Casio TE-100 User Manual

ELECTRONIC CASH REGISTER

TE-100YOU |

|

||

THANK |

|

||

YOUR |

RECEIPT |

||

AGAIN |

! |

||

CALL |

|||

|

|||

|

|

||

GROCERY |

|||

DAIRY |

. |

||

|

|

|

|

|

|

A |

|

|

. |

|

|

|

B |

|

|

. |

|

|

|

H |

|

|

|

FROZEN |

|||

FOOD |

|

||

DELICATESSEN |

|||

Eu |

Di |

U.K. |

USER'S MANUAL

Safety Precautions

•To use this product safely and correctly, read this manual thoroughly and operate as instructed.

After reading this guide, keep it close at hand for easy reference. Please keep all informations for future reference.

•Always observe the warnings and cautions indicated on the product.

About the icons

In this guide various icons are used to highlight safe operation of this product and to prevent injury to the operator and other personnel and also to prevent damage to property and this product. The icons and definitions are given below.

Indicates that there is a risk of severe injury or death if used incorrectly.

Indicates that injury or damage may result if used incorrectly.

Icon examples

To bring attention to risks and possible damage, the following types of icons are used.

The  symbol indicates that it includes some symbol for attracting attention (including warning). In this triangle the actual type of precautions to be taken (electric shock, in this case) is indicated.

symbol indicates that it includes some symbol for attracting attention (including warning). In this triangle the actual type of precautions to be taken (electric shock, in this case) is indicated.

The  symbol indicates a prohibited action. In this symbol the actual type of prohibited actions (disassembly, in this case) will be indicated.

symbol indicates a prohibited action. In this symbol the actual type of prohibited actions (disassembly, in this case) will be indicated.

The  symbol indicates a restriction. In this symbol the type of actual restriction (removal of the power plug from an outlet, in this case) is indicated.

symbol indicates a restriction. In this symbol the type of actual restriction (removal of the power plug from an outlet, in this case) is indicated.

Warning!

Warning!

Handling the register

Should the register malfunction, start to emit smoke or a strange odor, or otherwise behave abnormally, immediately shut down the power and unplug the AC plug from the power outlet. Continued use creates the danger of fire and electric shock.

• Contact CASIO service representative.

Do not place containers of liquids near the register and do not allow any foreign matter to get into it. Should water or other foreign matter get into the register, immediately shut down the power and unplug the AC plug from the power outlet. Continued use creates the danger of shorting, fire and electric shock.

• Contact CASIO service representative.

Should you drop the register and damage it, immediately shut down the power and unplug the AC plug from the power outlet. Continued use creates the danger of shorting, fire and electric shock.

•Attempting to repair the register yourself is extremely dangerous. Contact CASIO service representative.

E 2

Warning!

Warning!

Never try to take the register apart or modify it in any way. High-voltage components inside the register create the danger of fire and electric shock.

• Contact CASIO service representative for all repair and maintenance.

Power plug and AC outlet

Use only a proper AC electric outlet (100V~240V) . Use of an outlet with a different voltage from the rating creates the danger of malfunction, fire, and electric shock. Overloading an electric outlet creates the danger of overheating and fire.

Make sure the power plug is inserted as far as it will go. Loose plugs create the danger of electric shock, overheating, and fire.

• Do not use the register if the plug is damaged. Never connect to a power outlet that is loose.

Use a dry cloth to periodically wipe off any dust built up on the prongs of the plug. Humidity can cause poor insulation and create the danger of electric shock and fire if dust stays on the prongs.

Do not allow the power cord or plug to become damaged, and never try to modify them in any way. Continued use of a damaged power cord can cause deterioration of the insulation, exposure of internal wiring, and shorting, which creates the danger of electric shock and fire.

•Contact CASIO service representative whenever the power cord or plug requires repair or maintenance.

Caution!

Caution!

Do not place the register on an unstable or uneven surface. Doing so can cause the register — especially when the drawer is open — to fall, creating the danger of malfunction, fire, and electric shock.

Do not place the register in the following areas.

•Areas where the register will be subject to large amounts of humidity or dust, or directly exposed to hot or cold air.

•Areas exposed to direct sunlight, in a close motor vehicle, or any other area subject to very high temperatures.

The above conditions can cause malfunction, which creates the danger of fire.

Do not overlay bend the power cord, do not allow it to be caught between desks or other furniture, and never place heavy objects on top of the power cord. Doing so can cause shorting or breaking of the power cord, creating the danger of fire and electric shock.

Be sure to grasp the plug when unplugging the power cord from the wall outlet. Pulling on the cord can damage it, break the wiring, or cause short, creating the danger of fire and electric shock.

Never touch the plug while your hands are wet. Doing so creates the danger of electric shock. Pulling on the cord can damage it, break the wiring, or cause short, creating the danger of fire and electric shock.

Never touch the printer head and the platen.

3 E

Introduction & Contents

Introduction & Contents ...................................................................................... |

4 |

Getting Started ..................................................................................................... |

7 |

Remove the cash register from its box. ............................................................................ |

7 |

Remove the tape holding parts of the cash register in place. ........................................... |

7 |

Install the three memory backup batteries. ....................................................................... |

7 |

Install receipt/journal paper. .............................................................................................. |

9 |

Plug the cash register into a wall outlet. .......................................................................... |

11 |

Insert the mode key marked “PGM” into the mode switch. .............................................. |

11 |

Turn the mode key to the “REG” position. ....................................................................... |

11 |

Set the date. ................................................................................................................... |

12 |

Set the time..................................................................................................................... |

12 |

Select printouts receipt or journal. .................................................................................. |

12 |

Tax table programming ................................................................................................... |

13 |

Introducing TE-100 ............................................................................................. |

17 |

General guide ................................................................................................................. |

17 |

Roll paper, Receipt On/Off key, Mode key, Drawer, Drawer lock .......................................................... |

17 |

Mode switch, Lock/unlock the multipurpose tray................................................................................... |

18 |

Displays .......................................................................................................................... |

19 |

Keyboard ........................................................................................................................ |

20 |

Basic Operations and Setups ........................................................................... |

22 |

How to read the printouts .................................................................................................... |

22 |

How to use your cash register ............................................................................................. |

23 |

Displaying the time and date .......................................................................................... |

24 |

Preparing and using department keys ................................................................................. |

25 |

Registering department keys .......................................................................................... |

25 |

Programming department keys....................................................................................... |

26 |

Registering department keys by programming data ....................................................... |

27 |

Preparing and using PLUs .................................................................................................. |

28 |

Programming PLUs ........................................................................................................ |

28 |

Registering PLUs ............................................................................................................ |

29 |

Preparing and using discounts ............................................................................................ |

30 |

Programming discounts .................................................................................................. |

30 |

Registering discounts ..................................................................................................... |

31 |

Preparing and using reductions ........................................................................................... |

32 |

Programming for reductions ........................................................................................... |

32 |

Registering reductions .................................................................................................... |

33 |

Registering charge and check payments ............................................................................ |

34 |

Registering returned goods in the REG mode .................................................................... |

35 |

Registering returned goods in the RF mode ....................................................................... |

36 |

Registering money received on account ............................................................................. |

37 |

Registering money paid out ................................................................................................. |

37 |

Making corrections in a registration ..................................................................................... |

38 |

No sale registration ............................................................................................................. |

40 |

Printing the daily sales reset report ..................................................................................... |

41 |

Convenient Operations and Setups ................................................................. |

42 |

Clerk control function ........................................................................................................... |

42 |

Clerk sign on and sign off ............................................................................................... |

42 |

Post-finalization receipt format, General printing control, |

|

Compulsory, Machine features ........................................................................................... |

43 |

About post-finalization receipt......................................................................................... |

43 |

E 4

Programming general printing control ............................................................................. |

44 |

Programming compulsory and clerk control function ...................................................... |

45 |

Programming read/reset report printing control .............................................................. |

46 |

Setting a store/machine number ......................................................................................... |

46 |

Programming to clerk .......................................................................................................... |

47 |

Programming clerk number ............................................................................................ |

47 |

Programming trainee status of clerk ............................................................................... |

47 |

Programming descriptors and messages ............................................................................ |

48 |

Programming report descriptor, grand total, special character, |

|

report title, receipt message and clerk name ................................................................. |

48 |

Report descriptor ................................................................................................................................... |

48 |

Clerk name, Grand total, Special character, Report title ....................................................................... |

49 |

Receipt message .................................................................................................................................. |

50 |

Programming department key descriptor........................................................................ |

50 |

Programming PLU descriptor ......................................................................................... |

51 |

Programming function key descriptor ............................................................................. |

52 |

Programming receipt message/logo stamp control function ........................................... |

52 |

Entering characters ............................................................................................................. |

53 |

Using character keyboard ............................................................................................... |

53 |

Entering characters by code ........................................................................................... |

54 |

Department key feature programming ................................................................................. |

55 |

Batch feature programming ............................................................................................ |

55 |

Individual feature programming ...................................................................................... |

56 |

PLU feature programming ................................................................................................... |

57 |

Batch feature programming ............................................................................................ |

57 |

Individual feature programming ...................................................................................... |

58 |

Printing VAT breakdowns .................................................................................................... |

