Page 1

Financial Toolbox

User’s Guide

™3

Page 2

How to Contact The MathWorks

www.mathworks.

comp.soft-sys.matlab Newsgroup

www.mathworks.com/contact_TS.html Technical Support

suggest@mathworks.com Product enhancement suggestions

bugs@mathwo

doc@mathworks.com Documentation error reports

service@mathworks.com Order status, license renewals, passcodes

info@mathwo

com

rks.com

rks.com

Web

Bug reports

Sales, prici

ng, and general information

508-647-7000 (Phone)

508-647-7001 (Fax)

The MathWorks, Inc.

3 Apple Hill Drive

Natick, MA 01760-2098

For contact information about worldwide offices, see the MathWorks Web site.

Financial Toolbox™ User’s Guide

© COPY R IGHT 1995–2010 The MathW orks, Inc.

The software described in this document is furnished under a license agreement. The software may be used

or copied only under the terms of the license agreement. No part of this manual may be photocopied or

reproduced in any form without prior written consent from The MathW orks, Inc.

FEDERAL ACQUISITION: This provision applies to all acquisitions of the Program and Documentation

by, for, or through the federal government of the United States. By accepting delivery of the Program

or Documentation, the government hereby agrees that this s oftware or docume n tation qualifies as

commercial computer software or commercial computer software documentation as such terms are used

or defined in FAR 12.212, DFARS Part 227.72, and DFARS 252.227-7014. Accordingly, the terms and

conditions of this Agreement and only those rights specified in this Agreement, shall pertain to and govern

theuse,modification,reproduction,release,performance,display,anddisclosureoftheProgramand

Documentation by the federal government (or other entity acquiring for or through the federal government)

and shall supersede any conflicting contractual terms or conditions. If this License fails to meet the

government’s needs or is inconsistent in any respect with federal procurement law, the government agrees

to return the Program and Docu mentation, unused, to The MathWorks, Inc.

Trademarks

MATLAB and Simulink are registered trademarks of The MathWorks, Inc. See

www.mathworks.com/trademarks for a list of additional trademarks. Other product or brand

names may be trademarks or registered trademarks of their respective holders.

Patents

The MathWorks products are protected by one or more U.S. patents. Please see

www.mathworks.com/patents for more information.

Page 3

Revision History

October 1995 First printing

January 1998 Second printing Revised for Version 1.1

January 1999 Third printing Revised for Version 2.0 (Release 11)

November 2000 Fourth printing Revised for Version 2.1.2 (Release 12)

May 2003 Online only Revised for Version 2.3 (Release 13)

June 2004 Online only Revised for Version 2.4 (Release 14)

August 2004 Online only Revised for Version 2.4.1 (Release 14+)

September 2005 Fifth printing Revised for Version 2.5 (Release 14SP3)

March 2006 Online only Revised for Version 3.0 (Release 2006a)

September 2006 Sixth printing Revised for Version 3.1 (Release 2006b)

March 2007 Online only Revised for Version 3.2 (Release 2007a)

September 2007 Online only Revised for Version 3.3 (Release 2007b)

March 2008 Online only Revised for Version 3.4 (Release 2008a)

October 2008 Online only Revised for Version 3.5 (Release 2008b)

March 2009 Online only Revised for Version 3.6 (Release 2009a)

September 2009 Online only Revised for Version 3.7 (Release 2009b)

March 2010 Online only Revised for Version 3.7.1 (Release 2010a)

