Page 1

Fixed-Income Tool

User’s Guide

box™ 1

Page 2

How to Contact The MathWorks

www.mathworks.

comp.soft-sys.matlab Newsgroup

www.mathworks.com/contact_TS.html Technical Support

suggest@mathworks.com Product enhancement suggestions

bugs@mathwo

doc@mathworks.com Documentation error reports

service@mathworks.com Order status, license renewals, passcodes

info@mathwo

com

rks.com

rks.com

Web

Bug reports

Sales, prici

ng, and general information

508-647-7000 (Phone)

508-647-7001 (Fax)

The MathWorks, Inc.

3 Apple Hill Drive

Natick, MA 01760-2098

For contact information about worldwide offices, see the MathWorks Web site.

Fixed-Income Toolbox™ User’s Guide

© COPYRIGHT 2003–20 10 by The MathWorks, Inc.

The software described in this document is furnished under a license agreement. The software may be used

or copied only under the terms of the license agreement. No part of this manual may be photocopied or

reproduced in any form without prior written consent from The MathW orks, Inc.

FEDERAL ACQUISITION: This provision applies to all acquisitions of the Program and Documentation

by, for, or through the federal government of the United States. By accepting delivery of the Program

or Documentation, the government hereby agrees that this software or documentation qualifies as

commercial computer software or commercial computer software documentation as such terms are used

or defined in FAR 12.212, DFARS Part 227.72, and DFARS 252.227-7014. Accordingly, the terms and

conditions of this Agreement and only those rights specified in this Agreement, shall pertain to and govern

theuse,modification,reproduction,release,performance,display,anddisclosureoftheProgramand

Documentation by the federal government (or other entity acquiring for or through the federal government)

and shall supersede any conflicting contractual terms or conditions. If this License fails to meet the

government’s needs or is inconsistent in any respect with federal procurement law, the government agrees

to return the Program and Docu mentation, unused, to The MathWorks, Inc.

Trademarks

MATLAB and Simulink are registered trademarks of The MathWorks, Inc. See

www.mathworks.com/trademarks for a list of additional trademarks. Other product or brand

names may be trademarks or registered trademarks of their respective holders.

Patents

The MathWorks products are protected by one or more U.S. patents. Please see

www.mathworks.com/patents for more information.

Page 3

Revision History

May 2003 Online only New for V ersion 1.0 (Release 13)

November 2003 First printing Unchanged

June 2004 Online only Revised for Version 1.0.1 (Release 14)

August 2004 Online only Revised for Version 1.1 (Release 14+)

September 2005 Online only Revised for Version 1.1.1 (Release 14SP3)

March 2006 Online only Revised for Version 1.1.2 (Release 2006a)

September 2006 Online only Revised for Version 1.2 (Release 2006b)

March 2007 Online only Revised for Version 1.3 (Release 2007a)

September 2007 Online only Revised for Version 1.4 (Release 2007b)

March 2008 Online only Revised for Version 1.5 (Release 2008a)

October 2008 Online only Revised for Version 1.6 (Release 2008b)

March 2009 Online only Revised for Version 1.7 (Release 2009a)

September 2009 Online only Revised for Version 1.8 (Release 2009b)

March 2010 Online only Revised for Version 1.9 (Release 2010a)

Page 4

Page 5

Getting Started

1

Product Overview ................................. 1-2

Introduction

Expected Background

...................................... 1-2

.............................. 1-2

Contents

What This Product Provides

Supported Tasks

Using Mortgage-Backed Securities

Using Debt Instruments

Using Derivative Securities

Using Interest-Rate Curve Objects

.................................. 1-4

........................ 1-4

................... 1-4

............................ 1-5

......................... 1-5

................... 1-5

Mortgage-Backed Securities

2

What Are Mortgage-Backed Securities? .............. 2-2

Using Fixed-Rate Mortgage Pool Functions

Introduction

Inputs to Functions

Generating Prepayment Vectors

Mortgage Prepayments

Risk Measurement

Mortgage Pool Valuation

Computing Option-Adjusted Spread

Prepayments with Fewer Than 360 Months Remaining

Pools with Different Numbers of Coupons Remaining

...................................... 2-3

................................ 2-4

..................... 2-4

............................. 2-6

................................ 2-8

........................... 2-9

.................. 2-10

.......... 2-3

.. 2-13

.... 2-15

v

Page 6

Debt Instruments

3

Treasury Bills Defined ............................. 3-2

Computing T reasury Bill Price and Yield

Introduction

Treasury Bill Repurchase Agreements

Treasury Bill Yields

Using Zero-Coupon Bonds

Introduction

Measuring Zero-Coupon Bond Function Quality

PricingTreasuryNotes

Pricing Corporate Bonds

Stepped-Coupon Bonds

Introduction

Cash Flows from Stepped-Coupon Bonds

Price and Yield of Stepped-Coupon Bonds

Term Structure Calculations

Introduction

Computing Spot and Forward Curves

Computing Spreads

...................................... 3-3

................ 3-3

............................... 3-5

.......................... 3-7

...................................... 3-7

............................. 3-8

............................ 3-10

............................ 3-12

...................................... 3-12

....................... 3-15

...................................... 3-15

................. 3-15

................................ 3-17

............ 3-3

........ 3-7

.............. 3-12

.............. 3-14

vi Contents

4

ing and Hedging

Pric

Pricing Assumptions

Swap

p Pricing Example

Swa

tfolio Hedging

Por

nvertible B on d Valuation

Co

nd Fu tures

Bo

.................................

.....................................

Derivative Securities

...............................

..........................

.............................

........................

4-

4-

4-2

4-2

4-3

4-8

10

12

Page 7

Supported Bond Futures ............................ 4-12

Example Analysis of Bond Futures

Managing Interest-Rate Risk with Bond Futures

................... 4-14

........ 4-16

Interest-Rate Curve Objects

5

Introduction to Interest-Rate Curve Objects ......... 5-2

Class Structure

Supported Workflow Model Using Interest-Rate Curve

Objects

................................... 5-2

........................................ 5-3

Creating Interest-Rate Curve Objects

Creating an IRDataCurve Object

Using the IRDataCurve Constructor with Dates and

Data

.......................................... 5-6

Using IRDataCurve bo otstrap Method for Bootstrapping

Based on Market Instruments

Creating an IRFunctionCurve Object

Using a Function Handle to Fit an IRFunctionCurve

Object

Using the Nelson-Siegel M ethod to Fit an IRFunctionCurve

Object

Using the Svensson Method to Fit an IRFunctionCurve

Object

UsingtheSmoothingSplineMethodtoFitan

IRFunctionCurve Object

Using the fitFunction to Create a Custom Fitting Function

for an IRFunctionCurve Object

Converting an IRDataCurve or IRFunctionCurve

Object

Introduction

Using the toRateSpec Method

Using Vector of Dates and Data Methods

......................................... 5-13

......................................... 5-14

......................................... 5-16

.......................................... 5-25

...................................... 5-25

..................... 5-7

.......................... 5-18

....................... 5-25

............... 5-4

.................... 5-6

................ 5-13

.................... 5-21

.............. 5-26

vii

Page 8

Function Reference

6

Bond Futures ..................................... 6-2

Certificates of Deposit

Convertible Bonds

Derivative Securities

Interest-Rate Curve Objects

Mortgage-Backed Securities

Option-Adjusted Spread Computations

Stepped-Coupon Bonds

Treasury Bills

Zero-Coupon Instruments

..................................... 6-9

............................. 6-2

................................. 6-3

.............................. 6-3

........................ 6-3

........................ 6-6

............................ 6-8

.......................... 6-10

.............. 6-7

viii Contents

Functions — Alphabetical List

7

Class Reference

A

@IRBootstrapOptions .............................. A-2

Hierarchy

Constructor

........................................ A-2

...................................... A-2

Page 9

Public Read-Only Properties ........................ A-2

Methods

......................................... A-3

@IRCurve

Hierarchy

Description

Constructor

Public Read-Only Properties

Methods

@IRDataCurve

Hierarchy

Description

Constructor

Public Read-Only Properties

Methods

@IRFitOptions

Hierarchy

Description

Constructor

Public Read-Only Properties

Methods

@IRFunctionCurve

Hierarchy

Description

Constructor

Public Read-Only Properties

Methods

......................................... A-4

........................................ A-4

....................................... A-4

...................................... A-4

......................................... A-6

..................................... A-7

........................................ A-7

....................................... A-7

...................................... A-7

......................................... A-9

..................................... A-10

........................................ A-10

....................................... A-10

...................................... A-10

......................................... A-11

................................ A-12

........................................ A-12

....................................... A-12

...................................... A-12

......................................... A-14

........................ A-4

........................ A-8

........................ A-11

........................ A-13

Bibliography

B

Fitting Interest-Rate Curve Functions ............... B-2

Bootstrapping a Swap Curve

....................... B-3

ix

Page 10

Bond Futures ..................................... B-4

Examples

C

Treasury Bills ..................................... C-2

Using Zero-Coupon Bonds

Stepped-Coupon Bonds

Pricing and Hedging

Bond Futures

..................................... C-2

............................... C-2

.......................... C-2

............................ C-2

Glossary

Index

x Contents

Page 11

Getting Started

• “Product Overview” on page 1-2

• “What This Product Provides” on page 1-4

1

Page 12

1 Getting Started

Product Overview

Introduction

Fixed-Income Toolbox™ software extends MATLAB®with functions for

fixed-income modeling and analysis. You can use the toolbox to determine

the price, yield, and cash flow for many types of fixed-income securities,

including mortgage-backed securities, corporate bonds, treasury bonds,

municipal bonds, certificates of deposit, and treasury bills. Fixed-Income

Toolbox functions also enable you to work with derivatives, including swaps,

convertible bonds, and treasury futures. The built-in functions can be used to

create customized fixed-income models based on mortgage-backed securities

and debt instruments.

