Page 1

PayPal Certified

Developer Program

Study Guide

For Professional Use Only

Currently only available in English.

A usage Professional Uniquement

Disponible en Anglais uniquement pour l’instant.

Last updated: March 2008

Page 2

PayPal Certified Developer Program Study Guide

Document Number: 100018.en_US-200803

© 2008 PayPal, Inc. All rights reserved. PayPal is a registered trademark of PayPal, Inc. The PayPal logo is a trademark of PayPal, Inc. Other

trademarks and brands are the property of their respective owners.

The information in this document belongs to PayPal, Inc. It may not be used, reproduced or disclosed without the written approval of PayPal, Inc.

PayPal (Europe) Ltd. is authorised and regulated by the Financial Services Authority in the United Kingdom as an electronic money institution.

PayPal FSA Register Number: 226056.

Notice of non-liability:

PayPal, Inc. is providing the information in this document to you “AS-IS” with all faults. PayPal, Inc. makes no warranties of any kind (whether express,

implied or statutory) with respect to the information contained herein. PayPal, Inc. assumes no liability for damages (whether direct or indirect), caused

by errors or omissions, or resulting from the use of this document or the information contained in this document or resulting from the application or use

of the product or service described herein. PayPal, Inc. reserves the right to make changes to any information herein without further notice.

Page 3

Contents

Chapter 1 Online Payment Processing . . . . . . . . . . . . . . . . . 11

Online Selling Basics. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

The Payment Processing Network . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Individuals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Institutions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Processes and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

How Online Payment Processing Works. . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Payment Processing Authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Payment Processing Settlement. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

What to Look for in an Online Payment Processing Solution . . . . . . . . . . . . . . . . 13

PayPal’s Payment Processing Solutions. . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Chapter 2 Internet Security and Fraud Prevention . . . . . . . . . . .23

Why Every Business Should Be Concerned About Internet Fraud . . . . . . . . . . . . . 23

Liability for Internet Fraud . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

Internet Fraud: What It Is and How It Happens . . . . . . . . . . . . . . . . . . . . . . . 25

Who Is at Risk for Online Fraud . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Reducing Exposure to Fraud. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

What Banks and Card Associations Are Doing to Prevent Online Credit Card Fraud . . . . 28

What PayPal Is Doing to Protect Your Business Against Fraud . . . . . . . . . . . . . . . 29

How to Reduce Chargebacks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

Disclosure and Compliance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Disclosure Policy. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

PCI Data Security Standard Compliance . . . . . . . . . . . . . . . . . . . . . . . . 31

Additional Resources About Disclosure and Compliance . . . . . . . . . . . . . . . . 33

PayPal Fraud Protection Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Detailed Service Descriptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

PayPal Fraud Protection Services Upgrade Options . . . . . . . . . . . . . . . . . . 36

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

PayPal Certified Developer Program Study Guide March 2008 3

Page 4

Contents

Chapter 3 Getting Started With Account Setup . . . . . . . . . . . . 43

Basic Steps for Getting Started . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

PayPal Sandbox . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Review Question . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Chapter 4 API Credentials . . . . . . . . . . . . . . . . . . . . . . . 47

What API Credentials Are . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Choosing an Authentication Method . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

Establishing API Credentials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

API Signature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

API Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

Using API Credentials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

Chapter 5 Name-Value Pair (NVP) API . . . . . . . . . . . . . . . . .53

Integrating with the PayPal API . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Basic Steps. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Create a Web Application . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Get API Credentials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

Create and Post the Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Interpret the Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Technical Details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Request-Response Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

Request Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

Response Format . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Posting Using HTTPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

Chapter 6 Express Checkout . . . . . . . . . . . . . . . . . . . . . .59

How Express Checkout Works. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59

Express Checkout API Reference Information. . . . . . . . . . . . . . . . . . . . . . . . 61

SetExpressCheckout Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

SetExpressCheckout Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65

GetExpressCheckoutDetails Request . . . . . . . . . . . . . . . . . . . . . . . . . . 66

GetExpressCheckoutDetails Response . . . . . . . . . . . . . . . . . . . . . . . . . 66

DoExpressCheckoutPayment Request . . . . . . . . . . . . . . . . . . . . . . . . . 68

DoExpressCheckoutPayment Response . . . . . . . . . . . . . . . . . . . . . . . . 71

4 March 2008 PayPal Certified Developer Program Study Guide

Page 5

Contents

Button and Logo Placement and Use . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

PayPal Button as a Checkout Choice . . . . . . . . . . . . . . . . . . . . . . . . . . 74

PayPal Button as a Payment Method . . . . . . . . . . . . . . . . . . . . . . . . . . 74

Using PayPal-Hosted Images . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Tips . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Redirecting to PayPal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75

Recommendation for Browser Redirection . . . . . . . . . . . . . . . . . . . . . . . 75

Order Review Page Setup . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Authorization & Capture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Chapter 7 Direct Payment API . . . . . . . . . . . . . . . . . . . . .79

How Direct Payment Works . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

Direct Payment API Reference Information . . . . . . . . . . . . . . . . . . . . . . . . . 80

DoDirectPayment Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

DoDirectPayment Response. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

Authorization & Capture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Chapter 8 Transactions. . . . . . . . . . . . . . . . . . . . . . . . . 87

Authorization & Capture APIs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Authorization Process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Honor Period and Authorization Period . . . . . . . . . . . . . . . . . . . . . . . . . 88

Authorization & Capture API Reference Information . . . . . . . . . . . . . . . . . . 88

Authorization & Capture Best Practices . . . . . . . . . . . . . . . . . . . . . . . . . 93

For More Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

Refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

RefundTransaction Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

RefundTransaction Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

Transaction Searches . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

TransactionSearch Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

TransactionSearch Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Retrieving Transaction Details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

GetTransactionDetails Request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

GetTransactionDetails Response . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

Payment Notification Integration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

Email . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99

Reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .100

PayPal Certified Developer Program Study Guide March 2008 5

Page 6

Contents

Instant Payment Notification (IPN). . . . . . . . . . . . . . . . . . . . . . . . . . . .100

Dispute Notification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .103

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .103

Chapter 9 Sandbox Testing. . . . . . . . . . . . . . . . . . . . . . 105

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .105

At a Glance: Differences between the Sandbox and Live PayPal . . . . . . . . . . . .105

Accessing the PayPal Sandbox . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .107

Signing Up for Sandbox Access . . . . . . . . . . . . . . . . . . . . . . . . . . . . .108

Welcome to the PayPal Sandbox . . . . . . . . . . . . . . . . . . . . . . . . . . . .110

Test Email . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .110

Setting Up Test Accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

Planning the Types of Test Accounts You Need . . . . . . . . . . . . . . . . . . . . . 111

Managing Test Accounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112

Adding a Funding Source . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

Signing Up for Website Payments Pro. . . . . . . . . . . . . . . . . . . . . . . . . . 117

Testing PayPal Website Features . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118

Website Payments with the “Buy Now” Button . . . . . . . . . . . . . . . . . . . . . 118

Handling Pending Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .120

Instant Payment Notification (IPN). . . . . . . . . . . . . . . . . . . . . . . . . . . .121

Verifying a Test Refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .122

Transferring Funds to a Test Account . . . . . . . . . . . . . . . . . . . . . . . . . .122

Clearing or Failing Test eCheck Transactions . . . . . . . . . . . . . . . . . . . . . .123

Sending Funds to a Seller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .123

Billing A Customer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .124

Testing PayPal NVP APIs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .125

Testing Express Checkout . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .126

Testing Error Conditions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .129

API Testing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .130

Testing Using AVS Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .134

Testing Using CVV Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .138

Testing Recurring Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .140

Review Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .141

Appendix A Answers to Review Questions. . . . . . . . . . . . . . . 143

Chapter 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .143

Chapter 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .146

Chapter 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .150

6 March 2008 PayPal Certified Developer Program Study Guide

Page 7

Contents

Chapter 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .151

Chapter 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .151

Chapter 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .151

Chapter 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .151

Chapter 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .152

Appendix B General Reference Information . . . . . . . . . . . . . . 153

ShippingAddress Parameter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .153

PayPal-Supported Transactional Currencies . . . . . . . . . . . . . . . . . . . . . . . .154

AVS Response Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .155

CVV2 Response Codes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .156

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 157

Index. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

PayPal Certified Developer Program Study Guide March 2008 7

Page 8

Contents

8 March 2008 PayPal Certified Developer Program Study Guide

Page 9

List of Tables

Table 1.1 PayPal Payment Processing Solutions . . . . . . . . . . . . . . . . . . 17

