your own website.

For example, you can provide your own logo and colors.

4. When your buyer clicks the Continue button, PayPal sends the buyer back to your site at

the return URL you specified in the Set Express Checkout request. The token is appended

to the URL to identify the buyer.

5. Optionally you can send the Get Express Checkout Details request to obtain details about

your buyer such as the buyer’s telephone number and shipping address. You send the token

to identify the buyer. The server returns the requested information.

1

6. When your buyer clicks the Pay button, you send the Do Express Checkout Payment

request to perform the actual payment transaction.

7. The server returns the transaction result.

Express Checkout Flow

Through a set of name-value pair parameters, you provide Express Checkout transaction data

to the server. The server responds with RESULT and RESPMSG values, along with other

response parameter data about the transaction.

Unlike most Payflow Pro transactions, which consist of a single request call, Express

Checkout is a three-step process where the second step is optional:

1. Set Express Checkout sets up the data about the transaction and controls what is displayed

to the buyer on the PayPal site when the buyer chooses PayPal at checkout.

2. Get Express Checkout Details is an optional request enabling you to obtain information

about the transaction for display on your own website.

3. Do Express Checkout Payment performs the actual money transfer.

This guide refers to this request sequence and the resulting buyer experience as the Express

Checkout flow.

Express Checkout for Payflow Pro 11

Page 12

Express Checkout Processing Flow

1

Express Checkout Sale Transaction Example

Express Checkout ACTION Values

To identify each request in the Express Checkout flow, you pass the appropriate ACTION

parameter. The table below shows the value of

TABLE 1.1 ACTION values for Exp ress Che ckout

Request ACTION value

Set Express Checkout ACTION=S

Get Express Checkout Details ACTION=G

Do Express Checkout Payment ACTION=D

Express Checkout Token

The TOKEN value returned in the response to Set Express Checkout associates the buyer with

this particular Express Checkout flow. You pass it back to the server in these Express

Checkout requests:

ACTION for each Express Checkout request.

z In the HTTP request to redirect the buyer’s browser to the PayPal web site

z In the Get Express Checkout Details request to obtain the buyer’s shipping information

z In the Do Express Checkout Payment request to carry out the transaction

Express Checkout Sale Transaction Example

This section describes the Express Checkout flow in greater detail using a Sale transaction as

the example. See Appendix A, “Express Checkout Parameter Reference,” for detailed

descriptions of all required and optional Express Checkout transaction parameters.

z Set Express Checkout (ACTION=S)

z Redirecting the Buyer to PayPal

z Get Express Checkout Details (ACTION=G)

z Redirecting the Buyer to Your Website

z Do Express Checkout Payment (ACTION=D)

Set Express Checkout (ACTION=S)

The Set Express Checkout request passes the transaction details from your website to PayPal

when a buyer chooses to pay with PayPal.

Set Express Checkout requires that you pass data for the following parameters.

z ACTION

z AMT

12 Express Checkout for Payflow Pro

Page 13

Express Checkout Processing Flow

Express Checkout Sale Transaction Example

z RETURNURL

z CANCELURL

This is an example Set Express Checkout request for a Sale transaction:

TRXTYPE=S

&ACTION=S

AMT=35.00

&CANCELURL=http://www.order_pa ge.com

&CUSTOM=TRVV14459

&EMAIL=buyer_name@abc.com

&PARTNER=partner

&PWD=password

&RETURNURL=http://www.confirma tion_page.com

&TENDER=P

&USER=user

&VENDOR=vendor

NOTE: It is strongly recommended that RETURNURL be the URL of the final review page on

your website where the buyer confirms the order and payment. Likewise, CANCELURL

should be the URL of the original page on your website where the buyer initially chose

to use PayPal.

1

This is a response to the request:

RESULT=0

&RESPMSG=Approved

&TOKEN=EC-17C76533PL706494P

RESULT and RESPONSE values are returned with all transactions. In a successful response, the

value of RESULT is 0. For details on the set of response parameters generally passed back in

transactions, see Chapter 4, “Transaction Responses.” The TOKEN value returned associates

this buyer with this particular Express Checkout flow.

Redirecting the Buyer to PayPal

After your buyer clicks the PayPal button and you submit the Set Express Checkout request,

you will want to automatically direct your buyer to the PayPal website. The redirect URL for

this is:

https://www.paypal.com/cgi-bin /webscr?cmd=_expre ss-checkout&token=<TO KEN>

TOKEN is the value returned in the Set Express Checkout response.

NOTE: Express Checkout has a variation on this redirect URL (called useraction) that

allows you to bypass the call to Get Express Checkout Details and to change the text of

the button displayed on the PayPal website from “Continue” to “Pay Now.” For more

information, see “Eliminating Your Order Review Page” on page 17.

PayPal recommends that you use the HTTPS response 302 “Object Moved” with your URL as

the value of the Location header in the HTTPS response. Alternately, you can generate a web

page for your buyer that includes a META REFRESH tag in the header. An example is shown

Express Checkout for Payflow Pro 13

Page 14

Express Checkout Processing Flow

1

Express Checkout Sale Transaction Example

below. Remember to replace <TOKEN> with the token value that you received in the Set

Express Checkout response.

The following example uses the META REFRESH tag.

<html>

<head>

<META HTTP-EQUIV="Refresh"CONTE NT="0;URL=https://w ww.paypal.com/cgibin/webscr?cmd=_express-checko ut&token=<TOKEN>">

</head>

<body>

<!-- Most buyers will see the text below for les s than a second. -->

<!-- Some browser types (examp le, cell phone)do not support META refr esh tags. -->

<a href="https://www.paypal.com/cg i-bin/webscr?cmd=_exp resscheckout&token=<TOKEN>"Click h ere if you are not redirected to PayPal within 5

seconds.</a>

</body>

</html>

Get Express Checkout Details (ACTION=G)

The Get Express Checkout Details request enables you to retrieve the buyer’s billing

information, such as the shipping address and email address. If you use Get Express Checkout

Details, you need to pass data for these parameters.

z ACTION

z TOKEN

The following is an example Get Express Checkout Details request:

TRXTYPE=S

&VENDOR=vendor

&USER=user

&PWD=pwd

&TENDER=P

&PARTNER=partner

&ACTION=G

&TOKEN=EC-17C76533PL706494P

The following is the Get Express Checkout Details response:

14 Express Checkout for Payflow Pro

Page 15

RESULT=0

&RESPMSG=Approved

&AVSADDR=Y

&TOKEN=EC-17C76533PL706494P

&PAYERID=FHY4JXY7CV9PG

&EMAIL=buyer_name@aol.com

&PAYERSTATUS=verified

&FIRSTNAME=J

&LASTNAME=Smith

&CUSTOM=TRVV14459

&BUSINESS=Monroe Creek Regiona l Interiors

&SHIPTONAME=J Smith

&SHIPTOSTREET=5262 Green Stree t #8

&SHIPTOCITY=San Jose

&SHIPTOSTATE=CA

&SHIPTOZIP=95148

&SHIPTOCOUNTRY=US

Redirecting the Buyer to Your Website

Express Checkout Processing Flow

Express Checkout Sale Transaction Example

1

PayPal redirects the buyer back to your website at the location you specified in the

RETURNURL parameter to Get Express Checkout request. To the URL string, PayPal appends

the TOKEN and PAYERID name-value pairs, as shown below:

http://[RETURNURL]/?token=<TOK EN>&PayerID=<PAYER ID>

You need to pass the PAYERID in the Do Express Checkout Payment request.

Do Express Checkout Payment (ACTION=D)

The Do Express Checkout Payment request performs the actual money transfer of the Sale

transaction.

Do Express Checkout Payment request requires that you pass data for these parameters.

z ACTION

z TOKEN

z PAYERID

z AMT

The following is an example Do Express Checkout Payment request:

Express Checkout for Payflow Pro 15

Page 16

Express Checkout Processing Flow

1

Other Express Checkout Concepts

TRXTYPE=S

&VENDOR=vendor

&USER=user

&PWD=pwd

&TENDER=P

PARTNER=partner

&ACTION=D

&TOKEN=EC-17C76533PL706494P

&PAYERID=FHY4JXY7CV9PG

&AMT=35.00

The following is an example response:

RESULT=0

&PNREF=EFHP0CDBF5C7

&RESPMSG=Approved

&AVSADDR=Y

&TOKEN=EC-17C76533PL706494P

&PAYERID=FHY4JXY7CV9PG

&PPREF=2P599077L3553652G

&PAYMENTTYPE=instantonly

The response returns a 12-character PNREF (Payflow Transaction ID) that is used to identify

this transaction in PayPal reports.

