Page 1

Digital Goods

Integration Guide - EC

Edition

Last updated: January 2012

Page 2

Digital Goods Integration Guide - Express Checkout Edition

Document Number: 10118.en_US-201201

© 2012 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

Copyright © PayPal. All rights reserved. PayPal S.à r.l. et Cie, S.C.A., Société en Commandite par Actions. Registered office: 22-24 Boulevard Royal, L2449, Luxembourg, R.C.S. Luxembourg B 118 349

Consumer advisory: The PayPal™ payment service is regarded as a stored value facility under Singapore law. As such, it does not require the approval

of the Monetary Authority of Singapore. You are advised to read the terms and conditions carefully.

Notice of non-liability:

PayPal, Inc. is providing the information i n this document t o you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information co ntained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting f rom the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Preface . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

About This Guide. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Intended Audience . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Where to Go for More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Documentation Feedback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Chapter 1 Introducing Digital Goods for Express Checkout . . . . . . 9

Introducing Digital Goods Payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Express Checkout Buttons. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Digital Goods Payments In More Detail . . . . . . . . . . . . . . . . . . . . . . . . . 10

Digital Goods Flows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Other Payments Features That Digital Goods Supports. . . . . . . . . . . . . . . . . 16

After Performing Digital Goods Transactions . . . . . . . . . . . . . . . . . . . . . . 16

Features Not Supported With Digital Goods. . . . . . . . . . . . . . . . . . . . . . . 16

Other Digital Goods Caveats . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Chapter 2 Integrating Digital Goods for Express Checkout . . . . . .19

Overview of Digital Goods Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Integrating Digital Goods Payments With Express Checkout . . . . . . . . . . . . . . . . 22

Setting Up A Digital Goods Payment Transaction. . . . . . . . . . . . . . . . . . . . 22

Redirecting the Buyer to PayPal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

After PayPal Redirects the Buyer To Your Web Page . . . . . . . . . . . . . . . . . . 25

Completing the Digital Goods Transaction. . . . . . . . . . . . . . . . . . . . . . . . 25

Setting Up Web Pages To Invoke the Digital Goods Payments Flow . . . . . . . . . . 26

Chapter 3 Issuing Refunds . . . . . . . . . . . . . . . . . . . . . . .31

Chapter 4 Handling Recurring Payments . . . . . . . . . . . . . . . .33

How Recurring Payments Work . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Recurring Payments Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Options for Creating a Recurring Payments Profile . . . . . . . . . . . . . . . . . . . . . 35

Digital Goods Integration Guide - EC Edition January 2012 3

Page 4

Contents

Specifying the Regular Payment Period . . . . . . . . . . . . . . . . . . . . . . . . . 35

Including an Optional Trial Period . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Specifying an Initial Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Maximum Number of Failed Payments . . . . . . . . . . . . . . . . . . . . . . . . . 37

Billing the Outstanding Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Identifying Items as Digital or Physical Goods. . . . . . . . . . . . . . . . . . . . . . 37

Recurring Payments With the Express Checkout API . . . . . . . . . . . . . . . . . . . . 38

Initiating the Processing Flow With SetExpressCheckout . . . . . . . . . . . . . . . 41

Redirecting the Buyer to PayPal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

Getting Buyer Details Using GetExpressCheckoutDetails. . . . . . . . . . . . . . . . 42

Creating the Profiles With CreateRecurringPaymentsProfile . . . . . . . . . . . . . . 42

Recurring Payments Profile Status. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Getting Recurring Payments Profile Information. . . . . . . . . . . . . . . . . . . . . . . 44

Modifying a Recurring Payments Profile. . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Updating Addresses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Updating the Billing Amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Billing the Outstanding Amount of a Profile . . . . . . . . . . . . . . . . . . . . . . . . . 46

Recurring Payments Notifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Appendix A Options For Closing the Lightbox or Mini-browser . . . . . 49

Reloading Parent Page to a Specific URL . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Reloading Parent Page by Removing Frames. . . . . . . . . . . . . . . . . . . . . . . . 50

Appendix B Methods For Integrating Digital Goods Into Flash . . . . .51

Integrating Digital Goods With Flash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Integrating Digital Goods With Flash - Third-Party Merchant . . . . . . . . . . . . . . . . 51

Appendix C Express Checkout API Fields Supported By Digital Goods .53

Express Checkout NVP API Fields Supported By Digital Goods . . . . . . . . . . . . . . 53

SetExpressCheckout NVP Request Fields . . . . . . . . . . . . . . . . . . . . . . . 53

SetExpressCheckout NVP Response Fields . . . . . . . . . . . . . . . . . . . . . . 54

GetExpressCheckoutDetails NVP Request Fields . . . . . . . . . . . . . . . . . . . 54

GetExpressCheckoutDetails NVP Response Fields . . . . . . . . . . . . . . . . . . 54

DoExpressCheckoutPayment NVP Request Fields . . . . . . . . . . . . . . . . . . . 56

DoExpressCheckoutPayment NVP Response Fields . . . . . . . . . . . . . . . . . . 56

Express Checkout SOAP API Fields Supported By Digital Goods . . . . . . . . . . . . . 57

SetExpressCheckout SOAP Request Fields . . . . . . . . . . . . . . . . . . . . . . 57

4 January 2012 Digital Goods Integration Guide - EC Edition

Page 5

Contents

SetExpressCheckout SOAP Response Fields . . . . . . . . . . . . . . . . . . . . . 58

GetExpressCheckoutDetails SOAP Request Fields . . . . . . . . . . . . . . . . . . 58

GetExpressCheckoutDetails SOAP Response Fields . . . . . . . . . . . . . . . . . 59

DoExpressCheckoutPayment SOAP Request Fields . . . . . . . . . . . . . . . . . . 60

DoExpressCheckoutPayment SOAP Response Fields . . . . . . . . . . . . . . . . . 61

Revision History. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

Digital Goods Integration Guide - EC Edition January 2012 5

Page 6

Contents

6 January 2012 Digital Goods Integration Guide - EC Edition

Page 7

Preface

About This Guide

Digital Goods Integration Guide - Express Checkout Edition describes how to implement

PayPal for Digital Goods.

Intended Audience

This document is intended for developers implementing PayPal for Digital Goods using the

Express Checkout API.

Where to Go for More Information

Merchant Setup and Administration Guide

Documentation Feedback

Help us improve this guide by sending feedback to:

documentationfeedback@paypal.com

Digital Goods Integration Guide - EC Edition January 2012 7

Page 8

Documentation Feedback

8 January 2012 Digital Goods Integration Guide - EC Edition

Page 9

Introducing Digital Goods for

1

Express Checkout

Digital Goods for Express Checkout streamlines the checkout process for buyers and keeps

buyers on your website.

“Introducing Digital Goods Payments” on page 9

Introducing Digital Goods Payments

Digital goods payments combine JavaScript with the Express Checkout API to streamline the

checkout process for buyers of digital goods.

Digital goods are items such as e-books, music files, and digital images distributed in

electronic format. The buyer can conveniently purchase digital goods during checkout with a

minimum of clicks without leaving your website or interrupting their online activities.

The following figure encapsulates digital goods payments:

PayPal for digital goods payments

To make a payment for a digital goods item, the buyer:

1. Clicks Pay With PayPal.

The button click triggers the call to the SetExpressCheckout API operation. PayPal

redirects the buyer to a lightbox overlaying your website.

2. Clicks Pay to accept the order.

The button click triggers JavaScript code that closes the lightbox.

Digital Goods Integration Guide - EC Edition January 2012 9

Page 10

Introducing Digital Goods for Express Checkout

1

Introducing Digital Goods Payments

3. Confirms the order on your page after the lightbox closes.

4. Resumes activity on your page.

Express Checkout Buttons

The button you place on your web page to initiate PayPal digital goods transactions is

available at the following URL:

https://www.paypal.com/en_US/i/btn/btn_ dg_pay_w_paypal.gif

NOTE: Do not host copies of the PayPal images locally on your servers. Outdated PayPal

images reduce buyer confidence in your site.

Digital Goods Payments In More Detail

To the buyer, the digital goods payment process appears to be built into your website. The

digital goods payment process occurs in a lightbox that temporarily overlays your website.

Your buyer’s digital goods payment experience depends upon two factors:

1. The value you set for the experience type variable on your web page

You determine how the digital goods flow appears to your buyers by setting (or not setting)

the experience type variable (expType) on your web page

(For details on setting expType, see “JavaScript Functions For Digital Goods Payments”

on page 28).

2. Whether the buyer is remembered from a previous transaction

Your buyers partially determine the digital goods flow by choosing whether to check the

“remember me” box on the login page. (Checking the box creates a “remember me cookie”

on the buyer’s machine that lets them skip the login page on subsequent visits.)

The following table describes the possible digital goods (DG) flows that the combination of

expType and “Remember Me Cookie” present to a buyer:

expType Remember Me Cookie DG Flow Experience

instant No The login page opens in a mini-browser.

Yes The merchant review page opens in a lightbox, and a mask is

applied over the underlying web page.

mini No The login page opens in a mini-browser, and a mask is applied

over the underlying web page.

10 January 2012 Digital Goods Integration Guide - EC Edition

Page 11

Introducing Digital Goods for Express Checkout

Introducing Digital Goods Payments

expType Remember Me Cookie DG Flow Experience

Yes The merchant review page opens in a mini-browser, and a

mask is applied over the underlying web page.

popup No The login page opens in a mini-browser, and a mask is not

applied to the underlying web page.

Yes The merchant review page opens in a mini-browser, and a

mask is not applied to the underlying web page.

(not set) No A launch page opens in a lightbox. From here the buyer can

log in (the flow then proceeds to the login page in a minibrowser) or sign up with PayPal, or pay as a guest.

Yes DG opens the merchant review page in a lightbox, and a mask

is applied over the underlying web page.

NOTE: New DG Merchants: Set expTyp e to ‘instant’ for the best performance.

Existing DG Merchants: You can bypass the legacy flow’s lightbox launch page by

setting expType, or leave your web page unchanged to maintain the current behavior.

