Page 1

TRANSELECT (V2000)

MERCHANT OPERATING MANUAL

For Terminal Software Version 7.52

Document Release Date: July 27, 2007

Document Version:1.1

Page 2

Copyright © Moneris Solutions, 2007.

All rights reserved. No part of this publication may be reproduced, stored in retrieval system, or

transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or

otherwise, without the prior written permission of Moneris Solutions.

Page 3

Table of Contents

CHAPTER 1: About Your Terminal 1

Equipment Care 2

Terminal Key Board 2

PINPad Key Functions 3

CHAPTER 2: Terminal Features and Procedures 5

Standard Features 5

POS Administrative (Admin) Card 5

Cardholder Conflicts 5

Code 10 Authorization 5

Credit Transaction Pre-Authorization 6

Printer Problems 6

Securing Your Terminal 7

Stored Credit and Debit Transactions 7

Training Mode 7

Card Masking 7

Optional Features 8

Balance Prompt 8

Invoice Number 8

Optional Signature Line On Credit Card Transactions 8

Purchasing Card 9

Reprint Transaction 9

Third Party Card Processing 9

Tip Processing 9

Clerk Subtotalling 9

Clerk ID 10

Clerk Subtotals Reported As Group 10

Multiple Terminal Reporting 11

Terminal Name 11

Multiple Terminal Reporting In Group 11

CHAPTER 3: Processing Credit Transactions 13

Entering Credit Card Information 13

Processing Credit Card Purchase Transactions 14

Processing Credit Card Purchase Transactions (Back Up Procedure) 15

Correcting/Voiding Credit Card Purchase 16

Processing Credit Card Refund 17

Correcting/Voiding Credit Card Refund 19

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 i

Page 4

Table of Contents

Processing Pre-Authorized Credit Transaction 20

Completing A Pre-Authorized Credit Transaction 21

Processing Credit Card Advice Transaction 22

CHAPTER 4: Processing Debit Transactions 23

Entering Debit Card Information 23

Processing Debit Card Purchases 23

Processing Debit Purchase (without Tip Entry) 24

Processing Debit Purchase with Tip Entry 25

Correcting/Voiding Debit Card Purchase 26

Processing Debit Card Refund 27

Correcting/Voiding Debit Card Refund 29

CHAPTER 5: Processing E-commerce And Mail / Telephone Order

Transactions 31

Processing Transactions with E-Commerce and MOTO Enabled 32

E-commerce Purchase 32

MOTO Purchase 33

Processing Transactions with Only E-Commerce Enabled 34

Processing Transactions with Only MOTO Enabled 35

CHAPTER 6: Processing ERNEX Transactions 37

Ernex Features 37

Clerk IDs 37

Gift Card Validation Code (CVC) 37

Stored Transactions 37

Card Masking 38

ERNEX Admin Functions 38

Balancing and Closing Your Terminal with Ernex 38

Initializing with ERNEX 38

Re-initialization with ERNEX 39

Host Communication Test with ERNEX (ADMIN 58) 40

Performing ERNEX Gift Card Transactions 41

Gift Card Activation 41

Gift Card Activation with CASH PAYMENT 41

Gift Card Activation with DEBIT, CREDIT or GIFT CARD PAYMENT 42

Gift Card Purchase Transactions 43

Split Tender Purchase with Gift Card 44

Split Tender Purchase - Gift Card with Second Gift Card Payment 45

Split Tender Purchase - Gift Card with CASH Payment 46

Gift Card Inquiry (ADMIN 55) 46

ii Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 5

Table of Contents

Deactivating a Gift Card (ADMIN 51) 47

Gift Card General Void (ADMIN 56) 48

Performing Ernex Loyalty Card and Combination Card Transactions 48

Loyalty Card Activation (ADMIN 51) 49

Loyalty Purchase Transactions 50

Loyalty Purchase - Combination Card 50

Purchase - Loyalty Card and Debit or Credit Card 51

Purchase - Loyalty Card and Cash

or Loyalty Card ONLY Transaction 51

Pre-Authorization with a Loyalty Transaction 52

Pre-authorization Completion/Advice 53

Refunds with a Loyalty Card 54

Refund - Loyalty Card and ANY Debit or Credit Card 54

Refund - Loyalty Card and Cash OR

Loyalty Card Only 55

Loyalty Redemption (ADMIN 54) 56

Cardholder Inquiry (ADMIN 55) 56

Loyalty Card General Void (ADMIN 56) 57

Deactivating Loyalty Cards (ADMIN 51) 57

End-of-Day Procedures 58

Print Stored Transactions (ADMIN 60) 58

Transaction Inquiry List (ADMIN 66) 59

Merchant Subtotals Inquiry (ADMIN 95) 60

Batch Close (ADMIN 99) 61

CHAPTER 7: Balancing & Closing Your Terminal 63

Deposit Procedures 63

Option 1: Batch Closing 63

Option 2: Non-Batch Closing 64

CHAPTER 8: Processing Administrative Functions 65

Initializing Your Terminal (Initialization - ADMIN 01) 65

Logging On (ADMIN 02) 66

Logging Off (ADMIN 03) 67

Processing Transactions In Training Mode (ADMIN 05) 67

Exiting Training Mode 68

Configuring Your Terminal (ADMIN 08) 68

Some Notes on 3201 Communication 68

Setting Up Third Party Host Communication Parameters (ADMIN 10) 71

Setting Up Third Party Card (ADMIN 11) 73

Setting Up the Printer (ADMIN 14) 74

Setting Up Dial Communications (ADMIN 15) 75

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 iii

Page 6

Table of Contents

Printing Configuration Parameters (ADMIN 16) 77

Printing Stored Transactions (ADMIN 60) 77

Performing Transaction Inquiry (ADMIN 66) 79

Performing Credit and Debit Deposit Totals Inquiry (ADMIN 77) 81

Setting Up Multiple Terminal Transaction (ADMIN 80) 81

Processing Multiple Terminal Reporting (ADMIN 85) 82

Setting Up Clerk Subtotalling (ADMIN 83) 83

Maintaining Clerk ID (ADMIN 84) 85

Adding a Clerk ID 85

Removing a Clerk ID 86

Setting Default Clerk ID (ADMIN 81) 86

Processing Clerk Subtotalling Inquiry (ADMIN 82) 87

Processing Credit and Debit Transaction Subtotals (ADMIN 95) 89

Closing Batch Transaction [Close Batch] (ADMIN 99) 90

CHAPTER 9: Troubleshooting 93

Error Messages 93

Helpful Hints On Balancing Problems 96

Batch Not Balanced 96

Clerk Subtotalling And Multiple Terminal Reporting 96

Warning Messages For Clerk Subtotalling And Multiple Terminal

Reporting 96

Helpful Hints On Communication Problems 97

Communication Problem Using A Datapac 3201 Line 97

Quatro Is Not Working 97

Communication Problem Using A Datapac 3101 Dial Line 97

Helpful Hints On Hardware Problems 98

Changing Terminal Language 98

Forwarding Printer Paper 98

Printer Lights Not On 98

Printer Paper-Low Light On 98

PINPad Display Screen Blank 98

Printer Ready Light Flashing 98

Reprint A Transaction 98

Rotary To Touch Tone 98

Touch Tone To Rotary 98

iv Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 7

Merchant and T erminal Information

Merchant Name:

Merchant Location:

Moneris Merchant ID Number:

Initialization Telephone Number:

DATAPAC 3201 (Polled) Communication Information:

Moneris Solutions Poll Code:

Third Party Poll Code:

Call the Moneris Merchant Service Centre at

1-866-319-7450 (toll-free long distance)

for Information and Assistance with

• Balancing your terminal

• Problems with your equipment

• Processing financial transactions

• Processing non-financial transactions

• Security features - merchant responsibility or liability concerns

• Settlement processing

• Setting up your terminal

• Ordering terminal supplies

Available 24 Hours a Day, 7 Days a Week

Contact Moneris Authorization at:

1-833-802-2637 (toll-free long distance)

for assistance with:

• Voice authorizations

• Code 10 situations

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 v

Page 8

Merchant and Terminal Information

Terminal Supplies

It is recommended that merchants obtain their POS stationery and paper

rolls from Moneris to ensure that these supplies comply with the applicable

specifications. Contact the Moneris Merchant Service Centre (see above)

to obtain additional supplies for your terminal.

Additional Documentation

To download additional copies of this Merchant Operating Manual, visitwww. moneris.com/merchant/manuals/index.html and select Transelect.

T o download a copy of theT ranselect Quick Reference Guide for Debit and

CreditProcedures, visit www.moneris.com/merchant/qrguides and select

Transelect.

vi Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 9

CHAPTER 1: About Y our T erminal

This section of the manual will introduce you to your terminal. It tells you

about the components of the terminal, how to care for the terminal, the terminal keyboard, and PINPad key functions. The Transelect terminal connects to the POINT OF SALE (POS) payment service provided by

Moneris. Your TRANSELECT includes a terminal, a printer, and a PINPad (if you process Interac Direct Payment/Debit transactions).

Note: Throughout this document Interac Direct Payment or IDP will be

referred to as “Direct Card Transaction”.

The Terminal can be set-up to accept and process:

• Credit Cards - VISA, MasterCard, American Express (AMEX), JCB,

and Diners Club/enRoute

• Interac Direct Payment/Debit Cards

• Ernex Gift and Loyalty Cards

The Printer connects to the terminal and to a power outlet. The printer provides:

• Transaction records on two-part paper or one-part, double-copy paper.

IMPORTANT: T o main tain compliance with card masking requirements,

the printer must print the receipt at least twice (even if

you use two-part paper). See section 8.8: Setting Up

the Printer (ADMIN 14) for instructions.

• Journal listings of transactions, totals, etc.

Note: Retain an unmasked copy of all approved credit and debit receipts for

one year.

If you accept Debit Cards, a PINPad is required with your Transelect Terminal. The PINPad consists of a display window for prompts and messages, and a keypad.

Note: Since your customers PIN (the Personal Identification Number) is

required for all Debit transactions and is confidential, it will not

appear on the display on either your PINPad or terminal. Please

respect your customer’s privacy when they key in their PIN.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 1

Page 10

CHAPTER 1: About Your Terminal

1.1: Equipment Care

IMPORTANT: You must use the exact power adaptor and cable pro-

vided with the terminal by Moneris Solutions. Failure to

do so may affect the operability of, or cause damage to

the terminal and Moneris Solutions shall have no liability

whatsoever for a failure to follow these instructions.

IMPORTANT: Misuse of equipment could result in replacement liability.

• Avoid spilling liquids on components

• Do not expose components to extreme temperatures

• To ensure the warranty on equipment, it is recommended that merchants obtain their POS stationery and paper rolls from Moneris.

