Page 1

Financial Derivat

User’s Guide

ives Toolbox™ 5

Page 2

How to Contact The MathWorks

www.mathworks.

comp.soft-sys.matlab Newsgroup

www.mathworks.com/contact_TS.html Technical Support

suggest@mathworks.com Product enhancement suggestions

bugs@mathwo

doc@mathworks.com Documentation error reports

service@mathworks.com Order status, license renewals, passcodes

info@mathwo

com

rks.com

rks.com

Web

Bug reports

Sales, prici

ng, and general information

508-647-7000 (Phone)

508-647-7001 (Fax)

The MathWorks, Inc.

3 Apple Hill Drive

Natick, MA 01760-2098

For contact information about worldwide offices, see the MathWorks Web site.

Financial Derivatives Toolbox™ User’s G uide

© COPY R IGHT 2000–2010 The MathW orks, Inc.

The software described in this document is furnished under a license agreement. The software may be used

or copied only under the terms of the license agreement. No part of this manual may be photocopied or

reproduced in any form without prior written consent from The MathW orks, Inc.

FEDERAL ACQUISITION: This provision applies to all acquisitions of the Program and Documentation

by, for, or through the federal government of the United States. By accepting delivery of the Program

or Documentation, the government hereby agrees that this s oftware or docume n tation qualifies as

commercial computer software or commercial computer software documentation as such terms are used

or defined in FAR 12.212, DFARS Part 227.72, and DFARS 252.227-7014. Accordingly, the terms and

conditions of this Agreement and only those rights specified in this Agreement, shall pertain to and govern

theuse,modification,reproduction,release,performance,display,anddisclosureoftheProgramand

Documentation by the federal government (or other entity acquiring for or through the federal government)

and shall supersede any conflicting contractual terms or conditions. If this License fails to meet the

government’s needs or is inconsistent in any respect with federal procurement law, the government agrees

to return the Program and Docu mentation, unused, to The MathWorks, Inc.

Trademarks

MATLAB and Simulink are registered trademarks of The MathWorks, Inc. See

www.mathworks.com/trademarks for a list of additional trademarks. Other product or brand

names may be trademarks or registered trademarks of their respective holders.

Patents

The MathWorks products are protected by one or more U.S. patents. Please see

www.mathworks.com/patents for more information.

Page 3

Revision History

June 2000 First printing New for Version 1.0 (Release 12)

September 2001 Second printing Revised for Version 2.0 (Release 12.1)

April 2004 Third printing Revised for Version 3.0 (Release 14)

September 2005 Fourth printing Revised for Version 4.0 (Release 14SP3)

March 2006 Online only Revised for Version 4.0.1 (Release 2006a)

September 2006 Online only Revised for Version 4.1 (Release 2006b)

March 2007 Fifth printing Revised for Version 5.0 (Release 2007a)

September 2007 Sixth printing Revised for Version 5.1 (Release 2007b)

March 2008 Online only Revised for Version 5.2 (Release 2008a)

October 2008 Online only Revised for Version 5.3 (Release 2008b)

March 2009 Online only Revised for Version 5.4 (Release 2009a)

September 2009 Online only Revised for Version 5.5 (Release 2009b)

March 2010 Online only Revised for Version 5.5.1 (Release 2010a)

Page 4

Page 5

Getting Started

1

Product Overview ................................. 1-2

Introduction

Interest-Rate-Based Derivativ es

Equity-Based Derivatives

...................................... 1-2

..................... 1-2

........................... 1-3

Contents

Expected Background

Portfolio Creation

Introduction

Interest-Rate-Based Derivativ es

Equity Derivatives

Adding Instruments to an Existing Portfolio

Portfolio Management

Instrument Constructors

Creating New Instruments or Properties

Searching or Subsetting a Portfolio

...................................... 1-5

.............................. 1-4

................................. 1-5

................................ 1-6

............................. 1-9

........................... 1-9

Interest-Rate Derivatives

2

Understanding Interest-Rate Derivative

Instruments

Introduction

Bond

Bond Options

Bond with Embedded Options

Fixed-Rate Note

Floating-Rate Note

Cap

Floor

............................................ 2-3

............................................. 2-7

............................................ 2-7

..................................... 2-2

...................................... 2-2

..................................... 2-4

.................................. 2-5

................................ 2-6

..................... 1-5

........... 1-7

.............. 1-10

................... 1-12

....................... 2-5

v

Page 6

Swap ............................................ 2-8

Swaption

........................................ 2-9

Overview of Interest-Rate Models

Interest-Rate Modeling

Rate and Price Trees

Viewing Rate or Price Movement with This Toolbox

Understanding the Interest-Rate Term Structure

Introduction

Interest Rates Versus Discount Factors

Interest-Rate Term Conversions

Functions That Model the Interest-Rate Term Structure

Computing Prices and Sensitivities Using the

Interest-Rate T erm Structure

Introduction

Computing Instrument Prices

Computing Instrument Sensitivities

Understanding Interest-Rate Tree Models

Introduction

Building a Tree of Forward Rates

Specifying the Volatility Model (VolSpec)

Specifying the Interest-Rate Term Structure (RateSpec)

Calibrating the Hull-White Model Using Market Data

Specifying the Time Structure (TimeSpec)

