Page 1

THE SAFEST WAY

DESIGNED FOR BUSINESS ON THE MOVE

Android Nexus One, Android Samsung Galaxy and

Windows OS and Mac OS PC not included.

iPod, iPhone and iPad not included.

User Guide

Mobile Merchant and Virtual Terminal

Powered by Magensa

Registered to ISO 9001:2008 © Copyright 2014 MagTek, Inc. PN 99800094 rev. 15.02 6/14

Page 2

Copyright and About MagTek

Copyright© 2014 MagTek®, Inc.

Printed in the United States of America

Information in this document is subject to change without notice. No part of this document may be reproduced or transmitted

in any form or by any means, electronic or mechanical, for any purpose, without the express written permission of MagTek, Inc.

MagTek® is a registered trademark of MagTek, Inc.

MagnePrint® is a registered trademark of MagTek, Inc.

MagneSafe™ is a trademark of MagTek, Inc.

Magensa™ is a trademark of MagTek, Inc.

USB (Universal Serial Bus) Specication is Copyright© 1998 by Compaq Computer Corporation, Intel Corporation, Microsoft

Corporation, NEC Corporation.

About MagTek

Founded in 1972, MagTek is a leading manufacturer of electronic systems for the reliable issuance, reading, transmission and

security of cards, checks, PINs and identication documents. Leading with innovation and engineering excellence, MagTek is

known for quality and dependability. Its products include secure card reader/authenticators, encrypting check scanners, PIN

pads and distributed credential personalization systems. These products are used worldwide by nancial institutions, retailers,

and processors to provide secure and efcient payment and identication transactions.

Today, MagTek continues to innovate. Its MagneSafe™ hardware architecture leverages strong encryption, secure tokenization,

dynamic card authentication, and device/host validation enabling users to assess the trustworthiness of credentials and

terminals used for online identication, payment processing, and high-value electronic transactions.

MagTek is headquartered in Seal Beach, CA. For more information, please visit www.magtek.com.

Manufactured by:

MagTek® Inc.,

1710 Apollo Court

Seal Beach, CA 90740

p 562.546.6335

f 562.546.6569

www.magtek.com

2

www.qwickpay.com

Page 3

Table of Contents

QwickPAY delivers a broad range of compatibility, allowing your browser-based, iOS, and Android devices to evolve into a highly

secure payment system. Any variations between platforms are noted herein.

Mobile Business

A. About

i. About QwickPAY 1

ii. Using the Demos 2

iii. Contact Support 3

B. Managing my Account for my Mobile Device

1. Account a. Request subscription 4

2. Setup a. Custom receipts: setup on virtual terminal 5

3. App a. Download 6

b. Security and GPS tracking 7

c. App Login 8

d. Save QwickPAY Credentials in Safari 9

e. Change e-mail 10

f. Change password 10

g. Overview 11

h. Change and update tax and tip 12

4. Connect a. Connect iDynamo/iDynamo 5 to iOS 13

b.i. Connect BulleT to Android device 14

b.ii. Connect BulleT to newer Android versions 15

c. Connect uDynamo to audio jack 16

5. Make a Sale a. Transaction authentication and authorization 17

b. Make a sale - swipe 18

c. Make a sale - QwickCode 19

6. Other Transactions a. Void - before settlement 20

b. Refund - after settlement 21

7. Administrative a. Reports 22

b. History 22

C. Managing my account in my Virtual Terminal

1. Account a. Request subscription 23

2. Setup a. Setup Custom Receipts 24

3. Cloud Application a. Requirements and Specications 25

b. Login and Device Selection 26

c. Change password, change nickname 27

d. Change and update tax and tip defaults 27

e. Overview 28

4. Connect a. USB and Bluetooth connection 29

5. Make a Sale a. Card present sale uDynamo and Dynamag USB HID 30

b. Card present sale using BulleT USB HID 31

c. Card present sale using BulleT KB 32

d. Card present sale using Flash USB HID 33

e. MagTek PCI PED via USB HID connection 34

card present, card not present

f. Card not present manual enytry 35

6. Other Transactions a. Void - before settlement 36

b. Refund - after settlement 36

7. Administrative a. History and reports 37

D. Appendix

Codes: i. Pay by Swipe 38

ii. Pay by Manual Entry 39

iii. Pay by Qwick Code 40

Error: iv. SMTP port 25 error 41

Limited warranty 42

FCC warning statement 43

3

www.qwickpay.com

Page 4

A. About

i. Overview of QwickPAY

From the company that invented the rst hand card-swipe reader comes QwickPAY, a complete mobile payment solution

that uses the most reliable and safest card swipe reader (secure card reader authenticator, SCRA). QwickPAY is made for

businesses that need an easy solution to take credit card transactions while on the go. All you need is the QwickPAY App, a

merchant account, and the SCRA and you can easily accept credit cards including Visa, MasterCard, Amex, and Discover from

almost anywhere.

QwickPAY delivers a broad range of compatibility, allowing your browser-based, iOS, and Android devices to evolve into a

highly secure payment system. QwickPAY provides a payment processing platform, an account management system, a virtual

terminal, reporting, encryption, card and device authentication, counterfeit card detection and card tokenization.

Key Features

• E-mail receipts

• Create custom receipts

• Easy to use transaction reporting

• Capture digital signatures

• Capture images of cardholder or goods purchased

• Auto calculate Tip and Tax

• Fill customer contact info from address book

• Card-present ONLY transactions

• Visa, MasterCard, Amex, Discover

• Protects data and surpasses the PCI DSS standards

with the MagneSafe™ Security Architecture

• Immediate encryption (Triple DES) of all cardholder

data with a derived unique key per transaction

(DUKPT)

• Immediate tokenization or “substitution” of all

cardholder data

• Immediate authentication of the card to ensure it is

not a fraudulent copy

• Dynamic payment card data with every transaction for

maximum cardholder protection

SCRA Features

• Bi-directional card reading

• Reads encoded data that meets ANSI/ISO/AAMVA/JIS

Type 2 standards

• Reads up to three tracks of card data

• Supplies 54 byte MagnePrint® value

• Unique, non-changeable serial number which allows

individual tracking

• Encrypts all track data and MagnePrint value

• Provides clear text conrmation data including card

holder’s name, expiration date, and a portion of the

PAN as part of the masked track data

• Mutual authentication mode

• Affordable and exible

• Lowers the cost of card acceptance by offering

authentic, card present transactions

• Reduces the scope of PCI compliance by eliminating

sensitive card data from App

• Eliminates charge back process by declining

counterfeit cards

QwickPAY provides unmatched security for cardholders and merchants with DETA transaction security.

DETA = Transaction Security.

• Dynamic: payment card data.

• Encryption: within the head – decrypted data delivered only to a PCI DSS certied payment processor or gateway.

• Tokenization: of sensitive data (3 types - Card, PAN, and Transaction) & QwickPAY QwickCode exchange.

• Authentication: of card, cardholder data, device, host, and session - eliminates the costs and hassles related to the

charge back process by identifying counterfeit cards.

1

www.qwickpay.com

Page 5

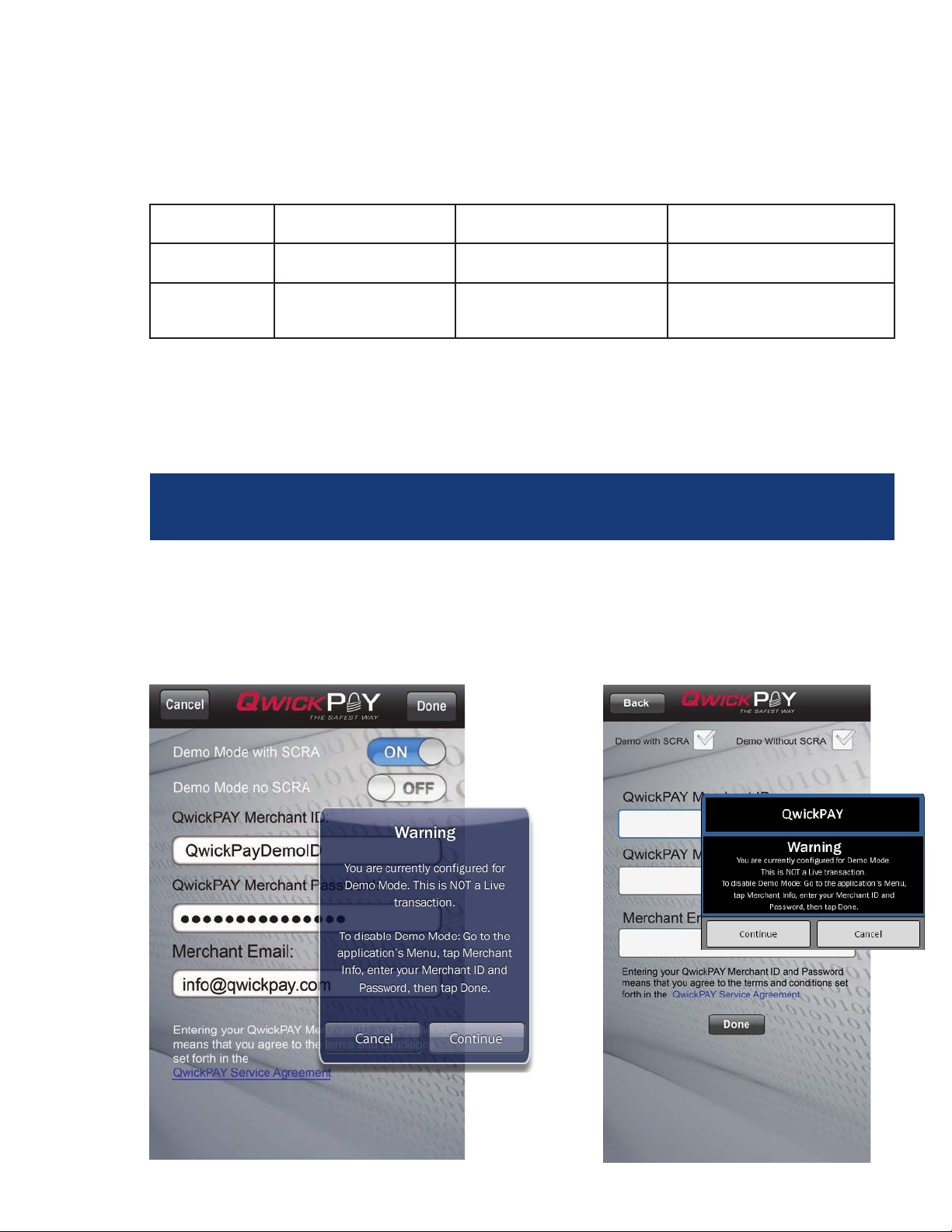

ii. Using the Demos

QwickPAY provides demos within the App. Simply download the App from the App Store or Google Play Android Market and tap on

Menu then Merchant Info> and choose your demo mode (with or without a secure card reader authenticator, for iOS the SCRA is

called an iDynamo/iDynamo 5). The demo credentials will automatically complete, you just need to enter your e-mail address.

Credentials

Credentials are case sensitive.

DEMO With

Merchant ID

SCRA

Demo QwickPayDemoID demo

Without

SCRA

Virtual

Terminal

Merchant

Password

After you enter your e-mail address tap Done.

You can then use real credit cards to perform demo transactions. Please be certain to enter in your live credentials once you

are ready to make live transactions. You cannot perform actual transactions for settlement in demo mode.

QwickPayDemoPwd QwickPayDemoPwd Go4QwickPAY!!!

ATTEMPTING LIVE TRANSACTIONS IN DEMO MODE WILL NOT TRANSFER FUNDS.

If you are in Demo Mode and try to make a Live transaction and hit Submit you will get the following warning:

Warning

You are currently congured for Demo Mode. This is NOT a Live transaction. To disable Demo Mode: Go to the Application’s

MENU, tap Merchant Info, enter your Merchant ID and Password, then tap DONE.

Monies will not be transferred in Demo mode.

Additionally the e-mail receipt message will state:

“You are currently congured for Demo Mode. This is NOT a live transaction.”

Sample iOS Device Screen Shot

Sample Android Screen Shot

2

www.qwickpay.com

Page 6

iii. Contact Support

Contact

For assistance related to processing, transactions, applications, and settlement, please contact the MagTek vendor that

provided you with your Login credentials or directly contact your processor (the entity that supplied your merchant account).

They will be able to provide you with the best possible service. Most merchant account providers have 365/24/7 support. For

additional assistance, please contact your QwickPAY supplier or email us at support@qwickpay.com.

