Page 1

Financial Derivatives

Toolbox™ Release Notes

Page 2

How to Contact The MathWorks

www.mathworks.

comp.soft-sys.matlab Newsgroup

www.mathworks.com/contact_TS.html Technical Support

suggest@mathworks.com Product enhancement suggestions

bugs@mathwo

doc@mathworks.com Documentation error reports

service@mathworks.com Order status, license renewals, passcodes

info@mathwo

com

rks.com

rks.com

Web

Bug reports

Sales, prici

ng, and general information

508-647-7000 (Phone)

508-647-7001 (Fax)

The MathWorks, Inc.

3 Apple Hill Drive

Natick, MA 01760-2098

For contact information about worldwide offices, see the MathWorks Web site.

Financial Derivatives Toolbox™ Release Notes

© COPYRIGHT 2004–20 10 by The MathWorks, Inc.

The software described in this document is furnished under a license agreement. The software may be used

or copied only under the terms of the license agreement. No part of this manual may be photocopied or

reproduced in any form without prior written consent from The MathW orks, Inc.

FEDERAL ACQUISITION: This provision applies to all acquisitions of the Program and Documentation

by, for, or through the federal government of the United States. By accepting delivery of the Program

or Documentation, the government hereby agrees that this software or documentation qualifies as

commercial computer software or commercial computer software documentation as such terms are used

or defined in FAR 12.212, DFARS Part 227.72, and DFARS 252.227-7014. Accordingly, the terms and

conditions of this Agreement and only those rights specified in this Agreement, shall pertain to and govern

theuse,modification,reproduction,release,performance,display,anddisclosureoftheProgramand

Documentation by the federal government (or other entity acquiring for or through the federal government)

and shall supersede any conflicting contractual terms or conditions. If this License fails to meet the

government’s needs or is inconsistent in any respect with federal procurement law, the government agrees

to return the Program and Docu mentation, unused, to The MathWorks, Inc.

Trademarks

MATLAB and Simulink are registered trademarks of The MathWorks, Inc. See

www.mathworks.com/trademarks for a list of additional trademarks. Other product or brand

names may be trademarks or registered trademarks of their respective holders.

Patents

The MathWorks products are protected by one or more U.S. patents. Please see

www.mathworks.com/patents for more information.