Page 4

Page 5

Getting Started

1

Product Overview ................................. 1-2

Contents

Expected Background

Using Matrix Functions for Finance

Introduction

Key Definitions

Referencing M atrix Elements

Transposing Matrices

Matrix Algebra Refresher

Introduction

Adding and Subtracting Matrices

Multiplying Matrices

Dividing Matrices

Solving Simultaneous Linear Eq uations

Operating Element by Element

Function Input and Output Arguments

Input Arguments

Output Arguments

Interest Rate Arguments

...................................... 1-5

...................................... 1-8

.............................. 1-4

................. 1-5

................................... 1-5

........................ 1-6

.............................. 1-7

.......................... 1-8

.................... 1-8

.............................. 1-9

................................. 1-14

...................... 1-18

.................................. 1-19

................................ 1-21

........................... 1-22

............... 1-15

.............. 1-19

Performing Common Financial Tasks

2

Introduction ...................................... 2-2

Handling and Converting Dates

Date Formats

..................................... 2-4

..................... 2-4

v

Page 6

Date Conversions ................................. 2-5

Current Date and Time

Determining Dates

............................. 2-8

................................ 2-9

Formatting Currency

Charting Financial Data

Introduction

High-Low-Close Chart Example

Bollinger Chart Example

AnalyzingandComputingCashFlows

Introduction

Interest Rates/Rates of Return

Present or Future Values

Depreciation

Annuities

Pricing and Computing Yields for Fixed-Income

Securities

Introduction

Terminology

Framework

Default Parameter Values

Coupon Date Calculations

Yield Conventions

Pricing Functions

Yield Functions

Fixed-Income Sensitivities

...................................... 2-13

...................................... 2-17

..................................... 2-19

........................................ 2-19

....................................... 2-21

...................................... 2-21

...................................... 2-21

...................................... 2-26

.............................. 2-12

........................... 2-13

...................... 2-14

........................... 2-15

............... 2-17

....................... 2-17

........................... 2-18

.......................... 2-27

.......................... 2-30

................................. 2-31

................................. 2-31

................................... 2-32

.......................... 2-33

vi Contents

Term Structure of Interest Rates

Introduction

Deriving an Implied Zero Curve

Pricing and Analyzing Equity Derivatives

Introduction

Sensitivity Measures

Analysis Models

...................................... 2-36

...................................... 2-39

............................... 2-39

................................... 2-40

.................... 2-36

...................... 2-37

........... 2-39

Page 7

Portfolio Analysis

3

Analyzing Portfolios ............................... 3-2

Portfolio Optimization Functions

Portfolio Construction Exam ples

Introduction

Efficient Frontier Example

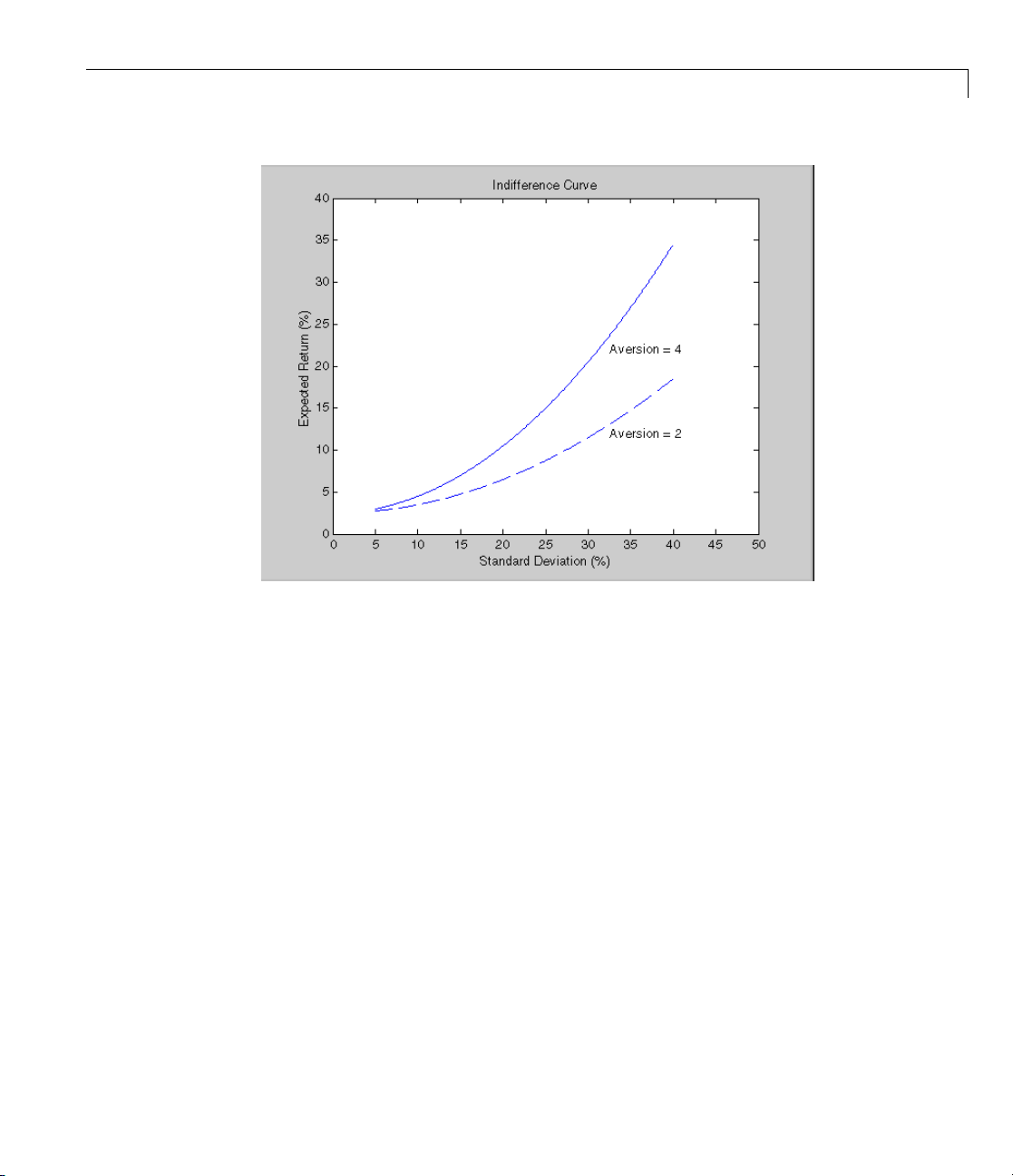

Portfolio Selection and Risk Aversion

Introduction

Optimal Risky Portfolio Example

Constraint Specification

Example

Linear Constraint Equations

Specifying Additional Constraints

Active Returns and Tracking Error Efficient

Frontier

...................................... 3-5

.......................... 3-5

...................................... 3-8

........................... 3-12

......................................... 3-12

........................................ 3-20

................... 3-3

................... 3-5

............... 3-8

..................... 3-9

........................ 3-14

.................... 3-17

Investment Performance Metrics

4

Overview of Performance Metrics ................... 4-2

Performance Metrics Classes

Performance Metrics Example

Using the Sharpe Ratio

Introduction

Sharpe Ratio Example

Using the Information Ratio

Introduction

...................................... 4-6

...................................... 4-8

........................ 4-2

....................... 4-3

............................. 4-6

............................. 4-6

........................ 4-8

vii

Page 8

Information Ratio Example ......................... 4-8

Tracking Error

Introduction

Tracking E rror Example

Risk-Adjusted Return

Introduction

Risk-Adjusted Return Example

Sample and Expected Lower Partial Moments

Introduction

Sample Lower Partial Moments Example

Expected Lower Partial Moments Example

Maximum and Expected Maximum Drawdown

Introduction

Maximum Drawdown Example

Expected Maxim um Drawdown Example

.................................... 4-10

...................................... 4-10

............................ 4-10

.............................. 4-11

...................................... 4-11

...................... 4-11

...................................... 4-14

.............. 4-14

............ 4-15

...................................... 4-17

...................... 4-17

.............. 4-19

Regression with Missing Data

........ 4-14

....... 4-17

viii Contents

5

Multivariate Normal Regression .................... 5-2

Introduction

Multivariate Normal Linear Regression

Maximum Likelihood Estimation

Special Case o f a Multip l e Linear Regression Model

Least-Squares Regression

Mean and Covariance Estimation

Convergence

Fisher Information

Statistical Tests

Maximum Likelihood Estimation with Missing Data

Introduction

ECM Algorithm

Standard Errors

...................................... 5-2

............... 5-3

..................... 5-4

........................... 5-5

.................... 5-5

..................................... 5-6

................................ 5-6

................................... 5-7

...................................... 5-9

................................... 5-10

.................................. 5-10

..... 5-5

.. 5-9

Page 9

Data Augmentation ................................ 5-11

Multivariate Normal Regression Functions

Multivariate Normal Regression Without M i ssi ng Data

Multivariate Normal Regression With Missi ng Data

Least-Squares Regressio n with Missing Data

Multivariate Normal Parameter Estimat ion with Missing

Data

.......................................... 5-15

Support Functions

................................. 5-16

............ 5-12

.. 5-14

..... 5-14

........... 5-15

Multivariate Normal Regression Types

Regressions

Multivariate Normal Regression

Least-Squares Regression

Covariance-Weighted Least Squares

Feasible Generalized Least Squares

Seemingly Unrelated Regression

Mean and Covariance Parameter Estimation

Troubleshooting M ultiva riate Normal Regression

Slow Convergence

Nonrandom Residuals

Nonconvergence

Example of Portfolios with Missing Data

Valuation with Missing Data

Introduction

Capital Asset Pricing Model

Estimation of the CAPM

Estimation with Missing Data

Estimation of Some Te chno lo gy Stock Betas

Grouped Estimatio n of Some Technology Stock Betas

References

...................................... 5-17

..................... 5-17

........................... 5-18

..................... 5-21

................................. 5-24

.............................. 5-24

................................... 5-25

........................ 5-34

...................................... 5-34

......................... 5-34

............................ 5-35

....................... 5-36

....................................... 5-42

.............. 5-17

.................. 5-19

.................. 5-20

.............. 5-26

............ 5-36

........... 5-23

....... 5-23

.... 5-39

Solving Sample Problems

6

Introduction ...................................... 6-2

Common Problems in Finance

Sensitivity of Bond Prices to Changes in Interest Rates

...................... 6-3

.. 6-3

ix

Page 10

Constructing a Bond Portfolio to Hedge Against Duration

and Convexity

Sensitivity of Bond Prices to Parallel Shifts in the Yield

Curve

Sensitivity of Bond Prices to Nonparallel Shifts in the Yield

Curve

Constructing Greek-Neutral Portfolios of European Stock

Options

Term Structure Analysis and Interest Rate Swap

Pricing

......................................... 6-9

......................................... 6-12

........................................ 6-18

.................................. 6-6

....................................... 6-14

Producing G raphics with the Toolbox

Introduction

Plotting an Efficient Frontier

Plotting Sensitivities of an Option

Plotting Sensitivities of a Portfolio of Options

...................................... 6-21

........................ 6-21

............... 6-21

.................... 6-24

.......... 6-26

Financial Time Series Analysis

7

Analyzing Financial Tim e Series .................... 7-2

Creating Financial Time Series Objects

Introduction

Using the Constructor

Transforming a Text File

Visualizing Financial Time Series Objec ts

Introduction

Using chartfts

Zoom Tool

Combine Axes Tool

...................................... 7-3

.............................. 7-3

........................... 7-14

...................................... 7-18

.................................... 7-18

........................................ 7-21

................................ 7-24

.............. 7-3

........... 7-18

x Contents

Page 11

Using Financial Time Series

8

Introduction ...................................... 8-2

Working with Financial Time Series Objects

Introduction

Financial Time Series Object Structure

Data Extraction

Object-to-Matrix Conversion

Indexing a Financial Time Series Object

Operations

Data Transformation and Frequency Conversion

Demonstration Program

Overview

Loading the Data

Create Financial Time Series Objects

Create Clos ing Prices A djus tment Series

Adjust Closing Prices and Make Them Spot Prices

Create Return Series

Regress R eturn Series Against Metric Data

Plot the Results

Calculate the Dividend Rate

...................................... 8-3

............... 8-3

................................... 8-4

........................ 8-6

............... 8-8

....................................... 8-15

........................... 8-25

........................................ 8-25

.................................. 8-26

................. 8-26

.............. 8-27

.............................. 8-28

............ 8-28

................................... 8-29

......................... 8-30

Financial Time Series Tool (FTSTool)