Examples of Tree Creation

Examining Trees

...................................... 2-15

...................................... 2-30

...................................... 2-35

............................. 2-10

............................... 2-11

.......................... 2-49

.................................. 2-50

................... 2-10

............... 2-15

..................... 2-20

..................... 2-30

....................... 2-31

.................. 2-33

........... 2-35

.................... 2-36

.............. 2-38

............. 2-47

..... 2-12

..... 2-15

.. 2-24

.. 2-41

... 2-42

vi Contents

Computing Prices and Sensitivities Using Interest-Rate

Tree Models

Introduction

Computing Instrument Prices

Computing Instrument Sensitivities

Interest-Rate Derivatives Using Closed Form

Solutions

Pricing C aps and Floors Using the Black Option Model

Graphical Representation of Trees

..................................... 2-62

...................................... 2-62

....................... 2-62

.................. 2-71

....................................... 2-74

.. 2-74

.................. 2-75

Page 7

Introduction ...................................... 2-75

Observing Interest Rates

Observing Instrument Prices

........................... 2-75

........................ 2-79

Equity Derivatives

3

Understanding Equity Trees ........................ 3-2

Introduction

Building Equity Binary Trees

Building Implied Trinomial Trees

Examining Equity Trees

Differences Between CRR and EQP Tree Structures

...................................... 3-2

....................... 3-3

.................... 3-8

........................... 3-16

..... 3-20

Understanding Equity Exotic Options

Introduction

Asian Option

Barrier Option

Basket Option

Compound Option

Lookback Optio n

Digital Option

Rainbow Option

Vanilla Option

Computing Prices a n d Sensitivitie s for Equity

Derivatives Using Trees

Computing Instrument Prices

Computing Prices Using CRR

Computing Prices Using EQP

Computing Prices Using ITT

Examining Output from the Pricing Functions

Computing Instrument Sensitivities

Graphical Representation of CRR, EQP, and ITT Trees

Equity Derivatives Using Closed-Form Solutions

Introduction

Computing Prices and Sensitivities Using the Black-Scholes

Model

...................................... 3-22

..................................... 3-22

.................................... 3-23

.................................... 3-25

................................. 3-26

.................................. 3-27

.................................... 3-28

................................... 3-29

.................................... 3-30

.......................... 3-32

....................... 3-32

....................... 3-34

....................... 3-36

........................ 3-38

...................................... 3-50

......................................... 3-54

............... 3-22

.......... 3-40

.................. 3-44

.. 3-48

..... 3-50

vii

Page 8

Computing Prices and Sensitivities Using the Black

Model

Computing Prices and Sensitivities Using the

Roll-Geske-Whaley Model

Computing Prices and Sensitivities Using the

Bjerksund-Stensland Model

......................................... 3-56

........................ 3-57

....................... 3-58

Hedging Portfolios

4

Hedging .......................................... 4-2

Hedging Function s

Introduction

Hedging with hedgeopt

Self-Financing Hedges with hedgeslf

Specifying Constraints with ConSet

Introduction

Setting Constraints

Portfolio Rebalancing

Hedging with Co n strained Portfolios

Overview

Example: Fully Hedged Portfolio

Example: Minimize Portfolio Sensitivities

Example: Under-Determined System

Example: Portfolio Constraints with hedgeslf

...................................... 4-3

...................................... 4-16

........................................ 4-21

................................ 4-3

............................. 4-4

................................ 4-16

.............................. 4-19

5

.................. 4-12

................. 4-16

................ 4-21

..................... 4-21

............. 4-24

................. 4-25

.......... 4-27

Function Reference

viii Contents

Portfolio Hedge Allocation ......................... 5-3

Interest-Rate T erm Structure

....................... 5-3

Page 9

Heath-Jarrow-Morton Trees ........................ 5-3

Black-Derman-Toy Trees

Black-Karasinski Trees

Cox-Ross-Rubinstein Trees

Equal Probabilities Binomial Trees

Hull-White Trees

Implied Trinomial Tree

Heath-Jarrow-Morton Utilities

Black-Derman-Toy Utilities

Black-Karasinski Utilities

Cox-Ross-Rubinstein Utilities

.................................. 5-6

........................... 5-4

............................ 5-4

......................... 5-5

............................ 5-6

...................... 5-7

......................... 5-7

.......................... 5-8

....................... 5-9

................. 5-5

Equal Probabilities Tree Utilities

Implied Trinomial Tree Utilities

Hull-White Utilities

Tree Manipulation

Derivatives Pricing Options

Pricing and Sensitivity Using Black-Scholes Option

Pricing Model

................................ 5-11

................................. 5-11

................................... 5-12

................... 5-10

.................... 5-10

........................ 5-12

ix

Page 10

Pricing and Sensitivity Using Black Option Pricing

Model

Pricing and Sensitivity Using Longstaff-Schwartz

Option Pricing Model

Pricing and Sensitivity Using Nengjiu Ju

Approximation Model

Pricing and Sensitivity Using Role-Geske-Whaley

Option Pricing Model

Pricing and Sensitivity Using Bjerksund-Stensland

Option Pricing Model

Pricing and Sensitivity Using Stulz Option Pricing

Model

.......................................... 5-13

............................ 5-14

............................ 5-14

............................ 5-15

............................ 5-15

.......................................... 5-16

Instrument Portfolio Handling

Financial Object Structures

Interest Term Structure

Date

Graphical Display

.............................................. 5-18

............................ 5-18

................................. 5-19

...................... 5-16

........................ 5-18

x Contents

Page 11

Functions — Alphabetical List

6

Derivatives Pricing Options

A

Pricing Options Structure .......................... A-2

Introduction

Default Structure

...................................... A-2

................................. A-2

Customizing the Structure

......................... A-5

Bibliography

B

Black-Derman-Toy (BDT) Modeling ................. B-2

Heath-Jarrow-Morton (HJM) Modeling

Hull-White (HW) and Bla ck-Karasinski (BK)

Modeling

Cox-Ross-Rubinstein (CRR) Modeling

Implied Trinomial Tree (ITT) Modeling

Equal Probabilities Tree (EQP) Modeling

....................................... B-4

.............. B-3

............... B-5

.............. B-6

............ B-7

Closed-Form Solutions Modeling

Financial Derivatives

.............................. B-9

.................... B-8

xi

Page 12

Examples

C

Instrument Portfolio Examples ..................... C-2

Interest Rate Environment Examples

HJM Examples

Volatility Modeling

BDT Examples

Rate Specification Creation

Time Specification

Sensitivity

Treeviewer Examples

Creating Equity Derivatives

Pricing Equity Derivatives

.................................... C-2

................................ C-2

..................................... C-2

........................ C-3

................................. C-3

........................................ C-3

.............................. C-3

........................ C-3

......................... C-4

............... C-2

xii Contents

Closed-Form Solution Examples

Hedging Examples

Hedging with Co n strained Portfolios

................................. C-4

.................... C-4

................ C-4

Page 13

Glossary

Index

xiii

Page 14

xiv Contents

Page 15

Getting Started

• “Product Overview” on page 1-2

• “Expected Background” on p age 1-4

• “Portfolio Creation” on p age 1-5

• “Portfolio Management” on page 1-9

1

Page 16

1 Getting Started

Product Overview

Introduction

Financial D erivative s Toolbox™ software provides components for analyzing

individual derivative instruments and portfolios containing several types of

interest-rate-based and equity-based financial instruments.

Interest-Rate-Based Derivatives

The toolbox provides functionality that supports the creation and management

of these interest-rate-based instruments:

In this section...

“Introduction” on page 1-2

“Interest-Rate-Based Derivatives” on page 1-2

“Equity-Based Derivatives” on page 1-3

1-2

• Bonds

• Bond options (puts and calls)

• Caps

• Fixed-rate notes

• Floating-rate notes

• Floors

• Swaps

• Swaption

• CallableandPuttablebonds

Additionally, the toolbox provides functions to create arbitrary cash flow

instruments. The toolbox provides pricing and sensitivity routines for these

instruments. See “Computing Prices and Sensitivities Using the Interest-Rate

Term Structure” on page 2-30 or “Computing Prices and Sensitivities Using

Interest-Rate Tree Models” on pag e 2-62 for information.

Page 17

Product Overview

Equity-Based De

The toolbox also

derivatives, in

• Asian option s

• Barrier optio

• Compound opti

• Lookback opt

• Vanilla stoc

The toolbox

instrument

Using Tree

provides functions to create and manage various equity-based

cluding the following:

ns

ons

ions

k options (put and call options)

also provides pricing and sensitivity routines for these

s. (See “Computing Prices and Sensitivities for Equity Derivatives

s” on page 3-32.)

rivatives

1-3

Page 18

1 Getting Started

Expected Background

In general, this guide assumes experience working with financial derivatives

and some familiarity with the underlying models.

In designing Financial Derivatives Toolbox documentation, we assume your

title is similar to one of these:

• Analyst, quantitative analyst

• Risk manager

• Portfolio manager

• Fund manager, asset m anager

• Financial engineer

• Trader

• Student, professor, or other academic

1-4

We also assum e your background, education, training, and responsibilities

match some aspects of this profile:

• Finance, economics, perhaps accounting

• Engineering, mathematics, physics, other quantitative sciences

• Bachelor’s degree minimum; MS or MBA likely; Ph.D. perhaps; CFA

• Comfortable with probability theory, statistics, and algebra

• Understand linear or m atrix algebra, calculus, and differential equations

• Previously done traditional programming(C,Fortran,etc.)

• Responsible for instruments or analyses involving large sums of money

• Perhaps new to MATLAB

Page 19

Portfolio Creation

In this section...

“Introduction” on page 1-5

“Interest-Rate-Based Derivatives” on page 1-5

“Equity Derivatives” on page 1-6

“Adding Instruments to an Existing Portfolio” on page 1-7

Introduction

The instadd function creates a set of instruments (portfolio) or adds

instruments to an existing instrument collection. The

specifies the type of the investment instrument. For interest-rate-based

derivatives, the types are:

Floor,andSwap. For equity derivatives, the types are Asian, Barrier,

Compound, Lookback,andOptStock.

Portfolio Creation

TypeString argument

Bond, OptBond, CashFlow, Fixed, Float, Cap,

The input arguments following

investment instrument. Thus, the

remainder of the input arguments is interpreted. For example,

thetypestring

InstSet = instadd('Bond', CouponRate, Settle, Maturity, Period,

Basis, EndMonthRule, IssueDate, FirstCouponDate, LastCouponDate,

StartDate, Face)

Bond creates a portfolio of bond instruments.

TypeString are specific to the type of

TypeString argument determines how the

instadd with

Interest-Rate-Based Derivatives

In addition to the bond instrument already described, the toolbox can create

portfolios containing the following set of interest-rate-based derivatives:

• Bond option

InstSet = instadd('OptBond', BondIndex, OptSpec, Strike, ExerciseDates, AmericanOpt)

• Arbitrary cash flow instrument

InstSet = instadd('CashFlow', CFlowAmounts, CFlowDates, Settle, Basis)

1-5

Page 20

1 Getting Started

• Fixed-rate note instrument

InstSet = instadd('Fixed', CouponRate, Settle, Maturity, FixedReset, Basis, Principal)

• Floating-rate note instrument

InstSet = instadd('Float', Spread, Settle, Maturity, FloatReset, Basis, Principal)

• Cap instrument

InstSet = instadd('Cap', Strike, Settle, Maturity, CapReset, Basis, Principal)

• Floor instrument

InstSet = instadd('Floor', Strike, Settle, Maturity, FloorReset, Basis, Principal)

• Swap instrument

InstSet = instadd('Swap', LegRate, Settle, Maturity, LegReset, Basis, Principal, LegType)

• Swaption instrument

1-6

InstSet = instadd('Swaption', OptSpec, Strike, ExerciseDates, Spread, ...

Settle, Maturity, AmericanOpt, SwapReset, Basis, Principal)

• Bond with embedded option instrument

InstSet = instadd('OptEmBond', CouponRate, Settle, Maturity, OptSpec, Strike, ...

ExerciseDates, 'AmericanOpt', AmericanOpt, 'Period', Period,'Basis', Basis, ...

'EndMonthRule', EndMonthRule,'Face',Face,'IssueDate', IssueDate, 'FirstCouponDate', ...

FirstCouponDate, 'LastCouponDate', LastCouponDate,'StartDate', StartDate)

Equity Derivatives

The toolbox can create portfolios con taining the following set of equity

derivatives:

• Asian instrument

InstSet = instadd('Asian', OptSpec, Strike, Settle, ExerciseDates, AmericanOpt, ...

AvgType, AvgPrice, AvgDate)

• Barrier instrument

Page 21

Portfolio Creation

InstSet = instadd('Barrier', OptSpec, Strike, Settle, ExerciseDates, AmericanOpt, ...

BarrierType, Barrier, Rebate)

• Compound instrument

InstSet = instadd('Compound', UOptSpec, UStrike, USettle, UExerciseDates, UAmericanOpt, ...

COptSpec, CStrike, CSettle, CExerciseDates, CAmericanOpt)

• Lookback instrument

InstSet = instadd('Lookback', OptSpec, Strike, Settle, ExerciseDates, AmericanOpt)

• Stock option instrument

InstSet = instadd('OptStock', OptSpec, Strike, Settle, Maturity, AmericanOpt)

Adding Instruments to an Existing Portfolio

To use the instadd function to add additional instruments to an existing

instrument portfolio, provide the name of an existing portfolio as the first

argument to the

instadd function.