• For instructions on changing paper and ribbons, refer to your printer

manual

• For equipment failure, contact Moneris Solutions Merchant Service

Centre

• Avoid unnecessary movement of the terminal to prevent accidental disconnection of any of the cables

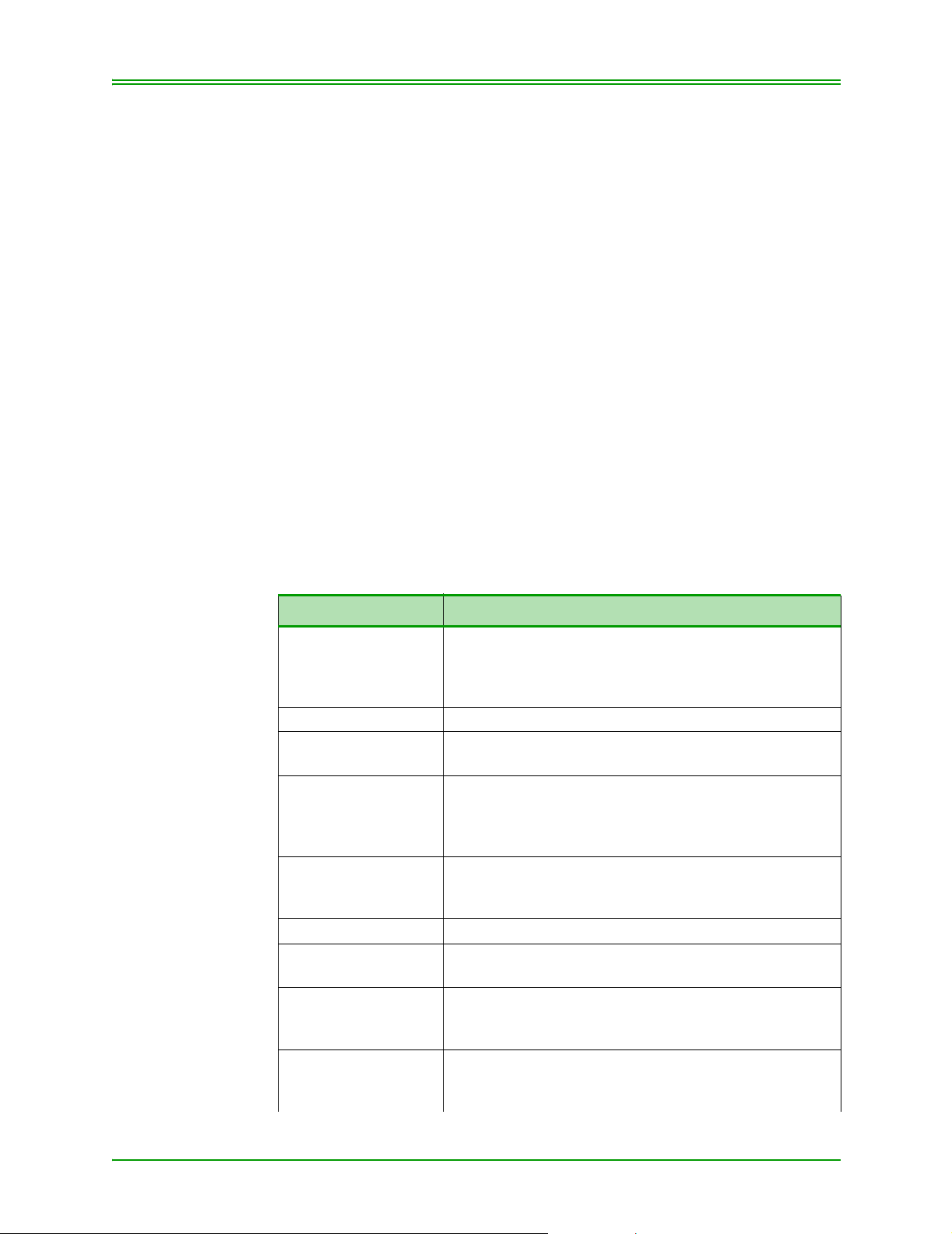

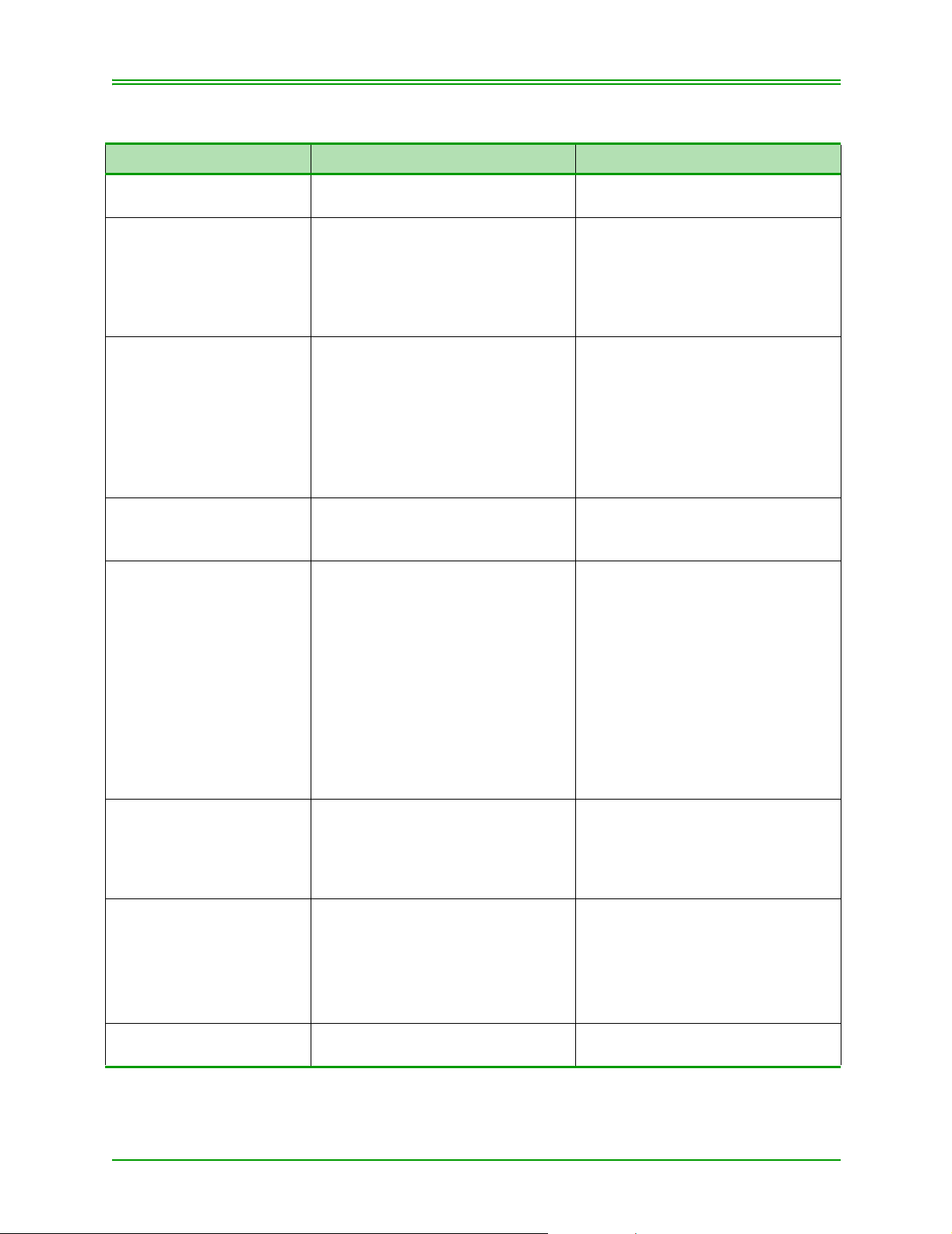

1.2: Terminal Key Board

KEY EXPLANATION

A, B, C Use these keys to respond to prompts for various

ADMIN Press this key before all administrative functions.

ADVICE To complete a Pre-Authorized or Voice Authorized

ALPHABETIC To access an alphabetic character, press the number

CANCEL/EXIT To reset the terminal to the ready state after completing

DELETE To delete the last character keyed on the keyboard.

ENTER Press on completion of input and in response to the

NUMERIC KEYS 0-9 To key in a numeric response to a prompt. The decimal

PP LANG Press the SHIFT (T) key and then the PP LANG key to

(including Credit and Debit Card) transactions. The

arrows below the keys allow you to scroll up and down

or sideways when additional information is available.

Credit transaction.

key that contains the desired letter and the n the SHIFT

(T) key; continue pressing the SHIFT (T) key until the

desired letter displays on the terminal.

a transaction, or to cancel a transaction already in

progress.

display on the terminal.

automatically inserts on dollar amount keyed. Example:

$145.27 – key in 14527

change the language on the PINPad from English to

French or vice versa.

2 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 11

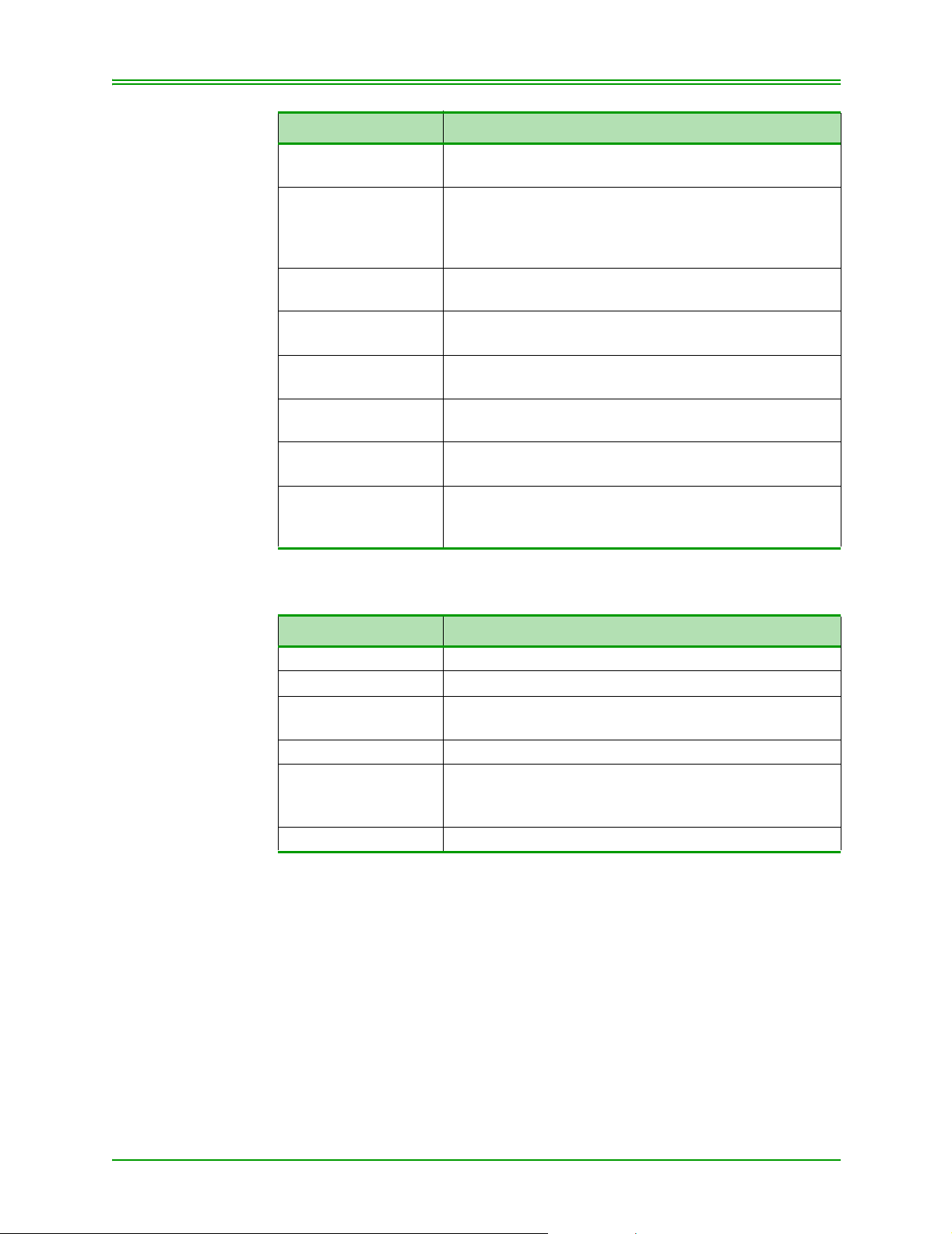

CHAPTER 1: About Your Terminal

KEY EXPLANATION

PRE-AUTH Press this key to obtain authorization only on Credit

Card Transaction.