In this section...

“Introduction” on page 1-2

“Expected Background” on page 1-2

1-2

Expected Background

In general, this guide assumes experience working with fixed-income

instruments and some familiarity with the underlying models.

Your title is likely one of these:

• Analyst, quantitative analyst

• Risk manager

• Portfolio manager

• Fund manager, asset m anager

• Financial engineer

• Trader

• Student, professor, or other academic

Your background, education, training, and responsibilities likely match some

aspectsofthisprofile:

Page 13

Product Overview

• Finance, economics, perhaps accounting

• Engineering, mathematics, physics, other quantitative sciences

• Bachelor’s degree minimum; MS or MBA likely; Ph.D. perhaps; CFA

• Comfortable with probability theory, statistics, and algebra

• Understand linear or matrix algebra and calculus

• Perhaps new to MATLAB software

1-3

Page 14

1 Getting Started

What This Product Provides

In this section...

“Supported Tasks” on page 1-4

“Using Mortgage-Backed Securities” on page 1-4

“Using Debt Instruments” on page 1-5

“Using Derivative Securities” on page 1-5

“Using Interest-Rate Curve Objects” on page 1-5

Supported Tasks

Fixed-Income Toolbox software extends MATLAB software with functions for

fixed-income modeling and analysis. You can use the toolbox to determine the

price, yield, and cash flow for many types of fixed-income securities, including

mortgage-backed securities, corporate bonds, Treasury bonds, municipal

bonds, certificates of deposit, and Treasury bills.

1-4

Fixed-Income Toolbox software also enables y ou to work with derivatives,

including swaps, convertible bonds, and Treasury futures. You can use

built-in functions to create customized fixed-income models based on

mortgage-backed securities and debt instruments. You can then use

Fixed-Income Toolbox softwaretoperformthefollowing:

• Calculate the price and yield for generic fixed-rate mortgage pools and

balloon mortgages.

• Determine the price, yield, discount rate, and cash-flow schedule for

debt instruments, including Treasury bills, zero-coupon bonds, and

stepped-coupon bonds.

• Calculate swap rates and sensitivities.

• Analyze the term structure of interest rates, including bootstrapping and

fitting the term structure to market data using parametric models.

Using Mortgage-Backed Securities

With Fixed-Income Toolbox software, you can model generic fixed-rate

mortgage pools and balloon mortgages. Tools are provided for:

Page 15

What This Product Provides

• Calculating the price and yield of mortgage-backed securities using

prepayment options derived from uniform practices of the Public Securities

Association (PSA)

• Determining the mortgage-pool price or effective duration using the

option-adjusted spread (OAS) method

• Calculating basic risk measurements for a mortgage-pool portfolio using

convexity, duration, and average life

Using Debt Instruments

You can also use Fixed-Income Toolbox software to work with a variety of debt

instruments. You can calculate price, yield, dis count rate, and break-even

discount rate for treasury bills, and determine price, yield, and cash- flow

schedules for corporate, treasury, and municipal bonds. The zero-coupon

functions in Fixed-Income Toolbox software help with the extraction of

present value from virtually any fixed-coupon instrument for any time period.

Toolbox functions also let you calculate price, yield, and cash-flow schedules

for stepped-coupon bonds. The n ext coupon dates are computed automatically

from the last entered input end dates. The payment due on settlement

represents the accrued interest due on that day.

Using Derivative Securities

In addition, Fixed-Income Toolbox software provides tools based on Black’s

option functions for working with fixed-income derivatives. These tools let

you calculate swap price by computing par yields that equate the floating-rate

side of a swap to the fixed-rate side. You can set the present value of the fixed

side to the present value of the floating side without aligning and comparing

fixed and floating periods. The duration-hedging capability in the toolbox lets

you hedge a portfolio and address interest-rate risk exposure with a swap

arrangement. Fixed-Income Toolbox software lets you use binomial a nd

trinomial trees to v a lue convertible bonds. The value of the convertible bond

is determined by the uncertainty of the relative stock.

Using Interest-Rate Curve Objects

Fixed-Income Toolbox software provides tools for analyzing the term structure

of interest rates, including bootstrapping and fitting the term structure to

market data using parametric models (e.g., Nelson-Siegel and Svensson),

1-5

Page 16

1 Getting Started

spline-based models, and user-defined functions. Fixed-Income Toolbox

supports three class objects:

• “@IRCurve” on page A-4

Creates an interest-rate curves and includes methods for extracting

forward, zero, and discount factors curves.

Supports a method to convert to a

acceptable input format for the Financial Derivatives Toolbox™ function

intenvset.

• “@IRDataCurve” on page A-7

Represents interest-rate curves based on vectors of dates and data.

This class supports bootstrapping an interest-rate curve from market

instruments with a range of interpolation methods.

• “@IRFunctionCurve” on page A-12

Represents an interest-rate curve with a function; the function can be

specified directly, or a form of the function can be specified and then the

parameters are fit to available market data. In addition, you can determine

which type of interest-rate curve (zero, forward, or discount curve) fits the

market data, as well as, any custom functions.

RateSpec structure, which is an

1-6

Page 17

2

Mortgage-Backed Securities

• “What Are Mortgage-Backed Securities?” on page 2-2

• “Using Fixed-Rate Mortgage Pool Functions” on page 2-3

Page 18

2 Mortgage-Backed Securities

What Are Mor tgage-Backed Securities?

Mortgage-backed securities (MBSs) are a type of investment that represents

ownership in a group of mortgages. Principal and interest from the individual

mortgages are used to pay principal and interest on the MBS.

Ownership in a group of mortgages is typically represented by a pass-through

certificate (PC). Most pass-through certificates are issued by the Government

National Mortgage Agency, a branch of the United States government,

or by one of two private corporations: Fannie Mae or Freddie Mac. With

these certificates, homeowners’ payments pass from the originating bank

through the issuing agency to holders of the certificates. These agencies also

frequently guarantee that the ce rtificate holder receives timely payment of

principal and interest from the PCs.

2-2

Page 19

Using Fixed-Rate Mortgage Pool Functions

Using Fixed-Rate Mortgage Pool Functions

In this section...

“Introduction” on page 2-3

“Inputs to Functions” on page 2-4

“Generating Prepayment Vectors” on page 2-4

“Mortgage Prepayments” on page 2-6

“Risk Measurement” on page 2-8

“Mortgage Pool Valuation” on page 2-9

“Computing Option-Adjusted Spread” on page 2-10

“Prepayments with Fewer Than 360 Months Remaining” on page 2-13

“Pools with Different Numbers of Coupons Remaining” on page 2-15

Introduction

Fixed-Income Toolbox software supports calculations involved with generic

fixed-rate mortgage pools and balloon mortgages. Pass-through certificates

typically ha ve embedded call options in the form of prepayment. Prepayment

is an excess payment applied to the principal of a PC. These accelerated

payments reduce the effective life of a PC.

The toolbox comes with a sta n da rd Bond Market Association (PSA)

prepayment model and can generate multiples of standard prepayment

speeds. The Public Securities Association provides a set of uniform practices

for calculating the characteristics of mortgage-backed securities when there is

an assumed prepayment function.

You can obtain more information about these uniform practices on the PSA

Web site (

Alternatively, aside from the standard PSA implementation in this toolbox,

you can supply yo ur own projected prepayment vectors. At this time, however,

custom prepayment functionality that incorporates pool-specific information

and interest rate forecasts are not available in this toolbox. If you plan to use

http://www.bondmarkets.com).

2-3

Page 20

2 Mortgage-Backed Securities

custom prepayment vectors in your calculations, you presumably already

own such a suite in MATLAB.

Inputs to Functions

Because of the generic, all-purpos e nature of the toolbox pass-through

functions, you can fine-tune them to conform to a particular mortgage. Most

functions require at least this set of inputs:

• Gross coupon rate

• Settlement date

• Issue (effective) date

• Maturity date

Typical optional inputs include standard prepay m en t speed (or customized

vector), net coupon rate (if different from gross coupon rate), and payment

delay in number of days.

