Page 1

FastBreak

Version 6.x

Edge Ware, Inc.

www.edge-ware.com

Page 2

Disclaimer and License Agreement

The information that FastBreak and FastBreak Pro provide is only part of the information

needed for a good investment program. Consult your investment representative before

buying or selling any fund or stock. Read the prospectus to determine whether an investment meets your objectives.

EDGE WARE, INC. DOES NOT RECOMMEND SPECIFIC INVESTMENTS

SUITABLE FOR YOUR PERSONAL OBJECTIVES BUT IS LIMITED TO PROVIDING INFORMATION FROM THE BEST AVAILABLE SOURCES. HOWEVER, THESE SOURCES ARE KNOWN TO CONTAIN ERRORS, AND EDGE

WARE, INC. DOES NOT ASSUME LIABILITY FOR ERRORS IN INFORMATION. THIS PRODUCT IS DISTRIBUTED “AS IS” WITHOUT WARRANTIES

OF ANY KIND, EITHER EXPRESSED OR IMPLIED. NEITHER EDGE WARE,

INC. NOR ANYONE ELSE INVOLVED IN CREATING, PRODUCING, OR DISTRIBUTING THIS PRODUCT SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL OR CONSEQUENTIAL DAMAGES ARISING

FROM THE USE OF THIS PRODUCT.

Program and documentation copyright 2009 by Edge Ware, Inc. All rights are reserved.

The software packaged with this manual is not copy-protected. Duplication of this software is limited to one backup copy. No part of this manual may be reproduced or transmitted in any form without written consent from Edge Ware, Inc.

FastBreak, FastBreak Pro, FastGraph, and Edge Ware logo are trademarks of Edge Ware,

Inc.

FastTrack is a trademark of Investors FastTrack.

Windows 95, Windows 98, Windows NT, Windows 2000, Windows Me, Windows XP,

Windows Vista, Microsoft Office, Notepad, and Excel are trademarks of Microsoft Corporation

2

Page 3

Table of Contents

1.0 Preface..........................................................................4

2.0 Introduction ..................................................................5

3.0 Upgrade Notes..............................................................6

4.0 FastBreak Trading System..........................................13

5.0 Technical Support and Upgrades................................16

6.0 Installing FastBreak....................................................18

7.0 FastBreak Options and Functions...............................21

8.0 FastBreak Examples ...................................................64

9.0 Analyzing FastBreak Output ......................................68

10.0 Building Market Timing Signals ..............................73

11.0 FastBreak Calculation Details ..................................75

12.0 Suggestions on Improving Trading Strategies..........79

13.0 Trading using FastBreak...........................................80

14.0 Batch System Processing..........................................81

15.0 Frequently Asked Questions.....................................83

16.0 Resources..................................................................87

Appendix A - Technical Discussion.................................88

3

Page 4

1.0 Preface

Note: A PDF copy of this manual is on your installation disk. We recommend you put

a copy on your computer so you will always have a copy available.

This manual supports both Standard FastBreak and FastBreak Pro. FastBreak Pro users

will see additional icons on the icon tool bar and two extra pull down menus. The additional FastBreak Pro screens, and optimizer functionality activated by these icons, are

covered in the second manual that comes with the FastBreak Pro software. When we refer to FastBreak in this manual it will always apply to both Standard FastBreak and FastBreak Pro unless otherwise noted. Also, when we refer to mutual funds in the manual

this will also apply to stocks unless otherwise noted.

Don’t let all the parameter boxes, icons, and fancy techno terms intimidate you. We can

tell you that if you read the manuals and run the examples provided you will quickly develop an appreciation for FastBreak.

Anyone who has attended a FastTrack user group meeting or conference knows that FastTrack users span a very wide range of experience levels. Using FastBreak requires

knowledge of computers, investing terminology, FastTrack, as well as FastBreak. With

this variation in the audience knowledge base, it is always a struggle to know the right

amount of detail to address all these issues. We can never make the software and manual

simple enough for the new investor, and never add enough complexity for the “power

user.” We have put options in FastBreak that many users will never use and there is

nothing wrong with that. If there is an option you don’t understand on the initial reading

of the manual, don’t activate it; come back to it at a later time as your experience grows.

One mistake some users of FastBreak make is to start out activating all the options and

choosing the most complicated strategies. A considerable amount of error checking of

user inputs has been incorporated to make the software crash resistant, but it is possible to

get errors and crashes. If you start out making several changes to a run and then get an

error, it will be very difficult to determine what went wrong. We provide examples that

are good starting places. Start slowly. You can setup the examples with a minimum

amount of effort, make one or two small changes to customize to your needs, and be on

your way.

As you want to go deeper into designing trading systems you may want to checkout the

resources we listed in the Resources chapter.

4

Page 5

2.0 Introduction

An early version of FastBreak was reviewed in the July 1999 issue of Technical Analysis

of STOCKS & COMMODITIES, the premier technical analysis investment magazine.

Their review, in part, said, “This is easily the most elaborate fund switching software

we’ve run across, and it’d be worth the time to check it out.” The latest version of Fast-

Break you have in your hands is far more advanced than the version reviewed.

FastBreak is an investment tool that relies on the Investors FastTrack database. For those

not familiar with FastTrack, it is a mutual fund & stock database and software analysis

package. The database is updated each day the market is open with the closing prices of

thousands of mutual funds, stocks and indexes. Users of FastBreak must be subscribers

to FastTrack and have the FastTrack software and databases installed prior to installing

FastBreak. Call Investors FastTrack at 800-749-1348 or visit their web site

www.fasttrack.net to subscribe. Do not call FastTrack for information relat-

ing to FastBreak. We have a good working relationship with FastTrack but we are

completely separate companies.

The authors of FastBreak have completed a large number of studies using the software

and you may ask, “Why not just make the results available?” The simple answer is that

our investment objectives and risk tolerance may not be the same as yours. Also, with the

evolution of market conditions and the availability of new mutual funds and the deletion

of old funds these strategies can become dated. We have built an easy to use tool that

will allow any user to back test and study trading strategies.

FastBreak has been used by hundreds of investors since 1996, and some of our best enhancements have come from user suggestions. Thank you for your support, and we wish

you profitable trading.

Edge Ware, Inc

5

Page 6

3.0 Upgrade Notes

Maintaining Existing FastBreak Trading Strategies

If you have existing FastBreak strategies that you like we recommend that you keep the

old version of FastBreak on your computer until you have verified that the strategies produce the same results with the new version. Prior to installing the new version of FastBreak go to the folder where the existing version is located, typically ftbreak (ftbreakp for

Pro users), and find the file ftbreak.exe (ftbreakp.exe for Pro users). Rename this file

ftbreakVx.exe (ftbreakpVx.exe) where Vx represents your current version

(ftbreakV6.2.exe for example). Now put a shortcut to this file on your desk top.

We also recommend that if you are making a major upgrade, i.e. from Version 5 to Version 6, then install the new version in a new folder, e.g., ftbreak6 (ftbreakp6 for Pro users). This will allow you to segregate your new files and systems that are associated with

this new major version.

If you see significant changes in favorite trading strategies then continue to run these

strategies in your old version of FastBreak until you have a chance to create new strategies in the new version. You can have multiple versions of FastBreak installed on a computer so there is no problem running these old strategies.

Changes for FastBreak Pro Version 6.5

Note: There was no Standard FastBreak Version 6.3 or Version 6.4. The FastBreak

Pro V6.3 releases only affected changes to FastBreak Pro. The change (Combine/Complementary Systems) in FastBreak Pro V6.4 was primarily a capability that is

useful for Pro users and we didn’t build a Standard V6.4. The changes in V6.5 affect

both Standard and Pro. We want to keep version numbers consistent when functionality affects both versions, which is the case for V6.5.

Combine/Complementary Systems

This was a capability added in V6.4 of FastBreak Pro but we are adding it as part of the

V6.5 Standard FastBreak upgrade; however, the full power of the capability can only be

realized in FastBreak Pro. In FastBreak Pro the optimizer will try to build a new system

to complement an existing system or two systems. In Standard FastBreak the capability

allows a user to combine a trading system in conjunction with one or two existing trading

systems and show the Summary results and FNU for the combined system. One purpose

of this capability is to build complementary systems that may reduce the MDD or volatility of an entire portfolio that is trading multiple systems.

As an example, perhaps the investor has developed a system that trades ETFs. The annual return of this system may be excellent but has significant drawdowns on a regular

basis. This is often the case with a system that trades based on very long term trends

6

Page 7

without the benefit of tight stops. FastBreak now allows you to import the equity curve

(FNU file) from this existing system and combine it with a complementary system that

reduces the overall MDD when the two systems are traded together.

This functionality can also be used to combine FastBreak trading systems that complement non-FastBreak trading systems.

Bug Fix and Better Error Checking on Early Start Date

V6.5 fixes a problem when the Correlation Check option is used. Sometimes the correlation check wasn’t properly being applied.

As more and more users use ETFs that have a limited price history that would result in

errors if a user selected a start date that is too early. We have made changes that will result in fewer errors/crashes if an early start date is chosen. A user should still try to select

a start date that is relevant to the beginning of price data for funds in the trading family.

BOOM (Breakout Optimization Method) with Linear Slope Ranking

Long term FastBreak users are familiar with the BOOM option for ranking. Read the description for the option later in the manual. We have made BOOM available to use with

the Linear Slope ranking method. In recent years we have found that Linear Slope is a

great ranking method for stocks and ETFs. This ranking method appears to help adjust

for the greater volatility of stocks/ETFs vs. the less volatile mutual funds so allowing

BOOM to be used with Linear Slope was a natural extension.

Buying Weakness and Selling Strength

FastBreak Pro V6.5 adds two new capabilities (RAT and BAT) for buying and selling

into what may be permanent or temporary strength. Some of the changes are intended to

build systems that are complementary to traditional FastBreak systems that always buy

into strength. This will become clear as each of the new options is explained. Note: The

new options will only work with Linear Slope ranking. We will give only a brief overview here in the upgrade notes. More information can be found later in the manual

with calculation details in the Appendix.

RAT (Return Advance to Trend)

Typical FastBreak trading systems usually buy maximum price strength/momentum.

Trading systems can take a different approach and successfully take advantage of buying

temporary price weakness or selling into short term price strength. RAT is an option to

take advantage of these temporary moves. The assumption is that the move is temporary

and the price will revert to the trend.

BAT (Breakout Above Trend)

Sometimes a stock will have a good positive long term price trend, but for various reasons new buying will come into the stock and an even better trend will be established.

This is different from the BOOM option which tries to determine when a stock that has

been falling breaks out to the upside.

7

Page 8

Changes in Version 6.2

This section will cover enhancements in FastBreak Version 6.2 and is of interest to users

of previous versions of Standard FastBreak. Note: For users of previous versions of

FastBreak Pro see the Upgrade Notes in the supplemental FastBreak Pro manual.

