Quicken for Mac 2006

User Guide

Copyright

© 2005 Intuit Inc. All rights reserved.

Trademarks

Intuit, the Intuit Logo, Quicken, Quicken Loans, QuickBooks, TurboTax, and QuickBase, among others, are registered

trademarks and/or registered service marks of Intuit Inc. in the United States and other countries. The Dollar Sign logo is

a trademark and/or service mark of Intuit Inc. in the United States and/or other countries. Various Quicken products and

services are protected by pending and one or more of the following issued U.S. Patents: 5134564, 5423033, 5649115, 5842185,

5903881 and 6446048.

Apple, the Apple Logo, Macintosh, Mac, the Mac logo, Mac OS and .Mac are trademarks and/or service marks of Apple

Computer, Inc., registered in the U.S.A. and other countries.

All other product names, company names, trademarks and service marks are the property of their respective owners and

should be treated as such. Some names, company names, and data used in examples and help content are fictitious and are

used for illustration purposes only. Any resemblance of fictitious data to a real person or company is purely coincidental.

All features, services and any terms and conditions are subject to change without notice. Online financial services, online

account services, online banking, online investing, transaction download, online payment, online bill presentment, and

online tax preparation, whether prepared by Intuit or third parties, are available only in the United States and require

Internet access. These services may vary from participating financial institutions and may be subject to application

approval, terms, conditions, and additional fees.

Software License Agreement

Please see the Software License Agreement (from Quicken, choose Help > Quicken Help, then click the "Software License

Agreement" link) for the terms and conditions under which the Software is licensed to you.

2

Table of Contents

1 Installation and setup 11

System requirements 11

Installing Quicken 12

Getting started if you’re new to Quicken 13

Upgrading from a previous version of Quicken 14

What’s new in this version of Quicken 16

2 Here’s what Quicken can do for you 17

Managing your bank accounts 17

Online account access 19

Tracking your investments 20

Tracking your assets and debts 21

Planning ahead 22

Reports and graphs 22

Up–to–the–minute financial information on the Web 24

3Working with Quicken 25

The Quicken workspace 25

Customizing your Quicken workspace 27

Getting step-by-step assistance from Quicken Help 29

Using this manual 31

3

4 Accounts track what you own and owe 32

About Quicken data files 32

About Quicken accounts 34

Setting up a Quicken account 35

Opening an account register 37

Editing, hiding and deleting accounts 38

5 Categories and classes track income and expenses 40

About categories 40

Setting up categories and subcategories 42

Editing, deleting, and moving categories and subcategories 47

About classes 48

Setting up classes and subclasses 50

Editing, deleting, and moving classes and subclasses 50

6 Keeping your accounts up to date 52

Recording your day-to-day expenses 52

Correcting mistakes 58

What do I put in the Category field? 59

Transferring money between accounts 64

Entering transactions with more than one category 68

Speeding up data entry 73

Finding a specific transaction 75

Customizing the register 76

Printing the register 77

4

7 Paying your bills 78

Scheduling bill payments 78

Writing checks with Quicken 84

Adding Quicken transactions to iCal 87

Printing Intuit checks 90

8 Reconciling Quicken accounts 104

Before you start reconciling 105

Starting reconciliation 107

Marking cleared transactions 111

Completing reconciliation 113

Solving reconciliation problems 115

9 Banking online 124

Quicken’s online banking services 125

How online banking works 125

Applying at your financial institution 127

Setting up a Quicken account for online banking 128

Downloading transactions 129

Making your downloaded transactions easier to read 134

Transferring money between online accounts 141

Making online payments 142

Communicating with your financial institution 148

Keep your accounts up to date 151

Storing your PINs and passwords 154

Setting up Quicken Bill Pay 157

Using Web Connect 158

5

10 Tracking your cash 162

When to use Quicken cash accounts 162

Entering cash transactions in Quicken bank accounts 163

Setting up and using Quicken cash accounts 165

11 Tracking your credit cards 169

When to use credit card accounts 169

Entering credit card transactions in a checking account 170

Setting up and using credit card accounts 172

12 Tracking assets and liabilities 178

When to use Quicken asset and liability accounts 178

Setting up and using asset and liability accounts 181

13 Tracking loans and mortgages 187

How Quicken tracks a loan 187

Setting up a loan 190

Handling different types of loans 196

Making a loan payment 198

Changing and deleting loans 202

Refinancing a loan 202

Estimating year-to-date loan interest 205

6

14 Tracking investments 206

About investment accounts 206

Tracking your investment data in Quicken 213

Setting up an investment account 225

Setting up a Quicken mutual fund account 235

Recording investment transactions 239

Updating security prices 263

Tracking indexes and securities you don’t own 267

Entering a transaction history for investments 268

Changing, deleting, and moving securities 271

Reconciling investment accounts 274

15 Investing online 276

Setting up an investment account for online access 276

Downloading investment transactions 276

Updating security prices online 280

Researching securities on the Web 286

Exporting your portfolio to Quicken.com 287

7

16 Creating reports 288

About reports 288

Creating an EasyAnswer report 289

Creating a QuickReport 291

Creating a basic Quicken report 291

Customizing reports 293

Reusing custom report settings 310

Investigating items in reports with QuickZoom 312

Changing report preferences 314

Updating reports 314

Printing and exporting reports 315

Seeing the big picture with Insights 316

17 Creating graphs 318

About graphs 318

Creating an EasyAnswer graph 319

Creating a standard graph 320

Customizing a graph 322

Investigating items in graphs with QuickZoom 326

Changing graph preferences 328

Printing graphs 328

8

18 Planning your financial future 329

An overview of Quicken’s planning tools 330

Budgeting 333

Forecasting 345

Financial planning calculators 355

Quicken.com planning tools 358

Home Inventory 359

Emergency Records Organizer 359

19 Getting ready for tax time 360

Tracking tax-related income and expenses 360

Creating tax reports 370

Transferring Quicken data to tax software 373

Estimating taxes with Quicken Tax Planner 374

Estimating capital gains 379

Appendix A: Working with Quicken data files 381

Using more than one Quicken data file 381

Importing and exporting Quicken data 382

Backing up your data file 386

Archiving your data file at the end of the year 389

Setting up passwords 395

Appendix B: Troubleshooting and contacting Intuit 397

Saving a phone call 397

Before you contact us 401

Who to contact 404

9

Index 407

Quicken Keyboard Shortcuts 445

10

1

Installation and setup

System requirements ............................................................................................................11

Installing Quicken.................................................................................................................12

Getting started if you’re new to Quicken..........................................................................13

Upgrading from a previous version of Quicken ..............................................................14

What’s new in this version of Quicken..............................................................................16

System requirements

To use Quicken for Mac 2006, you need the following:

• Macintosh with G3 processor

• Mac OS X, version 10.2.8, 10.3.9, or 10.4.1

• 128MB of RAM

1

• 50MB of available hard disk space

• Color monitor with at least 1024x768 resolution

•To print checks: Intuit checks and a laser or inkjet printer

•To access online features: Internet access (fees may apply), and Internet Explorer

5.2.2 or Safari 1.0.3

11

•To back up to iDisk: a .Mac account (fees apply)

To find out which version of the system software you are using or how much RAM

you have, choose About This Mac from the Apple (K) menu. To find out how much

free space you have on your hard disk, look at the bottom of the Finder window.

Installing Quicken

It’s a good idea to back up your existing Quicken data files before installing if you’ve

used a previous version of Quicken. (See “Backing up your data file” on page 386 for

more information.)

in your

1

Insert the Quicken

2

Double-click the Install Quicken icon.

3

Enter your computer administrator password and click OK.

4

Read the Read Me file and click Continue.

5

Read the Software License Agreement, click Continue, and then click Agree.

6

Select an installation destination and click Continue.

7

Follow the onscreen instructions to complete installation.

If you’re new to Quicken, go to “Getting started if you’re new to Quicken” next.

CD

CD-ROM

drive.

Chapter 1, Installation and setup 12

If you’re upgrading from a previous version of Quicken for Mac, skip to “Upgrading

from a previous version of Quicken” on page 14.

Getting started if you’re new to Quicken

If this is the first time you’ve used Quicken, Quicken will create a new data file for you

and then guide you through setting up your first bank account and entering your first

transaction. The whole process takes only a few minutes.

The Quicken icon looks like this:

See Chapter 6, Keeping your accounts

up to date, on page 52 for information

about entering transactions in a

register.

1

Go to the folder where you installed Quicken and double-click the Quicken icon.

2

Quicken asks you to personalize your copy of Quicken; type your name and click

OK.

3

In the welcome screen, click New User to set up a file for your Quicken data.

4

Follow the onscreen instructions to create your first Quicken account.

Congratulations! You’ve set up your first account. Now you can bring the account up

to date:

• Enter all the transactions that have occurred in this account between the ending

balance on your last bank statement and today. These transactions may be checks

that you have written and recorded in your paper check register, electronic funds

transactions (deposits to or withdrawals

transfers to or from the account, or

ATM

from the account).

Chapter 1, Installation and setup 13

• Enter all transactions dated before the statement’s ending date that have not yet

appeared on any bank statement.

Or you can wait and enter these transactions when you get your next bank

statement and are ready to reconcile your Quicken account with the bank

statement. See “Before you start reconciling” on page 105.

Then, when your next bank statement arrives, you can reconcile it with the

transactions you’ve recorded in your Quicken account. See Chapter 8, Reconciling

Quicken accounts, on page 104 for information about reconciling bank accounts.

Upgrading from a previous version of Quicken

If you are upgrading from a previous version of Quicken, be sure to move your

existing Quicken data files into your Documents folder. Then, if you still have your

Install CD from your previous version of Quicken, you can delete your old Quicken

CD

folder from your hard disk. If you no longer have your original

before you delete it. We strongly recommend that you delete your old copy of

Quicken.