2-4

All calculations are based on expected payment dates and actual cash flow to

the investor. For example, when

to

mbsdurp, the function returns a modified duration based on CouponRate.

(A notable exception is

based on the

GrossRate.)

mbspassthrough, which returns interest quantities

GrossRate and CouponRate differ as inputs

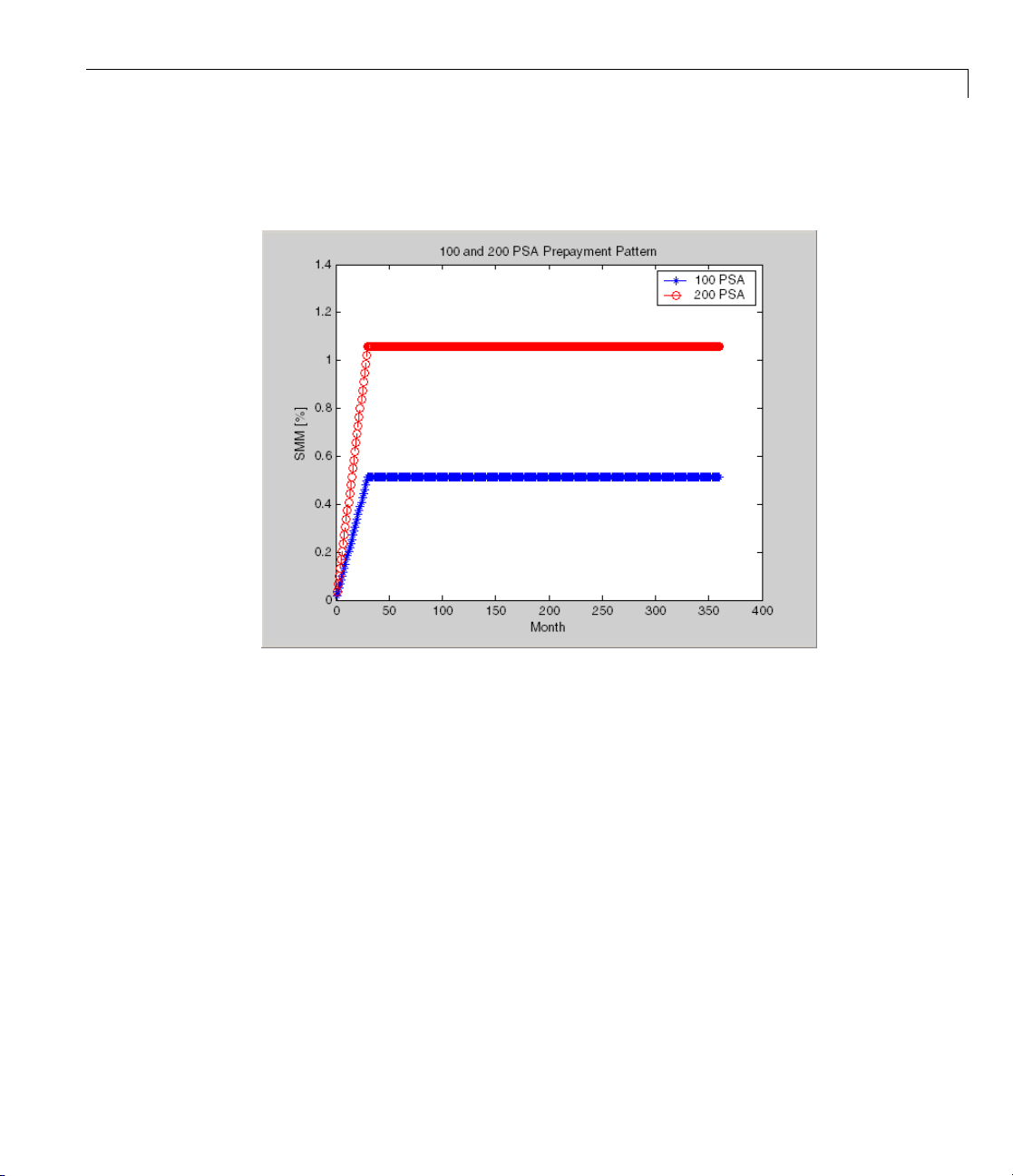

Generating Prepayment Vectors

You can generate PSA multiple prepayment vectors quickly. T o generate

prepayment vectors of 100 and 200 PSA, type

PSASpeed = [100, 200];

[CPR, SMM] = psaspeed2rate (PSASpeed);

This function computes two prepayment values: conditional prepayment

rate (CPR) and single monthly mortality (SMM) rate. CPR is the percentage

of outstanding principal prepaid in1year. SMMisthepercentageof

outstanding principal prepaid in 1 month. In other words, CPR is an annual

version of SMM.

Page 21

Using Fixed-Rate Mortgage Pool Functions

Since the entire 360-by-2 array is too long to show in this document, observe

the SMM (100 and 200 PSA) plots, spaced one month apart, instead.

Prepayment assumptions form the basis upon which far more comprehensive

MBS calculations are based. As an illustration observe the following example,

which shows the use of the function

mbscfamounts to generate cash flows and

timings based on a set of standard prepayments.

Considerthreemortgagepoolsthatweresoldontheissuedate(whichstarts

unamortized). The first two pools "balloon out" in 60 months, and the third is

regularly amortized to the end. The prepayment speeds are assumed to be

100, 200, and 200 PSA, respectively.

Settle = [datenum('1-Feb-2000');

datenum('1-Feb-2000');

datenum('1-Feb-2000')];

Maturity = [datenum('1-F eb-2030')];

IssueDate = datenum('1-Feb-2000');

2-5

Page 22

2 Mortgage-Backed Securities

The fourth output argument, Factors, indicates the fraction of the balance

still outstanding at the beginning of each month. A snapshot of this argument

in the MATLAB Variable Editor illustrates the 60-month life of the first two

of the mortgages with balloon payments and the continuation of the third

mortgage until the end (360 months).

GrossRate = 0.08125;

CouponRate = 0.075;

Delay = 14;

PSASpeed = [100, 200];

[CPR, SMM] = psaspeed2rate (PSASpeed);

PrepayMatrix = ones(360,3);

PrepayMatrix(1:60,1:2) = SMM(1:60,1:2);

PrepayMatrix(:,3) = SMM(:,2);

[CFlowAmounts, CFlowDates, TFactors, Factors] = . ..

mbscfamounts(Settle, Maturity, IssueDate, GrossRate, ...

CouponRate, Delay, [], PrepayMatrix);

2-6

You can readily see that mbscfamounts is the building block of most fixed rate

and balloon pool cash flows.

Mortgage Prepayments

Prepayment is beneficial to the pass-through owner when a mortgage pool

has been p urchased at discount. The next example compares mortgage

yields (compounded monthly) versus the purchase clean price with constant

Page 23

Using Fixed-Rate Mortgage Pool Functions

prepayment speed. The example illustrates that when you have purchased

a pool at a discount, prepay m ent generates a higher yield with decreasing

purchase price.

Price = [85; 90; 95];

Settle = datenum('15-Apr-2002');

Maturity = datenum('1 Jan 2030');

IssueDate = datenum('1-Jan-2000');

GrossRate = 0.08125;

CouponRate = 0.075;

Delay = 14;

Speed = 100;

Compute the mortgage and bond-equivalent yields.

[MYield, BEMBSYield] = mb syield(Price, Settle, Maturity, ...

IssueDate, GrossRate, CouponRate, Delay, Speed)

MYield =

0.1018

0.0918

0.0828

BEMBSYield =

0.1040

0.0936

0.0842

If for this same pool of mortgages, there was no prepayment (Speed = 0),

the yields would decline to

MYield =

0.0926

0.0861

0.0802

BEMBSYield =

2-7

Page 24

2 Mortgage-Backed Securities

Likewise, if the rate of prepayment doubled (Speed = 200), the yields would

increase to

0.0944

0.0877

0.0815

MYield =

0.1124

0.0984

0.0858

BEMBSYield =

0.1151

0.1004

0.0873

2-8

For the same prepayment vector, deeper discount pools earn higher yields.

For more information, see

mbsprice and mbsyield.

Risk Measurement

Fixed-Income Toolbox software provides the most basic risk measures of

a pool portfolio:

• Modified duration

• Convexity

• Averagelifeofpool

Consider the following ex ample, which calculates the Macaulay and modified

durations given the price of a mortgage pool.

Price = [95; 100; 105];

Settle = datenum('15-Apr-2002');

Maturity = datenum('1-Jan-2030');

IssueDate = datenum('1-Jan-2000');

GrossRate = 0.08125;

Page 25

Using Fixed-Rate Mortgage Pool Functions

CouponRate = 0.075;

Delay = 14;

Speed = 100;

[YearDuration, ModDuration] = mbsdurp(Price, Settle, ...

