AICPA Town Hall User Manual

April 8, 2021

© 2021 Association of International Certified Professional Accountants. All rights reserved.

#AICPATownHall#AICPATownHall

AICP A Town Hall Agenda

1. Opening Comments & Policy Maker Update

2. Relief Programs Discussion

• Final Stretch PPP, ERC, EIDL, SVOG, RRP

3. Hot Tax Topics

4. Open Forum and Closing Remarks

2

2

Webinar Housekeeping Particulars:

• Earn CPE credit by responding to 75% of attendance pop-ups

• You can als o use the bottom tool bar to download material s and ask questions

• Please refresh browser if video freezes

• To access links in t he deck, download t o your local computer

#AICPATownHall

Presenters

3

3

Erik Asgeirsson

President & CEO

CPA.com

AICPA Subsidiary

@erikasgeirsson

Kristin Esposito

CPA

Dir.,T ax Policy & Advocacy

AICPA

Mark Peterson

Executive Vice President,

Advocacy

AICPA

Lisa Simpson

CPA, CGMA

VP, Firm Services

AICPA

@lisatsimpsoncpa

Cari Weston

CPA, CGMA

Director, Tax Practice & Ethics

AICPA

@cariwestoncpa

#AICPATownHall

Engagement With Stakeholders & Broad Ecosystem

4

4

Government

• Treasury, IRS

• SBA

• Policy Makers

Business

Advisors

• 44K firms

• Other advisors

• AICPA Role

• Payroll Processers

• Tax & G/L data

• Other data

#AICPATownHall

#AICPATownHall

Information

Providers

Lenders

• Banks

• Credit Unions

• Fintech lenders

Lawmakers Worried

about Small Business

Impact

• House Legislation

• Statements by Chairs of Small

Business Committees

• Statement from Chairman of

Ways and Means Oversight

Committee

5

Senate Finance Committee

Hearing

#AICPATownHall#AICPATownHall

• Senators eager to ask tough

questions

• Tyranny of the Calendar

Policy Maker Key Topics

• B iden $2.3 trillion infrastructure, tax plus plan

• Congressional oversight

• PPP Schedule C retroactive

6

#AICPATownHall

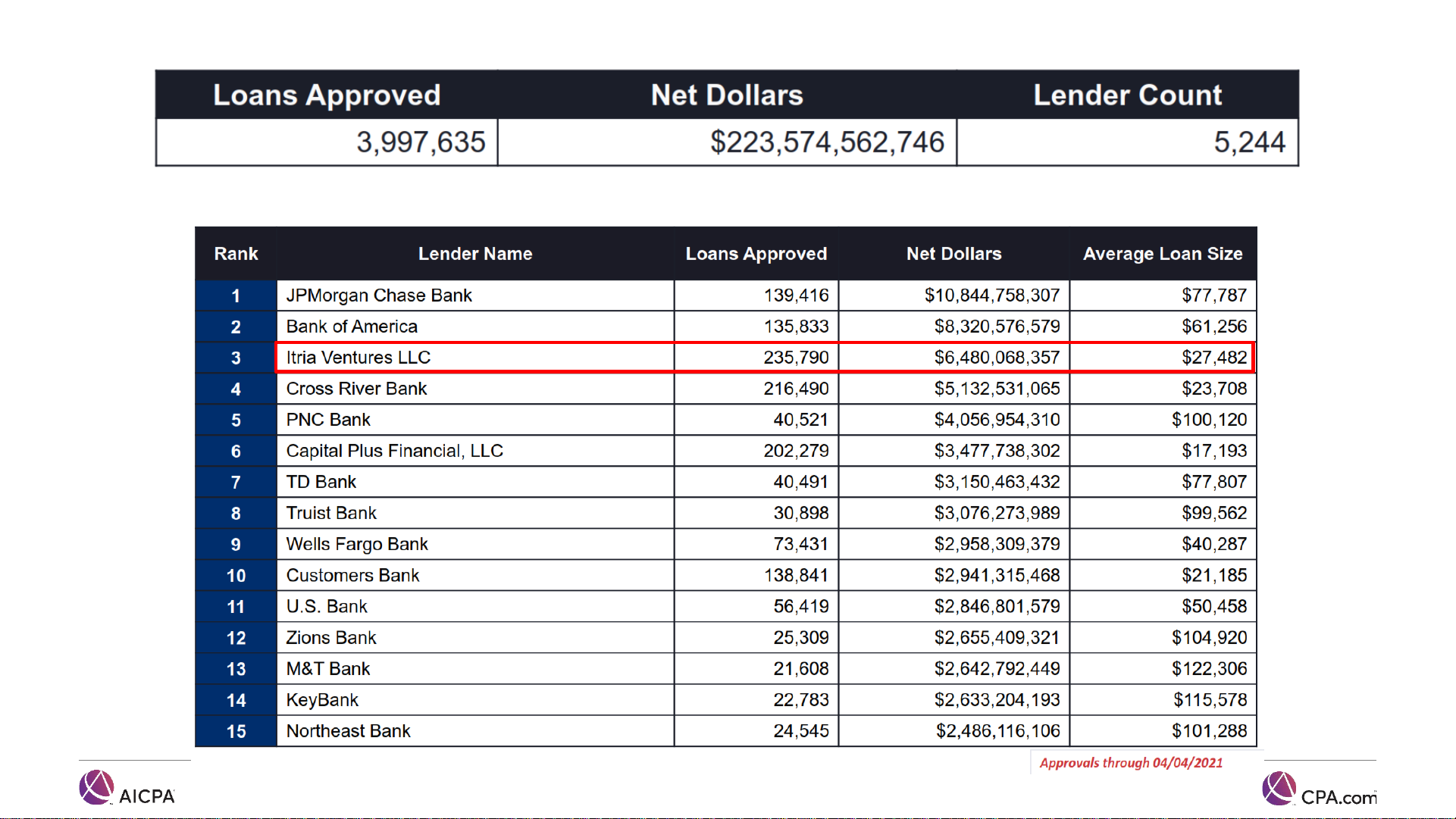

Summary of 2021 PPP Approved Lending as of 4/4/21

Top PPP Lenders of 2021 PPP

Biz2Credit Financial Subsidiary

7

#AICPATownHall

PPP Extension: Lender & Firm Activities

• Lender resolution of PPP application error codes

• Ongoing improvements, but still t housands of apps held up

• More capabilities being offered to resolve error codes

• Also working additional documentation needs

• Many firms are reviewing Schedule C clients

• Determining many c li ents were not aware of PPP eligibility

8

• Some lenders have stopped receiving new PPP applications

• Other lenders plan to stop prior to funding r unni ng out

• SBA official stated funds forecasted to run out in April

High Interest: 2021 Draw One Applicants Getting 2

Information for clients who are seeking a 2nd Draw PPP

loan after receiving a 1st Draw loan in 2021.

• SBA initially did not permit 2nd Draw loan applications for

borrowers who only took their first PPP loan in 2021.

• New rule from SBA allows these borrowers to apply for and

receive their 2nd Dr aw PPP loan.

• Must certify that funds from first round hav e been used (or will be

nd

9

Draw

used) by the time the s econd PPP loan is received.

• To qualify for a 2nd Draw PPP loan, the client’s business must

have experienced a revenue reduction of 25% or greater due to

the COVID-19 pandemic.

#AICPATownHall

