DIGNET BC365 User Manual

Created by:

DESCRIPTION OF LOCALIZATION

FUNCTIONALITIES ON BC365

19.06.2020.

Table of Contents

1 STANDARD PACK FEATURES ............................................................................... 1

1.1 VAT forms (PP PDV, POPDV) ......................................................................... 1

1.2 VAT Forms with option for import to e-Tax service ........................................... 5

1.3 VAT books (Issued invoice / Received invoices) ............................................... 8

1.4 Open entries of customer and vendor (IOP) .................................................. 10

1.5 Customer or vendor detailed trial balance ..................................................... 13

1.6 Item card report ........................................................................................ 15

1.7 Trial balance ............................................................................................. 16

1.8 Printout of sales documents according to Serbian regulations .......................... 19

2 ADVANCE PACK FEATURES ............................................................................... 20

2.1 Integration with banks ............................................................................... 20

2.2 Modified prepayment invoices and credit memos ........................................... 22

2.3 Exchange rate download ............................................................................. 23

2.4 Posting Compensation Proposal ................................................................... 23

3 Additional report features ................................................................................. 24

1 STANDARD PACK FEATURES

1.1 VAT forms (PP PDV, POPDV)

Taxpayers have obligation to regularly submit VAT forms. Forms should be submitted

monthly.

