Introduction

This Solutions Handbook has been designed to supplement the HP-12C Owner's

Handbook by providing a variety of applications in the financial area. Programs

and/or step-by-step keystroke procedures with corresponding examples in each

specific topic are explained. We hope that this book will serve as a reference

guide to many of your problems an d will show you how to redesign our examples

to fit your specific needs.

Real Estate

Refinancing

It can be mutually advantageous to both borrower and lender to refinance an

existing mortgage which has an interest rate substantially below the current

market rate, with a loan at a below-market rate. The borrower has the immediate

use of tax-free cash, while the lender has substantially increased debt service on

a relatively small cash outlay.

To find the benefits to both borrower and lender:

1. Calculate the monthly payment on the existing mortgage.

2. Calculate the monthly payment on the new mortgage.

3. Calculate the net monthly payment received by the lender (and paid by the borrower) by

adding the figure found in Step 1 to the figure found in Step 2.

4. Calculate the Net Present Value (NPV) to the lender of the net cash advanced.

5. Calculate the yield to the lender as an IRR.

6. Calculate the NPV to the borrower of the net cash received.

Example 1: An investment property has an existing mortgage which originated 8

years ago with an original term of 25 years, fully amortized in level monthly

payments at 6.5% interest. The current balance is $133,190.

Although the going current market interest rate is 11.5%, the lender has agreed

to refinance the property with a $200,000, 17 year, level-monthly-payment loan at

9.5% interest.

What are the NPV and effective yield to the lender on the net abount of cash

actually advanced?

What is the NPV to the borrower on this amount if he can earn a 15.25% equity

yield rate on the net proceeds of the loan?

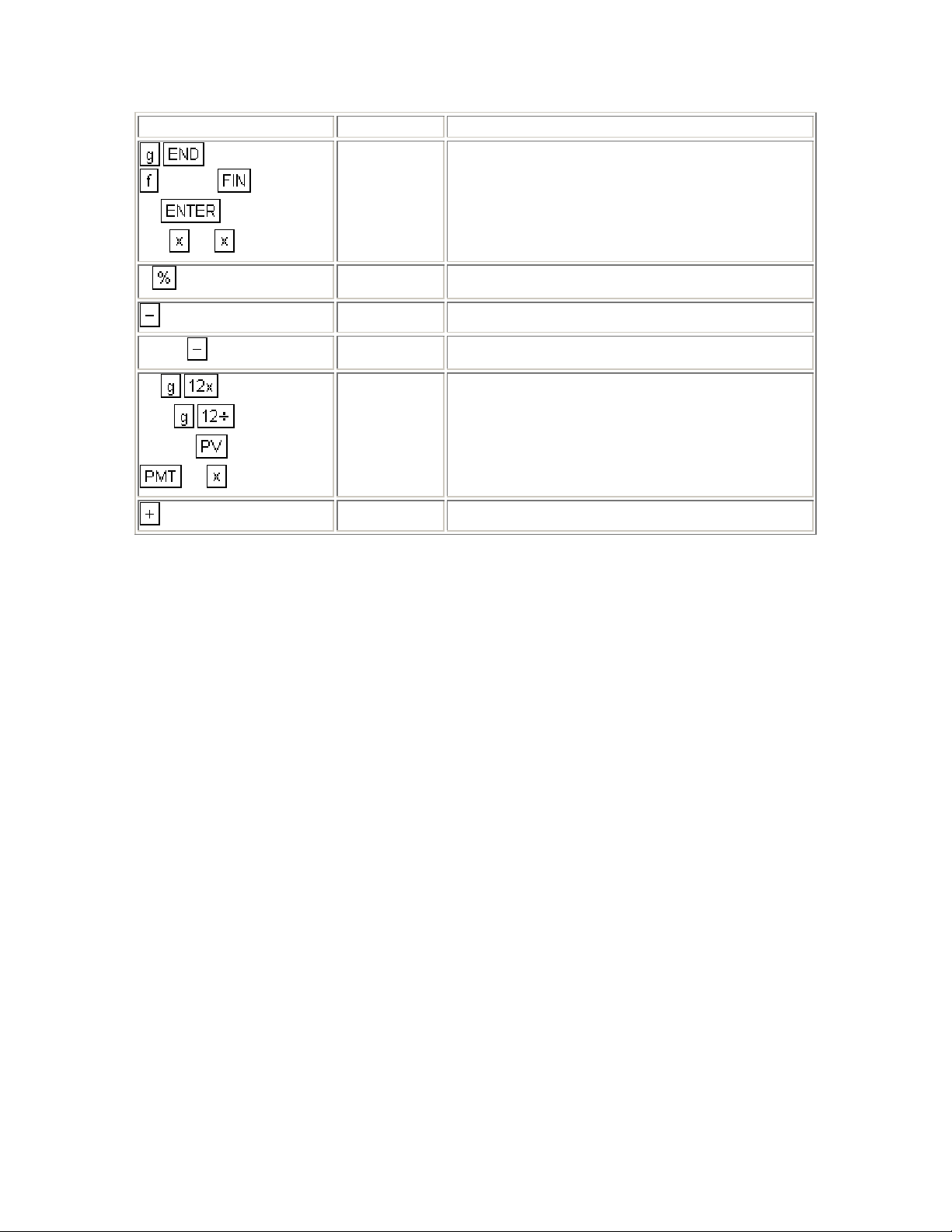

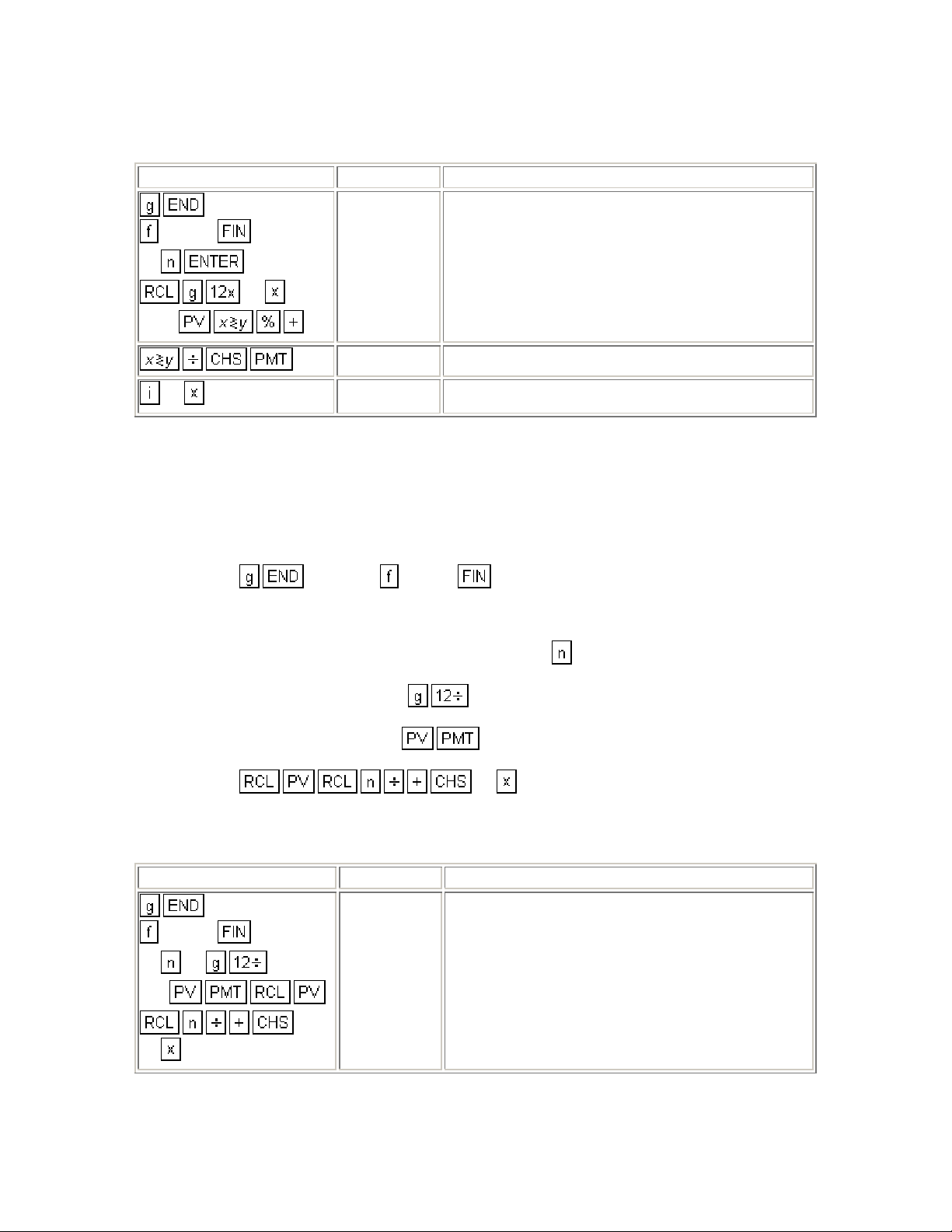

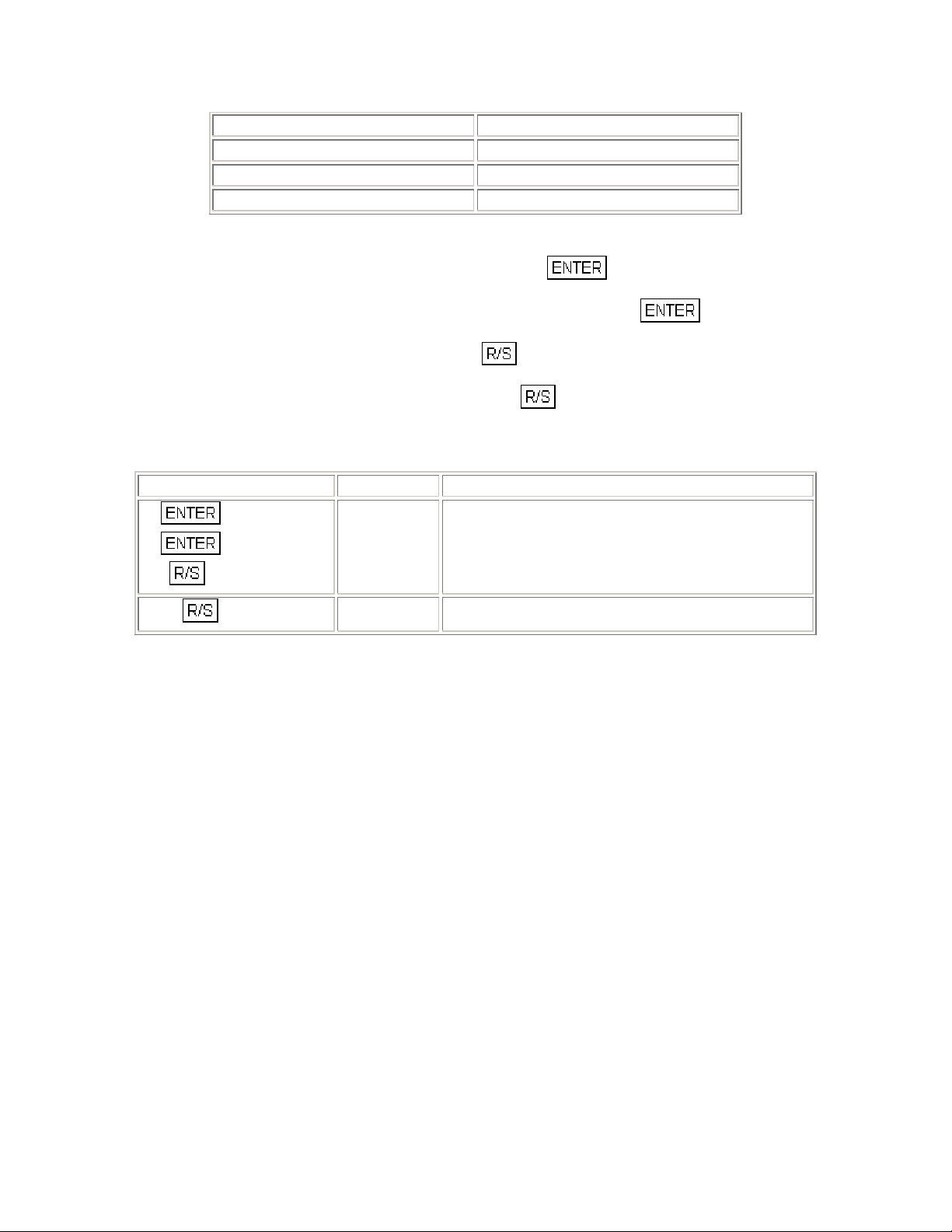

Keystrokes Display

CLEAR

17

6.5

-1,080.33

Monthly payment on existing mortgage received by

lender.

133190

0

9.5

200000

1,979.56 Monthly payment on new mortgage.

0

133190

11.5

0

0

12

15.25

0

0

899.23 Net monthly payment (to lender).

-66,810.00 Net amount of cash advanced (by lender).

-80,425.02 Present value of net

-13,615.02

14.83

-65,376.72 Present value of net monthly payment at 15.25%.

1,433.28

NPV to lender of net cash advanced

% nominal yield (IRR).

NPV to borrower.

Wrap-Around Mortgage

A wrap-around mortgage is essentially the same as a refinancing mortgage,

except that the new mortgage is granted by a different lender, who assumes the

payments on the existing mortgage, which remains in full force. The new

(second) mortgage is thus "wrapped around" the existing mortgage. The "wraparound" lender advances the net difference between the new (second) mortgage

and the existing mortgage in cash to the borrower, and receives as net cash flow,

the difference between debt service on the new (second) mortgage and debt

service on the existing mortgage.

When the terms of the origin al mortgage and the wrap-around are the same, the

procedures in calculating NPV and IRR to the lender and NPV to the borrower

are exactly the same as those presented in the preceding section on refinancing.

Example 1: A mortgage loan on an income property has a remaining balance of

$200,132.06. When the load originated 8 years ago, it had a 20-year term with

full amortization in level monthly payments at 6.75% interest.

A lender has agreed to "wrap" a $300,000 second mortgage at 10%, with full

amortization in level monthly payments over 12 years. What is the effective yield

(IRR) to the lender on the net cash advanced?