Other Express Checkout Concepts

The following topics are related to processing Express Checkout transactions.

z “Obtaining the Buyer’s Telephone Number During Checkout” on page 16

z “Pending Responses” on page 17

z “Eliminating Your Order Review Page” on page 17

Obtaining the Buyer’s Telephone Number During Checkout

You have three options regarding the buyer’s contact telephone number. You can choose to:

z Not request the contact telephone number (default)

z Request the contact telephone number as an optional field

z Require that the buyer enter their contact telephone number to proceed.

If you choose to require the buyer provide a telephone number, a telephone number displays in

the Contact Information on the PayPal Review page during checkout. Help text tells the buyer

how to change the number displayed to their own number.

To choose one of the three preceding options:

1. Log in to your PayPal account.

16 Express Checkout for Payflow Pro

Page 17

2. From the Profile tab, click Website Payments Preferences.

3. Choose from the three options for handling the contact telephone number at the bottom of

the page.

Eliminating Your Order Review Page

You can make checkout appear to complete on the PayPal website rather than on your own

and, therefore, eliminate the need for an Order Review page on your site. (Of course, when the

buyer returns from PayPal, you still call the Do Express Checkout Payment request to

complete the transaction.) In this situation, you would want the button text on the PayPal

Review page to appear as “Pay Now” rather than “Continue.”

You control the button text through the value of the useraction variable. You set this

variable on the PayPal URL to which you redirect the buyer after calling Set Express

Checkout.

NOTE: As a best practice, you should incorporate the “Pay Now” button text in the Express

Checkout flow that redirects the buyer to PayPal from your shopping cart at the start of

checkout.

Express Checkout Processing Flow

Other Express Checkout Concepts

1

Values and resulting button text are described below:

z If you do not set useraction or you set useraction to continue, PayPal displays the

button text “Continue.”

z If you set useraction to commit, PayPal displays the button text “Pay Now.”

To display the “Pay Now” button text, for example, append &useraction=commit to the

redirect URL string as shown below where tokenvalue is the token value returned in the Set

Express Checkout response.

"https://www.paypal.com/cgi-bi n/webscr?cmd=_expr esscheckout&token=tokenvalue&user action=commit"

Pending Responses

If the Do Express Checkout Payment PENDINGREASON response is a value other than none or

completed, the payment is pending. T ypically, this means the buyer has paid with an eCheck.

In such a case, funds are not guaranteed, and you should not ship or deliver items or services

until the payment has successfully completed.

NOTE: PayPal recommends that you block eChecks as a payment method in your PayPal

account profile if you are unable to handle pending st ate payments.

To find out the status of a pending payment, you can:

z Submit an Inquiry transaction.

z Check the status from the PayPal User Interface. See PayPal online help for details.

Express Checkout for Payflow Pro 17

Page 18

Express Checkout Processing Flow

1

Other Express Checkout Concepts

18 Express Checkout for Payflow Pro

Page 19

2

Billing Agreements and Reference Transactions

This chapter describes how you can automatically bill a buyer’s PayPal account based on

buyer information you obtained in a previous transaction. To perform this type of transaction

you first must obtain a billing agreement between you and the buyer.

z “About Reference Transactions” on page 19

z “About Billing Agreements” on page 20

z “Wa ys To Obtain a BAID” on page 20

z “Obtaining the BAID With Express Checkout Purchase” on page 21

z “Obtaining the BAID Without Express Checkout Purchase” on page 25

z “Updating a Billing Agreement” on page 29

z “Using Reference Transactions” on page 30

IMPORTANT: You must be enabled by PayPal to use reference transactions. Contact

PayPal for details.

About Reference Transactions

A reference transaction takes existing billing information already gathered from a previously

authorized transaction and reuses it to charge the buyer in a subsequent transaction.

Before you can use a reference transaction, you must set up a billing agreement with the buyer .

(See About Billing Agreements.) When you obtain the billing agreement, you can withdraw

funds from the buyer’s PayPal account without manual intervention using a reference

transaction. You can only use reference transactions with Authorization or Sale transactions

(TRXTYPE is A or S).

To enable line-item support in reference transactions, which includes the parameters below,

you must contact Merchant Technical Support at

z L_NAMEn

z L_DESCn

z L_COSTn

z L_TAXAMTn

z L_QTYn

http://www.paypal.com/mts:

Express Checkout for Payflow Pro 19

Page 20

Billing Agreements and Reference Transactions

2

About Billing Agreements

About Billing Agreements

A billing agreement allows PayPal to withdraw funds from the buyer’s PayPal account

without requiring the buyer to log in to PayPal. Billing agreements are maintained by PayPal.

You must establish a billing agreement with a buyer if, for example, you and the buyer agree

that you will bill that buyer on a regularly scheduled basis such as monthly for a magazine

subscription. Before a billing agreement can take effect, the buyer must log in to PayPal once

to consent to it. With buyer consent, PayPal creates a billing agreement ID (BAID) to

represent the agreement. You pass the BAID in subsequent requests to bill the buyer. PayPal

withdraws funds without requiring the buyer to log in. A billing agreement is good until you or

the buyer cancels it.

A buyer may have multiple magazine subscriptions, each with a separate billing agreement. In

such cases, be sure to associate each transaction with the correct billing agreement.

About Billing Types

To specify how the buyer will be billed, you set the billing type in the call to Set Express

Checkout. Table 2.1describes the values of this parameter:

TABLE 2.1 Billing type values

Value Description

MerchantInitiatedBilling Use to obtain a

billing the buyer one or more times, call Do Express Checkout

Payment outside the Express Checkout flow and pass the BAID

to bill the buyer.

RecurringBilling Use to obtain a

bill the buyer on a recurring basis. See the Payflow Pro

Recurring Billing Service User’s Guide for details on using the

BAID to create a recurring billing profile.

RecurringPayments Use to obtain a

to bill the buyer on a recurring basis.

NOTE: This billing type does not create a BAID. See Website

Payments Pro Payflow Edition - Recurring Payments

Developer’s Guide for details on using this billing type

value to create a Recurring Payments profile.

BAID in the Express Checkout flow. To initiate

BAID for creating a recurring billing profile to

TOKEN for creating a recurring payments profile

Ways To Obtain a BAID

You can obtain a BAID whether or not the buyer logs in to PayPal to make a purchase. The

following sections describe how.

20 Express Checkout for Payflow Pro

Page 21

Billing Agreements and Reference Transactions

Obtaining the BAID With Express Checkout Purchase

z When the buyer is making a purchase

Say that you have implemented Express Checkout on your website. The buyer logs in to

purchase an item of merchandise and chooses PayPal to pay for it. In the normal Express

Checkout flow, the buyer is then redirected to PayPal to log in to verify their billing

information. If the buyer approves payment on the PayPal Review page, you receive the

billing agreement as part of the transaction.You can use that billing agreement later to bill the

buyer a set amount on a recurring basis, such as once-a-month, for future purchases. The buyer

doesn’t need to log into PayPal each time to make a payment.

z When the buyer is not making a purchase

Typically, the buyer chooses a billing agreement without making a purchase when they

subscribe for merchandise they will pay for on a recurring schedule. If, for example, the buyer

logs in to your website to order a magazine subscription, you set up an agreement to bill the

buyer on a scheduled basis—say, once a month. In the billing agreement flow without

purchase, the buyer is redirected to PayPal to log in. On the PayPal site, they consent to the

billing agreement. Next month, when you send the buyer the first magazine issue, the billing

agreement authorizes you to start charging the buyer’s PayPal account on the agreed upon

recurring basis without having the buyer log in to PayPal.