Page 3

Summary by Version ............................... 1

Version 5.5.1 (R2010a) Financial Derivatives Toolbox

Software

Version 5.5 (R2009b) Financial Derivatives Toolbox

Software

Version 5.4 (R2009a) Financial Derivatives Toolbox

Software

Version 5.3 (R2008b) Financial Derivatives Toolbox

Software

Version 5.2 (R2008a) Financial Derivatives Toolbox

Software

........................................ 4

........................................ 5

........................................ 7

........................................ 10

........................................ 13

Contents

Version 5.1 (R2007b) Financial Derivatives Toolbox

Software

Version 5.0 (R2007a) Financial Derivatives Toolbox

Software

Version 4.1 (R2006b) Financial Derivatives Toolbox

Software

Version 4.0.1 (R2006a) Financial Derivatives Toolbox

Software

Version 4.0 (R14SP3) Financial Derivatives Toolbox

Software

Version 3.0 (R14) Financial Derivatives Toolbox

Software

........................................ 17

........................................ 20

........................................ 24

........................................ 25

........................................ 26

........................................ 30

iii

Page 4

Compatibility Summary for Financial Derivatives

Toolbox Software

................................ 33

iv Contents

Page 5

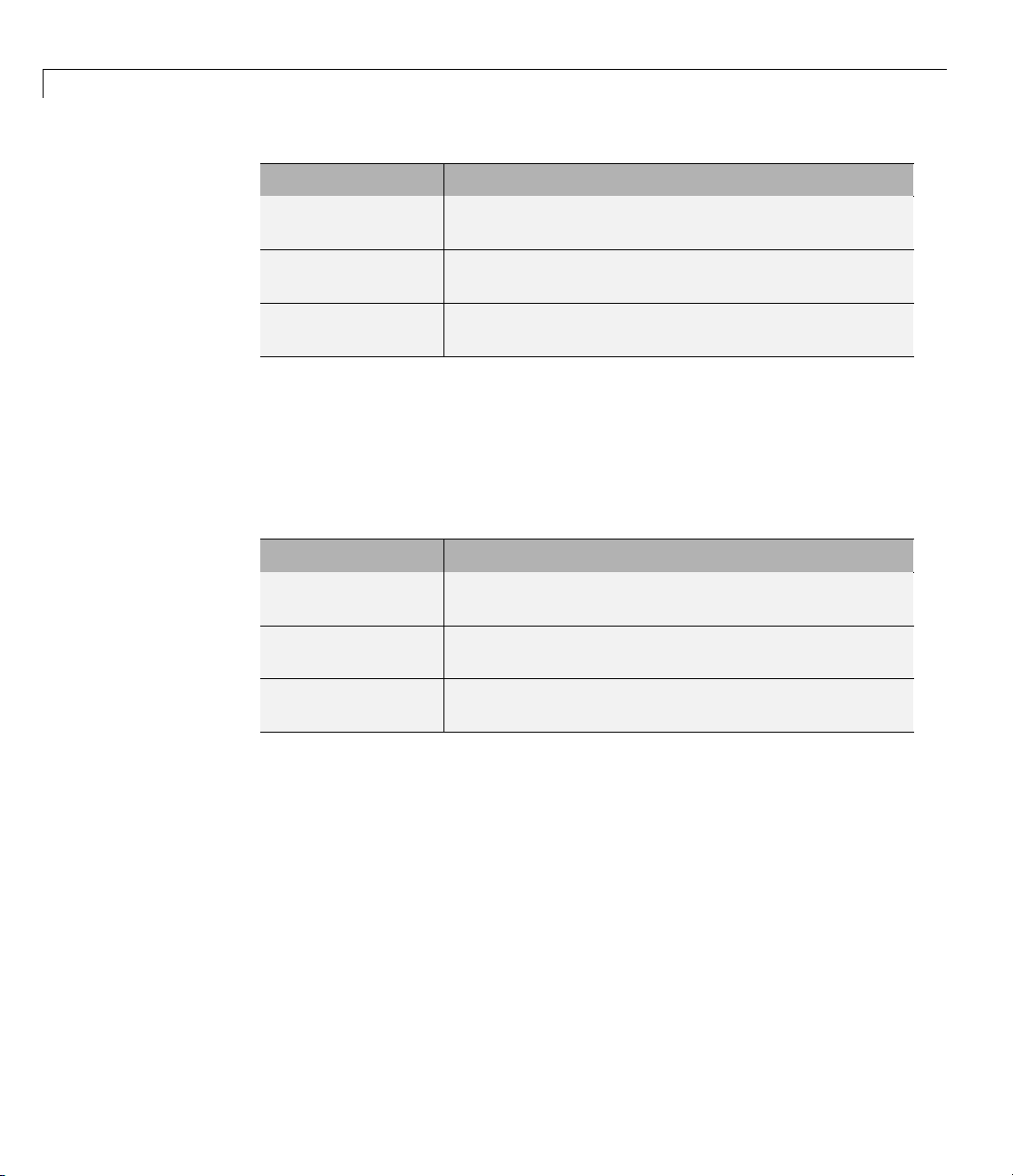

SummarybyVersion

This table provides quick access to what’s new in each version. For

clarification, see “Using Release Notes” on page 2 .

Financial Derivatives Toolbox™ Release Notes

Version

(Release)

Latest Versi

V5.5.1 (R201

V5.5 (R2009b)

V5.4 (R2009a)

V5.3 (R2

V5.2 (R2008a)

V5.1 (R2007b)

V5.0

V4.1 (R2006b)

008b)

(R2007a)

New Features

and Changes

on

No No Bug Reports

0a)

Yes

Details

Yes

Details

Yes

Details

Yes

Details

Yes

ls

Detai

Yes

Details

No No Bug Reports No

Version

Compatibility

Considerations

No Bug Reports

No Bug Repor

No Bug Reports

No Bug Reports

No Bug Re

No Bug Reports No

Fixed Bugs

and Known

Problems

Includes fix

Includes fixes

Includes

Includes fixes

Includes fixes

ports

es

ts

fixes

Related

Documentation

at Web Site

Printable R elease

Notes: PDF

Current product

documentation

No

No

No

No

No

V4.0.1 (R2006a)

V4.0 (R14SP3)

V3.0 (R14)

No No Bug Reports No

Yes

Details

s

Ye

etails

D

No Bug Reports No

No

No bug fixes

No

1

Page 6

Financial Derivatives Toolbox™ Release Notes

Using Release No

Use release note

• New features

• Changes

• Potential imp

Review the re

product (for

bugs, or comp

If you are up

review the c

you upgrad

What Is in t

New Featu

• New func

• Changes

s when upgrading to a new er version to learn about:

act o n your existing files and practices

lease notes for other M athWorks™ products required for this

example, MATLAB

atibility considerations in other products impact you.

grading from a softw are version other than the most recent one,

urrent release notes and all interim versions. For example, when

e from V1.0 to V1.2, review the release notes for V1.1 and V1.2.

he Release Notes

res and Changes

tionality

to existing functionality

tes

®

or Simulink®). Determine if enhancements,

Versio

When a n

versi

impac

Comp

Repo

in in

comp

Fix

The

vi

n Compatibility Considerations

ew feature or change introduces a reported incompatibil ity between

ons, the Compatibility Considerations subsection explains the

t.

atibility issues reported after the product release appear under Bug

rts at The MathWorks™ Web site. Bug fixes can sometimes result

compatibilities, so review the fixed bugs in Bug Reports for any

atibility impact.

ed Bugs and Known Problems

MathWorks offers a user-searchable Bug Reports database so you can

ew Bug Reports. The development team updates this database at release

2

Page 7

SummarybyVersion

time and as more information becomes available. Bug Reports include

provisions for any known workarounds or file replacem ents. Information is

available for bugs existing in or fixed in Release 14SP2 or later. Information

is not avail able for all bugs in earlier releases.

Access Bug Reports using y our MathWorks Account.

3

Page 8

Financial Derivatives Toolbox™ Release Notes

Version 5.5.1 (R2010a) Financial Derivatives Toolbox

Software

This table summ

New Features and

Changes

No No Bug Reports

Version

Compatibility

Considerations

There are no new features or changes in this version.

arizes what’s new in Version 5.5.1 (R2010a):

Fixed Bugs an d

Known Problems

Includes fixes

Related

Documentation at

Web Site

Printable Re

Notes: PDF

Current pro

documenta

lease

duct

tion

4

Page 9

Version 5.5 (R2009b) Financial Derivatives Toolbox™ Software

Version 5.5 (R2009b) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports

New features and changes introduced in this version are:

• “Support for the Basket Option Instrument Using the Longstaff-Schwartz

Model and Nengjiu Ju Approximation Model” on page 5

• “Support for the BUS/252 Day-Count Convention” on page 6

arizes what’s new in Version 5.5 (R2009b):

Fixed Bugs an d

Known Problems

Includes fixes

Related

Documentation at

Web Site

No

SupportfortheBasketOptionInstrumentUsing

the L ongstaff-Schwartz Model and Nengjiu Ju

Approximation Model

Supports the following using the Longstaff-Schwartz model:

Functi

baske

bask

bas

on

tbyls

etsensbyls

ketstockspec

Purpos

Price

model

Calc

usin

Spec

e

basket options using the Longstaff-Schwartz

.

ulate price and sensitivities for basket options

g the Longstaff-Schwartz model.

ify basket stock structure.

Supports the following using the Nengjiu Ju approximation model:

5

Page 10

Financial Derivatives Toolbox™ Release Notes

Function Purpose

basketbyju

basketsensbyju

For more information, see Basket Options in the Financial D erivatives

Toolbox™ User’s Guide documentation.