Version 6.2 (V6.2) is the first release version of V6.X. It has exactly the same functionality of beta V6.1.

V6.1 of Standard FastBreak was a beta version that could be run by users of V5. We

made the beta available free of charge for V5 users. V6.1 will continue to function; however, going forward we will not maintain the beta version. Now that V6.2 is the official

release version any future enhancements or bug fixes will build upon V6.2. Users of versions prior to Version 6 will need to upgrade if they want to take advantage of any future

builds. Our policy is to provide technical support to the most two recent versions, e.g.,

V5.X and V6.X.

Note: There wasn’t a V6.0 of Standard FastBreak.

Trendline Stop and Buy Filters

Version 6 provides trendline Buy Filters and Sell Stops. Trendlines are one of the oldest

and still most useful technical analysis tools. Trendlines can be used to determine when a

stock or mutual fund has broken down in an upward move, i.e., used as a sell Stop, or

trendlines can be used to determine if a downward move has ended and it is safe to buy,

i.e., Buy filter. The vast majority of trendline users use a manual method to draw the

trendline on a paper chart or a computer screen. Programming a computer to calculate a

trendline that a human brain can draw in a few seconds is a daunting task; however, there

is a tendency when manually drawing trendlines to “force” the line to other expectations.

A mathematical algorithm is not subject to such expectations, but at the same time cannot

“see” other potential complications and complexities.

Adding trendlines to the Buy Filter and Stops required changes in the layout to three tabs:

Strategy, Stop Loss, and Buy Filter tabs, but you should quickly become comfortable with

the new layout.

Details of the Trendline algorithm are provided in the Appendix A.

NOTE: The algorithm to determine trendlines is very computer time intensive. If you

are using a very large trading family you will notice a long delay to evaluate the strategy. More about this in the Appendix A discussion.

Changes in Version 5

8

Page 9

This section will cover enhancements in FastBreak Version 5 and is of interest to users of

previous versions of Standard FastBreak. Note: For users of previous versions of Fast-

Break Pro see the Upgrade Notes in the supplemental FastBreak Pro manual.

You may ask how Version 5 of Standard FastBreak is different from previous versions

and if you should reread the manual. The answer is that the changes are extensive and we

suggest you read the entire manual to understand the enhancements. The examples are

for the most part unchanged and you can skip these sections if you are a veteran FastBreak user. The following list of changes covers upgrades from Version 4 to Version 5.

Some users may be upgrading from a very old version and a section follows to cover upgrades from Version 2. Note: There wasn’t a Version 3 of Standard FastBreak.

Changes between Version 4 and Version 5

Capability to build market timing systems and signal files.

o We believe this is the most exciting new functionality. This functionality was

developed, in large part, to better trade individual stocks. Over the years we

have found that FastBreak stock trading systems have the potential for fantastic returns, but we have also found that controlling drawdown is a challenge in

bear markets. We have found that even in severe bear markets there will be

stocks that rally strongly, however, these rallies often fail resulting in a whipsaw trades. We saw the need for market timing signals that would keep the

trading system out of the very worst of markets. There are numerous market

timing signals available but so many of these are not robust and fail the test of

time. Also, we wanted to develop our own signals that met our needs, e.g.,

switches per year, drawdown, markets traded etc.

o One disadvantage of the many market signals available is that they are devel-

oped for a specific index, e.g., S&P 500 Index. Often, there is a divergence in

different stock indexes, i.e., small cap stocks performing well while large cap

stocks are not. FastBreak allows the use to combine multiple indexes (or any

stock, fund, FNU file) into a family. This allows the user to build signals that

stay in a buy mode if any of the indexes are in an uptrend and will only signal

a sell signal if all are in a down trend.

o We have used this capability to build signals for trading diversified mutual

funds and individual stocks. We have also used it to build market sector specific signals; for example, we have built signals to build trading systems for

energy stocks.

o Signal file building systems can be run like a regular FastBreak trading sys-

tem, except the output is a FastTrack signal file. This signal file can then be

used in a FastBreak trading system or other FastTrack applications.

Rank using Ulcer Performance Index (UPI). This option will tend to purchase high-

UPI funds and produce strategies that have a high UPI equity curve.

9

Page 10

Rank using Sharpe Ratio. This option will tend to purchase high Sharp Ratio funds

and produce strategies that have a high Sharp Ratio equity curve.

Removed the Long Rank + Short Rank momentum ranking option. This option had

the tendency to give ambiguous ranking order because the value produced was an integer (whole) number and more than one fund could have the same value.

Removed the Families/Individual option on the Funds/Index tab. This option was

never very useful.

Changed the logic in the Harnsberger option. Previously, Harnsberger would only

trigger a sell if you were not holding the top Buy ranked fund. This made sense on

early versions of the program when we didn't have buy filters. Now, it is very common for you not to hold the #1 Buy ranked fund because of the filters. Also, with

some users having large numbers of funds or stocks in their trading families, the difference in rate of change between the #1 Buy ranked fund and the Nth Buy ranked

fund may be very small. However, the Nth ranked fund may meet all your buy criteria

when the #1 fund does not. We changed the logic so that it will always try to buy a

top ranked fund that meets your buying criteria. The fund sold must meet your minimum holding period value. This is now very similar to setting the top % to zero percent. One difference is that if more than one fund can be sold on a given day the

Harnsberger option will sell the weakest (as measured by Sell ranking) fund. We now

put an H in the Why Detail file column to indicate a Harnsberger sell.

Stop loss using a short/long Exponential Moving Average (EMA) crossover. This is

similar to the current EMA stop except that the fund NAV is smoothed with a short

term EMA.

Buy filter using a short/long Exponential Moving Average (EMA) crossover. This is

similar to the current EMA Buy filter except that the fund NAV is smoothed with a

short term EMA.

The next four enhancements are all similar in that they allow the user to modify stop

or buy filter options according to market conditions or a user defined input file. The

modification is triggered when an index (or any user defined fund or FNU file) drops

below its user defined EMA line. For example, if the S&P is used as the index then

the parameters are not modified as long as the index stays above a user defined EMA

line. If the S&P falls below its EMA line then a factor is applied to the standard

value. A simple example is that when the market is in a strong uptrend high beta

funds may be a good investment option. However, when the market is in a downturn

or trading market it may be prudent to purchase low beta funds.

o Adjust the Trailing Stop Loss value based on market conditions or external

file input.

o Adjust the EMA Stop value based on market conditions or external file input.

10

Page 11

o Adjust the Beta Buy filter value based on market conditions or external file

input.

o Adjust the EMA Buy filter value based on market conditions or external file

input

Beta buy filter can now be a non-correlated beta as an option. Beta is the ratio of the

volatility of a fund divided by the volatility of an index (typically the S&P 500), multiplied by a correlation value between the fund and the index. If a fund has a low correlation to the index it can have a low beta but be a very volatile fund. An example

would be a gold fund. Gold funds have a low or even negative market correlation and

yet are very volatile. Filtering on standard beta may not filter out a gold fund. Using

the non-correlated beta filter allows a user to mix a wide range of fund types including those that may not have a high market correlation value, e.g., bonds, international

etc., in a trading family and have the ability to filter those with high volatility.

Improved the BOSS stop option to be more effective with some ranking methods.

Ability to begin the effectiveness of a stop option later than the first day. Previous

versions required the stop to be in effect on the first day a fund was purchased. Some

users have the requirement to hold a fund for a fixed number of days after purchase.

They can now start a stop after this number of days.

Ability to search the Buy and Sell ranking list by fund symbol. Some users have very

large trading families and it is difficult to locate a particular issue in the ranking list.

This option allows the user to do an efficient search for the fund symbol.

Additional Changes between Version 2 and Version 5

Note: You can load trading systems developed with Version 2 of FastBreak into this

new version, however, the first time you load an old trading system you must input the

beta /correlation index and calculation period on the Funds/Index tab. After you have

entered this information you will need to resave the DFT file.

Load all three FastTrack databases at the same time

Batch mode

Alpha ranking

Breakout Optimization Method (BOOM)

Better Opportunity Sell Signal (BOSS)

RSI stop

Numerous buy filters: EMA, parabolic, RSI, beta, and correlation

New information in summary and detail files

Enhancements to adjustment factor options

Because of changes in program calculation logic you may see changes in results from

your trading systems developed with prior versions of FastBreak. This is why we rec-

11

Page 12

ommend you keep the old version of FastBreak on your computer until you verify your

systems haven’t changed. Here are just a few reasons why strategies my give different

results with the new version:

In previous versions of Standard FastBreak if a stop was hit, but the fund hitting the

stop was still the top ranked fund, the detail file would show the fund being sold and

then repurchased. New logic always checks to determine if the fund being purchased

was the one just sold. If that is the case the sell is negated.

We removed the Adaptive Moving Average as a stop option. This was done because

we never found the AMA to be a particularly effective stop option and we wanted to

make room on the Stops tab for a much more effective new option called BOSS.

Change in the logic for the Rate of Return Sell stop. We now check a candidate fund

prior to purchase for this stop to verify that it exceeds the stop parameters specified.

12

Page 13

4.0 FastBreak Trading System

FastBreak uses a trading system method that buys mutual funds showing strong relative

trends in price and sells funds that are showing poor relative trends in price. You may

hear traders refer to this type of trading system using many names: market sector upgrading, momentum investing, trend following, fund ranking, and relative strength trading.

We will take a quick look at each of these concepts, because there are small differences,

and explain how FastBreak works.

Market Sector Upgrading (MSU) The simple explanation of MSU is moving your investment out of a sector of the market that is showing poor relative strength and into a

sector of the market that is showing the best or better relative strength. For purposes of

this discussion, the word “sector” refers to industry groups that make up the market, for

example, health care, transportation, technology, etc. An example of MSU would be a

move from the energy sector into the health care sector if health care funds are showing

better price strength relative to energy funds.

MSU tends to be a fully invested trading strategy that relies on being in the strongest sector of the market for good performance rather than using market timing. However, in

bear markets, money market funds can be a considered a strong sector for investing.

Many investors using MSU use the Fidelity Investments Select Funds, but there are other

mutual funds offered that concentrate on a narrow sector of the market, for example, Rydex and ProFunds have a large number of sector funds.

Why do different sectors of the market rotate in and out of favor? There is probably no

single answer to this question. Some of the rotation may be due to the economic cycle

(The All Season Investor by Martin J. Pring is an excellent book on this subject) or presidential election cycle. Political climate can be another influence. Health care funds were

impacted in 1993 with the debate on a national health care plan but bounced back with

excellent gains in 1994 and 1995 when that plan was abandoned.