Maturity, IssueDate, GrossRate, CouponRate, Delay, Speed)

YearDuration =

6.1341

6.3882

6.6339

ModDuration =

5.8863

6.1552

6.4159

Using Fixed-Income Toolbox functions, you can obtain modified duration

and convexity from either price or yield, as long as you specify a prepayment

vector or an assumed prepayment speed. The toolbox risk-measurement

functions (

mbsdurp, mbsdury, mbsconvp, mbsconvy,andmbswal)adheretothe

guidelines listed in the PSA Uniform Practices manual.

Mortgage Pool Valuation

For accurate valuation of a mortgage pool, you must generate interest rate

paths and use them with mortgage pool characteristics to properly value

the pool. A widely used methodology is the option-adjusted spread (OAS).

OAS measures the yield spread that is not directly attributable to the

characteristics of a fixed-income investment.

Calculating OAS

Prepayment alters the cash flows of an otherwise regularly amortizing

mortgage pool. A comprehensive option-adjusted spread calculation

typically begins with the generation of a set of paths of spot rates to predict

prepayment. A path is collection of i spot-rate paths, with corresponding

j cashflowsoneachofthosepaths.

2-9

Page 26

2 Mortgage-Backed Securities

The effect of the OAS on pool pricing is shown mathematically in the following

equation, where K is the option-adjuste d spread.

CF

ij

∑

1()

++

j

CF

ij

zerorates K

ij

T

ij

PoolPrice

mmberofPaths

=×

NumberofPaths

1

Nu

∑

i

Calculating Effective Duration

Alternatively, if you are more interested in the sensitivity of a mortgage pool

to interest rate changes, use effective duration, which is a more appropriate

measure. Effective duration is defined mathematically with the following

equation.

+− −()()

ΔΔ

Py y Py y

Effective Duration

=

()

Δ2

Py y

Calculating Market Price

The toolbox has all the components required to calculate OAS and effective

duration if you supply prepayment vectors or assumptions. For O AS, given a

prepayment vector, you can generate a set of cash flows with

Discounting these cash flows with the reference curve and then adding OAS

produces the market price. See “Computing Option-Adjusted Spread” on page

2-10 fo r a discussion on the computation of option-adjusted spread.

Effective duration is a more difficult issue. W hile modified duration changes

the discounting process (by changing the yield used to discount cash flows),

effective duration must account for the change in cash flow because of the

change in yield. A possible solution is to recompute prices using

a small change in yield, in both the upwards and downwards directions. In

this case, you must recompute the prepayment input. Internally, this alters

the cash flows of the mortgage pool. Assuming that the OAS stays constant in

all yield environments, you can apply a set of discounting factors to the cash

flows in up and down yield environments to find the effective duration.

mbscfamounts.

mbsprice for

2-10

Computing Option-Adjusted Spread

The option-adjuste d spread (OAS) is an amount of extra interest added above

(orbelowifnegative)thereferencezerocurve. TocomputetheOAS,youmust

Page 27

Using Fixed-Rate Mortgage Pool Functions

provide the zero curve as an extra input. You can specify the zero curve in

any intervals and with any compounding method. (To minimize any error

due to interpolation, keep the intervals as regular and frequent as possible.)

You must supply a prepayment vector or specify a speed corresponding to

a standard PSA prepayment vector.

Onewaytocomputetheappropriatezerocurveforanagencyistolookatits

bond yields and bootstrap them from the shortest m aturity onwards. You can

do this with Financial Toolb ox™ functions

zbtprice and zbtyield.

The following example shows how to calculate an appropriate zero curve

followed by computation of the pool’s OAS. This example calculates the OAS

of a 30-year fixed rate mortgage with about a 28-year w eigh t ed average

maturity left, given an assumption of 0, 50, and 100 PSA prepayment speeds.

Create curve for

Bonds = [datenum('11/21/2002') 0 100 0 2 1;

Yields = [0.0162;

zerorates.

datenum('02/20/2003') 0 100 0 2 1;

datenum('07/31/2004') 0.03 100 2 3 1;

datenum('08/15/2007') 0.035 100 2 3 1;

datenum('08/15/2012') 0.04875 100 2 3 1;

datenum('02/15/2031') 0.05375 100 2 3 1];

0.0163;

0.0211;

0.0328;

0.0420;

0.0501];

Since the above is Treasury data and not selected agency data, a term

structure of spread is assumed. In this example, the spread declines

proportionally from a maximum of 250 basis points at the shortest maturity.

Yields = Yields + 0.025 * (1./[1:6]');

Get parameters from Bonds matrix.

Settle = datenum('20-Aug-2002');

Maturity = Bonds(:,1);

2-11

Page 28

2 Mortgage-Backed Securities

Use zbtprice to solve for zero rates.

Use output from zbtprice to calculate the OAS.

CouponRate = Bonds(:,2);

Face = Bonds(:,3);

Period = Bonds(:,4);

Basis = Bonds(:,5);

EndMonthRule = Bonds(:,6);

[Prices, AccruedInterest] = bndprice(Yields, CouponRate, ...

Settle, Maturity, Period, Basis, EndMonthRule, [], [], [], [], ...

Face);

[ZeroRatesP, CurveDatesP] = zbtprice(Bonds, Prices, Settle);

ZeroCompounding = 2*ones(size(ZeroRatesP));

ZeroMatrix = [CurveDatesP, ZeroRatesP, ZeroCompounding];

Price = 95;

Settle = datenum('20-Aug-2002');

Maturity = datenum('2-Jan-2030');

IssueDate = datenum('2-Jan-2000');

GrossRate = 0.08125;

CouponRate = 0.075;

Delay = 14;

Interpolation = 1;

PrepaySpeed = [0; 50; 100];

2-12

OAS = mbsprice2oas(ZeroMatrix, Price, Settle, Maturity, ...

IssueDate, GrossRate, CouponRate, Delay, Interpolation, ...

PrepaySpeed)

OAS =

26.0502

28.6348

31.2222

This example shows that one cash flow set is being discounted and solved for

its OAS, as contrasted with the

NumberOfPaths set of cash flows as shown

Page 29

Using Fixed-Rate Mortgage Pool Functions

in “Mortgage Pool Valuation” on page 2-9. Averaging the sets of cash flows

resulting from all simulations into one average cash flow vector and solving

for the OAS, discounts the averaged cash flows to have a present value of

today’s (average) price.

While this example uses the mortgage pool price (

theOAS,youcanalsouseyieldtoresolveit(

reverse OAS functions that return prices and yields given OAS (

and mbsoas2yield).

The example also restates earlier examples that show discount securities

benefit from higher l evel of prepayme nt, keeping everything else unchanged.

The relation is reversed for premium securities.

mbsprice2oas) to determine

mbsyield2oas). Also, there are

mbsoas2price

Prepayments with Fewer Than 360 Months Remaining

When fewer than 360 months remain in the pool, the applicable PSA

prepayment vector is "seasoned" by the pool’s age. (Elements in the

360-element prepayment vector that repres ent past payments are skipped.

For example, on a 30-year mortgage that is 10 months old, only the final

350 prepayments are applied.)

Assume, for example, that you h ave two 30-year loans, one new and another

10 months old. Both have the same PSA speed of 100 and prepay using the

vectors plotted below.

2-13

Page 30

2 M ortgage-Backed Securities

2-14

Still within the scope of relative valuation, you could also solve for the

percentage of the standard PSA prepayment vector given the pool’s arbitrary,

user-supplied prepayment vector, such that the PSA speed gives the same

Macaulay duration as the user-supplied prepayment vector.

If yo u supply a custom prepayment vector, you must account for the number

of months remaining.

Price = 101;

Settle = datenum('1-Jan-2001');

Maturity = datenum('1-Jan-2030');

IssueDate = datenum('1-Jan-2000');

GrossRate = 0.08125;

PrepayMatrix = 0.005*ones(348,1);

CouponRate = 0.075;

Delay = 14;

ImpliedSpeed = mbsprice2speed(Price, Settle, Maturity, ...

IssueDate, GrossRate, PrepayMatrix, CouponRate, Delay)

Page 31

Using Fixed-Rate Mortgage Pool Functions

ImpliedSpeed =

104.2526

Examine the prepayment input. The remaining 29 years require 348 monthly

elements in the prepayment vector. Supposethen,keepingeverythingthe

same, you change

Settle = datenum('14-Feb-2003');

Settle to February 14, 2003.

You can use cpncount to count all incoming coupons received after Settle

by invoking

NumCouponsRemaining = cpncount(Settle, Maturity, 12, 1, [], ...

IssueDate)

NumCouponsRemaining =

323

The input 12 defines the monthly payment frequency, 1 defines the 30/360

basis, and

IssueDate defines aging and determination-of-holder date.

Thus, you must supply a 323-element vector to account for a prepayment

corresponding to each monthly payment.

Pools with Different Numbers of Coupons Remaining

Suppose one pool has two remaining coupons, and the other has three.