SupportfortheBUS/252Day-CountConvention

Support for the Basis day-count convention for BUS/252. BUS/252 is the

number of business days between the previous coupon payment and the

settlement data divided by 252. BUS/252 business days are non-weekend,

non-holiday days. The

Price basket options using the Nengjiu Ju m odel.

Calculate price and sensitivities for basket options

using the Nengjiu Ju model.

holidays.m file defines holidays.

6

Page 11

Version 5.4 (R2009a) Financial Derivatives Toolbox™ Software

Version 5.4 (R2009a) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports

New features and changes introduced in this version are:

• “Support for European Digital Options Using the Black-Scholes Pricing

Model” on page 7

• “Support for European Rainbow Options Using the Stulz Option Pricing

Model” on page 8

• “Support for Caps and Floors Using the Black Option Pricing Model” on

page 9

• “Support for Calibrating the Hull-White Model Using Market Data of Caps

and Floors” on page 9

arizes what’s new in Version 5.4 (R2009a):

Fixed Bugs an d

Known Problems

Includes fixes

Related

Documentation at

Web Site

No

Support for European Digital Options Using the

Black-Scholes Pricing Model

Supports the following:

Funct

cash

etbybls

ass

pbybls

ga

ion

bybls

Purpo

Calc

opti

Cal

opt

Ca

th

se

ulate price of cash-or-nothing digital

ons using the Black-Scholes model.

culate price o f asset-or-nothing digital

ions using the Black-Scholes model.

lculate price of gap digital opti on s using

e Black-Scholes model.

7

Page 12

Financial Derivatives Toolbox™ Release Notes

Function Purpose

supersharebybls

cashsensbybls

assetsensbybls

gapsensbybls

supersharesensbybls

For more information, see “Digital Option”.

Calculate price of supershare digital options

using the Black-Scholes model.

Calculate price and sensitivities of

cash-or-nothing digital options using the

Black-Scholes model.

Calculate price and sensitivities of

asset-or-nothing digital options using the

Black-Scholes model.

Calculate price and sensitivities of gap

digital options using the Black-Scholes

model.

Calculate price and sensitivities of

supershare digital options using the

Black-Scholes model.

Support for European Rainbow Options Using the

Stulz Option Pricing Model

Supports the following:

Function Purpose

minassetbystulz

minassetsensbystulz

maxassetbystulz

maxassetsensbystulz

8

Calculate European rainbow option price on

minimum of two risky assets using the Stulz

option pricing model.

Calculate E uropean rainbow option prices

and sensitivities on minimum of two risky

assets using the Stulz pricing model.

Calculate European rainbow option price on

maximum of two risky assets using the Stulz

option pricing model.

Calculate E uropean rainbow option prices

and sensitivities on maximum of two risky

assets using the Stulz pricing model.

Page 13

Version 5.4 (R2009a) Financial Derivatives Toolbox™ Software

For more information, see “Rainbow Option”.

Support for Caps and F loors Using the Black Option

Pricing Model

Supports the following:

Function Purpose

capbyblk

floorbyblk

For more info rmation, see “Interest-Rate Derivatives Using Closed Form

Solutions”.

PricecapsusingtheBlackoptionpricingmodel.

Price floors using the Black option pricing m od el .

Support for Calibrating the Hull-White Model Using

Market Data of Caps and Floors

Supports the following:

Function Purpose

hwcalbycap

hwcalbyfloor

For more information, see “Calibrating the Hull-White Model Using Market

Data”.

Calibrate Hull-White tree using caps.

CalibrateHull-Whitetreeusingfloors.

9

Page 14

Financial Derivatives Toolbox™ Release Notes

Version 5.3 (R2008b) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports

New features and changes introduced in this version are:

• “Support for European Chooser Options Using the Black-Scholes Mo del”

on page 10

• “Support for the Black Model for European Options ” on page 11

• “Support for the Black-Scholes Model for European Options with Different

Type of Dividends” on page 11

• “Support for the Bjerksund-Stensland Model for American Options with

Continuous Dividend” on page 11

• “Support for the Roll-Geske-Whaley Model for American Call Options with

a Single Cash Dividend” on page 12

• “Enhancements to

arizes what’s new in Version 5.3 (R2008b):

Fixed Bugs an d

Known Problems

Includes fixes

stockspec”onpage12

Related

Documentation at

Web Site

No

10

Support for European Chooser Options Using the

Black-Scholes Model

Supports the following:

tion

Func

oserbybls

cho

ose

Purp

Prices European simple chooser options using the

Black-Scholes model.

Page 15

Version 5.3 (R2008b) Financial Derivatives Toolbox™ Software

Support for the Black Model for European Options

Supports the following:

Function Purpose

optstockbyblk

optstocksensbyblk

impvbyblk

For more information on the Black model, see “Computing Prices and

Sensitivities Using the Black Model”.

Prices options using the Black option pricing model.

Calculates option prices and sensitivities on futures

using the Black pricing model.

Calculates implied volatility using the Black option

pricing model.

Support for the Black-Scholes Model for European

Options with Different Type of Dividends

Supports the following:

Function Purpose

optstockbybls

optstocksensbybls

impvbybls

For more information on the Black-Scholes model, see “Computing Prices and

Sensitivities Using the Black-Scholes Model”.

Prices options using the Black-Scholes option pricing

model.

Calculates option prices and sensitivities on futures

using the Black-Scholes option pricing model.

Calculate implied volatility using the Black–Scholes

option pricing model.

Support for the Bjerksund-Stensland Model for

American Options with Continuous Dividend

Supports the following:

11

Page 16

Financial Derivatives Toolbox™ Release Notes

Function Purpose

optstockbybjs

optstocksensbybjs

impvbybjs

For more information on the Bjerksund-Stensland model, see “Computing

Prices and Sensitivities Using the Bjerksund-Stensland Model”.