Consider, for example, a portfolio containing two cap instruments only:

Strike = [0.06; 0.07];

Settle = '08-Feb-2000';

Maturity = '15-Jan-2003';

Port_1 = instadd('Cap', Strike, Settle, Maturity);

These commands create a portfolio containing two cap instruments with the

same settlement and maturity dates, but with different strikes. In general,

the input arguments describing an instrument can be either a scalar, or

a number of instruments (

NumInst)-by-1 vector in which each element

corresponds to an instrument. Using a scalar assigns the same value to all

instruments passed in the call to

Use the

instdisp command to display the contents of the instrument set:

instdisp(Port_1)

Index Type Strike Settl e Maturity CapReset Basis Principal

instadd.

1-7

Page 22

1 Getting Started

1 Cap 0.06 08-Feb-2000 15-Jan-2003 1 0 100

2 Cap 0.07 08-Feb-2000 15-Jan-2003 1 0 100

Now add a single bond instrument to Port_1. The bond has a 4.0% coupon

and the same settlement and maturity dates as the cap instruments.

CouponRate = 0.04;

Port_1 = instadd(Port_1, 'Bond', CouponRate, Settle, Maturity);

Use in stdi sp again to see the resulting instrument set:

instdisp(Port_1)

Index Type Strike Settle Maturity CapReset Basis Principal

1 Cap 0.06 08-Feb-2000 15-Jan-2003 1 0 100

2 Cap 0.07 08-Feb-2000 15-Jan-2003 1 0 100

Index Type CouponRate Settle Maturity Period Basis EndMonthRule IssueDate ... Face

3 Bond 0.04 08-Feb-2000 15-Jan-2003 2 0 1 NaN ... 100

1-8

Page 23

Portfolio Management

In this section...

“Instrument Constructors” on page 1-9

“Creating New Instruments or Properties” on page 1-10

“Searching or Subsetting a Portfolio” on page 1-12

Instrument Constructors

The toolbox provides constructors for the most common financial instruments.

A constructor is a function that builds a structure dedicated to a certain type

of object; in this toolbox, an object is a type of market instrument.

The instruments and their constructors in this toolbox are listed below.

Instrument Constructor

Asian option

Barrier option

Bond

Bond option

Arbitrary cash flow

Compound option

Fixed-rate note

Floating-rate note

Cap

Floor

Lookback option

Stock option

Swap

Swaption

Portfolio Management

instasian

instbarrier

instbond

instoptbnd

instcf

instcompound

instfixed

instfloat

instcap

instfloor

instlookback

instoptstock

instswap

instswaption

1-9

Page 24

1 Getting Started

Each instrument has parameters (fields) that describe the instrument. The

toolbox functions let you do the following:

• Create an instrum ent or portfolio of instruments.

• Enumerate stored instrument types and infor mation fields.

• Enumerate instrument field data.

• Search and select instruments.

The instrument structure consists of various fields according to instrument

type. A field is an element of data associated with the instrument. For

example, a bond instrument contains the fields

Maturity,andsoon. Additionally,eachinstrument has a field that identifies

the investment type (bond, cap, floor, and so on).

In reality, the set of parameters for each instrument is not fixed. You have

the ability to add additional parameters. These additional fields are ignored

by the toolbox functions. They may be used to attach additional information

to each instrument, such as a n internal code describing the bond.

CouponRate, Settle,

1-10

Parameters not specified when creating an instrument default to

in general, means that the functions using the instrument set (such as

intenvprice or hjmprice ) will use default values. At the time of pricing,

an error occurs if any of the required fields is missing, such as

cap or

CouponRate in a bon d.

NaN,which,

Strike in a

Creating New Instruments or Properties

Use the instaddfield function to create a kind of instrument or to add new

properties to the i ns trume n ts in an existing instrument col le ction.

To create a kind of instrument with

arguments:

•

Type

• FieldName

• Data

instaddfield, you must specify three

Page 25

Portfolio Management

Type defines the type of the new instrument, for example, Future. FieldName

names the fields uniquely associated with the new type of instrument. Data

contains the data for the fields of the new instrument.

An optional fourth argument is

ClassList. ClassList specifies the da ta

types of the contents of each unique field for the new instrument.

Use either syntax to create a kind of instrument using

InstSet = instaddfield('FieldName', FieldList, 'Data', DataList,...

'Type', TypeString)

InstSet = instaddfield('FieldName', FieldList, 'FieldClass',...

ClassList, 'Data' , Dat aList, 'Type', TypeString)

instaddfield:

To add new instruments to an existing set, use:

InstSetNew = instaddfield(InstSetOld, 'FieldName', FieldList,...

'Data', DataList, 'Type', TypeString)

As an example, consider a futures contract with a delivery date of July 1 5,

2000, and a quoted price of $104.40. Since Financial Derivatives Toolbox

software does not directly support this instrument, you must create it using

the function

• Type:

instaddfield. Use these parameters to create instruments:

Future

• Field names: Delivery and Price

• Data: Delivery is July 15, 2000, and price is $104.40.

Enter the data into MATLAB

®

software:

Type = 'Future';

FieldName = {'Delivery', 'Price'};

Data = {'Jul-15-2000', 104.4};

Finally, create the portfolio with a single instrument:

Port = instaddfield('Type', Type, 'FieldName', FieldName,...

'Data', Data);

1-11

Page 26

1 Getting Started

Now use the function instdisp to examine the resulting single-instrument

portfolio:

instdisp(Port)

Index Type Delivery Price

1 Future Jul-15-2000 104.4

Because your portfolio Port has the same structure as those created using

the function

portfolios created using

cap instruments to

Strike = [0.06; 0.07];

Settle = '08-Feb-2000';

Maturity = '15-Jan-2003';

Port = instadd(Port, 'C ap', Strike, Settle, Maturity);

instadd, y ou can combine portfolios created using instadd with

instaddfield. For example, you can now add two

Port with instadd.

View the resulting portfolio using instdisp.

1-12

instdisp(Port)

Index Type Delivery Price

1 Future 15-Jul-2000 104.4

Index Type Strike Settl e Maturity CapReset Basis Principal

2 Cap 0.06 08-Feb-2000 15-Jan-2003 1 0 100

3 Cap 0.07 08-Feb-2000 15-Jan-2003 1 0 100

Searching or Subsetting a Por tfolio

Financial Derivatives Toolbox software provides functions that enable y ou to:

• Find specific instruments within a portfolio.

• Create a subse t portfolio consisting of instruments selected from a larger

portfolio.

The

instfind function finds instruments with a specific parameter value;

it returns an instrument index (position) in a large instrument set. The

instselect function, on the other hand, subsets a large instrument set into

Page 27

Portfolio Management

a portfolio of instruments w ith designated parameter values; it returns an

instrument set (portfolio) rather than an index.

instfind

The general syntax for instfind is

IndexMatch = instfind(InstSet, 'FieldName', FieldList, 'Data',...

DataList, 'Index', IndexSet, 'Type', TypeList)

InstSet is the instrument set to search. Within InstSet instruments

categorized by type, each type can have different da ta fields. T he stored data

field is a row vector or string for each instrument.

The

FieldList, DataList,andTypeList arguments indicate v alues to

search for in the

set.

FieldList is a cell array of field name(s) specific to the instruments.

DataList is a cell array or matrix of acceptable values for the parameter(s)

specified in

DataList) parameters must appear tog ether or not at all.

FieldName, Data,andType data fields of the instrument

FieldList. FieldName and Data (consequently, Field List and

IndexSet is a vector of integer index(es) designating positions of instruments

in the instrument set to check for matches; the default is all indices available

in the instrument set.

instruments to match one of the

TypeList is a string or cell array of strings restricting

TypeList types; the default is all types in the

instrument set.

IndexMatch is a vector of positions of instruments matching the input

criteria. Instruments are returned in

Index,andType conditions are met. An instrument meets an individual

field condition if the stored

in the

DataList for that FieldName.

FieldName data matches any of the rows listed

instfind Examples. TheexamplesusetheprovidedMAT-file

The MAT-file contains an instrument set,

IndexMatch if all the FieldName, Data,

deriv.mat.

HJMInstSet, that contains eight

instruments of sev en types.

1-13

Page 28

1 Getting Started

load deriv.mat

instdisp(HJMInstSet)

Index Type CouponRate Settle Maturity Period Basis ... Name Quantity

1 Bond 0.04 01-Jan-2000 01-Jan-2003 1 NaN ... 4% bond 100

2 Bond 0.04 01-Jan-2000 01-Jan-2004 2 NaN ... 4% bond 50

Index Type UnderInd OptSpec Strike ExerciseDates AmericanOpt Name Quantity

3 OptBond 2 call 101 01-Jan-2003 NaN Option 101 -50

Index Type CouponRate Settle Maturity FixedReset Basis Principal Name Quantity

4 Fixed 0.04 01-Jan-2000 01-Jan-2003 1 NaN NaN 4% Fixed 80

Index Type Spread Settle Maturity FloatReset Basis Principal Name Quantity

5 Float 20 01-Jan-2000 01-Jan-2003 1 NaN NaN 20BP Float 8

Index Type Strike Settle Maturity CapReset Basis Principal Name Quantity

6 Cap 0.03 01-Jan-2000 01-Jan-2004 1 NaN NaN 3% Cap 30

1-14

Index Type Strike Settle Maturity FloorReset Basis Principal Name Quantity

7 Floor 0.03 01-Jan-2000 01-Jan-2004 1 NaN NaN 3% Floor 40

Index Type LegRate Settle Maturity LegReset Basis Principal LegType Name Quantity

8 Swap [0.06 20] 01-Jan-2000 01-Jan-2003 [1 1] NaN NaN [NaN] 6%/20BP Swap 10

Find all instruments with a maturity date of January 01, 2003.