......... 8-3

........ 8-19

...... 8-28

9

What Is the Financial Time Series Tool? ............. 9-2

Getting Started with FTSTool

Loading Data with FTSTool

Overview

Obtaining External Data

Obtaining Internal Data

Viewing the MATLAB Workspace

........................................ 9-5

............................ 9-7

...................... 9-4

........................ 9-5

........................... 9-5

.................... 9-8

xi

Page 12

Using FTSTool for Supported Tasks ................. 9-10

Creating a Financial Time Series Object

Merging Financial Time Series Objects

Converting a Financial Time Series Object to a MATLAB

Double-Precision Matrix

Plotting the Output in Several Formats

Viewing Data for a Financial Time Series Object in the

Data Table

Modifying D ata for a Financial Time Series Object in the

Data Table

Viewing and Modifying the Properties for a FINTS

Object

..................................... 9-13

..................................... 9-15

......................................... 9-17

.......................... 9-12

............... 9-10

................ 9-11

............... 9-12

10

11

Using FTSTool with Other Time Series GUIs

......... 9-18

Financial Time Series Graphical User Interface

Introduction ...................................... 10-2

Main Window

Using the Financial Time Series GUI

Getting Started

Data Menu

Analysis Menu

Graphs Menu

Saving Time Series Data

.................................... 10-2

................ 10-7

................................... 10-7

....................................... 10-9

.................................... 10-13

..................................... 10-15

........................... 10-19

Trading Date Utilities

xii Contents

Trading Calendars Graphical User Interface ......... 11-2

UICalendar Graphical User Interface

Using UICalendar in Standalone Mode

............... 11-4

................ 11-4

Page 13

12

Using UICalendar with an Application ................ 11-5

Technical Analysis

Introduction ...................................... 12-2

13

Examples

Overview

Moving Average Convergence/Divergence (MACD)

Williams %R

Relative Strength Index (RSI)

On-Balance Volume (OBV)

......................................... 12-4

........................................ 12-4

...... 12-4

..................................... 12-6

....................... 12-7

.......................... 12-8

Function Reference

Dates ............................................. 13-2

Current Time and Date

Date and Time Components

Date Conversion

Financial Dates

Coupon Bond Dates

Currency and Price

Financial Data Charts

................................... 13-4

............................. 13-2

......................... 13-2

.................................. 13-3

................................ 13-5

................................ 13-6

.............................. 13-6

Cash Flows

Annuities

Amortization and Depreciation

Present Value

Future Value

Payment C alculations

Rates of Return

........................................ 13-7

........................................ 13-7

.................................... 13-8

..................................... 13-8

.............................. 13-8

................................... 13-8

...................... 13-7

xiii

Page 14

Cash Flow Sensitivities ............................ 13-9

Fixed-Income Securities

Accrued Interest

Prices

Term Structure of Interest Rates

Yields

Spreads

Interest Rate Sensitivities

Portfolios

Portfolio Analysis

Performance Metrics

Financial Statistics

Expectation Conditional Maximization

Multivariate Normal Regression

Expectation Conditional Maximization – Multivariate

Expectation Conditional Maximization – Least-Squares

Seemingly Unrelated Regression

Derivatives

Option Valuation and Sensitivity

........................................... 13-10

........................................... 13-11

......................................... 13-11

......................................... 13-11

Normal R egre ssion

Regression

.................................. 13-9

..................................... 13-16

....................................... 13-16

............................ 13-9

..................... 13-10

.......................... 13-11

................................. 13-12

............................... 13-13

................................ 13-14

................ 13-14

..................... 13-15

.............................. 13-15

..................... 13-16

..................... 13-16

xiv Contents

GARCH Processes

Univariate GARCH Processes

Financial Time Series Object and File Construction

Financial Time Series Arithmetic

Financial Time Series Math

Financial T im e Series Descriptive Statistics

Financial Time Series Utility

................................. 13-17

....................... 13-17

................... 13-18

........................ 13-19

......... 13-19

....................... 13-20

.. 13-18

Page 15

Financial Time Series Data Transformation .......... 13-21

14

A

Financial Time Series Indicator

Financial Time Series GUI

Financial Time Series Tool

..................... 13-22

.......................... 13-23

......................... 13-23

Functions — Alphabetical List

Bibliography

Bond Pricing and Yields ............................ A-2

Term Structure of Interest Rates

.................... A-3

Derivatives Pricing and Yields

Portfolio Analysis

Investment Performance Metrics

Financial Statistics

Other References

.................................. A-5

................................ A-8

.................................. A-9

...................... A-4

................... A-6

xv

Page 16

Examples

B

Bond Examples .................................... B-2

Portfolio Examples

Financial Statistics

Sample Programs

Graphics Programs

Charting Financial Time Series

Indexing Financial Time Series

Financial Time Series Demonstration Program

Financial Time Series Graphical User Interface

Examples

Technical Analysis

....................................... B-3

................................ B-2

................................ B-2

.................................. B-2

................................ B-2

..................... B-3

..................... B-3

................................. B-3

...... B-3

xvi Contents

Glossary

Index

Page 17

Getting Started

• “Product Overview” on page 1-2

• “Expected Background” on p age 1-4

• “Using Matrix Functions for Finance” on page 1-5

• “Matrix Algebra Refresher” on page 1-8

• “Function Input and Output Arguments” on page 1-19

1

Page 18

1 Getting Started

Product Overview

The MATLAB®and Financial Toolbox™ products provide a complete

integrated computing environment for financial analysis and engineering.

The too lbox has everything you need to perform mathematical and statistical

analysis of financial data and display the results with presentation-quality

graphics. You can quickly ask, visualize, and answer complicated questions.

In traditional or spreadsheet programming, you must deal with all sorts of

housekeeping details: declaring, data typing, sizing, and so on. MATLAB

software does all that for you. You just write expressions the way y ou

think of problems. There is no need to switch tools, convert files, or rewrite

applications.

With the MATLAB and Financial Toolbox products, you can do the following:

• Compute and analyze prices, yields, and sensitivities for derivatives and

• Perform Securities Industry Association (SIA) co mpatible fixed-income

other securities, and for portfolios of securities.

pricing, yield, and sensitivity an alysis.

1-2

• Analyze or manage portfolios.

• Design and evaluate hedging strategies.

• Identify, measure, and control risk.

• Analyze and compute cash flows, including rates of return and depreciation

streams.

• Analyze and predict economic activity.

• Visualize and analyze financial time series data.

• Create structured financial instruments, including foreign-exchange

instruments.

• Teach or conduct academic research.

This chapter uses MATLAB to review the fundamentals of matrix algebra you

need for financial analysis and engineering applications. It contains these

sections:

Page 19

Product Overview

• “Using Matrix Functions for Finance” on page 1-5

Reviews “Key Definitions” on page 1-5 and some matrix algebra

fundamentals, such as “Referencing Matrix Elements” on page 1-6 and

“Transposing Matrices” on page 1-7.

• “Matrix Algebra Refresher” on page 1-8

Provides a brief refresher on using matrix functions in financial analysis

and engineering

• “Function Input and Output Arguments” on page 1-19

Describes acceptable formats for providing data to MATLAB and the

resulting output from computations on the supplied data.

This material explains some MATLAB concepts and operations using financial

examples to help get you started.

1-3

Page 20

1 Getting Started

Expected Background

In general, this guide assumes experience working with financial derivatives

and some familiarity with the underlying models.

In designing Financial Toolbox documentation, we assume that your title is

like one of these:

• Analyst, quantitative analyst

• Risk manager

• Portfolio manager

• Asset allocator

• Financial engineer

• Trader

• Student, professor, or other academic

1-4

We also assum e your background, education, training, and responsibilities

match some aspects of this profile:

• Finance, economics, perhaps accounting

• Engineering, mathematics, physics, other quantitative sciences

• Focus on quantitative approaches to financial problems

Page 21

Using Matrix F unctions for Finance

In this section...

“Introduction” on page 1-5

“Key Definitions” on page 1-5

“Referencing Matrix Elements” on page 1-6

“Transposing Matrices” on page 1-7

Introduction

Many financial analysis procedures involve sets of numbers; for example, a

portfolio of securities at various prices and yields. Matrices, matrix functions,

and matrix algebra are the most efficient ways to analyze sets of numbers

and their relationships. Spreadsheets focus on individual cells and the

relationships between cells. While you can think of a set of spreadsheet cells (a

range of rows and columns) as a matrix, a matrix-oriented tool like MATLAB

softwaremanipulatessetsofnumbersmore quickly, easily, and naturally.