Support for the Roll-Geske-Whaley Model for

American Call Options with a Single Cash Dividend

Supports the following:

Function Purpose

optstockbyrgw

optstocksensbyrgw

impvbyrgw

Prices options using the Bjerksund-Stensland option

pricing model.

Calculates option prices and sensitivities on futures

using the Bjerksund-Stensland option pricing model.

Calculates implied v olatility using the

Bjerksund-Stensland option pricing model.

Prices options using the Roll-Geske-Whaley option

pricing model.

Calculates option prices and sensitivities on futures

using the Roll-Geske-Whaley option pricing model.

Calculates implied v olatility using the

Roll-Geske-Whaley option pricing model.

12

For more information on the Roll-Geske-Whaley model, see “Computing

Prices and Sensitivities Using the Roll-Geske-Whaley Model”.

Enhancements to stockspec

stockspec is now capable of handling several instruments. This modified

implementation of

options using some of the equity models, such as the closed-form solutions

and analytical approximations. For the equity tree models,

only the fir st instrument represented in the structure

the equity tree.

stockspec is particularly useful when pricing equity

stockspec takes

StockSpec to build

Page 17

Version 5.2 (R2008a) Financial Derivatives Toolbox™ Software

Version 5.2 (R2008a) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports

New features and changes introduced in this version are:

• “Pricing Callable and Puttable Bonds” on page 13

• “Support for Actual/365 (ISDA)” on page 14

arizes what’s new in Version 5.2 (R2008a):

Fixed Bugs an d

Known Problems

Includes fixes

Related

Documentation at

Web Site

No

Pricing Callable and Puttable Bonds

Supports the following pricing for callable and puttable bonds:

Functio

optemb

optembndbybk

optembndbyhjm

opt

instoptembnd

n

ndbybdt

embndbyhw

Purpose

Price bonds with embedded options by a

Black-Derman-Toy interest rate tree.

Price bonds with embedded options by a

Black-Karasinski interest-rate tree.

e bonds with embedded options by an

Pric

h-Jarrow-Morton interest-rate tree.

Heat

Price bonds with embedded options by a Hull-White

interest-rate tree.

Constructor for the 'Type', 'OptEmBond' instrument

bond option.

n addition, the following functions have been modified to support callable

I

nd puttable bonds:

a

13

Page 18

Financial Derivatives Toolbox™ Release Notes

• instadd

• bdtprice

• hwprice

• hjmprice

• bkprice

• bdtsens

• hwsens

• hjmsens

• bksens

Support for Actual/365 (ISDA)

The following functions now support day count conventions for the basis

argument based on ISDA (Internation a l Swap Dealers Association) actual/365:

•

bondbybdt

14

• bondbybk

• bondbyhjm

• bondbyhw

• bondbyzero

• capbybdt

• capbybk

• capbyhjm

• capbyhw

• cfbybdt

• cfbybk

• cfbyhjm

• cfbyhw

• cfbyzero

Page 19

• date2time

• disc2rate

• fixedbybdt

• fixedbybk

• fixedbyhjm

• fixedbyhw

• fixedbyzero

• floatbybdt

• floatbybk

• floatbyhjm

• floatbyhw

• floatbyzero

• floorbybdt

Version 5.2 (R2008a) Financial Derivatives Toolbox™ Software

• floorbybk

• floorbyhjm

• floorbyhw

• instbond

• instcap

• instcf

• instfixed

• instfloat

• instfloor

• instswap

• instswaption

• intenvset

• optbndbybdt

• optbndbybk

15

Page 20

Financial Derivatives Toolbox™ Release Notes

• optbndbyhjm

• optbndbyhw

• rate2disc

• swapbybdt

• swapbybk

• swapbyhjm

• swapbyhw

• swapbyzero

• swaptionbybdt

• swaptionbybk

• swaptionbyhjm

• swaptionbyhw

• time2date

16

Page 21

Version 5.1 (R2007b) Financial Derivatives Toolbox™ Software

Version 5.1 (R2007b) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports No

New features and changes introduced in this version are:

arizes what’s new in Version 5.1 (R2007b):

Fixed Bugs an d

Known Problems

Related

Documentation at

Web Site

ISMA Support for 30/360 Basis as a Variant of

30/360E with Annual Compounding

The following functions now support day count conventions for the basis

argument to support 30/360 International Securities Market Association

(ISMA) convention as a variant of 30/360E with annual compounding:

•

bondbybdt

• bondbybk

• bondbyhjm

• bondbyhw

• bondbyzero

• capbybdt

• capbybk

• capbyhjm

• capbyhw

• cfbybdt

• cfbybk

• cfbyhjm

17

Page 22

Financial Derivatives Toolbox™ Release Notes

• cfbyhw

• cfbyzero

• date2time

• disc2rate

• fixedbybdt

• fixedbybk

• fixedbyhjm

• fixedbyhw

• fixedbyzero

• floatbybdt

• floatbybk

• floatbyhjm

• floatbyhw

18

• floatbyzero

• floorbybdt

• floorbybk

• floorbyhjm

• floorbyhw

• instbond

• instcap

• instcf

• instfixed

• instfloat

• instfloor

• instswap

• instswaption

• intenvset

Page 23

• optbndbybdt

• optbndbybk

• optbndbyhjm

• optbndbyhw

• rate2disc

• swapbybdt

• swapbybk

• swapbyhjm

• swapbyhw

• swapbyzero

• swaptionbybdt

• swaptionbybk

• swaptionbyhjm

Version 5.1 (R2007b) Financial Derivatives Toolbox™ Software

• swaptionbyhw

• time2date

19

Page 24

Financial Derivatives Toolbox™ Release Notes

Version 5.0 (R2007a) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports No

New features and changes introduced in this version are:

• “Pricing and Sensitivity from the Implied Trinomial Tree Stock Tree” on

page 20

• “Implied Trinomial Tree Utilities” on page 21

• “Enhancement to the treeviewer Function” on page 21

• “ISMA Support” on page 21

arizes what’s new in Version 5.0 (R2007a):

Fixed Bugs an d

Known Problems

Related

Documentation at

Web Site

Pricing and Sensitivity from the Implied Trinomial

Tree Stock Tree

The following table summarizes the functions supported for pricing and

sensitivity from implied trinomial trees.