1

Digital Goods Flows

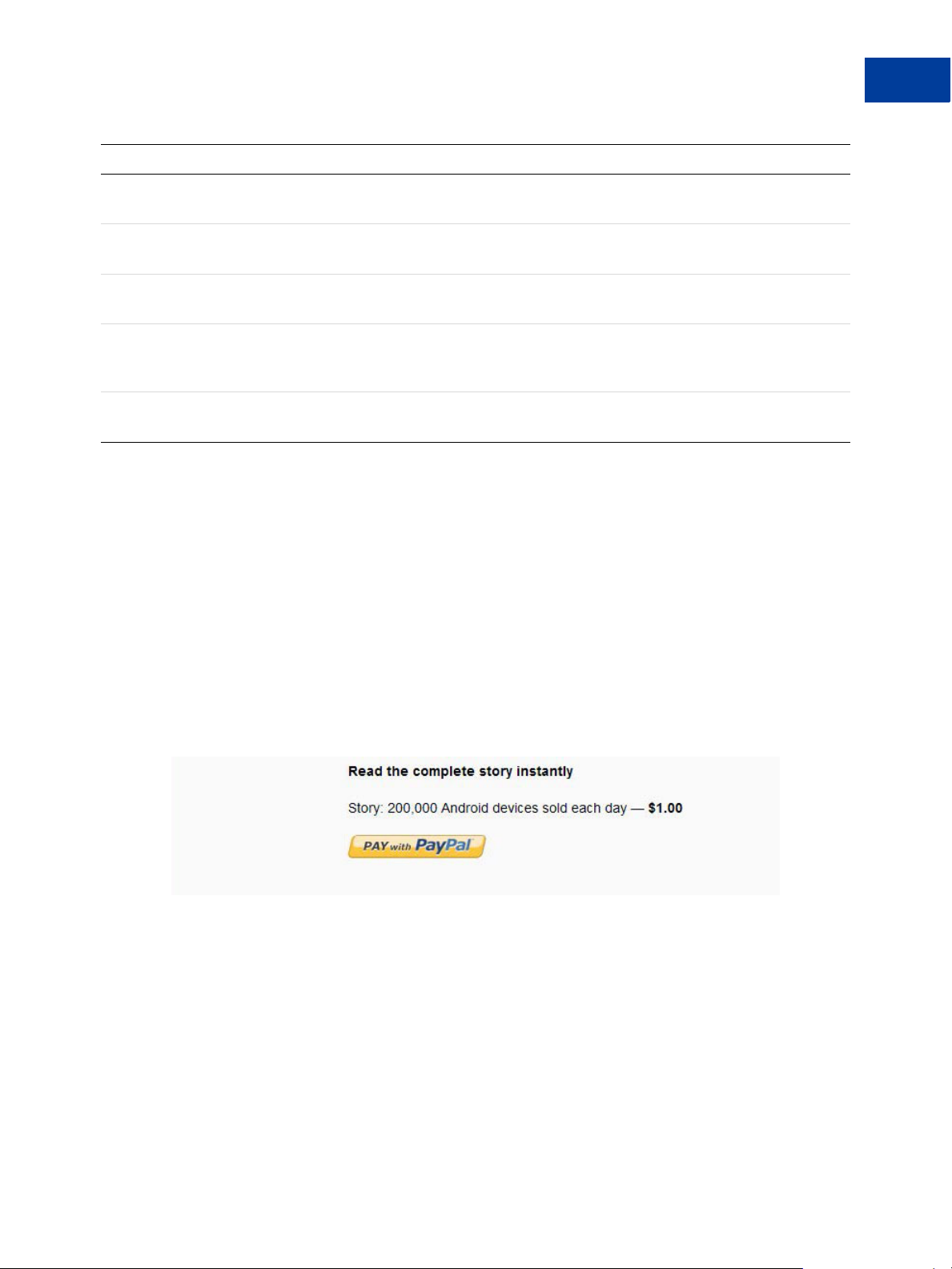

This section shows examples of different Digital Goods flows. The first example shows the

DG Instant flow (expType set to ‘instant’) for a new buyer (or a buyer who didn’t check

the “remember me” box on the login page). The second example shows the same DG Instant

flow for a returning buyer who checked the “remember me” box. The third example shows the

legacy flow (expType is unset) for a new buyer.

The buyer initiates all DG flows by clicking Pay with PayPal:

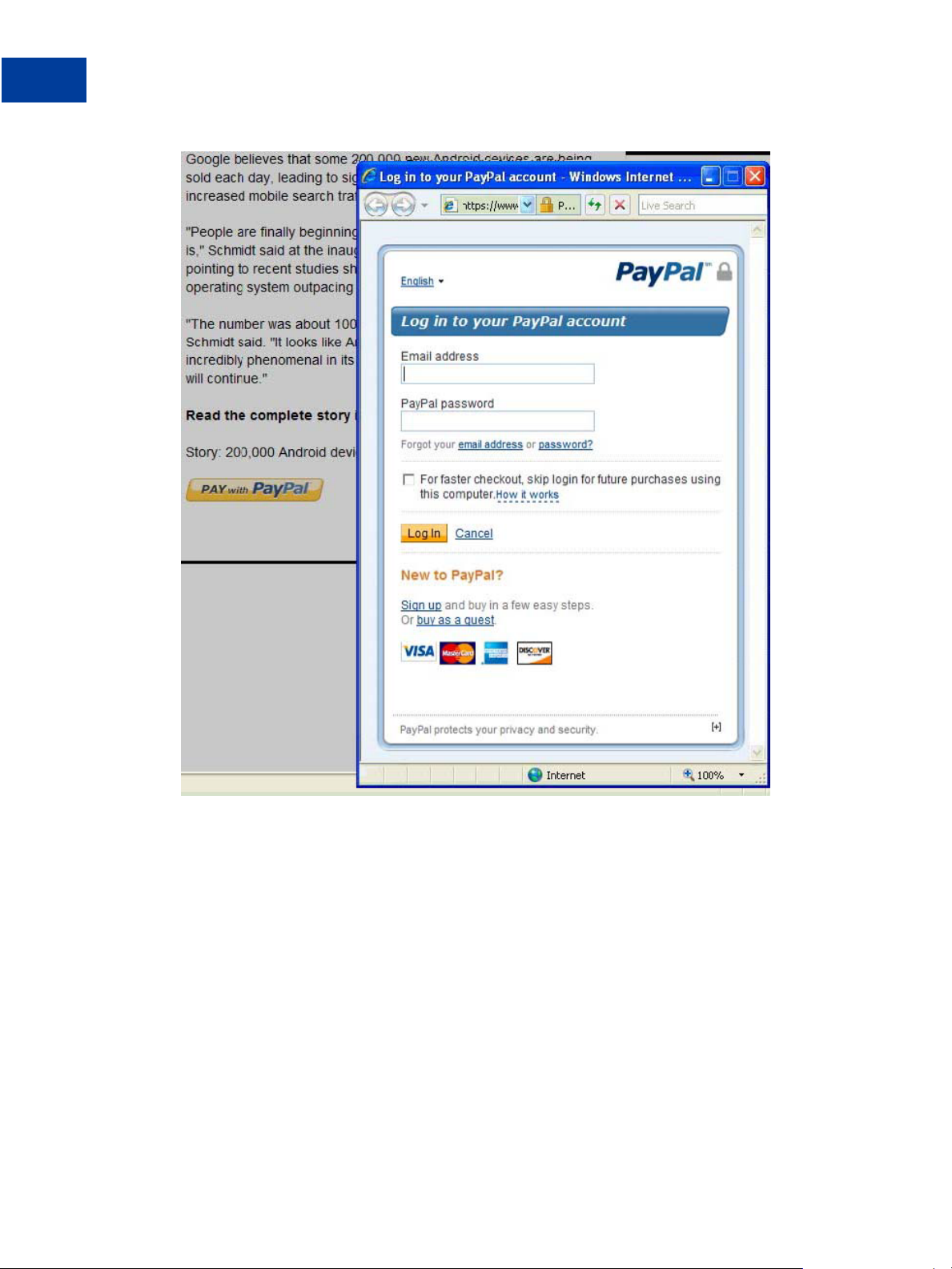

1. The expType variable is set to ‘instant’ and the buyer is new:

The DG flow opens the Log in to your PayPal account page in a mini-browser, with a

mask over the underlying page:

Digital Goods Integration Guide - EC Edition January 2012 11

Page 12

Introducing Digital Goods for Express Checkout

1

Introducing Digital Goods Payments

From this page, the buyer can log in (optionally checking the “remember me” box for

subsequent purchases if there is little risk of their account being misused), or cancel the

transaction.

IMPORTANT: Opting in to the remember me behavior does not guarantee that the buyer

will not be asked to provide log-in credentials.

Buyers without a PayPal account can sign up for one, or proceed as a guest and complete

their purchase with a credit card.

NOTE: Guest checkout provides only the visual benefits of a digital goods payment. It

does not reduce the payment steps.

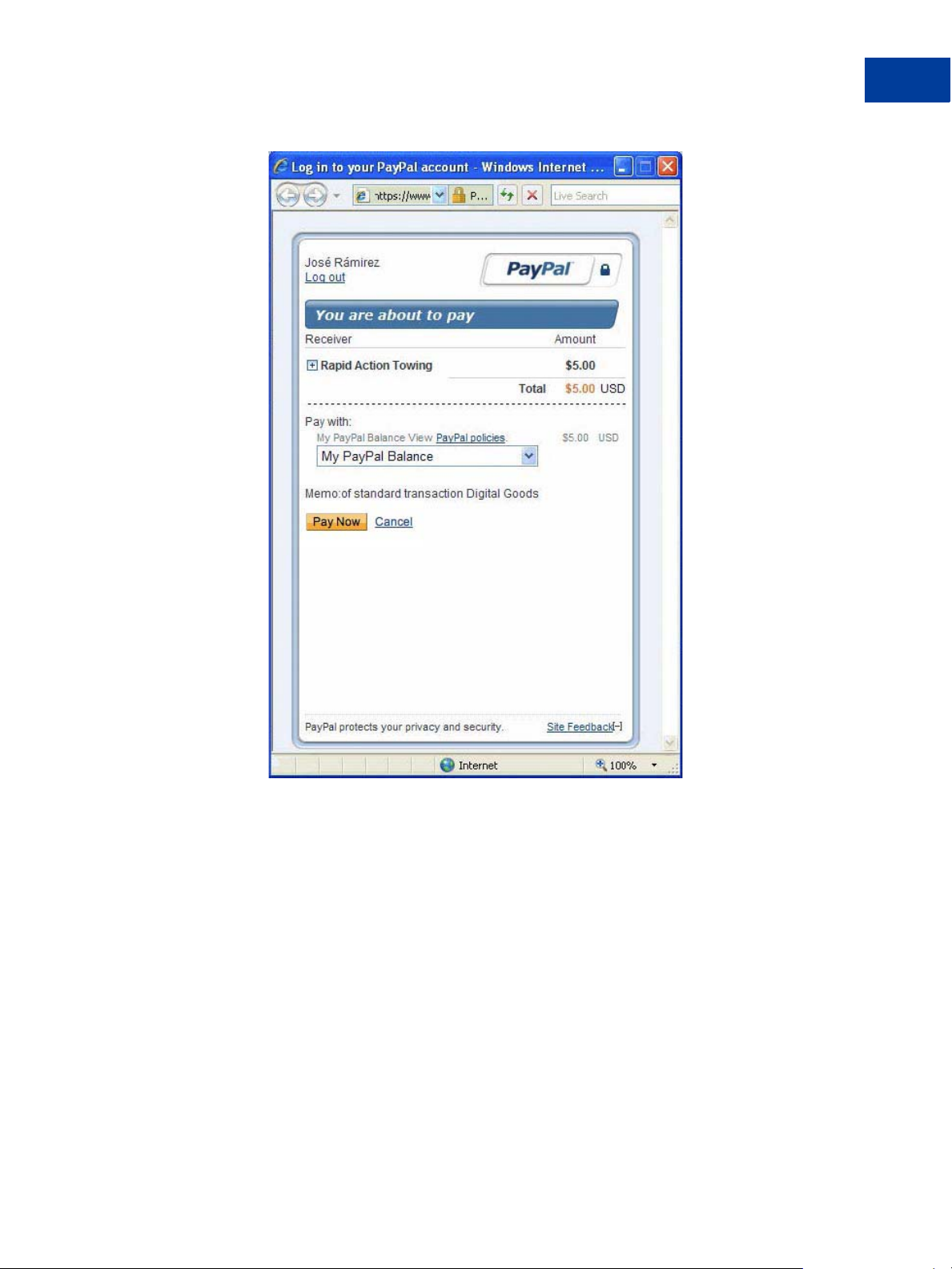

After successfully logging in, the digital flow presents the You are about to pay page in a

mini-browser:

12 January 2012 Digital Goods Integration Guide - EC Edition

Page 13

Introducing Digital Goods for Express Checkout

Introducing Digital Goods Payments

1

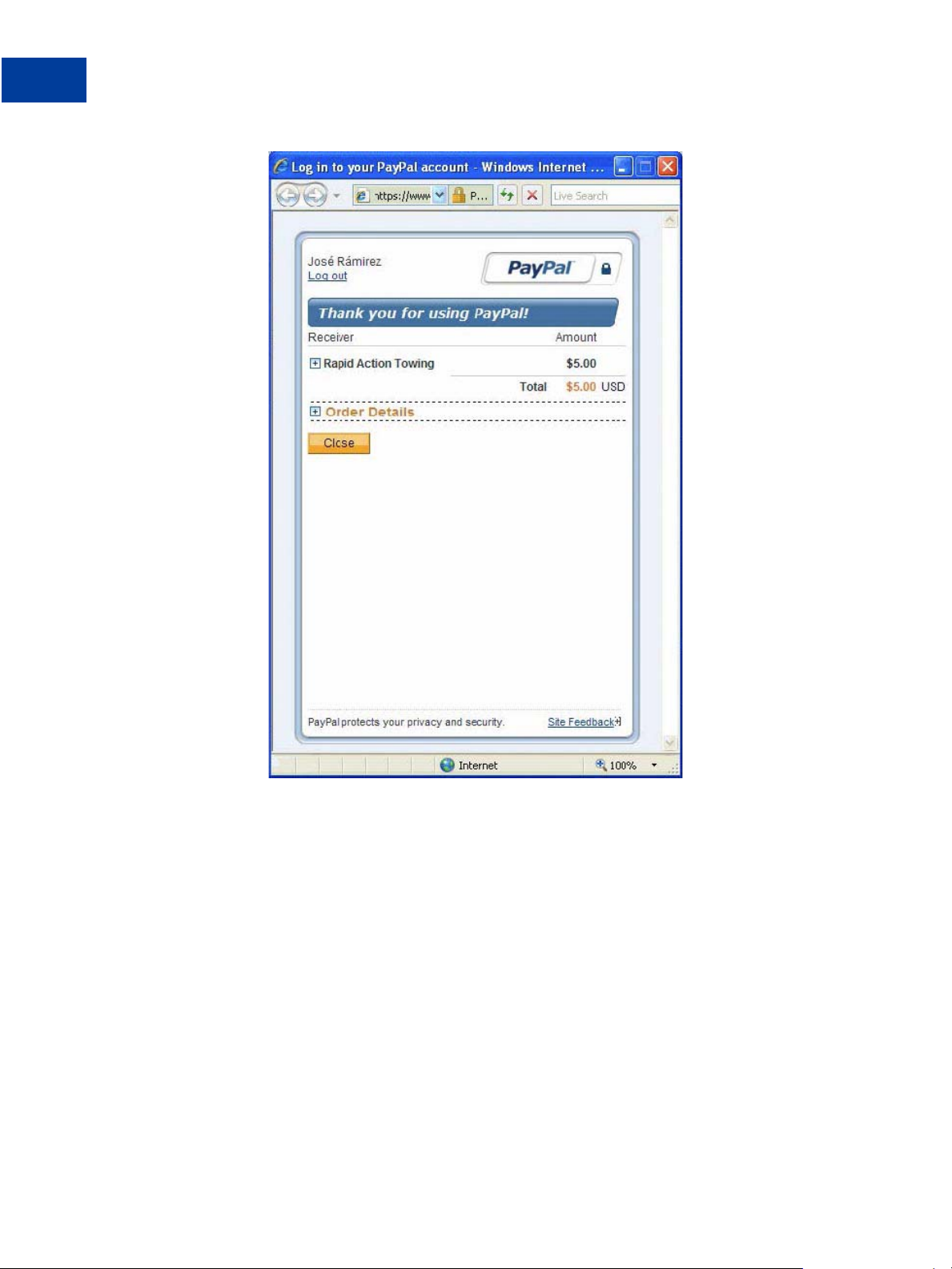

If the buyer chooses Cancel, PayPal redirects the buyer’s browser to the cancel URL

specified in the SetExpressCheckout API operation’s request message. If the buyer

chooses Pay, the Thank you for using PayPal page appears in the mini-browser:

Digital Goods Integration Guide - EC Edition January 2012 13

Page 14

Introducing Digital Goods for Express Checkout

1

Introducing Digital Goods Payments

When the buyer clicks Close, PayPal redirects the buyer’s browser to the return URL

specified in the SetExpressCheckout API operation’s request message.

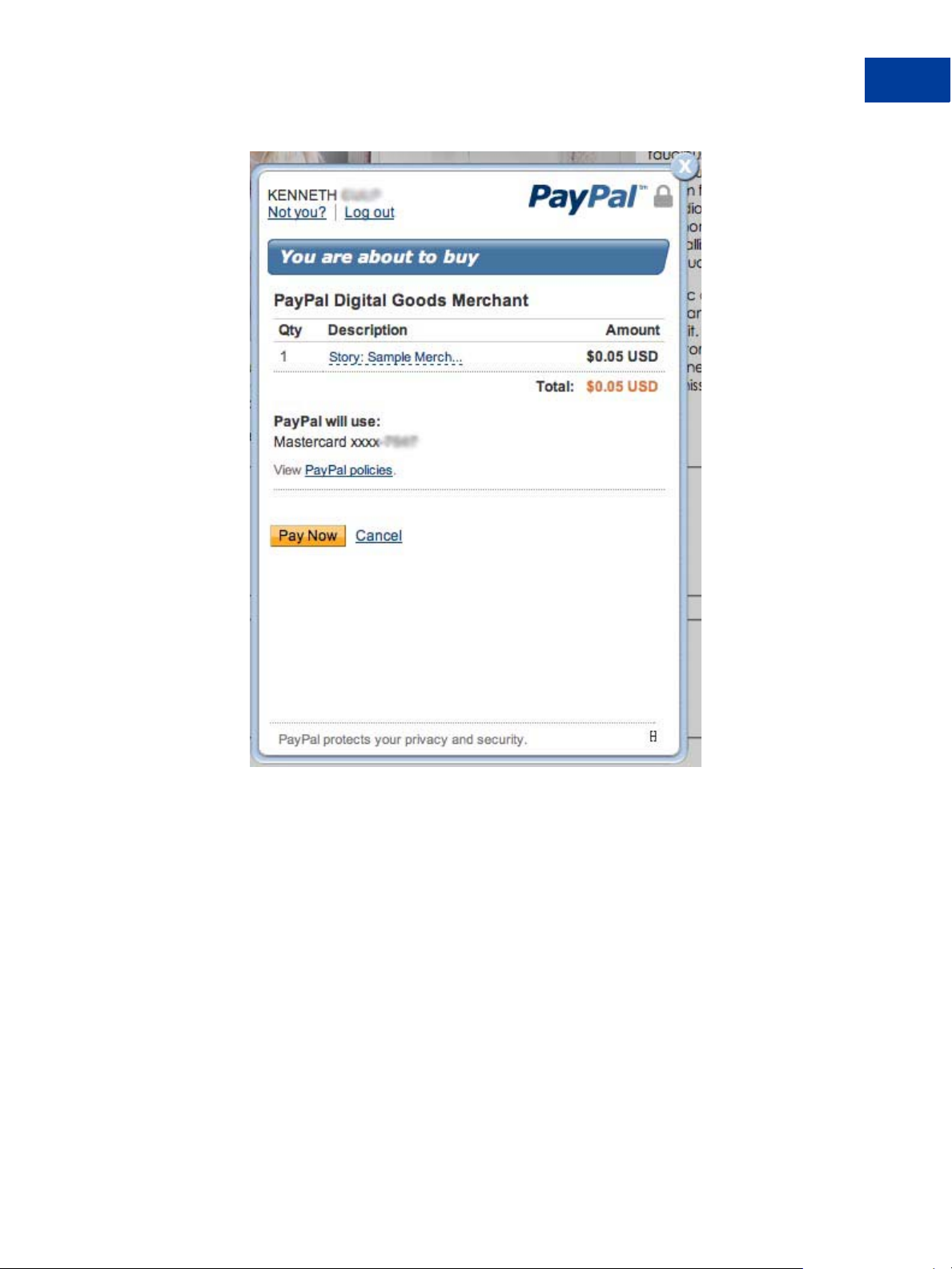

2. The expType varible is set to ‘instant’ and the buyer checked the “remember me” box:

The digital goods flow skips the login screen and the flow proceeds directly to the payment

page in a lightbox:

14 January 2012 Digital Goods Integration Guide - EC Edition

Page 15

Introducing Digital Goods for Express Checkout

Introducing Digital Goods Payments

1

The rest of the flow proceeds as shown in the previous example, but the pages are

displayed in the lightbox, instead of the mini-browser.

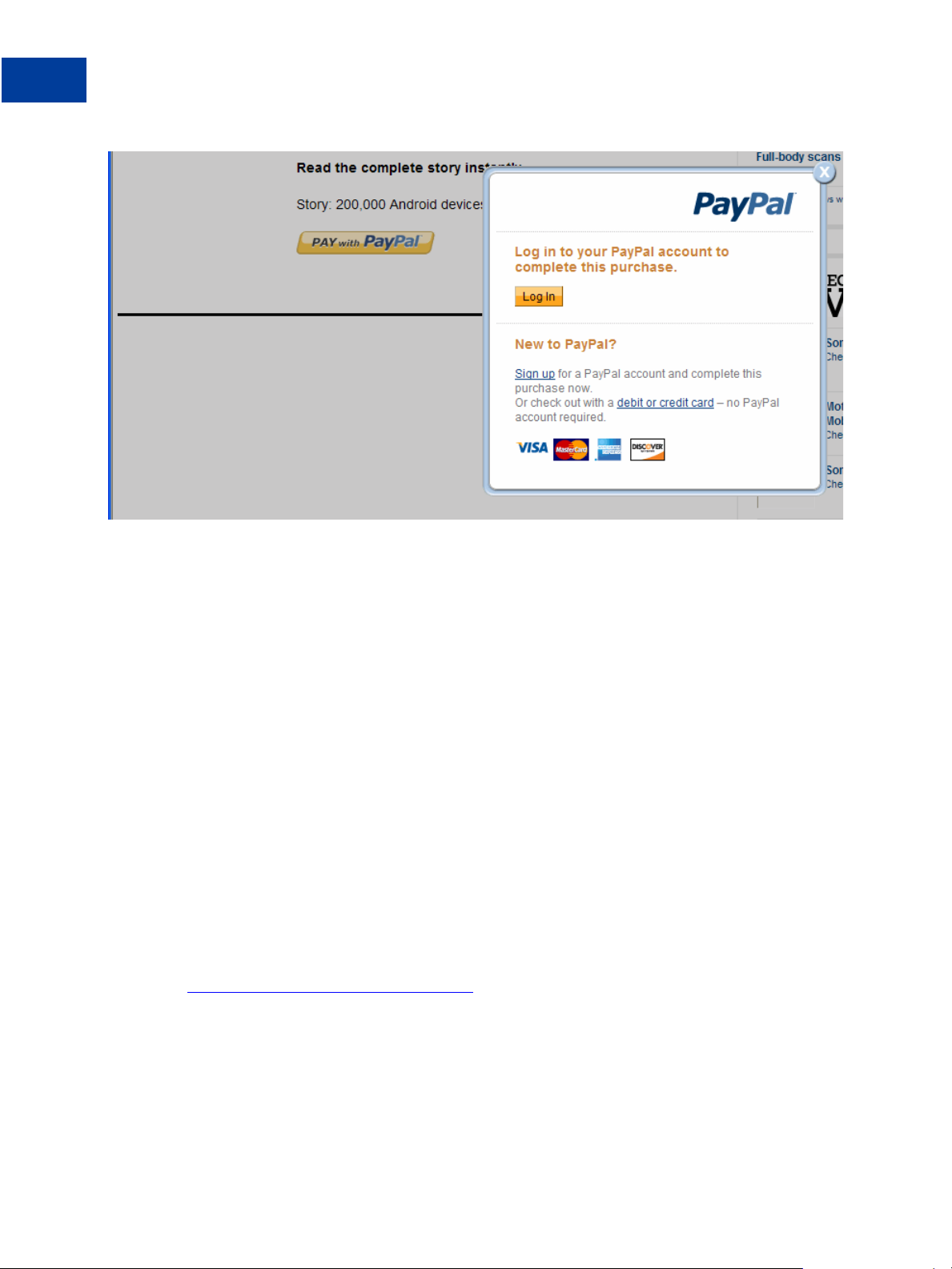

3. The expType variable is unset and the buyer is new:

The launcher page only appears if expType variable is not set and the buyer has not

previously checked the “remember me” box on the login page:

Digital Goods Integration Guide - EC Edition January 2012 15

Page 16

Introducing Digital Goods for Express Checkout

1

Introducing Digital Goods Payments

Other Payments Features That Digital Goods Supports

You can use digital goods with the following payments features:

Recurring payments. Some Express Checkout fields are not relevant to the digital goods

flows, and thus are not supported. See “Features Not Supported With Digital Goods” on

page 16 for details.