, back up the folder

Note: If you are upgrading from Quicken 1 or 1.5, a document with instructions for

upgrading is available from Intuit Technical Support; choose Online > To the Web >

Online Technical Support.

1

After you have installed Quicken, moved your Quicken data files to your

Documents folder, and removed your old Quicken application from your hard

disk, you can open your Quicken data file one of these three ways:

Chapter 1, Installation and setup 14

• Double-click your Quicken data file icon.

• Double-click the Quicken application icon.

• Drag your Quicken data file icon to the Quicken icon.

2

If Quicken asks you to personalize your copy of Quicken, type your name and click

OK.

3

In the welcome screen, click Upgrading User.

You’ll see a series of screens telling you what’s new in Quicken. Click Continue

after you read each screen.

4

If the Open File dialog appears, select your data file and click Open.

Before Quicken opens your data file, it creates a backup copy of the file and puts it in

your Documents/Quicken Backup Folder/Old Quicken Data folder.

Converting your data file may take a

little while, especially if the file is

large.

After the backup file is created, Quicken updates your original data file for Quicken

2006 and you’re ready to work. To update another Quicken data file, choose File >

Open File and select that file.

Note: After you update your file to Quicken 2006 format, you

CANNOT

go back and

use the same file with an earlier version of Quicken. If you ever need to use your old

data with your previous version of Quicken, you can open the copy of the file that

Quicken put in the Old Quicken Data folder.

Chapter 1, Installation and setup 15

What’s new in this version of Quicken

To see what’s new in this version of Quicken, go to Quicken Help and click

What’s new in Quicken 2006

Chapter 1, Installation and setup 16

Here’s what Quicken can do

2

for you

Managing your bank accounts............................................................................................17

Online account access...........................................................................................................19

Tracking your investments..................................................................................................20

Tracking your assets and debts...........................................................................................21

Planning ahead......................................................................................................................22

Reports and graphs...............................................................................................................22

Up–to–the–minute financial information on the Web.....................................................24

Managing your bank accounts

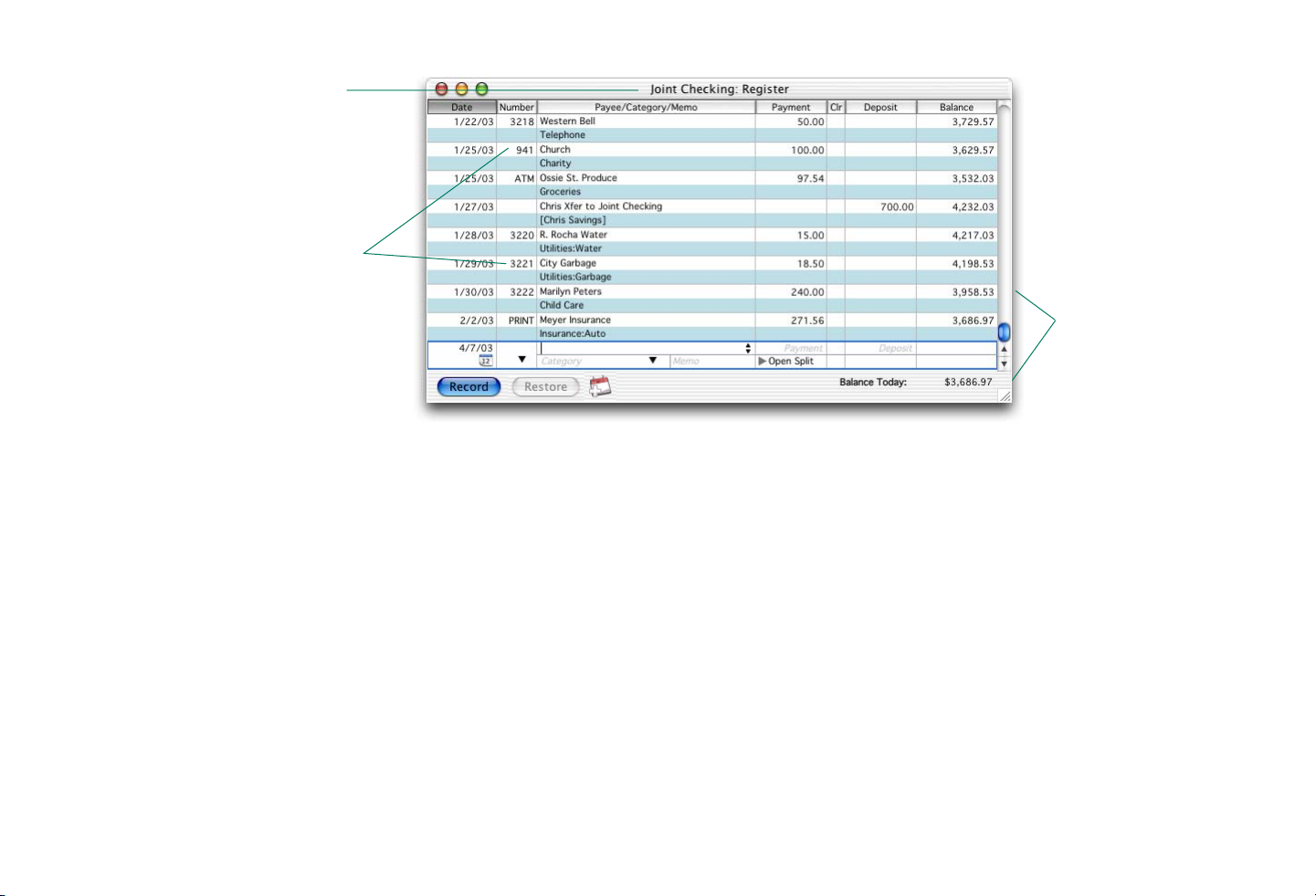

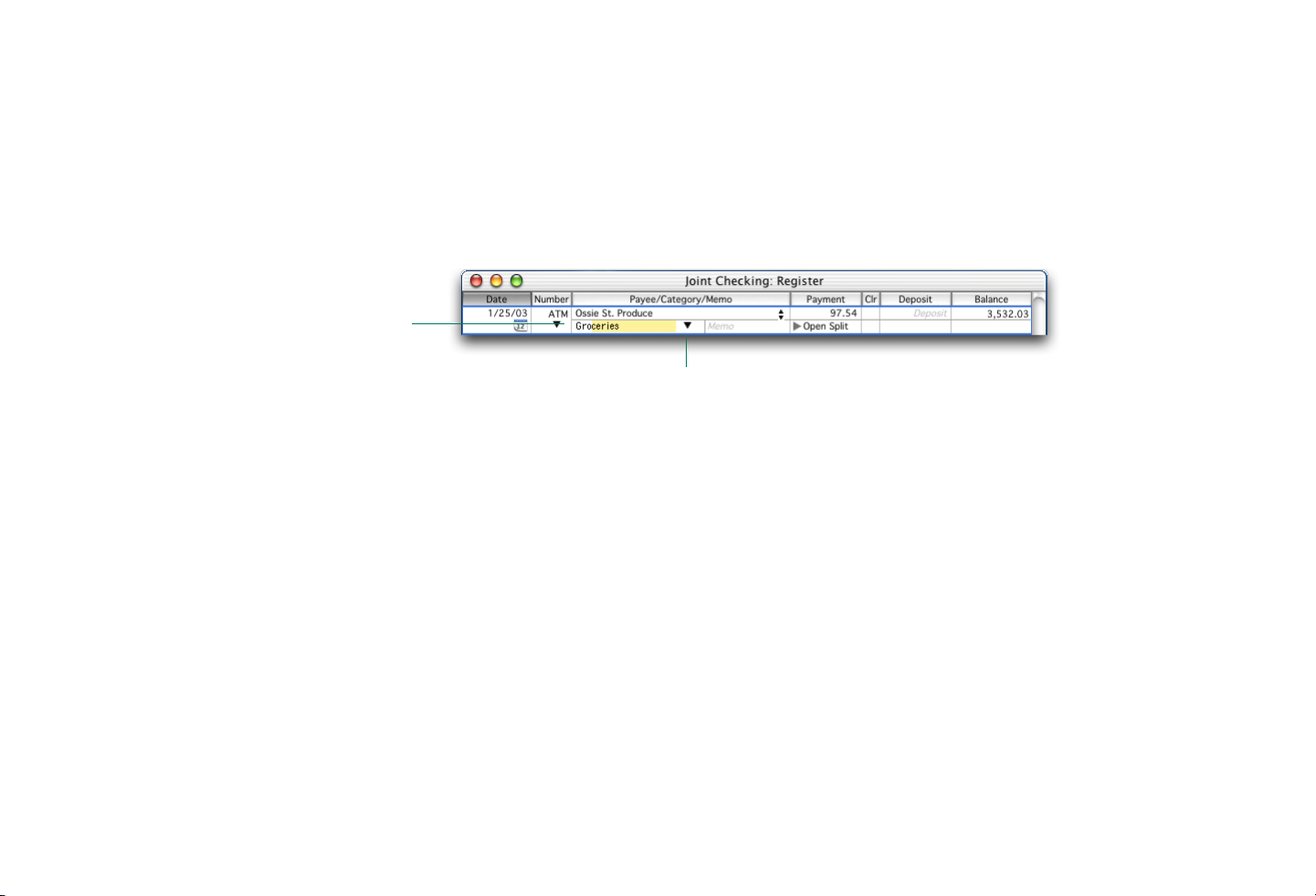

A Quicken bank account register looks a lot like a paper checkbook register. You enter

all the transactions that affect your account balance in the register, including checks

(automated teller machine)

you’ve written, deposits, electronic transfers,

transactions, and so on.