61 |

Percent key feature programming ....................................................................................... |

62 |

Currency exchange programming ....................................................................................... |

64 |

Currency exchange rate programming ........................................................................... |

64 |

Currency exchange feature programming ...................................................................... |

64 |

Other function key feature programming ............................................................................. |

67 |

Cash, Charge, Check key ............................................................................................... |

67 |

Received on account, Paidout key, Minus key ............................................................... |

68 |

#/No sale key .................................................................................................................. |

68 |

Calculator functions ............................................................................................................. |

69 |

About the daylight saving time ............................................................................................ |

70 |

Printing read/reset reports ................................................................................................... |

71 |

Reading the cash register's program................................................................................... |

77 |

Troubleshooting ................................................................................................. |

80 |

When an error occurs .......................................................................................................... |

80 |

When the register does not operate at all ........................................................................... |

81 |

When the L sign appears on the display ............................................................................. |

82 |

In case of power failure ....................................................................................................... |

82 |

User Maintenance and Options ........................................................................ |

83 |

To replace journal paper ...................................................................................................... |

83 |

To replace receipt paper ...................................................................................................... |

84 |

Options ................................................................................................................................ |

84 |

Specifications ..................................................................................................... |

85 |

Index .................................................................................................................... |

86 |

Introduction & Contents

5 E

Introduction & Contents

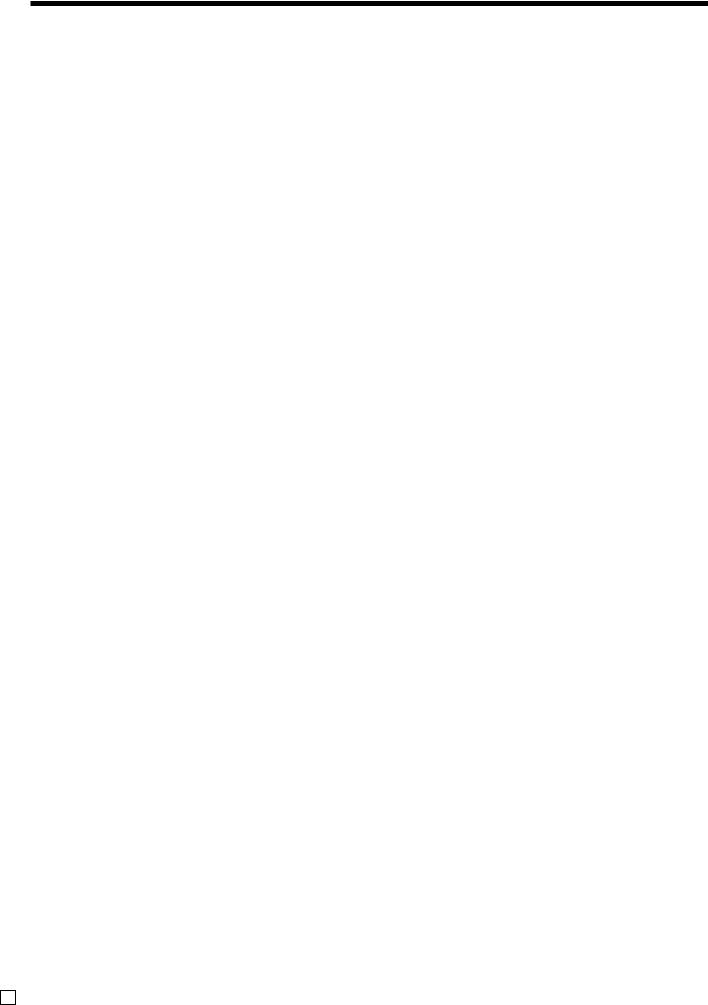

Unpacking the register

Mode key (Operator/Program key)

User's manual/

Drawer key

Take-up reel

User'sManual

Roll paper

Memory backup batteries

Welcome to the CASIO TE-100!

Congratulations upon your selection of a CASIO Electronic Cash Register, which is designed to provide years of reliable operation.

Operation of a CASIO cash register is simple enough to be mastered without special training. Everything you need to know is included in this manual, so keep it on hand for reference.

Consult your CASIO dealer if you have any questions about points not specifically covered in this manual.

The main plug on this equipment must be used to disconnect main power.

Please ensure that the socket outlet is installed near the equipment and shall be easily accessible.

Please keep all information for future reference.

E 6

Getting Started

This section outlines how to unpack the cash register and get it ready to operate. You should read this part of the manual even if you have used a cash register before. The following is the basic set up procedure, along with page references where you should look for more details.

|

|

|

|

|

|

U |

|

|

|

|

|

s |

|

|

|

|

|

re |

|

|

|

|

|

's |

|

|

|

|

|

aM |

|

|

|

|

|

n |

|

|

|

|

|

u |

|

|

|

|

|

|

la |

|

|

|

|

|

|

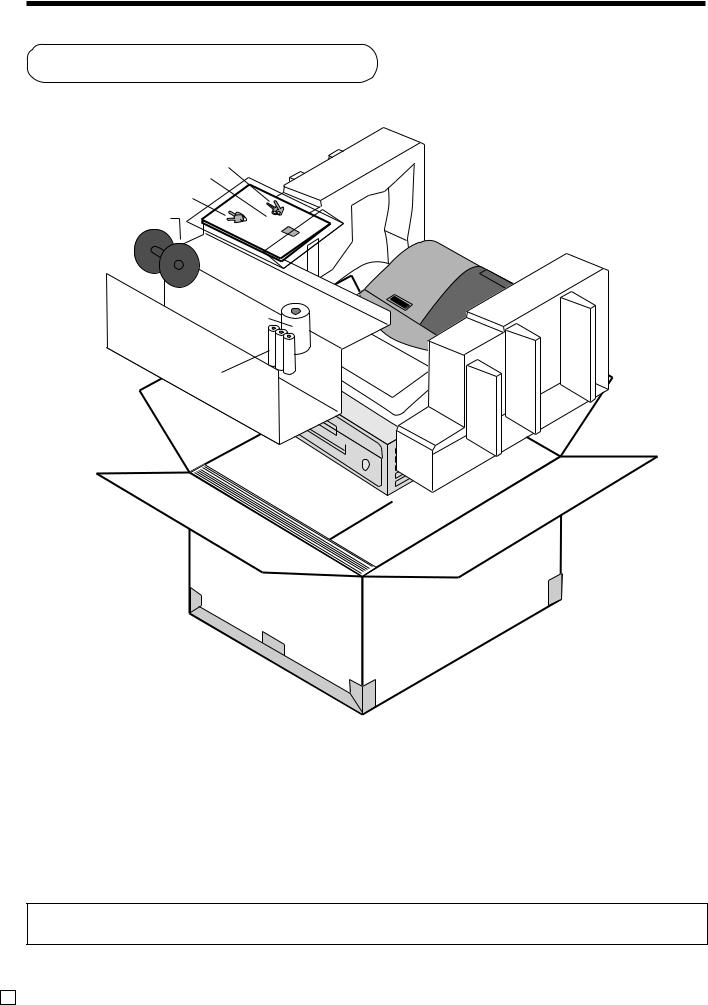

1.

Remove the cash register from its box.

Make sure that all of the parts and accessories are included.

2.

Remove the tape holding parts of the cash register in place.

Also remove the small plastic bag taped to the printer cover. Inside you will find the mode keys.

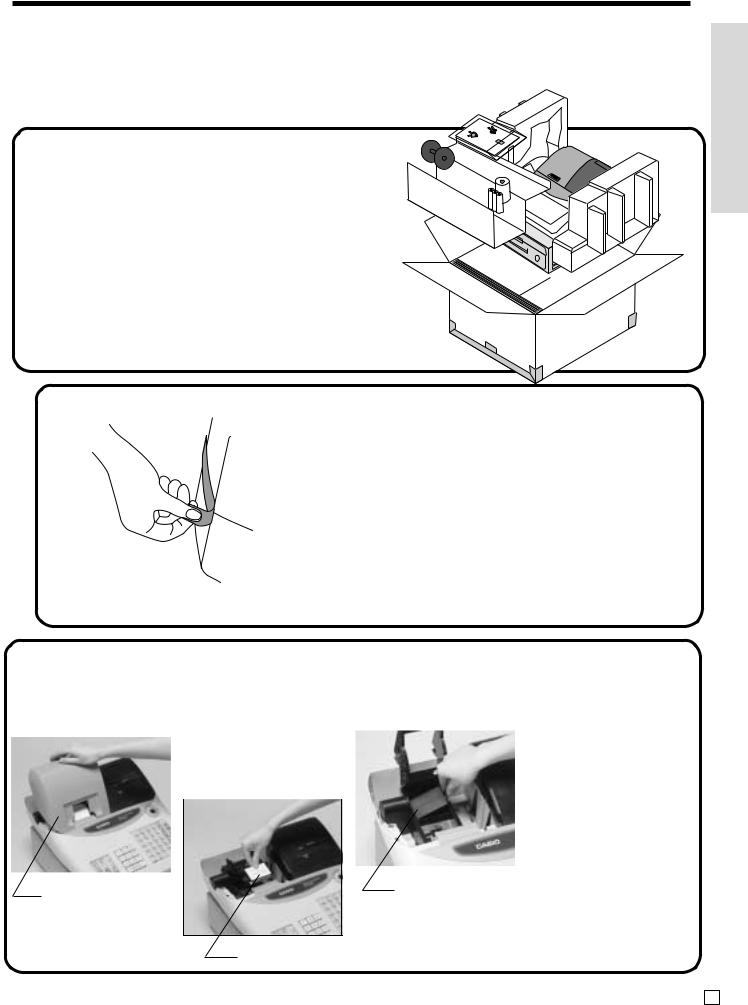

Install the three memory |

|

|

|

||

3. backup batteries. |

|

|

|

||

|

|

1. Remove the printer |

|

|

2. Remove the battery |

|

|

|

|

||

|

|

|

|||

|

|

cover and open the |

|

|

|

|

|

|

|

compartment cover. |

|

|

|

platen arm. |

|

|

|

|

|

|

|

Slide the cover and |

|

|

|

|

|

|

|

|

|

|

|

|

pull it up. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

printer cover |

battery compartment cover |

|

|

|

platen arm |

Intruduction & Contents/Getting Started

7 E

Getting Started

3. Install the three memory backup batteries. (continued…)

3. Note the (+) and (–) markings in the battery compartment. Load a set of three new SUM- 3 (UM-3) batteries so that their positive (+) and negative (–) ends are facing as indicated by the markings.