After Performing Digital Goods Transactions

After performing digital goods payments transactions, you can use PayPal API operations to

perform the following back-office tasks:

Issue refunds.

Get transaction details.

Search transactions.

Features Not Supported With Digital Goods

Digital goods does not support the following Express Checkout features described in the

Express Checkout Advanced Features Guide.

Physical goods

Digital goods are digital media that the buyer downloads or accesses online.

Shipping addresses

Downloading electronic media only does not involve shipping addresses.

16 January 2012 Digital Goods Integration Guide - EC Edition

Page 17

Introducing Digital Goods for Express Checkout

Introducing Digital Goods Payments

Instant Update API

The PayPal server calls your callback server to instantly update the PayPal pages based on

shipping options changes the buyer selects.

Parallel payments

Parameter fields describe the details of up to 10 payments. Digital goods supports passing a

value for one payment only.

Immediate Payment

Immediate Payment checks that you receive payment at the time the buyer commits to a

purchase (instant payment methods only).

Authorization and Capture API

SetCustomerBillingAgreement API

Giropay

Incentives

Several fields in the Recurring Payments API and in the Reference Transaction API are not

relevant for digital goods transactions and thus are not supported. Do not use the API fields in

the following lists for digital goods operations.

1

Unsupported Fields in the Recurring Payments and Reference Transaction Name/Value

Pair (NVP) APIs:

SHIPTONAME

SHIPTOSTREET

SHIPTOSTREET2

SHIPTOCITY

SHIPTOSTATE

SHIPTOZIP

SHIPTOCOUNTRY

SHIPTOCOUNTRYCODE

SHIPTOPHONENUM

SHIPPINGAMT

REGULARSHIPINGAMT

Unsupported Fields in the Recurring Payments and Reference Transaction SOAP APIs:

Name

Street1

Street2

CityName

StateOrProvince

Digital Goods Integration Guide - EC Edition January 2012 17

Page 18

Introducing Digital Goods for Express Checkout

1

Introducing Digital Goods Payments

PostalCode

Country

Phone

ShippingAmount

Other Digital Goods Caveats

Observe the following notes when integrating digital goods:

Your website requires a P3P header if it is not directly integrating digital goods.

If your site uses a hosted cart embedded in another merchant’s site, you need a P3P header.

For details on P3P, see the following link:

P3P documentation

Pass all the required Express Checkout API parameter fields in digital goods transactions.

For details, see “Integrating Digital Goods Payments With Express Checkout” on page 22.

18 January 2012 Digital Goods Integration Guide - EC Edition

Page 19

Integrating Digital Goods for

2

Express Checkout

This chapter describes how to integrate Digital Goods for Express Checkout with your

website.

“Overview of Digital Goods Integration” on page 19

“Integrating Digital Goods Payments With Express Checkout” on page 22

Overview of Digital Goods Integration

There are two possible ways to integrate the digital goods flow with Express Checkout:

Merchants using PHP can use the PHP Wizard, located here: https://www.paypal-

labs.com/integrationwizard/.

Merchants using other platforms must take the manual approach to integration. Future

releases will feature integration wizards for other platforms.

In either event, when the integration is successfully completed, you will have added the digital

goods JavaScript to the page, set up code to invoke the digital goods flow, and specified URLs

for return and cancel pages.

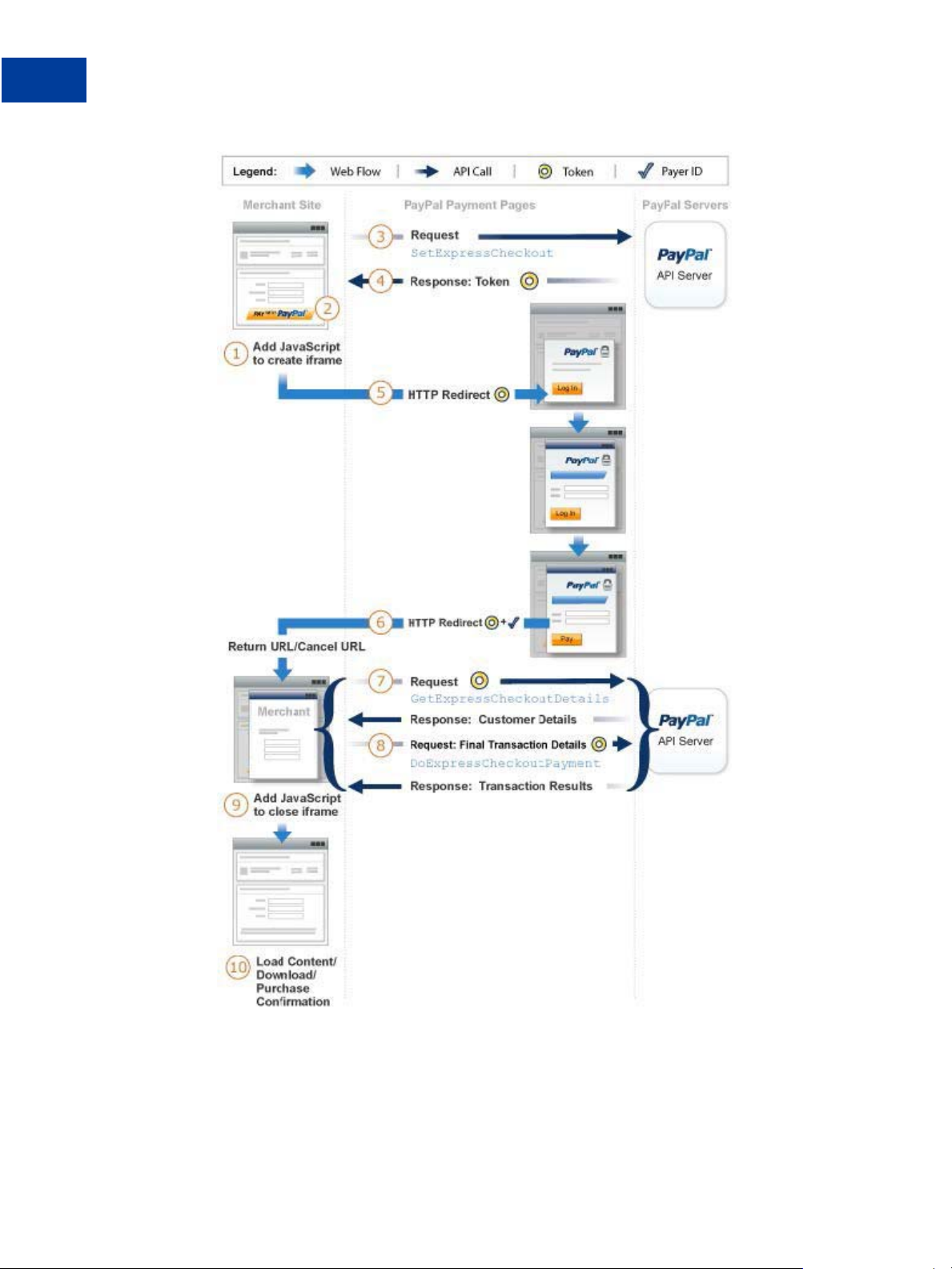

The following figure summarizes the manual integration steps for the digital goods payments

flow:

Digital Goods Integration Guide - EC Edition January 2012 19

Page 20

Integrating Digital Goods for Express Checkout

2

Overview of Digital Goods Integration

20 January 2012 Digital Goods Integration Guide - EC Edition

Page 21

Integrating Digital Goods for Express Checkout

Overview of Digital Goods Integration

The numbers in the figure correspond to the following steps:

1. Add the dg.js JavaScript (provided by PayPal) to the webpage on which you implement

the Pay With PayPal button. This script manages the PayPal digital goods payments flow.

This flow appears in a lightbox overlaying your webpage.

2. Place the Pay With PayPal button on the same webpage on which you add the dg.js

script.

3. When the buyer clicks Pay With PayPal, call the S etExpressCheckout API operation.

NOTE: Make sure that your API version is 65.1 or greater for each PayPal API call that

you make.

Pass details of the items purchased and other parameter fields required in digital goods

transactions. See “Setting Up A Digital Goods Payment Transaction” on page 22for

details.

4. A successful response returns a token to identify the digital goods transaction. Y o u pass the

token in subsequent Express Checkout API operations related to this transaction.

5. Redirect the buyer to the digital goods flow. Append the token returned in the

SetExpressCheckout response to the redirect URL.

2

If this is the first time the buyer is purchasing digital goods on your page, a mini-browser

displays that lets the buyer log in to PayPal and initiate approval for the payment.

6. After the buyer clicks Pay to approve or cancel, PayPal redirects the buyer to the respective

return or cancel URL page on your site. PayPal passes the token and the buyer’s Payer ID

with the redirect.

7. If the buyer approves payment, you can optionally call GetEx pressCheckoutDetails

to obtain buyer details to display to your webpage.

8. If the buyer approves payment, call DoExpressCheckoutPayment to complete the

payment, including the details of the items purchased.

9. Add JavaScript code to your return and cancel URL pages to close the digital goods

lightbox.

10.Fulfill the buyer’s order from your webpage.

Download the digital goods and provide a purchase confirmation .

NOTE: Make sure that you test your integration before taking your pages live.

Digital Goods Integration Guide - EC Edition January 2012 21

Page 22

Integrating Digital Goods for Express Checkout

2

Integrating Digital Goods Payments With Express Checkout

Integrating Digital Goods Payments With Express

Checkout

Integrating PayPal digital goods payments with the Express Checkout API requires

implementing the following API operations: SetExpressCheckout and

DoExpressCheckoutPayment. Optionally, you can implement

GetExpressCheckoutDetails.

Setting Up A Digital Goods Payment Transaction

To set up a digital goods payment transaction, call the SetExpressC heckout API request

operation. Provide sufficient information to initiate and redirect the buyer to the digital goods

payment flow.

This example assumes that you have set up the mechanism to communicate with the PayPal

server and you have a PayPal Business account with API credentials. It also assumes that the

payment action is a final sale.

NOTE: Use API version 65.1 or greater for all API calls for digital goods payments.

To set up a transaction, you specify values in the SetExpressCheckout request and then

call the API. The values you specify control the options available to you and the buyer.

NOTE: In the call to SetExpressCheckout, you are required to pass values for each digital

goods item the buyer is purchasing and to set the item category field to Digital. (For

details on these parameters, see step 7 in the setup procedure that follows.) To obtain

the discount rate for digital goods, you also must pass these parameters and values in

the call to DoExpressCheckoutPayment.

To set up the transaction:

1. Pass the total amount of the payment as the value of PAYMENTREQUEST_0_AMT; include

the currency if it is not in US dollars. For example:

PAYMENTREQUEST_0_AMT=amount

PAYMENTREQUEST_0_CURRENCYCODE= currencyID

Specify the total amount of the transaction. Regardless of the specified currency, the format

must have a decimal point. There must be exactly 2 digits to the right of the decimal point.

There can be an optional thousands separator to the left. The separator must be a comma.

For example, specify EUR 2.000,00 as 2000.00 or 2,000.00. The specified amount cannot

exceed USD $10,000.00, regardless of the currency used.

2. If you pass in a tax amount for each item, set PAYMENTREQUEST_0_TAXAMT to the total

amount of tax.