ATM

2

17

Quicken displays the name of the

account (Joint Checking) in the

window title.

You can use more than one series of

check numbers at a time. You can

write your checks by hand, print Intuit

checks directly from Quicken, or use

a combination of both.

Quicken computes the

account balance

automatically each

time you record a

transaction.

Quicken helps you accomplish many banking tasks quickly and easily:

• Keep detailed records of all your transactions without spending a lot of time

entering data. QuickFill™ remembers each transaction you enter, so you only have

to type recurring transactions once.

• Reconcile your Quicken accounts to make sure they agree with the statements from

your bank.

•Transfer money between Quicken accounts. Quicken records the transfer in both

accounts and updates your balances automatically.

• Schedule any kind of transaction—from a car payment that you pay at the same

time every month, to a class fee that you pay only once, to a paycheck direct

deposit. When a bill is due or when payday finally rolls around, Quicken either

Chapter 2, Here’s what Quicken can do for you 18

Entering categories is easy. As soon as you

type the letters “Gr,” QuickFill completes

the category name “Groceries.”

reminds you about it or simply enters it for you automatically—whichever you

prefer.

• Keep track of where your money goes with categories. For example, if you buy

groceries at several different stores, you can tell Quicken to use the same

“Groceries” category each time you record a payment to any of those stores in any

Quicken register. Then, at the end of the month, you can create a report or graph

that shows how much you spent on groceries that month.

You can also choose a category name from the pop-up menu in the Category field.

Online account access

Online account access gives you convenient, day or night access to your accounts

using state-of-the-art encryption and security features. With online account access,

you can:

• Update your Quicken registers, following a schedule you choose, with

transactions downloaded directly from your financial institution, saving data

entry time and effort

• Easily reconcile your accounts with automatic transaction matching

• Pay your bills without ever writing a check or licking a stamp

•Transfer funds between accounts at the same financial institution

Chapter 2, Here’s what Quicken can do for you 19

• Retrieve account balances and credit and charge card information, so you have

up-to-date information for better financial decision making

• Schedule a payment now to be paid at a future date you specify

• Update securities transactions in an investment account

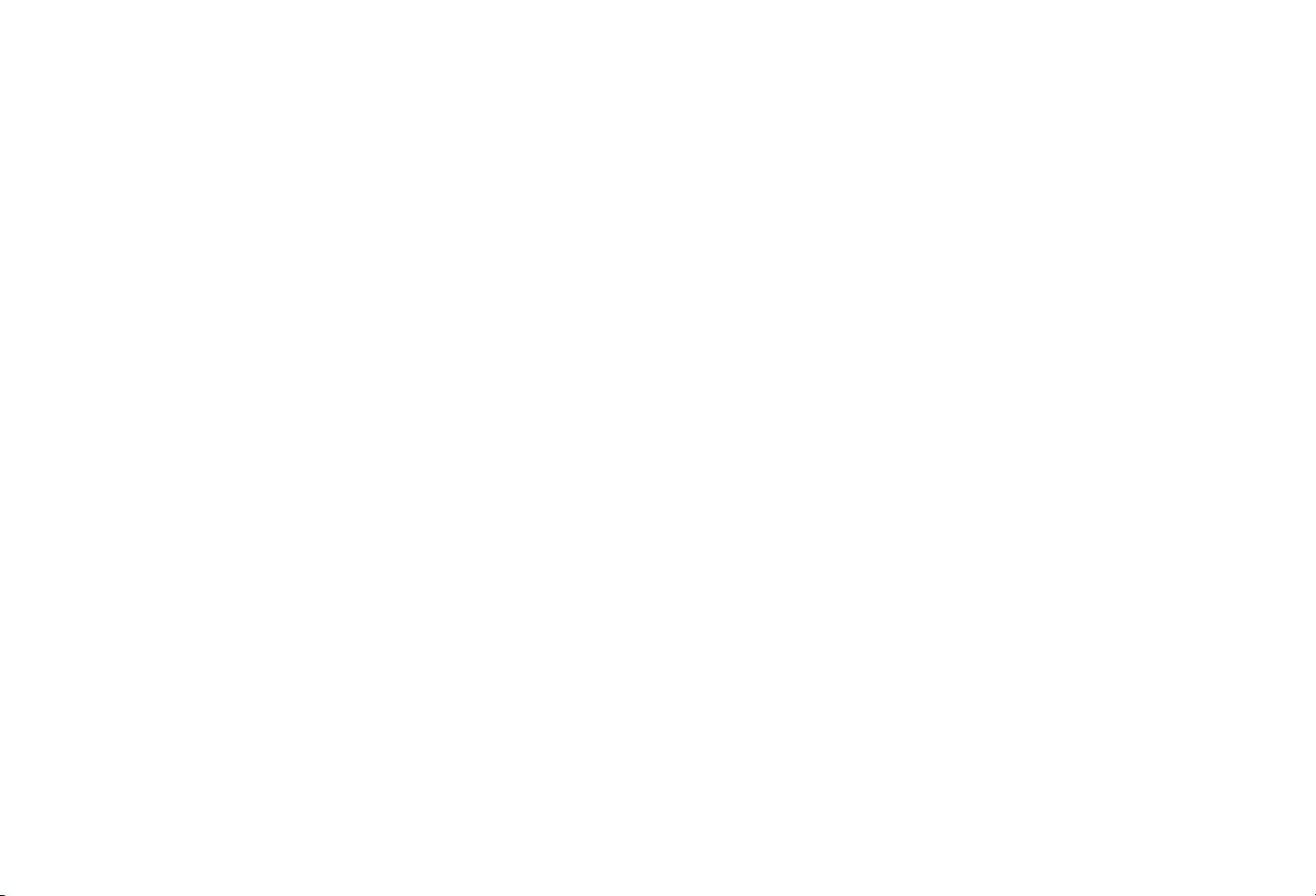

Tracking your investments

Use investment accounts to track what you own in stocks, bonds, mutual funds, and

other types of investments that fluctuate in price. Investment accounts let you:

• Compare the performance of your investments

• Keep detailed records of investment transactions

• Update current market values

• Report on investment income and capital gains

The Portfolio window lets you see all your investment accounts in a single window.

You can update security prices and view summary information for all your securities.

Chapter 2, Here’s what Quicken can do for you 20

Tracking your assets and debts

Quicken can help you track loan balances, the value of your car or other personal

possessions, and the balances due on your credit cards. If you set up accounts for all

your assets and debts, Quicken can include them in net worth reports and graphs to

give you an accurate view of your total financial picture.

When Quicken tracks loans and mortgages, it keeps track of both the amount of

interest you’ve paid and the loan’s outstanding principal balance—it even calculates

the proportions of interest and principal for each payment.

Chapter 2, Here’s what Quicken can do for you 21

Planning ahead

Quicken offers a variety of long- and short-term planning tools to help you look into

your financial future. Use reports, graphs, and budgets to assess your current financial

health, and then try out “what-if” scenarios with the financial planning calculators.

The Quicken Tax Planner helps you estimate what your next tax bill will be, and the

loan tracking tools help you shop for loans by figuring exactly how much interest and

principal you would pay in different loan scenarios.

For more information on Quicken’s planning tools, see Chapter 18, Planning your

financial future, on page 329.

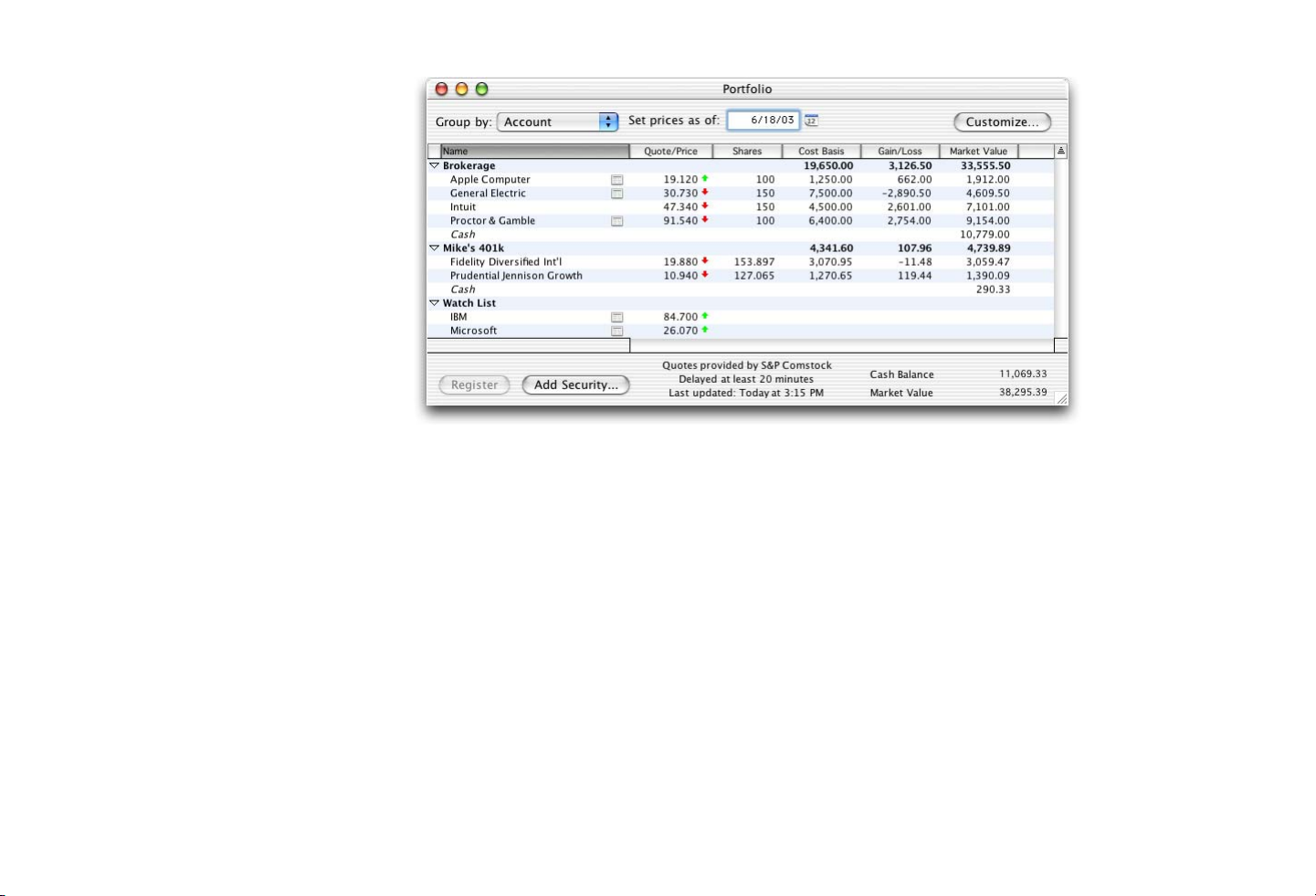

Reports and graphs

Quicken can create many different kinds of reports and graphs to give you insight into