20

ion

Funct

rice

ittp

ittsens

itttree

ttimespec

it

tockoptspec

s

Purpo

Price instruments by an implied trinomial tree.

Instrument sensitivities and prices by an implied

trinomial tree.

Bu

Sp

S

se

ild an implied trinomial stock tree.

ecify tim e structure for an implied trinomial tree.

pecify European stock options structure.

Page 25

Version 5.0 (R2007a) Financial Derivatives Toolbox™ Software

Implied Trinomi

The following ta

trees.

Function Purpose

optstockbyitt

barrierbyitt

asianbyitt

lookbackb

compound

ble summarizes the functions supported for implied trinomial

yitt

byitt

al Tree Utilities

Price options on stocks by an implied trinomial tree.

Price barrie

Price Asian

Price lookb

Price compound options by an implied trinomial tree.

r options by an implied trinomial tree.

options by an implied trinomial tree.

ack op t ion from an im p li ed trinomial tree.

Enhancement to the treeviewer Function

The treeviewer function, which provides a graphical display of rates and

prices, has been modified to accept Implied Trinomial Trees (ITTs) as input.

ISMA Support

The following functions now support the International Securities Market

Association(ISMA)conventionforthe

•

bondbybdt

basis argument:

• bondbybk

• bondbyhjm

• bondbyhw

• bondbyzero

• capbybdt

• capbybk

• capbyhjm

• capbyhw

• cfbybdt

• cfbybk

21

Page 26

Financial Derivatives Toolbox™ Release Notes

• cfbyhjm

• cfbyhw

• cfbyzero

• date2time

• disc2rate

• fixedbybdt

• fixedbybk

• fixedbyhjm

• fixedbyhw

• fixedbyzero

• floatbybdt

• floatbybk

• floatbyhjm

22

• floatbyhw

• floatbyzero

• floorbybdt

• floorbybk

• floorbyhjm

• floorbyhw

• instbond

• instcap

• instcf

• instfixed

• instfloat

• instfloor

• instswap

• intenvset

Page 27

• optbndbybdt

• optbndbybk

• optbndbyhjm

• optbndbyhw

• rate2disc

• swapbybdt

• swapbybk

• swapbyhjm

• swapbyhw

• swapbyzero

• time2date

Version 5.0 (R2007a) Financial Derivatives Toolbox™ Software

23

Page 28

Financial Derivatives Toolbox™ Release Notes

Version 4.1 (R2006b) Financial Derivatives Toolbox

Software

This table summ

New Features and

Changes

No No Bug Reports No

Version

Compatibility

Considerations

arizes what’s new in Version 4.1 (R2006b):

Fixed Bugs an d

Known Problems

Related

Documentation at

Web Site

24

Page 29

Version 4.0.1 (R2006a) Financial Derivatives Toolbox™ S oftware

Version 4.0.1 (R2006a) Financial Derivatives Toolbox

Software

This table summ

New Features and

Changes

No No Bug Reports No

Version

Compatibility

Considerations

arizes what’s new in Version 4.0.1 (R2006a):

Fixed Bugs and

Known Problems

Related

Documentation at

Web Site

25

Page 30

Financial Derivatives Toolbox™ Release Notes

Version 4.0 (R14SP3) Financial Derivatives Toolbox

Software

New Features and

Changes

Yes

Details below

This table summ

Version

Compatibility

Considerations

No Bug Reports No

New features and changes introduced in this version are:

• “New Interest Rate Models” on page 26

• “Recombining Trinomial Trees” on page 29

• “Enhancement to the treeviewer Function” on page 29

arizes what’s new in Version 4.0 (R14SP3):

Fixed Bugs an d

Known Problems

Related

Documentation at

Web Site

NewInterestRateModels

Two interest rate models have been introduced with Version 4.0:

• Hull-White (HW) model

The Hull-White model incorporates the initial term s tructure of interest

rates and the volatility term structure to build a trinomial recombining tree

of short rates. The resulting tree is used to value interest rate-dependent

securities. The implementation of the HW model in Financial Derivatives

Toolbox software is limited to one factor.

26

• Black-Karasinski (BK) model

The BK model is a single-factor, log-normal version of the Hull-White

model.