22 January 2012 Digital Goods Integration Guide - EC Edition

Page 23

Integrating Digital Goods for Express Checkout

Integrating Digital Goods Payments With Express Checkout

3. Specify the return URL to a page on your site.

RETURNURL=https://...

The return URL is the page to which PayPal redirects your buyer after the buyer approves

the payment. Typically this is a secure page (https://...) on your site.

NOTE: You can use the return URL to pass parameters between pages on your site. For

example, you can set your return URL to specify additional parameters using the

https://www.

parameters become available as request parameters on the page specified by the

return URL.

If you do not require the buyer to explicitly review and confirm the payment on your

review page, the buyer can confirm payment on PayPal. Add th e token and the

value commit as a name/value pair to the return URL:

https://www.paypal.com/incontext?token=

mit

4. Specify the cancel URL.

yourcompany.com/page.html?param=value... syntax. The

useraction

TOKENReturned&useraction=com

2

The cancel URL is the page to which PayPal redirects your buyer if the buyer does not

approve the payment. Typically, this is the secure page (https://...) on your site from

which you redirected the buyer to the PayPal digital goods payments flow.

NOTE: You can pass SetExpressC heckout request values as parameters in your URL

to have the values available, if necessary, after PayPal redirects to your URL.

CANCELURL=cancel_url

5. If you pass a value for PAYMENTREQUEST_0_PAYMENTACTION, you must pass the value

Sale (default).

6. Set PAYMENTREQUEST_0_ITEMAMT to the total of all items in the order.

7. Pass values for the following parameters for each item the buyer is purchasing.

– L_PAYMENTREQUEST_0_NAM E

n

– L_PAYMENTREQUEST_0_AMT n

– L_PAYMENTREQUEST_0_QTY n

– L_PAYMENTREQUEST_0_ITE MCATEGORYn (you must set the value to Digital)

NOTE: Make sure L_PAYMENTREQUEST_0_ITEMCATEGORY is set to Dig ital for every

item in the DoExpressCheckoutPayment request as well as

SetExpressCheckout. Failing to do so will result in incorrect fee calculations.

8. Set REQCONFIRMSHIPPING to 0.

9. Set NOSHIPPING to 1.

Digital Goods Integration Guide - EC Edition January 2012 23

Page 24

Integrating Digital Goods for Express Checkout

2

Integrating Digital Goods Payments With Express Checkout

10.Execute the SetExpressCheckout API operation to set up the Express Checkout

transaction.

11. Test that the response to the SetExpressCheckout API operation was successful.

Upon success, the SetExpressCheckout API operation returns a token. PayPal uses the

token to associate the execution of API operations and commands with a specific instance

of the checkout experience.

12.If calling the SetExpressCheckout API was successful, redirect the buyer to the digital

goods payments flow with the following redirect URL. Append the token value returned in

the SetExpressCheckout response to the URL:

SetExpressCheckout Example For Digital Goods

The following is an example of SetExpressCheckout parameters and values for a digital

goods payments transaction.

Request Parameters

[requiredSecurityParameters]

&METHOD=SetExpressCheckout

&RETURNURL=http://...

&CANCELURL=http://...

&PAYMENTREQUEST_0_CURRENCYCODE =USD

&PAYMENTREQUEST_0_AMT=300

&PAYMENTREQUEST_0_ITEMAMT=200

&PAYMENTREQUEST_0_PAYMENTACTIO N=Sale

&L_PAYMENTREQUEST_0_ITEMCATEGO RY0=Digital

&L_PAYMENTREQUEST_0_ITEMCATEGO RY1=Digital

&L_PAYMENTREQUEST_0_NAME0=Kitt y Antics

&L_PAYMENTREQUEST_0_NAME1=All Abo ut Cats

&L_PAYMENTREQUEST_0_QTY0=1

&L_PAYMENTREQUEST_0_QTY1=1

&L_PAYMENTREQUEST_0_AMT0=100

&L_PAYMENTREQUEST_0_AMT1=100

Response Parameters

[successResponseFields]

&TOKEN=EC-17C76533PL706494P

Redirecting the Buyer to PayPal

T o redirect you r buyer to the PayPal digital go ods payments flow, specify this URL along with

the token returned by the SetExpressCheckout API operation.

https://www.paypal.com/incontext?token=

24 January 2012 Digital Goods Integration Guide - EC Edition

TOKENReturned

Page 25

Integrating Digital Goods for Express Checkout

Integrating Digital Goods Payments With Express Checkout

After the buyer approves the payment or cancels, PayPal redirects back to the return or cancel

URL:

Return URL—If the buyer approves the payment, PayPal redirects to the return URL with

the token you passed in the redirect to PayPal and the buyer’s unique identifier (Payer ID).

Cancel URL—If the buyer cancels, PayPal redirects to the cancel URL with the token that

you passed in the redirect to PayPal.

After PayPal Redirects the Buyer To Your Web Page

The actions you take after PayPal redirects the buyer back to your web page depend upon

whether the buyer approves or cancels the order.

If the buyer approves the order and pays for the digital goods, do the following:

1. Optionally, call the GetExpressCheckoutDetails API operation to obtain details

about the buyer to display to your webpage.

2. Call DoExpressCheckout to complete payment.

2

Completing the Digital Goods Transaction

To complete the digital goods transaction after the buyer approves the order, call the

DoExpressCheckoutPayment API operation.

When calling DoExpressCheckoutPayment, do the following:

1. Pass the token and Payer ID returned by PayPal when it redirected the buyer back to your

site.

TOKEN=tokenValue

PAYERID=payerId

2. Pass the total amount of the payment as the value of PAYMENTREQUEST_0_AMT; include

the currency if it is not in US dollars.

Specify the total amount of the transaction. Regardless of the specified currency, the format

must have decimal point. The decimal point must include exactly 2 digits to the right and

an optional thousands separator to the left, which must be a comma.

For example, specify EUR 2.000,00 as 2000.00 or 2,000.00. The specified amount cannot

exceed USD $10,000.00, regardless of the currency used.

PAYMENTREQUEST_0_AMT=amount

PAYMENTREQUEST_0_CURRENCYCODE= currencyID

3. If you passed in a tax amount for each item, set PAYMENTREQUEST_0_TAXAMT to the total

amount of tax.

Digital Goods Integration Guide - EC Edition January 2012 25

Page 26

Integrating Digital Goods for Express Checkout

2

Integrating Digital Goods Payments With Express Checkout

4. If you pass a value for PAYMENTREQUEST_0_PAYMENTACTION, you must pass the value

Sale (default).

5. Set PAYMENTREQUEST_0_ITEMAMT to the total of all items in the order.

6. Pass values for the following parameters for each item the buyer is purchasing.

NOTE: Even though you passed values for these parameters in the call to

SetExpressCheckout, you must pass them again in the call to

DoExpressCheckoutPayment. Otherwise, you do not receive the discount rate

for digital goods.

– L_PAYMENTREQUEST_0_NAM E

n

– L_PAYMENTREQUEST_0_AMT n

– L_PAYMENTREQUEST_0_QTY n

– L_PAYMENTREQUEST_0_ITE MCATEGORYn (you must set the value to Digital)

7. Examine the values returned if the transaction completes successfully.

Setting Up Web Pages To Invoke the Digital Goods Payments Flow

To invoke the digital goods payments flow, follow these steps to add JavaScript to your

webpages:

1. Add the JavaScript file dg.js to your page, using the path shown. For example:

<script src="https://www.paypa lobjects.com/js/ex ternal/dg.js"

</script>

For best performance, place the path to the JavaScript file just before the closing </body>

element in your page.

2. Customize and include the following code after the JavaScript file. Replace "submitBtn"

with the ID of your HTML form button.

<script>

var dg = new PAYPAL.apps.DGFlow({

// the HTML ID of the form sub mit button which c alls setEC

trigger: "submitBtn"

// the experience type: instan t or mini

expType: ’instant’

});

</script>

NOTE: Do not set a target for the redirect on button click.

3. Include the following JavaScript code on the return URL and cancel URL pages. The

JavaScript closes the digital goods payment flow in the overlay window and sends the

buyer to the correct page.

26 January 2012 Digital Goods Integration Guide - EC Edition

Page 27

Integrating Digital Goods for Express Checkout

Integrating Digital Goods Payments With Express Checkout

NOTE: Make sure that you include content to be displayed in case the customer has

JavaScript disabled on their browser. You should include a link to deliver the content

if the purchase completes successfully.

<script>

if (window.opener){

window.close();

}

else if (top.dg.isOpen() == tr ue){

top.dg.closeFlow();

}

</script>

T o update the page asynchronously without reloading, you need to make some Ajax calls as in

the following example. This is the preferred method for closing the digital go ods paymen ts

flow. For other options, see “Integrating Digital Goods W ith Flash - Third-Party Merchant” on

page 51.

<!-- Use result of DoEC to sen d the buyer to the correct page -->

<!DOCTYPE html>

<html>

<head>

<title></title>

<script>

// Sample AJAX code us ing jQuery (any AJ AX

// library works)

$.ajax({

url: 'http://example.com/path_to_fulfillment_content',

type: 'GET',

error: function () {

// Handle error cases

},

success: function ( response){

// Replace conte nt on page, initia te

// download, etc .

}

});

</script>

</head>

<body>

<!-- Include non-JavaScript co ntent here -->

If this page does not redirect <a href="[page to deliver content

to non-JS customer]">Click Her e</a>

</body>

</html>

2

Digital Goods Integration Guide - EC Edition January 2012 27

Page 28

Integrating Digital Goods for Express Checkout

2

Integrating Digital Goods Payments With Express Checkout

JavaScript Functions For Digital Goods Payments

Include dg.js on any page that invokes or terminates the digital goods payments flow. The

JavaScript functions in dg.js set up and control the PayPal lightbox and mini-browser.

Function and Signature Description

PAYPAL.apps.DGFlow = function

({trigger:

HTML_id_of_event_triggering_flow

expType: experience_type

})

Sets up the digital goods payment flow.

Set the experience type variable (expType) to:

instant—DG flow in lightbox, with overlay mask

mini—DG flow in mini-browser with overlay mask

popup—DG flow in mini-browser

Leave expType unset for the legacy DG flow.

setTrigger: function (

id) Adds a trigger for the flow, where id is the HTML ID of the

event that triggers the flow. The flow must first be set up by

calling PAYPAL.apps.DGFlow.

startFlow: function (

url) Explicitly starts the digital goods flow, where url is the URL

that triggers the flow.

NOTE: Y ou are only required to explicitly start the flow when

there is no triggering event; for example, when you

want to associate digital goods payments with playing

a Flash movie.

closeFlow: function () Closes the mini-browser or lightbox associated with the flow.

Use this function after the buyer completes or cancels the

payment.

isOpen: function () Determines whether the flow is still active.

28 January 2012 Digital Goods Integration Guide - EC Edition

Page 29

Integrating Digital Goods for Express Checkout

Integrating Digital Goods Payments With Express Checkout

Example Merchant Page With Digital Goods JavaScript

The following code presents an example of the HTML code on the merchant page:

<html>

<head>

<meta charset="utf-8" />

<title></title>

<style type="text/css"></style>

</head>

<body>

<!-- Custom merchant code (pat h to merchant app, etc.) -->

<h1>El Jefe's Tours</h1>

<form action="path to setECURL" method=" post">

<p>

<input id="submitBtn" type="submit"

value="Pay with PayPal" />

<input type="hidden" name="success_ url"

value="path to successURL" />

<input type="hidden" name="cancel_u rl"

value="path to cancelURL">

</p>

</form>

<!-- End custom merchant code -->

<script

src="https://paypalobjects.com /js/external/dg.js ">

</script>

<script>

var dg = new PAYPAL.apps.DGFlow({

// HTML ID of form submit butt ons that call setE C

trigger:’submitBtn’,

expType:’instant’

});

</script>

</body>

</html>

2

Digital Goods Integration Guide - EC Edition January 2012 29

Page 30

Integrating Digital Goods for Express Checkout

2

Integrating Digital Goods Payments With Express Checkout

30 January 2012 Digital Goods Integration Guide - EC Edition

Page 31

3

Issuing Refunds

You can use the RefundTransaction PayPal API operation to issue refunds.