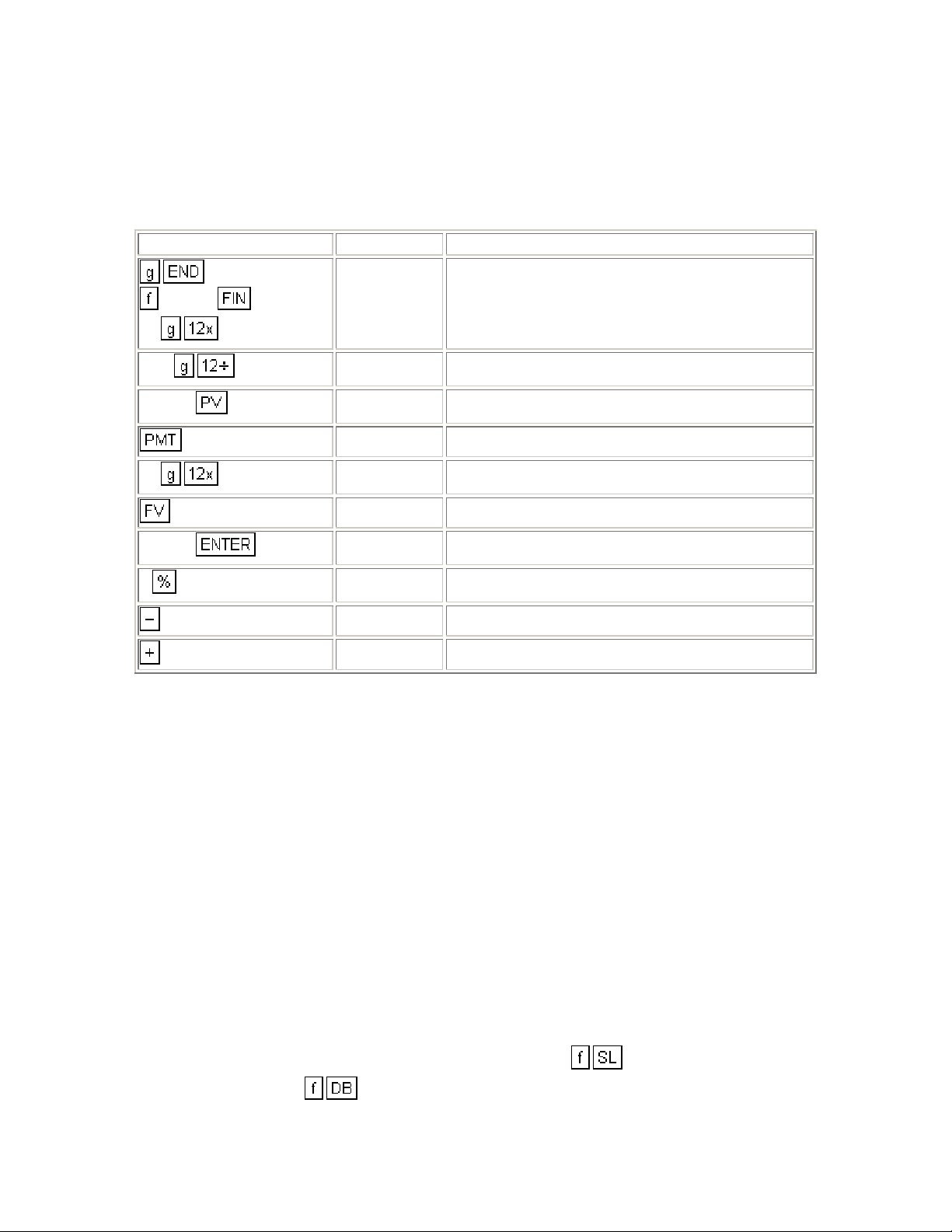

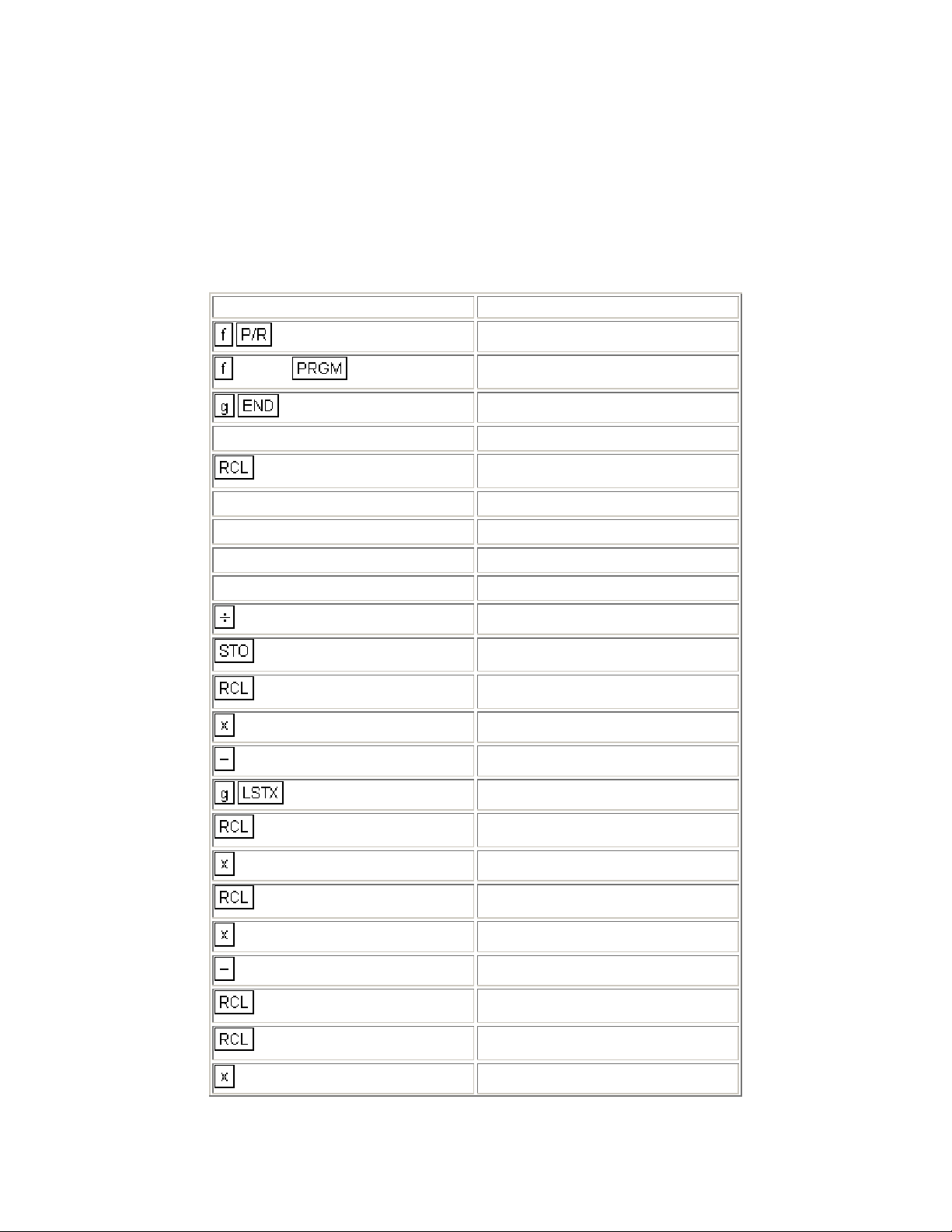

Keystrokes Display

144.00

Total number of months remaining in original load

(into n).

CLEAR

20

8

6.75

200132.06

10

300000

200132.06

12

0

0

0.56 Monthly interest rate (into i).

200,132.06 Loan amount (into PV).

-2,031.55 Monthly payment on existing mortgage (calculated).

0.83 Monthly interest on wrap-around.

-300,000.00 Amount of wrap-around (into PV).

3,585.23 Monthly payment on wrap-around (calculated).

1,553.69 Net monthly payment received (into PMT).

-99,867.94 Net cash advanced (into PV).

15.85

Nominal yield (IRR) to lender (calculated).

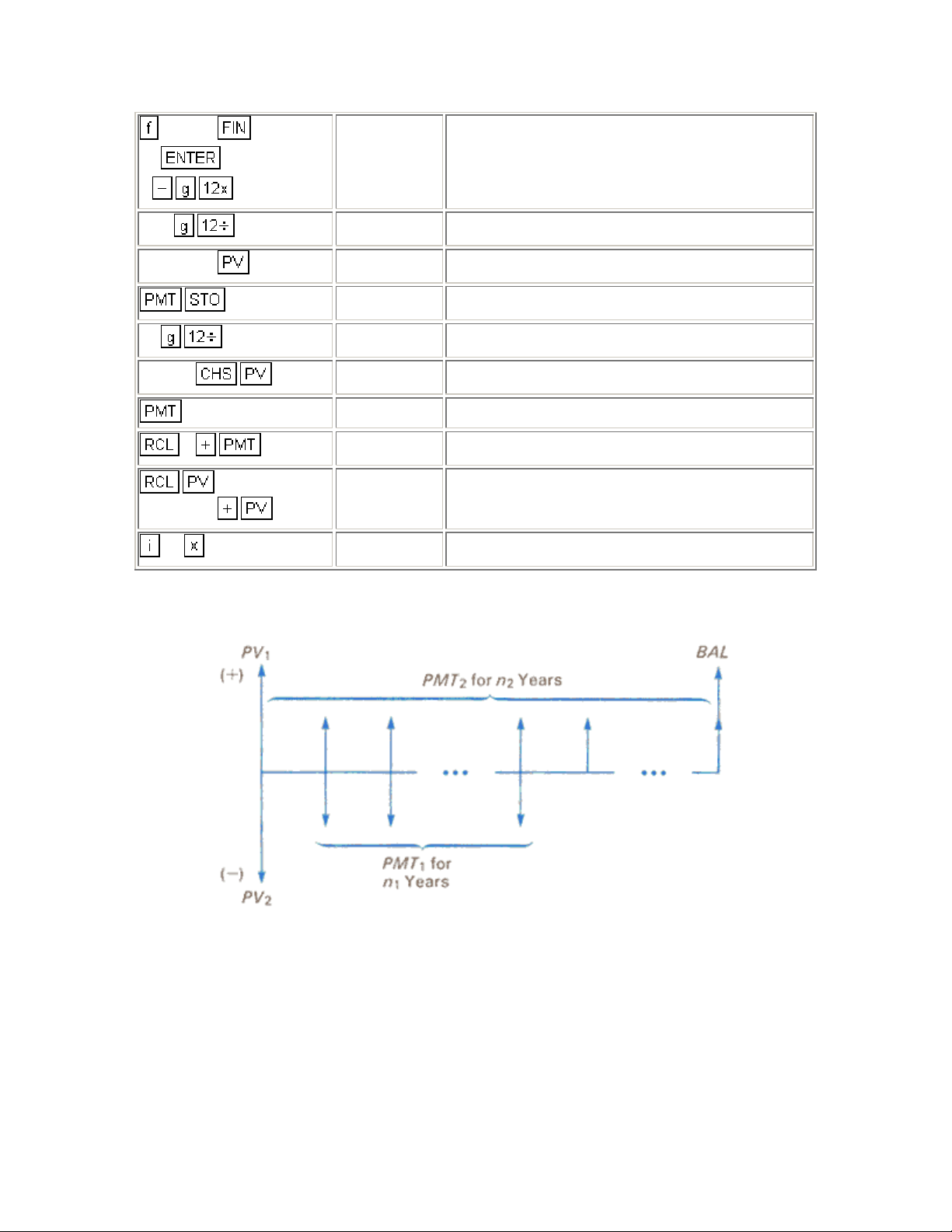

Sometimes the wrap around mortgage will have a longer payback period than the

original mortgage, or a balloon payment may exist.

where:

n1 = number of years remaining in original mortgage

PMT

= yearly payment of original m ortgage

1

= remaining balance of orig ina l m ort gage

PV

1

n

= number of years in wrap-around mortgage

2

PMT

= yearly payment of wrap-around m or tgage

2

PV

= total amount of wrap-around mortgage

2

BAL = balloon payment

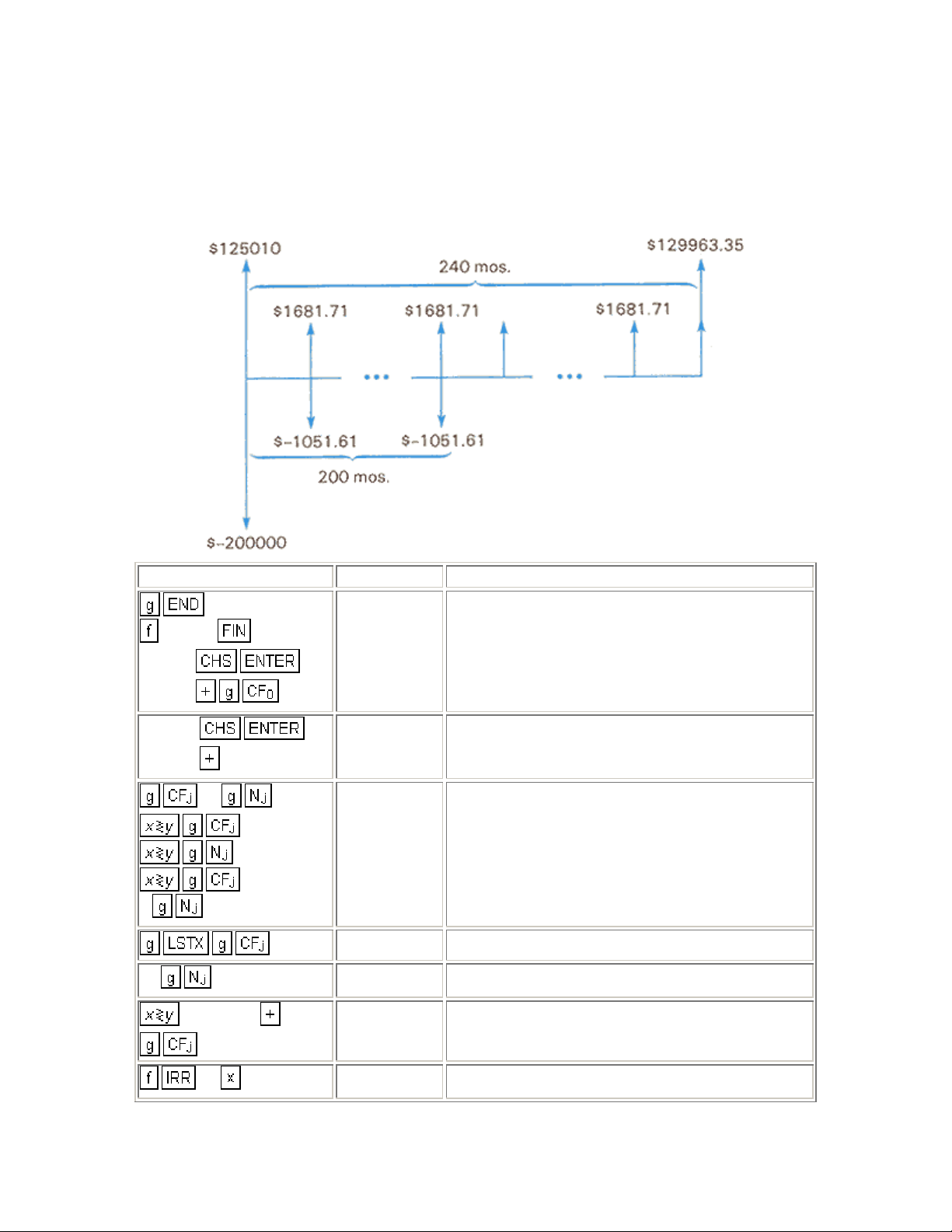

Example 2: A customer has an existing mortgage with a balance of $125.010, a

remaining term of 200 months, and a $1051.61 monthly payment. He wishes to

obtain a $200,000, 9 1/2% wrap-around with 240 monthly payments of $1681.71

and a balloon payment at the end of the 240th month of $129,963.35. If you, as a

lender, accept the proposal, what is your rate of return?

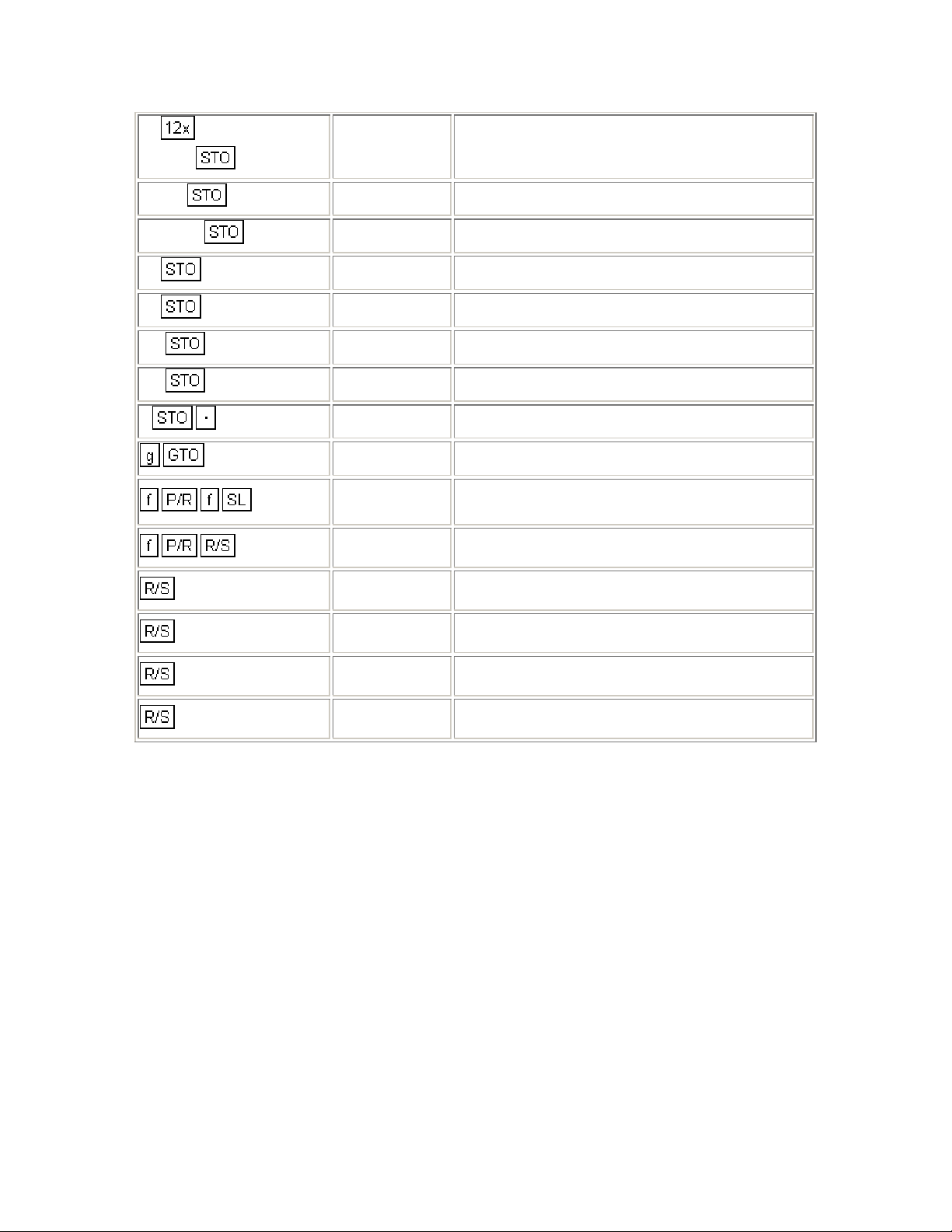

Keystrokes Display

CLEAR

200000

125010

1051.61

1681.71

2

39

99

129963.35

-74,990.00 Net investment.

630.10 Net cash flow received by lender.

The above cash flow occurs 200 times.

1,681.71 Next cash flow received by lender.

39.00 Cash flow occurs 39 times.

131,645.06 Final cash flow.

