OVERVIEW

Financial institutions, banking offices, credit unions, merchants, and other

intermediaries are adopting new methods for processing check payments and

deposits as a result of the Check 21 Act. The Check Clearing for the 21

or Check 21 Act, was signed into U.S. law on October 28, 2003. Designed to foster

innovation in the American payments system, Check 21 enhances efficiency by

reducing many of the legal impediments to check truncation.

Prior to Check 21, checks were processed in a centralized manner: Once received

at bank branches, ATMs, merchants, intermediaries, etc., checks were physically

transported to an operations center for back-end processing where functions such as

encoding, proofing, balancing, and sorting were performed before being sent to the

Federal Reserve for final processing. This was a lengthy and costly manual process,

and checks were physically returned to the customer with their monthly statements.

Today, with the advent of imaging technology and the enactment of Check 21, checks

no longer require manual transportation and central processing. Instead, check

t

s

Century Act,

images can be sent electronically, either to a central processing bank or directly to

the Federal Reserve Bank with an Electronic Cash Letter (ECL).

The Canon CR-180 and CR-55 Check Transport devices, together with the featured

software applications listed in this brochure, are the vehicles driving the adoption

of Check 21, enabling financial organizations of all sizes to gain the benefits derived

from decentralized check image processing.

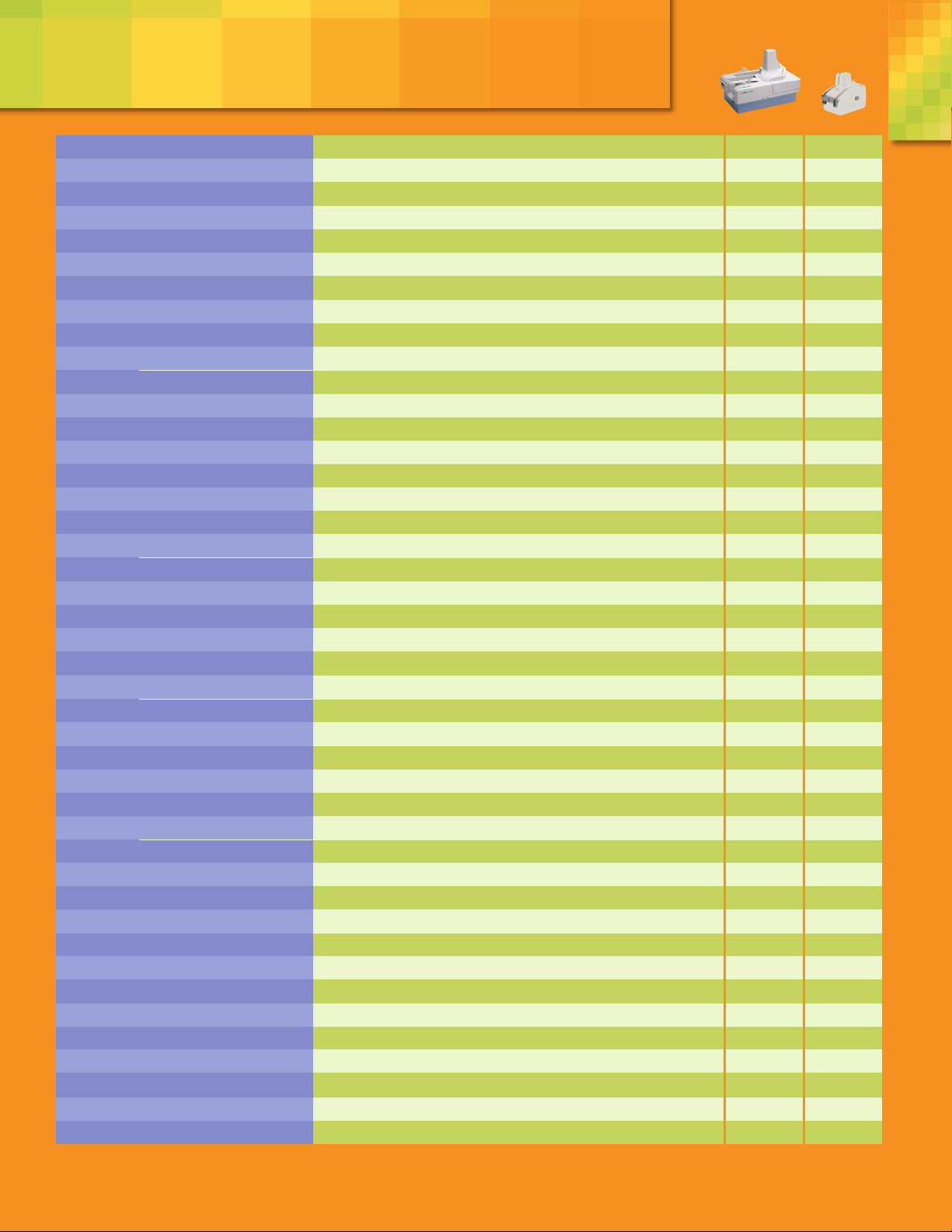

Compatibility T able

s a compatibility list that is consistently being updated. For the most current list, please visit Canon U.S.A.’s Web site

i

at

www.usa.canon.com, and click on the CR-180 orCR-55 product page to find the listing.

with many of the industry’s leading Check 21 solution providers. This

COMPANY PRODUCT CR-180 CR-55

Canon’s CR-Series CheckTransports have been tested for compatibility

dvanced Financial Solutions, Inc. ImageVision •

A

nderson Imaging Group AIG Scan •

A

perta VPTA+, VRPA+ ••

A

quracy LLC AQURIT

A

udioTel Corporation Genesys Imaging •

A

utomated Systems, Inc. Insite Check Imaging ••

A

ankWare ImageCentre •