Mat2003 = ...

instfind(HJMInstSet,'FieldName','Maturity','Data','01-Jan-2003')

Mat2003 =

1

4

5

8

Find all cap and floor instruments with a maturity date of January 01, 2004.

Page 29

Portfolio Management

CapFloor = instfind(HJMInstSet,...

'FieldName','Maturity','Data','01-Jan-2004', 'Type',...

{'Cap';'Floor'})

CapFloor =

6

7

Find all instruments where the portfolio is long or short a quantity of 50.

Pos50 = instfind(HJMInstSet,'FieldName',...

'Quantity','Data',{'50';'-50'})

Pos50 =

2

3

instselect

The syntax for instselect is the same syntax as for instfind. ins tsel ect

returns a full portfolio instead of indexes into the original portfolio. Compare

the values returned by both functions by calling them equivalently.

Previously you used

maturity date of January 01, 2003.

Mat2003 = ...

instfind(HJMInstSet,'FieldName','Maturity','Data','01-Jan-2003')

Mat2003 =

1

4

5

8

Now use the same instrument set as a starting point, but execute the

instselect function instead, to produce a new instrument set matching

the identical search criteria.

instfind to find all instruments in HJMInstSet with a

1-15

Page 30

1 Getting Started

Index Type CouponRate Settle Maturity Period Basis ......... Name Quantity

1 Bond 0.04 01-Jan-2000 01-Jan-2003 1 NaN ......... 4% bond 100

Index Type CouponRate Settle Maturity FixedReset Basis Principal Name Quantity

2 Fixed 0.04 01-Jan-2000 01-Jan-2003 1 NaN NaN 4% Fixed 80

Index Type Spread Settle Maturity FloatReset Basis Principal Name Quantity

3 Float 20 01-Jan-2000 01-Jan-2003 1 NaN NaN 20BP Float 8

Index Type LegRate Settle Maturity LegReset Basis Principal LegType Name Quantity

4 Swap [0.06 20] 01-Jan-2000 01-Jan-2003 [1 1] NaN NaN [NaN] 6%/20BP Swap 10

Select2003 = ...

instselect(HJMInstSet,'FieldName','Maturity','Data',...

'01-Jan-2003')

instdisp(Select2003)

1-16

instselect Examples. These examples use the portfolio ExampleInst

provided with the MAT-file InstSetExamples.mat.

load InstSetExamples.mat

instdisp(ExampleInst)

Index Type Strike Price Opt Contracts

1 Option 95 12.2 Call 0

2 Option 100 9.2 Call 0

3 Option 105 6.8 Call 1000

Index Type Delivery F Contracts

4 Futures 01-Jul-1999 104.4 -1000

Index Type Strike Price Opt Contracts

5 Option 105 7.4 Put -1000

6 Option 95 2.9 Put 0

Index Type Price Maturity Contracts

7 TBill 99 01-Jul-1999 6

Page 31

Portfolio Management

The instrument set contains 3 instrument types: Option, Futures,andTBill.

Use

instselect to make a new instrument set containing only options struck

at

95. In other words, select all instruments containing the field Strike and

with the data value for that field equal to

InstSet = instselect(ExampleInst,'FieldName','Str ike','Data',95);

instdisp(InstSet)

Index Type Strike Price Opt Contracts

1 Option 95 12.2 Call 0

2 Option 95 2.9 Put 0

95.

You can use all the various forms of instselect and instfind to locate

specific instruments within this instrument set.

1-17

Page 32

1 Getting Started

1-18

Page 33

Interest-Rate Derivatives

• “Understanding Interest-Rate Derivative Instruments” on page 2-2

• “Overview of Interest-Rate Models” on page 2-10

• “Understanding the Interest-Rate Term Structure” on page 2-15

• “Computing Prices and Sensitivities Using the Interest-Rate Term

Structure” on page 2-30

• “Understanding Interest-Rate Tree Models” on page 2-35

• “Computing Prices and Sensitiv ities Using Interest-Rate Tree M odels”

on page 2-62

2

• “Interest-Rate Derivatives Using Closed Form Solutions” on page 2-74

• “Graphical Representation of Trees” on page 2-75

Page 34

2 Interest-Rate Derivatives

Understanding Interest-Rate Derivative Instruments

In this section...

“Introduction” on page 2-2

“Bond” on page 2-3

“Bond Options” on page 2-4

“Bond with Embedded Options” on page 2-5

“Fixed-Rate Note” on page 2-5

“Floating-Rate Note” on page 2-6

“Cap” on page 2-7

“Floor” on page 2 -7

“Swap” on page 2-8

“Swaption” on page 2-9

2-2

Introduction

Financial Derivatives Toolbox software extends the Financial Toolbox™

capabilities in the areas of fixed-income derivatives and securities contingent

on interest rates. The toolbox provides components for analyzing individual

financial derivative instruments and portfolios. Specifically, it provides

functions for calculating prices and sensitivities, for hedging, and for

visualizing results.

The toolbox provides a set of functions that perform computations on portfolios

containing the following interest-rate based financial instruments:

• Bond

• Bond options

• Bond with embedded options

• Fixed-rate note

• Floating-rate note

• Cap

Page 35

Understanding Interest-Rate Derivative Instruments

• Floor

• Swap

• Swaption

Additionally, Financial Derivatives Toolbox software lets you create and

price arbitrary cash flow instruments based on zero-coupon bonds or on any

supported interest-rate model. For more information, see “Interest-Rate

Modeling” on page 2-10.

Bond

A bond is a long-term debt security with a preset interest-rate and maturity.

At maturity you must pay the principal and interest.

The price or value of a bond is determined by discounting the expected cash

flows of the bond to the present, u sing the appropriate discount rate. The

following equation represents the relationship of the expected cash flows

and discount rate:

t

2

⎡

⎛

11

−+

⎢

⎜

C

⎝

B

⎢

0

=

⎢

2

⎢

⎢

⎣

−

⎤

r

⎞

⎥

⎟

2

⎠

r

2

⎥

⎥

⎥

⎥

⎦

F

+

⎛

1

⎜

⎝

t

2

r

⎞

+

⎟

2

⎠

where:

B

is the bond value.

0

C is the annual coupon payment.

F isthefacevalueofthebond.

r is the required return on the bond.

t is the number o f years remaining until maturity.

Financial Derivatives Tool box supports the following for pric ing and

specifying a bond.

2-3

Page 36

2 Interest-Rate Derivatives

Function Purpose

bondbybdt

bondbyhw

bondbybk

bondbyhjm

bondbyzero

instbond

Price a bond using a BDT interest-rate tree.

Price a bond using an HW interest-rate tree.

Price a bond using a BK interest-rate tree.

Price a bond using an HJM interest-rate tree.

Price a bond using a set of zero curves.

Construct a bond instrument.

Bond Options

Financial Derivatives Toolbox software supports three types of put and call

options on bonds:

• American option: An option that you exercise any time u ntil i ts expiration

date.

2-4

• European option: An option that you exercise only on its expiration date.

• Bermuda option: A Bermuda option resembles a hybrid of American and

European options. You can exercise it on predetermined dates only, usually

monthly.

Financial Derivatives Tool box supports the following for pric ing and

specifying a bond option.

Function Purpose

optbndbybdt

Price a bond option price using a BDT

interest-rate tree.

optbndbyhw

Price a bond option price u sin g an HW

interest-rate tree.

optbndbybk

Price a bond option price using a BK

interest-rate tree.

optbndbyhjm

Price a bond option price us ing an HJM

interest-rate tree.

instoptbnd

Construct a bond option instrument.

Page 37

Understanding Interest-Rate Derivative Instruments

Bond with Embedd

A bond with embed

bond at a predete

Toolbox softwa

puttable bonds

The pricing fo

• For a callabl

• For a puttab

Financial

specifyin

Function Purpose

optembndbybdt

optembndbyhw

optem

optembndbyhjm

instoptembnd

Derivatives Toolbox supports the following for pricing and

g a bond with embedded options.

bndbybk

ded options allows the issuer to buy back or redeem the

rmined price at specified future dates. Financial Derivatives

re supports American, European, and Bermuda callable and

.

r a bond with embedded options is as follows:

ebond:

le bond:

ed Options

PriceCallableBond = BondPrice - BondCallOption

PricePuttableBond = PriceBond + PricePutOption

Price a bond with emb edded options using a

BDT interest-rate tree .

Price a

HW inte

Price a bond with emb edded options using a

BK interest-rate tree.

Price a bond with embedded options using an

HJM interest-rate tree.