Use the RefundTransaction API to issue one or more refunds associated with a

transaction, such as a transaction created by a capture of a payment. The transaction is

identified by a transaction ID that PayPal assigns when the payment is captured.

NOTE: You cannot make a refund if the transaction occurred after the refund period has

passed; typically, the refund period is 60 days.

You can refund amounts up to the total amount of the original transaction. If you specify a a

full refund, the entire amount is refunded. If you specify a partial refund, you must specify the

amount to refund, the currency, and a description of the refund, which is called a memo.

When you call the RefundTransactio n API, PayPal responds with another transaction ID,

which is associated with the refund (not the original transaction), and additional information

about the refund. This information identifies

the gross amount of the refund, which is returned to the payer

the amount of the refund associated with the original transaction fee, which is returned to

you

the net amount of the refund, which is deducted from your balance

To issue a refund

1. In the RefundTransaction request, specify the transaction ID of the transaction whose

payment you want to refund.

TRANSACTIONID=transaction_id

2. Specify the kind of refund, which is either Full or Partial.

REFUNDTYPE=Full

or

REFUNDTYPE=Partial

3. For a partial refund, specify the refund amount, including the currency.

AMT=amount

CURRENCYCODE=currencyID

Digital Goods Integration Guide - EC Edition January 2012 31

Page 32

Issuing Refunds

3

4. For a partial refund, specify the memo description.

NOTE=description

5. Execute the RefundTransaction operation.

6. Check the acknowledgement status in the RefundTransaction response to ensure that

the operation was successful.

32 January 2012 Digital Goods Integration Guide - EC Edition

Page 33

4

Handling Recurring Payments

Set up a recurring payment to handle subscription and other payments that occur on a fixed

schedule.

How Recurring Payments Work

Recurring Payments Terms

Options for Creating a Recurring Payments Profile

Recurring Payments With the Express Checkout API

Recurring Payments Profile Status

Getting Recurring Payments Profile Information

Modifying a Recurring Payments Profile

Billing the Outstanding Amount of a Profile

Recurring Payments Notifications

How Recurring Payments Work

To view a video that demonstrates how to set up Recurring Payments, navigate to: Recurring

Payments Demo

When you support recurring payments for a buyer, you create a recurring payments profile.

The profile contains information about the recurring payments, including details for an

optional trial period and a regular payment period. Both periods contain information about the

payment frequency and payment amounts, including shipping and tax, if applicable.

After creating a profile, PayPal automatically queues payments based on the billing start date,

billing frequency, and billin g amount. Payments reoccur until th e profile expires, t here are too

many failed payments to continue, or you cancel the profile.

NOTE: When using Express Checkout, the buyer can also cancel a recurring payments

profile.

PayPal funds queued payments using the normal payment method hierarchy within the buyer’s

PayPal account.

After creating a recurring payments profile, you can view profile details or cancel the profile

from your PayPal account. You can also access recurring payments reports from the PayPal

Business Overview page.

Also, after creating a recurring payments profile, you can use the Recurring Payments API to

do the following:

Get information details about a recurring payments profile.

Digital Goods Integration Guide - EC Edition January 2012 33

Page 34

Handling Recurring Payments

4

Recurring Payments T erms

Change the status of a recurring payments profile.

Update the details of the recurring payments profile.

Bill the outstanding amount of the recurring payments profile.

Limitations

The current release of the Recurring Payments API has the following limitations:

A profile can have at most one optional trial period and a single regular payment period.

The profile start date may not be earlier than the profile creation date.

Recurring Payments with Express Checkout also has the following limitations:

To be able to create a recurring payments profile for the buyer, you must ensure that the

buyer’s PayPal account includes an active credit card.

You can create a maximum of 10 recurring payments profiles during checkout.

You can increase the profile amount by only 20% in each 180-day interval after you create

the profile.

Recurring Payments Terms

The following table lists and describes terms that are commonly used in the context of PayPal

recurring payments.

Recurring Payments Terms

Term Definition

Recurring payments profile Your record of a recurring transaction for a single buyer. The profile

includes all information required to automatically bill the buyer a fixed

amount of money at a fixed interval.

Billing cycle Make one payment per billing cycle. Each billing cycle has 2 components:

The billing period specifies the unit to calculate the billing cycle (such as

days or months).

The billing frequency specifies the number of billing periods that make

up the billing cycle.

For example, if the billing period is Month and the billing frequency is 2, the

billing cycle is 2 months. If the billing period is Week and the billing

frequency is 6, PayPal schedules the payments every 6 weeks.

Regular payment period The main subscription period for this profile, which defines a payment

amount for each billing cycle. The regular payment period begins after the

trial period, if you specify a trial period for the profile.

34 January 2012 Digital Goods Integration Guide - EC Edition

Page 35

Handling Recurring Payments

Options for Creating a Recurring Payments Profile

Term Definition

Trial period An optional subscription period before the regular payment period begins. A

trial period may not have the same billing cycles and payment amounts as

the regular payment period.

Payment amount The amount the buyer pays for each billing cycle.

Outstanding balance If a payment fails for any reason, PayPal adds that amount to the profile’s

outstanding balance.

Profile ID An alphanumeric string (generated by PayPal) th at uniquely identifies a

recurring profile. You can specify the Profile ID in the

TransactionSearch API operation to ob tain all payments associated

with the identified profile.

Options for Creating a Recurring Payments Profile

You can create a recurring payments profile that allows a regular payment period, an optional

trial period, an initial payment, and other options.

4

Specifying the Regular Payment Period

Each recurring payments profile has a regular payment period that defines the amount and

frequency of the payment. The following table lists the required fields for specifying the

regular payment period.

Required fields for specifying a regular payment period

NVP SOAP Description

PROFILESTARTDATE RecurringPaymentsProfileDet

ails.BillingStartDate

BILLINGPERIOD Sc heduleDetails.

PaymentPeriod.BillingPeriod

The date when billing for this profile

begins.

NOTE: The profile may take up to 24

hours for activation.

The unit of measure for the billing cycle.

Must be one of the following:

Day

W eek

S emiMonth

M onth

Y ear

Digital Goods Integration Guide - EC Edition January 2012 35

Page 36

Handling Recurring Payments

4

Options for Creating a Recurring Payments Profile

NVP SOAP Description

BILLINGFREQUENCY ScheduleDetails.

PaymentPeriod.BillingFreque

ncy

AMT ScheduleDetails.

PaymentPeriod.Amount

You can optionally include a value for TOTALBILLINGCYCLES (SOAP field

ScheduleDetails.PaymentPeriod.TotalBill ingCycles), which specifies the total

number of billing cycles in the regular payment period. If you either do not specify a value or

specify the value 0, the payments continue until PayPal (or the buyer) cancels or suspends the

profile. If the value is greater than 0, the regular payment period continues for the specified

number of billing cycles.

You can also specify an optional shipping amount or tax amount for the regular payment

period.

Including an Optional Trial Period

The number of billing periods that make

up one billing cycle. The combination of

billing frequency and billing period must

be less than or equal to one year.

NOTE: If the billing period is

SemiMonth, the billing

frequency must be 1.

Amount to bill for each billing cycle.

You can optionally include a trial period in the profile by specifying the following fields in the

CreateRecurringPaymentsProfile request. The following table lists the required fields

for creating an optional trial period.

Required fields for specifying a trial period

NVP SOAP

TRIALBILLINGPERIOD ScheduleDetails.TrialPeriod.Bil lingPeriod

TRIALBILLINGFREQUENCY ScheduleDetails.TrialPeriod.Bil lingFrequency

TRIALAMT ScheduleDetails.TrialPeriod.Amo unt

TRIALTOTALBILLINGCYCLES ScheduleDetails.TrialPeriod.Tot alBillingCycles

Specifying an Initial Payment

You can optionally specify an initial non-recurring payment when the recurring payments

profile is created by including the following fields in the

CreateRecurringPaymentsProfile request:

36 January 2012 Digital Goods Integration Guide - EC Edition

Page 37

Handling Recurring Payments

Options for Creating a Recurring Payments Profile

Required fields for specifying an initial payment

NVP SOAP

INITAMT ScheduleDetails.ActivationDetai ls.InitialAmount

FAILEDINITAMTACTION ScheduleDetails.ActivationDetai ls.FailedInitAmoun tAction

By default, PayPal does not activate the profile if the initial payment amount fails. To override

this default behavior, set the FAILEDINITAMTACTION field to ContinueOnFailur e. If the

initial payment amount fails, ContinueOnFailure instructs PayPal to add the failed

payment amount to the outstanding balance due on this recurring payment profile.

If you do not set FAILEDINITAMTACTION or set it to CancelOnFailure, PayPal creates the

recurring payment profile. However, PayPal places the profile into a pending status until the

initial payment completes. If the initial payment clears, PayPal notifies you by Instant

Payment Notification (IPN) that it has activated the pending profile. If the payment fails,

PayPal notifies you by IPN that it has canceled the pending profile.

If you created the profile using Express Checkout, the buyer receives an email stating that

PayPal cleared the initial payment or canceled the pending profile.

4

Maximum Number of Failed Payments

By including the MAXFAILEDPAYMENTS field in the CreateRecurringPayment sProfile

request, you set the number of failed payments allowed before PayPal automatically suspends

the profile. PayPal sends you an IPN message when the number of failed payments reaches the

maximum number specified.

Billing the Outstanding Amount

If a payment fails for any reason, PayPal adds the billing amount (including shipping and tax,

if applicable) to the profile’s outstanding balance. Use the AUTOBILLOUTAMT field in the

CreateRecurringPaymentsProfile request to specify whether PayPal should add the

outstanding amount to the payment amount for the next billing cycle.

Whether or not you choose to include the outstanding amount with the payment for the next

billing cycle, you can also use the BillOutstandingAmount API to programmatically

collect that amount at any time.

Identifying Items as Digital or Physical Goods

Set all the payment details item fields in the following table in the

CreateRecurringPaymentsProfile request. If all items are digital goods, be sure to set

the item category field to Digital to get the discount rate for digital goods.

Digital Goods Integration Guide - EC Edition January 2012 37

Page 38

Handling Recurring Payments

4

Recurring Payments With the Express Checkout API

Required fields for specifying item details

NVP SOAP Description

L_PAYMENTREQUEST_0_

ITEMCATEGORY

L_PAYMENTREQUEST_0_

NAME

n

L_PAYMENTREQUEST_0_

n

AMT

L_PAYMENTREQUEST_0_

n

QTY

n

ItemCategory For digital goods, this field must be set to

Digital.

Digital

P hysical

Name Item name.

Amount Cost of item.

Quantity Item quantity.

Recurring Payments With the Express Checkout API

During the checkout flow, you can create one or more recurring payments and mix recurring

payments with other purchases.