Table 2.1 High Fraud Risk Quick Reference . . . . . . . . . . . . . . . . . . . . . 26

Table 2.2 PCI Data Security Standard . . . . . . . . . . . . . . . . . . . . . . . . 32

Table 2.3 Merchant Levels for PCI Compliance . . . . . . . . . . . . . . . . . . . 32

Table 2.4 PCI Compliance Validation Requirements . . . . . . . . . . . . . . . . . 33

Table 2.5 Fraud Protection Services Purchase Options . . . . . . . . . . . . . . . 34

Table 2.6 Comparison of Fraud Protection Services . . . . . . . . . . . . . . . . . 35

Table 4.1 Required Security Parameters . . . . . . . . . . . . . . . . . . . . . . . 50

Table 5.1 URL-Encoding Methods . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Table 5.2 General Format of a Request . . . . . . . . . . . . . . . . . . . . . . . 56

Table 5.3 General Format of a Successful Response . . . . . . . . . . . . . . . . 57

Table 5.4 ACK Parameter Values . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Table 5.5 Format of an Error Response . . . . . . . . . . . . . . . . . . . . . . . 57

Table 6.1 Express Checkout Flow-of-Control and Integration Points . . . . . . . . . 60

Table 6.2 SetExpressCheckout Request Parameters . . . . . . . . . . . . . . . . 62

Table 6.3 SetExpressCheckout Response Fields . . . . . . . . . . . . . . . . . . 65

Table 6.4 GetExpressCheckoutDetails Request Parameters . . . . . . . . . . . . . 66

Table 6.5 GetExpressCheckoutDetails Response Fields . . . . . . . . . . . . . . . 66

Table 6.6 DoExpressCheckoutPayment Request Parameters . . . . . . . . . . . . 68

Table 6.7 DoExpressCheckoutPayment Response Fields . . . . . . . . . . . . . . 71

Table 7.1 DoDirectPayment Request Parameters . . . . . . . . . . . . . . . . . . 80

Table 7.2 DoDirectPayment Response Fields . . . . . . . . . . . . . . . . . . . . 84

Table 8.1 DoCapture Request Parameters . . . . . . . . . . . . . . . . . . . . . . 88

Table 8.2 DoCapture Response Fields . . . . . . . . . . . . . . . . . . . . . . . . 89

Table 8.3 DoVoid Request Parameters . . . . . . . . . . . . . . . . . . . . . . . . 91

Table 8.4 DoVoid Response Fields . . . . . . . . . . . . . . . . . . . . . . . . . . 92

Table 8.5 DoReauthorization Request Parameters . . . . . . . . . . . . . . . . . . 92

Table 8.6 DoReauthorization Response Fields . . . . . . . . . . . . . . . . . . . . 92

Table 8.7 RefundTransaction Request Parameters . . . . . . . . . . . . . . . . . 94

Table 8.8 RefundTransaction Response Fields . . . . . . . . . . . . . . . . . . . 94

Table 8.9 TransactionSearch Request Parameters . . . . . . . . . . . . . . . . . 95

PayPal Certified Developer Program Study Guide March 2008 9

Page 10

List of Tables

Table 8.10 TransactionSearch Response Fields . . . . . . . . . . . . . . . . . . . . 98

Table 8.11 GetTransactionDetails Request Parameters . . . . . . . . . . . . . . . . 99

Table 9.1 Differences between PayPal Sandbox, and Live PayPal . . . . . . . . .105

Table 9.2 API Fields That Trigger Error Conditions . . . . . . . . . . . . . . . . . .130

Table 9.3 AVS Error Conditions and Triggers . . . . . . . . . . . . . . . . . . . . .134

Table 9.4 CVV Error Conditions and Triggers . . . . . . . . . . . . . . . . . . . .138

Table B.1 ShippingAddress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .153

Table B.2 PayPal-Supported Currencies and Currency Codes for Transactions . . .154

Table B.3 AVS Response Codes . . . . . . . . . . . . . . . . . . . . . . . . . . .155

Table B.4 CVV2 Response Codes . . . . . . . . . . . . . . . . . . . . . . . . . .156

10 March 2008 PayPal Certified Developer Program Study Guide

Page 11

Online Payment Processing

1

Online payment processing simplifies the operation of an online store by providing a reliable,

easy, secure, and seamless experience for merchants and customers.

In this chapter, you will learn:

z Online payment processing basics

z How the payment processing network operates

z How payment processing works

z What to look for in an online payment processing solution

z PayPal’s payment processing solutions

Online Selling Basics

With the right payment processing services, online merchants can get paid quickly and easily

while protecting themselves against fraud. The most critical step in establishing an online store

is ensuring that you can accept customer payments for single or repeated transactions. Online

payment processing tools offer customers the convenience of paying by credit card, PayPal®,

or other electronic payment sources like debit cards, purchase cards, and eChecks.

Additionally, successful online merchants must make sure their stores are secure. Online fraud

rates are climbing, but smart merchants can protect themselves with security and fraud

prevention systems from a company they trust. According to CyberSource Corp., businesses

lost nearly $2.8 billion USD to online fraud in 2005, up from $2.6 billion USD in 2004.

PayPal’s Fraud Protection Services provide secure and reliable tools that offer peace of mind.

The Payment Processing Network

The payment processing network connects sellers, buyers, and banks to enable the secure and

reliable execution of online transactions. Sellers need an internet merchant account with an

acquiring bank that allows them to accept customer credit cards electronically. Customers

need a bank that issues credit cards and verifies the customer’s credit limit and available cash

balance for proposed purchases. The elements and participants include individuals,

institutions, and processes and services.

PayPal Certified Developer Program Study Guide March 2008 11

Page 12

Online Payment Processing

1

How Online Payment Processing Works

Individuals

z Merchant: Someone who sells goods or services.

z Customer: The holder of the payment instrument.

Institutions

z Customer issuing bank: The institution providing the customer’s credit card.

z Acquiring bank: Provides internet merchant accounts required to enable online card

authorization and payment processing.

z Credit card associations: Financial institutions that provide credit card services in concert

with credit card associations such as Visa and MasterCard.

z Processor: A large data center that processes credit card transactions and settles funds for

merchants. A processor can be either a bank or a company dedicated to providing these

services. Ceridian is an example of a payment processor.

Processes and Services

z Authorizations: The process of verifying that customer credit cards are active and have

sufficient available credit limits.

z Settlements: Processing authorized transactions to settle funds into a merchant’s account.

z Payment processing service: A service that connects merchants, customers, and banks

involved in online transactions. A third party, such as PayPal with its secure payment

gateway, usually offers this service.

How Online Payment Processing Works

Online payment processing consists of two principal steps: authorization and settlement.

Authorization verifies that the card is active and the customer has sufficient credit to make the

transaction. Settlement is the process of charging the customer’s card account and transferring

money from the customer’s account to the merchant’s account.

Payment Processing Authorization

During authorization, a bank verifies that holders of a payment instrument, like a credit card,

have sufficient credit or funds to make a purchase. The payment authorization process engages

multiple institutions and services to verify that sufficient credit is available to complete the

transaction as follows:

1. Customer decides to purchase online and inputs credit card information.

12 March 2008 PayPal Certified Developer Program Study Guide

Page 13

2. Merchant’s website receives customer information and sends it to payment processing

service.

3. Processing service routes information to processor.

4. Processor routes information to bank that issued customer’s credit card.

5. Issuing bank sends authorization (or declination) to processor.

6. Processor routes transaction results to payment processing service.

7. Processing service sends results to merchant.

8. Merchant decides to accept or reject purchase. (Here, the merchant should take additional

precautions to ensure the credit card is not stolen and that the customer actually owns this

card.)

Payment Processing Settlement

Once the merchant has shipped the product or authorized the download of merchandise, the

merchant may request that the payment processing service settle the transaction. During

settlement, funds are transferred from the customer’s account to the merchant’s bank account.

Online Payment Processing

What to Look for in an Online Payment Processing Solution

1

1. Merchant informs the payment processing service to settle transactions.

2. Payment processing service sends transactions to processor.

3. Processor checks the information, and forwards settled transaction information to the card

association and card-issuing bank.

4. Transactions are settled to the card issuers and funds move between the acquiring bank and

issuing bank. Funds received for these transactions are sent to the merchant’s bank account.