MATLAB software expects the prepaymentmatrixtobeinthefollowing

format:

V11 V21

V12 V22

NaN V23

denotes the single monthly mortality (SMM) rate for pool i during the jth

V

ij

coupon period since

The use of

NaN to pad the prepayment matrix is necessary because MATLAB

cannot concatenate vectors of different lengths into a matrix. Also, it can

Settle.

2-15

Page 32

2 M ortgage-Backed Securities

serve as an error check against any unintended operation (any MATLAB

operation that would return

For example, assume that the 2 month pool has a constant SMM of 0.5% and

the 3 month has a constant SMM of 1% in every period. The prepayment

matrix you would create is depicted below.

NaN).

2-16

Create this input in whatever manner is best for you.

Summary of Prepayment Data Vector Representation

• When you specify a PSA prepayment speed, MATLAB "seasons" the pool

according to its age.

• Whenyouspecifyyourownprepayment matrix, identify the maximum

number of coupons remaining using

elements up to the point when cash flow ceases to exist.

• When different length pools must exist inthesamematrix,padtheshorter

one(s) with

specific pool.

NaN. Each column of the prepayment matrix corresponds to a

cpncount. Then supply the matrix

Page 33

Debt Instruments

• “Treasury Bills Defined” on page 3-2

• “Computing Treasury Bill Price and Yield” on page 3-3

• “Using Zero-Coupon Bonds” on page 3-7

• “Stepped-Coupon Bonds” on page 3-12

• “Term Structure Calculations” on page 3-15

3

Page 34

3 Debt Instruments

Treasury Bills Defined

Treasury bills are short-term securities (issued with maturities of 1 year

or less) sold by the United States Treasury. Sales of these securities are

frequent, usually week ly. F rom time to time, the Treasury also offers longer

duration securities called Treasury notes and Treasury bonds.

A Treasury bill is a discount security. The holder of the Treasury bill does not

receive periodic interest paym ents. Instead,atthetimeofsale,apercentage

discount is applied to the face value. At maturity, the holder redeems the

bill for full face value.

The basis for Treasury bill interest calculation is actual/360. Under this

system, interest accrues on the actual number of e lapsed days between

purchase and maturity, and each year contains 360 days.

3-2

Page 35

Computing Treasury Bill Price and Yield

In this section...

“Introduction” on page 3-3

“Treasury Bill Repurchase Agreements” on page 3-3

“Treasury Bill Yields” on page 3-5

Introduction

Fixed-Income Toolbox software provides the following suite of functions for

computing price and yield on Treasury bills.

Treasury Bill Function s

Function Purpose

tbilldi

tbillpr

tbillrepo

tbillyield

tbillyield2disc

tbillval01

sc2yield

ice

Convert d

Price Treasury bill given its yield or discount rate.

Break-even discount of repurchase agreement.

Yield and discount of Treasury bill given its price.

Convert yield to discount rate.

The value of 1 basis point given the characteristics

of the Treasury bill, as represented by its

settlement and maturity dates. You can relate

the basis point to d iscount, money-market, or

bond-equivalent yield.

iscount rate to yield.

Computing Treasury Bill Price a n d Yield

For all functions with yield in the computation, you can specify yield as

money-market or bond-equivalent yield. The functions all assume a face value

of $100 for each Treasury bill.

Treasury Bill Repurchase Agreements

The following example shows how to compute the break-even discount rate.

This is the rate that correctly prices the Treasury bill such that the profit

from selling the tail equ als 0.

3-3

Page 36

3 Debt Instruments

Maturity = '26-Dec-2002';

InitialDiscount = 0.0161;

PurchaseDate = '26-Sep-2002';

SaleDate = '26-Oct-2002';

RepoRate = 0.0149;

BreakevenDiscount = tbillrepo(RepoRate, InitialDiscount, ...

PurchaseDate, SaleDate, Maturity)

BreakevenDiscount =

0.0167

You can check the result of this computation by examining the cash flows

in and out from the repurchase transaction. First compute the price of the

Treasury bill on the purchase date (September 26).

PriceOnPurchaseDate = tbillprice(InitialDiscount, ...

PurchaseDate, Maturity, 3)

3-4

PriceOnPurchaseDate =

99.5930

Next compute the interest due on the repurchase agreement.

RepoInterest = ...

RepoRate*PriceOnPurchaseDate*days360(PurchaseDate,SaleDate)/360

RepoInterest =

0.1237

RepoInterest

for a 1.49% 30-day term repurchase agreement (30/360 basis)

is 0.1237.

Finally,computethepriceoftheTreasurybillonthesaledate(October26).

PriceOnSaleDate = tbillprice(BreakevenDiscount, SaleDate, ...

Maturity, 3)

Page 37

Computing Treasury Bill Price a n d Yield

PriceOnSaleDate =

99.7167

Examining the cash flows, observe that the break-even discount causes the

sum of the price on the purchase date plus the accrued 30-day interest to be

equaltothepriceonsaledate. Thenexttableshowsthecashflows.

Cash Flows from Repurchase Agreement

Date CashOutFlow CashInFlow

9/26/2002

10/26/2002

Purchase T-bill

Payment of repo

Repo interest

99.593

99.593

0.1238

Repo m oney

Sell T-bill

99.593

99.7168

Total

199.3098 199.3098

Treasury Bill Yields

Using the same data as before, you can examine the money-market and

bond-equivalent yields of the Treasury bill at the time of purchase and sale.

The function

Maturity = '26-Dec-2002';

InitialDiscount = 0.0161;

PurchaseDate = '26-Sep-2002';

SaleDate = '26-Oct-2002';

RepoRate = 0.0149;

BreakevenDiscount = tbillrepo(RepoRate, InitialDiscount, ...

PurchaseDate, SaleDate, Maturity)

[BEYield, MMYield] = ...

tbilldisc2yield([InitialDiscount; BreakevenDiscount], ...

[PurchaseDate; SaleDate], Maturity)

BreakevenDiscount =

tbilldisc2yield can perform both computations at one time.

3-5

Page 38

3 Debt Instruments

0.0167

BEYield =

0.0164

0.0170

MMYield =

0.0162

0.0168

For the short Treasury bill (fewer than 182 days to m aturity), the

money-market yield is 360/365 of the bond-equivalent yield, as this example

shows.

3-6

Page 39

Using Zero-Coupon Bonds

In this section...

“Introduction” on page 3-7

“Measuring Zero-Coupon Bond Function Quality” on page 3-7

“Pricing Treasury Notes” on page 3-8

“Pricing Corporate Bonds” on page 3-10

Introduction

A zero-coupon bond is a corporate, Treasury, or municipal debt instrument

that pays no periodic interest. T ypically, the bond is redeemed at maturity

for its full face value. It will be a security issued at a discount from its face

value, or it may be a coupon bond stripped o f its coupons and repackaged

as a zero-coupon bond.

Fixed-Income Toolbox software provides functions for valuing zero-coupon

debt instruments. These functions supplement existing coupon bond functions

such as

software.

bndprice and bndyield that are available in Financial Toolbox

Using Zero-Coupon Bonds

Measuring Zero-Coupon Bond Function Quality

Zero-coupon function quality is measured by h ow consistent the results

are with coupon-bearing bonds. Because the zero coupon’s yield is

bond-equivalent, comparisons with coupon-bearing bonds are possible.

In the textbook case, where time (t) is measured continuously and the rate

(r) is continuously compounded, the value of a zero bond is the principal

tiplied by

mul

be variable, requiring a more consistent approach to meet the stricter

can

ands of accurate pricing.

dem

e following two examples

Th

rt−

. In reality, the rate quoted is continuous and the basis

e

3-7

Page 40

3 Debt Instruments

• “Pricing Treasury Notes” on page 3-8

• “Pricing Corporate Bonds” on page 3-10

show how the zero functions are consistent with supported coupon bond

functions.

Pricing Treasury Notes

A Treasury note can be considered to be a package of zeros. The toolbox

functions that price zeros require a coupon bond equivalent yield. That

yield can originate from any type of coupon paying bond, with any periodic

payment, or any accrual basis. The next example shows the use of the toolbox

to price a Treasury note and compares the calculated price with the actual

price quotation for that day.

Settle = datenum('02-03-2003');

MaturityCpn = datenum('05-15-2009');

Period = 2;

Basis = 0;

3-8

% Quoted yield.

QYield = 0.03342;

% Quoted price.

QPriceACT = 112.127;

CouponRate = 0.055;

Extract the cash flow and compute price from the sum of zeros discounted.

[CFlows, CDates] = cfa mounts(CouponRate, Settle, MaturityCpn, ...

Period, Basis);

MaturityofZeros = CDates;

Compute the price of the coupon bond identically a s a collection of zeros by

multiplying the disco unt factors to the corresponding cash flows.

PriceofZeros = CFlows * zeroprice(QYi eld, Settle, .. .

MaturityofZeros, Period, Basis)/100;

Page 41

The following table shows the intermediate calculations.