Construct a bond-with-embedded-options

instrument.

bond with embedded options using an

rest rate tree.

xed-Rate Note

Fi

ixed-rate note is a long-term debt security with a preset interest rate

A f

nd. At maturity the interest must be paid. The principal may or may not

a

e paid at maturity. In Financial Derivatives Toolbox software, the principal

b

salwayspaidatmaturity.

i

Financial Derivatives Tool box supports the following for pric ing and

specifying a fixed-rate note.

2-5

Page 38

2 Interest-Rate Derivatives

Function Purpose

fixedbybdt

Price a fixed-rate note using a BDT

interest-rate tree.

fixedbyhw

Price a fixed-rate note using an HW

interest-rate tree.

fixedbybk

Price a fixed-rate note us in g a BK interest-rate

tree.

fixedbyhjm

Price a fixed-rate note using an HJM

interest-rate tree.

fixedbyzero

Price a fixed-rate note using a set of zero

curves.

instfixed

Construct a fixed-rate instrument.

Floating-Rate Note

A floating-rate note is a security like a bond, but the interest rate of the note

is reset periodically, relative to a reference index rate, to reflect fluctuations

in market interest rates.

2-6

Financial Derivatives Tool box supports the following for pric ing and

specifying a floating-rate note.

Function Purpose

floatbybdt

Priceafloating-ratenoteusingaBDT

interest-rate tree.

floatbyhw

Priceafloating-ratenoteusinganHW

interest-rate tree.

floatbybk

Price a floating-rate note using a BK

interest-rate tree.

floatbyhjm

Priceafloating-ratenoteusinganHJM

interest-rate tree.

floatbyzero

Price a floating-rate note using a set of zero

curves.

instfloat

Construct a floating-rate note instrument.

Page 39

Cap

A cap is a contrac

rate to be paid by

The payoff for a

max( , )CurrentRate CapRate− 0

t that includes a guarantee that sets the maximum interest

the holder, based on an otherwise floating interest rate.

cap is:

Understanding Interest-Rate Derivative Instruments

Financial De

specifying a

Function Purpose

capbybdt

capbyhw

capbybk

capbyhjm

capbyblk

cap

inst

rivatives Toolbox supports the following for pricing and

cap instrument.

Price a cap instrument using a BDT

interest-rate tree.

Price a ca

interest

Price a cap instrument using a BK interest-rate

tree.

Price a cap instrument using an HJM

interest-rate tree.

Price

pric

Cons

p instrument using an HW

-rate tree.

a cap instrument using the Black option

ing model.

truct a cap instrument.

Floor

A floor isacontractthatincludesaguarantee setting the minimum interest

rate to be received by the holder, basedonanotherwisefloatinginterest

rate. T he payoff for a floor is:

max( , )FloorRate CurrentRate− 0

Financial Derivatives Tool box supports the following for pric ing and

specifying a floor instrument.

2-7

Page 40

2 Interest-Rate Derivatives

Function Purpose

floorbybdt

Price a floor instrument using a BDT

interest-rate tree.

floorbyhw

Price a floor instrument using an HW

interest-rate tree.

floorbybk

Price a floor instrument using a BK

interest-rate tree.

floorbyhjm

Price a floor instrument using an HJM

interest-rate tree.

instfloor

Construct a floor instrument.

Swap

A swap is contract between two parties obligating the parties to exchange

future cash flows. This toolbox version handles only the vanilla swap, which

is composed of a floating-rate leg and a fixed-rate leg.

2-8

Financial Derivatives Tool box supports the following for pric ing and

specifying a swap instrument.

Function Purpose

swapbybdt

Price a swap instrument using a BDT

interest-rate tree.

swapbyhw

Price a swap instrument usi n g an HW

interest-rate tree.

swapbybk

Price a swap instrument using a BK

interest-rate tree.

swapbyhjm

Price a swap instrument using an HJM

interest-rate tree.

swapbyzero

Price a swap instrument using a set of zero

curves.

instswap

Construct a swap instrument.

Page 41

Understanding Interest-Rate Derivative Instruments

Swaption

A swaption is an option to enter into an interest-rate swap contract. A call

swaption allows the option buyer to enter into an interest-rate swap where the

buyer of the option pays the fixed-rate and receives the floating-rate. A put

swaption allows the option buyer to enter into an interest-rate swap w here

the buyer of the option receives the fixed-rate and pays the floating-rate.

Financial Derivatives Tool box supports the following for pric ing and

specifying a swaption instrument.

Function Purpose

swaptionby

swaptionbyhw

swaptionbybk

swapti

instswaption

bdt

onbyhjm

Price a swaption instrument using a BDT

interest-rate tree.

Price a swaption instrument using an HW

interest-rate tree.

Price a sw

interes

aption instrument using a BK

t-rate tree.

Price a swaption instrument using an H JM

interest-rate tree.

Construct a swaption instrument.

2-9

Page 42

2 Interest-Rate Derivatives

Overview of Interest-Rate Models

In this section...

“Interest-Rate Modeling” on page 2-10

“Rate and Price Trees” on page 2-11

“Viewing Rate or Price Movement with This Toolbox” on page 2-12

Interest-Rate Modeling

Financial Derivatives Toolbox software computes prices and sensitivities of

interest-rate contingent claims based on several methods of modeling changes

in interest rates over time:

• The interest-rate term structure

Thismodelusessetsofzero-couponbonds to predict changes in interest

rates.

2-10

• Heath-Jarrow-Morton (HJM) model

The HJM model considers a given initial term structure of interest

rates and a specification of the volatility of forward rates to build a tree

representing the evolution of the interest rates, based on a statistical

process.

• Black-Derman-Toy (BDT) model

In the BDT model, all security prices and rates depend on the short rate

(annualized 1-period interest rate). The model uses long rates and their

volatilities to construct a tree of possiblefutureshortrates. Theresulting

tree can then be used to determine the v alue of interest-rate sensitive

securities from this tree.

• Hull-White (HW) model

The Hull-White model incorporates the initial term s tructure of interest

rates and the volatility term structure to build a trinomial recombining tree

of short rates. The resulting tree is used to value interest-rate d ependent

securities. The implementation of the HW model in Financial Derivatives

Toolbox software is limited to one factor.

• Black-Karasinski (BK) model

Page 43

Overview of Interest-Rate Models

The BK model is a sing le-factor, log-normal version of the HW model.

For detailed information about interest-rate models, see:

• “Computing Prices and Sensitivities Using the Interest-Rate Term

Structure” on page 2-30 for a discussion of price a nd sensitivity based on

portfolios of ze ro-coupo n bonds

• “Computing Prices and Sensitivities Using Interest-Rate Tree Models” on

page 2-62 for a discussion of price and sensitivity based on the HJM and

BDT interest-rate models

Note Historically, the initial version of Financial Derivatives Toolbox

software provided only the HJM interest-rate model. A later version added

the BDT model. The current versionaddsboththeHWandBKmodels.

This chapter provides extensive examples of using the HJM and BDT

models to compute prices and sensitivities of interest-rate based financial

derivatives.

The HW and BK tree structures are similar to the BDT tree structure.

To avoid needless repetition throughout this chapter, documentation is

provided only where significant deviations from the BDT structure exist.

Specifically, “HW and BK Tree Structures” on page 2-57 explains the few

noteworthy differences among the various formats.

If you need more detailed information about functions that use the HW and

BK tree structures, see Chapter 5, “Function Reference”, which provides

extensive reference information for all functions that compose this toolbox.

Rate and Price Trees

The interest-rate or price trees supported in this toolbox can be either

binomial (two branches per node) or trinomial (3 branches per node).

Typically, binomial trees assume that u nderlying interest rates or p rices can

only either increase or decrease a t each node. Trinomial trees allow for a more

complex movement of rates or prices. With trinomial trees the movement

of rates or prices at each node is unrestricted (for example, up-up-up or

unchanged-down-down).