Please have your reader charged (if required) and have the part number and serial number available before you call for faster

service. Your serial number is on the reader itself or launch the App and tap on Menu then iDynamo/MagneSafe SCRA to view

the serial number and rmware version.

A note on your merchant account

Your merchant account is separate from your QwickPAY subscription. Your merchant account provides an agreement between you,

a merchant bank and a payment processor for the settlement of credit card and/or debit card transactions. Most transactions

settle within 24 hours.

Merchant service providers deliver the nancial linkage between you, your customers, your bank and the credit card companies.

Fees and fee structures will vary, but you can expect that every merchant processing account will include a Discount Rate. This

is the percentage of the transaction amount you will be billed for the transactions you process. Rates vary based on certain risk

criteria usually categorized into “Qualied”, “Mid-Qualied” and “Non-Qualied” tiers. In addition, rates vary depending on your

type of business, whether or not you swiped the customer’s card through the reader and other factors that can be explained in

further detail by your merchant account provider. To ensure that you get the lowest fees possible, always swipe the customer’s

card through the SCRA, and be sure to include all the required information whenever processing a transaction.

3

www.qwickpay.com

Page 7

B. Managing my account for mobile devices.

B. Managing my account on my mobile devices

1

Getting a QwickPAY Account

Request a Subscription

Request a Subscription

You can go to the QwickPAY web site www.qwickpay.com and click on Activate to get a subscription with QwickPAY (“Get

QwickPAY” brings you to the online shop and allows you to purchase secure card reader authenticators).

A merchant account is required to use QwickPAY. If you already have a merchant account (meaning you can already accept

credit cards) or if you need to establish a merchant account, you can select the appropriate form to complete online. A

representative will contact you to complete the subscription process.

Account Activation

Once your account has been activated, you will be sent your credentials, Merchant ID (Username) andQwickPAY Merchant

Passord for login. The credentials are case sensitive. Please enter the credentials exactly.

Go to https://myqwickpay.com with your account credentials and setup your custom receipts.

4

www.qwickpay.com

Page 8

B. Managing my account for mobile devices.

2

Setting up Account

Custom Receipts

QwickPAY allows you to create your own custom receipts.

1. Locate your credentials.

2. Go to https://myqwickpay.com/login.aspx.

3. Enter your QwickPAY Merchant ID and Password.

4. Under SETTINGS go to CUSTOM RECEIPTS.

5. Add your Logo, a header, and a footer; you can also add a signature line for the virtual terminal receipts, allowing you to print

out receipts for hard copy signature after transactions are completed. [See items 1- 5 below]

6. SAVE your updates.

In order for the virtual terminal and mobile application to be synchronized with updates to the custom receipts, you will need

to completely close and restart the QwickPAY App on your mobile device. The receipt formatting updates are saved locally on

your device and each time you start the App it will check for the most recent revision. If updates are available, they will be

automatically downloaded and saved.

Logo Image

1

The logo must be in PNG, GIF or JPG

format and can’t be more than 40

kilobytes in size, 250 pixels wide

and 100 pixels high. You can access

photos on your PC or mobile device.

1

TIP: If you want the logo background

to blend in with the background of the

receipt, you should put the logo on a

white background with the hex color set

to #FFFFFF.

Header

2

The header is the information

located at the top of the receipts just

under the logo. It is always centered.

Most commonly the header consists

of address and contact details.

Signature Line (Virtual

3

Terminal ONLY)

Check the box to add a signature

line for virtual terminal receipts so

customers can sign a printed copy.

This eld will not show or populate with

signatures taken on mobile devices.

Footer Information

4

The footer information is located

after the receipt information and is

left justied. It is commonly used for

thanking customers, URL information

and return policies.

2

3

4

5

Save

5

Be certain to SAVE your receipt

updates. To view the updates on your

mobile devices be certain to close

and re-open the App on your device.

5

www.qwickpay.com

Page 9

B. Managing my account for mobile devices.

3

Application

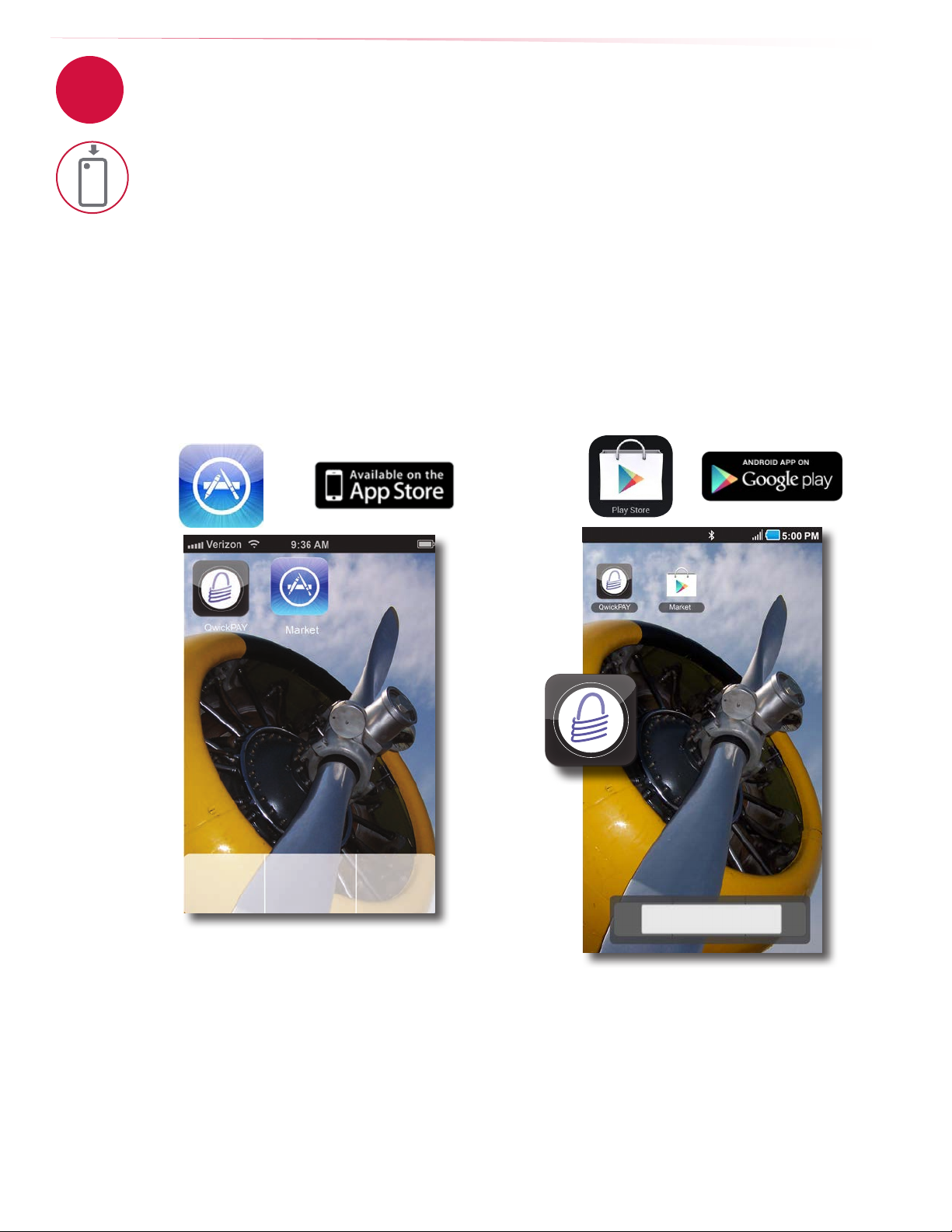

a. Download the QwickPAY App for free

iPhone, iPad, and iPod touch Users

1. iOS users tap on App Store icon on the main screen of

your mobile device.

2. Enter your account password and user name. If you do

not already have an account you will need to establish

one with iTunes.

3. You can then enter the link information below or do a

search for QwickPAY: http://itunes.Apple.com/us/App/

qwickpay/id371172197?mt=8

4. Select QwickPAY from the list.*

5. Tap on Install. The App will automatically start to install

on your mobile device.

6. Once it is installed you will see the icon on your main screen.

Android Users

1. Android users tap on Google Play Store icon on the main

screen of your mobile device.

2. Enter your account password and user name. If you do

not already have an account you will need to establish

one with Google Play.

3. You can then enter the link information below or do a

search for QwickPAY: https://play.google.com/store/

Apps/details?id=com.magtek.mobile.android.QwickPAY

4. Select QwickPAY from the list.*

5. Tap on Install. The App will automatically start to install

on your mobile device.

6. Once it is installed you will see the icon on your main screen.

6

www.qwickpay.com

Page 10

3

B. Managing my account for mobile devices.

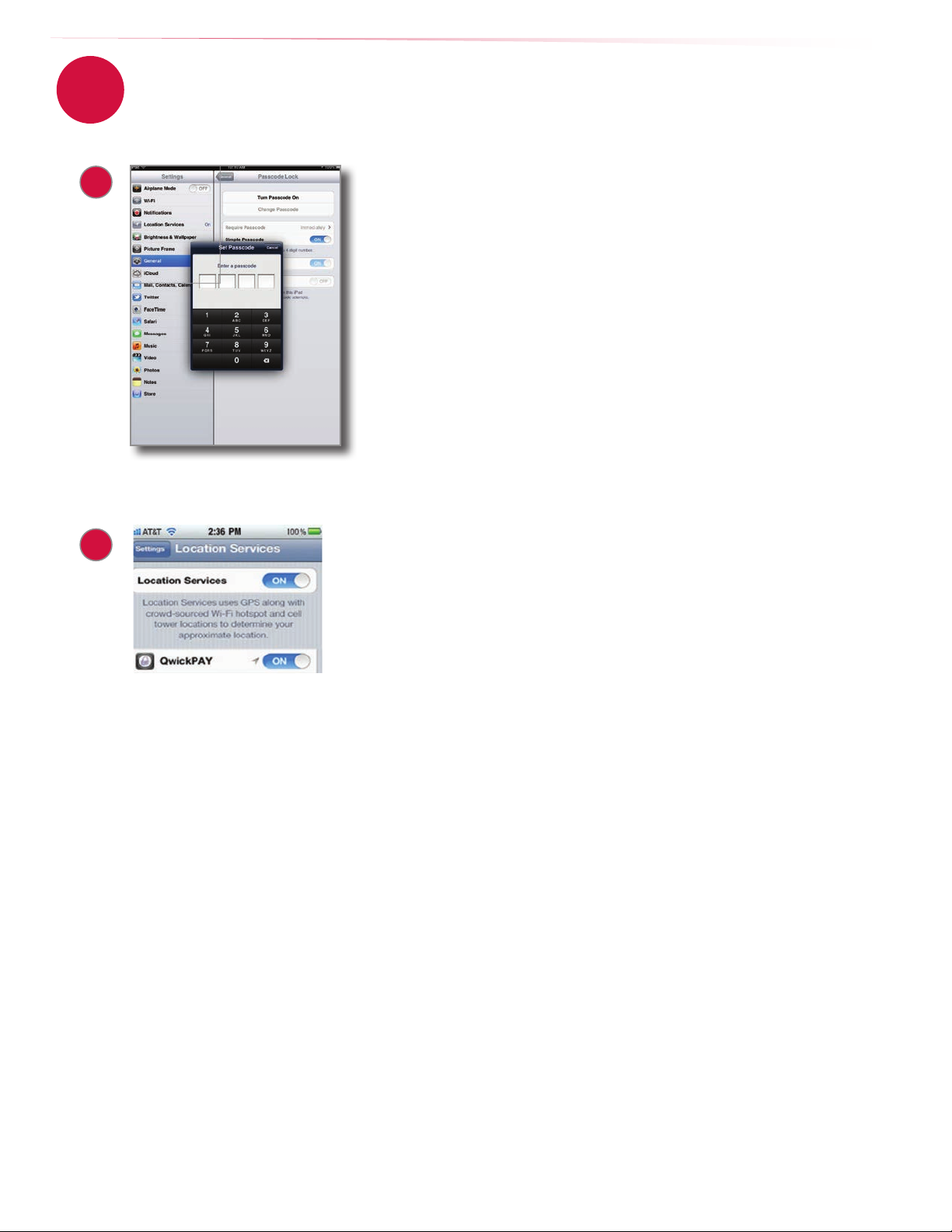

b. Security and GPS Tracking

SECURITY

1

SET GPS TRACKING

2

Protect your device with a passcode.

For added protection, be certain to protect your device with a passcode.

