Page 1

Automotive Division Call

hosted by Liberum

Peter Schiefer, Division President Automotive (ATV)

5 October 2020

Page 2

Market position and

short- and mid-term outlook

Page 3

Infineon’s automotive semiconductor revenue (in USD for CY; based on market figures by Strategy Analytics)

Infineon has been growing by 10% p.a. in automotive semis over

the last two decades and hence steadily gaining market share

740

1818

1307

2270

2890

4210

4987

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

0

1000

2000

3000

4000

5000

6000

revenue

Infineon International Rectifier Cypress

[USD m]

Source: Strategy Analytics: Automotive Semiconductor Vendor Market Shares. 2001 through 2020

CAGR

(00-18)

: +10.1%

4157

830

#2

#1

13.4%

7.9% − 11.2%

#3

6.7%

market position

market share

3

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 4

Infineon’s top market position is built on system competence based

on an industry-leading product portfolio

› New #1 in the total market post acquisition of Cypress

› Solid #1 in power despite xEV subsidies cut in China in H2 CY19

› Undisputed #1 in automotive NOR Flash memory

› Fostering #2 in sensors (from 10.4%

CY12

to 13.5%

CY19

)

› Significant market share gain in microcontroller – both organically

(strong demand for AURIX™) and via Cypress acquisition

13.4%

11.3%

8.7%

8.1%

7.6%

Infineon

NXP

Renesas

TI

STMicro

Automotive semiconductors (2019 total market: $37.2bn)

6.7%

7.0%

8.0%

13.5%

14.1%

Melexis

NXP

ON Semi

Infineon

Bosch

Sensors

Source: Strategy Analytics: Automotive Semiconductor Vendor Market Shares v2. May 2020. The market shares shown here are the combined market shares of Infineon and Cypress based on their individual figures.