B

luepoint Solutions, Inc. C21Capture™ •

B

®

•

•

Business Imaging Systems, Inc. Mobilis Professional, MasterScan Check •

C&A Associates, Inc. ImageMaster Suite (ImageChex Express products) ••

Captovation Incorporated Captovation CheckCapture ••

Carreker Corporation Source Capture Suite/Corporate Capture™, Source Capture Suite/Branch Capture™ •

ChexDirect, Inc. ChexDirect ARC •

Community Banking Systems, Ltd. net.check •

Contact Innovations, Inc. ImageArchive Check/Cheque •

COWWW Software COWWWScan •

Data Financial Business Services, Inc. ChekScan Pro, Draft Conversion Plus ••

Datamonics Check Pro 21

™

•

DocuWare Corporation DocuWare •

EFC Systems, Inc. DigiFunds Pro, DigiFunds SE (CR-55 only) ••

Financialware, Inc. Active: View

Fiserv Imagesoft Nautilus

®

®

QuickCapture

™

• •

••

Genikon Corporation Archive Plus •

InfoDynamics, Inc. INTACT, inCHECK

™

•

Integrated Financial Systems, Inc. OdinCheck-21 •

Integrated Scanning of America, Inc. IsaIms, IsaIms.NET •

Jaguar Software Development, Inc. MirrorImage ••

™

Jara Diversified Services Draft Conversion Plus

aserfiche Laserfiche •

L

, Draft Control Processing System •

MICR Automation, Inc. MICR Image 21 •

National Source One LLC GoldCheck21 •

Northwest Bank Technology, Inc. Mips Image Capture, Branch Capture ••

Pegasus Imaging Prizm IP, Prizm IQA, ScanFix, Prizm Viewer •

recision Software Technologies, Inc. EZ-Scan

P

™

•

•

PSIGEN Software, Inc. PSI:Capture for Checks ••

Reed Data, Inc. 2020DOC

®

•

ScanPoint, Inc. EasyFile Check21 •

Software Earnings First Touch iCapture •

®

SortLogic SYSTEMS, a division of Omni-Soft, Inc. SortLogic

Remote Deposit Capture, SortLogic®DPX Transport Interface •

Technology Management Resources, Inc. Citation e-Remit ••

Turbotransactions, Inc. CheckData ••

Vsoft Corporation eDesk Capture •

Wausau Financial Systems Optima3 •

Disclaimer: Canon presents this table to illustrate third-party companies that have independently tested Canon’s CR-180 and CR-55 Check Transport devices for compatibility with their products. Canon does notwarrant or

guarantee these third-party solutions in any way. Canon has no responsibility for use of these third-party productsand solutions or their compatibility with Canon products in any way.