Using Matrix Functions for Finance

Key Definitions

Matrix. A rectangular array of numeric or algebraic quantities subject to

mathematical operations; the regular formation of elements into rows and

columns. Described as a “m-by-n”matrix,withm the number of rows and

n the number of columns. The description is always “row-by-column.” For

example, here is a

values, coupon rates, and coupon payment frequencies per year (the columns)

entered using MATLAB notation:

Bonds = [1000 0.06 2

Vecto r. A matrix with only one row or column. Described as a “1-by-n”or

“m-byhere is a

1” matrix. The description is always “row-by-column.” For example,

1-by-4 vector of cash flo ws in MATLAB notation:

Cash = [1500 4470 5280 -1 299]

2-by-3 matrix of two bonds (the rows) with different par

500 0.055 4]

1-5

Page 22

1 Getting Started

Scalar. A 1-by-1 matrix; that is, a single number.

Referencing Matrix Elements

To reference specific matrix elements, use (row, column) notation. For

example:

Bonds(1,2)

ans =

0.06

Cash(3)

ans =

5280.00

1-6

You can enlarge matrices using small matrices or vectors as elements. For

example,

AddBond = [1000 0.065 2];

Bonds = [Bonds; AddBond]

adds another row to the matrix and creates

Bonds =

1000 0.06 2

500 0.055 4

1000 0.065 2

Likewise,

Prices = [987.50

475.00

995.00]

Bonds = [Prices, Bonds]

Page 23

Using Matrix Functions for Finance

adds another column and creates

Bonds =

987.50 1000 0.06 2

475.00 500 0.055 4

995.00 1000 0.065 2

Finally, the colon (:) is important in generating and referencing matrix

elements. For example, to reference the par value, coupon rate, and coupon

frequency of the second bond:

BondItems = Bonds(2, 2:4)

BondItems =

500.00 0.05 5 4

Transposing Matrices

Sometimes matrices are in the wrong configuration for an operation. In

MATLAB, the apostrophe or prime character (

become rows, rows become columns. For example,

') transposes a matrix: columns

Cash = [1500 4470 5280 -1 299] '

produces

Cash =

1500

4470

5280

-1299

1-7

Page 24

1 Getting Started

Matrix Algebra Refresher

In this section...

“Introduction” on page 1-8

“Adding and Subtracting Matrices” on page 1-8

“Multiplying Matrices” on page 1-9

“Dividing Matrices” on page 1-14

“Solving Simultaneous Linear Equations” on page 1-15

“Operating Element by Element” on page 1-18

Introduction

The explanations in the sections that follow should help refresh your skills for

using matrix algebra and using MATLAB functions.

In addition, William Sh arpe’s Macro-Investment Analysis also provides an

excellent explanation of matrix algebra operations using MATLAB. It is

available on the Web at:

1-8

http://www.stanford.edu/~wfsharpe/mia/mia.htm

Tip When you are setting up a problem, it helps to “talk through” the units

and dimensions associated with each input and output matrix. In the

example under “Multiplying Matrices” on page 1-9, one input matrix has

“five days’ closing prices for three stocks,” the other input matrix has “shares

of three stocks in two portfolios,” and the output matrix therefore has “five

days’ closing values for two portfolios.” It also helps to name variables using

descriptive terms.

Adding and Subtracting Matrices

Matrix addition and subtraction operate element-by-element. The two input

matrices must have the same dimensions. The result is a ne w matrix of

the same dimensions where each element is the sum or difference of each

corresponding input element. For example, consider combining portfolios of

Page 25

Matrix Algebra Refresher

different quantities of the same stocks (“shares of stocks A, B, and C [the

rows] in portfolios P and Q [the columns] plus shares of A, B, and C in

portfolios R and S”).

Portfolios_PQ = [100 200

500 400

300 150];

Portfolios_RS = [175 125

200 200

100 500];

NewPortfolios = Portfolios_PQ + Portf olios_RS

NewPortfolios =

275 325

700 600

400 650

Adding or subtracting a scalar and a m a trix is allowed and also operates

element-by-element.

SmallerPortf = NewPortfolios-10

SmallerPortf =

265.00 315.00

690.00 590.00

390.00 640.00

Multiplying Matrices

Matrix multiplication does not operate element-by-element. It operates

according to the rules of linear algebra. In multiplying matrices, it helps to

remember this key rule: the inner dimensions must be the same. That is, if

the first matrix is m-bym-by-n. It also helps to “talk through” the units of each matrix, as mentioned

in “Using Matrix Functions for Finance” on page 1-5.

Matrix multiplication also is not commutative; that is, it is not independent of

order. A*B does not equal B*A. The dimension rule illustrates this property.

3, the second must be 3-b y-n. The resulting matrix is

1-9

Page 26

1 Getting Started

If A is 1-by-3 matrix and B is 3-by-1 matrix, A*B yields a scalar (1-by-1)

matrix but B*A yields a

3-by-3 matrix.

Multiplying Vectors

Vector multiplication follows the same rule s an d h el ps i ll ustrate the

principles. For example, a stock portfo li o has three different stocks and their

closing prices today are:

ClosePrices = [42.5 15 78.875]

The portfolio contains these numbers of shares of each stock.

NumShares = [100

500

300]

To find the value of the portfolio, multiply the vectors

PortfValue = ClosePrices * NumShares

1-10

which yields:

PortfValue =

3.5413e+004

The vectors are 1-by-3 and 3-by-1;theresultingvectoris1-by-1, a scalar.

Multiplying these vectors thus means multiplying each closing price by its

respective number of shares and summing the result.

To illustrate order dependence, switch the order of the vectors

Values = NumShares * Clos ePri ces

Values =

1.0e+004 *

0.4250 0.1500 0.7887

2.1250 0.7500 3.9438

Page 27

Matrix Algebra Refresher

1.2750 0.4500 2.3663

which shows the closing values of 100, 500, and 300 shares of each stock, not

the portfolio value, and m eaningless for this example.

Computing Dot Products of Vectors

In matrix algebra, if X and Y arevectorsofthesamelength

Yyy y

=

,,,

[]

Xxx x

=

[]

then the dot product

XY xy x y x y

i…=+++

is the scalar product of the two vectors. It is an exception to the commutative

rule. To compute the dot product in MATLAB, use

. Just be sure the two vectors have the same dimensions. To illustrate, use

X)

the previous vectors.

…

12

,,,

…

12

11 22

n

n

nn

sum(X .* Y) or sum(Y .*

Value = sum(NumShares .* ClosePrices')

Value =

3.5413e+004

Value = sum(ClosePrices .* NumShares')

Value =

3.5413e+004

As expected, the value in these cases matches the PortfValue computed

previously.

1-11

Page 28

1 Getting Started

Multiplying Vectors and Matrices

Multiplying vectors and matrices fol lows th e matrix multiplication rules and

process. For example, a portfolio matrix contains closing prices for a week. A

second m atrix (vector) contains the stock quantities in the p ortfolio.

WeekClosePr = [42.5 15 78.875

42.125 15. 5 78.75

42.125 15. 125 79

42.625 15. 25 78.875

43 15.25 78.625];

PortQuan = [100

500

300];

To see the closing portfolio value for each day, simply multiply

WeekPortValue = WeekClosePr * PortQua n

WeekPortValue =

1-12

1.0e+004 *

3.5412

3.5587

3.5475

3.5550

3.5513

The prices matrix is 5-by-3, the quantity matrix (vector) is 3-by-1,sothe

resulting matrix (vector) is

5-by-1.

Multiplying Two Matrices

Matrix multiplication also follows the rules of matrix algebra. In matrix

algebra notation, if A is an m-by-n matrix and B is an n-by-p matrix

Page 29

Matrix Algebra Refresher

aa a

⎡

11 12 1

⎢

⎢

⎢

aa a

A

=

ii in

12

⎢

⎢

⎢

aa a

mm mn

12

⎣

n

⎤

⎥

⎥

⎥

, ==

⎥

⎥

⎥

⎦

bbb

⎡

11 1 1

⎢

bbb

21 2 2

⎢

B

⎢

⎢

bbb

⎢

nnjnp

1

⎣

jp

jp

⎤

⎥

⎥

⎥

⎥

⎥

⎦

then C=A*B is an m-by-p matrix; and the element cijin the ith row and

jth column of C is

cab ab ab

=+++

ij i j i in nj

11 212

… .