Momentum Investing Momentum investing (not to be confused with earnings momentum) buys funds showing a surge in price with the thought that the price will continue to

move upward. This system is not limited to any particular type of fund.

Trend Following Trend following systems rely on longer term, major up trends in price.

Trend following systems usually don’t get in at the start of a major up trend or get out at

the top of an up trend. The system usually waits until an up trend is firmly established before purchasing a fund and often waits until the trend is clearly ended before selling. The

system is not limited to any particular type of fund.

Relative Strength Trading and Ranking Strategies Trading systems based on relative

strength or ranking are very similar. Relative strength usually compares the price action

13

Page 14

of a fund to an index and buys the fund that is showing the strongest strength compared to

the index. Ranking strategies compare the price action of a fund to a group or “family” of

other funds. The fund showing the greatest percentage change in price is purchased.

There are obvious similarities in all these systems. FastBreak uses the Ranking method to

select the funds to buy and sell. The how or why a sector or fund is rotating in or out of

favor is not as important as making an accurate determination that the rotation is happening, and the trend will continue long enough so that the movement is tradable.

There are many good technical tools available to help determine when the trend has

changed, such as trend line analysis, RSI, moving averages and AccuTrack. Some techniques only help predict a trend for a specific fund that may be changing: trend line analysis and moving averages are examples. Other tools and indicators not only give buy and

sell indications but can show relative strength between different funds, AccuTrack for

example.

No technical analysis technique is perfect. Many techniques require the user to “interpret”

or make a value judgment. Others require considerable amounts of time to calculate or

evaluate changing trends. Finally, if many different funds give a buy signal, there is always the question of which funds should be purchased for the best return?

Many FastTrack users have been using “fund ranking” to determine the particular fund to

buy or sell, and this is the system FastBreak uses. Fund ranking is a very simple concept

to explain, but refer to the FastTrack manual for a complete description. First, the investor makes a family of the funds under consideration for trading. The family is then

“ranked” for gain over a given period (15 market days for example) using the blue pole

and the “Rank” command. The funds are listed using the “List” command. The investor

typically sells a fund that has dropped out of some predetermined top percent of the

ranked funds (50% is common). The investor then buys the top “ranked” fund. As an

example, if the investor makes a 15 day rank on 20 sector funds, and the fund being held

is more than 10 places down on the ranked list the fund is sold and the money rolled into

the first fund on the ranked list. The following table is used to illustrate the example.

The table is a 15 market day FastTrack rank list. Assume this list contains all the funds in

the trading family. Any fund below FSVLX on the list would be sold. The fund to purchase is FSELX.

SELECT Family Ranked from 01/10/96 to 01/31/96 ending 01/31/96

No Symbol Fund Name Gain

---- ----- ------------------------------- ---- ---- ---- ---- -----1 FSELX Fidelity Sel Electronics/008 13.8

2 FSPTX Fidelity Sel Technology/064 10.0

3 FDCPX Fidelity Sel Computers/007 9.7

4 FIDSX Fidelity Sel Financial Svc/066 9.6

5 FSLBX Fidelity Sel Broker & Inv/068 9.6

6 FSRBX Fidelity Sel Regional Bank/507 9.0

14

Page 15

7 FBIOX Fidelity Sel Biotechnology/042 8.5

8 FSCPX Fidelity Sel Consumer Prod/517 8.4

9 FSCSX Fidelity Sel Software-Comp/028 8.2

10 FSVLX Fidelity Sel Home Finance/098 7.3

11 FSHCX Fidelity Sel Medical/505 7.0

12 FSCGX Fidelity Sel Indus Equip/510 6.7

13 FDFAX Fidelity Sel Food & Agric/009 6.6

14 FSPHX Fidelity Sel Health Care/063 6.6

15 FSPCX Fidelity Sel Insurance/045 5.9

16 FSDCX Fidelity Sel Develop Comm/518 5.8

17 FSPFX Fidelity Sel Paper & Forest/50 5.1

18 FSDAX Fidelity Sel Defens & Aero/067 4.8

19 FSCHX Fidelity Sel Chemicals/069 4.7

20 FSDPX Fidelity Sel Indus Material/50 4.6

This is a simple concept; however, there are many questions an investor could ask. It was

these questions that lead to developing FastBreak. The following list has a few of the

questions FastBreak allows the user to run historical analysis on:

What if the buy ranking period is different from the sell ranking period?

What if the fund has a minimum holding period to avoid transaction fees?

What if a strategy has a stop loss, even if there is a transaction fee?

What if more than one fund is held?

What if there is a change in the point a fund drops in the ranked list before it is sold, i.e.

top 50%, 30%, 20%....?

What has been the historical maximum draw down for a strategy?

What are the Ulcer Index and Ulcer Performance Index for a strategy?

What happens to the historical performance if funds are added or removed from a trading

family?

What if I want to add a fund or stock into my strategy using the FastTrack FNU file format?

What if I use a market timing signal in my strategy?

Warning, back testing is no guarantee of future results, but it can provide

very useful information when developing trading systems.

15

Page 16

5.0 Technical Support and Upgrades

Note: Do not call Investors FastTrack for technical support.

Do not use the 800 order line number for technical support. This is a commercial

order line that only takes orders and they are not equipped to answer any questions.

Any messages left with the order line will not be returned.

Please read this entire manual and check the FAQ chapter before contacting support. We

have tried to make this software and documentation as user-friendly as possible. You

should have a basic working knowledge of Windows, i.e., how to copy and move files,

change directories, select drives, etc.

Technical support is typically provided by email. You will usually receive a response

within 24 hours.

We can be contacted at email2ew@edge-ware.com. This address will send your note to

both Ken and Nelson and will help you receive a timely response. We recommend that

you always use this address. If one of us is traveling or otherwise unavailable your note is

likely to be answered sooner if it is sent to both of us.

If your support issue can’t be handled by email we will arrange for telephone support.

We charge $25 for replacement installation CDs.

There is no charge for most technical support. Problems with reinstalling FastBreak is

our number one tech support problem. We receive a large number of support requests

from users reinstalling FastBreak because of hard drive failures, purchase of new computers, etc. We reserve the right to charge $50 to assist in reinstallation of the product,

starting six months after purchase. If you follow the following steps you shouldn’t have

any problem reinstalling.

Reinstalling FastBreak

You MUST use the installation CD to reinstall. We have had a number of users just try

to copy files to the new computer or hard drive. This will not work. Here are the steps:

Install FastTrack first

Do at least one download and update of FastTrack data

Verify that the FastTrack account number on this computer matches the account

number on the FastBreak CD

Install FastBreak using the installation CD

Go to our web site and download the latest upgrade, if one exists

16

Page 17

Upgrades

We provide minor upgrades to FastBreak on our web site, and if you encounter an error,

we suggest you download the latest version of the software because this will often solve

the problem. The Edge Ware Internet Web site (www.edge-ware.com) always has the

latest version for download along with release notes.

FastBreak is constantly improving, and we try very hard to get those improvements in the

hands of our users as fast as possible. As we make changes new versions are often placed

on our web site for free downloading. This creates problems with keeping documentation

up-to-date for the latest version because it isn’t practical to rewrite the manual each time

we make a change. In most cases, the installation you receive will actually be the most

recent version, and there may be an addendum in this manual that will describe how the

recent version is different from what is described in the main body of the manual.

17

Page 18

6.0 Installing FastBreak

Note: If you computer doesn’t have a CD drive you can still install FastBreak. If you can

get access to a computer with a CD drive then copy all the installation files on the CD to a

memory card. Load the files on the new computer into a temporary folder. C

To install FastBreak:

Note: Windows 7 Installation Note – During installation on a computer with Windows

7 you may get an error during installation (the error may mention mcf40.dll) If this

occurs, click Ignore and the installation will complete properly.

1) Stop any application that may be running. Note: We have had a number of users call

with installation problems because Microsoft Office was running in the background.

2) Insert the installation CD and double click the SETUP.EXE file to start the installation.

(Note, there are other “Setup” files on the CD so be sure to click only the SETUP.EXE

file)

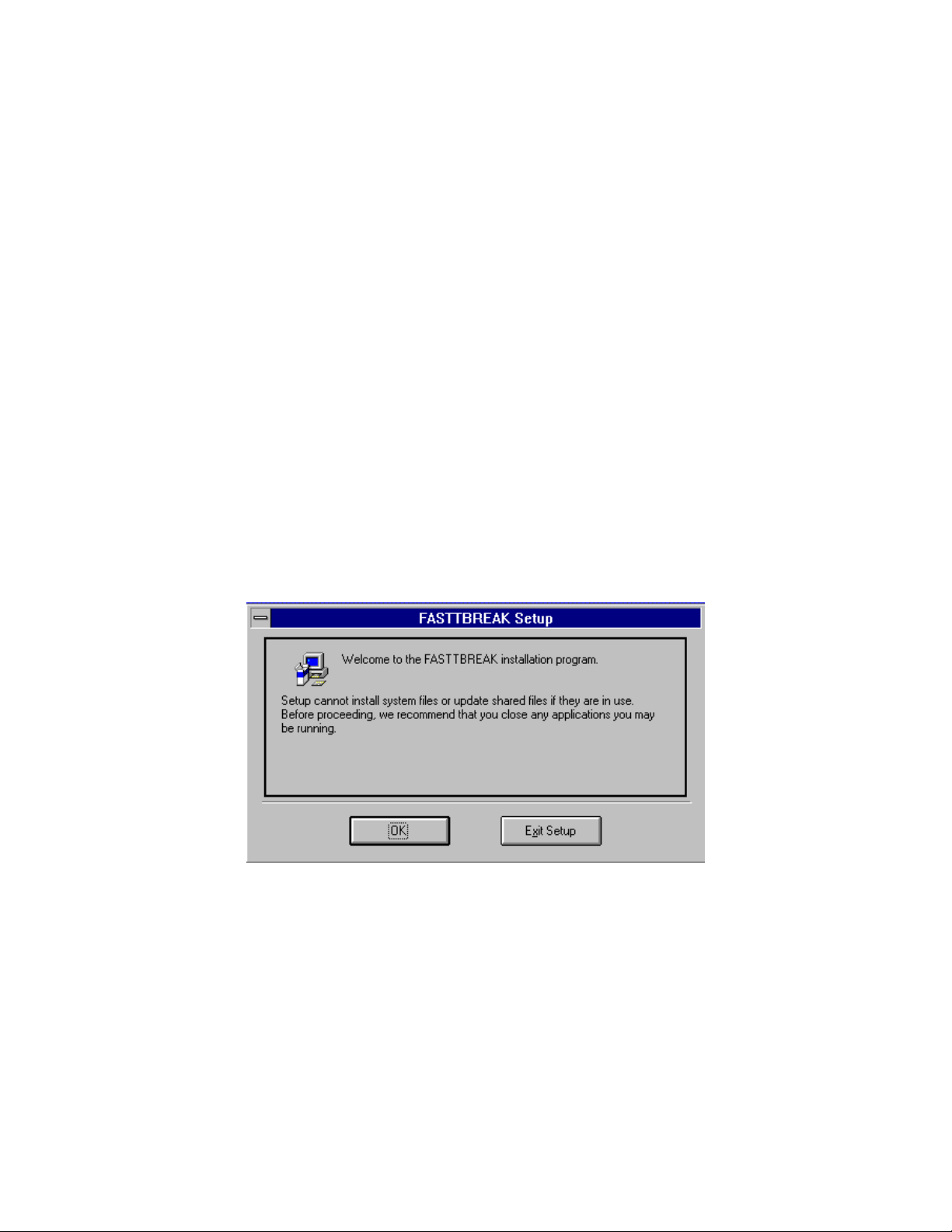

3) The first screen you will see is:

This is a warning to close any applications you may have running. The various versions

of Windows have different methods for determining applications that are running. Consult your Windows manual to determine how your version works. If you don’t have applications running select OK otherwise, exit Setup and close the applications.