6.6%

9.8%

27.0%

27.2%

Microchip

TI

Infineon

Renesas

NXP

16.2%

Microcontrollers

Power semiconductors

5.4%

8.2%

9.1%

13.9%

25.5%

ON Semi

TI

Bosch

STMicro

Infineon

4

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 5

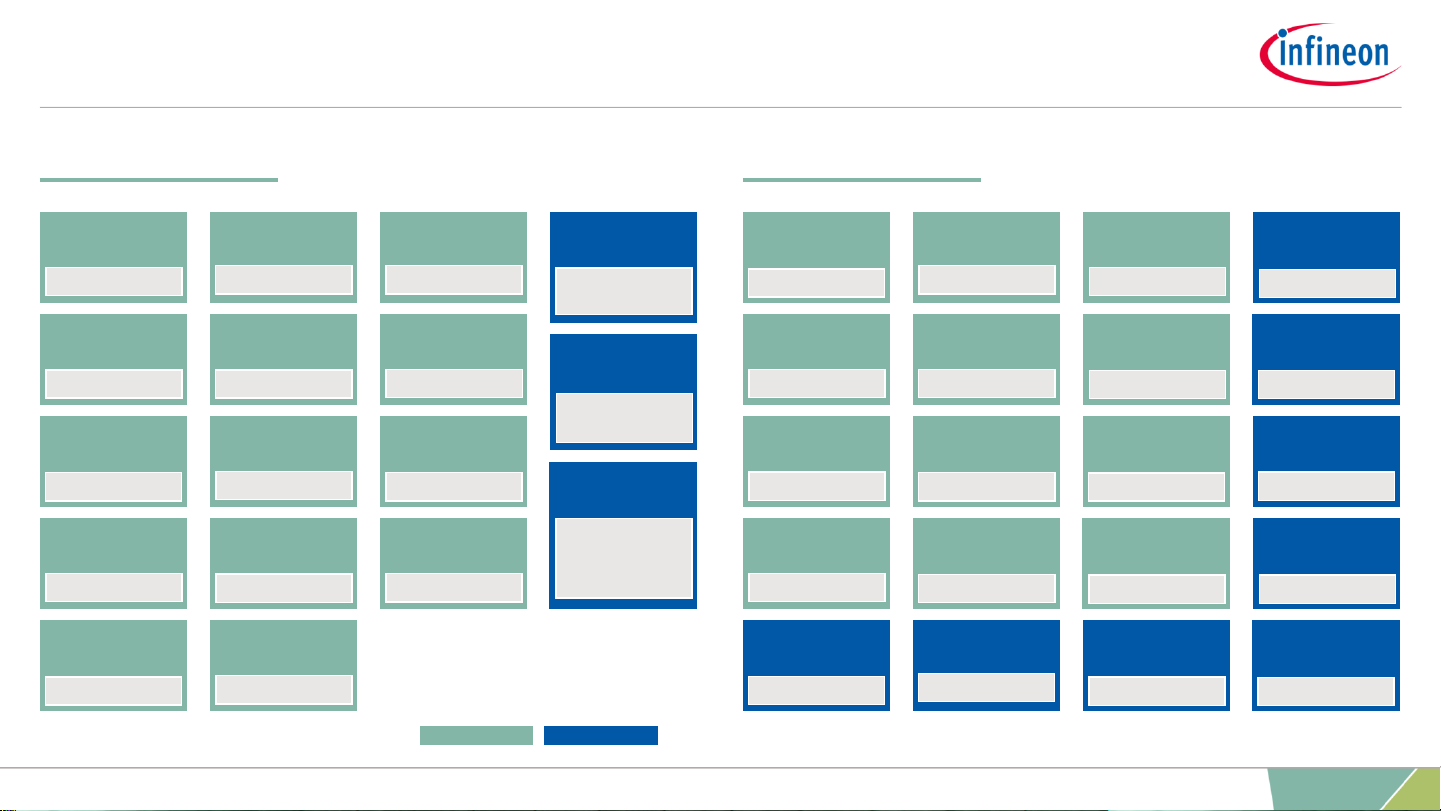

Market recovery expected to continue across all regions; high

demand for xEV in Europe; L1/L2/L2+ penetration on schedule

Market Outlook for Q4 CY20 Market Outlook for CY21

Car units

xEV

ADAS/AD

› Continued recovery of car sales and production › Y-Y recovery with unit growth at mid-teens %

› Strong momentum in Europe

› Some recovery in the US and China

› No major change in OEMs’ plans in near-term

› L2 growth to continue

› Further increase in L2 penetration expected

› L2+ shipments at low volumes

› Incentives and CO2regulations should keep

demand high; especially in Europe

› Improving consumer sentiment around

sustainability theme

› Steady investments in EV charging infra-structure

further lowering reservation towards EVs

Source: Infineon; based on or includes content supplied by IHS Markit, Automotive Group: Light Vehicle Production Forecast. September 2020.

5

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 6

After nearly 20% y-y decline globally in CY20 due to COVID-19,

all regions are forecast to snap back in CY21

Light vehicle production (year-over-year growth)

North America (16.3m units in 2019) Europe (21.1m units in 2019)

Greater China (24.7m units in 2019)

2019 2020 2021 2021-2025

RoW (13.7m units in 2019)

World (88.9m units in 2019)

Japan / Korea (13.1m units in 2019)

2019 2020 2021 2021-2025

2019 2020 2021 2021-2025

2019 2020 2021 2021-2025

2019 2020 2021 2021-2025

2019 2020 2021 2021-2025

Source: Based on or includes content supplied by IHS Markit, Automotive Group: Light Vehicle Production Forecast. September 2020.

6

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

-3.8%

-20.9%

17.6%

1.8% p.a.

-3.8%

-24.1%

16.7%

2.5% p.a.

-8.1%

-9.1%

6.3%

4.7% p.a.

-0.7%

-17.1%

7.2%

1.5% p.a.

-9.6%

-31.2%

24.5%

8.1% p.a.

-5.6%

-19.4%

13.2%

3.8% p.a.