4. Replace the battery compartment cover. |

5. Close the platen arm and replace the printer cover. |

Important!

These batteries protect information stored in your cash register's memory when there is a power failure or when you unplug the cash register. Be sure to install these batteries.

Precaution!

Incorrectly using batteries can cause them to burst or leak, possibly damaging the interior of the cash register. Note the following.

•Be sure that the positive (+) and negative (–) ends of the batteries are facing as marked in the battery compartment when you load them into the unit.

•Never mix batteries of different types.

•Never mix old batteries with new ones.

•Never leave dead batteries in the battery compartment.

•Remove the batteries if you do not plan to use the cash register for long periods.

•Replace the batteries at least once a year, no matter how much the cash register is used during the period.

WARNING!

•Never try to recharge the batteries supplied with the unit.

•Do not expose batteries to direct heat, let them become shorted or try to take them apart.

Keep batteries out of the reach of small children. If your child should swallow a battery, consult a physician immediately.

E 8

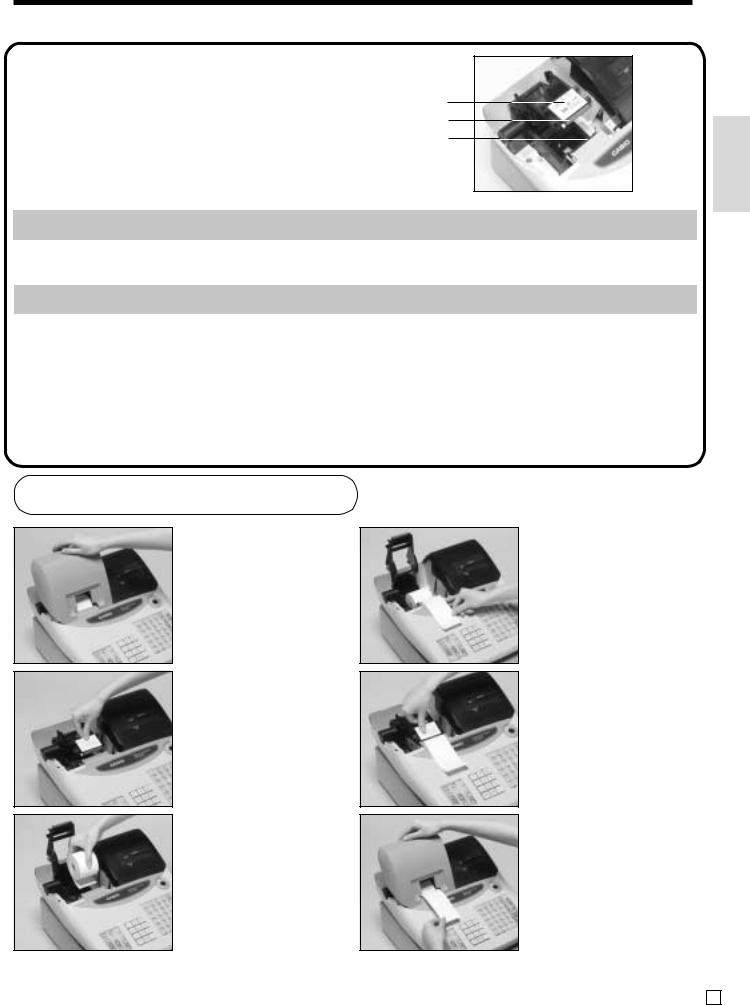

4. Install receipt/journal paper.

Platen arm Platen Printer

Important!

Take away the head protection sheet from the printer and close the platen arm.

Caution! (in handling the thermal paper)

•Never touch the printer head and the platen.

•Unpack the thermal paper just before your use.

•Avoid heat/direct sunlight.

•Avoid dusty and humid places for storage.

•Do not scratch the paper.

•Do not keep the printed paper under the following circumstances:

High humidity and temperature/direct sunlight/contact with glue, thinner or a rubber eraser.

To install receipt paper

Step 1

Remove the printer cover.

Step 2

Open the platen arm.

Step 4

Put the leading end of the paper over the printer.

Step 5

Close the platen arm slowly until it locks steadily.

Getting Started

Step 3

Ensuring the paper is being fed from the bottom of the roll, lower the roll into the space behind the printer.

Complete

Replace the printer cover, passing the leading end of the paper through the cutter slot. Tear off the excess paper.

9 E

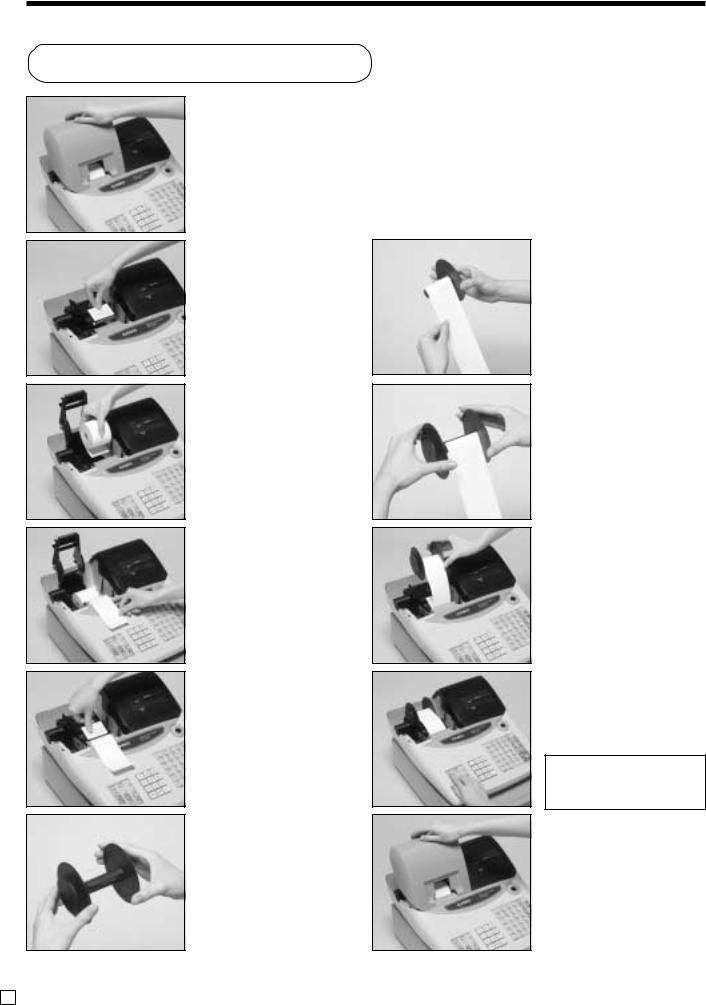

Getting Started

To install journal paper

Step 1

Remove the printer cover.

Step 2

Open the platen arm.

Step 3

Ensuring the paper is being fed from the bottom of the roll, lower the roll into the space behind the printer.

Step 4

Put the leading end of the paper over the printer.

Step 5

Close the platen arm slowly until it locks steadily.

Step 6

Remove the paper guide of the take-up reel.

Step 7

Slide the leading end of the paper into the groove on the spindle of the takeup reel and wind it onto the reel two or three turns.

Step 8

Replace the paper guide of the take-up reel.

Step 9

Place the take-up reel into place behind the printer, above the roll paper.

Step 10

Press the fkey to take up any slack in the paper.

During machine installation, press the f key after power on.

Complete

Replace the printer cover.