your finances. With Quicken’s flexible reporting tools, you can include information

from any or all of your Quicken accounts. You can create a QuickReport™ or an

EasyAnswer report or graph for a quick update, or you can customize standard

Quicken reports and graphs by changing the layout and choosing just the accounts

and categories you want to see.

Suppose you want to look at your expenses for the last three months of last year. You

can see the information you want in a category summary report or an expense

comparison graph.

Chapter 2, Here’s what Quicken can do for you 22

In a category summary report,

Quicken totals your income and

expenses and displays the totals on

the screen. You can also print the

report if you like.

To view the transactions that make up

a value in a report, double-click the

value to get a QuickZoom report (a list

of transactions). To change one of the

transactions in that list, double-click it

to go to the register with that

transaction selected.

Subcategories help you analyze your

spending or income patterns; you can

look at a detailed breakdown of how

much you’ve spent or earned for each

subcategory as well as see a total for

the category.

An expense comparison

graph shows how much you

are spending on individual

categories in relation to your

total spending and to other

categories. You can use graphs

to analyze spending patterns,

show your top ten expenses,

alert yourself to overspending,

and compare historical data.

To see more detail about a

value in a graph (for example,

a specific pie slice),

double-click the value to get a

QuickZoom graph.

Chapter 2, Here’s what Quicken can do for you 23

Up–to–the–minute financial information on the Web

If you have a Web browser, it’s easy to connect to the Web right from Quicken. Just

choose Online > To the Web and then choose your Web destination. Quicken’s home

page on the Web is updated continuously to give you the very latest in financial

information, online banking, and Quicken technical support.

Chapter 2, Here’s what Quicken can do for you 24

3

Working with Quicken

The Quicken workspace.......................................................................................................25

Customizing your Quicken workspace .............................................................................27

Getting step-by-step assistance from Quicken Help .......................................................29

Using this manual .................................................................................................................31

The Quicken workspace

Activity areas

Quicken has six activity areas that are represented by six tabs at the top of your screen.

These tabs help organize your work and prevent your workspace from becoming

cluttered with too many open windows.

• Banking: Work with bank accounts, including checking, savings, and money

market accounts.

3

• Investing: Track stocks, bonds, mutual funds, and other investments.

• Planning: Budget and forecast how new events might affect your finances, plan for

tax time, and develop strategies to save more and pay less interest on your debts.

• Reporting: Create reports and graphs that tell you where your money comes from

and where it goes.

25

• Property & Loans: Track credit cards, loans and mortgages, and assets such as your

home.

• Services: The last area contains task buttons that help you access financial

information resources on the Web.

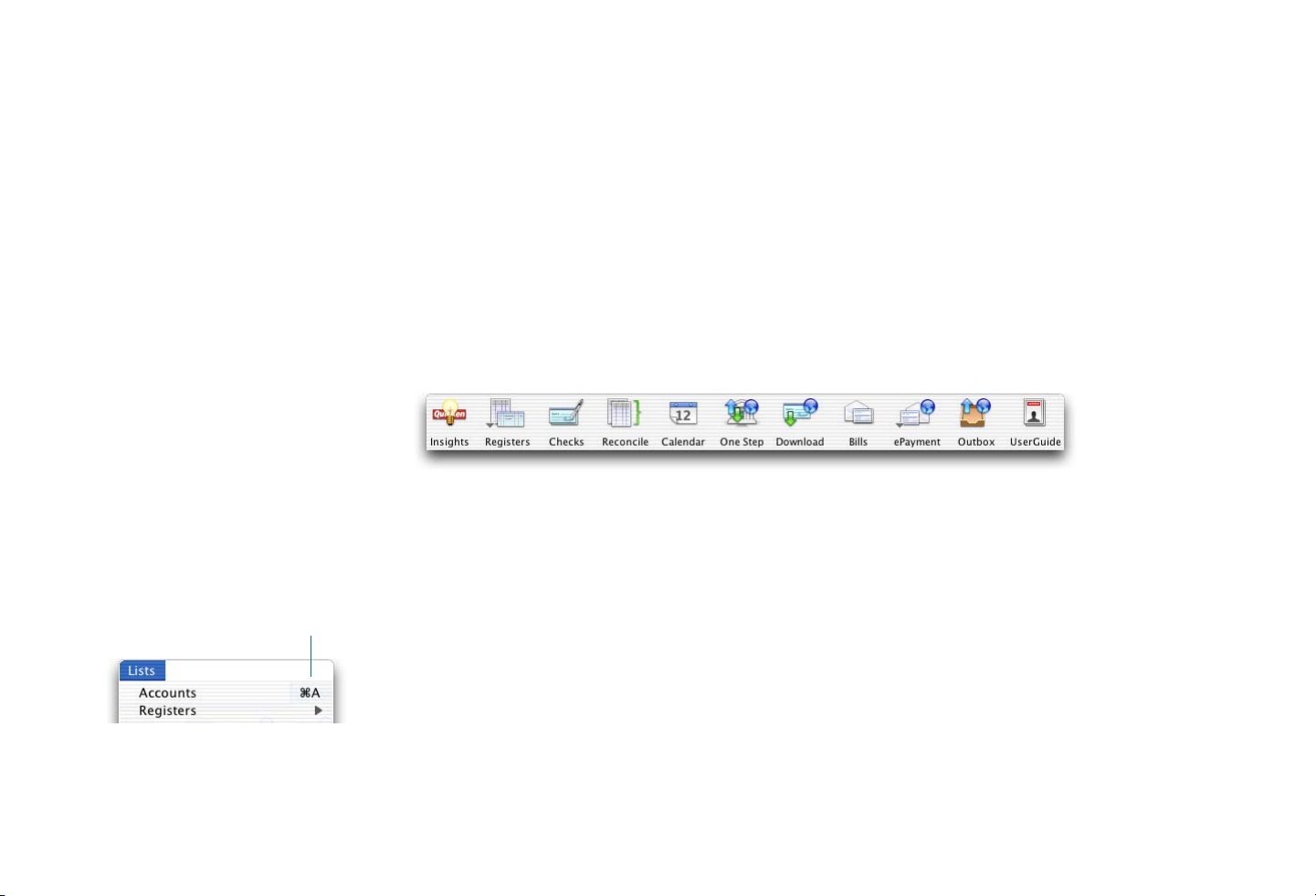

Toolbar

You can choose Quicken commands by clicking a button in the toolbar. The toolbar

includes the buttons for the most commonly used commands in the activity area

you’ve selected. For example, the toolbar in the Banking area includes buttons for

common banking tasks.

To add, delete, and rearrange command buttons, see “Customizing your Quicken

workspace” on page 27.

Here is the keyboard shortcut for the

Accounts command.

Keyboard shortcuts

A keyboard shortcut is a combination of keys you press at the same time to choose a

command. To use a keyboard shortcut, hold down the x (Command) key while you

press another key. To open the Account list, for example, hold down the x key and

press A. You can see a list of keyboard shortcuts on page 445. You can also create your

own keyboard shortcuts in Quicken. See “Creating your own Command-key

shortcuts” on page 28.

Chapter 3, Working with Quicken 26

Customizing your Quicken workspace

You can define your Quicken workspace by personalizing the toolbar, and adding,

rearranging, or removing tabs and command buttons.

Customizing the toolbar

You can use the toolbar just as it is, or you can change it so it suits your working style.

Adding a button to the toolbar

You can add many Quicken menu commands to the toolbar in any activity area tab.

You could, for example, add the Portfolio button to the toolbar in the Banking tab to

easily access your Portfolio window while you work in the Banking area.

1

Choose Quicken > Configure Toolbar.

2

Click the activity area tab where you want to add the command button.

3

Choose the command button you want to add to the activity area tab from the

scrolling list of commands.

4

Drag the button from the Command Button list onto the toolbar.

Rearranging and removing command buttons

To change the position of a command button, open the Configure Toolbar window.

Select and drag the button you want to move to a new location in the toolbar.

Chapter 3, Working with Quicken 27

To remove a single command button, open the Configure Toolbar window. Select the

button you want to remove and drag it off the toolbar. To remove the whole toolbar,

clear the Show Tabs, Show Command Buttons, and Show Account Buttons

checkboxes.

Creating your own Command-key shortcuts

You can access your favorite commands faster by creating shortcuts for them. A

shortcut lets you execute the command with a simple key sequence: pressing the x key

plus one other key. You can assign a Command-key shortcut to any menu command,

including any account name in the Registers menu.

1

Hold down the x key and click in the menu bar. Don’t release the mouse button.