Set your GPS tracking to ON or OFF

GPS tracking is currently only supported on Apple iOS devices. When you rst Install

QwickPAY, the App will ask you if you wish to allow the QwickPAY App you are installing

to use your current location. This feature provides a record of where the transaction

took place. If you tap OK, the GPS coordinates will appear on all the QwickPAY

transaction receipts.

If you tap Don’t Allow, these coordinates will not appear on your QwickPAY transaction

receipts.

If you decide to change your settings on your iOS device:

1. Tap on Settings on your main screen

2. Next tap on Location Services.

3. Once in Location Services look for the QwickPAY App. Turn the location services on

or off for the App.

4. Return to Settings or exit out and the new settings will be saved. The feature will

then be enabled or disabled.

7

www.qwickpay.com

Page 11

3

B. Managing my account for mobile devices.

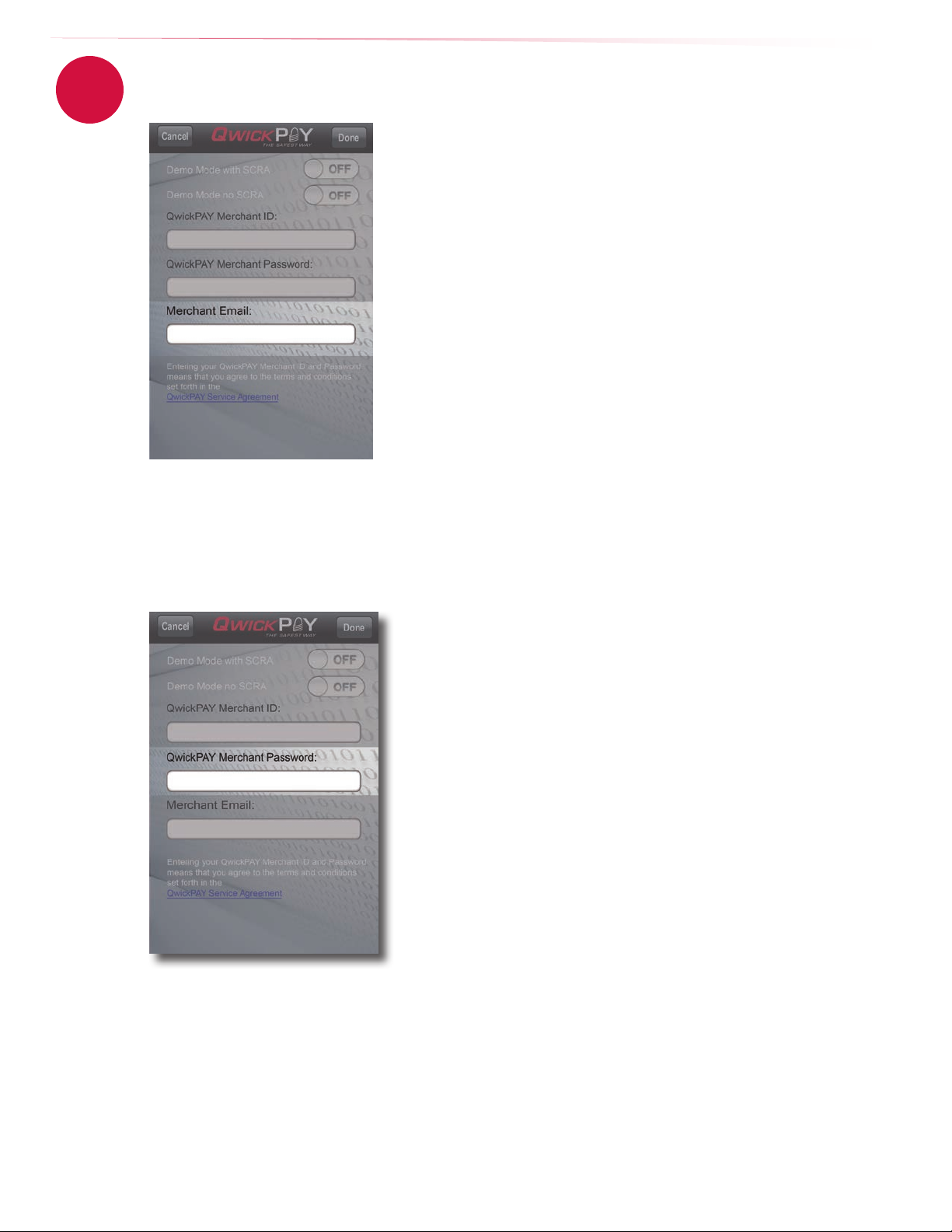

c. App Login

Enter your credentials - Make sure you are NOT in Demo mode

Once your subscription is processed you will receive your login credentials; these may come direct from QwickPAY or from your

merchant account card processor. LAUNCH the Application. Tap on the splash screen and then tap on the MENU button in

top right corner. Tap on MERCHANT INFO>. Enter your credentials and the e-mail address you wish to be associated with this

subscription and tap DONE to save your completed details.

1 2

LAUNCH MENU

4 5

3

MAIN MENU

MERCHANT INFO ENTER DETAILS

8

Make certain demos

are OFF when your are

ready to perform real-world

LIVE transactions.

www.qwickpay.com

Page 12

3

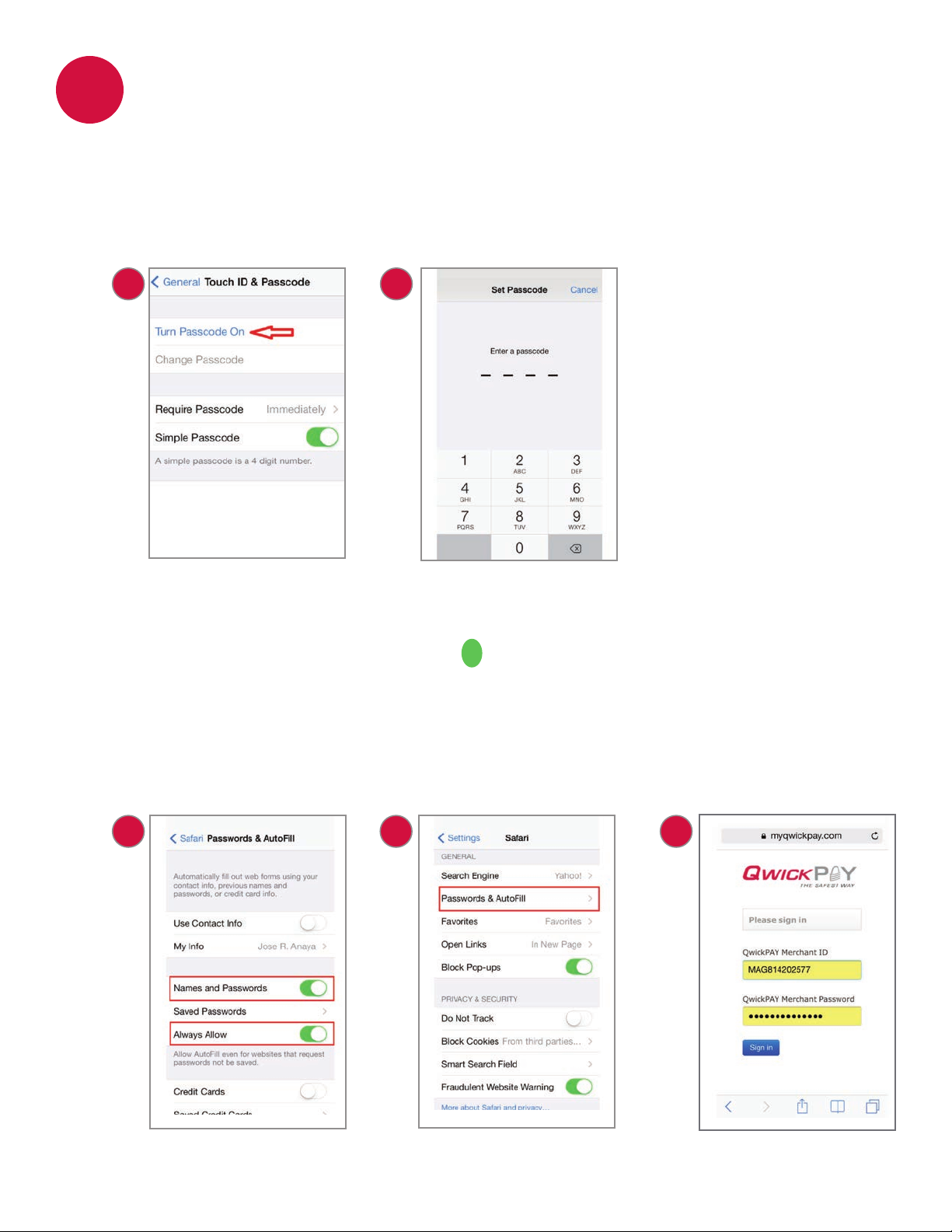

d. SaveQwickPAYCredentialsinSafarionaniOS7AppleDevice

In order to have the QwickPAY Credentials saved in the QwickPAY VT, you must rst enable Apple’s Passcode Feature for

security reasons. Below are the steps on how you can congure any Apple Device with the new iOS7 from Apple to save the

QwickPAY Credentials.

Set Passcode for the Apple Device:

1. Go into Settings/General/Touch ID & Passcode on the Apple device.

2. Tap on Turn Passcode On and set a four digit code to activate the Passcode feature on your Apple device.

1 2

Go To Settings Passcode

Set and congure Safari:

Go into Settings/Safari/Passwords & AutoFill (3) and turn On the Names and Passwords & Always Allow (4) features on the Apple device.

Now push your Home button once to go to your Home Screen and then launch Safari and type myqwickpay.com in the URL bar

to go to MyQwickPAY.com site. Once you are there, type in your QwickPAY Credentials and then tap the Sign in button and you

will receive a message like the one shown below asking if you wish to save the password, please tap on Save Password.

Next time you visit this site, it will automatically ll in your QwickPAY Credentials without showing what the Password is and will look similar

to the picture below. Tap the Sign in button and you are in and ready to conduct any task you wish to do on your QwickPAY Account.

43 5

9

www.qwickpay.com

Page 13

3

B. Managing my account for mobile devices.

e. Change e-mail

Changing e-mail on your account

To change e-mail address or credentials in the QwickPAY App:

1. Launch the QwickPAY App and tap on the screen to get in.

2. Once you are in the main page of QwickPAY, tap on the Menu button on the top

right hand corner.

3. Now that you are in the menu screen, tap on the Merchant Info> option.

4. At the bottom of the Merchant Info screen, you can enter in a new e-mail

address in the Merchant Email eld.

5. Tap Done to save the update.

NOTE: Please do NOT adjust or touch the Merchant ID or Merchant Password

already in use unless you need to change it. Also make sure that the Demo Mode’s

are OFF.

f. Change password

If you change your QwickPAY Password in your virtual terminal, you must also update the QwickPAY App running on any mobile

device in order for the passwords to match.

Mobile Device

1. Launch and open the QwickPAY App.

2. Once you are in the main page of QwickPAY, tap on the Menu button on the

top right hand corner.

3. Tap on the Merchant Info> button.

4. Make certain that the Demo Mode’s are OFF.

5. Clear or tap on the X next to the QwickPAY Merchant Password elds to

remove the old password.

6. Type in the new password you just created on your virtual terminal in these

two middle elds. (No need to touch the Merchant ID because that will

never change.) You can update the merchant e-mail address here as well;

where all copies of the QwickPAY transaction receipts go.

7. Then tap on the Done button at the bottom of the page to save these

settings.

If the credentials took properly, it will take you back one page and then tap on

the Back button to take you back to the main QwickPAY page and you’ll be ready

to start processing card transactions.

[Make the password easy for you to remember, but too hard for anyone

else to surmise.

NOTE: MagTek/QwickPAY does not save nor store these custom

passwords, so please make sure you remember it or write it down and

store in a safe place.]