Increased Scrutiny on Applications

Depa rtment o f Justic e

– Targeting

PPP Fraudule nt Activ ities

S BA I ns pector G ener al D etail s A cti ons to C ombat F r aud in

T es timony Before C ongr ess

Fraud probes in the Small Business Administration’s pandemic-relief loan programs will

take 10 years to resolve, according to the agency’s watchdog.

SBA Inspector General

Hannibal

Ware said fraud is so widespread in the SBA’s

Paycheck Protection Program and Economic Injury Disaster Loan program that it will

take a targeted effort to oversee them and crack down on fraudulent activity, despite a

40% increase in staffing provided by recent legislation.

“Fraud investigations will be a decade-long effort due to the performance of

those loans

within

SBA’s portfolios, and the statute of limitations for fraud,”

Ware said Wednesday during a Senate Small Business Committee hearing.

While the twin programs have saved businesses from failing due to the pandemic, they

have also fallen prey to fraudsters taking advantage of the government.

The SBA has made or guaranteed more than 17 million loans and grants, providing

about $910 billion so far. But financial institutions have flagged more than 41,000

suspicious activities related to the programs from last April through October, William

Shear, director

of the Government Accountability Office’s Financial

Markets

and

Community

Investment unit, said

during

the

hearing.

Department of J us tice Statement Abo ut Ac tio ns the D epartment is

T aking Agains t S BA Loan Fr aud on March 26, 2 021

These cases involve attempts to obtain over $569 million from the U.S. government

and unsuspecting individuals throu gh fra ud and have b een br oug ht in 56 feder a l

districts around the country.

OIG has increased staffing in both its Auditing and Investigations Divisions with

the supplemental funds appropriated to our office to increase our review and

investigative capacity by approximately 40 percent. The supplemental funds are

available until exhaustion, with some funding being directed for the purpose of EIDL

oversight. These supplemental funds are critical for this initial oversight

S BA Inspector General Hannibal Ware’s testi mony before the S enate

Small Business Committee on March 25, 2021

10

#AICPATownHall

PPP Forgiveness Statistics as of 4/1/21

Total 2020 PPP volume 5.2M

Forgiven 2.4M

Under review 290K

Applications not yet received 2.5M

11

Total 2020 PPP Volume = $521.2B

$209.1B has been forgiven*

*Many PPP Forgiveness Applications above

$2 million well past 90-day period

#AICPATownHall

Business Relief Pr ogr ams

#AICPATownHall

© 2021 Association of International Certified Professional Accountants. All rights reserved.

Key Federal Business Relief Options

• Paycheck Protection Program

• Employee Retention Credit

13

• Covid-19 Economic Inj ury Disaster Loan

• Targeted EIDL Advance

• Shuttered V enue Operators Grant

• Restaurant Revitalization Fund

• SBA Debt Relief

Help your clients

navigate the options

• Know the basics

• Identify the relevant

programs for your

clients

• Develop strategy to

build capacity or refer

to your network

• Communicate options

to clients and set

expectations

#AICPATownHall

Loading...

Loading...