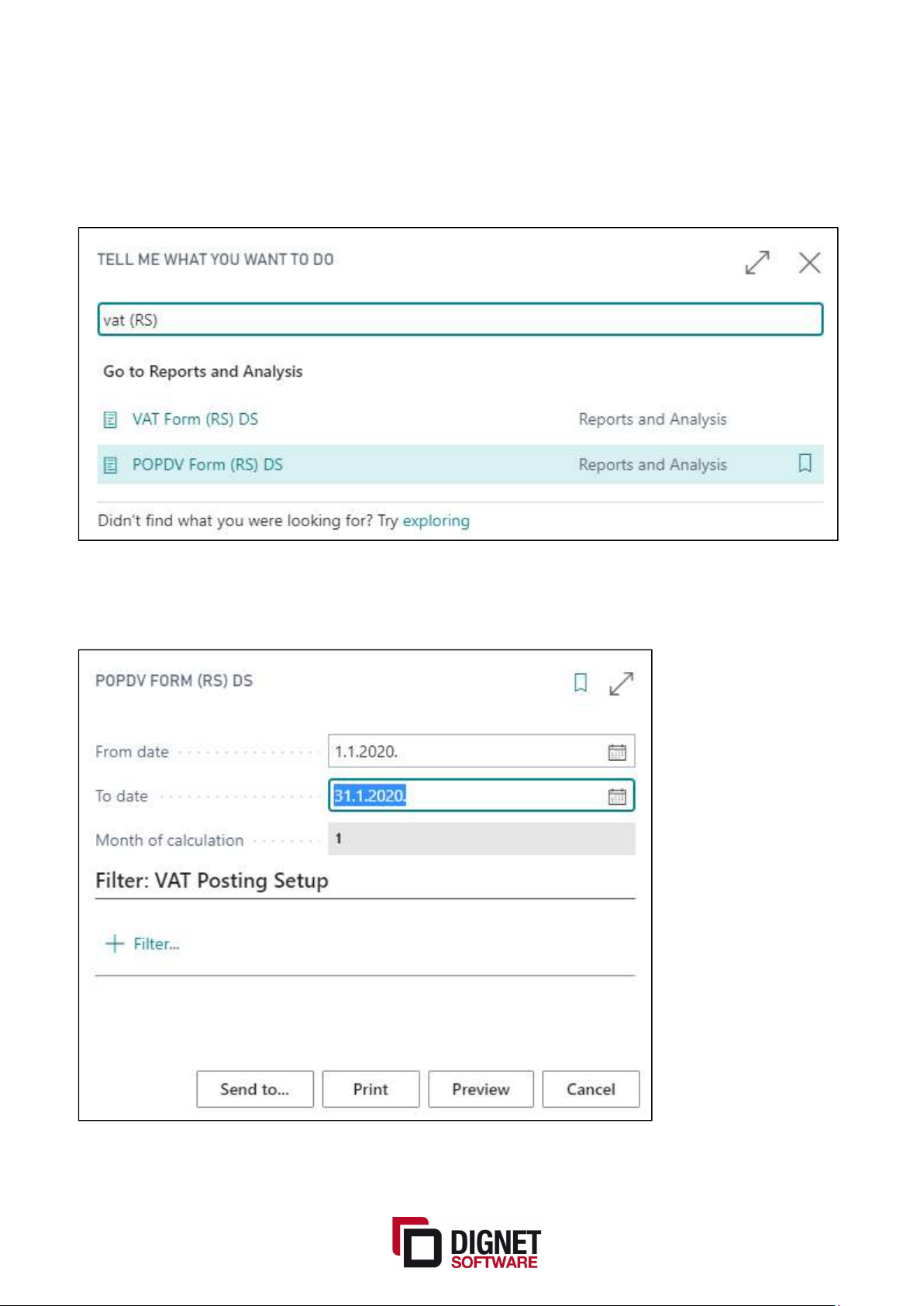

The VAT forms can be created automatically from NAV. In Search bar you should type in

“VAT (RS)”. List of VAT reports that matches this description will appear.

1.1.1 VAT Statement (Form) – PP PDV

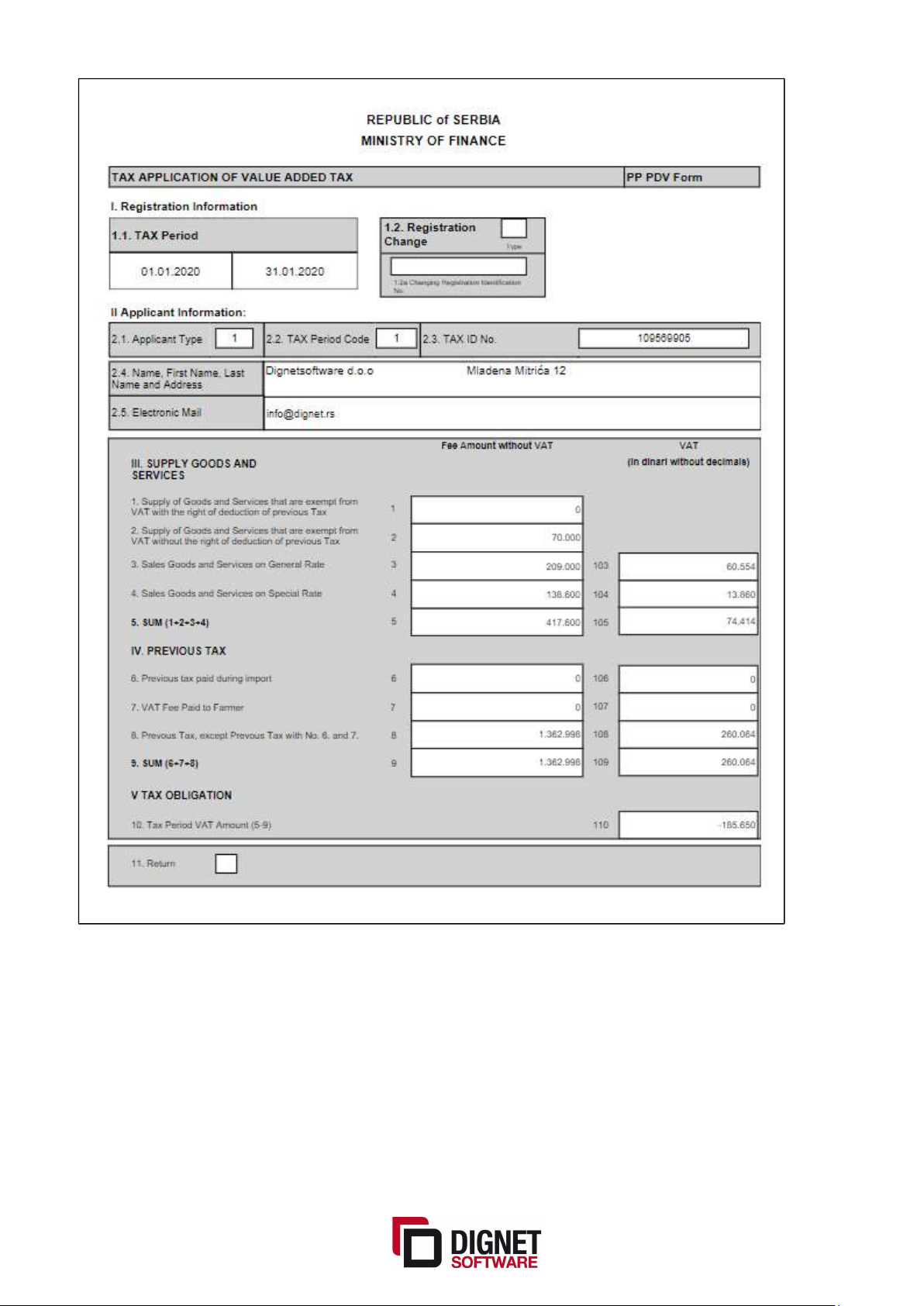

The taxpayer should, for the taxation period, determine the VAT liability and state it in the

VAT statement, which lists all the information required for the calculation.