10

www.qwickpay.com

Page 14

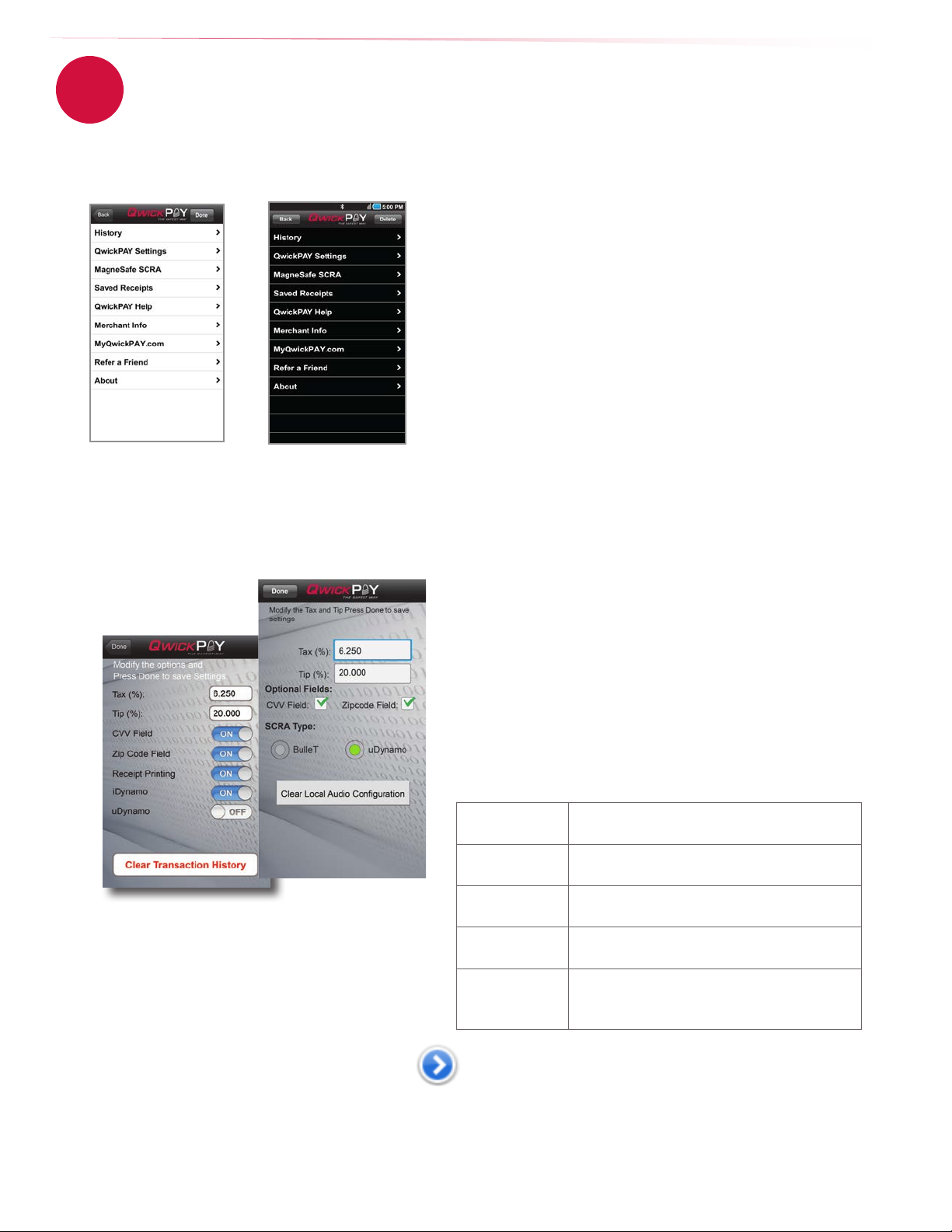

g. App overview

3

QwickPAY allows you to turn your browser-based Windows or Macintosh-based PC or mobile device into a POS terminal. It also

provides the administrative architecture you need to run your business. The default landing screen for QwickPAY is the transaction

screen. If you tap the Menu button you can view history and more.

Simulated iOS screen Simulated Android screen

B. Managing my account for mobile devices.

QwickPAY Menu

History

QwickPAY Payment Protection Gateway provides all the reporting you need

to run the sales-end of your mobile business.

• Transaction search functionality

• Transaction detail viewing

• Allows you to easily pull up transactions for Voids and Refunds

MagneSafe SCRA

Tap this to see the SCRA’s unique serial number and rmware version.

The serial number will always be 7 digits and begin with a letter. The

rmware version will always be numeric.

Saved Receipts

Tap here to view receipts; useful when the network connection is lost or if

you do not have an e-mail account set up on the device.

QwickPAY Help

Tap here to launch the QwickPAY web site support page.

Merchant info

Tap here to Login and enter your credentials and e-mail. This information

does not synchronize with your virtual terminal and will need to be

updated at both locations.

QwickPAY Promos

Check here for updates on QwickPAY promotions.

Refer a Friend

Tap here to send a populated e-mail to friends and colleagues about

QwickPAY.

About

Touch here for version and Application information.

QwickPAY Settings

QwickPAY allows you to enter default settings for Tax and Tip values; CVV Field

on or off; Zip Code Field on or off; and Receipt Printing on or off (iOS only).

Tax and Tip

CVV Field

Zip Code Field

Receipt

Printing

Clear

Transaction

History

You can override the Tax and Tip manually at the point of sale by tapping

on the blue arrow and editing the values on the Tax and Tip screen.

11

Set your default calculations for tax and tip.

Set the default to require or not to require by

selecting ON or OFF.

Set the default to require or not to require by

selecting ON or OFF.

Available only with iOS. ON enables you to print

a hard copy receipt to an AirPrint printer.

Clears the transaction history on your phone.

The data is aggregated and remains in your

virtual terminal.

www.qwickpay.com

Page 15

h. Setting tax and tip

3

iOS screen simulations

Android screen simulations

B. Managing my account for mobile devices.

Default tax and tip settings

This sets a default tax and tip calculated percentage of the sale amount.

1. Launch the App.

2. Tap on Menu.

3. Tap QwickPAY Settings.

4. Set the tax and tip default calculation settings percentages. In this example the

tax is set to 6.250% and the tip is set to 20.000%.

5. Tap Done to save changes.

6. Tap Back to go to the transaction screen.

The next time you go to make a sale the tax and tip will automatically calculate to

this default setting.

At the point of sale alter the tax and tip amounts

This allows you to edit the tax and tip amount at the point of sale.

Launch the App

After you enter an Amount in the Amount eld can you edit the Tax and Tip.

Once you enter the Amount, you can tap on the blue arrow and the Tax and

Tip override screen will slide into view.

(The Amount eld is carried over from the prior screen and cannot be edited here.

To edit the Amount, tap Next and go back to the Trans.Sale/Swipe page to adjust the

Amount.)

Here you can select to enter either the Tax and Tip percentages or the Tax and Tip

amounts. Change any of the elds using the keyboard for input. (Changing the

percentages will show how the amounts change and changing the amounts will

show how the percentages change.)

Tap Next to save your changes for this sale.

Tax and Tip will revert back to default settings for subsequent transactions.

12

www.qwickpay.com

Page 16

B. Managing my account for mobile devices.

4

Connect

a. Connect iDynamo/iDynamo 5 to iOS device

MagTek Adapters for Better Stability

MagTek supplies adapter kits with the respective iDynamo devices to make attaching to your

different iOS devices simple. The iDynamo adapter kits are available for iPod touch 3rd and

4th generation (using an insert that slips into the iPhone 3GS adapter), iPhone 4s/iPhone 4,

iPhone 3GS, iPad, and iPad 3rd generation/iPad 2. The iDynamo 5 adapter kits are available

for iPod touch 5th generation, iPhone 5c, iPhone 5s/iPhone 5, iPad Air, iPad with Retina Display,

iPad mini with Retina Display, and iPad mini.

Connect the iDynamo via the 30-pin or iDynamo 5 via the Lightning connector. Launch QwickPAY

and tap on MENU. Then tap on QWICKPAY SETTINGS. Select the iDynamo device (“On”). Then

press the DONE button.

iDynamo

iPod touch

3rd and 4th generation

(This uses the iPhone 3GS adapter

and a small insert that slips in.

Be sure to position the insert so

the inside name matches your

iOS device.)

iPhone 4

iPhone 3GS iPadiPhone 4s

iPad

3rd generation

iPad 2

Made for

iPad Air*

iPad with Retina display*

iPad mini with Retina display*

iPad mini*

iPad

(3rd generation)

iPad 2

iPad

iPhone 5c*

iPhone 5s*

iPhone 5*

iPhone 4s

iPhone 4

iPhone 3GS

iPod touch

(3rd, 4th and 5th* generation)

* iDynamo 5 Lightning connector

iDynamo with 30-pin connector

iDynamo 5

iPod touch

5th generation

iPhone 5c

iPhone 5s

iPhone 5

iPad mini iPad with

iPad Air

iPad mini with

Retina display

Retina display

Sub header

Your will see the App sub header change from Disconnected to Armed and Ready to Device Connected.

“Made for iPod” and “Made for iPhone” and “Made for iPad” mean that an electronic accessory has been designed to connect specically to iPod or iPhone or respectively, and has been

certied by the developer to meet Apple performance standards. Apple is not responsible for the operation of this device or its compliance with safety and regulatory standards. iPod touch,

iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries.

iPod, iPhone and iPad not included.

13

www.qwickpay.com

Page 17

4

Made for

OS 2.3.3 or higher

B. Managing my account for mobile devices.

b. Pair and Connect BulleT via Bluetooth

i. Android

The MagTek BulleT secure card reader authenticator uses Bluetooth technology to connect and communicate with your

Android device. The BulleT uses an internal, rechargeable battery.

USB HID connection

Insert the Micro-B end of the cable into Micro-B port on the bottom of the reader and the Standard-A

connector into a USB port on the PC/Mac. USB connection will automatically detect your device.

Charge

Attach the USB cable. It takes approximately 2.5 hours to fully charge the battery and it will stay charged for

approximately 100 card swipes. The LED will slowly blink amber while the battery is charging and then turn

solid amber when the battery is fully charged (for best results, allow the battery to fully charge).

LED Indicator (Charging)

Power Switch

The power switch is located on the front of the reader.

Press to turn ON (default is 120 seconds).

Hold 1 second to extend ON.

Hold 3 seconds to turn OFF.

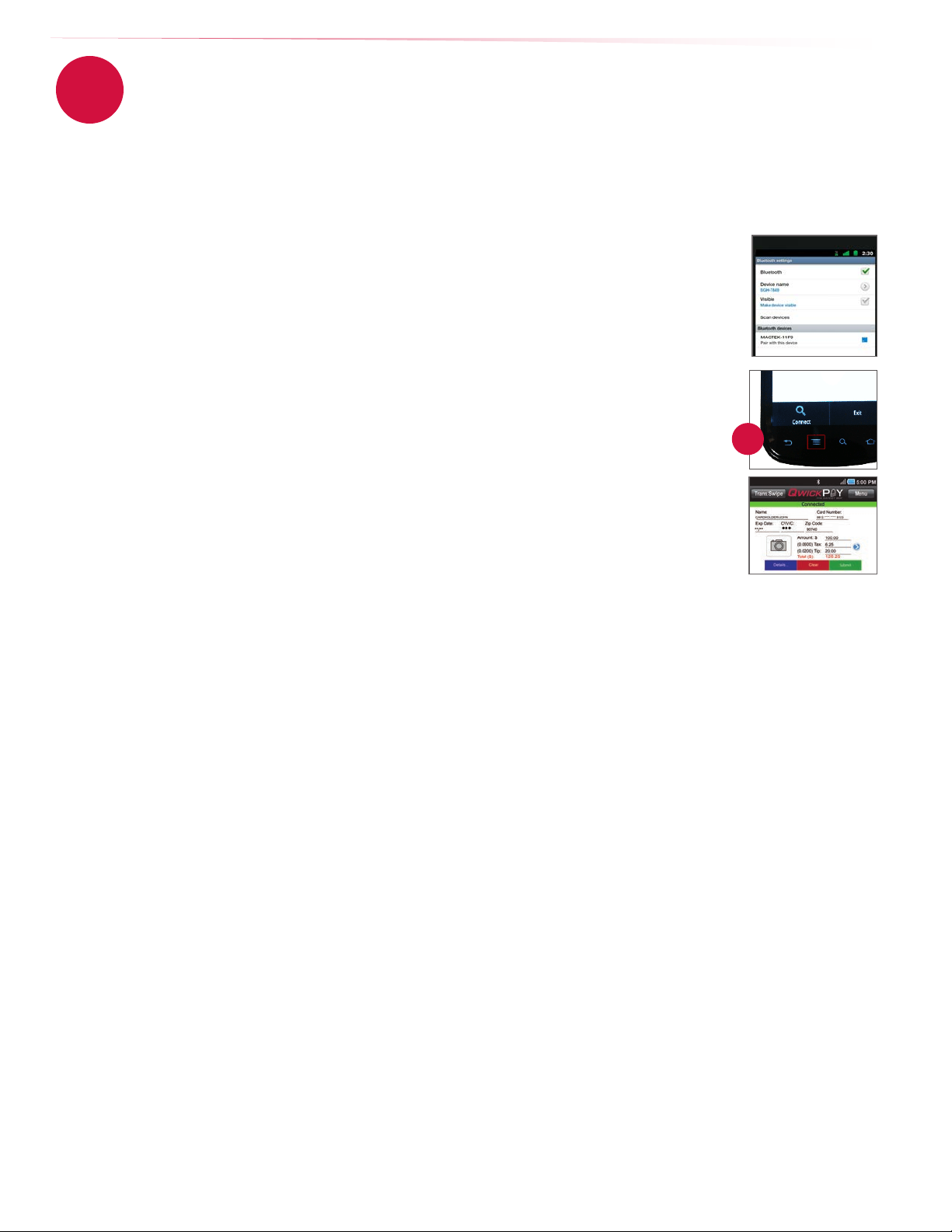

Pairing and Connecting

1. On your Android device pull up APPLICATIONS or MENU (depending on your

Android device) and select SETTINGS.