E 10

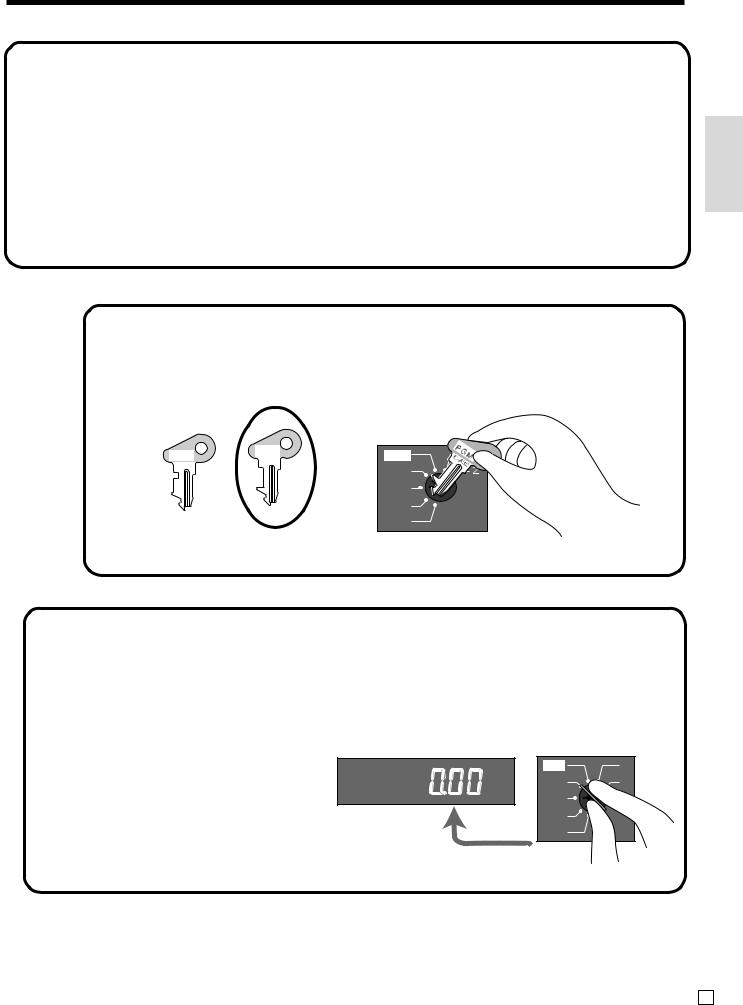

5. Plug the cash register into a wall outlet.

Be sure to check the sticker (rating plate) on the side of the cash register to make sure that its voltage matches that of the power supply in your area.

6. Insert the mode key marked “PGM” into the mode switch.

Getting Started

OP |

PGM |

CAL |

|

C-A32

C-A02

REG

OFF

RF

PGM

7. Turn the mode key to the “REG” position.

The display should change to the following.

CAL X

REG Z

OFF

RF

PGM

11 E

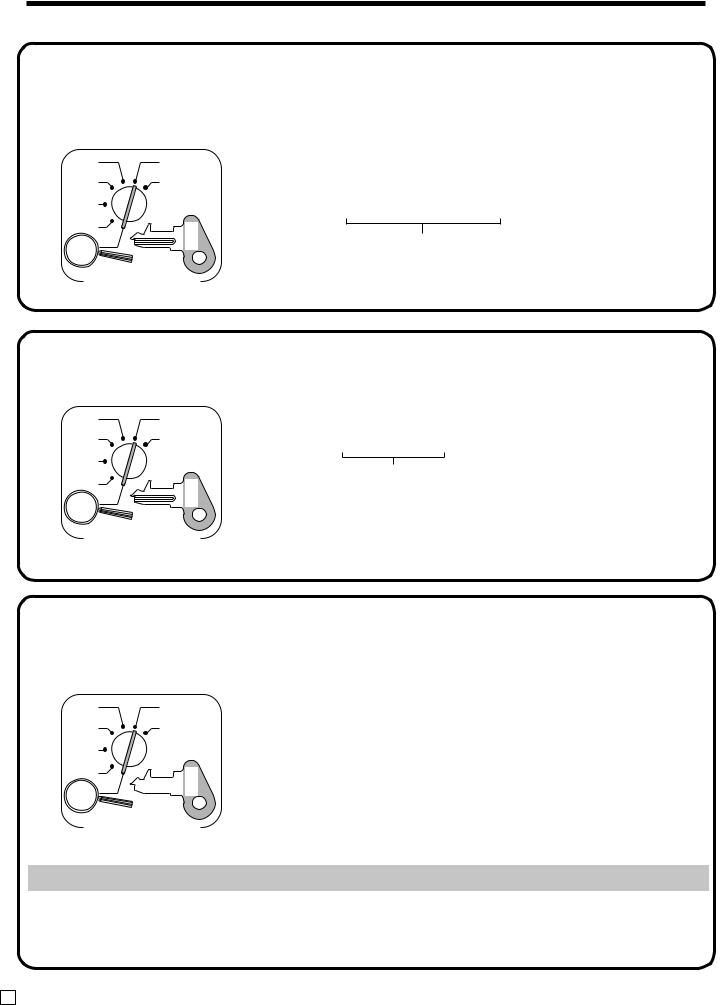

Getting Started

8. Set the date.

CAL |

X |

|

|

REG |

Z |

|

|

OFF |

|

|

|

RF |

C-A32 |

PGM |

|

PGM |

|||

|

|

Mode Switch

61s6 :: :: :: 6 X 6 C

Year Month Day

Current date

Example:

15, March 2002 2 020315

9. Set the time.

CAL |

X |

|

|

REG |

Z |

|

|

OFF |

|

|

|

RF |

C-A32 |

PGM |

|

PGM |

|||

|

|

Mode Switch

61s6 :::: 6X6C

Current time

Example:

08:20 AM 2 0820 09:45 PM 2 2145

10. Select printouts receipt or journal.

CAL

REG

OFF

RF

PGM

X

Z

A32-C

PGM

61s6 { Issue receipt = 0 }6 h6 s

Print journal = 1

Mode Switch

Note !

If you need journal and are sometimes required receipts by customers, select “issue receipt”.

After business hours, issue the electronic journal report.

E 12

11. Tax table programming

This cash register is capable of automatically calculating up to four different sales taxes. The sales tax calculations are based on rates, so you must tell the cash register the rates, the type of tax (add-in or addon), and the type of rounding to apply. Note that special rounding methods (page 15) are also available to meet certain local tax requirements.

Important!

After you program the tax calculations, you also have to individually specify which departments

(page 26) and PLUs (page 28) are to be taxed.

Programming tax calculations (without special rounding)

Prepare the following subjects:

1.Tax rates

2.Rounding method for tax calculation (Round up/Round off/Cut off)

3.Tax calculation system (Add-on/Add-in)

Programming procedure

CAL

REG

OFF

RF

PGM

X

Z

A32-C

PGM

Assign tax table 1. ................................................................................. |

6 |

Assigning tax table 2, enter 0225.

Assigning tax table 3, enter 0325.

Assigning tax table 4, enter 0425.

Enter tax rate (2 integers and 4 decimals)..

Mode Switch

4

3s

4

0125s

4

Example: 15% |

= 15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.25% |

= 8^25 |

|

6 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

.................................................................. |

|

|

|

|

: : : : : :a |

||||||||||||||

Enter rounding method, tax calculation method.. |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0a |

|||||||

|

Fraction round up |

9 |

0 |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

||

|

Fraction round off |

5 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Fraction cut off |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Always “0” |

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Add-on tax |

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Add-in tax |

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

:4 |

:3 |

:2 |

:1 a |

||||||||||

|

.................................................................. |

|

|

|

|

D |

D |

D |

D |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

Terminate the procedure.. ...................................................................... 6 |

|

|

|

|

|

|

s |

|||||||||||||

Getting Started

13 E

Getting Started

11. Tax table programming (continued…)

Programming tax calculations (with special rounding)

Prepare the following subjects:

1.Tax rates

2.Rounding method for tax calculation (Round up/Round off/Cut off)

3.Tax calculation system (No/Add-on/Add-in)

4.Rounding system (Special rounding 1/Special rounding 2/Special rounding 3/Danish rounding /Australian rounding) :only effective for Tax Table 1

CAL |

X |

Programming procedure |

Z |

REG |

|

OFF |

|

RF |

C |

PGM |

-A32 |

|

PGM

|

|

|

|

|

|

|

|

|

|

|

|

Mode Switch |

|||||

|

|

|

|

|

|

|

|

|

|

4 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3s |

||||

|

|

|

|

|

|

|

|

|

|

4 |

|

||||||

Assign tax table 1. ................................................................................. |

|

6 |

0125s |

||||||||||||||

Assigning tax table 2, enter 0225. |

|

|

|

|

|

|

|

|

|||||||||

Assigning tax table 3, enter 0325. |

|

|

|

|

|

|

|

|

|||||||||

Assigning tax table 4, enter 0425. |

|

|

|

|

|

|

|

|

|||||||||

Enter tax rate (2 integers and 4 decimals) |

|

|

|

|

|

|

4 |

|

|||||||||

Example: 15% = 15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

8.25% = 8^25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

non tax = 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

................................................................ |

|

|

|

|

|

|

6 : : : : : :a |

||||||||

Enter rounding method, tax calculation method.. |

4 |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0a |

||||

|

|

Fraction round up |

9 |

0 |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

4 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Fraction round off |

5 |

0 |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Fraction cut off |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Special rounding 1 * |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Special rounding 2 * |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special rounding 3 * |

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Special rounding 4 * |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special rounding 5 * |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Add-on tax |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Add-in tax |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

* See the next page. |

|

|

|

|

|

|

|

D4 D3 D2 D1 |

|||||||

|

................................................................................... |

|

|

|

|

|

|

|

6 : : : :a |

||||||||

|

|

|

|

|

|

|

|

|

|

4 |

|

||||||

Terminate the procedure. ....................................................................... |

|

6 |

|

|

|

|

|

s |

|||||||||

E 14

11. About special rounding…

Besides cut off, round off and round up, you can also specify “special rounding” for subtotals and totals or changes. Special rounding converts the right-most digit(s) of an amount to “0” or “5” to comply with the requirements of certain areas.