18

Page 19

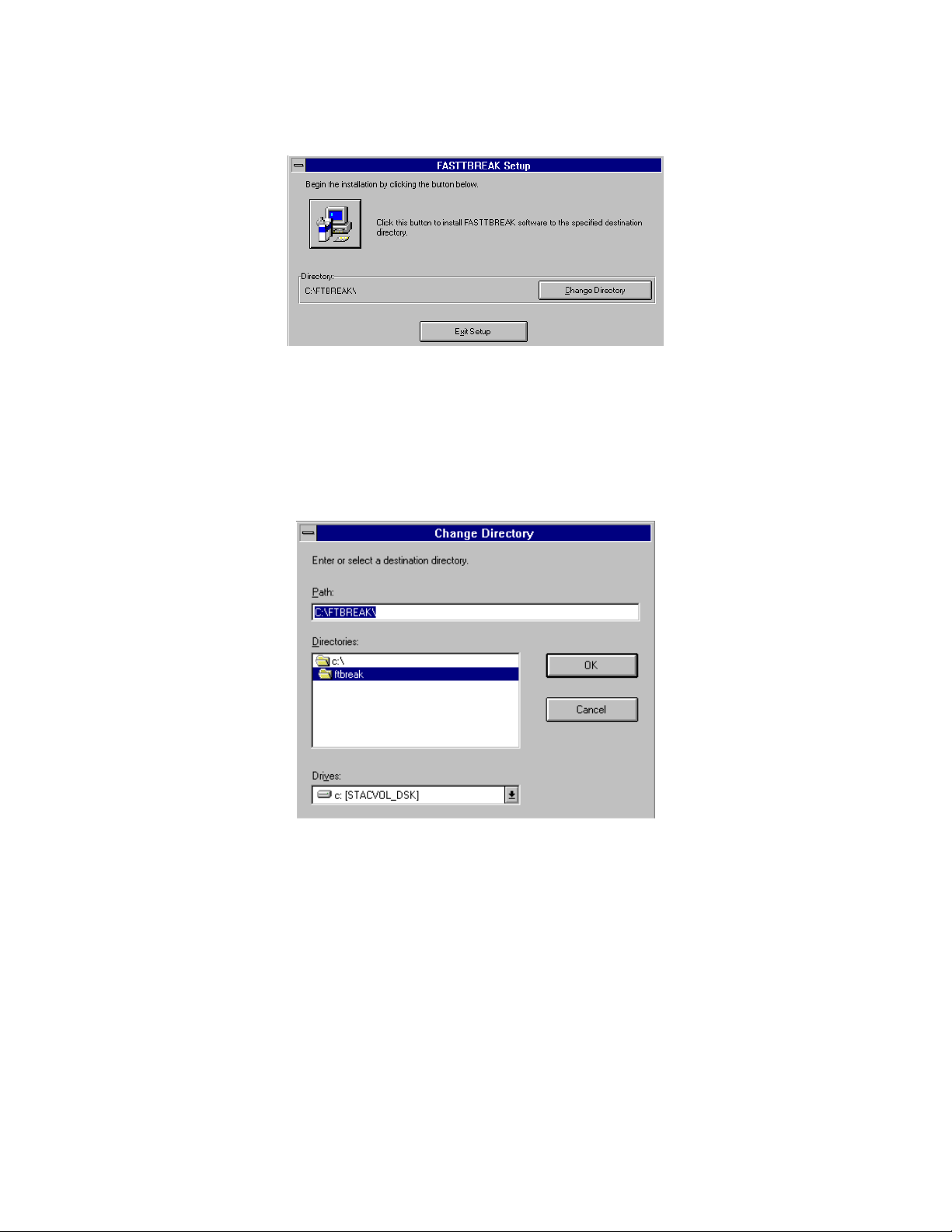

4) The second screen you will see is:

The setup program is asking the name of the drive and directory where FastBreak is to be

installed. The default is C:\FTBREAK (FTBREAKP for Pro), and we suggest that you

use the default directory name. If the default is acceptable click on the button that resembles a computer.

5) If you need to change the drive letter or directory path click the Change Directory but-

ton and the following screen will appear:

This screen allows you to change the drive and/or the path and directory. If you need to

change the drive, click on the Drives pull down arrow button to get a list of your drives to

select from. Once you have selected a drive, click on the drive folder to see a list of existing directories for installation or type a directory name in the Path box, then click the OK

button.

6) A FastBreak icon will be created in your Windows Programs environment.

19

Page 20

Reinstalling FastBreak

Note: Windows 7 Installation Note – During installation on a computer with Windows

7 you may get an error during installation (the error may mention mcf40.dll) If this

occurs, click Ignore and the installation will complete properly.

Reinstalling FastBreak is our number one tech support problem. Users crash hard drives,

buy new computers, new laptops, etc. You MUST use the installation CD to reinstall.

We have had a number of users just try to copy files to the new computer or hard drive.

This will not work. Here are the steps:

Install FastTrack first

Do at least one download and update of FastTrack data

Verify that the FastTrack account number on this computer matches the account num-

ber on the FastBreak CD

Install FastBreak using the installation CD

Go to our web site and download the latest upgrade, if one exists

20

Page 21

7.0 FastBreak Options and Functions

FastBreak is run from the Windows environment, and your installation should have created an icon when you click on the Windows Start button and go to Programs. If you

want to put an icon on your Windows desktop find the ftbreak.exe (ftbreakp.exe for Pro)

and put a shortcut to this file on your desktop. Refer to your Windows manual for guidance on how to do this. Click the icon as you would to launch any application. The first

time FastBreak is run, it will check your C: drive for the FastTrack database. If the data

is not found, a window is displayed that lets you pick the drive and directory where the

FastTrack data is located. See the installation chapter for details on how to complete installation.