Hull-White and Black-Karasinski Functions

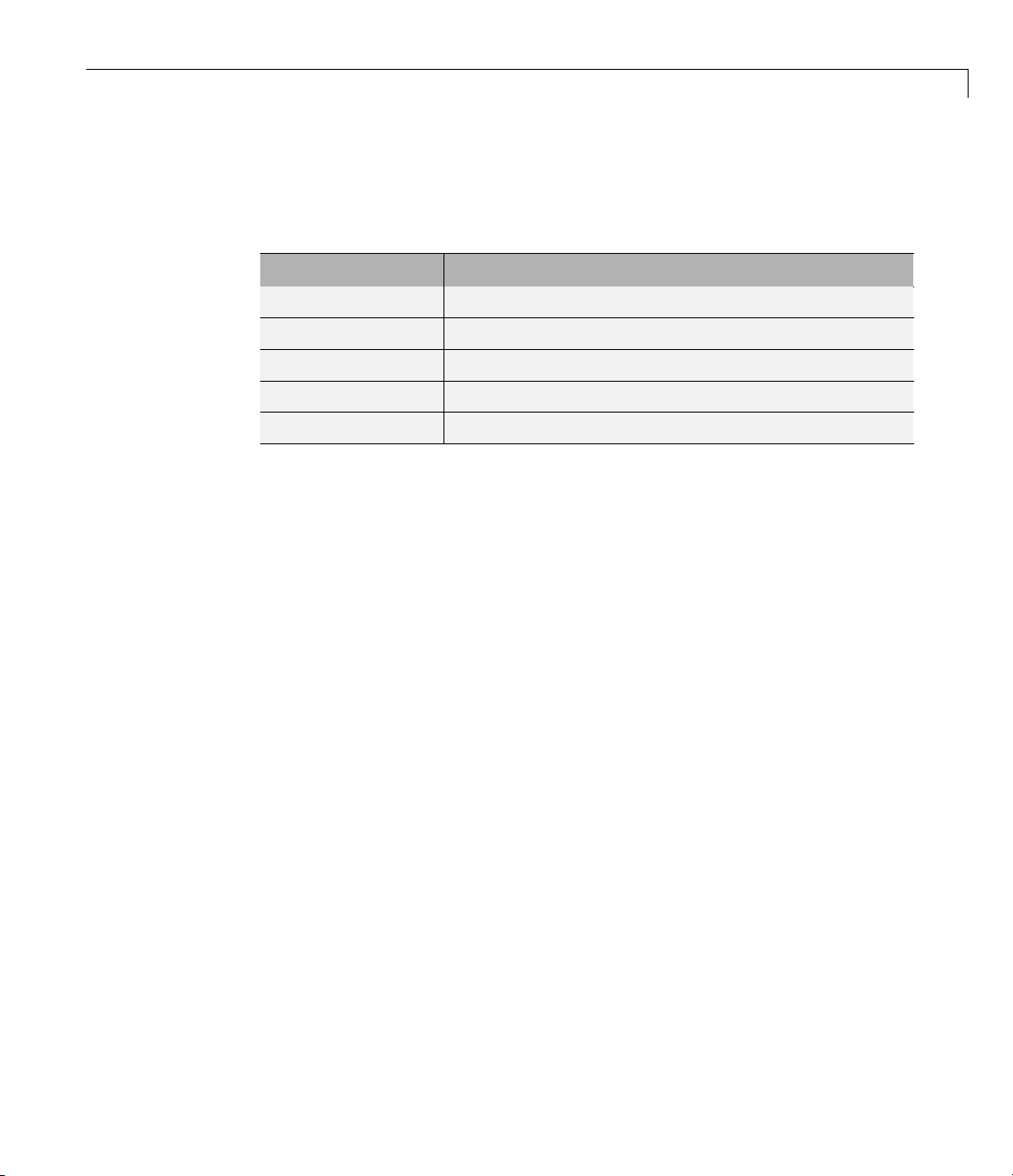

The following tables summarize the Black-Karasinski and Hull-White

functions by their category of usage.

Page 31

Version 4.0 (R14SP3) Financial Derivatives Toolbox™ Software

Price and Sensitivity from Black-Karasinski Trees

Function Purpose

bkprice

bksens

Instrument prices from Black-Karasinski tree.

Instrument prices and sensitivities from

Black-Karasinski tree.

bktimespec

bktree

bkvolspec

Specify time structure for Black-Karasinski tree.

Construct Black-Karasinski interest-rate tree.

Specify Black-Karasinski interest-rate volatility

process.

Price and Sensitivity from Hull-White Trees

Function Purpose

hwprice

hwsens

hwtimespec

hwtree

hwvolspec

Instrument prices from Hull-White tree.

Instrument prices and sensitivities from Hull-White

tree.

Specify time structure for Hull-White tree.

Construct Hull-White interest-rate tree.

Specify Hull-White interest-rate volatility pr oce ss.

Black-Karasinski Utilities

Function Purpose

bondbybk

capbybk

cfbybk

fixedbybk

Price bond from Black-Karasinski interest-rate tree.

Price cap instrument from Black-Karasinski

interest-rate tree.

Price arbitrary set of cash flows from Black-Karasinski

interest-rate tree.

Price fixed-rate note from Black-Karasinski

interest-rate tree.

27

Page 32

Financial Derivatives Toolbox™ Release Notes

Function Purpose

floatbybk

floorbybk

optbndbybk

swapbybk

Hull-White Utilities

Function Purpose

bondbyhw

capbyhw

cfbyhw

fixedbyhw

floatbyhw

floorbyhw

optbndbyhw

swapbyhw

Price floating-rate note from Black -K a rasin sk i

interest-rate tree.

Price floor instrumen t from Black-Karasin sk i

interest-rate tree.

Price bond option from Black-Karasinski interest-rate

tree.

Price swap instrument from Black-Karasinski

interest-rate tree.

Price bond from Hull-White interest-rate tree.

Price cap in stru ment from Hu l l- W hite interest-rate

tree.

Price arbitrary set o f cash flows from Hull-White

interest-rate tree.

Price fixed-rate note from Hull-White interest-rate

tree.

Price floating-rate note from Hull-White interest-rate

tree.

Price floor instrument from Hull-White interest-rate

tree.

Price bond option from Hull-White interest-rate tree.

Price swap instrument from HJM interest-rate tree.