Page 7

Electro-mobility

Page 8

Trends toward electrification of cars remain unchanged; driven by

more stringent legal guidelines

Passenger car CO2emission development and regional regulations CO2emission by degree of electrification

120

102

84

28

0 0

ICE 48 V

MHEV

FHEV PHEV BEV FCEV

CO

2

emission (g/km

)

-15%

-30% -77%

-100% -100%

› EU continues towards stringent emission

standards

› Recently, the governor of California signed an

executive order mandating that all new cars

to be sold in California from 2035 must be

zero-emission vehicles

Source: The International Council on Clean Transportation (ICCT): Passenger vehicle fuel economy. May 2020.

0

50

100

150

200

2010 2015 2020 2025 2030

US Japan China EU

enacted target

historical performance

-15% vs 2021

-37.5% vs 2021

US (2026): 108g/km

Japan (2030):

73.5g/km

EU (2030): 59g/km

China (2025): 93.4g/km

CO

2

emission values (g/km; normalized to NEDC

8

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

CO2emission: Tank-to-wheel

Page 9

The longer-term trend towards xEV is unchanged; most likely even

accelerating due to incentive programs and green deals

Car production by fuel type

0%

25%

50%

75%

100%

2016 2018 2020 2022 2024 2026 2028 2030 2032

ICE Mild Hybrids Full & Plug-in Hybrids and BEVs Fuel Cell

Source: Based on or includes content supplied by IHS Markit, Automotive Group: Alternative propulsion forecast. July 2020.

xEV penetration: >25% by 2023

xEV penetration: >50% by 2027

9

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 10

The incremental content of power semiconductors in xEV is a

significant opportunity for Infineon

2020 average xEV semiconductor content by degree of electrification

48 V / Mild Hybrids Full & Plug-in Hybrids and Battery Electric Vehicles

* Non-Powertrain: average semiconductor content in body, chassis, safety and infotainment application segments

** "power" includes voltage regulators and ASIC; "others" include opto, small signal discretes, memory

Source: Infineon; based on or includes content supplied by IHS Markit, Automotive Group: Alternative Propulsion Forecast. July 2020;

Strategy Analytics: Automotive Semiconductor Demand Forecast 2018-2027 and Automotive Sensor Demand 2018-2027. July 2020

$7

$0

$396

$61

$17

$90

$572

Non-

Power-

train*

ICE

Power-

train

xEV

Sensors

xEV

MCUs

xEV

Power**

xEV

Others**

Total

semi

BoM

$396

$38

$14

$23

$330

$32

$834

Non-

Power-

train*

ICE

Power-

train

xEV

Sensors

xEV

MCUs

xEV

Power**

xEV

Others**

Total

semi

BoM

2020 2.1m vehicles 5.8m vehicles

2022 5.8m vehicles 12.2m vehicles

2025 18.8m vehicles 21.0m vehicles

2030 27.3m vehicles 32.0m vehicles

10

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 11

Infineon offers full system solutions addressing all xEV segments:

pure EV and all types of hybrid EVs

Infineon offers full portfolio for the control loop of an electric car

SiC and IGBT

for high-voltage battery

electric vehicles, plug-in

and full hybrids

MOSFETs

for 48 V mild hybrids

bare-die

discretes

modules

bare-die

discretes

chip embedding

Power semisDriversMicrocontrollersSensors

AURIX™

driver ICs

high-voltage

EiceDRIVER™

Power supply and communication

OPTIREG™

board network transceivers

11

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

current sensor

...and more

rotor position sensor

Page 12

Key package innovations complement Infineon’s leading position in

chip technologies for 48 V systems

Key package innovations driving growth for the xEV business

Technology

Customer

benefits

Success

Chip embedding technology

(jointly with Schweizer Electronic):

Infineon MOSFET integrated within the PCB

top side cooling pad

top-side view bottom-side view transparent view

MOSFET soldered traditionally on the PCB

but more efficient cooling from the top

Top-side cooling package Power chip embedding

Significantly improved thermal management

Increase of power density, energy efficiency and

reliability: up to 60% performance improvement

compared to traditionally designed system

Major European tier-1 awarded Infineon with

a triple-digit million Euro design-win

Vitesco first player to adopt the technology

12

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 13

Copyright © Infineon Technologies AG 2020. All rights reserved.