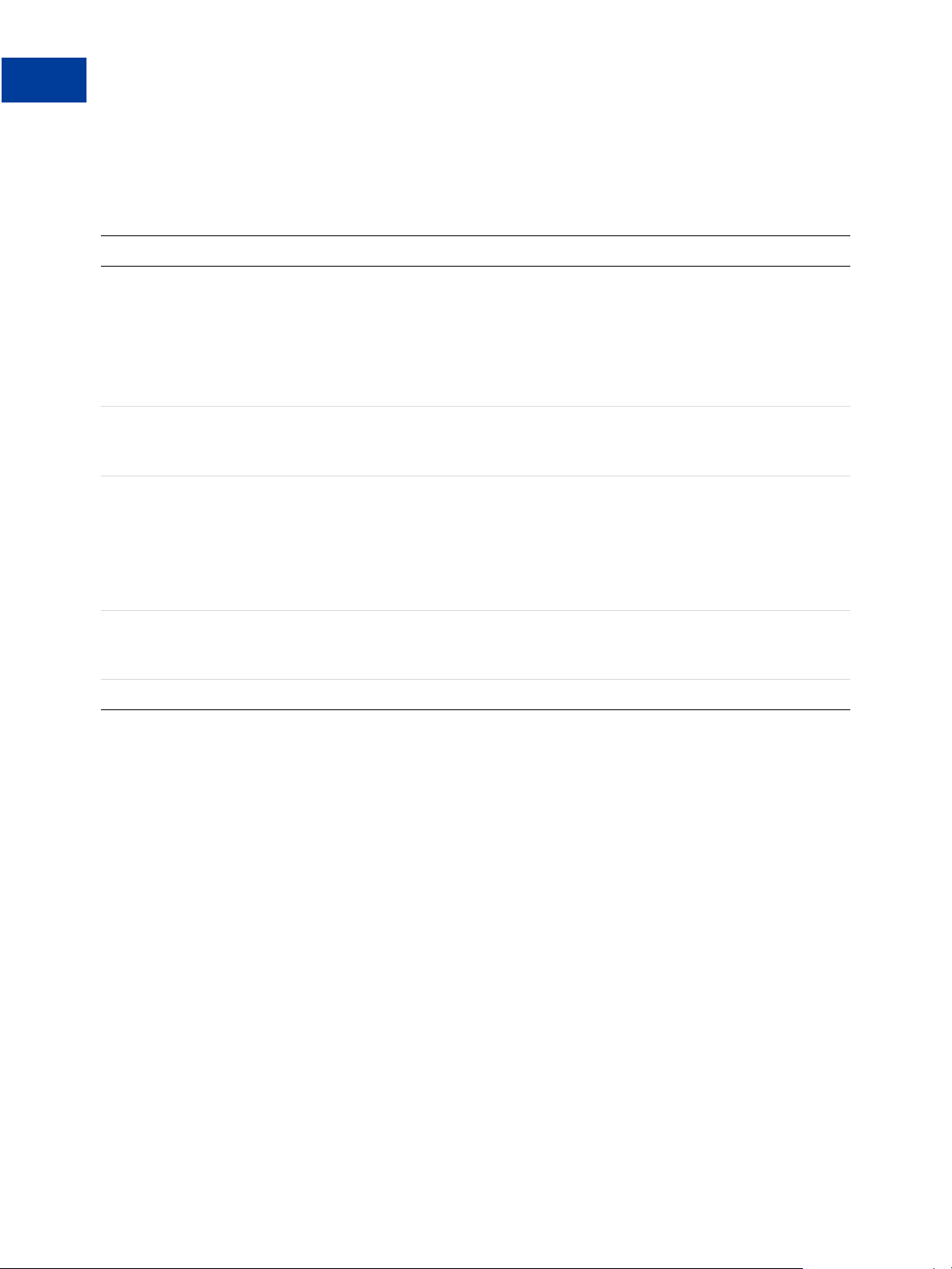

The following diagram illustrates the typical processing flow to create recurring payments

during checkout.

38 January 2012 Digital Goods Integration Guide - EC Edition

Page 39

Handling Recurring Payments

Recurring Payments With the Express Checkout API

4

The circled numbers in the diagram correspond to the numbered steps in the following table:

NOTE: For digital goods, you must use API version 65.1 or greater.

Digital Goods Integration Guide - EC Edition January 2012 39

Page 40

Handling Recurring Payments

4

Recurring Payments With the Express Checkout API

Recurring payments processing flow

Step Merchant... PayPal...

1 Adds JavaScript to your webpage to create the

PayPal digital goods payments flow, which appears

in a lightbox overlaying your webpage (Digital

Goods only).

2 Places the Pay With PayPal button on your

webpage.

3Calls SetExpressCheckout, setting up one or

more billing agreements in the request.

4 Returns a token that identifies the transaction to the

merchant.

5 Redirects buyer’s browser to:

https://www.paypal.com/cgibin/webscr?cmd=_express-checko ut

&token=

SetExpressCheckout

<token returned by

>

Displays login page and allows user to select

payment options and shipping address.

6 Redirects buyer’s browser to returnURL passed to

SetExpressCheckout if buyer agrees to payment

description.

7Calls GetExpressCheckoutDetails to get

buyer information (optional).

Returns GetExpressCheckoutDetails

response.

Displays merchant review page for buyer.

8Calls DoExpressCheckoutPayment if the order

includes one-time purchases as well as a recurring

payment. Otherwise, skip this step.

Returns DoExpressCheckoutPayment response.

9Calls CreateRecurring PaymentsProfile one

time for each recurring payment item included in

the order. If the order includes a one-time digital

goods purchase, sets values for the required

payment details item parameters. Sets the item

category to Digital.

Returns ProfileID in

CreateRecurringPaymentsProfile response

for each profile successfully created.

40 January 2012 Digital Goods Integration Guide - EC Edition

Page 41

Handling Recurring Payments

Recurring Payments With the Express Checkout API

Step Merchant... PayPal...

10 Adds JavaScript to close the lightbox (Digital

Goods only).

11 Fulfills the buyer’s order and displays a successful

transaction page.

Initiating the Processing Flow With SetExpressCheckout

As in the Express Checkout flow, the SetExpr essCheckout request notifies PayPal that you

are:

Initiating an order that can be either a one-time purchase, up to 10 recurring payments, or a

mixture of a one-time purchase and recurring payments

Initiating the processing flow to create one or more billing agreements for recurring

payments with no associated one-time purchase or recurring payment

NOTE: You can also initiate the processing flow using SetCustomerBillingAgreement

for orders that contain only a single recurring payment.

4

Typically, you set the amount of the payment for an Express Checkout transaction when you

call the SetExpressCheckout request. You confirm the amount in the

DoExpressCheckoutPayment request. If, however, you set the amount of the payment to 0

in the SetExpressCheckout request, you can create a billing agreement without initiating a

payment.

NOTE: To create a billing agreement without purchase, use Version 54.0 or higher, of the

PayPal API.

To set up one or more billing agreements for recurring payments, modify the

SetExpressCheckout request as follows:

1. Add an L_BILLINGTYPEn field for each billing agreement you want to create; n is a value

in the range of 0 to 9, inclusive. Set the value of each field to RecurringPayments.

L_BILLINGTYPE0=RecurringPayments

2. Add an L_BILLINGAGREEMENTDESCRIPTIONn field to correspond to each

L_BILLINGTYPEn field you pass; n is a value in the range of 0 to 9, inclusive. Set the

value of each field to the description of the goods or services associated with that billing

agreement, for example:

L_BILLINGAGREEMENTDESCRIPTION0=Time Mag azine subscription

3. If there is no associated purchase, set PAYMENTREQUEST_0_AMT to 0.

PAYMENTREQUEST_0_AMT=0

Digital Goods Integration Guide - EC Edition January 2012 41

Page 42

Handling Recurring Payments

4

Recurring Payments With the Express Checkout API

4. (Optional) Set MAXAMT to the average expected transaction amount.

PayPal uses the value you pass to validate the buyer’s payment method for recurring

payments. If you do not specify a value, the default is 25.00.

The SetExpre ssCheckout response provides a token that uniquely identifies the transaction

for subsequent redirects and API calls.

Redirecting the Buyer to PayPal

After you receive a successful response from SetExpressCheckout, add the TOKEN from

the SetExpressCheckout respon se as a name/value pair to the following URL, and redirect

your buyer to it:

https://www.paypal.com/cgi-bin /webscr?cmd=_expre ss-checkout&

token=<value_returned_by_SetExpressCheckoutResponse>

When redirecting the buyer to PayPal, PayPal recommends that you use the HTTPS response

302 “Object Moved” with the URL as the value of the Location header in the HTTPS

response. Make sure that you use an SSL-enabled server to prevent browser warnings about a

mix of secure and insecure graphics.

Getting Buyer Details Using GetExpressCheckoutDetails

The GetExpressCheckoutDetails method returns information about the buyer, including

name and email address stored on PayPal. You can optionally call this API after PayPal

redirects the buyer’s browser to the ReturnURL you specified in the SetExpressCheckout

request.

The GetExpressCheckoutDetails request has one required parameter, TOKEN, which is

the value returned in the SetExpressCheckout response.

PayPal does not return the values you specified for the following parameter fields in the

GetExpressCheckoutDetails response unless the transaction includes a purchase. PayPal

ignores the fields if you set up a billing agreement for a recurring payment that is not

immediately charged.

PAYMENTREQUEST_n_DESC

PAYMENTREQUEST_n_CUSTOM

PAYMENTREQUEST_n_INVNUM

Creating the Profiles With CreateRecurringPaymentsProfile

After your buyer has agreed to the recurring payments billing agreement on your confirmation

page, you must call CreateRecurringPaymentsProfile to create the profile. If you are

creating multiple recurring payments profiles, you must call

CreateRecurringPaymentsProfile once for each profile you plan to create.

42 January 2012 Digital Goods Integration Guide - EC Edition

Page 43

Handling Recurring Payments

Recurring Payments With the Express Checkout API

If the transaction includes a mixture of a one-time purchase and recurring payments profiles,

call DoExpressCheckou tPayment to complete the one-time purchase transaction. Then call

CreateRecurringPaymentsProfile for each recurring payment profile you plan to

create.

IMPORTANT: PayPal does not create the recurring payments profile until you receive a

success response from the CreateRecurringPaymentsProfile call.

T o obtain the best rates for digital goods, set values for the following required pay ment details

item fields:

L_PAYMENTREQUEST_0_NAMEn

L_PAYMENTREQUEST_0_AMTn

L_PAYMENTREQUEST_0_QTYn

L_PAYMENTREQUEST_0_ITEMCATEGORYn (you must set the value to Digital)

NOTE: The payment details item fields are available with version 69.0 and later of the

CreateRecurringPaymentsProfile API.

The CreateRecurringPaymentsProfile response contains a Profile ID, which is an

encoded string that uniquely identifies the recurring payments profile.

4

The following is a CreateRecurringPaymentsProfile example that enables you to

obtain the best rates for digital goods items.

Request Parameters

[requiredSecurityParameters]

&METHOD=CreateRecurringPayment sProfile

TOKEN=EC-13W99099UU817504D

&PROFILESTARTDATE:20XX-03-05T03 :00:00

&DESC=Movie clips

&BILLINGPERIOD=Month

&BILLINGFREQUENCY=12

&AMT=1.00

&CURRENCYCODE=USD

&EMAIL=payername@bbb.net

&L_PAYMENTREQUEST_0_ITEMCATEGO RY0=Digital

&L_PAYMENTREQUEST_0_NAME0=Kitt y Antics

&L_PAYMENTREQUEST_0_AMT0=1.00

&L_PAYMENTREQUEST_0_QTY0=1

Response Parameters

[successResponseFields]

&PROFILEID=I-G7ALAX8095JY

&PROFILESTATUS=Active

Digital Goods Integration Guide - EC Edition January 2012 43

Page 44

Handling Recurring Payments

4

Recurring Payments Profile Status

Recurring Payments Profile Status

The recurring payments actions you may take depend on the status of the profile.

A recurring payments profile can have one of the following status values:

ActiveProfile

PendingProfile

ExpiredProfile

SuspendedProfile

CancelledProfile

If PayPal successfully creates the profile, the profile has an ActiveProfile status. However,

if a non-recurring initial payment fails and you set FAILEDINITAMTA CTION to

CancelOnFailure in the CreateRecurringPayment sProfile request, PayPal creates

the profile with a status of PendingProfile. The profile remains in this status until the

initial payment either completes successfully or fails.