To illustrate, assume there are two portfolios of the same three stocks above

but with different quantities.

Portfolios = [100 200

500 400

300 150];

Multiplying the 5-by-3 week’s closing prices matrix by the 3-by-2 portfolios

matrix yields a

5-by-2 matrix showing each day’s closing value for both

portfolios.

PortfolioValues = WeekClosePr * Portf olios

PortfolioValues =

1.0e+004 *

3.5412 2.6331

3.5587 2.6437

3.5475 2.6325

3.5550 2.6456

3.5513 2.6494

Monday’s values result from multiplying each Monday closing price by its

respective number of shares and summing the result for the first portfolio,

then doing the same for the second portfolio. Tuesday’svaluesresultfrom

multiplying each Tuesday closing price by its r espective n umber of shares and

1-13

Page 30

1 Getting Started

summing the result for the first portfolio, then doing the same for the second

portfolio. And so on through the rest of the week. With one simple command,

MATLAB quickly performs many calculations.

Multiplying a Matrix by a Scalar

Multiplying a matrix by a scalar is an exception to the dimension and

commutative rules. It just operates element-by-element.

Portfolios = [100 200

500 400

300 150];

DoublePort = Portfolios * 2

DoublePort =

200 400

1000 800

600 300

1-14

Dividing Matrices

Matrix division is useful primarily for solving equations, and especially for

solving simultaneous linear equations (see “Solving Sim ultaneous Linear

Equations” on page 1-15). For example, you want to solve for X in A*X = B.

In ordinary algebra, you would divide both sides of the equation by A,andX

would equal B/A. However, since matrix algebra is not commutative (A*X

≠ X*A), different processes apply. In formal matrix algebra, the solution

involves matrix inversion. MATLAB, however, simplifies the process by

providing two matrix division sym bols, le ft and right (

X = A\B solves for X in A*X=Band

X = B/A solves for X in X*A=B.

In general, ma trix

A must be a nonsingular square matrix; that is, it must

be invertible and it must have the same number of rows and columns.

(Generally, a m a trix is invertible if the matrix times its inverse equals the

identity matrix. To understand the theory and proofs, consult a textbook on

linear algebra such as Elementary Linear Algebra by Hill listed in Appendix

\ and /). In general,

Page 31

Matrix Algebra Refresher

A, “Bibliography”.) MATLAB gives a warning message if the matrix is

singular or nearly so.

Solving Simultaneou s Linear Equations

Matrix division is especially useful in solving simultaneous linear equations.

Consider this problem: G iven two portfolios of mortgage-based instruments,

each w ith certain yields depending on the prime rate, how do you weight the

portfolios to achieve certain annual cash flows? The answer involves solving

two linear equations.

A linear equation is any equation of the form

ax ay b

+=,

12

where a1, a2,andb are constants (with a1and a2not both 0), and x and y are

variables. (It’s a linear equation because it describes a line in the xy-plane. For

example, the equation 2x + y = 8 describes a line such that if x =2,theny =4.)

A system of linear equations is a set of linear equations that you usually

want to solve at the same time; that is, simultaneously. A basic principle for

exact answers in solving simultaneous linear equations requires that there

be as many equations as there are unknowns. To get exact answers for x

and y, there must be two equations. For example, to solve for x and y in the

system of linear equations

213

xy

+=

318

xy

−=−,

there must be two equations, which there are. Matrix algebra represents this

system as an equation involving three matrices: A for the left-side constants,

X for the variables, and B for the right-side constants

21

⎡

AX

⎢

⎣

where A*X = B.

⎤

, , ,

⎥

−

13

⎦

x

⎡

⎤

=

⎢

⎥

y

⎣

⎦

13

⎡

B=

⎤

=

⎢

⎥

−

18

⎣

⎦

1-15

Page 32

1 Getting Started

Solving the system simultaneously means solving for X. Using MATLAB,

A=[2 1

1 -3];

B = [13

-18];

X=A\B

solves for X in A*X=B.

X = [3 7]

So x =3andy = 7 in th is example. In general, you can use matrix algebra to

solve any system of linear equations such as

ax ax ax b

+++ =

11 1 12 2 1 1

ax ax ax b

+++ =

21 1 22 2 2 2

…

…

nn

nn

ax ax

++

mm

11 22

… ++=ax b

mn n m

1-16

by representing them as matrices

aa a

⎡

11 12 1

⎢

aa a

21 22 2

⎢

A

=

⎢

⎢

aa a

mm mn

12

⎣

⎤

n

⎥

n

⎥

,

⎥

⎥

⎦

x

⎡

⎤

1

⎢

⎥

x

22

⎢

X

⎥

=

,

⎢

⎥

⎢

⎥

x

nm

⎣

⎦

b

⎡

⎤

1

⎢

⎥

b

2

⎢

B

⎥

=

⎢

⎥

⎢

⎥

b

⎣

⎦

and solving for X in A*X = B .

To illustrate, consider this situation. There are two portfolios of

mortgage-based instruments, M1 and M2. They have current annual cash

payments of $100 and $70 per unit, respectiv ely, based on today’s p rime rate.

If the prime rate moves down one percentage point, their payments would

be $80 and $40. An investor holds 10 units of M1 and 20 units of M2. The

investor’s receipts equal cash payments times units, or R = C * U, for each

prime-rate scenario. As word e quations:

Page 33

Matrix Algebra Refresher

M1 M2

Prime flat: $100 * 10 units + $70 * 20 units = $2400

receipts

Prime down:

$80 * 10 units + $40 * 20 units = $1600

receipts

As MATLAB matrices:

Cash = [100 70

80 40];

Units = [10

20];

Receipts = Cash * Units

Receipts =

2400

1600

Now the investor asks this question: Given these two portfolios and their

characteristics, how many units of each should I h old to receive $7000 if the

prime rate stays flat and $5000 if the prime drops one percentage point? Find

the answer by solving two linear equations.

M1 M2

Prime flat: $100 * x units + $70 * y units = $7000

receipts

Prime down:

$80 * x units + $40 * y units = $5000

receipts

her words, solve for U (units) in the equation R (receipts) = C (cash) * U

In ot

its). Using MATLAB left division

(un

Cash = [100 70

80 40];

1-17

Page 34

1 Getting Started

Receipts = [7000

5000];

Units = Cash \ Receipts

Units =

43.7500

37.5000

The investor should hold 43.75 units of portfolio M1 and 37.5 units of portfolio

M2 to achieve the annual receipts desired.

Operating Element by Element

Finally, element-by-element arithmetic operations are called array operations.

To indicate a MATLAB array operation, precede the operator with a period

(

.). Addition and subtraction, and matrix multi plication and d ivision by a

scalar, are already array operations so no period is necessary. When using

array operations on two matrices, the dimensions of the matrices must be the

same. For example, given vectors of stock dividends and closing prices

1-18

Dividends = [1.90 0.40 1.56 4.50];

Prices = [25.625 17.75 26.125 60.50];

Yields = Dividends ./ Pric es

Yields =

0.0741 0.0225 0.0597 0.0744

Page 35

Function Input and Output Arguments

In this section...

“Input Arguments” on page 1-19

“Output Arguments” on page 1-21

“Interest Rate Arguments” on page 1-22

Input Arguments

Matrix Input

MATLAB software was designed to be a large-scale array (vector or

matrix) processor. In addition to its linear algebra applications, the

general array-based processing facility can perform repeated operations on

collections of data. When MATLAB code is written to operate simultaneou sl y

on collections of data stored in arrays, th e code is said to be vectorized.

Vectorized code is not only clean and concise, but is also efficiently processed

by the underlying MATLAB engine.

Function Input and Output Arguments

Because MATLAB can process vectors and matrices easily, most Financial

Toolbox functions allow vector or matrix input arguments, rather than just

single (scalar) values. For example, the

rate of return of a cash flow stream. It accepts a vector of cash flows and

returns a scalar-valued internal rate of return. However, it also accepts a

matrix o f cash flow streams, a column in the matrix representing a different

cash flow stream. In this case,

each entry in the vector corresponding to a column of the input matrix. Many

other toolbox functions work similarly.