PURCHASE If the magnetic strip is not working on a Credit Card

transaction, press the PURCHASE key before manually keying the Credit Card Number. Also used for ecommerce and mail/ tel order transactions.

PUR CORR/VOID Use this key to reverse a purchase transaction pro-

cessed incorrectly on a Credit or Debit card.

REFUND Use this key to refund Credit and Debit Card transac-

tions.

REF CORR/VOID Use this key to reverse a REFUND transaction pro-

cessed incorrectly on a Credit or Debit Card.

RETRY To re-try certain declined transactions. This key is only

available when the Retry prompt, displays.

SHIFT (T) To access alphabetic characters on the keyboard and

the functions listed below the keys.

T LANG Press the SHIFT (T) key and then the T LANG key to

change the language on the terminal from English to

French or vice versa.

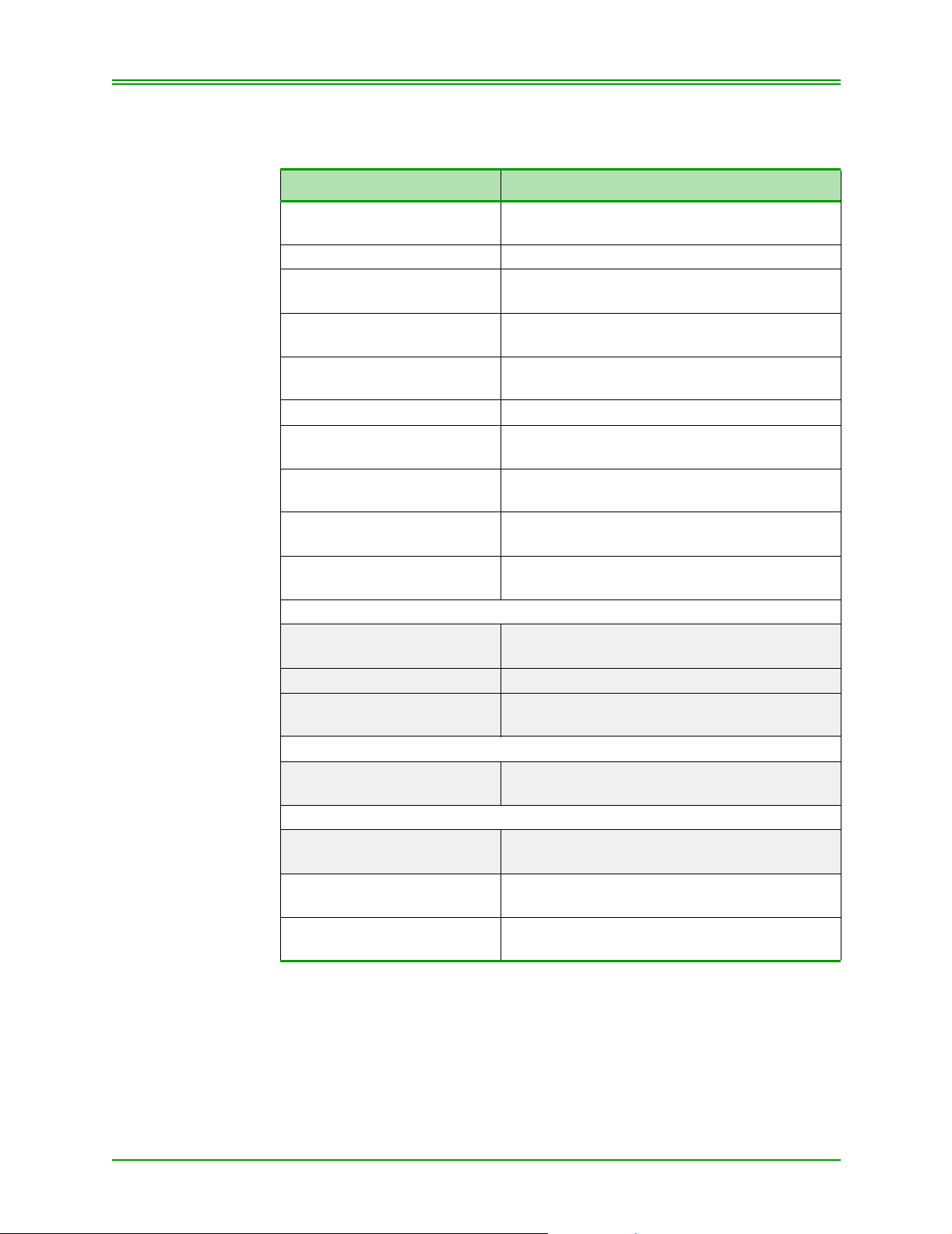

1.3: PINPad Key Functions

KEYS EXPLANATION

CHQ To select chequing account.

SAV/EP To select savings account.

NUMERIC Keys

(0 - 9)

CANCEL/ANNUL To cancel a transaction.

CORR To clear the display of data so the customer may re-key

OK To approve the transaction, amount, and PIN.

To key in a confidential Personal Identification Number

(PIN).

information or if no data has been input, to revert to the

previous prompt.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 3

Page 12

CHAPTER 1: About Your Terminal

4 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 13

CHAPTER 2: T erminal Features and Procedures

2.1: Standard Features

2.1.1: POS Administrative (Admin) Card

The POS Administrative (ADMIN) Card allows personnel to access various terminal functions and complete various financial transactions against

the merchant’s deposit account. If you (the merchant) accept only credit

cards, a POS Administrative Card may not be required.

IMPORTANT: You, the mer chant, ar e solely r esponsible for the security and

care of all of your POS Administrative Cards at all times. If

your POS Administrative Card is lost, stolen, or damaged

(or if you suspect it may be lost or stolen) call the Moneris

Merchant Service Centre immed iatel y.

All financial transactions completed with a POS

Administrative Card are subject to the guidelines of the

“Debit Card Merchant Agreement” with Moneris. The

Agreement contains important provisions regarding your

responsibility for POS Administrative Card security and

your liability for financial transactions made with a POS

Administrative Card.

2.1.2: Cardholder Conflicts

Merchants should not attempt to resolve or compensate Debit Cardholder

disputed transactions. Direct the Cardholder to their Financial Institution.

2.1.3: Code 10 Authorization

If you feel that a customer, card or transaction is suspicious and needs

investigating call the Authorization Centre and ask for a Code 10. This will

immediately alert the operator without alarming your customer. The operator will ask you some “Yes/No” questions and then provide instructions.

Here are some examples of situations in which you would call for a Code

10.

• If the signatures on the card and the signature on the POS receipt, do

not seem to match.

• If the card has been tampered with

• If the name on the card is inconsistent with the person’s gender

• If the customer is purchasing an unusual number of expensive items

• If the customer’s purchases seem randomly selected, with little regard

for size, quality or value

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 5

Page 14

CHAPTER 2: Terminal Features and Procedures

• If the customer seems nervous or signs slowly with uncertainly.

2.1.4: Credit Transaction Pre-Authorization

Use the Pre-Authorization transaction to obtain an authorization “only”

against a Credit Card’s “open to buy”. This transaction does not result in a

charge to the cardholder or a deposit to your account. Traditionally Preauthorization transactions are used in hotels, restaurants and car rental

environments where the final amount of the sale is unknown.

To process a Pre-Authorization transaction, refer to 3.6: Processing PreAuthorized Credit Transaction on page 20.

To complete a Pre-Authorized or Voice Authorized transaction and process

a charge against a Credit Card, refer to 3.7: Completing A Pre-Authorized

Credit Transaction on page 21 or 3.8: Processing Credit Card Advice

Transaction on page 22.

Note: If the amount of the final transaction is substantially less than the Pre-

Authorization amount. Contact the Voice Authorization Department of

the appropriate Credit Card Company and ask them to release the

amount previously authorized against the cardholder “Open To Buy”.

2.1.5: Printer Problems

If your printer is not working and you are unable to print a customer

receipt, contact Moneris Solutions Merchant Services to report the problem

and process the transaction as follows:

For Debit transactions - process the transaction through your terminal

and manually prepare a receipt (in duplicate) with full details including:

• Date of the transaction

• Amount of transaction

• Cardholder’s Card number

• The account type selected (Chequing or Savings)

Provide one copy of the manual receipt to your customer and retain one

copy for your records, or reverse the transaction and accept another form of

payment.

For Credit transactions - Process the transaction through your terminal

and manually prepare a Sales Draft with full details, including:

•an imprint of the Credit Card (Account number , Issue/Expiry Date and

Cardholder Name must be legible)

• date of transaction

• amount of transaction

• cardholder signature

• authorization number

6 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 15

CHAPTER 2: Terminal Features and Procedures

Provide one copy of the Sales Draft to your customer and retain one copy

for your records.

Note: If you processed transactions through your terminal when your printer

was not working, do not process them again when your printer is back

in operation.

2.1.6: Securing Your Terminal

To minimize the risk of unauthorized transactions being processed through

your (the merchant’s ) terminal after business hours, log the terminal OFF at

the end of each business day (after a “Closed Batch” transaction) refer to

8.3: Logging Off (ADMIN 03) on page 67.

At the start of the next business day, Log your terminal ON - refer to 8.2:

Logging On (ADMIN 02) on page 66.

Your POS ADMIN Card is required to “LOGON” to your terminal.

2.1.7: Stored Credit and Debit Transactions

Your Transelect terminal can store 500 APPROVED Credit and Debit

transaction records. The oldest transaction will drop off, once the memory

of the terminal reaches capacity. If your terminal is replaced, the memory

cannot be transferred to the replacement terminal and is therefore lost.

Refer to 8.11: Printing Stored Transactions (ADMIN 60) on page 77 and

8.12: Performing Transaction Inquiry (ADMIN 66) on page 79. To clear

your terminals stored transaction memory, refer to 8.1: Initializing Your

Terminal (Initialization - ADMIN 01) on page 65.

2.1.8: Training Mode

Your Transelect terminal is able to simulate CREDIT and DEBIT CARD

financial transactions in Training Mode. Transactions processed in Training Mode will not affect your customer’s accounts or your business

accounts. Financial settlement does NOT occur for transactions processed

while your terminal is in training mode. For instructions on entering Training Mode, refer to 8.4: Processing Transactions In T raining Mode (ADMIN

05) on page 67.

2.1.9: Card Masking

To reduce the risk of fraudulent card use, only a portion of the cardholder's

card number is printed on the cardholder receipt. The remainder of the card

number is masked, i.e., an '*' is printed for each remaining digit in the card

number. Debit card, credit card (including private label), gift card and loyalty card numbers are masked.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 7

Page 16

CHAPTER 2: Terminal Features and Procedures

Note: Remember to give the cardholder the MASKED copy of the receipt and

keep the unmasked copy for your records. The unmasked copy is

required to resolve charge-back issues quickly.

For debit card numbers, the first 10 digits of the card are printed in clear.

From the 11th digit onwards, asterisks are printed in the place of the real

digits, e.g.: 0123456789******.

For credit card, gift card and loyalty card numbers, only the last four digits

are printed in clear, the rest are replaced with an asterisk, e.g.:

*************1234.

To further reduce fraudulent card use, the credit card, gift card and loyalty

card expiry dates are not printed on the cardholder copy of the receipt.