2-11

Page 44

2 Interest-Rate Derivatives

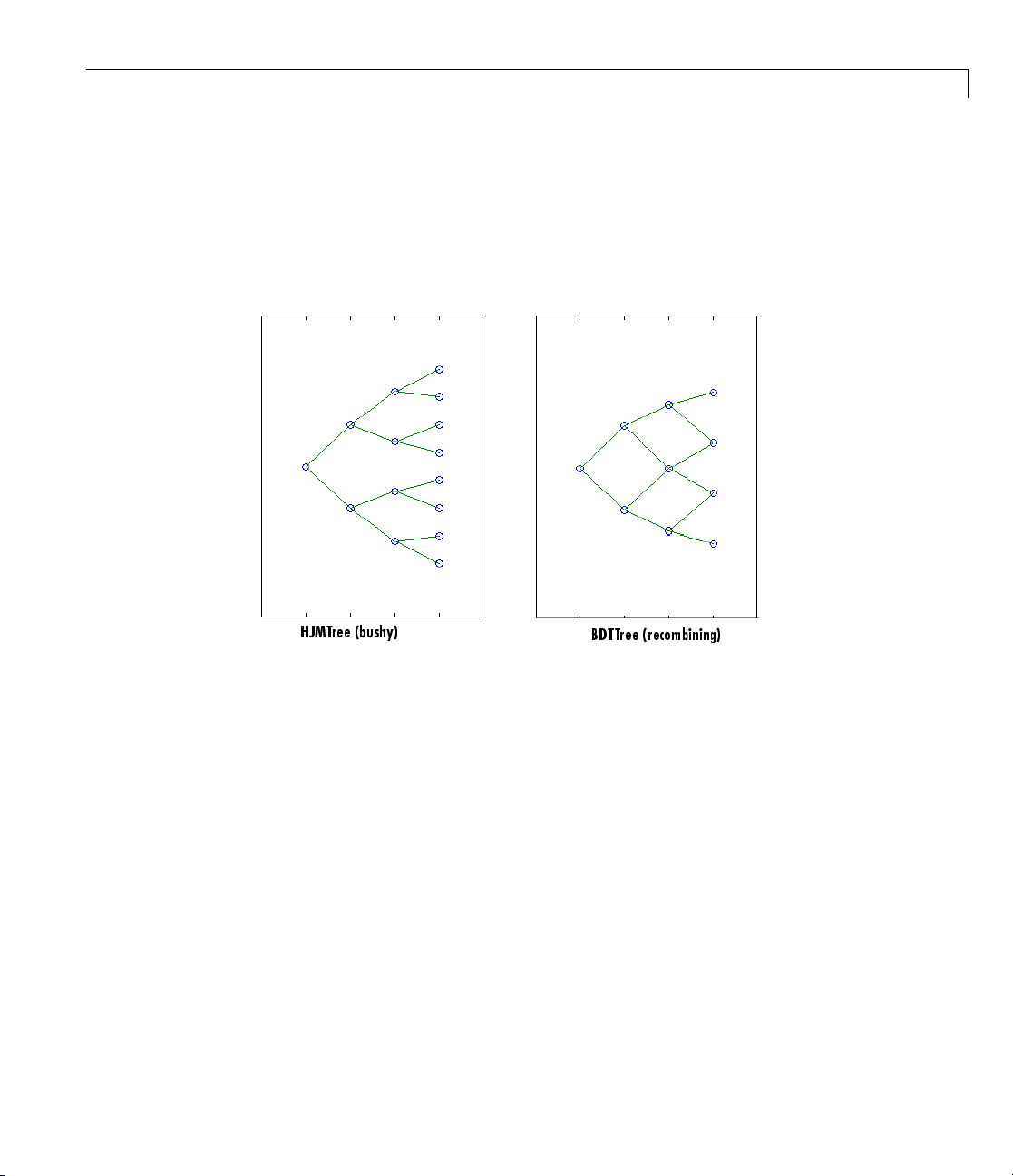

Types of Trees

Financial Derivatives Toolbox trees can be classified as bushy or recombining.

A bushy tree is a tree in which the number of branches increases exponentially

relative to observation times; branches never recombine. In this context,

a recombining tree is the opposite of a bushy tree. A recombining tree has

branches that recombine over time. From any given node, the node reached

bytakingthepathup-downisthesamenodereachedbytakingthepath

down-up. A bushy tree and a recombining binomial tree are illustrated next.

2-12

In this toolbox the Heath-Jarrow-Morton model works with bushy trees.

The Black-Derman-Toy model, on the other hand, works with recombining

binomial trees.

The other two interest rate models supported in this toolbox, Hull-White and

Black-Karasinski, work with recombining trinomial trees.

Viewing Rate or Price Movement with This Toolbox

This toolbox provides the data file deriv.mat that contains four interest-rate

based trees:

•

HJMTree — A bushy binomial tree

BDTTree — A recombining binomial tree

•

Page 45

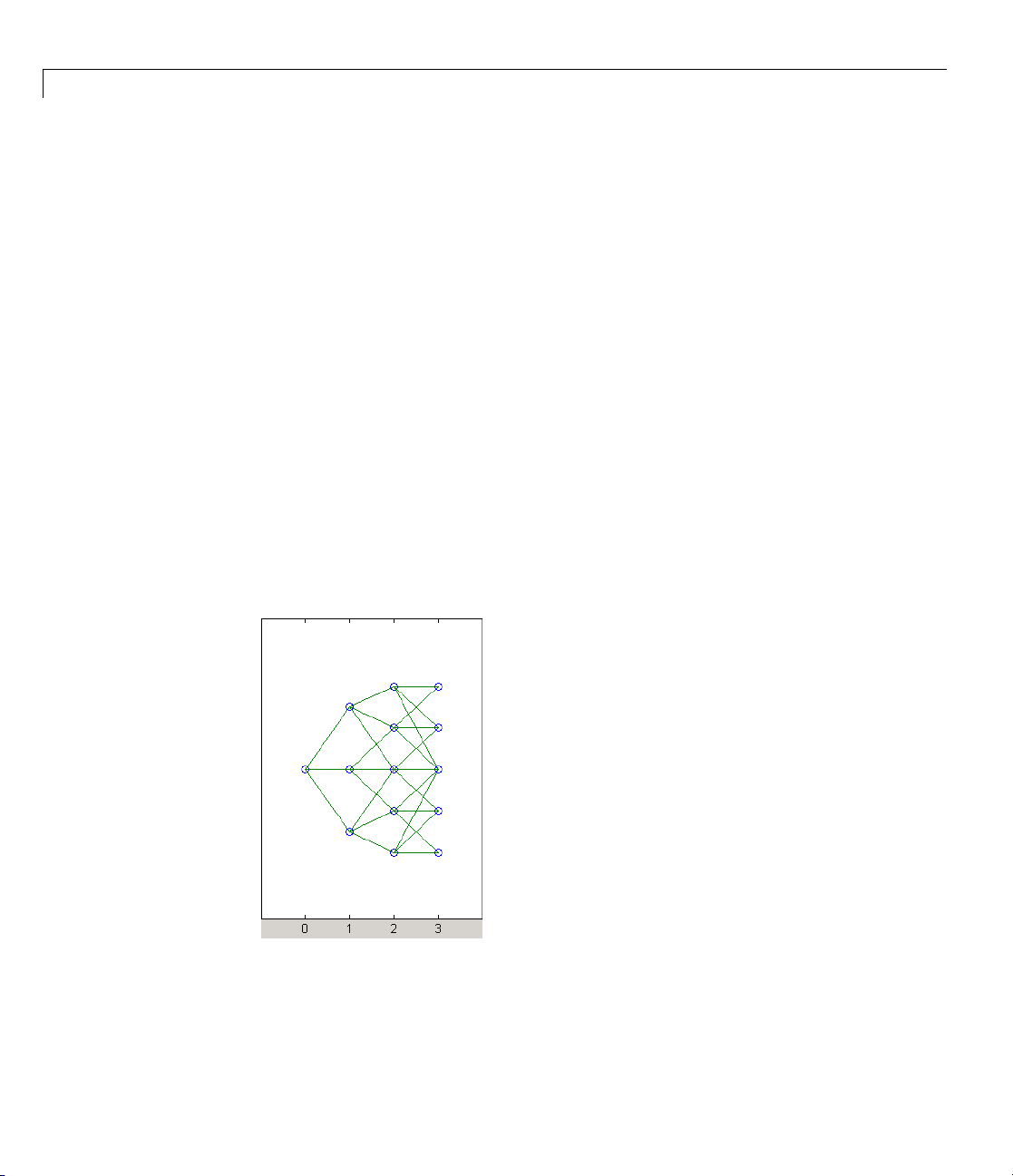

• HWTree and BKTree — Recombining trinomial trees

Overview of Interest-Rate Models

The toolbox also provides the

treeviewer function, w hich graphically displays

the shape and data of price, interest rate, and cash flow trees. Viewed with

treeviewer, the bushy shape of an HJM tree and the recombining shape

of a BDT tree are apparent.

With treeviewer, you can also see the recombining shape of HW and BK

trinomial trees.

2-13

Page 46

2 Interest-Rate Derivatives

2-14

Page 47

Understanding the Interest-Rate Term S tructure

Understanding the Interest-Rate Term Structure

In this section...

“Introduction” on page 2-15

“Interest Rates Versus Discount Factors” on page 2-15

“Interest-Rate Term Conversions” on page 2-20

“Functions That Model the Interest-Rate Term Structure” on page 2-24

Introduction

The interest-rate term structure represents the evolution of interest rates

through time. In MATLAB software, the interest-rate environment is

encapsulated in a structure called

structure holds all information required to completely identify the evolution

of interest rates. Several functions included in Financial Derivatives Toolbox

software are dedicated to the creating and managing of the

structure. Many others take this structure as an input argument representing

the evolution of interest rates.

RateSpec (rate specification). This

RateSpec

Before looking further at the

that provide key functio nality for working with interest rates:

opposite,

discount factors and interest rates. The third function,

the effect of term changes on the interest rates.

rate2disc,andratetimes. The first two functions map between

RateSpec structure, examine three functions

disc2rate,its

ratetimes,calculates

Interest Rates Versus Discount Factors

Discount factors are coefficients commonly used to find the current value

of future cash flows. As such, there is a direct mapping between the rate

applicable to a period of time, and the corresponding discount factor. The

function

interest rates. The function

rates applicable to a given term (period) into the corresponding discount

factors.