1 Special Rounding 1

Last (right-most) digit |

|

Rounding result |

Examples: |

|

|

|

0 |

~ 2 |

2 |

0 |

1.21 |

|

1.20 |

3 |

~ 7 |

2 |

5 |

1.26 |

|

1.25 |

8 |

~ 9 |

2 |

10 |

1.28 |

|

1.30 |

2 Special Rounding 2 |

|

|

|

|

|

|

Last (right-most) digit |

|

Rounding result |

Examples: |

|

|

|

0 |

~ 4 |

2 |

0 |

1.12 |

|

1.10 |

5 |

~ 9 |

2 |

10 |

1.55 |

|

1.60 |

3 Special Rounding 3 |

|

|

|

|

|

|

Last (right-most) digits |

|

Rounding result |

Examples: |

|

|

|

00 |

~ 24 |

2 |

0 |

1.24 |

|

1.00 |

25 |

~ 74 |

2 |

50 |

1.52 |

|

1.50 |

75 |

~ 99 |

2 |

100 |

1.77 |

|

2.00 |

4Special Rounding 4 (Danish Rounding)

With Danish rounding, the rounding method applies to subtotals depends on whether you finalize the transaction by inputting an amount tendered or not.

• When a finalization is performed without |

• When a finalization is performed with |

||||||

an amount tendered entry |

|

an amount tendered entry |

|

||||

Last (right-most) 2 digits |

|

Rounding result |

Last (right-most) 2 digits |

|

Rounding result |

||

of subtotal |

|

of change due |

|

|

|||

|

|

|

|

|

|||

00 |

~ 12 |

2 |

00 |

00 ~ 12 |

|

2 |

00 |

13 |

~ 37 |

2 |

25 |

13 ~ 37 |

|

2 |

25 |

38 |

~ 62 |

2 |

50 |

38 ~ 62 |

|

2 |

50 |

63 |

~ 87 |

2 |

75 |

63 ~ 87 |

|

2 |

75 |

88 |

~ 99 |

2 |

100 |

88 ~ 99 |

|

2 |

100 |

5 Special Rounding 5 (Australian Rounding) |

|

|

|

|

|||

Last (right-most) digit |

|

Rounding result |

Examples: |

|

|

|

|

0 |

~ 2 |

2 |

0 |

1.21 |

|

1.20 |

|

3 |

~ 7 |

2 |

5 |

1.26 |

|

1.25 |

|

8 |

~ 9 |

2 |

10 |

1.28 |

|

1.30 |

|

•Partial tenders (payments): for Danish Rounding

No rounding is performed for the amount of tendered nor for the change amount due when the customer makes a partial tender. When a partial tender results in a remaining balance within the range of 1 through 12, the transaction is finalized as if there was no remaining balance.

•Display and printing of subtotals: for Danish and Australian Rounding

When you press the skey, the unrounded subtotal is printed and shown on the display. If the cash register is also set up to apply an add-on tax rate, the add-on tax amount is also included in the subtotal that is printed and displayed.

Important!

When you are using Danish rounding, you can use the akey to register tendered amount in which the last (right-most) digits are 00, 25, 50 or 75. This restriction does not apply to the hand kkeys.

Getting Started

15 E

Getting Started

12. For Australia only

You can set some programmable options to suit the Australian GST by the following procedure.

CAL X

REG

Z

Z

OFF

RF |

C-A32 |

PGM |

|

PGM |

|||

|

|

Mode Switch

601012001s66 a(Execution)

6 s(Cancellation)

After completion of this procedure, the “GST system was changed” message was printed on receipt and;

1 Tax symbol (*) is printed.

2 Taxable amount is skipped.

3 “GST INCLUDED” is set to the TX1 descriptor.

4 “TAXABLE AMT” is set to the TA1 descriptor. 5 Total line is printed even in direct (cash) sale. 6 Australian rounding is set.

7 “$” is set to the monetary symbol. 8 Print “MOF message” on receipt.

9Tax (10% tax rate, add-in tax, fraction round off) is set to the tax table 1. No data is set to other tax tables.

0 The taxable amount and tax amount except TA1/TX1 are not printed on report.

ARestriction (to 0, 5) on last amount digit of cash sales, received on account, paid out, and money declaration.

E 16

Introducing TE-100

General guide

This part of the manual introduces you to the cash register and provides a general explanation of its various parts.

Take-up reel |

Pop-up display |

|

(customer display) |

Roll paper |

Main display |

Printer |

Mode switch |

|

Keyboard |

|

Multipurpose tray |

|

Drawer |

Printer cover |

Drawer lock |

|

Roll paper

You can use the roll paper to print receipts and a journal (page 9 ~ 10).

Receipt On/Off key

When you are using the printer for receipt printer, you can use this key (in the REG and RF

modes only) to turn the printer on and off. If a customer asks for a receipt while receipt printing is turned off by this key, you can issue a post-finalization receipt (page 43).

Mode key

There are two types of mode keys: the program key (marked “PGM”) and the operator key (marked “OP”). The program key can be used to set the mode switch to any position, while the operator key can select the REG, CAL and OFF position.

Drawer

The drawer opens automatically whenever you finalize a registration and whenever you issue a read or reset report. The drawer will not open if it is locked with the drawer key.

Drawer lock

Use the drawer key to lock and unlock the drawer.

Multipurpose tray

This tray can always be opened if the locking knob is in the unlock position.

Use the locking knob to lock and unlock this tray.

PGM |

OP |

C-A32 |

C-A02 |

Program Operator

key key

Getting Started/Introducing TE-100

17 E

Introducing TE-100

Mode switch

Use the mode keys to change the position of the mode switch and select the mode you want to use.

CAL X

REG |

Z |

OFF

RF

PGM

Mode Switch |

Mode Name |

Description |

|

|

|

Z |

RESET |

Reads sales data in memory and clears the data. |

|

|

|

X |

READ |

Reads sales data in memory without clearing the data. |

|

|

|

CAL |

CALCULATOR |

Use this mode for calculator. |

|

|

|

REG |

REGISTER |

Use this mode for normal registration. |

|

|

|

OFF |

STAND-BY |

Cash register standing by. |

|

|

|

RF |

REFUND |

Use this mode to register refund transaction. |

|

|

|

PGM |

PROGRAM |

Use this mode for cash register programming. |

|

|

|

Lock/unlock the multipurpose tray

Lock (Red) Unlock

(Green)

When the cash drawer does not open!

In case of power failure or the machine is in malfunction, the cash drawer does not open automatically. Even in these cases, you can open the cash drawer by pulling drawer release lever (see below).

Important!

The drawer will not open, if it is locked with a drawer lock key.