2

The following pages describe ways to obtain a BAID:

z “Obtaining the BAID With Express Checkout Purchase” on page 21

z “Obtaining the BAID Without Express Checkout Purchase” on page 25

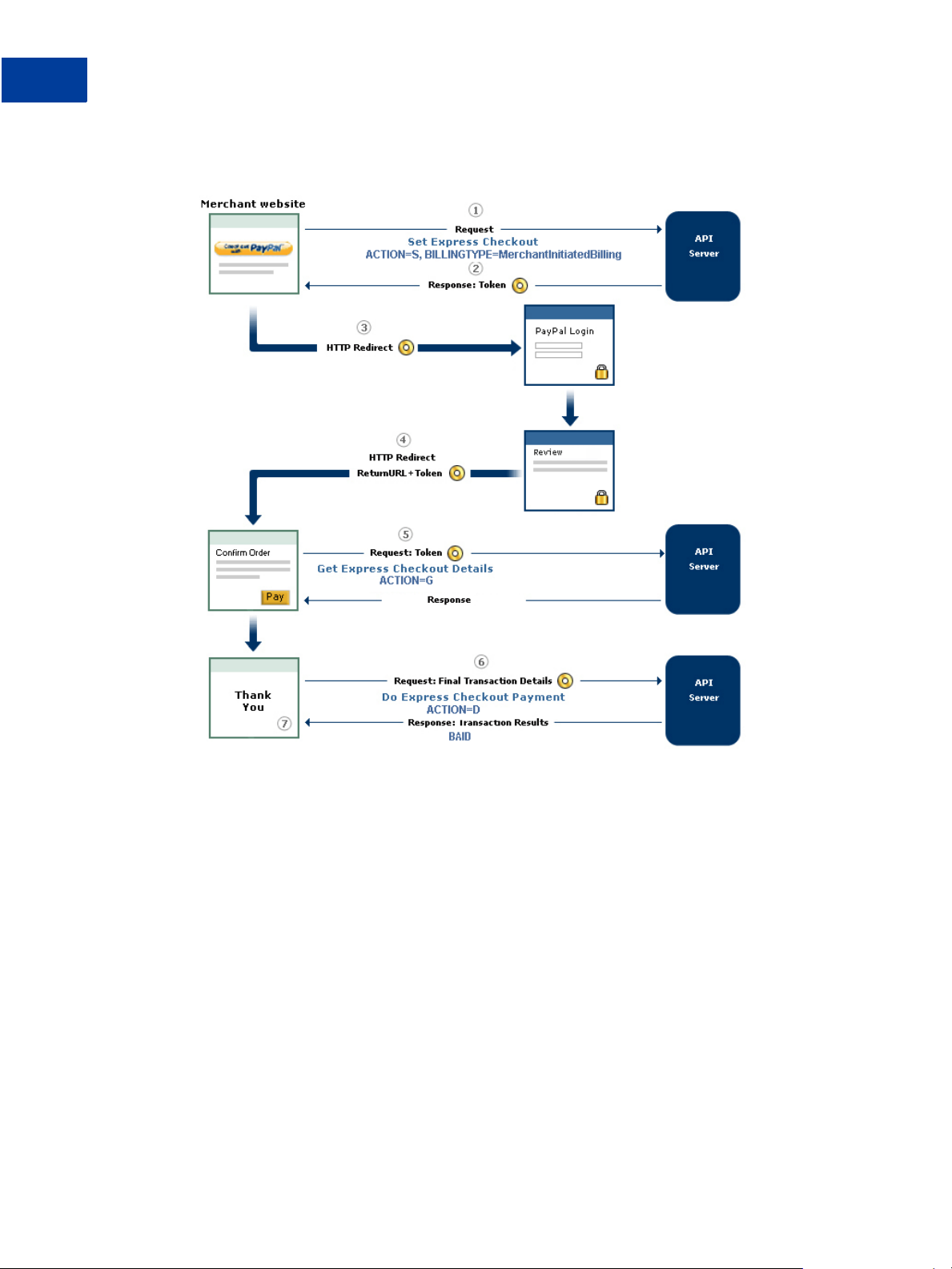

Obtaining the BAID With Express Checkout Purchase

To set up the billing agreement and obtain the BAID when the buyer makes an Express

Checkout purchase from your website, you need only provide additional parameters and

values in the Express Checkout calls. Figure 2.1 summarizes the flow.

Express Checkout for Payflow Pro 21

Page 22

Billing Agreements and Reference Transactions

2

Obtaining the BAID With Express Checkout Purchase

FIGURE 2.1 Obtaining the BAID with Express Checkout purchase

The message flow consists of the following comments, which correspond to the circled

numbers in Figure 2.1. The comments pertain specifically to setting up a billing agreement and

obtaining a BAID.

1. When the buyer chooses to set up a billing agreement, call the Set Express Checkout

request (ACTION=S) and pass the following information about the agreement:

– The billing type (required)

– A description of the goods or services associated with the agreement (optional)

– The type of PayPal payment you require (optional)

– A string for your use in any way (optional)

2. PayPal returns a TOKEN that you use in subsequent steps.

3. After the buyer clicks the PayPal button and you submit the Set Express Checkout request,

you will want to automatically direct your buyer to the PayPal website to log in or set up a

22 Express Checkout for Payflow Pro

Page 23

Billing Agreements and Reference Transactions

Obtaining the BAID With Express Checkout Purchase

PayPal account. The redirect URL for this is shown below. TOKEN is the value returned in

the Set Express Checkout response.

https://www.paypal.com/cgi-bin/webscr?c md=_expresscheckout&token=<TOKEN>

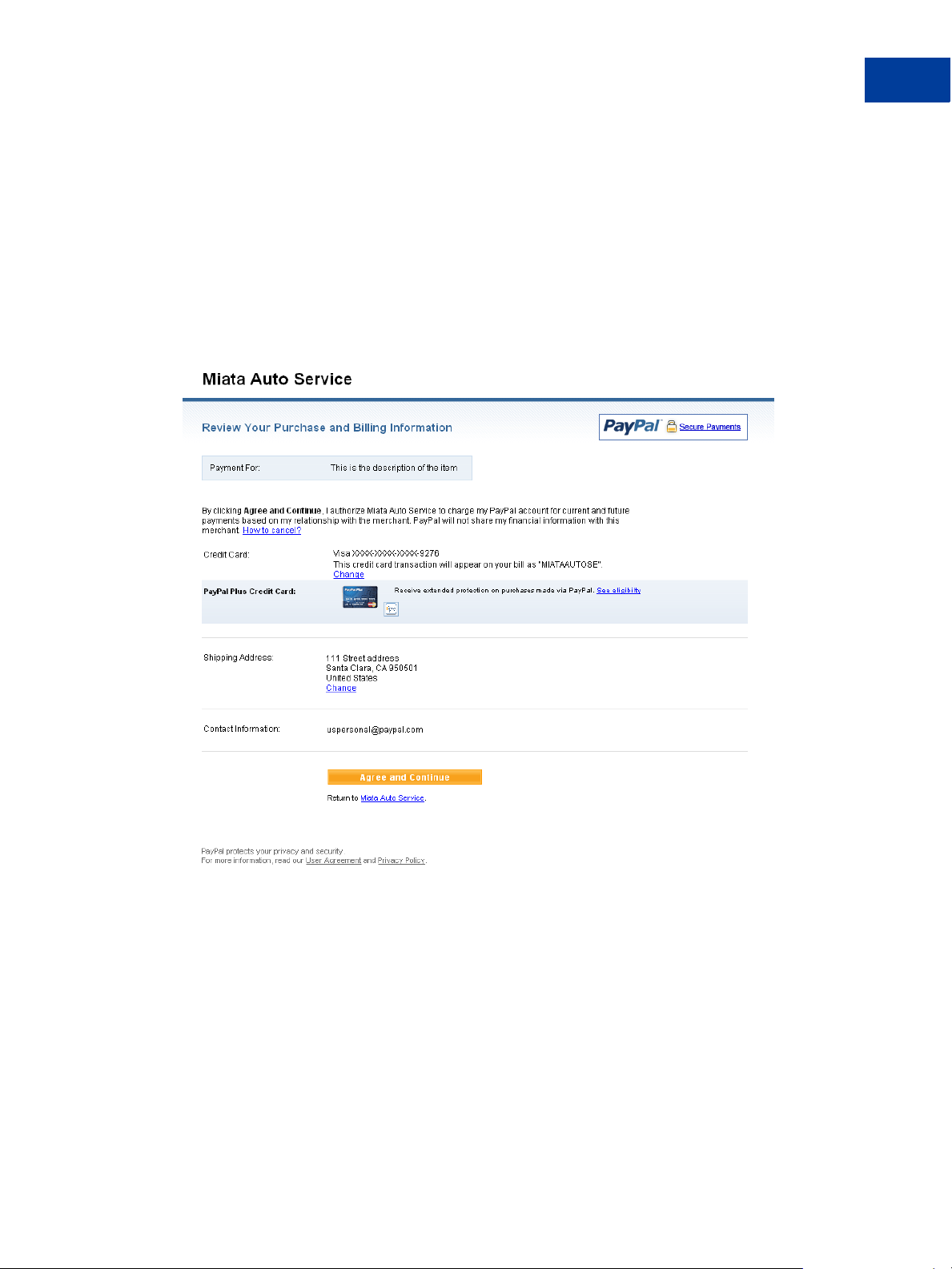

When the buyer logs in, the buyer is presented with a PayPal Review page, such as the

example page shown in Figure 2.2.

FIGURE 2.2 PayPal Review page

2

4. PayPal redirects the buyer’s browser to your return page.

5. Call the Get Express Checkout Details request (ACTION=G) to obtain information about the

buyer and the buyer’s checkout status. PayPal returns checkout details, including whether

the billing agreement was accepted.

6. Call the Do Express Checkout Payment request (ACTION=D) to complete the purchase.

7. PayPal returns information about the purchase. If the required billing agreement

information was passed, PayPal returns a BAID. Save the BAID to implement Payflow

reference transactions.