Discounted Cash

Cash Flows Discount Factors

Flows

-1.2155 1.0000 -1.2155

2.7500 0.9908 2.7246

2.7500 0.9745 2.6799

2.7500 0.9585 2.6359

2.7500 0.9427 2.5925

2.7500 0.9272 2.5499

2.7500 0.9120 2.5080

2.7500 0.8970 2.4668

2.7500 0.8823 2.4263

2.7500 0.8678 2.3864

2.7500 0.8535 2.3472

2.7500 0.8395 2.3086

2.7500 0.8257 2.2706

102.7500 0.8121 83.4451

Total

112.1263

Using Zero-Coupon Bonds

Compare the quoted price and the calculated p rice based on zeros.

[QPriceACT PriceofZeros]

ans =

112.1270 112 .1263

This example shows that zeropr ice can satisfactorily price a Treasury note,

a semiannual actual/actual basis bond, as if it were a composed of a series

of zero-coupon bonds.

3-9

Page 42

3 Debt Instruments

Pricing Corpora

You can similarl

zero-coupon bon

zeros exist. Yo

quoted coupon-

Settle = datenum('02-05-2003');

MaturityCpn = datenum('01-14-2009');

Period = 2;

Basis = 1;

% Quoted yield.

QYield = 0.05974;

% Quoted price.

QPrice30 = 99.382;

CouponRate = 0.05850;

Extract ca

[CFlows, CDates] = cfa mounts(CouponRate, Settle, MaturityCpn, ...

Period, Basis);

Maturity = CDates;

Compute

multip

the price of the coupon bond identically as a collection of zeros by

lying the discount factors to the corresponding cash flows.

y price a corporate bond, for which there is no corresponding

d, as opposed to a Treasury note, for which corresponding

u can create a synthetic zero-coupon bond and arrive at the

bond price when you later sum the zeros.

sh flow and compute price from the sum of zeros.

te Bonds

3-10

Price30 = CFlows * zeroprice(QYield, Settle, Mat urity, Period, ...

Basis)/100;

Compa

As a

(

re quoted price and calculated price based on zeros.

[QPrice30 Price30]

ans =

99.3820 99.3 828

test of fidelity, intentionally giving the wrong basis, say actual/actual

sis = 0

Ba

) instead of 30/360, gives a price of 99.3972. Such a systematic

Page 43

Using Zero-Coupon Bonds

error, if recurring in a more complex pric in g routine, quickly adds up to large

inaccuracies.

In summ ary, the zero functions in MATLAB software facilitate extraction of

present value from virtually any fixed-coupon instrument, up to any period

in time.

3-11

Page 44

3 Debt Instruments

Stepped-Coupon Bonds

In this section...

“Introduction” on page 3-12

“Cash Flows from Stepped-Coupon Bonds” on page 3-12

“Price and Yield of Stepped-Coupon Bonds” on page 3-14

Introduction

A stepped-coupon bond has a fixed schedule of changing coupon amounts.

Like fixed coupon bonds, stepped-couponbondscouldhavedifferent periodic

payments and accrual bases.

The functions

such bonds. An accompanying function

stepcpnprice and stepcpnyield compute prices and yields of

stepcpncfamounts produces the cash

flow schedules pertaining to these bonds.

Cash Flows from Stepped-Coupon Bonds

Consider a bond that has a schedule of two coupons. Suppose the bond starts

out with a 2% coupon that steps up to 4% in 2 years and onward to maturity.

Assume that the issue and settlement dates are both March 15, 2003. The

bond has a 5 year maturity. Use

flow schedule and times.

Settle = datenum('15-Mar-2003');

Maturity = datenum('15-Mar-2008');

ConvDates = [datenum('15-Mar-2005')];

CouponRates = [0.02, 0. 04];

[CFlows, CDates, CTimes] = stepcpncfamounts(Settle, Maturity, ...

ConvDates, CouponRates)

Notably, ConvDates has 1 less element than CouponRates because MATLAB

software assumes that the first element of

schedule between

Settle (March 15, 2003) and the first element of ConvDates

(March 15, 2005), shown diagrammatically below.

stepcpncfamounts to generate the cash

CouponRates indicates the coupon

3-12

Page 45

Stepped-Coupon Bonds

Effective 2% on March

15, 2003

Coupon Dates Semiannual Coupon Payment

15-Mar-03

15-Sep-03

15-Mar-04

15-Sep-04

15-Mar-05

15-Sep-05

15-Mar-06

15-Sep-06

15-Mar-07

15-Sep-07

15-Mar-08

Pay 2% from March

15, 2003

Pay 4% from March

15, 2003

Effective 4% on March

15, 2005

0

1

1

1

1

2

2

2

2

2

102

The payment on March 15, 2005 is still a 2% coupon. Payment of the 4%

coupon starts with the next payment, September 15, 2005. March 15, 2005

is the end of first coupon schedule, not to be confused with the beginning of

the second.

In summary, MATLAB takes user input as the end dates of coupon schedules

and computes the next coupon dates automatically.

The payment due on settlement (zero in this case) represents the accrued

interestdueonthatday. Itisnegative if such amount is nonzero. Comparison

with

cfamounts in Financial Toolbox software shows that the two functions

operate identically.

3-13

Page 46

3 Debt Instruments

Price and Yield of Stepped-Coupon Bonds

The toolbox provides two basic analytical functions to compute price and

yield for stepped-coupon bonds. Using the above bond as an example, you can

compute the price when the yield is known.

You can estimate the y ield to maturity as a number-of-year weighted average

of coupon rates. For this b ond, the estimated yield is:

()()22 43

×+×

5

.

or 3.33%. While definitely not exact (due to nonlinear relation of price and

yield), this estimate suggests close to par valuation and serves as a quick

first check on the function.

Yield = 0.0333;

[Price, AccruedInterest] = stepcpnprice(Yield, Settle, ...

Maturity, ConvDates, CouponRates)

3-14

The price returned is 99.2237 (per $100 notional), and the accrued interest is

zero, consistent with our earlier assertions.

To validate that there is consistency among the stepped-coupon functions,

you can use the above price and see if indeed it implies a 3.33% yield by

using

stepcpnyield.

YTM = stepcpnyield(Price, Settle, Maturity, ConvDates, ...

CouponRates)

YTM =

0.0333

Page 47

Term Structure Calculations

In this section...

“Introduction” on page 3-15

“Computing Spot and Forward Curves” on page 3-15

“Computing Spreads” on page 3-17

Introduction

So far, a more formal definition of "yield" and its application has not been

developed. In many situations when cash flow is available, discounting factors

to the cash flows may not be immediately apparent. In other cases, what

is relevant is often a spread, the difference between curves (also known as

the term structure of spread).

All these calculations require one main ingredient, the Treasury spot,

par-yield, or forward curve. Typically, the generation of these curves starts

with a series of on-the-run and selected off-the-run issues as inputs.

Term S t ruct u re Ca l cula tion s

MATLAB software uses these bonds to find spot rates one at a time, from the

shortest maturity onwards, using bootstrap techniques. All cash flows are

used to construct the spot curve, and rates between maturities (for these

coupons) are interpolated linearly.

Computing Spot and Forward Curves

For an illustration of how this works, observe the use of zbtyield (or

equivalently

Bills Maturity Date Current Yield

3month

onth

6m

zbtprice) on a portfolio of six Treasury bills and bonds.

5

7/03

4/1

7/17/03

1.1

1.18

3-15

Page 48

3 Debt Instruments

Notes/Bonds

Coupon

2year 1.750

5year 3.000

10 year 4.000

30 year 5.375

Maturity Date

12/31/04

11/15/07

11/15/12

2/15/31

Current Yield

1.68

2.97

4.01

4.92

You can specify prices or yields to the bonds above to infer the spot curve. The

function

To proceed, first assemble the above table into a variable called

zbtyield accepts yields (bond-equivalent yield, to be exact).

Bonds.The

first column contains maturities, the second contains coupons, and the third

contains notionals or face values of the bonds. (Note that bills have zero

coupons.)

Bonds = [datenum('04/17/2003') 0 100;

datenum('07/17/2003') 0 100;

datenum('12/31/2004') 0.0175 100;

datenum('11/15/2007') 0.03 100;

datenum('11/15/2012') 0.04 100;

datenum('02/15/2031') 0.05375 100];

Then specify the corresponding yields.

3-16

Yields = [0.0115;

0.0118;

0.0168;

0.0297;

0.0401;

0.0492];

You are now ready to compute the spot curve for each of these six maturities.

The spot curve is based upon a settlement date of January 17, 2003.

Settle = datenum('17-Jan-2003');

[ZeroRates, CurveDates] = zbtyield(Bonds, Yields, Settle)

This gets you the Treasury spot curve for the day.

Page 49

Term S t ruct u re Ca l cula tion s

You can compute the forward curve from this spot curve with zero2fwd.

[ForwardRates, CurveDates] = zero2fwd(ZeroRates, CurveDates, ...

Settle)

Here the notion of forward rates refers to rates between the maturity dates

shown above, not to a certain period (forward 3 month rates, for example).