Your printer must be configured to print a minimum of 2 copies of the

receipt (even if you use 2-part paper) to maintain compliance with card

masking requirements. See section 8.8: Setting Up the Printer (ADMIN

14) for instructions.

2.2: Optional Features

The following features are optional and can be activated in each of your

terminals.

2.2.1: Balance Prompt

This feature enables you to “flag” your Closed Batch Transaction (ADMIN

99) with an “Out of Balance” condition. This feature is used solely for your

“in house” record keeping and is not reported to Moneris.

This feature is activated in the ADMIN 08 –Configuring The Terminal.

2.2.2: Invoice Number

This feature enables you to key in an INVOICE number with every Credit

and Debit financial transaction. An Invoice number can be from 1 to 7

numbers or letters. If this feature is activated, you have the option of keying an INVOICE NUMBER with every transaction or bypassing it by

pressing ENTER when prompted. This feature is activated while configuring your terminal. Refer to 8.5: Configuring Your Terminal (ADMIN 08)

on page 68.

2.2.3: Optional Signature Line On Credit Card Transac-

tions

This feature enables you to turn off/on the Cardholder Signature Line for

all Credit Transactions. This option can only be turned OFF in business

environments where a Credit Card is not presented e.g. Mail Order Busi-

8 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 17

CHAPTER 2: Terminal Features and Procedures

nesses. This feature is activated while configuring your terminal. Refer to

8.5: Configuring Your Terminal (ADMIN 08) on page 68.

2.2.4: Purchasing Card

If this feature is activated and programmed in your terminal, the Customer

Reference Number (if keyed) will be printed on every Purchasing Card

Receipt. The terminal will prompt for tax amount, if you do not wish to key

in the amount of tax key in 0 when prompted. This feature is activated

while configuring your terminal. Refer to 8.5: Configuring Your Terminal

(ADMIN 08) on page 68.

2.2.5: Reprint Transaction

To reprint the last transaction after the terminal has returned to the

"READY" prompt, press SHIFT (T) key and then the RETRY key. The

word *DUPLICATE* will be printed on the top and bottom lines of the

Receipt.

You can also print a duplicate of the last financial transaction by pressing

ENTER on the terminal prior to pressing the CANCEL/EXIT key.

Note: The card number is masked on reprinted receipts.

2.2.6: Third Party Card Processing

This feature enables you to process Third Party transactions (e.g. JCB).

Contact your Moneris Solutions Sales Representative for further details.

Third Party processing parameters are keyed in ADMIN 10 and ADMIN

11; refer to CHAPTER 8: Processing Administrative Functions for using

administrative functions.

2.2.7: Tip Processing

This feature enables you to customize your terminal to process tip amount

on all card purchase (Credit, Debit, Third Party cards) transactions traditionally used in restaurant environments. You must have a PINSmart PINPad to enable your terminal process tip on Debit card transactions. The

feature is enabled while configuring your terminal. Refer to Section 8.5:

Configuring Your Terminal (ADMIN 08) on page 68.

2.2.8: Clerk Subtotalling

This feature provides you with the option of obtaining Subtotals of an individual or group of employees on one or more terminals. This feature is activated using ADMIN functions 81, 82, 83 and 84; refer to CHAPTER 8:

Processing Administrative Functions.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 9

Page 18

CHAPTER 2: Terminal Features and Procedures

Clerk ID’ s are keyed in the terminal and retained on the Moneris Host. This

enables you to obtain financial totals and the number of transactions processed on all of your terminals by a specific Clerk or group of Clerks.

2.2.9: Clerk ID

While setting up Clerk Subtotalling, you will select how the Clerk ID is to

be keyed. You can set the Clerk ID to Default on a specific terminal, or you

may choose the option of keying the Clerk ID at the start of every transaction either manually or by swiping a magnetic stripe card. In the Clerk ID

field, you can key in 1 - 6 characters using numbers or letters. It is be the

employer’s responsibility to obtain Magnetic Stripe Card - refer Guidelines

below.

Note: The Addition and deletion of Clerk ID's is controlled by the Merchant

and may have direct impact on Clerk Subtotal reports. Therefore,

Moneris is unable to guarantee accurate reporting between Clerk

Subtotals and totals reported in your Close Batch transactions. Also

note that the terminal can be configured to ask for Clerk ID for every

transaction performed (see ADMIN 83 in Section 8 for how to do this)

A total of two hundred and fifty-five (255) clerk ID’s can be attached to

your Merchant Location.

The following are guidelines for Magnetic Stripe Cards with Clerk ID’s:

• The Clerk ID field can be extracted from the magnetic stripe data on a

card.

• The standard for these cards is "ISO/IEC 7813 IDentification cards Financial Transaction Cards"

• The ID can be extracted from either Track 1 or Track 2 and your terminal will need to be set up accordingly; refer to Setting Up Clerk Subtotalling (ADMIN 83) in Section 8.

There are several Manufactures of Magnetic Stripe Cards, the following

are just a few; SCS-Security Card Systems Inc., NBS-National Business

Systems, B. A. Custom Cards and Bicybec.

Provide the card Manufacturer with the following information:

• Track 1 and 2: Uses the last 6 digits of the first field on the track

• Name: Uses the first 6 characters of the name field on track 1

2.2.10: Clerk Subtotals Reported As Group

More than one Clerk ID can be defined as a “GROUP” (GRP). A group

represents more than one Clerk ID that shares a common starting characters (Pre-fix). The number of common starting characters in a group can

vary from 1 to 5. For example, Clerk ID’s 1, 11, 111, can be keyed as a

10 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 19

CHAPTER 2: Terminal Features and Procedures

GRP PRE-FIX with the number 1. All Clerk ID's that begin with the number 1 will be reported.

2.2.11: Multiple Terminal Reporting

Multiple Terminal Closing - Using one transaction, at any of your termi-

nals, you can close one terminal, a group of terminals or all of your terminals (attached to the same merchant number). This feature is activated in

ADMIN 80 and 85; refer to Section 8.

Multiple Deposit Totals - Use this transaction if you close your terminals

more than once per day . This transaction provides you with the grand totals

of all closed batches for the day.

The Multiple Terminal Close transaction (ADMIN 85) does not compare

totals stored in the terminals memory with totals stored in Moneris’ Host

Computer. Therefore, ensure that your receipts balance to the total of your

Multiple Closed Batch.

Note: The standard Terminal Close transaction (ADMIN 99) compares

terminal totals stored in the terminals memory with totals stored in

Moneris’ Host Computer.

2.2.12: Terminal Name

Key in your terminal name, 1 - 6 characters using numbers or letters. The

same terminal name cannot be used on more than one terminal. You can

identify up to 100 different Terminal Names (this would require 100 different Terminals).

2.2.13: Multiple Terminal Reporting In Group

More than one terminal can be defined as a "GROUP” (GRP). A group represents more than one Terminal ID that shares a common starting characters (Pre-fix). The number of common starting characters in a group can

vary from 1 to 5. For example, Terminal names, “FRONT 1, FRONT 2",

can be keyed as GRP PRE-FIX with the letter F. All Terminals that begin

with the letter “F” will then report Deposit totals and / or will be closed as a

group.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 11

Page 20

CHAPTER 2: Terminal Features and Procedures

12 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 21

CHAPTER 3: Processing Credit T ransactions

This section outlines how to process Credit card transactions. Before you

can process transactions, you must configure your terminal (see Section 8).

To reduce the risk of fraudulent card use, only a portion of the cardholder's

card number is printed on the cardholder receipt. The remainder of the card

number is masked. For credit card numbers, only the last four digits are

printed in clear, the rest are replaced with an asterisk, e.g.:

*************1234.

3.1: Entering Credit Card Information

There are two methods for entering Credit card information into the

Transelect terminal:

• manually keying in the Credit card information on the terminal keypad.

• swiping the Credit card on the magnetic stripe reader (MSR)

Manually Entering the Credit Card Information

If the terminal’s MSR cannot read the magnetic stripe on the customer card

or the card is not available, manually key in the details of the Credit card.

The following instructions are for a Credit Purchase. To perform a manually entered CREDIT REFUND or CORRECTION transaction, simply

press the REFUND or CORRECTION key in the first step as appropriate.