Express Checkout for Payflow Pro 23

Page 24

Billing Agreements and Reference Transactions

2

Obtaining the BAID With Express Checkout Purchase

Example of Obtaining the BAID With Express Checkout Purchase

This section provides an example of Express Checkout Authorization request and response

name-value pair strings, illustrating the billing agreement parameters. Billing agreement

parameters are shown in boldface.

Set Express Checkout Request (ACTION=S)

The following is an example of a Set Express Checkout request:

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=S

&TENDER=P

&RETURNURL=http://return.com

&CANCELURL=http://cancel.com&A MT=10.00

&BA_DES C=purchase Time Ma gazine

&BILLIN GTYPE=MerchantInit iatedBilling

&BA_CUSTO M=add magazine subscr iption

&PAYMENTT YPE=any

Set Express Checkout Response

RESULT=0

&RESPMSG=Approved

&CORRELATIONID=ec093d08c9f39

&TOKEN=EC-36X58962RS656712N

Get Express Checkout Details Request (ACTION=G)

The following request contains no new parameters:

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=G

&TENDER=P

&TOKEN=EC-36X58962RS656712N

24 Express Checkout for Payflow Pro

Page 25

Billing Agreements and Reference Transactions

Obtaining the BAID Without Express Checkout Purchase

Get Express Checkout Details Response

RESULT=0

&RESPMSG=Approved

&TOKEN=EC-F3BQJQG7UGVDL754

&CORRELATIONID=9c3706997455e

&EMAIL=jsmith@paypal.com

&PAYERSTATUS=verified

&FIRSTNAME=Joe

&LASTNAME=Smith

&SHIPTONAME=Joe Smith

&SHIPTOSTREET=111 Main St

&SHIPTOCITY=San Jose

&SHIPTOSTATE=CA

&SHIPTOZIP=95100

&SHIPTOCOUNTRY=US

Do Express Checkout Payment Request (ACTION=D)

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=D

&TENDER=P

&AMT=10.00

&TOKEN=EC-36X58962RS656712N

&PAYERID=J5MSNK7FP5KA8

2

Do Express Checkout Payment Response

The response returns the BAID:

RESULT=0

&PNREF=E24P0A03B013

&RESPMSG=Approved

&TOKEN=EC-11X52562RT656789N

&PPREF=44000000000180903

&CORRELATIONID=3a3204997455r

&BAID=B-12345678901234567

&PAYMENTTYPE=any

&PENDINGREASON=authorization

Obtaining the BAID Without Express Checkout Purchase

To set up the billing agreement and obtain the BAID without the buyer making an Express

Checkout purchase from your website, you add one new request to create the billing

agreement to your current Express Checkout integration. Figure 2.3 summarizes the flow.

Express Checkout for Payflow Pro 25

Page 26

Billing Agreements and Reference Transactions

2

Obtaining the BAID Without Express Checkout Purchase

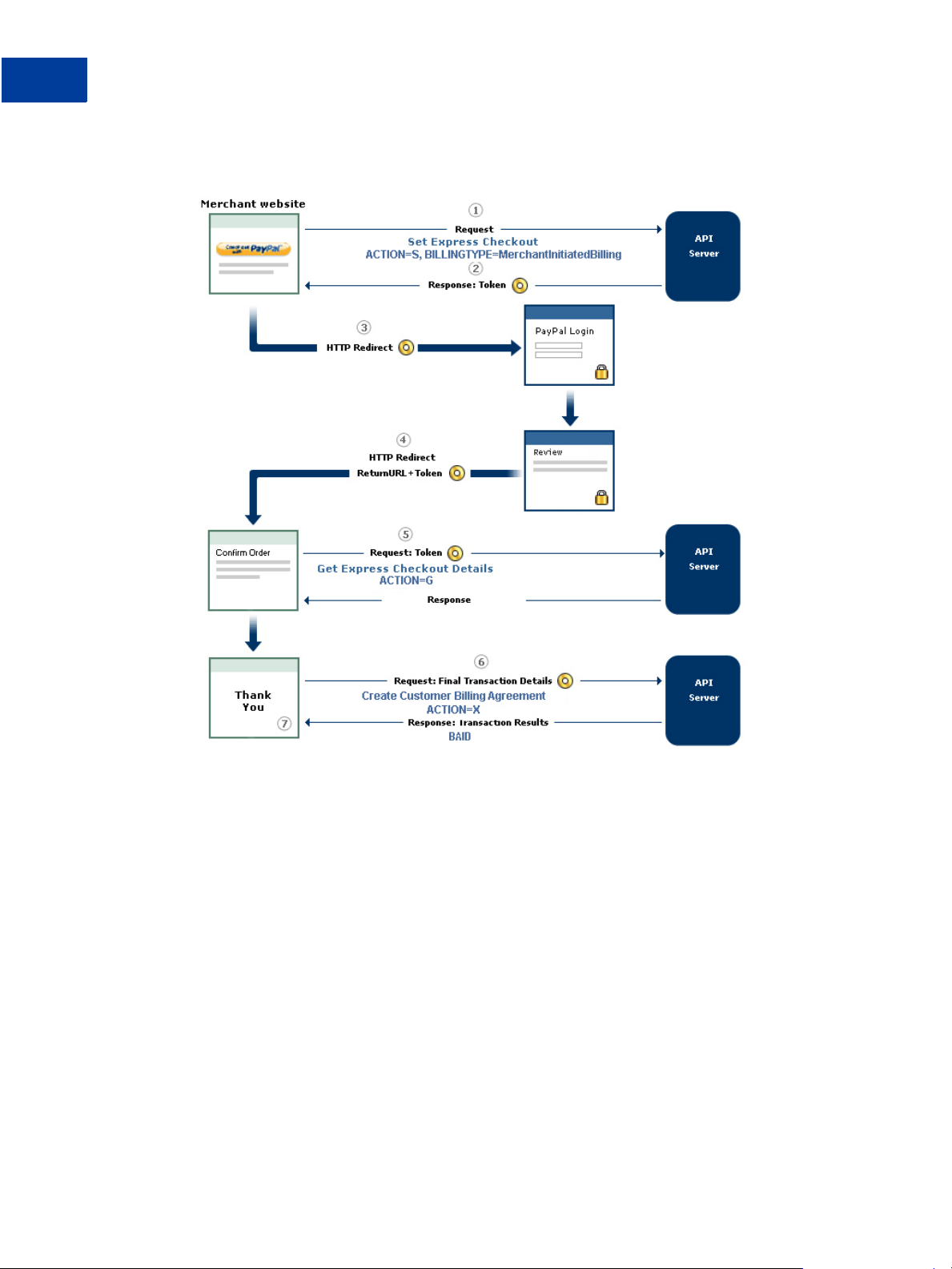

FIGURE 2.3 Obtaining the BAID without Express Checkout purchase

The message flow consists of the following comments, which correspond to the circled

numbers in Figure 2.1. The comments pertain specifically to setting up a billing agreement and

obtaining a BAID.

1. When the buyer chooses to set up a billing agreement, call the Set Express Checkout

request (ACTION=S) and pass information about the agreement:

– The billing type (required)

– A description of the goods or services associated with the agreement (optional)

– The type of PayPal payment you require (optional)

– A string for your use in any way (optional)

NOTE: Even though the buyer is not making a purchase in this flow, provide a value for AMT,

for example, AMT=0.00.

2. PayPal returns a TOKEN that you use in subsequent steps.

26 Express Checkout for Payflow Pro

Page 27

Billing Agreements and Reference Transactions

Obtaining the BAID Without Express Checkout Purchase

3. Redirect the buyer’s browser to PayPal to allow the buyer to log in to PayPal or set up a

PayPal account. After the buyer clicks the PayPal button and you submit the Set Express

Checkout request, you will want to automatically direct your buyer to the PayPal website.