5. Acquiring bank credits merchant’s bank account.

6. Issuing bank includes merchant’s charge on customer’s credit card account.

What to Look for in an Online Payment Processing Solution

Finding a reliable, secure, and flexible payment processing solution is critical. A payment

processing solution should be:

Secure

z Backed by an established, trustworthy company

z Comply with the Payment Card Industry (PCI) Data Security Standard

z Provide comprehensive and standard antifraud features

z Store customer financial information with state-of-the-art encryption

z Supply password-protected account management

PayPal Certified Developer Program Study Guide March 2008 13

Page 14

Online Payment Processing

1

PayPal’s Payment Processing Solutions

Reliable

z Provide reliable and cost-effective acceptance and processing of a variety of payment types

z Authorize credit cards in real time

z Scale to thousands of transactions to meet peak demand

z Based on a fault-tolerant network of redundant servers to ensure uninterrupted operations

Easy to Use

z Provide easy, flexible integration with merchant’s website

z Scale rapidly and seamlessly as transaction volume increases

z Work with leading internet merchant account providers

z Provide easy-to-use tracking and reporting system

z Store transaction records securely

z Process offline transactions through a virtual terminal

z Provide recurring billing payment for services

z Offer upgrade options to accommodate future growth

PayPal’s Payment Processing Solutions

PayPal’s payment processing solutions are designed to meet the demanding and diverse needs

of a variety of online merchants. By providing affordable payment connections among

merchants, customers, and financial networks, PayPal’s solutions take advantage of the latest

technical resources to streamline transactions, while helping to prevent fraud. Products

including Payflow Link, Payflow Pro, Website Payments Standard, and Website Payments Pro

allow everyone from mom-and-pop online retail stores to enterprise-level businesses to

process transactions easily, reliably, and securely.

PayPal’s Fraud Protection Services and Recurring Billing Service for Payflow, along with

other customer service packages, include professional integration support. Most importantly,

Payflow offers one of the industry’s few payment processing services with immediate

connectivity to all major processors and most shopping carts. Note, however, that you do not

need a PayPal account to process credit cards on your website.

Once you have your own website, ask a few simple questions to determine which product is

right for you:

1. Do you need an all-in-one solution that includes an internet merchant account and

allows you to process credit cards online?

If you don’t have your own internet merchant or business bank account, PayPal can

provide a total solution with its Website Payments Standard and Website Payments Pro

solutions:

– Website Payments Pro: Website Payments Pro is an all-in-one payment solution that

allows customers to shop and pay on your site. You can accept credit cards directly on

14 March 2008 PayPal Certified Developer Program Study Guide

Page 15

Online Payment Processing

PayPal’s Payment Processing Solutions

your site and get the features of a merchant account and gateway through a single

provider at a lower cost. Website Payments Pro allows you to control your checkout from

start to finish.

For more information on Website Payments Pro, go to: https://www.paypal.com/cgi-

bin/webscr?cmd=_wp-pro-overview-outside.

– Website Payments Standard: Website Payments Standard lets customers shop on your

website and pay on PayPal. It offers a pay-peruse model with no set-up or monthly fees.

Like Website Payments Pro, it includes shipping and tax calculators, reporting tools to

measure your business, and support for international currencies.

For more information on Website Payments Standard, go to:

https://www.paypal.com/cgi-bin/webscr?cmd=_wp-standard-overview-outside

2. Do you have your own internet merchant account or business bank account that

allows you to process credit cards online?

If you do, consider PayPal Payflow Gateway products. A gateway provides a secure

connection between your online store and your internet merchant account.

– Payflow Pro: Scalable and fully customizable, the Payflow Pro solution is

recommended for merchants who require peak site performance and direct control over

payment functionality on their site. Merchants using this service can enhance the

customer experience by allowing shoppers to complete the checkout process without

ever leaving your site.

For more information on Payflow Pro, go to: https://www.paypal.com/cgi-

bin/webscr?cmd=_payflow-pro-overview-outside.

– Payflow Link: This service is designed for merchants who require a simple solution to

selling on the web. In order to use this service, you need to add only a small piece of

HTML code that will link your customers to order forms hosted by PayPal. This simple

package allows you to process payments by credit cards, debit cards, and checks, online

and offline. It also works with most major shopping carts.

For more information on Payflow Link, go to: https://www.paypal.com/cgi-

bin/webscr?cmd=_payflow-link-overview-outside.

.

1

3. Do you need a basic payment processing service?

Look first to a basic PayPal service for processing credit cards payments. These include:

– PayPal Email Payments: Email Payments lets you send customers email invoices that

they can pay on PayPal. This simple solution does not require you to have a shopping

cart or an internet merchant account.

For more information on PayPal Email Payments, go to: https://www.paypal.com/cgi-

bin/webscr?cmd=_email-payments-overview-outside.

– PayPal Virtual Terminal: Virtual Terminal provides your business with the same

functionality as a stand-alone credit card-processing terminal, but allows you to accept

credit card payments by phone, fax, and email. You can use Virtual Terminal on any

computer with an internet connection.

For more information on PayPal Virtual Terminal, go to: https://www.paypal.com/cgi-

bin/webscr?cmd=_vt_hub-outside.

PayPal Certified Developer Program Study Guide March 2008 15

Page 16

Online Payment Processing

1

PayPal’s Payment Processing Solutions

– PayPal as an Additional Payment Option: This option allows merchants to put the

PayPal logo on their own website to accept PayPal as an alternative payment source, in

addition to credit cards such as MasterCard® or Visa®.

For more information on PayPal as an Additional Payment Option, go to:

https://www.paypal.com/cgi-bin/webscr?cmd=_additional-payment-overview-outside

.