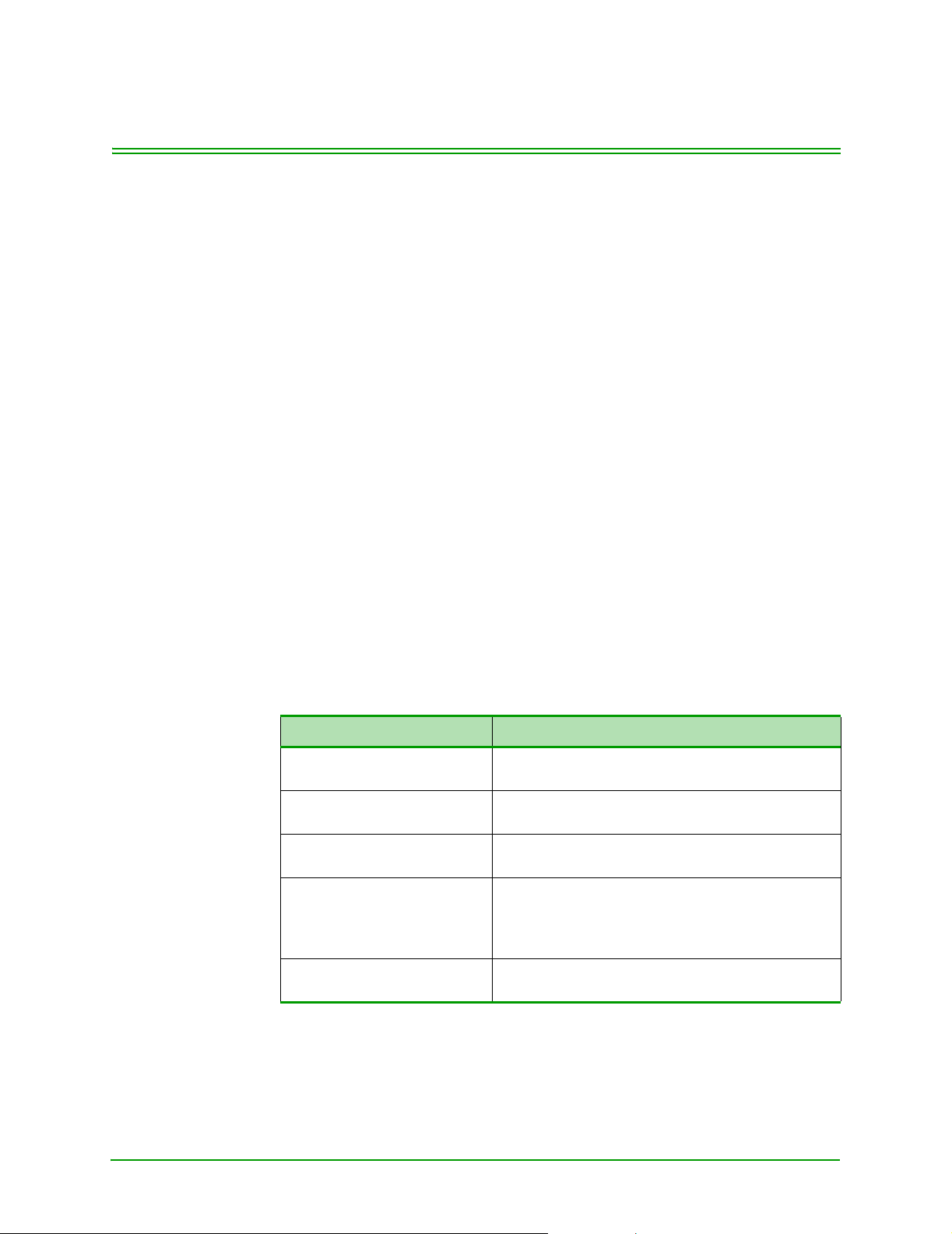

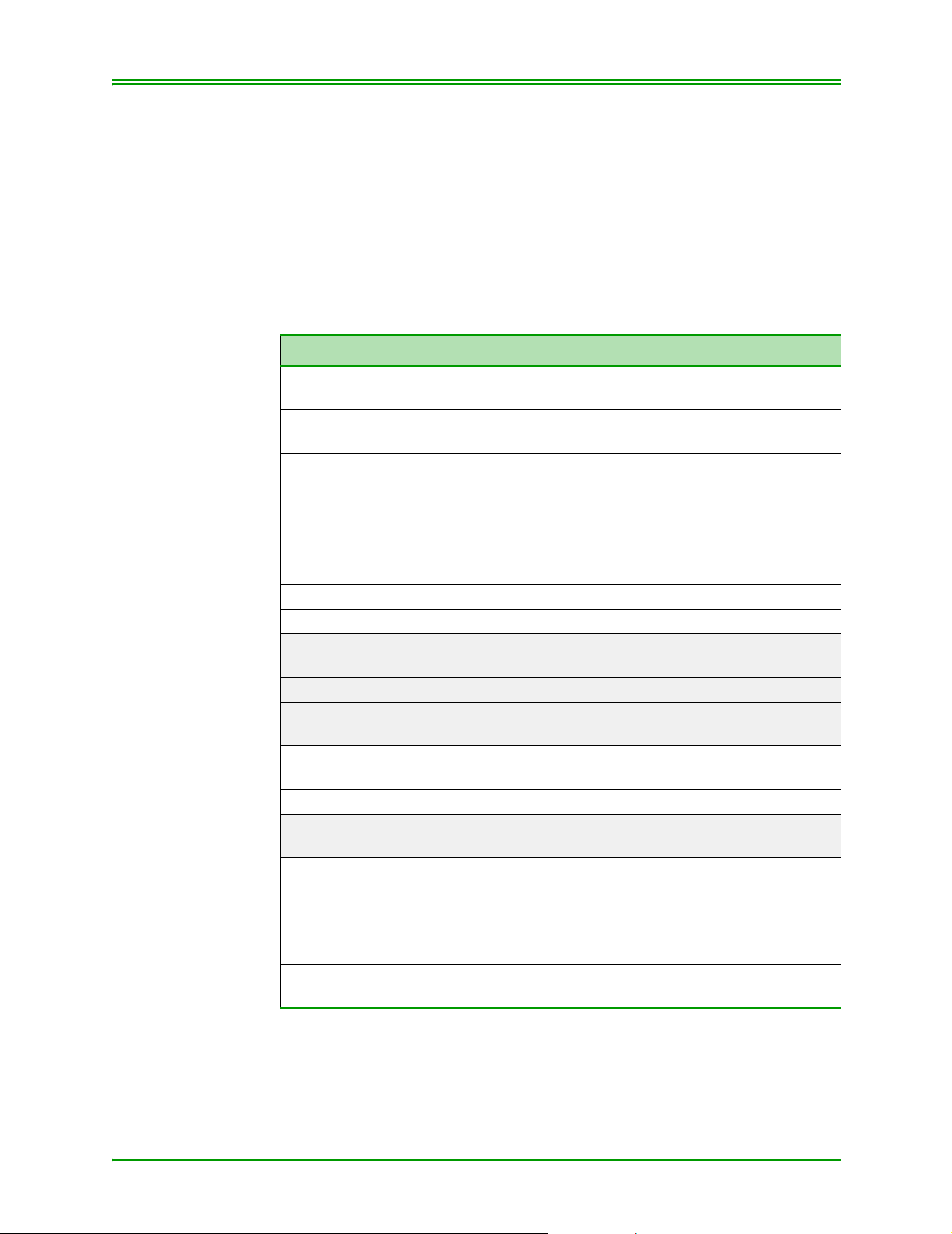

TERMINAL DISPLAY: OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

SWIPE CUSTOMER CARD

ENTER EXPIRY DATE

MMYY

PLEASE TAKE AN

IMPRINT OF THE CARD

ENTER CLERK ID To continue the transaction go to the ENTER

Press the PURCHASE key.

Manually key in the card number and press

ENTER.

Key in the expiry date (MMYY) and press

ENTER.

Using the imprinter and a paper sales draft provided with your terminal, take an imprint of the

Credit card. Make sure the account number and

expiry date are clear and readable.

CLERK ID prompt in the appropriate section.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 13

Page 22

CHAPTER 3: Processing Credit Transactions

Swiping the Credit Card

Simply swipe the Credit card’s magnetic stripe through th e magnetic stripe

reader (MSR) on the terminal. The MSR will read the information on the

stripe, then display the card number and prompt you to press ENTER to

confirm that the card number displayed matches the number on the front of

the card.

The instructions in this chapter use the SWIPE CUSTOMER CARD

method for entering the card data.

3.2: Processing Credit Card Purchase Transactions

This transaction electronically authorizes and captures credit card purchases. Settlement to your business account occurs electronically for all

closed batches. If your terminal’s e-commerce and mail/tel order func-

tions are configured, refer to Processing E-commerce And Mail / Telephone Order Transactions.

When a Credit Card is swiped through the terminal’s magnetic stripe

reader, the card number encoded on the magnetic stripe appears on the terminal display. To avoid charge-backs, ensure that the number displayed on

the terminal is the same as the number embossed on the card. Contact Moneris Solutions Authorization Department immediately if there is a discrepancy between the two numbers.

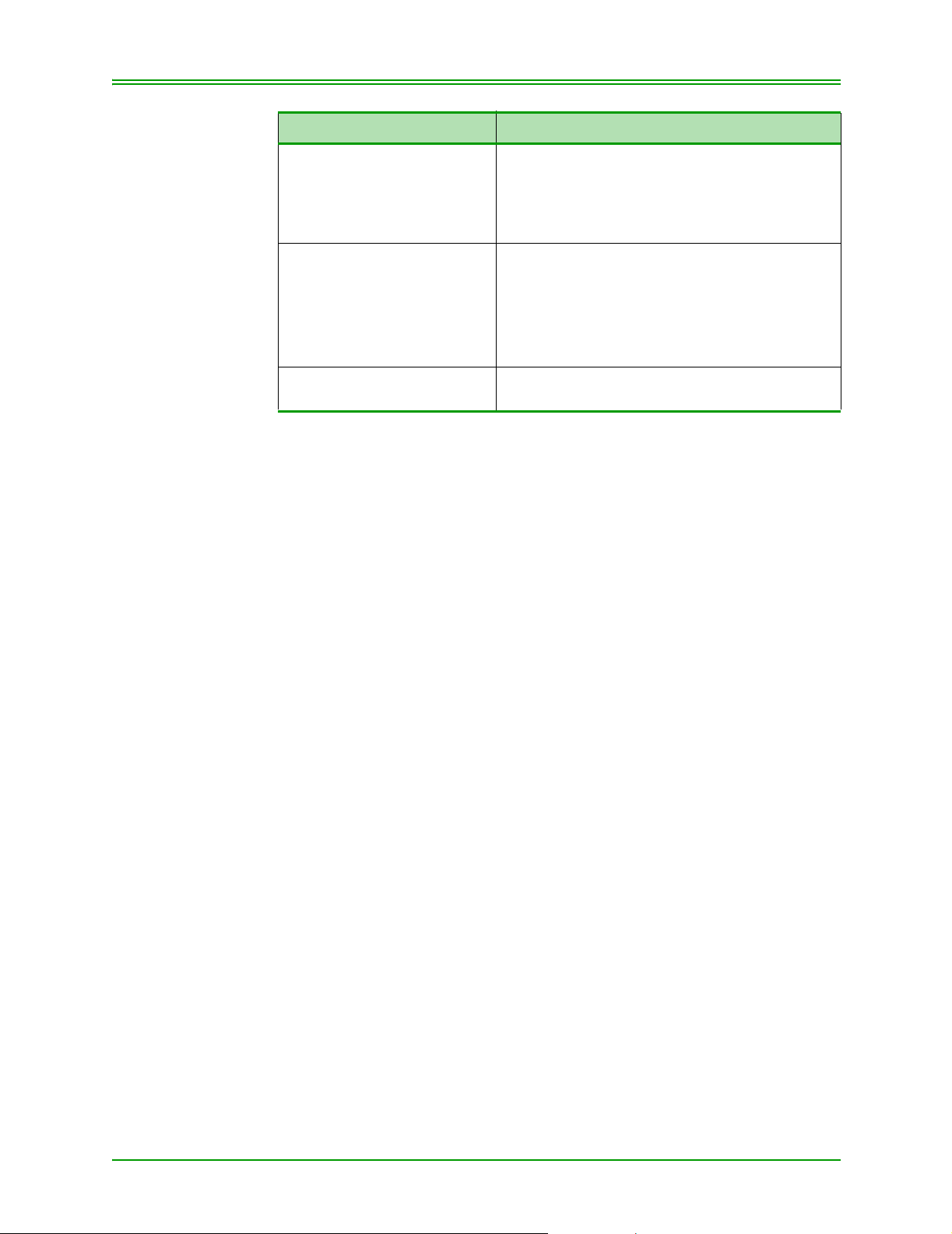

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

################

PRESS ENTER TO CONT

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

Swipe customer card

Press ENTER

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt.

It only appears if the Clerk ID prompt

has been enabled in Admin 83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

It only appears if the Invoice

Numbers prompt has been enabled

in Admin 08.

Key in amount of Purchase (without the decimal point) and press ENTER

14 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 23

CHAPTER 3: Processing Credit Transactions

TERMINAL DISPLAY OPERATOR'S ACTION

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Please wait

The cardholder must sign the unmasked copy

of the receipt.

Give the masked copy of the receipt to your

customer and retain the signed, unmasked

copy for your records.

###### = Authorization number

Press the CANCEL/EXIT key to return to

READY prompt

3.2.1: Processing Credit Card Purchase T ransactions (Back

Up Procedure)

Use the following procedure to complete a purchase transaction when you

are unable to process the transaction through your terminal due to System

or Hardware Problems.

1. Prepare a paper Sales Draft with full details, including:

•An imprint of the Credit Card (Account number , Issue/Expiry Date

and Cardholder Name must be legible)

• date of transaction

• cardholder signature

• authorization number *

* If the amount of the transaction exceeds your “Downtime floor limit”

established by Moneris, obtain a “Voice Authorization” by calling the

Moneris Authorization centre.

2. Once the cardholder has signed the Sales Draft, compare the signature

to that located on the signature panel of the card. (Immediately report

discrepancies in signature and name to the Voice Authorization Department of the applicable Credit Card Company).

3. Provide the cardholder with their copy of the receipt and retain the

“Merchant copy” for your records.

4. Contact Moneris Solutions Merchant Services to report the problem

(telephone number listed in the front of this manual).

5. Once your T ranselect terminal is operational, the purchase transactions,

which occurred while your terminal was not available, must be manually processed through the Transelect terminal as “ADVICE” transac-

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 15

Page 24

CHAPTER 3: Processing Credit Transactions

tions. For processing Advice transactions, refer to Processing Credit

Card Advice Transaction in this Section.