The redirect URL for this is shown below. TOKEN is the value returned in the Set Express

Checkout response.

https://www.paypal.com/cgi-bin/webscr?c md=_expresscheckout&token=<TOKEN>

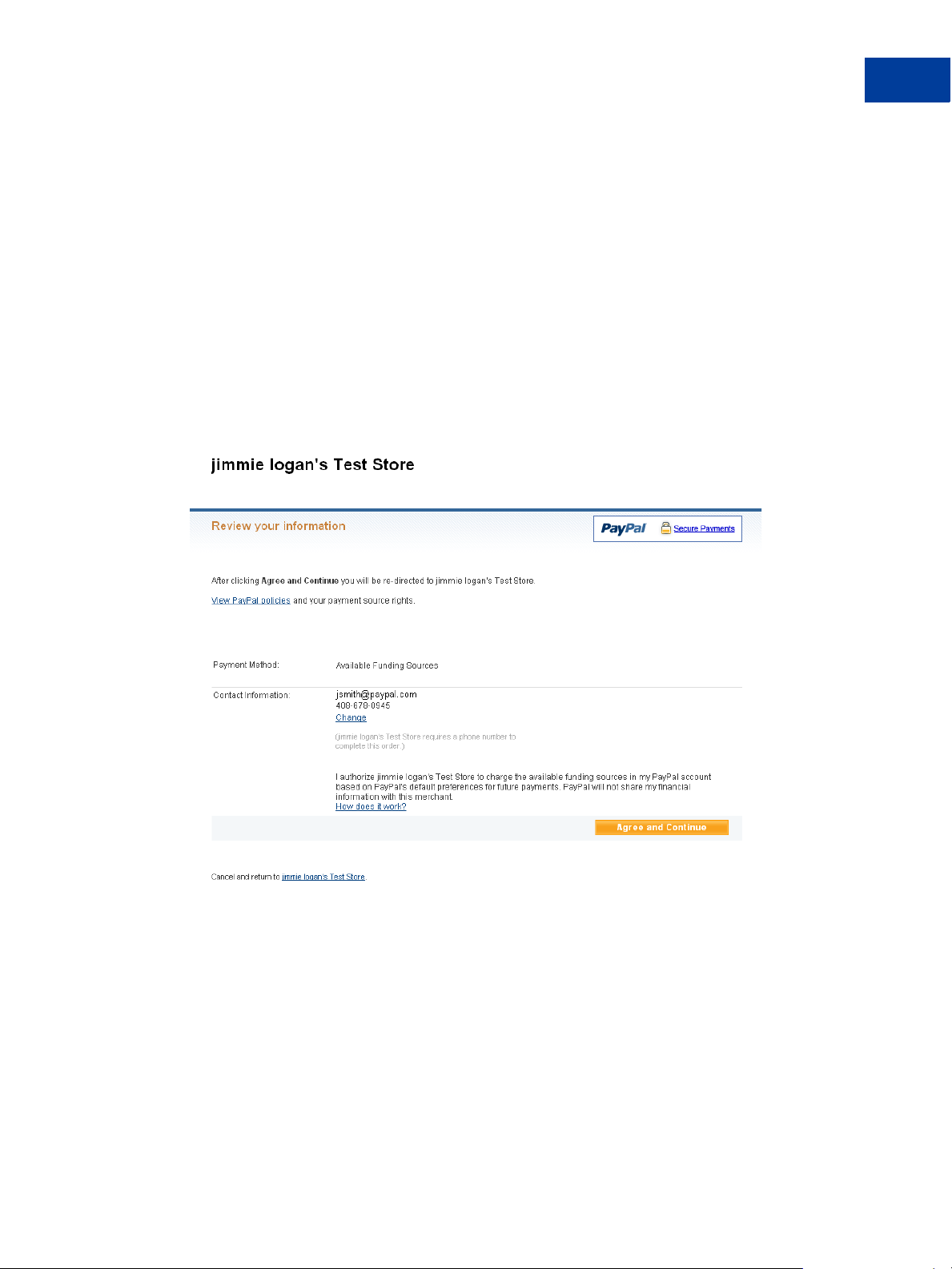

The buyer is presented with a PayPal Review page, such as the example page shown in

Figure 2.4. The buyer must click Agree and Continue for steps 5 through 8 below to

occur.

FIGURE 2.4 PayPal Review page

2

4. PayPal redirects the buyer’s browser to your return page.

5. Call the Get Express Checkout Details request (ACTION=G) to obtain information about the

buyer. PayPal returns the buyer information, including whether the billing agreement was

accepted.

6. Call the Create buyer Billing Agreement request (ACTION=X) to obtain the BAID.

7. PayPal returns a BAID. Save the BAID to implement Payflow reference transactions.

Express Checkout for Payflow Pro 27

Page 28

Billing Agreements and Reference Transactions

2

Obtaining the BAID Without Express Checkout Purchase

Example of Obtaining the BAID Without Express Checkout Purchase

This section provides an example of obtaining the BAID. The billing agreement parameters

(and AMT , which must be 0) are shown in boldface.

Set Express Checkout Request (ACTION=S)

The following is an example of a Set Express Checkout request that passes billing agreement

parameters:

IMPORTANT: Even though no payment is sent, the value of TRXTYPE must be A in the

request strings.

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=S

&TENDER=P

&RETURNURL=http://return.com

&CANCELURL=http://cancel.com

&AMT=0. 00

&BA_DES C=purchase Time ma gazine

&BILLIN GTYPE=MerchantInit iatedBilling

&PAYMENTT YPE=any

&BA_CUSTO M=magazine subscription

Set Express Checkout Response

RESULT=0

&RESPMSG=Approved

&TOKEN=EC-36X58962RS656712N

&CORRELATIONID=a398b1f35ebfa

Create Customer Billing Agreement Request (ACTION=X)

The Create Customer Billing Agreement request passes the TOKEN returned in the Set Express

Checkout response:

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=X

&TENDER=P

&TOKEN=EC-36X58962RS656712N

Create Customer Billing Agreement Response

The response returns the BAID:

28 Express Checkout for Payflow Pro

Page 29

RESULT=0

&PNREF=E24P0A03B013

&RESPMSG=Approved

&TOKEN=EC-36X58962RS656712N

&PPREF=44000000000180903

&CORRELATIONID=3a3204997455r

&BAID=B-12345678901234567

Updating a Billing Agreement

You can use the Update Billing Agreement request to cancel the billing agreement or update

the billing agreement description.

Some points to note:

z Do not pass TRXTYPE with this transaction.

z BAID is the only required parameter (ACTION=U).

z The only value you can pass for BA_STATUS is cance l to change the billing agreement

status.

Billing Agreements and Reference Transactions

Updating a Billing Agreement

2

z You can change the billing agreement description by entering a different string value for

BA_DESC.

z The response does not return a PNREF .

PayPal responds with the BAID and other information about the buyer whose agreement was

updated.

Although a buyer can log in to PayPal to manage agreements, the Update Billing Agreement

request enables the buyer to cancel an agreement from your website without logging in to

PayPal. You can provide your own page for maintaining agreements with the buyer.

Example of Updating a Billing Agreement

The following is an example of updating a billing agreement description. Billing agreement

parameters are shown in boldface:

Request

PARTNER=partner

&VENDOR=vendor

&PWD=password

&TENDER=P

&USER=user

&ACTION=U

&BA_DESC= Description

&BAID=B-9 2K90916NV400134C

&BA_STATU S=cancel

Express Checkout for Payflow Pro 29

Page 30

Billing Agreements and Reference Transactions

2

Using Reference Transactions

Response

RESULT=0

&RESPMSG=Approved

&PPREF=68W3371331353001F

&CORRELATIONID=6d348905b0d59

&BAID=B-92K90916NV400134C

Using Reference Transactions

This section provides examples of reference transactions that bill PayPal accounts. The

examples illustrate two parameter options. In the reference transaction request, you can pass

either of the following name-value pair parameters returned in either the response to Create

Customer Billing Agreement (ACTION=X) or the response to Do Express Checkout Payment

(ACTION=D):

z PNREF passed as value of ORIGID

z BAID

The examples below are based on Do Express Checkout Payment (ACTION=D) and illustrate

passing the ORIGID and the BAID. The reference transaction request does not pass the Express

Checkout TOKEN or PAYERID as described in “Express Checkout Processing Flow ”

on page 9.

Reference Transaction Request Passing the BAID

Request

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=D

&TENDER=P

&AMT=1&BA ID=B-1234567890123456 7

Response

RESULT=0

&PNREF=E24P0A03B014

&RESPMSG=Approved

&PPREF=44000000000180905

&CORRELATIONID=dr093d08c9f01

&FEEAMT=0.33

&BAID=B-12345678901234567

&PAYMENTTYPE=instant

&PENDINGREASON=authorization

30 Express Checkout for Payflow Pro

Page 31

Billing Agreements and Reference Transactions

Using Reference Transactions

Reference Transaction Request Passing the PNREF Value as ORIGID

Request

In this example, the BAID is not required because the ORIGID is being passed:

PARTNER=partner

&VENDOR=vendor

&PWD=password

&USER=user

&TRXTYPE=A

&ACTION=D

&TENDER=P

&AMT=1

&ORIGID=E 24P0A03B013

Response

RESULT=0

&PNREF=E24P0A03B015

&RESPMSG=Approved

&PPREF=44000000000180907

&CORRELATIONID=dr093d08c9f01

&BAID=B-1 2345678901234567

&PAYMENTTYPE=instant

&PENDINGREASON=authorization

2

Express Checkout for Payflow Pro 31

Page 32

Billing Agreements and Reference Transactions

2

Using Reference Transactions

32 Express Checkout for Payflow Pro

Page 33

3

Express Checkout Transaction Types

The Payflow gateway supports transaction types (TRXTYPE) for obtaining payment during the

Express Checkout flow as well as for managing the capture of payments after the Express

Checkout flow.

z Honor Period and Authorization Period

z Payment Transaction Types

z Sale

z Authorization

z Order

z Do Reauthorization

z Do Authorization

z Delayed Capture

z Void

z Credit

Honor Period and Authorization Period

Your business may not be able to provide immediate fulfillment of a product or service. An

item, for example, may not be immediately available to ship because it is temporarily out of

stock. Under these circumstances, you can have the buyer approve of placing a 29-day hold or

authorization period on their balance for the amount of the authorization to ensure funds are

available for capture.