2. Select WIRELESS AND NETWORK.

3. Select BLUETOOTH SETTINGS.

4. Turn on the BulleT reader; a green light will ash when the device is trying to

connect.

5. On your Android device select SCAN FOR DEVICES.

6. Select the MAGTEK DEVICE when it appears on the screen.

7. The screen will prompt you for a PIN (the default is 1234).

8. At this point the device is PAIRED BUT NOT CONNECTED to QwickPAY.

9. Go to the QwickPAY Application on your device.

10. In the App, the top red bar shows the device is not connected.

11. Press the ‘Android MENU’ button on your Android device and choose CONNECT.

12. Connect to the desired MAGTEK BLUETOOTH device.

13. The top green bar shows the device is now connected.

14. The device is now ready to use.

LED Indicators

LED Color LED Condition USB Connection Meaning

Off Off n/a No power

Green Steady On -- Ready to read a card - after power button pushed

11

Green Rapid Flashing No Searching for Bluetooth connection

Green Slow Blinking -- Authentication has been established -

Green On 2 seconds -- Good Read

Amber Steady On Yes Battery fully charged

Amber Short Flash No After power button is pushed

Amber Slow Blinking Yes Battery charging

Red Steady On -- Authentication failed

Red Short Flash -- Following amber after power button is pushed

Red Rapid Flashing Yes Battery voltage too low to operate normally

Red On 2 seconds -- Bad card swipe

14

ready to read a card

www.qwickpay.com

Page 18

4

B. Managing my account for mobile devices.

b. Connect BulleT via Bluetooth

ii. For Newer Android devices

In newer versions of the Android OS customers may experience an issue when they are trying to discover and pair the BulleT

when scanning for available Bluetooth Devices in their Android Phone/Tablet. Previously they would nd and pair very easily

because it would display and identify the BulleT as MAGTEK – A0123D4, but in newer Android OS’s it is displaying as a MAC

Address in this format of NC-2H-KM-7G-KW.

Here is a procedure to nd the correct MAC Address and Pair the Android device with the BulleT

reader:

1. On your Android device pull up APPLICATIONS or MENU (depending on your Android device)

and select SETTINGS.

2. Select WIRELESS AND NETWORK.

3. Select BLUETOOTH SETTINGS.

4. Turn on the BulleT reader; a green light will ash when the device is trying to connect.

5. On your Android device select SCAN FOR DEVICES.

6. Start selecting found devices one by one.

7. The screen will prompt you for a PIN (the default is 1234).

8. Enter the PIN code and see which one locks the connection with the BulleT and displays a

solid green LED light.

9. Write down that MAC Address and save this Bluetooth name for future reference.

10. At this point the device is PAIRED BUT NOT CONNECTED to QwickPAY.

11. Go to the QwickPAY Application on your device.

12. In the App, the top red bar shows the device is not connected.

13. Press the ‘Android MENU’ button on your Android device and choose CONNECT.

14. Connect to the desired MAGTEK BLUETOOTH device.

15. The top green bar shows the device is now connected.

16. The device is now ready to use.

11

15

www.qwickpay.com

Page 19

4

c. Connect uDynamo

The uDynamo can be used with Android or iOS devices.

Charging

To charge the battery, connect the device to a USB host interface. Ensure the LED indicator shows that the

battery is charging (ashing amber and green). The uDynamo is powered by rechargeable internal lithium-

ion batteries. The uDynamo can process up to 300 swipes on a single battery charge. If the reader is left on

awaiting a card swipe, the battery will deplete in 3.5 hours. Recharging can take up to 6 hours.

Charging and Powering On/Off LED Indicators

LED Meaning Notes

Steady Green Fully Charged State Ready for a card swipe.

Blinking Green Authenticated While the reader is authenticated, no charging or battery level informa-

Steady Red Authentication Failed After an authentication failure, the LED remains red until a power cycle

Blinking Green

and Amber

Blinking Short

Red and Long

Green

Fast Blinking Red Reader is in Critically Low Battery

Solid Amber Charging in Critically Low Battery

Charging in Healthy Battery State The reader is in the Healthy State when the batter voltage is in between

Reader in Low Battery State The read is fully operational.

State

State

B. Managing my account for mobile devices.

Waiting for authentication.

tion is indicated.

or successful authentication.

No charging or battery level information is indicated.

the Fully Charged State and the Low Battery State.

Recommend charging the reader until the battery reaches the Healthy

State.

Card swipe disabled. Stop using the reader. If the reader is connected

to a mobile device, disconnect it before charging.

Card swipes and most commands are unavailable. Allow the reader to

charge to at least the Low Battery State before using again.

LED Indicator (Charging)

Card transactions may be performed using either the audio jack or USB interface while the uDynamo is

charging.

USB connection

Using the included Micro-USB cable (Micro-B), connect the uDynamo to a host USB port on your computer

or mobile phone/tablet. Then launch QwickPAY. The device is now connected and ready to use.

Audio jack connection:

When using the uDynamo’s audio jack connection, make certain to set up QwickPAY to communicate with the audio

device. Plug the uDynamo into the audio jack. Then launch QwickPAY and tap on MENU. Then tap on QWICKPAY

SETTINGS. Select the uDynamo device (‘On’). Then press the DONE button. Updating SETTINGS will enable

QwickPAY to automatically:

1. The volume of the device will be automatically turned up to max when the uDynamo is plugged in. (If

you have a physical mute button on your device, QwickPAY cannot automatically detect this and you

will need to turn mute OFF.);

2. Turn the device ON and OFF automatically, to save on battery usage. (QwickPAY will turn on

automatically only while you are on a transaction swipe screen and power off as soon as you go to

another screen in order to decrease the frequency of recharging.)

The device is now connected and ready to use.

Protect the uDynamo’s audio jack by folding it in when not in use.

Note: The uDynamo has no user controls. It requires QwickPAY to control the operation of the card reader.

16

www.qwickpay.com

Page 20

B. Managing my account for mobile devices.

5

Make a Sale - Transactions

a. Transaction authentication and authorization

Once you Submit your transaction, a transaction authorization and authentication screen appears.

Authentication

You may not be familiar with authentication since this is something that is unique to QwickPAY and the

MagneSafe™ Security Architecture (MSA). Only secure card reader authenticators (SCRAs) use the MSA

and can perform real-time counterfeit card detection and encrypt the card data within the read head.

SCRAs use the MSA to deliver instant encryption so your customers’ sensitive card details never enter

your phone and are sent securely over SSL connections for decryption, authentication and processing.

This lowers the scope and cost of PCI audits, saving you more time and money. A key feature of

MagneSafe is MagnePrint® card authentication, a patented, proven technology which reliably identies

counterfeit credit cards. MagnePrint is a dynamic card authentication technology based on the unique

physical properties of the magnetic stripe, also referred to as the stripe’s digital identier or (DI). It

provides validation that the card itself is genuine and that its encoded data has not been altered.

Authorization

You are probably familiar with transaction authorization: the process of conrming payment with the credit card company. The

card data and amount are sent securely for processing with the customer’s credit card account. Processing involves conrming

card number, expiration, CVV values, name on the card, zip codes and available funds.

No Authentication data is present when using manual card

entry, since the card is not read.

1. Authentication Data

MP Score - aka Authentication Value

This is MagnePrint® score from the transaction. The score

will range anywhere from -1 to +1 and be represented as 3

decimal places (ex - .856). The higher the score, the more

likely the card is authentic and not a copied card. The lower

the score, the more likely it is a fraudulent card and may incur

a charge back. If the MagnePrint score is below a 0.3, then

QwickPAY will display the following alert:

COUNTERFEIT ALERT

Examine the card carefully,

it is likely a counterfeit.

If you suspect fraud, make

a Code 10 call.

1.

2.

MP Count

The quantity of times the MagnePrint has been read.

2. Authorization

Trans Type

The type of transaction. Examples can be: Sales – Swipe,

Sale – Qwick Code, Void or Refund.

Status

The status of the transaction as it is returned from the

cardholder’s nancial institution, i.e., approved, declined, etc.

Transaction ID

An alpha/numeric code returned from the QwickPAY Payment

Protection Gateway that is unique to the specic transaction.

Auth Code

The authorization code that is returned from the cardholder’s

nancial institution when a transaction is authorized for sale.

VISIT

QwickPAY Support FAQs

and go to Security for more

info on Code 10.

If you press Proceed, you

can continue with the

transaction.

MP Days on File

This is the number of days that the MagnePrint has been on le.

MP Reg by

The party that initially registered the MagnePrint; examples

can be: Merchant, Gateway, Processor, Brand or Financial

Institution.

17

Total Charge/Amount

The total amount charged for a specic transaction (with

applicable tax and tip).

Tip Amount

The amount of dollars charged as Tip.

Tax Amt

The amount of dollars charged as Sales Tax.

Card #

The primary account number (or PAN) from the card used to

initiate the transaction. This number will be partially masked.

Exp date

The expiration date of the card used to initiate the

transaction.

E-mail

The customer e-mail address where the receipt will be sent.

Location

The geographical location where the transaction was made.

This can be set to ON or OFF on your device settings.

www.qwickpay.com

Page 21

B. Managing my account for mobile devices.

5

Sale Transactions

b. Make a sale - swipe

iOS Android

Select Transaction Type

Starting from QwickPAY’s main transaction screen, touch the Trans.Sale button in the

upper left corner. Select Sale-Swipe to accept a credit card.

1. Swipe the Card*

Swipe the payment card through the SCRA. The card data is masked so that full card

data is never displayed. The customer name and account automatically appear from

the card swipe. You can tap Details to add information to your customer contact

(including e-mail and address). Details are stored in your virtual terminal.

Manual Entry (CNP) Transactions:

• Press Trans.Sale and choose Sale - Manual Entry

• QwickPAY will automatically open a browser and log the merchant into the

QwickPAY Virtual Terminal with no additional prompt for QwickPAY Merchant ID and

Password. The merchant will be able to perform Manual Entry Transactions only.

All other Virtual Terminal functionality will require full login via a separate browser

session and full login using the QwickPAY Merchant ID and Password. (See page

35, Virtual Terminal Card not present for details.)

2. Enter the Details

Enter the CVV2/CVC2 and a ZIP code to better validate the card (no need to require

CVV and zip if card is swiped - optional).

Enter the dollar amount, tax and tip (these are automatically calculated, but can be

changed by pressing the blue arrow button).

Take a picture using the Camera function to include a photo of the customer or the

goods being purchased (optional). You can also select an image from your Photo

Library (size is 78x70 pixels), which could include an inventory of your products.

Submit the Sale

Press the green Submit button, when you are ready to process the sale.

Transaction Authorization

The transaction is sent to the QwickPAY Payment Protection Gateway and a response

will appear almost immediately.

(An error alert will appear if the card could not be properly authenticated due to a poor MagnePrint score.)

Press Add to Contacts to save the customer details (optional).

3. Take Signature

Customers may sign the receipt with their nger or use an optional stylus.

4. Send Receipt

Press Send to send your custom receipt via e-mail to the customer. A copy will

automatically go to your merchant e-mail address.

QwickPAY mobile stores Saved Receipts locally on your phone (50 KB). You can

delete the saved receipts at your discretion. QwickPAY virtual terminal stores a

history of all transaction receipts, e.g., under Account there are Saved Receipts;

there you can click on the saved receipts to view details and print. These are

securely stored with the QwickPAY Payment Protection Gateway.

Print Receipt (only available with iOS)

After you e-mail the receipt you can also optionally print the receipt to any available

AirPrint printer. Under QwickPAY Settings change Receipt Printing to On and

QwickPAY will automatically prompt you to print a receipt after each transaction.