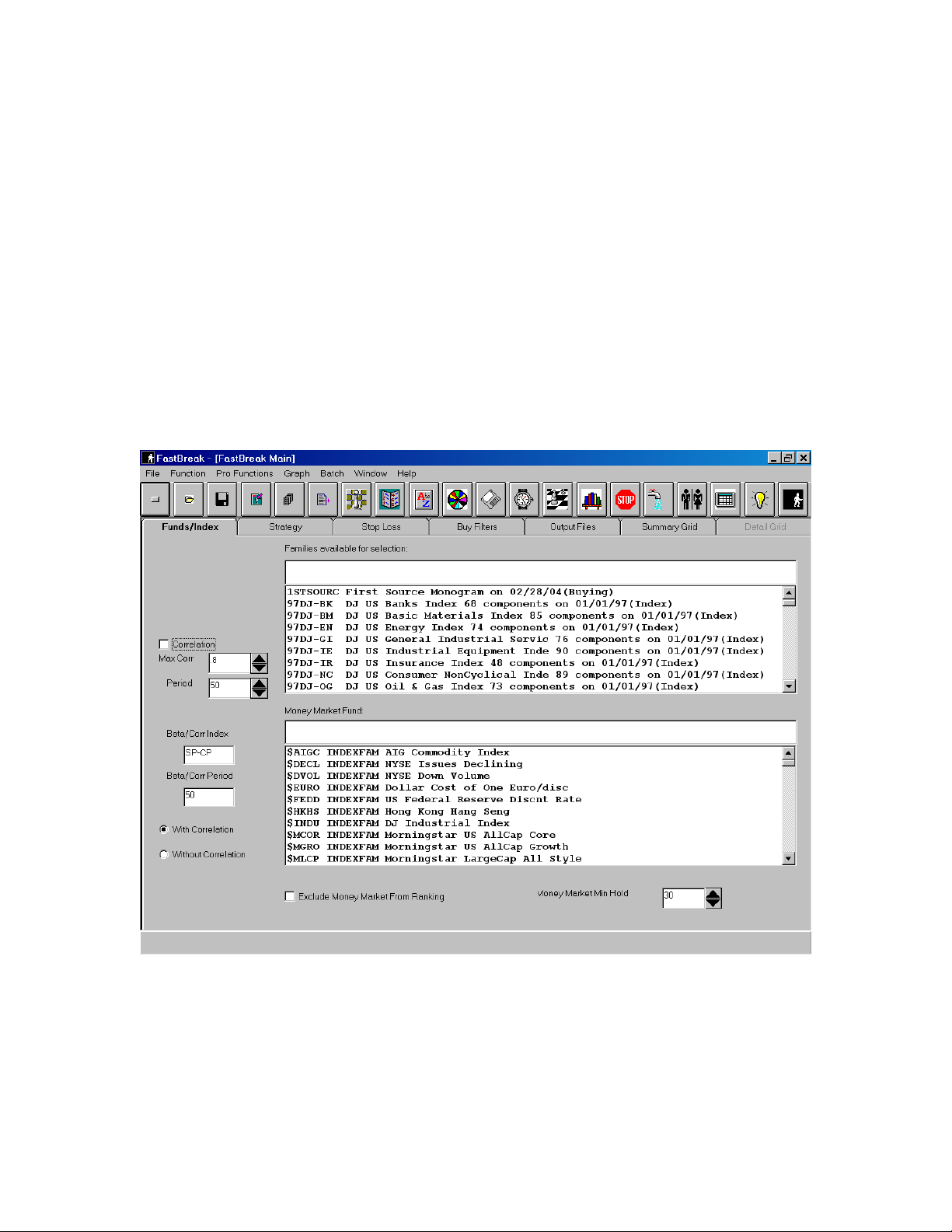

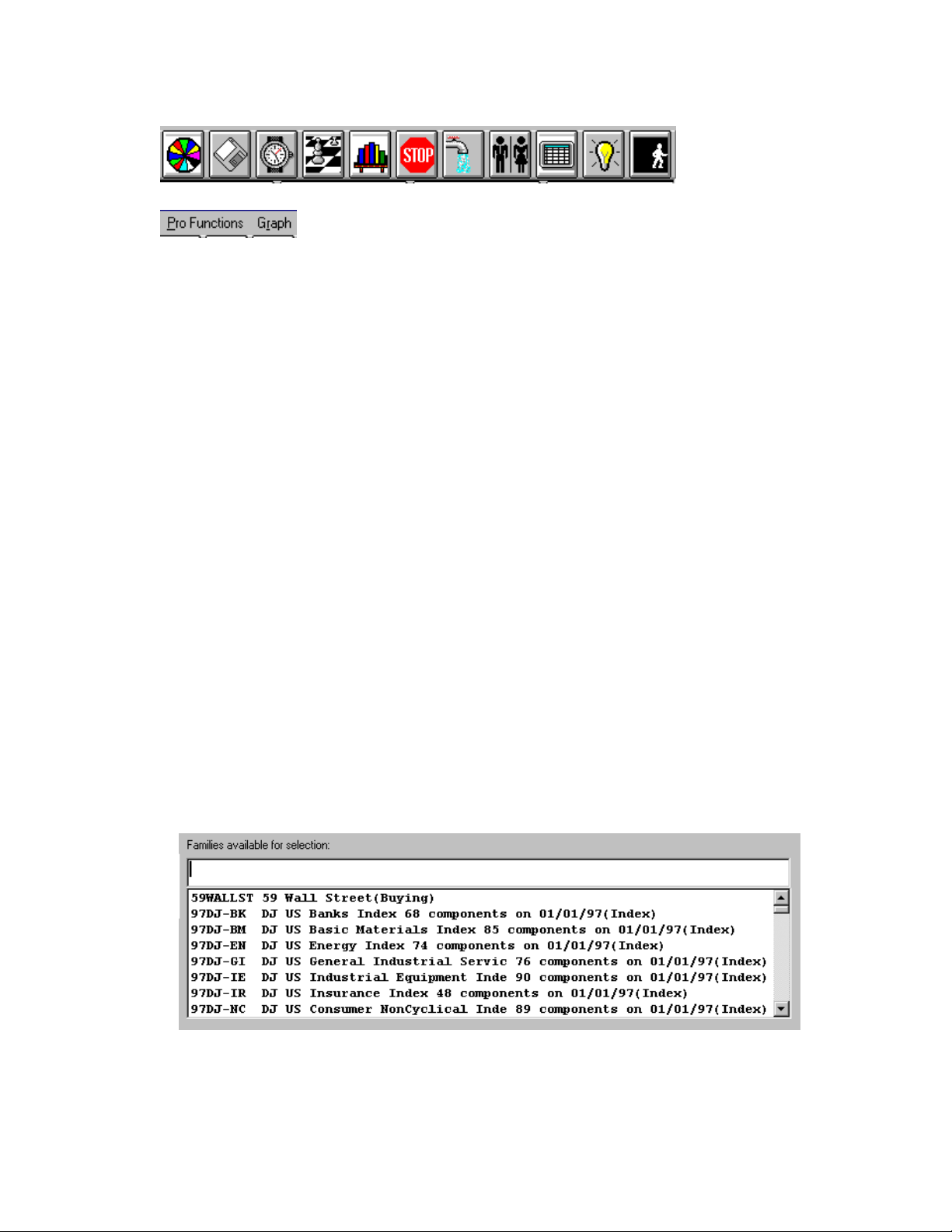

When FastBreak is launched the main menu will appear:

Note: All the full screen prints in this manual are from FastBreak Pro. Standard

FastBreak will not have the following icons and pull down menus (Pro Functions and

Graph). This manual will only address functions common to both Standard FastBreak

and FastBreak Pro. These icons and menus control functionality unique to FastBreak

Pro:

21

Page 22

When FastBreak is launched, it will read all the family names in your FastTrack directories (Ft\Ftdef, Ft\Userdef, and Ft\Ft4win\Sftdef), including user created families, and load

all the fund names including your FNU files. If FastBreak hits an error during the loading of your FNU files this indicates you have a corrupt FNU file. You will need to move

all your FNU files from your FastTrack (FT) folder to a temporary location. Now, try to

restart FastBreak. If FastBreak launches you will need to determine which of your FNU

files is corrupted. This can be done by moving the files one at a time from the temporary

location and launching FastBreak after each transfer.

The menu may initially look very complicated but is quite logical and user friendly. We

will step through each menu item and describe each feature. FastBreak uses the very

common Windows Tab and Tool Bar method of presenting functions and data.

Funds/Index Tab

When FastBreak launches the Funds/Index Tab is on top. See the previous page. This

screen is used to select your Trading Family and Money Market Fund to use in the trading

strategy.

Selecting your strategy trading family

FastBreak allows selection of a prebuilt family of funds, either a family built by FastTrack or user-built family. See your FastTrack manual on how to build a trading family.

All the available families will be shown in the top Families available for selection box.

Put the cursor in the empty line just above the first family name and start to type the name

of the family to be traded. FastBreak will find the family as the name is typed. Note:

The indexing may have problems if you have family names starting with unusual

22

Page 23

characters such as ~,@ etc. You can also use the slider bar to the right of the family

names to find the family of interest. Once the family is located, use the cursor and left

mouse button to click the family. It will highlight as in the above screen. Note: The

highlighted family will NOT appear in the box where you started to type the name.

Note: FastBreak will read all your FNU files. When these files are made part of your

trading family, FastBreak will include them in the trading strategy. See the FastTrack

manual for information on FNU files.

Money Market Fund Selection

Next, select a money market fund from the list of fund names just to the right of the

“Money Market Fund” label. Any fund, stock or FNU file can be selected as a money

market fund and the selection is made in the same way families and funds are selected.

Notes: When selecting a money market fund make certain the fund is available the entire time period you are planning to test. FastBreak will give you a warning notice if

the fund doesn’t span the testing period. When building trading families in FastTrack,

do not put your money market into the trading family.

Exclude Money Market from Ranking

Many users only want to go into the designated money market fund when using a market

timing signal file. Clicking this option will prevent the money market fund from being

selected as part of the ranking strategy, but on a signal file “sell” the money market will

be used. Note: Even if you use this option you may sometimes find that FastBreak has

purchased the money market fund even when not on a signal file sell. If FastBreak is

trying to purchase a fund but none of the funds in your trading family meet your buying criteria, then money market will be purchased as a last resort. For example, perhaps you are using the Exponential Moving Average buy filter, but all the funds are

below the specified moving average, FastBreak will purchase the money market fund

as a last resort.

Money Market Minimum Hold

23

Page 24

If using money market in a ranking strategy, this menu item will allow you set a minimum holding period for the money market fund before it can be sold. Many users like to

set this to a short value because money market funds usually do not have a minimum hold

period or short term trading fees. If you use a substitute fund in place of a money market

fund, remember that FastBreak does not apply any short term trading fees to the money

market. Note: The period is in calendar days not market days.

Maximum Correlation Check

This option allows a strategy to avoid buying and holding similar funds at the same time.

If the correlation option is checked, the fund under consideration for purchase will be

compared in correlation to the other funds currently held by the strategy. If the fund under consideration is correlated greater than the specified value, then the fund will be rejected for purchase and the next highest ranked fund will be considered. The correlation

is calculated over a user defined period. We recommend that at least 50 trading days be

used for the calculation. Correlation can range from -1.0, negative correlation, to perfect

correlation of 1.0 Note: Many funds will become highly correlated over short periods

even though they may have low correlation over long time periods. For this reason the

correlation value should be set to a high value. A reasonable maximum correlation

value would be 0.9 or higher.

Statistics Index and Period

FastBreak calculates a variety of statistics on your trading system, including Beta and

Correlation. These statistics will be covered in the Output section of the manual. To calculate some of these statistics, FastTrack requires an index to be specified. The default

index is the S&P 500 index (SP-CP in the FastTrack database). If you want statistics calculated using a different index, you must specify the FastTrack symbol here. A period, in

market days, is required for the calculation. The default is 50 days. We don’t recommend periods shorter than 50 days, but longer periods are certainly reasonable. Finally,

the user has a choice of calculating the beta using correlation, which is the traditional

method, or without correlation. When choosing Without Correlation, the beta calculated

isn’t actually beta, but is the ratio of the equity curve daily standard deviation and the index daily standard deviation.

24

Page 25

Strategy Tab

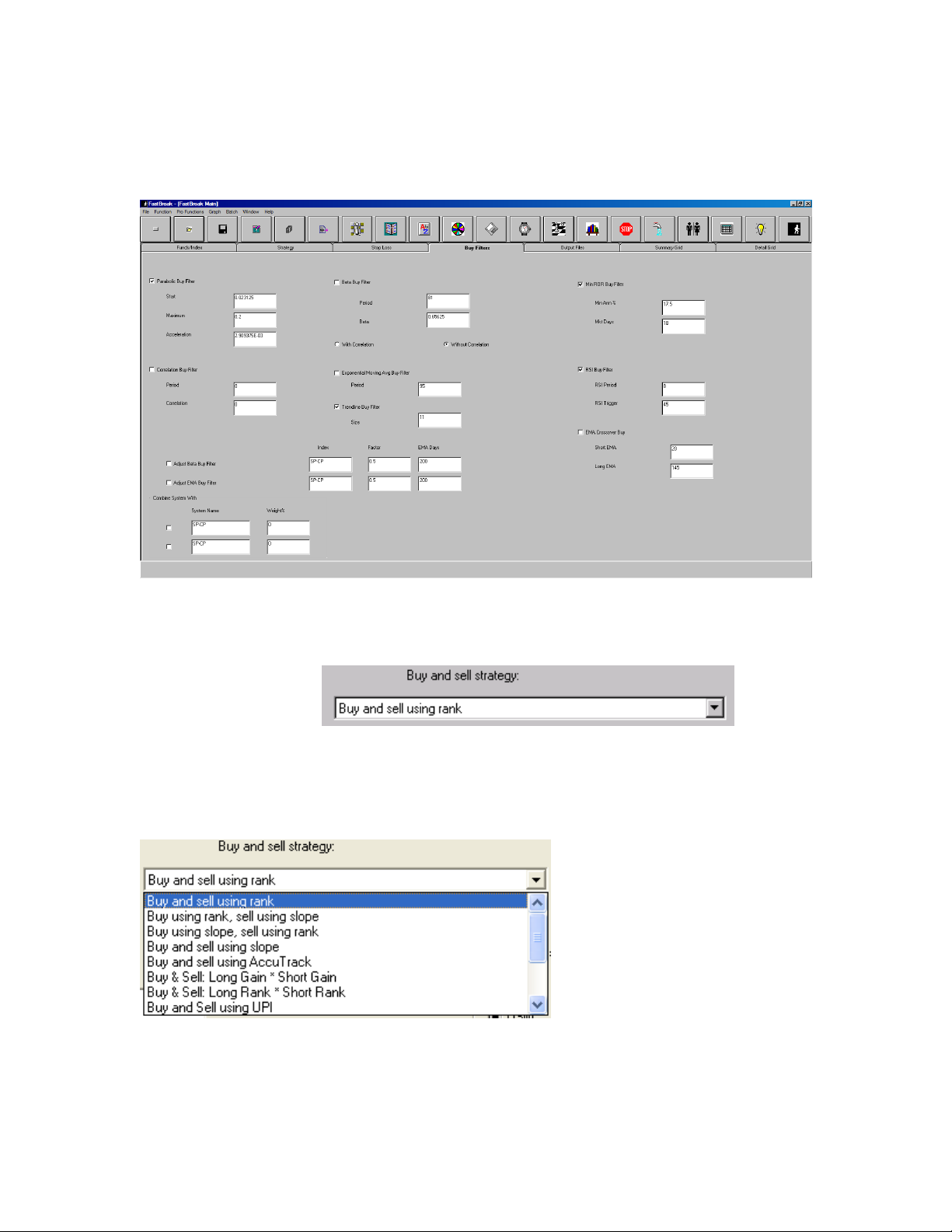

Next, click on the Strategy Tab to bring up the following screen:

This is the most complicated menu screen in FastBreak. This tab sets up the majority of

the trading strategy parameters.