After a successful authorization, PayPal honors the authorized funds for a three-day honor

period. You can extend the honor period once with a Do Reauthorization or multiple times

with a Do Authorization.

Payment Transaction Types

During the Express Checkout flow, the following transaction types are supported:

z Sale (TRXTYPE=S)

z Authorization (TRXTYPE=A)

z Order (TRXTYPE=O)

Express Checkout for Payflow Pro 33

Page 34

Express Checkout Transaction Types

3

Sale

After the Express Checkout flow , you can manage the capture of payment using the following

transaction types:

z Do Reauthorization (TRXTYPE=A)

z Do Authorization (TRXTYPE=A)

z Delayed Capture (TRXTYPE=D)

z Void (TRXTYPE=V)

z Credit (TRXTYPE=C)

Sale

A Sale transaction charges the specified amount against the account, and marks the transaction

for immediate fund transfer.

Use a Sale transaction when you can fulfill an order immediately and you know the final

amount of the payment at the time you send the Do Express Checkout Payment Details

request. A Sale is appropriate, for example, if you have the items in stock for immediate

shipment.

To set up a Sale, set these parameters in the Set Express Checkout, Get Express Checkout

Details, and Do Express Checkout Payment requests:

z Set Express Checkout request: TRXTYPE=S, ACTION=S

z Get Express Checkout Details request (optional): TRXTYPE=S, ACTION=G

z Do Express Checkout Payment request: TRXTYPE=S, ACTION=D

After you send the Do Express Checkout Payment request for a Sale transaction, which returns

a RESULT value of 0 (success), the payment is complete and no further action is necessary.

You cannot capture a further payment or void any part of the payment.

For a detailed example of a Sale transaction, see Express Checkout Sale Transaction Example.

Authorization

An Authorization transaction represents an agreement to pay. It places the buyer’s funds on

hold for a three-day honor period is valid for 29 days. It does not transfer funds.

If your business does not provide immediate fulfillment of products or services, an

Authorization enables you to capture funds with a Delayed Capture transaction when backordered merchandise, for example, does become available. You can capture up to the

authorized amount specified in the original Authorization transaction.

If you are still not able to complete the Authorization and Delayed Capture within the 29-day

period, you can perform a one-time extension of the Authorization using a Do

Reauthorization. Merchants get around these limitations by choosing to perform an Order

34 Express Checkout for Payflow Pro

Page 35

Express Checkout Transaction Types

Order

transaction instead of an Authorization. Orders provide greater flexibility with fewer time

constraints when handling products or services that not immediately available.

An Authorization uses the same parameters as a Sale transaction except that TRXTYPE is A.

See Express Checkout Sale Transaction Example for details.

To set up an Authorization, set these parameters in the Set Express Checkout, Get Express

Checkout Details, and Do Express Checkout Payment requests:

z Set Express Checkout request: TRXTYPE=A, ACTION=S

z Get Express Checkout Details request (optional): TRXTYPE=A, ACTION=G

z Do Express Checkout Payment request: TRXTYPE=A, ACTION=D

Note the value of PNREF in the Do Express Checkout Payment response, for example:

RESULT=0

&PNREF=EFHP0CDBF5C7

&RESPMSG=Approved

&TOKEN=EC-17C76533PL706494P

&PAYERID=FHY4JXY7CV9PG

&PPREF=2P599077L3553652G

3

Order

To capture authorized funds, you use the PNREF to reference the original Authorization

transaction. See Delayed Capture for details.

An Order transaction represents an agreement to pay one or more authorized amounts up to

the specified total over a maximum of 29 days.

Orders provide you with greater flexibility in delivering merchandise than Authorizations. You

should use an Order when a Sale

or an Authorization with a single Do Reauthorization do not

meet your needs. Situations in which Orders are appropriate include the handling of the

following:

z Back orders, in which you send available merchandise immediately and the remaining

merchandise, as it is available

z Split orders, in which you send merchandise in more than one shipment—perhaps to

different addresses—and you want to collect a payment for each shipment

z Drop shipments, or shipments from other vendors, for which you accep t the payment

To create multiple authorizations of the Order over the 29-day period, use the Do

Authorization transaction. E

ach Do Authorization places the buyer’s funds on hold for up

to three days. If the three-day honor period or the valid authorization period expires, simply

create another Do Authorization.

To set up an Order,

1. Set TRXTYPE=O in the Set Express Checkout, Get Express Checkout Details, and Do

Express Checkout Payment requests in your Express Checkout flow.

Express Checkout for Payflow Pro 35

Page 36

Express Checkout Transaction Types

3

Do Reauthorization

– Set Express Checkout request: TRXTYPE=O, ACTION=S

– Get Express Checkout Details request (optional): TRXTYPE=O, ACTION=G

– Do Express Checkout Payment request: TRXTYPE=O, ACTION=D

2. Note the value of PNREF in the Do Express Checkout Payment response, for example:

RESULT=0

&PNREF=EFHP0CDBF5C7

&RESPMSG=Approved

&TOKEN=EC-17C76533PL706494P

&PAYERID=FHY4JXY7CV9PG

&PPREF=2P599077L3553652G

To capture an Order, you must first authorize it.

1. To authorize the Order, set ORIGID=PNREF (PNREF value returned in original Order

response) and TRXTYPE=A in a Do Authorization transaction request, for example:

TRXTYPE=A

&TENDER=P

&PARTNER=partner

&USER=user

&VENDOR=vendor

&PWD=pwd

&ORIGID=EFHP0CDBF5C7

This is the Do Authorization response:

RESULT=0

&PNREF=EFHP0CDCG6C8

&RESPMSG=Approved

&PPREF=3Q600078M3553652G

2. To capture the Do Authorization, set ORIGID=PNREF (PNREF returned in the Do

Authorization response) and TRXTYPE=D, for example:

"TRXTYPE=Dcg&TENDER=P&PARTNER= partner&USER=user&VEN DOR=vendor&PWD=pwd &OR

IGID=EFHP0CDBF6C8"

Do Reauthorization

To reauthorize an Authorization for an additional three-day honor period, you can use a Do

Reauthorization transaction. A Do Reauthorization can be used at most once during the 29-day

authorization period.

To set up a Do Reauthorization, you must pass the following parameters in the request string:

z Set ORIGID=PNREF (PNREF returned in the original Authorization response)

z Set TRXTYPE=A

z Set DoReauthorization=1

This is an example Do Reauthorization request with required parameters:

36 Express Checkout for Payflow Pro

Page 37

TRXTYPE=A

&TENDER=P

&PARTNER=partner

&USER=user

&VENDOR=vendor

&PWD=pwd

&ORIGID=E FHP0CDBF5C7

&DOREAUTH ORIZATION=1

Do Authorization

A Do Authorization transaction represents an agreement to pay and places the buyer’s funds

from the original Order transaction on hold for up to three days. It does not transfer funds.

NOTE: You can only use Do Authorization if the original transaction in the Express Checkout

flow is an Order. You cannot use Do Reauthorization against a Do Authorization.

To set up a Do Authorization, you must pass the following parameters in the request string:

Express Checkout Transaction Types

Do Authorization

3

z Set ORIGID=PNREF (PNREF value returned in the original Order transaction response

only)

NOTE: Do not pass the PPREF returned from the original Order transaction in place of the

PNREF.

z Set TRXTYPE=A

In this example, the PNREF returned in the original Order response is EFHP0CDBF7D9. This is

the Do Authorization request string:

TRXTYPE=A

&TENDER=P

&PARTNER=partner

&USER=user

&VENDOR=vendor

&PWD=pwd

&ORIGID=E FHP0CDBF7D9

Delayed Capture

A Delayed Capture transaction captures authorized funds and transfers them to PayPal. Once a

capture is approved, you will see the funds in your PayPal account.

You can capture up to the amount specified in the original Authorization.