E 18

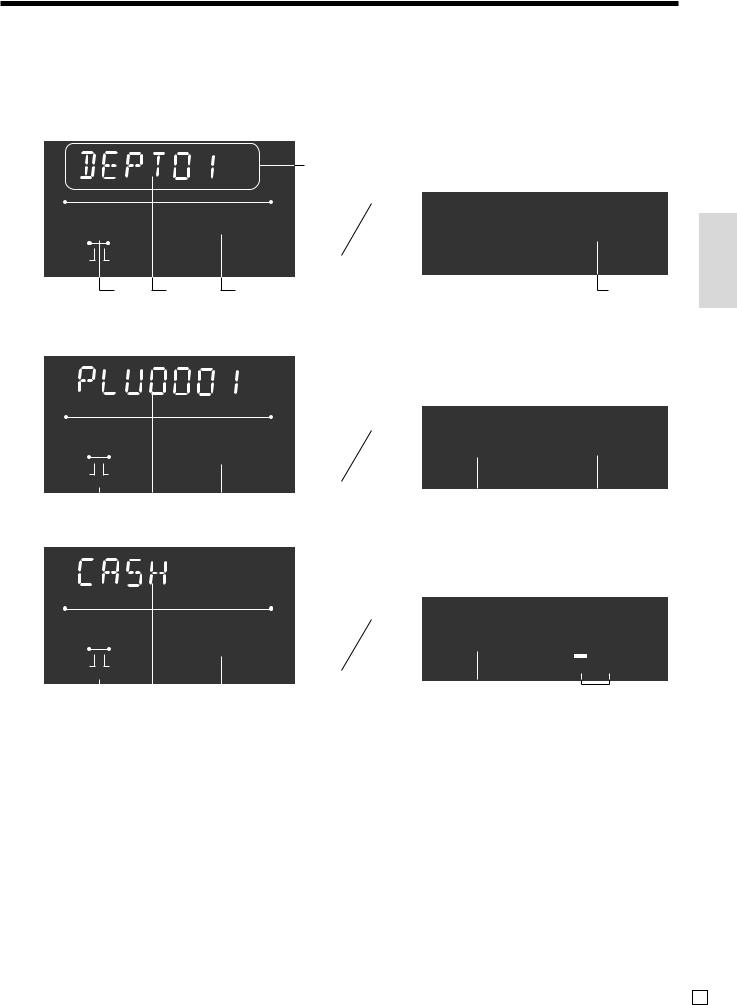

Displays

Main Display |

Pop-up (customer) display |

(alphanumeric + numeric display) |

(numeric display) |

Item registration (by department/PLU) |

|

|

|

|

|

alphanumeric display |

|

|

AMOUNT |

|

|

|

|

|

!50 |

!50 |

RPT |

RECEIPT |

|

|

TOTAL CHANGE |

|

ON |

|

|

|

|

5 |

2 |

1 |

1 |

Repeat registration |

|

|

|

|

AMOUNT

3"50

RPT |

RECEIPT |

|

ON |

3

3  2

2  1

1

Totalize operation

|

|

|

|

AMOUNT |

|

|

_ |

1"34 |

|||||

RPT RECEIPT |

|

|

|

|

||

|

ON |

|

|

|

|

|

|

|

5 |

|

2 |

|

1 |

|

|

|

|

|||

|

|

|

||||

1Amount/Quantity

This part of the display shows monetary amounts. It also can be used to show the current time.

(The current date is shown in the alphanumeric display.)

2Item/Key descriptor

When you register an item or key, the item/key descriptor appears here.

Mode descriptor is also displayed here.

3Number of repeats

Anytime you perform a repeat registration (page 25, 29), the number of repeats appears here.

3"50

TOTAL CHANGE

3

3  1

1

_1"34

TOTAL CHANGE

5

5  4

4

Note that only one digit is displayed for the number of repeats. This means that a “5” could mean 5, 15 or even 25 repeats.

4Total/Change indicators

When the TOTAL indicator is lit, the displayed value is monetary total or subtotal amount.

When the CHANGE indicator is lit, the displayed value is the change due.

5Receipt on/off indicators

When the register is in “issuing receipt” mode, under-bar sign is lit on this digit. (REG/RF mode, during standing-by only)

Introducing TE-100

19 E

Introducing TE-100

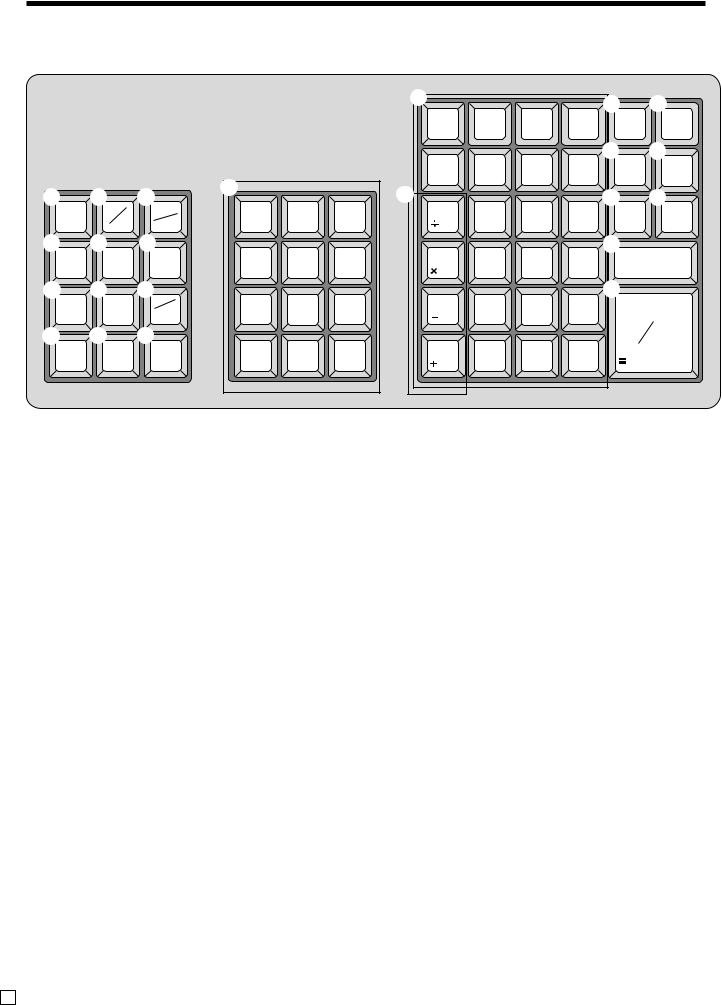

Keyboard

1 |

2 |

3 |

C |

|

|

|

|

|

|

||||

FEED |

# |

OPEN |

7 |

8 |

9 |

|

|

||||||

NS |

CLK# |

|||||

|

||||||

4 |

5 |

6 |

4 |

5 |

6 |

|

% |

PRICE |

PLU |

||||

|

||||||

7 |

8 |

9 |

|

|

|

|

— |

RF |

X |

1 |

2 |

3 |

|

DATE |

||||||

|

|

TIME |

||||

0 |

A |

B |

|

|

|

|

POST |

ERR.CORR |

C |

0 |

00 |

• |

|

RECEIPT |

||||||

CANCEL |

||||||

EXCHG |

C/AC |

• Register Mode

1 Paper feed key f |

9 |

D |

|

|

|

E |

F |

|

|

|

|

|

|||

6 |

12 |

18 |

24 |

VAT |

RECEIPT |

|

ON/OFF |

||||||

|

||||||

|

|

|

|

G |

H |

|

5 |

11 |

17 |

23 |

RC |

PD |

|

MR |

|

|||||

M |

|

|

|

I |

J |

|

4 |

10 |

16 |

22 |

CH |

CHK |

|

|

|

|||||

|

|

|

|

K |

|

|

3 |

9 |

15 |

22 |

SUBTOTAL |

||

|

|

|

|

L |

|

|

2 |

8 |

14 |

21 |

CA |

AMT |

|

|

|

|

|

|||

|

|

|

|

|

TEND |

|

1 |

7 |

13 |

19 |

|

|

|

Multiplication/Date/Time key X |

|

|||||

Hold this key down to feed paper from the printer.

2Non-add/No sale key B

Non-add key: To print reference number (to identify a personal check, credit card, etc.) during a transaction, use this key after some numerical entries.

No sale key: Use this key to open the drawer without registering anything.

3Open/Clerk number key o

It is necessary to select one of these functions (page 45). Open key: Use this key to temporarily release a limitation on the number of digits that can be input for a unit price. Clerk number key: Use this key to sign clerk on and off the register.

4Percent key p

Use this key to register premiums or discounts.

5Price key :

Use this key to register unit prices for subdepartment.

6PLU key +

Use this key to input PLU (subdepartment) numbers.

7Minus key m

Use this key to input values for subtraction.

8 Refund key R

Use this key to input a quantity for a multiplication operation. Between transactions, this key displays the current time and date.

0Post receipt/Currency exchange key ;

Post receipt key: Use this key to produce a post-finaliza- tion receipt (page 43).

Currency Exchange key: Use this key for calculating subtotal amounts or paying amount due in foreign currency (page 64).

AError correct/Cancel key e

Use this key to correct registration errors and to cancel registration of entire transactions.

BClear key C

Use this key to clear an entry that has not yet been registered.

CTen key pad 0, 1, ~ 9, -, ^

Use these keys to input numbers.

DDepartment keys &, ', ~ .

Use these keys to register items to departments.

EVAT key v

Use this key to print a VAT breakdown.

Use this key to input refund amounts and void certain entries.

E 20

FReceipt on/off key D

Use this key twice to change the status “receipt issue” or “no receipt.” This key is only effective when the “use printer for receipt printer” in the printer control program is selected. In case of “receipt issue”, the “RECEIPT ON” indicator is lit.

GReceived on account key [

Use this key following a numeric entry to register money received for non-sale transactions.

HPaid out key P

Use this key following a numeric entry to register money paid out from the drawer.

ICharge key h

Use this key to register a charge sale.

JCheck key k

Use this key to register a check tender.

KSubtotal key s

Use this key to display and print the current subtotal (includes add-on tax) amount.

LCash amount tendered key a

Use this key to register a cash sale.

• Calculator Mode

2 Drawer open key B

4 Percent key p

B Clear/All clear key C

C Ten key pad 0, 1, ~ 9, -, ^

M Arithmetic operation key &, ', (and )

G Memory recall key [

L Equal key a

Introducing TE-100

21 E

Basic Operations and Setups

How to read the printouts

•The journal and receipts are records of all transactions and operations.

•The contents printed on receipts and journal are identical, except the date printing line. (The date line is printed on receipts and reports.)

•You can choose the journal skip function (page 44).

If the journal skip function is selected, the cash register will print the total amount of each transaction, and the details of premium, discount and reduction operations only, without printing department and PLU item registrations on the journal.

•The following items can be skipped on receipts and journal.