Note: If a scanner does not show a circle with a particular software, it simply means that testing is currently under way. For the mostup-to-date list, please visit Canon U.S.A.’s Web site at www.usa.canon.com, and click on

the product page of the CR-180 or CR-55 Check Scanner.

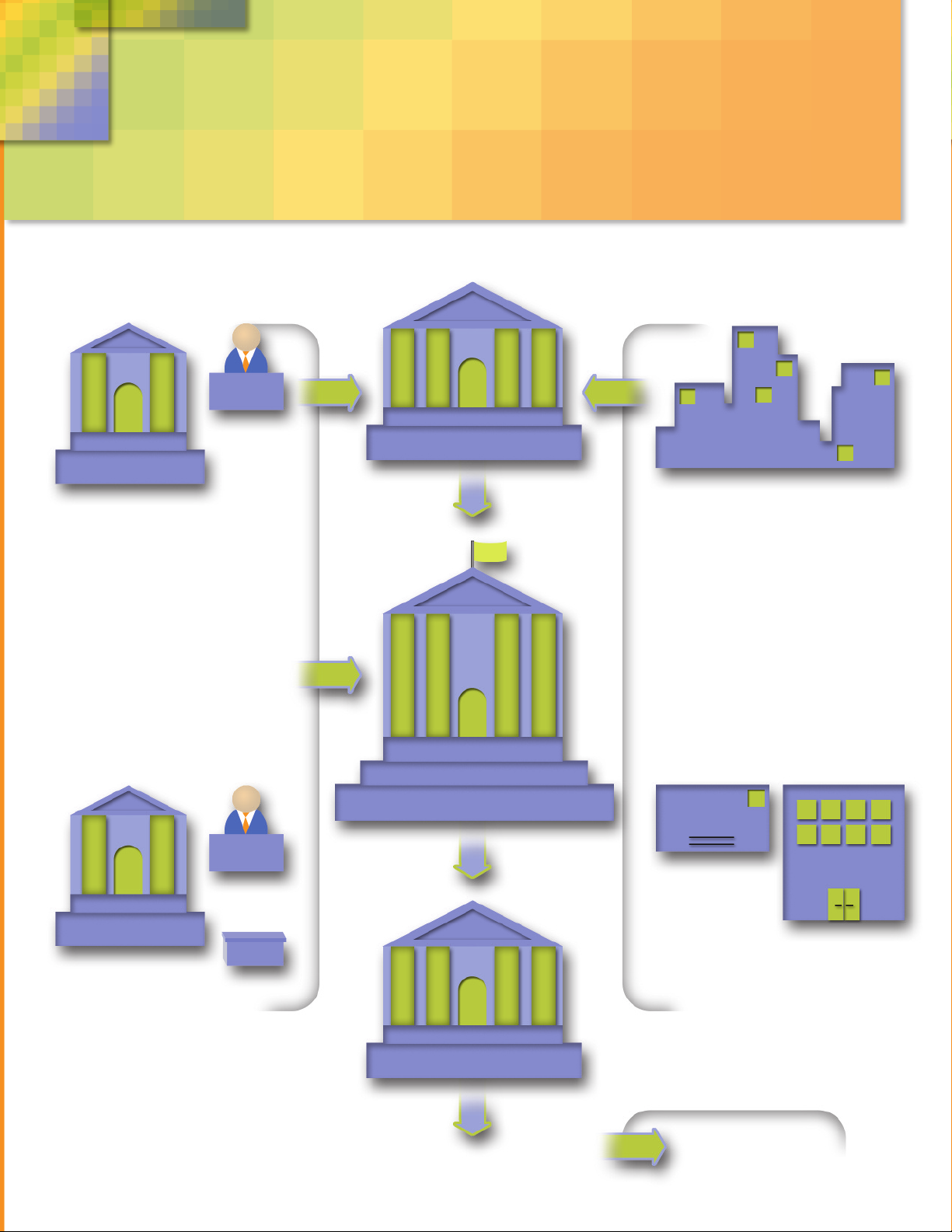

Check 21 Workflow Applications

heck 21 facilitates check truncation by creating a new

C

negotiable instrument called a substitute check or Image

Replacement Document (IRD) that permits banks to truncate

original checks, to process check information electronically, and to deliver

substitute checks to banks that want to continue receiving paper checks.

1. Front Counter/

Teller Capture

Teller

• CR-55 at Teller

• 3,000 items/day

Central Processing Bank

Bank Branch

• Capture Image at Point of Presentment

A teller receives a check deposit or payment at

a local bank branch. The check is scanned at

the point of presentment and the bank uses

a check processing software solution with the

CR-55 to send the image of the check to a

central processing bank or directly to the

Federal Reserve Bank for processing.

The following illustrations describe four current

check payment trends in the U.S. market: 1) Front

Counter/Teller Capture; 2) BackCounter/Branch

Capture; 3) Remote Deposit/Merchant Capture;

and 4) Remittance/Lockbox Processing.

3. Remote Deposit/

Merchant Capture

Merchants

• Retail Stores

• Utilities

• Accounting Offices

• Mom and Pop Shops

• Doctors’ Offices

Customer-facing businesses—such as retail

stores, utilities, and doctors’ offices—accept

checks for payments. Depending on the volume

and if they process the checks at the point of presentment or in batches, the business can utilize

either the CR-55 or CR-180 to transmit received

checks electronically to their bank for deposit.

• Any Business

Accepting Checks

• CR-180 or CR-55

(depending on volume)

2. Back Counter/

Branch Capture

Teller

• CR-55

• 3,000 items/day

Bank Branch

• Capture Image at Point

resentment and/or

P

of

as Batch Processing