3.3: Correcting/Voiding Credit Card Purchase

Use this transaction to correct a purchase transaction that was keyed incorrectly. Process this transaction for the entire amount of the original incorrect purchase and then re-key the purchase correctly. This transaction

cancels the original purchase if both transactions were processed in the

same batch.

Note: Y our Administrative (ADMIN) Car d is r equir ed to complete a Purchase

Correction/Void transaction.

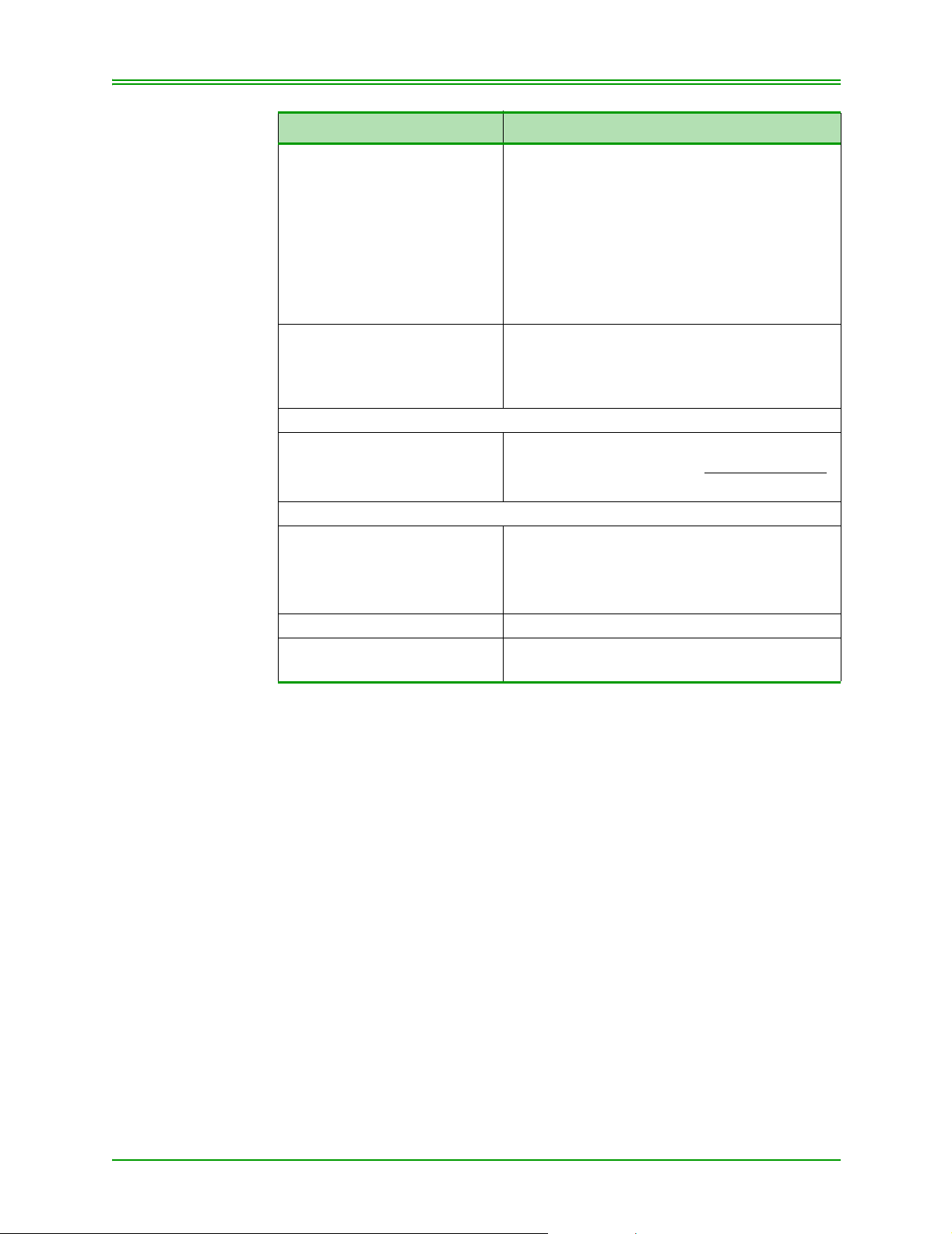

TERMINAL DISPLAY OPERATOR'S ACTIONS

READY

SWIPE CUSTOMER CARD

PURCHASE VOID

SWIPE ADMIN CARD

PURCHASE VOID

SWIPE CUSTOMERS CARD

################

PRESS ENTER TO CONT

PURCHASE VOID

ENTER CLERK ID

PURCHASE VOID

ENTER INVOICE NUMBER

ENTER ORIGINAL

AUTHORIZATION NUMBER

PURCHASE VOID

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

Press PUR CORR/VOID key

Swipe POS ADMIN Card

Swipe Customer Card

Press ENTER

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt.

It only appears if the Clerk ID

propman has been enabled in Admin

83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

It only appears if the Invoice Numbers

prompt has been enabled in Admin

08.

Key in original Authorization Number from the

Purchase transaction and press ENTER.

Key in the entire amount of the purchase transaction to be voided/corrected (without the decimal point) and press ENTER.

Please Wait

16 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 25

CHAPTER 3: Processing Credit Transactions

TERMINAL DISPLAY OPERATOR'S ACTIONS

APPROVED

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

You, the Merchant, sign the masked receipt.

Give the masked copy of the receipt to your

customer and retain the unmasked copy for

your records

Press CANCEL/EXIT key to return to READY

prompt

3.4: Processing Credit Card Refund

Use this transaction to refund the full or partial value of a Purchase transaction.

Note: Your Administrative (ADMIN) Card is required to complete a Refund

transaction.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

REFUND

SWIPE ADMIN CARD

REFUND

SWIPE CUSTOMER CARD

################

PRESS ENTER TO CONT

REFUND

ENTER CLERK ID

REFUND

ENTER INVOICE NUMBER

ENTER ORIGINAL

AUTHORIZATION NUMBER

REFUND

ENTER AMOUNT

Press REFUND key

Swipe POS ADMIN Card

Swipe Customer Card

Press ENTER

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

Key in original Authorization Number from the

Purchase transaction and press ENTER.

OR

Key in 999999 if the original Authorization

Number is not available and press ENTER.

Key in amount of the transaction being

refunded (without the decimal point) and press

ENTER.

It only appears if the Clerk ID

propman has been enabled in Admin

83.

It only appears if the Invoice Numbers

prompt has been enabled in Admin

08.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 17

Page 26

CHAPTER 3: Processing Credit Transactions

TERMINAL DISPLAY OPERATOR'S ACTION

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

APPROVED

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Please wait

You, the Merchant, sign the masked receipt.

Give the masked copy of the receipt to your

customer and retain the unmasked copy for

your records

Press CANCEL/EXIT key to return to READY

prompt

18 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 27

CHAPTER 3: Processing Credit Transactions

3.5: Correcting/Voiding Credit Card Refund

Use this transaction to correct a refund transaction that was keyed incorrectly. Process this transaction for the entire amount of the original refund

and then re-process the refund correctly. This transaction cancels the original refund if both transactions were processed in the same batch.

Note: Your Administrative (ADMIN) Card is required to complete a Refund

Correction/Void transaction.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

REFUND VOID

SWIPE ADMIN CARD

REFUND VOID

SWIPE CUSTOMER CARD

################

PRESS ENTER TO CONT

REFUND VOID

ENTER CLERK ID

REFUND VOID

ENTER INVOICE NUMBER

ENTER ORIGINAL

AUTHORIZATION NUMBER

REFUND VOID

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

APPROVED

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press REF CORR/VOID key

Swipe POS ADMIN Card

Swipe Customer Card

Press ENTER

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt.

It only appears if the Clerk ID

propman has been enabled in Admin

83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

It only appears if the Invoice Numbers

prompt has been enabled in Admin

08.

Key in the Original Authorization Number from

the Refund transaction and press ENTER

Key in the entire amount of the Refund tran sa ction being Voided and press ENTER.

Please wait

The cardholder must sign the unmasked copy

of the receipt.

Give the masked copy of the receipt to your

customer and retain the signed, unmasked

copy for your records.

Press CANCEL/EXIT key to return to READY

prompt

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 19

Page 28

CHAPTER 3: Processing Credit Transactions

3.6: Processing Pre-Authorized Credit Transaction

Use this transaction to obtain authorization for a purchase transaction

where the final dollar value of the transaction is unknown. E.g. In a restaurant environment, a tip may be added.

This function ONLY provides authorization and does not capture the transaction for deposit. Refer to Section 3.7: Completing A Pre-Authorized

Credit Transaction on page 21 to complete and capture the transaction.

Note: To print a TIP LINE on the Customer Receipt - refer to Section 8.5:

Configuring Your Terminal (ADMIN 08) on page 68.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

PRE-AUTHORIZATION

SWIPE CUSTOMER CARD

################

PRESS ENTER TO CONT

PRE-AUTHORIZATION

ENTER CLERK ID

PRE-AUTHORIZATION

ENTER INVOICE NUMBER

PRE-AUTHORIZATION

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press PRE-AUTH key

Swipe Customer Card

Press ENTER

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt.

It only appears if the Clerk ID

propman has been enabled in Admin

83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

It only appears if the Invoice Numbers

prompt has been enabled in Admin

08.

Key in amount to be authorized (without the

decimal point) and press ENTER.

Please wait

The cardholder must sign the unmasked copy

of the receipt.

Give the masked copy of the receipt to your

customer and retain the signed, unmasked

copy for your records.

Press the CANCEL/EXIT key to return to the

READY prompt.

20 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 29

CHAPTER 3: Processing Credit Transactions

3.7: Completing A Pre-Authorized Cr edit Transaction

Use this transaction to complete a Pre-Authorized transaction previously

processed on your terminal. This transaction captures the transaction for

settlement.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

FIND ORIGINAL?

YES - A NO – C

ENTER SEQUENCE NO

OF ORIGINAL TRANS

################

PRESS ENTER TO CONT

OLD CLERK ID ####

NEW CLERK ID

ADVICE

ENTER INVOICE NUMBER

OLD AMT. $##.##

ENTER NEW AMOUNT

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press ADVICE key

Press A

Key in the last 6 digits of the receipt number and

press ENTER. Do not include the dash from the

Pre-Authorized Transaction Receipt.

Confirm card number displayed on the screen

matches the Card Number on the receipt, then

press ENTER to continue.

Key in your Clerk ID and press ENTER.

OR

Press ENTER to accept the displayed Clerk ID.

Note: This is an OPTIONAL prompt.

It only appears if the Clerk ID propman

has been enabled in Admin 83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

It only appears if the Invoice Numbers

prompt has been enabled in Admin 08.

Press ENTER to accept original authorized

amount or key in new amount and press

ENTER

Please wait

If your customer signed the original Pre-Authorized transaction receipt, then your customer is

not required to sign the “ADVICE” receipt. However, you must retain a copy of the ADVICE

receipt.

Press the CANCEL/EXIT key to return to the

READY prompt.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 21

Page 30

CHAPTER 3: Processing Credit Transactions

3.8: Processing Credit Card Advice Transaction

Use this transaction to complete Credit Purchase transactions that you were

unable to process at the time of the Sale due to System or Terminal problems. This transaction captures the transaction for settlement.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

FIND ORIGINAL?

YES-A NO-C

ADVICE

ENTER ACCOUNT NO.