16 March 2008 PayPal Certified Developer Program Study Guide

Page 17

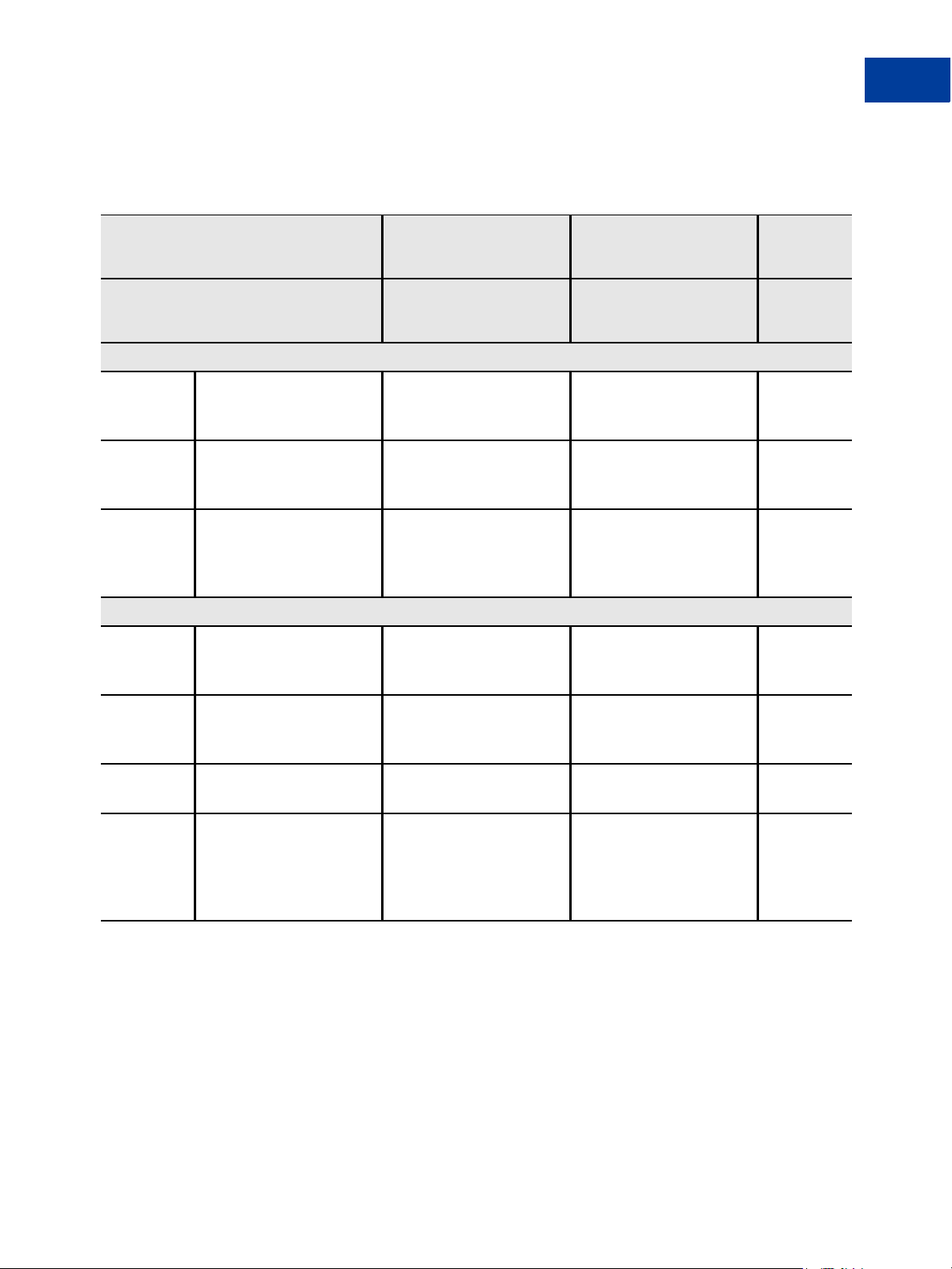

TABLE 1.1 PayPal Payment Processing Solutions

I need an all-in-one

solution

I have an internet

merchant account

Online Payment Processing

PayPal’s Payment Processing Solutions

Additional

I need basic payment

processing

payment

option

1

Website

Payments

Pro

Customer Experience

Where

customers

shop:

Where

customers

check out:

Customers

Shop on

merchant

website

Merchant

website or

on PayPal

No No No No No No No

need a

PayPal

account:

Integration

Internet

Included Not needed Required Required Not needed Included Required

merchant

account:

Shopping

Yes Yes Yes Yes Not

cart

support:

Website

Payments

Standard

Shop on

merchant

website

Payflow

Pro

Shop on

merchant

website

PayPal Merchant

website or

on PayPal

Payflow

Link

Shop on

merchant

website

Email

Payments

Varies with

merchant

business

Virtual

Terminal PayPal

Varies with

merchant

business

PayPal PayPal Phone, fax,

or mail

Not

required

required

Shop on

merchant

website

PayPal

Ye s

Technical

skills:

Ability to

APIs HTML APIs or

HTML

APIs or

HTML

Not

required

Not

required

APIs or

HTML

Included Upgrade Included Included Upgrade Included Upgrade

accept

phone, fax,

or mail

orders

N OTE: This Study Guide and the PayPal Developer Certification cover the Website Payments

Pro solution with Express Checkout.

PayPal Certified Developer Program Study Guide March 2008 17

Page 18

Online Payment Processing

1

Review Questions

Review Questions

Answers to review questions are in Appendix A, “Answers to Review Questions.”

1. Indicate if each statement is True (T) or False (F).

_____ The most critical step in establishing an online store is ensuring that you can accept

_____ According to Cybersource Corp., businesses lost nearly $2.8 billion USD to online

_____ The payment processing network connects buyers, sellers, and banks to enable the

_____ By providing affordable payment connections among merchants, customers, and

2. Match each participant in the payment processing network to the role they perform.

customer payments for single or repeated transactions.

fraud in 2005, down from $3.0 billion USD in 2004.

secure and reliable execution of online transactions.

financial networks, PayPal’s solutions take advantage of the latest technical

resources to streamline transactions, while helping to prevent fraud.

Response Participant Role Performed

Merchant 1. The holder of the payment instrument.

Customer 2. A financial institution that provides credit card

services in concert with credit card associations such

as Visa and MasterCard.

Customer Issuing Bank 3. Someone who sells goods or services.

Acquiring Bank 4. A large data center that processes credit card

transactions and settles funds for merchants.

Credit Card Association 5. An institution that provides merchant accounts

required to enable online card authorization and

payment processing.

Processor 6. The institution providing the customer’s credit card.

18 March 2008 PayPal Certified Developer Program Study Guide

Page 19

Online Payment Processing

Review Questions

3. The following steps describe the payment authorization process. Indicate the correct order

of the steps by placing the step number to the left of each description.

_____ Processor routes information to bank that issued customer’s credit card.

_____ Merchant’s website receives customer information and sends it to payment

processing service.

_____ Processing service sends results to merchant.

_____ Merchant decides to accept or reject purchase.

_____ Customer decides to purchase online and inputs credit card information.

_____ Processor routes transaction results to payment processing service.

_____ Processing service routes information to processor.

_____ Issuing bank sends authorization (or declination) to processor.

4. The following steps describe the payment processing settlement process. Indicate the

correct order of the steps by placing the step number to the left of each description.

_____ Acquiring bank credits merchant’s bank account.

_____ Merchant informs the payment processing service to settle transactions.

_____ Processor checks the information, and forwards settled transaction information to

the card association and card-issuing bank.

_____ Issuing bank includes merchant’s charge on customer’s credit card account.

_____ Transactions are settled to the card issuers and funds move between the acquiring

bank and issuing bank. Funds received for these transactions are sent to the

merchant’s bank account.

_____ Payment processing service sends transactions to processor.

1

5. Finding a reliable, secure, and flexible payment processing solution is critical. What

features should a payment processing solution offer? (Select all that apply.)

_____ Backed by an established, trustworthy company

_____ Comply with Payment Card Industry (PCI) Data Security Standard

_____ Store customer financial information in plain sight

_____ Authorize credit cards in real time

_____ Based on a network that provides near real-time credit card transactions

_____ Scale rapidly and seamlessly as transaction volume increases

_____ Offer upgrade options to accommodate future growth

_____ Provide recurrent billing payment for service

PayPal Certified Developer Program Study Guide March 2008 19

Page 20

Online Payment Processing

1

Review Questions

6. Match each PayPal solution to the service it offers.

Response PayPal Product Service Description

Website Payments Pro 1. Lets you send customers email invoices that they

can pay on PayPal. This simple solution does not

require you to have a shopping cart or an internet

merchant account.

Website Payments Standard 2. A gateway that provides a secure connection

between your online store and your internet

merchant account. Scalable and fully customizable,

this solution is recommended for merchants who

require peak site performance and direct control over

payment functionality on their site. Merchants using

this service can enhance the customer experience by

allowing shoppers to complete the checkout process

without ever leaving your site.

Payflow Pro 3. Allows merchants to put the PayPal logo on their

own website to accept PayPal as an alternative

payment source, in addition to credit cards such as

MasterCard® or Visa®.

Payflow Link 4. An all-in-one payment solution that allows

customers to shop and pay on your site. You can

accept credit cards directly on your site and get the

features of a merchant account and gateway through

a single provider at a lower cost.

PayPal Email Payments 5. A gateway that provides a secure connection

between your online store and your internet

merchant account. This service is designed for

merchants who require a simple solution to selling

on the web. In order to use this service, you need to

add only a small piece of HTML code that will link

your customers to order forms hosted by PayPal.

PayPal Virtual Terminal 6. Provides your business with the same functionality

as a stand-alone credit card-processing terminal, but

allows you to accept credit card payments by phone,

fax, and email.

PayPal as an Additional Payment

Option

7. Lets customers shop on your website and pay on

PayPal. It offers a pay-peruse model with no set-up

or monthly fees. It includes shipping and tax

calculators, reporting tools to measure your

business, and support for international currencies.

20 March 2008 PayPal Certified Developer Program Study Guide

Page 21

Online Payment Processing

Review Questions

7. Select the PayPal payment processing solutions that enable a customer to checkout on the

merchant’s website.

_____ Website Payments Pro

_____ Website Payments Standard

_____ Payflo Pro

_____ Payflow Link

_____ Email Payments

_____ Virtual Terminal

_____ PayPal as an Additional Payment Option

8. Select the PayPal payment processing solutions that require API or HTML technical skills

to develop payment processing applications.

_____ Website Payments Pro

_____ Website Payments Standard

_____ Payflo Pro

_____ Payflow Link

_____ Email Payments

_____ Virtual Terminal

_____ PayPal as an Additional Payment Option

1

PayPal Certified Developer Program Study Guide March 2008 21

Page 22

Online Payment Processing

1

Review Questions

22 March 2008 PayPal Certified Developer Program Study Guide

Page 23

2

Internet Security and Fraud Prevention

E-commerce has become an essential sales channel for businesses both domestically and

internationally. Unfortunately, e-commerce has also become an attractive revenue source for

criminals who perpetrate internet fraud. You need to be aware and informed so that you can

take steps to protect your business. Security for online payments is everyone’s responsibility.