•Time

•Consecutive number

•Taxable status

•Taxable amount

Receipt Sample

************************ |

|

||

* |

|

* |

|

* |

* THANK YOU * |

*— Logo message |

|

** |

CALL AGAIN |

** |

or graphic logo |

* |

|

* |

|

|

|

||

************************ |

|

||

*COMMERCIAL MESSAGE *

*COMMERCIAL MESSAGE *

* COMMERCIAL MESSAGE *— Commercial message

*COMMERCIAL MESSAGE *

*COMMERCIAL MESSAGE *

REG 15-03-2002 12:34 — Mode/Date/Time

CLERK 01 0001-000123— Clerk/Machine No.

-Consecutive No.

DEPT01 |

T1 |

•1.00 |

DEPT02 |

T1 |

•2.00 |

5 |

X |

@1.00 |

DEPT03 |

T2 |

•5.00 |

TAX-AMT 1 |

|

•3.00— Taxable amount |

TAX 1 |

5% |

•0.15 with tax rate |

TAX-AMT 2 |

|

•5.00 |

TAX 2 |

4% |

•0.20 |

TAX |

|

•0.35— Tax total |

TOTAL |

|

•8.35 |

CASH |

|

•10.00 |

CHANGE |

|

•1.65 |

|

7 No |

— Item counter |

***BOTTOM MESSAGE ***

***BOTTOM MESSAGE ***

*** BOTTOM MESSAGE ***— Bottom message

***BOTTOM MESSAGE ***

***BOTTOM MESSAGE ***

Journal Sample (Item lines Included) (normal height)

REG |

|

|

12:33 |

CLERK 01 |

|

0001-000122 |

|

DEPT01 |

|

T1 |

•1.00 |

DEPT02 |

|

T1 |

•2.00 |

TAX-AMT 1 |

|

|

•3.00 |

TAX 1 |

|

|

•0.15 |

TAX |

|

|

•0.15 |

REG |

|

|

12:34 |

CLERK 01 |

|

0001-000123 |

|

DEPT01 |

|

T1 |

•1.00 |

DEPT02 |

|

T1 |

•2.00 |

5 |

X |

|

@1.00 |

DEPT03 |

|

T2 |

•5.00 |

TAX-AMT 1 |

|

|

•3.00 |

TAX 1 |

|

5% |

•0.15 |

TAX-AMT 2 |

|

|

•5.00 |

TAX 2 |

|

4% |

•0.20 |

TAX |

|

|

•0.35 |

TOTAL |

|

|

•8.35 |

CASH |

|

|

•10.00 |

CHANGE |

|

|

•1.65 |

DEPT01 |

|

T1 |

•1.00 |

DEPT02 |

|

T1 |

•2.00 |

5 |

X |

|

@1.00 |

DEPT03 |

|

T2 |

•5.00 |

|

|

|

|

Journal Sample (Item lines Skipped) (half height)

REG 15-03-2002 12:32

|

|

2 No |

|

REG |

15-03-2002 12:33 |

||

CLERK 01 |

0001-000122 |

||

TAX-AMT 1 |

|

•3.00 |

|

TAX 1 |

|

5% |

•0.15 |

TAX |

|

|

•0.15 |

CASH |

|

•3.15 |

|

|

|

2 No |

|

REG |

15-03-2002 12:34 |

||

CLERK 01 |

0001-000123 |

||

TAX-AMT 1 |

|

•3.00 |

|

TAX 1 |

|

5% |

•0.15 |

TAX-AMT 2 |

|

•5.00 |

|

TAX 2 |

|

4% |

•0.20 |

TAX |

|

|

•0.35 |

TOTAL |

|

•8.35 |

|

CASH |

|

|

•10.00 |

CHANGE |

|

•1.65 |

|

|

|

7 No |

|

REG 15-03-2002 12:35

In the operation examples contained in this manual, the print samples are what would be produced if the roll paper is being used for receipts. They are not actual size. Actual receipts are 58 mm wide. Also, all sample receipts and journals are printout images.

E 22

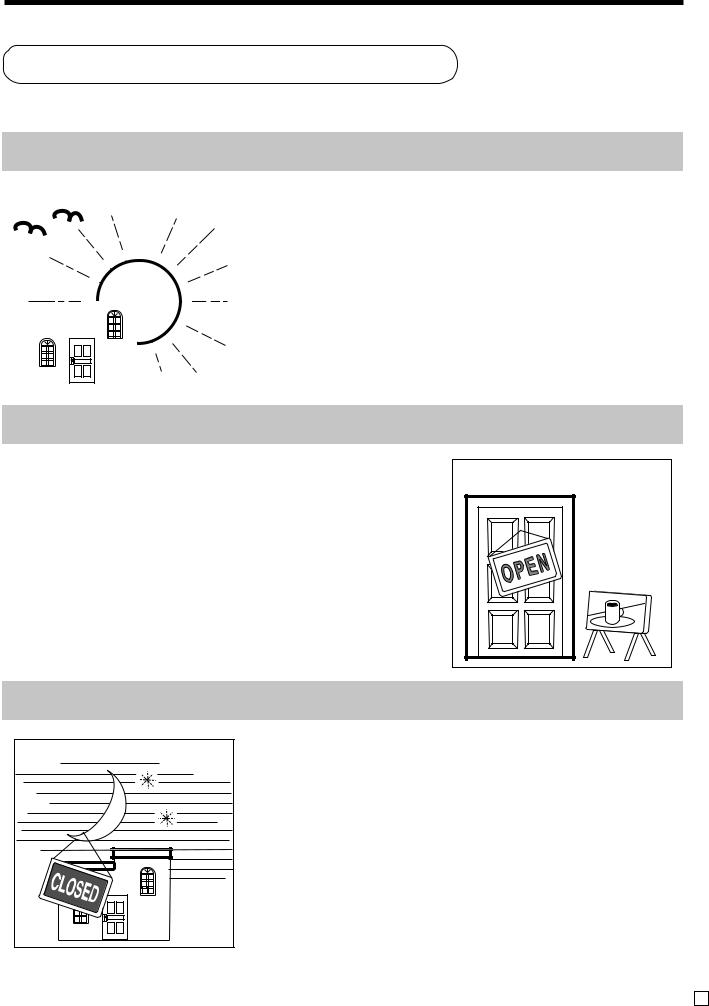

How to use your cash register

The following describes the general procedure you should use in order to get the most out of your cash register.

BEFORE business hours…

|

|

|

|

|

• Check to make sure that the cash register is |

|

|

|

|

|

|

|

plugged in securely. |

Page 11 |

|

|

|

|

|

|

• Check to make sure there is enough paper |

|

|

|

|

|

|

|

left on the roll. |

Page 9, 10 |

|

|

|

|

|

|

• Read the financial totals to confirm that they are |

|

|

|

|

|

|

|

all zero. |

Page 72 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||

|

|

|

|

|

• Check the date and time. |

Page 24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DURING business hours… |

|

Setups |

|

|

|

||

• |

Register transactions. |

Page 25 |

BasicOperationsand |

• |

Periodically read totals. |

Page 71 |

|

|

|

|

|

AFTER business hours…

• Issue electronic journal report. (if necessary) |

Page 74 |

|

• Reset the daily totals. |

Page 41 |

|

• |

Remove the journal. |

Page 83 |

• |

Empty the cash drawer and leave it open. |

Page 18 |

• Take the cash and journal to the office.

23 E

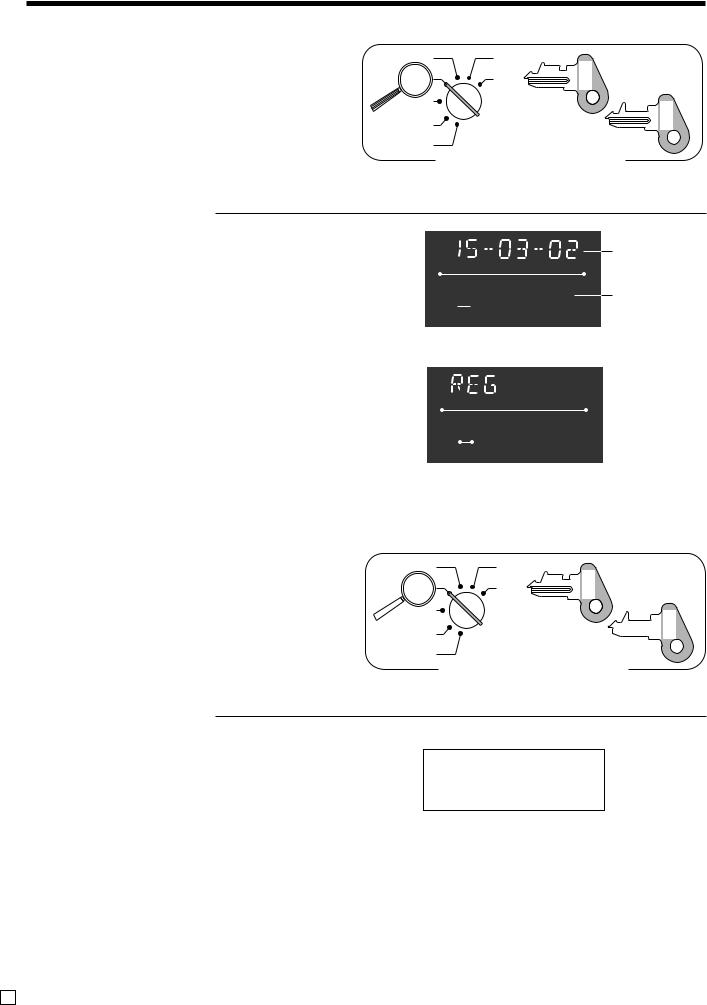

Basic Operations and Setups

Displaying the time and date |

CAL |

|

|

You can show the time and date on the display of the |

REG |

cash register whenever there is no registration being |

OFF |

made. |

RF |

|

PGM |

To display and clear the time and date |

|

OPERATION |

|

X

C

X

Z |

C-A02 |

OP |

C-A32 |

PGM |

Mode Switch

DISPLAY

Day Month Year

AMOUNT

08-3~ Hour Minutes.