Besides main inverter and on-board charger, battery management

is a good example for Infineon’s system solution competence

13

2020-10-05

Infineon offers basically all components of a complete battery management system (BMS)

b a t t e r y c e l l

IC #1

IC #2 IC #3

IC #4

IC #5

IC #6 IC #7

IC #8

MCU

current

sensor

pressure

sensor

gas

sensor

PMIC

CAN

transceiver

CAN bus

auxiliaries

security IC

motor control IC

pump fan etc.

MOSFET

› multi-channel battery monitoring and balancing system ICs

covering cell charge balancing, cell voltage and temperature

measurement

› wireless controll ICs

› PMIC

› CAN transceivers for robust communication between cells

and battery main controller

› MCU with scalable processing performance, connectivity and

embedded hardware security

› F-RAM for data logging and mission profile

› high-voltage power MOSFET replacing relay and pyro fuse

› low-power pressure sensors

› gas sensor (H2or HCO3)

› current sensor; type depending on cell topology

› trusted security solutions to support battery identification,

functional safety and IP protection

› embedded motor control ICs for various motor types

› standard power MOSFETs

total BoM for 48 V BMS: $30 – $70

total BoM for high-voltage BMS: $50 – $160

8x..12x

1x..2x

1x..2x

1x

1x..3x

8x

1x

1x..3x

1x

1x..4x

wireless

connection

F-RAM

power

switch

wireless

connection

wireless

connection

wireless

connection

wireless

connection

wireless

connection

wireless

connection

wireless

connection

8x..12x

1x

1x

available today

pre market intro-

duction phase

Page 14

Copyright © Infineon Technologies AG 2020. All rights reserved.

14

To meet best cost-performance ratio in xEV drivetrain, IGBT and

SiC technologies will co-exist

2020-10-05

Selected examples of IGBT versus SiC

Technology and market development

Example: All-wheel drive BEV

Axle 2Axle 1

Focus on

Range: SiC

Cost

Large battery: SiC

Small battery: IGBT

Focus on cost only: IGBT

Example: Axle split PHEV

Axle 2Axle 1

Focus on range: Internal

Combustion Engine

Focus on cost only: IGBT

Choice of power semiconductor technology in main inverter

› More and more OEMs are considering SiC as an

alternative to IGBTs

› OEMs’ choice of main inverter technology depends on

the choice of

› range versus cost, and

› size/cost of the battery

Market development

› Higher-volume platforms to be launched in ~2025 are

being awarded over the next quarters

› To address range anxiety, OEMs shift focus to sufficient

reach (for mid- to high-end cars preferably)

› To improve their CO2footprint online retailers need to

operate fully electrified delivery vehicles

Source: Infineon

Page 15

When OEMs will introduce SiC-based car models to increase their

fleet offering, Infineon can leverage its huge IGBT customer base

Infineon offers a seamless and cost-effective upgrade path across the entire power range

15

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Scalability:

Same package for

all power ranges

Same driver ICs for

all power ranges

> 200 kW

SiC MOSFET-based

CoolSiC™ HybridPACK™

100 – 150 kW

Si IGBT-based

HybridPACK™

150 – 200 kW

Si IGBT-based

HybridPACK™

EiceDRIVER™ family

IGBT

SiC

higher-power IGBT

Page 16

Infineon has an excellent position to win upcoming SiC-based xEV

platforms

Infineon’s leverage in SiC

16

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

› Infineon is addressing the xEV market with its growing portfolio of SiC-based components

optimized for automotive applications

› Infineon’s large IGBT customer base is an essential asset for the transition to SiC