At larger bank branches, the tellers accept the

checks at the front counters and could scan them at

this point of presentment with the CR-55, or they

may batch scan them at a back counter at specified

times during the day. Using the check processing

software with the CR-180 or CR-55, the images are

then sent either to a central processing bank or

directly to the Federal Reserve Bank for processing.

• CR-180

• 20,000

items/day

Federal Reserve Bank

Paying Bank

Customer Statement

4. Remittance/

Lockbox Processing

Postal

Letter

• Batch Processing

•

CR-180 or CR-55

(depending on volume)

for credit cards, utility bills,

s

lip

s

t

n

yme

a

P

tc. are usually sent through the mail with a

e

check to an intermediary facility where they are

received in a “locked box.” Together, the check

nt slip are scanned and balanced

yme

and pa

using the CR-55 and/or CR-180 systems.

KEY

=

Image

k

hec

C

Electronic Cash Letters

Intermediaries

s and

GLOSSARY

Automatic Clearing House

electronic high-volume, low-value payments.

pplication Service Provider(ASP)-A service provider will actually

A

host a remote deposit application for a bank. A remote deposit ASP

will deliver the remote deposit application services to the bank’s

customers, receive the check image data from those customers,

and transmit the data to the bank.

BOFD

- Bank of First Deposit.

Courtesy Amount Recognition (CAR) - The ability to automatically

locate, analyze, and recognize handwritten or machine-printed

courtesy amounts on documents. The Courtesy Amount is the

check value written in numeric form.

Centralized Capture

either single or regional, where all checks deposited at the

bank are transported to be processed and cleared.

Check 21

into United States law on October 28, 2003. The law facilitates check

truncation by creating a new negotiable instrument called a substitute

check or Image Replacement Document (IRD) that permits banks to

truncate original checks, process check information electronically,

and deliver substitute checks to banks that want to continue

receiving paper checks.