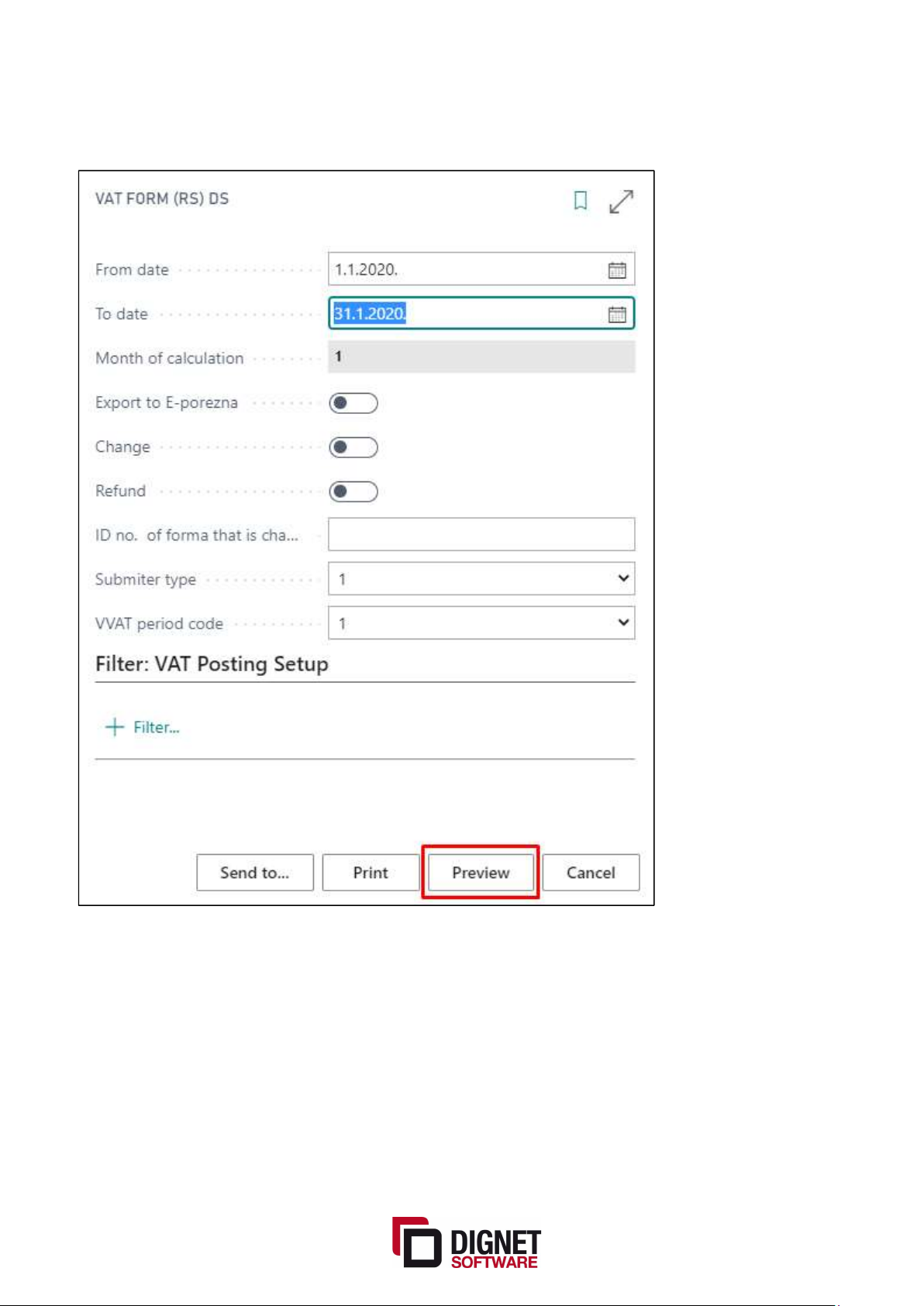

Select “VAT Form (RS)” from the list and click on it. New window will automatically open.