(24-hour system)

(24-hour system)

RPT RECEIPT ON

AMOUNT

~00

RPT RECEIPT

ON

Preparing coins for change

You can use the following procedure to open the drawer without registering an item. This operation must be performed out of a sale.

(You can use the [key instead of the Bkey. See page 37.)

Opening the drawer without a sale

OPERATION

CAL |

X |

|

OP |

REG |

Z |

C-A02 |

OFF

OFF

RF

PGM

Mode Switch

RECEIPT

B

REG 15-03-2002 08:35 000001

A32-C

PGM

#/NS ••••••••••••

E 24

Preparing and using department keys

Registering department keys

|

CAL |

The following examples show how you can use the |

REG |

department keys in various types of registrations. |

OFF |

|

|

|

RF |

|

PGM |

Single item sale |

|

OPERATION

X

Z |

C-A02 |

OP |

Mode Switch

RECEIPT

A32-C

PGM

|

|

|

|

|

1- |

|

|

|

|

|

|||||

|

|

|

Unit price |

$1.00 |

|

REG 15-03-2002 08:40 |

— Mode/date/time |

||||||||

|

Item |

|

Quantity |

1 |

Unit price |

|

|

|

000002— Consecutive No. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Department |

|||

|

|

|

Dept. |

1 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

DEPT01 |

|

•1.00— descriptor/unit price |

||||||

|

|

|

|

|

|

& |

|

|

|||||||

|

Payment |

Cash |

$1.00 |

|

CASH |

|

•1.00— Cash total amount |

||||||||

|

|

|

|

|

|

Department |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

||

Repeat |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

OPERATION |

|

|

RECEIPT |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

Item |

Unit price |

$1.50 |

150& |

REG 15-03-2002 08:45 |

|

|

|

|||||||

|

Quantity |

3 |

|

|

|

|

|

|

000003 |

|

|

||||

|

& |

|

|

|

|

||||||||||

|

|

|

Dept. |

1 |

|

|

|

DEPT01 |

|

•1.50 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Payment |

Cash |

$10.00 |

|

& |

|

|

DEPT01 |

|

•1.50— Repeat |

|||||

|

|

|

|

|

|

|

|

|

|

DEPT01 |

|

•1.50— Repeat |

|||

|

|

|

|

|

|

s |

|

|

|||||||

|

|

|

|

|

|

|

TOTAL |

|

•4.50 |

||||||

|

|

|

|

|

|

|

CASH |

|

•10.00 |

||||||

|

|

|

|

|

|

10-a |

CHANGE |

|

•5.50 |

||||||

Multiplication |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

OPERATION |

|

|

RECEIPT |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item |

Unit price |

$1.00 |

12^5 |

X |

|

|

REG 15-03-2002 08:50 |

|

|

|

||||

|

Quantity |

12.5 |

Quantity |

|

|

|

|

|

000004 |

|

|

||||

|

|

|

Dept. |

1 |

(4-digit integer/2-digit decimal) |

|

12.5 |

X |

@1.00 |

— Quantity/unit price |

|||||

|

Payment |

Cash |

$20.00 |

1-& |

|

DEPT01 |

|

•12.50 |

|||||||

|

|

|

|

|

|

|

TOTAL |

|

•12.50 |

||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

s |

|

CASH |

|

•20.00 |

|||||

|

|

|

|

|

|

|

CHANGE |

|

•7.50 |

||||||

|

|

|

|

|

|

20-a |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Basic Operations and Setups

25 E

Basic Operations and Setups

Programming department keys

To program a unit price for each department

CAL |

X |

|

|

REG |

Z |

|

|

OFF |

|

|

|

RF |

C-A32 |

PGM |

|

PGM |

|||

|

|

Mode Switch

To other department

|

|

|

|

|

|

|

{ |

&(Dept.1) |

} |

|

|

|

61s |

|

'(Dept.2) |

|

|

||||||||

6 s |

||||||||||||

6 :::::: 6 |

||||||||||||

|

|

|

|

|

|

|

: |

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

Unit |

|

price |

.(Dept.24) |

|

|

|||||

|

|

|

|

|

||||||||

|

Example: |

|

|

|

|

|

|

|

|

|

||

$1.00 |

2 100 |

|

|

|

|

|

||||||

$10.25 |

2 1025 |

|

|

|

|

|

||||||

$1,234.56 |

2 123456 |

|

|

|

||||||||

To program the tax calculation status for each department

Tax calculation status

This specification defines which tax table should be used for automatic tax calculation. See page 13 for information on setting up the tax tables.

Programming procedure

Different status to different department

Same status to different department

CAL

REG

OFF

RF

PGM

X

Z

A32-C

PGM

[(Tax table 1) |

|

|

&(Dept.1) |

|

|

|

P(Tax table 2) |

|

|

|

|

|

|

|

|

'(Dept.2) |

|

|

|

|

61s6 k(Tax table 3) |

6 |

|

6 s |

|||

{e(Tax table 4) } |

{ |

: |

} |

|

|

|

.(Dept.24) |

|

|

||||

B(Non tax) |

|

|

|

|

|

|

Mode Switch

Note: Tax symbols

T1: Tax table 1

T2: Tax table 2

T3: Tax table 3

T4: Tax table 4

All departments are initialized as non-tax.

E 26

Registering department keys by |

CAL |

|

programming data |

||

REG |

||

|

OFF |

|

|

RF |

|

|

PGM |

|

Preset price |

|

|

OPERATION |

|

X

Z |

C-A02 |

OP |

C-A32 |

PGM |

Mode Switch

RECEIPT

|

Unit price |

($1.00) |

Item |

Quantity |

1 |

|

Dept. |

2 |

Payment |

Cash |

$1.00 |

( ): Preset value

'

a

REG 15-03-2002 08:55 000005

DEPT02 |

•1.00— Department |

|

CASH |

•1.00 |

descriptor/unit price |

|

||

Preset tax status (Add-on tax)

|

|

|

|

OPERATION |

RECEIPT |

|||||

|

|

|

|

|

|

|

|

|||

|

Unit price |

($2.00) |

5X REG 15-03-2002 09:00 |

|||||||

Item 1 |

Quantity |

5 |

( |

|

|

|

000006 |

|

Tax status symbols * |

|

|

|

|

|

|

||||||

Dept. |

3 |

5 X |

|

|

@2.00 |

|

||||

|

|

|

|

|||||||

|

|

|

|

|

DEPT03 |

T1 |

•10.00 |

|||

|

Taxable |

(1) |

|

|||||||

|

) DEPT04 |

T2 |

•2.00 |

|||||||

|

Unit price |

($2.00) |

||||||||

|

s |

TAX-AMT 1 |

|

|

•10.00— Taxable Amount 1 |

|||||

Item 2 |

Quantity |

1 |

TAX 1 |

|

|

•0.50— Tax 1 |

||||

|

|

|

|

TAX-AMT 2 |

|

|

•2.00— Taxable Amount 2 |

|||

Dept. |

4 |

20-a |

|

|

||||||

|

TAX 2 |

|

|

•0.12— Tax 2 |

||||||

|

Taxable |

(2) |

TOTAL |

|

|

•12.62 |

||||

|

|

|

|

|||||||

|

|

|

|

|

CASH |

|

|

•20.00 |

||

Payment |

Cash |

$20.00 |

|

|

|

|||||

|

CHANGE |

|

|

•7.38 |

||||||

( ): Preset value

* To print tax status symbols, please refer to page 44.

Preset tax status (Add-in tax)

OPERATION |

RECEIPT |

|

Unit price |

($2.00) |

|

Item 1 |

Quantity |

5 |

|

Dept. |

3 |

||

|

|||

|

Taxable |

(1) |

|

|

Unit price |

($2.00) |

|

Item 2 |

Quantity |

1 |

|

Dept. |

4 |

||

|

|||

|

Taxable |

(2) |

|

Payment |

Cash |

$20.00 |

( ): Preset value

5X REG 15-03-2002 09:05 |

|||||

( |

|

|

|

000007 |

|

|

|

|

|

Tax status symbols * |

|

|

5 X |

|

|

@2.00 |

|

|

|

|

|

||

|

|

|

|||

) |

DEPT03 |

T1 |

•10.00 |

||

DEPT04 |

T2 |

•2.00 |

|||

sCASH •20.00•12.00TOTAL

20-a CHANGE •8.00

* To print tax status symbols, please refer to page 44.

Basic Operations and Setups

27 E

Loading...

Loading...