Buy and Sell Strategy

This may be the most difficult part of FastBreak to understand. The “Buy and sell strategy” menu is a pull down menu. Click the down arrow button just to the right of the box

below the line that reads “Buy and sell strategy” to see all the trading options available.

Each choice is described below:

25

Page 26

Buy and sell using rank - This is the most often used strategy. A simple FastTrack type

ranking is made on the funds in the selected family. The ranking produces a list of funds

in order of decreasing gain over some specified time period. This is equivalent to using

the blue pole and rank function in FastTrack. FastBreak will “buy” a fund if it is the top

ranked fund and will “sell” a held fund if it drops out of the top part of the family of

funds during a ranking.

Buy using rank and sell using slope - FastBreak will “buy” using a simple ranking but

“sell” if the slope of a “normalized” price chart for a held fund drops in relation to the

slope for all the other funds in the family. This is more fully explained in Appendix A.

The slope can be calculated using a variety of curve fit methods that will be selected using a soon to be described selection menu. Using a curve fit of the daily price data will

smooth the data and tend to filter out short term price volatility. The number of daily

price points used to determine the slope is set by a parameter to be described later.

Buy using slope and sell using slope - This is similar to the above strategy except the

strategy does a curve fit on the daily price data for each fund in determining “buying” and

“selling” funds.

AccuTrack buy and AccuTrack sell - This is the most difficult strategy to understand

and is one the slowest from a computer run time prospective. The user may want to own

a very fast computer before using this strategy! Some users have referred to this as an

“AccuTrack Bubble Sort.” The AccuTrack indicator should be familiar to all FastTrack

users and is described in the FastTrack manual. It is an indicator that can be used to find

the relative strength between two funds. Typically, one of the funds is made the AccuTrack index. FastBreak will select two of the funds in your family making one the

“fund” and the other the “index.” Next, a determination is made on which is the stronger

fund based on the AccuTrack value. If the value is greater than 50, the fund is stronger.

If the AccuTrack value is less than 50 the index is the strongest. If the “fund” is stronger,

FastBreak will make it the new index and go to the next fund in your family to repeat the

calculation. This is done for all the funds in the trading family. The fund that is in the

“index” position at the end is considered the strongest fund. The process is repeated over

again and again for the remaining funds. The funds are ranked by this technique from

strongest to weakest. Selecting this strategy option will cause a change in some of the

other screen options. AccuTrack trading parameters will replace the ranking buy and sell

ranking parameters. This will be explained later in this chapter.

Buy & Sell: Long Gain * Short Gain - This option combines a long ranking period gain

with a short ranking period gain by multiplying them together. This method will give

weight to both long term price performance and short term price performance. For example, if testing a long period of 40 market days and a short period of 5 market days the program will first take the ratio of the NAV of the fund today and 40 days ago. Next, the

ratio of the NAV of the fund today and 5 days ago is calculated. The final step is to multiply these two ratios together. Putting numbers to this example - we will assume a fund

has a current NAV of $18.00, a $17.75 NAV five days ago, and a $17.45 NAV forty days

26

Page 27

ago. The long period NAV ratio is: 18.00/17.45=1.0315, and the short period NAV ratio

is: 18.00/17.75=1.014. Multiplying these two ratios together: 1.0315 X 1.014= 1.046.

This is done for each fund, and the multiplied ratio results are used to do a ranking with

the fund having the largest value as the #1 fund.

When this option is selected four new boxes appear on the screen, Min Long, Max Long,

Min Short, and Max Short. This allows a range of long and short combinations to be

tested. This will be explained shortly.

Buy & Sell: Long Rank * Short Rank - This option also combines long and short term

price performance to rank funds. A ranking of the family is made over a long look-back

period and then a second ranking is made over a short look-back period. The actual ranking positions are multiplied together, and this final result is used to make a third and final

ranking. For example, a fund may be ranked number 5 in the trading family over the past

40 market days and ranked number 8 over the past 5 market days. The result of multiplying these two ranking positions together is: 5 X 8 = 40. As you can see, the lower the

ranking value the smaller the final result, therefore, when the third and final ranking is

performed on this multiplication of two ranking periods the fund with the LOWEST

value is ranked number one.

When this option is selected four new boxes appear on the screen, Min Long, Max Long,

Min Short, and Max Short. This allows a range of long and short combinations to be

tested.

Buy & Sell: Buy and Sell using UPI – Calculation of Ulcer Performance Index (UPI) is

explained in the Appendix. Choosing this option ranks funds based on a short term UPI

value. This usually results in buying funds that have a smoother equity curve

Buy & Sell: Short EMA/Long EMA - This option creates a ratio of the Short Exponential Moving Average (EMA) divided by a Long EMA. If a fund is starting to move up,

the short EMA will be a larger number than the long EMA. The ratio for all the funds is

then ranked from largest to smallest. When a fund starts to turn down the ratio will become smaller.

Buy & Sell: General Anchored Momentum - This option is based on work by Rudy

Stefenel and published in Technical Analysis of Stocks & Commodities. See Appendix A

for a detailed description.

Buy & Sell: Most Anchored Momentum - This option is based on work by Rudy Stefenel and published in Technical Analysis of Stocks & Commodities. See Appendix A for

a detailed description.

Buy & Sell Using Alpha Ranking – This option ranks funds based on short term “alpha.” See Appendix A for a detailed description of alpha.

27

Page 28

Buy and Sell using Sharpe Ratio – This option ranks funds based on short term Sharpe

Ratio. Sharpe Ratio is a common measure of reward and risk. See FastTrack Help for a

description of Sharpe Ratio.

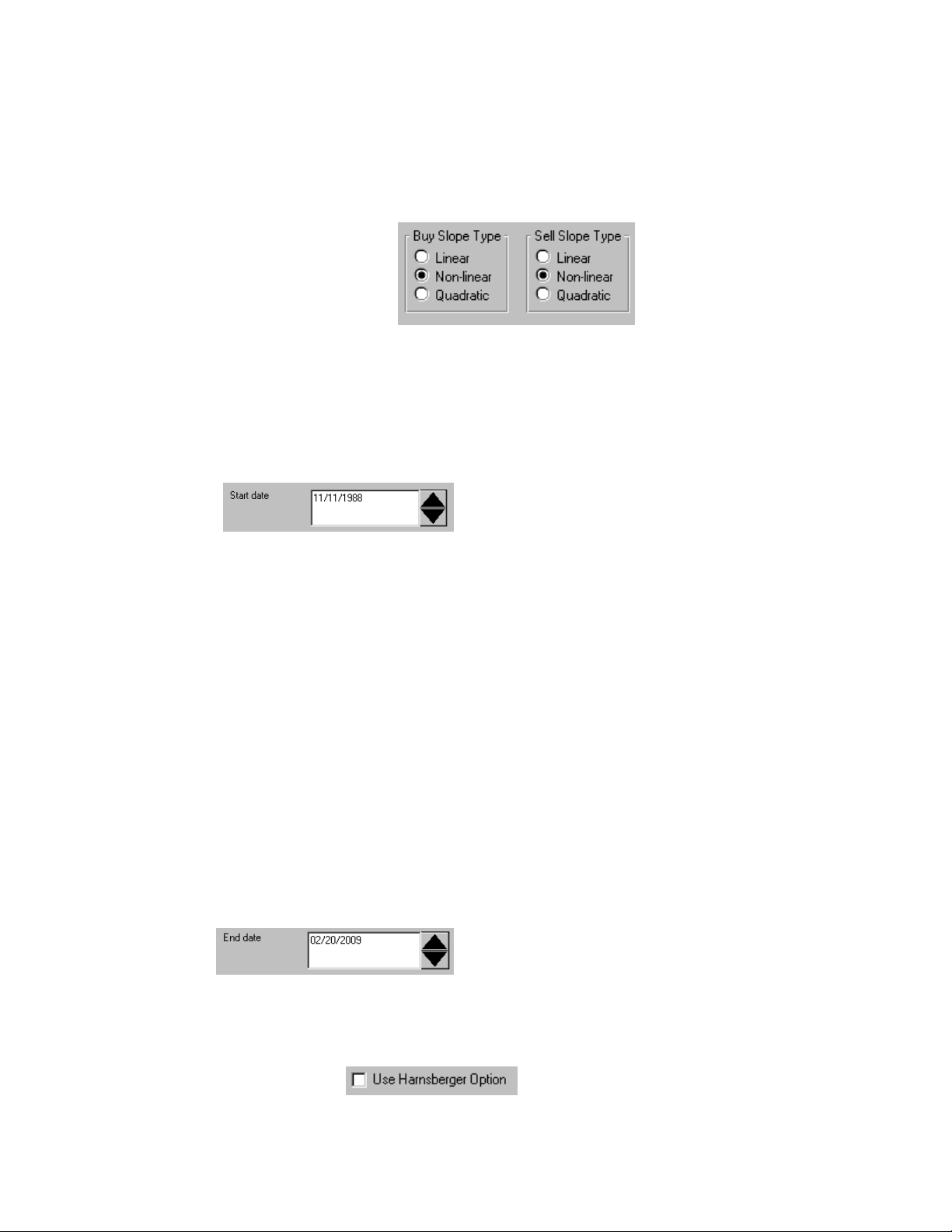

Buy Slope Type/Sell Slope Type

This button selection menu is used to select the type of slope to use when using a curve fit

strategy. Linear, Power (shown as Non-linear) or Quadratic curve fits can be used. Note,

when a strategy is selected that does not use a curve fit this menu “grays out” and prevents selection. If using a curve fit for buying and selling, different types of curve fits can

be selected. See the Appendix A for a description of each type of curve fit.