12

11.84 Rate of return to lender.

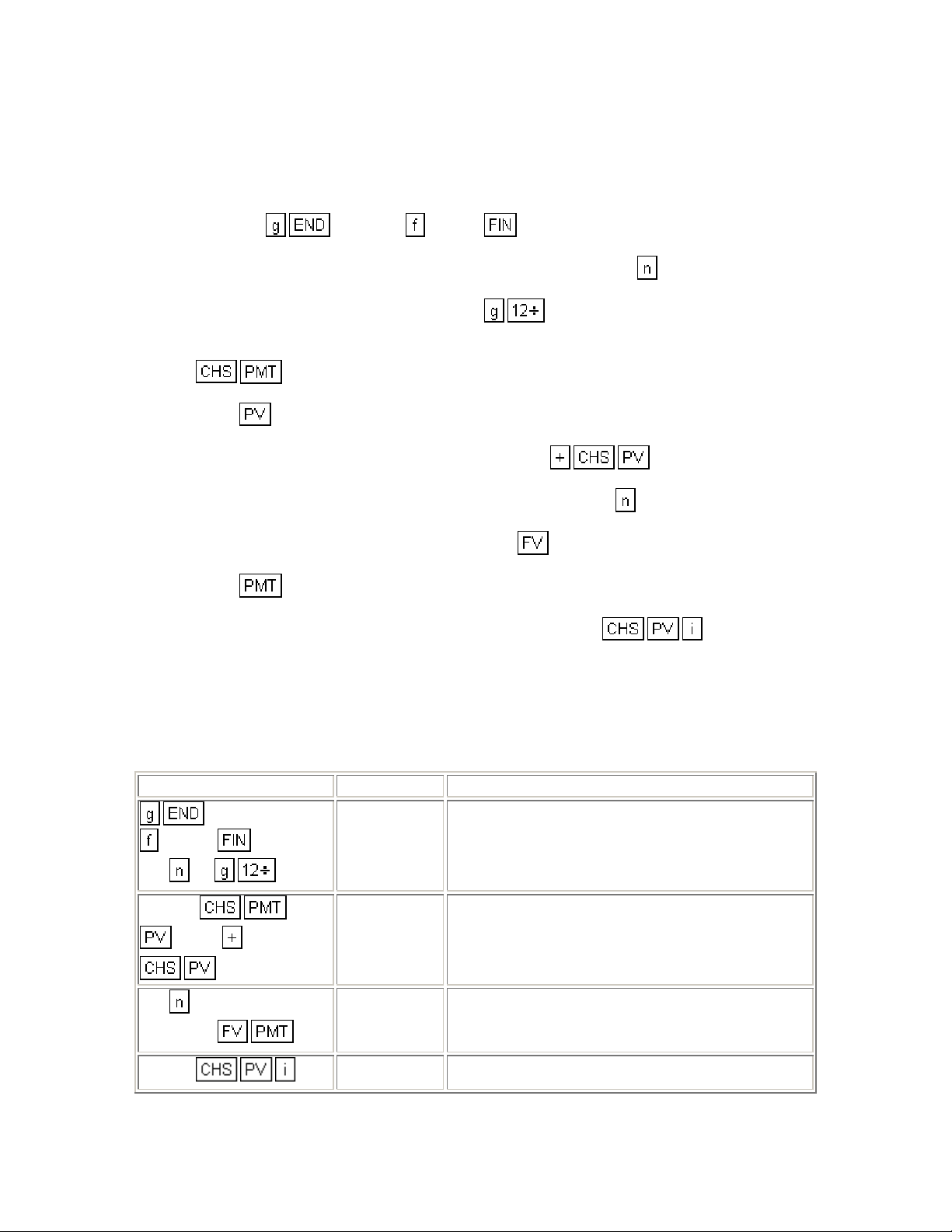

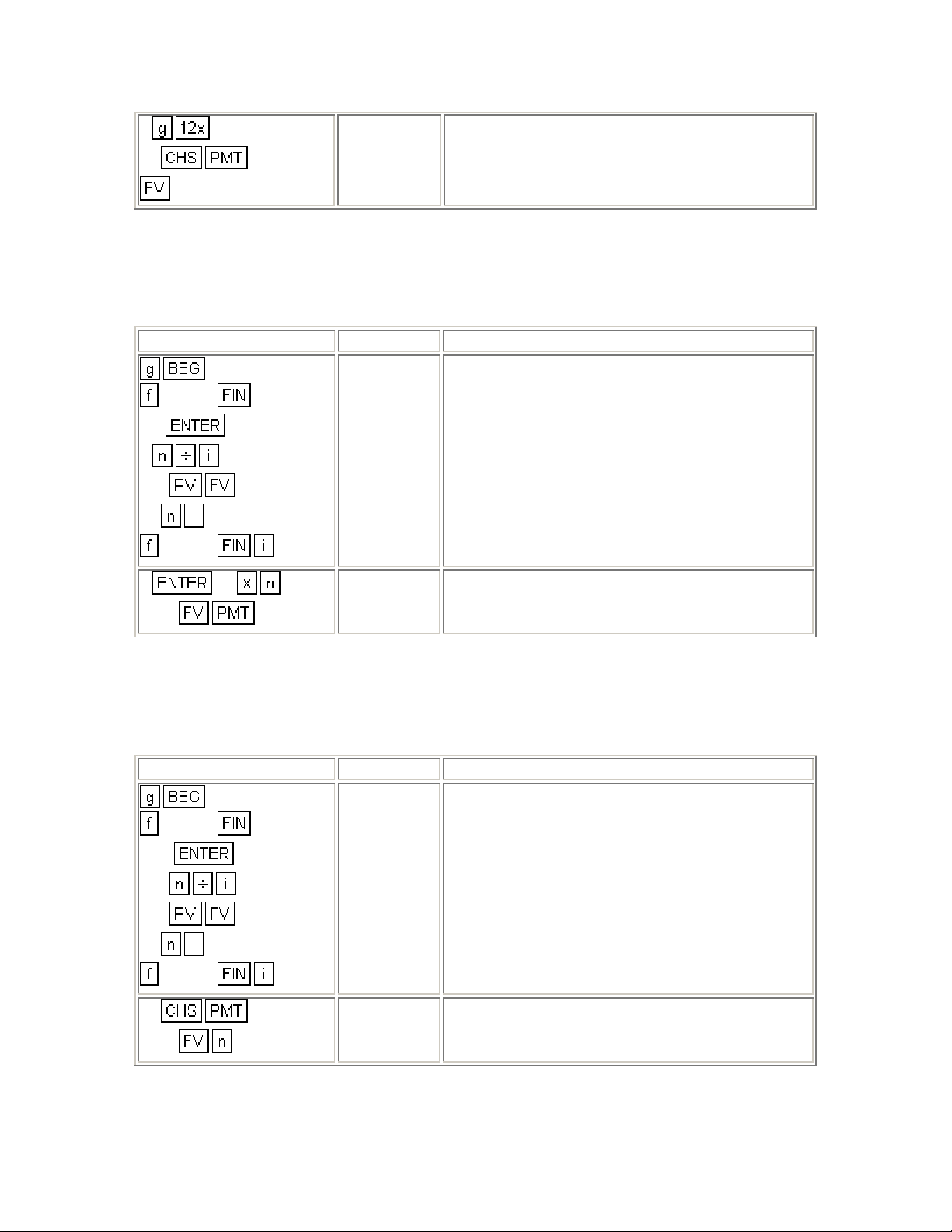

If you, as a lender, know the yield on the entire transaction, and you wish to

obtain the payment amount on the wrap-around mortgage to achieve this yield,

use the following procedure. Once the monthly payment is known, the borrower's

periodic interest rate may also be determined.

1. Press the and press CLEAR .

2. Key in the remaining periods of the original mortgage and press

3. Key in the desired annual yield and press

4. Key in the monthly payment to be made by the lender on the original mortgage and press

.

5. Press

6. Key in the net amount of cash advanced and press

7. Key in the total term of the wrap-around mortgage and press

8. If a balloon payment exists, key it in and press

9. Press

10. Key in the amount of the wrap-around mortgage and press

borrower's periodic interest rate.

.

to obtain the payment amount necessary to achieve the desired yield.

.

.

.

.

.

to obtain the

Example 3: Your firm has determined that the yield on a wrap-around mortgage

should be 12% annually. In the previous example, what monthly payment must

be received to achieve this yield on a $200,000 wrap-around? What interest rate

is the borrower paying?

Keystrokes Display

CLEAR

200

1051.61

240

129963.35

12

74990

Number of periods and monthly interest rate.

-165,776.92 Present value of payments plus cash advanced.

1,693.97 Monthly payment received by lender

9.58 Annual interest rate paid by borrower.

12

Income Property Cash Flow Analysis

Before-Tax Cash Flows

The before-tax cash flows applicable to real estate analysis and problems are:

Potential Gross Income

•

Effective Gross Income

•

Net Operating Income (also called Net Income Before Recapture.)

•

Cash Throw-off to Equity (also called Gross Spendable Cash)

•

The derivation of these cash flows follows a set sequence:

1. Calculate Potential Gross Income by multiplying the rent per unit times the number of

units, times the number of rental payments periods per year. This gives the rental income

the property would generate if it were fully occupied.

2. Deduct Allowance for Vacancy and Rental Loss. This is usually expressed as a

percentage. The result is Rent Collections (which is also Effective Gross Income if there

is no "Other Income").

3. Add "Other Income" such as receipts from concessions (laundry equipment, etc.),

produced from sources other than the rental office space. This is Effective Gross Income.

4. Deduct Operating Expenses. These are expenditures the landlord-investor must make,

by contract or custom, to preserve the property and keep in capable of producing the

gross income. The result is the Net Operating Income.

5. Deduct Annual Debt Service on the mortgage. This produces Cash Throw-Off to Equity.

Thus:

Effective Gross Income =

Potential Gross Income - Vacancy Loss + Other Income.

Net Operating Income =

Effective Gross Income - Operating Expenses.

Cash Throw-Off =

Net Operating Income - Annual Dept Service.

Example: A 60-unit apartment building has rentals of $250 per unit per month.

With a 5% vacancy rate, the annual operating cost is $76,855.

The property has just been financed with a $700,000 mortgage, fully amortized in

a level monthly payments at 11.5% over 20 years.

a. What is he Effective Gross Income?

b. What is the Net Operating Income?

c. What is the Cash Throw-Off to Equity?

Keystrokes Display

CLEAR

60

250

5

76855

20

11.5

700000

12

12

180,000.00 Potential Gross Income.

9,000.00 Vacancy Loss.

171,000.00 Effective Gross Income.

94,145.00 Net Operating Income.

-89,580.09 Annual Debt Service.

4,564.91 Cash Throw-Off.

Before-Tax Reversions (Resale Proceeds)

The reversion receivable at the end of the income projection period is usually

based on forecast or anticipated resale of the property at that time. The beforetax reversion amount applicable to real estate analysis and problems are:

Sale Price.

•

Cash Proceeds of Resale.

•

Outstanding Mortgage Balance.

•

Net Cash Proceeds of Resale to Equity.

•

The derivation of these reversions are as follows:

1. Forecast or estimate Sales Price. Deduct sales and Transaction Costs. The result is the

Proceeds of Resale.

2. Calculate the Outstanding Balance of the Mortgage at the end of the Income Projection

Period and subtract it from Proceeds of Resale. The result is net Cash Proceeds of

Resale.

Thus:

Cash Proceeds of Resale =

Sales Price - Transaction Costs.

Net Cash Proceeds of Resale =

Cash Proceeds of Resale - Outstanding Mortgage Balance.

Example: The apartment property in the preceding example is expected to be

resold in 10 years. The anticipated resale price is $800,000. The transaction

costs are expected to be 7% of the resale price. The mortgage is the same as

that indicated in the preceding example.

What will the Mortgage Balance be in 10 years?

•

What are the Cash Proceeds of Resale and Net Cash Proceeds of Resale?

•

Keystrokes Display

CLEAR

240.00 Mortgage term.

20

11.5

700000

10

800000

7

0.96 Mortgage rate.

Property value.

-7,465.01 Monthly payment.

120.00 Projection period.

-530,956.57 Mortgage balance in 10 years.

Estimated resale.

56,000.00 Transaction costs.

744,000.00 Cash Proceeds of Resale.

213,043.43 Net Cash Proceeds of Resale.

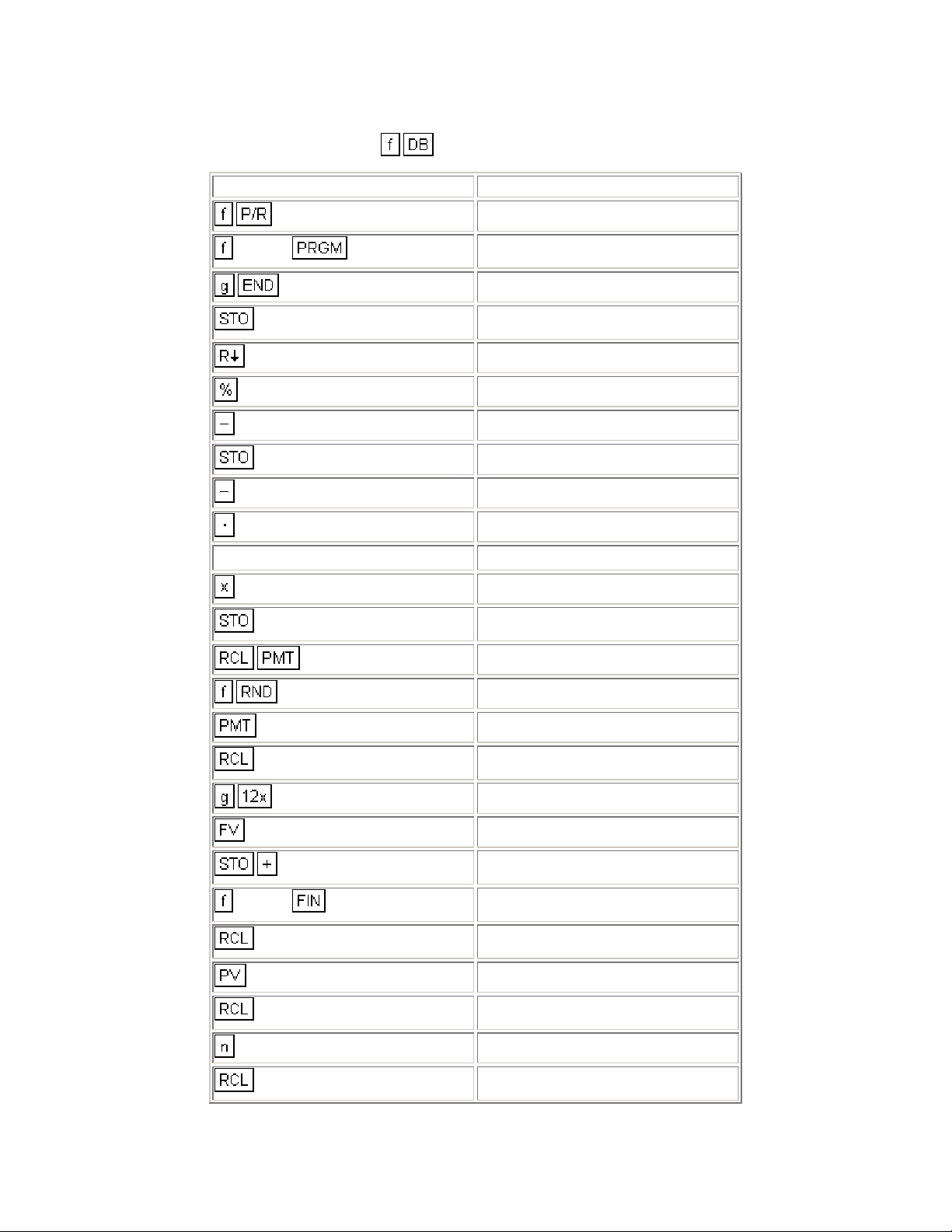

After-Tax Cash Flows

The After-Tax Cash Flow (ATCF) is found for the each year by deducting the

Income Tax Liability for that year from the Cash Throw Off.

where:

Taxable Income =

Net Operating Income - interest - depreciation.

Tax Liability =

Taxable Income x Marginal Tax Rate.

After Tax Cash Flow =

Cash Throw Off - Tax Liability.

The After-Tax Cash Flow for the initial and successive years may be calculated

by the following HP-12C program. This program calculates the Net Operating

Income using the Potential Gross Income, operational cost and vacancy rate.

The Net Operating Income is readjusted each year from the growth rates in

Potential Gross Income and operational costs.

The user is able to change the method of finding the depreciation from declining

balance to straight line. To make the change, key in at line 32 of the

program in place of .