2

Release the x key and select the menu command to which you want to assign a

shortcut.

3

With the command selected, release the mouse button.

Quicken displays a window that shows the menu name, command name, and

existing Command-key shortcut (if any).

For example, if you want the shortcut

for an account named Checking to be

-1, type 1 and click OK.

x

4 Type the key you want to combine with the x key and click OK.

If another menu command already has the same Command-key shortcut assigned

to it, Quicken asks you to confirm the change. If you confirm the change, Quicken

removes the shortcut from the other menu command and assigns it to the

command you selected.

Chapter 3, Working with Quicken 28

Removing a Command-key shortcut

1 Hold down the x key and click in the menu bar. Don’t release the mouse button.

2 Release the x key and select the menu command.

3 With the menu command selected, release the mouse button.

4 Delete the shortcut from the Command Key field in the Edit Command Key

window.

5 Click OK.

Getting step-by-step assistance from Quicken Help

If you have a question about how to do something in Quicken, go to Quicken Help for

step-by-step assistance. When you use Quicken Help, its window moves in front of

any windows you have open in Quicken. If you need to move it, just drag its title bar.

To return to Quicken, click in any Quicken window.

The step-by-step procedures that are available in Quicken Help are listed in tables like

this one.

For step-by-step help, go to Registers in Quicken Help and select

How do I enter a transaction?

Chapter 3, Working with Quicken 29

There are a number of different ways to open Quicken Help:

• Choose Help > Quicken Help.

•Press x-?

•Press the Help key if you are using an extended keyboard.

• Hold down the Control key, and click in a window to display a contextual menu.

Choose Help for information specific to the window you’re working with.

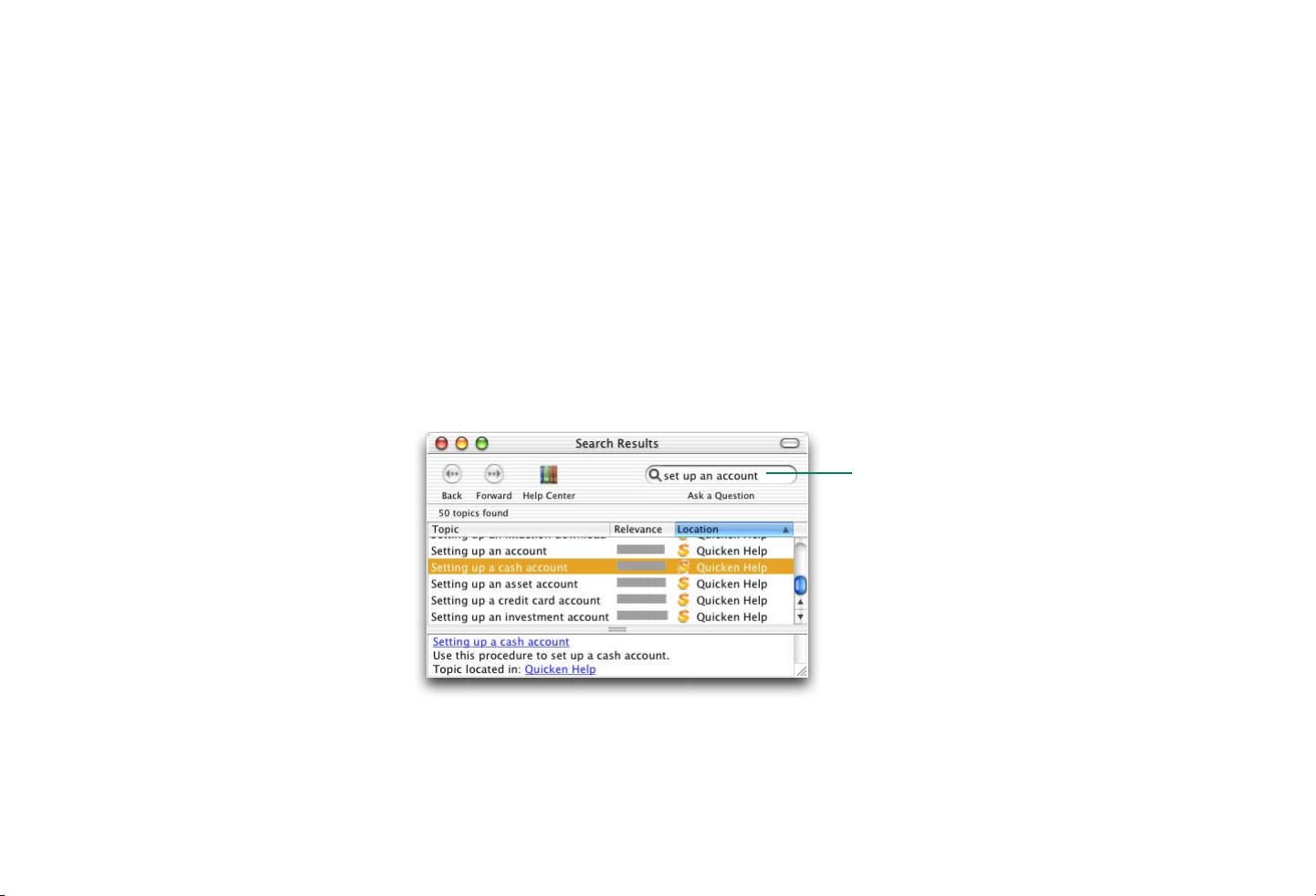

Searching Quicken Help

When you type in your text and click Search (or press Enter), Quicken Help displays

a list of related tasks. Click the topic that interests you.

Type a word or phrase and press Enter.

Chapter 3, Working with Quicken 30

Learning useful tips and shortcuts

Tips & Shortcuts are helpful hints that can help you get more out of using Quicken.

Choose Tips & Shortcuts from the Quicken Help table of contents. Then click a link to

see a series of tips and shortcuts for that topic area.

Using this manual

Quicken includes this onscreen User Guide. You can open this Adobe Acrobat

document by choosing Help > User Guide.

Chapter 3, Working with Quicken 31

Accounts track what you

4

own and owe

About Quicken data files .....................................................................................................32

About Quicken accounts......................................................................................................34

Setting up a Quicken account..............................................................................................35

Opening an account register................................................................................................37

Editing, hiding and deleting accounts ...............................................................................38

About Quicken data files

Your Quicken data file contains all your financial data. Your personal Quicken data

file might contain several accounts, such as a checking account, a savings account,

credit card accounts, and an investment account. If you use your Quicken data file for

business, it might contain a business checking account, an A/R account, an A/P

account, and a capital equipment account.

4

32

A Quicken data file is like a drawer in a filing

cabinet, and the accounts in it are like the

folders in that file drawer. You might, for

example, have folders in your financial file

drawer labeled Checking, Savings, Car loan,

Mortgage, and so on.

All the accounts in one Quicken data file share the same lists of categories, classes, and

other information—and you can transfer funds from one account to another within

the same file. Plus, when you run a Quicken report or graph, you can choose to see

data from any or all of the accounts in your file. For example, if you want a status

report on the accounts you use every day, you can create a net worth report that

includes the balances from your checking, credit card, and savings accounts. If you

want your net worth report to show your overall financial picture, you can include

information from all of the accounts in your file, including investment accounts,

retirement accounts, and the asset and liability accounts you use to track the value of

your home and the remaining balance on its mortgage.

If you use Quicken for personal finances only, you probably need just one data file.

Quicken reports, graphs, and budgets only include information from accounts that are

in the same data file. However, you may decide you need more than one data file if,

for example, you want to keep your personal and business finances completely

separate. See “Using more than one Quicken data file” on page 381.

Chapter 4, Accounts track what you own and owe 33

About Quicken accounts

Each Quicken account represents either something you own (an asset) or something

you owe (a liability), and lets you track the money—or value—that is added to or

subtracted from that account.

Quicken is flexible enough to let you track as many as 255 accounts in one file. Some

people track only their primary checking account; others want to know where every

penny goes. Some people use just one checking account for a while and then add other

accounts as they go along; others set up all their accounts before they begin entering

any data.

Accounts that track what you own

• Bank accounts (checking, savings, and money market). Use these to track your

checking accounts, savings accounts, and money market accounts. You can print

checks and make electronic payments from these types of accounts. See Chapter 7,

Paying your bills, on page 78, and Chapter 9, Banking online, on page 124.

• Cash accounts. Use this to track your cash. See Chapter 10, Tracking your cash, on

page 162.

• Asset, house, and vehicle accounts. Use these to track the value of an asset such as

a home or car. For a business, use asset accounts to track your capital equipment

or accounts receivable. See Chapter 12, Tracking assets and liabilities, on page 178.

• Investment accounts (brokerage, 401(k), and IRA). Use these to track multiple

investments in a single account. See Chapter 14, Tracking investments, on

page 206.

Chapter 4, Accounts track what you own and owe 34

• Single mutual fund accounts. Use this to track a single mutual fund. See

Chapter 14, Tracking investments, on page 206.

Accounts that track what you owe

• Credit card and line of credit accounts. Use these to track your credit cards, lines

of credit, and equity lines. See Chapter 11, Tracking your credit cards, on page 169.

• Liability accounts. Use these to track something you owe, such as a mortgage or

car loan. For a business, use liability accounts to track accrued liabilities or

accounts payable. See Chapter 12, Tracking assets and liabilities, on page 178.

Setting up a Quicken account

The steps for setting up an account are basically the same for all Quicken accounts.

You can edit most account information later if you decide to change it (see page 38).

Note: To set up an investment account or track a loan, see “Setting up an investment

account” on page 225, “Setting up a Quicken mutual fund account” on page 235, or

“Setting up a loan” on page 190, before you set up the account.

1 Choose File > New > Account, or List > Accounts and then click New.

The Account Setup Assistant appears.