In this chapter, you will learn about:

z Why every merchant should be concerned about internet fraud

z Liability for internet fraud

z Internet fraud: What it is and how it happens

z Who is at risk for online fraud

z How to reduce your exposure to fraud

z What banks and credit card associations are doing to prevent online credit card fraud

z What PayPal is doing to protect your business against fraud

z Providing disclosure to your customers and compliance with the Payment Card Industry

(PCI) standard

z PayPal® Fraud Protection Services

Why Every Business Should Be Concerned About Internet Fraud

Every merchant is at risk for fraud. When doing business online, you should be particularly

aware of fraud.

Offline merchants can see who they are doing business with, look at their customers’ credit

cards, and watch them sign the receipt. In the online world, however, customers never sign a

paper receipt, so authentication becomes a challenge. Moreover, in the online world, hackers

can break into your network without your knowledge and steal money, products, and sensitive

information. They can also steal customer identities and commit crimes against other

merchants, using your business as a launch pad for further crimes.

Internet fraud is also more difficult to detect than in the brick-and-mortar world. Criminals

who break into a physical store are much more visible than criminals who break in through the

web and erase their footprints. Additionally, in the online world, criminals have multiple

access points for break-ins, because the merchant store is networked internally and to other

businesses.

Because of these vulnerabilities, total losses from online payment fraud have steadily

increased. According to CyberSource’s 2006 Online Fraud Report, an estimated $2.8 billion

USD was lost to online fraud in the U.S. and Canada in 2005. The Nilson Report, a payment

PayPal Certified Developer Program Study Guide March 2008 23

Page 24

Internet Security and Fraud Prevention

2

Liability for Internet Fraud

trade publication, estimates the rate of credit card fraud to be 18 cents to 24 cents per $100

USD of online sales – three to four times higher than the overall fraud rate.

The threat of online fraud is so pervasive that the U.S. government now mandates security

requirements for businesses that handle financial information online. Today these regulations

apply mainly to the banking community, but as an internet merchant you access the financial

networks for each transaction made on your site. As a result, security at the point of sale is

becoming an increasing concern for both credit card associations and the government.

Credit card associations, for their part, hold merchants liable for fraudulent transactions

because the credit card isn’t physically present during online purchases. So merchants must

take additional steps against online fraud. Credit card associations can impose stiff penalties

for fraud – expenses on top of stolen goods and related shipping costs.

Moreover, American Express, Diners Club, Discover Card, JCB, MasterCard International and

Visa U.S.A. have adopted the Payment Card Industry (PCI) Data Security Standard developed

to protect account and transaction information of cardholders. The PCI standard requires

merchants to adhere to a set of information security requirements or risk substantial fines.

Security must therefore be a key concern.

Liability for Internet Fraud

In the offline world, you can take steps to safeguard your transactions by getting a signature

and authorization, thereby shifting the liability of the transaction to the card issuer. In the

online world, the liability for a fraudulent transaction always rests squarely with the merchant.

Online transactions are considered card-not-present transactions and are inherently riskier. The

financial consequences for a merchant who processes a fraudulent online transaction can be

significant:

z Inventory loss and shipping costs for physical goods that are fraudulently purchased and

then delivered

z Chargeback penalties assessed by the acquiring bank of $15-$30 USD per fraudulent

transaction

According to Gartner Group estimates, merchants reject an estimated 5% of all transactions

out of suspicion of fraud, while only 2% of transactions are actually fraudulent. The result is a

significant amount of lost sales (up to 3% of sales volume) in an attempt to reduce fraud risk.

In addition to losing product and paying chargeback penalties, your business also faces costs

due to fraud:

z Higher discount rates assessed as a result of processing fraudulent payments

z Labor cost for the merchant to investigate and resolve the chargeback

z Five- to six-figure card association fines or cancellation of a merchant’s account when card

fraud rates are consistently high

Implementing better tools and raising awareness can help you reduce lost revenue by turning

away fewer legitimate customers who seem suspicious. You can also resolve chargebacks

24 March 2008 PayPal Certified Developer Program Study Guide

Page 25

Internet Security and Fraud Prevention

Internet Fraud: What It Is and How It Happens

more quickly, thus saving time and money. In some cases, online merchants have reduced their

chargeback rate from 7% to 2%.

Internet Fraud: What It Is and How It Happens

All internet payment fraud is based on stolen consumer or merchant identities. It also requires

access to payment networks to complete the fraud. The result is product theft, identity theft,

and cash theft.

z Product Theft: Occurs when a criminal uses stolen credit card information to purchase

goods and services.

z Identity Theft: Occurs when stolen credit card information is combined with readily

available social security numbers and address information to open new credit cards under

the victim’s name and address.

z Cash Theft: Occurs when criminals break into a virtual cash register by stealing merchant

account access information and impersonating you in order to issue credits or payments to

themselves.

2

Fortunately, there are ways to protect against fraud. The most important thing you can do is

choose a reliable and secure payment solution that includes basic and advanced antifraud

features. Here are some of the most common fraud-related risks facing online merchants:

Consumer Identity Theft

Criminals steal consumer credit card information through a variety of methods, including

dumpster diving for paper receipts, hacking into e-commerce networks, or using handheld

“skimmers” to digitally scan numbers from credit cards of unsuspecting people at restaurants

or cash registers. Phishers, meanwhile, will send fraudulent emails to consumers warning, for

instance, of a problem with a credit card account in an attempt to trick the person to provide

personal information. Once they’ve obtained the credit card information, these criminals can

use it to steal products outright or open other accounts by impersonating the victim.

Merchant Identity Theft

Just as offline criminals can break into a cash register, online criminals can hack into the

accounts of web merchants and funnel money to themselves. These criminals might be

employees or visitors to a building who copy unprotected login information. They then can use

the information to hack into a back-end system to hijack a merchant’s payment gateway

account, which provides the secure connection between your online store and your internet

merchant account. Through this move, they can steal cash directly from the business by

issuing themselves credit cards and payments.

Accessing Payment Networks

Once criminals have stolen an identity, they may access a payment network to complete the

fraud. Most do this through two primary channels: a web merchant’s checkout page or a

payment gateway account. Although a checkout page provides convenience for both buyer and

seller, it can raise some security concerns. For example, some criminals use the page to test

PayPal Certified Developer Program Study Guide March 2008 25

Page 26

Internet Security and Fraud Prevention

2

Who Is at Risk for Online Fraud

stolen credit cards. For the merchant, it is crucial to use products with built-in fraud protection

to prevent this sort of digital theft.

Chargebacks

Chargebacks occur when a cardholder disputes a credit card purchase. During such disputes,

the card-issuing bank initiates a chargeback against the merchant, retrieving the funds for the

sale from the merchant’s bank account. The bank initiating the chargeback is not required to

notify the merchant or the merchant bank. Proving that the disputed transaction was legitimate

can cost merchants significant time and resources, so keeping chargebacks to a minimum is

essential. Chargebacks can hurt a merchant’s bottom line by lowering its credit rating,

diverting resources to resolve the dispute, and siphoning revenue from lost goods and shipping

costs. The most common type of chargeback occurs when the customer:

z Did not receive the item ordered

z Did not receive the item believed to be ordered

z Had his or her credit card stolen and used by the thief

z Stole merchandise or services through the fraudulent use of a chargeback

Who Is at Risk for Online Fraud

Fraud can happen to any merchant at any time, and a single fraud incident can be enough to

put a merchant out of business. That said, some merchants are at greater risk for certain types

of fraud than others. PayPal has put together the following quick reference to identify some of

the higher-than-average risk categories.

TABLE 2.1 High Fraud Risk Quick Reference

Merchant Type Potential Risk

Merchants with vulnerable security defenses Criminals take advantage of sophisticated spidering techniques to

identify merchants with network vulnerabilities, and can then

break into your network to steal account access information for

hijacking or merchant takeovers.

High-visibility merchants Fraud attempts are higher for merchants who advertise heavily or

are in the news because criminals know that merchants who

experience high transaction volumes have less time to defend

against fraud.

Products/Services Sold Potential Risk

High-ticket physical goods that are easily

resold

These items, including luxury goods, computers, and other

electronic equipment, are most attractive to criminals.

Goods that can be downloaded from the

internet

26 March 2008 PayPal Certified Developer Program Study Guide

The purchase of these goods doesn’t require physical address

information, making it easier for criminals to disguise a

fraudulent transaction.