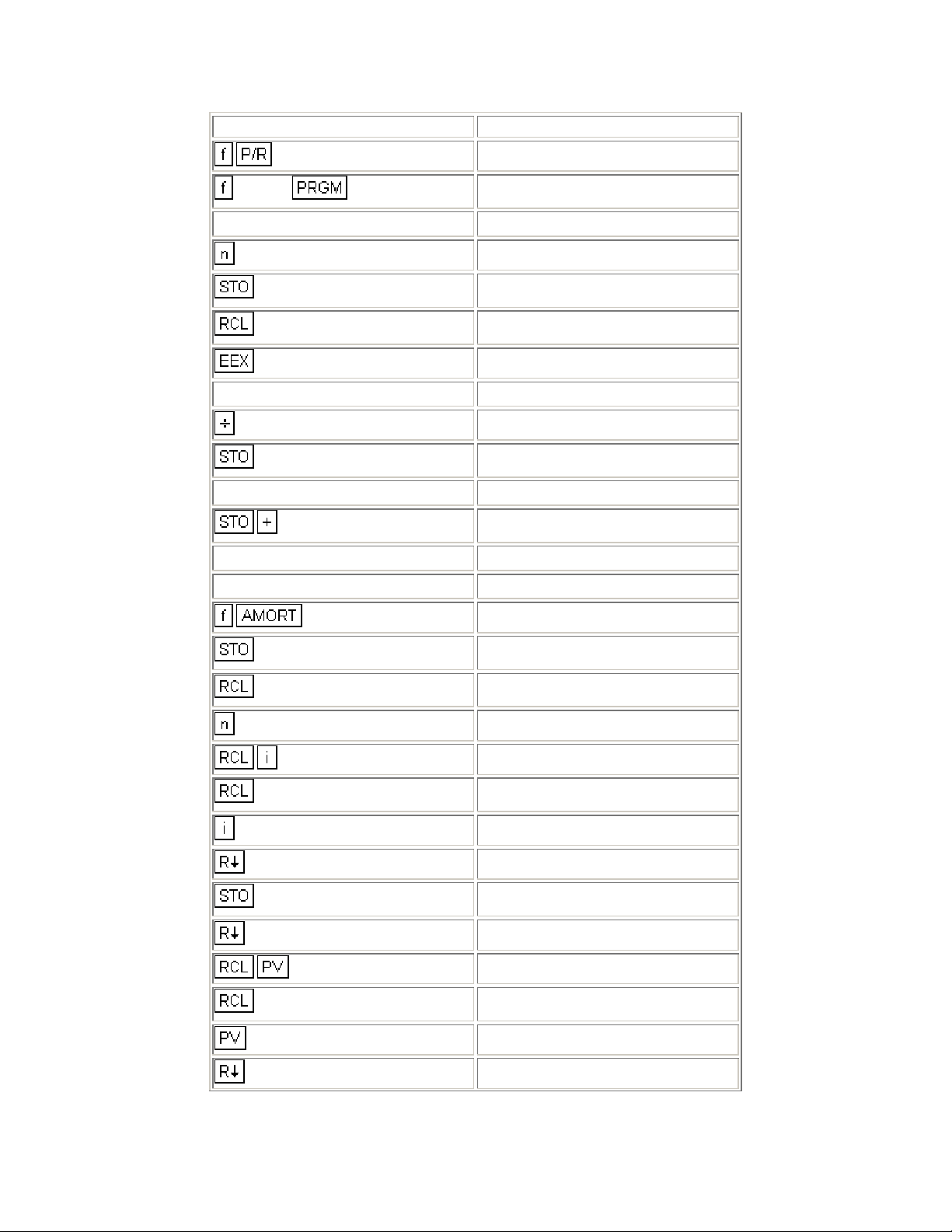

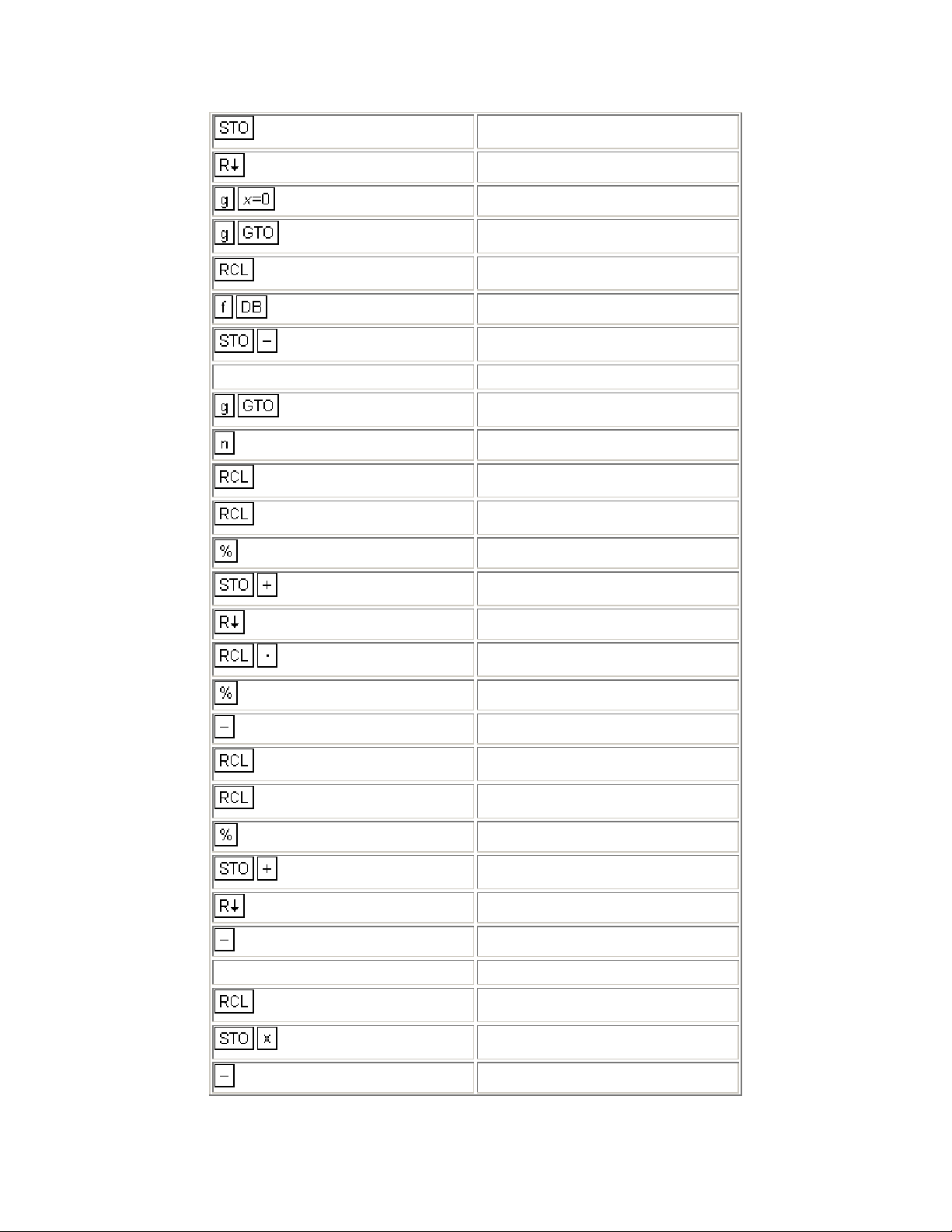

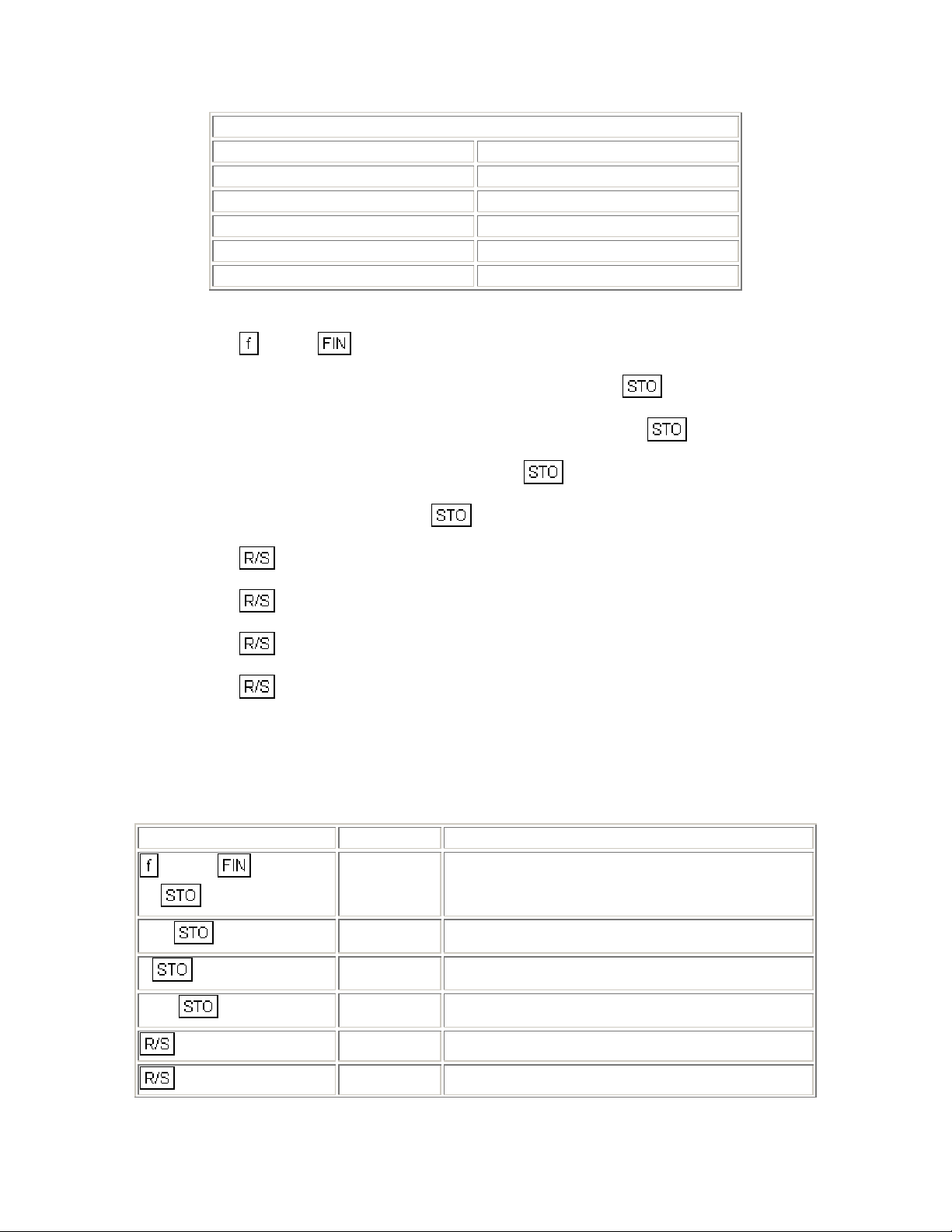

KEYSTROKES DISPLAY

CLEAR

0

1

7

2

7

1

1

1

2

0001- 0

02- 11

03- 44 1

04- 45 7

05- 26

06- 2

07- 10

08- 44 7

09- 1

10-44 40 1

11- 1

12- 2

0

5

6

6

4

13- 42 11

14- 44 0

15- 45 5

16- 11

17- 45 12

18- 45 6

19- 12

20- 33

21- 44 6

22- 33

23- 45 13

24- 45 4

25- 13

26- 33

4

27- 44 4

0

36

1

0

28- 33

29- 43 35

30-43,33 36

31- 45 1

32- 42 25

33-44 30 0

34- 0

17

2

8

2

35-43,33 17

36- 11

37- 45 2

38- 45 8

39- 25

40-44 40 2

1

0

3

9

3

41- 33

42-45 48 0

43- 25

44- 30

45- 45 3

46- 45 9

47- 25

48-44 40 3

49- 33

50- 30

51- 1

7

0

52- 45 7

53-44 20 0

54- 30

1

55- 20

56- 45 14

57- 1

2

0

1

09

REGISTERS

n: Used i: Annual %

PV: Used PMT: Monthly

FV: 0 R0: Used

R1: Counter

R3: Oper. cost R4: Dep. value

R5: Dep. life R6: Factor (DB)

R7: Tax Rate R8: % gr. (PGI)

R9: % gr. (op) R.0: Vacancy rt.

58- 2

59- 20

60- 40

61- 45 0

62- 30

63- 45 1

64- 43 31

65- 34

66- 31

67-43,33 09

R

: PGI

2

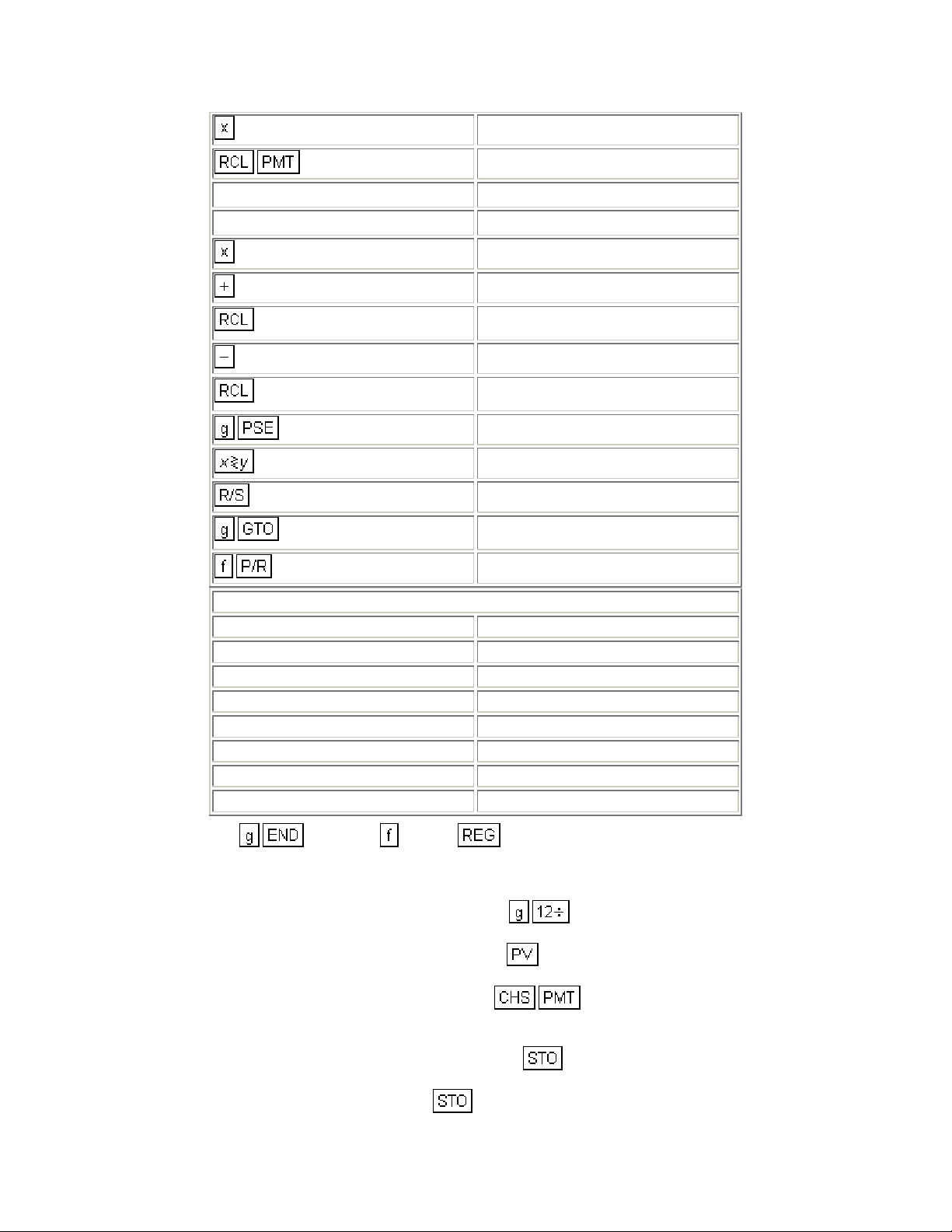

1. Press and press CLEAR .

2. Key in loan values:

Key in annual interest rate and press

•

Key in principal to be paid and press

•

Key in monthly payment and press

•

(If any of the values are not known, they should be solved for.)

3. Key in Potential Gross Income (PGI) and press

4. Key in Operational cost and press

3.

2.

5. Key in depreciable value and press 4.

6. Key in depreciable life and press

7. Key in factor (for declining balance only) and press

8. Key in the Marginal Tax Rate (as a percentage) and press

9. Key in the growth rate in Potential Gross Income ( 0 for no growth) and press

10. Key in the growth rate in operational cost (0 if no growth) and press

11. Key in the vacancy rate (0 for no vacancy rate) and press

12. Key in the desired depreciation function at line 32 in the program.

13. Press

with the ATCF for that year. The Y-register contains the year.

14. Continue pressing

to compute ATCF. The display will pause showing the year and then will stop

to compute successive After-Tax Cash Flows.

5.

6.

7.

8.

9.

0.

Example 1: A triplex was recently purchased for $100,000 with a 30-year loan at

12.25% and a 20% down payment. Not including a 5% annual vacancy rate, the

potential gross income is $9,900 with an annual growth rate of 6%. Operating

expenses are $3,291.75 with a 2.5% growth rate. The depreciable value is

$75,000 with a projected useful life of $20 years. Assuming a 125% declining

balance depreciation, what are the After-Tax Cash Flows for the first 10 years if

the investors Marginal Tax Rate is 35%?

Keystrokes Display

CLEAR

100000

20

12.25

30

9900 2

3291.75 3

75000 4

20 5

80,000.00 Mortgage amount.

1.02 Monthly interest rate.

360 Mortgage term.

-838.32 Monthly payment.

9,900.00 Potential Gross Income.