› Scalable portfolio of Infineon allows for easy and seamless upgrade from IGBT-based

inverters to SiC-based inverters

› Existing customers can beef-up their platform performance while sticking to the same

module form factor

Leverage of

customer

base

Technology

leverage

Scalability

Page 17

Automated Driving

Page 18

The growth of L1/L2/L2+ is the main driver of ADAS semi content

until 2030; low near-term impact from L3/L4/L5

Source: Strategy Analytics: Metrix Live. December 2019; L2 includes L2 and L2+

89%

52%

26%

13%

5%

11%

40%

46%

28%

16%

7%

27%

53%

59%

4%

10%

11%

0%

25%

50%

75%

100%

2015 2020 2025 2030 2035

Level 0 Level 1 Level 2 Level 3 Level 4 Level 5

Car production by degree of automation

18

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

73%

81%

47%

Page 19

Radar/Lidar modules and sensor fusion will grab the lion’s share of

semiconductor BoM in ADAS/AD-equipped cars

Incremental average semiconductor content per car by level of automation at the given years

$160 - $180

Level 4/L5

L4/L5 vehicles in 2030: ~2.5m

Level 2

L2 vehicles in 2020: ~5m

Level 2+

L2+ in 2025: ~2.5m

$280 - $350 $1,150 - $1,250

Bill-of-materials

Camera modules

Radar & Lidar modules

Sensor fusion

Others (e.g. actuators)

40 - 50% of BoM

~30%

20 - 30%

5 - 10%

40 - 50% of BoM

~30%

20 - 30%

5 - 10%

15 - 20% of BoM

30 - 45%

30 - 45%

5 - 10%

19

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Source: Strategy Analytics: Automated Driving Semiconductor Market Estimate. August 2020; Infineon

BoM contains all type of semiconductors (e.g. radar modules include µC); sensor fusion does not include memory.

BoM are projected figures for the respective time frame.

Page 20

Copyright © Infineon Technologies AG 2020. All rights reserved.

20

Infineon will roughly double its BoM content in upcoming highvolume radar systems by offering an optimized system portfolio

2020-10-05

Infineon’s increasing offering in 77 GHz radar system solutions

Current UpcomingPast

53.3%

24.6%

8.3%

7.7%

3.1%

Infineon

NXP

STMicro

UMS

Denso

Source: Yole Developpement: Status of the Radar Industry. May 2020.

2019 automotive radar sensor IC market (77 / 24 GHz)

› Dedicated AURIX™

microcontrollers with

hardware-coded radar

signal preprocessing will

roughly double Infineon’s

semiconductor content

› System-level offering combining

radar sensor ICs, microcontrollers and power supply

› Major advantages for

customers:

- interoperability

- shorter development time

- faster time-to-market

Radar sensor

(SiGe)

Radar sensor

(SiGe)

Radar sensor

(28nm CMOS,

SiGe)

AURIX™ 2G

(2ndgen)

Microcontroller

AURIX™ 3G

(3rdgen)

Microcontroller

Power supply

Page 21

Higher levels of automated driving require trust via solutions that

one can depend on

…requires dependable systems

Dependable

Sensing

Dependable

Computing

Secure

Communication

Dependable

Actuation

Dependable

Memory

+ + + +

= Infineon’s field of competence

Dependable

Power Supply

+

Increasing degree of automation…

21

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

driver’s task

machine’s task

Level 0

No System

Eyes-off

Level 3

Brains-off

Level 4

No Driver

Level 5

Hands-off

Level 2

Feet-off

Level 1

“Fail safe” “Fail operational”

The need for dependable systems per degree of automation

Page 22

Copyright © Infineon Technologies AG 2020. All rights reserved.

22

The need for dependability will drive demand for semiconductors;

example: intelligent power switches

2020-10-05

Example: Power distribution architecture in a car by degree of automation

Number of intelligent power switches

Level 2Level 2 Level 3 Level 4/5

Sophisticated “dependability” conceptRedundancy for critical loadsDedicated protected

branches for critical loads

Today’s

reference architecture

Level 2+

1x 1.3x 2x >3x

Source: Infineon

Page 23

Infineon’s NOR Flash business is another beneficiary of the

need for dependability

› increasing system complexity drives demand for higher off-chip code storage

› growing number of applications based on high-performance processing units:

› code and parameter storage for MCUs, GPUs, MPUs, and other SoCs

› configuration data for FPGAs

Infineon’s unique offering: Semper™ Secure NOR Flash

› Infineon Semper™ Secure NOR Flash is the first memory solution to

combine security and functional safety in a single NOR Flash device

› Infineon Semper™ Secure NOR Flash delivers the security, safety, and

reliability required for the most advanced connected automotive systems

23

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Automotive applications of NOR Flash

› ADAS/AD

› instrument clusters

› navigation systems

› Software-over-the-air (SOTA) updates

Structural growth drivers for NOR Flash in general

Page 24

The Infineon AURIX™ µC family has become the first-choice automotive architecture for high-growth and safety-critical applications

FY10 FY20e FY25e

powertrain

› ICE engine management

› ICE transmission

› xEV motor control

classical safety

› power steering

› braking

› airbag

ADAS/AD

› camera host control

› sensor fusion host control

› radar signal pre-processing

domain and zone control

› drive domain

› body & convenience domain

› zone control

CAGR

(FY10-FY25)

= 11.5%

CAGR

(FY20-FY25)

= 50%

CAGR

(FY20-FY25)

= 34%

[indexed:

FY10 = 100]

CAGR

(FY10-FY25)

= 5.7%

TAM:

€1.6bn

TAM:

€4.8bn

Source: Infineon; Strategy Analytics: Automotive Semiconductor Demand Forecast. February 2020. Covering Infineon target markets; excl. body, comfort, infotainment.

24

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Infineon AURIX™ revenue development over time

Page 25

Strong microcontroller footprint in next-generation high-volume

platforms

› 14 MCUs (+ NOR Flash + Wi-Fi)

› start of production: end of CY20

› 20 MCUs

› start of production: CY22

25

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

OEM platform #2:OEM platform #1:

Engine control

module

AURIX™ TC38x

Drivetrain control

module

AURIX™ TC23x

Transmission

control module

AURIX™ TC27x

Automatic gear

shifter module

AURIX™ TC23x

Electronic slip

differential

AURIX™ TC23x

Braking

AURIX™ TC39x

Airbag

AURIX™ TC23x

Electric power

steering

AURIX™ TC27x

Automatic sway

bar

AURIX™ TC23x

Map driver

assistance

AURIX™ TC39x

Secure gateway

module

AURIX™ TC39x

AD fusion

standard

AURIX™ TC39x

AD fusion

high-end

AURIX™ TC39x

Central AD

decision module

AURIX™ TC39x

Engine

management

AURIX™ TC38x

Diesel engine

management

AURIX™ TC39x

Transmission

control module

AURIX™ TC38x

Inverter PHEV

AURIX™ TC38x

Door module

FR MB91520

Braking

AURIX™ TC38x

Airbag

AURIX™ TC37x

Electric power

steering

AURIX™ TC36x

Suspension CVC

AURIX™ TC38x

Alarm system

module

FR MB91F520

Digital instrument

cluster

Traveo I S6J332

Front camera

AURIX™ TC37x

Radar domain

processing

AURIX™ TC39x

AD fusion

standard

AURIX™ TC39x

AD fusion

high-end

AURIX™ TC39x

Instrument

cluster

NOR Flash

S26KS512

Infotainment

module

89359

(Wi-Fi / Bluetooth)

Central AD

module

NOR Flash

S70FL01G

S25FL512

S25FS512

8” rear-seat

entertainment

TrueTouch TMA78

10” navigation

module

TrueTouch TMA1036

Cluster TFT

module

FCR4 MB9DF125

Climate,

gearshift MMI

FR CY91xxx

Head light

module

FR MB91F525

Infineon heritage Cypress heritage

Page 26

Take aways

26

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

› In 2021, the automotive market is expected to snap back

› Growth of xEV is accelerated by incentive programs and green deals

› Infineon is very well positioned to win upcoming SiC-based xEV

platforms:

› due to its scalable product offering

› by leveraging its huge IGBT customer base

› For ADAS/AD, dependability is a must and is a key driver of

semiconductor content growth

› Infineon offers an unmatched portfolio for dependable systems

› AURIX™ has become the first-choice microcontroller for high-growth

applications

Page 27

Page 28

Glossary

AC-DC alternating current - direct current

AD automated driving

ADAS advanced driver assistance system

BEV battery electric vehicle

BMS battery management system

BoM bill of material

CAN controller area network

CMOS complementary metal-oxid semiconductor

CPU central processing unit

CVC California vehicle code

DC-DC direct current - direct current

ECU electronic control unit

EPS electric power steering

EV electric vehicle

FCEV fuel cell electric vehicle

FHEV full-hybrid electric vehicle

FPGA field programmable gate array

GaN gallium nitride

GPU graphics processing unit

HSM hardware security module

HV high-voltage

HW hardware

IC integrated circuit

ICE internal combustion engine

IGBT insulated gate bipolar transistor

IVN in-vehicle networking

MCU microcontrollerunit

µC microcontroller

MHEV, mildhybrid

mild-hybrid electric vehicle; vehicles using start-stop systems, recuperation, DCDC conversion, e-motor

micro-hybrid vehicles using start-stop systems and limited recuperation

mild-hybrid vehicles using start-stop systems, recuperation, DC-DC conversion, e-motor

MOSFET metal-oxide siliconfield-effect transistor

MPU microprocessor unit

NEDC new European drive cycle

OBC on-board charger

OEM original equipment manufacturer

PCB printed circuit board

PHEV plug-in hybrid electric vehicle

PMIC power management IC

PT powertrain

RF radio frequency

RoW rest of world

Si silicon

SiC silicon carbide

SiGe silicon germanium

SoC system-on-chip

SOTA software over-the-air

SW software

TAM total addressable market

ToF time-of-flight

V2X vehicle-to-everything communication

xEV all degrees of vehicle electrification (EV, FHEV, HEV, PHEV)

28

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 29

Disclaimer

Disclaimer

This presentation contains forward-looking statements about the business, financial condition and earnings performance of the Infineon Group.

These statements are based on assumptions and projections resting upon currently available information and present estimates. They are subject to a multitude of uncertainties and risks.

Actual business development may therefore differ materially from what has been expected.

Beyond disclosure requirements stipulated by law, Infineon does not undertake any obligation to update forward-looking statements.

Specific disclaimer for IHS Markit – reports, data and information referenced in this document:

The IHS Markit reports, data and information referenced herein (the "IHS Markit Materials") are the copyrighted property of IHS Markit Ltd. and its subsidiaries ("IHS Markit") and represent

data, research, opinions or viewpoints published by IHS Markit, and are not representations of fact. The IHS Markit Materials speak as of the original publication date thereof and not as of the

date of this document. The information and opinions expressed in the IHS Markit Materials are subject to change without notice and neither IHS Markit nor, as a consequence, Infineon have

any duty or responsibility to update the IHS Markit Materials or this publication. Moreover, while the IHS Markit Materials reproduced herein are from sources considered reliable, the accuracy

and completeness thereof are not warranted, nor are the opinions and analyses which are based upon it. IHS Markit and the trademarks used in the Data, if any, are trademarks of IHS Markit.

Other trademarks appearing in the IHS Markit Materials are the property of IHS Markit or their respective owners.

29

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Page 30

Peter Schiefer

Division President Automotive

› since 2016: Division President Automotive

› Sep 2012: Head of Infineon worldwide Operations, responsible for chip

production, assembly and testing, as well as process technology

development, supply chain and purchasing

› Jan 2012: Division President Power Management & Multimarket

› since 2018: Member and Vice Chairman of the Board of Directors of the JV

SIAPM (SAIC Infineon Automotive Power Modules (Shanghai) Co. Ltd.)

› 2013 – 2016: Member of the Supervisory Board of Infineon Technologies

Austria

› since 2012: Member of the Supervisory Board of Infineon Technologies

Dresden

› Peter Schiefer was born in Munich, Germany, in 1965. He holds a Diploma in

Electrical Engineering from the University of Applied Sciences in Munich.

› He joined Infineon (Siemens AG until 1999) in 1990.

30

2020-10-05 Copyright © Infineon Technologies AG 2020. All rights reserved.

Loading...

Loading...