Computing Spreads

Calculating the spread between specific, fixed forward periods (such as the

Treasury-Eurodollar spread) requires an extra step. Interpolate the zero

rates (or zero prices, instead) for the corresponding maturities on the interval

dates. Then use the interpolated zero rates to deduce the forward rates, and

thus the spread of Eurodollar forward curve segments versus the relevant

forward segments from Treasury bills.

3-17

Page 50

3 Debt Instruments

Additionally, the variety of curve functions (including zero2fwd)helpsto

standardize such calculations. For instance, by making both rates quoted

with quarterly compounding and on an actual/360 basis, the resulting spread

structure is fully comparable. This avoi ds the small inconsistency that occurs

when directly comparing the bond-equ ivalent yield of a Treasury bill to the

quarterly forward rates implied by Eurodollar futures.

Noise in Curve Computations

When introducing more bonds in constructing curves, noise may become a

factor and may need some “smoothing” (with splines, for example); this helps

obtain a s moother forward curve.

The following spot and forward curves are constructed from 67 Treasury

bonds. The fitted and bootstrapped spot curve (bottom right figure) displays

comparable stability. The forward curve (upper-left figure) contains

significant noise and shows an improbable forward rate structure. The

noise is not necessarily bad; it could uncover trading opportunities for a

relative-value approach. Yet, a more balanced approach is desired when the

bootstrapped forward curve oscillates this much and contains a negative rate

as large as -10% (not shown in the plot because it is outside the limits).

3-18

Page 51

Term S t ruct u re Ca l cula tion s

This example uses termfit,ademonstrationfunction from Financial Toolbox

software that also requires the use of Spline Toolbox™ software.

3-19

Page 52

3 Debt Instruments

3-20

Page 53

Derivative Securities

• “Pricing and Hedging” on page 4-2

• “Convertible Bond Valuation” on page 4-10

• “Bond Futures” on page 4-12

4

Page 54

4 Derivative Securities

Pricing and Hedging

In this section...

“Swap Pricing Assumptions” on page 4-2

“Swap Pricing Example” on page 4-3

“Portfolio Hedging” on page 4-8

Swap Pricing Assumptions

Fixed-Income Toolbox softw are contains the function liborfloat2fixed,

which computes a fixed-rate par yield that equates the floating-rate side of

a swap to the fixed-rate side. The solver sets the present value of the fixed

side to the present value of the floating side without having to line up and

compare fixed and f loating periods.

Assumptions on Floating-Rate Input

4-2

• Rates are quarterly, for example, that of Eurodollar futures.

• Effective date is the first third Wednesday after the settlement date.

• All delivery dates are spaced 3 months apart.

• All periods start on the third Wednesday of delivery months.

• All periods end on the same dates of delivery months, 3 months after the

start dates.

• Accrual basis of floating rates is actual/360.

• Applicable forward rates are estimated by interpolation in months when

forward-rate data is not available.

umptions on Fixed-Rate Output

Ass

• Des

• Th

ign allows you to create a bond of any coupon, basis, or frequency, based

n the floating-rate input.

upo

e start date is a valuation date, that is, a date when an agreement to

ter into a contract by the settlement date is made.

en

Page 55

Pricing and Hedging

• Settlement can be on or after the start date. If it is after, a forward

fixed-rate contract results.

• EffectivedateisassumedtobethefirstthirdWednesdayaftersettlement,

thesamedateasthatofthefloatingrate.

• The end date of the bond is a designated number of years away, on the

same day and month as the effective date.

• Coupon payments occur on anniversary dates. The frequency is determined

by the period of the bond.

• Fixed rates are not interpolated. A fixed-rate bond of thesamepresent

value as that of the floating-rate payments is created.

Swap Pricing Example

This example shows the use of the functions in computing the fixed rate

applicable to a series of 2-, 5-, and 10-year swaps based on Eurodollar market

data. According to the Chicago Mercantile Exchange (

Eurodollar data on Friday, October 11, 2002, was as shown in the following

table.

http://www.cme.com),

Note This example illustrates swap calculations in MATLAB software.

Timing of the data set used was not rigorously examined and was assumed to

be the proxy for the swap rate reported on October 11, 2002.

Eurodollar Data on Friday, October 11, 2002

Month Year Settle

10 2002 98.21

11

12 2002 98.3

1

2 2003 98.31

3 2003 98.275

6 2003 98.12

2002 98.26

2003 98.3

4-3

Page 56

4 Derivative Securities

Eurodollar Data on Friday, October 11, 2002 (Continued)

Month Year Settle

9 2003 97.87

12 2003 97.575

3 2004 97.26

6 2004 96.98

9 2004 96.745

12 2004 96.515

3 2005 96.33

6 2005 96.135

9 2005 95.955

12 2005 95.78

3 2006 95.63

6 2006 95.465

9 2006 95.315

12 2006 95.16

3 2007 95.025

6 2007 94.88

9 2007 94.74

4.005

9

5

28

12 2007 94.59

3 2008 94.48

6 2008 94.375

9200894.

12 2008 94.185

3 2009 94.1

62

9 2009 93.925

12 2009 93.865

009

4-4

Page 57

Eurodollar Data on Friday, October 11, 2002 (Continued)

Month Year Settle

3 2010 93.82

6 2010 93.755

9 2010 93.7

12 2010 93.645

3 2011 93.61

6 2011 93.56

9 2011 93.515

12 2011 93.47

3 2012 93.445

6 2012 93.41

9 2012 93.39

Pricing and Hedging

Using this data, you can compute 1-, 2-, 3-, 4-, 5-, 7-, and 10-year swap rates

with the toolbox function

liborfloat2fixed. The function requires you

to input only Eurodollar data, the settlement date, and tenor of the swap.

MATLAB software then performs the required computations.

To illustrate how this function works, first load the data contained in the

supplied Excel

[EDRawData, textdata] = x lsread('EDdata.xls');

®

worksheet EDdata.xls.

Extract the month from the first column and the year from the second column.

The rate used as proxy is the arithmetic average of rates on opening and

closing.

Month = EDRawData(:,1);

Year = ED RawD ata(:,2);

IMMData = (EDRawData(:,4)+EDRawData(:,6))/2;

EDFutData = [Month, Year, IMMData];

Next, input the current date.

4-5

Page 58

4 Derivative Securities

Settle = datenum('11-Oct-2002');

To compute for the 2 year swap rate, set the tenor to 2.

Tenor = 2;

Finally, compute the swap rate with liborfloat2fixed.

[FixedSpec, ForwardDates, ForwardRates] = ...

liborfloat2fixed(EDFutData, Settle, Tenor)

MATLAB returns a par-swap rate of 2.23% using the default setting

(quarterly compounding and 30/360 accrual), and forward dates and

rates data (quarterly compounded), comparable to 2.17% of Friday’s

average broker data in Table H15 of Federal Reserve Statistical Release

(

http://www.federalreserve.gov/releases/h15/update/).

FixedSpec =

Coupon: 0.0223

Settle: '16-Oct-2002'

Maturity: '16-Oct-2004'

Period: 4

Basis: 1

4-6

ForwardDates =

731505

731596

731687

731778

731869

731967

732058

732149

ForwardRates =

0.0178

0.0168

Page 59

Pricing and Hedging

0.0171

0.0189

0.0216

0.0250

0.0280

0.0306

In the FixedSpec output, note that the swap rate actually goes forward from

the third Wednesday of October 2002 (October 16, 2002), 5 days after the

original

for the swap rate on

Settle input (October 11, 2002). This, however, is still the best proxy

Settle, as the assumption merely starts the swap’s

effective period and does not affect its valuation method or its length.

The correction suggested by Hull and White improves the result by turning

on convexity adjustment as part of the input to

liborfloat2fixed.(See

Hull, J., Options, Futures, and Other Derivatives, 4th Edition, Prentice-Hall,

2000.) For a long swap, for example, 5 years or more, this correction could

provetobelarge.

The adjustment requires additional parameters:

•

StartDate, which you make the same as Settle (the default) by providing

an empty matrix

ConvexAdj to tell liborfloat2fixed to perform the adjustment.

•

RateParam, which provides the parameters a and S as input to the

•

[] as input.

Hull-White short rate process.

• Optional parameters

matrices

FixedCompound,withwhichyoucanfacilitatecomparison with values cited

•

[] to accept the M ATLAB defaults.

InArrears and Sigma, for which you can use empty

in Table H15 of Federal Reserve Statistical Release by turning the default

quarterly compounding into sem iannual compounding, with the (default)

basis of 30/360.

StartDate = [];

Interpolation = [];

ConvexAdj = 1;

RateParam = [0.03; 0.017];

FixedCompound = 2;

4-7

Page 60

4 Derivative Securities

[FixedSpec, ForwardDaates, ForwardRates] = ...

liborfloat2fixed(EDFutData, Settle, Tenor, StartDate, ...