3,291.75 1st year operating cost.

75,000.00 Depreciable value.

20.00 Useful life.

125 6

125.00 Decline in balance factor.

35 7

6 8

2.5 9

5 .0

35.00 Marginal Tax Rate.

6.00 Potential Gross Income growth rate.

2.50 Operating cost growth.

5.00 Vacancy rate.

1.00

-1,020.88

2.00

-822.59

3.00

-598.85

4.00

-72.16

5.00

232.35

6.00

565.48

7.00

928.23

8.00

1,321.62

9.00

1,746.81

10.00

-1,020.88

Year 1

ATCF

1

Year 2

ATCF

2

Year 3

ATCF

3

Year 4

ATCF

4

Year 5

ATCF

5

Year 6

ATCF

6

Year 7

ATCF

7

Year 8

ATCF

8

Year 9

ATCF

9

Year 10

ATCF

10

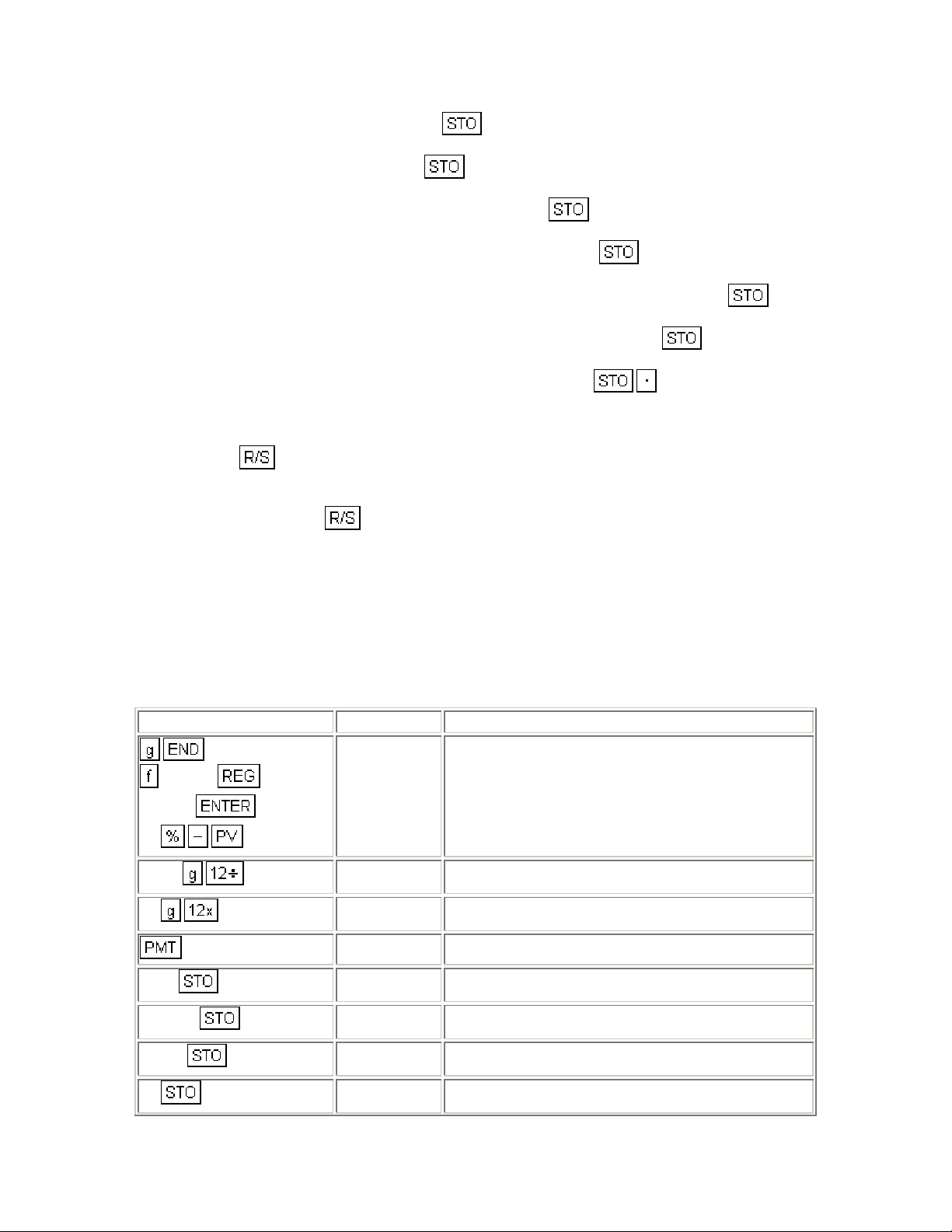

Example 2: An office building was purchased for $1,400,000. The value of

depreciable improvements is $1,200,000.00 with a 35 year economic life.

Straight line depreciation will be used. The property is financed with a $1,050,000

loan. The terms of the loan are 9.5% interest and $9,173.81 monthly payments

for 25 years. The office building generates a Potential Gross Income of

$175,2000 which grows at a 3.5% annual rate. The operating cost is $40,296.00

with a 1.6% annual growth rate. Assuming a Marginal Tax Rate of 50% and a

vacancy rate of 7%, what are the After-Tax Cash Flows for the first 5 years?

Keystrokes Display

CLEAR

1050000

9173.81

175,200.00 Potential Gross Income.

25

175200

40296 3

1200000 4

35 5

50 7

3.5 8

1.6 9

7 0

2

31

40,296.00 1st year operating cost.

1,200,000.00 Depreciable value.

35.00 Depreciable life.

50.00 Marginal tax rate.

3.50 Potential Gross Income

1.60 Operating cost growth rate.

7.00 Vacancy rate.

7.00 Go to dep. step.

32- 42

23

1.00

18,021.07

2.00

20,014.26

3.00

22,048.90

4.00

24,123.14

5.00

26,234.69

Change to SL.

Year 1

ATCF

1

Year 2

ATCF

2

Year 3

ATCF

3

Year 4

ATCF

4

Year 5

ATCF

5

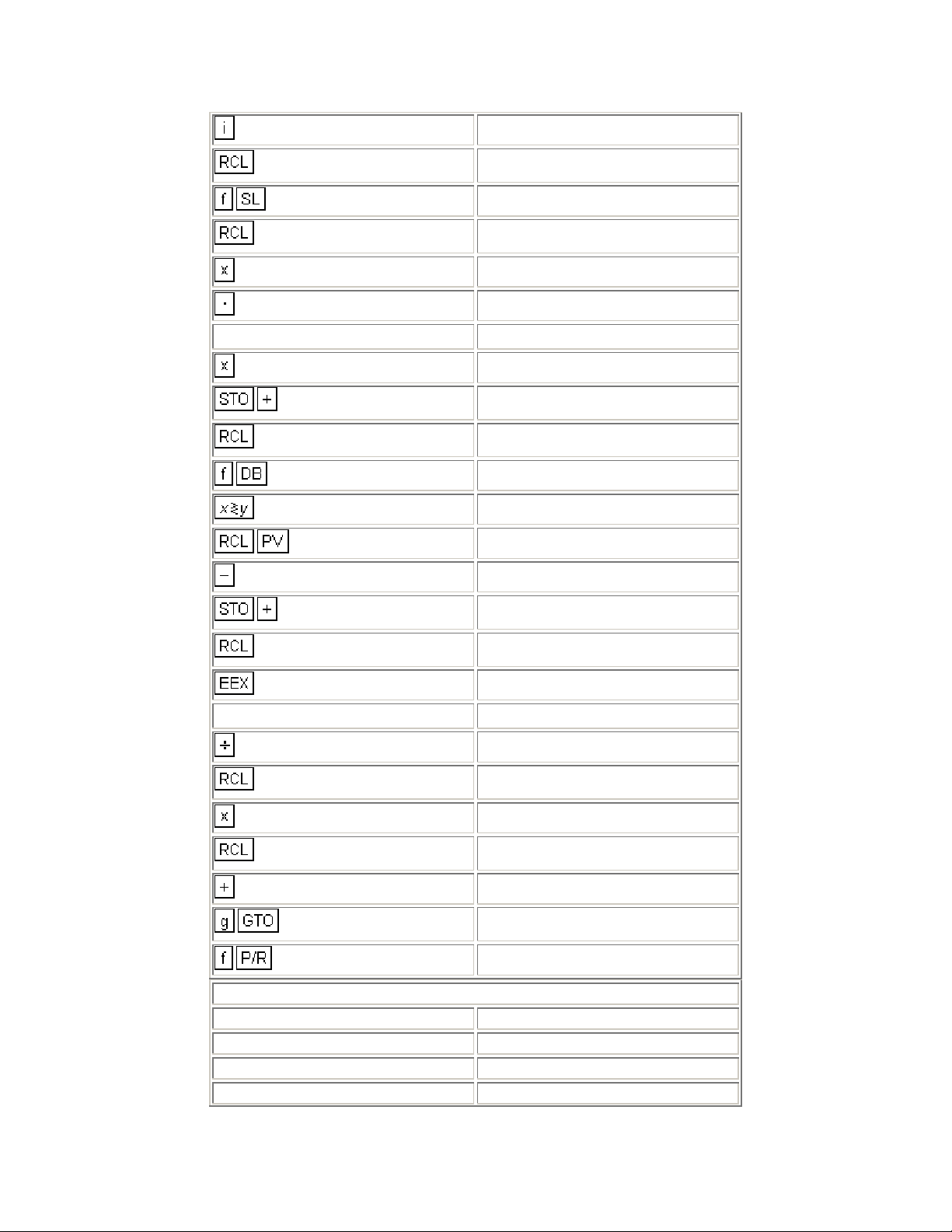

After-Tax Net Cash Proceeds of Resale

The After-Tax Net Cash Proceeds of Resale (ATNCPR) is the after-tax reversion

to equity; generally, the estimated resale price of the property less commissions,

outstanding debt and any tax claim.

The After-Tax Net Cash Proceeds can be found using the HP-12C program

which follows. In calculating the owner's income tax liability on resale, this

program assumes that the owner elects to have his capital gain taxed at 40% of

his Marginal Tax Rate. This assumption is in accordance with a 1978 Federal tax

ruling.

* (*

Federal Taxes, code sec. 1202 (32,036))

This program uses declining balance depreciation to find the amount of

depreciation from purchase to sal e. This amount is used to determine the excess

depreciation (which is equal to the amount of actual depreciation minus the

amount of the straight line depreciation).

The user may change to a different depreciation method by keying in the desired

function at line 35 in place of .

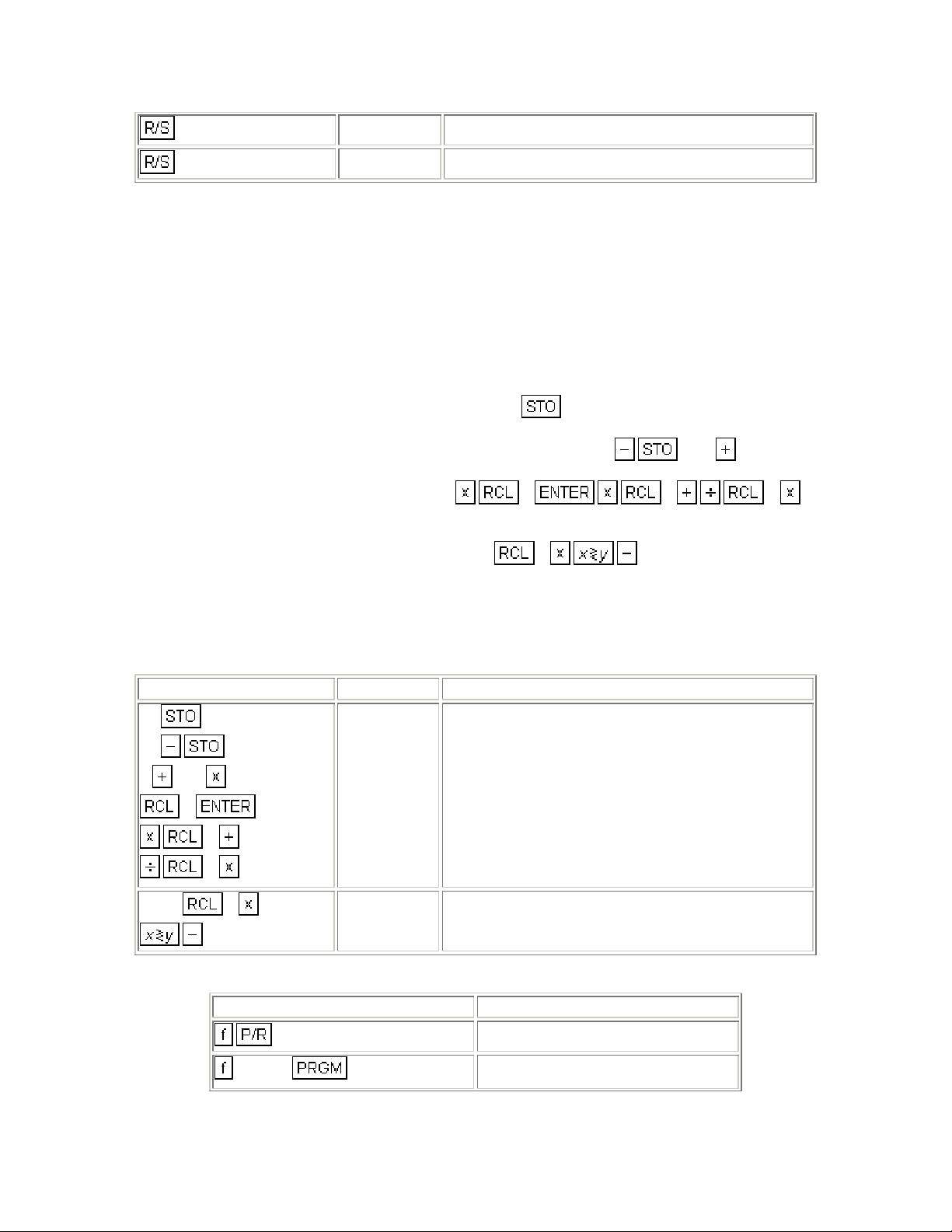

KEYSTROKES DISPLAY

CLEAR

2

4

1

0001- 43 8

02- 44 2

03- 33

04- 25

05- 30

06- 44 0

07- 30

08- 48

09- 4

10- 20

11- 44 1

12- 45 14

13- 42 14

14- 14

2

0

CLEAR

3

4

5

15- 45 2

16- 43 11

17- 15

18-44 40 0

19- 42 34

20- 45 3

21- 13

22- 45 4

23- 11

24- 45 5

25- 12

6

2

2

26- 45 2

27- 42 23

28- 45 2

29- 20

30- 48

31- 6

1

2

1

32- 20

33-44 40 1

34- 45 2

35- 42 25

36- 34

37- 45 13

38- 30

39-44 40 1

6

2

1

0

00

REGISTERS

n: Used i: Used

PV: Used PMT: Used

FV: Used R0: Used

R1: Used R2: Desired yr.

40- 45 6

41- 26

42- 2

43- 10

44- 45 1

45- 20

46- 45 0

47- 40

48-43,33 00

R3: Dep. value R4: Dep. life

R5: Factor R6: MTR

R7-R.3: Unused

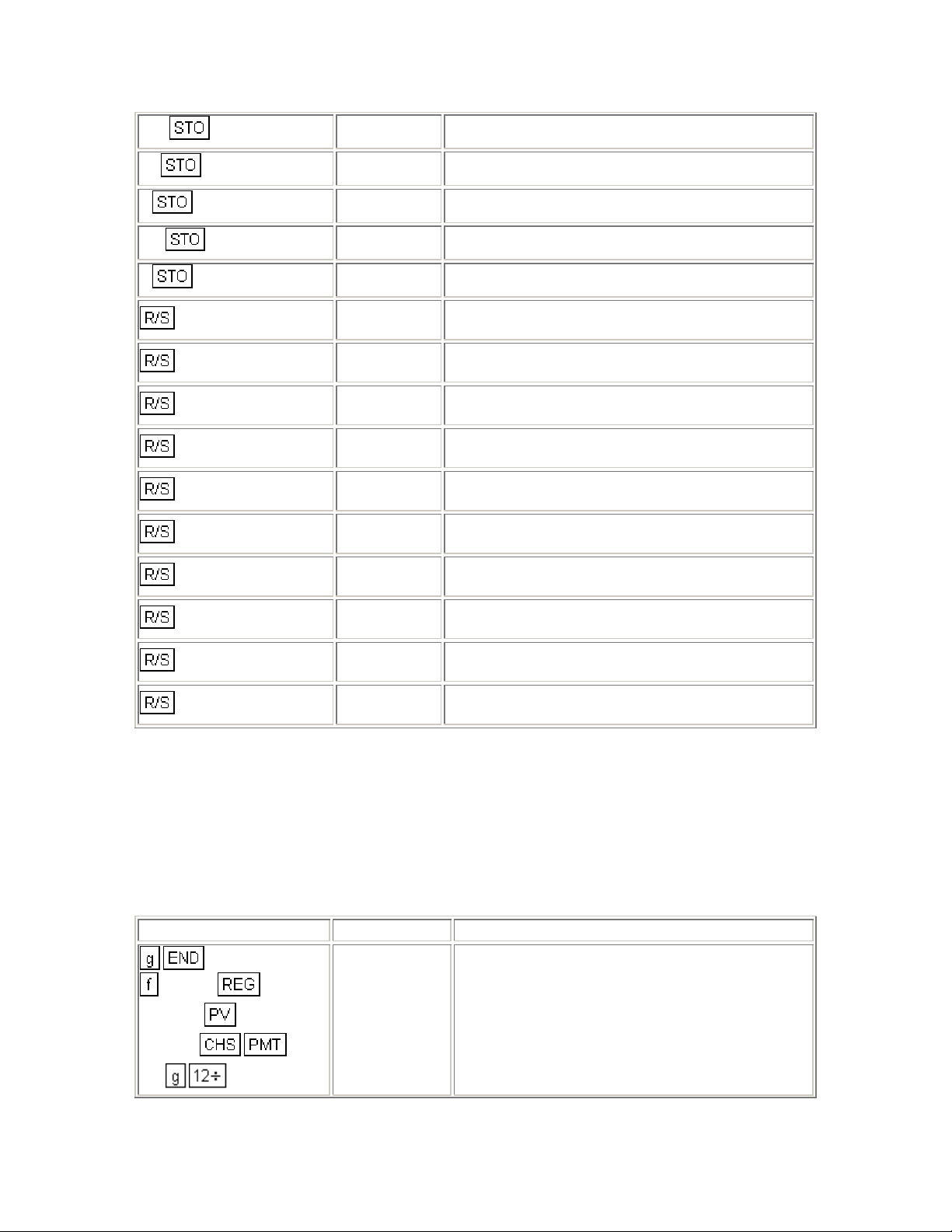

1. Key in the program and press CLEAR .

2. Key in the loan values:

Key in annual interest rate and press

•

Key in mortgage amount and press

•

Key in monthly payment and press

•

(If any of the values are unknown, they should be solved for.)