18

www.qwickpay.com

Page 22

5

B. Managing my account for mobile devices.

c. Make a sale - QwickCode

A Sale - Qwick Code transaction sends the 8-digit alpha Qwick Code to the QwickPAY Payment Protection Gateway whereby the

Qwick Code is securely exchanged for decrypted card data which is then transmitted on to a PCI certied processor and used for

authorization. The funds available on the customer’s credit/debit card will then be reduced by the amount of the transaction, and

the transaction will be placed in a queue for settlement later in the day.

iOS Android

Select Transaction Type

Starting from QwickPAY’s main transaction screen, touch the Trans.Sale button in the

upper left corner. Select Sale-QwickCode to accept a Qwick Code.

1. Enter the Qwick Code

Enter the 8-digit Qwick Code.

2. Enter the Amount

Enter the dollar amount(s), tax and tip (they are automatically calculated, but can be

changed by pressing the blue arrow button).

Take a picture using the Camera function to include a photo of the customer or the

goods being purchased (optional). You can also select an image from your Photo

Library (size is 78x70 pixels), which could include an inventory of your products.

Submit the Sale

Press the green Submit button, when you are ready to process the sale.

Transaction Authorization

The transaction is sent to the QwickPAY Payment Protection Gateway and a response

will appear almost immediately.

(An error alert will appear if the card could not be properly authenticated due to a poor MagnePrint score.)

Press Add to Contacts to save the customer details (optional).

3. Take Signature

Customers may sign the receipt with their nger or use an optional stylus.

4. Send Receipt

Press Send to send your custom receipt via e-mail to the customer. A copy will

automatically go to your merchant e-mail address.

QwickPAY mobile stores Saved Receipts locally on your phone (50 KB). You can

delete the saved receipts at your discretion. QwickPAY virtual terminal stores a

history of all transaction receipts, e.g., under Account there are Saved Receipts;

there you can click on the saved receipts to view details and print. These are

securely stored with the QwickPAY Payment Protection Gateway.

Print Receipt (only available with iOS)

After you e-mail the receipt you can also optionally print the receipt to any available

AirPrint printer. Under QwickPAY Settings change Receipt Printing to On and

QwickPAY will automatically prompt you to print a receipt after each transaction.

19

www.qwickpay.com

Page 23

B. Managing my account for mobile devices.

6

Other Transactions

a. Void - before settlement

You can perform a void on any sale transaction that has been submitted for payment but has not yet been settled.

iOS Android

QwickPAY

The easiest way to perform a void is to:

• Launch the mobile App.

• Press the Menu button in the upper right hand corner of the screen.

• Then select History. The most recent transactions are listed rst. (Note: You will

only see transactions that were performed in the App you are currently in.)

• Next, select the transaction to be voided and its details will display.

• Tap the Void button in the upper right hand corner of the screen and it will

automatically launch the Trans.Void screen where it will populate the transaction

ID to be voided.

• When ready, press the Submit button to void the transaction.

If preferred, you can have the customer sign the receipt indicating the transaction

was voided and have an optional receipt sent to them by e-mail.

Another way to perform a Void is to:

• Launch the mobile App.

• Choose the Trans.Void transaction from the transaction options listed in the

upper left corner of the screen.

• Next, enter the original transaction ID from the transaction you wish to void.

(Note: You can enter any QwickPAY transaction ID)

• When ready, press the Submit button to void the transaction.

If preferred, you can have the customer sign the receipt indicating the transaction

was voided and have an optional receipt sent to them by e-mail.

Saved Receipts

QwickPAY mobile stores Saved Receipts locally on your phone (50 KB). You can delete

the saved receipts at your discretion.

QwickPAY virtual terminal stores a history of all transaction receipts, e.g., under

Reports there are Saved Receipts; there you can click on the saved receipts to view

details and print. These are securely stored with the QwickPAY Payment Protection

Gateway.

20

www.qwickpay.com

Page 24

B. Managing my account for mobile devices.

6

Other Transactions

b. Refund - after settlement

You can perform a refund on any sale transaction that has been settled.

iOS Android

QwickPAY

The easiest way to perform a Refund is to:

• Launch the mobile App.

• Then press the Menu button in the upper right hand corner of the screen.

• Then select History. The most recent transactions are listed rst. (Note: You will

only see transactions that were performed in the App you are currently in.)

• Next, select the transaction to be Refunded and its details will display.

• Tap the Refund button in the upper right hand corner of the screen and it

will automatically launch the Trans.Refund screen where it will populate the

transaction ID to be refunded.

• Enter the original sale amount or adjust by pressing the amount eld and

launching the keyboard.

• When ready, press the Submit button to refund the transaction.

Please require the customer to sign the receipt indicating the transaction was

Refunded and have an optional receipt sent to them by e-mail.

Another way to perform a Refund is to:

• Launch the mobile App.

• Choose the Trans.Refund transaction from the transaction options listed in the

upper left corner of the screen.

• Next, enter the original transaction ID from the transaction you wish to refund.

(Note: You can enter any QwickPAY transaction ID).

• Enter the amount you wish to refund.

• When ready, press the Submit button to refund the transaction.

If preferred, you can have the customer sign the receipt indicating the transaction

was refunded and have an optional receipt sent to them by e-mail.

Saved Receipts

QwickPAY mobile stores Saved Receipts locally on your phone (50 KB). You can delete

the saved receipts at your discretion.

QwickPAY virtual terminal stores a history of all transaction receipts, e.g., under

Reports there are Saved Receipts; there you can click on the saved receipts to view

details and print. These are securely stored with the QwickPAY Payment Protection

Gateway.

21

www.qwickpay.com

Page 25

B. Managing my account for mobile devices.

7

Administrative

a. Reports

To view reports for your QwickPAY subscription please visit your virtual terminal.

b. History

On your Mobile Device

Only the transactions performed on your mobile device can be seen on your mobile device.

All transaction history is stored in the virtual terminal.

History should be cleared from your phone at the discretion of the user; a warning message will appear when the memory is

near the limit (each transaction takes about 20 KB of storage space without a receipt and with a receipt it takes approximately

50KB of storage space).

22

www.qwickpay.com

Page 26

C. Virtual terminal

Getting a QwickPAY Account

1

Request a Subscription

Request a Subscription

You should use the same account for your Mobile Devices that you use for your Virtual

Terminal. Some users may prefer to only use one or the other - but no matter where you access

QwickPAY from, you are accessing the same account. If you have not yet requested a QwickPAY

account, follow the directions below. If you already have a QwicKPAY subscription skip to the

Virtual Terminal Step 2 for Setup.

You can go to the QwickPAY web site www.qwickpay.com and click on Activate to get a subscription with QwickPAY (“Get

QwickPAY” brings you to the online shop and allows you to purchase secure card reader authenticators).

A merchant account is required to use QwickPAY. If you already have a merchant account (meaning you can already accept

credit cards) or if you need to establish a merchant account, you can select the appropriate form to complete online. A

representative will contact you to complete the subscription process.

C. Managing my account in the Virtual Terminal

Account Activation

Once your account has been activated, you will be sent your credentials, Merchant ID (Username) andQwickPAY Merchant

Passord for login. The credentials are case sensitive. Please enter the credentials exactly.

Go to https://myqwickpay.com with your account credentials and setup your custom receipts.

23

www.qwickpay.com

Page 27

C. Virtual terminal

C. Managing my account in the Virtual Terminal

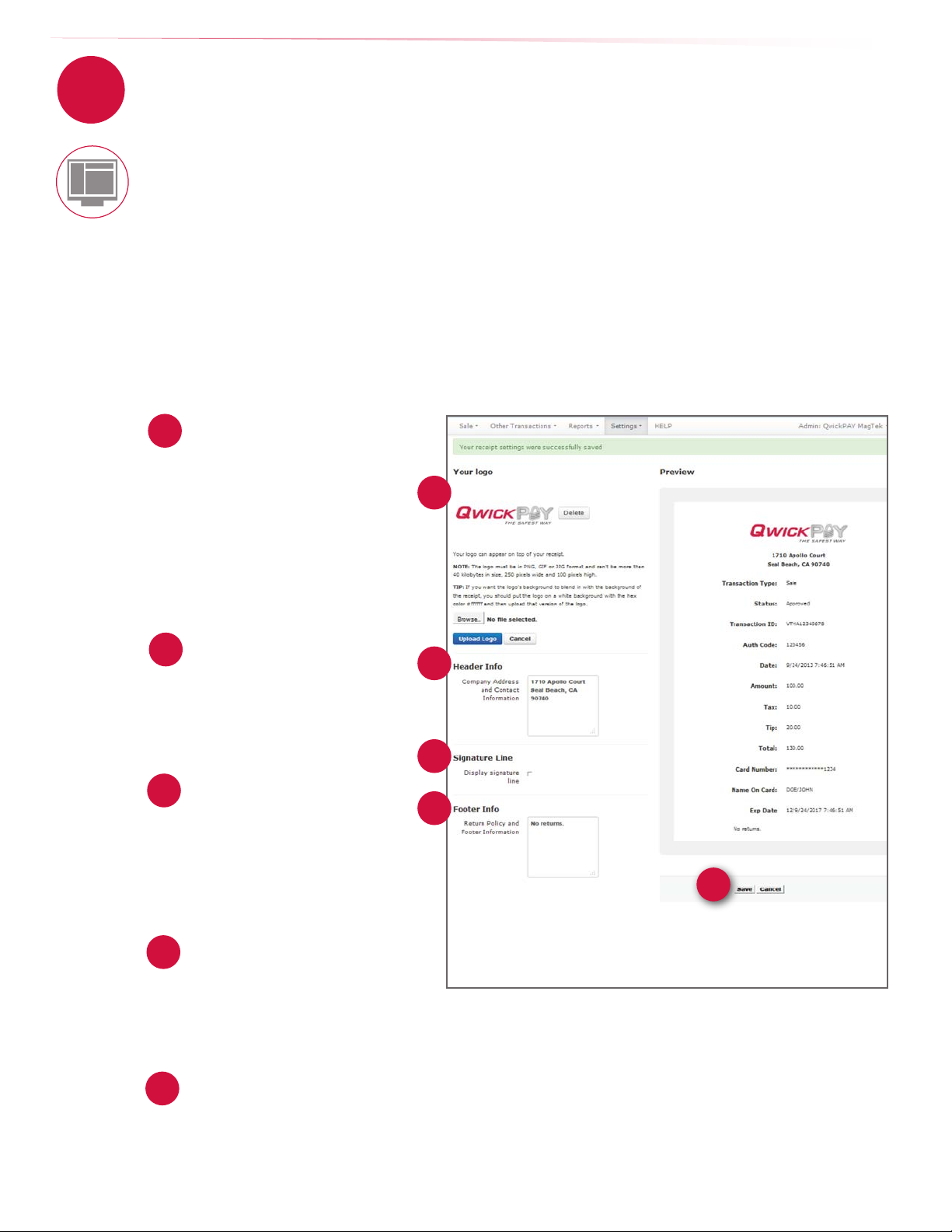

2

Setting up Account

Custom receipts - receipt settings

QwickPAY allows you to create your own custom receipts.

1. Locate your credentials.

2. Go to https://myqwickpay.com/login.aspx.

3. Enter your QwickPAY Merchant ID and Password.

4. Under SETTINGS go to CUSTOM RECEIPTS.

5. Add your Logo, a header, and a footer; you can also add a signature line for the virtual terminal receipts, allowing you to print

out receipts for hard copy signature after transactions are completed. [See items 1- 5 below]

6. SAVE your updates.

In order for the virtual terminal and mobile application to be synchronized with updates to the custom receipts, you will need to completely

close and restart the QwickPAY App on your mobile device. The receipt formatting updates are saved locally on your device and each time

you start the App it will check for the most recent revision. If updates are available, they will be automatically downloaded and saved.

Logo Image

1

The logo must be in PNG, GIF or JPG

format and can’t be more than 40

kilobytes in size, 250 pixels wide and

100 pixels high. You can access photos

on your PC or mobile device.

TIP: If you want the logo background to blend

in with the background of the receipt, you

should put the logo on a white background

with the hex color set to #FFFFFF.

Header

2

The header is the information located

at the top of the receipts just under

the logo. It is always centered. Most

commonly the header consists of

address and contact details.

Signature Line (Virtual

3

Terminal ONLY)

Check the box to add a signature line for

virtual terminal receipts so customers

can sign a printed copy. This eld will not

show or populate with signatures taken on

mobile devices.