28

Page 33

Version 4.0 (R14SP3) Financial Derivatives Toolbox™ Software

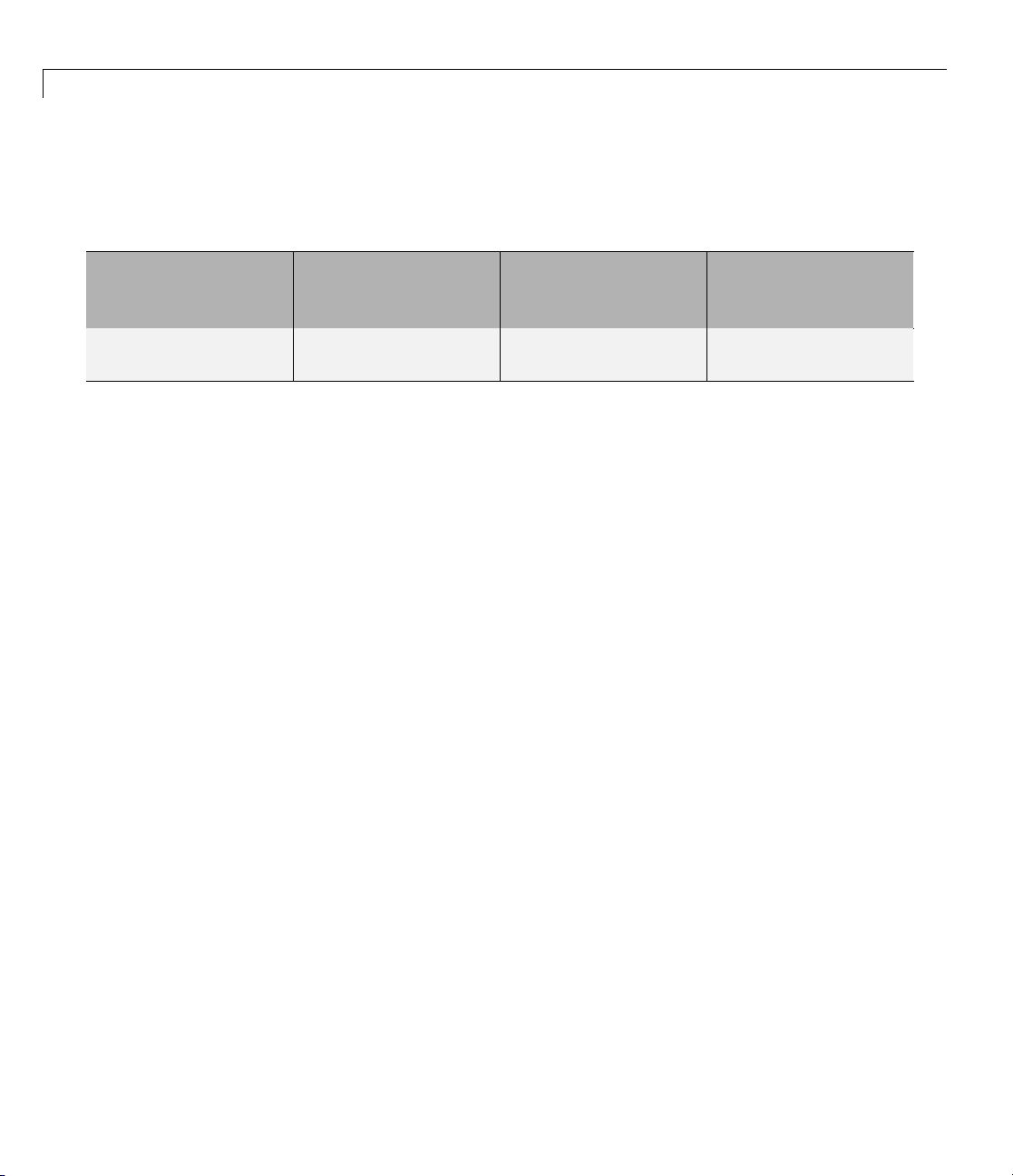

Tree Manipulation

Function Purpose

cvtree

mktrintree

trintreepath

trintreeshape

Convert inv erse discount tree to interest-rate tree.

Create recombining trinomial tree.

Extract entries from node of recombining trinomial

tree.

Retrieve shape of recombining trinomial tree.

Recombining Trinomial Trees

The interest-rate or price trees supported in this toolbox can be either

binomial (two branches per node) or trinomial (three branches per node).

Typically, binomial trees assume that u nderlying interest rates or p rices can

only either increase or decrease a t each node. Trinomial trees allow for a more

complex movement of rates or prices. With trinomial trees the movement

of rates or prices at each node is unrestricted (for example, up-up-up or

unchanged-down-down).

Enhancement to the treeviewer Function

The treeviewer function, which provides a graphical display of rates and

prices, h as been modified to display recombining trinomial trees.

29

Page 34

Financial Derivatives Toolbox™ Release Notes

Version 3.0 (R14) Financial Derivatives Toolbox Software

This table summarizes what’s new in Version 3.0 (R14):

New Features and

Changes

Yes

Details below

Version

Compatibility

Considerations

No

New features and changes introduced in this version are:

• “Support for Equity Derivatives” on page 30

• “Enhancement to the treeviewer Function” on page 32

Fixed Bugs an d

Known Problems

No bug fixes

Related

Documentation at

Web Site

No

Support for Equity Derivatives

Starting with Version 3.0, Financial Derivatives Toolbox software supports

two types of recombining tree models to represent the evolution of stock

prices: the Cox-Ross-Rubinstein (CRR) model and the Equal Probabilities

(EQP) model. The CRR and EQP models are examples of discrete time

models. A discrete time model divides time into discrete bits, and prices can

be computed at these specific times only.

The CRR model is one of the most common methods used to model the

evolution of stock processes. T he strength of the CRR model lies in its

simplicity. It is a good model when dealing with a large number of tree levels.

The CRR model yields the correct expected value for each node of the tree and

provides a good approximation for the corresponding local volatility. The

approximation becomes better as the number of time steps represented in

the tree is increased.

30

The EQP model is another discrete time model. It has the advantage of

building a tree with the exact volatility in each tree node, even with small

numbers of time steps. It also provides better results than CRR in some given

trading environments, e.g., when s tock volatility is low and interest rates are

high. However, this additional precision causes increased complexity, which

is reflected in the number of calculations required to build a tree.