Calculating Discount Factors from Rates

As an example, consider these annualized zero-coupon bond rates.

disc2rate converts discount factors for a given term (period) into

rate2disc does the opposite; it converts interest

2-15

Page 48

2 Interest-Rate Derivatives

From To Rate

15 Feb 2000

15 Aug 2000

15 Feb 2000 15 Feb 2 001

15 Feb 2000

15 Aug 2001

15 Feb 2000 15 Feb 2 002

15 Feb 2000

15 Aug 2002

0.05

0.056

0.06

0.065

0.075

To calculate the discount factors corresponding to these interest rates, call

rate2disc using the syntax

Disc = rate2disc(Compounding, Rates, EndDates, StartDates,

ValuationDate)

where:

•

Compounding represents the frequency at which the zero rates are

compounded when annualized. For this example, assume this value to be 2.

2-16

•

Rates is a vector of annualized percentage rates representing the interest

rate applicable to each time interval.

•

EndDates is a vector of date s representing the end of each interest-rate

term (period).

•

StartDates is a vector of dates representing the beginning of each

interest-rate term.

•

ValuationDate is the date of observation for which the discount factors

are calculated. In this particular example, use February 15, 2000 as the

beginning date for all interest-rate terms.

Next, set the variables in MATLAB.

StartDates = ['15-Feb-2000'];

EndDates = ['15-Aug-2000'; '15-Feb-2001'; '15-Aug-2001';...

'15-Feb-2002'; '15-Aug-2002'];

Compounding = 2;

ValuationDate = ['15-Feb-2000'];

Page 49

Understanding the Interest-Rate Term S tructure

Rates = [0.05; 0.056; 0.06; 0.065; 0.075];

Finally, compute the discount factors.

Disc = rate2disc(Compounding, Rates, EndDates, StartDates,...

ValuationDate)

Disc =

0.9756

0.9463

0.9151

0.8799

0.8319

By adding a fourth column to the rates table (see “Calculating Discount

Factors from Rates” on page 2-15) to include the corresponding discounts, you

can see the evolution of the discount factors.

From To Rate Discount

15 Feb 2000

15 Aug 2000

15 Feb 2000 15 Feb 2001

15 Feb 2000

15 Aug 2001

15 Feb 2000 15 Feb 2002

15 Feb 2000

15 Aug 2002

0.05 0.9756

0.056 0.9463

0.06 0.9151

0.065 0.8799

0.075 0.8319

Optional Time Factor Outputs

The function rate2disc optionally returns two additional output argu ments:

EndTimes and StartTimes. These vectors of time factors represent the start

dates and end dates in discount periodic units. The scale of these units is

determined by the value of the input variable

To examine the time factor outputs, find the corresponding values in the

previous example.

[Disc, EndTimes, StartTimes] = rate2d isc(Compounding, Rates,...

Compounding.

2-17

Page 50

2 Interest-Rate Derivatives

EndDates, StartDates, ValuationDate);

Arrange the two v ectors into a single array for easier visualization.

Times = [StartTimes, EndTimes]

Times =

01

02

03

04

05

Because the valuation date is equal to the start date for all periods, the

StartTimes vector is composed of 0s. Also, since the value of Compounding is

2, the rates are compounded semiannually, which sets the units o f periodic

discount to 6 months. The vector

EndDates is composed of dates separated

by intervals of 6 months from the valuation date. This explains why the

EndTimes vector is a progression of integers from 1 to 5.

2-18

Alternative Syntax (rate2disc)

The function rate2disc also accommodates an alternative syntax that uses

periodic discount units instead of dates. Since the relationship between

discount factors and interes t rates is based on time periods and not on

absolute dates, this form of

periods. In this mode, the valuation date corresponds to 0, and the vectors

StartTimes and EndTimes are used as input arguments instead of their date

equivalents,

Disc = rate2disc(Compounding, Rates, EndTimes, StartTimes)

StartDates and EndDates.Thissyntaxforrate2disc is:

Using as input the StartTimes and EndTimes vectors computed previously,

you should obtain the previous results for the discount factors.

Disc = rate2disc(Compounding, Rates, EndTimes, StartTimes)

Disc =

0.9756

rate2disc allows you to work directly with time

Page 51

Understanding the Interest-Rate Term S tructure

0.9463

0.9151

0.8799

0.8319

Calculating Rates from Discounts

The function disc2rate is the complement to rate2disc.Itfindstherates

applicable to a set of compounding periods, given the discount factor in those

periods. The syntax for calling this func tion is:

Rates = disc2rate(Compounding, Disc, EndDates, StartDates,

ValuationDate)

Each argument to this function has the same meaning as in rate2disc.

Use the results found in the previous example to return the rate values you

started with.

Rates = disc2rate(Compounding, Disc, EndDates, StartDates,...

ValuationDate)

Rates =

0.0500

0.0560

0.0600

0.0650

0.0750

Alternative Syntax (disc2rate)

As in the case of r ate2disc, disc2rate optionally returns StartTimes and

EndTimes vectors representing the start and end times measured in discount

periodic units. Again, working with the same values as before, you should

obtain the same numbers.

[Rates, EndTimes, StartTimes] = disc2 rate(Compounding, Disc,...

EndDates, StartDates, ValuationDate);

Arrange the results in a matrix convenient to display.

2-19

Page 52

2 Interest-Rate Derivatives

Result = [StartTimes, EndTimes, Rates]

Result =

0 1.0000 0.0500

0 2.0000 0.0560

0 3.0000 0.0600

0 4.0000 0.0650

0 5.0000 0.0750

As with rate2disc, the relationship between rates and discount factors is

determined by time periods and not by absolute dates. Consequently, the

alternate syntax for

disc2rate uses time vectors instead of dates, and it

assumes that the valuation date corresponds to time = 0. The time-based

calling syntax is:

Rates = disc2rate(Compounding, Disc, EndTimes, StartTimes);

Using this syntax, you again ob tain the original values for the interest rates.

2-20

Rates = disc2rate(Compounding, Disc, EndTimes, StartTimes)

Rates =

0.0500

0.0560

0.0600

0.0650

0.0750

Interest-Rate Term Conversions

Interest rate evolution is typically represented by a set of interest rates,

including the beginning and end of the periods the rates apply to. Fo r zero

rates, the start dates are typically at the valuation date, with the rates

extending from that valuation date until their respective maturity dates.

Spot Curve to Forward Curve Conversion

Frequently, given a set of rates including their start and end dates, you may

be interested in finding the rates a pp licable to different term s (periods). This

Page 53

Understanding the Interest-Rate Term S tructure

problem is addressed by the function ratetimes. This function interpolates

the interest rates given a change in the original terms. The syntax for calling

ratetimes is

[Rates, EndTimes, StartTimes] = ratetimes(Compounding, RefRates,

RefEndDates, RefStartDates, EndDates, StartDates, ValuationDate);

where:

•

Compounding represents the frequency at which the zero rates are

compounded when annualized.

•

RefRates is a vector of initial interest rates representing the interest rates

applicable to the initial time intervals.

•

RefEndDates is a vector of dates representing the end of the interest rate

terms (period) applicable to

RefStartDates is a v ector of dates representing the beginning of the

•

interest rate terms applicable to

EndDates represent the maturity dates f or which the interest rates are

•

RefRates.

RefRates.

interpolated.

•

StartDates represent the starting dates for which the interest rates are

interpolated.

•

ValuationDate is the date of observation, from which the StartTimes and

EndTimes are calculated. This date represents time = 0.

The input arguments to this function can be separated into two groups:

• The initial or reference interest rates, including the terms for which they

are valid

• Terms for which the new interest rates are calculated

As an example, consider the rate table sp ecif ie d in “Calculating Discount

Factors from Rates” on page 2-15.

From To Rate

15 Feb 2000

15 Aug 2000

15 Feb 2000 15 Feb 2 001

0.05

0.056

2-21

Page 54

2 Interest-Rate Derivatives

From To Rate

15 Feb 2000

15 Aug 2001

15 Feb 2000 15 Feb 2 002

15 Feb 2000

15 Aug 2002

0.06

0.065

0.075

Assuming that the valuation date is February 15, 2000, these rates represent

zero-coupon bond rates with maturities specified in the seco nd column. Use

the function

ratetimes to calculate the forward rates at the beginning of all

periods implied in the table. Assume a compounding value of 2.

% Reference Rates.

RefStartDates = ['15-Feb-2000'];

RefEndDates = ['15-Aug-2000'; '15-Feb-2001'; '15-Aug-2001';...

'15-Feb-2002'; '15-Aug-2002'];

Compounding = 2;

ValuationDate = ['15-Feb-2000'];

RefRates = [0.05; 0.056; 0 .06 ; 0.065; 0.075];

2-22

% New Terms.

StartDates = ['15-Feb-2000'; '15-Aug-2000'; '15-Feb-2001';...

'15-Aug-2001'; '15-Feb-2002'];

EndDates = ['15-Aug-2000 '; '15-Feb-2001 '; '15-Aug-2001 ';...

'15-Feb-2002'; '15-Aug-2002'];

% Find the new rates.

Rates = ratetimes(Compounding, RefRates, RefEndDates,...

RefStartDates, EndDates, StartDates, ValuationDate)

Rates =

0.0500

0.0620

0.0680

0.0801

0.1155

Placethesevaluesinatablelikethepreviousone. Observetheevolutionof

the forward rates based on the initial zero-coupon rates.