ENTER EXPIRY DATE

MMYY

ADVICE

ENTER CLERK ID

ADVICE

ENTER INVOICE NUMBER

ENTER ORIGINAL

AUTHORIZATION NUMBER

ADVICE

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING / RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRAN RECORD

READY

SWIPE CUSTOMER CARD

Press ADVICE key

Press C

Key in Cardholder number manually and press

ENTER

Key in the card’s expiry date and press ENTER

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt.

It only appears if the Clerk ID

propman has been enabled in Admin

83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt.

It only appears if the Invoice Numbers

prompt has been enabled in Admin

08.

Key in Authorization obtained from “Voice

Authorization” and press ENTER.

If the transaction was below your floor limit and

you did not obtain Voice Authorization, key in

the date when the original transaction was

made (DDMMYY) as your authorization number and press ENTER.

Key in amount of the transaction (without the

decimal point) and press ENTER.

Please wait

Retain a copy of receipt.

Press the CANCEL/EXIT key to return to

READY prompt

22 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 31

CHAPTER 4: Processing Debit T ransactions

This section outlines how to process debit card transactions. Before you

can process any transaction, you must first configure your terminal. Refer

to CHAPTER 8: Processing Administrative Functions.

Note: The debit cardholder must be present for all debit transactions.

To reduce the risk of fraudulent card use, only a portion of the cardholder's

card number is printed on the cardholder receipt. The remainder of the card

number is masked. For debit card numbers, the first 10 digits of the card

are printed in clear . From the 11th digi t onwards, asterisks are printed in the

place of the real digits, e.g.: 0123456789******.

4.1: Entering Debit Card Information

There is only one method for entering Debit card information into the

Transelect terminal:

• swiping the Debit card on the magnetic stripe reader

IMPORTANT: Debit card information can NOT be manually entered on

the Transelect terminal. The Debit card MUST be

swiped.

Swiping the Debit Card

Simply swipe the Debit card’s magnetic stripe through the magnetic stripe

reader (MSR) on the terminal. The MSR will read the information on the

stripe.

4.2: Processing Debit Card Purchases

This transaction electronically authorizes and captures debit card purchases. Settlement to your business account occurs electronically for all

“closed batches”.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 23

Page 32

CHAPTER 4: Processing Debit Transactions

4.2.1: Processing Debit Purchase (without Tip Entry)

TERMINAL DISPLAY OPERATOR’S ACTION CUSTOMER ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

*PURCHASE

CONTINUE ON PINPAD

DIALLING

SENDING

RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Swipe Customer Card

Key in your Clerk ID and press

ENTER.

Note: This prompt only

appears if the Clerk ID

prompt has been

enabled in Admin 83.

Key in the invoice number and

press ENTER.

OR

Press ENTER to leave this blank.

Note: This prompt only appears

if the Invoice Number

prompt has been enabled

in Admin 08.

Key in the amount of the Purchase

(without decimal point) and press

ENTER

Give PINPad to customer 1.Verify the transaction type and

amount. If correct, press OK.

2.Select Chequing or Savings

account.

3.Key in your PIN and press OK.

4.Return the PINPad to the

operator.

Note: Press CANCEL at any

time to stop the

transaction.

Press CORR to make

changes to the last entry.

Return Card to customer “PLEASE WAIT FOR MESSAGE”

appears on the PINPad display.

Give the masked copy of the receipt

to your customer and retain the

unmasked copy for your records.

“APPROVED-THANKS

OBTAIN CARD”

is displayed on the PINPad.

Press CANCEL/EXIT key to return

to READY prompt.

###### = the Authorization Number

24 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 33

CHAPTER 4: Processing Debit Transactions

4.2.2: Processing Debit Purchase with Tip Entry

TERMINAL DISPLAY OPERATOR’S ACTION CUSTOMER ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

*PURCHASE

CONTINUE ON PINPAD

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

Swipe Customer Card

Key in your Clerk ID and press

ENTER.

Note: This prompt appears

only if the Clerk ID

prompt is enabled in

Admin 83.

Key in the invoice number and

press ENTER

OR

Press ENTER to leave this blank.

Note: This prompt appears

only if the Invoice

Numbers prompt is

enabled in Admin 08.

Key in the amount of the purchase

(without decimal point) and press

ENTER

Give the PINPad to customer 1. Verify the transaction type and

amount. If correct, press OK.

2. Enter the tip amount and press

OK

OR

To bypass tip, simply press OK.

3. Verify the Purchase plus Tip

amount. Press OK.

4. Select Chequing or Savings

account.

5. Key in your PIN and press OK.

6. Return the PINPad to the

operator.

Note: Press CANCEL at any

time to stop the

transaction.

Press CORR to make

changes to the last entry.

Return the Debit card to the customer.

“PLEASE WAIT FOR MESSAGE”

appears on the PINPad display.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 25

Page 34

CHAPTER 4: Processing Debit Transactions

TERMINAL DISPLAY OPERATOR’S ACTION CUSTOMER ACTION

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Give the masked copy of the receipt

to your customer and retain the

unmasked copy for your records.

Press CANCEL/EXIT to return to

the READY prompt.

(###### = the Authorization Number)

“APPROVED-THANKS

OBTAIN CARD”

is displayed on the PINPad.

4.3: Correcting/Voiding Debit Card Purchase

Use this transaction to correct a purchase transaction that was keyed incorrectly. Process this transaction for the entire amount of the original purchase transaction and then re-key the purchase correctly.

Note: Your POS Administrative Card (ADMIN) is required to complete a

Purchase Correction/Void transaction

TERMINAL DISPLAY OPERATOR'S ACTION CUSTOMER ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE VOID

SWIPE ADMIN CARD

PURCHASE VOID

SWIPE CUSTOMER CARD

PURCHASE VOID

ENTER CLERK ID

PURCHASE VOID

ENTER INVOICE NUMBER

ENTER ORIGINAL

AUTHORIZATION NUMBER

PURCHASE VOID

ENTER AMOUNT

Press PUR CORR/VOID key

Swipe POS ADMIN Card

Swipe Customer Card

Key in your Clerk ID and press

ENTER.

Note: This prompt appears

only if the Clerk ID

prompt has been

enabled in Admin 83.

Key in the invoice number and

press ENTER

OR

Press ENTER to leave this blank.

Note: This prompt appears only

if the Invoice Numbers

prompt has been enabled

in Admin 08.

Key in Authorization # from purchase transaction being corrected/

voided and press ENTER

Key in the entire amount of the purchase transaction being Corrected/

Voided (without the decimal) and

press ENTER

26 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 35

CHAPTER 4: Processing Debit Transactions

TERMINAL DISPLAY OPERATOR'S ACTION CUSTOMER ACTION

*PURCHASE VOID

CONTINUE ON PINPAD

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Give PINPad to customer 1.Verify the transaction type and

amount. If correct, press OK.

2.Select Chequing or Savings

account.

3.Key in your PIN and press OK.

4.Return the PINPad to the

operator.

Note: Press CANCEL at any

time to stop the

transaction.

Press CORR to make

changes to the last entry.

Return Card to Customer “PLEASE WAIT FOR MESSAGE”

appears on the PINPad display.

Give the masked copy of the receipt

to your customer and retain the

unmasked copy for your records.

Press CANCEL/EXIT key to return

to READY prompt.

“APPROVED-THANKS

OBTAIN CARD”

is displayed on the PINPad.

4.4: Processing Debit Card Refund

Use this transaction to refund full or partial value of a Purchase transaction.

Note: Your POS Administrative Card (ADMIN) is required to complete a

Refund Transaction.

TERMINAL DISPLAY OPERA TOR'S ACT ION CUSTOMER ACTION

READY

SWIPE CUSTOMER CARD

REFUND

SWIPE ADMIN CARD

REFUND

SWIPE CUSTOMER CARD

REFUND

ENTER CLERK ID

Press REFUND key

Swipe POS ADMIN Card

Swipe customer card

Key in your Clerk ID and press

ENTER.

Note: This prompt appears

only if the Clerk ID

prompt has been

enabled in Admin 83.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 27

Page 36

CHAPTER 4: Processing Debit Transactions

TERMINAL DISPLAY OPERATOR'S ACT ION CUSTOMER ACTION

REFUND

ENTER INVOICE NUMBER

REFUND

ENTER AMOUNT

*REFUND

CONTINUE ON PINPAD

DIALING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Key in the invoice number and

press ENTER

OR

Press ENTER to leave this blank.

Note: This prompt appears only

if the Invoice Numbers

prompt has been enabled

in Admin 08.

Key in the amount of the transaction being Refunded (without the

decimal point) and press ENTER

Partial amount of original purchase

may be refunded)

Give PINPad to customer 1.Verify the transaction type and

amount. If correct, press OK.

2.Select Chequing or Savings

account.

3.Key in your PIN and press OK.

4.Return the PINPad to the

operator.

Note: Press CANCEL at any

time to stop the

transaction.

Press CORR to make

changes to the last entry.

Return card to customer “PLEASE WAIT FOR MESSAGE”

appears on the PINPad display.

Give the masked copy of the receipt

to your customer and retain the

unmasked copy for your records.

“APPROVED-THANKS

OBTAIN CARD”

is displayed on the PINPad.

Press CANCEL/EXIT key to return

to READY prompt

28 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 37

CHAPTER 4: Processing Debit Transactions

4.5: Correcting/Voiding Debit Card Refund

Use this transaction to correct a Refund transaction that was keyed incorrectly. Process this transaction for the entire amount of the original Refund

and then re-process the Refund correctly.

Note: Your POS Administrative Card (ADMIN) is required to complete a

Refund Correction/ Void transaction .

TERMINAL DISPLAY OPERATOR ACTION CUSTOMER'S ACTION

READY

SWIPE CUSTOMER CARD

REFUND VOID

SWIPE ADMIN CARD

REFUND VOID

SWIPE CUSTOMER CARD

REFUND VOID

ENTER CLERK ID

REFUND VOID

ENTER INVOICE NUMBER

ENTER ORIGINAL

AUTHORIZATION NUMBER

REFUND VOID

ENTER AMOUNT

*REFUND VOID

CONTINUE ON PINPAD

Press REF CORR/VOID key

Swipe POS ADMIN Card

Swipe customer card

Key in your Clerk ID and press

ENTER.

Note: This prompt appears

only if the Clerk ID

prompt has been

enabled in Admin 83.

Key in the invoice number and

press ENTER

OR

Press ENTER to leave this blank.

Note: This prompt appears only

if the Invoice Numbers

prompt has been enabled

in Admin 08.

Key in the Authorization # from the

refund transaction being Voided/

Corrected and press ENTER

Key in the entire amount of the

refund transactions being Voided/

Corrected (without the decimal

point) and press ENTER being

Give PINPad to customer 1.Verify the transaction type and

amount. If correct, press OK.

2.Select Chequing or Savings

account.

3.Key in your PIN and press OK.

4.Return the PINPad to the

operator.

Note: Press CANCEL at any

time to stop the

transaction.

Press CORR to make

changes to the last entry.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 29

Page 38

CHAPTER 4: Processing Debit Transactions

TERMINAL DISPLAY OPERATOR ACTION CUSTOMER'S ACTION

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Return card to customer “PLEASE WAIT FOR MESSAGE”

appears on the PINPad display.

Give the masked copy of the receipt

to your customer and retain the

unmasked copy for your records.

Press CANCEL/EXIT key to return

to READY prompt

“APPROVED-THANKS

OBTAIN CARD”

is displayed on the PINPad.

30 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 39

CHAPTER 5: Processing E-commerce And Mail /

T elephone Order Transactions

Your terminal can process e-commerce and mail/ telephone order (MOTO)

transactions. It has to be enabled, using ADMIN 08 function (see Section

8.5: Configuring Your Terminal (ADMIN 08) on page 68.) This section

outlines the procedure for processing e-commerce and mail/ telephone

order transactions. To process e-commerce and mail/ telephone order transaction follow the following steps depending on your terminal configuration.