3. Key in depreciable value and press

4. Key in depreciable life in years and press

5. Key in accelerated depreciation factor for the declining balance method and press

5.

6. Key in your Marginal Tax Rate as a percentage and press

7. Key in the purchase price and press

8. Key in the sale price and press

9. Key in the % commission charged on the sale and press

*

If a dollar value is desired instead of a commission rate, key in , which does

3.

4.

.

.

.

.

.

6.

.*

not affect the register values, at line 04 of the program.

10. Key in the number of years after purchase and press

.

Example 1: An apartment complex, purchased for $900,000 ten years ago, is

sold for $1,750,000. The closing cost are 8% of the sale price and the income tax

rate is 48%.

A $700,000 loan for 20 years at 9.5% annual interest was used to purchase the

complex. When it was purchased the depreciable value was $750,000 with a

useful life of 25 years. Using 125% declining balance depreciation, what are the

After-Tax Net Cash Proceeds in year 10?

Keystrokes Display

CLEAR

0.00

700000

700,000.00 Mortgage.

9.5

20

750000 3

25 4

125 5

48 6

900000

1750000

8

10

0.79 Monthly interest.

240.00 Number of payments.

-6,524.92 Monthly payment.

750,000.00 Depreci abl e value.

25.00 Depreciable life.

125.00 Factor.

48.00 Marginal Tax Rate.

900,000.00 Purchas e pr ice.

1,750,000.00 Sale price.

8.00 Commission rate.

911,372.04

ATNCPR.

Lending

Loan With a Constant Amount Paid Towards Principal

This type of loan is structured such that the principal is repaid in equal

installments with the interest paid in addition. Therefor each periodic payment

has a constant amount applied toward the principle and a varying amount of

interest.

Loan Reduction Schedule

If the constant periodic payment to principal, annual interest rate, and loan

amount are known, the total payment, interest portion of each payment, and

remaining balance after each successive payment may be calculated as follows:

1. Key in the constant periodic payment to principal and press 0.

2. Key in periodic interest rate and press

3. Key in the loan amount. If you wish to skip to another time period, press

key in the number of payments to be skipped, and press

4. Press

5. Press

6. Press

7. Return to step 4 for each successive payment.

to obtain the interest portion of the payment.

0 to obtain the total payment.

0 to obtain the remaining balance of the loan.

.

. Then

0 .

Example 1: A $60,000 land loan at 10% interest calls for equal semi-annual

principal payments over a 6-year maturity. What is the loan reduction schedule

for the first year? (Constant payment to principal is $5000 semi-annually). What

is the fourth year's schedule (skip 4 payments)?

Keystrokes Display

5000 0

10

2

5.00 Semi-annual interest rate.

60000

0

3,000.00 First payment's interest.

8,000.00 Total first payment.

0

55,000.00 Remaining balance.

0

0

4 0

0

0

0

0

2,750.00 Second payment's interest.

7,750.00 Total second payment.

50,000.00 Remaining balance after the first year.

1,500.00 Seventh payment's interest.

6,500.00 Total seventh payment.

25,000.00 Remaining balance.

1,250.00 Eighth payment's interest.

6,250.00 Total eighth payment.

20,000.00 Remaining balance after fourth year.

Add-On Interest Rate Converted to APR

An add-on interest rate determines what po rtion of the principal will be added on

for repayment of a loan. This sum is then divided by the number of months in a

loan to determine the monthly payment. For example, a 10% add-on rate for 36

months on $3000 means add one-tenth of $3000 for 3 years (300 x 3) - usually

called the "finance charge" - for a total of $3900. The monthly payment is

$3900/36.

This keystroke procedure converts an add-on interest rate to a annual

percentage rate when the add-on rate and number of months are known.

1. Press and press CLEAR .

2. Key in the number of months in loan and press

3. Key in the add-on rate and press

4. Key in the amount of the loan and press

cash paid out.)

5. Press

6. Press

12 to obtain the APR.

.

.

.

* (*

Positive for cash received; negative for

.

Example 1: Calculate the APR and monthly payment of a 12% $1000 add-on

loan which has a life of 18 months.

Keystrokes Display

CLEAR

18

12

1,180.00 Amount of loan.

1000

12

-65.56 Monthly payment.

21.64 Annual Percentage Rate.

APR Converted to Add-On Interest Rate.

Given the number of months and annual percentage rate, this procedure

calculates the corresponding add-on interest rate.

1. Press and press CLEAR .

2. Enter the following information:

a. Key in number of months of loan and press

b. Key in APR and press

c. Key in 100 and press

3. Press

.

.

12 to obtain the add-on rate.

.

Example 1: What is the equivalent add-on rate for an 18 month loan with an

APR of 14%.

Keystrokes Display

CLEAR

14

18

100

12

7.63 Add-On Interes t Rate .

Add-On Rate Loan with Credit Life.

This HP-12C program calculates the monthly payment amount, credit life amount

(an optional insurance which cancels any remaining indebtedness at the death of

the borrower), total finance charge, and annual percentage rate (APR) for an

add-on interest rate (AIR) loan. The monthly payment is rounded (in normal

manner) to the nearest cent. If other rounding techniques are used, slightly

different results may occur.

KEYSTROKES DISPLAY

CLEAR

1

0

1

2

0

0

4

2

0001- 43 8

02- 1

03- 45 0

04- 1

05- 2

06- 0

07- 0

08- 10

09- 44 4

10- 45 2

11- 20

12- 30

13- 43 36

1

4

4

1

14- 45 1

15- 20

16- 45 4

17- 20

18- 30

19- 45 4

20- 45 1

21- 20

1

22- 1

3

0

0

23- 40

24- 34

25- 10

26- 45 3

27- 20

28- 45 0

29- 10

30- 42 14

31- 16

32- 14

33- 31

34- 45 14

35- 45 0

36- 20

37- 16

38- 13

39- 45 13

1

2

2

2

0

40- 45 2

41- 25

42- 45 0

43- 20

44- 1

45- 2

5

46- 10

47- 44 5

48- 26

49- 2

50- 20

51- 43 35

52- 43 35

0

1

61

5

53-43,33 61

54- 45 5

55- 48

56- 0

57- 1

5

5

3

58- 40

59- 42 14

60- 44 5

61- 45 5

62- 31

63- 45 13

64- 34

65- 30

66- 45 3

5

3

0

00

67- 30

68- 16

69- 31

70- 45 5

71- 45 3

72- 40

73- 13

74- 45 0

75- 11

76- 12

77-45,43 12

78-43,33 00

n: N i: i

PV: Used

FV: 0

R1: AIR R

R3: Loan

R5: Used R6-R9: Unused

1. Key in the program.

REGISTERS

PMT: PMT

: N

R

0

: CL (%)

2

R

: N/1200

4

2. Press

3. Key in the number of monthly payments in the loan and press

4. Key in the annual add-on interest rate as a percentage and press

5. Key in the credit life as a percentage and press

6. Key in the loan amount and press

7. Press

8. Press

9. Press

10. Press

CLEAR .

0.

1.

2.

3.

to find the monthly payment amount.

to obtain the amount of credit life.

to calculate the total finance charge.

to calculate the annual percentage rate.

11. For a new loan return to step 3.

Example 1: You wish to quote a loan on a $3100 balance, payable over 36

months at an add-on rate of 6.75%. Credit life (CL) is 1%. What are the monthly

payment amount, credit life amount, total finance charge, and APR?

Keystrokes Display

CLEAR

36

0

6.75 1

1 2

3100 3

36.00 Months.

6.75 Add-on interest rate.

1.00 Credit life (%).

3100.00 Loan.

-107.42 Monthly payment.

116.02 Credit life.

-651.10 Total finance charge.

12.39

APR.

Interest Rebate - Rule of 78's

This procedure finds the unearned interest rebate, as well as the remaining

principal balance due for a prepaid consumer loan using the Rule of 78's. The

known values are the current installment number, the total number of

installments for which the loan was written, and the total finance charge (amount

of interest). The information is entered as fol l ows:

1. Key in number of months in the loan and press 1.

2. Key in payment number when prepayment occurs and press

3. Key in total finance charge and press

to obtain the unearned interest (rebate).

4. Key in periodic payment amount and press

principal outstanding.

1 1 2

2 to obtain the amount of

2 1 .

Example 1: A 30 month $1000 loan having a finance charge of $180, is being

repaid at $39.33 per month. What is the rebate and balance due after the 25th

regular payment?

Keystrokes Display

30 1

25

1

180

2

5.81 Rebate.

1

1

2

39.33 2

190.84 Outstanding principal.

The following HP-12C program can be used to evaluate the previous example.

KEYSTROKES DISPLAY

CLEAR

00-

0

01- 44 0

1

2

1

2

2

02- 33

03- 44 2

04- 33

05- 44 1

06- 45 2

07- 30

08- 44 2

09- 1

0

1

10- 40

11- 45 0

12- 20

13- 45 1

14- 36

15- 20

1

2

2

00

REGISTERS

n: Unused i: Unused

16- 45 1

17- 40

18- 10

19- 45 2

20- 20

21- 31

22- 45 2

23- 20

24- 34

25- 30

26-43,33 00

PV: Unused PMT: Unused

FV: Unused R0: Fin. charge

R1: Payment # R2: # months

R3-R.6: Unused

1. Key in the program.

2. Key in the number of months in the loan and press

3. Key in the payment number when prepayment occurs and press

4. Key in the total finance charge and press

5. Key in the periodic payment amount and press

outstanding.

6. For a new case return to step 2.

Keystrokes Display

30

25

180

39.33

5.81 Rebate.

190.84 Outstanding balance.

to obtain the unearned interest (rebate).

to find the amount of principal

Graduated Payment Mortgages

.

.

The Graduated Payment Mortgage is designed to meet the needs of young home

buyers who currently cannot afford high mortgage payments, but who have the

potential of increasing earning in the years on come.

Under the Graduated Payment Mortgage plan, the payments increase by a fixed

percentage at the end of each year for a specified number of years. Thereafter,

the payment amount remains constant for remaining life of the mortgage.

The result is that the borrower pays a reduced payment (a payment which is less

than a traditional mortgage payment) in the early years, and in the later years

makes larger payments than he would with a traditional loan. Over the entire

term of the mortgage, the borrower would pay more than he would with

conventional financing.

Given the term of the mortgage (in years), the annual percentage rate, the loan

amount, the percentage that the payments increase, and the number of years

that the payments increase, the following HP-12C program determines the

monthly payments and remaining balance for each year until the level payment is

reached.

KEYSTROKES DISPLAY

CLEAR

2

1

1

0

2

0001- 43 8

02- 44 2

03- 34

04- 1

05- 25

06- 1

07- 40

08- 44 0

09- 45 11

10- 45 2

11- 30

12- 43 11

13- 45 12

14- 43 12

15- 45 13

1

1

3

16- 44 3

17- 1

18- 16

19- 14

20- 13

21- 16

22- 15

23- 1

0

24- 43 11

25- 45 14

26- 45 0

27- 10

1

28- 14

29- 13

30- 16

31- 15

32- 1

1

1

1

2

40

25

3

4

3

33-44 40 1

34- 45 1

35- 45 2

36- 30

37- 43 35

38-43,33 40

39-43,33 25

40- 45 3

41- 45 13

42- 10

43- 44 4

44- 45 3

45- 13

46- 1

1

3

3

4

47- 44 3

48- 45 3

49- 31

50- 45 4

51- 1

0

1

52- 45 0

53- 45 1

54- 21

55- 10

1

56- 20

57- 16

58- 42 14

59- 14

60- 31

61- 15

62- 15

63- 42 14

64- 31

65- 16

66- 13

67- 1

3

1

1

74

48

4

76

REGISTERS

n: Used i: i/12

PV: Used PMT: Used

FV: Used R0: Used

R1: Used R2: Used

R3: Used R4: Level Pmt.

R5-R9: Unused

68-44 40 3

69-44 30 1

70- 45 1

71- 43 35

72-43,33 74

73-43,33 48

74- 45 4

75- 16

76- 31

77-43,33 76

1. Key in the program.

2. Press CLEAR .

3. Key in the term of the loan and press

4. Key in the annual interest rate and press

5. Key in the total loan amount and press

6. Key in the rate of graduation (as a percent) and press

7. Key in the number of years for which the loan graduates and press

information will be displayed for each year until a level payment is reached.

a. The current year.

Then press

b. The monthly payment for the current year.

Then press

c. The remaining balance to be paid on the loan at the end of the current year.

Then press

level payment has been reached, the program will stop, displaying the monthly

payment over the remaining term of the loan.

8. For a new case press

to continue.

to continue.

to return to step a. unless the level payment is reached. If the

00 and return to step 2.

.

.

.

.

. The following

Example: A young couple recently purchased a new house with a Graduated

Payment Mortgage. The loan is for $50,000 over a period of 30 years at an

annual interest rate of 12.5%. The monthly payments will be graduating at an

annual rate of 5% for the first 5 years and then will be level for the remaining 25

years. What are the monthly payment amount for the first 6 years?

Keystrokes Display

CLEAR

30

12.5

50000

5

5

0.00

30.00 Term

12.50 Annual interest rate

50,000.00 Loan amount

5.00 Rate of graduation

1.00 Year 1

-448.88 1st year monthly payment.

-50,914.67 Remaining balance after 1st year.

2.00 Year 2

-471.33 2nd year monthly payment.

-51,665.07 Remaining balance after 2nd year.

3.00 Year 3

-494.89 3rd year monthly payment.

-52,215.34 Remaining balance after 3rd year.

4.00 Year 4

-519.64 4th year monthly payment.

-52,523.34 Remaining balance after 4th year.

5.00 Year 5

-545.62 5th year monthly payment.

-52,542.97 Remaining balance after 5th year.

-572.90 Monthly payment for remainder of term.

Variable Rate Mortgages

As its name suggests, a variable rate mortgage is a mortgage loan which

provides for adjustment of its interest rate as market interest rates change. As a

result, the current interest rate on a variable rate mortgage may differ from its

origination rate (i.e., the rate when the loan was made). This is the difference

between a variable rate mortgage and the standard fixed payment mortgage,

where the interest rate and the monthly payment are constant throughout the

term.

Under the agreement of the variable rate mortgage, the mortgage is examined

periodically to determine any rate adjustments. The rate adjustment may be

implemented in two ways:

1. Adjusting the monthly payment.

2. Modifying the term of the mortgage.

The period and limits to interest rate increases vary from state to state.

Each periodic adjustment may be calculated by using the HP-12C with the

following keystroke procedure. The original terms of the mortgage are assumed

to be known.

1. Press and press CLEAR .

2. Key in the remaining balance of the loan and press . The remaining balance is the

difference between the loan amount and the total principal from the payments which have

been made.

To calculate the remaining balance, do the following:

a. Key in the previous remaining balance. If this is the first mortgage adjustment,

this value is the original amount of the loan. Pr ess

b. Key in the annual interest rate before the adjustment (as a percentage) and

press

c. Key in the number of years since the last adjustment. If this is the first mortgage

adjustment, then key in the number of years since the origination of the

mortgage. Press

.

.

.

d. Key in the monthly payment over this period and press

e. Press

.

3. Key in the adjusted annual interest rate (as a percentage) and press

To calculate the new monthly payment:

a. Key in the remaining life of the mortgage (years) and press

b. Press

To calculate the revised remaining term of the mortgage:

c. Key in the present monthly payment and press

d. Press

to find the remaining balance, then press CLEAR

to find the new monthly payment.

.