Start date

This is the date when FastBreak will start testing a strategy. Note: FastBreak uses 8 digits for dates. You must include all four digits in a year, and if a month or day is only

one digit (1-9) you must include a zero in front of the digit. One of the most common

mistakes that will result in run errors is not entering dates correctly. Note: FastBreak

will not let you set a date earlier than the first date data is available in the FastTrack

data base (typically 09/01/1988). Also, because ranking strategies are being used, you

must have data available for ranking proceeding the start date. FastBreak will default to a

start date that allows the number of days required for the maximum ranking period that is

expected in the strategy to be tested. For example, if a maximum ranking period of 50

days is to be tested, FastBreak will verify that there are 50 days of data preceding the Start

Date in the FastTrack data base. If you try to violate these rules FastBreak will “beep” at

you. Note: FastBreak does the same error check for other options, including stops and

filters that require a “period” of data. For example, if using the maximum correlation

check with a period of 100 trading days, then the start date will be adjusted to allow

100 days of data prior to the start date. It is important not to override the FastBreak

default date.

End date

This is the date FastBreak will use to end the testing. The default is the last day in the

FastTrack database.

Use Harnsberger Option

28

Page 29

The Harnsberger Option invokes a strategy developed in cooperation with Fritz Harnsberger, a money manager in Santa Barbara (see Resource chapter). Mr. Harnsberger

noted that the standard FastBreak ranking system is a “sell based” system in that it will

not buy a new fund until a currently held fund drops in relative strength and generates a

sell. Often there may be a fund or funds that are doing extremely well on the buy ranking

but can’t be purchased until a fund is sold.

The Harnsberger Strategy is a “buy based” system in that when a fund not held is highly

buy ranked, it is purchased and replaces the weakest fund held. The advantage of this

method is that a new fund leader is purchased as soon as possible.

Please see the chapter on FastBreak Calculation Details for additional details on the

Harnsberger Strategy.

Use POP (Persistence of Price)

Selecting this box activates the Persistence of Price function. See Appendix A for a complete description of how this function works.

Note: POP will work only with certain ranking options. See the table at the end of this

chapter. You may want to consider excluding Money Market from ranking when using this option because the option will have a tendency to purchase the money market

very often (money market funds never have drawdowns). However, for a more conservative strategy, leave the Money Market in the ranking.

Use Short Trading

Selecting this box activates short trading functionality. Some mutual funds, and stocks,

can be “sold short” and this option allows strategies to be tested that use relative strength

as a buy and sell criteria for short selling. In this case, the fund to be sold short is the one

showing the weakest relative strength. The short position is ended when the fund has

good relative strength compared to the other funds in the trading family.

When this option is selected, FastBreak creates an “inverse” fund for each fund in the

trading family. For example, if the real fund is down 2% one day, the inverse fund is up

2%. This inverse relationship is calculated for each day in the data base. All performance data will be created with the assumption that a “short position” is held in the fund.

Set sell rank = buy rank

If this box is checked the number of days used for a buy ranking period is also used for

the sell rank period. Notice that when this box is selected the “Sell min” and “Sell max”

selection boxes are not available because they become meaningless.

29

Page 30

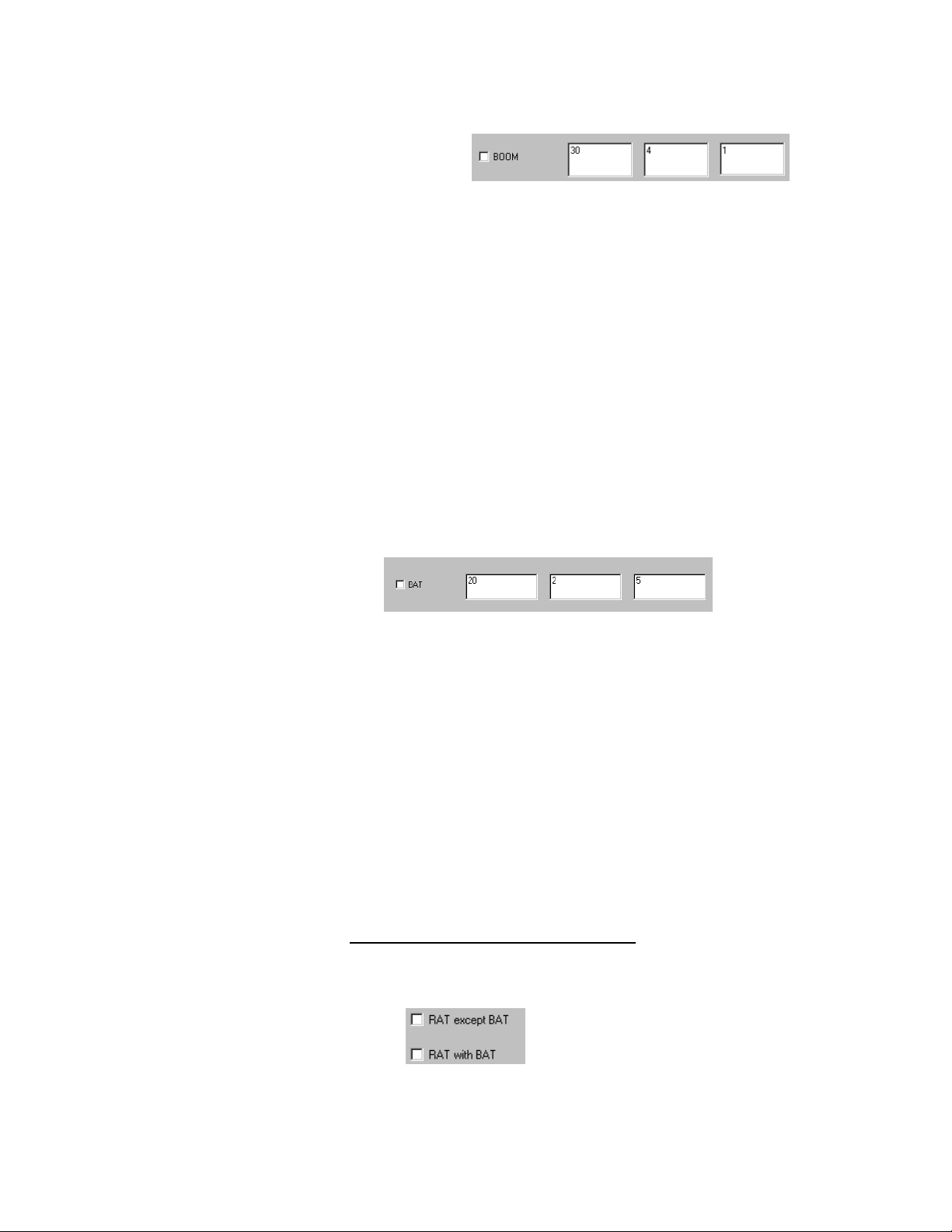

Breakout Optimization Method (BOOM)

This is a very powerful proprietary option available only in FastBreak. The exact process

of how the option works is not fully disclosed at this time because of the proprietary nature. BOOM often allows a strategy to purchase a fund much earlier in an up-trend

breakout than would be captured by standard ranking methods. Note: The BOOM option

will not work with all ranking strategies. See the table at the end of this chapter.

This option is very effective and we recommend that you consider testing with the option.

There are three parameters required. From left to right we will call them Parameter 1, 2

and 3. Note: This option was designed with the intention that the optimizer in Fast-

Break Pro would find optimum parameter values. The method used in BOOM has little intuitive meaning, and suggesting reasonable values without the benefit of the optimizer in FastBreak Pro is very difficult. Here are some suggestions. Value for Parame-

ter 1 is 30, Parameter 2 is 5 and Parameter 3 is 1. If you find that a trading system is buying a fund too early on a breakout and you are buying too many false rallies, consider increasing Parameter 2. If rallies are purchased too late then consider decreasing Parameter

2.

Breakout Above Trend (BAT)

Sometimes a stock (or fund) will have a good positive long term price trend, but for various reasons new buying will come into the stock and an even better trend will be established. This is different from the BOOM option which tries to determine when a stock

that has been falling breaks out to the upside. The parameters used by BAT are very

similar to the way BOOM works. Note: This option was designed with the intention

that the optimizer in FastBreak Pro would find optimum parameter values. The

method used in BAT has little intuitive meaning, and suggesting reasonable values

without the benefit of the optimizer in FastBreak Pro is very difficult. See the guidance

for choosing parameters in the BOOM description above. Please refer to Appendix A

to see a much fuller explanation of how the BAT function works along with graphical

examples. The Appendix also explains how BAT can work in conjunction with Return

Advance to Trend (RAT).

Note: BAT (and RAT) will only work with Linear Slope ranking. See Appendix for explanation. Also, BAT will not work with the ranking Adjust option. Both of these options adjust the ranking periods and if you try to use them together they will conflict.

Return Advance to Trend (RAT)

30

Page 31

Typical FastBreak trading systems usually buy maximum price strength/momentum.

Trading systems can take a different approach and successfully take advantage of buying

temporary price weakness or selling into short term price strength. RAT is an option to

take advantage of these temporary moves. The assumption is that the move is temporary

and the price will revert to trend. Note: Please see Appendix for a much fuller explana-

tion of how RAT works along with graphical examples.

Note: RAT will only work with Linear Slope ranking. See Appendix for explanation.

Note: The next several parameter boxes do not have as much significance for users of

FastBreak Pro as they do for users of the Standard version. The genetic algorithm

optimizer in FastBreak Pro will determine values for all trading system parameters,

including the ranking parameters. However, FastBreak Pro users can use the following parameter options to “fine tune” the ranking periods in their trading systems. See

FastBreak Pro manual for more details.

Buy min, Buy max, and Buy Delta days

These three parameters define all the test cases that FastBreak will evaluate as buy ranking periods. The units are market days. For example, if Buy min = 2 , Buy max = 50,

and Buy Delta = 1, FastBreak will loop through all ranking periods between 2 days and

50 days or 49 test cases. Setting Buy Delta = 3, FastBreak will increment the test cases

by 3 days, i.e., 2, 5, 8 ... days and this can greatly reduce the run time. If Buy min and

Buy max are set to the same value all test cases will be evaluated using that value. Note:

These ranking periods are “market days” and not calendar days. You must understand the difference. This is the same method used in FastTrack for ranking period. If

you want to rank over the past month this will be about 21 market days.

When using a “buy using slope strategy,” these parameters are used to determine the

number of days over which the price data is curve fit. When using UPI or Sharpe Ratio

ranking, these values are the number of market days used to calculate either UPI or

Sharpe Ratio.