Page 27

Internet Security and Fraud Prevention

Reducing Exposure to Fraud

T

ABLE 2.1 High Fraud Risk Quick Reference

Customer Base Potential Risk

International It is difficult to validate the address or identity of foreign buyers,

and it is more difficult to investigate and prosecute fraudulent

activity from an overseas source.

Sales Season Potential Risk

Heavy proportion of fourth quarter sales Criminals know that you have limited time for fraud protection

when sales volumes are high. That’s why internet fraud triples in

the fourth quarter.

Special promotions Criminals watch for special offers. They know that you have

limited time for fraud protection measures when sales volumes

are high.

Reducing Exposure to Fraud

2

It is possible to significantly reduce your exposure to fraud. There are essentially three levels

of exposure to fraud on the internet: the individual transactions, the payment gateway account,

and the merchant network. Protecting your business from fraud requires that you address each

of these levels in an integrated manner.

Transaction Level

Ensure that each transaction you accept and process is valid. You should also be careful not to

deny suspicious transactions that are actually valid.

Authenticate buyers when possible. This includes understanding who your repeat

customers are and keeping lists of repeat customers who have legitimately transacted on your

site. Make sure all customer information is encrypted and stored safely. Also, take advantage

of MasterCard® and Visa® buyer authentication programs to authenticate customers and

reduce your liability.

Screen orders for fraud patterns. There is a wealth of information associated with each

transaction that can help you understand the risk level. To effectively manage all the risk

information associated with a transaction, it is important to use a rules engine. A rules engine

automates the process of transaction screening so that you quickly fulfill orders for good

customers and proactively block risky orders. PayPal Fraud Protection Services allows you to

cost-effectively deploy a rules engine as well as benefit from PayPal’s continuously updated

lists of high-risk indicators.

Review suspicious transactions. Finally, review each transaction that is suspicious to make

sure you are doing business with a legitimate customer. Online merchants today reject 5% of

all transactions because they do not have the time or information to determine whether a

suspicious transaction is actually a good one. PayPal Fraud Protection Services allows you to

PayPal Certified Developer Program Study Guide March 2008 27

Page 28

Internet Security and Fraud Prevention

2

What Banks and Card Associations Are Doing to Prevent Online Credit Card Fraud

automatically and continuously review only the suspicious orders, before you process them,

allowing time to make an informed decision.

Account Level

Make sure that only authorized users have access to your payment gateway account, and be

alert for suspicious account access patterns.

Lock down administrative access. With PayPal Fraud Protection Services, you can limit

access to high-risk administrative transactions, such as issuing credits. You should also change

your account password on a regular basis.

Monitor account level activity for suspicious patterns. Watch your account for signs of

unauthorized access, which could indicate merchant account takeover. Account Monitoring

from PayPal offers affordable, customized, live account monitoring staffed by experienced

fraud professionals. The service can help you catch account takeover before it does any

damage, whether the takeover is due to a hacker or fraudulent employee usage of your service.

Network Level

Ensure your network or “perimeter” is defended against unauthorized access.

Lock down network access. With PayPal Manager, you can ensure that only IP addresses

you select have access to your network.

Update all patches on servers and operating systems. Invest in regularly scheduled

security audits or port scans to identify network vulnerabilities. PayPal Fraud Protection

Services offers a free network scan from Qualys, included with every Basic or Advanced

PayPal Fraud Protection Service.

Monitor firewall activity. Enterprise e-commerce companies should also monitor their

network’s perimeter security on a 24-hour basis.

What Banks and Card Associations Are Doing to Prevent Online

Credit Card Fraud

Consumers shop online for convenience and speed, but historical authentication requirements

have often proved to be cumbersome, time-consuming, and ineffective.

New buyer authentication programs, such as MasterCard® SecureCode, and Verified by

Visa®, provide more streamlined and customer-friendly authentication through passwords.

These programs enable you to gain liability protection by prompting consumers to provide a

password with their card issuers at checkout, similar to providing a PIN number for ATM

transactions. Transactions in which consumers authenticate themselves to issuers effectively

shift liability from the merchant to the issuer. Merchants are not held liable for fraudulent

transactions processed using buyer authentication.

PayPal’s suite of Fraud Protection Services makes it easy for you to take advantage of this

powerful system. (Check with your internet merchant account provider directly to determine if

28 March 2008 PayPal Certified Developer Program Study Guide

Page 29

Internet Security and Fraud Prevention

What PayPal Is Doing to Protect Your Business Against Fraud

they have deployed buyer authentication.) Through Fraud Protection Services, one seamless

integration gives you access to both Verified by Visa and MasterCard SecureCode with your

PayPal gateway service.

What PayPal Is Doing to Protect Your Business Against Fraud

The security of your information, transactions, and money is the core of our business and our

top priority at PayPal. We help you protect against fraud, so you can grow your business and

minimize losses.

PayPal leverages the Secure Sockets Layer (SSL) protocol, which provides crucial online

identity and security to help establish trust between parties involved in e-commerce

transactions. Customers can be assured that the website they’re communicating with is

genuine and that the information they send through web browsers stays private and

confidential.

Moreover, using SSL with an encryption key length of 128 bits (the highest level

commercially available), PayPal automatically encrypts your confidential information in

transit from your computer to ours. Once your information reaches us, it resides on a server

that is heavily guarded both physically and electronically. Our servers sit behind a monitored

electronic firewall and are not connected directly to the internet, so your private information is

available only to authorized computers.

2

How to Reduce Chargebacks

Dealing effectively with customer issues is a great way to minimize risk and reduce

chargebacks. By communicating clearly and keeping good records, you can avoid many

potential problems today, which are much easier than trying to resolve them with a credit card

company tomorrow. PayPal has developed these helpful tips for avoiding customer complaints

that can lead to chargebacks:

z Provide realistic delivery time estimates and use tracking that shows proof that the items

were received

z Describe the sale item in as much detail as possible. Include clear images and

measurements so that customers have a good understanding of what they’re getting.

z Make sure you clearly disclose the total cost to customers up front: the price, taxes,

shipping costs, etc.

z Provide customers with a way to contact you should they have a problem. Often a simple

email exchange or phone call clears up a misunderstanding instantly.

z Respond promptly and courteously to customer inquiries.

PayPal Certified Developer Program Study Guide March 2008 29

Page 30

Internet Security and Fraud Prevention

2

Disclosure and Compliance

Disclosure and Compliance

Disclosure Policy

Your disclosure policy tells your customers that you’re honest and dependable and that you

care about them and protecting their information. It shows your customers that you believe in

transparency and accountability. It provides a framework and standards for your business

policies, how you deal with your customer information, and how you communicate with your

customers.

Your disclosure policy typically includes five things: a business description, privacy policy,

shipping policy, return policy, and contact information. The more your customers know about

you, the more comfortable they’ll be giving you their business. So be honest, open, direct, and

precise. Here are more details about the five areas you should cover:

1. Business description. Write a clear description of what your company does, including

what products and services it provides. Post it in a prominent place on your website, often

the “About Us” section.

2. Privacy policy. Your privacy policy should clearly state how you treat and protect your

customers’ information. It’s essential that your policy is easy to find on your website,

usually linked from your homepage. Typical elements of a privacy policy include:

– What personally identifiable customer information you collect

– How the information is used

– With whom you share and do not share this information

– What choices are available to your customers regarding collection, use, and distribution

of the information

– What choices are available to your customers regarding communications from you –

email, direct mail, etc.

– The kind of security procedures in place to protect the loss, misuse, or alteration of

information under your control

– How your customers can correct any inaccuracies in the information

3. Shipping policy. You’ve made the sale. Your customers are anxious to get their purchases.

So keep that excitement and positive momentum going with a shipping policy that’s simple

and straightforward:

– Spell out your shipping terms in detail, disclosing if costs are determined by weight or

the amount of the purchase

– Indicate the classes of shipping you offer - ground, express, overnight, etc.

– Indicate if you ship to APO, FPO, and international addresses

– Tell your customers in what timeframe they can expect their purchase

– Show your customers how they can track their shipment. (Your shippers should be able

to provide most of this information for you.)

30 March 2008 PayPal Certified Developer Program Study Guide

Page 31

Internet Security and Fraud Prevention

Disclosure and Compliance

4. Return policy. Your customers love simplicity and forgiveness. They sometimes make

mistakes and order the wrong products. They may be unfamiliar with what they are

ordering, and it’s not what they had in mind. By allowing your customers to return an item

in a timely fashion, and making it easy to do so, you are gaining their loyalty. A clear return

policy also comes in handy if the order arrives damaged. So make it easy for them to

initiate returns:

– Spell out exactly what your return policy is, for example that you accept returns only as

exchanges or you accept returns and will credit their payment card

– Be specific about how many days after purchase the item can be returned in order to get

a credit or exchange

– Let them know if you charge a restocking fee on returns

– Include a return shipping label with every order

– Provide clear return instructions, such as asking for a reason for the return and a

telephone number in case you have questions

– Provide guidance on how to pack the return and where they should bring it to ship it back

to you

– Include your customer service number or email address in case customers have questions

or comments.