As an example, suppose you make an initial investment of $100, from which

you then receive by a series of annual cash receipts of $10, $20, $30, $40, and

$50. This cash flow stream may be stored in a vector

CashFlows = [-100 10 20 30 40 50]'

which MATLAB displays as

CashFlows =

irr returns a vector of internal rates of return,

irr function computes the internal

1-19

Page 36

1 Getting Started

-100

10

20

30

40

50

The irr function can compute the internal rate of return of this stream.

Rate = irr(CashFlows)

The internal rate of return of this investment is

Rate =

0.1201

or 12.01%.

In this case, a single cash flow stream (written as an input vector) produces a

scalar output – the internal rate of return of the investment.

1-20

Extending this example, if you process a matrix of identical cash f low streams

Rate = irr([Cash

Flows CashFlows CashFlows])

you should expect to see identical internal rates of return for each of the three

investments.

Rate =

0.1201 0.1201 0.1201

This simple example illustrates the power of vectorized programming. The

example shows how to collect data into a matrix and then use a toolbox

function to compute answers for the entire collection. This feature can be

useful in portfolio management, for example, where you might want to

organize multiple assets into a single collection. Place data for each asset in

a different col u m n or row of a matrix, then pass the matrix to a Financial

Toolbox function. MATLAB performs the same computation on all of the

assets at once.

Page 37

Function Input and Output Arguments

Matrices of String Input

Enter MATLAB strings surrounded by single quotes ('string').

Strings are stored as character arrays, one ASCII character per element.

Thus, the date string

DateString = '9/16/2001'

is actually a 1-by-9 vector. Strings making up the rows of a matrix or vector

all must have the same length. To enter several date strings, therefore, use

a column vector and be sure all strings are the same length. Fill in with

spaces or zeros. For example, to create a vector of dates corresponding to

irregular cash flows

DateFields = ['01/12/2001'

'02/14/2001'

'03/03/2001'

'06/14/2001'

'12/01/2001'];

DateFields

actually becomes a 5-by-10 character array.

Don’t mix numbers and strings in a matrix. If you do, MA TLAB treats all

entriesascharacters. Forexample,

Item = [83 90 99 '14-Sep-1999']

becomes a 1-by-14 character array, not a 1-by-4 vector, and it contains

Item =

SZc14-Sep-1999

Output Arguments

Some functions return no arguments, some return just one, and some return

multiple arguments. Functions that return multiple arguments use the

syntax

[A, B, C] = function(variables...)

1-21

Page 38

1 Getting Started

to return arguments A, B,andC. If you omit all but one, the function returns

the first argument. Thus, for this example if you use the syntax

X = function(variables...)

function

Some functions that return vectors accept only scalars as arguments. Why

could such functions not accept vectors as arguments and return matrices,

where each column in the output matrix corres ponds to an entry in the input

vector? The answer is that the output vectors can be variable length and

thus will not fit in a matrix without some convention to indicate that the

shorter columns are missing data.

Functions that require asset life as an input, and return values corresponding

to different periods over that life, cannot g enerally handle vectors or matrices

as input arguments. Those functions are:

amortize

depfixdb

depgendb

depsoyd

For example, suppose you have a collection of assets such as automobiles

and you want to compute the depreciation schedules for them. The function

depfixdb computes a stream of declining-balance depreciation values for an

asset. You might want to set u p a vector where each entry is the initial value

of each asset.

up such a collection of automobiles as an input vector, and the lifetimes of

those a utomobiles varied, the resulting depreciation streams would differ in

length according to the life of each automobile, a nd the output column lengths

would vary. A matrix must ha v e the sa me number of rows in each column.

returns a value for A , but not for B or C.

Amortization

Fixed declining-balance depreciation

General declining-balance depreciation

Sum of years’ digits depreciation

depfixdb also needs the lifetime of an asset. If you were to set

1-22

Interest Rate Arguments

One common argument, both as input and output, is interest rate. All

Financial Toolbox functions expect and return interest rates as decimal

fractions. Thus an interest rate of 9.5% is indicated as 0.095.

Page 39

Performing Common Financial Tasks

• “Introduction” on page 2-2

• “Handling and Converting Dates” on page 2-4

• “Formatting Currency” on page 2-12

• “Charting Financial Data” on page 2-13

• “Analyzing and Computing Cash Flows” on page 2-17

2

• “Pricing and Computing Yields for F ixed-Income Securities” on page 2-21

• “Term Structure of Interest Rates” on page 2-36

• “Pricing and Analyzing Equity Derivatives” on page 2-39

Page 40

2 Performing Common Financial Tasks

Introduction

Financial Toolbox software contains functions that perform many common

financial tasks, including:

• “Handling and Converting Dates” on page 2-4

Calendar functions convert dates among different formats (including

Excel

business days, compute time differences between dates, find coupon dates

and coupon periods for coupon bonds, and compute time periods based on

360-, 365-, or 366-day years.

• “Formatting Currency” on page 2-12

The toolbox includes functions for handling decimal values in bank

(currency) formats and as fractional prices.

• “Charting Financial Data” on page 2-13

Charting functions produce a variety of financial charts including Bollinger

bands, h igh-low-close charts, candlestick plots, point and figure plots, and

moving-average plots.

®

formats), determine future or past dates,finddatesofholidaysand

2-2

• “Analyzing and Computing Cash Flows” on page 2-17

Cash-flow evaluation and financial accounting functions compute interest

rates, rates of return, payments associated with loans and annuities,

future and present values, depreciation, and other standard accounting

calculations associated with cash-flow streams.

• “Pricing and Computing Yields for F ixed-Income Securities” on page 2-21

Securities Industry Association (SIA) compliant fixed-income functions

compute prices, yields, accrued interest, and sensitivities for securities

such as bonds, zero-coupon bonds, and Treasury bills. They handle odd

first and last periods in price/yield calculations, compute accrued interest

and discount rates, and calculate convexity and duration. Another set of

functions analyzes term structure of interest rates, including pricing bonds

from yield curves and bootstrapping yield curves from market prices.

• “Pricing and Analyzing Equity Derivatives” on page 2-39

Derivatives analysis functions compute prices, yields, and sensitivities for

derivative securities. They deal with both European and American options.

Page 41

Black-Scholes functions work with European options. They compute

delta, gamma, lambda, rho, theta, an d vega, as well as values of call and

put options.

Binomial functions work with American options, computing put and call

prices.

• “Analyzing Portfolios” on page 3-2

Portfolio analysis functions provide basic utilities to compute variances and

covariance of portfolios, find combinations to minimi z e variance, compute

Markowitz efficient frontiers, and calculate combined rates of return.

• Modeling volatility in time series.

Generalized Autoregressive Conditional Heteroskedasticity

(GARCH) functions model the volatility of univariate economic time series.

(Econometrics Toolbox™ software provides a more comprehensive and

integrated computing environment. For information, see the Econometrics

Toolbox User’s Guide documentation or the financial products W eb pa ge at

http://www.mathworks.com/products/finprod.)

Introduction

2-3

Page 42

2 Performing Common Financial Tasks

Handling and Converting Dates

In this section...

“Date Formats” on page 2-4

“Date Conversions” on page 2-5

“Current Date and Time” on page 2-8

“Determining Dates” on page 2-9

Date Formats

Since virtually all financial data is dated or derives from a time series,

financial functions must have extensive date-handling capabilities. You most

often work with date strings (14-Sep-1999) when dealing with dates. Financial

Toolbox software works internally with serial date numbers (for example,

730377). A serial date number represents a calendar date as the number of

days that has passed since a fixed base date. In MATLAB software, serial date

number 1 is January 1, 0000 A.D. MATLAB also uses serial time to represent

fractions of days beginning at midnight; for exam ple, 6 p.m. equals 0 .75 serial

days. So 6:00 p.m. on 14-Sep-1999, in MATLAB, is date number

730377.75.

2-4

Note If you specify a two-digit year, MATLAB assumes that the year lies

within the 100-year period centered about the current year. See the function

datenum for specific information. MATLAB internal date handling and

calculations generate no ambiguous values. However, whenever possible,

programmers should use serial date numbers or date strings containing

four-digit years.

Many toolbox functions that require dates accept either date strings or

serial date numbers. If you are dealing with a few dates at the MATLAB

command-line level, date strings are more convenient. If you are using toolbox

functions on large numbers of dates, as in analyzing large portfolios or cash

flows, performance improves if you use date numbers.