Express Checkout for Payflow Pro 37

Page 38

Express Checkout Transaction Types

3

Delayed Capture

Complete Capture

To set up a capture of the total amount in the original Authorization, you must pass the

following parameters in the Delayed Capture request string:

z Set ORIGID=PNREF (PNREF value returned in the original Authorization, Do

Authorization, or Do Reauthorization transaction response)

z Set TRXTYPE=D

This is an example Delayed Capture request with required parameters.

TRXTYPE=D

&TENDER=P

&PARTNER=partner

&USER=user

&VENDOR=vendor

&PWD=pwd

&ORIGID=E FHP0CDBF5C7

Partial Capture

To set up a partial capture of authorized funds, pass the following parameters in the Delayed

Capture request string:

z Set ORIGID=PNREF (PNREF value returned in the original Authorization, Do

Authorization, or Do Reauthorization transaction response)

z Set TRXTYPE=D

z Set the value for AMT

z Set CAPTURECOMPLETE=N to perform a partial capture; set CAPTURECOMP LETE=Y to void

any remaining amount of the original authorized transaction

This example is based on an initial Authorization for $100. You charge $66 for the first partial

shipment using a Delayed Capture transaction. You charge the $34 for the final part of the

shipment using a second Delayed Capture transaction.

1. Capture the authorized funds for a partial shipment of $66.

TRXTYPE=D

&TENDER=C

&PWD=SuperUserPassword

&PARTNER=PayPal

VENDOR=SuperMerchant

USER=SuperMerchant

&CAPTURECOMP LETE=N

&ORIGID=EFHP 0D426A51

&AMT=66.00

2. Once you have shipped the remainder of the merchandise, capture the $34 balance.

TRXTYPE=D&TENDER=C&PWD=SuperUs erPassword&PARTNER =PayPal&VENDOR=SuperM erc

hant&USER=SuperMerchant&CAPTUR ECOMPLETE=Y&ORIGID=EFHP0D426A51&AMT=34.00

38 Express Checkout for Payflow Pro

Page 39

Void

Express Checkout Transaction Types

Void

A Void transaction voids any of the following transaction types:

z Order

z Authorizations (Authorization, Do Authorization, or Do Reauthorization)

NOTE: Y ou can use a Void transaction only on transactions that have not yet settled. To refund

a buyer’s money for a settled transaction, you must use a Credit transaction.

If you void an unsettled transaction, the full authorized amount of the original transaction

becomes void and can no longer be captured.

NOTE: As part of its internal process, PayPal makes reasonable effort to process authorization

reversals for void transactions for debit and credit cards. However, there is no

guarantee authorization reversal requests will be honored.

To set up a Void transaction, you must pass the following parameters in the request string:

z Set ORIGID=PNREF (PNREF value returned in the response to the original Authorization or

Order)

3

Credit

z Set TRXTYPE=V

This is an example Void transaction request with the required parameters set.

TRXTYPE=V

&TENDER=P

&PARTNER=partner

&USER=user

&VENDOR=vendor

&PWD=pwd

&ORIGID=E FHP0CDBF5C7

A Credit transaction refunds the buyer for a settled transaction. Credit transactions are

permitted only against existing Sale and Delayed Capture transactions.

To set up a Credit transaction request, you must pass the following parameters in the request

string:

z Set ORIGID=PNREF (PNREF value returned in the response to the original Sale or Delayed

Capture)

z Set TRXTYPE=C

z Set the value for AMT if the amount of the credit differs from the original Sale or Delayed

Capture transaction

This is an example Credit request with the required parameters set:

Express Checkout for Payflow Pro 39

Page 40

Express Checkout Transaction Types

3

Credit

TRXTYPE=C

&TENDER=P

PARTNER=partner

VENDOR=vendor

&USER=user

&PWD=password

&ORIGID=E FHP0D426A62

&AMT=45.0 0

Say , for example, a buyer purchases merchandise from a particular merchant using the buyer’s

PayPal account. The merchant can send a Memo Post Sale (above transaction) to Paymentech

so Paymentech can include that Sale information in the merchant’s Paymentech account. The

advantage to the merchant is that the merchant can view PayPal Sale activities in their

Paymentech reports.

The merchant uses a Memo Post Credit to send the buyer’s Credit transaction information to

Paymentech so the merchant can see the buyer’s Credit information in their Paymentech

reports.

40 Express Checkout for Payflow Pro

Page 41

Transaction Responses

4

Transaction response parameters indicate the status of the transaction and return requested

information.

z Response Parameters

z Address Verification Service Responses From PayPal

z Card Security Code Results

z PNREF Value

z RESULT Values and RESPMSG Text

Response Parameters

When a transaction finishes, the server returns a response made up of name-value pairs. For

example, this is a response to a Sale transaction request:

RESULT=0

&PNREF=EFHP0D426A53

&RESPMSG=APPROVED

&AUTHCODE=25TEST

&AVSADDR=Y

&AVSZIP=N

&CVV2MATCH=Y

&PPREF=68W3371331353001F

&CORRELATIONID=2dc60e253495e

Express Checkout transaction responses include the response parameters described below as

well as parameters returned by the specific transaction type (TRXTYPE) and ACTION.

TABLE 4.1 General resp onse p arame ters

Parameter Description

RESULT The outcome of the attempted transaction. A result of 0 (zero) indicates the

transaction was approved. Any other number indicates a decline or error.

NOTE: The PayPal processor may also return a warning message in the

RESPMSG string when RESULT=0. For more information on corrective

actions, see the PayPal developer documentation on Developer Central.

Limitations: Numeric.

PNREF Payflow Transaction ID, a unique 12-character alphanumeric string that

identifies the transaction.

Express Checkout for Payflow Pro 41

Page 42

Transaction Responses

4

Address Verification Service Responses From PayPal

T

ABLE 4.1 Gene ral response p arame ters

Parameter Description

PPREF Unique PayPal transaction ID of the payment.

If the request ACTION was A (Authorization), you should store the value of

PPREF if you need to research a specific transaction with PayPal.

Limitations: 17-character string.

RESPMSG The response message returned with the transaction result. Exact wording varies.

Sometimes a colon appears after the initial RESPMSG followed by more detailed

information.

NOTE: The PayPal processor may also return a warning message in the

RESPMSG string when RESULT=0. For more information on corrective

actions, see the PayPal developer documentation on Developer Central.

Limitations: Alphanumeric.

CORRELATIONID Value used for tracking.

Limitations: 13-character alphanumeric string.

Address Verification Service Responses From PayPal

The table below compares the detailed response returned by the PayPal processor for addre ss

verification to the normalized response value (Y, N, or X) returned in the AVSADDR and AVSZIP

response parameters. If you want to obtain the PayPal processor value, set the VERBOSITY

parameter to MEDIUM. With this setting, the processor value is returned in the PROCAVS

response parameter.

T

ABLE 4.2 Address Verification Service response value mapp ing

PayPal

Processor

Address

Verification

Service Code Meaning AVSADDR AVSZIP

AAddress YN

B International “A” Y N

C International “N” N N

D International “X” Y Y

E Not allowed for MOTO (Internet/Phone) transactions X X

F UK-specific “X” Y Y

G Global Unavailable X X

I International Unavailable X X

42 Express Checkout for Payflow Pro

Page 43

Transaction Responses

Card Security Code Results

T

ABLE 4.2 Address Verification Service response value mapp ing

PayPal

Processor

Address

Verification

Service Code Meaning AVSADDR AVSZIP

NNo NN

P Postal (International “Z”) N Y

RRetry XX

S Service not Supported X X

U Unavailable X X

WWhole Zip NY

X Exact Match Y Y

YYes YY

4

ZZip NY

All other X X

Card Security Code Results

The CVV2MATCH parameter returns Y, N, or X.

The

CVV2MATCH parameter returns Y, N, X, or a processor-specific response.

Normalized Results

If you submit the transaction request parameter for card security code (that is, the CVV2

parameter), the cardholder’s bank returns a normalized Yes/No response in the CVV2MATCH

response parameter, as described in the table below.

T

ABLE 4.3 CVV2MATCH response values

CVV2MATCH Value Description

Y The submitted value matches the data on file for the card

N The submitted value does not match the data on file for the card.

X The cardholder’s bank does not support this service.

Express Checkout for Payflow Pro 43

Page 44

Transaction Responses

4

PNREF Value

PayPal Card Security Code Results

The table below shows the detailed results returned by the PayPal processor for card security

codes. If you want to obtain the PayPal processor value, set the VERBOSITY parameter to

MEDIUM. The processor value is returned in the PROCCVV2 response parameter.