2

5. Contact information. Keep the channels of communication open. Make it easy for your

customers to get in touch with you:

– Give examples of reasons they may want to contact you, for example questions about

privacy policy, return policy, availability of goods, etc.

– Provide a phone number, and give the days and hours the phone lines are answered

– Provide an email address, and give a timeframe when an answer can be expected

– Provide a mailing address, and suggest to whose attention it should be addressed

PCI Data Security Standard Compliance

Just as a disclosure policy describes your business and states your business practices, your

compliance with the PCI Data Security Standard communicates how much you care about

your customers and reinforces an atmosphere of safety for all online merchants.

Consumers are becoming increasingly aware of the dangers of identity theft due to

compromised data and stolen credit card information. PCI compliance assures your customers

that you’re looking out for their safety and well-being. Approach it with that in mind, and you

transform compliance into a competitive edge and asset instead of a dreaded “must do.”

Today, virtually all major credit card companies, including American Express®, Diners

Club®, Discover® Card, JCB®, MasterCard International®, and Visa® U.S.A., require

merchants and service providers to comply with the PCI standard. When you process credit

card transactions through a merchant account, you also need to meet PCI validation

requirements, including quarterly and annual audits, security self-assessments, and security

scans. Your exact validation requirements are determined by your volume of credit card

transactions.

PayPal Certified Developer Program Study Guide March 2008 31

Page 32

Internet Security and Fraud Prevention

2

Disclosure and Compliance

While validating that you’re in compliance with the PCI standard is a requirement, it’s also an

opportunity. Finding and fixing compliance gaps before your audit keeps your company

running smoothly and your reputation intact. It provides you with tangible proof that you can

communicate to your customers on how well you’re protecting them.

The quickest and easiest way to meet PCI compliance standards is to outsource the job. A

number of PayPal payment solutions are hosted, relieving the online merchant of the

compliance responsibility. The PayPal Gateway payment solution, which allows the merchant

to handle credit data, does require compliance and validation by the merchants themselves.

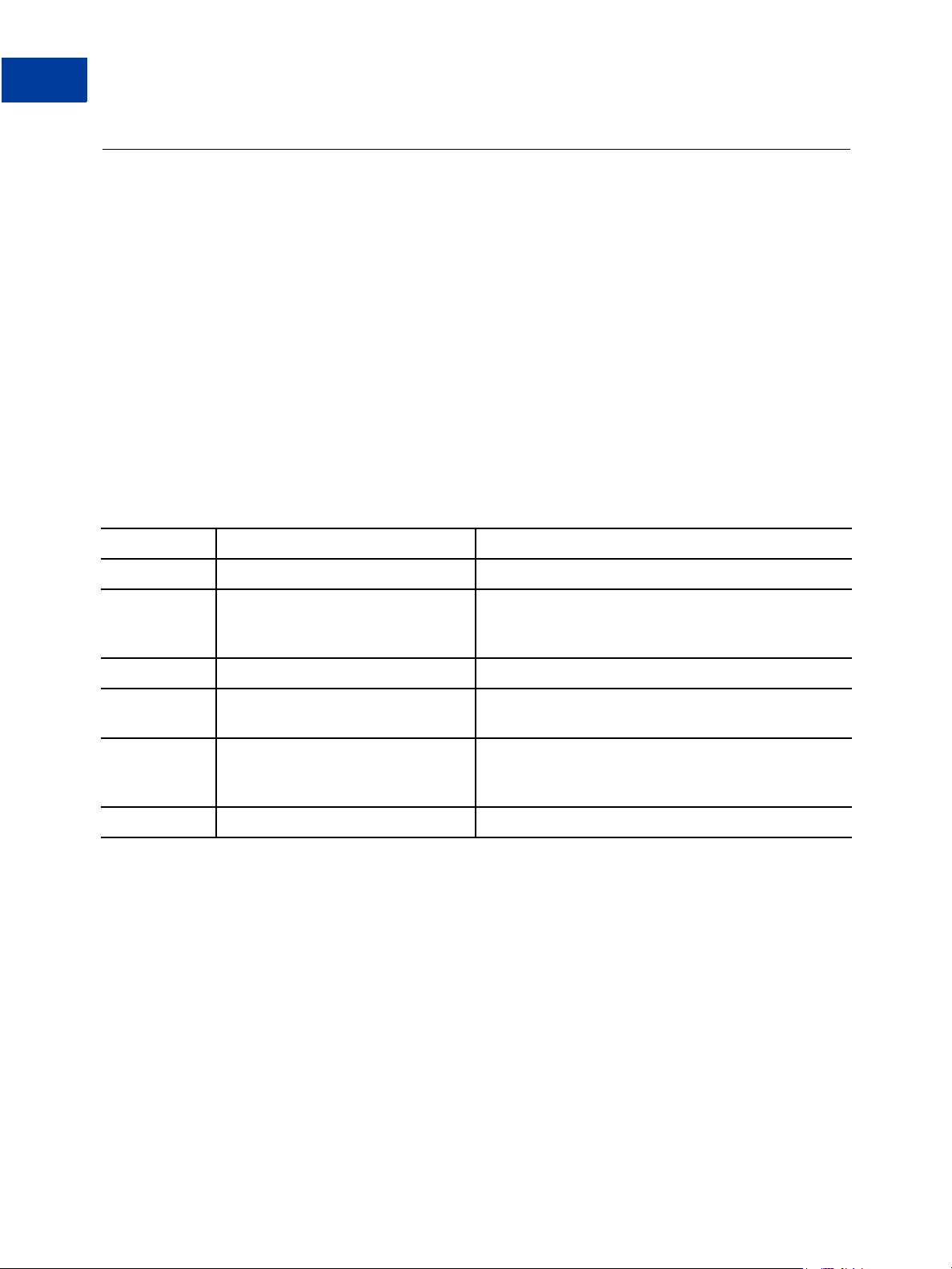

TABLE 2.2 PCI Data Security Standard

Standards Requirements

Build and Maintain a Secure Network 1. Install and maintain a firewall configuration to protect data.

2. Do not use vendor-supplied defaults for system passwords

and other security parameters.

Protect Cardholder Data 3. Protect stored data.

4. Encrypt transmission of cardholder data and sensitive

information across public networks.

Maintain a Vulnerability Management Program 5. Use and regularly update antivirus software.

6. Develop and maintain secure systems and applications.

Implement Strong-Access Control Measures 7. Restrict access to data by business need-to-know.

8. Assign a unique ID to each person with computer access.

9. Restrict physical access to cardholder data.

Regularly Monitor and Test Networks 10. Track and monitor all access to network resources and

cardholder data.

11. Regularly test security systems and processes.

Maintain an Information Security Policy 12. Maintain a policy that addresses information security.

The compliance level of each merchant is the responsibility of the merchant’s acquiring bank

(a bank that provides credit card merchant accounts and is responsible for submitting credit

card purchase information to the credit card associations). The four merchant levels are based

on annual credit card transaction volume.

T

ABLE 2.3 Merchant Levels for PCI Compliance

Level Description

Level 1 Any merchant – regardless of acceptance channel – processing over 6 million credit card

transactions per year.

Any merchant that has suffered a hack or an attack that resulted in an account data compromise.

Any merchant identified by any card association as Level 1.

Level 2 Any merchant processing 150,000 to 6 million e-commerce transactions per year.

Level 3 Any merchant processing 20,000 to 150,000 e-commerce transactions per year.

32 March 2008 PayPal Certified Developer Program Study Guide

Page 33

T

ABLE 2.3 Merchant Levels for PCI Compliance

Level Description

Internet Security and Fraud Prevention

Disclosure and Compliance

2

Level 4

Any merchant processing fewer than 20,000 e-commerce transactions per year, and all other

merchants processing up to 6,000,000 credit card transactions per year.

In addition to adhering to the PCI Data Security Standard, compliance validation is required

for Level 1, Level 2, and Level 3 merchants, and may be required for Level 4 merchants.