2 Follow the onscreen instructions to create the account.

Chapter 4, Accounts track what you own and owe 35

When you are done with the Assistant, Quicken creates the account, adds its name

to both the Account list and the Categories & Transfers list, downloads current

transactions (if you set up online account access), and opens its register.

Chapter 4, Accounts track what you own and owe 36

You can come back

to this transaction

later and change the

opening balance

amount and the date

if you need to.

Opening an account register

There are several ways to open a register in the current data file (or bring it to the front

if it’s already open):

• Click the button for that account in the account bar at the bottom of the toolbar.

Quicken displays buttons of the most recent accounts you’ve opened:

Note: If you don’t see buttons like the ones shown above, choose Lists > Accounts,

select the account, click Edit, and make sure that both the Show account in lists and

Show account in toolbar checkboxes are checked.

• Choose the account from the Registers pop-up menu in the toolbar.

• Choose Lists > Registers > [account].

• Choose Lists > Accounts, and then double-click the account name.

Chapter 4, Accounts track what you own and owe 37

• If the account you want to work with is already open, use the Windows menu to

bring the open account to the front.

You can work with more than one account at a time by opening multiple register

windows. You can always tell which account you have open because the account

name is part of the Register window title.

Editing, hiding and deleting accounts

To edit a Quicken account, select the account name in the Account list and click Edit.

Then change the account information in the Edit Account window. You can rename

an account, change the account description, change an account’s online access, and

read or edit any notes you added. You can edit the credit limit for a credit card account

or change an investment account’s tax status. You can also change the account type in

most cases.*

If you don’t use an account anymore, you can hide it so that it doesn’t show up in the

Account list or the Categories & Transfers list. Its transactions are still there so you can

use them in reports and graphs, but it doesn’t show up in any lists. To hide an account,

select it in the Account list and click Edit. Clear the Show account in lists checkbox. In

the Account list, clear the Show hidden accounts checkbox. To see the hidden account

again, select the Show hidden accounts checkbox in the Account list.

You can delete an account by selecting it in the Account list and clicking Delete.

* You can’t change the account type of an investment or mutual fund account, and you can’t change a

bank, cash, asset, credit card, or liability account into an investment or mutual fund account.

Chapter 4, Accounts track what you own and owe 38

Caution: Do not delete an account as a step in changing account information. If you

delete an account, you lose all of the transactions in it. When you edit the account

information, the account retains all of its transactions.

When you delete an account, you lose all of the transactions in that account, and any

transfers between the deleted account and your other Quicken accounts lose the

transfer information.

For step-by-step help, go to Accounts in Quicken Help and select

How do I edit account information?

How do I hide an account?

How do I delete an account?

Chapter 4, Accounts track what you own and owe 39

Categories and classes track

5

income and expenses

About categories....................................................................................................................40

Setting up categories and subcategories............................................................................42

Editing, deleting, and moving categories and subcategories.........................................47

About classes .........................................................................................................................48

Setting up classes and subclasses .......................................................................................50

Editing, deleting, and moving classes and subclasses.....................................................50

About categories

Categories are labels you assign to transactions to help you track where your money

goes. When you “categorize” your transactions, Quicken can give you insight into

your finances through reports, graphs, and budgets. Reports and graphs can tell you:

5

• How much you spend each month on groceries, utilities, mortgage interest, auto

maintenance, and more. These items are tracked using expense categories.

• How much you receive each month in salary, bonuses, dividends, interest income,

rental income, and so on. These items are tracked using income categories.

40

If you assign categories to the transactions you enter in Quicken, you can:

•Create income- and expense-based reports and graphs that show where your

money comes from and how you spend it. See Chapter 16, Creating reports, on

page 288, and Chapter 17, Creating graphs, on page 318.

• Set up budget amounts for some or all of your categories and create reports or

graphs that compare your budget to your actual expenses and income. See

“Budgeting” on page 333.

• Save time when preparing your tax returns by generating a list of tax-related

income and expenses, or by exporting information to tax-preparation software. See

Chapter 19, Getting ready for tax time, on page 360.

“What do I put in the Category field?”

on page 59, explains how to assign

categories to transactions.

You can assign a category to any transaction in any non-investment account.* If you

write a check for groceries, you could assign the category “Groceries” to the

transaction when you enter it in your Quicken checking account register. If you pay

for the groceries by credit card, you would also assign the category “Groceries” to the

transaction when you enter it in your credit card account register.

The more specific your categories are, the more detailed your reports and budgets will

be.

It is important to assign categories and subcategories consistently. For example, if you

sometimes assign the category “Auto” to transactions for gasoline, but other times

you assign the category and subcategory “Auto:Fuel,” Quicken displays two separate

amounts in reports: one for “Auto” transactions, and another for “Auto:Fuel”

transactions. Use the Replace command to find all occurrences of “Auto” in a register

* Quicken assigns special investment categories to many kinds of investment transactions. See the table

that begins on page 244 for more information.

Chapter 5, Categories and classes track income and expenses 41

and decide whether to recategorize some of them as “Auto:Fuel” (see “Finding a

specific transaction” on page 75).

Tip: You’ll get more accurate reports, graphs, and budgets if you categorize credit and

charge card purchases the same way you categorize checking account transactions,

instead of assigning a general category like “AmEx” or “Credit card.” See Chapter 11,

Tracking your credit cards, on page 169.

Setting up categories and subcategories

When you started Quicken for the first time, you had the opportunity to include a

preset home category list, business category list, or both in your Quicken data file. You

can use the preset categories as they are or modify them to suit your needs.

Note: If you chose not to include Quicken’s preset category lists when you initially

created your data file, but now wish to include them, choose Lists > Categories &

Transfers > Import Business Categories and/or Import Home Categories.

To get started quickly, use one of the preset category lists and then add new categories

as you work with Quicken. Or, if you prefer, review the preset category lists and the

modified lists on page 44 and then create your own list.

To see your list, choose Lists > Categories & Transfers > List.

The next page shows the preset category lists provided by Quicken:

Chapter 5, Categories and classes track income and expenses 42

Quicken’s preset Categories &

Transfers lists

The list on the left is the preset list of

home categories that Quicken

provides, and the one on the right is

the preset list of business categories.

Subcategories are indented under the

main category. Click the triangle to

the left of the category name to hide or

show its subcategories.

Click a column title to change the order in

which categories appear in the list. This

list is sorted by category name, but you

could also choose to sort it by type if, for

example, you want to group your all of

your income categories together. You can

also sort by tax status or

description.

Delete any unused categories by

selecting them in the list and clicking

Delete. For example, if you live in the

U.S., you may want to delete all the

Canadian categories. And if you live

in Canada, you may want to delete the

U.S. tax categories.

You can mark categories as

tax-related and assign tax

form information to them.

See Chapter 19, Getting

ready for tax time, on

page 360.

Chapter 5, Categories and classes track income and expenses 43

Here are two sample category lists:

• The list on the left is a partial view of

a category list used by a couple who

want to track their income and

expenses in more detail than

provided by the preset home category

list.

• The list on the right is shorter than the

preset list of home categories, and it

contains main categories only—no

subcategories.

The first time you set up an investment

or single mutual fund account, Quicken

adds these investment categories

(preceded by •) to your Categories &

Transfers list.

Modifying the preset category lists

You can modify a preset category list by creating new categories or new subcategories

and by editing or deleting existing categories and subcategories. You can also change

a category into a subcategory or a subcategory into a category, and you can move

subcategories from one category to another. See “Creating new categories” on

page 45, “Creating subcategories” on page 46, and “Editing, deleting, and moving

categories and subcategories” on page 47.

Account names in brackets ( [ ] ) are

included in this list so you can transfer

funds between accounts. Double-click

an account name to create a transfer.

See “Transferring money between

accounts” on page 64.

Chapter 5, Categories and classes track income and expenses 44

The category name can be up to 32

characters long. Be careful not to enter

more than one name for the same

category. For example, if you type

“Clothes,” Quicken will see it as a new

category even if you already have a

category called “Clothing.”

Click Income if this is an income category

such as salary, interest income, or rent

from an investment property. Click

Expense if this is an expense category such

as groceries, utilities, mortgage interest, or

charity.

Creating new categories

You can set up your categories before you enter any transactions, or you can set them

up “on the fly” while you are entering transactions.

1 Choose Lists > Categories & Transfers > List (x-L).

2 Click New (x-N).

3 Enter information about the category.

The category description can be up

to 54 characters long. You can show

the description instead of the

category name in reports and

graphs if you want to see a more

detailed description.

(Optional) Select the Tax-related

checkbox if you want to use this

category to track tax-related income

or expenses.

(Optional) Select Assign a tax link if you

wish to assign a category to a specific line

item on an IRS form. See “Marking

categories as tax-related” on page 361.

4 Click Create to add the category to the Categories & Transfers list.

Chapter 5, Categories and classes track income and expenses 45

To add the subcategory “Insurance” under

“Auto,” select “Auto” and click Add

Subcategory. Then type “Insurance” in the

Category field and click Create.

Creating subcategories

Using subcategories gives you more flexibility than using categories alone. For

example, under the category “Utilities” you could have subcategories such as “Cable

TV,” “Gas & Electric,” and “Water.” Then you can show information for each

subcategory under the main categories in your reports, graphs, and budgets.

1 Choose Lists > Categories & Transfers > List (x-L).

2 In the Categories & Transfers window, select the category for which you want to

create a subcategory and click Add Subcategory.

Quicken doesn’t display a type

(income or expense) for

subcategories because they are

always the same type as the parent

category.

3 Enter information about the subcategory just as you would for a new category.

See the illustration in step 3 on page 45.

4 Click Create to add the subcategory to the list.

Quicken displays the new subcategory below the main category in the Categories

& Transfers list. Subcategories are listed in alphabetical order.