Sell min, Sell max, and Sell Delta

31

Page 32

These values are similar to Buy min and Buy max except they set the range for all sell

ranking periods to be tried. If Buy min = 2, Buy max = 50, Sell Delta = 1, Sell min = 2,

Sell max = 50 and Sell Delta = 1, FastBreak will loop through 2401 test cases (49X49).

As noted above, if “Set sell rank = buy rank” is checked, these three parameters are not

used and FastBreak will gray them out. Note: These ranking periods are “market days”

and not calendar days. You must understand the difference. This is the same method

used in FastTrack for ranking period. If you want to rank over the past month this

will be about 21 market days.

When using a “sell using slope strategy,” these parameters are used to determine the number of days over which the price data is curve fit. When using UPI or Sharpe Ratio ranking, these values are the number of market days used to calculate either UPI or Sharpe

Ratio.

Min AT 1, Max AT 1, Delta AT1

Min AT 2, Max AT 2, Delta AT2

Note: These parameters are only visible if Buy and Sell using AccuTrack has been selected. These parameters are very similar to the Buy and Sell parameters just discussed.

They are used to define the range of parameters when testing the AccuTrack trading strategy. AT 1 refers to the AccuTrack 1 Short Parameter, smoothing factor and AT 2 refers

to the AccuTrack 2 Long Parameter, moving average. See the FastTrack manual for a

description of these values.

Min Long, Max Long, Delta

Min Short, Max Short, Delta

Note: These parameters are only visible if Long Gain*Short Gain, Long Rank*Short

Rank, or Short EMA/Long EMA is selected. These parameters are very similar to the

Buy and Sell parameters just discussed. They are used to define the range of parameters

when testing trading strategies that combine short and long term look-back periods.

32

Page 33

Min Period, Max Period, Delta, and SMA Period

Min EMA, Max EMA, Delta

Note: These parameters are only visible if Buy and Sell using General Anchored Momentum has been selected. See Appendix A for a complete discussion of this strategy.

Min and Max Period describe the range of look-back periods to test. Delta is the size of

the increments to use in the testing range. SMA Period is the Simple Moving Average

Period used to smooth the price data centered on the look back period. Min and Max

EMA describe the range of Exponential Moving Average Periods used to smooth the current price.

Min Buy Period, Max Buy Period, Delta, and EMA Period

Min Sell Period, Max Sell Period, Delta

Note: These parameters are only visible if Buy and Sell using Most Anchored Momentum has been selected. See Appendix A for a complete discussion of this strategy. Min

and Max Buy Period describe the range of look-back periods to test for buying a fund.

Delta is the size of the increment to use in the testing range. Min and Max Sell Period

describe the range of the look-back period to test for selling a fund. Delta is the size of

the increment to use in the testing range. EMA Period is the Exponential Moving Average to use to smooth the most current price.

33

Page 34

Buy Min, Buy Max, Buy Delta, Alpha index

Sell Min, Sell Max, Sell Delta

Note: These parameters are only visible if Buy and Sell using Alpha has been selected.

See Appendix A for a complete discussion of this strategy. Min and Max Buy Period describe the range of look-back periods to calculate alpha for buying a fund. Delta is the

size of the increment to use in the testing range. Min and Max Sell Period describe the

range of the look-back period to calculate alpha for selling a fund. Delta is the size of the

increment to use in the testing range. Alpha index is the index to use to calculate alpha.

The default is the S&P 500 index (SP-CP in FastTrack); however, any index, fund, stock

or FNU file can be used. Note: You must select an index that is available from the Start

Date plus going back additional days to account for the maximum ranking period you

expect to test.

User Min Hold

This is the minimum number of days to hold a fund that has been purchased. Some funds

have short term trading fees if the funds are held less than a prescribed minimum number

of days. Setting Min hold to this number will force the trading strategy to hold the fund

for at least this minimum number and avoid the trading fee. Note: User Min hold is in

calendar days not market days.

There are two situations when Min hold will be violated. First, if a signal file is used and

a signal is given to sell, all held funds will be sold into the money market fund even if the

funds have been held less than the minimum number of days. Second, if a fund hits one

of the stop loss functions, the fund will be sold even if held less than the minimum number of days.

STRF Min hold

34

Page 35

This screen option allows you to select the Short Term Redemption Fee (STRF) minimum holding period. If the funds in your family apply a redemption fee if the fund is

traded within a minimum number of days, then use this option. For example, the Fidelity

Select funds have a 0.75% fee if traded within 30 days.

Short loss

This is the percent cost if a fund is sold before it is held the “STRF Min hold” number of

days. For example, some funds have a transaction fee of 0.75% if held less than 30 days.

FastBreak will subtract this fee from a sell trade for a fund that is held less than the

“STRF Min hold” period. The one exception is for the money market fund where Short

loss never applies. Short loss is input as a positive number.

Delay .

Note: Most users will use a 1 day delay. The zero day delay option is a bit archaic at this

point, but may be useful for those who trade stocks/ETFs at the next day open. The zero

day delay option was initially added at user request when Fidelity Select funds had

hourly pricing. Users wanted to trade the Select funds at the next day 10:00 am pricing

and the assumption was that the 10:00 am pricing would be close to the previous day

close. FastBreak assumes you can buy and sell funds on a given day at the 10:00 price

that is equal to the previous day’s closing price. The typical FastBreak user will update

FastTrack each evening and then run FastBreak. If a trade signal is given, the trade

would take place at tomorrow’s closing price when using mutual funds. This would be a

1 day delay. However, if the investor is trading stocks or ETFs then the investor may determine that tomorrow’s 10:00 am trading price may be close to today’s closing price.

FastBreak considers this a 0 day delay. Note: FastBreak uses the FastTrack data base

which contains ONLY closing prices. Therefore, FastBreak has no actual knowledge

of the trading prices other than daily close. Using the 0 delay is an estimation, and it

does not change the actual day that the trades are made.

FastBreak will only support delays of zero or one market day.

Top %

This value determines when to sell a fund or continue to hold. The value input is the percent of all funds available in the trading family that a held fund needs to sustain in order

to continue to be held. For example, assume a trading family containing 28 funds, and

each day all the funds are ranked over some time period. The funds are ranked in order of

strongest to weakest. If Top % is set to 50, then FastBreak will continue to hold the fund

35

Page 36

while it is in position 1-14 (Top 50%) in the rank list. If the fund falls in the range of 15

– 28, it will be sold. If the trading family contains 30 funds, but only 24 are available

early in the testing period, Top% is applied to 24 during that early time period. See FastBreak Calculation Details chapter for additional information.

# funds

This is simply the number of funds the investor wants to hold at any given time. Adding

additional funds to a strategy usually hurts return performance, but can decrease volatility

and reduce drawdown.

Use Log Trendline

Trendline generally come in two “flavors” e.g., logarithmic or arithmetic, and FastBreak

has both available. There are advantages and disadvantages to each. Logarithmic are

generally recommended, but see FastTrack Help for more information. If you check the

Use Log Trendline box then FastBreak will use logarithmic trendlines for BOTH the

Trendline Buy Filter and the Trendline Sell Stop options.

Trading Days

Use this option to determine how often you want your strategy to trade. Selecting Daily,

the most common choice, will allow the strategy to trade on any day. Selecting Weekly

will only allow the strategy to signal trades on Friday close only. Many users like this

option because the weekend is the only time when they have an opportunity to look at

their investments. Any signals given would then be executed on Monday. User Defined

Days allows the user to select any number of calendar days. For example, some users

only like to trade on an infrequent basis because of investment plan restrictions, for example. If you are interested in trades taking place only about one per month then use a

value of 30-31 days in this field. Note: This value is input in calendar days and not

market days. Also, this option does not affect the stop loss or signal file trades. A trade

due to a stop loss or signal file trade can be generated on any market day.

Use signal file

36

Page 37

Checking this box will open a file selection menu, and a standard FastTrack signal file

can be selected. The signal files are usually in a separate subdirectory in the FastTrack

directory. This signal file requires a “buy” before any fund, except money market, can be

purchased. When a signal file gives a “sell” funds will be sold ignoring all other rules

including the Min hold rule. All positions will be put into the selected money market

fund. Using a signal file allows the user to include market timing in a strategy. The percentage of the investment transferred into money market can be controlled using the

“Market Risk” box that appears. See the next section for a description of this option.

Checking the Use Signal File box will produce the following standard file selection

menu:

Notice that all the .sig files in the FastTrack sig directory are listed. This menu allows

you to change the Drive and Directory where your .sig files are stored. We recommend

that you keep them in the sig subdirectory in FastTrack. You can change the file type to

something other than .sig but, again, we recommend staying with the standard defaults.

Select a signal file with a left mouse click on the file name.

Market Risk

The option appears when using a signal file. When set to 0%, the most common user option, all funds will be transferred to the money market fund when the signal file gives a

sell. If set to 50% half of all funds will be transferred to the money market fund when the

signal file gives a sell. Any value between 0 and 100% can be used. Values other than

0% would be used for an investor who wants to reduce market exposure during a signal

file sell but keep a portion of funds invested. There is additional information on this option in the FAQ chapter. Note: When using this option with a value greater than zero, it

is very important that the Start Date occur during a time period when the signal file is

on a buy signal. FastBreak Pro users should also pick a date for the out-of-sample

start date that corresponds to a time period when the signal file is on a buy. If using a

market risk of zero (the most common option for most users) the start dates do not need

to be coordinated with signal buy periods.

37

Page 38

Balance Multiple Funds

This menu item allows the user to “Balance” the money among accounts if multiple funds

are being held. See the chapter on FastBreak Calculation Details for a detailed explanation of this feature. It is very important to understand this item if a fund other than an actual money market fund is selected as the “Money Market Fund.” Note: The balance op-

tion will not work if using a signal file and a market risk greater than zero.

Use Trade Signal

This option is for those users who want to trade only on specific dates. This option allows a user to build a signal file that forces a very specific trading system. For example,

if a user wants to test a strategy that trades only on the first day of each month then the

user will build a signal file that contains those dates. The format of this signal file is

nearly the same as the standard FastTrack signal file:

"314Monthly signals"

T,09/01/88

T,10/03/88

T,11/01/88

etc.

Only “T” (for Trade) values are used and not “B” or “S” values, as in the standard signal

file.

This file can be built in a text editor or built using the FastTrack signal file process and

then modified using a text editor.

Note: The dates used need to be market days to activate a trade. If the date is a weekend or market holiday, then the date will be ignored. Notice in the above example that

the 3rdof October is used rather than the 1st. This is because the 3rdis the first trading

day of October in 1988.

Other uses for this option are left to the imagination of the user.

38

Page 39

Dynamic Adjustment of Ranking Periods and Top%