Page 1 of 24

Here you need to enter taxation reference period. Optionally you can enter other relevant

data such as Return or Deposit from previous period, etc.

Once you entered reference period click Preview.

VAT form will be filled with VAT entries created in reference period you entered before.

Page 2 of 24

Page 3 of 24

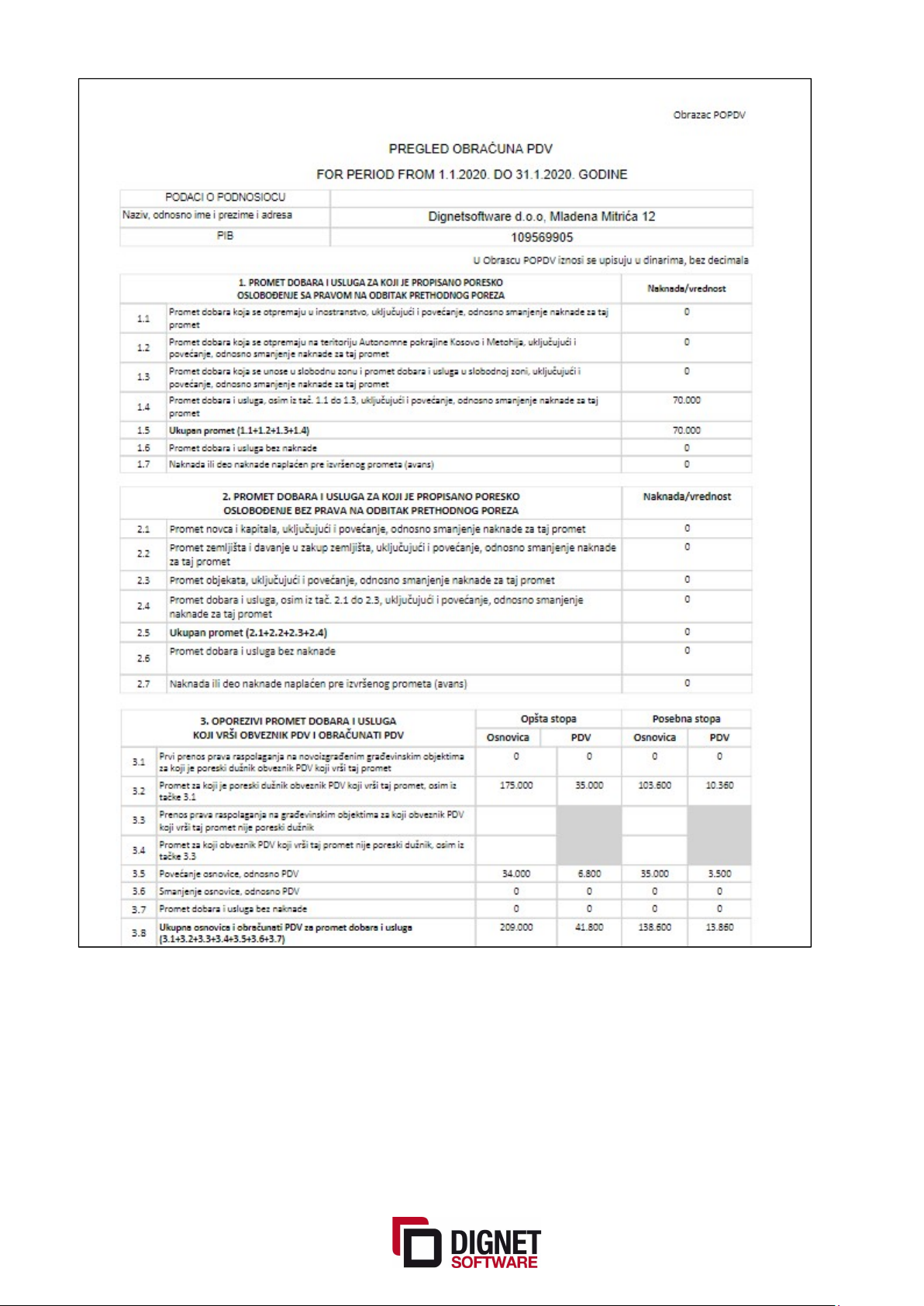

1.1.2 POPDV

An integral part of the VAT Statement is the POPDV report through which some additional

informations about VAT transactions are given.

Select “VAT report PDV-S DS” from the list. New window will automatically open.

Taxation reference period in this window is automatically filled with previous taxation

period, since current period is not finished yet. Click Preview to create a report.