12 to find the remaining term of the mortgage in years.

.

.

.

Example: A homeowner purchased his house 3 years ago with a $50,000

variable rate mortgage. With a 30-year term, his current monthly payment is

$495.15. When the interest rate is adjusted from 11.5% to 11.75%, what will the

monthly payment be? If the monthly payment remained unchanged, find the

revised remaining term on the mortgage.

Keystrokes Display

CLEAR

50000

11.5

3

495.15

50,000.00 Original amount of loan.

0.96 Original monthly interest rate.

36.00 Period.

-495.15 Previous monthly payment.

-49,316.74

CLEAR

49,316.74 Remaining balance.

11.75

30 3

495.15

12

0.98 Adjusted monthly interest.

27.00 Remaining life of mortgage.

324.00

-504.35 New monthly payment.

-495.15 Previous monthly payment.

31.67 New remaining term (years).

Skipped Payments

Sometimes a loan (or lease) may be negotiated in which a specific set of monthly

payments are going to be skipped each year. Seasonally is usually the reason for

such an agreement. For example, because of heavy rainfall, a bulldozer cannot

be operated in Oregon during December, January, and February, and the lessee

wishes to make payments only when his machinery is being used. He will make

nine payments per year, but the interest will continue to accumulate over the

months in which a payment is not made.

To find the monthly payment amount necessary to amortize the loan in the

specified amount of time, information is entered as follows:

1. Press and press CLEAR .

2. Key in the number of the last payment period before payments close the first time and

press

3. Key in the annual interest rate as a percentage and press

4. Press

5. Key in the number of payments which are skipped and press

6. Press 0

7. Key in the total number of years in the loan and press

.

1 .

12 0 0 .

1 0

0.

12 100 CLEAR

.

8. Key in the loan amount and press 0 to obtain the monthly payment

amount when the payment is made at the end of the month.

9. Press

10. Key in the annual interest rate as a percent and press

payment amount when the payment is made at the beginning of the month.

0 1 .

to find the monthly

Example: A bulldozer worth $100,000 is being purchased in September. The first

payment is due one month later, and payments will continue over a period of 5

years. Due to the weather, the machinery will not be used during the winter

months, and the purchaser does not wish to make payments during January,

February, and March (months 4 thru 6). If the current interest rate is 14%, what is

the monthly payment necessary to amortize the loan?

Keystrokes Display

CLEAR

3

14

1

12

3.00

Number of payment made before a group of

payments is skipped.

0

3

1

0

100

5

0

0

12

CLEAR

100000

0

3,119.98 Monthly payment in arrears.

0

Savings

Initial Deposit with Periodic Deposits

Given an initial deposit into a savings account, and a series of periodic deposits

coincident with the compounding period, the future value (or accumulated

amount) may be calculated as follows:

1. Press and press CLEAR .

2. Key in the initial investment and press

3. Key in the number of additional periodic deposits and press

4. Key in the periodic interest rate and press

5. Key in the periodic deposit and press

6. Press

to determine the value of the account at the end of the time period.

.

.

.

.

Example: You have just opened a savings account with a $200 deposit. If you

deposit $50 a month, and the account earns 5 1/4 % compounded monthly, how

much will you have in 3 years?

Keystrokes Display

CLEAR

200

3

5.25

2,178.94 Value of the account.

50

Note: If the periodic deposits do not coincide with the compounding periods, the

account must be evaluated in another manner. First, find the future value of the

initial deposits and store it. Then use the procedure for compounding periods

different from payment periods to calculate the future value of the periodic

deposits. Recall the future value of the initial deposit and add to obtain the value

of the account.

Number of Periods to Deplete a Savings Account or to Reach a Specified Balance.

Given the current value of a savings account, the periodic interest rate, the

amount of the periodic withdrawal, and a specified balance, this procedure

determines the number of periods to reach that balance (the balance is zero if

the account is depleted).

1. Press and press CLEAR .

2. Key in the value of the savings account and press

3. Key in the periodic interest rate and press

4. Key in the amount of the periodic withdrawal and press

5. Key in the amount remaining in the account and press

the account is depleted (FV=0).

6. Press

to determine the number of periods to reach the specified balance.

.

.

.

. This step may be omitted if

Example: Your savings account presently contains $18,000 and earns 5 1/4%

compounded monthly. You wish to withdraw $300 a month until the account is

depleted. How long will this take? If you wish to reduce the account to $5,000,

how many withdrawals can you make?

Keystrokes Display

CLEAR

18000

71.00 Months to deplete account.

5.5

300

5000

53.00 Months to reduce the account to $5,000

Periodic Deposits and Withdrawals

This section is presented as a guideline for evaluating a savings plan when

deposits and withdrawals occur at irregular intervals. One problem is given, and

a step by step method for setting up and solving the problem is presented:

Example: You are presently depositing $50 and the end of each month into a

local savings and loan, earning 5 1/2% compounded monthly. Your current

balance is $1023.25. How much will you have accumulated in 5 months?

The cash flow diagram looks like this:

Keystrokes Display

CLEAR

50

5.5

1023.25

5

1,299.22 Amount in account.

Now suppose that at the beginning of the 6th month you withdrew $80.

What is the new balance?

Keystrokes Display

80

1,219.22 New balance.

You increase your monthly deposit to $65. How much will you have in 3 months?

The cash flow diagram looks like this:

65

Keystrokes Display

1,431.95 Account bal ance.

3

Suppose that for 2 months you decide not to make a periodi c dep osit. What is

the balance in the account?

Keystrokes Display

0

2

1,455.11 Account bal ance.

This type of procedure may be continued for any length of time, and may be

modified to meet the user's particular needs.

Savings Account Compounded Daily

This HP 12C program determines the value of a savings account when interest is

compounded daily, based on a 365 day year. The user is able to calculate the

total amount remaining in the account after a series of transactions on specified

dates.

KEYSTROKES DISPLAY

CLEAR

3

6

5

0

0001- 16

02- 13

03- 33

04- 3

05- 6

06- 5

07- 10

08- 12

09- 33

10- 44 0

11- 45 13

12- 16

13- 31

2

1

0

1

14- 44 2

15- 33

16- 44 1

17- 45 0

18- 45 1

19- 43 26

20- 11

21- 15

22- 42 14

23- 15

24- 36

25- 45 13

26- 40

3

2

1

0

13

REGISTERS

n: ∆days

PV: Used PMT: 0

FV: Used R0: Initial date

R1: Next date R2: $ amount

R3: Interest R4-R.4: Unused

27-44 40 3

28- 45 15

29- 45 2

30- 40

31- 16

32- 13

33- 45 1

34- 44 0

35- 45 13

36- 16

37-43,33 13

i: i/365

1. Key in the program

2. Press

3. Key in the date (MM.DDYYYY) of the first transaction and press

4. Key in the annual nominal interest rate as a percentage and press

5. Key in the amount of the initial deposit and press

6. Key in the date of the next transaction and press

7. Key in the amount of the transaction (positive for money deposited, negative for cash

withdrawn) and press to determine the amount in the account.

8. Repeat steps 6 and 7 for subsequent transactions.

9. To see the total interest to date, press

CLEAR and press .

.

.

.

.

3.

10. For a new case press and go to step 2.

Example: Compute the amount remaining in this 5.25% account after the

following transactions:

1. January 19, 1981 deposit $125.00

2. February 24, 1981 deposit $60.00

3. March 16, 1981 deposit $70.00

4. April 6, 1981 withdraw $50.00

5. June 1, 1981 deposit $175.00

6. July 6, 1981 withdraw $100.00

Keystrokes

CLEAR

1.191981

5.25

125

2.241981

60

3.161981

70

4.061981

50

6.0111981

175

Display

125.00 Initial Deposit.

185.65 Balance in account, February 24, 1981.

256.18 Balance in account, March 16, 1981.

206.95 Balance in account, April 6 1981 .

383.62 Balance in account, June 1, 1981.

7.061981

100

3

285.56 Balance in account, July 6, 1981.

5.56 Total interest.

Compounding Periods Different From Payment Periods

In financial calculations involving a series of payments equally spaced in time

with periodic compounding, both periods of time are normally equal and

coincident. This assumption is preprogrammed into the HP 12C.

I savings plans however, money may become available for deposit or investment

at a frequency different from the compounding frequencies offered. The HP 12C

can easily be used in these calculations. However, because of the assumptions

mentioned the periodic interest rate must be adjusted to correspond to an

equivalent rate for the payment period.

Payments deposited for a partial compounding period will accrue simple interest

for the remainder of the comp ounding period. T his is often th e case, but may not

be true for all institutions.

These procedures present solutions for future value, payment amount, an d

number of payments. In addition, it should be noted that only annuity due

(payments at the beginning of payment period) calculations are shown since this

is the most common in savings plan calculations.

To calculate the equivalent payment period interest rate, information is entered

as follows:

1. Press and press CLEAR .

2. Key in the annual interest rate (as a percent) and press

3. Key in the number of compounding periods per year and press

4. Key in 100 and press

5. Key in the number of payments (deposits) per year and press

.

.

.

CLEAR .

The interest rate which corresponds to the payment period is now in register "i"

and you are ready to proceed.

Example 1: Solving for future value.

Starting today you make monthly deposits of $25 into an account paying 5%

compounded daily (365-day basis). At the end of 7 years, how much will you

receive from the account?

Keystrokes Display

CLEAR

5

365

0.42 Equivalent periodic interest rate.

100

12

CLEAR

7

25

2,519.61 Future value.

Example 2: Solving for payment amount.

For 8 years you wish to make weekly deposits in a savings account paying 5.5%

compounded quarterly. What amount must you deposit each week to accumulate

$6000.

Keystrokes Display

CLEAR

5.5

4

100

52

CLEAR

8 52

6000

0.11 Equivalent periodic interest rate.

-11.49 Periodic payment.

Example 3: Solving for number of payment periods.

You can make weekly deposits of $10 in to an account paying 5.25%

compounded daily (365-day basis). How long will it take you to accumulate

$1000?

Keystrokes Display

CLEAR

5.25

365

0.10 Equivalent periodic interest rate.

100

52

CLEAR

10

1000

96.00 Weeks.

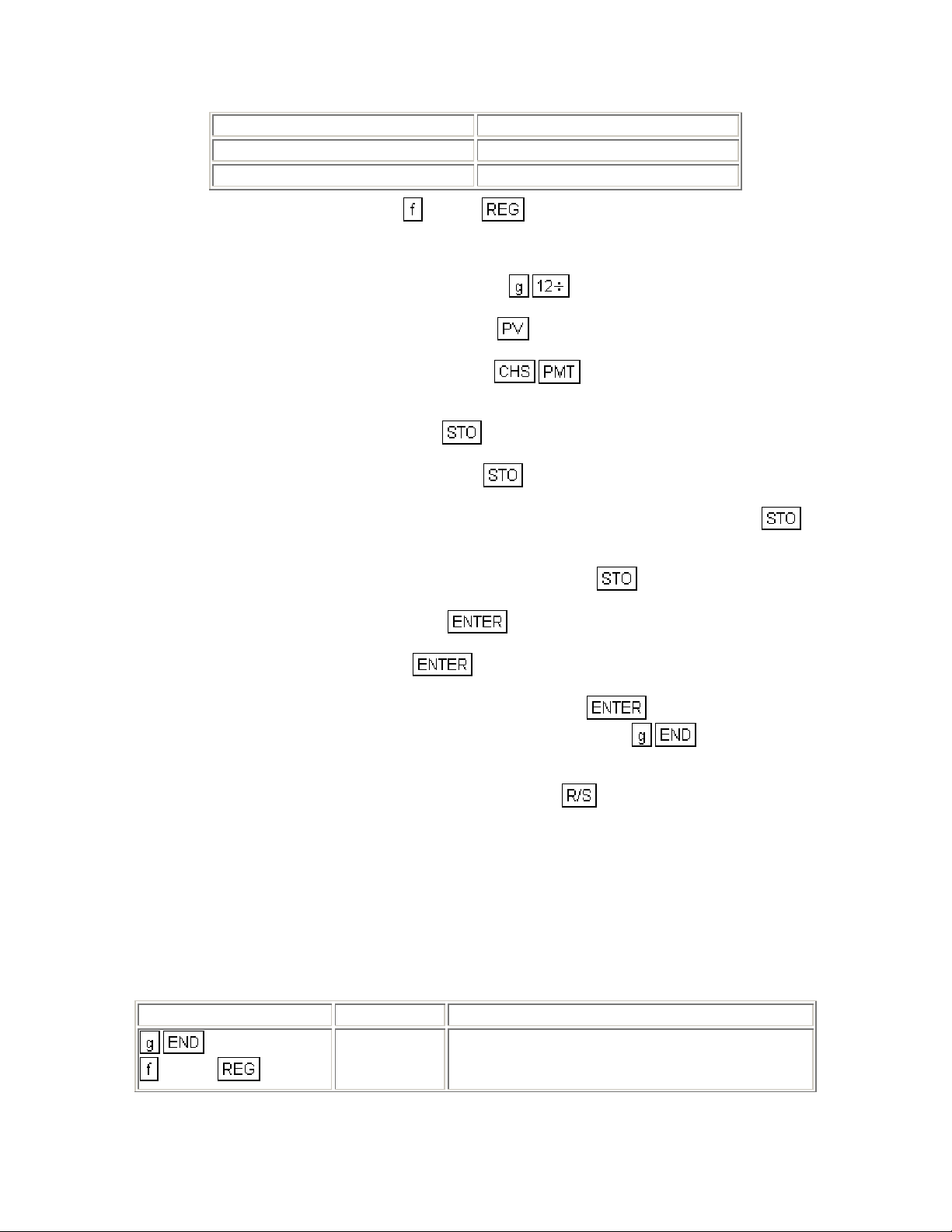

Investment Analysis

Lease vs. Purchase

An investment decision frequently encountered is the decision to lease or

purchase capital equipment or buildings. Although a thorough evaluation of a

complex acquisition usually requires the services of a qualified accountant, it is

possible to simplify a number of the assumptions to produce a first

approximation.

The following HP-12C program assumes that the purchase is financed with a

loan and that the loan is made for the term of the lease. The tax advantages of

interest paid, depreciation, and the investment credit which accrues from

ownership are compared to the tax advantage of treating the lease payment as

an expense. The resulting cash flows are discounted to the present at the firm's

after-tax cost of capital.

KEYSTROKES DISPLAY

CLEAR

1

0

3

8

1

1

9

0001- 30

02- 1

03-44 40 0

04- 45 3

05- 30

06- 20

07- 44 8

08- 1

09- 42 11

10- 44 1

11- 45 13

12- 44 9

0

13- 45 14

14-44 48 0

15- 45 11

1

2

5

6

7

0

1

9

16-44 48 1

17- 45 12

18-44 48 2

19- 45 5

20- 13

21- 45 6

22- 11

23- 45 7

24- 12

25- 45 0

26- 42 24

27-44 40 1

28- 45 9

0

1

2

1

3

8

29- 13

30-45 48 0

31- 14

32-45 48 1

33- 11

34-45 48 2

35- 12

36- 45 1

37- 45 3

38- 20

39- 45 14

40- 30

41- 45 8

42- 30

4

43- 45 4

0

2

00

REGISTERS

n: Used i: Used

PV: Used PMT: Used

FV: 0 R0: Used

R1: Used R2: Purch. Adv.

R3: Tax R4: Discount

R5: Dep. Value R6: Dep. life

R7: Factor (DB) R8: Used

R9: Used R.0: Used

R.1: Used R.2: Used

R.3: Unused

44- 45 0

45- 21

46- 10

47-44 40 2

48-43,33 00

Instructions:

1. Key in the program.

-Select the depreciation function and key in at line 26.

2. Press

3. Input the following information for the purchase of the loan:

-Key in the number of years for amortization and press

-Key in the annual interest rate and press

-Key in the loan amount (purchase price) and press

-Press

4. Key in the marginal effective tax rate (as a decimal) and press

5. Key in the discount rate (as a decimal) or cost of capital and press

6. Key in the depreciable value and press

7. Key in the depreciable live and press

and press CLEAR .

.

to find the annual payment.

5.

6.

.

.

3.

1 4.

8. For declining balance depreciation, key in the depreciation factor (as a percentage) and

00

00

press

9. Key in the total first lease payment (including any advance payments) and press

10. Key in the first year's maintenance expense that would be anticipated if the asset was

owned and press

not a factor in the lease vs. purchase decision and 0 expense should be used.

7.

1 3 2.

. If the lease contract does not include maintenance, then it is

11. Key in the next lease payment and press

payment does not occur (e.g. the last several payments of an advance payment contract)

use 0 for the payment.

12. Repeat steps 10 and 11 for all maintenance expenses and lease payments over the term

of the analysis.

Optional - If the investment tax credit is taken, key in the amount of the credit after

finishing steps 10 and 11 for the year in which the credit is taken and press

. Continue steps 10 and 11 for the remainder of the term.

13. After all the lease payments and expenses have been entered (steps 10 and 11), key in

the lease buy back option and press

buy back option exists, use the estimated salvage value of the purchased equipment at

the end of the term.

14. To find the net advantage of owning press

lease advantage.