A profile has a status of ExpiredProfile when PayPal completes the total billing cycles for

the optional trial and the regular payment periods.

You can suspend or cancel a profile by using the

ManageRecurringPaymentsProfileStatus API. You can also reactivate a suspended

profile. If PayPal has already reached the maximum number of failed payments, however, you

must increase the number of failed payments before reactivating the profile.

NOTE: You can also suspend, cancel, or reactive a recurring payments profile through the

PayPal website.

For recurring payments profiles created with the Express Checkout API, the buyer receives an

email about the change in status of their recurring payment.

Getting Recurring Payments Profile Information

Use the GetRecurringPaymentsProfileDetails API to obtain information about a

profile.

NOTE: You can also get information about recurring payments profiles from the PayPal

website.

Along with the information that you specified in the CreateRecurringPaymentsProfile

request, GetRecurringPaymentsProfileDetails also returns the following summary

information about the profile:

Profile status

Next scheduled billing date

Number of billing cycles completed in the active subscription period

44 January 2012 Digital Goods Integration Guide - EC Edition

Page 45

Number of billing cycles remaining in the active subscription period

Current outstanding balance

Total number of failed billing cycles

Date of the last successful payment received

Amount of the last successful payment received

Modifying a Recurring Payments Profile

Use the UpdateRecurringPaymentsProfile API to modify a recurring payments profile.

NOTE: You can also modify recurring payments profiles from the PayPal website.

You can modify only the following specific information about an active or suspended profile:

Subscriber name or address

Past due or outstanding amount

Handling Recurring Payments

Modifying a Recurring Payments Profile

4

Whether to bill the outstanding amount with the next billing cycle

Maximum number of failed payments allowed

Profile description and reference

Number of additional billing cycles

Billing amount, tax amount, or shipping amount

NOTE: You cannot modify the billing frequency or billing period of a profile. You can modify

the number of billing cycles in the profile.

You can modify the following profile information during the trial period or regular payment

period.

Billing amount

Number of billing cycles

NOTE: For recurring payments with the Express Checkout API, PayPal does not allow certain

updates, such as billing amount, within 3 days of the scheduled billing date.

The profile changes take effect with the next payment after the call to update the profile. Say,

for example, the buyer has made 1 trial payment out of a total of 3. You call

UpdateRecurringPaymentsProfile to increase the number of billing cycles to 5. This

provides the buyer with 4 additional trial payments. If you call

UpdateRecurringPaymentsProfile during the regular payment period, t he changes take

effect with the buyer’s next scheduled regular payment.

For complete details, see the Name-Value Pair Developer Guide and Reference or the SOAP

API Reference.

Digital Goods Integration Guide - EC Edition January 2012 45

Page 46

Handling Recurring Payments

4

Billing the Outstanding Amount of a Profile

Updating Addresses

When you update the subscriber shipping address, you must enter all of address fields, not just

those that are changing:

To update the subscriber’s street address, for example, specify all the address fields listed in

the Name-Value Pair Developer Guide and Refer ence or SOAP API Reference. Do not specify

only the street address field.

Updating the Billing Amount

For profiles created using Express Checkout, you can increase the recurring payment total

amount by 20% maximum in a fixed 180-day interval after profile creation. The 20%

maximum is based on the total amount of the profile at the beginning of the 180-day interval,

including any shipping or tax amount.

If, for example, you create a profile on March 10 with a total amount of $100, during the 180day interval from March 10 to September 6, you can increase the amount to a maximum of

$120 (120% of $100).

Suppose that during the first 180-day interval, you increased the payment amount to $110.

During the next 180-day interval (starting September 7), you can only increase the amount of

the payment to a maximum of $132 (120% of $110).

Billing the Outstanding Amount of a Profile

Use the BillOutstandingAmount API to immediately bill the buyer for the current past

due or outstanding amount for a recurring payments profile.

NOTE: You can also bill the buyer for the current past due or outstanding amount for a

recurring payments profile from the PayPal website.

To bill the outstanding amount:

The profile status must be active or suspended.

NOTE: The BillOutstandingAm ount API does not reactivate a suspended profile. You

need to call ManageRecurringProfileStatus to do this.

The profile must have a non-zero outstanding balance.

The amount of the payment cannot exceed the outstanding amount for the profile.

The BillOutstandingAmount call cannot be within 24 hours of a regularly scheduled

payment for this profile.

NOTE: An error occurs when another outstanding balance payment is already queued.

PayPal informs you by IPN about the success or failure of the outstanding payment. For

profiles created using Express Checkout, the buyer receives an email notification of the

payment.

46 January 2012 Digital Goods Integration Guide - EC Edition

Page 47

Handling Recurring Payments

Recurring Payments Notifications

Recurring Payments Notifications

PayPal notifies you of recurring payments events through IPN and email. Typically, however,

you can call GetTransactionDetails to obtain the information you need.

PayPal notifies you of certain events through IPN. For recurring payments profiles created

using Express Checkout, PayPal also notifies buyers of specific events by email. The

following table indicates when PayPal generates IPN and emails:

Recurring payments IPN messages and email

Event IPN Buyer Email

Profile successfully created Ye s Yes

Profile creation failed Yes Yes

Profile canceled from paypal.com interface Yes Yes

Profile status changed using API No Yes

Profile updated using API No Yes

4

Initial payment either succeeded or failed Yes Yes

Payment either succeeded or failed (during either trial

period or regular payment period)

Outstanding payment either succeeded or failed Yes Yes

Maximum number of failed payments reached Yes No

NOTE: API transactions such as ManangeRecurringPaymentsProfileStatus do not

Yes Yes

trigger IPN notification. The API response immediately provides the success or failure

of the call.

Digital Goods Integration Guide - EC Edition January 2012 47

Page 48

Handling Recurring Payments

4

Recurring Payments Notifications

48 January 2012 Digital Goods Integration Guide - EC Edition

Page 49

Options For Closing the Lightbox

A

or Mini-browser

The following options for closing the lightbox or mini-browser reload the parent page:

“Reloading Parent Page to a Specific URL” on page 49

“Reloading Parent Page by Removing Frames” on page 50

Reloading Parent Page to a Specific URL

This procedure for closing the lightbox or mini-browser reloads the parent page to a specific

URL:

1. Optionally, to obtain details about the buyer to display to your web page, call the

GetExpressCheckoutDetails API operation.

2. Call DoExpressCheckout to complete payment. See “Completing the Digital Goods

Transaction” on page 25.

3. Include JavaScript code, such as in the following example, on the return URL and cancel

URL pages:

<!-- Use result of DoEC to sen d the buyer to the correct page -->

<!DOCTYPE html>

<html>

<head>

<title></title>

<script>

top.location.href=’http://example.com/path_to_fulfillment_p age’;

</script>

</head>

<body>

If this page does not redir ect <a href="[page to deliver content

to non-JS customer]">Click Her e</a>

</body>

</html>

If the buyer cancels the order, close the lightbox or mini-browser without fulfilling the order.

The top window is the browser window. This code replaces the top window content with the

content of the page at the specified URL.

Digital Goods Integration Guide - EC Edition January 2012 49

Page 50

Options For Closing the Lightbox or Mini-browser

A

Reloading Parent Page by Removing Frames

Reloading Parent Page by Removing Frames

This procedure for closing the lightbox or mini-browser reloads the parent page by removing

frames:

1. Optionally, to obtain details about the buyer to display to your web page, call the

GetExpressCheckoutDetails API operation.

2. Call DoExpressCheckout to complete payment. See “Completing the Digital Goods

Transaction” on page 25.

NOTE: You perform the previous 2 steps while you are still in control of the lightbox.

3. Include JavaScript code, such as in the following example, on the return URL and cancel

URL pages:

<!-- Use result of DoEC to sen d the buyer to the correct page -->

<!DOCTYPE html>

<html>

<head>

<title></title>

<script>

if (window != top) {

top.location.replace(d ocument.location);

}

</script>

</head>

<body>

<!-- Include non-JavaScript c ontent here -->

If this page does not redirect <a href="[page to deliver content

to non-JS customer]">Click Her e</a>

</body>

</html>

If the buyer cancels the order, close the lightbox or mini-browser without fulfilling the order.

The top window is the browser window. This code replaces the top window content with the

content of the page at the specified URL.

50 January 2012 Digital Goods Integration Guide - EC Edition

Page 51

Methods For Integrating Digital

B

Goods Into Flash

You can integrate digital goods into a Flash file.

“Integrating Digital Goods With Flash - Third-Party Merchant” on page 51

“Integrating Digital Goods With Flash” on page 51

Integrating Digital Goods With Flash

The following is an example of how a first-party merchant can integrate digital goods with

Flash.

To integrate digital goods with Flash:

1. Include the digital goods JavaScript library in the HTML page game.html, which also

includes the Flash movie game.swf.

2. Include the following ActionScript in the Flash movie game.swf to initialize the digital

goods object:

dg_button.addEventListener(

MouseEvent.MOUSE_UP,

function(evt:MouseEvent):void {

var payment_URL:String = "<Mer chant URL to initi ate API call>";

// use ExternalInterface to call the JavaScrip t method dg.startFlow

var result:uint =

ExternalInterface.call("dg.sta rtFlow",payment_URL );

}

);

function paymentComplete(response Text):void {

// use responseText to do any customizations

}

// register the callback metho d so it can be cal led via JavaScript

ExternalInterface.addCallback( "paymentCompleteEx t", paymentComplete);

Integrating Digital Goods With Flash - Third-Party Merchant

The following is an example of how a third-party merchant can integrate digital goods with

Flash.

In the following example, use ActionScript 3.0’s LocalConnection in the Flash movie,

game.swf, to respond to the payment.

Digital Goods Integration Guide - EC Edition January 2012 51

Page 52

Methods For Integrating Digital Goods Into Flash

B

Integrating Digital Goods With Flash - Third-Party Merchant

1. Create the Flash movie, game.swf, with the following code. The code assumes the button

click on dg_button initiates payment.

// create local connection

var conn:LocalConnection;

conn = new LocalConnection();

// allow cross domain connecti on

conn.allowDomain('*');

// identify this movie as the receiver (i.e. cli ent)

conn.client = this;

dg_button.addEventListener(

MouseEvent.MOUSE_UP,

function(evt:MouseEvent):void {

// following URL will begin the DG API call

var payment_URL:String =

"<Merchant URL to initiate API call>";

// following JS opens a new wi ndow to the approp riate size

// for DG checkout

var jscommand:String = "windo w.open('"+payment_ URL+"','win',

'height=550,width=400,toolbar= no,scrollbars=no'); ";

var url:URLRequest = new URLRe quest("javascript: " +

jscommand + "

void(0);");

navigateToURL(url, "_self");

//initiate listening on connec tion

conn.connect('paymentConn');

});

function paymentComplete(response Text):void {

//use responseText to do any c ustomizations

//close the LocalConnection

conn.close();

}

2. Specify another Flash movie, return.swf, as the return URL in the API call.

3. Use FlashVars or ExternalInterface in return.swf to gather any required values

from the API response.

4. Use the LocalConnection from step 1 in return.swf to communicate with

game.swf, for example:

var sendingLC:LocalConnection = new Local Connection();

// do anything required to get API response para meters into

// the ‘response’ variable

// connect to game.swf and cal l paymentComplete

sendingLC.send('paymentConn', 'pa ymentComplete', respons e);

52 January 2012 Digital Goods Integration Guide - EC Edition

Page 53

Express Checkout API Fields

C

Supported By Digital Goods

A subset of the Express Checkout API parameter fields are relevant in digital goods

integrations.

“Express Checkout NVP API Fields Supported By Digital Goods” on page 53

“Express Checkout SOAP API Fields Supported By Digital Goods” on page 57

Express Checkout NVP API Fields Supported By Digital Goods

SetExpressCheckout NVP Request Fields