ABLE 2.4 PCI Compliance Validation Requirements

T

Level Validation Action Validated By

Level 1 Annual Onsite PCI Data Security Assessment

and

Quarterly Network Scan

Level 2 and 3 Annual PCI Self-Assessment Questionnaire

and

Quarterly Network Scan

Level 4

Annual PCI Self-Assessment Questionnaire

and

Quarterly Network Scan

N OTE: Level 4 merchants must comply with the PCI Data Security Standard. However,

Qualified Data Security Company or Internal

Audit if signed by Officer of the company

Qualified Independent Scan Vendor

Merchant

Qualified Independent Scan Vendor

Merchant

Qualified Independent Scan Vendor

compliance validation for merchants in this category is determined by the merchant’s

acquirer.

Additional Resources About Disclosure and Compliance

There are other online resources that can help you in developing your own disclosure policy

and meeting PCI compliance requirements. They include:

z The Privacy Planner from BBBOnLine helps you create a simple, solid, online privacy

policy for your e-commerce business: http://www.privacyplanner.com.

z The Direct Marketing Association (DMA) offers a small businessfriendly online privacy

policy generator: http://www.the-dma.org/privacy/privacypolicygenerator.shtml.

z The Federal Trade Commission offers valuable information on preventing identity theft at

http://www.consumer.gov/idtheft/. Also be sure to visit the central FTC site at

http://www.ftc.gov/ for additional information and advice.

z Both the Visa and MasterCard websites have extensive information about meeting PCI

Payment Data Security Standards: http://www.visa.com and http://www.mastercard.com.

PayPal Certified Developer Program Study Guide March 2008 33

Page 34

Internet Security and Fraud Prevention

2

PayPal Fraud Protection Services

PayPal Fraud Protection Services

Protecting your business against the consequences of even a single fraud attempt requires a

significant time commitment and ties up valuable resources. PayPal has designed its suite of

Fraud Protection Services based on merchant feedback and the needs of the online business

community. Our solution not only gives you added protection against credit card fraud, cash

fraud, and hacking attempts, but it also allows you to manage all these features quickly and

easily with a single, intuitive interface.

Each PayPal Payflow Gateway solution includes standard antifraud features:

z Card security code. A three- or four-digit number printed on the physical card, which a

customer provides to you at checkout.

z Address verification system (AVS). A system that verifies the credit card holder’s

personal address and billing information.

Each Fraud Protection service also offers a Buyer Authentication upgrade option that

seamlessly integrates an advanced antifraud feature that allows credit card holders to submit a

special password directly to their card-issuing bank during a transaction. Buyer Authentication

provides essential merchant liability protection against fraudulent credit card transactions.

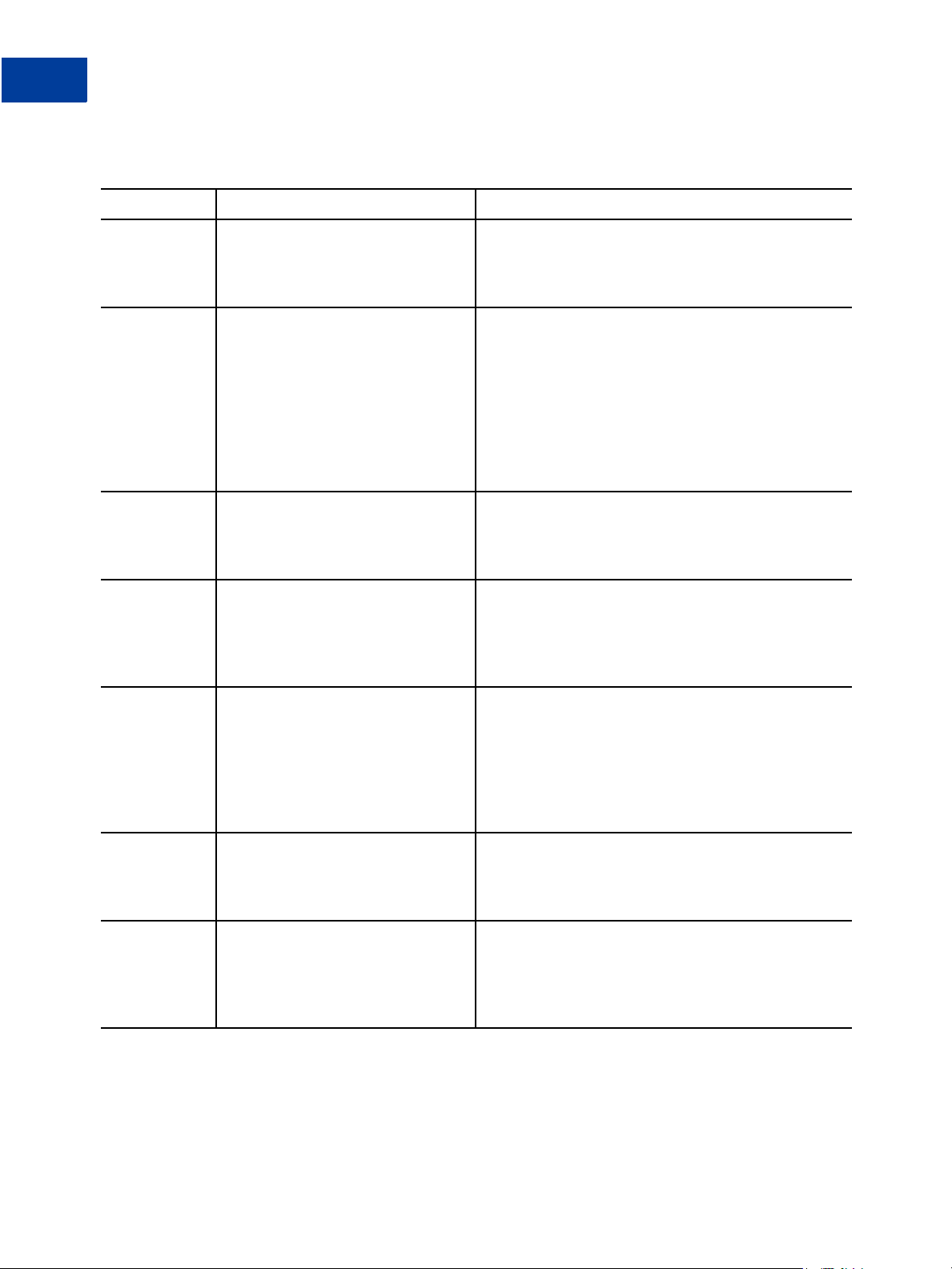

TABLE 2.5 Fraud Protection Services Purchase Options

Service Merchant Type Key Benefits

Package Options

Basic Designed for merchants with low

transaction volume

Advanced Designed for merchants with mid- to

high-level transaction volumes

Upgrade Options

Account Monitoring All merchants Account activity monitoring seven days a

Buyer Authentication All merchants Card association liability protection for

Maximum ease and convenience

Maximum customization and protection

week

authenticated shoppers

Detailed Service Descriptions

Basic Fraud Protection Service

Basic Fraud Protection Service is the ideal solution for merchants who process low transaction

volumes through a Payflow payment gateway. It offers industry-leading security technology at

an affordable price and lets your business:

z Maximize liability protection. Meet credit card company standards for address

verification and card security codes.

34 March 2008 PayPal Certified Developer Program Study Guide

Page 35

Internet Security and Fraud Prevention

PayPal Fraud Protection Services

z Reduce chargeback costs. Automatically reject or flag transactions that you deem

suspicious.

z Get started fast. Quickly set up and manage your security system with easy-to-use tools.

Basic Fraud Protection Service works by using:

z Filters. Quickly set up filters that you can customize to fit your business needs.

z Online reports. Easily review and then accept or reject online orders.

z Monitoring. Standard reports let you check on filter and their effects.

Advanced Fraud Protection Service

Advanced Fraud Protection Service is essential for businesses processing medium-to-high

transaction volumes, handling international customers, or selling high-risk merchandise

through a Payflow payment gateway. It is a flexible security solution that helps your business:

z Avoid losses. Special tools flag unusual orders, questionable addresses, high-risk

payments, and international orders.

z Lower costs. Spend less money on fraud management by automating order reviews and

tailoring the system to meet your needs.

2

Advanced Fraud Protection Service works by using:

z Enhanced filters. Supplement the basic filters with ones specially suited for your high-risk

needs.

z Online reports. Easily accept or reject online orders with the added security benefit of

audit reports.

z Watch lists. Create custom lists based on products or other criteria.