The Financial Toolbox software provides functions that convert date strings

to serial date numbers, and vice versa.

Page 43

Date Conversions

Functions that convert between date formats are

Handling and Converting Dates

datedisp

Displays a numeric matrix with date entries f ormatted

as date strings

datenum

datestr

m2xdate

Converts a date s tring to a serial date number

Converts a serial date number to a date string

Converts MATLAB serial date number to Excel serial

date number

x2mdate

Converts Excel serial date number to MATLAB serial

date number

Another function,

vector whose elements are

datevec, converts a date number or date string to a date

[Year Month Day Hour Minute Second].Date

vectors are mostly an internal format for some MATLAB functions; you would

not often use them in financial calculations.

Input Conversions

The datenum function is important for using Financial Toolbox software

efficiently.

'dd-mmm-yyyy', 'mm/dd/yyyy' or 'dd-mmm-yyyy, hh:mm:ss.ss' most

common. The input string can have up to six fields formed by letters and

numbers separated by any other characters:

• The day field is an integer from 1 through 31.

datenum takes an input string in any of several formats, with

• The month field is either an integer from 1 through 12 or an alphabetical

string with at least three characters.

• The year field is a nonnegative integer: if only two numbers are specified,

then the year is assumed to lie within the 100-year period centered about

the current year; if the year is omitted, the current year is used as the

default.

• The hours, minutes, and seconds fields are optional. They are integers

separated by colons or followed by

'am' or 'pm'.

For example, if the current year is 1999, then these are all equivalent

2-5

Page 44

2 Performing Common Financial Tasks

'17-May-1999'

'17-May-99'

'17-may'

'May 17, 1999'

'5/17/99'

'5/17'

and both of these represent the same time.

'17-May-1999, 18:30'

'5/17/99/6:30 pm'

Note that the default format for numbers-only input follows the American

convention. Thus 3/6 is March 6, not June 3.

With

datenum you can convert dates into serial date format, store them in a

matrix variable, then later pass the variable to a function. Alternatively, you

can use

datenum directly in a f u nction input argume nt l ist.

2-6

For example, consider the function

bndprice that computes the price of a bond

given the yield-to-maturity. First set up variables for the yield-to-maturity,

coupon rate, and the necessary dates.

Yield = 0.07;

CouponRate = 0.08;

Settle = datenum('17-May-2000');

Maturity = datenum('01-Oct -200 0');

Then call the function with the variables

bndprice(Yie

ld, CouponRate, Settle, M aturity)

Alternatively, convert d ate strings to serial date numbers directly in the

function input argument list.

bndprice(0.07, 0.08, datenum('17-May-2000'),...

datenum('01-Oct-2000'))

bndprice is an example of a function designed to detect the presence of date

strings and make the conversion automatically. For these functions date

strings may be passed directly.

Page 45

Handling and Converting Dates

bndprice(0.07, 0.08, '17-May-2000', '01-Oct-2000')

Thedecisiontorepresentdatesaseither date strings or serial date numbers

is often a matter of convenience. For example, when formatting data for

visual display or for debugging date-handling code, it is often much easier

to view dates as date strings because serial date numbers are difficult to

interpret. Alternatively, serial date numbers are just another type of numeric

data, and can be placed in a matrix along with any other numeric data for

convenient manipulation.

Remember that if you create a vector of input date strings, use a column

vectorandbesureallstringsarethesamelength. Fillwithspacesorzeros.

See “Matrices of String Input” on page 1-21.

Output Conversions

The function datestr converts a serial date number to one of 19 different

date string output formats showing date, time, or both. The default output for

dates is a day-month-year string, for example, 24-Aug-2000. This function is

quite useful for preparing output reports.

Format Description

01-Mar-2000 15:45:17

01-Mar-2000

03/01/00

Mar

M

3

03/01

1

Wed

W

2000

99

day-month-year hour:minute:second

day-month-year

month/day/year

month, three letters

month, single letter

month

month/day

day of month

day of week, three letters

day of week, single letter

year, four numbers

year, two numbers

2-7

Page 46

2 Performing Common Financial Tasks

Format Description

Mar01

15:45:17

03:45:17 PM

15:45

03:45 PM

Q1-99

Q1

CurrentDateandTime

The functions today and now return serial date numbers for the current date,

and the current date and time, respectively.

today

month year

hour:minute:second

hour:minute:second AM or PM

hour:minute

hour:minute AM or PM

calendar quarter-year

calendar quarter

2-8

ans =

730693

now

ans =

730693.48

The MATLAB function date returns a string for today’s date.

date

ans =

26-Jul-2000

Page 47

Handling and Converting Dates

Determining Dates

The Financial Toolbox software provides many functions for determining

specific dates, including functions which account for holidays and other

nontrading days. For example, you schedule an accounting procedure for the

last Friday of every month. The

2000; the 6 specifies Friday.

Fridates = lweekdate(6, 2000, 1:12);

Fridays = datestr(Fridates)

Fridays =

28-Jan-2000

25-Feb-2000

31-Mar-2000

28-Apr-2000

26-May-2000

30-Jun-2000

28-Jul-2000

25-Aug-2000

29-Sep-2000

27-Oct-2000

24-Nov-2000

29-Dec-2000

lweekdate function returns those dates for

OryourcompanyclosesonMartinLutherKingJr. Day,whichisthethird

Monday in January. T he

nweekdate function determines those dates for 2001

through 2004.

MLKDates = nweekdate(3, 2, 2001:2004, 1);

MLKDays = datestr(MLKDates)

MLKDays =

15-Jan-2001

21-Jan-2002

20-Jan-2003

19-Jan-2004

2-9

Page 48

2 Performing Common Financial Tasks

Accounting for holidays and other nontrading days is important when

examining financial dates. The Financial Toolbox software provides the

holidays function, which contains holidays and special nontrading days for

the New York Stock Exchange between 1950 and 2030, inclusive. In addition,

you can use

the New York Stock Exchange from January 1, 1885 to December 31, 2050.

nyseclosures returns a vector of serial date numbers corresponding to

market closures between the dates

nyseclosures to evaluate all known or anticipated closures of

StartDate and EndDate,inclusive.

In this example, you can use

holidays to determine the standard holidays in

the last half of 2000:

LHHDates = holidays('1-Jul-2000', '31-Dec-2000');

LHHDays = datestr(LHHDates)

LHHDays =

04-Jul-2000

04-Sep-2000

23-Nov-2000

25-Dec-2000

Now use the toolbox busdate function to determine the next business day

after these holidays.

LHNextDates = busdate(LHHDates);

LHNextDays = datestr(LHNextDates)

LHNextDays =

05-Jul-2000

05-Sep-2000

24-Nov-2000

26-Dec-2000

2-10

The toolbox also provides the cfdates function to determine cash-flow dates

for securities with periodic payments. This function accounts for the coupons

per year, the day-count basis, and the end-of-month rule. For example, to

Page 49

Handling and Converting Dates

determine the cash-flow dates for a security that pays four coupons per year

on the last day of the month, on an actual/365 day-count basis, just enter the

settlement date, the maturity date, and the parameters.

PayDates = cfdates('14-Mar-2000', '30-Nov-2001', 4, 3, 1);

PayDays = datestr(PayDates)

PayDays =

31-May-2000

31-Aug-2000

30-Nov-2000

28-Feb-2001

31-May-2001

31-Aug-2001

30-Nov-2001

2-11

Page 50

2 Performing Common Financial Tasks

Formatting Currency

Financial Toolbox software provides several functions to format currency and

chart financial data. The currency formatting functions are

cur2frac

cur2str

frac2cur

These examples show their use.

Dec = frac2cur('12.1', 8)

returns Dec = 12.125, which is the decimal equivalent of 12-1/8. The second

input variable is the denominator of the fraction.

Str = cur2str (-8 264, 2)

returns the string ($8264.00). For this toolbox function, the output format

is a numerical format with dollar sign prefix, two decimal places, and

negative numbers in parentheses; for example,

standard MATLAB bank format uses two decimal places, no dollar sign, and a

minus sign for negative numbers; for example, -

Converts decimal currency values to

fractional values

Converts a value to Financial Toolbox bank

format

Converts fractional currency values to

decimal values

($123.45) an d $6789.01.The

123.45 and 6789.01.