Page 35

Version 3.0 (R14) Financial Derivatives Toolbox™ Software

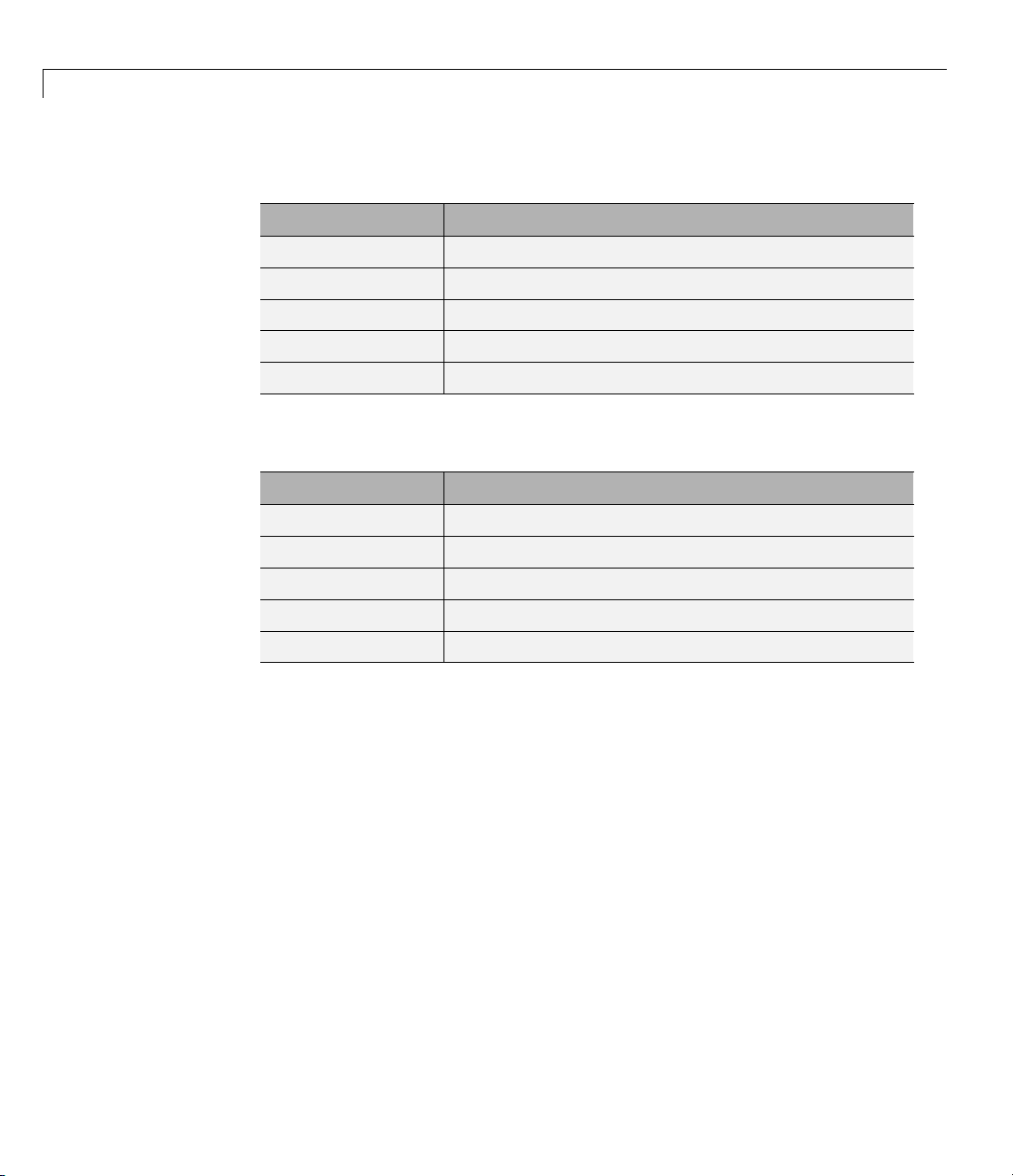

New Functions in Version 3.0

The following set of functions has b een added to the toolbox for Version 3.0.

Price and Sensitivity from Cox-Ross-Rubinstein Trees

Function Purpose

crrprice

crrsens

crrtimespec

crrtimespec

Instrument prices from a CRR tree.

Instrument prices and sensitivities by a CRR tree.

Specify time structure for a CRR tree.

Construct a CRR stock tree.

Cox-Ross-Rubinstein Utilities

Function Purpose

asianbycrr

barrierbycrr

compoundbycrr

lookbackbycrr

optstockbycrr

Price Asian option by a CRR tree.

Price barrier option by a CRR tree.

Price compound option by a CRR tree.

Price lookback option by a CRR tree.

Price stock option by a CRR tree.

Price and Sensitivity from Equal Probabilities Binomial Trees

Function Purpose

eqpprice

eqpsens

eqptimespec

eqptree

Instrument prices from an EQP binomial tree.

Instrument prices and sensitivities from an EQP

binomial tree.

Specify time structure for EQ P tree.

Construct EQP stock tree.

31

Page 36

Financial Derivatives Toolbox™ Release Notes

Equal Probabilities Tree Utilities

Function Purpose

asianbyeqp

barrierbyeqp

compoundbyeqp

lookbackbyeqp

optstockbyeqp

Instrument Portfolio Handling

Function Purpose

instasian

instbarrier

instcompound

instlookback

instoptstock

Price Asian option by an EQP tree.

Price barrier option by an EQP tree.

Price compound option by an EQP tree.

Price lookback option by an EQP tree.

Price stock option by an EQP tree.

Construct Asian option instrument.

Construct barrier option instrument.

Construct compound option instrument.

Construct lookback instrument.

Construct stock option.

32

Enhancement to the treeviewer Function

The treeviewer function, which provides a graphical display of rates and

prices, has been modified to accept Cox-Ross-Rubenstein (CRR) and Equal

Probabilities(EQP)equitytreesasinput.

Page 37

Compatibility Summary for Financial Derivatives Toolbox™ S oftware

Compatibility Summar y for Financial Derivatives Toolbox

Software

This table summarizes new features and changes that might cause

incompatibilities when you upgrade from an earlier version, or wh en you

use files on multiple versions. Details are provided with the description of

the new feature or change.

Version (Release) New Features and Changes with Version

Compatibility Impact

Latest Version

V5.5.1 (R2010a)

V5.5 (R2009b)

V5.4 (R2009a)

V5.3 (R2008b)

V5.2 (R2008a)

V5.1 (R2007b)

V5.0 (R2007a)

V4.1 (R2006b)

V4.0.1 (R2006a)

V4.0 (R14SP3)

V3.0 (R14)

None

None

None

None

None

None

None

None

None

None

None

33

Loading...

Loading...