. During any year in which a lease

43

1 3 43 . If no

2. A negative value represents a net

Example: Home Style Bagel Company is evaluating the acquisition of a mixer

which can be leased for $1700 a year with the first and last payments in advance

and a $750 buy back option at the end of 10 years (maintenance is included).

The same equipment could be purchased for $10,000 with a 12% loan amortized

over 10 years. Ownership maintenance is estimated to be 2% of the purchase

price per year for the first for years. A major overhaul is predicted for the 5th year

at a cost of $1500. Subsequent yearly maintenance of 3% is estimated for the

remainder of the 10-year term. The company would use sum of the years digits

depreciation on a 10 year life with $1500 salvage value. An accountant informs

management to take the 10% capital investment tax credit at the end of the

second year and to figure the cash flows at a 48% tax rate. The after tax cost of

capital (discounting rate) is 5 percent.

Because lease payments are made in advance and standard loan payments are

made in arrears the following cash flow schedule is appropriate for a lease with

the last payment in advance.

Year Maintenance Lease Payment Tax Credit Buy Back

0 1

1700 + 1700

2

17

200

2

200

3

200

4

1500

5

300

6

300

7

300

8

300

9

300

10

Keystrokes Display

1700

1700

1700

1700

1700

1700

1700

0

0

1000

750

CLEAR

10 12

10000

.48 3

.05

1

10000

1500

10 6

1700

1 3 2

200

1700

4

5

0.00

-10,000.00 Always use negative loan amount.

1,769.84 Purchase payment.

0.48 Marginal tax rate.

1.05 Discounting factor.

8,500.00 Depreciable value.

10.00 Depreciable life.

3,400.00 1st lease payment.

1,768.00 After-tax expense.

312.36 Pr esent va lu e of 1st year's net pur chas e.

200

1700

1000 43

200

1700

200

1700

200.43 2nd year's advantage.

1,000.00 Tax credit.

907.03 Present value of tax credit.

95.05 3rd year.

-4.38 4th year.

200

1700

-628.09 5th year.

200

1700

200

1700

200

1700

300 0

300 0

750

1 3

43

2

-226.44 6th year.

-309.48 7th year.

-388.81 8th year.

-1,034.72 9th year.

-1,080,88 10th year.

750.00 Buy back.

390.00 After tax buy back expense.

239.43 Present value.

-150.49 Net lease advantage.

Break-Even Analysis

Break-even analysis is basically a technique for analyzing the relationships

among fixed costs, variable costs, and income. Until the break even point is

reached at the intersection of the total income and total cost lines, the producer

operates at a loss. After the break-even point each unit produced and sold

makes a profit. Break even analysis may be represented as follows.

The variables are: fixed costs (F), Sales price per unit (P), variable cost per unit

(V), number of units sold (U), and gross profit (GP). One can readily evaluate

GP, U or P given the four other variables. To calculate the break-even volume,

simply let the gross profit equal zero and calculate the number of units sold (U).

To calculate the break-even volume:

1. Key in the fixed costs and press .

2. Key in the unit price and press

3. Key in the variable cost per unit and press

4. Press

to calculate the break-even volume.

.

.

To calculate the gross profit at a given volume:

1. Key in the unit price and press .

2. Key in the variable cost per unit and press

3. Key in the number of units sold and press

4. Key in the fixed cost and press

to calculate the gross profit.

.

.

To calculate the sales volume needed to achieve a specified gross profit:

1. Key in the desired gross profit and press .

2. Key in the fixed cost and press

3. Key in sales price per unit and press

4. Key in the variable cost per unit and press

5. Press

to calculate the sales volume.

.

.

.

To calculate the required sales price to achieve a given gross profit at a specified

sales volume:

1. Key in the fixed costs and press .

2. Key in the gross desired and press

3. Key in the specified sales volume in units and press

4. Key in the variable cost per unit and press

unit.

.

.

to calculate the required sales price per

Example 1: The E.Z. Sells company markets textbooks on salesmanship. The

fixed cost involved in setting up to print the books are $12,000. The variable cost

per copy, including printing and marketing the books are $6.75 per copy. The

sales price per copy is $13.00. How many copies must be sold to break even?

Keystrokes Display

12000

13

6.75

12,000.00 Fixed cost.

13.00 Sales price.

1,920.00 Break-even volume.

Find the gross profit if 2500 units are sold.

13

6.75

2500

12000

13.00 Sales price.

6.25 Profit per unit.

15,625.00

3,625.00 Gross profit.

If a gross profit of $4,500 is desired at a sales volume of 2500 units, what should

the sales price be?

12000

12,000.00 Fixed cost.

4500

2500

6.75

16,500.00

6.60

13.35 Sales price per unit to achieve desired gross profit.

For repeated calculation the following HP-12C program can be used.

KEYSTROKES DISPLAY

CLEAR

3

2

00

4

0001- 45 3

02- 45 2

03- 30

04-43,33 00

05- 45 4

06- 20

1

00

5

1

00

1

5

4

07- 45 1

08- 30

09-43,33 00

10- 45 5

11- 45 1

12- 40

13- 34

14- 10

15-43,33 00

16- 45 1

17- 45 5

18- 40

19- 45 4

20- 10

2

21- 45 2

00

22- 40

23-43,33 00

REGISTERS

n: Unused i: Unused

PV: Unused PMT: Unused

FV: Unused R0: Unused

R1: F R

R3: P R

R5: GP

R

2

4

6-R.6

: V

: U

: Unused

1. Key in the program and store the know variables as follows:

a. Key in the fixed costs, F and press

1.

b. Key in the variable costs per unit, V and press

c. Key in the unit price, P (if known) and press

d. Key in the sales volume, U, in units (if known) and press

2.

3.

4.

e. Key in the gross profit, GP, (if known) and press

5.

2. To calculate the sales volume to achieve a desired gross profit:

a. Store values as shown in 1a, 1b, and 1c.

b. Key in the desired gross profit (zero for break even) and press

c. Press

10 to calculate the required volume.

5.

3. To calculate the gross profit at a given sales volume.

a. Store values as shown in 1a, 1b, 1c, and 1d.

b. Press

05 to calculate gross profit.

4. To calculate the sales price per unit to achieve a desired gross profit at a specified sales

volume:

a. Store values as shown in 1a, 1b, 1d, and 1e.

b. Press

16 to calculate the required sales price.

Example 2: A manufacturer of automotive accessories produces rear view

mirrors. A new line of mirrors will require fixed costs of $35,00 to produce. Each

mirror has a variable cost of $8.25. The price of mirrors is tentatively set at

$12.50 each. What volume is needed to break even?

Keystrokes Display

35000 1

8.25 2

12.5 3

0 5

10

35,000.00 Fixed cost.

8.25 Variable cost.

12.50 Sales price.

0.00

8,235.29

Break-even volume is between 8,235 and 8,236

units.

What would be the gross profit if the price is raised to $14.00 and the sales

volume is 10,000 units?

Keystrokes Display

14 3

10000 4

05

14.00 Sales price.

F and V are already stored.

10,000.00 Volume.

22,500.00 Gross Profit.

Operating Leverage

The degree of operating leverage (OL) at a point is defined as the ratio of the

percentage change in net operating income to the percentage change in units

sold. The greatest degree of operating leverage is found near the break even

point where a small change in sales may produce a very large increase in profits.

Likewise, firms with a small degree of operating leverage are operating farther

form the break even point, and they are relatively insensitive to changes in sales

volume.

The necessary inputs to calculate the degree of operating leverage and fixed

costs (F), sales price per unit (P), variable cost per unit (V) and number of units

(U).

The operating leverage may be readily calculated as follows:

1. Key in the sales price per unit and press .

2. Key in the variable cost per unit and press

.

3. Key in the number of units and press .

4. Key in the fixed cost and press

to obtain the operating leverage.

Example 1: For the data given in example 1 of the Break-Even Analysis section,

calculate the operating leverage at 2000 units and at 5000 units when the sales

price is $13 a copy

Keystrokes Display

13

6.75

2000

12000

13

6.75

5000

12000

13.00 Price per copy.

6.25 Profit per copy.

25.00 Close to break-even point.

13.00 Price per copy.

6.25 Profit per copy.

1.62

Operating further from the break-even point and less

sensitive to changes in sales volume.

For repeated calculations the following HP-12C program can be used:

KEYSTROKES DISPLAY

CLEAR

3

2

1

00

0001- 45 3

02- 45 2

03- 30

04- 20

05- 36

06- 36

07- 45 1

08- 30

09- 10

10-43,33 00

REGISTERS

n: Unused i: Unused

PV: Unused PMT: Unused

FV: Unused R0: Unused

R1: F R

R3: P

1. Key in the program.

2. Key in and store input variables F, V and P as described in the Break-Even Analysis

program.

R

2

4-R.8

: V

: Unused

3. Key in the sales volume and press

4. To calculate a new operating leverage at a different sales volume, key in the new sales

volume and press

to calculate the operating leverage.

Example 2: For the figures given in example 2 of the Break-Even Analysis

section, calculate the operating leverage at a sales volume of 9,000 and 20,000

units if the sales price is $12.50 per unit.

Keystrokes Display

35000 1

8.25 2

12.5 3

9000

20000

35,000.00 Fixed costs.

8.25 Variable cost.

12.50 Sales price.

11.77 Operating leverage near break-even.

1.70 Operating leverage further from break-even.

Profit and Loss Analysis

The HP-12C may be programmed to perform simplified profit and loss analysis

using the standard profit income formula and can be used as a dynamic

simulator to quickly explore ra nges of variables affecting the profitability of a

marketing operation.

The program operates with net income return and operating expenses as

percentages. Both percentage fig ures ar e ba s ed on net sales price.

It may also be used to simulate a company wide income statement by replacing

list price with gross sales and manufacturing cost with cost of goods sold.

Any of the five variables: a) list price, b) discount (as a percentage of list price),

c) manufacturing cost, d) operating expense (as a percentage), e) net profit after

tax (as a percentage) may be calculated if the other four are known.

Since the tax rage varies from company to company, provision is made for

inputting your applicable tax rate. The example problem uses a tax rate of 48%.

KEYSTROKES DISPLAY

CLEAR

5

6

4

0

0

00

0001- 45 5

02- 45 6

03- 10

04- 45 4

05- 40

06- 16

07- 45 0

08- 40

09- 45 0

10- 10

11-43,33 00

1

3

1

2

0

12- 45 3

13- 45 1

14- 45 2

15- 45 0

16- 10

17- 16

18- 1

19- 40

20- 20

21- 31

22- 10

1

23- 16

24- 1

0

00

1

1

0

00

25- 40

26- 45 0

27- 20

28-43,33 00

29- 10

30- 16

31- 45 1

32- 40

33- 45 1

34- 10

35- 45 0

36- 20

37-43,33 00

5

6

00

4

6

00

REGISTERS

n: Unused i: Unused

PV: Unused PMT: Unused

38- 45 5

39- 45 6

40- 10

41- 30

42-43,33 00

43- 45 4

44- 30

45- 45 6

46- 20

47-43,33 00

FV: Unused R0: 100

R1: list price R2: % discount

R3: mfg. cost R4: % op. exp.

R5: % net profit R6: 1-% tax

R7-R.3: Unused

1. Key in the program and press CLEAR , then key in 100 and press 0.

2. Key in 1 and press

press

3.

a. Key in the list price in dollars (if known) and press 1.

b. Key in the discount in percent (if known) and press

c. Key in the manufacturing cost in dollars (if known) and press

d. Key in the operating expense in percent (if known) and press

e. Key in the net profit after tax in percent (if known) and press

4. To calculate list price:

a. Do steps 2 and 3b, c, d, e above.

b. Press

5. To calculate discount:

6.

3 1 14 00.

, then key in your appropriate tax rate as a decimal and

2.

3.

4.

5.

a. Do steps 2 and 3a, c, d, e above.

b. Press

6. To calculate manufacturing cost:

a. Do steps 2 and 3a, b, d, e, above.

b. Press

7. To calculate operating expense:

a. Do steps 2 and 3a, b, c, e, above.

b. Press

8. To calculate net profit after tax:

a. Do steps 2 and 3a, b, c, d, above.

3 29 .

13 01 .

12 38 .

b. Press 12 43 .

Example: What is the net return on an item that is sold for $11.9 8, di scoun ted

through distribution an average of 35% and has a manufacturing cost of $2.50?

The standard company operating expense is 32% of net shipping (sales) price

and tax rate is 48%.

Keystrokes Display

CLEAR

100

1 .48 6

11.98 1

35 2

2.50 3

32 4

0

12

43

100.00

0.52 48% tax rate.

11.98 List price ($).

35.00 Discount (%).

2.50 Manufacturing cost ($).

32.00 Operating expenses (%).

67.90

18.67 Net profit (%).

If manufacturing expenses increase to $3.25, what is the effect on net profit?

3.25

3.25 3

12

43

Manufacturing cost.

58.26

13.66 Net profit reduced to 13.66%

If the manufacturing cost is maintained at $3.25, how high could the overhead

(operating expense) be before the product begins to lose money?

0 5

12

38

0.00

58.26

58.26 Maximum operating expense (%).

At 32% operating expense and $3.25 manufacturing cost, what should the list

price be to generate 20% net profit?

20 5

3

1 14

20.00

11.00

16.93 List price ($).

What reduction in manufacturing cost would achieve the same result without

necessitating an increase in list price above $11.98?

13

01

7.79

2.30 Manufacturing cost ($).

Securities

After-Tax Yield

The following HP-12C program calculate the after tax yield to maturity of a bond

held for more than one year. The calculations assumes an actual/actual day

basis. For after-tax computations, the interest or coupon payments are

considered income, while the difference between the bond or note face value and

its purchase price is considered capital gains.

KEYSTROKES DISPLAY

CLEAR

CLEAR

7

6

2

1

4

2

2

0001- 42 34

02- 44 7

03- 33

04- 44 6

05- 45 2

06- 45 1

07- 30

08- 45 4

09- 25

10- 45 2

11- 34

12- 30

13- 26

14- 2

0

3

5

15- 10

16- 44 0

17- 45 3

18- 45 5

19- 25

20- 30

0

1

0

6

7

00

REGISTERS

n: Unused i: Yield

PV: Used PMT: Used

FV: 0 R0: Used

R1: Purchase price R2: Sales price

R3: Coupon rate R4: Capital rate

R5: Income rate R6: Used

R7: Used R8-R.5: Unused

21- 45 0

22- 10

23- 14

24- 45 1

25- 45 0

26- 10

27- 13

28- 45 6

29- 45 7

30- 42 22

31-43,33 00

1. Key in the program.

2. Key in the purchase price and press

3. Key in the sales price and press

4. Key in the annual coupon rate (as a percentage) and press

5. Key in capital gains tax rate (as a percentage) and press

6. Key in the income tax rate (as a percentage) and press

7. Press

.

1.

2.

3.

4.

5.

8. Key in the purchase date (MM.DDYYYY) and press .

9. Key in the assumed sell date (MM.DDYYYY) and press

a percentage).

10. For the same bond but different date return to step 8.

11. For a new case return to step 2.

to find the after-tax yield (as

Example: You can buy a 7% bond on October 1, 1981 for $70 and expect to sell

it in 5 years for $90. What is your net (after-tax) yield over the 5-year period if

interim coupon payments are considered as income, and your tax bracket is

50%?

(One-half of the long term capital gain is taxable at 50%, so the tax on capital

gains alone is 25%)

Keystrokes Display

70 1

90 2

7 3

25 4

10.00 Purchase pr ice.

90.00 Selling pric e.

7.00 Annual coupon rate.

25.00 Capital gains tax rate.

50 5

10.011981

10.011986

50.00 Income tax rate.

10.01 Purchase Date.

8.53 % after tax yield.

Discounted Notes

A note is a written agreement to pay a sum of money plus interest at a certain

rate. Notes to not have periodic coupons, since all interest is paid at maturity.

A discounted note is a note that is purchase below its face value. The following

HP 12C program finds the price and/or yield* (*The yield is a reflection of the

return on an investment) of a discounted note.

KEYSTROKES DISPLAY

CLEAR

00-

1

01- 45 1

2

02- 45 2

1

3

5

03- 43 26

04- 45 3

05- 10

06- 45 5

07- 25

08- 1

4

5

1

09- 34

10- 30

11- 45 4

12- 20

13- 44 5

14- 31

15- 45 1

1

2

2

3

4

5

16- 45 2

17- 43 26

18- 45 3

19- 34

20- 10

21- 45 4

22- 45 5

23- 10

24- 1

25- 30

26- 20

27- 26

28- 2

29- 20

00

30-43,33 00

n: Unused i: Unused

PV: Unused PMT: Unused

FV: Unused R0: Unused

R1: Settl. date R2: Mat. date

R3: 360 or 365 R4: redemp. value

R5: dis./price R6-R.5: Unused

1. Key in the program.

REGISTERS

2. Press

3. Key in the settlement date (MM.DDYYYY) and press

4. Key in the maturity date (MM.DDYYYY) and press

5. Key in the number of days in a year (360 or 365) and press

6. Key in the redemption value per $100 and press

7. To calculate the purchase price:

a. Key in the discount rate and press

b. Press

c. Press

d. For a new case, go to step 3.

8. To calculate the yield when the price is known:

a. Key in the price and press

.

2.

4.

5.

to calculate the purchase price.

to calculate the yield.

5.

1.

3.