2-12

Page 51

Charting Financial Data

In this section...

“Introduction” on page 2-13

“High-Low-Close Chart Example” on page 2-14

“Bollinger Chart Example” on page 2-15

Introduction

The following toolbox financial charting functions plot financial data and

produce presentation-quality figures quickly and easily.

Charting Financial Data

bolling

bollinger

candle

candle

pointfig

highlow

highlow

avg

mov

Bollinger band chart

Time seri

Candles

es Bollinger band

tick chart

Time series candle plot

Point and figure chart

High, low, open, close chart

series High-Low plot

Time

Leading and lagging moving averages chart

These functions work with standard MATLAB functions that draw axes,

control appearance, and add labels and titles. The toolbox also provides a

comprehensive set of charting functions that work with financial time series

objects. For lists of these, see “Financial Data Charts” on page 13-6 and

“Financial Time Series Indicator” on page 13-22.

Here are two plotting examples: a high-low-close chart of sample IBM

®

stock

price data, and a Bollinger band chart of the same data. These examples load

data from an external file (

the data. The MATLAB variable

ibm.dat), then call the functions using subsets of

ibm , which is created by loading ibm.dat,

is a six-column matrix where each row is a trading day’s data and where

columns 2, 3, and 4 contain the high, low , and closing prices, respectively.

2-13

Page 52

2 Performing Common Financial Tasks

Note The data in ibm.dat is fictional and for ill ustrative use only.

High-Low-Close Chart Example

First load the data and set up matrix dimensions. load and size are standard

MATLAB functions.

load ibm.dat;

[ro, co] = size(ibm);

Openafigurewindowforthechart. UsetheFinancialToolboxhigh low

function to plot high, low, and close prices for the last 50 trading days in

the data file.

figure;

highlow(ibm(ro-50:ro,2),ibm(ro-50:ro,3),ibm(ro-50:ro,4),[],'b');

Add labels and title, and set axes with standard MATLAB functions. Use the

Financial Toolbox

dateaxis function to provide dates for the x-axis ticks.

2-14

xlabel('');

ylabel('Price ($)');

title('International Business Machines, 941231 - 950219');

axis([0 50 -inf inf]);

dateaxis('x',6,'31-Dec-1994')

MATLAB produces a figure like this. The plotted data and axes you see may

differ. Viewed online, the high-low-close bars are blue.

Page 53

Charting Financial Data

Bollinger Chart Example

The bolling function in Financial Toolbox software produces a Bollinger

band chart using all the closi ng prices in the same IBM stock price matrix.

A Bollinger band chart plots actual data along with three other bands of

data. The upper band is two standard deviations above a moving average;

the lower band is two standard deviations below that moving average; and

themiddlebandisthemovingaverageitself. Thisexampleusesa15-day

moving average.

Assuming the previous IBM data is still loaded, execute the function.

bolling(ibm(:,4), 15, 0);

Specify the axes, labels, and titles. Again, use dateaxis to add the x-axis

dates.

axis([0 ro min(ibm(:,4)) max(ibm(:,4))]);

ylabel('Price ($)');

2-15

Page 54

2 Performing Common Financial Tasks

title(['International Business Machines']);

dateaxis('x', 6,'31-Dec-1994')

2-16

For help using MATLAB plotting functions, see Creating Plots in the

MATLAB documentation. See the MATLAB docume ntation for details on the

axis, title, xlabel,andylabel functions.

Page 55

Analyzing and Computing Cash Flows

In this section...

“Introduction” on page 2-17

“Interest Rates/Rates of Return” on page 2-17

“Present or Future Values” on page 2-18

“Depreciation” on page 2-19

“Annuities” on page 2-19

Introduction

Financial Toolbox cash-flow functions compute interest rates and rates of

return, present or future values, depreciation streams, and annuities.

Some examples in this se ction use this income stream: an initial i n vestment

of $20,000 followed by three annual return payments, a second investment of

$5,000, then four more returns. Investments are negative cash flows, return

payments are positive cash flows.

AnalyzingandComputingCashFlows

Stream = [-20000, 2000, 2500, 3500, -5000, 6500,...

9500, 9500, 9500];

Interest Rates/Rates of Return

Several functions calculate interest rates involved with cash flows. To

compute the internal rate of return of the cash stream, execute the toolbox

function

which gives a rate of return of 11.72%.

Note that the internal rate of return of a cash flow may not have a unique

value. E very time the sign changes in a cash flow, the equation defining

cangiveuptotwoadditionalanswers. Anirr computation requires solving a

polynomial equation, and the number of real roots of such an equation can

depend on the number of sign changes in the coefficients. The equation for

internal rate of return is

irr

ROR = irr(Stream)

irr

2-17

Page 56

2 Performing Common Financial Tasks

cf

12

()

1

+

cf

+

r

()

r

+

11

++

2

cf

n

+=… ,

n

()

r

+

Investment

0

where Investment is a (negative) initial cash outlay at time 0, cfnis the cash

flow in the nth period, and n is the number of periods.

irr finds the rate r such

that the present value of the cash flow equals the initial investment. If all of

the cf

s are positive there is only one solution. Eve ry time there is a change of

n

sign between coefficients, up to two addit ion a l real roots are possible.

Another toolbox rate function,

effrr, calculates the effective rate of return

given an annual interest rate (also known as nominal rate or annual

percentage rate, APR) and number of compounding periods per year. To find

the e ffectiv e rate of a 9% APR compounded monthly, enter

Rate = effrr(0.09, 12)

The answer is 9.38%.

A companion function

nomrr computes the nominal rate of return given the

effective annual rate and the number of com pounding periods.

Present or Future Values

The too lbox includes functions to compute the present or future value of cash

flows at regular or irregular time intervals with equal or unequal payments:

fvfix, fvvar, pvfix,andpvvar.The-fix functions assume equal cash flows

at regular intervals, while the

irregular periods.

-var functions allow irregular cash flows at

2-18

Now compute the net present value of the sample income stream for which

you computed the internal rate of return. This exercise also serves as a

check on that calculation because the net present value of a cash stream at

its internal rate of return should be zero. Enter

NPV = pvvar(Stream, ROR)

which returns an answer very close to zero. The answer usually is not exactly

zero due to rounding errors and the computational precision of the computer.

Page 57

AnalyzingandComputingCashFlows

Note Other toolbox functions behave similarly. The functions that compute

a bond’s yield, for example, often must solve a nonlinear equation. If you

then use that yield to compute the net present value of the bond’s income

stream, it usually does not exactly equal the purchase price, but the difference

is negligible for practica l applications.

Depreciation

The toolbox includes functions to compute standard depreciation schedules:

straight line, general declining-balance, fixed declining-balance, and sum of

years’ digits. Functions also compute a complete amortization schedule for

an asset, and return the remaining depreciable value after a depreciation

schedule has been applied.

This example depreciates an automobile worth $15,000 over five years with

a salvage value of $1,500. It computes the general declining balance using

two d ifferent depreciation rates: 50% (or 1.5), and 100% (or 2.0, also known

as double declining balance). Enter

Decline1 = depgendb(15000, 1500, 5, 1.5)

Decline2 = depgendb(15000, 1500, 5, 2 .0)

which returns

Decline1 =

4500.00 3150.00 2205.00 1543.50 2101.50

Decline2 =

6000.00 3600.00 2160.00 1296.00 444.00

These functions return the actual depreciation amount for the first four years

and the remaining d epreciable value as the entry for the fifth year.

Annuities

Several toolbox functions deal with annuities. This first example shows

how to compute the interest rate associated with a series of loan payme nts

when only the payment amounts and principal are known. For a loan whose

original value was $5000.00 and which was paid back monthly over four years

at $130.00/month

2-19

Page 58

2 Performing Common Financial Tasks

Rate = annurate(4*12, 130, 5000, 0, 0)

The function returns a rate of 0.0094 monthly, or about 11.28% annually.

The next example uses a present-value function to show how to compute the

initial principal when the payment an d rate are kn ow n . For a loan paid at

$300.00/month over four years at 11% annual interest

Principal = pvfix(0.11/12, 4*12, 300, 0, 0)

The function returns the original principal value of $11,607.43.

Thefinalexamplecomputesanamortization schedule for a loan or annuity.