Chapter 5, Categories and classes track income and expenses 46

Editing, deleting, and moving categories and subcategories

You can edit category or subcategory information by selecting a category in the

Categories & Transfers list and clicking Edit. If you rename a category or subcategory,

Quicken automatically replaces the old name with the new name in all transactions

categorized with the old name.

You can delete a category or subcategory by selecting it in the Categories & Transfers

list and clicking Delete.* When you delete a category or subcategory, Quicken

removes the name from the Categories & Transfers list and from the Category field of

any transactions to which it is assigned.

Caution: Don’t delete a category or subcategory as a step in changing its name. Delete

a category or subcategory only if you don’t expect to use it again or if you want to

reassign the transactions for the deleted category to several different categories.

You can also change a category into a subcategory, or move a subcategory from one

category to another by dragging and dropping them in the Categories & Transfers list.

For step-by-step help, go to Categories & Classes in Quicken Help and select

How do I edit categories and subcategories?

How do I delete categories and subcategories?

* You cannot edit or delete the predefined investment categories (those preceded by •), and you can

only edit or delete transfer categories from the Categories & Transfers list by editing, hiding, or

deleting the associated account (see “Editing, hiding and deleting accounts” on page 38).

Chapter 5, Categories and classes track income and expenses 47

For step-by-step help, go to Categories & Classes in Quicken Help and select

How do I move categories and subcategories?

About classes

Classes add an additional dimension to reports and graphs by letting you specify

where, to what, or to whom transactions apply. Classes do not replace categories; they

add information to transactions that already have categories. Unlike subcategories,

which can only be used with their parent category, classes can be used with any

category. You can create reports and graphs based on categories, classes, or both.

You can use classes in situations like these:

• If you share a Quicken data file with others in your household, you can create a

class for each person so you can track how much each person earns and spends

without creating subcategories for each category. For example, spouses could

classify dining expenses as Dining/Sue and Dining/Jim, and clothing expenses as

Clothing/Sue and Clothing/Jim.

• If you use your personal checking account for business and personal expenses, you

can identify business transactions with the class Business to distinguish them from

personal expenses in the same category. For example, you could classify business

expenses as Dining/Business, Entertainment/Business and Subscriptions/

Business.

• If you manage properties, you can identify transactions by property name or

address. For example, six water bills could be categorized as utility expenses and

Chapter 5, Categories and classes track income and expenses 48

classified as applying to six different properties by entering Utilities:Water/ElmSt,

Utilities:Water/OakSt, and so on.

• If you work with multiple clients, you can identify transactions by client name.

Then you can report separately on the income and expenses related to each client.

For example, you might classify income earned as Income/Smith, Income/Jones,

and Income/Lee.

The following table gives examples of how to use classes:

Use classes to specify Reason for using classes Examples of class names

Whom the transaction is for:

•Your clients

•Your salespeople

•You or your spouse

Where the transaction applies:

•Sales regions

•Property names

Track income and expense by client

Track commissions

Track income and expense by individual

Track performance by division

Track income and expense by property

SellCo, Mena, Bartel, Lew & Co.

Bob, Karen, Glenn, Kate, Eric

Chris, Terry

Midwest, West, East, North, South

Harlow St, Ward Way, Rusko Ave

What the transaction is for:

•Job or project names

•Equipment or vehicle

•Business use

Perform job costing

Track expense by item

Separate business income and expense

from personal income and expense

Chapter 5, Categories and classes track income and expenses 49

Crandall, Miller, Smith

Truck, phone, fax, copier

Business

Setting up classes and subclasses

Quicken does not provide a preset list of classes. To create a class, choose Lists >

Classes and click New. You can set up classes before you enter any transactions, or

you can set them up “on the fly” while you are entering transactions. For more

information, see “Assigning a class to a transaction” on page 62.

For step-by-step help, go to Categories & Classes in Quicken Help and select

How do I set up classes and subclasses?

Editing, deleting, and moving classes and subclasses

You can edit class or subclass information by selecting a class in the Class list and

clicking Edit. If you rename a class or subclass, Quicken automatically replaces the old

name with the new name in all transactions classified with the old name.

You can delete a class or subclass by selecting it in the Class list and clicking Delete.

When you delete a class or subclass, Quicken removes the name from the Class list

and from any transactions to which it is assigned.

Caution: Don’t delete a class or subclass as a step in changing its name. Delete a class

or subclass only if you don’t expect to use it again or if you want to reassign the

transactions for the deleted class to several different classes.

You can also change a class into a subclass, change a subclass into a class, or move a

subclass from one class to another. Just drag and drop them in the Class list.

Chapter 5, Categories and classes track income and expenses 50

You cannot change a class into a category, or vice versa.

For step-by-step help, go to Categories & Classes in Quicken Help and select

How do I edit classes and subclasses?

How do I delete classes and subclasses?

How do I move classes and subclasses?

Chapter 5, Categories and classes track income and expenses 51

Keeping your accounts up

6

to date

Recording your day-to-day expenses ................................................................................52

Correcting mistakes ..............................................................................................................58

What do I put in the Category field?..................................................................................59

Transferring money between accounts..............................................................................64

Entering transactions with more than one category........................................................68

Speeding up data entry ........................................................................................................73

Finding a specific transaction..............................................................................................75

Customizing the register......................................................................................................76

Printing the register ..............................................................................................................77

Recording your day-to-day expenses

6

Every Quicken account has a register where you can enter transactions for that

account. A transaction is any item that affects the balance in your account. Common

transactions in a bank account include:

52

• checks (written by hand or printed with Quicken)

ATM (automated teller machine) transactions

•

• deposits

• EFT (electronic funds transfer) deposits or withdrawals

• bank service charges and interest

When you set up a new account, Quicken opens the Register window for that account.

You can record all transactions for that account in the register—although you may

want to enter online payments and checks you plan to print with Quicken in the Write

Checks window (see “Writing checks with Quicken” on page 84) or the Enter Online

Payment window (see “Creating and sending online payments” on page 144).

All Quicken accounts have registers. Although the types of transactions vary from

register to register, the basic entry techniques are the same whether you are using the

register for a bank, cash, credit card, asset, or liability account.*

* Investment and single mutual fund accounts also have registers, but investment transactions require

additional information. See “Entering investment transactions in the register” on page 241.

Chapter 6, Keeping your accounts up to date 53

Click Number to sort the register by

check number.

Enter the amount of a check or other

payment in the Payment column;

enter the amount of a deposit in the

Deposit column.

Post-dated transactions appear below

the orange line.

The active, selected transaction has a

blue border around it.

Click Record to save the transaction

and update the account balance.

Click Restore to revert the transaction

to the way it was before you changed

it.

Quicken shows the name of the account in the window title. A "C" in the Clr

column indicates the

cleared status of each

transaction. See

page 114.

Balance Today is the

balance of all

transactions through

today. If you postdate

transactions,

Quicken also

displays an ending

balance that is the

balance of all

transactions in the

register.

Click here to add the selected transaction to iCal (see page 87 for more information).

Entering a transaction in the register

1 Choose Lists > Registers > [account].

You can also open a register by choosing the account name from the Registers

pop-up menu when you are in the Banking, Investing, or Property & Loans areas.

2 If the selected transaction is not a blank transaction, choose Edit > New Transaction

(x-N).

3 Enter information about the new transaction in each field.

Chapter 6, Keeping your accounts up to date 54

Type a date, or use the pop-up

calendar to select a date.

In the Number column, enter a

check number, or press + to

automatically enter the next

check number.

You can also select an item from

the pop-up menu. Choose List

from the pop-up menu to create

your own items.

In the Payee or Description field, enter a payee name or

other description for the transaction.

Enter a category to track income and

expenses. See “What do I put in the

Category field?” on page 59.

(Optional) Enter other

information about this

transaction here.

Press Tab to move the insertion point to the next field. If you prefer to press Return

instead of Tab to move from field to field, see “Customizing the register” on

page 76.

4 Click Record. Quicken saves each new transaction in your data file as you record it.

When you record a transaction, Quicken sorts it in the register and recalculates all

subsequent balances. You can sort transactions by date or by check number.

Entering a transaction in the Calendar

In the Payment or Deposit column, enter the

amount of the payment or deposit.

Quicken calculates a new

balance for you when you record

the transaction.

You can also schedule transactions —

including recurring transactions such

as bill payments and your paycheck

deposit — in the Calendar or the

register for dates in the future (see

“Scheduling bill payments” on

page 78.

You can enter new transactions in the Quicken Financial Calendar™ for today or for

any date in the past. You can also edit or delete transactions or move transactions from

one day to another. You can enter, edit, move, or delete transactions in the Calendar

for any non-investment account.

When you add a new transaction in the Calendar, Quicken automatically records it in

the appropriate register as well.

Chapter 6, Keeping your accounts up to date 55

1 In the Banking area, click the Calendar button in the toolbar, or choose Activities >

Calendar.

Use the arrow keys to move from day to

day, and the PgUp and PgDn keys to move

from month to month.

Today’s date is shaded blue.

If there are more transactions for a day

than will fit, the date is followed by an

ellipsis (...). Double-click the day to see all

its transactions in a separate Transactions

window.

The selected day is shaded gray.

Click Selected Accounts to select the

accounts you want to see. The Calendar

initially shows transactions from all

accounts except investment accounts.

Click the arrow buttons to move forward or backward one month at a time.

Click

Add

Note to

add a

note for

the

selecte

d day.

Double

-click

the

note to

read or

edit the

note.

2 Select the day (past or present) on which you want to record the transaction.

3 Click New Transaction in the lower right corner of the Calendar window.

4 Enter information about the transaction in each field, just as you would in a

register.