TABLE 4.4 Card security code respo nse co de mappin g

PayPal Processor CVV2

Code

M Match Y

NNo MatchN

P Not Processed X

S Service Not Supported X

U Unavailable X

X No Response X

All other X

PNREF Value

The PNREF is a unique transaction identification number issued by PayPal that identifies the

transaction for billing, reporting, and transaction data purposes. The PNREF value appears in

the Transaction ID column in PayPal Manager reports.

z The PNREF value is used as the ORIGID value (original transaction ID) in Delayed Capture

transactions (TRXTYPE=D), Credits (TRXTYPE=C), Inquiries (TRXTYPE=I), and Voids

(TRXTYPE=V).

PayPal Processor Code

Description PROCVV2MATCH

z The PNREF value is used as the ORIGID value (original transaction ID) value in reference

transactions for Authorization (TRXTYPE=A) and Sale (TRXTYPE=S).

NOTE: The PNREF is also referred to as the Transaction ID in PayPal Manager.

PNREF Format

The PNREF is a 12-character string of printable characters, for example:

z VADE0B248932

z ACRAF23DB3C4

NOTE: Printable characters also include symbols other than letters and numbers such as the

question mark (?). A PNREF typically contains letters and numbers only.

The PNREF in a transaction response tells you that your transaction is connecting to PayPal.

44 Express Checkout for Payflow Pro

Page 45

RESULT Values and RESPMSG Text

RESULT Values and RESPMSG Text

The RESULT parameter and value is the first name-value pair returned in the response string.

The value of RESULT indicates the overall status of the transaction attempt:

z A value of 0 (zero) indicates that no errors occurred and the transaction was approved.

z A value less than zero indicates that a communication error occurred. In this case, no

transaction is attempted.

z A value greater than zero indicates a decline or error (except in the case of RESULT 104.

See the table below).

The response message (RESPMSG) provides a brief description for decline or error results.

RESULT Values for Transaction Declines or Errors

For non-zero RESULT values, the response string includes a RESPMSG name-value pair. The

exact wording of the RESPMSG (shown in bold) may vary. Sometimes a colon appears after the

initial RESPMSG followed by more detailed information.

Transaction Responses

4

When interpreting RESULT values for the PayPal processor, note the following:

z When RESULT=0, warning information may be returned that is useful to the request

application. See the PayPal API documentation on Developer Central for detailed

information on corrective actions.

z When RESULT=104, you must log in to the PayPal website to determine if the transaction

actually went through. If the transaction does not appear in the History section, you should

retry it.

TABLE 4.5 Payflow Transaction RESULT Values and RESPMSG Text

RESULT RESPMSG and Explanation

0 Approved

1 User authentication failed. Error is caused by one or more of the following:

z Login information is incorrect. Verify that USER, VENDOR, PAR TNER, and

PASSWORD have been entered correctly. VENDOR is your merchant ID and USER

is the same as VENDOR unless you created a Payflow Pro user. All fields are case

sensitive.

z Invalid Processor information entered. Contact merchant bank to verify.

z "Allowed IP Address" security feature implemented. The transaction is coming

from an unknown IP address. See PayPal Manager online help for details on

how to use Manager to update the allowed IP addresses.

z You are using a test (not active) account to submit a transaction to the live

PayPal servers. Change the host address from the test server URL to the live

server URL

Express Checkout for Payflow Pro 45

Page 46

Transaction Responses

4

RESULT Values and RESPMSG Text

T

ABLE 4.5 Payflow Transaction RESULT Values and RESPMSG Text

RESULT RESPMSG and Explanation

2 Invalid tender type. Your merchant bank account does not support the following

3 Invalid transaction type. Transaction type is not appropriate for this transaction.

4 Invalid amount format. Use the format: “#####.##” Do not include currency

5 Invalid merchant information. Processor does not recognize your merchant

6 Invalid or unsupported currency code

7 Field format error. Invalid information entered. See RESPMSG

8 Not a transaction server

9 Too many parameters or invalid stream

credit card type that was submitted.

For example, you cannot credit an authorization-only transaction

symbols or commas.

account information. Contact your bank account acquirer to resolve this problem.

10 Too many line items

11 Client time-out waiting for response

12 Declined. Check the credit card number, expiration date, and transaction

information to make sure they were entered correctly. If this does not resolve the

problem, have the customer call their card issuing bank to resolve.

13 Referral. Transaction cannot be approved electronically but can be approved with a

verbal authorization. Contact your merchant bank to obtain an authorization and

submit a manual Voice Authorization transaction.

19 Original transaction ID not found. The transaction ID you entered for this

transaction is not valid. See RESPMSG

20 Cannot find the customer reference number

22 Invalid ABA number

23 Invalid account number. Check credit card number and re-submit.

24 Invalid expiration date. Check and re-submit.

25 Invalid Host Mapping. Error is caused by one or more of the following:

z You are trying to process a tender type such as Discover Card, but you are not

set up with your merchant bank to accept this card type.

z You are try ing to process an Ex press Checkout transaction when your account is

not set up to do so. Contact your account holder to have Express Checkout

added to your account.

46 Express Checkout for Payflow Pro

Page 47

Transaction Responses

RESULT Values and RESPMSG Text

T

ABLE 4.5 Payflow Transaction RESULT Values and RESPMSG Text

RESULT RESPMSG and Explanation

26 Invalid vendor account. Login information is incorrect. Verify that USER,

VENDOR, P ARTNER, and PASSWORD have been entered correctly. VENDOR is

your merchant ID and USER is the same as VENDOR unless you created a Payflow

Pro user. All fields are case sensitive.

27 Insufficient partner permissions

28 Insufficient user permissions

29 Invalid XML document. This could be caused by an unrecognized XML tag or a

bad XML format that cannot be parsed by the system.

30 Duplicate transaction

31 Error in adding the recurring profile

32 Error in modifying the recurring profile

33 Error in canceling the recurring profile

4

34 Error in forcing the recurring profile

35 Error in reactivating the recurring profile

36 OLTP Transaction failed

37 Invalid recurring profile ID

50 Insufficient funds available in account

51 Exceeds per transaction limit

99 General error. See RESPMSG.

100 Transaction type not supported by host

101 Time-out value too small

102 Processor not available

103 Error reading response from host

104 Timeout waiting for processor response. Try your transaction again.

105 Credit error. Make sure you have not already credited this transaction, or that this

transaction ID is for a creditable transaction. (For example, you cannot credit an

authorization.)

106 Host not available

107 Duplicate suppression time-out

Express Checkout for Payflow Pro 47

Page 48

Transaction Responses

4

RESULT Values and RESPMSG Text

T

ABLE 4.5 Payflow Transaction RESULT Values and RESPMSG Text

RESULT RESPMSG and Explanation

108 Void error. See RESPMSG. Make sure the transaction ID entered has not already

109 Time-out waiting for host response

110 Referenced auth (against order) Error

111 Capture error. Either an attempt to capture a transaction that is not an

112 Failed AVS check. Address and ZIP code do not match. An authorization may still

113 Merchant sale total will exceed the sales cap with current transaction. ACH

been voided. If not, then look at the Transaction Detail screen for this transaction to

see if it has settled. (The Batch field is set to a number greater than zero if the

transaction has been settled). If the transaction has already settled, your only

recourse is a reversal (credit a payment or submit a payment for a credit)

authorization transaction type, or an attempt to capture an authorization transaction

that has already been captured.

exist on the cardholder’s account.

transactions only.

114 Card Security Code (CSC) Mismatch. An authorization may still exist on the

cardholder’s account.

115 System busy, try again later

116 VPS Internal error. Failed to lock terminal number

117 Failed merchant rule check. One or more of the following three failures occurred:

An attempt was made to submit a transaction that failed to meet the security

settings specified on the PayPal Manager Security Settings page. If the transaction

exceeded the Maximum Amount security setting, then no values are returned for

AVS or CSC.

AVS validation failed. The AVS return value shou ld appear in the RESPMSG.

CSC validation failed. The CSC return value should appear in the RESPMSG

118 Invalid keywords found in string fields

120 Attempt to reference a failed transaction

121 Not enabled for feature

122 Merchant sale total will exceed the credit cap with current transaction. ACH

transactions only.

125 Fraud Protection Services Filter — Declined by filters

48 Express Checkout for Payflow Pro

Page 49

Transaction Responses

RESULT Values and RESPMSG Text

T

ABLE 4.5 Payflow Transaction RESULT Values and RESPMSG Text

RESULT RESPMSG and Explanation

126 Fraud Protection Services Filter — Flagged for review by filters

IMPORTANT: RESULT value 126 indicates that a transaction triggered a fraud

filter. This is not an error, but a notice that the transaction is in a

review status. The transaction has been authorized but requires you

to review and to manually accept the transaction before it will be

allowed to settle.

RESULT value 126 is intended to give you an idea of the kind of transaction that is

considered suspicious to enable you to evaluate whether you can benefit from using

the Fraud Protection Services.