Interpolation, ConvexAdj, RateParam, [], [], Fixe dCom pound)

This returns 2.21% as the 2-year swap rate, quite close to the reported swap

rate for that date.

Analogously, the following table summarizesthesolutionsfor1-,3-,5-,7-,

and 10-year swap rates (convexity-adjusted and unadjusted).

Calculated and Market Average Data of Swap Rates on Friday,

October 11, 2 002

Swap

Length

(Years) Unadjusted Adjusted Table H15

1

2 2.24% 2.21% 2.22%

3 2.70% 2.66% 2.66% 0

4

5 3.50% 3.37% 3.36%

7 4.16% 3.92% 3.89% +3

10 4.87% 4.42% 4.39% +3

1.80% 1.79% 1.80%

3.12% 3.03% 3.04%

Adjusted

Error

(Basis Points)

-1

-1

-1

+1

Portfolio Hedging

You can use these results further, such as for hedging a portfolio. The

liborduration function provides a duration-hedging capability. You can

isolate assets (or liabilities) from interest-rate risk exposure with a swap

arrangement.

Suppose you own a b ond with these characteristics:

• $100 million face value

4-8

• 7% coupon paid semiannually

Page 61

• 5% yield to maturity

• Settlement on October 11, 2002

• Maturity on January 15, 2010

• Interest accruing on an actual/365 basis

Pricing and Hedging

Use of the

bnddury function from Financial Toolbox software shows a modified

duration of 5.6806 years.

To immunize this asset, you can enter into a pay-fixed swap,

specifically a swap in the amount of notional principal (Ns) such that

Ns*SwapDuration + $100M*5.6806 = 0 (or Ns = -100*5.6806/SwapDuration).

Suppose again, you choose to use a 5-, 7-, or 10-year swap (3.37%, 3.92%, and

4.42% from the previous table) as your hedging tool.

SwapFixRate = [0.0337; 0. 0392; 0.0442];

Tenor = [5; 7; 10];

Settle = '11-Oct-2002';

PayFixDuration = liborduration(SwapFixRate, Tenor, Settle)

This gives a duration of -3.6835, -4.7307, and -6.0661 years for 5-, 7-, and

10-year swaps. The corresponding notional amount is computed by

Ns = -100*5.6806./PayFixDuration

Ns =

154.2163

120.0786

93.6443

The n otional amount entered in pay-fixed side of the swap instantaneously

immunizes the portfolio.

4-9

Page 62

4 Derivative Securities

Convertible Bond Valuation

A convertible bond (CB) is a debt instrument that can be converted into a

predetermined amount of a company’s equity at certain times before the

bond’s maturity.

Fixed-Income Toolbox software uses a binomial and trinomial tree a pproa ch

(

cbprice)tovalueconvertiblebonds. Thevalueofaconvertiblebondis

determined by the uncertainty of the related stock. Once the stock evolution

is modeled, backward discounting is computed.

The last column of such trees provides the data to decide which is more

profitable: the debt notional (plus interest, if any) or the equivalent number of

shares per the notional.

Where debt prevails, the too lbox discounts backward with the risk-free

rate plus the spread reflecting the credit risk of the issuer. Where stock

prevails, the toolbox discounts with the risk-free rate. The intrinsic value of

a convertible bond is the sum of the (probability-adjusted) debt and stock

portions from the last node. This is compared to current stock price, to see

if voluntary or forced conversion may take place. Otherwise, its value is

the intrinsic value. From here, the same discounting process is repeated

after adjusting debt portion to be equal to 0 if any conversion takes place.

Dividends and coupons are handled discretely, at the date they occur.

4-10

The approach is equivalent to solving a one-dimensional partial differential

equation such as one described by Tsiveriotis and Fernandes. (See Tsiveriotis,

K. and C. Fernandes (1998), “Valuing Convertible Bonds with Credit Risk,”

The Journal of Fixed Income, 8 (3), 95-102.) Using the same example of

bond specifications that they use (4% annual coupon, payable twice a year,

callable after 2 years at 110, and redeemable at par in 5 years), the toolbox

gives results like theirs.

Page 63

Convertible Bond Valuation

The figure on the left shows the bond "floor" of the convertible (a 5% yield,

given a 4% coupon at about 97% par) when share prices are low.

The change of curvature located at the end of the second year is due to the

activation of the embedded (soft) call feature (visible on the surface plot in

the right figure).

Finally, there is the flat section when time is nearing expiration and share

prices are high, indicating a delta of unity, a characteristic of in-the-money

equity options embedded in a bond.

4-11

Page 64

4 Derivative Securities

Bond Futures

In this section...

“Supported Bond Futures” on page 4-12

“Example Analysis of Bond Futures” on page 4-14

“Managing Interest-Rate Risk with Bond Futures” on page 4-16

Supported Bond Futures

Bond futures are futures contracts where the commodity for delivery is a

government bond. There are established global markets for government bond

futures. Bond futures provide a liquid alternative for managing interest-rate

risk.

In the U.S. market, the Chicago Mercantile Exchange (CME) offers futures on

Treasury bonds and notes with maturities of 2, 5, 10, and 30 years. Typically,

the following bond future contracts from the CME have maturities of 3, 6, 9,

and 12 months:

4-12

• 30-year U.S. Treasury bond

• 10-year U.S. Treasury bond

• 5-year U.S. Treasury bond

• 2-year U.S. Treasury bond

The short position in a Treasury bond or note future contract must deliver

to the long position in one of many possible existing Treasury bonds. For

example, in a 30-year Treasury bond future, the short position must deliver a

Treasury bond with at least 15 years to maturity. Because these bonds have

different values, the bond future contract is standardized by computing a

conversion factor. The conversion factor normalizes the price of a bond to a

theoretical bond with a coupon of 6%. The price of a bond future contract is

represented as:

InvoicePrice FutPrice CF AI=×+

ere:

wh

Page 65

Bond Futures

FutPrice is the price of the bond future.

CF is the conversion factor for a bond to deliver in a futures contract.

AI is the accrued interest.

You can reference these conversion factors at U.S. Treasury Bond Futures

Contract. The short position in a futures contract has the option of which

bond to deliver and, in the U.S. bond market, when in the delivery month to

deliver the bond. The short position typically chooses to deliver the bond

known as the Cheapest to Deliver (CTD). The CTD bond most often delivers

on the last delivery day of the month.

Fixed-Income Toolbox software supports the following bond futures:

• U.S. Treasury bonds and notes

• German Bobl, Bund, Buxl, and Schatz

• UK Gilts

• Japanese government bonds (JGBs)

The functions supporting all bond futures are:

Function Purpose

convfactor

Calculates bond conversion factors for U.S. Treasury

bonds, German Bobl, Bund, Buxl, and Schatz, U.K.

Gilts, and JGBs.

bndfutprice

bndfutimprepo

Prices bond future given repo rates.

Calculates implied repo rates for a bond future given

price.

The functions supporting U.S. Treasury bond futures are:

4-13

Page 66

4 Derivative Securities

Function Purpose

tfutbyprice

Calculates future prices of Treasury bonds given the

spot price.

tfutbyyield

Calculates future prices of Treasury bonds given

current yield.

tfutimprepo

Calculates implied repo rates for the Treasury bond

future given price.

tfutpricebyrepo

Calculates implied repo rates given the Treasury

bond future price.

tfutyieldb

yrepo

Calculates

bond future

implied repo rates given the Treasury

yield.

Example A nalysis of Bond Futures

The following example demonstrates analyzing German Euro-Bund futures

traded on Eurex. However,

apply to bond futures in the U.S., U.K., Germany, and Japan. The workflow

for this analysis is:

convfactor, bndfutprice,andbndfutimprepo

4-14

1 Calculate bond conversion factors.

2 Calcula

3 Price the bond future using the term implied repo rate .

te implied repo rates to find the CTD bond.

Calculating Bond Conversion Factors

Use conversion factors to normalize the price of a particular bond for delivery

in a futures contract. When using conversion factors, the assumption is that a

bond for delivery has a 6% coupon. Use

factors for all bond futures from the U.S., Germany, Japan, and U.K.

For example, conversion factors for Euro-Bund futures on Eurex are listed at

www.eurexchange.com. The delivery date for Euro-Bund futures is the 10th

day of the month, as opposed to bond futures in the U.S., where the short

position has the option of choosing when to deliver the bond.

For the 4% bond, compute the conversion factor with:

convfactor to calculate conversion

Page 67

Bond Futures

CF1 = convfactor('10-Sep-2009','04-Jul-2018', .0425,.06,3)

CF1 =

0.8827

This syntax for convfactor worksfineforbondswithstandardcoupon

periods. However, some deliverable bonds have long or short first coupon

periods. Compute the conversion factors for such bonds using the optional

input parameters

input arguments for

CF2 = convfactor('10-Sep-2009','04-Jan-2019', .0375,'Conve ntion',3,'startdate',...

datenum('14-Nov-2008'))

CF2 =

0.8426

StartDate and FirstCouponDate. Specify all optional