1

2

3

4

5

Footer Information

The footer information is located

4

after the receipt information and is

left justied. It is commonly used for

thanking customers, URL information

and return policies.

Save

Be certain to SAVE your receipt updates.

5

To view the updates on your mobile

devices be certain to close and re-open

the App on your device.

24

www.qwickpay.com

Page 28

C. Virtual terminal

Cloud Application

3

a. Requirements and Specications

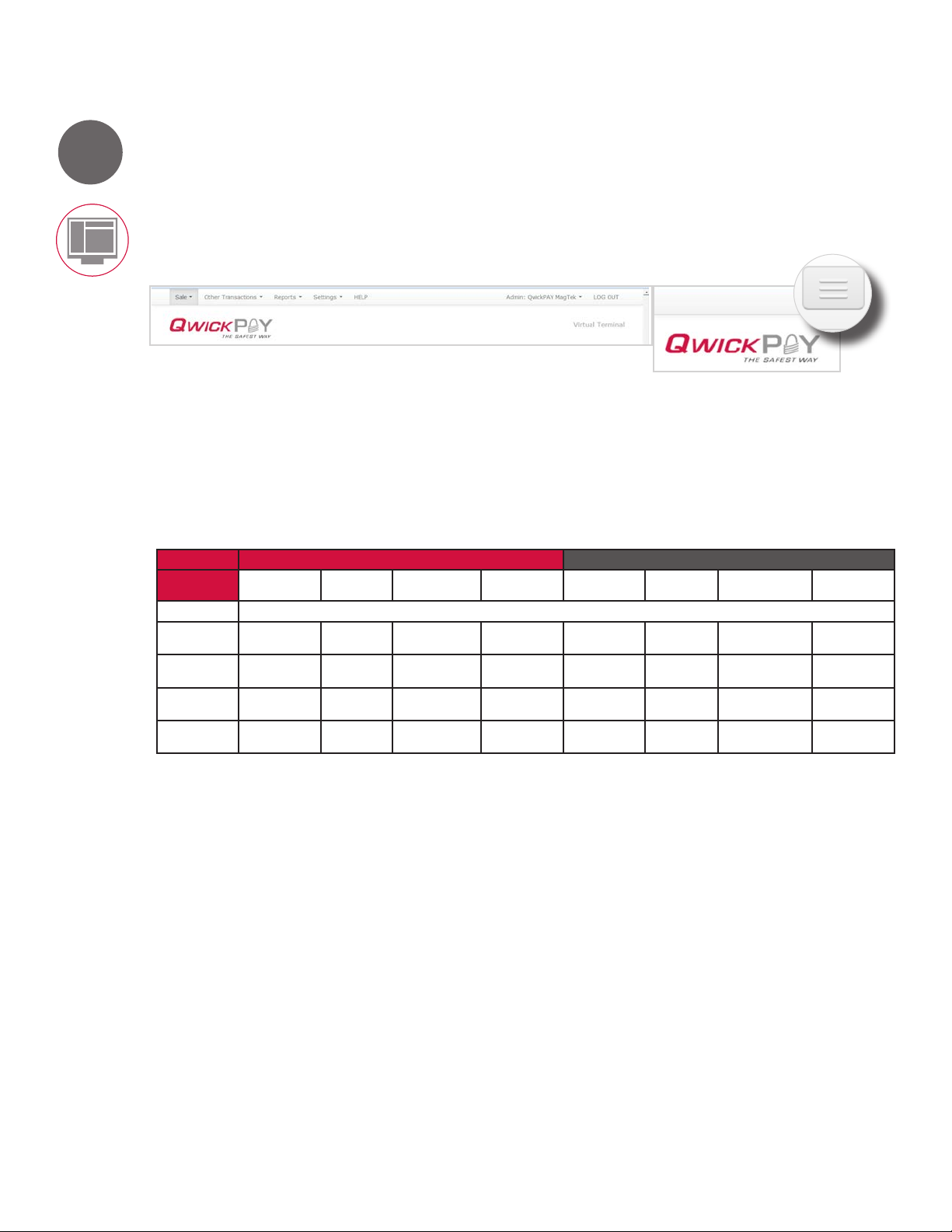

Mobile responsive, virtual terminal for QwickPAY. The Virtual terminal Navigation is either horizontal across the

top of the page on a full size browser window or as a drop down list in the top right corner on a mobile browser.

Sale transactions are grouped under the heading of SALE.

In order to provide access to the virtual terminal from almost any computing platform, QwickPAY works BEST

with Firefox 24.0 as a browser (PC or Mac) and using a mobile browser on iOS or Android devices.

C. Managing my account in the Virtual Terminal

Browser Requirements

OS Windows - Win 7 and 8 64-bit Mac OS X - 10.8.5

Browser Chrome

Device

HID Swipe

29.0.1547.76 m

Firefox

ver. 24.0

Internet Explorer

9 and 10

Opera

ver 16.0

Chrome

30.0.1599.66 beta

Firefox

ver. 24.0

Safari

ver. 6.0.5

Opera

ver 16.0

HID PIN Pad

HID Flash

HID KB Swipe

Works with

Not functional at this time

Settings

Cookies must be enabled in the browser’s settings.

MUST launch the browser the rst time as “Run As Administrator” to successfully download and install the MagTek Java Applet(s).

Java 7 or newer must be installed and running.

To determine the version of Java that you have, please go to http://www.java.com/en/ and click the link “Do I Have Java?”

25

www.qwickpay.com

Page 29

C. Virtual terminal

b. Login and Device Selection

3

C. Managing my account in the Virtual Terminal

1. Login

Go to https://MyQwickPAY.com

and enter your login credentials.

2. Select Device

While visiting for the rst time, you can select your default Virtual Terminal Device.

3. Install

When you go to make a transaction you will be asked to download the Applet(s). Click

RUN to continue the process.

26

www.qwickpay.com

Page 30

C. Virtual terminal

c. Change your password

3

If you change your QwickPAY Password in your virtual terminal, you must also update the QwickPAY App running on any mobile

device in order for the passwords to match.

C. Managing my account in the Virtual Terminal

Virtual Terminal Change Password

1. Locate your credentials. (This will come from the company where you

purchased QwickPAY). It will contain your QwickPAY Merchant ID and

QwickPAY Merchant Password. The credentials are case sensitive.

Please enter the credentials exactly.

2. Go to https://myqwickpay.com/login.aspx and login.

3. Select ADMIN: JOHN CARDHOLDER.

4. Under ADMIN select CHANGE PASSWORD/NICKNAME.

5. Enter the original QwickPAY password onto the top eld (you can copy

and paste).

6. Then create a new password in the lower eld.

7. Reenter for verication.

8. Click on CHANGE PASSWORD.

9. Your password is now reset. Be sure to update the new password on

any mobile device that is using QwickPAY (iOS or Android).

d. Setting tax and tip

[Make the password easy for you to remember, but too hard for anyone else

to surmise. NOTE: MagTek/QwickPAY does not save nor store these custom

passwords, so please make sure you remember it or write it down and store

in a safe place.]

Virtual Terminal - Merchant Nickname

The Merchant Nickname is a new feature that lets the merchant choose

a unique nickname name that can be used login into QwickPAY instead

of using the system generated QwickPAY Merchant ID. Enter a Merchant

Nickname and press the Update button. If the Nickname is already in use,

a message will direct the user to try another Nickname. If the Nickname is

available, it will be saved to your QwickPAY prole and ready for use with

future login.

Set Tax and Tip on the Virtual Terminal

You can access the Virtual Terminal using your mobile device’s browser or

from your PC. There you can select SETTINGS and then select TAX & TIP

from the drop down menu.

This Default Tax and Tip will be pre-populated on any Sale transaction. To

override, simply use your keyboard to override any Default values.

27

www.qwickpay.com

Page 31

C. Virtual terminal

e. Terminal Name

3

If you want to track and report the name of a computer/browser where a Virtual Terminal-based transaction was performed (ex - Joe’s

Front Desk Computer), users can now give that computer a “Terminal Name”. Go to Settings/Terminal Name in the Virtual Terminal and

once set, you will be able to view transaction history and sort the transactions by Terminal Name using the Standard or Custom Reports.

Note: Android and iOS Device Names will also be saved in the Terminal Name eld in the database for unied transaction reporting.

This will give users the ability to track and sort transactions from multiple QwickPAY platforms.

f. Overview

The virtual terminal is your ofce in the cloud; this is where you can access all aggregated transactions, create reports, perform

administrative tasks and create customized receipts.

SALE Turn your computer into a POS terminal and make sales.

Swipe Use a MagTek SCRA to securely swipe in custom cardholder information.

QwickCode Use a token created by QwickCodes for secure transactions.

Manual Entry Card not present, manual entry allows you to enter card data (PAN, Name and Exp Date) when

Barcode Upload a QwickCode (barcode image) to QwickPAY and submit payment.

OTHER TRANSACTIONS Issue credits to your customers.

REFUND Enter in the transaction ID to refund a sale after settlement.

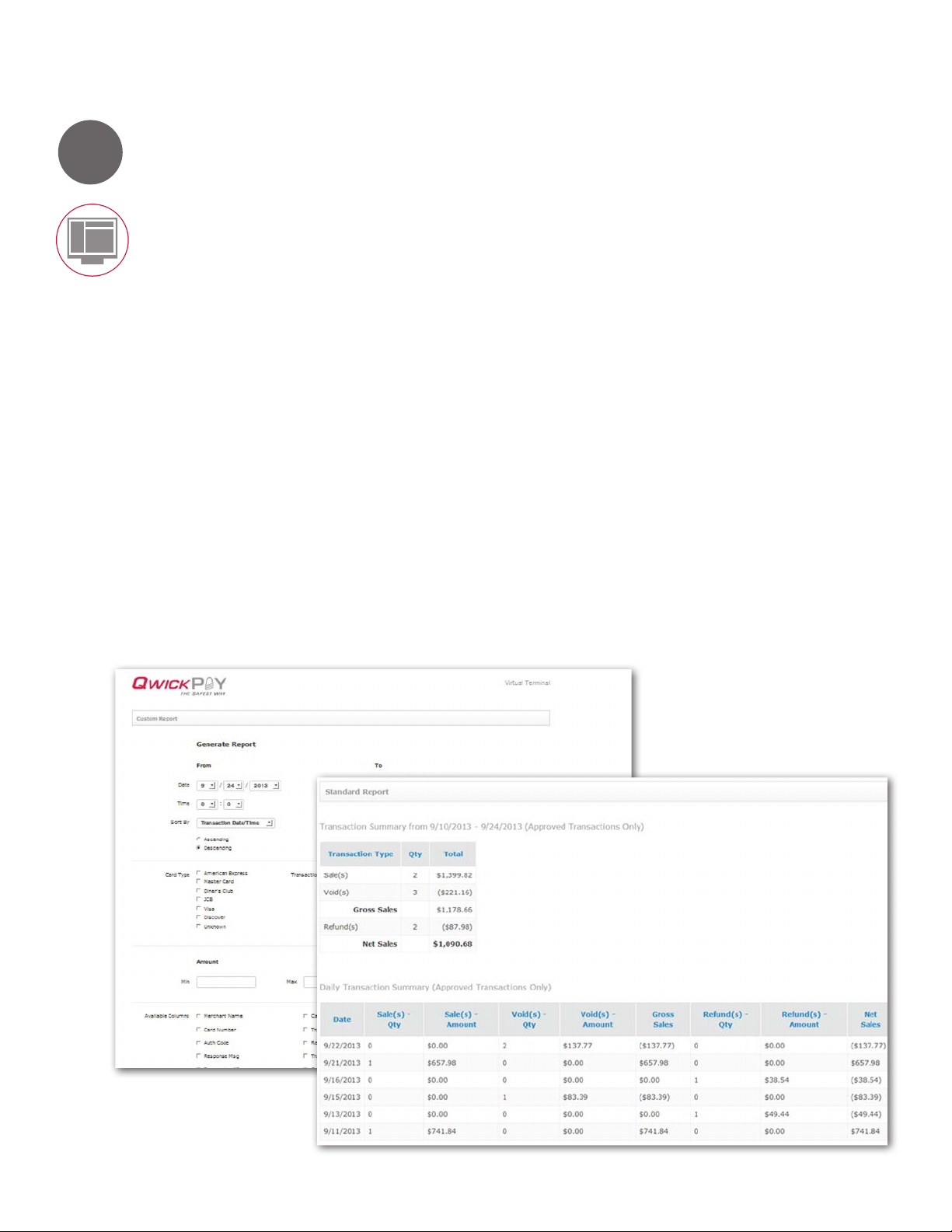

REPORTS

STANDARD The Standard Report is designed to act as a “Daily Report”. The merchant should run this report every

CUSTOM Allows you to create a custom report of your aggregated transactions.