Page 55

Understanding the Interest-Rate Term S tructure

From To Rate

15 Feb 2000

15 Aug 2000

15 Feb 2001

15 Aug 2001

15 Feb 2002

15 Aug 2000

15 Feb 2001

15 Aug 2001

15 Feb 2002

15 Aug 2002

0.0500

0.0620

0.0680

0.0801

0.1155

Alternative Syntax (ratetimes)

The ratetimes function can provide the additional output arguments

StartTimes and EndTimes, which represent the time factor equivalents to

the

StartDates and EndDates vectors. The ratetimes function uses time

factors for interpolating the rates. These time factors are calculated from

the start and end dates, and the valuation date, which are passed as input

arguments.

0 as the valuation date. This alternate syntax is:

ratetimes can also use time factors directly, assuming time =

[Rates, EndTimes, StartTimes] = rat etimes(Compounding, RefRates,

RefEndTimes, RefStartTimes, EndTimes, StartTimes);

Use this alternate version of ratetimes to find the forward rates again. In

this case, you must first find the time factors of the reference curve. Use

date2time for this.

RefEndTimes = date2time(ValuationDate, RefEndDates, Compounding)

RefEndTimes =

1

2

3

4

5

RefStartTimes = date2time(ValuationDate, RefStartDates,...

Compounding)

2-23

Page 56

2 Interest-Rate Derivatives

RefStartTimes =

0

These are the expected values, given semiannual discounts (as denoted by a

value of 2 in the variable

Compounding),enddatesseparatedby6-month

periods, and the valuation date equal to the d ate marking beginning of the

first period (time factor = 0).

Now call

[Rates, EndTimes, StartTimes] = ratet imes(Compounding,...

RefRates, RefEndTimes, RefStartTimes, EndTimes, StartTimes);

Rates =

EndTimes

ratetimes with the alternate syntax.

0.0500

0.0620

0.0680

0.0801

0.1155

and StartTimes have, as expected, the same values they had as

input arguments.

Times = [StartTimes, EndTimes]

Times =

01

12

23

34

45

2-24

Functions That Model the Interest-Rate Term Structure

Financial Derivatives Toolbox software includes a set of functions to

encapsulate interest-rate term information into a single structure. These

functions present a convenient way to package all information related to

Page 57

Understanding the Interest-Rate Term S tructure

interest-rate terms into a common format, and to resolve interdependencies

when one or more of the parameters is modified. For information, see:

• “Creating or Modifying (intenvset)” on page 2-25 for a discussion of how

to create or modify an interest-rate term structure (

intenvset function

RateSpec)usingthe

• “Obtaining Specific Properties (intenvget)” on page 2-27 for a discussion of

how to extract specific properties from a

RateSpec

Creating or Modifying (intenvset)

The main function to create o r modify an interest-rate term structure

RateSpec (rates specification) is in tenvset. If the first argument to this

function is a previously created

rate specification and returns a new one. Otherwise, it creates a

Use

intenvset to create or modify an interest-rate’s term structureRateSpec.

If the first argument to

intenvset is a previously created RateSpec,the

functionmodifiestheexistingratespecification and returns a ne w one;

otherwise,

intenvset creates a RateSpec.

RateSpec, the function modifies the e xisting

RateSpec.

When using

RateSpec to specify the rate term structure to price instruments

based on yields (zero coupon rates) or forward rates, specify zero rates or

forward rates as the input argument. However, the

limited or specific to this problem domain.

of rates-times relationships;

modifier, and

intenvget as an accessor. The interest rate m odels supported

intenvset acts as either a constructor or a

RateSpec is an encapsulation

RateSpec structure is not

by the Financial Derivatives Toolbox softw are work either with zero coupon

rates or forward rates .

The other

intenvset arguments are property-value pairs, indicating the new

value for these prope rti e s. The properties that can be specified or modified are:

•

Basis

• Compounding

• Disc

• EndDates

• EndMonthRule

2-25

Page 58

2 Interest-Rate Derivatives

• Rates

• StartDates

• ValuationDate

To learn about the properties EndMonthRul e and Basis,type

help ftbEndMonthRule and help ftbBasis or see the Financial Toolbox

documentation.

Consider again the original table of interest rates (see “Calculating Discount

Factors from Rates” on page 2-15).

From To Rate

15 Feb 2000

15 Aug 2000

15 Feb 2000 15 Feb 2 001

15 Feb 2000

15 Aug 2001

15 Feb 2000 15 Feb 2 002

15 Feb 2000

15 Aug 2002

0.05

0.056

0.06

0.065

0.075

2-26

Use the information in this table to populate the

StartDates = ['15-Feb-2000'];

EndDates = ['15-Aug-2000 ';

'15-Feb-2001';

'15-Aug-2001';

'15-Feb-2002';

'15-Aug-2002'];

Compounding = 2;

ValuationDate = ['15-Feb-2000'];

Rates = [0.05; 0.056; 0.06; 0.065; 0.075];

rs = intenvset('Compounding',Compounding,'StartDates',...

StartDates, 'EndDates', EndDates, 'Rates', Rates,...

'ValuationDate', ValuationDate)

rs =

RateSpec structure.

Page 59

Understanding the Interest-Rate Term S tructure

FinObj: 'RateSpec'

Compounding: 2

Disc: [5x1 double]

Rates: [5x1 double]

EndTimes: [5x1 double]

StartTimes: [5x1 double]

EndDates: [5x1 double]

StartDates: 730531

ValuationDate: 730531

Basis: 0

EndMonthRule: 1

Some of the properties filled in the structure were not passed explicitly in

the call to

RateSpec. The values of the automatically completed properties

depend on the properties that are explicitly passed. Consider for example

the

StartTimes and EndTimes vectors. Since the StartDates and EndDates

vectors are passed in, and the ValuationDate, intenvset has all the

information required to calculate

StartTimes and EndTimes.Hence,these

two properties are read-only.

Obtaining Specific Properties (intenvget)

The complementary function to intenvset is intenvget, which gets function

specific properties from the interest-rate term structure. Its syntax is:

ParameterValue = intenvget(RateSpec, 'ParameterName')

To obtain the vector EndTimes from the RateSpec s tructure, enter:

EndTimes = intenvget(rs, 'EndTimes')

EndTimes =

1

2

3

4

5

2-27

Page 60

2 Interest-Rate Derivatives

To obtain Disc, the values for the discount factors that were calculated

automatically by

Disc = intenvget(rs, 'Disc')

Disc =

0.9756

0.9463

0.9151

0.8799

0.8319

intenvset,type:

These discount factors correspond to the periods starting from StartDates

and ending in EndDates.

Caution Although you can directly access these fields within the structure

instead of using

intenvget,itisadvisednottodoso. Theformatofthe

interest-rate term structure could change in future versions of the toolbox.

Should that happen, any code accessing the

RateSpec fields directly would

stop working.

2-28

Now use the RateSpec structure with its functions to examine how changes in

specific properties of the interest-rate term structure affect those depending

on it. As an exercise, change the value of

Compounding from 2 (semiannual)

to 1 (annual).

rs = intenvset(rs, 'Compounding', 1);

Since StartTimes and EndTimes are measured in units of periodic discount, a

change in

Compounding from 2 to 1 redefines the basic unit from semiannual

to annual. This means that a period of 6 months is represented with a value

of 0.5, and a period of 1 year is represented by 1. To obtain the vectors

StartTimes and EndTimes,enter:

StartTimes = intenvget(rs, 'StartTimes');

EndTimes = intenvget(rs, 'EndTimes');

Times = [StartTimes, EndTimes]

Page 61

Understanding the Interest-Rate Term S tructure

Times =

0 0.5000

0 1.0000

0 1.5000

0 2.0000

0 2.5000

Since all the values in StartDates are t h e same as the valuation date, all

StartTimes values are 0. O n the other hand, the values in the EndDates

vector are d ate s separated by 6-month periods. Since the redefined value

of compounding is 1,

EndTimes becomes a sequence of numbers separated

by increments of 0.5.

2-29

Page 62

2 Interest-Rate Derivatives

Computing Prices and Sensitivities Using the Interest-Rate

Term Structure

In this section...

“Introduction” on page 2-30

“Computing Instrument Prices” on page 2-31

“Computing Instrument Sensitivities” on page 2-33

Introducti

The instru

types of in

current ve

instrume

• Bonds

• Fixed-r

• Floatin

• Swaps

In addi

price a

Note t

above

beca

the e

pric

thes

Fin

the

com

su

Se

tion to these instruments, the toolbox also supports the calculation of

nd sensitivities of arbitrary sets of cas h flows.

hat options and interest-rate floors and caps are absent from the

list of supported instruments. These instruments are not supported

use their pricing and sensitivity function require a stochastic model for

volution of interest rates. The interest-rate term structure used for

ing is treated as deterministic, andassuchisnotadequateforpricing

e instruments.

ancial Derivatives Toolbox software also contains functions that use

Heath-Jarrow-Morton (HJM) and Black-Derman-Toy (BDT) models to

pute prices and sensitivities for financial instruments. These models

pport computations involving options and interest-rate floors and caps.

e “Computing Prices and Sensitivities Using Interest-Rate Tree Models”

on

ments can be presented to the functions as a portfolio of different

struments or as gro up s of instruments of the same ty pe . The

rsion of the toolbox can compute price and sensitivities for four

nt types using interest-rate curves:

ate notes

g-rate notes

2-30