Note: E-commerce and Mail/ Tel transactions can only be performed without

swiping a card. It is assumed that the cardholder will not be there. If a

card is swiped, the features cannot be used.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 31

Page 40

CHAPTER 5: Processing E-comm and MOTO Transactions

5.1: Processing Transactions with E-Commerce and MOTO Enabled

5.1.1: E-commerce Purchase

To process an E-Commerce transaction when both E-Commerce and

MOTO transactions are enabled on your terminal:

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

SWIPE CUSTOMER CARD

ENTER EXPIRY DATE

MMYY

REGULAR-A E-COMM-B

MAIL/TEL ORDER-C

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press PURCHASE key

Manually key in card number and press ENTER

Key in expiry date (MMYY) and press ENTER

To select e-commerce processing, press B

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt. It appears

only if the Clerk ID prompt is enabled in

Admin 83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt. It appears

only if the Invoice Numbers prompt is

enabled in Admin 08.

Key in purchase amount and press ENTER

Please wait

Press CANCEL/EXIT to return to the READY

prompt.

32 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 41

CHAPTER 5: Processing E-comm and MOTO Transactions

5.1.2: MOTO Purchase

T o process a MOT O transaction when both E-Commerce and MOT O transactions are enabled on your terminal:

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

SWIPE CUSTOMER CARD

ENTER EXPIRY DATE

MMYY

REGULAR-A E-COMM-B

MAIL/TEL ORDER-C

SINGLE–A RECURRING–

MORE OPTIONS-C

If C (MORE OPTIONS) is selected

INSTALLMENT–A

OTHER TYPE–B

MORE OPTIONS-C

If A (SINGLE) or

A (INSTALLMENT) or

B (RECURRING) or

B (OTHER TYPE) is selected:

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press PURCHASE key

Manually key in card number and press ENTER

Key in expiry date (MMYY) and press ENTER

To select mail/ tel order processing, press C

Press A to process a one-time transaction.

B

Press B to process a transaction that occurs on

a regular basis (e.g. monthly).

Press C to view other options.

Press A to process an installment payment.

Press B to process a transaction that does not

fall under the first four options.

Press C to view the first list of options.

Key in your Clerk ID and press ENTER.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Key in purchase amount and press ENTER

Please wait

Press CANCEL/EXIT to return to the READY

prompt.

Note: This is an OPTIONAL prompt. It appears

only if the Clerk ID prompt is enabled in

Admin 83.

Note: This is an OPTIONAL prompt. It appears

only if the Invoice Numbers prompt is

enabled in Admin 08.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 33

Page 42

CHAPTER 5: Processing E-comm and MOTO Transactions

5.2: Processing Transactions with Only E-Commerce Enabled

Note: E-commerce and Mail/ Tel transactions can only be performed without

swiping a card. It is assumed that the cardholder will not be there. If a

card is swiped, the features cannot be used.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

SWIPE CUSTOMER CARD

ENTER EXPIRY DATE

MMYY

E-COMMERCE TRANS?

YES – A NO-C

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press PURCHASE key

Manually key in card number and press ENTER

Key in expiry date (MMYY) and press ENTER

To process an e-commerce transaction, press A

Note: To process a normal purchase transaction,

press C.

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt. It appears

only if the Clerk ID prompt is enabled in

Admin 83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt. It appears

only if the Invoice Numbers prompt is

enabled in Admin 08.

Key in purchase amount and press ENTER

Please wait

Press CANCEL/EXIT to return to the READY

prompt.

34 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 43

CHAPTER 5: Processing E-comm and MOTO Transactions

5.3: Processing Transactions with Only MOTO Enabled

Note: E-commerce and Mail/ Tel transactions can only be performed without

swiping a card. It is assumed that the cardholder will not be there. If a

card is swiped, the features cannot be used.

TERMINAL DISPLAY OPERATOR'S ACTION

READY

SWIPE CUSTOMER CARD

PURCHASE

SWIPE CUSTOMER CARD

ENTER EXPIRY DATE

MMYY

MAIL/TELEPHONE ORDER?

YES–A NO-C

SINGLE–A

RECURRING–B

MORE OPTIONS–C

If C (MORE OPTIONS) is selected

INSTALLMENT–A

OTHER TYPE–B

MORE OPTIONS–C

If A (SINGLE) or B (RECURRING) is selected

PURCHASE

ENTER CLERK ID

PURCHASE

ENTER INVOICE NUMBER

PURCHASE

ENTER AMOUNT

DIALLING

CALL ANSWERED

SENDING/RECEIVING

PROCESSING

PRINTING

APPROVED ######

PROVIDE TRANS RECORD

READY

SWIPE CUSTOMER CARD

Press PURCHASE key

Manually key in card number and press ENTER

Key in expiry date (MMYY) and press ENTER

To select mail/ tel order transaction, press A

Note: Press C to process a normal purchase

transaction.

Press A to process a one-time transaction.

Press B to process a transaction that occurs on

a regular basis (e.g. monthly).

Press C to view other options.

Press A to process an installment payment.

Press B to process a transaction that does not

fall under the first four options.

Press C to view the first list of options.

Key in your Clerk ID and press ENTER.

Note: This is an OPTIONAL prompt. It appears

only if the Clerk ID prompt is enabled in

Admin 83.

Key in the invoice number and press ENTER

OR

Press ENTER to leave this blank.

Note: This is an OPTIONAL prompt. It appears

only if the Invoice Numbers prompt is

enabled in Admin 08.

Key in purchase amount and press ENTER

Please wait

Press CANCEL/EXIT to return to the READY

prompt.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 35

Page 44

CHAPTER 5: Processing E-comm and MOTO Transactions

36 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 45

CHAPTER 6: Processing ERNEX T ransactions

Your Transelect Terminal is capable of processing Loyalty and Gift Card

transactions as well as financial transactions.

Prior to processing a Loyalty or Gift Card, the ERNEX host must be set up

to accept the transaction and your terminal must be set up to process the

transaction.

If you have questions, please contact Ernex at 1-888-376-3999, or at support@ernex.com.

6.1: Ernex Features

6.1.1: Clerk IDs

ERNEX is able to maintain Clerk totals that are independent of terminal

totals or batch totals. Each Clerk can select ERNEX totals or zero their loyalty totals, but they cannot close their batch with ERNEX.

Each Clerk is identified by a 1 - 6 character field. Clerk ID's can contain '0'

- '9' and 'A' - 'Z'. All other characters are not acceptable. Clerk ID's do NOT

need to be configured at ERNEX.

When the Clerk ID prompt is activated, each transaction must include a

Clerk ID (including administrative transactions). ERNEX Clerk ID's can be

used to total transactions by an ID or to identify a clerk in cases where an

employee incentive program is in use. In order to activate Clerk ID's contact Moneris.

6.1.2: Gift Card Validation Code (CVC)

Every Gift Card has a three digit Card Validation Code (CVC) which is

printed on the front or back of the Gift Card. The CVC provides additional

security against fraudulent cards and must be keyed in with every Gift Card

transaction.

6.1.3: Stored Transactions

Your Transelect Terminal can store up to 1000 Approved ERNEX transactions. Once the transactions in the terminal memory reach capacity, the

oldest transaction drops off. If your terminal is replaced, the memory cannot be transferred to the replacement terminal and is therefore lost.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 37

Page 46

CHAPTER 6: Processing ERNEX Transactions

6.1.4: Card Masking

To reduce the risk of fraudulent card use, only a portion of the cardholder's

card number is printed on the cardholder receipt. The remainder of the card

number is masked, i.e., an '*' is printed for each remaining digit in the card

number.

Note: Remember to give the cardholder the MASKED copy of the receipt and

keep the unmasked copy for your records. The unmasked copy is

required to resolve charge-back issues quickly.

For gift card and loyalty card numbers, only the last four digits are printed

in clear, the rest are replaced with an asterisk, e.g.: *************1234.

To further reduce fraudulent card use, the gift card and loyalty card expiry

dates are not printed on the cardholder copy of the receipt.

Your printer must be configured to print a minimum of 2 copies of the

receipt (even if you use 2-part paper) to maintain compliance with card

masking requirements. See section 8.8: Setting Up the Printer (ADMIN

14) for instructions.

6.2: ERNEX Admin Functions

6.2.1: Balancing and Closing Your Terminal with Ernex

Your terminal performs a Gift and Loyalty close batch in the same manner

as a Financial close batch.

For a Gift and Loyalty close batch request, the application sends an in-balance or out of balance flag to ERNEX. After the terminal has received and

compared between the terminal and the ERNEX host, a balance status will

indicate "batch is in balance" or "batch is out of balance" and is printed on

the report.

Once your E-Gift and/or Loyalty program has been set up with ERNEX,

and you have received your ERNEX terminal identification number, you

must initialize your terminal with ERNEX in order to begin processing Gift

Card and/or Loyalty Card transactions.

6.2.2: Initializing with ERNEX

No receipt is printed with this transaction.

Also if you have more than 1 terminal at your location, each device has to

have 2 different ERNEX terminal IDs.

38 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 47

CHAPTER 6: Processing ERNEX Transactions

TERMINAL DISPLAY OPERATOR ACTIONS

READY

SWIPE CUSTOMER CARD

ENTER ADMIN CODE Enter 57 and press ENTER

ENTER TERMINAL ID Key in ERNEX terminal ID (4 or 5 digit numeric

DIALING/SENDING/

RECEIVING

READY

SWIPE CUSTOMER CARD

Press ADMIN key

number) and press ENTER.

Or to retain displayed terminal ID press

ENTER

Transaction in progress, please wait

Terminal is initialized

6.2.3: Re-initialization with ERNEX

From time to time, your terminal may ask you to re-initialize with ERNEX.

This will occur because there will have been changes made to your program, and you will need to re-initialize with ERNEX to download the new

configuration to your Transelect. The terminal screen will show a message

"Initialization with ERNEX required". You will be able to continue transactions as usual until the end of business on the day the message appears. If

you do not initialize your terminal before the following day, you will no

longer be able to complete any transactions with ERNEX. You MUST initialize your terminal with ERNEX to continue. The idle prompt on the terminal will change to the normal idle prompt as soon as the terminal has

been successfully initialized with ERNEX.

T o re-initialize yo ur terminal with ERNEX, please follow the procedures in

section 6.2.2: Initializing with ERNEX.

IMPORTANT: Ensure you have closed your batch and printed out

your required reports before re-initializing your

terminal with ERNEX. This function will clear and

reset the ERNEX information in your terminal.

Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1 39

Page 48

CHAPTER 6: Processing ERNEX Transactions

6.2.4: Host Communication Test with ERNEX (ADMIN 58)

This function tests the communication path from the terminal to ERNEX

without the use of a loyalty card.

TERMINAL DISPLAY OPERATOR ACTIONS

READY

SWIPE CUSTOMER CARD

ENTER ADMIN CODE Enter 58 and press ENTER

DIALING/SENDING/

PROCESSING/

RECEIVING

ERNEX APPROVED

READY

SWIPE CUSTOMER CARD

Press ADMIN key

Transaction in progress, please wait

40 Moneris TRANSELECT (V2000) Merchant Operating Manual v.1.1

Page 49

CHAPTER 6: Processing ERNEX Transactions

6.3: Performing ERNEX Gift Card Transactions

6.3.1: Gift Card Activation

We recommend that Gift Cards be activated ONLY when they are sold.