SAVED RECEIPTS These are your aggregated saved receipts from all devices using this QwickPAY subscription.

SETTINGS

READER CONFIGURATIONS Allows you to select the conguration of yoru reader.

TERMINAL NAME If you want to track and report the name of a computer where a transaction was performed (ex - Joe’s

RECEIPT SETTINGS This allows you to build your own branded and customized receipts. See the next page for complete

TAX & TIP Set your default tax and tip settings.

READER CONFIGURATIONS Pick your point of sale device

HELP Brings you to www.qwickpay.com/support

ADMIN: QWICKPAY

CHANGE PASSWORD Allows your to change your password on your virtual terminal.

MERCHANT NICKNAME The Merchant Nickname is a new feature that lets the merchant choose a unique nickname name that

LOGOUT Securely logout

C. Managing my account in the Virtual Terminal

necessary. You can securely enter the data into the keyboard or for more secure entry and possible

reduced PCI scope, you can use a MagTek IPAD.

VOID Enter in the transaction ID to void a sale prior to settlement.

day and it will report on that day’s transactions. It has a defaulted “From Date” of TODAY (which can

be overridden to any date back as far as 90 days) and an implied “To Date” of TODAY which cannot be

changed. (This requires very few buttons or options to click to run the report).

The Custom Report is designed to let the merchant get more granular with what to show/not show and

for what data range (as long as it does not exceed 90 days). Reports go as far back as 90 days for a

Start Date (FROM) with an End date (TO) of any day up until and including TODAY.

Front Desk Computer), please give this computer a “Terminal Name”. Once set, you will be able to view

transaction history and sort the transactions by Terminal Name using the Standard or Custom Reports.

Please choose a Terminal Name that is between 1 and 64 alphanumeric characters.

details.

If you change your password, it will only change the password from the device you are using and does

not change your subscription password. If you want all of your devices to have a matching password, you

will need to update them all accordingly.

can be used to login into QwickPAY instead of using the system generated QwickPAY Merchant ID.

28

www.qwickpay.com

Page 32

C. Virtual terminal

Connect

4

Connecting via USB HID

QwickPAY offers a variety of MagneSafe card readers that can be used with the Virtual Terminal. Using the included Micro-USB

cable (Micro-B), connect the uDynamo, Dynamag, BulleT, Flash, or IPAD to a host USB port on your computer or mobile phone/

tablet. The uDynamo, Dynamag, BulleT, Flash and IPAD allow you to swipe card data into the virtual terminal. The IPAD also

allows card data to be manually entered into its secure keypad where the data can be encrypted and secured prior to the card

data entering the Virtual Terminal. This may allow for greater reduced PCI scope.

It is required to do the following to drive the USB HID MagneSafe Devices:

Cookies must be enabled in the browser’s settings; MUST launch the browser the rst time as “Run As Administrator” to successfully

download and install the MagTek Java Applet(s); Java 7 or newer must be installed and running. (To determine the version of Java

that you have, please go to http://www.java.com/en/ and click the link “Do I Have Java?”)

C. Managing my account in the Virtual Terminal

uDynamo

USB HID connection

Dynamag

USB HID connection

Flash

mobile storage of data

USB HIB connection

IPAD® DynaPro DynaPro

Mini

PIN entry/SCRA devices with USB HID connection

Connecting BulleT (USB HID or Bluetooth keyboard connection)

Charging and Power

It takes approximately 2.5 hours to fully charge the battery and it will stay charged for approximately 100 card swipes. The

LED will slowly blink amber while the battery is charging and then turn solid amber when the battery is fully charged (for best

results, allow the battery to fully charge).

USB HID connection for transactions

Attach the Micro-USB cable to a USB port to process transactions using USB HID connection.

Bluetooth keyboard (KB) connection

1. Go to Control Panel for Windows or System Preferences for a Mac

2. Select Bluetooth Settings

3. Add a Bluetooth Device

BulleT

USB HID or

Bluetooth keyboard

connection

4. Turn on the BulleT KB reader; a green light will ash when the device is trying to connect

5. Select Scan for devices

6. Select the MagTek Keyboard device when it appears on the screen

7. Computers and smart phones/tablets should automatically pair with the reader

8. At this point the BulleT KB is paired and ready for use

29

www.qwickpay.com

Page 33

C. Virtual terminal

Sale

5

a. Card present sale using uDynamo or Dynamag via USB HID

uDynamo and Dynamag, when connected via USB, operate in the same manner.

Dynamag

USB HID connection

C. Managing my account in the Virtual Terminal

Sale Transaction

Connect the uDynamo or Dynamag with the supplied USB cable to a USB port on the PC.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

1. Select SALE from the menu.

Select SWIPE from the drop down menu.

2. You will be asked to “Please swipe card”.

Swipe the customer’s card. the card data will automatically populate and the

card is authenticated.

3. Type in the amount you want to charge, including tax and/or tip. (You can set Tax

and Tip with Default values saved in Settings/Tax & Tip.)

If you want to email a copy of the receipt, make sure to click or tap on the

DETAILS button and enter in the email address.

uDynamo

USB HID connection

4. Click/tap on the SUBMIT button once you are ready to process this transaction.

Once charged, you will see the approval or decline message.

Click/tap on View Receipt if you wish to view, print or email the receipt.

30

www.qwickpay.com

Page 34

C. Virtual terminal

b. Card present sale using the BulleT via USB HID connection

5

BulleT

USB HID connection

C. Managing my account in the Virtual Terminal

Sale Transaction

Connect the BulleT with the supplied USB cable to a USB port on the PC.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

1. Select SALE from the menu.

Select SWIPE from the drop down menu.

2. Then turn on the BulleT. Once you have this connection, it will stay connected

with a solid green light until you either disconnect it from the PC or reboot the

PC. NOTE: The LED must be solid green on the BulleT in order for it to swipe

credit cards into the QwickPAY Virtual Terminal.

3. You will be asked to “Please swipe card”.

Swipe the customer’s card. the card data will automatically populate and the

card is authenticated.

4. Type in the amount you want to charge, including tax and/or tip. (You can set Tax

and Tip with Default values saved in Settings/Tax & Tip.)

If you want to email a copy of the receipt, make sure to click or tap on the

DETAILS button and enter in the email address.

5. Click/tap on the SUBMIT button once you are ready to process this transaction.

Once charged, you will see the approval or decline message.

Click/tap on View Receipt if you wish to view, print or email the receipt.

31

www.qwickpay.com

Page 35

C. Virtual terminal

c. Card present sale using the BulleT KB via Bluetooth keyboard connection

5

BulleT

Bluetooth keyboard

connection

C. Managing my account in the Virtual Terminal

Sale Transaction

Make sure the BulleT KB is paired with your computer or mobile device.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

Select SCRA USB KeyBoard under Settings/Reader Congurations.

Press Submit to Save.

1. Select SALE from the menu.

Select SWIPE from the drop down menu.

2. You will be asked to “Please swipe card.” (Make sure to power the BulleT KB on.)

Swipe the customer’s card. A blue status bar will display as the card data

is being transmitted by the reader to the Virtual Terminal. When done, the

card data will automatically populate the necessary elds and the card is

authenticated.

3. Type in the amount you want to charge, including tax and/or tip. (You can set Tax

and Tip with Default values saved in Settings/Tax & Tip).

If you want to email a copy of the receipt, make sure to click or tap on the

DETAILS button and enter in the email address.

4. Click/tap on the SUBMIT button once you are ready to process this transaction.

Once charged, you will see the approval or decline message.

Click/tap on View Receipt if you wish to view, print or email the receipt.

32

www.qwickpay.com

Page 36

C. Virtual terminal

d. Card present sale using the Flash via USB HID connection

5

Flash

mobile storage of data

USB HIB connection

C. Managing my account in the Virtual Terminal

Transaction

The Flash reader securely stores card swipes. These securely stored swipes can then

be downloaded to the QwickPAY app.

You may connect the Flash to any USB port on your PC.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

1. Select SALE from the menu.

Select SWIPE from the drop down menu.

2. Turn on the Flash.

3. The Download Transaction button will apear with a message displaying how many

pending transactions the Flash reader holds. If there are transactions, simply click

or tap the Download Transaction button. If there are no transactions stored the

message will display, “There are no transactions on your Flash reader.”

The stored transactions will download with the oldest swipe saved (rst in, rst

out). The card data will automatically populate and the card is authenticated.

4. Type in the amount you want to charge, including tax and/or tip. (You can set Tax

and Tip with Default values saved in Settings/Tax & Tip.)

If you want to email a copy of the receipt, make sure to click or tap on the

DETAILS button and enter in the email address.

5. Click/tap on the SUBMIT button once you are ready to process this transaction.

Once charged, you will see the approval or decline message.

Click/tap on View Receipt if you wish to view, print or email the receipt.

33

www.qwickpay.com

Page 37

C. Virtual terminal

e. MagTek PIN Entry Device (PED) via USB HID connection

5

Card present sale

IPAD® DynaPro DynaPro

Mini

PIN entry/SCRA devices with USB HID connection

C. Managing my account in the Virtual Terminal

Card Data Swiped on a Secure Card Reader Authenticator/PED

Connect the MagTek PED to a USB port on the Windows-based PC.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

1. Select SALE from the menu.

Select SWIPE from the drop down menu.

Instructions on the MagTek PED’s screen will ask you to “Swipe Card”. Please

swipe the payment card.

2. Swipe the customer’s card. The card data will automatically populate and the

card is authenticated.

3. Type in the amount you want to charge, including tax and/or tip. (You can set Tax

and Tip with Default values saved in Settings/Tax & Tip.)

If you want to email a copy of the receipt, make sure to click or tap on the

DETAILS button and enter in the email address.

4. Click/tap on the SUBMIT button once you are ready to process this transaction.

Once charged, you will see the approval or decline message.

Click/tap on View Receipt if you wish to view, print or email the receipt.

Card-not-present sale - MANUAL ENTRY PIN Pad

Card Data Manually Entered into a Secure PIN Entry Device (PIN Pad)

Connect the MagTek PED to a USB port on the PC.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

1. Select SALE from the menu.

2. Select MANUAL ENTRY (PIN Pad) from the drop down menu.

For best security, Merchants can use a MagTek PED to enter the card data into the

QwickPAY Virtual Terminal. You would need to select MANUAL ENTRY (PIN Pad). Card

data is encrypted in the PED before being sent over secure SSL network connections.

Instructions on the MagTek PED’s screen will ask you to enter the card data.

3. Enter the Account Number of the card, its Expiration Date and the Card

Verication Code (CVV2). In this case, CVV2 is not being checked so any 3-4

digits entered into the MagTek PED device will be ignored.

You can additionally add the customer’s contact information by clicking on DETAILS

(these are optional elds). This allows you to keep a record of the customer’s

contact information and if an email address is collected, will also allow you to send

a copy of the receipt to the customer after the transaction is processed.

4. Press the GREEN ENTER button on the MagTek PED device.

34

www.qwickpay.com

Page 38

C. Virtual terminal

Sale

5

f. Card-not-present sale - MANUAL ENTRY Keyboard

C. Managing my account in the Virtual Terminal

Sale Transaction

It is possible to make a sale where the card is not present and the merchant

manually enters the card data into the QwickPAY Virtual Terminal using their key pad

or keyboard.

Go to https://myqwickpay.com and log into your QwickPAY virtual terminal account.

Login using your QwickPAY Merchant ID and password.

1. SELECT SALE from the menu and MANUAL ENTRY (Keyboard) from the drop down

menu. Merchants can key enter the card number using their key pad or key board.

You will see a CAUTION message warning you that card not present transactions

are less secure. Tap or click CONTINUE to make the sale.

2. ENTER manually the necessary card data and the amount you wish to charge.

You can additionally add the customer’s contact information by clicking on DETAILS

(these are optional elds). This allows you to keep a record of the customer’s

contact information and if an email address is collected, will also allow you to send

a copy of the receipt to the customer after the transaction is processed.

3. SUBMIT Tap or click on the SUBMIT button once you are ready to process this

transaction. Once charged, you will see the approval or decline message.

4. EMAIL Tap or click on VIEW RECEIPT if you wish to view, print or email the

receipt.

Personal Computer Browser Apple Browser Personal Computer Browser

35

www.qwickpay.com

Page 39

C. Virtual terminal