For more information, see “Entering a transaction in the register” on page 54.

Chapter 6, Keeping your accounts up to date 56

Make sure the correct account is shown in

the Account field. When you record the

transaction, it is entered both in the

Calendar and in the register for the

selected account.

Quicken 2006 offers more flexibility in

scheduling frequencies than ever before.

For information about the scheduling

section of the window, see “Scheduling a

future transaction in the Calendar” on

page 79.

Click here to add the selected

transaction to iCal (see page 87 for more

information).

Use these buttons to

enter an online

transaction (only if the

account is already

enabled for online

payment), a check, or a

transaction in the register.

This is the Balance Today

(and an ending balance,

if there are any postdated

transactions in the

register) for the selected

account.

5 Click Record to record the transaction in the Calendar and in the register.

You can also enter a new past or present (recorded for today) transaction in the

Calendar by:

• Dragging a transaction from the QuickFill Transactions list (see “Entering data

with QuickFill” on page 73).

• Copying a transaction from any open Transactions window. Hold down the

Option key while you drag and drop the transaction to today or to a day in the past

(or to the Transactions window for that day).

Chapter 6, Keeping your accounts up to date 57

You can also print the Calendar or add a reminder note to a day in the Calendar.

For step-by-step help, go to Paying bills in Quicken Help and select

How do I add calendar notes?

Correcting mistakes

To make a change to a transaction, select it and edit any field by selecting the incorrect

information and typing over it. To undo a single mistake while entering or editing

information in a field, choose Edit > Undo (x-Z). To restore a transaction to the way it

was before you made any changes to it, click the Restore button. The only item in the

transaction you cannot edit is the balance in the Balance column.

Note: Changing a reconciled transaction—one with a bold R in the Clr column—can

cause problems when you reconcile your Quicken records with your bank statement.

Quicken warns if you are about to change a reconciled transaction.

You can edit any transaction in the Calendar, even if you originally entered it in the

register. If you enter a transaction in the wrong account, you can easily move it to the

correct account by editing it in the Calendar to change the account.

You can also move a transaction to another account using the contextual menu in the

register. Select the transaction you want to move, hold down the Control key and click

Chapter 6, Keeping your accounts up to date 58

in the register; choose Move this Transaction from the contextual menu. Then enter

the “to” account name in the Move Transaction window.

For step-by-step help, go to Registers in Quicken Help and select

How do I edit a transaction?

How do I move a transaction?

You can delete a transaction by selecting it and choosing Edit > Delete Transaction

(x-D). Sometimes you may prefer to void a transaction instead of deleting it. By

marking a printed or handwritten check as void, you can keep an accurate record of

each numbered check. To void a transaction, select it and choose Edit > Void

Transaction.

For step-by-step help, go to Registers in Quicken Help and select

How do I delete or void a transaction?

What do I put in the Category field?

You can enter any of these items in the Category field of a transaction:

• Categories and subcategories let you label your transactions so you can track

where your money comes from and where it goes. See “Assigning a category to a

transaction” next.

Chapter 6, Keeping your accounts up to date 59

• Classes and subclasses let you define transactions even more specifically than with

categories alone. Some Quicken users benefit from using classes; others find that

categories are all they need to track their finances. See “Assigning a class to a

transaction” on page 62.

• Transfers let you move money from one Quicken account to another. See

“Transferring money between accounts” on page 64.

Tip: To assign more than one category, class, or transfer to a single transaction, you

can “split” the transaction. See page 68.

Assigning a category to a transaction

See “About categories” on page 40 for

more information about creating and

using categories.

You should assign at least one category to each transaction because Quicken uses the

category information you assign to create reports, graphs, and budgets based on your

income and expenses. If you don’t assign a category to a transaction, Quicken uses the

label “Other” to refer to uncategorized amounts in reports and graphs. You can set a

preference telling Quicken to warn you if you forget to enter a category; see

“Customizing the register” on page 76.

You can assign a category to a transaction by:

• typing the category name in the Category field

• choosing a category from the pop-up menu in the Category field

• selecting a category in the Categories & Transfers list

Chapter 6, Keeping your accounts up to date 60

Typing a category name in the register

1 Click in the Category field of the transaction you want to categorize.

2 Start typing the category name.

If the first few characters match the beginning of more than one category name,

QuickFill enters the first category that begins with the letters you typed. Keep

typing until QuickFill enters the correct category name.

You can also choose a category from the pop-up menu in the Category field.

3 When Quicken displays the category you want, either press Tab to accept that

category, or type a colon ( : ) to enter a subcategory.

The colon always appears at the end of the text that’s currently in the Category

field, no matter where the cursor is located when you type it.

4 (Optional) Start typing a subcategory name.

Type the letter “u” to enter the

category name “Utilities.”

Continue typing until QuickFill fills in the correct subcategory.

To enter a subcategory, type a colon as soon as you see the category you want. In this case, typing the

letter “w” after the colon displays the subcategory name “Water.”

Chapter 6, Keeping your accounts up to date 61

If you enter a category (or subcategory) name that isn’t in the Categories & Transfers

list, Quicken asks if you want to set it up.

Choosing a category from the Categories & Transfers list

1 Click anywhere in the transaction you want to categorize.

2 Choose Lists > Categories & Transfers > List (x-L).

3 Double-click a category name in the list to paste it in the Category field.

You can also select the category name you want and click Use or press Return. Or

you can drag the category name from the Categories & Transfers list and drop it in

the selected transaction in the register.

Assigning a class to a transaction

Classes do not replace categories; rather, they add more information to transactions

that already have categories. See “About classes” on page 48 to determine whether

classes are appropriate for your situation.

You can assign a class to a transaction by:

• typing the class name in the Category field

• selecting a class in the Class list

Typing a class name in the register

1 Click in the Category field of the transaction you want to classify.

Chapter 6, Keeping your accounts up to date 62

You can add a class name after a category name, or after an account name to

classify a transfer transaction.

2 Type a forward slash ( / ).

The forward slash separates the class from the category (or account). It always

appears at the end of the text that’s currently in the Category field, no matter where

the cursor is located when you type it.

3 Begin typing the class name.

If the first few characters match the beginning of more than one class name,

QuickFill enters the first class that begins with the letters you typed. Keep typing

until QuickFill enters the correct class name.

As soon as you type a forward slash, Quicken recognizes that you are entering a class. In this example,

the category is Repairs and the class is Oak St.

4 When Quicken displays the class you want, either press Tab to accept that class or

type a colon ( : ) to enter a subclass.

The colon always appears at the end of the text that’s currently in the Category

field, no matter where the cursor is located when you type it.

5 (Optional) Start typing a subclass name.

Chapter 6, Keeping your accounts up to date 63

Continue typing until Quicken fills in the correct subclass. You might, for example

want to add a subclass to the transaction in step 3 to specify which unit needed

repairs: Repairs/Oak St:Unit1.

If you enter a class (or subclass) name that isn’t in the Class list, Quicken asks if you

want to set it up.

Choosing a class from the Class list

1 Click anywhere in the transaction you want to classify.

2 Choose Lists > Classes (x-K).

3 Double-click a class name to paste it in the Category field.

You can also select the class name you want and click Use or press Return. Or you

can drag the class name from the Class list and drop it in the selected transaction

in the register.

Transferring money between accounts

Transfers can record these and other common transactions:

• movement of funds from a checking account to a savings account

• cash advances from a credit card account to a checking account

• loan payments from a checking account to a liability account that tracks the

balance of the loan

Chapter 6, Keeping your accounts up to date 64

Here is a transfer transaction in the

source account. The brackets show

that it is a transfer.

The transfer transaction is

automatically recorded in the

destination account as a result of the

transfer.

When you record a transfer transaction in a source account, Quicken automatically

creates a parallel transaction in the destination account. If the source transaction is a

payment or decrease, the destination transaction is a deposit or increase.

For example, if you transfer $500 from your savings account to your checking account

to cover household expenses, you would type a left bracket ( [ ), and then enter the

name of the checking account in the Category field of the transfer transaction in your

savings account. Quicken automatically records a corresponding deposit transaction

of $500.00 in the Deposit column of your checking account. You don’t include an

income or expense category in the Category field for a transfer transaction because

you have simply moved funds from one account to another.

If the register for the source account is already open, you can transfer money by

entering the transfer information directly in the Category field of the transfer

transaction.

1 In the register for the source account, enter the name of the destination account in

the Category field by typing [ , and then typing the name of the account.

OR

Chapter 6, Keeping your accounts up to date 65

If you type “[jo”, QuickFill adds “int

Checking].”

Choose the destination account name from the pop-up menu in the Category field

(account names are at the bottom of the list).

2 When Quicken displays the account you want, press Tab.

3 Click Record to record the transfer transaction.

Quicken records the transaction in this register and creates a parallel transaction in

the destination account register for the same amount.

In some cases, you may want to transfer part of the total amount of a transaction. For

example, you may want to transfer some of your paycheck into a retirement account.

Or you might want to transfer the portion of your mortgage payment that goes toward

the loan principal into a liability account that tracks the loan balance and assign an

expense category to the interest portion of the payment. See “Entering transactions

with more than one category” on page 68 for information about transferring part of a

transaction.

You can include class information in a transfer transaction. If, for example, you pay

for an antique table from a checking account and you want to record the purchase in

an asset account called “Personal Assets” and assign the class “Antiques” to the

transaction, you would enter “[Personal Assets]/Antiques” in the Category field.

Chapter 6, Keeping your accounts up to date 66

You can also enter a transfer transaction between accounts by choosing Activities >

Transfer Money.

For step-by-step help, go to Registers in Quicken Help and select

How do I transfer funds between accounts?

Changing a transaction that includes a transfer

When you change a transaction that includes a transfer to or from another account, the

transaction created by the transfer may also change.