Check Truncation

the clearing process and not returning it with the monthly statement;

typically confined to credit unions and money markets. (The term

“truncation” is incorrectly used in the “Check Truncation Act”; the

term should actually be “conversion” or the “Check Conversion Act.”)

Distributed Capture

of deposit; includes teller, branch back office, remotely at a business

entity location, and at an ATM.

Electronic Check Presentment (ECP)

an electronic payment to be debited from a customer’s bankaccount

and transferred to a business’ bank account. It is often used for

recurring payments and for businesses wanting to simplify and

reduce the cost associated with collecting payments from customers.

- The Check Clearing for the 21st Century Act was signed

(ACH)

- Networks in the U.S. used to clear

- Banks will have operational facilities,

- The practice of holding a check at the last point in

- Capturing the data from a check at the point

- A service that provides for

About the CR-180

The Canon CR-180 device is a durable,

high-speed back counter scanning system

used by banks, credit unions, check-clearing

houses, and large retail operations. With duplex

anning speeds of 180 checks per minute*

c

s

and highly accurate MICR read capabilities, the CR-180 is one

of the fastest and most affordable compact devices in its class.

R-180 device supports an average daily volume of up to

The C

20,000 checks, and batches of up to 200 items can be scanned

simultaneously and automatically sorted to two different output

pockets using preconfigured rules based on the MICR data on the

checks. Featuring a built-in jogger unit and prescan imprinter,

the CR-180 system delivers outstanding functionality and value.

Encode

- To place magnetic ink characters on the face of an item.

Usually refers to the dollar amount.

ndorsement-Check payment approval and audit information

E

applied to the rear of a check. The payee will sign the check for cashing

or deposit. The depositing institution will print their name, location, and

date information when deposited. Automaticequipment will apply date

and reference numbers on the check for auditing and research purposes.

Float

- The dollar amount of items outstanding and in the process

of being collected by banks; also called uncollected float.

Image Replacement Document (IRD)

image copy (as a paper reproduction of the original check) that may,

under certain legal arrangements, be the practical and legal equivalent

of the original check. Also known as Substitute Check, the term IRD

is used by the Accredited Standards Committee in the technical

specification for substitute checks.

Legal Amount Recognition

written/printed in words from a check image.

Lockbox

- A bill payment is typically addressed to a Post Office box

number. The address will actually be a service provider for the biller,

who will then receive and process the payments.

Lockbox Check Conversion

received in the mail by a biller into electronic items.

Magnetic InkCharacter Recognition (MICR)

at the bottom of a check or other financial documents by equipment using

ink with iron-oxide pigments capable of being magnetized. Transports

can either read these characters magnetically (actually “charging” the

characters) or optically. A magnetic read of the characters is normally

more accurate. The font style for MICR characters is called E-13B.

Remote Capture

A business will use remote deposit to capture and transmit their

received checks over the Internet to their bank for deposit.

- Capturing the data at a business entity location.

(LAR)

- The process of converting checks

- A substitute machine-readable

- Technology to read the amount

- The font that is imprinted

About the CR-55

Whether deployed at the teller line in bank

branches or commercial/retail locations, the

ers the perfect combination

-55 device of

R

C

of functionality, size, and speed for distributed

check imaging applications, including branch

emote deposit. For unmatched image reproduction,

ure and r

apt

c

he user-friendly CR-55 device offers a choice of high-quality scan-

t

ning in black and white, grayscale, or 24-bit color and resolutions

o 300 dpi. The

up t

of

images of both sides of checks at a fast 55 check-per-minute*

speed. A built-in prescan imprinter comes standard and the device

ures infrared double-feed detection for dependable paper

at

e

also f

feeding and image capture. Designed for a wide range of check

processing environments, the CR-55 device requires minimal

g and ef

ainin

tr

CR-55 device captures MICR data along with

ortless operation.

f

f

* Examples based on typical settings, rated in checks/images per minute with U.S. personal checks @ 200 dpi in black and white or grayscale.

Loading...

Loading...