Page 4 of 24

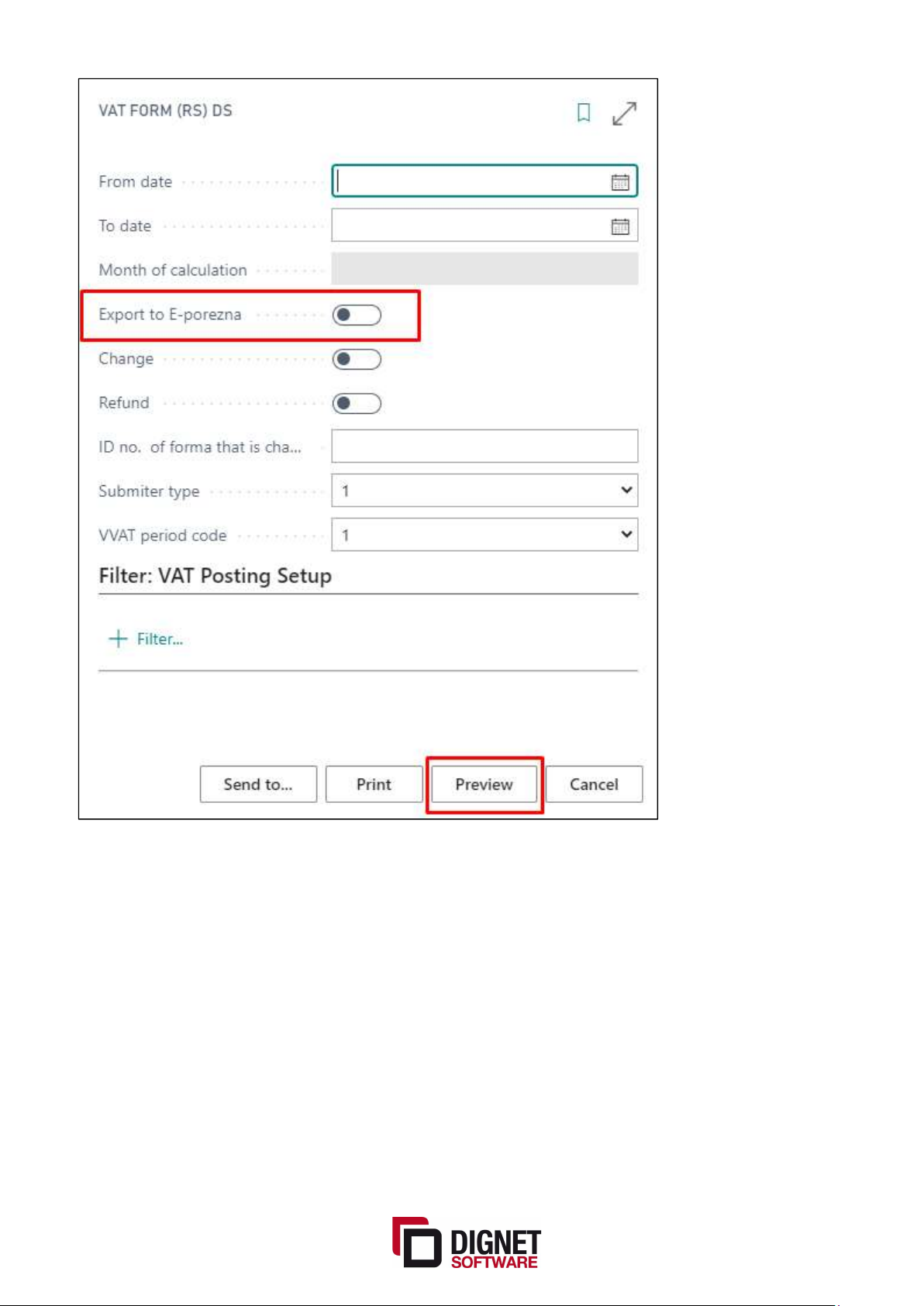

1.2 VAT Forms with option for import to e-Tax service

VAT form (PP PDV) have the option to be saved as e-Tax Import XML file to facilitate their

timely and accurate submission.

If you want to create xml file to be uploaded to e-Tax service, you should mark field Export

to E-Porezna (E-Tax) and then click Preview. The field is located on request page of VAT

form report

Page 5 of 24

Required elements for importing data into e-Tax are filled directly from NAV when creating

XML file

Page 6 of 24

Loading...

Loading...